|

|

市場調査レポート

商品コード

1769080

ファシリティマネジメントの世界市場:オファリング別、ソリューション別、サービス別、業界別、地域別 - 2030年までの予測Facility Management Market by Offering (Solutions (IWMS, BIM, Facility Operations & Security Management) and Services), Vertical (BFSI, Retail, Construction & Real Estate, Healthcare & Life Sciences), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ファシリティマネジメントの世界市場:オファリング別、ソリューション別、サービス別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月07日

発行: MarketsandMarkets

ページ情報: 英文 319 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ファシリティマネジメントの市場規模は、2025年に610億8,000万米ドル、2030年には1,385億米ドルに達すると推定され、2025年から2030年までのCAGRは17.8%と見込まれています。

市場成長の原動力となっているのは、業務効率とリアルタイムのデータ洞察を組み合わせたインテリジェント設備システムの普及です。組織が安全性、持続可能性、効率的なワークスペース管理を優先する中、IWMS、BIM、HVAC制御用プラットフォーム、ビデオ監視、緊急対応などの統合ソリューションが急速に導入されています。スマートインフラの存在感の高まり、エネルギー効率基準を満たすことへのプレッシャー、ハイブリッドワークモデルへのシフトが、この採用をさらに加速させています。さらに、COVID後の健康と衛生への注目の高まりにより、タッチレス技術、空気品質モニタリング、予知保全機能への投資が増加しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | (100万/10億米ドル) |

| セグメント別 | オファリング別、ソリューション別、サービス別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

このような勢いにもかかわらず、市場拡大のペースにはいくつかの抑制要因が影響し続けています。レガシー・ビルをアップグレードするための初期資本要件が高いことに加え、エンド・ツー・エンドのデジタル・システムを導入することが複雑なため、短期的なROIを正当化することが困難な企業もあります。IoT対応インフラを取り巻くサイバーセキュリティ上の懸念、断片化したベンダーエコシステム間の統合問題、普遍的な相互運用性標準の不在が、展開をさらに複雑にしています。さらに、特に中小企業では、こうした高度なシステムを管理する熟練した専門家の数が限られているため、普及が引き続き制限されています。それにもかかわらず、長期的な運用利益とシステムの回復力を引き出すために、合理化された展開と統合サービスに投資する企業が増えています。

ビデオ監視および入退室管理システムは、24時間体制の安全性を確保し、不正アクセスを防止し、施設全体の一元的な可視化を可能にするため、最新の施設運用に不可欠です。これらのソリューションには、顔認識、異常検知、行動分析のためのAIが組み込まれています。施設運用におけるこれらのソリューションの優位性は、リアルタイムの状況認識と、脅威の検知と対応における自動化のニーズの高まりによってもたらされています。これらのシステムは、受動的な監視にとどまらず、非常時には積極的に警報や施錠のトリガーとなったり、空調や照明システムと統合されたりします。例えば、アラバマ大学では、緊急管理センターとリンクするビデオ監視と入退室管理システムを採用し、リアルタイムのロックダウン・プロトコルや遠隔での本人確認を可能にしています。

同様に、Amazonのフルフィルメント・センターは、機密エリアへの立ち入りを制御し、従業員の移動を管理し、ロジスティクスの継続性をサポートするために、統合された監視・入退室システムを導入しています。ヘルスケア、教育、製造業などの組織がコンプライアンスと業務効率のためにこのようなシステムを採用する中、ビデオ監視と入退室管理は施設運営とセキュリティ管理に不可欠な要素として際立っています。

導入・統合サービスは、IWMS、BIM、HVACオートメーション、IoTベースの監視ツールなどの複雑なシステムを統一された運用フローに整合させることで、施設をインテリジェントな環境に変える基盤を形成します。これらのサービスにより、企業は自社のインフラに合わせてソリューションをカスタマイズできるため、スムーズな展開と最小限の混乱で済みます。ビルがよりデータ主導型の資産となるにつれ、セキュリティ、環境、不動産、運用の各システムを接続するには、専門家による統合が不可欠となります。

例えば、ルフトハンザテクニックがハンブルクの施設を刷新した際、100を超えるレガシーシステムを、運用、エネルギー追跡、メンテナンス用にカスタマイズされたダッシュボードを備えた中央IWMSに統合しました。同様に、インド科学研究所は、エネルギーと空間の効率を高めるために、キャンパス全体のプラットフォームを通じて統合されたBIMとスマート照明を採用しました。これらのサービスは、拡張性と回復力を可能にし、システムが統合的に動作することを保証し、施設のパフォーマンスと居住者の満足度を高めるインサイトを提供します。

北米は、デジタルインフラの早期導入、厳格な規制遵守、成熟したアウトソーシング文化に牽引され、予測期間中に市場シェアが最大になると予測されます。同地域には、商業ビル、調査施設、空港、キャンパスなどが密集しており、安全性、持続可能性、運用効率に特化したファシリティマネジメントシステムが求められています。組織は、IWMS、BIM、環境管理ソリューションなどの統合プラットフォームを広く採用しています。例えば、Microsoftのレドモンド・キャンパスは、照明、セキュリティ、エネルギー、ワークプレイスサービスを統合エコシステムに接続する完全デジタル化システムで運営されており、クリーブランド・クリニックは、医療施設全体で患者の安全性とオペレーションの卓越性を確保するために、リアルタイムの監視と環境制御を統合しています。強力なベンダーの存在感、スマートビルのアップグレード、オンプレミス統合をサポートするデータプライバシーの義務化は、引き続きこの地域のリーダーシップを強化しています。

一方、アジア太平洋は、急速な都市化、商業インフラの活況、エネルギー効率の高い建物への需要の高まりにより、予測期間中に最も急成長する市場になると予想されます。中国、インド、東南アジア諸国は、スマートシティ構想を積極的に推進し、不動産や公共インフラのデジタル変革を受け入れています。政府の支援、FMサービスのアウトソーシングの増加、製造拠点やハイテク・キャンパスへの投資の拡大は、採用をさらに加速させています。世界FMベンダーが拠点を拡大し、地域企業がコスト効率と拡張性に優れたソリューションを優先する中、APACはファシリティマネジメントの革新と展開において高い可能性を秘めた地域として浮上しています。

当レポートでは、世界のファシリティマネジメント市場について調査し、オファリング別、ソリューション別、サービス別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ファシリティマネジメントソリューションとサービスの進化

- エコシステム分析

- ケーススタディ分析

- バリューチェーン分析

- 規制状況

- 価格分析

- 技術分析

- 特許分析

- 主要な会議とイベント

- ファシリティマネジメント市場向け技術ロードマップ

- ファシリティマネジメント市場におけるベストプラクティス

- 投資と資金調達のシナリオ

- ファシリティマネジメント市場における生成AIの影響

- 2025年の米国関税の影響- 概要

第6章 ファシリティマネジメント市場(オファリング別)

- イントロダクション

- ソリューション

- サービス

第7章 ファシリティマネジメント市場(ソリューション別)

- イントロダクション

- 統合職場管理システム

- ビルディング・インフォメーション・モデリング

- 施設運営とセキュリティ管理

- 施設環境管理

- 施設資産管理

第8章 ファシリティマネジメント市場(サービス別)

- イントロダクション

- 専門サービス

- マネージドサービス

第9章 ファシリティマネジメント市場(業界別)

- イントロダクション

- 銀行、金融サービス、保険

- IT・ITES

- 政府・公共部門

- ヘルスケア・ライフサイエンス

- 教育

- 小売

- 製造

- 建設・不動産

- 通信

- 旅行とホスピタリティ

- その他

第10章 ファシリティマネジメント市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:マクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 北欧

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- インド

- 日本

- オーストラリアとニュージーランド

- 韓国

- 東南アジア

- その他

- 中東・アフリカ

- 中東・アフリカ:マクロ経済見通し

- 中東

- アフリカ

- ラテンアメリカ

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年~2024年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- ブランド/製品比較

- 企業評価と財務指標

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- CBRE GROUP

- JONES LANG LASALLE

- TRIMBLE

- NEMETSCHEK

- JOHNSON CONTROLS

- IBM

- ORACLE

- SAP

- FORTIVE

- INFOR

- MRI SOFTWARE

- EPTURA

- PLANON

- APLEONA GROUP

- CUSHMAN & WAKEFIELD

- SODEXO

- ARAMARK

- スタートアップ/中小企業

- CAUSEWAY TECHNOLOGIES

- SERVICE WORKS GLOBAL

- FACILITIES MANAGEMENT EXPRESS(FMX)

- ARCHIDATA

- UPKEEP

- FACILITYONE TECHNOLOGIES

- OFFICESPACE SOFTWARE

- FACILIO

- EFACILITY

- INNOMAINT

- NUVOLO

- QUICKFMS

- ZLINK

第13章 隣接市場と関連市場

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 ROLE OF PLAYERS IN FACILITY MANAGEMENT MARKET ECOSYSTEM

- TABLE 3 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 INDICATIVE PRICING ANALYSIS OF FACILITY MANAGEMENT SOLUTION, BY KEY PLAYERS, 2024

- TABLE 8 INDICATIVE PRICING ANALYSIS OF FACILITY MANAGEMENT SERVICE, 2024

- TABLE 9 LIST OF KEY PATENTS

- TABLE 10 FACILITY MANAGEMENT MARKET: PORTER'S FIVE FORCES MODEL ANALYSIS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 13 FACILITY MANAGEMENT MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 15 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 16 FACILITY MANAGEMENT MARKET, BY OFFERING, 2017-2024 (USD MILLION)

- TABLE 17 FACILITY MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 18 SOLUTIONS: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 19 SOLUTIONS: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 20 SERVICES: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 21 SERVICES: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 22 FACILITY MANAGEMENT MARKET, BY SOLUTION, 2017-2024 (USD MILLION)

- TABLE 23 FACILITY MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 24 INTEGRATED WORKPLACE MANAGEMENT SYSTEM: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 25 INTEGRATED WORKPLACE MANAGEMENT SYSTEM: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 BUILDING INFORMATION MODELING: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 27 BUILDING INFORMATION MODELING: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 FACILITY OPERATIONS AND SECURITY MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 29 FACILITY OPERATIONS AND SECURITY MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

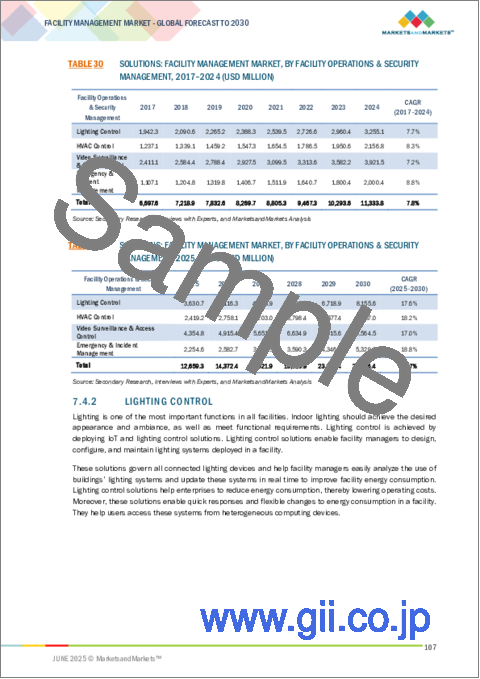

- TABLE 30 SOLUTIONS: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2017-2024 (USD MILLION)

- TABLE 31 SOLUTIONS: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2025-2030 (USD MILLION)

- TABLE 32 LIGHTING CONTROL: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 33 LIGHTING CONTROL: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 HVAC CONTROL: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 35 HVAC CONTROL: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 VIDEO SURVEILLANCE & ACCESS CONTROL: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 37 VIDEO SURVEILLANCE & ACCESS CONTROL: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 EMERGENCY & INCIDENT MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 39 EMERGENCY & INCIDENT MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 FACILITY ENVIRONMENT MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 41 FACILITY ENVIRONMENT MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 SOLUTIONS: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2017-2024 (USD MILLION)

- TABLE 43 SOLUTIONS: FACILITY MANAGEMENT MARKET SIZE, BY FACILITY ENVIRONMENT MANAGEMENT, 2025-2030 (USD MILLION)

- TABLE 44 SUSTAINABILITY MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 45 SUSTAINABILITY MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 WASTE MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 47 WASTE MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 FACILITY PROPERTY MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 49 FACILITY PROPERTY MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 SOLUTIONS: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2017-2024 (USD MILLION)

- TABLE 51 SOLUTIONS: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2025-2030 (USD MILLION)

- TABLE 52 LEASE ACCOUNTING AND REAL ESTATE MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 53 LEASE ACCOUNTING AND REAL ESTATE: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 ASSET MAINTENANCE MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 55 ASSET MAINTENANCE MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 WORKSPACE & RELOCATION MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 57 WORKSPACE & RELOCATION MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 RESERVATION MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 59 RESERVATION MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 FACILITY MANAGEMENT MARKET, BY SERVICE, 2017-2024 (USD MILLION)

- TABLE 61 FACILITY MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 62 FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2024 (USD MILLION)

- TABLE 63 FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 64 PROFESSIONAL SERVICES: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 65 PROFESSIONAL SERVICES: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 DEPLOYMENT & INTEGRATION: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 67 DEPLOYMENT & INTEGRATION: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 CONSULTING & TRAINING: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 69 CONSULTING & TRAINING: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 AUDITING & QUALITY ASSESSMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 71 AUDITING & QUALITY ASSESSMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 SUPPORT & MAINTENANCE: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 73 SUPPORT & MAINTENANCE: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 SERVICE-LEVEL AGREEMENT MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 75 SERVICE-LEVEL AGREEMENT MANAGEMENT: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 MANAGED SERVICES: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 77 MANAGED SERVICES: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 FACILITY MANAGEMENT MARKET, BY VERTICAL, 2017-2024 (USD MILLION)

- TABLE 79 FACILITY MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 80 BANKING, FINANCIAL SERVICES, AND INSURANCE: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 81 BANKING, FINANCIAL SERVICES, AND INSURANCE: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 IT & ITES: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 83 IT & ITES: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 GOVERNMENT & PUBLIC SECTOR: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 85 GOVERNMENT & PUBLIC SECTOR: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 HEALTHCARE & LIFE SCIENCES: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 87 HEALTHCARE & LIFE SCIENCES: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 EDUCATION: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 89 EDUCATION: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 RETAIL: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 91 RETAIL: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 MANUFACTURING: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 93 MANUFACTURING: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 CONSTRUCTION & REAL ESTATE: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 95 CONSTRUCTION & REAL ESTATE: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 TELECOM: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 97 TELECOM: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 TRAVEL & HOSPITALITY: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 99 TRAVEL & HOSPITALITY: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 OTHER VERTICALS: FACILITY MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 101 OTHER VERTICALS: FACILITY MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 FACILITY MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 103 FACILITY MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 111 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 113 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 115 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 116 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 117 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 119 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 121 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 122 US: FACILITY MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 123 US: FACILITY MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 124 US: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 125 US: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 126 US: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 127 US: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 128 US: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 129 US: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 130 US: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 131 US: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 132 US: FACILITY MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 133 US: FACILITY MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 134 US: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 135 US: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 136 US: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 137 US: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 138 CANADA: FACILITY MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 139 CANADA: FACILITY MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 140 CANADA: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 141 CANADA: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 142 CANADA: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 143 CANADA: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 144 CANADA: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 145 CANADA: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 146 CANADA: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 147 CANADA: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 148 CANADA: FACILITY MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 149 CANADA: FACILITY MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 150 CANADA: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 151 CANADA: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 152 CANADA: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 153 CANADA: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 154 EUROPE: FACILITY MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 155 EUROPE: FACILITY MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 156 EUROPE: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 157 EUROPE: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 158 EUROPE: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 159 EUROPE: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 160 EUROPE: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 161 EUROPE: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 162 EUROPE: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 163 EUROPE: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 164 EUROPE: FACILITY MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 165 EUROPE: FACILITY MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 166 EUROPE: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 167 EUROPE: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 168 EUROPE: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 169 EUROPE: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 170 EUROPE: FACILITY MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 171 EUROPE: FACILITY MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 172 GERMANY: FACILITY MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 173 GERMANY: FACILITY MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 174 GERMANY: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 175 GERMANY: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 176 GERMANY: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 177 GERMANY: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 178 GERMANY: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 179 GERMANY: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 180 GERMANY: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 181 GERMANY: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 182 GERMANY: FACILITY MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 183 GERMANY: FACILITY MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 184 GERMANY: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 185 GERMANY: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 186 GERMANY: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 187 GERMANY: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 188 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 189 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 190 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 191 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 192 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 193 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 194 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 195 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 196 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 197 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 198 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 199 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 200 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 201 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 202 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 203 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 204 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 205 ASIA PACIFIC: FACILITY MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 206 CHINA: FACILITY MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 207 CHINA: FACILITY MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 208 CHINA: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 209 CHINA: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 210 CHINA: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 211 CHINA: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 212 CHINA: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 213 CHINA: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 214 CHINA: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 215 CHINA: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 216 CHINA: FACILITY MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 217 CHINA: FACILITY MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 218 CHINA: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 219 CHINA: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 220 CHINA: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 221 CHINA: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: FACILITY MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 240 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 241 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 242 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 243 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 244 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 245 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 246 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 247 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 248 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 249 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 250 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 251 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 252 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 253 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 254 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 255 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 256 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 257 MIDDLE EAST: FACILITY MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 258 KSA: FACILITY MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 259 KSA: FACILITY MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 260 KSA: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 261 KSA: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 262 KSA: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 263 KSA: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 264 KSA: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 265 KSA: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 266 KSA: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 267 KSA: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 268 KSA: FACILITY MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 269 KSA: FACILITY MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 270 KSA: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 271 KSA: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 272 KSA: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 273 KSA: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 274 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 275 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 276 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 277 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 278 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 279 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 280 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 281 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 282 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 283 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 284 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 285 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 286 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 287 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 288 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 289 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 290 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 291 LATIN AMERICA: FACILITY MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 292 BRAZIL: FACILITY MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 293 BRAZIL: FACILITY MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 294 BRAZIL: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 295 BRAZIL: FACILITY MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 296 BRAZIL: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 297 BRAZIL: FACILITY MANAGEMENT MARKET, BY FACILITY OPERATIONS & SECURITY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 298 BRAZIL: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 299 BRAZIL: FACILITY MANAGEMENT MARKET, BY FACILITY ENVIRONMENT MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 300 BRAZIL: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2017-2022 (USD MILLION)

- TABLE 301 BRAZIL: FACILITY MANAGEMENT MARKET, BY FACILITY PROPERTY MANAGEMENT, 2023-2028 (USD MILLION)

- TABLE 302 BRAZIL: FACILITY MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 303 BRAZIL: FACILITY MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 304 BRAZIL: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 305 BRAZIL: FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 306 BRAZIL: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 307 BRAZIL: FACILITY MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 308 OVERVIEW OF STRATEGIES DEPLOYED BY KEY FACILITY MANAGEMENT MARKET PLAYERS, JANUARY 2023-JUNE 2025

- TABLE 309 FACILITY MANAGEMENT MARKET: DEGREE OF COMPETITION

- TABLE 310 FACILITY MANAGEMENT MARKET: REGION FOOTPRINT

- TABLE 311 FACILITY MANAGEMENT MARKET: OFFERING FOOTPRINT

- TABLE 312 FACILITY MANAGEMENT MARKET: SOLUTION FOOTPRINT

- TABLE 313 FACILITY MANAGEMENT MARKET: VERTICAL FOOTPRINT

- TABLE 314 FACILITY MANAGEMENT MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 315 FACILITY MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 316 FACILITY MANAGEMENT MARKET: PRODUCT LAUNCHES, JANUARY 2023-JUNE 2025

- TABLE 317 FACILITY MANAGEMENT MARKET: DEALS, JANUARY 2023-JUNE 2025

- TABLE 318 CBRE GROUP: COMPANY OVERVIEW

- TABLE 319 CBRE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 CBRE GROUP: DEALS

- TABLE 321 JONES LANG LASALLE: BUSINESS OVERVIEW

- TABLE 322 JONES LANG LASALLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 323 JONES LANG LASALLE: DEALS

- TABLE 324 TRIMBLE: COMPANY OVERVIEW

- TABLE 325 TRIMBLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 TRIMBLE: PRODUCT LAUNCHES

- TABLE 327 TRIMBLE: DEALS

- TABLE 328 NEMETSCHEK: COMPANY OVERVIEW

- TABLE 329 NEMETSCHEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 330 NEMETSCHEK: PRODUCT LAUNCHES

- TABLE 331 NEMETSCHEK: DEALS

- TABLE 332 JOHNSON CONTROLS: COMPANY OVERVIEW

- TABLE 333 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 JOHNSON CONTROLS: PRODUCT LAUNCHES

- TABLE 335 JOHNSON CONTROLS: DEALS

- TABLE 336 JOHNSON CONTROLS: OTHERS

- TABLE 337 IBM: COMPANY OVERVIEW

- TABLE 338 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 339 ORACLE: COMPANY OVERVIEW

- TABLE 340 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 341 SAP: COMPANY OVERVIEW

- TABLE 342 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 SAP: PRODUCT LAUNCHES

- TABLE 344 SAP: DEALS

- TABLE 345 FORTIVE: BUSINESS OVERVIEW

- TABLE 346 FORTIVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 347 FORTIVE: DEALS

- TABLE 348 INFOR: COMPANY OVERVIEW

- TABLE 349 INFOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 350 INFOR: DEALS

- TABLE 351 MRI SOFTWARE: COMPANY OVERVIEW

- TABLE 352 MRI SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 353 MRI SOFTWARE: PRODUCT LAUNCHES

- TABLE 354 MRI SOFTWARE: DEALS

- TABLE 355 MRI SOFTWARE: OTHERS

- TABLE 356 EPTURA: COMPANY OVERVIEW

- TABLE 357 EPTURA: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 358 EPTURA: PRODUCT LAUNCHES

- TABLE 359 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2020-2025 (USD MILLION)

- TABLE 360 SOLUTIONS: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 361 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY SERVICE, 2020-2025 (USD MILLION)

- TABLE 362 SERVICES: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 363 PROFESSIONAL SERVICES: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

- TABLE 364 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2020-2025 (USD MILLION)

- TABLE 365 ON-PREMISES: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 366 CLOUD: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 367 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2020-2025 (USD MILLION)

- TABLE 368 SMALL AND MEDIUM-SIZED ENTERPRISES: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 369 LARGE ENTERPRISES: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 370 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2020-2025 (USD MILLION)

- TABLE 371 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 372 ENTERPRISE ASSET MANAGEMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 373 ENTERPRISE ASSET MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 374 ENTERPRISE ASSET MANAGEMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 375 ENTERPRISE ASSET MANAGEMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 376 ENTERPRISE ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 377 ENTERPRISE ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 378 ENTERPRISE ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 379 ENTERPRISE ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 380 ENTERPRISE ASSET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 381 ENTERPRISE ASSET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 382 ENTERPRISE ASSET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 383 ENTERPRISE ASSET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 FACILITY MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 FACILITY MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN FACILITY MANAGEMENT MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): FACILITY MANAGEMENT MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 7 FACILITY MANAGEMENT MARKET: MARKET ESTIMATION APPROACH -4 - SUPPLY-SIDE ANALYSIS

- FIGURE 8 FACILITY MANAGEMENT MARKET: DATA TRIANGULATION

- FIGURE 9 FACILITY MANAGEMENT MARKET, 2023-2030 (USD MILLION)

- FIGURE 10 FACILITY MANAGEMENT MARKET, BY REGION, 2025

- FIGURE 11 RISING GOVERNMENT INITIATIVES FOR SMART CITY DEPLOYMENTS LEVERAGING FACILITY MANAGEMENT MARKET GROWTH

- FIGURE 12 SOLUTION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 DEPLOYMENT & INTEGRATION SERVICE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 FACILITY PROPERTY MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 SOLUTION AND BFSI SEGMENTS ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2025

- FIGURE 17 FACILITY MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 EVOLUTION: FACILITY MANAGEMENT SOLUTIONS AND SERVICES

- FIGURE 19 KEY PLAYERS IN FACILITY MANAGEMENT MARKET ECOSYSTEM

- FIGURE 20 FACILITY MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 INDICATIVE PRICING ANALYSIS OF FACILITY MANAGEMENT SOLUTION, BY KEY PLAYERS, 2024

- FIGURE 22 LIST OF KEY PATENTS FOR FACILITY MANAGEMENT, 2014-2025

- FIGURE 23 FACILITY MANAGEMENT MARKET: PORTER'S FIVE FORCES MODEL

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 26 FACILITY MANAGEMENT MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2019-2024 (USD MILLION)

- FIGURE 28 MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING FACILITY MANAGEMENT ACROSS VARIOUS TYPES OF SOLUTIONS

- FIGURE 29 GENERATIVE AI BEST PRACTICES ACROSS MAJOR INDUSTRIES

- FIGURE 30 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 FACILITY ENVIRONMENT MANAGEMENT SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 EMERGENCY & INCIDENT MANAGEMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 WASTE MANAGEMENT SOLUTIONS MARKET PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 RESERVATION MANAGEMENT SOLUTIONS TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 36 SUPPORT & MAINTENANCE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 IT & ITES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 40 SHARES OF LEADING COMPANIES IN FACILITY MANAGEMENT MARKET, 2024

- FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS IN FACILITY MANAGEMENT MARKET, 2020-2024 (USD MILLION)

- FIGURE 42 FACILITY MANAGEMENT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 43 COMPANY VALUATION OF KEY VENDORS, 2025

- FIGURE 44 FINANCIAL METRICS OF KEY VENDORS, 2025

- FIGURE 45 FACILITY MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 FACILITY MANAGEMENT MARKET: COMPANY FOOTPRINT

- FIGURE 47 FACILITY MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 CBRE GROUP: COMPANY SNAPSHOT

- FIGURE 49 JONES LANG LASALLE: COMPANY SNAPSHOT

- FIGURE 50 TRIMBLE: COMPANY SNAPSHOT

- FIGURE 51 NEMETSCHEK: COMPANY SNAPSHOT

- FIGURE 52 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 53 IBM: COMPANY SNAPSHOT

- FIGURE 54 ORACLE: COMPANY SNAPSHOT

- FIGURE 55 SAP: COMPANY SNAPSHOT

- FIGURE 56 FORTIVE: COMPANY SNAPSHOT

The facility management market is estimated to be USD 61.08 billion in 2025 and reach USD 138.50 billion in 2030 at a CAGR of 17.8%, from 2025 to 2030. Market growth is being driven by the widespread adoption of intelligent facility systems that combine operational efficiency with real-time data insights. As organizations prioritize safety, sustainability, and efficient workspace management, integrated solutions such as IWMS, BIM, and platforms for HVAC control, video surveillance, and emergency responses are seeing rapid deployment. The growing presence of smart infrastructure, pressure to meet energy efficiency norms, and the shift to hybrid working models have further accelerated this adoption. Additionally, increased focus on health and hygiene post-COVID has led to increased investments in touchless technologies, air quality monitoring, and predictive maintenance capabilities.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | (USD) Million/Billion |

| Segments | By offering, solution, service, vertical, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Despite this momentum, several restraints continue to impact the pace of market expansion. High initial capital requirements for upgrading legacy buildings, along with the complexity of implementing end-to-end digital systems, make it difficult for some enterprises to justify short-term ROI. Cybersecurity concerns surrounding IoT-enabled infrastructure, integration issues across fragmented vendor ecosystems, and the absence of universal interoperability standards further complicate deployment. Moreover, the limited availability of skilled professionals to manage these advanced systems, especially among small and mid-sized enterprises, continues to restrict widespread adoption. Nonetheless, businesses are increasingly investing in streamlined deployment and integration services to unlock long-term operational gains and system resilience.

The video surveillance and access control segment of facility operations and security management contributed to the largest market size during the forecast period

Video surveillance and access control systems are integral to modern facility operations as they ensure round-the-clock safety, prevent unauthorized access, and enable centralized visibility across premises. These solutions incorporate AI for facial recognition, anomaly detection, and behavior analysis. Their dominance in facility operations is driven by the growing need for real-time situational awareness and automation in threat detection and response. These systems go beyond passive monitoring as they actively trigger alerts, lockdowns, or integrate with HVAC and lighting systems during emergencies. For instance, the University of Alabama adopted a layered video surveillance and access control system that links with its emergency management center, enabling real-time lockdown protocols and remote identity verification.

Similarly, Amazon's fulfillment centers have deployed integrated surveillance and access systems to control entry at sensitive areas, manage employee movement, and support logistics continuity. As organizations across healthcare, education, and manufacturing adopt such systems for compliance and operational efficiency, video surveillance and access control stand out as essential components in facility operations and security management.

The deployment & integration services segment is projected to register the largest market share during the forecast period

Deployment and integration services form the foundation for transforming facilities into intelligent environments by aligning complex systems such as IWMS, BIM, HVAC automation, and IoT-based monitoring tools into a unified operational flow. These services enable organizations to customize solutions to their infrastructure, ensuring smooth rollout and minimal disruption. As buildings become more data-driven assets, expert integration is essential to connecting security, environment, property, and operations systems.

For instance, when Lufthansa Technik revamped its Hamburg facility, it integrated over 100 legacy systems into a central IWMS with tailored dashboards for operations, energy tracking, and maintenance, requiring precision integration and phased deployment to avoid downtime. Similarly, the Indian Institute of Science adopted BIM and smart lighting integrated through a campus-wide platform to enhance energy and space efficiency, all accomplished with dedicated deployment support. These services enable scalability and resilience and ensure systems operate cohesively, delivering insights that drive facility performance and occupant satisfaction.

North America leads in market share, while Asia Pacific emerges as the fastest-growing region during the forecast period

North America is projected to witness the largest market share during the forecast period, driven by early adoption of digital infrastructure, stringent regulatory compliance, and a mature outsourcing culture. The region hosts a dense concentration of commercial buildings, research facilities, airports, and campuses that demand specialized facility management systems for safety, sustainability, and operational efficiency. Organizations widely adopt integrated platforms such as IWMS, BIM, and environmental management solutions. For instance, Microsoft's Redmond campus operates with a fully digitized system that connects lighting, security, energy, and workplace services into a unified ecosystem, while the Cleveland Clinic integrates real-time surveillance and environmental controls to ensure patient safety and operational excellence across medical facilities. Strong vendor presence, smart building upgrades, and data privacy mandates supporting on-premises integration continue to reinforce the region's leadership.

Meanwhile, Asia Pacific is expected to be the fastest-growing market during the forecast period due to rapid urbanization, a boom in commercial infrastructure, and increasing demand for energy-efficient buildings. China, India, and Southeast Asian nations are actively pursuing smart city initiatives and embracing digital transformation in real estate and public infrastructure. Government support, a rise in outsourced FM services, and growing investments in manufacturing hubs and tech campuses are further accelerating adoption. As global FM vendors expand their footprint and regional enterprises prioritize cost-efficient, scalable solutions, APAC is emerging as a high-potential zone for facility management innovation and deployment.

Breakdown of primary interviews

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primary interviews is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 40%, and Tier 3 - 25%

- By Designation: C-level - 20%, Directors - 30%, and Others - 50%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of the World - 5%

The major players in the facility management market are CBRE Group (US), Jones Lang Lasalle (US), Trimble (US), Nemetschek (Germany), Johnson Controls (US), IBM (US), Oracle (US), SAP (Germany), Fortive (US), Infor (US), MRI Software (US), Eptura (US), Planon (Netherlands), Apleona Group (Germany), Cushman & Wakefield (US), Sodexo (France), and Aramark (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, product launches, product enhancements, and acquisitions to expand their footprint in the facility management market.

Research Coverage

The market study covers the facility management market size and the growth potential across different segments, including offering (solutions and services), solution (integrated workplace management system, building information modeling, facility operations & security management {lightning control, HVAC control, video surveillance and access control, and emergency and incident management}, facility environment management {sustainability management, waste management}, and facility property management {lease accounting and real estate management, asset management, workplace and relocation management, and reservation management}), service (professional {deployment and integration, consulting, auditing and quality assessment, support and maintenance, and service level agreement management} and managed services), vertical (IT & ITES, telecom, BFSI, healthcare & life sciences, education, retail, travel & hospitality, manufacturing, construction & real estate, government & public sector, and other verticals), and regions. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global facility management market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of market dynamics: Key drivers (increasing demand for integrated workplace management systems (IWMS), rising emphasis on sustainability and energy efficiency, growth in smart building and IoT adoption, expansion of commercial real estate and infrastructure projects), restraints (high cost of deployment and integration of advanced solutions, data privacy and cybersecurity concerns, lack of standardization across regions, resistance to outsourcing among small and mid-sized enterprises), opportunities (AI and automation in facility operations & security management, growing adoption of building information modeling (BIM), rapid urbanization in emerging economies, increasing focus on remote facility environment management), and challenges (shortage of skilled professionals in digital FM technologies, complexity in managing multi-site, multi-vendor environments, integration issues with legacy systems, ensuring regulatory compliance across global jurisdictions) influencing the growth of the facility management market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the facility management market

- Market Development: Comprehensive information about lucrative markets - analyzing facility management market across various regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the facility management market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as CBRE Group (US), Jones Lang Lasalle (US), Trimble (US), Nemetschek (Germany), Johnson Controls (US), IBM (US), Oracle (US), SAP (Germany), Fortive (US), Infor (US), MRI Software (US), Eptura (US), Planon (Netherlands), Apleona Group (Germany), Cushman & Wakefield (US), Sodexo (France), and Aramark (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 FACILITY MANAGEMENT MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FACILITY MANAGEMENT MARKET

- 4.2 FACILITY MANAGEMENT MARKET, BY OFFERING

- 4.3 FACILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE

- 4.4 FACILITY MANAGEMENT MARKET, BY SOLUTION

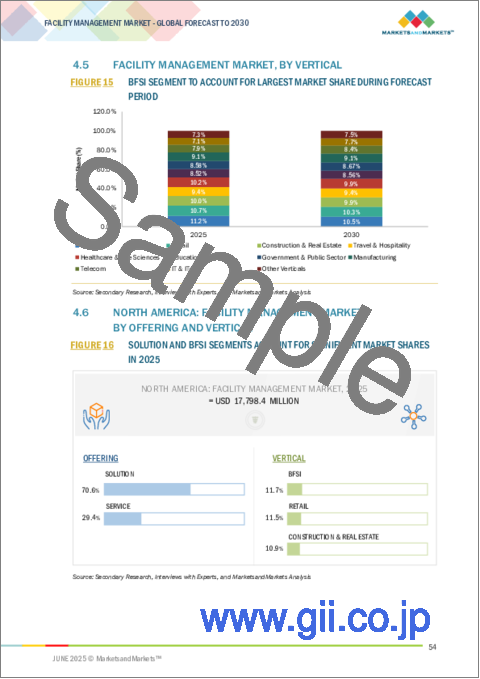

- 4.5 FACILITY MANAGEMENT MARKET, BY VERTICAL

- 4.6 NORTH AMERICA: FACILITY MANAGEMENT MARKET, BY OFFERING AND VERTICAL

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in demand for cloud-based facility management solutions

- 5.2.1.2 Increasing need for facility management solutions integrated with intelligent software

- 5.2.1.3 Rising focus of enterprises to comply with regulatory policies

- 5.2.1.4 Increase in adoption of IoT and AI in facility management solutions

- 5.2.1.5 Growing inclination to use advanced technologies and maintain sustainability at workplaces

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of managerial awareness and standardization

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing trend of outsourcing facility management operations

- 5.2.3.2 Rising focus on integrating BIM with facility management solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration of facility management with legacy ERP systems

- 5.2.4.2 Dearth of skilled or expert workforce

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF FACILITY MANAGEMENT SOLUTIONS AND SERVICES

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 GLIDEWELL AUTOMATED WORKFLOWS AND INCREASED VISIBILITY WITH UPKEEP'S MOBILE-FIRST SOLUTION

- 5.5.2 MAX LIFE INSURANCE UTILIZED QUICKFMS SOLUTIONS TO MANAGE LEASES

- 5.5.3 JLL HELPED LEADING BREWING COMPANY IN CREATING TECHNOLOGY-ENABLED HYBRID WORKPLACE WHILE MAXIMIZING SPACE UTILIZATION

- 5.5.4 FEDERAL AGENCY STREAMLINED SPACE MANAGEMENT USING NUVOLO

- 5.5.5 BROWN UNIVERSITY INTEGRATED BUILDING AUTOMATION SYSTEM WITH PLANON TO STREAMLINE AND AUTOMATE WORK ORDER PROCESSES

- 5.5.6 ARAMARK TRANSFORMED CAMPUS SERVICE DELIVERY AND IMPROVED KPIS USING ITS SERVICE EXCELLENCE FRAMEWORK IN FACILITIES MANAGEMENT

- 5.6 VALUE CHAIN ANALYSIS

- 5.6.1 CONNECTIVITY PROVIDERS

- 5.6.2 FACILITY MANAGEMENT SOFTWARE AND TECHNOLOGY PROVIDERS

- 5.6.3 FACILITY MANAGEMENT SOLUTION PROVIDERS

- 5.6.4 SYSTEM INTEGRATION AND SERVICE PROVIDERS

- 5.6.5 INDUSTRY VERTICALS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1.1 North America

- 5.7.1.1.1 US

- 5.7.1.1.2 Canada

- 5.7.1.2 Europe

- 5.7.1.3 Asia Pacific

- 5.7.1.3.1 South Korea

- 5.7.1.3.2 China

- 5.7.1.3.3 India

- 5.7.1.4 Middle East & Africa

- 5.7.1.4.1 UAE

- 5.7.1.4.2 South Africa

- 5.7.1.5 Latin America

- 5.7.1.5.1 Brazil

- 5.7.1.5.2 Mexico

- 5.7.1.1 North America

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF FACILITY MANAGEMENT SOLUTION, BY KEY PLAYERS, 2024

- 5.8.2 INDICATIVE PRICING ANALYSIS OF FACILITY MANAGEMENT SERVICE, 2024

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Artificial Intelligence (AI)

- 5.9.1.2 Machine Learning (ML)

- 5.9.1.3 Internet of Things (IoT)

- 5.9.1.4 Digital Twin

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Augmented Reality (AR)/Virtual Reality (VR)

- 5.9.2.2 Edge Computing

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 Cloud Computing

- 5.9.3.2 Cybersecurity

- 5.9.3.3 Big Data Analytics

- 5.9.3.4 Computer Vision

- 5.9.3.5 Blockchain

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1.1 Threat of new entrants

- 5.10.1.2 Threat of substitutes

- 5.10.1.3 Bargaining power of buyers

- 5.10.1.4 Bargaining power of suppliers

- 5.10.1.5 Intensity of competitive rivalry

- 5.10.2 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.2.1 Key stakeholders in buying criteria

- 5.10.2.2 Buying criteria

- 5.10.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10.1 PORTER'S FIVE FORCES ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS

- 5.12 TECHNOLOGY ROADMAP FOR FACILITY MANAGEMENT MARKET

- 5.12.1 SHORT-TERM ROADMAP (2023-2025)

- 5.12.2 MID-TERM ROADMAP (2026-2028)

- 5.12.3 LONG-TERM ROADMAP (2029-2030)

- 5.13 BEST PRACTICES IN FACILITY MANAGEMENT MARKET

- 5.13.1 PROACTIVE AND PREDICTIVE MAINTENANCE

- 5.13.2 INTEGRATED FACILITY MANAGEMENT SYSTEMS

- 5.13.3 SUSTAINABILITY AND ENERGY EFFICIENCY INITIATIVES

- 5.13.4 EMPHASIS ON OCCUPANT EXPERIENCE

- 5.13.5 ADOPTION OF AUTOMATION AND ROBOTICS

- 5.13.6 CONTINUOUS TRAINING AND SKILL DEVELOPMENT

- 5.14 INVESTMENT AND FUNDING SCENARIO

- 5.15 IMPACT OF GENERATIVE AI ON FACILITY MANAGEMENT MARKET

- 5.15.1 TOP USE CASES AND MARKET POTENTIAL

- 5.15.1.1 Key use cases

- 5.15.2 BEST PRACTICES

- 5.15.2.1 Manufacturing Industry

- 5.15.2.2 Commercial real estate industry

- 5.15.2.3 Healthcare infrastructure

- 5.15.3 CASE STUDIES OF GENERATIVE AI IMPLEMENTATION

- 5.15.3.1 AI-driven Energy Efficiency Across Corporate Campuses

- 5.15.3.2 Automated Lease Abstraction and Compliance Tracking

- 5.15.3.3 Intelligent Maintenance in Healthcare Facilities

- 5.15.4 CLIENT READINESS AND IMPACT ASSESSMENT

- 5.15.4.1 Client A: Integrated Facility Services Provider

- 5.15.4.2 Client B: Critical Infrastructure Facility Operator

- 5.15.4.3 Client C: Workplace Experience & FM Platform Provider

- 5.15.1 TOP USE CASES AND MARKET POTENTIAL

- 5.16 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.16.1 INTRODUCTION

- 5.16.2 EY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 North america

- 5.16.4.1.1 United States

- 5.16.4.1.2 Canada

- 5.16.4.1.3 Mexico

- 5.16.4.2 Europe

- 5.16.4.2.1 Germany

- 5.16.4.2.2 France

- 5.16.4.2.3 United Kingdom

- 5.16.4.3 Asia Pacific

- 5.16.4.3.1 China

- 5.16.4.3.2 India

- 5.16.4.3.3 Australia

- 5.16.4.4 Industries

- 5.16.4.4.1 Commercial Real Estate:

- 5.16.4.4.2 Manufacturing and Industrial Facilities:

- 5.16.4.4.3 Healthcare (Hospitals & Medical Facilities):

- 5.16.4.1 North america

6 FACILITY MANAGEMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: FACILITY MANAGEMENT MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 ENHANCEMENT OF CUSTOMER EXPERIENCE BY ADOPTING FACILITY MANAGEMENT SOLUTIONS TO BOOST MARKET

- 6.3 SERVICES

- 6.3.1 SERVICES TO PROMOTE EFFICIENT AND EFFECTIVE MANAGEMENT OF FACILITY INFRASTRUCTURE

7 FACILITY MANAGEMENT MARKET, BY SOLUTION

- 7.1 INTRODUCTION

- 7.1.1 SOLUTIONS: FACILITY MANAGEMENT MARKET DRIVERS

- 7.2 INTEGRATED WORKPLACE MANAGEMENT SYSTEM

- 7.2.1 EXTENSIVE RANGE OF FACILITY MANAGEMENT TOOLS UNDER SINGLE, UNIFIED SOFTWARE PLATFORM TO MAXIMIZE EFFICIENCY

- 7.3 BUILDING INFORMATION MODELING

- 7.3.1 USE OF BIM SOFTWARE DURING OPERATIONAL PHASE OF BUILDINGS' LIFE CYCLE TO IMPROVE EFFECTIVENESS OF FACILITY OPERATIONS

- 7.4 FACILITY OPERATIONS & SECURITY MANAGEMENT

- 7.4.1 FACILITY OPERATIONS & SECURITY MANAGEMENT SOLUTIONS TO HELP ENTERPRISES ACHIEVE INCREASED EFFICIENCIES

- 7.4.2 LIGHTING CONTROL

- 7.4.3 HVAC CONTROL

- 7.4.4 VIDEO SURVEILLANCE & ACCESS CONTROL

- 7.4.5 EMERGENCY & INCIDENT MANAGEMENT

- 7.5 FACILITY ENVIRONMENT MANAGEMENT

- 7.5.1 FACILITY ENVIRONMENT MANAGEMENT SOLUTIONS TO HELP REDUCE ENVIRONMENTAL HAZARDS

- 7.5.2 SUSTAINABILITY MANAGEMENT

- 7.5.3 WASTE MANAGEMENT

- 7.6 FACILITY PROPERTY MANAGEMENT

- 7.6.1 FACILITY PROPERTY MANAGEMENT SOLUTIONS TO HELP ENTERPRISES ENHANCE EFFICIENCY AND EFFECTIVENESS

- 7.6.2 LEASE ACCOUNTING & REAL ESTATE MANAGEMENT

- 7.6.3 ASSET MAINTENANCE MANAGEMENT

- 7.6.4 WORKSPACE & RELOCATION MANAGEMENT

- 7.6.5 RESERVATION MANAGEMENT

8 FACILITY MANAGEMENT MARKET, BY SERVICE

- 8.1 INTRODUCTION

- 8.1.1 SERVICES: FACILITY MANAGEMENT MARKET DRIVERS

- 8.2 PROFESSIONAL SERVICES

- 8.2.1 CUSTOMIZED IMPLEMENTATION AND RISK ASSESSMENT OFFERED BY PROFESSIONAL SERVICES TO BOOST MARKET

- 8.2.2 DEPLOYMENT & INTEGRATION

- 8.2.3 CONSULTING & TRAINING

- 8.2.4 AUDITING & QUALITY ASSESSMENT

- 8.2.5 SUPPORT & MAINTENANCE

- 8.2.6 SERVICE-LEVEL AGREEMENT MANAGEMENT

- 8.3 MANAGED SERVICES

- 8.3.1 RISE IN NEED TO REDUCE DATA BREACHES AND COUNTER CYBER THREATS TO FUEL DEMAND FOR MANAGED SERVICES

9 FACILITY MANAGEMENT MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICALS: FACILITY MANAGEMENT MARKET DRIVERS

- 9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 9.2.1 UNPRECEDENTED RISE IN DEMAND FOR HIGH-QUALITY, INNOVATIVE SERVICES TO DRIVE MARKET

- 9.2.2 BANKING, FINANCIAL SERVICES, AND INSURANCE: FACILITY MANAGEMENT USE CASES

- 9.2.2.1 Document and records management

- 9.2.2.2 Emergency response planning

- 9.3 IT & ITES

- 9.3.1 NEED TO OPTIMIZE OFFICE SPACES AND IMPLEMENT STRINGENT SECURITY MEASURES TO PROTECT SENSITIVE CLIENT DATA

- 9.3.2 IT & ITES: FACILITY MANAGEMENT USE CASES

- 9.3.2.1 Asset tracking and provisioning

- 9.3.2.2 Space management

- 9.4 GOVERNMENT & PUBLIC SECTOR

- 9.4.1 INCREASING NEED TO EFFECTIVELY MANAGE AND MAINTAIN FACILITIES TO FUEL MARKET GROWTH

- 9.4.2 GOVERNMENT & PUBLIC SECTOR: FACILITY MANAGEMENT USE CASES

- 9.4.2.1 Asset management

- 9.4.2.2 Emergency preparedness and response

- 9.5 HEALTHCARE & LIFE SCIENCES

- 9.5.1 NEED FOR EFFICIENT AND EFFECTIVE MANAGEMENT OF FACILITY'S PHYSICAL ENVIRONMENT & INFRASTRUCTURE TO DRIVE MARKET

- 9.5.2 HEALTHCARE & LIFE SCIENCES: FACILITY MANAGEMENT USE CASES

- 9.5.2.1 Security and access control

- 9.5.2.2 Asset tracking and maintenance

- 9.6 EDUCATION

- 9.6.1 RISE IN NEED FOR STRATEGIC PLANNING, DECISION-MAKING, AND FINANCIAL MANAGEMENT TO DRIVE MARKET

- 9.6.2 EDUCATION: FACILITY MANAGEMENT USE CASES

- 9.6.2.1 Classroom scheduling and optimization

- 9.6.2.2 Distance learning support

- 9.7 RETAIL

- 9.7.1 GLOBAL DEPLOYMENT OF FACILITY MANAGEMENT SOLUTIONS TO ENHANCE EFFICIENCY OF RETAIL BUSINESS OPERATIONS

- 9.7.2 RETAIL: FACILITY MANAGEMENT USE CASES

- 9.7.2.1 Facility space management and allocation

- 9.7.2.2 Asset tracking and maintenance

- 9.8 MANUFACTURING

- 9.8.1 SPIKE IN DEMAND TO REDUCE OPERATIONAL COSTS AND IMPROVE OVERALL PRODUCT PERFORMANCE TO BOOST MARKET

- 9.8.2 MANUFACTURING: FACILITY MANAGEMENT USE CASES

- 9.8.2.1 Inventory management

- 9.8.2.2 Data analytics and reporting

- 9.9 CONSTRUCTION & REAL ESTATE

- 9.9.1 FACILITY MANAGEMENT SERVICES TO HELP ENTERPRISES MANAGE INFRASTRUCTURE CHANGES AND INCREASE PROFITABILITY

- 9.9.2 CONSTRUCTION & REAL ESTATE: FACILITY MANAGEMENT USE CASES

- 9.9.2.1 Lease and contract management

- 9.9.2.2 Emergency and incident management

- 9.10 TELECOM

- 9.10.1 ADOPTION OF FACILITY MANAGEMENT SOLUTIONS TO MEET REQUIREMENTS FOR HIGH-SPEED AND RELIABLE CONNECTIVITY

- 9.10.2 TELECOM: FACILITY MANAGEMENT USE CASES

- 9.10.2.1 Maintenance and repairs

- 9.10.2.2 Space management

- 9.11 TRAVEL & HOSPITALITY

- 9.11.1 RISE IN NEED TO ENHANCE OVERALL GUEST EXPERIENCE AND ENSURE SAFETY AND FUNCTIONALITY OF FACILITIES TO DRIVE MARKET

- 9.11.2 TRAVEL & HOSPITALITY: FACILITY MANAGEMENT USE CASES

- 9.11.2.1 Guest requests and feedback

- 9.11.2.2 Asset management

- 9.12 OTHER VERTICALS

- 9.12.1 OTHER VERTICALS: FACILITY MANAGEMENT USE CASES

- 9.12.1.1 Resource allocation

- 9.12.1.2 Fleet management and maintenance

- 9.12.1.3 Sustainability initiatives

- 9.12.1 OTHER VERTICALS: FACILITY MANAGEMENT USE CASES

10 FACILITY MANAGEMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.2.1 Increased adoption of cloud technology and high focus on innovations to drive growth

- 10.2.3 CANADA

- 10.2.3.1 Smart city and high infrastructural development to boost market

- 10.3 EUROPE

- 10.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.2 GERMANY

- 10.3.2.1 Emergence of IoT, big data, and AI to drive growth of facility management solutions in Germany

- 10.3.3 UNITED KINGDOM

- 10.3.3.1 Digital transformations, technological advancements, and industrial automation initiatives to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Advanced economy and flourishing IoT, AI, and ML advancements to drive growth of facility management in France

- 10.3.5 ITALY

- 10.3.5.1 Government initiatives to boost adoption of facility management solutions

- 10.3.6 SPAIN

- 10.3.6.1 Increase in popularity of smart building technologies and sustainability-focused facility management services to boost market

- 10.3.7 NORDICS

- 10.3.7.1 Rising adoption of smart facility management in Nordics to drive market

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Boom in renewable energy, education, and healthcare industries to fuel market growth

- 10.4.3 INDIA

- 10.4.3.1 Rise in adoption of facility management solutions and services in corporate sector to propel market

- 10.4.4 JAPAN

- 10.4.4.1 Complexities involved in cost-effective management of critical functions to boost market

- 10.4.5 AUSTRALIA & NEW ZEALAND

- 10.4.5.1 Technological advancements in Australia & New Zealand to drive market

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Rise in government initiatives to encourage adoption of facility management solutions

- 10.4.7 SOUTHEAST ASIA

- 10.4.7.1 Increasing demand for smart building technologies and efficient workplace management to contribute to market growth

- 10.4.8 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Rise in adoption of facility management services due to surge in demand for commercial real estate

- 10.5.2.2 Kingdom of Saudi Arabia

- 10.5.2.2.1 Development of commercial projects and refurbishment of existing buildings to drive demand for facility management services

- 10.5.2.3 United Arab Emirates

- 10.5.2.3.1 Economic growth of country and readiness to adopt advanced technologies to contribute to market growth

- 10.5.2.4 Rest of Middle East

- 10.5.3 AFRICA

- 10.5.3.1 Increasing developments in construction industry to drive facility management market

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.2 BRAZIL

- 10.6.2.1 High foreign direct investments and presence of large enterprises to drive market

- 10.6.3 MEXICO

- 10.6.3.1 Cost-effectiveness, adoption of cloud-based services, and rapid infrastructure development to drive need for facility management

- 10.6.4 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2020-2024

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Offering footprint

- 11.7.5.4 Solution footprint

- 11.7.5.5 Vertical footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- 12.1.1 CBRE GROUP

- 12.1.1.1 Business overview

- 12.1.1.2 Products /Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 JONES LANG LASALLE

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 TRIMBLE

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 NEMETSCHEK

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 JOHNSON CONTROLS

- 12.1.5.1 Business overview

- 12.1.5.2 Products /Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 IBM

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.7 ORACLE

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.8 SAP

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.9 FORTIVE

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.10 INFOR

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.11 MRI SOFTWARE

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.12 EPTURA

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.13 PLANON

- 12.1.14 APLEONA GROUP

- 12.1.15 CUSHMAN & WAKEFIELD

- 12.1.16 SODEXO

- 12.1.17 ARAMARK

- 12.1.1 CBRE GROUP

- 12.2 STARTUPS/SMES

- 12.2.1 CAUSEWAY TECHNOLOGIES

- 12.2.2 SERVICE WORKS GLOBAL

- 12.2.3 FACILITIES MANAGEMENT EXPRESS (FMX)

- 12.2.4 ARCHIDATA

- 12.2.5 UPKEEP

- 12.2.6 FACILITYONE TECHNOLOGIES

- 12.2.7 OFFICESPACE SOFTWARE

- 12.2.8 FACILIO

- 12.2.9 EFACILITY

- 12.2.10 INNOMAINT

- 12.2.11 NUVOLO

- 12.2.12 QUICKFMS