|

|

市場調査レポート

商品コード

1771773

UV消毒装置の世界市場:コンポーネント別、定格電力別、用途別、エンドユーザー別、地域別 - 2030年までの予測UV Disinfection Equipment Market by UV Lamps (Mercury UV Lamps, UV LEDs), Reactor Chambers, Quartz Sleeves, Controller Units, Water and Wastewater Disinfection, Process Water Disinfection, Surface Disinfection, Air Disinfection - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| UV消毒装置の世界市場:コンポーネント別、定格電力別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月14日

発行: MarketsandMarkets

ページ情報: 英文 259 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のUV消毒装置の市場規模は、2025年に38億7,000万米ドルと推定され、予測期間中のCAGRは15.4%と見込まれており、2030年には79億4,000万米ドルに達すると予測されています。

水系感染症に対する意識の高まり、衛生への関心の高まり、化学薬品を使用しない消毒ソリューションに対する需要の高まりにより、UV消毒システムは様々な最終用途分野で強い牽引力を獲得しています。UV消毒システムは、水系感染症に対する意識の高まり、衛生への関心の高まり、化学薬品を使用しない消毒ソリューションへの需要の高まりにより、様々な最終用途分野で強い牽引力を獲得しています。これらのシステムは、紫外線を利用して水、空気、表面からバクテリア、ウイルス、その他の有害微生物を除去するよう設計されており、環境にやさしく非常に効果的な消毒方法を提供しています。自治体、ヘルスケア施設、商業施設、工業施設では、厳しい規制基準を満たし、公衆衛生の安全性を高めるため、UV消毒装置の導入が進んでいます。UV-C LED、リアルタイムモニタリング、IoT対応システムの技術的進歩により、運用効率が向上し、消毒プロセスの遠隔管理が可能になっています。これらの技術革新は、手作業の必要性を減らし、安定した性能を確保し、全体的なメンテナンスコストの削減に貢献しています。廃水処理、飲料水浄化、空気殺菌におけるUVシステムの統合の拡大は、市場の急速な拡大にさらに寄与し、世界の健康と持続可能性の目標を支援しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | コンポーネント別、定格電力別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

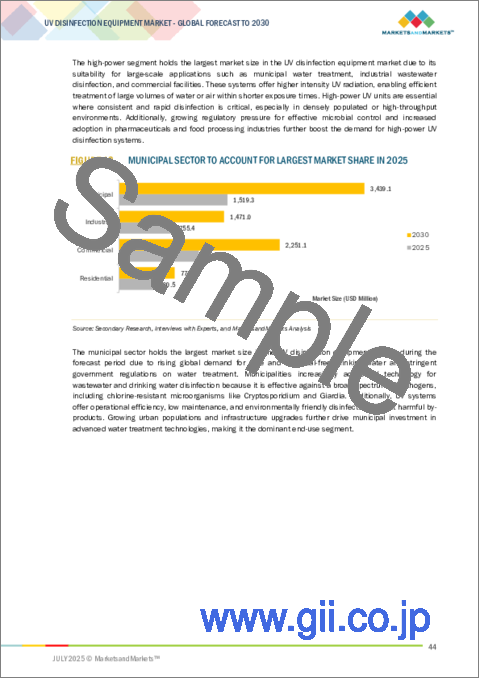

高出力セグメントは、大規模な自治体や産業施設での広範な使用、高い殺菌能力と効率、高流量水処理および空気処理での高い普及率により、予測期間中最大の市場規模を保持します。自治体や産業施設での広範な使用は、公衆衛生と操業の安全を維持するために大規模で継続的な殺菌を必要とするため、高い需要を生み出しています。このような高出力のUVシステムは、限られた時間内に大量の水や空気を殺菌するのに不可欠であり、厳しい政府規制や業界基準を確実に満たすために必要なものです。UVシステムは、より高い殺菌能力と効率を持っており、性能にばらつきがなく、様々な病原体を中和するのに適しています。さらに、UV照射を均一にするために高流量システムを管理する能力があるため、中核インフラ計画における高出力UVシステムの受け入れが確実になり、予測期間中の採用が促進されます。都市化と工業化の進展に伴い、大容量で効果的な殺菌ソリューションがより切実に必要とされるようになり、ハイパワーUVシステムの商業的地位はさらに強化されています。これらすべての要因が相まって、予測期間における同セグメントの市場シェアは圧倒的です。

UVランプは、中核的な消毒プロセスにおける重要な役割、限られた運用寿命による頻繁な交換要件、ランプ性能、効率、環境安全性を強化する技術進歩により、予測期間中に最高のCAGRで成長すると予測されています。UVランプの重要な役割は、すべてのUV殺菌システムにおいて均一な需要を確保することであり、UVランプは装置において不可欠でかけがえのないコンポーネントとなっています。UVランプは、不要な微生物を破壊する殺菌UV光の最初の光源であり、自治体、産業、住宅、ヘルスケア用途のシームレスなシステム運用に不可欠です。また、UVランプの運転寿命は9,000~1万2,000時間と限られており、システムの性能を維持するためには頻繁に交換する必要があります。このため、安定したアフターマーケット需要が生まれ、長期にわたって販売量が増加するリピート収益が生まれます。さらに、継続的な技術革新により、UVランプはより効率的で長持ちし、環境に優しいものとなっています。従来のランプに代わるUV-C LEDや水銀フリーのような技術は、エネルギー効率を高め、環境フットプリントを最小化しています。こうした改善により、エンドユーザーは既存システムの改修や、ポータブル機器やHVAC除染ユニットなどの新たな用途にUVランプを導入する意欲を高めています。これらの力がUVランプ分野の爆発的かつ持続的な拡大に大きな役割を果たしています。

アジア太平洋は、都市人口の増加と工業化、上下水道処理インフラ投資、公衆衛生意識の高まりと化学薬品を使わない消毒プロセスへのニーズの高まりにより、予測期間中に最高のCAGRで成長すると予測されています。この地域では、特に中国、インド、インドネシア、ベトナムなどの国々で、急速な都市化と工業化が進んでいます。その結果、水の使用量が増え、汚染物質も増加し、清潔で安全な水を供給するためにUVシステムのような効果的で信頼性の高い殺菌技術が求められています。これに対応するため、この地域の政府や民間企業は上下水道処理施設に多額の投資を行っており、自治体や産業プロセスにおけるUV消毒装置の大規模な導入が可能となっています。さらに、衛生の重要性や化学消毒剤による健康への脅威に対する一般市民の意識の高まりが、UVベースの化学薬品を使用しない技術への移行を早めています。これは特に住宅、商業、ヘルスケア市場で顕著であり、持続可能でユーザーフレンドリーな消毒技術への需要が高まっています。これらの要因も相まって、アジア太平洋地域はUV消毒装置市場において堅調かつ安定した成長を記録すると予測されており、予測期間においてアジア太平洋地域はUV消毒装置市場において最も急成長する地域市場となっています。

当レポートでは、世界のUV消毒装置市場について調査し、コンポーネント別、定格電力別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ

- 投資と資金調達のシナリオ

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- AI/生成AIがUV消毒装置市場に与える影響

- 2025年の米国関税がUV消毒装置市場に与える影響

- 主要関税率

- 価格影響分析

- 国/地域への影響

- エンドユーザーへの影響

第6章 UV消毒装置市場(コンポーネント別)

- イントロダクション

- UVランプ

- 反応室

- クォーツスリーブ

- コントローラーユニット

- その他

第7章 UV消毒装置市場(定格電力別)

- イントロダクション

- 低

- 中

- 高

第8章 UV消毒装置市場(用途別)

- イントロダクション

- 水と廃水の消毒

- プロセス水の消毒

- 空気消毒

- 表面消毒

第9章 UV消毒装置市場(エンドユーザー別)

- イントロダクション

- 住宅

- 商業

- 工業

- 自治体

第10章 UV消毒装置市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- オランダ

- 北欧

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- その他の地域:マクロ経済見通し

- 中東

- バーレーン

- クウェート

- オマーン

- カタール

- サウジアラビア

- アラブ首長国連邦

- アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2024年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- イントロダクション

- 主要参入企業

- XYLEM

- HALMA GROUP

- INDUSTRIE DE NORA S.P.A.

- DR. HONLE AG

- TROJAN TECHNOLOGIES GROUP ULC

- ATLANTIC ULTRAVIOLET CORPORATION

- ATLANTIUM TECHNOLOGIES LTD.

- ADVANCED UV, INC.

- AMERICAN ULTRAVIOLET

- LUMALIER

- その他の企業

- SEOUL VIOSYS CO., LTD.

- HITECH ULTRAVIOLET PVT. LTD.

- UVO3

- SUEZ WATER TECHNOLOGIES & SOLUTIONS

- UV PURE

- ALFAA UV

- LIT COMPANY

- ULTRAAQUA

- AUSTRALIAN ULTRAVIOLET SERVICES PTY. LTD.

- S.I.T.A, SRL

- NUUV

- INTEGRATED AQUA SYSTEMS, INC.

- AQUANETTO GROUP GMBH

- NECTAR SOLUTIONS

- AQUATIC SOLUTIONS

第13章 付録

List of Tables

- TABLE 1 UV DISINFECTION EQUIPMENT MARKET: RISK ASSESSMENT

- TABLE 2 AVERAGE SELLING PRICE TREND OF UV LAMPS, BY REGION, 2021-2024 (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF QUARTZ SLEEVES, BY REGION, 2021-2024 (USD)

- TABLE 4 AVERAGE SELLING PRICE OF UV LAMPS, BY KEY PLAYER, 2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE OF QUARTZ SLEEVES, BY KEY PLAYER, 2024 (USD)

- TABLE 6 ROLE OF COMPANIES IN UV DISINFECTION EQUIPMENT ECOSYSTEM

- TABLE 7 LIST OF MAJOR PATENTS, 2023-2024

- TABLE 8 IMPORT DATA FOR HS CODE 853949-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 853949-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 MFN TARIFFS FOR HS CODE 853949-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 UV DISINFECTION EQUIPMENT: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE END USERS

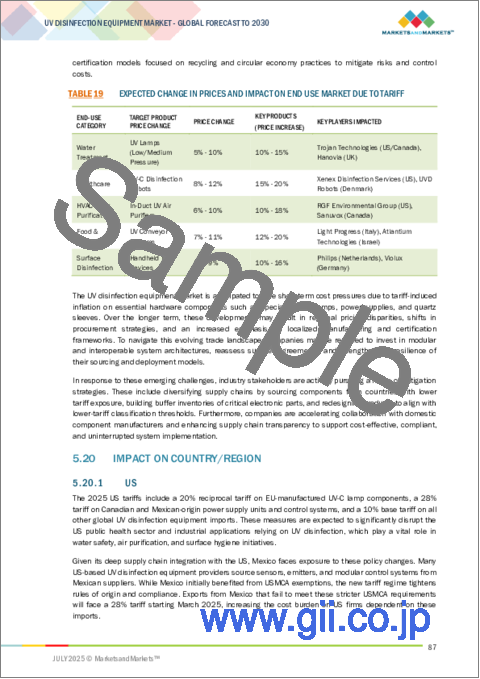

- TABLE 18 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 19 EXPECTED CHANGE IN PRICES AND IMPACT ON END USE MARKET DUE TO TARIFF

- TABLE 20 UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 21 UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 22 UV LAMP: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 23 UV LAMP: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 UV LAMP: UV DISINFECTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 25 UV LAMP: UV DISINFECTION EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 26 UV LAMP: UV DISINFECTION EQUIPMENT MARKET, 2021-2024 (MILLION UNITS)

- TABLE 27 UV LAMP: UV DISINFECTION EQUIPMENT MARKET, 2025-2030 (MILLION UNITS)

- TABLE 28 MERCURY UV LAMP: UV DISINFECTION EQUIPMENT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 29 MERCURY UV LAMP: UV DISINFECTION EQUIPMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 30 REACTOR CHAMBER: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 REACTOR CHAMBER: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 QUARTZ SLEEVE: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 QUARTZ SLEEVE: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 CONTROLLER UNIT: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 CONTROLLER UNIT: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 OTHER COMPONENTS: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 OTHER COMPONENTS: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 UV DISINFECTION EQUIPMENT MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 39 UV DISINFECTION EQUIPMENT MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 40 UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 41 UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 42 WATER & WASTEWATER DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 WATER & WASTEWATER DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 PROCESS WATER DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 PROCESS WATER DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 AIR DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 AIR DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 SURFACE DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 SURFACE DISINFECTION: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 51 UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 52 RESIDENTIAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 RESIDENTIAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 COMMERCIAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 COMMERCIAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 INDUSTRIAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 INDUSTRIAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 MUNICIPAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 MUNICIPAL: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 63 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 65 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY LAMPS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY LAMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 69 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 71 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 74 US: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 75 US: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 76 CANADA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 77 CANADA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 78 MEXICO: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 79 MEXICO: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 80 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 82 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 83 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 84 EUROPE: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 85 EUROPE: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 86 EUROPE: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY LAMPS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 87 EUROPE: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY LAMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 88 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 89 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 90 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 91 EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 92 UK: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 93 UK: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 94 GERMANY: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 95 GERMANY: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 96 FRANCE: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 97 FRANCE: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 98 ITALY: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 99 ITALY: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 100 NETHERLANDS: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 101 NETHERLANDS: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 102 NORDICS: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 103 NORDICS: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 104 REST OF EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 105 REST OF EUROPE: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 107 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 109 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 111 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY LAMPS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 113 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY LAMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 115 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 117 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 118 CHINA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 119 CHINA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 120 JAPAN: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 121 JAPAN: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 SOUTH KOREA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 123 SOUTH KOREA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 124 INDIA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 125 INDIA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 AUSTRALIA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 127 AUSTRALIA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 128 INDONESIA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 129 INDONESIA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 MALAYSIA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 131 MALAYSIA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 132 THAILAND: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 133 THAILAND: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 VIETNAM: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 135 VIETNAM: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 ROW: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 139 ROW: UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 140 ROW: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 141 ROW: UV DISINFECTION EQUIPMENT MARKET FOR UV LAMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 142 ROW: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY LAMPS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 143 ROW: UV DISINFECTION EQUIPMENT MARKET FOR MERCURY LAMPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 144 ROW: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 ROW: UV DISINFECTION EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 146 ROW: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 147 ROW: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 148 ROW: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 149 ROW: UV DISINFECTION EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 150 MIDDLE EAST: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 151 MIDDLE EAST: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 153 MIDDLE EAST: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 154 AFRICA: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 155 AFRICA: UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 156 AFRICA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 157 AFRICA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 158 SOUTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 159 SOUTH AMERICA: UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 160 UV DISINFECTION EQUIPMENT MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 161 UV DISINFECTION EQUIPMENT MARKET: MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- TABLE 162 UV DISINFECTION EQUIPMENT MARKET: REGION FOOTPRINT

- TABLE 163 UV DISINFECTION EQUIPMENT MARKET: COMPONENT FOOTPRINT

- TABLE 164 UV DISINFECTION EQUIPMENT MARKET: APPLICATION FOOTPRINT

- TABLE 165 UV DISINFECTION EQUIPMENT MARKET: END USER FOOTPRINT

- TABLE 166 UV DISINFECTION EQUIPMENT MARKET: LIST OF STARTUPS/SMES

- TABLE 167 UV DISINFECTION EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 168 UV DISINFECTION EQUIPMENT MARKET: PRODUCT LAUNCHES, JUNE 2021-APRIL 2025

- TABLE 169 UV DISINFECTION EQUIPMENT MARKET: DEALS, JUNE 2021-APRIL 2025

- TABLE 170 XYLEM: COMPANY OVERVIEW

- TABLE 171 XYLEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 XYLEM: DEALS

- TABLE 173 HALMA GROUP: COMPANY OVERVIEW

- TABLE 174 HALMA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 INDUSTRIE DE NORA S.P.A.: COMPANY OVERVIEW

- TABLE 176 INDUSTRIE DE NORA S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 INDUSTRIE DE NORA S.P.A.: DEALS

- TABLE 178 DR. HONLE AG: COMPANY OVERVIEW

- TABLE 179 DR. HONLE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 TROJAN TECHNOLOGIES GROUP ULC: COMPANY OVERVIEW

- TABLE 181 TROJAN TECHNOLOGIES GROUP ULC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 ATLANTIC ULTRAVIOLET CORPORATION: COMPANY OVERVIEW

- TABLE 183 ATLANTIC ULTRAVIOLET CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 184 ATLANTIC ULTRAVIOLET CORPORATION: PRODUCT LAUNCHES

- TABLE 185 ATLANTIUM TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 186 ATLANTIUM TECHNOLOGIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 ADVANCED UV, INC.: COMPANY OVERVIEW

- TABLE 188 ADVANCED UV, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 AMERICAN ULTRAVIOLET: COMPANY OVERVIEW

- TABLE 190 AMERICAN ULTRAVIOLET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 LUMALIER: COMPANY OVERVIEW

- TABLE 192 LUMALIER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 UV DISINFECTION EQUIPMENT MARKET AND REGIONAL SEGMENTATION

- FIGURE 2 UV DISINFECTION EQUIPMENT MARKET: RESEARCH DESIGN

- FIGURE 3 UV DISINFECTION EQUIPMENT MARKET: BOTTOM-UP APPROACH

- FIGURE 4 UV DISINFECTION EQUIPMENT MARKET: TOP-DOWN APPROACH

- FIGURE 5 UV DISINFECTION EQUIPMENT MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- FIGURE 6 UV DISINFECTION EQUIPMENT MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 7 UV DISINFECTION EQUIPMENT MARKET: DATA TRIANGULATION

- FIGURE 8 UV DISINFECTION EQUIPMENT MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 UV DISINFECTION EQUIPMENT MARKET SNAPSHOT

- FIGURE 10 UV LAMP SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 11 WATER & WASTEWATER DISINFECTION SEGMENT TO LEAD MARKET IN 2025

- FIGURE 12 HIGH POWER SEGMENT TO SECURE LARGEST MARKET SHARE IN 2025

- FIGURE 13 MUNICIPAL SECTOR TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 14 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 15 RISING ADOPTION OF UV-C LED AND ADVANCED DISINFECTION TECHNOLOGIES ACROSS INDUSTRIAL AND MUNICIPAL SECTORS TO DRIVE MARKET GROWTH

- FIGURE 16 UV LAMP TO HOLD MOST SIGNIFICANT MARKET SHARE IN 2030

- FIGURE 17 WATER & WASTEWATER DISINFECTION SEGMENT TO SECURE LARGEST MARKET SHARE IN 2030

- FIGURE 18 HIGH POWER RATING SEGMENT TO HOLD LARGEST MARKET SIZE IN 2030

- FIGURE 19 MUNICIPAL SECTOR TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 20 ASIA PACIFIC TO LEAD MARKET IN 2030

- FIGURE 21 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 22 UV DISINFECTION EQUIPMENT MARKET DYNAMICS

- FIGURE 23 IMPACT ANALYSIS OF DRIVERS ON UV DISINFECTION EQUIPMENT MARKET

- FIGURE 24 IMPACT ANALYSIS OF RESTRAINTS ON UV DISINFECTION EQUIPMENT MARKET

- FIGURE 25 IMPACT ANALYSIS OF OPPORTUNITIES IN UV DISINFECTION EQUIPMENT MARKET

- FIGURE 26 IMPACT ANALYSIS OF CHALLENGES ON UV DISINFECTION EQUIPMENT MARKET

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 AVERAGE SELLING PRICE TREND OF UV LAMPS, BY REGION, 2021-2024

- FIGURE 29 AVERAGE SELLING PRICE TREND OF QUARTZ SLEEVES, BY REGION, 2021-2024

- FIGURE 30 AVERAGE SELLING PRICE OF UV LAMPS, BY KEY PLAYER, 2024

- FIGURE 31 AVERAGE SELLING PRICE OF QUARTZ SLEEVES, BY KEY PLAYER, 2024

- FIGURE 32 VALUE CHAIN ANALYSIS

- FIGURE 33 ECOSYSTEM ANALYSIS

- FIGURE 34 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 35 IMPORT SCENARIO FOR HS CODE 853949-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 36 EXPORT DATA FOR HS CODE 853949-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 37 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 38 UV DISINFECTION EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 40 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 41 IMPACT OF AI/GEN AI ON UV DISINFECTION EQUIPMENT MARKET

- FIGURE 42 UV LAMP SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 43 MEDIUM SEGMENT TO RECORD HIGHEST CAGR IN 2030

- FIGURE 44 WATER & WASTEWATER DISINFECTION APPLICATION TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 45 MUNICIPAL SECTOR TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 46 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA: UV DISINFECTION EQUIPMENT MARKET SNAPSHOT

- FIGURE 48 EUROPE: UV DISINFECTION EQUIPMENT MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: UV DISINFECTION EQUIPMENT MARKET SNAPSHOT

- FIGURE 50 UV DISINFECTION EQUIPMENT MARKET SHARE ANALYSIS, 2024

- FIGURE 51 UV DISINFECTION EQUIPMENT MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 52 COMPANY VALUATION

- FIGURE 53 FINANCIAL METRICS

- FIGURE 54 UV DISINFECTION EQUIPMENT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 55 UV DISINFECTION EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 56 UV DISINFECTION EQUIPMENT MARKET: COMPANY FOOTPRINT

- FIGURE 57 UV DISINFECTION EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 58 XYLEM: COMPANY SNAPSHOT

- FIGURE 59 HALMA GROUP: COMPANY SNAPSHOT

- FIGURE 60 INDUSTRIE DE NORA S.P.A.: COMPANY SNAPSHOT

- FIGURE 61 DR. HONLE AG: COMPANY SNAPSHOT

The global UV Disinfection Equipment market UV disinfection equipment market was valued at USD 3.87 billion in 2025 and is projected to reach USD 7.94 billion by 2030, at a CAGR of 15.4% during the forecast period. With the growing awareness of waterborne diseases, increased focus on sanitation, and rising demand for chemical-free disinfection solutions, UV disinfection systems are gaining strong traction across various end-use sector. UV disinfection systems are gaining strong traction across various end-use sectors with the growing awareness of waterborne diseases, increased focus on sanitation, and rising demand for chemical-free disinfection solutions. These systems are designed to eliminate bacteria, viruses, and other harmful microorganisms from water, air, and surfaces using ultraviolet light, offering an environmentally friendly and highly effective disinfection method. Municipal bodies, healthcare facilities, commercial spaces, and industrial operations are progressively adopting UV disinfection equipment to meet strict regulatory standards and enhance public health safety. Technological advancements in UV-C LEDs, real-time monitoring, and IoT-enabled systems are improving operational efficiency and enabling remote management of disinfection processes. These innovations reduce the need for manual intervention, ensure consistent performance, and help lower overall maintenance costs. The growing integration of UV systems in wastewater treatment, drinking water purification, and air sterilization further contributes to the market's rapid expansion, supporting global health and sustainability goals.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, Power Rating, Application, End User, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"By Power Rating segment, the High power rating segment is expected to hold the largest market size share during the forecast period."

The high power segment holds the largest market size during the forecast period due to its extensive use in large municipal and industrial plants, higher disinfection capacity and efficiency, and higher penetration in high-flow water and air treatment applications. Extensive use in municipal and industrial facilities generates high demand since such applications need large-scale, continuous disinfection to maintain public health and operational safety. These UV systems of high power are essential in disinfecting huge amounts of water and air within limited time periods, something needed to ensure that the strict government regulations and industry standards are met. They have more disinfection capacity and efficiency, which makes them suitable for neutralizing a wide range of pathogens without any variability in performance, which makes them the best option for high-demand applications. Additionally, their capacity to manage high-flow systems for even distribution of UV exposure ensures higher acceptance of high-power UV systems in core infrastructure schemes, thus driving their adoption during the forecast period. With increasing urbanization and industrialization, high-capacity, effective disinfection solutions become more critically needed, further reinforcing the commercial position of high-power UV systems. All these factors combined lead to the dominant market share of the segment in the forecast period.

"By component segment, UV lamp is projected to grow at the highest CAGR during the forecast period."

UV Lamp is projected to grow at the highest CAGR during the forecast period due to its essential role in the core disinfection process, frequent replacement requirements due to limited operational lifespan, and technological advancements enhancing lamp performance, efficiency, and environmental safety. The critical role of UV lamps ensures uniform demand in all UV disinfection systems, making them an indispensable and irreplaceable component in the equipment. They are the first source of germicidal UV light that destroys unwanted microorganisms and are crucial for seamless system operation in municipal, industrial, residential, and healthcare applications. UV lamps also have a limited operation life of 9,000 to 12,000 hours and need to be replaced often to maintain system performance. This creates steady aftermarket demand and creates repeat revenue with growing sales volume over a long period. Furthermore, ongoing innovation is making UV lamps more efficient, longer-lasting, and environmentally friendly. Technologies like UV-C LEDs and mercury-free alternatives to traditional lamps are enhancing energy efficiency and minimizing environmental footprint. These improvements are motivating end users to retrofit existing systems and implement UV lamps in new applications such as portable devices and HVAC decontamination units. Together, these forces play a large role in the explosive and persistent expansion of the UV lamp segment.

"By region, Asia Pacific is anticipated to register the highest CAGR during the forecast period."

Asia Pacific is projected to grow at the highest CAGR during the forecast period, with increasing urban population and industrialization, water and wastewater treatment infrastructure investments, and rising public health consciousness and need for chemical-free disinfection processes. The area is witnessing rapid urbanization and industrialization, particularly in nations such as China, India, Indonesia, and Vietnam. This has resulted in higher water usage and greater amounts of contamination that demand effective and reliable disinfection technologies like UV systems to provide clean and safe water. In response, governments and private sector entities throughout the region are heavily investing in water and wastewater treatment facilities, enabling the massive adoption of UV disinfection equipment in municipal and industrial processes. In addition, increased public awareness of the importance of hygiene and health threats from chemical disinfectants is hastening the transition to UV-based, chemical-free technology. This is particularly strong in the residential, commercial, and healthcare markets, where demand for sustainable and user-friendly disinfection technologies is growing. Coupled with these factors, the region is anticipated to register robust and steady growth in the market for UV disinfection equipment, making Asia Pacific the fastest-growing regional market for UV disinfection equipment over the forecast period.

Extensive primary interviews were conducted with key industry experts in the UV disinfection equipment market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation -Directors - 50%, Managers - 30%, and Others - 20%

- By Region - Asia Pacific - 45%, Europe - 30%, North America - 20%, and RoW - 5%

The UV disinfection equipment market is dominated by a few globally established players, such as Xylem (US), Trojan Technologies Group ULC (UK), Halma Group (UK), Industrie De Nora S.p.A. (Italy), Atlantic Ultraviolet Corporation (US), Lumalier Corporation (US), Advanced UV, Inc. (US), American Ultraviolet (US), Honle AG (Germany), Atlantium Technologies Ltd (Israel), Seoul Viosys Co. Ltd. (South Korea), Hitech Ultraviolet Pvt Ltd. (India), UVO3 Ltd (UK), SUEZ Water Technologies & Solutions (US), UV Pure (US).

The study includes an in-depth competitive analysis of these key players in the UV Disinfection Equipment market, as well as their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the UV disinfection equipment market and forecasts its size by component (UV Lamps, Reactor Chambers, Quartz Sleeves, Controller Units, Other Components), power rating (Low, Medium, High), and application (Water and Wastewater Disinfection, Process Water Disinfection, Air Disinfection, Surface Disinfection). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes a value chain analysis of the key players and their competitive analysis in the UV Disinfection Equipment ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Rising demand for Non-Chemical Disinfection Methods, Increased awareness about water and airborne diseases, Extensive use of UV disinfection equipment in healthcare facilities for disinfecting hospital environment, Stringent government regulations and sanitation standards), restraints (Low cost of conventional disinfectants compared to UV lights, Limited penetration and shadowing effects, High initial investment costs), opportunities (Growing adoption of UV disinfection equipment for water and wastewater treatment worldwide, Rising demand for surface disinfection, Rise of UV disinfection in HVAC and air-purification systems), challenges (Expansion of UV disinfection equipment manufacturing facilities in short period of time, Technological Limitations in UV-C LED efficiency)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the UV Disinfection Equipment market

- Market Development: Comprehensive information about lucrative markets - the report analyses the UV disinfection equipment market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the UV Disinfection Equipment market

- Competitive Assessment: In-depth assessment of market shares, and growth strategies of leading players, such as Xylem (US), Trojan Technologies Group ULC (UK), Halma Group (UK), Industrie De Nora S.p.A. (Italy), Atlantic Ultraviolet Corporation (US), Lumalier Corporation (US), Advanced UV, Inc. (US), American Ultraviolet (US), Honle AG (Germany), Atlantium Technologies Ltd (Israel), Seoul Viosys Co. Ltd. (South Korea), Hitech Ultraviolet Pvt Ltd. (India), UVO3 Ltd (UK), SUEZ Water Technologies & Solutions (US), UV Pure (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key Industry Insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN UV DISINFECTION EQUIPMENT MARKET

- 4.2 UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT

- 4.3 UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION

- 4.4 UV DISINFECTION EQUIPMENT MARKET, BY POWER RATING

- 4.5 UV DISINFECTION EQUIPMENT MARKET, BY END USER

- 4.6 UV DISINFECTION EQUIPMENT MARKET, BY REGION

- 4.7 UV DISINFECTION EQUIPMENT MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for non-chemical disinfection methods

- 5.2.1.2 Increased awareness about waterborne and airborne diseases

- 5.2.1.3 Adoption of UV-C disinfection solutions in healthcare facilities

- 5.2.1.4 Stringency of government regulations and sanitation standards

- 5.2.2 RESTRAINTS

- 5.2.2.1 Preference for conventional disinfection methods due to low cost

- 5.2.2.2 Shadowing effects associated with UV-C light

- 5.2.2.3 High initial investment costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of UV disinfection equipment for water and wastewater treatment

- 5.2.3.2 Rising demand for surface disinfection

- 5.2.3.3 Integration of UV disinfection into HVAC and air-purification systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Procurement of specialized components within short timeframe

- 5.2.4.2 Technological limitations in UV-C LED efficiency

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF COMPONENTS, BY REGION (2021-2024)

- 5.4.2 AVERAGE SELLING PRICE OF COMPONENTS, BY KEY PLAYER, 2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Ultraviolet (UV) light technology

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Remote monitoring

- 5.7.2.2 Optical sensors

- 5.7.2.3 UV intensity meters

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Membrane filtration

- 5.7.3.2 Air filtration and HVAC systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 853949)

- 5.9.2 EXPORT DATA (HS CODE 853949)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDIES

- 5.11.1 NEW YORK CITY METRO HOSPITAL DEPLOYS UV DISINFECTION TO REDUCE HEALTHCARE-ASSOCIATED INFECTIONS

- 5.11.2 BEIJING METRO SYSTEM IMPLEMENTS UV AIR DISINFECTION IN HVAC SYSTEMS TO REDUCE MICROBIAL LOAD

- 5.11.3 FOOD PROCESSING PLANT IN GERMANY ENHANCES SAFETY WITH UV-C SURFACE DISINFECTION UNITS THAT IMPROVED COMPLIANCE WITH EU FOOD SAFETY STANDARDS

- 5.11.4 UAE INTERNATIONAL AIRPORT UTILIZES DEPLOYED AUTONOMOUS UV-C DISINFECTION ROBOTS IN TERMINALS

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS (HS CODE 853949)

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREATS OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 MPACT OF AI/GEN AI ON UV DISINFECTION EQUIPMENT MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON UV DISINFECTION EQUIPMENT MARKET

- 5.17.1 INTRODUCTION

- 5.18 KEY TARIFF RATES

- 5.19 PRICE IMPACT ANALYSIS

- 5.20 IMPACT ON COUNTRY/REGION

- 5.20.1 US

- 5.20.2 EUROPE

- 5.20.3 ASIA PACIFIC

- 5.21 IMPACT ON END USERS

6 UV DISINFECTION EQUIPMENT MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 UV LAMP

- 6.2.1 MERCURY UV LAMP

- 6.2.1.1 Low-pressure mercury UV lamp

- 6.2.1.1.1 Rising deployment in small to medium-scale applications due to low power consumption to drive market

- 6.2.1.2 Medium-pressure mercury UV lamp

- 6.2.1.2.1 Growing application in large-scale municipal water treatment, wastewater disinfection, and industrial processing to fuel market growth

- 6.2.1.3 Amalgam mercury UV lamp

- 6.2.1.3.1 Less sensitivity to ambient temperature fluctuations to foster market growth

- 6.2.1.1 Low-pressure mercury UV lamp

- 6.2.2 UV LED

- 6.2.2.1 Increasing regulatory pressure to phase out mercury to support market growth

- 6.2.1 MERCURY UV LAMP

- 6.3 REACTOR CHAMBER

- 6.3.1 INTEGRATION WITH SMART MONITORING SYSTEMS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 6.4 QUARTZ SLEEVE

- 6.4.1 GROWING FOCUS ON ENHANCING SLEEVE MATERIAL PURITY AND ANTI-FOULING COATINGS TO FUEL MARKET GROWTH

- 6.5 CONTROLLER UNIT

- 6.5.1 INTEGRATION WITH IOT PLATFORMS AND AI TO BOOST DEMAND

- 6.6 OTHER COMPONENTS

7 UV DISINFECTION EQUIPMENT MARKET, BY POWER RATING

- 7.1 INTRODUCTION

- 7.2 LOW

- 7.2.1 INTEGRATION WITH IOT AND MOBILE APPS FOR REMOTE MONITORING AND CONTROL TO DRIVE MARKET

- 7.3 MEDIUM

- 7.3.1 GROWING NEED FOR ROBUST AND RELIABLE DISINFECTION SYSTEMS IN HIGH-TRAFFIC PUBLIC SPACES TO FUEL MARKET GROWTH

- 7.4 HIGH

- 7.4.1 INCREASING GOVERNMENTAL FUNDING FOR INFRASTRUCTURE MODERNIZATION TO BOOST DEMAND

8 UV DISINFECTION EQUIPMENT MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 WATER & WASTEWATER DISINFECTION

- 8.2.1 INCREASING DEMAND FOR ENVIRONMENTALLY FRIENDLY WATER TREATMENT SOLUTIONS TO FUEL MARKET GROWTH

- 8.3 PROCESS WATER DISINFECTION

- 8.3.1 GROWING DEMAND FOR HIGH-PURITY WATER ACROSS VARIOUS INDUSTRIES TO FOSTER MARKET GROWTH

- 8.4 AIR DISINFECTION

- 8.4.1 INCREASING AWARENESS ABOUT AIRBORNE DISEASES TO SUPPORT MARKET GROWTH

- 8.5 SURFACE DISINFECTION

- 8.5.1 RISING CONCERNS OVER HYGIENE AND INFECTION CONTROL TO BOOST DEMAND

9 UV DISINFECTION EQUIPMENT MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 RESIDENTIAL

- 9.2.1 GROWING AWARENESS REGARDING HOME HYGIENE AND INDOOR AIR QUALITY TO BOLSTER MARKET GROWTH

- 9.3 COMMERCIAL

- 9.3.1 INCREASING NEED FOR SAFE ENVIRONMENTS IN HIGH-FOOTFALL SPACES TO FOSTER MARKET GROWTH

- 9.4 INDUSTRIAL

- 9.4.1 INTEGRATION OF INDUSTRY 4.0 TO FUEL MARKET GROWTH

- 9.5 MUNICIPAL

- 9.5.1 PUSH TOWARD SUSTAINABLE URBAN DEVELOPMENT TO SUPPORT MARKET GROWTH

10 UV DISINFECTION EQUIPMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.2.1 Increasing demand for chemical-free disinfection to foster market growth

- 10.2.3 CANADA

- 10.2.3.1 Ongoing technological innovations in energy-efficient UV LEDs to fuel market growth

- 10.2.4 MEXICO

- 10.2.4.1 Rising concerns over waterborne diseases to support market growth

- 10.3 EUROPE

- 10.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.2 UK

- 10.3.2.1 Integration of AI-enabled UV-C systems and IoT-based monitoring to fuel market growth

- 10.3.3 GERMANY

- 10.3.3.1 Stringent environmental regulations to foster market growth

- 10.3.4 FRANCE

- 10.3.4.1 Rising emphasis on energy-efficient and chemical-free sanitization solutions to support market growth

- 10.3.5 ITALY

- 10.3.5.1 Growing environmental awareness and stringent water quality regulations to boost demand

- 10.3.6 NETHERLANDS

- 10.3.6.1 Deployment of innovative solutions for water treatment and reuse to support market growth

- 10.3.7 NORDICS

- 10.3.7.1 Increasing investment in advanced disinfection technologies to propel market growth

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Rising emphasis on modernizing sanitation infrastructure to boost demand

- 10.4.3 JAPAN

- 10.4.3.1 Increasing demand for reliable sterilization methods in healthcare and public infrastructure to foster market growth

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Growing concerns regarding microbial contamination in water, air, and surfaces to support market growth

- 10.4.5 INDIA

- 10.4.5.1 Improved access to clean water and sanitation across urban and rural regions to fuel market growth

- 10.4.6 AUSTRALIA

- 10.4.6.1 National focus on environmental sustainability and public health protection to boost demand

- 10.4.7 INDONESIA

- 10.4.7.1 Rapid urbanization and industrial expansion to offer lucrative growth opportunities

- 10.4.8 MALAYSIA

- 10.4.8.1 Government-led initiatives to improve water quality and sanitation to support market growth

- 10.4.9 THAILAND

- 10.4.9.1 Rising adoption of disinfection technologies to boost demand

- 10.4.10 VIETNAM

- 10.4.10.1 Rapid growth in hospitality and food processing sectors to propel market growth

- 10.4.11 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 ROW: MACROECONOMIC OUTLOOK

- 10.5.2 MIDDLE EAST

- 10.5.3 BAHRAIN

- 10.5.3.1 Growing demand for sustainable and efficient water treatment solutions to foster market growth

- 10.5.4 KUWAIT

- 10.5.4.1 Rising awareness of safe disinfection technologies and supportive regulatory measures to support market growth

- 10.5.5 OMAN

- 10.5.5.1 Integration of UV disinfection technologies in water treatment plants, hospitals, and public utilities to foster market growth

- 10.5.6 QATAR

- 10.5.6.1 Emphasis on enhancing public health, water security, and environmental sustainability to boost demand

- 10.5.7 SAUDI ARABIA

- 10.5.7.1 Commitment to sustainable resource management and regulatory upgrades to fuel market growth

- 10.5.8 UAE

- 10.5.8.1 Growing public-private partnerships to strengthen market growth

- 10.5.8.2 Rest of Middle East

- 10.5.9 AFRICA

- 10.5.9.1 Increasing focus on modernizing water infrastructure to drive market

- 10.5.10 SOUTH AMERICA

- 10.5.10.1 Growing adoption of UV disinfection systems in urban water treatment facilities and remote communities to drive market

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2020-2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Component footprint

- 11.7.5.4 Application footprint

- 11.7.5.5 End user footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 List of startups/SMEs

- 11.8.5.2 Competitive benchmarking of startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 XYLEM

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths/Right to win

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses/Competitive threats

- 12.2.2 HALMA GROUP

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 MnM view

- 12.2.2.3.1 Key strengths/Right to win

- 12.2.2.3.2 Strategic choices

- 12.2.2.3.3 Weaknesses/Competitive threats

- 12.2.3 INDUSTRIE DE NORA S.P.A.

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Deals

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths/Right to win

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses/Competitive threats

- 12.2.4 DR. HONLE AG

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 MnM view

- 12.2.4.3.1 Key strengths/Right to win

- 12.2.4.3.2 Strategic choices

- 12.2.4.3.3 Weaknesses/Competitive threats

- 12.2.5 TROJAN TECHNOLOGIES GROUP ULC

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 MnM view

- 12.2.5.3.1 Key strengths/Right to win

- 12.2.5.3.2 Strategic choices

- 12.2.5.3.3 Weaknesses/Competitive threats

- 12.2.6 ATLANTIC ULTRAVIOLET CORPORATION

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Product launches

- 12.2.7 ATLANTIUM TECHNOLOGIES LTD.

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.8 ADVANCED UV, INC.

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.9 AMERICAN ULTRAVIOLET

- 12.2.9.1 Business overview

- 12.2.9.2 Products/Solutions/Services offered

- 12.2.10 LUMALIER

- 12.2.10.1 Business overview

- 12.2.10.2 Products/Solutions/Services offered

- 12.2.1 XYLEM

- 12.3 OTHER PLAYERS

- 12.3.1 SEOUL VIOSYS CO., LTD.

- 12.3.2 HITECH ULTRAVIOLET PVT. LTD.

- 12.3.3 UVO3

- 12.3.4 SUEZ WATER TECHNOLOGIES & SOLUTIONS

- 12.3.5 UV PURE

- 12.3.6 ALFAA UV

- 12.3.7 LIT COMPANY

- 12.3.8 ULTRAAQUA

- 12.3.9 AUSTRALIAN ULTRAVIOLET SERVICES PTY. LTD.

- 12.3.10 S.I.T.A, SRL

- 12.3.11 NUUV

- 12.3.12 INTEGRATED AQUA SYSTEMS, INC.

- 12.3.13 AQUANETTO GROUP GMBH

- 12.3.14 NECTAR SOLUTIONS

- 12.3.15 AQUATIC SOLUTIONS

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS