|

|

市場調査レポート

商品コード

1754850

3Dカメラの世界市場:画像検出技術別、タイプ別、エンドユーザー業界別、地域別 - 2030年までの予測3D Camera Market by Image Detection Technique (Time of Flight, Structured Light, Stereoscopic Vision), Type (Target, Target-free), Application (Still Photography, Video Recording), End Use (ADAS, Robotics, Machine Vision) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 3Dカメラの世界市場:画像検出技術別、タイプ別、エンドユーザー業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月10日

発行: MarketsandMarkets

ページ情報: 英文 236 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

3Dカメラの市場規模は、2025年の15億9,000万米ドルから2030年には34億9,000万米ドルに達し、2025年から2030年までのCAGRは17.0%になると予測されています。

スマートフォンやゲーム機などの家電製品への3Dカメラの統合が、市場の重要な促進要因となっています。国際通信連合の調査によると、スマートフォンメーカーの約40%が、写真撮影やゲーム体験を向上させるために3Dカメラ技術を採用しています。Apple(米国)やSamsung(韓国)などの大手ブランドは、最新スマートフォンモデルに先進的な3Dカメラを積極的に組み込んでおり、世界の消費者の採用が加速すると予想されます。この動向は、高品質の画像と没入感のあるユーザー体験に対する需要の高まりを浮き彫りにしており、3Dカメラ市場の拡大に大きく貢献しています。さらに、拡張現実(AR)と仮想現実(VR)の人気の高まりは、3Dカメラの需要をさらに押し上げています。これらの技術は、深度センシングと空間マッピングに大きく依存しているからです。実世界の正確な寸法をキャプチャする3Dカメラの能力は、AR/VR体験のパフォーマンスを向上させ、よりリアルでインタラクティブなものにします。このため、ゲーム、教育、仮想コラボレーション用に設計されたデバイスへの統合が進んでいます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 画像検出技術別、タイプ別、エンドユーザー業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

タイムオブフライトセグメントは、その優れた速度、精度、様々な用途における深度センシングへの適応性により、予測期間中に高い成長率が予想されています。ToF技術は、最小のレイテンシでリアルタイムに正確な深度情報をキャプチャする能力により、スマートフォン、自動車システム、ロボット工学、産業オートメーションへの統合が進んでいます。コンパクトな設計、低消費電力、AI搭載処理との互換性により、顔認識、ジェスチャー制御、物体追跡、障害物回避などの用途に最適です。スマートデバイスや自律システムの需要が急増する中、ToFカメラは拡張性と効率性に優れた3Dイメージングを求めるメーカーにとって、最適なソリューションになりつつあります。

ターゲットセグメントは、ロボット工学、産業オートメーション、自動車安全システム、ヘルスケアイメージングなどの多様で急成長している分野において、正確な物体追跡、深度マッピング、空間認識を可能にする重要な役割を担っているため、2025年にはより大きな市場シェアを占めると予想されています。これらのカメラは、機械やシステムにおけるリアルタイムの意思決定、特に障害物回避、精密検査、ジェスチャー認識などのタスクに不可欠です。その普及は、AI統合、エッジコンピューティング、センサー較正の進歩によってさらに後押しされ、コンシューマーや企業レベルでの導入に不可欠なものとなっています。産業界が自動化やインテリジェントシステムへの依存を強める中、ターゲットカメラはその性能、汎用性、信頼性により引き続き優位を占めています。

中国は強力な世界的製造拠点であり、部門を問わずスマート技術の採用が急速に進んでいます。同国は民生用電子機器、産業用オートメーション、監視、ロボット工学、自動車用途での3Dカメラ導入の最前線にあります。Huawei、Xiaomi、DJIなどの中国の大手ハイテク企業やOEMは、顔認識、AR/VR、ドローンナビゲーションなどの機能に3Dイメージングを統合しています。さらに、AI、スマート工場、デジタルインフラストラクチャーを推進する政府の支援政策、R&Dと現地生産能力への多額の投資が、地域の3Dカメラ展望における中国の優位性をさらに強化しています。

当レポートでは、世界の3Dカメラ市場について調査し、画像検出技術別、タイプ別、エンドユーザー業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- ケーススタディ

- 技術分析

- 特許分析

- 貿易分析

- 関税分析

- 基準と規制状況

- 2025年~2026年の主な会議とイベント

- 生成AI/AIが3Dカメラ市場に与える影響

- 2025年の米国関税の影響-3Dカメラ市場

- 最終用途産業への影響

第6章 用途

- イントロダクション

- 静止画

- ビデオ録画

第7章 3Dカメラ市場(画像検出技術別)

- イントロダクション

- 立体視

- 構造化ライト

- 飛行時間

第8章 3Dカメラ市場(タイプ別)

- イントロダクション

- ターゲットカメラ

- ターゲットフリーカメラ

第9章 3Dカメラ市場(エンドユーザー業界別)

- イントロダクション

- 家電

- ヘルスケア

- 工業

- 航空宇宙および防衛

- 建設

- 自動車

- メディア&エンターテインメント

- その他

第10章 3Dカメラ市場(地域別)

- イントロダクション

- 北米

- マクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- マクロ経済見通し

- 英国

- ドイツ

- フランス

- スペイン

- その他

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- その他

- その他の地域

- マクロ経済見通し

- 南米

- 中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 企業収益分析、2020~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- INTEL CORPORATION

- SONY CORPORATION

- HIKROBOT CO., LTD.

- RICOH

- BASLER AG

- ORBBEC INC.

- MATTERPORT, LLC.

- PANASONIC HOLDINGS CORPORATION

- GIRAFFE360

- INSTA360

- COGNEX CORPORATION

- KANDAO

- PICK-IT N.V.

- その他の企業

- CANON(AXIS COMMUNICATIONS)

- MECH-MIND ROBOTICS TECHNOLOGIES LTD.

- 4DAGE CO., LTD.

- REALSEE

- PLANITAR INC.

- BALLUFF INC

- IDS IMAGING DEVELOPMENT SYSTEMS GMBH

- ELO TOUCH SOLUTIONS, INC.

- STEMMER IMAGING

- ZIVID

- TELEDYNE VISION SOLUTIONS

- TORDIVEL AS

- SICK AG

第13章 付録

List of Tables

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 3D CAMERA MARKET: ROLE OF COMPANIES IN ECOSYSTEM/VALUE CHAIN

- TABLE 3 3D CAMERA MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

- TABLE 6 AVERAGE SELLING PRICE OF 3D CAMERAS, BY END-USER INDUSTRY AND COMPANY (USD)

- TABLE 7 USE CASE: AMAZON USED 3D CAMERA FROM INTEL

- TABLE 8 USE CASE: DJI USED HASSELBLAD 3D CAMERA IN ITS MAVIC 2 PRO DRONE

- TABLE 9 USE CASE: HTC USED INTEL 3D CAMERA IN ITS VIVE PRO VR HEADSET

- TABLE 10 USE CASE: APPLE IPHONE X USES 3D CAMERA MODULE MADE BY LUMENTUM

- TABLE 11 USE CASE: HP INTEGRATED 3D CAMERA SYSTEM FROM INTEL IN SPROUT PRO WORKSTATION

- TABLE 12 INDICATIVE LIST OF PATENTS IN 3D CAMERA MARKET, 2024

- TABLE 13 IMPORT DATA, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 EXPORT DATA, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 MFN TARIFFS FOR HS CODE: 852580 EXPORTED BY CHINA

- TABLE 16 MFN TARIFFS FOR HS CODE: 852580 EXPORTED BY US

- TABLE 17 MFN TARIFF FOR HS CODE: 852580 EXPORTED BY GERMANY

- TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 3D CAMERA MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 23 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 24 EXPECTED CHANGES IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFFS

- TABLE 25 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 26 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 27 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2021-2024 (MILLION UNITS)

- TABLE 28 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2025-2030 (MILLION UNITS)

- TABLE 29 STEROSCOPIC VISION: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 30 STEREOSCOPIC VISION: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 31 STRUCTURED LIGHT: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 32 STRUCTURED LIGHT: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 33 TIME OF FLIGHT: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 34 TIME OF FLIGHT: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 35 3D CAMERA MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 36 3D CAMERA MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 37 3D CAMERA MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 38 3D CAMERA MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 39 3D CAMERA MARKET FOR CONSUMER ELECTRONICS, BY IMAGE DETECTION TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 40 3D CAMERA MARKET FOR CONSUMER ELECTRONICS, BY IMAGE DETECTION TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 41 3D CAMERA MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 3D CAMERA MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: 3D CAMERA MARKET FOR CONSUMER ELECTRONICS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 44 NORTH AMERICA: 3D CAMERA MARKET FOR CONSUMER ELECTRONICS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 45 EUROPE: 3D CAMERA MARKET FOR CONSUMER ELECTRONICS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 46 EUROPE: 3D CAMERA MARKET FOR CONSUMER ELECTRONICS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: 3D CAMERA MARKET FOR CONSUMER ELECTRONICS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 ASIA PACIFIC: 3D CAMERA MARKET FOR CONSUMER ELECTRONICS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 REST OF THE WORLD: 3D CAMERA MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 REST OF THE WORLD: 3D CAMERA MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 3D CAMERA MARKET FOR HEALTHCARE, BY IMAGE DETECTION TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 52 3D CAMERA MARKET FOR HEALTHCARE, BY IMAGE DETECTION TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 53 3D CAMERA MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 3D CAMERA MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: 3D CAMERA MARKET FOR HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 NORTH AMERICA: 3D CAMERA MARKET FOR HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 EUROPE: 3D CAMERA MARKET FOR HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 EUROPE: 3D CAMERA MARKET FOR HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 ASIA PACIFIC: 3D CAMERA MARKET FOR HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 ASIA PACIFIC: 3D CAMERA MARKET FOR HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 REST OF THE WORLD: 3D CAMERA MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 REST OF THE WORLD: 3D CAMERA MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 3D CAMERA MARKET FOR INDUSTRIAL, BY IMAGE DETECTION TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 64 3D CAMERA MARKET FOR INDUSTRIAL, BY IMAGE DETECTION TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 65 3D CAMERA MARKET FOR INDUSTRIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 3D CAMERA MARKET FOR INDUSTRIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: 3D CAMERA MARKET FOR INDUSTRIAL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 68 NORTH AMERICA: 3D CAMERA MARKET FOR INDUSTRIAL, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 EUROPE: 3D CAMERA MARKET FOR INDUSTRIAL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 EUROPE: 3D CAMERA MARKET FOR INDUSTRIAL, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 ASIA PACIFIC: 3D CAMERA MARKET FOR INDUSTRIAL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 ASIA PACIFIC: 3D CAMERA MARKET FOR INDUSTRIAL, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 REST OF THE WORLD: 3D CAMERA MARKET FOR INDUSTRIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 REST OF THE WORLD: 3D CAMERA MARKET FOR INDUSTRIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 3D CAMERA MARKET FOR AEROSPACE & DEFENSE, BY IMAGE DETECTION TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 76 3D CAMERA MARKET FOR AEROSPACE & DEFENSE, BY IMAGE DETECTION TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 77 3D CAMERA MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 3D CAMERA MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: 3D CAMERA MARKET FOR AEROSPACE & DEFENSE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 NORTH AMERICA: 3D CAMERA MARKET FOR AEROSPACE & DEFENSE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 EUROPE: 3D CAMERA MARKET FOR AEROSPACE & DEFENSE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 EUROPE: 3D CAMERA MARKET FOR AEROSPACE & DEFENSE BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 ASIA PACIFIC: 3D CAMERA MARKET FOR AEROSPACE & DEFENSE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 84 ASIA PACIFIC: 3D CAMERA MARKET FOR AEROSPACE & DEFENSE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 REST OF THE WORLD: 3D CAMERA MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 REST OF THE WORLD: 3D CAMERA MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 3D CAMERA MARKET FOR CONSTRUCTION, BY IMAGE DETECTION TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 88 3D CAMERA MARKET FOR CONSTRUCTION, BY IMAGE DETECTION TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 89 3D CAMERA MARKET FOR CONSTRUCTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 3D CAMERA MARKET FOR CONSTRUCTION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: 3D CAMERA MARKET FOR CONSTRUCTION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 NORTH AMERICA: 3D CAMERA MARKET FOR CONSTRUCTION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: 3D CAMERA MARKET FOR CONSTRUCTION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 EUROPE: 3D CAMERA MARKET FOR CONSTRUCTION BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: 3D CAMERA MARKET FOR CONSTRUCTION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 ASIA PACIFIC: 3D CAMERA MARKET FOR CONSTRUCTION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 REST OF THE WORLD: 3D CAMERA MARKET FOR CONSTRUCTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 REST OF THE WORLD: 3D CAMERA MARKET FOR CONSTRUCTION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 3D CAMERA MARKET FOR AUTOMOTIVE, BY IMAGE DETECTION TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 100 3D CAMERA MARKET FOR AUTOMOTIVE, BY IMAGE DETECTION TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 101 3D CAMERA MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 3D CAMERA MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: 3D CAMERA MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: 3D CAMERA MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: 3D CAMERA MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 EUROPE: 3D CAMERA MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: 3D CAMERA MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 108 ASIA PACIFIC: 3D CAMERA MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 109 REST OF THE WORLD: 3D CAMERA MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 REST OF THE WORLD: 3D CAMERA MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 3D CAMERA MARKET FOR MEDIA & ENTERTAINMENT, BY IMAGE DETECTION TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 112 3D CAMERA MARKET FOR MEDIA & ENTERTAINMENT, BY IMAGE DETECTION TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 113 3D CAMERA MARKET FOR MEDIA & ENTERTAINMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 3D CAMERA MARKET FOR MEDIA & ENTERTAINMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: 3D CAMERA MARKET FOR MEDIA & ENTERTAINMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: 3D CAMERA MARKET FOR MEDIA & ENTERTAINMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: 3D CAMERA MARKET FOR MEDIA & ENTERTAINMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 EUROPE: 3D CAMERA MARKET FOR MEDIA & ENTERTAINMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: 3D CAMERA MARKET FOR MEDIA & ENTERTAINMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 120 ASIA PACIFIC: 3D CAMERA MARKET FOR MEDIA & ENTERTAINMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 REST OF THE WORLD: 3D CAMERA MARKET FOR MEDIA & ENTERTAINMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 122 REST OF THE WORLD: 3D CAMERA MARKET FOR MEDIA & ENTERTAINMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 123 3D CAMERA MARKET FOR OTHER END-USER INDUSTRIES, BY IMAGE DETECTION TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 124 3D CAMERA MARKET FOR OTHER END-USER INDUSTRIES, BY IMAGE DETECTION TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 125 3D CAMERA MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 126 3D CAMERA MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: 3D CAMERA MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 128 NORTH AMERICA: 3D CAMERA MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: 3D CAMERA MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 130 EUROPE: 3D CAMERA MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: 3D CAMERA MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: 3D CAMERA MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 133 REST OF THE WORLD: 3D CAMERA MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 134 REST OF THE WORLD: 3D CAMERA MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135 3D CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 136 3D CAMERA MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 137 NORTH AMERICA: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 138 NORTH AMERICA: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: 3D CAMERA MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 NORTH AMERICA: 3D CAMERA MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 EUROPE: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 142 EUROPE: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 EUROPE: 3D CAMERA MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 EUROPE: 3D CAMERA MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: 3D CAMERA MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: 3D CAMERA MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 149 REST OF THE WORLD: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 150 REST OF THE WORLD: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 REST OF THE WORLD: 3D CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 152 REST OF THE WORLD: 3D CAMERA MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 153 OVERVIEW OF STRATEGIES ADOPTED BY COMPANIES IN 3D CAMERA MARKET

- TABLE 154 3D CAMERA MARKET: DEGREE OF COMPETITION

- TABLE 155 :3D CAMERA MARKET: COMPANY FOOTPRINT

- TABLE 156 3D CAMERA MARKET: REGION FOOTPRINT

- TABLE 157 3D CAMERA MARKET: IMAGE DETECTION TECHNIQUE FOOTPRINT

- TABLE 158 3D CAMERA MARKET: TYPE FOOTPRINT

- TABLE 159 3D CAMERA MARKET: END-USER INDUSTRY FOOTPRINT

- TABLE 160 3D CAMERA MARKET: DETAILED LIST OF STARTUPS/SMES

- TABLE 161 3D CAMERA MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (1/4)

- TABLE 162 3D CAMERA MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (2/4)

- TABLE 163 3D CAMERA MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (3/4)

- TABLE 164 3D CAMERA MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (4/4)

- TABLE 165 3D CAMERA MARKET: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 166 3D CAMERA MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 167 INTEL CORPORATION: BUSINESS OVERVIEW

- TABLE 168 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 INTEL CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 170 INTEL CORPORATION: DEALS, JANUARY 2021-MAY 2025

- TABLE 171 SONY CORPORATION: BUSINESS OVERVIEW

- TABLE 172 SONY CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 HIKROBOT CO., LTD.: BUSINESS OVERVIEW

- TABLE 174 HIKROBOT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 HIKROBOT CO., LTD.: DEALS, JANUARY 2021-MAY 2025

- TABLE 176 RICOH: BUSINESS OVERVIEW

- TABLE 177 RICOH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 RICOH: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 179 BASLER AG: BUSINESS OVERVIEW

- TABLE 180 BASLER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 ORBBEC INC.: BUSINESS OVERVIEW

- TABLE 182 ORBBEC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 ORBBEC INC.: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 184 ORBBEC INC.: DEALS, JANUARY 2021-MAY 2025

- TABLE 185 MATTERPORT, LLC.: BUSINESS OVERVIEW

- TABLE 186 MATTERPORT, LLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 MATTERPORT, LLC.: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 188 MATTERPORT, LLC.: DEALS, JANUARY 2021-MAY 2025

- TABLE 189 PANASONIC HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 190 PANASONIC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 191 PANASONIC HOLDINGS CORPORATION: DEALS, JANUARY 2021-MAY 2025

- TABLE 192 GIRAFFE360: BUSINESS OVERVIEW

- TABLE 193 GIRAFFE360: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 GIRAFFE360: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 195 INSTA360: BUSINESS OVERVIEW

- TABLE 196 INSTA360: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 INSTA360: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 198 INSTA360: DEALS, JANUARY 2021-MAY 2025

- TABLE 199 COGNEX CORPORATION: BUSINESS OVERVIEW

- TABLE 200 COGNEX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 KANDAO: BUSINESS OVERVIEW

- TABLE 202 KANDAO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 PICK-IT N.V.: BUSINESS OVERVIEW

- TABLE 204 PICK-IT N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 3D CAMERA MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 3D CAMERA MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM SALES OF 3D CAMERA PRODUCTS AND SOLUTIONS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 TARGET CAMERA SEGMENT TO CAPTURE HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 9 TIME OF FLIGHT SEGMENT TO HOLD LARGEST SHARE OF IMAGE DETECTION TECHNIQUE MARKET OVER FORECAST PERIOD

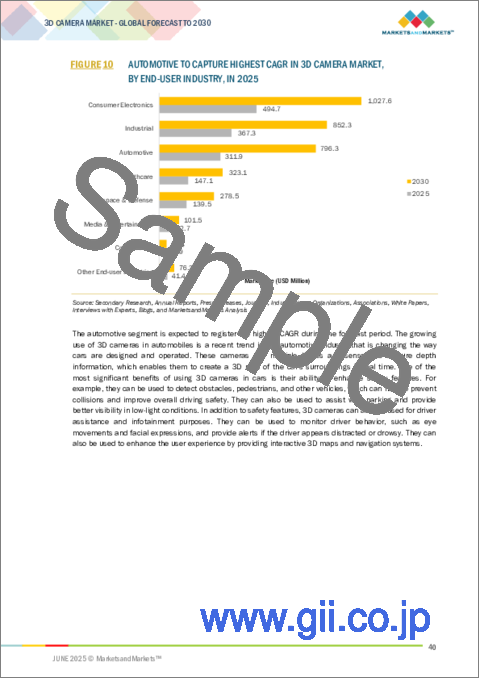

- FIGURE 10 AUTOMOTIVE TO CAPTURE HIGHEST CAGR IN 3D CAMERA MARKET, BY END-USER INDUSTRY, IN 2025

- FIGURE 11 3D CAMERA MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 12 INCREASING USE OF 3D CAMERAS IN CONSUMER ELECTRONICS INDUSTRY TO DRIVE MARKET

- FIGURE 13 TIME OF FLIGHT SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 14 TARGET CAMERA TO HOLD HIGHER SHARE DURING FORECAST PERIOD

- FIGURE 15 CHINA AND CONSUMER ELECTRONICS HELD LARGEST SHARE OF ASIA PACIFIC 3D CAMERA MARKET IN 2024

- FIGURE 16 3D CAMERA MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 17 3D CAMERA MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 3D CAMERA MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 19 3D CAMERA MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 20 3D CAMERA MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 21 3D CAMERA MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 22 VALUE CHAIN ANALYSIS: 3D CAMERA

- FIGURE 23 KEY PLAYERS IN 3D CAMERA MARKET

- FIGURE 24 3D CAMERA MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

- FIGURE 27 REVENUE SHIFTS FOR PLAYERS IN 3D CAMERA MARKET

- FIGURE 28 AVERAGE SELLING PRICES OF 3D CAMERAS IN DIFFERENT END-USER INDUSTRIES, BY COMPANY

- FIGURE 29 AVERAGE SELLING PRICE OF 3D CAMERAS, BY END-USER INDUSTRY

- FIGURE 30 PATENTS GRANTED IN 3D CAMERA MARKET, 2014-2024

- FIGURE 31 IMPORT DATA, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 32 EXPORT DATA, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 33 IMPACT OF AI ON 3D CAMERA MARKET

- FIGURE 34 TIME OF FLIGHT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 TARGET CAMERA SEGMENT TO GROW AT HIGHER CAGR IN 3D CAMERA MARKET DURING FORECAST PERIOD

- FIGURE 36 AUTOMOTIVE SEGMENT TO REGISTER HIGHEST CAGR IN 3D CAMERA MARKET DURING FORECAST PERIOD

- FIGURE 37 3D CAMERA MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 38 NORTH AMERICA: 3D CAMERA MARKET SNAPSHOT

- FIGURE 39 US TO HOLD LARGEST MARKET SHARE

- FIGURE 40 EUROPE: 3D CAMERA MARKET SNAPSHOT

- FIGURE 41 GERMANY TO HOLD LARGEST MARKET SHARE

- FIGURE 42 ASIA PACIFIC: 3D CAMERA MARKET SNAPSHOT

- FIGURE 43 CHINA TO HOLD LARGEST MARKET SHARE

- FIGURE 44 MIDDLE EAST & AFRICA TO HOLD LARGEST MARKET SHARE

- FIGURE 45 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN 3D CAMERA MARKET

- FIGURE 46 MARKET SHARES OF LEADING PLAYERS IN 3D CAMERA MARKET, 2024

- FIGURE 47 3D CAMERA MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 3D CAMERA MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 SONY CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 RICOH: COMPANY SNAPSHOT

- FIGURE 52 BASLER AG: COMPANY SNAPSHOT

- FIGURE 53 MATTERPORT, LLC.: COMPANY SNAPSHOT

- FIGURE 54 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 COGNEX CORPORATION: COMPANY SNAPSHOT

The 3D camera market is projected to grow from USD 1.59 billion in 2025 and is expected to reach USD 3.49 billion by 2030, growing at a CAGR of 17.0% from 2025 to 2030. The integration of 3D cameras into consumer electronics such as smartphones and gaming consoles is becoming a significant driver for the market. According to a survey by the International Telecommunication Union, around 40% of smartphone manufacturers are adopting 3D camera technology to enhance photography and gaming experiences. Leading brands like Apple (US) and Samsung (South Korea) actively incorporate advanced 3D cameras in their newest smartphone models, which is anticipated to accelerate global consumer adoption. This trend highlights the rising demand for high-quality imaging and immersive user experience, contributing substantially to the expansion of the 3D camera Market. Moreover, the growing popularity of augmented reality (AR) and virtual reality (VR) applications is further boosting the demand for 3D cameras, as these technologies rely heavily on depth sensing and spatial mapping. The ability of 3D cameras to capture accurate real-world dimensions enhances the performance of AR/VR experiences, making them more realistic and interactive. This has led to their increased integration into devices designed for gaming, education, and virtual collaboration.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Image Detection Technique, Type, End Use, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The time of flight segment in the 3D camera market is expected to witness a high CAGR from 2025 to 2030."

The time of flight segment is witnessing a high growth rate during the forecast period due to its superior speed, accuracy, and adaptability for depth sensing across various applications. ToF technology is increasingly integrated into smartphones, automotive systems, robotics, and industrial automation due to its ability to capture precise depth information in real time with minimal latency. Its compact design, low power consumption, and compatibility with AI-powered processing make it ideal for applications such as facial recognition, gesture control, object tracking, and obstacle avoidance. As demand surges for smart devices and autonomous systems, ToF cameras are becoming the go-to solution for manufacturers seeking scalable and efficient 3D imaging.

"The target segment is likely to hold a larger market share in 2025."

The target segment is expected to hold a larger market share in 2025 due to its critical role in enabling accurate object tracking, depth mapping, and spatial awareness across diverse and fast-growing applications such as robotics, industrial automation, automotive safety systems, and healthcare imaging. These cameras are essential for real-time decision-making in machines and systems, particularly in tasks such as obstacle avoidance, precision inspection, and gesture recognition. Their widespread adoption is further supported by advancements in AI integration, edge computing, and sensor calibration, making them indispensable in consumer and enterprise-level deployments. As industries increasingly rely on automation and intelligent systems, target cameras continue to dominate due to their performance, versatility, and reliability.

"China is expected to account for the largest market share of the Asia Pacific 3D camera market in 2025."

China has a strong global manufacturing hub and rapid adoption of smart technologies across sectors. The country is at the forefront of deploying 3D cameras in consumer electronics, industrial automation, surveillance, robotics, and automotive applications. Major Chinese tech giants and OEMs such as Huawei, Xiaomi, and DJI are integrating 3D imaging for features such as facial recognition, AR/VR, and drone navigation. Additionally, supportive government policies promoting AI, smart factories, digital infrastructure, and substantial investments in R&D and local production capabilities further reinforce the country's dominance in the regional 3D camera landscape.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 35%, Managers - 45%, and Others - 20%

- By Region: North America -25%, Europe - 40%, Asia Pacific- 25%, and RoW - 10%

Prominent players profiled in this report include Intel Corporation (US), Sony Corporation (Japan), Hikrobot Co., Ltd. (China), Ricoh (Japan), Basler AG (Germany), Orbbec Inc. (China), Matterport, LLC. (US), Panasonic Holdings Corporation (Japan), Giraffe360 (UK), and Insta360 (China).

Report Coverage

The report defines, describes, and forecasts the 3D camera market based on image detection technique (time of flight, structured light, stereoscopic vision), type (target, target-free), end use (consumer electronics, healthcare, industrial, aerospace & defense, construction, automotive, media & entertainment, and others), and region (North America, Europe, Asia Pacific, and RoW). It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the market's growth. It also analyzes competitive developments such as acquisitions, product launches, expansions, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue for the overall 3D camera market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following pointers:

- Analysis of key drivers (wide applications of 3D imaging), restraints (High product price due to limited demand), opportunities (Advances of AR/VR technologies), and challenges (increase in 3D camera production cost due to use of specialized hardware and software) of the 3D camera market

- Product development /Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the 3D camera market

- Market Development: Comprehensive information about lucrative markets; the report analyses the 3D camera market across various regions

- Market Diversification: Exhaustive information about new products launched, untapped geographies, recent developments, and investments in the 3D camera market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and offering of leading players, including Intel Corporation (US), Sony Corporation (Japan), Hikrobot Co., Ltd. (China), Ricoh (Japan), Basler AG (Germany), in the 3D camera market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Approach to arrive at market size using bottom-up analysis

- 2.2.3 TOP-DOWN APPROACH

- 2.2.3.1 Approach to capture market share using top-down analysis

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN 3D CAMERA MARKET

- 4.2 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE

- 4.3 3D CAMERA MARKET, BY TYPE

- 4.4 ASIA PACIFIC: 3D CAMERA MARKET, BY COUNTRY AND END-USER INDUSTRY

- 4.5 3D CAMERA MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Wide applications of 3D imaging

- 5.2.1.2 Increasing adoption of industrial robots

- 5.2.1.3 Rising demand for 3D cameras in construction

- 5.2.1.4 Integration of 3D cameras in consumer electronics

- 5.2.2 RESTRAINTS

- 5.2.2.1 High product price due to limited demand

- 5.2.2.2 Technological limitations associated with 3D cameras

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth of AR/VR

- 5.2.3.2 Advancements in 3D printing

- 5.2.3.3 Evolution of 3D camera technology

- 5.2.3.4 Increasing automated operations in industries

- 5.2.4 CHALLENGES

- 5.2.4.1 Increase in 3D camera production cost due to use of specialized hardware and software

- 5.2.4.2 Significant barriers to enter 3D camera market

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 INTENSITY OF COMPETITION RIVALRY

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 BUYING CRITERIA

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE, BY COMPANY

- 5.8.2 AVERAGE SELLING PRICE, BY END-USER INDUSTRY

- 5.9 CASE STUDIES

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 LIGHT DETECTION AND RANGING (LIDAR)

- 5.10.2 MULTI-CAMERA ARRAYS

- 5.10.3 QUANTUM IMAGING

- 5.10.4 COMPUTATIONAL PHOTOGRAPHY

- 5.10.5 METASURFACE LENSES

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA FOR HS CODE 852580

- 5.12.2 EXPORT DATA FOR HS CODE 852580

- 5.13 TARIFF ANALYSIS

- 5.14 STANDARDS AND REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS & REGULATIONS RELATED TO 3D CAMERA MARKET

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 IMPACT OF GEN AI/AI ON 3D CAMERA MARKET

- 5.16.1 INTRODUCTION

- 5.17 IMPACT OF 2025 US TARIFFS-3D CAMERA MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 APAC

- 5.18 IMPACT ON END-USE INDUSTRIES

6 APPLICATION

- 6.1 INTRODUCTION

- 6.2 STILL PHOTOGRAPHY

- 6.3 VIDEO RECORDING

7 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE

- 7.1 INTRODUCTION

- 7.2 STEREOSCOPIC VISION

- 7.2.1 ADVANTAGES IN ROBOT NAVIGATION AND MAPPING IN VARIED AND UNSTRUCTURED ENVIRONMENTS TO DRIVE ADOPTION

- 7.2.1.1 Use case: Zillow uses Matterport's 3D cameras to create high-quality and immersive virtual tours of properties listed on its website

- 7.2.1 ADVANTAGES IN ROBOT NAVIGATION AND MAPPING IN VARIED AND UNSTRUCTURED ENVIRONMENTS TO DRIVE ADOPTION

- 7.3 STRUCTURED LIGHT

- 7.3.1 RISING MANUFACTURING APPLICATIONS TO PROPEL DEMAND

- 7.3.1.1 Use case: 3D inspection of large heavy machinery components to save material cost

- 7.3.1 RISING MANUFACTURING APPLICATIONS TO PROPEL DEMAND

- 7.4 TIME OF FLIGHT

- 7.4.1 ABILITY TO PROVIDE FAST, ACCURATE, AND REAL-TIME 3D INFORMATION DRIVING USE IN ROBOTICS

- 7.4.1.1 Use case: 3D time of flight cameras to aid robotic palletizers

- 7.4.1 ABILITY TO PROVIDE FAST, ACCURATE, AND REAL-TIME 3D INFORMATION DRIVING USE IN ROBOTICS

8 3D CAMERA MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 TARGET CAMERA

- 8.2.1 BENEFITS OF TOF TECHNOLOGY TO DRIVE ADOPTION

- 8.2.1.1 Use case: Cheese factory in Netherlands uses time-of-flight 3D cameras in self-driving forklifts

- 8.2.1 BENEFITS OF TOF TECHNOLOGY TO DRIVE ADOPTION

- 8.3 TARGET-FREE CAMERA

- 8.3.1 COMBINATION OF TOF, STEREOSCOPIC VISION, AND STRUCTURED LIGHT TECHNOLOGIES TO SUPPORT DEMAND

- 8.3.1.1 Use case: Amazon Robotics uses 3D camera technology to capture images and track objects at its warehouses

- 8.3.1 COMBINATION OF TOF, STEREOSCOPIC VISION, AND STRUCTURED LIGHT TECHNOLOGIES TO SUPPORT DEMAND

9 3D CAMERA MARKET, BY END-USER INDUSTRY

- 9.1 INTRODUCTION

- 9.2 CONSUMER ELECTRONICS

- 9.2.1 GROWING ADOPTION OF 3D CAMERAS IN CONSUMER ELECTRONICS PRODUCTS TO DRIVE MARKET

- 9.2.2 SMARTPHONES

- 9.2.3 TABLETS

- 9.2.4 OTHERS

- 9.3 HEALTHCARE

- 9.3.1 WIDESPREAD USE OF 3D CAMERAS IN MEDICAL IMAGING TO BOOST MARKET GROWTH

- 9.3.1.1 Use case: Researchers at University of Michigan used 3D cameras to create a customized prosthetic socket

- 9.3.2 MEDICAL IMAGING

- 9.3.3 SURGERY ASSISTANCE

- 9.3.1 WIDESPREAD USE OF 3D CAMERAS IN MEDICAL IMAGING TO BOOST MARKET GROWTH

- 9.4 INDUSTRIAL

- 9.4.1 RISING ADOPTION OF 3D CAMERAS IN INDUSTRIAL MANUFACTURING TO PROPEL MARKET GROWTH

- 9.4.1.1 Use case: Manufacturer of autonomous mobile robots selected 3D cameras offered by e-con Systems for warehouse automation

- 9.4.2 ROBOTICS & AUTOMATION

- 9.4.3 MACHINE VISION

- 9.4.1 RISING ADOPTION OF 3D CAMERAS IN INDUSTRIAL MANUFACTURING TO PROPEL MARKET GROWTH

- 9.5 AEROSPACE & DEFENSE

- 9.5.1 DEVELOPMENT OF INSPECTION AND MAINTENANCE TECHNOLOGIES FOR AEROSPACE & DEFENSE TO CREATE DEMAND FOR 3D CAMERAS

- 9.5.1.1 Use case: 3D vision inspection of aerospace components

- 9.5.1 DEVELOPMENT OF INSPECTION AND MAINTENANCE TECHNOLOGIES FOR AEROSPACE & DEFENSE TO CREATE DEMAND FOR 3D CAMERAS

- 9.6 CONSTRUCTION

- 9.6.1 USE OF 3D CAMERAS IN CONSTRUCTION MAPPING AND SITE ANALYSIS TO BOOST MARKET

- 9.6.1.1 Use case: GreenValley International uses ONE Series 360 cameras to transform LiDAR mapping

- 9.6.1 USE OF 3D CAMERAS IN CONSTRUCTION MAPPING AND SITE ANALYSIS TO BOOST MARKET

- 9.7 AUTOMOTIVE

- 9.7.1 GROWING ADOPTION OF AUTONOMOUS VEHICLES TO DRIVE DEMAND FOR 3D CAMERAS

- 9.7.1.1 Use case: Automated car inspection with 3D cameras in Singapore

- 9.7.2 ADAS

- 9.7.3 PARKING ASSISTANCE

- 9.7.1 GROWING ADOPTION OF AUTONOMOUS VEHICLES TO DRIVE DEMAND FOR 3D CAMERAS

- 9.8 MEDIA & ENTERTAINMENT

- 9.8.1 WIDE RANGE OF APPLICATIONS OF 3D CAMERAS IN MEDIA & ENTERTAINMENT TO FOSTER MARKET GROWTH

- 9.8.1.1 Use case: Use of 3D cameras to broadcast sporting events

- 9.8.2 3D FILMMAKING

- 9.8.3 VR/AR CONTENT CREATION

- 9.8.1 WIDE RANGE OF APPLICATIONS OF 3D CAMERAS IN MEDIA & ENTERTAINMENT TO FOSTER MARKET GROWTH

- 9.9 OTHER END-USER INDUSTRIES

10 3D CAMERA MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.2.1 Increasing adoption of 3D cameras across industries to enhance market growth

- 10.2.2.2 Case study: Audi uses 3D camera systems from Hella Aglaia to provide a comprehensive view of vehicle's surroundings

- 10.2.3 CANADA

- 10.2.3.1 Increasing initiatives and investments in healthcare to boost growth

- 10.2.3.2 Case study: Johns Hopkins Hospital used 3D camera for spinal surgery

- 10.2.4 MEXICO

- 10.2.4.1 Demand from manufacturing sector to drive market

- 10.2.4.2 Case study: Ford redesigned assembly line using 3D cameras

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK

- 10.3.2 UK

- 10.3.2.1 Increasing adoption of AR/VR-based solutions to propel market

- 10.3.2.2 Case study: British museum used 3D cameras and VR technology to create virtual tours of its exhibits

- 10.3.3 GERMANY

- 10.3.3.1 Adoption of 3D cameras in autonomous driving to fuel market growth

- 10.3.3.2 Case study: General Motors used 3D cameras in Cruise AV autonomous vehicles

- 10.3.4 FRANCE

- 10.3.4.1 Strong focus on R&D in 3D technology to drive market

- 10.3.4.2 Case study: Boeing used 3D cameras to inspect aircraft components

- 10.3.5 SPAIN

- 10.3.5.1 Increasing adoption of 3D cameras in architecture and construction to augment market growth

- 10.3.5.2 Case study: Architecture restoration team used 3D cameras to plan and execute repairs

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Growing investments in AR/VR to drive 3D camera market

- 10.4.2.2 Case study: VUZIX used Plessey 3D cameras in its M400 Smart Glasses

- 10.4.3 JAPAN

- 10.4.3.1 Growth of application industries to ensure continued demand for 3D cameras

- 10.4.3.2 Case study: Amazon Robotics used 3D cameras offered by SICK at its warehouses

- 10.4.4 INDIA

- 10.4.4.1 Increasing adoption of 3D cameras in medical imaging to support growth

- 10.4.4.2 Case study: Siemens Healthineers used Intel RealSense depth cameras for medical imaging

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Increasing investments in industrial automation to boost market

- 10.4.5.2 Case study: Bosch used 3D cameras for industrial automation

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD

- 10.5.1 MACROECONOMIC OUTLOOK

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Government support for 3D printing to drive market

- 10.5.3 MIDDLE EAST AND AFRICA

- 10.5.3.1 Increasing adoption of 3D printing to boost market

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 COMPANY REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Image detection technique footprint

- 11.5.5.3.1 Type footprint

- 11.5.5.3.2 End-user industry footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES

- 11.7.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 INTEL CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 SONY CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Right to win

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses and competitive threats

- 12.1.3 HIKROBOT CO., LTD.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 RICOH

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 BASLER AG

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 ORBBEC INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.7 MATTERPORT, LLC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.8 PANASONIC HOLDINGS CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 GIRAFFE360

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.10 INSTA360

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.11 COGNEX CORPORATION

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.12 KANDAO

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.13 PICK-IT N.V.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.1 INTEL CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 CANON (AXIS COMMUNICATIONS)

- 12.2.2 MECH-MIND ROBOTICS TECHNOLOGIES LTD.

- 12.2.3 4DAGE CO., LTD.

- 12.2.4 REALSEE

- 12.2.5 PLANITAR INC.

- 12.2.6 BALLUFF INC

- 12.2.7 IDS IMAGING DEVELOPMENT SYSTEMS GMBH

- 12.2.8 ELO TOUCH SOLUTIONS, INC.

- 12.2.9 STEMMER IMAGING

- 12.2.10 ZIVID

- 12.2.11 TELEDYNE VISION SOLUTIONS

- 12.2.12 TORDIVEL AS

- 12.2.13 SICK AG

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS