|

|

市場調査レポート

商品コード

1762815

自動車用熱交換器の世界市場:推進力およびコンポーネント別、デザイン別、車両タイプ別、電気自動車タイプ別、オフハイウェイ車両タイプ別、地域別 - 2032年までの予測Automotive Heat Exchanger Market by Propulsion and Component (Radiator, Condenser, Chiller, Evaporator, Oil cooler, CAC, Heater, EGR), Design, OHV Type, Vehicle Type, EV Type (BEV, HEV, and PHEV), and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用熱交換器の世界市場:推進力およびコンポーネント別、デザイン別、車両タイプ別、電気自動車タイプ別、オフハイウェイ車両タイプ別、地域別 - 2032年までの予測 |

|

出版日: 2025年07月01日

発行: MarketsandMarkets

ページ情報: 英文 373 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

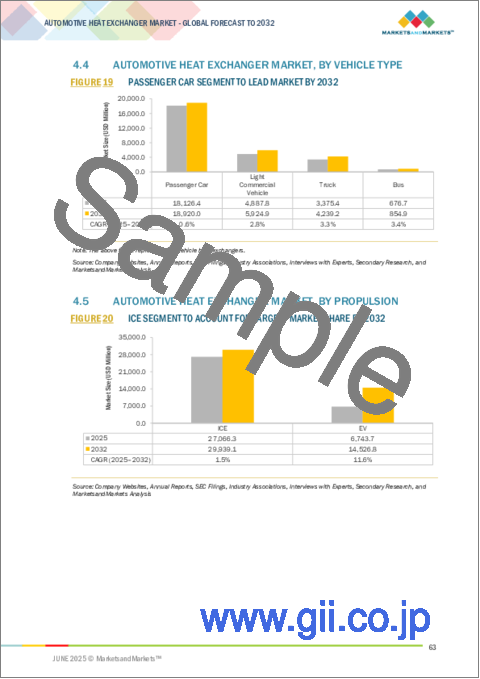

自動車用熱交換器の市場規模は、1.5%のCAGRで拡大し、2025年の270億7,000万米ドルから2032年には299億4,000万米ドルに成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 対象ユニット | 金額(100万米ドル)、数量(台) |

| セグメント別 | 推進力およびコンポーネント別、デザイン別、車両タイプ別、電気自動車タイプ別、オフハイウェイ車両タイプ別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、その他の地域 |

バッテリー容量が40kWhまでのEVは、通常、冷媒ベースのコールドプレートか、シンプルなシングルループの液体冷却システムで熱負荷を管理しています。バッテリー容量が82 kW程度まで増加すると、効果的な熱調節を確保するために、冷凍機、コールドプレート、調節バルブが統合されたマルチループ液冷システムなど、高度な熱管理ソリューションが必要になります。80 kWhを超える大型バッテリーパックでは、デュアルループ冷却システム、大容量冷却器、コールドプレート、熱管理バルブを組み合わせて、高出力運転と急速充電の要件をサポートすることが多いです。例えば、フォルクスワーゲンID.4は約82kWhのパウチセルバッテリーを搭載し、HVACシステムと統合された間接液体冷却ループとPTCヒーターを使用してバッテリー温度を調節しています。同様に、バッテリー容量が63kWhから87kWhの日産アリヤは、底部コールドプレートと最適化された冷却水流路を含む3層熱交換器による液冷システムを採用し、均等な熱分布を実現しています。対照的に、42 kWhの小型バッテリーを搭載するBMW i3は、冷媒ベースの蒸発式コールドプレートを採用しており、車両の空調システムを利用してバッテリー下面の約23%を冷却しています。

バッテリー電気自動車(BEV)は、その高いエネルギー密度と広範な熱管理ニーズにより、自動車用熱交換器市場で最大のシェアを占めています。BEVは大型バッテリーパックに依存しており、充放電サイクル中にかなりの熱を発生するため、バッテリー、パワーエレクトロニクス、電動ドライブトレインを保護する高度な熱交換器ソリューションが必要となります。例えば、MAHLE Anand Thermal Systems Private Limited(インド)は、Mahindra &Mahindraの2025年モデル「Mahindra BE 6」にバッテリー熱管理システムと冷却チラーを供給しました。厳しい排ガス規制、政府のインセンティブ、バッテリー技術の進歩により、BEVの採用が拡大しており、効率的なサーマルシステムの需要が大幅に高まっています。さらに、急速充電のサポート、バッテリー寿命の延長、車両全体の効率向上に対するニーズの高まりが、自動車メーカーに高性能サーマルソリューションの採用を促しています。スペース、重量、性能の要件を満たすため、BEVでは高い熱伝導性、耐腐食性、軽量特性を持つアルミニウムベースの材料がますます使用されるようになっています。また、MAHLE GmbHやModineなどの大手サプライヤーは、アルミポリマー複合材や高強度アルミ合金を導入しており、スタックプレート、アルミろう付け、マルチチャンネルラミネート構造などのコンパクトで効率的な設計は、EVプラットフォームへの組み込みが容易であることから支持を集めています。

乗用車セグメントは、予測期間中、自動車用熱交換器市場をリードすると予測されており、その主な要因は、様々な地域における内燃機関車の持続的な生産です。自動車メーカーが性能と効率のために内燃機関を最適化し続けているため、信頼性が高く大容量の熱管理システムへの需要が高まっています。最近のICE乗用車は、ターボ過給や排気ガス再循環(EGR)など、より熱集約的な技術を取り入れており、チャージ・エア・クーラー、エンジン・オイル・クーラー、ラジエーターなどの効率的な冷却ソリューションが必要とされています。さらに、排出ガス規制の強化や燃費向上の必要性に加え、自動車の電動化へのシフトが、効率的な熱管理システムの使用をさらに後押ししています。軽量素材の技術的進歩や、コンパクトで高性能な熱交換器の普及も、このセグメントの持続的成長に寄与しています。MAHLE GmbH(ドイツ)、Denso Corporation(日本)、Valeo(フランス)、Hanon Systems(韓国)、T.RAD(日本)などの自動車用熱交換器メーカーは、乗用車メーカーに製品を供給しています。例えば、 MAHLE GmbHはAudi AG(ドイツ)の2025年モデルのアウディA5向けにエンジンオイルクーラーを供給しています。同様に、T.RADはダイハツの2025年モデル「Rocky」、「Rocky HEV」、「Thor」、「Thor Custom」向けにラジエターを供給しています。

予測期間中、欧州は自動車用熱交換器市場で大きなシェアを占めると予想されます。欧州の自動車用熱交換器市場は、EUのEuro 6/7排ガス規制、CO2排出量目標(乗用車は95g/km)、2035年までに新車とバンのCO2排出量を100%削減することを義務付けるFit for 55パッケージなどの厳しい環境規制が主な要因となっています。これらの規制により、アルミニウム合金や複合ポリマーなどの高度な熱交換器材料や、燃費を改善し温室効果ガス排出を削減するための軽量断熱ソリューションに対する需要が大幅に増加しています。燃料効率と効果的な熱管理が重視されるようになったことで、EGRクーラー、チャージエアクーラー、オイルクーラーの需要も高まり、エンジン温度の低下、燃焼効率の向上、NOxとCO2の排出量削減に貢献しています。この地域のEVへの急速な移行は、EVパワートレイン特有の熱課題に対処するために設計された特殊な熱交換器の需要を加速しています。これには、バッテリー冷却プレート、パワーエレクトロニクス熱交換器、統合サーマルモジュール、ヒートポンプベースのHVACシステムなどが含まれ、これらはすべてEVの最適な性能、安全性、エネルギー効率を維持するために不可欠です。MAHLE GmbH(ドイツ)、Valeo(フランス)、AKG Group(ドイツ)、Nissens Automotive A/S(デンマーク)、Senior PLC(英国)、G&M Radiator(スコットランド)、Climetal S.L.(スペイン)、Constellium SE(フランス)などが、この地域の主要な自動車用熱交換器メーカーです。

当レポートでは、世界の自動車用熱交換器市場について調査し、推進力およびコンポーネント別、デザイン別、車両タイプ別、電気自動車タイプ別、オフハイウェイ車両タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 指標価格分析

- エコシステム分析

- サプライチェーン分析

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 特許分析

- 技術分析

- 主要サプライヤー別熱交換器工場の所在地

- 貿易分析

- 関税と規制状況

- 自動車用熱交換器市場に影響を与える主要な規制

- 2025年~2026年の主な会議とイベント

- 主要な利害関係者と購入基準

- 顧客ビジネスに影響を与える動向/混乱

- AI/生成AIの影響

- 自動車用熱交換器の進歩に関するMNMの洞察

- 代替燃料技術向け自動車用熱交換器の将来

- 国/地域別の主要OEM冷媒動向

- MNMの将来の熱交換器製品に関する洞察

第6章 自動車用熱交換器市場(推進力およびコンポーネント別)

- イントロダクション

- 内燃機関(ICE)

- 電気自動車(EV)

- 主要な業界洞察

第7章 自動車用熱交換器市場(デザイン別)

- イントロダクション

- チューブとフィン

- バーとプレート

- プレートタイプ

- その他

- 主要な業界洞察

第8章 自動車用熱交換器市場(車両タイプ別)

- イントロダクション

- 乗用車

- 軽商用車

- トラック

- バス

- 主要な業界洞察

第9章 自動車用熱交換器市場(電気自動車タイプ別)

- イントロダクション

- バッテリー電気自動車(BEV)

- プラグインハイブリッド電気自動車(PHEV)

- ハイブリッド電気自動車(HEV)

- 主要な業界洞察

第10章 自動車用熱交換器市場(オフハイウェイ車両タイプ別)

- イントロダクション

- 農業機器

- 建設機械

- 主要な洞察

第11章 自動車用熱交換器市場(地域別)

- イントロダクション

- アジア太平洋

- マクロ経済見通し

- 中国

- インド

- 日本

- 韓国

- その他

- 欧州

- ミクロ経済見通し

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- その他

- 北米

- マクロ経済見通し

- 米国

- カナダ

- メキシコ

- その他の地域

- マクロ経済見通し

- ブラジル

- ロシア

- 南アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 自動車用熱交換器メーカーの市場シェア分析(2024年)

- 2024年における上場企業/上場企業の収益分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- MAHLE GMBH

- DENSO CORPORATION

- VALEO

- HANON SYSTEMS

- T.RAD CO., LTD.

- SANDEN CORPORATION

- MARELLI HOLDINGS CO., LTD.

- DANA LIMITED

- BANCO PRODUCTS(INDIA)LTD.

- NIPPON LIGHT METAL HOLDINGS CO., LTD.

- MODINE

- AKG GROUP

- ESTRA

- その他の企業

- S.M. AUTO

- NISSENS AUTOMOTIVE A/S

- G&M RADIATOR

- BORGWARNER INC.

- TYC BROTHER INDUSTRIAL CO., LTD.

- TATA AUTOCOMP SYSTEMS

- SIAM CALSONIC CO., LTD.

- SENIOR PLC

- CONFLUX

- CLIMETAL S.L.

- CONSTELLIUM SE

- SUBROS LIMITED

第14章 市場における提言

第15章 付録

List of Tables

- TABLE 1 MARKET DEFINITION, BY COMPONENT

- TABLE 2 MARKET DEFINITION, BY DESIGN

- TABLE 3 MARKET DEFINITION, BY PROPULSION

- TABLE 4 MARKET DEFINITION, BY OFF-HIGHWAY VEHICLE TYPE

- TABLE 5 MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 6 MARKET DEFINITION, BY ELECTRIC VEHICLE TYPE

- TABLE 7 INCLUSIONS AND EXCLUSIONS

- TABLE 8 USD EXCHANGE RATES, 2020-2024

- TABLE 9 RISK ASSESSMENT

- TABLE 10 THERMAL PROPERTIES OF DIFFERENT NANOMATERIALS AND BASE FLUIDS

- TABLE 11 THERMAL PROPERTIES OF NANOPARTICLES

- TABLE 12 AVERAGE SELLING PRICE TREND, BY COMPONENT, 2022-2024 (USD)

- TABLE 13 AVERAGE SELLING PRICE TREND IN ASIA PACIFIC, BY COMPONENT, 2022-2024 (USD)

- TABLE 14 AVERAGE SELLING PRICE TREND IN EUROPE, BY COMPONENT, 2022-2024 (USD)

- TABLE 15 AVERAGE SELLING PRICE TREND IN NORTH AMERICA, BY COMPONENT, 2022-2024 (USD)

- TABLE 16 AVERAGE SELLING PRICE TREND IN REST OF THE WORLD, BY COMPONENT, 2022-2024 (USD)

- TABLE 17 AVERAGE SELLING PRICE TREND OF COMPONENTS, BY PROPULSION, 2024 (USD)

- TABLE 18 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 19 LIST OF FUNDING, JANUARY 2022-FEBRUARY 2025

- TABLE 20 PATENT REGISTRATIONS, 2022-2024

- TABLE 21 DENSO CORPORATION: HEAT EXCHANGER PLANT LOCATIONS

- TABLE 22 HANON SYSTEMS: HEAT EXCHANGER PLANT LOCATIONS

- TABLE 23 T.RAD CO., LTD.: HEAT EXCHANGER PLANT LOCATIONS

- TABLE 24 SANDEN CORPORATION: HEAT EXCHANGER PLANT LOCATIONS

- TABLE 25 MARELLI HOLDINGS CO., LTD.: HEAT EXCHANGER PLANT LOCATIONS

- TABLE 26 BANCO PRODUCTS (I) LTD.: HEAT EXCHANGER PLANT LOCATIONS

- TABLE 27 NIPPON LIGHT METAL CO., LTD: HEAT EXCHANGER PLANT LOCATIONS

- TABLE 28 IMPORT DATA FOR HS CODE 870891, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 29 EXPORT DATA FOR HS CODE 870891, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 30 IMPORT DATA FOR HS CODE 841520, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 31 EXPORT DATA FOR HS CODE 841520, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 32 IMPORT TARIFFS ON AUTOMOTIVE HEAT EXCHANGERS

- TABLE 33 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 34 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 35 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 36 REGULATIONS IMPACTING AUTOMOTIVE HEAT EXCHANGERS

- TABLE 37 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AUTOMOTIVE HEAT EXCHANGERS FOR VEHICLE TYPES (%)

- TABLE 39 KEY BUYING CRITERIA FOR AUTOMOTIVE HEAT EXCHANGERS, BY VEHICLE TYPE

- TABLE 40 COMPARISON OF MICROCHANNEL HEAT EXCHANGERS AND TRADITIONAL ROUND-TUBE DESIGNS

- TABLE 41 ENVIRONMENTAL IMPACT OF MATERIALS USED IN EV BATTERY THERMAL MANAGEMENT SYSTEMS

- TABLE 42 COOLING METHODS FOR FUEL CELLS

- TABLE 43 EUROPE: REFRIGERANT USE, BY OEM

- TABLE 44 NORTH AMERICA: REFRIGERANT USE, BY OEM

- TABLE 45 CHINA: REFRIGERANT USE, BY OEM

- TABLE 46 HEAT EXCHANGERS REQUIRED IN EV COOLING SYSTEMS

- TABLE 47 HEAT EXCHANGERS REQUIRED IN A/C HEAT PUMP SYSTEMS

- TABLE 48 HEAT EXCHANGERS REQUIRED IN A/C FUEL CELL SYSTEMS

- TABLE 49 HEAT EXCHANGER TECHNOLOGY TRENDS

- TABLE 50 AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 51 AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION, 2025-2032 (THOUSAND UNITS)

- TABLE 52 AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 53 AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 54 ICE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 55 ICE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 56 ICE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 ICE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 58 ENGINE RADIATOR: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 59 ENGINE RADIATOR: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 60 ENGINE RADIATOR: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 ENGINE RADIATOR: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 62 CONDENSER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 63 CONDENSER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 64 CONDENSER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 CONDENSER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 66 EVAPORATOR: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 67 EVAPORATOR: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 68 EVAPORATOR: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 EVAPORATOR: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 70 OIL COOLER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 71 OIL COOLER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 72 OIL COOLER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 OIL COOLER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 74 HEATER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 75 HEATER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 76 HEATER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 HEATER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 78 CHARGE AIR COOLER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 79 CHARGE AIR COOLER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 80 CHARGE AIR COOLER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 CHARGE AIR COOLER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 82 EXHAUST GAS HEAT EXCHANGER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 83 EXHAUST GAS HEAT EXCHANGER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 84 EXHAUST GAS HEAT EXCHANGER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 EXHAUST GAS HEAT EXCHANGER: ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 86 ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 87 ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 88 ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 90 BATTERY COOLING SYSTEM: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 91 BATTERY COOLING SYSTEM: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 92 BATTERY COOLING SYSTEM: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 93 BATTERY COOLING SYSTEM: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 94 ENGINE RADIATOR: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 95 ENGINE RADIATOR: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 96 ENGINE RADIATOR: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 ENGINE RADIATOR: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 98 CHILLER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 99 CHILLER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 100 CHILLER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 CHILLER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 102 WATER-COOLED CONDENSER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 103 WATER-COOLED CONDENSER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 104 WATER-COOLED CONDENSER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 105 WATER-COOLED CONDENSER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 106 AC CONDENSER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 107 AC CONDENSER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 108 AC CONDENSER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 109 AC CONDENSER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 110 EVAPORATOR: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 111 EVAPORATOR: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 112 EVAPORATOR: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 EVAPORATOR: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 114 OIL COOLER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 115 OIL COOLER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 116 OIL COOLER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 OIL COOLER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 118 HEATER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 119 HEATER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 120 HEATER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 HEATER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 122 CHARGE AIR COOLER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 123 CHARGE AIR COOLER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 124 CHARGE AIR COOLER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 CHARGE AIR COOLER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 126 EXHAUST GAS HEAT EXCHANGER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 127 EXHAUST GAS HEAT EXCHANGER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 128 EXHAUST GAS HEAT EXCHANGER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 129 EXHAUST GAS HEAT EXCHANGER: ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 130 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN, 2021-2024 (THOUSAND UNITS)

- TABLE 131 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN, 2025-2032 (THOUSAND UNITS)

- TABLE 132 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN, 2021-2024 (USD MILLION)

- TABLE 133 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN, 2025-2032 (USD MILLION)

- TABLE 134 TUBE AND FIN: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 135 TUBE AND FIN: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 136 TUBE AND FIN: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 137 TUBE AND FIN: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 138 BAR AND PLATE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 139 BAR AND PLATE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 140 BAR AND PLATE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 141 BAR AND PLATE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 142 PLATE TYPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 143 PLATE TYPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 144 PLATE TYPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 PLATE TYPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 146 OTHERS: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 147 OTHERS: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 148 OTHERS: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 149 OTHERS: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 150 AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 151 AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 152 AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 153 AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 154 PASSENGER CAR: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 155 PASSENGER CAR: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 156 PASSENGER CAR: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 157 PASSENGER CAR: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 158 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 159 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 160 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 161 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 162 TRUCK: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 163 TRUCK: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 164 TRUCK: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 165 TRUCK: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 166 BUS: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 167 BUS: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 168 BUS: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 169 BUS: AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 170 AUTOMOTIVE HEAT EXCHANGER MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 171 AUTOMOTIVE HEAT EXCHANGER MARKET, BY ELECTRIC VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 172 AUTOMOTIVE HEAT EXCHANGER MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 173 AUTOMOTIVE HEAT EXCHANGER MARKET, BY ELECTRIC VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 174 BATTERY ELECTRIC VEHICLE LAUNCHES, 2025

- TABLE 175 BATTERY ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 176 BATTERY ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 177 BATTERY ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 178 BATTERY ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 179 PLUG-IN HYBRID ELECTRIC VEHICLE LAUNCHES IN 2025

- TABLE 180 PLUG-IN HYBRID ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 181 PLUG-IN HYBRID ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 182 PLUG-IN HYBRID ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 183 PLUG-IN HYBRID ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 184 HYBRID ELECTRIC VEHICLE LAUNCHES IN 2024-2025

- TABLE 185 HYBRID ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 186 HYBRID ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 187 HYBRID ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 188 HYBRID ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 189 AUTOMOTIVE HEAT EXCHANGER MARKET, BY OFF-HIGHWAY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 190 AUTOMOTIVE HEAT EXCHANGER MARKET, BY OFF-HIGHWAY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 191 AUTOMOTIVE HEAT EXCHANGER MARKET, BY OFF-HIGHWAY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 192 AUTOMOTIVE HEAT EXCHANGER MARKET, BY OFF-HIGHWAY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 193 AGRICULTURAL EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 194 AGRICULTURAL EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 195 AGRICULTURAL EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 196 AGRICULTURAL EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 197 CONSTRUCTION EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 198 CONSTRUCTION EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 199 CONSTRUCTION EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 200 CONSTRUCTION EQUIPMENT HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 201 AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 202 AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 203 AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 204 AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 205 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 206 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 207 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 208 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 209 CHINA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 210 CHINA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 211 CHINA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 212 CHINA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 213 INDIA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 214 INDIA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 215 INDIA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 216 INDIA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 217 JAPAN: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 218 JAPAN: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 219 JAPAN: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 220 JAPAN: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 221 SOUTH KOREA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 222 SOUTH KOREA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 223 SOUTH KOREA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 224 SOUTH KOREA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 225 REST OF ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 226 REST OF ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 227 REST OF ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 228 REST OF ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 229 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 230 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 231 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 232 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 233 GERMANY: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 234 GERMANY: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 235 GERMANY: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 236 GERMANY: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 237 FRANCE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 238 FRANCE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 239 FRANCE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 240 FRANCE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 241 UK: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 242 UK: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 243 UK: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 244 UK: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 245 SPAIN: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 246 SPAIN: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 247 SPAIN: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 248 SPAIN: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 249 ITALY: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 250 ITALY: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 251 ITALY: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 252 ITALY: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 253 REST OF EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 254 REST OF EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 255 REST OF EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 256 REST OF EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 257 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 258 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 259 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 260 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 261 US: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 262 US: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 263 US: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 264 US: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 265 CANADA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 266 CANADA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 267 CANADA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 268 CANADA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 269 MEXICO: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 270 MEXICO: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 271 MEXICO: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 272 MEXICO: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 273 REST OF THE WORLD: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 274 REST OF THE WORLD: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 275 REST OF THE WORLD: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 276 REST OF THE WORLD: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 277 BRAZIL: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 278 BRAZIL: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 279 BRAZIL: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 280 BRAZIL: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 281 RUSSIA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 282 RUSSIA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 283 RUSSIA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 284 RUSSIA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 285 SOUTH AFRICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 286 SOUTH AFRICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 287 SOUTH AFRICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 288 SOUTH AFRICA: AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 289 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- TABLE 290 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2024

- TABLE 291 AUTOMOTIVE HEAT EXCHANGER MARKET: REGION FOOTPRINT, 2024

- TABLE 292 AUTOMOTIVE HEAT EXCHANGER MARKET: COMPONENT FOOTPRINT, 2024

- TABLE 293 AUTOMOTIVE HEAT EXCHANGER MARKET: OFF-HIGHWAY VEHICLE TYPE FOOTPRINT, 2024

- TABLE 294 AUTOMOTIVE HEAT EXCHANGER MARKET: VEHICLE TYPE FOOTPRINT, 2024

- TABLE 295 AUTOMOTIVE HEAT EXCHANGER MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 296 AUTOMOTIVE HEAT EXCHANGER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 297 AUTOMOTIVE HEAT EXCHANGER MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, MARCH 2021-JULY 2024

- TABLE 298 AUTOMOTIVE HEAT EXCHANGER MARKET: DEALS, FEBRUARY 2021-MARCH 2025

- TABLE 299 AUTOMOTIVE HEAT EXCHANGER MARKET: EXPANSION, JULY 2021-OCTOBER 2024

- TABLE 300 AUTOMOTIVE HEAT EXCHANGER MARKET: OTHER DEVELOPMENTS, JANUARY 2025-JULY 2025

- TABLE 301 MAHLE GMBH: COMPANY OVERVIEW

- TABLE 302 MAHLE GMBH: SUPPLIER ANALYSIS

- TABLE 303 MAHLE GMBH: PRODUCTS OFFERED

- TABLE 304 MAHLE GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 305 MAHLE GMBH: DEALS

- TABLE 306 MAHLE GMBH: OTHER DEVELOPMENTS

- TABLE 307 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 308 DENSO CORPORATION: SUPPLIER ANALYSIS

- TABLE 309 DENSO CORPORATION: PRODUCTS OFFERED

- TABLE 310 DENSO CORPORATION: EXPANSIONS

- TABLE 311 DENSO CORPORATION: OTHER DEVELOPMENTS

- TABLE 312 VALEO: COMPANY OVERVIEW

- TABLE 313 VALEO: SUPPLIER ANALYSIS

- TABLE 314 VALEO: PRODUCTS OFFERED

- TABLE 315 VALEO: PRODUCT LAUNCHES

- TABLE 316 VALEO: DEALS

- TABLE 317 VALEO: OTHER DEVELOPMENTS

- TABLE 318 HANON SYSTEMS: COMPANY OVERVIEW

- TABLE 319 HANON SYSTEMS: SUPPLIER ANALYSIS

- TABLE 320 HANON SYSTEMS: PRODUCTS OFFERED

- TABLE 321 HANON SYSTEMS: DEALS

- TABLE 322 HANON SYSTEMS: EXPANSIONS

- TABLE 323 HANON SYSTEMS: OTHER DEVELOPMENTS

- TABLE 324 T.RAD CO., LTD.: COMPANY OVERVIEW

- TABLE 325 T.RAD CO., LTD.: SUPPLIER ANALYSIS

- TABLE 326 T.RAD CO., LTD.: SUBSIDIARIES AND AFFILIATES (HEAT EXCHANGER BUSINESS)

- TABLE 327 T.RAD CO., LTD.: PRODUCTS OFFERED

- TABLE 328 T.RAD CO., LTD.: OTHER DEVELOPMENTS

- TABLE 329 SANDEN CORPORATION: COMPANY OVERVIEW

- TABLE 330 SANDEN CORPORATION: PRODUCTS OFFERED

- TABLE 331 SANDEN CORPORATION: PRODUCT LAUNCHES

- TABLE 332 SANDEN CORPORATION: DEALS

- TABLE 333 SANDEN CORPORATION: EXPANSIONS

- TABLE 334 MARELLI HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 335 MARELLI HOLDINGS CO., LTD.: SUPPLIER ANALYSIS

- TABLE 336 MARELLI HOLDINGS CO., LTD.: PRODUCTS OFFERED

- TABLE 337 MARELLI HOLDINGS CO., LTD.: PRODUCT LAUNCHES

- TABLE 338 MARELLI HOLDINGS CO., LTD.: DEALS

- TABLE 339 MARELLI HOLDINGS CO., LTD.: OTHER DEVELOPMENTS

- TABLE 340 DANA LIMITED: COMPANY OVERVIEW

- TABLE 341 DANA LIMITED: PRODUCTS OFFERED

- TABLE 342 DANA LIMITED: EXPANSIONS

- TABLE 343 DANA LIMITED: OTHER DEVELOPMENTS

- TABLE 344 BANCO PRODUCTS (INDIA) LTD.: COMPANY OVERVIEW

- TABLE 345 BANCO PRODUCTS (INDIA) LTD.: PRODUCTS OFFERED

- TABLE 346 BANCO PRODUCTS (INDIA) LTD.: DEALS

- TABLE 347 BANCO PRODUCTS (INDIA) LTD.: OTHER DEVELOPMENTS

- TABLE 348 NIPPON LIGHT METAL HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 349 NIPPON LIGHT METAL HOLDINGS CO., LTD.: PRODUCTS OFFERED

- TABLE 350 MODINE: COMPANY OVERVIEW

- TABLE 351 MODINE: PRODUCTS OFFERED

- TABLE 352 MODINE: PRODUCT LAUNCHES

- TABLE 353 MODINE: DEALS

- TABLE 354 MODINE: EXPANSIONS

- TABLE 355 MODINE: OTHER DEVELOPMENTS

- TABLE 356 AKG GROUP: COMPANY OVERVIEW

- TABLE 357 AKG GROUP: PRODUCTS OFFERED

- TABLE 358 ESTRA: COMPANY OVERVIEW

- TABLE 359 ESTRA: PRODUCTS OFFERED

- TABLE 360 S.M. AUTO: COMPANY OVERVIEW

- TABLE 361 NISSENS AUTOMOTIVE A/S: COMPANY OVERVIEW

- TABLE 362 G&M RADIATOR: COMPANY OVERVIEW

- TABLE 363 BORGWARNER INC.: COMPANY OVERVIEW

- TABLE 364 TYC BROTHER INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 365 TATA AUTOCOMP SYSTEMS: COMPANY OVERVIEW

- TABLE 366 SIAM CALSONIC CO., LTD.: COMPANY OVERVIEW

- TABLE 367 SENIOR PLC: COMPANY OVERVIEW

- TABLE 368 CONFLUX: COMPANY OVERVIEW

- TABLE 369 CLIMETAL S.L.: COMPANY OVERVIEW

- TABLE 370 CONSTELLIUM SE: COMPANY OVERVIEW

- TABLE 371 SUBROS LIMITED: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 MARKET ESTIMATION METHODOLOGY

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 MARKET ESTIMATION NOTES

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 11 AUTOMOTIVE HEAT EXCHANGER MARKET OVERVIEW

- FIGURE 12 ASIA PACIFIC TO CAPTURE DOMINANT MARKET SHARE BY 2032

- FIGURE 13 PASSENGER CAR SEGMENT TO LEAD MARKET BY 2032

- FIGURE 14 PLATE-TYPE HEAT EXCHANGER TO GROW AT FASTEST RATE DURING FORECAST PERIOD

- FIGURE 15 KEY PLAYERS IN AUTOMOTIVE HEAT EXCHANGER MARKET

- FIGURE 16 INCREASING DEMAND FOR FUEL-EFFICIENT VEHICLES TO DRIVE MARKET

- FIGURE 17 ASIA PACIFIC TO BE DOMINANT MARKET IN 2025

- FIGURE 18 TUBE AND FIN HEAT EXCHANGERS TO LEAD MARKET BY 2032

- FIGURE 19 PASSENGER CAR SEGMENT TO LEAD MARKET BY 2032

- FIGURE 20 ICE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2032

- FIGURE 21 BATTERY ELECTRIC VEHICLE SEGMENT TO LEAD MARKET BY 2032

- FIGURE 22 CONSTRUCTION EQUIPMENT SEGMENT TO LEAD MARKET BY 2032

- FIGURE 23 AUTOMOTIVE COOLING SYSTEMS

- FIGURE 24 AUTOMOTIVE HEAT EXCHANGER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 EVOLUTION OF BATTERY COOLING SYSTEM IN TESLA MODELS

- FIGURE 26 AVERAGE SELLING PRICE TREND, BY COMPONENT, 2022-2024 (USD)

- FIGURE 27 AVERAGE SELLING PRICE TREND IN ASIA PACIFIC, BY COMPONENT, 2022-2024 (USD)

- FIGURE 28 AVERAGE SELLING PRICE TREND IN EUROPE, BY COMPONENT, 2022-2024 (USD)

- FIGURE 29 AVERAGE SELLING PRICE TREND IN NORTH AMERICA, BY COMPONENT, 2022-2024 (USD)

- FIGURE 30 AVERAGE SELLING PRICE TREND IN REST OF THE WORLD, BY COMPONENT, 2022-2024 (USD)

- FIGURE 31 ECOSYSTEM ANALYSIS OF AUTOMOTIVE HEAT EXCHANGER MARKET

- FIGURE 32 SUPPLY CHAIN ANALYSIS

- FIGURE 33 INVESTMENTS AND FUNDING IN AUTOMOTIVE HEAT EXCHANGER MARKET, 2022-2025

- FIGURE 34 PATENT ANALYSIS, 2015-2024

- FIGURE 35 LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 36 CITY DRIVING ENERGY PATHWAYS

- FIGURE 37 OPERATING PRINCIPLE OF PHASE-CHANGE MATERIALS WITH THERMAL CONDUCTIVITY IMPROVEMENT METHODS

- FIGURE 38 OVERVIEW OF WORKING METHOD FOR BATTERY THERMAL MANAGEMENT SYSTEMS

- FIGURE 39 THERMAL MANAGEMENT OF AUDI Q6 E-TRON QUATTRO

- FIGURE 40 IMPORT DATA FOR HS CODE 870891, BY COUNTRY, 2021-2024 (USD MILLION)

- FIGURE 41 EXPORT DATA FOR HS CODE 870891, BY COUNTRY, 2021-2024 (USD MILLION)

- FIGURE 42 IMPORT DATA FOR HS CODE 841520, BY COUNTRY, 2021-2024 (USD MILLION)

- FIGURE 43 EXPORT DATA FOR HS CODE 841520, BY COUNTRY, 2021-2024 (USD MILLION)

- FIGURE 44 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AUTOMOTIVE HEAT EXCHANGERS FOR VEHICLE TYPES

- FIGURE 45 KEY BUYING CRITERIA FOR AUTOMOTIVE HEAT EXCHANGERS, BY VEHICLE TYPE

- FIGURE 46 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN AUTOMOTIVE HEAT EXCHANGER MARKET

- FIGURE 47 FUEL CELL VEHICLE THERMAL LOOP

- FIGURE 48 VOLKSWAGEN'S SUGGESTED PFAS-FREE TIMELINE

- FIGURE 49 AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- FIGURE 50 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN, 2025-2032 (USD MILLION)

- FIGURE 51 AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- FIGURE 52 AUTOMOTIVE HEAT EXCHANGER MARKET, BY ELECTRIC VEHICLE TYPE, 2025-2032 (USD MILLION)

- FIGURE 53 AUTOMOTIVE HEAT EXCHANGER MARKET, BY OFF-HIGHWAY VEHICLE TYPE, 2025-2032 (USD MILLION)

- FIGURE 54 AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2025-2032 (USD MILLION)

- FIGURE 55 ASIA PACIFIC: AUTOMOTIVE HEAT EXCHANGER MARKET SNAPSHOT

- FIGURE 56 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 57 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 58 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 59 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 60 EUROPE: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- FIGURE 61 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 62 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 63 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 64 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 65 NORTH AMERICA: AUTOMOTIVE HEAT EXCHANGER MARKET SNAPSHOT

- FIGURE 66 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 67 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 68 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 69 NORTH AMERICA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 70 REST OF THE WORLD: AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- FIGURE 71 REST OF THE WORLD: REAL GDP ANNUAL PERCENTAGE CHANGE, 2024-2026

- FIGURE 72 REST OF THE WORLD: GDP PER CAPITA, 2024-2026

- FIGURE 73 REST OF THE WORLD: AVERAGE CPI INFLATION RATE, 2024-2026

- FIGURE 74 REST OF THE WORLD: MANUFACTURING INDUSTRY'S VALUE (AS PART OF GDP 2024)

- FIGURE 75 MARKET SHARE ANALYSIS OF TOP AUTOMOTIVE HEAT EXCHANGER MANUFACTURERS, 2024

- FIGURE 76 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2020-2024

- FIGURE 77 COMPANY VALUATION OF TOP 5 PLAYERS (USD BILLION)

- FIGURE 78 FINANCIAL METRICS OF TOP 5 PLAYERS

- FIGURE 79 BRAND COMPARISON OF TOP 5 PLAYERS

- FIGURE 80 AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 81 AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 82 AUTOMOTIVE HEAT EXCHANGER MARKET: STARTUP/SME EVALUATION MATRIX, 2024

- FIGURE 83 MAHLE GMBH: COMPANY SNAPSHOT

- FIGURE 84 MAHLE GMBH: BUSINESS RESTRUCTURING

- FIGURE 85 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 86 VALEO: COMPANY SNAPSHOT

- FIGURE 87 HANON SYSTEMS: COMPANY SNAPSHOT

- FIGURE 88 T.RAD CO., LTD.: COMPANY SNAPSHOT

- FIGURE 89 T.RAD CO., LTD.: HEAT EXCHANGERS FOR FUEL CELL ELECTRIC VEHICLES

- FIGURE 90 T.RAD CO., LTD.: HEAT EXCHANGERS FOR GASOLINE/DIESEL ENGINE VEHICLES

- FIGURE 91 SANDEN CORPORATION: COMPANY SNAPSHOT

- FIGURE 92 SANDEN CORPORATION: PRODUCT PORTFOLIO

- FIGURE 93 MARELLI HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 94 MARELLI HOLDINGS CO., LTD.: THERMAL MANAGEMENT MODULE

- FIGURE 95 DANA LIMITED: COMPANY SNAPSHOT

- FIGURE 96 BANCO PRODUCTS (INDIA) LTD.: COMPANY SNAPSHOT

- FIGURE 97 NIPPON LIGHT METAL HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 98 MODINE: COMPANY SNAPSHOT

- FIGURE 99 ESTRA: COMPANY SNAPSHOT

The automotive heat exchanger market is projected to grow from USD 27.07 billion in 2025 to USD 29.94 billion by 2032 at a CAGR of 1.5%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million), Volume (Units) |

| Segments | By Propulsion and Component, Design, Off-highway vehicle type, Vehicle type, electric vehicle type, and Region |

| Regions covered | Asia Pacific, North America, Europe, and the Rest of the World |

EVs with battery capacities of up to 40 kWh typically rely on refrigerant-based cold plates or simple single-loop liquid cooling systems to manage thermal loads. As battery sizes increase to around 82 kW, advanced thermal management solutions are required, including multi-loop liquid cooling systems with integrated chillers, cold plates, and modulating valves to ensure effective heat regulation. For larger battery packs above 80 kWh, often combine dual-loop cooling systems, high-capacity chillers, cold plates, and thermal management valves to support high-power operation and fast charging requirements. For instance, the Volkswagen ID.4 comes with an ~82 kWh pouch cell battery and uses an indirect liquid cooling loop integrated with the HVAC system and a PTC heater to regulate battery temperature. Similarly, the Nissan Ariya, with a battery capacity between 63 kWh and 87 kWh, uses a liquid cooling system with a three-layer heat exchanger that includes a bottom cold plate and optimized coolant flow channels for even heat distribution. In contrast, the BMW i3, which has a smaller 42 kWh battery, uses a refrigerant-based evaporative cold plate that cools approximately 23% of the battery's underside using the vehicle's air conditioning system.

"The battery electric vehicle (BEV) segment is projected to hold the largest share of the automotive heat exchanger market during the forecast period."

Battery electric vehicles (BEVs) hold the largest share of the automotive heat exchanger market due to their high energy density and extensive thermal management needs. BEVs depend entirely on large battery packs, which generate substantial heat during charging and discharging cycles, requiring advanced heat exchanger solutions to protect batteries, power electronics, and electric drivetrains. For instance, MAHLE Anand Thermal Systems Private Limited (India) supplied a battery thermal management system and cooling chiller for Mahindra & Mahindra's 2025 Mahindra BE 6 model. The growing adoption of BEVs driven by stringent emission norms, government incentives, and progress in battery technologies is significantly boosting the demand for efficient thermal systems. Additionally, the increasing need to support fast charging, extend battery life, and enhance overall vehicle efficiency is prompting automakers to adopt high-performance thermal solutions. To meet space, weight, and performance requirements, BEVs increasingly use aluminum-based materials due to their high thermal conductivity, corrosion resistance, and lightweight properties. Leading suppliers such as MAHLE GmbH and Modine are also introducing aluminum-polymer composites and high-strength aluminum alloys, while compact and efficient designs such as stacked plates, brazed aluminum, and multi-channel laminated structures are gaining traction for their integration ease within EV platforms.

"The passenger car segment is projected to lead the automotive heat exchanger market during the forecast period."

The passenger car segment is expected to lead the automotive heat exchanger market during the forecast period, largely driven by the sustained production of ICE vehicles across various regions. As automakers continue to optimize combustion engines for performance and efficiency, the demand for reliable and high-capacity thermal management systems is increasing. Modern ICE passenger cars are incorporating more thermally intensive technologies such as turbocharging and exhaust gas recirculation (EGR), which require efficient cooling solutions such as charge air coolers, engine oil coolers, and radiators. Additionally, the shift toward vehicle electrification, along with stricter emission regulations and the need for improved fuel efficiency, is further boosting the use of efficient thermal management systems. Technological advancements in lightweight materials and the growing prevalence of compact, high-performance heat exchangers are also contributing to the sustained growth of this segment. Automotive heat exchanger manufacturers such as Mahle GmbH (Germany), Denso Corporation (Japan), Valeo (France), Hanon Systems (South Korea), and T.RAD Co., Ltd. (Japan) cater to passenger car companies. For instance, MAHLE GmbH supplied an engine oil cooler to Audi AG (Germany) for its 2025 Audi A5 vehicle model in Germany. Similarly, T.RAD Co., Ltd. provided a radiator to the Daihatsu for its 2025 Rocky, Rocky HEV, Thor, and Thor Custom vehicle models in Japan.

"Europe is expected to have a significant share of the automotive heat exchanger market during the forecast period."

Europe is expected to have a significant share of the automotive heat exchanger market during the forecast period. The European automotive heat exchanger market is primarily driven by stringent environmental regulations, such as the EU's Euro 6/7 emission standards, the CO2 fleet emission targets (95 g/km for passenger cars), and the Fit for 55 packages, which mandates a 100% reduction in CO2 emissions from new cars and vans by 2035. These regulations have significantly increased demand for advanced heat exchanger materials such as aluminum alloys and composite polymers, as well as lightweight thermal insulation solutions to improve fuel efficiency and reduce greenhouse gas emissions. The increasing emphasis on fuel efficiency and effective thermal management has also raised demand for EGR coolers, charge air coolers, and oil coolers, which help reduce engine temperatures, improve combustion efficiency, and lower NOx and CO2 emissions. The region's rapid transition toward EVs is accelerating demand for specialized heat exchangers designed to address the unique thermal challenges of EV powertrains. This includes battery cooling plates, power electronics heat exchangers, integrated thermal modules, and heat pump-based HVAC systems, all of which are critical for maintaining optimal performance, safety, and energy efficiency in EVs. MAHLE GmbH (Germany), Valeo (France), AKG Group (Germany), Nissens Automotive A/S (Denmark), Senior PLC (UK), G&M Radiator (Scotland), Climetal S.L. (Spain), and Constellium SE (France), among others, are some of the leading automotive heat exchanger manufacturers in the region.

In-depth interviews have been conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Tier I - 48%, Tier II - 28%, and OEM - 24%

- By Designation: C-Level - 56%, Managers - 28%, and Executives - 16%

- By Region: North America - 25%, Europe - 31%, Asia Pacific - 34%, and RoW - 10%

The automotive heat exchanger market is dominated by major players, including MAHLE GmbH (Germany), Denso Corporation (Japan), Valeo (France), Hanon Systems (South Korea), and T.RAD Co., Ltd. (Japan). These companies offer advanced automotive heat exchanger solutions that improve thermal efficiency, support the performance of modern powertrains, and comply with evolving regulatory and industry requirements.

Research Coverage:

The report covers the automotive heat exchanger market in terms of propulsion and component (ICE and EV), Design (plate bar, tube fin, plate type, and others), off-highway vehicle type, vehicle type, electric vehicle type, and region. It covers the competitive landscape and company profiles of the major automotive heat exchanger market ecosystem players.

The study also includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall automotive heat exchanger market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trends of the automotive heat exchanger market.

The report provides insights into the following pointers:

- Analysis of key drivers (increased cooling needs in high-performance and large-battery vehicles and technological advancements in materials and design), restraints (anticipated decline in sales of ice vehicles), opportunities (development of advanced nanoparticle-based coolants, and innovations in microchannel and lattice heat exchanger designs), and challenges (flow and distribution challenges with nanofluids, and material compatibility and corrosion issues)

- Product Development/Innovation: Detailed insights into upcoming technologies and research & development activities in the automotive heat exchanger market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the automotive heat exchanger market across regions)

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the automotive heat exchanger market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players such as Mahle GmbH (Germany), Denso Corporation (Japan), Valeo (France), Hanon Systems (South Korea), and T.RAD Co., Ltd. (Japan) in the automotive heat exchanger market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews: Demand and supply sides

- 2.1.2.2 Key industry insights and breakdown of primary interviews

- 2.1.2.3 Primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE HEAT EXCHANGER MARKET

- 4.2 AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION

- 4.3 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN

- 4.4 AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE

- 4.5 AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION

- 4.6 AUTOMOTIVE HEAT EXCHANGER MARKET, BY ELECTRIC VEHICLE TYPE

- 4.7 AUTOMOTIVE HEAT EXCHANGER MARKET, BY OFF-HIGHWAY VEHICLE TYPE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased cooling needs in high-performance and large-battery vehicles

- 5.2.1.2 Technological advancements in materials and design

- 5.2.2 RESTRAINTS

- 5.2.2.1 Decline in ICE vehicle sales

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of advanced nanoparticle-based coolants

- 5.2.3.2 Innovations in microchannel and lattice heat exchanger designs

- 5.2.4 CHALLENGES

- 5.2.4.1 Flow and distribution challenges with nanofluids

- 5.2.4.2 Material compatibility and corrosion issues

- 5.2.5 IMPACT ANALYSIS OF MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.3 INDICATIVE PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TREND, BY COMPONENT, 2022-2024

- 5.3.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.3.2.1 Asia Pacific

- 5.3.2.2 Europe

- 5.3.2.3 North America

- 5.3.2.4 Rest of the World

- 5.3.3 AVERAGE SELLING PRICE TREND OF COMPONENTS, BY PROPULSION, 2024

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 RAW MATERIAL SUPPLIERS

- 5.4.2 COMPONENT MANUFACTURERS

- 5.4.3 AUTOMOTIVE HEAT EXCHANGER MANUFACTURERS / TIER 1 SUPPLIERS

- 5.4.4 OEMS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 CONFLUX'S 3D-PRINTED WATER CHARGE AIR COOLER

- 5.6.2 TRANSFORMING THERMAL SYSTEMS WITH SERVICEABLE CARTRIDGE HEAT EXCHANGER

- 5.6.3 COST-EFFICIENT HEAT EXCHANGER PLATE MANUFACTURING WITH PHOTO CHEMICAL ETCHING

- 5.6.4 ACCELERATING PLATE HEAT EXCHANGER INNOVATION THROUGH SIMULATION-DRIVEN DESIGN

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 PATENT ANALYSIS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 KEY TECHNOLOGIES

- 5.9.2.1 Waste heat recovery systems (WHRS)

- 5.9.2.2 Phase-change materials (PCMs)

- 5.9.2.3 Novel cooling fluids

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 Battery thermal management system

- 5.9.3.2 Indirect charge air cooling

- 5.9.4 ADJACENT TECHNOLOGIES

- 5.9.4.1 Liquid-cooled charge air coolers

- 5.10 HEAT EXCHANGER PLANT LOCATIONS, BY KEY SUPPLIERS

- 5.10.1 DENSO CORPORATION

- 5.10.2 HANON SYSTEMS

- 5.10.3 T.RAD CO., LTD.

- 5.10.4 SANDEN CORPORATION

- 5.10.5 MARELLI HOLDINGS CO., LTD.

- 5.10.6 BANCO PRODUCTS (I) LTD.

- 5.10.7 NIPPON LIGHT METAL CO., LTD

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 870891

- 5.11.2 EXPORT DATA FOR HS CODE 870891

- 5.11.3 IMPORT DATA FOR HS CODE 841520

- 5.11.4 EXPORT DATA FOR HS CODE 841520

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF DATA

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY REGULATIONS IMPACTING AUTOMOTIVE HEAT EXCHANGER MARKET

- 5.13.1 US

- 5.13.2 EUROPEAN UNION

- 5.13.3 JAPAN

- 5.13.4 INDIA

- 5.13.5 CHINA

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.17 IMPACT OF AI/GENERATIVE AI

- 5.17.1 DESIGN

- 5.17.2 MANUFACTURING

- 5.17.3 MAINTENANCE

- 5.18 MNM INSIGHTS ON ADVANCEMENTS IN AUTOMOTIVE HEAT EXCHANGERS

- 5.18.1 GEOMETRIES AND ARCHITECTURES

- 5.18.1.1 Microchannel cores

- 5.18.1.2 Plate-fin and advanced fin designs

- 5.18.1.3 Additive manufacturing (3D printing)

- 5.18.1.4 Multi-mode/Adaptive features

- 5.18.2 SURFACE TREATMENTS AND COATINGS

- 5.18.2.1 Anti-corrosion coatings

- 5.18.2.2 Hydrophobic/Hydrophilic surface engineering

- 5.18.2.3 Thermal-enhancing surface coatings

- 5.18.3 MATERIAL

- 5.18.3.1 Advancement in materials

- 5.18.3.1.1 Lightweight aluminum alloys

- 5.18.3.1.2 Polymer and plastic composites

- 5.18.3.1.3 High-conductivity metals and coatings

- 5.18.3.1.4 Other materials

- 5.18.3.2 Sustainability and eco-friendly materials

- 5.18.3.1 Advancement in materials

- 5.18.1 GEOMETRIES AND ARCHITECTURES

- 5.19 FUTURE OF AUTOMOTIVE HEAT EXCHANGERS FOR ALTERNATIVE FUEL TECHNOLOGIES

- 5.19.1 FUEL CELL VEHICLE (FCEV) COOLING

- 5.19.2 BATTERY ELECTRIC (BEV) AND SOLID-STATE BATTERY (SSB) COOLING

- 5.20 KEY OEM REFRIGERANT TREND, BY COUNTRY/REGION

- 5.20.1 EUROPE

- 5.20.2 NORTH AMERICA

- 5.20.3 CHINA

- 5.21 MNM INSIGHTS ON FUTURE HEAT EXCHANGER PRODUCTS

- 5.21.1 EV COOLING SYSTEMS

- 5.21.2 A/C HEAT PUMP SYSTEMS

- 5.21.3 FUEL CELL SYSTEMS

- 5.21.4 HEAT EXCHANGER TECHNOLOGY TRENDS

6 AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION AND COMPONENT

- 6.1 INTRODUCTION

- 6.2 INTERNAL COMBUSTION ENGINE (ICE)

- 6.2.1 INCREASING ADOPTION OF TURBOCHARGING AND DOWNSIZED POWERTRAINS TO DRIVE MARKET

- 6.2.2 ICE AUTOMOTIVE HEAT EXCHANGER MARKET, BY COMPONENT

- 6.2.2.1 Engine radiator

- 6.2.2.2 Condenser

- 6.2.2.3 Evaporator

- 6.2.2.4 Oil cooler

- 6.2.2.5 Heater

- 6.2.2.6 Charge air cooler

- 6.2.2.7 Exhaust gas heat exchanger

- 6.3 ELECTRIC VEHICLE (EV)

- 6.3.1 ADVANCEMENTS IN BATTERY THERMAL MANAGEMENT SYSTEMS TO DRIVE MARKET

- 6.3.2 ELECTRIC VEHICLE HEAT EXCHANGER MARKET, BY COMPONENT

- 6.3.2.1 Battery cooling system

- 6.3.2.2 Engine radiator

- 6.3.2.3 Chiller

- 6.3.2.4 Water-cooled condenser

- 6.3.2.5 AC condenser

- 6.3.2.6 Evaporator

- 6.3.2.7 Oil cooler

- 6.3.2.8 Heater

- 6.3.2.9 Charge air cooler

- 6.3.2.10 Exhaust gas heat exchanger

- 6.4 KEY INDUSTRY INSIGHTS

7 AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN

- 7.1 INTRODUCTION

- 7.2 TUBE AND FIN

- 7.2.1 MASS PRODUCTION OF ICE VEHICLES TO DRIVE MARKET

- 7.3 BAR AND PLATE

- 7.3.1 GROWING DEMAND FOR DURABLE AND COMPACT THERMAL SYSTEMS TO DRIVE MARKET

- 7.4 PLATE TYPE

- 7.4.1 GROWING FOCUS ON VEHICLE LIGHTWEIGHTING AND THERMAL EFFICIENCY TO DRIVE MARKET

- 7.5 OTHERS

- 7.6 KEY INDUSTRY INSIGHTS

8 AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- 8.2 PASSENGER CAR

- 8.2.1 RISING USE OF TURBOCHARGED ENGINES TO DRIVE MARKET

- 8.3 LIGHT COMMERCIAL VEHICLE

- 8.3.1 FOCUS ON CLEANER AND MORE EFFICIENT VEHICLE OPERATIONS TO DRIVE MARKET

- 8.4 TRUCK

- 8.4.1 STRICTER EMISSION REGULATIONS TO DRIVE MARKET

- 8.5 BUS

- 8.5.1 RISING ADOPTION OF LOW-EMISSION TECHNOLOGIES TO DRIVE MARKET

- 8.6 KEY INDUSTRY INSIGHTS

9 AUTOMOTIVE HEAT EXCHANGER MARKET, BY ELECTRIC VEHICLE TYPE

- 9.1 INTRODUCTION

- 9.2 BATTERY ELECTRIC VEHICLE (BEV)

- 9.2.1 GROWING DEMAND FOR FAST CHARGING TO DRIVE MARKET

- 9.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 9.3.1 GROWING NEED TO MANAGE MULTIPLE THERMAL ZONES IN PHEVS TO DRIVE MARKET

- 9.4 HYBRID ELECTRIC VEHICLE (HEV)

- 9.4.1 INCREASING FOCUS ON BETTER FUEL ECONOMY TO DRIVE MARKET

- 9.5 KEY INDUSTRY INSIGHTS

10 AUTOMOTIVE HEAT EXCHANGER MARKET, BY OFF-HIGHWAY VEHICLE TYPE

- 10.1 INTRODUCTION

- 10.2 AGRICULTURAL EQUIPMENT

- 10.2.1 ADOPTION OF PRECISION FARMING AND SUSTAINABLE PRACTICES TO DRIVE MARKET

- 10.3 CONSTRUCTION EQUIPMENT

- 10.3.1 EXPANSION OF LOCAL MANUFACTURING CAPABILITIES AND OEM INVESTMENTS IN ASIA PACIFIC TO DRIVE MARKET

- 10.4 KEY PRIMARY INSIGHTS

11 AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 MACROECONOMIC OUTLOOK

- 11.2.2 CHINA

- 11.2.2.1 Growing popularity of hybrid-turbocharged engines to drive market

- 11.2.3 INDIA

- 11.2.3.1 Sustained ICE vehicle demand to drive market

- 11.2.4 JAPAN

- 11.2.4.1 OEMs' focus on developing ICE engine technologies to drive market

- 11.2.5 SOUTH KOREA

- 11.2.5.1 Increasing demand for premium vehicles to drive market

- 11.2.6 REST OF ASIA PACIFIC

- 11.3 EUROPE

- 11.3.1 MICROECONOMIC OUTLOOK

- 11.3.2 GERMANY

- 11.3.2.1 Presence of key OEMs to support long-term market growth

- 11.3.3 FRANCE

- 11.3.3.1 Government push for sustainable transport solutions to drive market

- 11.3.4 UK

- 11.3.4.1 Growing demand for LCVs due to booming e-commerce and logistics industries to drive market

- 11.3.5 SPAIN

- 11.3.5.1 Innovations in synthetic fuels to drive market

- 11.3.6 ITALY

- 11.3.6.1 Industrial collaboration strategy to drive market

- 11.3.7 REST OF EUROPE

- 11.4 NORTH AMERICA

- 11.4.1 MACROECONOMIC OUTLOOK

- 11.4.2 US

- 11.4.2.1 Increased R&D and OEM investments in thermal systems to drive market

- 11.4.3 CANADA

- 11.4.3.1 Focus on energy-efficient and lightweight vehicle production to drive market

- 11.4.4 MEXICO

- 11.4.4.1 Replacement of local transportation with zero-emission vehicles to drive market

- 11.5 REST OF THE WORLD

- 11.5.1 MACROECONOMIC OUTLOOK

- 11.5.2 BRAZIL

- 11.5.2.1 Introduction of locally manufactured hybrid models to drive market

- 11.5.3 RUSSIA

- 11.5.3.1 Surge in domestic OEM output to drive market

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Strong ICE vehicle production to drive market

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS FOR AUTOMOTIVE HEAT EXCHANGER MANUFACTURERS, 2024

- 12.4 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.5.1 COMPANY VALUATION

- 12.5.2 FINANCIAL METRICS

- 12.6 BRAND/ PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Component footprint

- 12.7.5.4 Off-highway vehicle type footprint

- 12.7.5.5 Vehicle type footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 List of startups/SMEs

- 12.8.5.2 Competitive benchmarking of startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 MAHLE GMBH

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches/developments

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 DENSO CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Expansions

- 13.1.2.3.2 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 VALEO

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 HANON SYSTEMS

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Expansions

- 13.1.4.3.3 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 T.RAD CO., LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 SANDEN CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.6.3.3 Expansions

- 13.1.7 MARELLI HOLDINGS CO., LTD.

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.7.3.3 Other developments

- 13.1.8 DANA LIMITED

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Expansions

- 13.1.8.3.2 Other developments

- 13.1.9 BANCO PRODUCTS (INDIA) LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Other developments

- 13.1.10 NIPPON LIGHT METAL HOLDINGS CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 MODINE

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product Launches

- 13.1.11.3.2 Deals

- 13.1.11.3.3 Expansions

- 13.1.11.3.4 Other developments

- 13.1.12 AKG GROUP

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 ESTRA

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.1 MAHLE GMBH

- 13.2 OTHER PLAYERS

- 13.2.1 S.M. AUTO

- 13.2.2 NISSENS AUTOMOTIVE A/S

- 13.2.3 G&M RADIATOR

- 13.2.4 BORGWARNER INC.

- 13.2.5 TYC BROTHER INDUSTRIAL CO., LTD.

- 13.2.6 TATA AUTOCOMP SYSTEMS

- 13.2.7 SIAM CALSONIC CO., LTD.

- 13.2.8 SENIOR PLC

- 13.2.9 CONFLUX

- 13.2.10 CLIMETAL S.L.

- 13.2.11 CONSTELLIUM SE

- 13.2.12 SUBROS LIMITED

14 RECOMMENDATIONS BY MARKETSANDMARKETS

- 14.1 SHIFTING MOBILITY TRENDS INFLUENCING AUTOMOTIVE HEAT EXCHANGER DEMAND IN KEY MARKETS

- 14.2 ADOPTION OF LIGHTWEIGHT AND SUSTAINABLE MATERIALS FOR NEXT-GEN MOBILITY

- 14.3 INNOVATION OF HEAT EXCHANGER DESIGNS FOR HIGH-EFFICIENCY

- 14.4 CONCLUSION

15 APPENDIX

- 15.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.4.1 AUTOMOTIVE HEAT EXCHANGER MARKET BY EV TYPE AT COUNTRY LEVEL

- 15.4.2 AUTOMOTIVE HEAT EXCHANGER MARKET BY COMPONENT TYPE AT COUNTRY LEVEL

- 15.4.3 COMPANY INFORMATION

- 15.4.3.1 Profiling of additional market players (up to five)

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS