|

|

市場調査レポート

商品コード

1782034

アンチモンフリーポリエステルの世界市場:製品タイプ別、触媒別、最終用途産業別、地域別 - 予測(~2030年)Antimony-free Polyesters Market by Product Type (Polyethylene Terephthalate, Polytrimethylene Terephthalate, Polybutylene Terephthalate ), Catalyst, End-use Industry, & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| アンチモンフリーポリエステルの世界市場:製品タイプ別、触媒別、最終用途産業別、地域別 - 予測(~2030年) |

|

出版日: 2025年07月29日

発行: MarketsandMarkets

ページ情報: 英文 253 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

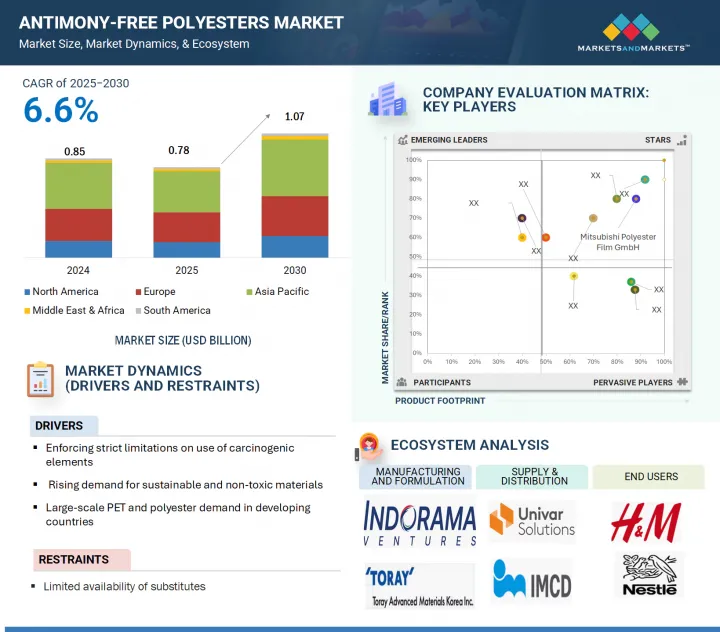

世界のアンチモンフリーポリエステルの市場規模は、2025年の7億8,000万米ドルから2030年までに10億7,000万米ドルに達すると予測され、予測期間にCAGRで6.6%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 金額(100万米ドル/10億米ドル)、数量(キロトン) |

| セグメント | 製品タイプ、触媒、最終用途産業、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、南米 |

アンチモンフリーポリエステルの需要は、最終製品に有毒残留物を残す可能性のある従来のアンチモン系触媒に関連する健康および環境上の懸念から高まっています。北米と欧州の規制圧力に対応するため、また食品包装、テキスタイル、医療機器、その他の無毒性と持続可能性を優先する用途でポリエステルの使用が増加しているため、メーカーは積極的に代替品を模索しています。アンチモンフリーのポリエステルはリサイクル性に優れ、世界の持続可能性への取り組みを支えています。消費者の意識が高まり、各ブランドが環境にやさしい製品を志向するようになるにつれて、アンチモンフリーポリエステルの需要は包装、テキスタイル、自動車、電子などのさまざまな産業で高まることが予測されます。

「ポリトリメチレンテレフタレート(PTT)セグメントが予測期間にアンチモンフリーポリエステル市場で金額ベースで最速の成長を記録する見込みです。」

ポリトリメチレンテレフタレート(PTT)は、高機能で持続可能なテキスタイル用途での使用の増加により、アンチモンフリーポリエステル市場で急成長しているセグメントです。PTTは優れた伸縮性、ソフトな風合い、鮮やかな染色性など、複数の重要な利点を備えており、カーペット、スポーツウェア、ホームテキスタイルに理想的です。より柔らかく、より長持ちし、見た目に美しいテキスタイルを求める消費者ニーズが高まる中、メーカーはこうしたニーズを満たすためにPTTに注目しています。テキスタイル加工技術の進歩により、PTT生産の費用対効果と効率が向上したこともまた、この成長を後押ししています。さらに、製造工程からアンチモンのような有毒物質を排除することへの規制の関心の高まりにより、PTTは現在、チタン系のシステムのような、より安全な触媒を使用して大規模に生産されています。

「チタン系触媒セグメントが予測期間にアンチモンフリーポリエステル市場で金額ベースで最速の成長を記録する見込みです。」

チタン系触媒は、その安全性、効率性、現行の生産方式との適合性により、アンチモンフリーポリエステル市場でもっとも急成長しているセグメントです。特にテキスタイルや食品包装などの用途でアンチモンの毒性に対する懸念が高まる中、産業界は急速に無毒性触媒へとシフトしています。チタン系触媒は、健康や環境へのリスクがないため、特に好まれています。チタン系触媒は熱安定性が高く、ポリマーの透明性を維持します。さらに、よりスムーズな加工を可能にし、透明ボトルや高機能テキスタイル、医療用材料の生産に不可欠な高い品質を保証します。その他の触媒とは異なり、チタン触媒は最小限の改質で既存の生産ラインに容易に組み込むことができるため、メーカーにとって経済的な選択肢となります。

「包装セグメントが予測期間にアンチモンフリーポリエステル市場で金額ベースでもっとも急成長する見込みです。」

アンチモンフリーポリエステル包装は、従来のアンチモン触媒PETに関連する健康、安全、環境上の懸念の高まりにより、市場内でもっとも急成長しているセグメントです。食品・飲料容器、特にペットボトルにはアンチモンが含まれており、規制当局や消費者の間で警戒が高まっています。この問題に対処するため、欧州連合(EU)、日本、韓国などの国々では厳しい規制を設け、より安全な代替品の採用を促しています。こうした規制の動きと、無害で持続可能な包装に対する消費者の意識と需要の高まりにより、アンチモンフリーポリエステルの使用が急速に増加しています。主要な日用品(FMCG)メーカーや飲料メーカーも持続可能性戦略の一環として持続可能で規格に適合した包装形式への移行を進めています。アンチモンフリーポリエステル、特にチタン系触媒を使用して生産されたPETは、健康基準に適合しながら同じ性能特性を維持しています。

当レポートでは、世界のアンチモンフリーポリエステル市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- アンチモンフリーポリエステル市場における魅力的な機会

- アンチモンフリーポリエステル市場:製品タイプ別

- アンチモンフリーポリエステル市場:最終用途産業別

- アンチモンフリーポリエステル市場:触媒別

- アンチモンフリーポリエステル市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- アンチモンフリーポリエステル市場における生成AIの影響

- イントロダクション

- アンチモンフリーポリエステル産業の形成における生成AIの役割

第6章 産業動向

- イントロダクション

- カスタマービジネスに影響を与える動向/混乱

- アンチモンフリーポリエステル市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 主要国/地域に対する影響

- 最終用途産業に対する影響

- サプライチェーン分析

- 価格分析

- 平均販売価格の動向:地域別(2021年~2024年)

- 平均販売価格の動向:製品タイプ別(2021年~2024年)

- 平均販売価格の動向:触媒別(2021年~2024年)

- 平均販売価格の動向:最終用途産業別(2021年~2024年)

- 主要企業の平均販売価格の動向:製品タイプ別(2024年)

- 投資と資金調達のシナリオ

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 調査手法

- 世界中で取得された特許

- 特許公報の動向

- 考察

- 特許の法的地位

- 管轄分析

- 主な出願者

- 主要特許のリスト

- 貿易分析

- 輸入シナリオ(HSコード282300)

- 輸出シナリオ(HSコード282300)

- 主な会議とイベント

- 関税と規制情勢

- アンチモンフリーポリエステルに関する関税

- 規制機関、政府機関、その他の組織

- アンチモンフリーポリエステルに関する規制と基準

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済の見通し

- ケーススタディ分析

第7章 アンチモンフリーポリエステル市場:製品タイプ別

- イントロダクション

- ポリエチレンテレフタレート(PET)

- ポリトリメチレンテレフタレート(PTT)

- ポリブチレンテレフタレート(PBT)

第8章 アンチモンフリーポリエステル市場:触媒別

- イントロダクション

- チタン系触媒

- アルミニウム系触媒

- チタンマグネシウム系触媒

- その他の触媒

- 亜鉛系触媒

- ゲルマニウム系触媒

- コバルト系触媒

- 有機金属化合物

- ビスマス系触媒

第9章 アンチモンフリーポリエステル市場:最終用途産業別

- イントロダクション

- テキスタイル

- 包装

- 自動車

- 建設

- その他の最終用途産業

- 医療

- 航空宇宙

- 再生可能エネルギー

- コンシューマーエレクトロニクス

第10章 アンチモンフリーポリエステル市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- その他の欧州

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 企業の評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- MITSUBISHI POLYESTER FILM GMBH

- INDORAMA VENTURES PUBLIC COMPANY LIMITED

- TORAY ADVANCED MATERIALS KOREA INC.

- TEIJIN LIMITED

- RELIANCE INDUSTRIES LIMITED

- FATRA, A.S.

- POLYPLEX

- NAN YA PLASTICS CORPORATION

- UFLEX LIMITED

- CHANG CHUN GROUP

- その他の企業

- HUBEI DECON POLYESTER CO., LTD.

- TIANJIN GT NEW MATERIAL TECHNOLOGY CO., LTD

- PT ASIA PACIFIC FIBERS TBK.

- HANGZHOU LEMMEJOY CHEMICAL FIBER CO., LTD.

- ZHEJIANG DONGTAI NEW MATERIALS CO., LTD.

- LEADEX & CO.

- ESTER

- JBF BAHRAIN W.L.L.

- SUZHOU CHUNSHENG ENVIRONMENTAL PROTECTION FIBER CO., LTD.

- HANGZHOU DENGTE TEXTILE MACHINERY CO., LTD.

- JUNISH

- TMMFA LIMITED

- NANTONG YANHUANG IMPORT & EXPORT CO., LTD.

第13章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF ANTIMONY-FREE POLYESTERS, BY REGION, 2021-2024 (USD/KG)

- TABLE 2 AVERAGE SELLING PRICE TREND OF ANTIMONY-FREE POLYESTERS, BY PRODUCT TYPE, 2021-2024 (USD/KG)

- TABLE 3 AVERAGE SELLING PRICE TREND OF ANTIMONY-FREE POLYESTERS, BY CATALYST, 2021-2024 (USD/KG)

- TABLE 4 AVERAGE SELLING PRICE TREND OF ANTIMONY-FREE POLYESTERS, BY END-USE INDUSTRY, 2021-2024 (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE TREND OF ANTIMONY-FREE POLYESTERS OFFERED BY KEY PLAYERS, BY PRODUCT TYPE, 2024 (USD/KG)

- TABLE 6 ANTIMONY-FREE POLYESTERS MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 7 KEY TECHNOLOGIES IN ANTIMONY-FREE POLYESTERS MARKET

- TABLE 8 COMPLEMENTARY TECHNOLOGIES IN ANTIMONY-FREE POLYESTERS MARKET

- TABLE 9 ADJACENT TECHNOLOGIES IN ANTIMONY-FREE POLYESTERS MARKET

- TABLE 10 ANTIMONY-FREE POLYESTERS MARKET: TOTAL NUMBER OF PATENTS

- TABLE 11 ANTIMONY-FREE POLYESTERS MARKET: LIST OF MAJOR PATENT OWNERS

- TABLE 12 ANTIMONY-FREE POLYESTERS MARKET: LIST OF MAJOR PATENTS, 2021-2024

- TABLE 13 ANTIMONY-FREE POLYESTERS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 TARIFF-RELATED TO ANTIMONY-FREE POLYESTERS

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ANTIMONY-FREE POLYESTERS MARKET: REGULATIONS AND STANDARDS

- TABLE 21 ANTIMONY-FREE POLYESTERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 24 GDP TRENDS AND FORECASTS, BY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 25 ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 26 ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 27 ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 28 ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 29 ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2021-2024 (USD MILLION)

- TABLE 30 ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2025-2030 (USD MILLION)

- TABLE 31 ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2021-2024 (KILOTON)

- TABLE 32 ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2025-2030 (KILOTON)

- TABLE 33 ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 34 ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 35 ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 36 ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 37 ANTIMONY-FREE POLYESTERS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 ANTIMONY-FREE POLYESTERS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 ANTIMONY-FREE POLYESTERS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 40 ANTIMONY-FREE POLYESTERS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 41 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 42 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 ASIA PACIFIC ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 44 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 45 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 46 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 48 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 49 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2021-2024 (USD MILLION)

- TABLE 50 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2025-2030 (USD MILLION)

- TABLE 51 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2021-2024 (KILOTON)

- TABLE 52 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2025-2030 (KILOTON)

- TABLE 53 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 54 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 55 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 56 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 57 CHINA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 58 CHINA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 59 CHINA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 60 CHINA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 61 JAPAN: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 62 JAPAN: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 63 JAPAN: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 64 JAPAN: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 65 INDIA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 66 INDIA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 67 INDIA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 68 INDIA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 69 SOUTH KOREA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 70 SOUTH KOREA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 71 SOUTH KOREA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 72 SOUTH KOREA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 73 REST OF ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 75 REST OF ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 76 REST OF ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 77 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 80 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 81 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 84 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 85 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2021-2024 (USD MILLION)

- TABLE 86 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2025-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2021-2024 (KILOTON)

- TABLE 88 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2025-2030 (KILOTON)

- TABLE 89 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 90 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 92 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 93 US: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 94 US: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 95 US: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 96 US: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 97 CANADA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 98 CANADA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 99 CANADA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 100 CANADA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 101 MEXICO: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 102 MEXICO: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 103 MEXICO: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 104 MEXICO: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 105 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 108 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 109 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 110 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 112 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 113 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2021-2024 (USD MILLION)

- TABLE 114 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2021-2024 (KILOTON)

- TABLE 116 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2025-2030 (KILOTON)

- TABLE 117 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 118 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 120 EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 121 GERMANY: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 122 GERMANY: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 123 GERMANY: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 124 GERMANY: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 125 ITALY: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 126 ITALY: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127 ITALY: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 128 ITALY: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 129 FRANCE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 130 FRANCE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 131 FRANCE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 132 FRANCE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 133 UK: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 134 UK: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 UK: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 136 UK: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 137 SPAIN: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 138 SPAIN: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 SPAIN: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 140 SPAIN: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 141 REST OF EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 142 REST OF EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 REST OF EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 144 REST OF EUROPE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 145 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 148 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 149 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 152 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 153 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2021-2024 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2021-2024 (KILOTON)

- TABLE 156 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2025-2030 (KILOTON)

- TABLE 157 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 160 MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 161 UAE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 162 UAE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 163 UAE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 164 UAE: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 165 SAUDI ARABIA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 166 SAUDI ARABIA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 167 SAUDI ARABIA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 168 SAUDI ARABIA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 169 REST OF GCC COUNTRIES: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 170 REST OF GCC COUNTRIES: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 171 REST OF GCC COUNTRIES: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 172 REST OF GCC COUNTRIES: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 173 SOUTH AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 174 SOUTH AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 175 SOUTH AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 176 SOUTH AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 177 REST OF MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 179 REST OF MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 180 REST OF MIDDLE EAST & AFRICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 181 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 182 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 184 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 185 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 186 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 187 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 188 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 189 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2021-2024 (USD MILLION)

- TABLE 190 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2025-2030 (USD MILLION)

- TABLE 191 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2021-2024 (KILOTON)

- TABLE 192 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST, 2025-2030 (KILOTON)

- TABLE 193 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 194 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 195 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 196 SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 197 BRAZIL: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 198 BRAZIL: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 199 BRAZIL: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 200 BRAZIL: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 201 ARGENTINA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 202 ARGENTINA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 203 ARGENTINA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 204 ARGENTINA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 205 REST OF SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 206 REST OF SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 207 REST OF SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 208 REST OF SOUTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 209 ANTIMONY-FREE POLYESTERS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-MAY 2025

- TABLE 210 ANTIMONY-FREE POLYESTERS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 211 ANTIMONY-FREE POLYESTERS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 212 ANTIMONY-FREE POLYESTERS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 213 ANTIMONY-FREE POLYESTERS MARKET: CATALYST FOOTPRINT

- TABLE 214 ANTIMONY-FREE POLYESTERS MARKET: REGION FOOTPRINT

- TABLE 215 ANTIMONY-FREE POLYESTERS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 216 ANTIMONY-FREE POLYESTERS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 217 ANTIMONY-FREE POLYESTERS MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 218 ANTIMONY-FREE POLYESTERS MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 219 MITSUBISHI POLYESTER FILM GMBH: COMPANY OVERVIEW

- TABLE 220 MITSUBISHI POLYESTER FILM GMBH: PRODUCTS OFFERED

- TABLE 221 MITSUBISHI POLYESTER FILM GMBH: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 222 INDORAMA VENTURES PUBLIC COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 223 INDORAMA VENTURES PUBLIC COMPANY LIMITED: PRODUCTS OFFERED

- TABLE 224 INDORAMA VENTURES PUBLIC COMPANY LIMITED: DEALS, JANUARY 2021-MAY 2025

- TABLE 225 TORAY ADVANCED MATERIALS KOREA INC.: COMPANY OVERVIEW

- TABLE 226 TORAY ADVANCED MATERIALS KOREA INC.: PRODUCTS OFFERED

- TABLE 227 TEIJIN LIMITED: COMPANY OVERVIEW

- TABLE 228 TEIJIN LIMITED: PRODUCTS OFFERED

- TABLE 229 TEIJIN LIMITED: DEALS, JANUARY 2021-MAY 2025

- TABLE 230 RELIANCE INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 231 RELIANCE INDUSTRIES LIMITED: PRODUCTS OFFERED

- TABLE 232 RELIANCE INDUSTRIES LIMITED: DEALS, JANUARY 2021-MAY 2025

- TABLE 233 FATRA, A.S.: COMPANY OVERVIEW

- TABLE 234 FATRA, A.S.: PRODUCTS OFFERED

- TABLE 235 POLYPLEX: COMPANY OVERVIEW

- TABLE 236 POLYPLEX: PRODUCTS OFFERED

- TABLE 237 NAN YA PLASTICS CORPORATION: COMPANY OVERVIEW

- TABLE 238 NAN YA PLASTICS CORPORATION: PRODUCTS OFFERED

- TABLE 239 NAN YA PLASTICS CORPORATION: DEALS, JANUARY 2021-MAY 2025

- TABLE 240 UFLEX LIMITED: COMPANY OVERVIEW

- TABLE 241 UFLEX LIMITED: PRODUCTS OFFERED

- TABLE 242 UFLEX LIMITED: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 243 CHANG CHUN GROUP: COMPANY OVERVIEW

- TABLE 244 CHANG CHUN GROUP: PRODUCTS OFFERED

- TABLE 245 HUBEI DECON POLYESTER CO., LTD.: COMPANY OVERVIEW

- TABLE 246 TIANJIN GT NEW MATERIAL TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 247 PT ASIA PACIFIC FIBERS TBK.: COMPANY OVERVIEW

- TABLE 248 HANGZHOU LEMMEJOY CHEMICAL FIBER CO., LTD.: COMPANY OVERVIEW

- TABLE 249 ZHEJIANG DONGTAI NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 250 LEADEX & CO.: COMPANY OVERVIEW

- TABLE 251 ESTER: COMPANY OVERVIEW

- TABLE 252 JBF BAHRAIN W.L.L.: COMPANY OVERVIEW

- TABLE 253 SUZHOU CHUNSHENG ENVIRONMENTAL PROTECTION FIBER CO., LTD.: COMPANY OVERVIEW

- TABLE 254 HANGZHOU DENGTE TEXTILE MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 255 JUNISH: COMPANY OVERVIEW

- TABLE 256 TMMFA LIMITED: COMPANY OVERVIEW

- TABLE 257 NANTONG YANHUANG IMPORT & EXPORT CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ANTIMONY-FREE POLYESTERS MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 ANTIMONY-FREE POLYESTERS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 ANTIMONY-FREE POLYESTERS MARKET: DATA TRIANGULATION

- FIGURE 8 POLYETHYLENE TEREPHTHALATE SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 9 TITANIUM-BASED CATALYSTS SEGMENT TO REGISTER HIGHEST GROWTH BETWEEN 2025 AND 2030

- FIGURE 10 TEXTILE SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 12 RISING DEMAND FROM AUTOMOTIVE, PACKAGING, AND TEXTILE SECTORS TO DRIVE MARKET

- FIGURE 13 POLYTRIMETHYLENE TEREPHTHALATE TO BE FASTEST-GROWING PRODUCT TYPE DURING FORECAST PERIOD

- FIGURE 14 PACKAGING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 TITANIUM-BASED CATALYSTS SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 17 ANTIMONY-FREE POLYESTERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 USE OF GENERATIVE AI IN ANTIMONY-FREE POLYESTERS MARKET

- FIGURE 19 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 20 ANTIMONY-FREE POLYESTERS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 AVERAGE SELLING PRICE TREND OF ANTIMONY-FREE POLYESTERS, BY REGION, 2021-2024 (USD/KG)

- FIGURE 22 AVERAGE SELLING PRICE TREND OF ANTIMONY-FREE POLYESTERS OFFERED BY KEY PLAYERS, BY PRODUCT TYPE, 2024 (USD/KG)

- FIGURE 23 ANTIMONY-FREE POLYESTERS MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 24 ANTIMONY-FREE POLYESTERS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 NUMBER OF PATENTS GRANTED IN LAST TEN YEARS, 2015-2024

- FIGURE 26 ANTIMONY-FREE POLYESTERS MARKET: LEGAL STATUS OF PATENTS

- FIGURE 27 PATENT ANALYSIS FOR ANTIMONY-FREE POLYESTERS, BY JURISDICTION, 2015-2024

- FIGURE 28 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 29 IMPORT DATA OF HS CODE 282300-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 30 EXPORT DATA OF HS CODE 282300-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 31 ANTIMONY-FREE POLYESTERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 34 POLYETHYLENE TEREPHTHALATE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 35 TITANIUM-BASED CATALYSTS SEGMENT TO LEAD MARKET IN 2025

- FIGURE 36 TEXTILE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC: ANTIMONY-FREE POLYESTERS MARKET SNAPSHOT

- FIGURE 39 NORTH AMERICA: ANTIMONY-FREE POLYESTERS MARKET SNAPSHOT

- FIGURE 40 EUROPE: ANTIMONY-FREE POLYESTERS MARKET SNAPSHOT

- FIGURE 41 ANTIMONY-FREE POLYESTERS MARKET SHARE ANALYSIS, 2024

- FIGURE 42 ANTIMONY-FREE POLYESTERS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 43 ANTIMONY-FREE POLYESTERS MARKET: BRAND/PRODUCT C OMPARATIVE ANALYSIS

- FIGURE 44 ANTIMONY-FREE POLYESTERS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 ANTIMONY-FREE POLYESTERS MARKET: COMPANY FOOTPRINT

- FIGURE 46 ANTIMONY-FREE POLYESTERS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 ANTIMONY-FREE POLYESTERS MARKET: EV/EBITDA OF KEY VENDORS

- FIGURE 48 ANTIMONY-FREE POLYESTERS MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN, 2020-2024

- FIGURE 49 INDORAMA VENTURES PUBLIC COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 50 TEIJIN LIMITED: COMPANY SNAPSHOT

- FIGURE 51 RELIANCE INDUSTRIES LIMITED: COMPANY SNAPSHOT

- FIGURE 52 POLYPLEX: COMPANY SNAPSHOT

- FIGURE 53 NAN YA PLASTICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 UFLEX LIMITED: COMPANY SNAPSHOT

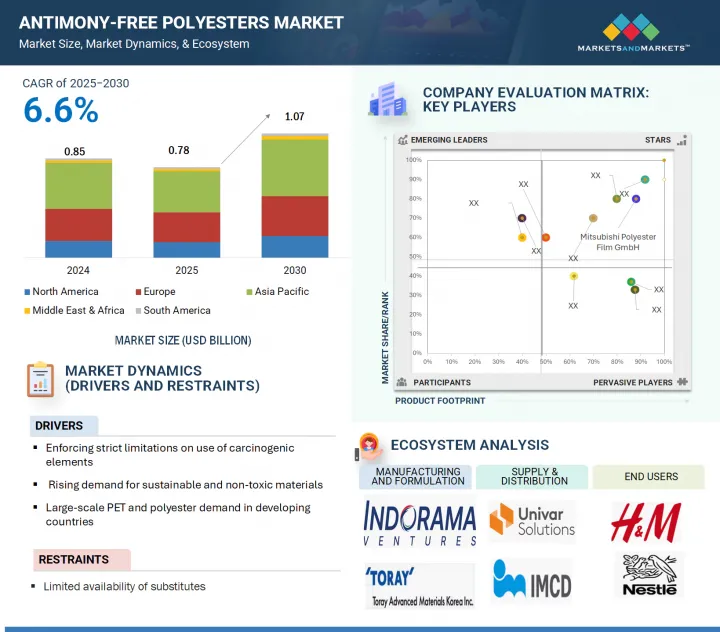

The antimony-free polyesters market size is projected to grow from usd 0.78 billion in 2025 to USD 1.07 billion by 2030, registering a CAGR of 6.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Kiloton) |

| Segments | Product Type, Catalyst, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

The demand for antimony-free polyesters has increased due to health and environmental concerns related to traditional antimony-based catalysts, which can leave toxic residues in the final products. Manufacturers are actively seeking alternatives in response to regulatory pressures from North America and Europe, as well as the growing use of polyester in food packaging, textiles, medical devices, and other applications that prioritize non-toxicity and sustainability. Antimony-free polyesters offer a greater degree of recyclability and support global sustainability initiatives. As consumer awareness grows and brands increasingly align themselves with eco-friendly products, the demand for antimony-free polyesters is expected to rise across various industries, including packaging, textiles, automotive, and electronics.

"Polytrimethylene terephthalate (PTT) segment is projected to register the fastest growth in the antimony-free polyesters market, in terms of value, during the forecast period."

Polytrimethylene terephthalate (PTT) is rapidly becoming the fastest-growing segment in the antimony-free polyester market due to its increasing use in high-performance and sustainable textile applications. PTT offers several key advantages, including excellent elasticity, a soft texture, and vibrant dyeability, making it ideal for carpets, sportswear, and home textiles. As consumer demand for softer, longer-lasting, and visually appealing fabrics rises, manufacturers are turning to PTT to meet these needs. This growth is also fueled by advancements in fiber processing technologies, which have enhanced the cost-effectiveness and efficiency of PTT production. Furthermore, with a growing regulatory focus on eliminating toxic materials like antimony from manufacturing processes, PTT is now being produced on a larger scale using safer catalysts, such as titanium-based systems.

"The titanium-based catalysts segment is projected to register the fastest growth in the antimony-free polyesters market, in terms of value, during the forecast period."

Titanium-based catalysts are the fastest-growing segment of the antimony-free polyesters market due to their safety, efficiency, and compatibility with current manufacturing practices. With increasing concerns about the toxicity of antimony-especially in applications like textiles and food packaging-industries are rapidly shifting toward non-toxic catalysts. Titanium-based catalysts are particularly favored because they do not present health or environmental risks. They offer high thermal stability and maintain polymer clarity. Additionally, they facilitate smoother processing and ensure high product quality, which is essential for producing clear bottles, high-performance fibers, and medical-grade materials. Unlike other catalysts, titanium catalysts can be easily integrated into existing production lines with minimal modifications, making them an economical choice for manufacturers.

"Packaging segment is projected to register the fastest growth in the antimony-free polyesters market, in terms of value, during the forecast period."

Antimony-free polyester packaging is the fastest-growing segment within the market due to heightened health, safety, and environmental concerns associated with conventional antimony-catalyzed PET. The presence of antimony in food and beverage containers, particularly PET bottles, has raised alarms among regulators and consumers. To address this issue, strict regulations in countries such as the European Union, Japan, and South Korea are encouraging the adoption of safer alternatives. This regulatory movement, combined with a growing consumer awareness and demand for non-toxic and sustainable packaging, is driving the rapid increase in the use of antimony-free polyester. Major fast-moving consumer goods (FMCG) and beverage companies are also transitioning to sustainable and compliant packaging formats as part of their sustainability strategies. Antimony-free polyester, especially PET produced with titanium-based catalysts, maintains the same performance attributes while complying with health standards.

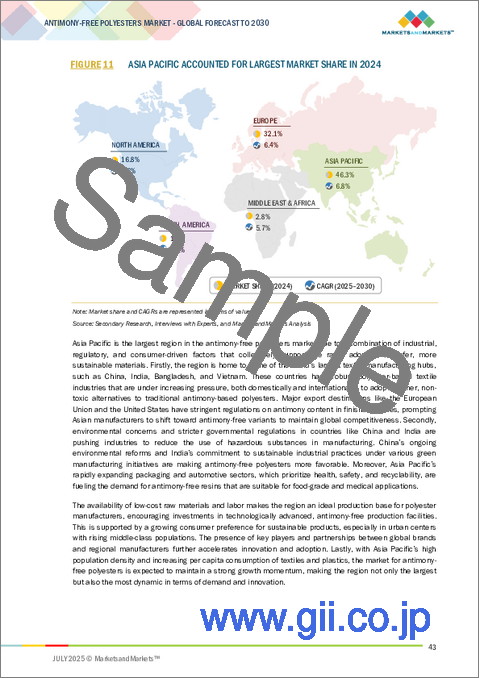

"Asia Pacific is projected to be the fastest-growing region in the antimony-free polyesters market, in terms of value, during the forecast period.

The Asia Pacific region is the fastest-growing market for antimony-free polyesters, driven by a combination of industrial, consumer, and regulatory factors. Countries like China, Japan, and South Korea are implementing stricter environmental and health regulations aimed at reducing the use of heavy metals, such as antimony, in manufacturing processes. As a result, polyester manufacturers are turning to safer alternatives, such as titanium- and aluminum-based catalysts. Additionally, Asia Pacific is home to some of the world's largest textile and packaging production centers, which create significant downstream demand for antimony-free polyesters. The rising middle class and increased awareness of environmental issues are also influencing consumer preferences toward sustainable and non-toxic products. Furthermore, urbanization, industrialization, and regional exports are driving the demand for compliant and environmentally friendly materials, including antimony-free polyesters.

In-depth interviews were conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the antimony-free polyesters market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 20%, Europe - 30%, Asia Pacific - 40%, Middle East & Africa- 5%, and South America - 5%

The antimony-free polyesters market comprises major players such as Mitsubishi Polyester Film GmbH (Germany), Ester Industries Ltd. (India), Indorama Ventures Public Company Limited (Thailand), Toray Advanced Materials Korea Inc. (South Korea), NAN YA PLASTICS CORPORATION (Taiwan), HANGZHOU LEMMEJOY CHEMICAL FIBER CO., LTD. (China), PT Asia Pacific Fibers Tbk (Indonesia), TIANJIN GT NEW MATERIAL TECHNOLOGY CO., LTD (China), Amerex Hubei Decon Polyester Co., Ltd. (China), and ZHEJIANG DONGTAI NEW MATERIALS CO., LTD.. (China). The study includes an in-depth competitive analysis of these key players in the antimony-free polyesters market, as well as their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for antimony-free polyesters on the basis of product type, catalyst, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the antimony-free polyesters market.

Key Benefits of Buying This Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the antimony-free polyesters market; high-growth regions; and market drivers, restraints, opportunities, and challenges. The report provides insights on the following pointers:

- Analysis of drivers: (rising demand for sustainable and non-toxic materials), restraints (limited availability of substitutes against antimony), opportunities (expanding use of PET in high-growth regions), and challenges (performance optimization in the production of antimony-free catalysts) influencing the growth of the antimony-free polyesters market.

- Market Penetration: Comprehensive information on antimony-free polyesters offered by top players in the antimony-free polyesters market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, expansions, investments, collaborations, and partnerships in the market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the antimony-free polyesters market across regions.

- Market Capacity: Production capacities of companies producing antimony-free polyesters are provided wherever available, with upcoming capacities for the antimony-free polyesters market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the antimony-free polyesters market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 RESEARCH LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary data sources

- 2.1.2.3 Key primary participants

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH

- 2.2.2 DEMAND-SIDE APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ANTIMONY-FREE POLYESTERS MARKET

- 4.2 ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE

- 4.3 ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY

- 4.4 ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST

- 4.5 ANTIMONY-FREE POLYESTERS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Strict limitations on use of carcinogenic elements

- 5.2.1.2 Rising demand for sustainable and non-toxic materials

- 5.2.1.3 Large-scale PET and polyester demand in developing countries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited availability of substitutes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements in catalyst development

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory compliance across regions for use of toxic chemicals

- 5.2.4.2 Performance optimization in production of antimony-free polyesters

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI ON ANTIMONY-FREE POLYESTERS MARKET

- 5.3.1 INTRODUCTION

- 5.3.2 ROLE OF GENERATIVE AI IN SHAPING ANTIMONY-FREE POLYESTERS INDUSTRY

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 IMPACT OF 2025 US TARIFF ON ANTIMONY-FREE POLYESTERS MARKET

- 6.3.1 INTRODUCTION

- 6.3.2 KEY TARIFF RATES

- 6.3.3 PRICE IMPACT ANALYSIS

- 6.3.4 IMPACT ON KEY COUNTRY/REGION

- 6.3.4.1 US

- 6.3.4.2 Europe

- 6.3.4.3 Asia Pacific

- 6.3.5 IMPACT ON END-USE INDUSTRIES

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 6.5.2 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2021-2024

- 6.5.3 AVERAGE SELLING PRICE TREND, BY CATALYST, 2021-2024

- 6.5.4 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY, 2021-2024

- 6.5.5 AVERAGE SELLING PRICE TREND OF KEY PLAYER, BY PRODUCT TYPE, 2024

- 6.6 INVESTMENT AND FUNDING SCENARIO

- 6.7 ECOSYSTEM ANALYSIS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.3 ADJACENT TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 PATENTS GRANTED WORLDWIDE

- 6.9.3 PATENT PUBLICATION TRENDS

- 6.9.4 INSIGHTS

- 6.9.5 LEGAL STATUS OF PATENTS

- 6.9.6 JURISDICTION ANALYSIS

- 6.9.7 TOP APPLICANTS

- 6.9.8 LIST OF MAJOR PATENTS

- 6.10 TRADE ANALYSIS

- 6.10.1 IMPORT SCENARIO (HS CODE 282300)

- 6.10.2 EXPORT SCENARIO (HS CODE 282300)

- 6.11 KEY CONFERENCES AND EVENTS

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 TARIFFS RELATED TO ANTIMONY-FREE POLYESTERS

- 6.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.3 REGULATIONS AND STANDARDS RELATED TO ANTIMONY-FREE POLYESTERS

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 THREAT OF NEW ENTRANTS

- 6.13.2 THREAT OF SUBSTITUTES

- 6.13.3 BARGAINING POWER OF SUPPLIERS

- 6.13.4 BARGAINING POWER OF BUYERS

- 6.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 MACROECONOMIC OUTLOOK

- 6.15.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.16 CASE STUDY ANALYSIS

- 6.16.1 INNOVATING SUSTAINABILITY WITH HUBEI DECON POLYESTER CO., LTD.

- 6.16.2 TWD FIBRES GMBH'S SUSTAINABLE YARN REVOLUTION

- 6.16.3 INDORAMA VENTURES' GLOBAL EXPANSION IN ANTIMONY-FREE PET

7 ANTIMONY-FREE POLYESTERS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 POLYETHYLENE TEREPHTHALATE (PET)

- 7.2.1 EXTENSIVE USE IN VARIOUS SECTORS TO DRIVE MARKET

- 7.3 POLYTRIMETHYLENE TEREPHTHALATE (PTT)

- 7.3.1 ELASTICITY, RESILIENCE, AND STAIN RESISTANCE TO DRIVE ADOPTION

- 7.4 POLYBUTYLENE TEREPHTHALATE (PBT)

- 7.4.1 GROWING DEMAND FOR ECO-FRIENDLY ENGINEERING PLASTICS TO DRIVE MARKET

8 ANTIMONY-FREE POLYESTERS MARKET, BY CATALYST

- 8.1 INTRODUCTION

- 8.2 TITANIUM-BASED CATALYSTS

- 8.2.1 HIGH THERMAL STABILITY, LOW TOXICITY, AND ABILITY TO PRODUCE HIGH-QUALITY, FOOD-SAFE POLYESTER PRODUCTS TO DRIVE MARKET

- 8.3 ALUMINUM-BASED CATALYSTS

- 8.3.1 COST-EFFECTIVE AND ECO-FRIENDLY NATURE TO DRIVE ADOPTION

- 8.4 TITANIUM-MAGNESIUM-BASED CATALYSTS

- 8.4.1 NON-TOXICITY, COMPLIANCE WITH ENVIRONMENTAL REGULATIONS, AND ABILITY TO REDUCE SIDE REACTIONS TO DRIVE MARKET

- 8.5 OTHER CATALYSTS

- 8.5.1 ZINC-BASED CATALYSTS

- 8.5.2 GERMANIUM-BASED CATALYSTS

- 8.5.3 COBALT-BASED CATALYSTS

- 8.5.4 ORGANOMETALLIC COMPOUNDS

- 8.5.5 BISMUTH-BASED CATALYSTS

9 ANTIMONY-FREE POLYESTERS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 TEXTILE

- 9.2.1 COST-EFFECTIVE AND ECO-FRIENDLY TEXTILE PRODUCTION WITH ALUMINUM CATALYSTS TO DRIVE MARKET

- 9.3 PACKAGING

- 9.3.1 INCREASING FOCUS ON FOOD SAFETY AND REGULATORY COMPLIANCE TO PROPEL MARKET

- 9.4 AUTOMOTIVE

- 9.4.1 RISING DEMAND FOR LIGHTWEIGHT, THERMALLY STABLE MATERIALS TO ENHANCE FUEL EFFICIENCY AND COMPLY WITH ENVIRONMENTAL REGULATIONS TO DRIVE MARKET

- 9.5 CONSTRUCTION

- 9.5.1 GROWING PREFERENCE FOR SUSTAINABLE, LOW-TOXICITY BUILDING MATERIALS TO SUPPORT MARKET GROWTH

- 9.6 OTHER END-USE INDUSTRIES

- 9.6.1 MEDICAL AND HEALTHCARE

- 9.6.2 AEROSPACE

- 9.6.3 RENEWABLE ENERGY

- 9.6.4 CONSUMER ELECTRONICS

10 ANTIMONY-FREE POLYESTERS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Regulatory push for sustainability to drive adoption

- 10.2.2 JAPAN

- 10.2.2.1 Technological advancements to propel market growth

- 10.2.3 INDIA

- 10.2.3.1 Sustainability focus to boost market growth

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Technological innovation to accelerate market growth

- 10.2.5 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Stringent regulatory framework to drive market growth

- 10.3.2 CANADA

- 10.3.2.1 Sustainability focus to propel market

- 10.3.3 MEXICO

- 10.3.3.1 Industrial growth to fuel demand

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Sustainable packaging solutions to drive demand

- 10.4.2 ITALY

- 10.4.2.1 Green transition to drive demand

- 10.4.3 FRANCE

- 10.4.3.1 Growing demand for PET across packaging, textile, and automotive industries to propel market

- 10.4.4 UK

- 10.4.4.1 Growing focus on renewable energy and alignment with stringent European regulatory standards to drive market

- 10.4.5 SPAIN

- 10.4.5.1 Adherence to stringent European regulations to drive demand

- 10.4.6 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 UAE

- 10.5.1.1.1 Strong incentives and policies supporting sustainability initiatives to drive market

- 10.5.1.2 Saudi Arabia

- 10.5.1.2.1 Vision 2030 and regulatory reforms to propel market

- 10.5.1.3 Rest of GCC countries

- 10.5.1.1 UAE

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Expanding industrial sector to propel market

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Health and safety concerns to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Sustainability and circular economy support to propel market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Product type footprint

- 11.6.5.3 End-use industry footprint

- 11.6.5.4 Catalyst footprint

- 11.6.5.5 Region footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- 11.9.2 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 MITSUBISHI POLYESTER FILM GMBH

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 INDORAMA VENTURES PUBLIC COMPANY LIMITED

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 TORAY ADVANCED MATERIALS KOREA INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Key strengths

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 TEIJIN LIMITED

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 RELIANCE INDUSTRIES LIMITED

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 FATRA, A.S.

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 MnM view

- 12.1.6.3.1 Key strengths

- 12.1.6.3.2 Strategic choices

- 12.1.6.3.3 Weaknesses and competitive threats

- 12.1.7 POLYPLEX

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 MnM view

- 12.1.7.3.1 Key strengths

- 12.1.7.3.2 Strategic choices

- 12.1.7.3.3 Weaknesses and competitive threats

- 12.1.8 NAN YA PLASTICS CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.4 MnM view

- 12.1.8.4.1 Key strengths

- 12.1.8.4.2 Strategic choices

- 12.1.8.4.3 Weaknesses and competitive threats

- 12.1.9 UFLEX LIMITED

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Expansions

- 12.1.9.4 MnM view

- 12.1.9.4.1 Key strengths

- 12.1.9.4.2 Strategic choices

- 12.1.9.4.3 Weaknesses and competitive threats

- 12.1.10 CHANG CHUN GROUP

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 MnM view

- 12.1.10.3.1 Key strengths

- 12.1.10.3.2 Strategic choices

- 12.1.10.3.3 Weaknesses and competitive threats

- 12.1.1 MITSUBISHI POLYESTER FILM GMBH

- 12.2 OTHER PLAYERS

- 12.2.1 HUBEI DECON POLYESTER CO., LTD.

- 12.2.2 TIANJIN GT NEW MATERIAL TECHNOLOGY CO., LTD

- 12.2.3 PT ASIA PACIFIC FIBERS TBK.

- 12.2.4 HANGZHOU LEMMEJOY CHEMICAL FIBER CO., LTD.

- 12.2.5 ZHEJIANG DONGTAI NEW MATERIALS CO., LTD.

- 12.2.6 LEADEX & CO.

- 12.2.7 ESTER

- 12.2.8 JBF BAHRAIN W.L.L.

- 12.2.9 SUZHOU CHUNSHENG ENVIRONMENTAL PROTECTION FIBER CO., LTD.

- 12.2.10 HANGZHOU DENGTE TEXTILE MACHINERY CO., LTD.

- 12.2.11 JUNISH

- 12.2.12 TMMFA LIMITED

- 12.2.13 NANTONG YANHUANG IMPORT & EXPORT CO., LTD.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS