|

|

市場調査レポート

商品コード

1742434

ニアアイディスプレイの世界市場:技術別、デバイスタイプ別、解像度別、業界別、地域別 - 2030年までの予測Near-Eye Display Market by Augmented Reality (AR) Devices, Virtual Reality (VR) & Mixed Reality (MR) Devices, Electronic Viewfinders (EVFs), TFT LCD, AMOLED, LCOS, OLEDOS, MicroLED, Laser Beam Scanning and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ニアアイディスプレイの世界市場:技術別、デバイスタイプ別、解像度別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月02日

発行: MarketsandMarkets

ページ情報: 英文 257 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

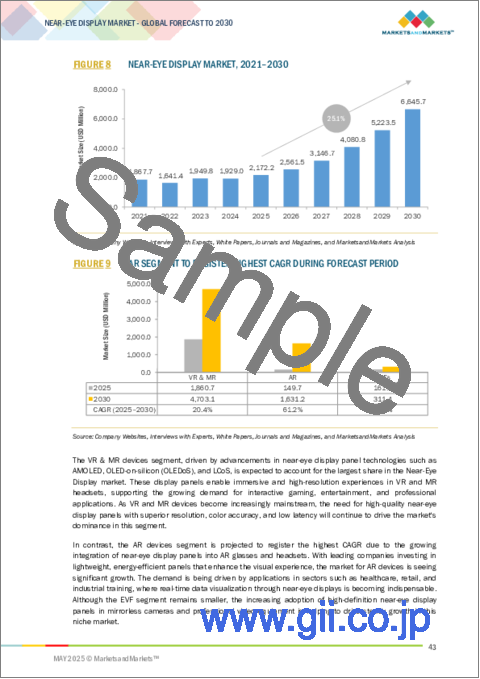

世界のニアアイディスプレイの市場規模は、25.1%のCAGRで拡大し、2025年の21億7,000万米ドルから2030年には66億5,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | 技術別、デバイスタイプ別、解像度別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

ニアアイディスプレイ市場は、ゲーム、トレーニング、シミュレーションにおけるユーザー体験を向上させる没入型ソリューションに対する需要の高まりによって、大きな成長を遂げています。OLEDオンシリコン(OLEDoS)技術の進歩は、ヘッドマウントディスプレイやスマートグラスの採用を後押ししています。さらに、外科手術の可視化や診断のためのヘルスケアや、訓練やリアルタイムの状況認識のための防衛分野で、ニアアイディスプレイの使用が拡大していることも、市場の成長に寄与しています。ピクセル密度や電力効率の向上など、マイクロディスプレイ技術のさらなる向上もこの成長を後押ししています。さらに、教育、製造、ビジネス環境における新しい拡張現実(AR)および仮想現実(VR)アプリケーションに対する需要の高まりは、ニアアイディスプレイの関連性と応用を高め続けています。

MicroLED技術は、予測期間中、ニアアイディスプレイ市場で最速の成長を記録する見込みです。MicroLED技術は、高輝度、優れたコントラスト比、低消費電力、高速応答時間といった優れた特性を備えており、拡張現実(AR)や仮想現実(VR)で高品質のグラフィックスを提供するために不可欠な品質であることから、需要が増加しています。MicroLEDディスプレイは極小の自己発光LEDで構成され、バックライトの必要性を効果的に排除しています。その結果、ディスプレイは薄型・軽量化されるだけでなく、エネルギー効率も向上し、スマートグラスやヘッドマウントディスプレイなどの小型デバイスに最適となります。OLED技術とは異なり、MicroLEDは耐久性に優れ、寿命が長く、焼き付きの問題もありません。このためMicroLEDディスプレイは、ヘルスケア、軍事、産業訓練環境などの分野における重要な用途に特に適しています。MicroLEDは明るい条件下でも鮮明であるため、ユーザーが直射日光の下で操作することが多い拡張現実(AR)にとって有効な選択肢となります。

これまで大量生産には複雑な製造技術による課題がありましたが、最近の進歩によりコスト削減と拡張性の向上が進んでいます。こうした技術革新の進展に伴い、MicroLEDはニアアイディスプレイ市場を変革する技術になると見られています。

HD解像度のニアアイディスプレイは、予測期間を通じて最大の市場シェアを占めると予想されます。これは主に、画質、処理要求、価格のバランスが取れているためです。車載機器に見られるHDスクリーンは、フルHDや4Kスクリーンに関連する高いハードウェア要件なしに、仮想現実(VR)、拡張現実(AR)、複合現実(MR)などのアプリケーション向けにシャープで魅力的な視覚体験を提供するのに十分なピクセル密度を提供します。

今日、多くのコンシューマーレベルのデバイスは、ウェアラブルに不可欠な低消費電力と長時間のバッテリー寿命を確保しながら、卓越したパフォーマンスを提供するためにHDスクリーンを利用しています。さらに、HD解像度は製造コスト効率が高いため、教育、トレーニング、ヘルスケアなど予算に敏感な業界で人気のある選択肢となっています。また、企業向けスマートグラスやヘッドセットへの関心の高まりも、堅牢でエネルギー効率に優れたスクリーンへの需要を後押ししており、HDパネルは現実的かつ効果的な選択肢であり続けています。メーカーがディスプレイ品質の向上とコンポーネントの小型化に努めているため、HD解像度はほとんどのニアアイディスプレイ用途で引き続き選択される可能性が高く、予測期間を通じて市場での地位は揺るぎないものとなります。

予測期間中、アジア太平洋がニアアイディスプレイ市場で最大のシェアを占めると思われます。同地域の優位性は、中国、日本、韓国、台湾の大手ディスプレイパネルメーカーや家電メーカーの存在感の高さによる。これらの国はすべて、ARおよびVRソリューションで利用されるOLED、MicroLED、LCDベースのニアアイディスプレイなどの高度なディスプレイ技術の成長と商業化の先頭に立っています。

ゲーム、教育、産業用途で没入型技術へのニーズが高まっていることが、市場の成長をさらに後押ししています。また、政府や民間投資家は、メタバースプラットフォーム、スマート製造、デジタルヘルスケアなどの新興技術に大規模な投資を行っており、これがニアアイディスプレイの需要を促進しています。急速な都市化、電子機器への消費支出の増加、技術志向の高いユーザーの大量ベースが、この地域のリーダー的地位をさらに証明しています。ディスプレイ生産へのさらなる投資とAR/VRデバイスの高い普及率により、アジア太平洋地域は近い将来もニアアイディスプレイ市場をリードし続けると思われます。

当レポートでは、世界のニアアイディスプレイ市場について調査し、技術別、デバイスタイプ別、解像度別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン分析

- 消費者ビジネスに影響を与える動向/混乱

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析、2015年~2024年

- 価格分析

- 2025年~2026年の主な会議とイベント

- 規制状況

- AI/生成AIがニアアイディスプレイ市場に与える影響

- 2025年の米国関税の影響- ニアアイディスプレイ市場

第6章 ニアアイディスプレイの輝度レベル

- イントロダクション

- 500 nit 未満

- 500~1,000 nit

- 1,000 nit 以上

第7章 ニアアイディスプレイの構成要素

- イントロダクション

- 画像ジェネレーター

- 光結合器

- イメージング光学

第8章 ニアアイディスプレイ市場(技術別)

- イントロダクション

- TFT液晶

- AMOLED

- LCOS

- OLEDoS

- マイクロLED

- レーザービームスキャン

第9章 ニアアイディスプレイ市場(デバイスタイプ別)

- イントロダクション

- AR

- VRとMR

- EVFS

第10章 ニアアイディスプレイ市場(解像度別)

- イントロダクション

- HD以下

- HD

- FHD

- FHD以上

第11章 ニアアイディスプレイ市場(業界別)

- イントロダクション

- 消費者

- 自動車

- 産業・企業

- 軍事、航空宇宙、防衛

- 小売・ホスピタリティ

- 医療

- 教育

- スポーツ・エンターテイメント

- その他

第12章 ニアアイディスプレイ市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- 中東

- アフリカ

- 南米

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2024年

- 市場シェア分析、2024年

- 収益分析、2019年~2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- SONY GROUP CORPORATION

- SEIKO EPSON CORPORATION

- BOE TECHNOLOGY GROUP CO., LTD.

- SEEYA TECHNOLOGY

- EMAGIN

- KOPIN CORPORATION

- MICROOLED

- HIMAX TECHNOLOGIES, INC.

- HOLOEYE PHOTONICS AG

- YUNNAN OLIGHTEK OPTO-ELECTRONIC TECHNOLOGY CO., LTD.

- その他の企業

- LG DISPLAY CO., LTD.

- WISECHIP SEMICONDUCTOR INC.

- LIGHTNING SILICON TECHNOLOGY, INC.

- OMNIVISION

- SYNDIANT

- VUEREAL

- MICROVISION

- JBD

- RAONTECH

- SILICON MICRO DISPLAY

- ENMESI.COM(SHENZHEN ANPO INTELLIGENCE TECHNOLOGY CO., LTD.)

- MOJO VISION

- CINOPTICS

- LUMIODE, INC.

- PLAYNITRIDE INC.

第15章 付録

List of Tables

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 RISK ANALYSIS

- TABLE 3 OLEDOS TECHNOLOGY USED IN AR AND VR DEVICES

- TABLE 4 NEAR-EYE DISPLAY MARKET: ECOSYSTEM

- TABLE 5 NEAR-EYE DISPLAY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 8 IMPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 LIST OF PATENTS PERTAINING TO NEAR-EYE DISPLAYS, 2021-2023

- TABLE 11 AVERAGE SELLING PRICE TREND OF NEAR-EYE DISPLAY PANELS PROVIDED BY KEY PLAYERS, 2021-2024

- TABLE 12 NEAR-EYE DISPLAY MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 18 NEAR-EYE DISPLAY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 19 NEAR-EYE DISPLAY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 20 TFT LCD: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 21 TFT LCD: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 22 AMOLED: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 23 AMOLED: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 24 LCOS: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 25 LCOS: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 26 OLEDOS: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 27 OLEDOS: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 28 MICROLED: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 29 MICROLED: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 30 LASER BEAM SCANNING: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 31 LASER BEAM SCANNING: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 32 NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 33 NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 34 NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (MILLION UNITS)

- TABLE 35 NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (MILLION UNITS)

- TABLE 36 AR: NEAR-EYE DISPLAY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 37 AR: NEAR-EYE DISPLAY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 38 AR: NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 39 AR: NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 40 AR: NEAR-EYE DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 AR: NEAR-EYE DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: NEAR-EYE DISPLAY MARKET FOR AR, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 43 NORTH AMERICA: NEAR-EYE DISPLAY MARKET FOR AR, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 44 EUROPE: NEAR-EYE DISPLAY MARKET FOR AR, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 45 EUROPE: NEAR-EYE DISPLAY MARKET FOR AR, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 46 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET FOR AR, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 47 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET FOR AR, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 48 ROW: NEAR-EYE DISPLAY MARKET FOR AR, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 49 ROW: NEAR-EYE DISPLAY MARKET FOR AR, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: NEAR-EYE DISPLAY MARKET FOR AR, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 51 NORTH AMERICA: NEAR-EYE DISPLAY MARKET FOR AR, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 52 EUROPE: NEAR-EYE DISPLAY MARKET FOR AR, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 53 EUROPE: NEAR-EYE DISPLAY MARKET FOR AR, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 54 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET FOR AR, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 55 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET FOR AR, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 56 ROW: NEAR-EYE DISPLAY MARKET FOR AR, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 57 ROW: NEAR-EYE DISPLAY MARKET FOR AR, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 58 VR & MR: NEAR-EYE DISPLAY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 59 VR & MR: NEAR-EYE DISPLAY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 60 VR & MR: NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 61 VR & MR: NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 62 VR & MR: NEAR-EYE DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 VR & MR: NEAR-EYE DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 65 NORTH AMERICA: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 66 EUROPE: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 67 EUROPE: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 68 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 69 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 70 ROW: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 71 ROW: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 74 EUROPE: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 75 EUROPE: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 76 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 77 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 78 ROW: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 79 ROW: NEAR-EYE DISPLAY MARKET FOR VR & MR, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 80 EVFS: NEAR-EYE DISPLAY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 81 EVFS: NEAR-EYE DISPLAY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 82 EVFS: NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 83 EVFS: NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 84 EVFS: NEAR-EYE DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 EVFS: NEAR-EYE DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: NEAR-EYE DISPLAY MARKET FOR EVFS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: NEAR-EYE DISPLAY MARKET FOR EVFS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 88 EUROPE: NEAR-EYE DISPLAY MARKET FOR EVFS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 89 EUROPE: NEAR-EYE DISPLAY MARKET FOR EVFS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET FOR EVFS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 91 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET FOR EVFS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 ROW: NEAR-EYE DISPLAY MARKET FOR EVFS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 93 ROW: NEAR-EYE DISPLAY MARKET FOR EVFS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: NEAR-EYE DISPLAY MARKET FOR EVFS, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: NEAR-EYE DISPLAY MARKET FOR EVFS, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 96 EUROPE: NEAR-EYE DISPLAY MARKET FOR EVFS, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 97 EUROPE: NEAR-EYE DISPLAY MARKET FOR EVFS, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 98 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET FOR EVFS, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 99 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET FOR EVFS, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 100 ROW: NEAR-EYE DISPLAY MARKET FOR EVFS, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 101 ROW: NEAR-EYE DISPLAY MARKET FOR EVFS, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 102 NEAR-EYE DISPLAY MARKET, BY RESOLUTION, 2021-2024 (USD MILLION)

- TABLE 103 NEAR-EYE DISPLAY MARKET, BY RESOLUTION, 2025-2030 (USD MILLION)

- TABLE 104 NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 105 NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 106 CONSUMER: NEAR-EYE DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 CONSUMER: NEAR-EYE DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 CONSUMER: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 109 CONSUMER: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 110 AUTOMOTIVE: NEAR-EYE DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 111 AUTOMOTIVE: NEAR-EYE DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 AUTOMOTIVE: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 113 AUTOMOTIVE: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 114 INDUSTRIAL & ENTERPRISE: NEAR-EYE DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 INDUSTRIAL & ENTERPRISE: NEAR-EYE DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 INDUSTRIAL & ENTERPRISE: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 117 INDUSTRIAL & ENTERPRISE: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 118 MILITARY, AEROSPACE & DEFENSE: NEAR-EYE DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 MILITARY, AEROSPACE & DEFENSE: NEAR-EYE DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 MILITARY, AEROSPACE & DEFENSE: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 121 MILITARY, AEROSPACE & DEFENSE: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 122 RETAIL & HOSPITALITY: NEAR-EYE DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 123 RETAIL & HOSPITALITY: NEAR-EYE DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 124 RETAIL & HOSPITALITY: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 125 RETAIL & HOSPITALITY: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 126 MEDICAL: NEAR-EYE DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 MEDICAL: NEAR-EYE DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 128 MEDICAL: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 129 MEDICAL: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 130 EDUCATION: NEAR-EYE DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 131 EDUCATION: NEAR-EYE DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 132 EDUCATION: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 133 EDUCATION: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 134 SPORTS & ENTERTAINMENT: NEAR-EYE DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 135 SPORTS & ENTERTAINMENT: NEAR-EYE DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 136 SPORTS & ENTERTAINMENT: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 137 SPORTS & ENTERTAINMENT: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 138 OTHER VERTICALS: NEAR-EYE DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 139 OTHER VERTICALS: NEAR-EYE DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 140 OTHER VERTICALS: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 141 OTHER VERTICALS: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 142 NEAR-EYE DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 143 NEAR-EYE DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 144 NORTH AMERICA: NEAR-EYE DISPLAY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 145 NORTH AMERICA: NEAR-EYE DISPLAY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 146 NORTH AMERICA: NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 147 NORTH AMERICA: NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 148 NORTH AMERICA: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 149 NORTH AMERICA: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 150 EUROPE: NEAR-EYE DISPLAY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 151 EUROPE: NEAR-EYE DISPLAY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 EUROPE: NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 153 EUROPE: NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 154 EUROPE: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 155 EUROPE: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 157 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 158 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 159 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 160 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 161 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 162 ROW: NEAR-EYE DISPLAY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 163 ROW: NEAR-EYE DISPLAY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 164 ROW: NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 165 ROW: NEAR-EYE DISPLAY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 166 ROW: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 167 ROW: NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 168 MIDDLE EAST: NEAR-EYE DISPLAY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 169 MIDDLE EAST: NEAR-EYE DISPLAY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 170 AFRICA: NEAR-EYE DISPLAY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 171 AFRICA: NEAR-EYE DISPLAY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 172 NEAR-EYE DISPLAY MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-DECEMBER 2024

- TABLE 173 NEAR-EYE DISPLAY MARKET: DEGREE OF COMPETITION, 2024

- TABLE 174 NEAR-EYE DISPLAY MARKET: REGION FOOTPRINT

- TABLE 175 NEAR-EYE DISPLAY MARKET: DEVICE TYPE FOOTPRINT

- TABLE 176 NEAR-EYE DISPLAY MARKET: TECHNOLOGY FOOTPRINT

- TABLE 177 NEAR-EYE DISPLAY MARKET: VERTICAL FOOTPRINT

- TABLE 178 NEAR-EYE DISPLAY MARKET: RESOLUTION FOOTPRINT

- TABLE 179 NEAR-EYE DISPLAY MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 180 NEAR-EYE DISPLAY MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 181 NEAR-EYE DISPLAY MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021-DECEMBER 2024

- TABLE 182 NEAR-EYE DISPLAY MARKET: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 183 NEAR-EYE DISPLAY MARKET: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 184 NEAR-EYE DISPLAY MARKET: OTHER DEVELOPMENTS, JANUARY 2021-DECEMBER 2024

- TABLE 185 SONY GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 186 SONY GROUP CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 SONY GROUP CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 188 SONY GROUP CORPORATION: EXPANSIONS

- TABLE 189 SEIKO EPSON CORPORATION: COMPANY OVERVIEW

- TABLE 190 SEIKO EPSON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 SEIKO EPSON CORPORATION: PRODUCT LAUNCHES/DEVELOPMENT

- TABLE 192 SEIKO EPSON CORPORATION: DEALS

- TABLE 193 BOE TECHNOLOGY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 194 BOE TECHNOLOGY GROUP CO., LTD.: PRODUCT /SOLUTIONS/SERVICES OFFERED

- TABLE 195 BOE TECHNOLOGY GROUP CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 196 SEEYA TECHNOLOGY: COMPANY OVERVIEW

- TABLE 197 SEEYA TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 SEEYA TECHNOLOGY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 199 EMAGIN: COMPANY OVERVIEW

- TABLE 200 EMAGIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 EMAGIN: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 202 EMAGIN: DEALS

- TABLE 203 EMAGIN: OTHER DEVELOPMENTS

- TABLE 204 KOPIN CORPORATION: COMPANY OVERVIEW

- TABLE 205 KOPIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 KOPIN CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 207 KOPIN CORPORATION: DEALS

- TABLE 208 KOPIN CORPORATION: OTHER DEVELOPMENTS

- TABLE 209 MICROOLED: COMPANY OVERVIEW

- TABLE 210 MICROOLED: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 211 HIMAX TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 212 HIMAX TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 HIMAX TECHNOLOGIES, INC.: PRODUCT LAUNCHES /DEVELOPMENTS

- TABLE 214 HIMAX TECHNOLOGIES, INC.: DEALS

- TABLE 215 HOLOEYE PHOTONICS AG: COMPANY OVERVIEW

- TABLE 216 HOLOEYE PHOTONICS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 HOLOEYE PHOTONICS AG: DEALS

- TABLE 218 YUNNAN OLIGHTEK OPTO-ELECTRONIC TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 219 YUNNAN OLIGHTEK OPTO-ELECTRONIC TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 NEAR-EYE DISPLAY MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 NEAR-EYE DISPLAY MARKET: RESEARCH DESIGN

- FIGURE 3 NEAR-EYE DISPLAY MARKET: BOTTOM-UP APPROACH

- FIGURE 4 DEMAND-SIDE ANALYSIS: NEAR-EYE DISPLAY MARKET

- FIGURE 5 NEAR-EYE DISPLAY MARKET: TOP-DOWN APPROACH

- FIGURE 6 SUPPLY-SIDE ANALYSIS: NEAR-EYE DISPLAY MARKET

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 NEAR-EYE DISPLAY MARKET, 2021-2030

- FIGURE 9 AR SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 CONSUMER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 11 OLEDOS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 12 HD SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 13 ASIA PACIFIC HELD LARGEST SHARE OF NEAR-EYE DISPLAY MARKET IN 2024

- FIGURE 14 INCREASING INVESTMENTS IN AR/VR TECHNOLOGIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- FIGURE 15 VR & MR SEGMENT TO DOMINATE NEAR-EYE DISPLAY MARKET IN 2030

- FIGURE 16 OLEDOS AND CONSUMER SEGMENTS HELD LARGEST SHARES OF NEAR-EYE DISPLAY MARKET IN 2024

- FIGURE 17 HD SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 18 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 NEAR-EYE DISPLAY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 IMPACT ANALYSIS OF DRIVERS ON NEAR-EYE DISPLAY MARKET

- FIGURE 21 RESTRAINTS AND THEIR IMPACT ON NEAR-EYE DISPLAY MARKET

- FIGURE 22 OPPORTUNITIES AND THEIR IMPACT ON NEAR-EYE DISPLAY MARKET

- FIGURE 23 CHALLENGES AND THEIR IMPACT ON NEAR-EYE DISPLAY MARKET

- FIGURE 24 NEAR-EYE DISPLAY MARKET: SUPPLY CHAIN

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 NEAR-EYE DISPLAY MARKET ECOSYSTEM

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO

- FIGURE 28 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 31 IMPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 32 EXPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 33 NUMBER OF PATENTS GRANTED, 2015-2024

- FIGURE 34 AVERAGE SELLING PRICE TREND OF NEAR-EYE DISPLAY PANELS OFFERED BY KEY PLAYERS, BY TECHNOLOGY, 2024

- FIGURE 35 AVERAGE SELLING PRICE TREND OF NEAR-EYE DISPLAY, BY REGION, 2020-2024

- FIGURE 36 IMPACT OF AI/GEN AI ON NEAR-EYE DISPLAY MARKET

- FIGURE 37 COMPONENTS OF NEAR-EYE DISPLAY

- FIGURE 38 OLEDOS TECHNOLOGY TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 39 VR & MR SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 40 HD SEGMENT TO LEAD MARKET THROUGH FORECAST PERIOD

- FIGURE 41 CONSUMER SEGMENT TO LEAD MARKET IN 2030

- FIGURE 42 NEAR-EYE DISPLAY MARKET, BY REGION

- FIGURE 43 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN NEAR-EYE DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA: NEAR-EYE DISPLAY MARKET SNAPSHOT

- FIGURE 45 EUROPE: NEAR-EYE DISPLAY MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: NEAR-EYE DISPLAY MARKET SNAPSHOT

- FIGURE 47 REVENUE ANALYSIS OF MAJOR COMPANIES IN NEAR-EYE DSIPLAY MARKET, 2022-2024 (USD MILLION)

- FIGURE 48 COMPANY VALUATION (USD BILLION)

- FIGURE 49 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 50 BRAND/PRODUCT COMPARISON

- FIGURE 51 NEAR-EYE DISPLAY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 52 NEAR-EYE DISPLAY MARKET: COMPANY FOOTPRINT

- FIGURE 53 NEAR-EYE DISPLAY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 54 SONY GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 BOE TECHNOLOGY GROUP CO., LTD.: COMPANY SNAPSHOT

- FIGURE 57 KOPIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 HIMAX TECHNOLOGIES, INC.: COMPANY SNAPSHOT

The global near-eye display market is anticipated to reach USD 6.65 billion by 2030 from USD 2.17 billion in 2025, at a CAGR of 25.1%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By technology, device type, resolution, vertical, and region |

| Regions covered | North America, Europe, APAC, RoW |

The near-eye display market is experiencing significant growth, driven by the increasing demand for immersive solutions that enhance user experiences in gaming, training, and simulation. Advancements in OLED-on-Silicon (OLEDoS) technology are boosting the adoption of head-mounted displays and smart glasses, as this technology offers higher resolution, improved contrast, and smaller form factors. Additionally, the expanding use of near-eye displays in healthcare for surgical visualization and diagnostics, as well as in the defense sector for training and real-time situational awareness, is contributing to market growth. Further improvements in microdisplay technologies, such as enhanced pixel density and power efficiency, also drive this growth. Furthermore, the rising demand for new augmented reality (AR) and virtual reality (VR) applications in education, manufacturing, and business environments continues to increase the relevance and application of near-eye displays.

"MicroLED to register highest CAGR in near-eye display market, by technology, during forecast period"

MicroLED technology is expected to register the fastest growth in the near-eye display market during the forecast period. The demand for MicroLED technology is on the rise, driven by its exceptional attributes: high brightness, superior contrast ratios, low power consumption, and rapid response times-essential qualities for delivering high-quality graphics in augmented reality (AR) and virtual reality (VR) applications. MicroLED displays are composed of minuscule, self-emissive LEDs, effectively eliminating the need for a backlight. This results in displays that are not only thinner and lighter but also more energy-efficient, making them ideal for compact devices such as smart glasses and head-mounted displays. Unlike OLED technology, MicroLED boasts enhanced durability and an extended lifespan, with no susceptibility to burn-in issues. This makes MicroLED displays particularly suited for critical applications in sectors such as healthcare, military, and industrial training environments. Their clarity in brightly lit conditions positions MicroLED as a viable option for augmented reality, where users often operate in direct sunlight.

While mass production has historically posed challenges due to complex fabrication techniques, recent advancements are driving cost reductions and improving scalability. As these innovations develop, MicroLED is poised to become a transformative technology within the near-eye display market.

"HD to account for largest share of near-eye display market, by resolution, throughout forecast period"

Near-eye displays with HD resolution are expected to hold the largest market share throughout the forecast period. This is primarily due to their balance of image quality, processing demands, and affordability. HD screens found in on-board devices offer sufficient pixel density to deliver sharp and engaging visual experiences for applications such as virtual reality (VR), augmented reality (AR), and mixed reality (MR) without the higher hardware requirements associated with Full HD or 4K screens.

Many consumer-level devices today utilize HD screens to provide exceptional performance while ensuring lower power consumption and longer battery life, which are essential features for wearables. Furthermore, HD resolution is more cost-effective to manufacture, making it a popular choice in budget-sensitive industries such as education, training, and healthcare. The increasing interest in smart glasses and headsets for enterprise applications is also driving the demand for robust and energy-efficient screens, and HD panels continue to be a viable and effective option. As manufacturers strive to enhance display quality and miniaturize components, HD resolution is likely to remain the preferred choice for most near-eye display applications, ensuring a strong market position throughout the forecast period.

"Asia Pacific to account for largest market share throughout forecast period"

Asia Pacific will account for the largest share of the near-eye display market during the forecast period. The region's dominance is due to the high presence of major display panel makers and consumer electronics firms in China, Japan, South Korea, and Taiwan. All these nations are spearheading the growth and commercialization of advanced display technologies such as OLED, MicroLED, and LCD-based near-eye displays utilized in AR and VR solutions.

The growing need for immersive technology in gaming, education, and industrial applications further drives market growth. Besides, governments and private investors are making massive investments in emerging technologies, such as metaverse platforms, smart manufacturing, and digital healthcare, which are fuelling the demand for near-eye displays. Rapid urbanization, growing consumer expenditure on electronics, and a high-volume base of technology-inclined users further attest to the region's leadership status. With further investments in display production and high penetration of AR/VR devices, Asia Pacific will continue to lead the near-eye display market in the near future.

The breakdown of the profiles of primary participants in the near-eye display market is as follows:

- By Company Type: Tier 1 - 30%, Tier 2 - 50%, and Tier 3 - 20%

- By Designation Type: C-level Executives - 25%, Directors - 35%, and Others - 40%

- By Region: Europe - 35%, North America - 25%, Asia Pacific - 30%, and Rest of the World - 10%

Note: Other designations include sales, marketing, and product managers.

The three tiers of the companies are based on their total revenues as of 2024, Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million.

The major players in the near-eye display market with a significant global presence include Sony Group Corporation (Japan), Seiko Epson Corporation (Japan), BOE Technology Group Co., Ltd. (China), SeeYA Technology (China), and eMagin (US).

Study Coverage

The report segments the near-eye display market and forecasts its size by technology, device type, resolution, vertical, and region. It also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth and covers qualitative and quantitative aspects of the market.

Reasons to buy the Report

The report will help market leaders/new entrants in this market with information on the closest approximate revenues for the overall near-eye display market and related segments. It will also help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (rising demand for immersive technologies to enhance user experience, rapid advancements in OLEDoS technology, increasing adoption of near-eye displays in healthcare and defense sectors, advancements in microdisplay technologies, and rising demand for advanced AR and VR technologies), restraints (limited availability of high-quality and engaging XR content and health issues associated with excessive use of AR and VR devices), opportunities (ongoing innovations in near-eye display technologies, and surging investments in development of advanced display), and challenges (technical and usability challenges associated with HMDs, complex manufacturing processes)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and the latest product launches in the near-eye display market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the near-eye display market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the near-eye display market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including Sony Group Corporation (Japan), Seiko Epson Corporation (Japan), BOE Technology Group Co., Ltd. (China), SeeYA Technology (China), eMagin (US), Kopin Corporation (US), Himax Technologies (Taiwan), MICROOLED Technologies (France), HOLOEYE Photonics AG (Germany), and Yunnan OLiGHTEK Opto-Electronic Technology Co., Ltd. (China).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Intended participants and key opinion leaders

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NEAR-EYE DISPLAY MARKET

- 4.2 NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE

- 4.3 NEAR-EYE DISPLAY MARKET, BY TECHNOLOGY AND VERTICAL

- 4.4 NEAR-EYE DISPLAY MARKET, BY RESOLUTION

- 4.5 NEAR-EYE DISPLAY MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for immersive technologies to enhance user experience

- 5.2.1.2 Rapid advancements in OLEDoS technology

- 5.2.1.3 Increasing adoption of near-eye displays in healthcare and defense sectors

- 5.2.1.4 Advancements in microdisplay technologies

- 5.2.1.5 Rising demand for advanced AR and VR technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited availability of high-quality and engaging XR content

- 5.2.2.2 Health issues associated with excessive use of AR and VR devices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Ongoing innovations in near-eye display technologies

- 5.2.3.2 Surging investments in development of advanced display technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical and usability challenges associated with HMDs

- 5.2.4.2 Complex manufacturing processes

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CONSUMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 MicroLED

- 5.7.1.2 LCoS

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Thin-film encapsulation

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 AR/VR

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 NATIONAL DENTAL CENTRE SINGAPORE AND THE MAGES INSTITUTE OF EXCELLENCE, WITH SEIKO EPSON, DEVELOPED SOLUTION BASED ON MOVERIO BT-200 SMART GLASSES, THAT ALLOWED DENTAL SURGEONS TO RETRIEVE PATIENT-SPECIFIC CONTENT

- 5.10.2 VERIZON DEPLOYED VR TECHNOLOGY TO UPSKILL SERVICE STAFF TO EMPATHIZE WITH CUSTOMERS

- 5.10.3 EMAGIN CORPORATION PROVIDED US ARMY WITH DISPLAYS THAT ENHANCED VISUAL ACUITY AND INFORMATION DENSITY IN AR APPLICATIONS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 8537)

- 5.11.2 EXPORT SCENARIO (HS CODE 8537)

- 5.12 PATENT ANALYSIS, 2015-2024

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TECHNOLOGY, 2024

- 5.13.2 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2024

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS AND REGULATIONS

- 5.15.2.1 Standards

- 5.15.2.2 Regulations

- 5.16 IMPACT OF AI/GEN AI ON NEAR-EYE DISPLAY MARKET

- 5.16.1 INTRODUCTION

- 5.17 IMPACT OF 2025 US TARIFF - NEAR-EYE DISPLAY MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON VERTICALS

6 BRIGHTNESS LEVELS IN NEAR-EYE DISPLAYS

- 6.1 INTRODUCTION

- 6.2 LESS THAN 500 NITS

- 6.3 500 TO 1,000 NITS

- 6.4 MORE THAN 1,000 NITS

7 COMPONENTS OF NEAR-EYE DISPLAY

- 7.1 INTRODUCTION

- 7.2 IMAGE GENERATORS

- 7.3 OPTICAL COMBINERS

- 7.4 IMAGING OPTICS

8 NEAR-EYE DISPLAY MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 TFT LCD

- 8.2.1 IMPROVED RESOLUTION, RESPONSE TIME, AND COLOR REPRODUCTION TO FOSTER MARKET GROWTH

- 8.3 AMOLED

- 8.3.1 RISING DEMAND FOR LESS ENERGY DRAIN AND LIGHTER CONSTRUCTION DISPLAY TECHNOLOGY TO FUEL MARKET GROWTH

- 8.4 LCOS

- 8.4.1 SURGING APPLICATIONS IN MEDICAL-GRADED AR GLASSES, MILITARY-GRADED HMDS, AND SURGICAL VISUALIZATION SYSTEMS TO BOOST DEMAND

- 8.5 OLEDOS

- 8.5.1 GROWING ADOPTION OF OLEDOS IN PREMIUM VR AND MR HMDS TO BOOST DEMAND

- 8.6 MICROLED

- 8.6.1 RISING DEMAND FOR ULTRA-BRIGHT, POWER-EFFICIENT DISPLAYS IN AR SMART GLASSES TO FOSTER MARKET GROWTH

- 8.7 LASER BEAM SCANNING

- 8.7.1 GROWING DEMAND FOR ULTRA-COMPACT, LIGHTWEIGHT NEAR-EYE DISPLAYS IN AR SMART GLASSES TO FUEL MARKET GROWTH

9 NEAR-EYE DISPLAY MARKET, BY DEVICE TYPE

- 9.1 INTRODUCTION

- 9.2 AR

- 9.2.1 ENHANCED REAL-WORLD ENVIRONMENTS WITH COMPUTER-GENERATED VISUALS TO FOSTER MARKET GROWTH

- 9.3 VR & MR

- 9.3.1 RISING DEMAND FOR IMMERSIVE EXPERIENCE IN GAMING AND ENTERTAINMENT SECTORS TO SUPPORT MARKET GROWTH

- 9.4 EVFS

- 9.4.1 FOCUS ON REDUCING DISPLAY WEIGHT AND POWER CONSUMPTION TO DRIVE MARKET

10 NEAR-EYE DISPLAY MARKET, BY RESOLUTION

- 10.1 INTRODUCTION

- 10.2 LOWER THAN HD

- 10.2.1 RISING APPLICATION IN EVFS TO DRIVE MARKET

- 10.3 HD

- 10.3.1 GROWING DEMAND FOR COST-EFFICIENT DISPLAY PANELS IN MID-RANGE AR/VR DEVICES TO FOSTER MARKET GROWTH

- 10.4 FHD

- 10.4.1 INCREASING NEED FOR HIGH-QUALITY VISUALS AT COST-EFFECTIVE PRICES TO DRIVE MARKET

- 10.5 HIGHER THAN FHD

- 10.5.1 RISING DEMAND FOR IMMERSIVE EXPERIENCES AND IMPROVED PICTURE QUALITY TO FUEL MARKET GROWTH

11 NEAR-EYE DISPLAY MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.2 CONSUMER

- 11.2.1 GROWING NUMBER OF OEMS OFFERING AR/VR PRODUCTS TO BOOST DEMAND

- 11.3 AUTOMOTIVE

- 11.3.1 SIGNIFICANT CONTRIBUTION IN HUMAN-MACHINE INTERFACE (HMI) DEVELOPMENT AND FACTORY TRAINING SIMULATIONS TO FUEL MARKET GROWTH

- 11.4 INDUSTRIAL & ENTERPRISE

- 11.4.1 RISING EMPHASIS ON DIGITAL TRANSFORMATION TO SUPPORT MARKET GROWTH

- 11.5 MILITARY, AEROSPACE, & DEFENSE

- 11.5.1 INCREASING APPLICATIONS FOR PILOT TRAINING TO TACKLE IN-FLIGHT SCENARIOS TO DRIVE MARKET

- 11.6 RETAIL & HOSPITALITY

- 11.6.1 EVOLUTION IN MARKETING AND PROMOTION WITH TECHNOLOGICAL ADVANCES TO FOSTER MARKET GROWTH

- 11.7 MEDICAL

- 11.7.1 GROWING SURGERY PRACTICE ON REALISTIC 3D MODELS TO DRIVE MARKET

- 11.8 EDUCATION

- 11.8.1 ENHANCED ENGAGEMENT AND INTERACTIVITY IN LEARNING ENVIRONMENTS TO FOSTER MARKET GROWTH

- 11.9 SPORTS & ENTERTAINMENT

- 11.9.1 GLOBAL EXPANSION OF THEME PARKS TO BOOST DEMAND

- 11.10 OTHER VERTICALS

12 NEAR-EYE DISPLAY MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Growing adoption of AR HMDs in simulation and thermal imaging in military sector to fuel market growth

- 12.2.3 CANADA

- 12.2.3.1 Government-led initiatives to focus on wearable technologies to drive market

- 12.2.4 MEXICO

- 12.2.4.1 Increased government expenditure in semiconductor sector to boost demand

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 UK

- 12.3.2.1 Thriving gaming industry to fuel market growth

- 12.3.3 GERMANY

- 12.3.3.1 Emphasis on innovating automotive industry to foster market growth

- 12.3.4 FRANCE

- 12.3.4.1 Expanding aerospace & defense sector to drive market

- 12.3.5 SPAIN

- 12.3.5.1 Surging investments in digital technologies to foster market growth

- 12.3.6 ITALY

- 12.3.6.1 Increasing adoption of digital solutions in key verticals to fuel market growth

- 12.3.7 POLAND

- 12.3.7.1 Thriving electronics and manufacturing sectors to boost demand

- 12.3.8 NORDICS

- 12.3.8.1 Surging adoption of immersive technologies through public-private partnerships to drive market

- 12.3.9 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Focusing on switching from manufacturing-driven to innovation-driven economy to offer lucrative growth opportunities

- 12.4.3 JAPAN

- 12.4.3.1 Increasing expenditure on healthcare and R&D activities to fuel market growth

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Government-led investments in promising technologies to offer lucrative growth opportunities

- 12.4.5 INDIA

- 12.4.5.1 Rising application of AR glasses in tourism, hospitality, medical, real estate, retail, and gaming sectors to drive market

- 12.4.6 AUSTRALIA

- 12.4.6.1 Surging procurement of AR/VR-based HMDs for simulation training, tactical visualization, and situational awareness to foster market growth

- 12.4.7 INDONESIA

- 12.4.7.1 Fast-growing digital economy and expanding manufacturing base to support market growth

- 12.4.8 MALAYSIA

- 12.4.8.1 Government-backed pilot programs and academic collaborations to drive market

- 12.4.9 THAILAND

- 12.4.9.1 Rise of smart factory pilots under Thailand 4.0 to offer lucrative growth opportunities

- 12.4.10 VIETNAM

- 12.4.10.1 Strong electronics manufacturing sector and government-backed digital initiatives to drive market

- 12.4.11 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MIDDLE EAST

- 12.5.1.1 Bahrain

- 12.5.1.1.1 Increasing integration of VR and AR technologies in education sector to drive market

- 12.5.1.2 Kuwait

- 12.5.1.2.1 Growing interest of public and private sectors in immersive technologies to fuel market growth

- 12.5.1.3 Qatar

- 12.5.1.3.1 Rising emphasis on innovation and presence of well-developed infrastructure for smart technologies to boost demand

- 12.5.1.4 Saudi Arabia

- 12.5.1.4.1 Government-led initiatives to diversify economy and boost digital transformation to foster market growth

- 12.5.1.5 UAE

- 12.5.1.5.1 Investment in digital infrastructure to boost demand

- 12.5.1.6 Rest of Middle East

- 12.5.1.1 Bahrain

- 12.5.2 AFRICA

- 12.5.2.1 South Africa

- 12.5.2.1.1 Advancements in education, healthcare, and entertainment sectors to boost demand

- 12.5.2.2 Rest of Africa

- 12.5.2.1 South Africa

- 12.5.3 SOUTH AMERICA

- 12.5.3.1 Growing demand for HMDs in engineering and design to foster market growth

- 12.5.1 MIDDLE EAST

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2019-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Device type footprint

- 13.7.5.4 Technology footprint

- 13.7.5.5 Vertical footprint

- 13.7.5.6 Resolution footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking for startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 SONY GROUP CORPORATION

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches/Developments

- 14.1.1.3.2 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 SEIKO EPSON CORPORATION

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches/Developments

- 14.1.2.3.2 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 BOE TECHNOLOGY GROUP CO., LTD.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches/Developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 SEEYA TECHNOLOGY

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches/Developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 EMAGIN

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches/Developments

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Other developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 KOPIN CORPORATION

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches/Developments

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Other developments

- 14.1.7 MICROOLED

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 HIMAX TECHNOLOGIES, INC.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches/Developments

- 14.1.8.3.2 Deals

- 14.1.9 HOLOEYE PHOTONICS AG

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.10 YUNNAN OLIGHTEK OPTO-ELECTRONIC TECHNOLOGY CO., LTD.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.1 SONY GROUP CORPORATION

- 14.2 OTHER PLAYERS

- 14.2.1 LG DISPLAY CO., LTD.

- 14.2.2 WISECHIP SEMICONDUCTOR INC.

- 14.2.3 LIGHTNING SILICON TECHNOLOGY, INC.

- 14.2.4 OMNIVISION

- 14.2.5 SYNDIANT

- 14.2.6 VUEREAL

- 14.2.7 MICROVISION

- 14.2.8 JBD

- 14.2.9 RAONTECH

- 14.2.10 SILICON MICRO DISPLAY

- 14.2.11 ENMESI.COM (SHENZHEN ANPO INTELLIGENCE TECHNOLOGY CO., LTD.)

- 14.2.12 MOJO VISION

- 14.2.13 CINOPTICS

- 14.2.14 LUMIODE, INC.

- 14.2.15 PLAYNITRIDE INC.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS