|

|

市場調査レポート

商品コード

1759935

タワークレーンレンタルの世界市場:容量別、製品タイプ別、最終用途産業別、地域別 - 2030年までの予測Tower Crane Rental Market by Capacity (Low (5-20 tons), Low to Medium (20-100 tons), Heavy (100-500 tons), Extreme Heavy (>500 tons)), End-use industry (Building & Construction, Infrastructure, Energy & Power), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| タワークレーンレンタルの世界市場:容量別、製品タイプ別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月27日

発行: MarketsandMarkets

ページ情報: 英文 226 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

タワークレーンレンタルの市場規模は、2025年の171億米ドルから2030年には221億米ドルに達すると予測され、予測期間中のCAGRは5.2%になるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象台数 | 金額(100万米ドル)、数量(台) |

| セグメント | 容量力別、製品タイプ別、最終用途産業別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

タワークレーンレンタル市場は、インフラ、商業、住宅の各分野で建設活動が活発化していることを背景に、大きな成長を遂げています。タワークレーンレンタルは、柔軟性、費用対効果、所有に伴う経済的負担を伴わない高度な機器へのアクセスを提供し、開発業者や請負業者にとって魅力的な選択肢となっています。タワークレーンレンタル需要は、都市開発、基幹交通システム、再生可能エネルギーインフラに多額の投資を行っている新興経済諸国において特に旺盛です。建設プロジェクトの規模と複雑さが増すにつれ、大容量で特殊なクレーンの使用が必要となり、レンタル需要がさらに加速しています。さらに、技術の進歩、安全機能の強化、遠隔操作の可能性がレンタルオプションの魅力を高めています。市場はアジア太平洋地域で特に活気があり、都市化の進行、政府主導のインフラ投資、プロジェクト固有の要件や持続可能性の目標に沿ったレンタルソリューションへのニーズの高まりがその原動力となっています。

低容量セグメント(5~10トン)は、タワークレーンレンタル業界内で2番目に大きなセグメントになると予測されています。このセグメントは、吊り上げ能力と運用の柔軟性のバランスを実現しており、重い吊り上げを必要としない中層ビル、複合商業施設、インフラプロジェクトに最適です。都市部における垂直拡張の増加傾向と、中小規模のインフラ構想の急増が、このカテゴリーの需要を促進しています。さらに、レンタルソリューションは、請負業者に長期所有の負担をかけずに信頼性の高い機器にアクセスできる費用対効果の高い手段を提供します。この分野の成長の可能性は特に新興経済諸国において顕著であり、コストに敏感な建設会社は効率的で効果的なリフティングソリューションを求めています。

インフラは、タワークレーンレンタル市場内で2番目に大きな最終用途部門を占めています。成長の主な原動力は、道路、橋、空港、鉄道などの主要インフラプロジェクトにおけるタワークレーンの需要の高まりです。これらのクレーンは、吊り上げ能力、リーチ、操作の柔軟性を最適化するために特別に設計されており、複雑な建設現場で重量物を吊り上げるために不可欠なものとなっています。

さらに、レンタル市場は、世界の都市化の動向とともに、特に新興経済国での公共インフラに対する政府機関の設備投資の増加によって、増加傾向にあります。資産の所有よりもレンタルが好まれるのは、柔軟性やコスト効率の向上など、大きな利点があるからです。また、タワークレーンをレンタルすることで、納期やコストを予測しやすくなり、建設プロジェクトの資金面やスケジュール面での要求に応えることができます。

北米は、世界第2位のタワークレーンレンタル市場であり続けると予想されます。この地域の建設活動は、主に商業用不動産開発、インフラ更新、住宅プロジェクトに後押しされ、レンタルクレーンの需要を大きく牽引しています。さらに、大規模な都市再開発の取り組み、高速道路のアップグレード、再生可能エネルギープロジェクトが市場の成長をさらに後押ししています。

重機を所有する代わりにレンタルする傾向は、費用対効果の高さ、メンテナンス責任の軽減、プロジェクト固有のニーズへの適応性などから、支持を集めています。さらに、定評あるレンタル会社の存在、安全規制の強化、技術的に高度なクレーンシステムの統合が、市場における北米の競争力を大幅に強化しています。

この調査には、タワークレーンレンタル市場におけるこれらの主要企業の企業プロファイル、最近の動向、主要市場戦略などの詳細な競合分析が含まれています。

当レポートでは、世界のタワークレーンレンタル市場について調査し、容量別、製品タイプ別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- バリューチェーン分析

- 関税と規制状況

- 価格分析

- 貿易分析

- 技術分析

- 生成AI/AIがタワークレーンレンタル市場に与える影響

- 特許分析

- ケーススタディ分析

- 2025年~2026年の主な会議とイベント

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済分析

- 2025年の米国関税がタワークレーンレンタル市場に与える影響

- 投資と資金調達のシナリオ

第6章 タワークレーンレンタル市場(容量別)

- イントロダクション

- 低(5~20トン)

- 低~中(20~100トン)

- 重量(100~500トン)

- 超重量(500トン以上)

第7章 タワークレーンレンタル市場(製品タイプ別)

- イントロダクション

- 自立式クレーン

- ハンマーヘッドクレーン

- ラフィングジブタワークレーン

- 移動式タワークレーン

- その他

第8章 タワークレーンレンタル市場(最終用途産業別)

- イントロダクション

- 建築・建設

- インフラ

- エネルギーと電力

- 海洋・オフショア

- その他

第9章 タワークレーンレンタル市場(地域別)

- イントロダクション

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場シェア分析

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- LIEBHERR

- BIGGE CRANE AND RIGGING CO.

- ACTION CONSTRUCTION EQUIPMENT LTD.

- LEAVITT CRANES

- WASEL GMBH

- FALCON TOWER CRANE SERVICES LTD.

- RAPICON INC.

- NFT GROUP

- SKYCRANE

- MAXIM CRANE WORKS

- SARENS N.V./S.A.

- UPERIO

- WOLFFKRAN INTERNATIONAL AG

- AINSCOUGH CRANE HIRE

- VMS EQUIPMENT

- その他の企業

- MORROW EQUIPMENT COMPANY, LLC

- STAFFORD TOWER CRANES

- TAT HONG HOLDINGS LTD.

- NESSCAMPBELL CRANE+RIGGING

- HERKULES S.A.

- MAMMOET

- ENG CRANES SRL

- VAN DER SPEK NV

- RELIABLE CRANE SERVICE

- SANGHVI MOVERS LIMITED

第12章 隣接市場と関連市場

第13章 付録

List of Tables

- TABLE 1 INFRASTRUCTURE DEVELOPMENT PROJECTS

- TABLE 2 ROLES OF COMPANIES IN TOWER CRANE RENTAL ECOSYSTEM

- TABLE 3 TARIFF DATA FOR HS CODE 842620-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 7 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 8 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 9 INDICATIVE PRICING ANALYSIS OF TOWER CRANE RENTAL OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/UNIT)

- TABLE 10 AVERAGE SELLING PRICE TREND OF TOWER CRANE RENTAL, BY REGION, 2023-2030 (USD/UNIT)

- TABLE 11 EXPORT DATA RELATED TO HS CODE 842620-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 IMPORT DATA RELATED TO HS CODE 842620-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 TOWER CRANE RENTAL MARKET: LIST OF KEY PATENTS, 2022-2024

- TABLE 14 TOWER CRANE RENTAL MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 TOWER CRANE RENTAL MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES

- TABLE 17 BUYING CRITERIA FOR KEY END-USE INDUSTRIES

- TABLE 18 GLOBAL GDP GROWTH PROJECTION, BY REGION, 2021-2028 (USD TRILLION)

- TABLE 19 TOWER CRANE RENTAL MARKET, BY CAPACITY, 2023-2030 (USD MILLION)

- TABLE 20 TOWER CRANE RENTAL MARKET, BY CAPACITY, 2023-2030 (UNIT)

- TABLE 21 TOWER CRANE RENTAL MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 22 TOWER CRANE RENTAL MARKET, BY PRODUCT TYPE, 2023-2030 (UNIT)

- TABLE 23 TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 24 TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 25 TOWER CRANE RENTAL MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 26 TOWER CRANE RENTAL MARKET, BY REGION, 2023-2030 (UNIT)

- TABLE 27 ASIA PACIFIC: TOWER CRANE RENTAL MARKET, BY CAPACITY, 2023-2030 (USD MILLION)

- TABLE 28 ASIA PACIFIC: TOWER CRANE RENTAL MARKET, BY CAPACITY, 2023-2030 (UNIT)

- TABLE 29 ASIA PACIFIC: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 30 ASIA PACIFIC: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 31 ASIA PACIFIC: TOWER CRANE RENTAL MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 ASIA PACIFIC: TOWER CRANE RENTAL MARKET, BY COUNTRY, 2023-2030 (UNIT)

- TABLE 33 CHINA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 34 CHINA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 35 INDIA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 36 INDIA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 37 JAPAN: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 38 JAPAN: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 39 SOUTH KOREA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 40 SOUTH KOREA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 41 AUSTRALIA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 42 AUSTRALIA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 43 REST OF ASIA PACIFIC: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 44 REST OF ASIA PACIFIC: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 45 NORTH AMERICA: TOWER CRANE RENTAL MARKET, BY CAPACITY, 2023-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: TOWER CRANE RENTAL MARKET, BY CAPACITY, 2023-2030 (UNIT)

- TABLE 47 NORTH AMERICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 49 NORTH AMERICA: TOWER CRANE RENTAL MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: TOWER CRANE RENTAL MARKET, BY COUNTRY, 2023-2030 (UNIT)

- TABLE 51 US: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 52 US: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 53 CANADA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 54 CANADA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 55 MEXICO: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 56 MEXICO: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 57 EUROPE: TOWER CRANE RENTAL MARKET, BY CAPACITY, 2023-2030 (USD MILLION)

- TABLE 58 EUROPE: TOWER CRANE RENTAL MARKET, BY CAPACITY, 2023-2030 (UNIT)

- TABLE 59 EUROPE: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 60 EUROPE: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 61 EUROPE: TOWER CRANE RENTAL MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 EUROPE: TOWER CRANE RENTAL MARKET, BY COUNTRY, 2023-2030 (UNIT)

- TABLE 63 GERMANY: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 64 GERMANY: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 65 UK: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 66 UK: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 67 FRANCE: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 68 FRANCE: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 69 SWITZERLAND: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 70 SWITZERLAND: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 71 ITALY: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 72 ITALY: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 73 SPAIN: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 74 SPAIN: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 75 REST OF EUROPE: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 76 REST OF EUROPE: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 77 MIDDLE EAST & AFRICA: TOWER CRANE RENTAL MARKET, BY CAPACITY, 2023-2030 (USD MILLION)

- TABLE 78 MIDDLE EAST & AFRICA: TOWER CRANE RENTAL MARKET, BY CAPACITY, 2023-2030 (UNIT)

- TABLE 79 MIDDLE EAST & AFRICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 80 MIDDLE EAST & AFRICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 81 MIDDLE EAST & AFRICA: TOWER CRANE RENTAL MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 MIDDLE EAST & AFRICA: TOWER CRANE RENTAL MARKET, BY COUNTRY, 2023-2030 (UNIT)

- TABLE 83 SAUDI ARABIA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 84 SAUDI ARABIA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 85 UAE: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 86 UAE: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 87 REST OF GCC COUNTRIES: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 88 REST OF GCC COUNTRIES: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 89 SOUTH AFRICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 90 SOUTH AFRICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 91 REST OF MIDDLE EAST & AFRICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 92 REST OF MIDDLE EAST & AFRICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 93 SOUTH AMERICA: TOWER CRANE RENTAL MARKET, BY CAPACITY, 2023-2030 (USD MILLION)

- TABLE 94 SOUTH AMERICA: TOWER CRANE RENTAL MARKET, BY CAPACITY, 2023-2030 (UNIT)

- TABLE 95 SOUTH AMERICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 96 SOUTH AMERICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 97 SOUTH AMERICA: TOWER CRANE RENTAL MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 98 SOUTH AMERICA: TOWER CRANE RENTAL MARKET, BY COUNTRY, 2023-2030 (UNIT)

- TABLE 99 BRAZIL: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY 2023-2030 (USD MILLION)

- TABLE 100 BRAZIL: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 101 ARGENTINA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 102 ARGENTINA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 103 REST OF SOUTH AMERICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 104 REST OF SOUTH AMERICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2023-2030 (UNIT)

- TABLE 105 TOWER CRANE RENTAL MARKET: OVERVIEW OF STRATEGIES ADOPTED BY MARKET PLAYERS BETWEEN JANUARY 2019 AND MAY 2025

- TABLE 106 TOWER CRANE RENTAL MARKET: DEGREE OF COMPETITION

- TABLE 107 TOWER CRANE RENTAL MARKET: REGION FOOTPRINT

- TABLE 108 TOWER CRANE RENTAL MARKET: CAPACITY FOOTPRINT

- TABLE 109 TOWER CRANE RENTAL MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 110 TOWER CRANE RENTAL MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 111 TOWER CRANE RENTAL MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 112 TOWER CRANE RENTAL MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 113 TOWER CRANE RENTAL MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 114 TOWER CRANE RENTAL MARKET: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 115 TOWER CRANE RENTAL MARKET: DEALS, JANUARY 2019-MAY 2025

- TABLE 116 LIEBHERR: COMPANY OVERVIEW

- TABLE 117 LIEBHERR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 118 LIEBHERR: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 119 LIEBHERR: DEALS, JANUARY 2019-MAY 2025

- TABLE 120 BIGGE CRANE AND RIGGING CO.: COMPANY OVERVIEW

- TABLE 121 BIGGE CRANE AND RIGGING CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 122 BIGGE CRANE AND RIGGING CO.: DEALS, JANUARY 2019-MAY 2025

- TABLE 123 ACTION CONSTRUCTION EQUIPMENT LTD.: COMPANY OVERVIEW

- TABLE 124 ACTION CONSTRUCTION EQUIPMENT LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 125 LEAVITT CRANES: COMPANY OVERVIEW

- TABLE 126 LEAVITT CRANES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 LEAVITT CRANES: DEALS, JANUARY 2019-MAY 2025

- TABLE 128 WASEL GMBH: COMPANY OVERVIEW

- TABLE 129 WASEL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 WASEL GMBH: DEALS, JANUARY 2019-MAY 2025

- TABLE 131 FALCON TOWER CRANE SERVICES LTD.: COMPANY OVERVIEW

- TABLE 132 FALCON TOWER CRANE SERVICES LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 133 RAPICON INC.: COMPANY OVERVIEW

- TABLE 134 RAPICON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 RAPICON INC.: DEALS, JANUARY 2019-MAY 2025

- TABLE 136 NFT GROUP: COMPANY OVERVIEW

- TABLE 137 NFT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 SKYCRANE: COMPANY OVERVIEW

- TABLE 139 SKYCRANE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 MAXIM CRANE WORKS: COMPANY OVERVIEW

- TABLE 141 MAXIM CRANE WORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 MAXIM CRANE WORKS: DEALS, JANUARY 2019-MAY 2025

- TABLE 143 SARENS N.V./S.A.: COMPANY OVERVIEW

- TABLE 144 SARENS N.V./S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 SARENS N.V./S.A.: DEALS, JANUARY 2019-MAY 2025

- TABLE 146 UPERIO: COMPANY OVERVIEW

- TABLE 147 UPERIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 WOLFFKRAN INTERNATIONAL AG: COMPANY OVERVIEW

- TABLE 149 WOLFFKRAN INTERNATIONAL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 WOLFFKRAN INTERNATIONAL AG: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 151 WOLFFKRAN INTERNATIONAL AG: DEALS, JANUARY 2019-MAY 2025

- TABLE 152 AINSCOUGH CRANE HIRE: COMPANY OVERVIEW

- TABLE 153 AINSCOUGH CRANE HIRE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 VMS EQUIPMENT: COMPANY OVERVIEW

- TABLE 155 VMS EQUIPMENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 MORROW EQUIPMENT COMPANY, LLC: COMPANY OVERVIEW

- TABLE 157 STAFFORD TOWER CRANES: COMPANY OVERVIEW

- TABLE 158 TAT HONG HOLDINGS LTD.: COMPANY OVERVIEW

- TABLE 159 NESSCAMPBELL CRANE + RIGGING: COMPANY OVERVIEW

- TABLE 160 HERKULES S.A.: COMPANY OVERVIEW

- TABLE 161 MAMMOET: COMPANY OVERVIEW

- TABLE 162 ENG CRANES SRL: COMPANY OVERVIEW

- TABLE 163 VAN DER SPEK: COMPANY OVERVIEW

- TABLE 164 RELIABLE CRANE SERVICE: COMPANY OVERVIEW

- TABLE 165 SANGHVI MOVERS LIMITED: COMPANY OVERVIEW

- TABLE 166 CRANE RENTAL MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 167 CRANE RENTAL MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 168 CRANE RENTAL MARKET, BY TYPE, 2020-2023 (UNIT)

- TABLE 169 CRANE RENTAL MARKET, BY TYPE, 2024-2029 (UNIT)

- TABLE 170 CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 171 CRANE RENTAL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 172 CRANE RENTAL MARKET, BY WEIGHTLIFTING CAPACITY, 2020-2023 (USD MILLION)

- TABLE 173 CRANE RENTAL MARKET, BY WEIGHTLIFTING CAPACITY, 2024-2029 (USD MILLION)

- TABLE 174 CRANE RENTAL MARKET, BY WEIGHTLIFTING CAPACITY, 2020-2023 (UNIT)

- TABLE 175 CRANE RENTAL MARKET, BY WEIGHTLIFTING CAPACITY, 2024-2029 (UNIT)

- TABLE 176 CRANE RENTAL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 177 CRANE RENTAL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 178 CRANE RENTAL MARKET, BY REGION, 2020-2023 (UNIT)

- TABLE 179 CRANE RENTAL MARKET, BY REGION, 2024-2029 (UNIT)

List of Figures

- FIGURE 1 TOWER CRANE RENTAL MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 TOWER CRANE RENTAL MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF INTERVIEWS WITH EXPERTS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 TOWER CRANE RENTAL MARKET: APPROACH 1

- FIGURE 7 TOWER CRANE RENTAL MARKET: APPROACH 2

- FIGURE 8 TOWER CRANE RENTAL MARKET: DATA TRIANGULATION

- FIGURE 9 LOW TO MEDIUM (20 TO 100 TON) SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 HAMMERHEAD CRANE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 BUILDING & CONSTRUCTION END-USE INDUSTRY SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF TOWER CRANE RENTAL MARKET IN 2024

- FIGURE 13 HIGH-RISE CONSTRUCTION AND ACCELERATED URBAN INFRASTRUCTURE TO DRIVE MARKET

- FIGURE 14 LOW (5 TO 20 TON) SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 LUFFING JIB TOWER CRANE SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 BUILDING & CONSTRUCTION SEGMENT TO REGISTER FASTEST GROWTH BETWEEN 2025 AND 2030

- FIGURE 17 LOW TO MEDIUM (20 TO 100 TON) SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2025

- FIGURE 18 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN TOWER CRANE RENTAL MARKET

- FIGURE 20 GLOBAL BUILDING FLOOR AREA IN ADVANCED, EMERGING, AND DEVELOPING ECONOMIES (2010-2022) WITH PROJECTIONS FOR 2030 (BILLION M2)

- FIGURE 21 ACTUAL AND FORECASTED WIND POWER GENERATION IN NET ZERO SCENARIO, (TWH)

- FIGURE 22 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 TOWER CRANE RENTAL MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 TOWER CRANE RENTAL MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF TOWER CRANE RENTAL OFFERED BY KEY PLAYERS, 2024 (USD/UNIT)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF TOWER CRANE RENTAL, BY REGION, 2023-2030 (USD/UNIT)

- FIGURE 27 EXPORT DATA FOR HS CODE 842620-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 28 IMPORT DATA FOR HS CODE 842620-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 29 TOWER CRANE RENTAL MARKET: IMPACT OF AI/GEN AI

- FIGURE 30 LIST OF MAJOR PATENTS APPLIED AND GRANTED RELATED TO TOWER CRANES, 2015-2024

- FIGURE 31 MAJOR PATENTS APPLIED AND GRANTED RELATED TO TOWER CRANE, BY COUNTRY/REGION, 2015-2024

- FIGURE 32 TOWER CRANE RENTAL MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES

- FIGURE 34 BUYING CRITERIA FOR KEY END-USE INDUSTRIES

- FIGURE 35 TOWER CRANE RENTAL MARKET: INVESTOR DEALS AND FUNDING TRENDS, 2018-2024 (USD MILLION)

- FIGURE 36 LOW TO MEDIUM (20 TO 100 TON) CAPACITY SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 37 HAMMERHEAD CRANE SEGMENT TO LEAD TOWER CRANE RENTAL MARKET DURING FORECAST PERIOD

- FIGURE 38 BUILDING & CONSTRUCTION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 39 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC: TOWER CRANE RENTAL MARKET SNAPSHOT

- FIGURE 41 NORTH AMERICA: TOWER CRANE RENTAL MARKET SNAPSHOT

- FIGURE 42 EUROPE: TOWER CRANE RENTAL MARKET SNAPSHOT

- FIGURE 43 TOWER CRANE RENTAL MARKET SHARE ANALYSIS, 2024

- FIGURE 44 TOWER CRANE RENTAL MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 45 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 46 TOWER CRANE RENTAL MARKET: COMPANY FOOTPRINT

- FIGURE 47 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 48 LIEBHERR: COMPANY SNAPSHOT

- FIGURE 49 ACTION CONSTRUCTION EQUIPMENT LTD.: COMPANY SNAPSHOT

The tower crane rental market is expected to reach USD 22.1 billion by 2030 from USD 17.1 billion in 2025, at a CAGR of 5.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Units) |

| Segments | Capacity, End-use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The tower crane rental market is experiencing significant growth, driven by an uptick in construction activity across infrastructure, commercial, and residential sectors. Renting tower cranes offers flexibility, cost-effectiveness, and access to advanced equipment without the financial burden of ownership, making it an appealing option for developers and contractors. Demand for tower crane rentals is particularly robust in emerging economies that are heavily investing in urban development, essential transportation systems, and renewable energy infrastructure. The increasing scale and complexity of construction projects are necessitating the use of high-capacity and specialized cranes, thereby further accelerating rental demand. Additionally, advancements in technology, enhanced safety features, and the capability for remote operation are increasing the appeal of rental options. The market is particularly vibrant in the Asia Pacific region, fueled by ongoing urbanization, government-led infrastructure investments, and a growing need for rental solutions that align with project-specific requirements and sustainability goals.

"Low (5-10 tons) to be the second-largest capacity segment"

The low-capacity segment (5-10 tons) is projected to be the second largest within the tower crane rental industry. This segment achieves a balance between lifting capacity and operational flexibility, making it ideally suited for mid-rise buildings, commercial complexes, and infrastructure projects that do not require heavy lifting. The increasing trend of vertical expansion in urban areas and a surge in small to mid-sized infrastructure initiatives drive demand for this category. Furthermore, rental solutions offer contractors a cost-effective means of accessing reliable equipment without the burden of long-term ownership. The growth potential in this segment is particularly pronounced in developing economies, where construction companies, often sensitive to costs, are seeking efficient and effective lifting solutions.

"Infrastructure segment accounted for the second-largest share in 2024"

Infrastructure represents the second-largest end-use sector within the tower crane rental market. Key drivers of growth include the rising demand for tower cranes in major infrastructure projects, such as roads, bridges, airports, and railways. These cranes are specifically engineered to optimize lifting capacity, reach, and operational flexibility, making them indispensable for hoisting heavy materials on complex construction sites.

Furthermore, the rental market is experiencing an upward trend, fueled by increased capital investments from government entities in public infrastructure, particularly in emerging economies, alongside broader global urbanization trends. The preference for asset rental over ownership offers significant advantages, including enhanced flexibility and cost efficiency. Additionally, renting a tower crane ensures predictable delivery timelines and costs, aligning with the financial and scheduling demands of construction projects.

"North America to be second-largest market during review period"

North America is anticipated to remain the second-largest global tower crane rental market. The region's construction activity, predominantly fueled by commercial real estate developments, infrastructure renewal, and residential projects, is driving substantial demand for rental cranes. Additionally, large-scale urban redevelopment initiatives, highway upgrades, and renewable energy projects are further propelling market growth.

The trend toward renting heavy equipment instead of ownership is gaining traction due to its cost-effectiveness, reduced maintenance responsibilities, and adaptability to project-specific needs. Moreover, the presence of well-established rental firms, enhanced safety regulations, and the integration of technologically advanced crane systems significantly bolster North America's competitive positioning in the market.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: Liebherr AG (Germany), Bigge Crane and Rigging Co. (US), ACE Construction Equipment Ltd. (India), Leavitt Cranes (Canada), Wasel GmbH (Germany), Falcon Tower Crane Services Ltd. (UK), Rapicon Inc. (Canada), NFT Group (UAE), Skycrane (Canada), and Maxim Crane Works (US).

The study includes an in-depth competitive analysis of these key players in the tower crane rental market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the tower crane rental market based on capacity (low (5-20 tons), low to medium (20-100 tons), heavy (100-500 tons), and extreme heavy (>500 tons)), end-use industry (building & construction, infrastructure, energy & power, marine & offshore, and other end-use industries), and region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the tower crane rental market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as partnerships, agreements, product launches, expansions, and acquisitions, associated with the tower crane rental market. This report covers a competitive analysis of upcoming startups in the tower crane rental market ecosystem. Reasons to Buy Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall tower crane rental market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Growth in construction and infrastructure projects and Rising emphasis on smart city developments), restraints (Preference for old cranes by tower crane rental companies, Price wars, reduced profit margins, and financial constraints for new entrants), opportunities (Increasing requirement for installation and maintenance of wind turbines and Technological advancements and digitalization of equipment), and challenges (High maintenance and operating costs and Lack of skilled labor force and maintenance & repair-related issues).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the tower crane rental market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the tower crane rental market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the tower crane rental market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Liebherr AG (Germany), Bigge Crane and Rigging Co. (US), ACE Construction Equipment Ltd. (India), Leavitt Cranes (Canada), Wasel GmbH (Germany), Falcon Tower Crane Services Ltd. (UK), Rapicon Inc. (Canada), NFT Group (UAE), Skycrane (Canada), and Maxim Crane Works (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 DEMAND-SIDE APPROACH

- 2.3.2 SUPPLY-SIDE APPROACH

- 2.4 MARKET FORECAST

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TOWER CRANE RENTAL MARKET

- 4.2 TOWER CRANE RENTAL MARKET, BY CAPACITY

- 4.3 TOWER CRANE RENTAL MARKET, BY PRODUCT TYPE

- 4.4 TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY

- 4.5 ASIA PACIFIC: TOWER CRANE RENTAL MARKET, BY CAPACITY AND COUNTRY

- 4.6 TOWER CRANE RENTAL MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in construction and infrastructure projects

- 5.2.1.2 Increasing emphasis on smart city developments

- 5.2.2 RESTRAINTS

- 5.2.2.1 Preference for old cranes by tower crane rental companies

- 5.2.2.2 Price wars, reduced profit margins, and financial constraints for new entrants

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing requirements for installation and maintenance of wind turbines

- 5.2.3.2 Technological advancements and digitalization of equipment

- 5.2.4 CHALLENGES

- 5.2.4.1 High maintenance and operating costs

- 5.2.4.2 Lack of skilled labor and maintenance and repair-related issues

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 TARIFF AND REGULATORY LANDSCAPE

- 5.6.1 TARIFF ANALYSIS (HS CODE 842620)

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.3 KEY REGULATIONS

- 5.6.3.1 GB/T 5031-2019

- 5.6.3.2 EN 14439:2006

- 5.6.3.3 ASME B30.3

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2030

- 5.8 TRADE ANALYSIS

- 5.8.1 EXPORT SCENARIO (HS CODE 842620)

- 5.8.2 IMPORT SCENARIO (HS CODE 842620)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 LiDAR technology transforming tower crane anticollision systems

- 5.9.1.2 Active BIM for optimal tower crane positioning

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Remote crane monitoring systems

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Variable Frequency Drives (VFDs)

- 5.9.1 KEY TECHNOLOGIES

- 5.10 IMPACT OF GEN AI/AI ON TOWER CRANE RENTAL MARKET

- 5.10.1 INTRODUCTION

- 5.10.2 IMPACT OF GEN AI ON TOWER CRANE RENTAL MARKET

- 5.11 PATENT ANALYSIS

- 5.11.1 INTRODUCTION

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 CUSTOMIZED COMANSA TOWER CRANE DELIVERS RELIABLE HEAVY LIFTING FOR AIBEL'S OFFSHORE PLATFORM PROJECT

- 5.12.2 INDIA'S HISTORIC ANJI KHAD CABLE-STAYED RAILWAY BRIDGE CONSTRUCTION

- 5.12.3 EFFICIENT LIFTING SUPPORT WITH LIEBHERR 81.1K SELF ERECTING TOWER CRANE AT YATE HOUSING PROJECT

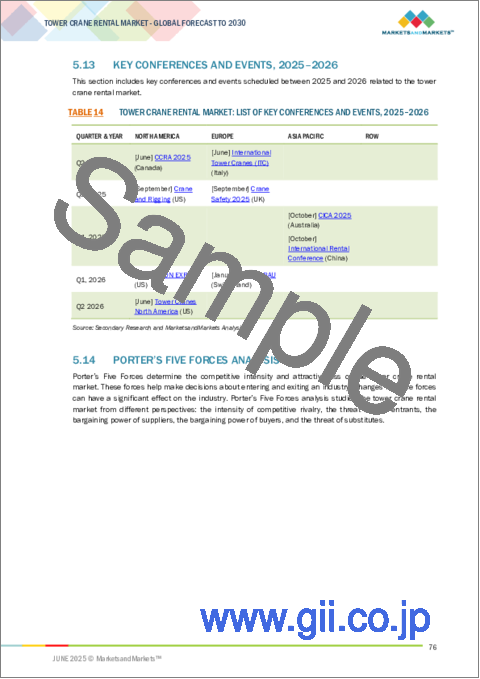

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 MACROECONOMIC ANALYSIS

- 5.16.1 INTRODUCTION

- 5.16.2 GDP TRENDS AND FORECASTS

- 5.17 IMPACT OF 2025 US TARIFF ON TOWER CRANE RENTAL MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 China

- 5.17.4.3 Germany

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.18 INVESTMENT AND FUNDING SCENARIO

6 TOWER CRANE RENTAL MARKET, BY CAPACITY

- 6.1 INTRODUCTION

- 6.2 LOW (5 TO 20 TON)

- 6.2.1 VERSATILITY, ACCESSIBILITY, AND COST-EFFECTIVENESS ACROSS APPLICATIONS TO DRIVE DEMAND

- 6.3 LOW TO MEDIUM (20 TO 100 TON)

- 6.3.1 UTILITY IN RESIDENTIAL, COMMERCIAL CONSTRUCTION, INFRASTRUCTURE MAINTENANCE, AND LANDSCAPING PROJECTS TO FUEL DEMAND

- 6.4 HEAVY (100 TO 500 TON)

- 6.4.1 APPLICATIONS IN LARGE-SCALE CONSTRUCTION PROJECTS, HEAVY INDUSTRY, AND SPECIALIZED LIFTING TO DRIVE DEMAND

- 6.5 EXTREME HEAVY (>500 TON)

- 6.5.1 DEMAND IN CONSTRUCTION, ENERGY, MINING, AND MARITIME SECTORS TO DRIVE MARKET

7 TOWER CRANE RENTAL MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 SELF-ERECTING CRANE

- 7.2.1 OPERATIONAL EFFICIENCY, RAPID DEPLOYMENT, AND SUITABILITY FOR COMPACT CONSTRUCTION SITES TO BOOST DEMAND

- 7.3 HAMMERHEAD CRANE

- 7.3.1 HIGH ADAPTABILITY IN LARGE-SCALE CONSTRUCTION PROJECTS TO FUEL GROWTH

- 7.4 LUFFING JIB TOWER CRANE

- 7.4.1 OPERATION IN HIGHLY CONGESTED CONSTRUCTION ENVIRONMENTS WITH MINIMAL SWING RADIUS AND SUPERIOR VERTICAL REACH TO DRIVE DEMAND

- 7.5 MOBILE TOWER CRANE

- 7.5.1 QUICK DEPLOYMENT, HIGH MOBILITY, AND VERSATILE LIFTING CAPABILITIES TO DRIVE MARKET

- 7.6 OTHER PRODUCT TYPES

8 TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 BUILDING & CONSTRUCTION

- 8.2.1 ENHANCED PRODUCTIVITY, ACCELERATED PROJECT TIMELINES, AND SAFETY TO DRIVE MARKET

- 8.3 INFRASTRUCTURE

- 8.3.1 LIFTING SOLUTIONS IN CONSTRUCTION, MAINTENANCE, AND DEVELOPMENT PROJECTS TO FUEL GROWTH

- 8.4 ENERGY & POWER

- 8.4.1 DIVERSE RANGE OF LIFTING SOLUTIONS TO DRIVE MARKET

- 8.5 MARINE & OFFSHORE

- 8.5.1 DEMAND FOR CONSTRUCTION, MAINTENANCE, SHIPBUILDING, AND HANDLING HEAVY EQUIPMENT TO BOOST MARKET

- 8.6 OTHER END-USE INDUSTRIES

9 TOWER CRANE RENTAL MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 ASIA PACIFIC: TOWER CRANE RENTAL MARKET, BY CAPACITY

- 9.2.2 ASIA PACIFIC: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY

- 9.2.3 ASIA PACIFIC: TOWER CRANE RENTAL MARKET, BY COUNTRY

- 9.2.3.1 China

- 9.2.3.1.1 Rapid urbanization and infrastructure development to fuel market

- 9.2.3.2 India

- 9.2.3.2.1 Cost-effectiveness and flexibility of rentals to fuel market

- 9.2.3.3 Japan

- 9.2.3.3.1 Expansion of energy & power sector to fuel market growth

- 9.2.3.4 South Korea

- 9.2.3.4.1 Infrastructure boom and technological advancements to drive market

- 9.2.3.5 Australia

- 9.2.3.5.1 Urbanization and infrastructure developments to support market growth

- 9.2.3.6 Rest of Asia Pacific

- 9.2.3.1 China

- 9.3 NORTH AMERICA

- 9.3.1 NORTH AMERICA: TOWER CRANE RENTAL MARKET, BY CAPACITY

- 9.3.2 NORTH AMERICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY

- 9.3.3 NORTH AMERICA: TOWER CRANE RENTAL MARKET, BY COUNTRY

- 9.3.3.1 US

- 9.3.3.1.1 Substantial investments in infrastructure, urban development, and industrial expansion to fuel demand

- 9.3.3.2 Canada

- 9.3.3.2.1 Investments in infrastructure, urban development, and industrial expansion to drive market

- 9.3.3.3 Mexico

- 9.3.3.3.1 Ambitious construction projects and steadily growing economy to drive growth

- 9.3.3.1 US

- 9.4 EUROPE

- 9.4.1 EUROPE: TOWER CRANE RENTAL MARKET, BY CAPACITY

- 9.4.2 EUROPE: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY

- 9.4.3 EUROPE: TOWER CRANE RENTAL MARKET, BY COUNTRY

- 9.4.3.1 Germany

- 9.4.3.1.1 Increasing infrastructure spending to drive market

- 9.4.3.2 UK

- 9.4.3.2.1 Flourishing building & construction industry to fuel growth

- 9.4.3.3 France

- 9.4.3.3.1 Ambitious construction projects and buoyant economic environment to drive market

- 9.4.3.4 Switzerland

- 9.4.3.4.1 Growing energy & power sector to propel demand

- 9.4.3.5 Italy

- 9.4.3.5.1 Ongoing investments in infrastructure and urban development projects to fuel market

- 9.4.3.6 Spain

- 9.4.3.6.1 Increasing investments in non-residential projects to boost market

- 9.4.3.7 Rest of Europe

- 9.4.3.1 Germany

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: TOWER CRANE RENTAL MARKET, BY CAPACITY

- 9.5.2 MIDDLE EAST & AFRICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY

- 9.5.3 MIDDLE EAST & AFRICA: TOWER CRANE RENTAL MARKET, BY COUNTRY

- 9.5.4 GCC COUNTRIES

- 9.5.4.1 Saudi Arabia

- 9.5.4.1.1 Infrastructure developments, urbanization, and industrial expansion to drive demand

- 9.5.4.2 UAE

- 9.5.4.2.1 Infrastructure projects and urban development initiatives to propel market growth

- 9.5.4.3 Rest of GCC countries

- 9.5.4.4 South Africa

- 9.5.4.4.1 Surge in construction activities to drive market growth

- 9.5.4.5 Rest of Middle East & Africa

- 9.5.4.1 Saudi Arabia

- 9.6 SOUTH AMERICA

- 9.6.1 SOUTH AMERICA: TOWER CRANE RENTAL MARKET, BY CAPACITY

- 9.6.2 SOUTH AMERICA: TOWER CRANE RENTAL MARKET, BY END-USE INDUSTRY

- 9.6.3 SOUTH AMERICA: TOWER CRANE RENTAL MARKET, BY COUNTRY

- 9.6.3.1 Brazil

- 9.6.3.1.1 Flourishing infrastructure and energy & power sectors to drive market

- 9.6.3.2 Argentina

- 9.6.3.2.1 Infrastructure development, residential construction, and urban renewal projects to boost market

- 9.6.3.3 Rest of South America

- 9.6.3.1 Brazil

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYERS STRATEGIES/ RIGHT TO WIN

- 10.3 MARKET SHARE ANALYSIS

- 10.4 BRAND/PRODUCT COMPARISON

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Capacity footprint

- 10.5.5.4 Product type footprint

- 10.5.5.5 End-use industry footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.6 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.7 COMPETITIVE SCENARIO

- 10.7.1 PRODUCT LAUNCHES

- 10.7.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 LIEBHERR

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 BIGGE CRANE AND RIGGING CO.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 ACTION CONSTRUCTION EQUIPMENT LTD.

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Right to win

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses and competitive threats

- 11.1.4 LEAVITT CRANES

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 WASEL GMBH

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.2.1 Deals

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 FALCON TOWER CRANE SERVICES LTD.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 MnM view

- 11.1.6.3.1 Right to win

- 11.1.6.3.2 Strategic choices

- 11.1.6.3.3 Weaknesses and competitive threats

- 11.1.7 RAPICON INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.4 MnM view

- 11.1.7.4.1 Right to win

- 11.1.7.4.2 Strategic choices

- 11.1.7.4.3 Weaknesses and competitive threats

- 11.1.8 NFT GROUP

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 MnM view

- 11.1.8.3.1 Right to win

- 11.1.8.3.2 Strategic choices

- 11.1.8.3.3 Weaknesses and competitive threats

- 11.1.9 SKYCRANE

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 MnM view

- 11.1.9.3.1 Right to win

- 11.1.9.3.2 Strategic choices

- 11.1.9.3.3 Weaknesses and competitive threats

- 11.1.10 MAXIM CRANE WORKS

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.10.4 MnM view

- 11.1.10.4.1 Right to win

- 11.1.10.4.2 Strategic choices

- 11.1.10.4.3 Weaknesses and competitive threats

- 11.1.11 SARENS N.V./S.A.

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.11.4 MnM view

- 11.1.11.4.1 Right to win

- 11.1.11.4.2 Strategic choices

- 11.1.11.4.3 Weaknesses and competitive threats

- 11.1.12 UPERIO

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.12.3 MnM view

- 11.1.12.3.1 Right to win

- 11.1.12.3.2 Strategic choices

- 11.1.12.3.3 Weaknesses and competitive threats

- 11.1.13 WOLFFKRAN INTERNATIONAL AG

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product launches

- 11.1.13.3.2 Deals

- 11.1.13.4 MnM view

- 11.1.13.4.1 Right to win

- 11.1.13.4.2 Strategic choices

- 11.1.13.4.3 Weaknesses and competitive threats

- 11.1.14 AINSCOUGH CRANE HIRE

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.14.3 MnM view

- 11.1.14.3.1 Right to win

- 11.1.14.3.2 Strategic choices

- 11.1.14.3.3 Weaknesses and competitive threats

- 11.1.15 VMS EQUIPMENT

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.15.3 MnM view

- 11.1.15.3.1 Right to win

- 11.1.15.3.2 Strategic choices

- 11.1.15.3.3 Weaknesses and competitive threats

- 11.1.1 LIEBHERR

- 11.2 OTHER PLAYERS

- 11.2.1 MORROW EQUIPMENT COMPANY, LLC

- 11.2.2 STAFFORD TOWER CRANES

- 11.2.3 TAT HONG HOLDINGS LTD.

- 11.2.4 NESSCAMPBELL CRANE + RIGGING

- 11.2.5 HERKULES S.A.

- 11.2.6 MAMMOET

- 11.2.7 ENG CRANES SRL

- 11.2.8 VAN DER SPEK NV

- 11.2.9 RELIABLE CRANE SERVICE

- 11.2.10 SANGHVI MOVERS LIMITED

12 ADJACENT & RELATED MARKET

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 CRANE RENTAL MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 CRANE RENTAL MARKET, BY TYPE

- 12.3.3 CRANE RENTAL MARKET, BY END-USE INDUSTRY

- 12.3.4 CRANE RENTAL MARKET, BY WEIGHTLIFTING CAPACITY

- 12.3.5 CRANE RENTAL MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS