|

|

市場調査レポート

商品コード

1562280

陸上防衛用慣性センサーの2030年までの欧州の市場予測- 地域別分析- 技術別、用途別Europe Inertial Sensor for Land Defense Systems Market Forecast to 2030 - Regional Analysis - by Technology and Application |

||||||

|

|||||||

| 陸上防衛用慣性センサーの2030年までの欧州の市場予測- 地域別分析- 技術別、用途別 |

|

出版日: 2024年07月04日

発行: The Insight Partners

ページ情報: 英文 88 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州の陸上防衛システム用慣性センサー市場は、2022年に2億4,678万米ドルと評価され、2030年には3億7,607万米ドルに達すると予測され、2022~2030年のCAGRは5.4%を記録すると予測されています。

MEMS技術の進歩が欧州の陸上防衛システム用慣性センサー市場を後押し

微小電気機械システム(MEMS)とは、微視的なセンサー、アクチュエーター、トランスデューサーを製造し、微視的なスケールで機械部品を動かすことを指します。陸上防衛システム用の慣性センサーにMEMS技術を活用することで、その応用範囲が広がっています。MEMS技術は、慣性センサーを微視的スケールで製造することを可能にし、無人地上車両や兵士着用デバイスなどの小型陸上防衛システムへの統合を可能にします。さらに、MEMS技術の採用はセンサー製造のコスト削減につながり、慣性センサーをより身近で手頃なものにしました。MEMSベースの慣性センサーは、高感度、高精度、安定性などの優れた性能特性を備えており、陸上防衛システムにおける精密なモーションセンシングやナビゲーションへの適性を高めています。例えば、2023年9月、航空宇宙・防衛産業向け慣性ナビゲーションソリューションの大手プロバイダーであるEMCORE Corporationは、TAC-440 MEMS慣性計測ユニット(IMU)の発売を発表しました。このIMUは、世界最小の1°/時IMUとして認められており、5立方インチ以下の超小型パッケージで提供されます。さらに、TAC-440はHoneywell 1930と4930 IMUをより高性能に置き換えるように設計されており、形態、フィット感、機能の互換性が改善されています。全体として、EMCORE CorporationによるTAC-440 MEMS慣性計測ユニットの導入は、慣性航法技術のセグメントにおける大きな進歩を意味します。その小型サイズ、コスト効率、性能の向上、統合の可能性、大量生産能力により、様々な陸上防衛用途において貴重な資産となります。MEMS技術はまた、複数のセンサーを1つのチップに統合することを可能にし、多軸モーションセンシング機能を記載しています。さらに、MEMS技術の大量生産能力は、陸上防衛システムにおける慣性センサーの普及に大きく貢献しています。このように、MEMS技術の進歩は慣性センサーの小型化、コスト削減、性能向上に大きな影響を与えており、これが市場を牽引しています。

欧州の陸上防衛システム用慣性センサー市場概要

欧州市場は、ドイツ、フランス、イタリア、英国、ロシア、その他の欧州に区分されます。陸上防衛システム用慣性センサー市場は、欧州で大幅な成長を遂げています。欧州は軍事基盤が大きいです。欧州防衛庁(EDA)は、相互運用性と効率性を高めるための能力計画、共同訓練、技術研究などのセグメントで加盟国を支援しています。例えば、EDAの活動は、主戦力戦車や装甲車、歩兵戦闘車などの軍事・艦隊部品の共同近代化、アップグレード、購入を通じて、より首尾一貫した欧州の能力状況へと変化する加盟国を支援することに重点を置いています。さらにEDAは、加盟国が軍事的機動性を高める活動を追求することを支援します。EU域内と域外における兵力の機動性の向上は、CSDPミッションや作戦、国内と多国間の活動の双方において、EU加盟国が自国の防衛ニーズと責任に沿った迅速な行動を可能にすることにより、欧州の安全保障を強化します。KNDSは、陸上防衛における欧州のリーダーの一社です。その製品群には、主力戦車、砲兵システム、装甲車、兵器システム(ロボット工学、弾薬、軍用橋梁、訓練ソリューション、戦闘管理システム、保護ソリューションを含む)、幅広い装備が含まれます。

欧州には、今後予定されている陸上防衛プロジェクトがいくつかあります。例えば、2024年1月、欧州委員会は、欧州連合軍の連携能力を向上させるため、タレスがコーディネートする陸上戦術連携戦闘(LATACC)プロジェクトを立ち上げるための助成契約に調印しました。LATACCプロジェクトには、欧州13カ国の34の産業界と研究機関(コアチームメンバーであるThales、Rheinmetall、Leonardo、Indra、Saab、ISD、John Cockerill Defenseを含む)が参加しています。欧州委員会は、欧州防衛基金(European Defence Fund)から5,337万米ドルの資金を得て、このプロジェクトに資金を提供しています。このように、慣性センサーは欧州の近代陸戦において重要な要素であり、最も厳しい環境においても、ナビゲーション、照準、プラットフォームの安定化に不可欠なデータを記載しています。したがって、上記のパラメータにより、陸上防衛システム用慣性センサー市場はこの地域で成長しています。

欧州の陸上防衛システム用慣性センサー市場の収益と2030年までの予測(金額)

欧州の陸上防衛システム用慣性センサー市場細分化

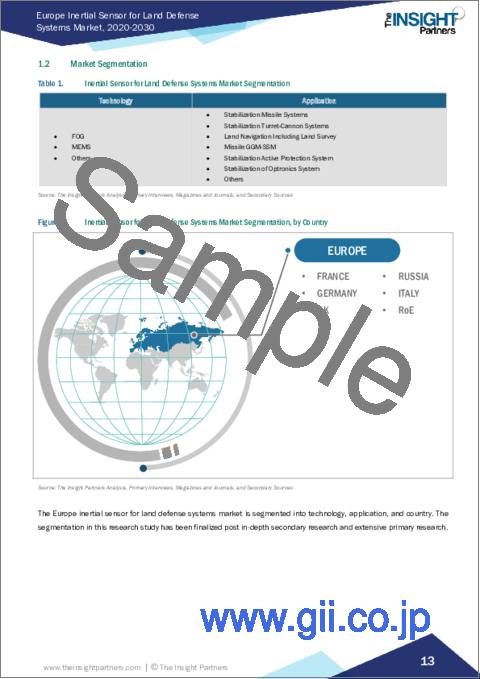

欧州の陸上防衛システム用慣性センサー市場は、技術、用途、国に分類されます。

技術別では、欧州の陸上防衛システム用慣性センサー市場は、FOG、MEMS、その他に分類されます。2022年にはFOGセグメントが最大の市場シェアを占めています。

用途別では、欧州の陸上防衛システム用慣性センサー市場は、安定化ミサイルシステム、安定化砲塔/大砲システム、陸上測量を含む陸上ナビゲーション、ミサイルGGM/SSM、安定化アクティブ保護システム、オプトロニックシステムの安定化、その他に区分されます。2022年には、安定化ミサイルシステムセグメントが最大の市場シェアを占めました。

国別では、欧州の陸上防衛システム用慣性センサー市場は、英国、フランス、ロシア、ドイツ、イタリア、その他の欧州に区分されます。2022年の欧州陸上防衛システム用慣性センサー市場シェアは英国が独占しています。

Collins Aerospace、Advanced Navigation Pty Ltd、Honeywell International Inc、Northrop Grumman Corp、SBG Systems SAS、Thales SA、GEM Elettronica SRL、Exail SASは、欧州の陸上防衛システム用慣性センサー市場で事業展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 陸上防衛システム用慣性センサー市場情勢

- イントロダクション

- PEST分析

- エコシステム分析

- コンポーネントサプライヤー

- メーカー

- ディストリビューター/サプライヤー

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 陸上防衛システム用慣性センサーの欧州市場:主要市場力学

- 陸上防衛システム用慣性センサー市場-主要市場力学

- 市場促進要因

- MEMS技術の進歩

- 兵器システムの信頼性重視

- 市場抑制要因

- 技術的限界

- 市場機会

- 政府のイニシアチブの高まりが機会を提供

- 戦場におけるGNSSスプーフィングとジャミングの脅威

- 今後の動向

- 慣性センサーと他のセンサー技術の統合

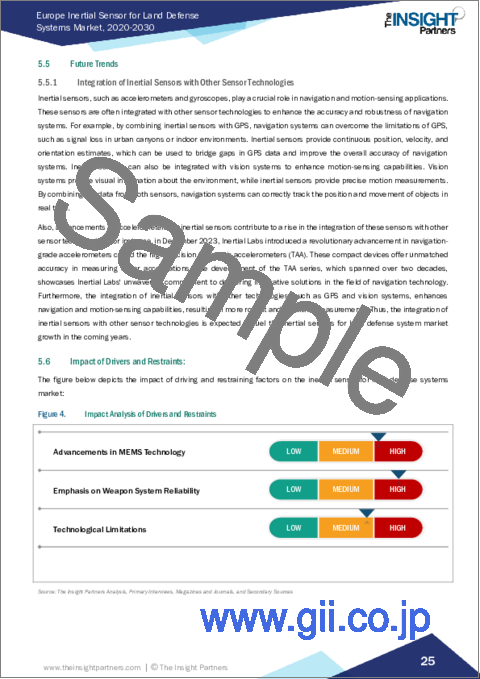

- 促進要因と阻害要因の影響

第6章 陸上防衛システム用慣性センサー市場-欧州市場分析

- 陸上防衛システム用慣性センサー市場収益(2020~2030年)

- 陸上防衛システム用慣性センサー市場予測分析

第7章 欧州陸上防衛システム用慣性センサー市場分析-技術別

- FOG

- MEMS

- その他

第8章 欧州陸上防衛システム用慣性センサー市場分析-用途別

- 安定化ミサイルシステム

- 安定化砲塔砲システム

- 陸上測量を含む陸上ナビゲーション

- ミサイルGGM-SSM

- 安定化アクティブ保護システム

- オプトロニクスシステムの安定化

- その他

第9章 欧州陸上防衛システム用慣性センサー市場:国別分析

- 欧州市場概要

- 欧州

- 英国

- フランス

- ロシア

- ドイツ

- イタリア

- その他の欧州

- 欧州

第10章 競合情勢

- 企業のポジショニングと集中度

- 主要参入企業別ヒートマップ分析

第11章 業界情勢

- イントロダクション

- 市場イニシアティブ

- 製品ニュース&企業ニュース

- コラボレーションとM&A

第12章 企業プロファイル

- Collins Aerospace

- Advanced Navigation Pty Ltd

- Honeywell International Inc

- Northrop Grumman Corp

- SBG Systems SAS

- Thales SA

- GEM Elettronica SRL

- Exail SAS

第13章 付録

List Of Tables

- Table 1. Inertial Sensor for Land Defense Systems Market Segmentation

- Table 2. List of Vendors

- Table 3. Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Table 4. Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Technology

- Table 5. Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 6. Europe: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Country

- Table 7. United Kingdom: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Technology

- Table 8. United Kingdom: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 9. France: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Technology

- Table 10. France: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 11. Russia: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Technology

- Table 12. Russia: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 13. Germany: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Technology

- Table 14. Germany: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 15. Italy: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Technology

- Table 16. Italy: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 17. Rest of Europe: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Technology

- Table 18. Rest of Europe: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 19. Company Positioning & Concentration

- Table 20. List of Abbreviation

List Of Figures

- Figure 1. Inertial Sensor for Land Defense Systems Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Ecosystem: Inertial Sensor for Land Defense Systems Market

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Inertial Sensor for Land Defense Systems Market Revenue (US$ Million), 2020-2030

- Figure 6. Inertial Sensor for Land Defense Systems Market Share (%) - by Technology (2022 and 2030)

- Figure 7. FOG: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. MEMS: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Others: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Inertial Sensor for Land Defense Systems Market Share (%) - by Application (2022 and 2030)

- Figure 11. Stabilization Missile Systems: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Stabilization Turret-Cannon Systems: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Land Navigation Including Land Survey: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Missile GGM-SSM: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Stabilization Active Protection System: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Stabilization of Optronics System: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Others: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Europe: Inertial Sensor for Land Defense Systems Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 19. Europe: Inertial Sensor for Land Defense Systems Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 20. United Kingdom: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. France: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Russia: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Germany: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Italy: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 25. Rest of Europe: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 26. Heat Map Analysis By Key Players

The Europe inertial sensors for land defense system market was valued at US$ 246.78 million in 2022 and is expected to reach US$ 376.07 million by 2030; it is estimated to record a CAGR of 5.4% from 2022 to 2030.

Advancements in MEMS Technology Fuel Europe inertial sensors for land defense system market

Microelectromechanical Systems (MEMS) refers to the fabrication of microscopic sensors, actuators, and transducers with moving mechanical parts at the microscopic scale. The utilization of MEMS technology in inertial sensors for land defense systems has expanded their range of applications. MEMS technology enables the production of inertial sensors on a microscopic scale, allowing for their integration into smaller land defense systems such as unmanned ground vehicles and soldier-worn devices. Additionally, the adoption of MEMS technology has led to cost reduction in sensor manufacturing, making inertial sensors more accessible and affordable. MEMS-based inertial sensors offer superior performance characteristics, including high sensitivity, accuracy, and stability, enhancing their suitability for precise motion sensing and navigation in land defense systems. For instance, in September 2023, EMCORE Corporation, a leading provider of inertial navigation solutions to the aerospace & defense industry, announced the launch of the TAC-440 MEMS Inertial Measurement Unit (IMU). This IMU is recognized as the world's smallest 1°/hour IMU and is available in an ultra-compact package of less than 5 cubic inches. Furthermore, the TAC-440 is designed to be a higher-performance replacement for the Honeywell 1930 and 4930 IMUs, offering improved form, fit, and function compatibility. Overall, the introduction of the TAC-440 MEMS Inertial Measurement Unit by EMCORE Corporation represents a significant advancement in the field of inertial navigation technology. Its small size, cost-effectiveness, improved performance, integration possibilities, and mass production capability make it a valuable asset for various land defense applications. MEMS technology also enables the integration of multiple sensors on a single chip, providing multi-axis motion sensing capabilities. Furthermore, the mass production capability of MEMS technology has substantially contributed to the widespread adoption of inertial sensors in land defense systems. Thus, advancements in MEMS technology have had a significant impact on the miniaturization, cost reduction, and improved performance of inertial sensors, which drives the market.

Europe inertial sensors for land defense system market overview

The market in Europe is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The inertial sensors for land defense systems market is witnessing substantial growth in Europe. Europe has a significant military base. The European Defense Agency (EDA) supports member states in areas such as capability planning, joint training, and technological research to increase interoperability and efficiency. For example, EDA's activities emphasize supporting member states in changing toward a more coherent European ability landscape through the collaborative modernization, upgrading, and purchase of military and fleet components such as main battle tanks and armored or infantry fighting vehicles. In addition, EDA supports Member States in pursuing activities that enhance military mobility. Better mobility of forces within and beyond the EU strengthens European security by enabling the EU member states to act faster, in line with their defense needs and responsibilities, both in the context of CSDP missions and operations and national and multinational activities. KNDS is among the European leaders in land defense. Its product range includes main battle tanks, artillery systems, armored vehicles, weapons systems (including robotics, ammunition, military bridges, training solutions, battle management systems, and protection solutions), and a wide range of equipment.

There are several upcoming land defense projects in Europe. For instance, in January 2024, The European Commission signed a grant agreement to launch the Land Tactical Collaborative Combat (LATACC) project coordinated by Thales to improve the collaborative capabilities of European coalition forces. The LATACC project brings together 34 industry players and research institutes (including core team members Thales, Rheinmetall, Leonardo, Indra, Saab, ISD, and John Cockerill Defense) from 13 European countries. The European Commission finances the project with US$ 53.37 million of funding from the European Defence Fund. Thus, inertial sensors are a critical component of modern land warfare in Europe, providing essential data for navigation, targeting, and platform stabilization in even the most challenging environments. Therefore, owing to the above parameters, the inertial sensors for land defense systems market is growing in the region.

Europe inertial sensors for land defense system market revenue and forecast to 2030 (US$ Million)

Europe inertial sensors for land defense system market segmentation

The Europe inertial sensors for land defense system market is categorized into technology, application, and country.

Based on technology, the Europe inertial sensors for land defense system market is categorized into FOG, MEMS, and others. The FOG segment held the largest market share in 2022.

In terms of application, the Europe inertial sensors for land defense system market is segmented into stabilization missile systems, stabilization turret/ cannon systems, land navigation including land survey, missile GGM/ SSM, stabilization active protection systems, stabilization of optronic systems, and others. The stabilization missile systems segment held the largest market share in 2022.

By country, the Europe inertial sensors for land defense system market is segmented into the UK, France, Russia, Germany, Italy, and the Rest of Europe. The UK dominated the Europe inertial sensors for land defense system market share in 2022.

Collins Aerospace, Advanced Navigation Pty Ltd, Honeywell International Inc, Northrop Grumman Corp, SBG Systems SAS, Thales SA, GEM Elettronica SRL, and Exail SAS are among the leading companies operating in the Europe inertial sensors for land defense system market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Inertial Sensor for Land Defense Systems Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 Component Suppliers

- 4.3.2 Manufacturers

- 4.3.3 Distributors/Suppliers

- 4.3.4 End Users

- 4.3.5 List of Vendors in the Value Chain

5. Europe Inertial Sensor for Land Defense Systems Market - Key Market Dynamics

- 5.1 Inertial Sensor for Land Defense Systems Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Advancements in MEMS Technology

- 5.2.2 Emphasis on Weapon System Reliability

- 5.3 Market Restraints

- 5.3.1 Technological Limitations

- 5.4 Market Opportunities

- 5.4.1 Rise in Government Initiatives Provides Opportunities

- 5.4.2 Threats of GNSS Spoofing and Jamming on Battlefields

- 5.5 Future Trends

- 5.5.1 Integration of Inertial Sensors with Other Sensor Technologies

- 5.6 Impact of Drivers and Restraints:

6. Inertial Sensor for Land Defense Systems Market - Europe Market Analysis

- 6.1 Inertial Sensor for Land Defense Systems Market Revenue (US$ Million), 2020-2030

- 6.2 Inertial Sensor for Land Defense Systems Market Forecast Analysis

7. Europe Inertial Sensor for Land Defense Systems Market Analysis - by Technology

- 7.1 FOG

- 7.1.1 Overview

- 7.1.2 FOG: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 MEMS

- 7.2.1 Overview

- 7.2.2 MEMS: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Others

- 7.3.1 Overview

- 7.3.2 Others: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

8. Europe Inertial Sensor for Land Defense Systems Market Analysis - by Application

- 8.1 Stabilization Missile Systems

- 8.1.1 Overview

- 8.1.2 Stabilization Missile Systems: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Stabilization Turret-Cannon Systems

- 8.2.1 Overview

- 8.2.2 Stabilization Turret-Cannon Systems: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Land Navigation Including Land Survey

- 8.3.1 Overview

- 8.3.2 Land Navigation Including Land Survey: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Missile GGM-SSM

- 8.4.1 Overview

- 8.4.2 Missile GGM-SSM: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Stabilization Active Protection System

- 8.5.1 Overview

- 8.5.2 Stabilization Active Protection System: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 8.6 Stabilization of Optronics System

- 8.6.1 Overview

- 8.6.2 Stabilization of Optronics System: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 8.7 Others

- 8.7.1 Overview

- 8.7.2 Others: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

9. Europe Inertial Sensor for Land Defense Systems Market - Country Analysis

- 9.1 Europe Market Overview

- 9.1.1 Europe: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast Analysis - by Country

- 9.1.1.1 Europe: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast Analysis - by Country

- 9.1.1.2 United Kingdom: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.2.1 United Kingdom: Inertial Sensor for Land Defense Systems Market Breakdown, by Technology

- 9.1.1.2.2 United Kingdom: Inertial Sensor for Land Defense Systems Market Breakdown, by Application

- 9.1.1.3 France: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.3.1 France: Inertial Sensor for Land Defense Systems Market Breakdown, by Technology

- 9.1.1.3.2 France: Inertial Sensor for Land Defense Systems Market Breakdown, by Application

- 9.1.1.4 Russia: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.4.1 Russia: Inertial Sensor for Land Defense Systems Market Breakdown, by Technology

- 9.1.1.4.2 Russia: Inertial Sensor for Land Defense Systems Market Breakdown, by Application

- 9.1.1.5 Germany: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.5.1 Germany: Inertial Sensor for Land Defense Systems Market Breakdown, by Technology

- 9.1.1.5.2 Germany: Inertial Sensor for Land Defense Systems Market Breakdown, by Application

- 9.1.1.6 Italy: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.6.1 Italy: Inertial Sensor for Land Defense Systems Market Breakdown, by Technology

- 9.1.1.6.2 Italy: Inertial Sensor for Land Defense Systems Market Breakdown, by Application

- 9.1.1.7 Rest of Europe: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.7.1 Rest of Europe: Inertial Sensor for Land Defense Systems Market Breakdown, by Technology

- 9.1.1.7.2 Rest of Europe: Inertial Sensor for Land Defense Systems Market Breakdown, by Application

- 9.1.1 Europe: Inertial Sensor for Land Defense Systems Market - Revenue and Forecast Analysis - by Country

10. Competitive Landscape

- 10.1 Company Positioning & Concentration

- 10.2 Heat Map Analysis By Key Players

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Product News & Company News

- 11.4 Collaboration and Mergers & Acquisitions

12. Company Profiles

- 12.1 Collins Aerospace

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Advanced Navigation Pty Ltd

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Honeywell International Inc

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Northrop Grumman Corp

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 SBG Systems SAS

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Thales SA

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 GEM Elettronica SRL

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Exail SAS

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

13. Appendix

- 13.1 Word Index