|

|

市場調査レポート

商品コード

1761744

北米の力率改善市場:無効電力別、タイプ別、販売チャネル別、用途別、地域別 - 2030年までの予測North America Power Factor Correction Market by Reactive Power (0-200 KVAr, 200-500 KVAr, 500-1,500 KVAr, Above 1,500 KVAr), Type (Automatic, Fixed), Sales Channel (Distributors, OEM Direct), Application, and Region - Global Trends & Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 北米の力率改善市場:無効電力別、タイプ別、販売チャネル別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月30日

発行: MarketsandMarkets

ページ情報: 英文 161 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の力率改善の市場規模は、2025年の7億3,420万米ドルから2030年には9億9,910万米ドルに達すると予測され、予測期間(2025年~2030年)のCAGRは6.2%になるとみられています。

エネルギーコストの上昇と厳しい規制により、製造業、石油・ガス、HVACなどの業界は、無効電力を最小化し、エネルギー損失を削減し、システムの信頼性を高めるために、コンデンサや自動制御システムなどの先進的なPFCソリューションの採用を推進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象台数 | 金額(100万米ドル)および数量(台) |

| セグメント | 無効電力別、タイプ別、販売チャネル別、用途別、地域別 |

| 対象地域 | 北米 |

OEMダイレクトセグメントは、オーダーメイドのエネルギー効率に優れたソリューションをメーカーに直接提供する役割を果たすため、北米の力率改善市場で最も高い成長を記録すると予測されています。石油・ガス、製造、水処理などの分野で産業が急成長する中、OEMはエネルギー効率基準を満たし、運用コストを削減し、電力品質を向上させるために、先進的なPFC技術を機器に組み込むことが増えており、それがこのセグメントの成長を促進しています。

自動セグメントは、リアルタイムで力率を動的に調整する能力により、北米の力率補正市場全体をリードし、様々な産業で最適なエネルギー効率を確保すると予測されています。インテリジェントコントローラを備えたコンデンサバンクなどの自動システムは、石油・ガス、製造、HVACなどの分野で広く採用されており、無効電力を最小化し、エネルギー損失を削減し、システムの信頼性を高めるため、最新の電力管理に適した選択肢となっています。

米国は、急速な工業化、インフラ開拓、エネルギー効率重視の姿勢を背景に、北米地域で最も急成長する力率改善市場になると予測されます。製造、鉱業、水処理などの産業における電力品質に対する需要の高まりと、省エネルギーを推進する政府の積極的な取り組みが、先進的な力率改善ソリューションの採用に拍車をかけています。

Eaton Corporation plc(アイルランド)、GE Vernova(米国)、Schneider Electric(フランス)、ABB(スイス)、Gentec(カナダ)は、北米力率改善市場の主要参入企業です。

この調査には、北米力率改善市場におけるこれらの主要企業の企業プロファイル、最近の動向、主な市場戦略など、詳細な競合分析が含まれています。

北米の力率改善市場をタイプ別(自動、固定)、販売チャネル別(ディストリビューター、OEM直販)、無効電力別(0~200KVAr、200~500KVAr、500~1500KVAr、1500KVAr以上)、用途別(産業、再生可能エネルギー、商業、データセンター、EV充電)、地域別(北米)に定義、記述、予測しています。北米の力率改善市場の成長に影響を与える市場促進要因・課題などの主な要因に関する詳細情報を調査範囲としています。主要な業界参入企業を詳細に分析し、事業概要、ソリューション、サービス、契約、投資、パートナーシップ、提携、合弁事業、協定、新製品・サービスの発売、M&Aなどの主要戦略、北米力率改善市場に関連する最近の動向に関する洞察を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 北米の力率改善市場におけるAI/生成AIの影響

- 北米:マクロ経済見通し

- 技術分析

- 特許分析

- 貿易分析

- 2024年~2025年の主な会議とイベント

- 価格分析

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 2025年の米国関税の影響-北米力率改善市場

第6章 北米の力率改善市場(無効電力別)

- イントロダクション

- 0~200 KVAR

- 200~500KVAR

- 500~1,500 KVAR

- 1,500 KVAR以上

第7章 北米の力率改善市場(タイプ別)

- イントロダクション

- 自動

- 固定

第8章 北米の力率改善市場(販売チャネル別)

- イントロダクション

- 販売代理店

- OEMダイレクト

第9章 北米の力率改善市場(用途別)

- イントロダクション

- 工業

- 再生可能エネルギー

- 商業

- データセンター

- EV充電

第10章 北米の力率改善市場(地域別)

- 北米

- 米国

- カナダ

- メキシコ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2019年~2023年

- 2023年の市場シェア分析

- 収益分析、2019年~2023年

- ブランド/製品比較

- 企業評価と財務指標、2024年

- 企業評価マトリックス:主要参入企業、2023年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- SCHNEIDER ELECTRIC

- EATON

- GE VERNOVA

- ABB

- HITACHI ENERGY LTD.

- GENTEC

- TCI, LLC

- POWERSIDE

- COS PHI

- CONTROLLIX CORPORATION

- CIRCUTOR

第13章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS, BY REACTIVE POWER

- TABLE 2 INCLUSIONS AND EXCLUSIONS, BY TYPE

- TABLE 3 INCLUSIONS AND EXCLUSIONS, BY SALES CHANNEL

- TABLE 4 INCLUSIONS AND EXCLUSIONS, BY APPLICATION

- TABLE 5 NORTH AMERICA POWER FACTOR CORRECTION MARKET SNAPSHOT

- TABLE 6 ROLE OF COMPANIES IN NORTH AMERICA POWER FACTOR CORRECTION ECOSYSTEM

- TABLE 7 WORLD GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 8 MANUFACTURING VALUE ADDED (% OF GDP), 2023

- TABLE 9 ELECTRICITY PRODUCTION, BY COUNTRY, 2023 (TWH)

- TABLE 10 POWER FACTOR CORRECTION MARKET: LIST OF MAJOR PATENTS, 2021-2024

- TABLE 11 EXPORT SCENARIO FOR HS CODE 8532-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 12 IMPORT SCENARIO FOR HS CODE 8532-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 13 NORTH AMERICA POWER FACTOR CORRECTION MARKET: LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 14 INDICATIVE PRICING TREND OF CAPACITOR BANKS USED IN POWER FACTOR CORRECTION, BY REACTIVE POWER, 2023 (USD PER UNIT)

- TABLE 15 AVERAGE SELLING PRICE TREND OF POWER FACTOR CORRECTION SYSTEM, BY REGION, 2021-2023 (USD PER UNIT)

- TABLE 16 IMPORT TARIFF FOR HS CODE 8532-COMPLIANT PRODUCTS, 2023

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 NORTH AMERICA POWER FACTOR CORRECTION REGULATIONS, BY REGULATORY BODY

- TABLE 19 NORTH AMERICA POWER FACTOR CORRECTION REGULATIONS, BY COUNTRY

- TABLE 20 NORTH AMERICA POWER FACTOR CORRECTION MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 21 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 22 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 23 NORTH POWER FACTOR CORRECTION MARKET, BY REACTIVE POWER, 2021-2023 (USD MILLION)

- TABLE 24 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY REACTIVE POWER, 2024-2030 (USD MILLION)

- TABLE 25 NORTH POWER FACTOR CORRECTION MARKET, BY REACTIVE POWER, 2021-2023 (UNITS)

- TABLE 26 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY REACTIVE POWER, 2024-2030 (UNITS)

- TABLE 27 0-200 KVAR: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 28 0-200 KVAR: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 29 200-500 KVAR: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 30 200-500 KVAR: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 31 500-1,500 KVAR: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 32 500-1,500 KVAR: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 33 ABOVE 1,500 KVAR: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 34 ABOVE 1,500 KVAR: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 36 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 37 AUTOMATIC: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 38 AUTOMATIC: POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 39 FIXED: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 40 FIXED: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY SALES CHANNEL, 2021-2023 (USD MILLION)

- TABLE 42 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY SALES CHANNEL, 2024-2030 (USD MILLION)

- TABLE 43 DISTRIBUTORS: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 44 DISTRIBUTORS: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 45 OEM DIRECT: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 46 OEM DIRECT: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 48 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 49 INDUSTRIAL: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 50 INDUSTRIAL: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 51 INDUSTRIAL: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 52 INDUSTRIAL: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 53 RENEWABLE: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 54 RENEWABLE: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 55 RENEWABLE: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY SOURCE, 2021-2023 (USD MILLION)

- TABLE 56 RENEWABLE: POWER FACTOR CORRECTION MARKET, BY SOURCE, 2024-2030 (USD MILLION)

- TABLE 57 COMMERCIAL: POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 58 COMMERCIAL: POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 59 DATA CENTER: POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 60 DATA CENTER: POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 61 EV CHARGING: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 62 EV CHARGING: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY REACTIVE POWER, 2021-2023 (USD MILLION)

- TABLE 64 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY REACTIVE POWER, 2024-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 66 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY SALES CHANNEL, 2021-2023 (USD MILLION)

- TABLE 68 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY SALES CHANNEL, 2024-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 70 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA POWER FACTOR CORRECTION MARKET FOR RENEWABLE APPLICATIONS, BY SOURCE, 2021-2023 (USD MILLION)

- TABLE 72 NORTH AMERICA POWER FACTOR CORRECTION MARKET FOR RENEWABLE APPLICATIONS, BY SOURCE, 2024-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA POWER FACTOR CORRECTION MARKET FOR INDUSTRIAL APPLICATIONS, BY END USER, 2021-2023 (USD MILLION)

- TABLE 74 NORTH AMERICA POWER FACTOR CORRECTION MARKET FOR INDUSTRIAL APPLICATIONS, BY END USER, 2024-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 76 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 77 US: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 78 US: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 79 CANADA: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 80 CANADA: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 81 MEXICO: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 82 MEXICO: NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA POWER FACTOR CORRECTION MARKET: OVERVIEW OF KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, JANUARY 2019-AUGUST 2023

- TABLE 84 NORTH AMERICA POWER FACTOR CORRECTION MARKET: DEGREE OF COMPETITION, 2023

- TABLE 85 NORTH AMERICA POWER FACTOR CORRECTION MARKET: REACTIVE POWER FOOTPRINT

- TABLE 86 NORTH AMERICA POWER FACTOR CORRECTION MARKET: APPLICATION FOOTPRINT

- TABLE 87 NORTH AMERICA POWER FACTOR CORRECTION MARKET: TYPE FOOTPRINT

- TABLE 88 NORTH AMERICA POWER FACTOR CORRECTION MARKET: PRODUCT LAUNCHES, JANUARY 2019-JUNE 2024

- TABLE 89 NORTH AMERICA POWER FACTOR CORRECTION MARKET: OTHER DEVELOPMENTS

- TABLE 90 SCHNIEDER ELECTRIC: COMPANY OVERVIEW

- TABLE 91 SCHNIEDER ELECTRIC: PRODUCTS OFFERED

- TABLE 92 SCHNEIDER ELECTRIC: RECENT DEVELOPMENTS

- TABLE 93 EATON: COMPANY OVERVIEW

- TABLE 94 EATON: PRODUCTS OFFERED

- TABLE 95 EATON: DEVELOPMENTS

- TABLE 96 GE VERNOVA: COMPANY OVERVIEW

- TABLE 97 GE VERNOVA: PRODUCTS OFFERED

- TABLE 98 GE VERNOVA: DEALS

- TABLE 99 ABB: COMPANY OVERVIEW

- TABLE 100 ABB: PRODUCTS OFFERED

- TABLE 101 HITACHI ENERGY LTD.: COMPANY OVERVIEW

- TABLE 102 HITACHI ENERGY LTD.: PRODUCTS OFFERED

- TABLE 103 HITACHI ENERGY: DEVELOPMENTS

- TABLE 104 GENTEC: COMPANY OVERVIEW

- TABLE 105 GENTEC: PRODUCTS OFFERED

- TABLE 106 GENTEC: DEVELOPMENTS

- TABLE 107 TCI, LLC: COMPANY OVERVIEW

- TABLE 108 TCI, LLC: PRODUCTS OFFERED

- TABLE 109 POWERSIDE: COMPANY OVERVIEW

- TABLE 110 POWERSIDE: PRODUCTS OFFERED

- TABLE 111 COS PHI: COMPANY OVERVIEW

- TABLE 112 COS PHI: PRODUCTS OFFERED

- TABLE 113 CONTROLLIX CORPORATION: COMPANY OVERVIEW

- TABLE 114 CONTROLLIX CORPORATION: PRODUCTS OFFERED

- TABLE 115 CIRCUTOR: COMPANY OVERVIEW

- TABLE 116 CIRCUTOR: PRODUCTS OFFERED

List of Figures

- FIGURE 1 NORTH AMERICA: POWER FACTOR CORRECTION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 NORTH AMERICA POWER FACTOR CORRECTION MARKET: RESEARCH DESIGN

- FIGURE 3 NORTH AMERICA POWER FACTOR CORRECTION MARKET: DATA TRIANGULATION

- FIGURE 4 NORTH AMERICA POWER FACTOR CORRECTION MARKET: BOTTOM-UP APPROACH

- FIGURE 5 NORTH AMERICA POWER FACTOR CORRECTION MARKET: TOP-DOWN APPROACH

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF POWER FACTOR CORRECTION SYSTEMS

- FIGURE 7 NORTH AMERICA POWER FACTOR CORRECTION MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DISTRIBUTORS TO BE LARGER SALES CHANNEL SEGMENT IN 2024

- FIGURE 9 AUTOMATIC TO BE LARGER TYPE SEGMENT IN 2024

- FIGURE 10 INDUSTRIAL APPLICATION SEGMENT TO LEAD MARKET IN 2024

- FIGURE 11 0-200 KVAR SEGMENT TO HOLD MAJORITY OF MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 INCREASING DEMAND FOR ENERGY EFFICIENCY ACROSS INDUSTRIAL SECTOR TO DRIVE MARKET

- FIGURE 13 DISTRIBUTORS AND AUTOMATIC SEGMENTS TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 14 DISTRIBUTORS SEGMENT TO CAPTURE LARGER MARKET SHARE IN 2030

- FIGURE 15 AUTOMATIC SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 16 0-200 KVAR SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 17 INDUSTRIAL SEGMENT TO LEAD MARKET IN 2030

- FIGURE 18 NORTH AMERICA POWER FACTOR CORRECTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 GLOBAL ENERGY INVESTMENTS IN CLEAN ENERGY AND FOSSIL FUELS, 2015-2023

- FIGURE 20 WORLDWIDE ANNUAL INVESTMENT IN ENERGY EFFICIENCY BY COMPANIES IN INDUSTRIAL SECTOR, 2020-2022

- FIGURE 21 INVESTMENTS IN POWER GRID INFRASTRUCTURE DEVELOPMENT, 2015-2022

- FIGURE 22 PUBLICLY AVAILABLE EV CHARGING POINTS IN US, FAST VS. SLOW, 2015-2023

- FIGURE 23 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 24 NORTH AMERICA POWER FACTOR CORRECTION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 NORTH AMERICA POWER FACTOR CORRECTION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 FUNDING SCENARIO FOR TOP PLAYERS

- FIGURE 27 IMPACT OF AI/GENERATIVE AI ON POWER FACTOR CORRECTION SUPPLY CHAIN

- FIGURE 28 POWER FACTOR CORRECTION MARKET: PATENTS APPLIED AND GRANTED, 2014-2023

- FIGURE 29 EXPORT DATA FOR HS CODE 8532-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023

- FIGURE 30 IMPORT DATA FOR HS CODE 8532-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023

- FIGURE 31 AVERAGE SELLING PRICE TREND OF POWER FACTOR CORRECTION SYSTEM, BY NORTH AMERICA, 2021-2023

- FIGURE 32 NORTH AMERICA POWER FACTOR CORRECTION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 35 NORTH AMERICA POWER FACTOR CORRECTION MARKET SHARE, BY REACTIVE POWER, 2023

- FIGURE 36 NORTH AMERICA POWER FACTOR CORRECTION MARKET SHARE, BY TYPE, 2023

- FIGURE 37 NORTH AMERICA POWER FACTOR CORRECTION MARKET SHARE, BY SALES CHANNEL, 2023

- FIGURE 38 NORTH AMERICA POWER FACTOR CORRECTION MARKET SHARE, BY APPLICATION, 2023

- FIGURE 39 NORTH AMERICA POWER FACTOR CORRECTION MARKET SHARE ANALYSIS, 2023

- FIGURE 40 NORTH AMERICA POWER FACTOR CORRECTION MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023

- FIGURE 41 BRAND COMPARISON

- FIGURE 42 COMPANY VALUATION

- FIGURE 43 FINANCIAL METRICS

- FIGURE 44 NORTH AMERICA POWER FACTOR CORRECTION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 45 NORTH AMERICA POWER FACTOR CORRECTION MARKET: COMPANY FOOTPRINT

- FIGURE 46 SCHNIEDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 47 EATON: COMPANY SNAPSHOT

- FIGURE 48 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 49 ABB: COMPANY SNAPSHOT

- FIGURE 50 HITACHI ENERGY LTD.: COMPANY SNAPSHOT

The North America power factor correction market is projected to reach USD 999.1 million by 2030 from an estimated USD 734.2 million in 2025, at a CAGR of 6.2% during the forecast period (2025-2030). Rising energy costs and stringent regulations are pushing industries like manufacturing, oil & gas, and HVAC to adopt advanced PFC solutions, such as capacitors and automatic control systems, to minimize reactive power, reduce energy losses, and enhance system reliability.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Units) |

| Segments | Type, Reactive Power, Sales Channel, Application, and Region |

| Regions covered | North America |

"OEM direct is expected to be the fastest-growing segment during the forecast period."

The OEM direct segment is projected to register the highest growth in the North America power factor correction market due to its role in delivering tailored, energy-efficient solutions directly to manufacturers. With rapid industrial growth in sectors like oil & gas, manufacturing, and water treatment, OEMs are increasingly integrating advanced PFC technologies into their equipment to meet energy efficiency standards, reduce operational costs, and improve power quality, thereby driving segment growth.

"Automatic segment to be largest type in North America power factor correction market"

The automatic segment is anticipated to lead the overall power factor correction market in the North America due to its ability to dynamically adjust power factor in real-time, ensuring optimal energy efficiency across various industries. Automatic systems, such as capacitor banks with intelligent controllers, are widely adopted in sectors like oil & gas, manufacturing, and HVAC, where they minimize reactive power, reduce energy losses, and enhance system reliability, making them a preferred choice for modern power management.

"US to register highest CAGR in North America power factor correction market"

The US is projected to be the fastest-growing power factor correction market in the North America region driven by rapid industrialization, infrastructure development, and a strong focus on energy efficiency. The increasing demand for power quality in industries such as manufacturing, mining, and water treatment, along with supportive government initiatives promoting energy conservation, is fueling the adoption of advanced power factor correction solutions across the country.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 45%, Tier 2 - 30%, and Tier 3 - 25%

By Designation: C-Level - 35%, Director Levels - 25%, and Others - 40%

Note 1: Others include sales managers, engineers, and regional managers.

Note 2: The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million.

Eaton Corporation plc (Ireland), GE Vernova (US), Schneider Electric (France), ABB (Switzerland), and Gentec (Canada) are some of the key players in the North America power factor correction market.

The study includes an in-depth competitive analysis of these key players in the North America power factor correction market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report defines, describes, and forecasts the North America power factor correction market by type (Automatic, Fixed), by sales channel (Distributors, OEM direct), by reactive power (0-200 KVAr, 200-500 KVAr, 500-1,500 KVAr, Above 1500 KVAr), by application (Industrial, Renewable, Commercial, Data Center, and EV Charging), and by region (North America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the North America power factor correction market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies such as contracts, investments, partnerships, collaborations, joint ventures, agreements, new product & service launches, and mergers & acquisitions; and recent developments associated with the North America power factor correction market.

Key Benefits of Buying the Report

- Analysis of key drivers (Increasing investments in clear energy projects, Rising deployment of low-voltage PFC systems in industrial facilities), restraints (High initial installation cost of PFC systems), opportunities (Introduction of incentive schemes by governments for adopting energy saving technologies, Growing inclination toward smart grid deployment, Elevating demand for electric vehicles), and challenges (Complexities associated with integrating PFC systems into existing infrastructure) influencing the growth of the power factor correction market.

- Product Development/Innovation: With a focus on energy efficiency and regulatory compliance, manufacturers in North America are advancing power factor correction (PFC) technologies. Companies are innovating by developing high-performance capacitors and control systems designed to meet the specific needs of the region's industrial and commercial sectors. These advancements aim to enhance power quality, reduce energy losses, and integrate seamlessly with modern infrastructure, driving broader adoption in applications like manufacturing and HVAC systems during the forecast period.

- Market Diversification: In August 2023, Eaton invested over USD 500 million to increase the manufacturing of electrical solutions and meet the surging demand for these solutions from the North American industries. This substantial investment aims to expedite the energy transition and digitalization in utilities, commercial, healthcare, industrial, and residential sectors.

- Market Development: The power factor correction market is driven by increasing emphasis on energy efficiency, regulatory compliance, and sustainable power management. Supportive government policies promoting reduced energy consumption and the rising adoption of PFCs in industrial and commercial applications, such as oil & gas and manufacturing are driving the power factor correction market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Eaton Corporation plc (Ireland), GE Vernova (US), Schneider Electric (France), ABB (Switzerland), and Gentec (Canada), among others, in the North America power factor correction market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 UNITS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 PRIMARY AND SECONDARY RESEARCH

- 2.2 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.1.2 Key secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Major primary interview participants

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primary interviews

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.3.1 Demand-side assumptions

- 2.3.3.2 Demand-side calculations

- 2.3.4 SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side assumptions

- 2.3.4.2 Supply-side calculations

- 2.3.5 GROWTH FORECAST

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NORTH AMERICA POWER FACTOR CORRECTION MARKET

- 4.2 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY SALES CHANNEL AND TYPE

- 4.3 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY SALES CHANNEL

- 4.4 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY TYPE

- 4.5 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY REACTIVE POWER

- 4.6 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY APPLICATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing investments in clean energy projects

- 5.2.1.2 Rising deployment of low-voltage PFC systems in industrial facilities

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial installation cost of PFC systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Introduction of incentive schemes by governments for adopting energy-saving technologies

- 5.2.3.2 Growing inclination toward smart grid deployment

- 5.2.3.3 Elevating demand for electric vehicles

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities associated with integrating PFC systems into existing infrastructure

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

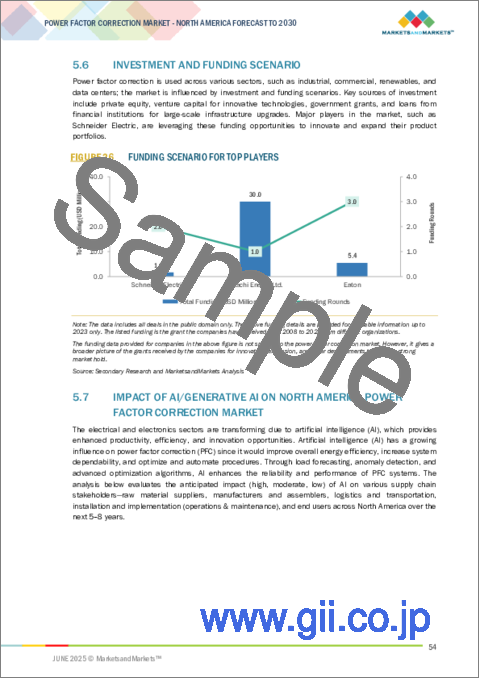

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 IMPACT OF AI/GENERATIVE AI ON NORTH AMERICA POWER FACTOR CORRECTION MARKET

- 5.7.1 RATIONALE FOR IMPACT LEVELS

- 5.8 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 5.8.1 INTRODUCTION

- 5.8.2 GDP TRENDS AND FORECAST

- 5.8.3 MANUFACTURING VALUE ADDED (% OF GDP)

- 5.8.4 ELECTRICITY PRODUCTION

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Internet of Things (IoT)

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Solid-state switching devices

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 EXPORT SCENARIO (HS CODE 8532)

- 5.11.2 IMPORT SCENARIO (HS CODE 8532)

- 5.12 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND OF POWER FACTOR CORRECTION SYSTEM, BY NORTH AMERICA

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF ANALYSIS

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.3 REGULATORY FRAMEWORK

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF SUBSTITUTES

- 5.15.2 BARGAINING POWER OF SUPPLIERS

- 5.15.3 BARGAINING POWER OF BUYERS

- 5.15.4 THREAT OF NEW ENTRANTS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 CASE STUDY ANALYSIS

- 5.17.1 ELIMINATING ENERGY PENALTIES THROUGH STRATEGIC POWER FACTOR CORRECTION

- 5.18 IMPACT OF 2025 US TARIFF - NORTH AMERICA POWER FACTOR CORRECTION MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON NORTH AMERICA

6 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY REACTIVE POWER

- 6.1 INTRODUCTION

- 6.2 0-200 KVAR

- 6.2.1 RISING DEMAND ACROSS SMALL COMMERCIAL APPLICATIONS TO DRIVE SEGMENTAL GROWTH

- 6.3 200-500 KVAR

- 6.3.1 RISING USE IN MEDIUM-SIZED COMMERCIAL BUILDINGS AND INDUSTRIAL FACILITIES TO DRIVE SEGMENTAL GROWTH

- 6.4 500-1,500 KVAR

- 6.4.1 INCREASING FOCUS OF LARGE INDUSTRIAL PLANT OWNERS ON MINIMIZING ENERGY LOSSES TO BOOST DEMAND

- 6.5 ABOVE 1,500 KVAR

- 6.5.1 PRESSING NEED TO STABILIZE VOLTAGE LEVELS ACROSS POWER GRID TO SUPPORT SEGMENTAL GROWTH

7 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 AUTOMATIC

- 7.2.1 ABILITY TO CRAFT EFFICIENT ELECTRICAL SYSTEMS TO BOOST DEMAND

- 7.3 FIXED

- 7.3.1 RISING FOCUS ON ENERGY COST REDUCTION TO SUPPORT SEGMENTAL GROWTH

8 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY SALES CHANNEL

- 8.1 INTRODUCTION

- 8.2 DISTRIBUTORS

- 8.2.1 ABILITY TO COVER BROADER GEOGRAPHIC AREAS AND ENTER NEW MARKETS AT FASTER RATE TO BOOST SEGMENTAL GROWTH

- 8.3 OEM DIRECT

- 8.3.1 HIGHER UPFRONT COSTS FOR TRAINING SALES TEAM TO LEAD TO SMALLER MARKET SHARE

9 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 INDUSTRIAL

- 9.2.1 RISING USE OF POWER-INTENSIVE INDUSTRIAL EQUIPMENT TO BOOST DEMAND

- 9.3 RENEWABLE

- 9.3.1 INTEGRATION OF RENEWABLE ENERGY SOURCES INTO POWER GRID TO PROPEL MARKET

- 9.4 COMMERCIAL

- 9.4.1 INCREASING DEMAND FOR ENERGY EFFICIENCY AND COST REDUCTION IN COMMERCIAL BUILDINGS TO DRIVE MARKET

- 9.5 DATA CENTER

- 9.5.1 SURGING NEED FOR EFFICIENT AND RELIABLE DATA CENTER INFRASTRUCTURE TO DRIVE MARKET GROWTH

- 9.6 EV CHARGING

- 9.6.1 INCREASING INVESTMENT AND RAPID EXPANSION OF ELECTRIC VEHICLES TO SUPPORT MARKET GROWTH

10 NORTH AMERICA POWER FACTOR CORRECTION MARKET, BY REGION

- 10.1 NORTH AMERICA

- 10.1.1 US

- 10.1.1.1 Increasing focus on sustainable energy production using renewable sources to boost demand

- 10.1.2 CANADA

- 10.1.2.1 Rising demand from automotive sector to augment market growth

- 10.1.3 MEXICO

- 10.1.3.1 Thriving industrial sector to drive demand

- 10.1.1 US

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019-2023

- 11.3 MARKET SHARE ANALYSIS, 2023

- 11.4 REVENUE ANALYSIS, 2019-2023

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING COMPANIES

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Company footprint

- 11.7.5.2 Reactive power footprint

- 11.7.5.3 Application footprint

- 11.7.5.4 Type footprint

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES

- 11.8.2 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SCHNEIDER ELECTRIC

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 EATON

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 GE VERNOVA

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 ABB

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Key strengths

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 HITACHI ENERGY LTD.

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 GENTEC

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.7 TCI, LLC

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.8 POWERSIDE

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.9 COS PHI

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 CONTROLLIX CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 CIRCUTOR

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.1 SCHNEIDER ELECTRIC

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS