|

|

市場調査レポート

商品コード

1761499

データセンターコロケーションの世界市場:サービスタイプ別、サービス規模別、ワークロードタイプ別、組織規模別、エンドユーザー別 - AI/生成AIの影響 - 2030年までの予測Data Center Colocation Market by Service Type (Traditional and Managed), Service Scale (Retail and Wholesale), Workload Type (General Purpose IT and HPC & AI), End User (Enterprises and Hyperscalers) with Impact of AI/GenAI - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| データセンターコロケーションの世界市場:サービスタイプ別、サービス規模別、ワークロードタイプ別、組織規模別、エンドユーザー別 - AI/生成AIの影響 - 2030年までの予測 |

|

出版日: 2025年06月27日

発行: MarketsandMarkets

ページ情報: 英文 278 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

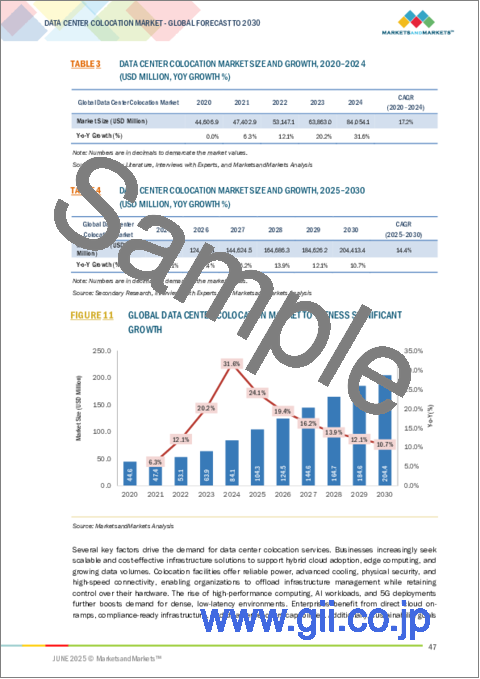

データセンターコロケーションの市場規模は急速に拡大しており、2025年の1,042億米ドルから2030年には2,044億米ドルに拡大すると予測され、予測期間中のCAGRは14.4%と見込まれています。

データセンターコロケーション市場は、いくつかの主要促進要因によって力強い勢いを見せています。これには、AIや高密度GPUワークロードをサポートするニーズの高まり、シームレスなデータフローを実現するハイブリッド・マルチクラウド相互接続エコシステムの台頭、ローカルホスティングとコンプライアンスを必要とするデータ主権規制の強化などが含まれます。こうした動向は、コロケーション・プロバイダーに新たな成長機会をもたらしています。しかし、いくつかの制約が採用を制限する可能性もあります。企業とサービス・プロバイダーの複雑な相互依存関係は、運用管理の低下を懸念させる。さらに、インフラをカスタマイズする必要性は、コロケーションサービスが提供する標準化されたモデルと相反することが多く、特定の展開ニーズを持つ企業にとっては障壁となります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント | サービスタイプ別、サービス規模別、ワークロードタイプ別、組織規模別、エンドユーザー別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

データセンターコロケーション市場において、マネージドコロケーションは予測期間中に最も急成長するサービスタイプであり、IT運用の簡素化と稼働時間の向上という企業のニーズに後押しされています。従来のコロケーションでは、安全なラックスペース、電力、冷却、基本的なネットワークアクセスが提供されますが、マネージド・コロケーションでは、リモートハンドサポート、システム監視、データバックアップ、ディザスタリカバリ、マネージドネットワークサービスが追加されます。このモデルは、中堅・中小企業、デジタル企業、ハイブリッドITに移行する企業など、大規模な社内チームがないにもかかわらず、信頼性と拡張性に優れ、コンプライアンスに準拠したインフラを必要とする企業に魅力的です。企業はコロケーション・プロバイダーに日常業務を任せることで、自社の主力製品やサービスに集中することができます。従来型のコロケーションは、社内のIT能力が高く、予算が厳しい企業の間では依然として人気があるが、その成長は鈍化しています。予測可能なコストとより高いサービスレベルを求める企業が増えるにつれ、マネージド・コロケーションの需要は他のサービスタイプを上回るようになると思われます。

リテールコロケーションは、参入障壁の低さ、柔軟な契約条件、迅速なプロビジョニング機能などを背景に、予測期間中、サービス規模別セグメントで最大のシェアを占めると思われます。このモデルは、複数のテナントが設定可能なラック、ケージ、キャビネットのスペースを共有するもので、多額の先行投資をせずに信頼性の高いインフラへの迅速なアクセスを必要とする中小企業、地域サービスプロバイダー、大企業の支店業務に適しています。従量制の課金体系と最小電力要件が小さいことから、リテール・コロケーションの優位性はさらに強固なものとなっており、企業はワークロードの変化に応じてシームレスに拡張することができます。ホールセールコロケーションは2番目に大きなセグメントですが、主に大規模な専用スペース、電力、冷却を求めるハイパースケーラーや大企業を対象としています。

北米は、確立されたインフラ、広範な相互接続ネットワーク、金融、ヘルスケア、クラウドプロバイダーからの旺盛な企業需要により、データセンターコロケーション市場におけるリーダーシップを維持しています。一方、アジア太平洋は、クラウドやAIインフラへの投資の急増を背景に、コロケーションの急成長地域として急加速しています。例えば、インドネシアのノンサ・デジタル・パークに72MWのデータセンター・キャンパスを建設するため、最近4億1,100万米ドルのルピア建て融資が実行されました。この成長は、ハイブリッドで地域密着型のコロケーション・ソリューションにおけるアジア太平洋地域の戦略的な勢いを強調しています。

当レポートでは、世界のデータセンターコロケーション市場について調査し、サービスタイプ別、サービス規模別、ワークロードタイプ別、組織規模別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- エコシステム分析

- サプライチェーン分析

- 価格分析

- 特許分析

- 技術分析

- 規制状況

- ポーターのファイブフォース分析

- 購買プロセスにおける主要な利害関係者

- 2025年の主な会議とイベント

- 顧客ビジネスに影響を与える動向/混乱

- ビジネスモデル分析

- 投資と資金調達のシナリオ

- データセンターコロケーション市場におけるAI/GEN AIの影響

第6章 データセンターコロケーション市場(サービスタイプ別)

- イントロダクション

- 伝統的なコロケーション

- マネージドコロケーション

第7章 データセンターコロケーション市場(サービス規模別)

- イントロダクション

- 小売コロケーション

- 卸売コロケーション

第8章 データセンターコロケーション市場(ワークロードタイプ別)

- イントロダクション

- 高性能コンピューティング

- 汎用IT

第9章 データセンターコロケーション市場(組織規模別)

- イントロダクション

- 中小企業

- 大企業

第10章 データセンターコロケーション市場(エンドユーザー別)

- イントロダクション

- ハイパースケーラー

- 企業

第11章 データセンターコロケーション市場(地域別)

- イントロダクション

- 北米

- 北米:データセンターコロケーション市場促進要因

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:データセンターコロケーション市場促進要因

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- 中欧と西欧のその他の地域

- 南欧

- 東欧

- 北欧

- アジア太平洋

- アジア太平洋:データセンターコロケーション市場促進要因

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- インド

- 香港

- その他

- 中東・アフリカ

- 中東・アフリカ:コロケーションデータセンター市場促進要因

- 中東・アフリカ:マクロ経済見通し

- 湾岸協力会議加盟国

- 南アフリカ

- その他

- ラテンアメリカ

- ラテンアメリカ:データセンターコロケーション市場促進要因

- ラテンアメリカ:マクロ経済展望

- ブラジル

- メキシコ

- その他

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析、2024年

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 主要ベンダーの企業評価と財務指標

- 競合シナリオと動向

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- EQUINIX

- DIGITAL REALTY

- NTT DATA

- QTS DATA CENTERS

- KDDI CORPORATION

- IRON MOUNTAIN

- CHINA TELECOM CORPORATION LTD

- CYRUSONE

- CENTERSQUARE

- VANTAGE DATA CENTERS

- その他の企業

- DATABANK

- EDGECONNEX

- SWITCH

- CORESITE

- ALIGNED DATA CENTERS

- FLEXENTIAL

- TIERPOINT

- COLOGIX

- TRG DATACENTERS

- SCALEMATRIX

- AT&T

- GLOBAL DATA SYSTEMS

- VERNE GLOBAL

- 365 DATA GROUP

- BDX DATA CENTERS

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 DATA CENTER COLOCATION MARKET SIZE AND GROWTH, 2020-2024 (USD MILLION, YOY GROWTH %)

- TABLE 4 DATA CENTER COLOCATION MARKET SIZE AND GROWTH, 2025-2030 (USD MILLION, YOY GROWTH %)

- TABLE 5 ROLES OF COMPANIES IN ECOSYSTEM

- TABLE 6 DATA CENTER COLOCATION MARKET: SUPPLY CHAIN ANALYSIS

- TABLE 7 INDICATIVE PRICING OF DATA CENTER COLOCATION SERVICES, BY REGION, 2024

- TABLE 8 LIST OF MAJOR PATENTS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PORTER'S FIVE FORCES ANALYSIS: DATA CENTER COLOCATION MARKET

- TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP TWO END USERS

- TABLE 15 KEY BUYING CRITERIA FOR TOP END USERS

- TABLE 16 DATA CENTER COLOCATION MARKET: KEY CONFERENCES AND EVENTS IN 2025

- TABLE 17 DATA CENTER COLOCATION MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 18 DATA CENTER COLOCATION MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 19 TRADITIONAL COLOCATION: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 20 TRADITIONAL COLOCATION: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21 MANAGED COLOCATION: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 22 MANAGED COLOCATION: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 24 DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 25 RETAIL COLOCATION: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 RETAIL COLOCATION: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 WHOLESALE COLOCATION: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 WHOLESALE COLOCATION: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 DATA CENTER COLOCATION MARKET, BY WORKLOAD TYPE, 2020-2024 (USD MILLION)

- TABLE 30 DATA CENTER COLOCATION MARKET, BY WORKLOAD TYPE, 2025-2030 (USD MILLION)

- TABLE 31 HIGH-PERFORMANCE COMPUTING: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 HIGH-PERFORMANCE COMPUTING: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 GENERAL PURPOSE IT: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 GENERAL PURPOSE IT: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 DATA CENTER COLOCATION MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 36 DATA CENTER COLOCATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 37 SMES: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 SMES: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 LARGE ENTERPRISES: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 LARGE ENTERPRISES: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 DATA CENTER COLOCATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 42 DATA CENTER COLOCATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 43 HYPERSCALERS: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 HYPERSCALERS: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 ENTERPRISES: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 ENTERPRISES: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 BFSI: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 BFSI: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 IT & ITES: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 IT & ITES: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 TELECOMMUNICATIONS: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 TELECOMMUNICATIONS: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 GOVERNMENT & PUBLIC SECTOR: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 GOVERNMENT & PUBLIC SECTOR: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 HEALTHCARE & LIFE SCIENCES: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 HEALTHCARE & LIFE SCIENCES: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 RETAIL & E-COMMERCE: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 RETAIL & E-COMMERCE: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 MANUFACTURING: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 MANUFACTURING: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 ENERGY & UTILITIES: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 ENERGY & UTILITIES: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 OTHER ENTERPRISES: DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 OTHER ENTERPRISES: DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 DATA CENTER COLOCATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 DATA CENTER COLOCATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: DATA CENTER COLOCATION MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 68 NORTH AMERICA: DATA CENTER COLOCATION MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 70 NORTH AMERICA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: DATA CENTER COLOCATION MARKET, BY WORKLOAD TYPE, 2020-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: DATA CENTER COLOCATION MARKET, BY WORKLOAD TYPE, 2025-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: DATA CENTER COLOCATION MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 74 NORTH AMERICA: DATA CENTER COLOCATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: DATA CENTER COLOCATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: DATA CENTER COLOCATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: DATA CENTER COLOCATION MARKET, BY ENTERPRISES, 2020-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: DATA CENTER COLOCATION MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 80 NORTH AMERICA: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 US: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 82 US: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 83 CANADA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 84 CANADA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 85 EUROPE: DATA CENTER COLOCATION MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 86 EUROPE: DATA CENTER COLOCATION MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 87 EUROPE: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 88 EUROPE: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: DATA CENTER COLOCATION MARKET, BY WORKLOAD TYPE, 2020-2024 (USD MILLION)

- TABLE 90 EUROPE: DATA CENTER COLOCATION MARKET, BY WORKLOAD TYPE, 2025-2030 (USD MILLION)

- TABLE 91 EUROPE: DATA CENTER COLOCATION MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 92 EUROPE: DATA CENTER COLOCATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: DATA CENTER COLOCATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 94 EUROPE: DATA CENTER COLOCATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 95 EUROPE: DATA CENTER COLOCATION MARKET, BY ENTERPRISES, 2020-2024 (USD MILLION)

- TABLE 96 EUROPE: DATA CENTER COLOCATION MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 98 EUROPE: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 CENTRAL AND WESTERN EUROPE: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 100 CENTRAL AND WESTERN EUROPE: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 SOUTHERN EUROPE: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 102 SOUTHERN EUROPE: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 UK: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 104 UK: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 105 GERMANY: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 106 GERMANY: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 107 FRANCE: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 108 FRANCE: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 109 REST OF CENTRAL & WESTERN EUROPE: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 110 REST OF CENTRAL & WESTERN EUROPE: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 111 ITALY: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 112 ITALY: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 113 REST OF SOUTHERN EUROPE: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 114 REST OF SOUTHERN EUROPE: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 115 EASTERN EUROPE: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 116 EASTERN EUROPE: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 117 NORTHERN EUROPE: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 118 NORTHERN EUROPE: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 120 ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 122 ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY WORKLOAD TYPE, 2020-2024 (USD MILLION)

- TABLE 124 ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY WORKLOAD TYPE, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 128 ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY ENTERPRISES, 2020-2024 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 133 CHINA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 134 CHINA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 135 JAPAN: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 136 JAPAN: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 137 INDIA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 138 INDIA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 139 HONG KONG: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 140 HONG KONG: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY WORKLOAD TYPE, 2020-2024 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY WORKLOAD TYPE, 2025-2030 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY ENTERPRISES, 2020-2024 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 157 GULF COOPERATION COUNCIL COUNTRIES: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 158 GULF COOPERATION COUNCIL COUNTRIES: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 159 GULF COOPERATION COUNCIL COUNTRIES: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 160 GULF COOPERATION COUNCIL COUNTRIES: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 161 KSA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 162 KSA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 163 UAE: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 164 UAE: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 165 REST OF GCC COUNTRIES: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 166 REST OF GCC COUNTRIES: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 167 SOUTH AFRICA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 168 SOUTH AFRICA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 169 REST OF MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 170 REST OF MIDDLE EAST & AFRICA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 171 LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 172 LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 173 LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 174 LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 175 LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY WORKLOAD TYPE, 2020-2024 (USD MILLION)

- TABLE 176 LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY WORKLOAD TYPE, 2025-2030 (USD MILLION)

- TABLE 177 LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 178 LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 179 LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 180 LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 181 LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY ENTERPRISES, 2020-2024 (USD MILLION)

- TABLE 182 LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 183 LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 184 LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 185 BRAZIL: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 186 BRAZIL: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 187 MEXICO: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 188 MEXICO: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 189 REST OF LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2020-2024 (USD MILLION)

- TABLE 190 REST OF LATIN AMERICA: DATA CENTER COLOCATION MARKET, BY SERVICE SCALE, 2025-2030 (USD MILLION)

- TABLE 191 DATA CENTER COLOCATION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2023-2025

- TABLE 192 MARKET SHARE OF KEY VENDORS, 2024

- TABLE 193 DATA CENTER COLOCATION MARKET: REGION FOOTPRINT

- TABLE 194 DATA CENTER COLOCATION MARKET: SERVICE TYPE FOOTPRINT

- TABLE 195 DATA CENTER COLOCATION MARKET: SERVICE SCALE FOOTPRINT

- TABLE 196 DATA CENTER COLOCATION MARKET: END USER FOOTPRINT

- TABLE 197 DATA CENTER COLOCATION MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 198 DATA CENTER COLOCATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 199 DATA CENTER COLOCATION MARKET: PRODUCT LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 200 DATA CENTER COLOCATION MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 201 EQUINIX: COMPANY OVERVIEW

- TABLE 202 EQUINIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 EQUINIX: PRODUCT LAUNCHES

- TABLE 204 EQUINIX: DEALS

- TABLE 205 EQUINIX: EXPANSIONS

- TABLE 206 DIGITAL REALTY: COMPANY OVERVIEW

- TABLE 207 DIGITAL REALTY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 DIGITAL REALTY: PRODUCT LAUNCHES

- TABLE 209 DIGITAL REALTY: DEALS

- TABLE 210 DIGITAL REALTY: EXPANSIONS

- TABLE 211 NTT DATA: COMPANY OVERVIEW

- TABLE 212 NTT DATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 NTT DATA: DEALS

- TABLE 214 NTT DATA: EXPANSIONS

- TABLE 215 QTS DATA CENTERS: COMPANY OVERVIEW

- TABLE 216 QTS DATA CENTERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 QTS DATA CENTERS: PRODUCT LAUNCHES

- TABLE 218 QTS DATA CENTERS: DEALS

- TABLE 219 KDDI CORPORATION: COMPANY OVERVIEW

- TABLE 220 KDDI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 KDDI CORPORATION: PRODUCT LAUNCHES

- TABLE 222 KDDI CORPORATION: DEALS

- TABLE 223 IRON MOUNTAIN: COMPANY OVERVIEW

- TABLE 224 IRON MOUNTAIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 IRON MOUNTAIN: DEALS

- TABLE 226 IRON MOUNTAIN: EXPANSIONS

- TABLE 227 CHINA TELECOM CORPORATION LTD: COMPANY OVERVIEW

- TABLE 228 CHINA TELECOM CORPORATION LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 CHINA TELECOM CORPORATION LTD: PRODUCT LAUNCHES

- TABLE 230 CHINA TELECOM CORPORATION LTD: EXPANSIONS

- TABLE 231 CYRUSONE: COMPANY OVERVIEW

- TABLE 232 CYRUSONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 CYRUSONE: PRODUCT LAUNCHES

- TABLE 234 CYRUSONE: DEALS

- TABLE 235 CYRUSONE: EXPANSIONS

- TABLE 236 CENTERSQUARE: COMPANY OVERVIEW

- TABLE 237 CENTERSQUARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 CENTERSQUARE: DEALS

- TABLE 239 VANTAGE DATA CENTERS: COMPANY OVERVIEW

- TABLE 240 VANTAGE DATA CENTERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 VANTAGE DATA CENTERS: DEALS

- TABLE 242 VANTAGE DATA CENTERS: EXPANSIONS

- TABLE 243 RELATED MARKETS

- TABLE 244 DATA CENTER RACK MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 245 DATA CENTER RACK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 246 HYPERSCALE DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 247 HYPERSCALE COMPUTING MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

List of Figures

- FIGURE 1 MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DATA CENTER COLOCATION MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 DATA CENTER COLOCATION MARKET: DATA TRIANGULATION

- FIGURE 5 DATA CENTER COLOCATION MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF DATA CENTER COLOCATION VENDORS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM OFFERINGS

- FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): DATA CENTER COLOCATION MARKET

- FIGURE 11 GLOBAL DATA CENTER COLOCATION MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 12 FASTEST-GROWING SEGMENTS IN DATA CENTER COLOCATION MARKET, 2025-2030

- FIGURE 13 DATA CENTER COLOCATION MARKET: REGIONAL SNAPSHOT

- FIGURE 14 RISING DIGITAL INFRASTRUCTURE DEMANDS AND AI WORKLOADS TO ACCELERATE MARKET GROWTH

- FIGURE 15 TRADITIONAL SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 RETAIL COLOCATION SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 GENERAL PURPOSE IT TO HOLD SIGNIFICANT SHARE DURING FORECAST PERIOD

- FIGURE 18 LARGE ENTERPRISES TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 20 IT & ITES SEGMENT TO HOLD MAJOR SHARE DURING FORECAST PERIOD

- FIGURE 21 ASIA PACIFIC TO EMERGE AS LARGEST MARKET FOR NEXT FIVE YEARS

- FIGURE 22 COLOCATION DATA CENTER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 DATA CENTER COLOCATION ECOSYSTEM

- FIGURE 24 GENERATIVE AI MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 INDICATIVE PRICING FOR KEY PLAYERS, BY DATA CENTER COLOCATION SERVICES, 2024

- FIGURE 26 NUMBER OF PATENTS PUBLISHED, 2014-2024

- FIGURE 27 PORTER'S FIVE FORCES ANALYSIS: DATA CENTER COLOCATION MARKET

- FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP TWO END USERS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP END USERS

- FIGURE 30 DATA CENTER COLOCATION MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 31 LEADING GLOBAL DATA CENTER COLOCATION VENDORS, BY NUMBER OF INVESTORS AND FUNDING ROUNDS, 2024

- FIGURE 32 MARKET POTENTIAL OF GENERATIVE AI IN TRANSFORMING DATA CENTER COLOCATION

- FIGURE 33 TRADITIONAL COLOCATION SEGMENT TO HOLD LARGER MARKET DURING FORECAST PERIOD

- FIGURE 34 RETAIL COLOCATION SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 35 GENERAL-PURPOSE IT SEGMENT TO HOLD LARGER MARKET DURING FORECAST PERIOD

- FIGURE 36 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET DURING FORECAST PERIOD

- FIGURE 37 ENTERPRISES SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 38 IT & ITES SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 42 REVENUE ANALYSIS OF KEY VENDORS, 2020-2024

- FIGURE 43 DATA CENTER COLOCATION MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 44 DATA CENTER COLOCATION MARKET: VENDOR PRODUCTS/BRANDS COMPARISON

- FIGURE 45 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 46 DATA CENTER COLOCATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 DATA CENTER COLOCATION MARKET: COMPANY FOOTPRINT

- FIGURE 48 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 49 DATA CENTER COLOCATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 COMPANY VALUATION OF KEY VENDORS

- FIGURE 51 EV/EBITDA ANALYSIS OF KEY VENDORS

- FIGURE 52 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 53 EQUINIX: COMPANY SNAPSHOT

- FIGURE 54 DIGITAL REALTY: COMPANY SNAPSHOT

- FIGURE 55 NTT DATA: COMPANY SNAPSHOT

- FIGURE 56 KDDI CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 IRON MOUNTAIN: COMPANY SNAPSHOT

- FIGURE 58 CHINA TELECOM CORPORATION LTD: COMPANY SNAPSHOT

The data center colocation market is expanding rapidly, with a projected market size rising from USD 104.2 billion in 2025 to USD 204.4 billion by 2030, at a CAGR of 14.4% during the forecast period. The data center colocation market is witnessing strong momentum due to several key drivers. These include the growing need to support AI and high-density GPU workloads, the rise of hybrid-multicloud interconnection ecosystems for seamless data flow, and increasing data-sovereignty regulations that require local hosting and compliance. These trends are creating new growth opportunities for colocation providers. However, some restraints could limit adoption. The complex interdependency between enterprises and service providers raises concerns about reduced operational control. Additionally, the need for customized infrastructure often conflicts with the standardized models offered by colocation services, creating a barrier for businesses with specific deployment needs.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Billion) |

| Segments | service type, service scale, workload type, organization size, end user |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

"Managed colocation segment to account for the fastest growth rate during the forecast period"

Managed colocation is the fastest-growing service type in the data center colocation market during the forecast period, driven by companies' need to simplify IT operations and improve uptime. Traditional colocation provides secure rack space, power, cooling, and basic network access, but managed colocation adds remote-hand support, system monitoring, data backup, disaster recovery, and managed network services. This model appeals to small and mid-sized businesses, digital companies, and organizations moving to hybrid IT that lack large in-house teams but still need reliable, scalable, and compliant infrastructure. Companies can focus on their core products and services by handing routine tasks to the colocation provider. Traditional colocation remains popular among firms with strong internal IT capabilities and tight budgets, but its growth is slower. As more organizations seek predictable costs and higher service levels, demand for managed colocation is set to outpace other service types.

"Retail colocation to hold the largest market share during the forecast period"

Retail colocation will hold the largest share of the service scale segment during the forecast period, driven by its low entry barriers, flexible contract terms, and rapid provisioning capabilities. This model-where multiple tenants share configurable rack, cage, and cabinet space-appeals to small and mid-sized enterprises, regional service providers, and branch operations of larger organizations that require quick access to reliable infrastructure without heavy upfront commitments. The pay-as-you-grow billing structure and smaller minimum power requirements further cement retail colocation's dominance, enabling businesses to scale seamlessly in response to changing workloads. Wholesale colocation, while the second-largest segment, caters primarily to hyperscalers and large enterprises seeking dedicated space, power, and cooling at scale; it continues to grow steadily but trails retail colocation's broader addressable market and faster deployment cycles.

"North America leads the data center colocation market, while Asia Pacific is the fastest-growing region"

North America maintains its leadership in the data center colocation market due to its well-established infrastructure, extensive interconnection networks, and strong enterprise demand from finance, healthcare, and cloud providers. Meanwhile, Asia Pacific is rapidly accelerating as the fastest-growing region in colocation, driven by surging investments in cloud and AI infrastructure. For instance, a recent USD 411 million rupiah-denominated loan is being deployed to build a 72-MW data center campus in Indonesia's Nongsa Digital Park, highlighting regional appetite for advanced, edge-ready facilities. This growth underscores Asia Pacific's strategic momentum in hybrid, localized colocation solutions.

Breakdown of Primaries

In-depth interviews were conducted with chief executive officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the data center colocation market.

- By Company: Tier I - 30%, Tier II - 45%, and Tier III - 25%

- By Designation: C-Level Executives - 50%, D-Level Executives -35%, and others - 15%

- By Region: North America - 50%, Europe - 30%, Asia Pacific - 15%, and Rest of the world - 5%

The report includes a study of key players offering data center colocation services. It profiles major vendors in the cloud computing market. The major market players include Equinix (US), Digital Realty (US), NTT Data Corporation (Japan), QTS Data Centers (US), KDDI Corporation (Japan), Iron Mountain (US), China Telcom (China), and CyrusOne (Texas), DataBank (Texas), EdgeConneX (USA), Switch (US), CoreSite (US), Aligned Data Centers (Texas), Flexential (US), TierPoint (US), Cologix (US), ScaleMatrix (US), AT&T (US), Global Data Systems (US), Data Foundary (US), 365 DataCenters (US), Kao Data (UK), Verizon (US), and T-Systems (Germany).

Research Coverage

This research report categorizes the data center colocation market based on Service Type (Traditional Colocation, Managed Colocation), Service Scale (Retail Colocation, Wholesale Colocation), Workload Type (High Performance Computing (HPC), General purpose IT), Organization Size (SMES, Large Enterprises), End User (Hyperscalers, and Enterprises (Banking, Financial Services, & Insurances (BFSI), IT & ITES, Telecommunications, Government & Public sector, Healthcare & Life Sciences, Retail & Ecommerce, Manufacturing, Energy & Utilities, Other Enterprises)), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the data center colocation market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, and mergers and acquisitions; and recent developments associated with the data center colocation market. This report also covered the competitive analysis of upcoming startups in the data center colocation market ecosystem.

Reason to Buy this Report

The report would provide the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall data center colocation market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their business and plan suitable go-to-market strategies. It will also help stakeholders understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (AI compute facilitator driving demand for specialized colocation infrastructure, digital sovereignty and geopolitical resilience accelerate colocation demand, shared green infrastructure enhances sustainable colocation deployments globally), restraints (complex interdependency raises concerns about provider controlled operations, complex interdependency burden limits seamless integration, talent gap at the edge challenges hybrid it scaling, customization versus standardization remains a key dilemma), opportunities (edge colocation and local ecosystems drive new growth, sustainability as a service gains enterprise attention, AI as a service infrastructure unlocks new growth in colocation), and challenges (colocation sprawl and distributed network management challenges enterprise efficiency, skills deficit hampers hybrid colocation management, regulatory scrutiny and data barriers complicate operations)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the data center colocation market

- Market Development: Comprehensive information about lucrative markets - the data center colocation market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the data center colocation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Equinix (US), Digital Realty (US), NTT Data Corporation (Japan), QTS Data Centers (US), KDDI Corporation (Japan), Iron Mountain (US), China Telcom (China), CyrusOne (Texas), DataBank (Texas), EdgeConneX (US), Switch (US), CoreSite (US), Aligned Data Centers (Texas), Flexential (US), TierPoint (US), Cologix (US), ScaleMatrix (US), AT&T (US), Global Data Systems (US), Data Foundary (US), 365 DataCenters (US), Kao Data (UK), Verizon (US), and T-Systems (Germany)

The report also helps stakeholders understand the pulse of the data center colocation market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DATA CENTER COLOCATION MARKET

- 4.2 DATA CENTER COLOCATION MARKET, BY SERVICE TYPE

- 4.3 DATA CENTER COLOCATION MARKET, BY SERVICE SCALE

- 4.4 DATA CENTER COLOCATION MARKET, BY WORKLOAD TYPE

- 4.5 DATA CENTER COLOCATION MARKET, BY ORGANIZATION SIZE

- 4.6 DATA CENTER COLOCATION MARKET, BY END USER

- 4.7 DATA CENTER COLOCATION MARKET, BY ENTERPRISE

- 4.8 DATA CENTER COLOCATION MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for AI & high-density GPU workloads

- 5.2.1.2 Surge in use of hybrid-multicloud interconnected ecosystems

- 5.2.1.3 Implementation of data-sovereignty regulations (hosting, residency, AI privacy)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Long lead times for critical electrical & mechanical gear

- 5.2.2.2 High up-front capital costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integrating sustainability in data colocation

- 5.2.3.2 Managed AI-Infrastructure-as-a-Service

- 5.2.4 CHALLENGES

- 5.2.4.1 Skilled labor shortage

- 5.2.4.2 Transforming legacy halls for cutting-edge liquid cooling solutions

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CASE STUDY 1: SAP SCALES GLOBAL CLOUD INFRASTRUCTURE 6X FASTER WITH DIGITAL REALTY'S PLATFORMDIGITAL COLOCATION SERVICES

- 5.3.2 CASE STUDY 2: BMW GROUP ENHANCES NETWORK STABILITY AND AUTOMATION USING NTT DATA'S MANAGED COLOCATION INFRASTRUCTURE

- 5.3.3 CASE STUDY 3: CBS INTERACTIVE ACHIEVES HIGH-DENSITY, ENERGY-EFFICIENT COLOCATION WITH IRON MOUNTAIN'S PHOENIX DATA CENTER

- 5.3.4 CASE STUDY 4: NESTLE JAPAN MODERNIZES EDI AND CLOUD MONITORING WITH EQUINIX'S SITEROCK AND IBX COLOCATION SOLUTIONS

- 5.3.5 CASE STUDY 5: EXABEAM STREAMLINES QA LAB MIGRATION WITH EVOCATIVE'S SEAMLESS COLOCATION AND REMOTE ACCESS SOLUTION

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 INDICATIVE PRICING OF DATA CENTER COLOCATION SERVICES, BY REGION, 2024

- 5.6.2 INDICATIVE PRICING FOR KEY PLAYERS, BY DATA CENTER COLOCATION SERVICES, 2024

- 5.7 PATENT ANALYSIS

- 5.7.1 LIST OF MAJOR PATENTS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGY

- 5.8.1.1 Power & cooling infrastructure

- 5.8.1.2 Remote monitoring and data center infrastructure management

- 5.8.1.3 Physical security & access control systems

- 5.8.1.4 Interconnection & carrier-neutral connectivity

- 5.8.2 COMPLIMENTARY TECHNOLOGY

- 5.8.2.1 AI & machine learning for predictive maintenance

- 5.8.2.2 Liquid & immersion cooling

- 5.8.2.3 Software-defined wide area network

- 5.8.2.4 Data Center as a Service

- 5.8.3 ADJACENT TECHNOLOGY

- 5.8.3.1 Public & hybrid cloud platforms

- 5.8.3.2 Edge computing

- 5.8.3.3 Content delivery networks

- 5.8.3.4 Enterprise storage & backup solutions

- 5.8.1 KEY TECHNOLOGY

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 KEY REGULATIONS, BY REGION

- 5.9.2.1 North America

- 5.9.2.2 Europe

- 5.9.2.3 Asia Pacific

- 5.9.2.4 Middle East & South Africa

- 5.9.2.5 Latin America

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS, 2025

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 BUSINESS MODEL ANALYSIS

- 5.14.1 PRICING MODEL

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 IMPACT OF AI/GEN AI IN DATA CENTER COLOCATION MARKET

- 5.16.1 TOP USE CASES AND MARKET POTENTIAL

- 5.16.1.1 Key use cases

- 5.16.2 CASE STUDY

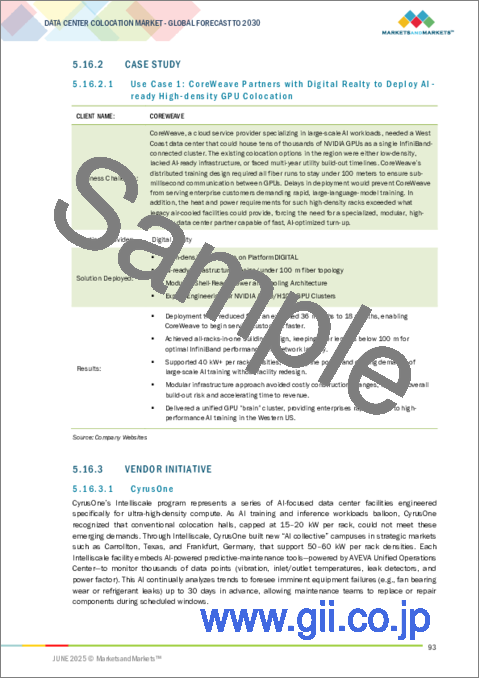

- 5.16.2.1 Use Case 1: CoreWeave Partners with Digital Realty to Deploy AI-ready High-density GPU Colocation

- 5.16.3 VENDOR INITIATIVE

- 5.16.3.1 CyrusOne

- 5.16.3.2 Digital Realty

- 5.16.1 TOP USE CASES AND MARKET POTENTIAL

6 DATA CENTER COLOCATION MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- 6.1.1 SERVICE TYPE: DATA CENTER COLOCATION MARKET DRIVERS

- 6.2 TRADITIONAL COLOCATION

- 6.2.1 GROWING PREFERENCE FOR FULL INFRASTRUCTURE CONTROL AND COMPLIANCE TO DRIVE SEGMENTAL GROWTH

- 6.3 MANAGED COLOCATION

- 6.3.1 RISING DEMAND FOR OPERATIONAL AGILITY AND REMOTE IT MANAGEMENT TO DRIVE SEGMENTAL GROWTH

7 DATA CENTER COLOCATION MARKET, BY SERVICE SCALE

- 7.1 INTRODUCTION

- 7.1.1 SERVICE SCALE: DATA CENTER COLOCATION MARKET DRIVERS

- 7.2 RETAIL COLOCATION

- 7.2.1 RISING DEMAND FOR SCALABLE, COST-EFFECTIVE INFRASTRUCTURE TO SUPPORT SME AND STARTUP GROWTH

- 7.3 WHOLESALE COLOCATION

- 7.3.1 INCREASING DEMAND FOR CUSTOMIZABLE, HIGH-CAPACITY INFRASTRUCTURE TO DRIVE MARKET

8 DATA CENTER COLOCATION MARKET, BY WORKLOAD TYPE

- 8.1 INTRODUCTION

- 8.1.1 WORKLOAD TYPE: DATA CENTER COLOCATION MARKET DRIVERS

- 8.2 HIGH PERFORMANCE COMPUTING

- 8.2.1 ACCELERATING DEMAND FOR SCALABLE, HIGH-SPEED INFRASTRUCTURE TO DRIVE MARKET

- 8.3 GENERAL PURPOSE IT

- 8.3.1 INCREASING DEMAND FOR SCALABLE, SECURE INFRASTRUCTURE TO SUPPORT CORE BUSINESS WORKLOADS AND SEGMENTAL GROWTH

9 DATA CENTER COLOCATION MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- 9.1.1 ORGANIZATION SIZE: DATA CENTER COLOCATION MARKET DRIVERS

- 9.2 SMES

- 9.2.1 EXPANDING NEED FOR SCALABLE, SECURE INFRASTRUCTURE AMONG SMES TO BOOST MARKET

- 9.3 LARGE ENTERPRISES

- 9.3.1 LEVERAGING ENTERPRISE-GRADE INFRASTRUCTURE AND STRATEGIC FLEXIBILITY TO STRENGTHEN LARGE ENTERPRISES

10 DATA CENTER COLOCATION MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.1.1 END USER: DATA CENTER COLOCATION MARKET DRIVERS

- 10.2 HYPERSCALERS

- 10.2.1 SURGING INFRASTRUCTURE DEMAND AND GLOBAL SCALABILITY PROPEL COLOCATION ADOPTION AMONG HYPERSCALE PROVIDERS

- 10.3 ENTERPRISES

- 10.3.1 DIVERSE INDUSTRY REQUIREMENTS AND DIGITAL DEMANDS DRIVE ENTERPRISE ADOPTION OF SCALABLE COLOCATION INFRASTRUCTURE

- 10.3.2 BANKING, FINANCIAL SERVICES, & INSURANCE

- 10.3.3 IT & ITES

- 10.3.4 TELECOMMUNICATIONS

- 10.3.5 GOVERNMENT & PUBLIC SECTOR

- 10.3.6 HEALTHCARE & LIFE SCIENCES

- 10.3.7 RETAIL & E-COMMERCE

- 10.3.8 MANUFACTURING

- 10.3.9 ENERGY & UTILITIES

- 10.3.10 OTHER ENTERPRISES

11 DATA CENTER COLOCATION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.1.1 NORTH AMERICA

- 11.1.2 NORTH AMERICA: DATA CENTER COLOCATION MARKET DRIVERS

- 11.1.3 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.1.4 US

- 11.1.4.1 Increasing data center colocation with strategic investments and government support to drive market

- 11.1.5 CANADA

- 11.1.5.1 Powering digital future through sustainable and innovative services to drive market

- 11.2 EUROPE

- 11.2.1 EUROPE: DATA CENTER COLOCATION MARKET DRIVERS

- 11.2.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.2.3 UK

- 11.2.3.1 Advancing digital future through strategic colocation and infrastructure expansion to drive market

- 11.2.4 GERMANY

- 11.2.4.1 Driving colocation growth with sustainable expansion and strategic innovation

- 11.2.5 FRANCE

- 11.2.5.1 Surge in building AI-ready infrastructure and global connectivity to boost market

- 11.2.6 REST OF CENTRAL & WESTERN EUROPE

- 11.2.7 SOUTHERN EUROPE

- 11.2.7.1 Italy

- 11.2.7.1.1 Digital backbone with strategic colocation expansions and government-backed infrastructure to drive market

- 11.2.7.2 Rest of Southern Europe

- 11.2.7.1 Italy

- 11.2.8 EASTERN EUROPE

- 11.2.9 NORTHERN EUROPE

- 11.3 ASIA PACIFIC

- 11.3.1 ASIA PACIFIC: DATA CENTER COLOCATION MARKET DRIVERS

- 11.3.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.3.3 CHINA

- 11.3.3.1 Powering digital future with sustainable and scalable colocation to drive market

- 11.3.4 JAPAN

- 11.3.4.1 Boosting digital future with advanced colocation solutions to drive market

- 11.3.5 INDIA

- 11.3.5.1 Rising internet usage, enterprise digitalization, and cloud adoption to drive market

- 11.3.6 HONG KONG

- 11.3.6.1 Strengthening data edge with rising enterprise demand for secure, high-availability infrastructure to drive market

- 11.3.7 REST OF ASIA PACIFIC

- 11.4 MIDDLE EAST & AFRICA

- 11.4.1 MIDDLE EAST & AFRICA: COLOCATION DATA CENTER MARKET DRIVERS

- 11.4.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.4.3 GULF COOPERATION COUNCIL COUNTRIES

- 11.4.3.1 Scaling data horizons with purpose-built colocation to drive market

- 11.4.3.2 KSA

- 11.4.3.2.1 Enabling resilient growth through scalable colocation to drive market

- 11.4.3.3 UAE

- 11.4.3.3.1 Redefining regional connectivity with scalable colocation to drive market

- 11.4.3.4 Rest of GCC countries

- 11.4.4 SOUTH AFRICA

- 11.4.4.1 Unlocking digital core with scalable colocation hubs to drive market

- 11.4.5 REST OF MIDDLE EAST & AFRICA

- 11.5 LATIN AMERICA

- 11.5.1 LATIN AMERICA: DATA CENTER COLOCATION MARKET DRIVERS

- 11.5.2 LATIN AMERICA: MACROECOMIC OUTLOOK

- 11.5.3 BRAZIL

- 11.5.3.1 Building digital backbone through next-gen colocation solutions to drive market

- 11.5.4 MEXICO

- 11.5.4.1 Need to enhance user experience and increase educational sector productivity to drive market

- 11.5.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.5.1 EQUINIX

- 12.5.2 DIGITAL REALTY

- 12.5.3 NTT GLOBAL DATA CENTERS

- 12.5.4 KDDI

- 12.5.5 QTS

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Service type footprint

- 12.6.5.4 Service scale footprint

- 12.6.5.5 End user footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUP/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 12.8.1 COMPANY VALUATION OF KEY VENDORS

- 12.8.2 FINANCIAL METRICS OF KEY VENDORS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 MAJOR PLAYERS

- 13.2.1 EQUINIX

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches

- 13.2.1.3.2 Deals

- 13.2.1.3.3 Expansions

- 13.2.1.4 MnM view

- 13.2.1.4.1 Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 DIGITAL REALTY

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches

- 13.2.2.3.2 Deals

- 13.2.2.3.3 Expansions

- 13.2.2.4 MnM view

- 13.2.2.4.1 Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 NTT DATA

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Deals

- 13.2.3.3.2 Expansions

- 13.2.3.4 MnM view

- 13.2.3.4.1 Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 QTS DATA CENTERS

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Right to win

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 KDDI CORPORATION

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product launches

- 13.2.5.3.2 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Right to win

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 IRON MOUNTAIN

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Deals

- 13.2.6.3.2 Expansions

- 13.2.7 CHINA TELECOM CORPORATION LTD

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Product launches

- 13.2.7.3.2 Expansions

- 13.2.8 CYRUSONE

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Product launches

- 13.2.8.3.2 Deals

- 13.2.8.3.3 Expansions

- 13.2.9 CENTERSQUARE

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Deals

- 13.2.10 VANTAGE DATA CENTERS

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Deals

- 13.2.10.3.2 Expansions

- 13.2.1 EQUINIX

- 13.3 OTHER PLAYERS

- 13.3.1 DATABANK

- 13.3.2 EDGECONNEX

- 13.3.3 SWITCH

- 13.3.4 CORESITE

- 13.3.5 ALIGNED DATA CENTERS

- 13.3.6 FLEXENTIAL

- 13.3.7 TIERPOINT

- 13.3.8 COLOGIX

- 13.3.9 TRG DATACENTERS

- 13.3.10 SCALEMATRIX

- 13.3.11 AT&T

- 13.3.12 GLOBAL DATA SYSTEMS

- 13.3.13 VERNE GLOBAL

- 13.3.14 365 DATA GROUP

- 13.3.15 BDX DATA CENTERS

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.1.1 LIMITATIONS

- 14.2 DATA CENTER RACK MARKET

- 14.3 HYPERSCALE DATA CENTER MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS