|

|

市場調査レポート

商品コード

1734007

中東・アフリカの可変周波数ドライブ市場:タイプ別、電圧別、定格電力別、用途別、エンドユーザー別、地域別 - 2030年までの動向と予測MEA Variable Frequency Drive Market by Type (AC Drive, DC Drive, Servo Drive), Application (Pumps, Fans & Blowers, Compressors, Conveyors, Others), Power Rating (Micro, Low, Medium, High), Voltage, End User, and Region - Global Trends & Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 中東・アフリカの可変周波数ドライブ市場:タイプ別、電圧別、定格電力別、用途別、エンドユーザー別、地域別 - 2030年までの動向と予測 |

|

出版日: 2025年05月15日

発行: MarketsandMarkets

ページ情報: 英文 240 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

中東・アフリカの可変周波数ドライブの市場規模は、予測期間(2025年~2030年)に5.6%のCAGRで拡大し、2025年の9億8,000万米ドルから2030年には12億9,000万米ドルに達すると予測されています。

中東・アフリカ地域では工業化が進み、エネルギー需要が増加しています。モーターの効率を改善し、エネルギー消費を最小限に抑え、効率を向上させる可変周波数ドライブの需要が高まっています。省エネと業務効率向上の動きが強まる中、VFDの採用は石油・ガス、製造、インフラなどの重要な分野で牽引役となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント別 | タイプ別、電圧別、定格電力別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 中東・アフリカ |

ACドライブ分野は、その高いエネルギー効率特性と正確なモーター性能により、中東・アフリカの可変周波数ドライブ(VFD)市場で最も高い成長を記録すると予測されています。同地域では産業化が急速に進んでおり、製造、石油・ガス、HVAC、水処理などの分野で、生産性の向上と運用コストの削減を目的としたエネルギー効率の高い技術の導入が進んでいます。ACドライブはこれらの目的をサポートし、エネルギー効率を最大化し、機械的ストレスを最小化し、システムの信頼性を高めます。

ポンプ分野は、省エネの可能性と様々な産業への幅広い応用から、中東・アフリカの可変周波数ドライブ市場全体をリードすると予測されます。VFDは、ポンプシステムの正確な速度制御を可能にし、より高い効率と省エネルギーにつながり、これは上下水道、HVAC、石油・ガス産業で重要です。実際の要件に応じてモーターの回転数を制御することで、VFDはエネルギー損失だけでなく機械的摩耗も削減します。

南アフリカは、中東・アフリカ地域で最も急成長する市場になると予測されています。この高成長の背景には、急速な工業化とインフラ更新活動の成長があります。さらに、電力システムの継続的な近代化と、鉱業、製造業、水処理産業における自動化適用の拡大が、同国の需要を牽引します。さらに、政府が支援する省エネルギープログラムは、産業部門にVFDの導入を促しています。

この調査には、中東・アフリカ可変周波数ドライブ市場におけるこれらの主要企業の企業プロファイル、最近の動向、主な市場戦略などの詳細な競合分析が含まれています。

当レポートでは、中東・アフリカの可変周波数ドライブ市場をタイプ別(ACドライブ、DCドライバ、サーボモータ)、定格電力別(マイクロパワードライブ、ローパワードライブ、ミディアムパワードライブ、ハイパワードライブ)、用途別(ポンプ、コンプレッサ、コンベア、ファン、その他)、エンドユーザー別(石油・ガス、化学・石油化学、鉱業・金属、建設・インフラ、食品・飲料、自動車、電力、水・廃水処理)、電圧別(低電圧、中電圧)、地域別(中東・アフリカ)に定義、記述、予測しています。本レポートの調査範囲は、可変周波数ドライブ市場の成長に影響を与える促進要因・市場抑制要因・課題・機会などの主な要因に関する詳細情報を網羅しています。主要な業界プレイヤーを詳細に分析し、その事業概要、ソリューション、サービス、契約、パートナーシップ、協定、新製品・サービスの発表、M&Aなどの主な戦略、中東アフリカの可変周波数ドライブ市場に関連する最近の動向についての洞察を提供しています。可変周波数ドライブ市場のエコシステムにおける今後の新興企業の競合分析もカバーしています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- バリューチェーン分析

- エコシステム分析

- ケーススタディ分析

- 技術分析

- 価格分析

- 規制状況

- 貿易分析

- 特許分析

- 2025年の主な会議とイベント

- 投資と資金調達のシナリオ

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- AI/生成AIの影響

- マクロ経済見通し

- 2025年の米国関税

第6章 中東・アフリカの可変周波数ドライブ市場(タイプ別)

- イントロダクション

- ACドライブ

- DCドライブ

- サーボドライブ

第7章 中東・アフリカの可変周波数ドライブ市場(電圧別)

- イントロダクション

- 低電圧

- 中電圧

第8章 中東・アフリカの可変周波数ドライブ市場(定格電力別)

- イントロダクション

- マイクロパワードライブ

- 低消費電力ドライブ

- ミディアムパワードライブ

- ハイパワードライブ

第9章 中東・アフリカの可変周波数ドライブ市場(用途別)

- イントロダクション

- ポンプ

- ファンとブロワー

- コンプレッサー

- コンベア

- その他

第10章 中東・アフリカの可変周波数ドライブ市場(エンドユーザー別)

- イントロダクション

- 発電

- 石油・ガス

- 化学製品および石油化学製品

- 鉱業・金属

- 建設・インフラ

- 飲食品

- 自動車

- 水・廃水処理

- その他

第11章 中東・アフリカの可変周波数ドライブ市場(地域別)

- 中東・アフリカ

- GCC

- 南アフリカ

- ナイジェリア

- ザンビア

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- SCHNEIDER ELECTRIC

- ABB

- SIEMENS

- DANFOSS

- ROCKWELL AUTOMATION

- GENERAL ELECTRIC

- WEG

- YASKAWA ELECTRIC CORPORATION

- HONEYWELL INTERNATIONAL INC.

- DELTA ELECTRONICS, INC.

- SUMITOMO HEAVY INDUSTRIES, LTD.

- TRIOL CORPORATION

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 MIDDLE EAST & AFRICA VARIABLE SPEED DRIVE MARKET SNAPSHOT

- TABLE 3 GCC COUNTRIES: LONG-TERM STRATEGIES FOR RENEWABLE ENERGY INTEGRATION

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE OF VARIABLE FREQUENCY DRIVES, BY POWER RATING, 2021-2024 (USD/UNIT)

- TABLE 6 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 IMPORT DATA FOR HS CODE 850110-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 8 EXPORT DATA FOR HS CODE 850110-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 9 IMPORT DATA FOR HS CODE 850120-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 850120-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 11 PATENT ANALYSIS

- TABLE 12 KEY CONFERENCES AND EVENTS, 2025

- TABLE 13 IMPACT OF PORTER'S FIVE FORCES

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TYPE

- TABLE 15 KEY BUYING CRITERIA, BY TYPE

- TABLE 16 WORLD GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 17 ANNUAL PERCENTAGE CHANGE IN INFLATION RATE AS PER AVERAGE CONSUMER PRICE, BY REGION, 2024

- TABLE 18 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 19 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 20 AC DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 21 AC DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 22 AC DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 23 AC DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 24 DC DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 25 DC DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 26 DC DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 27 DC DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 28 SERVO DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 29 SERVO DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 30 SERVO DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 31 SERVO DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 32 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 33 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 34 LOW VOLTAGE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 35 LOW VOLTAGE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 36 LOW VOLTAGE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 37 LOW VOLTAGE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 38 MEDIUM VOLTAGE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 39 MEDIUM VOLTAGE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 40 MEDIUM VOLTAGE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 41 MEDIUM VOLTAGE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 42 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 43 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 44 MICRO POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 45 MICRO POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 46 MICRO POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 47 MICRO POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 48 LOW POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 49 LOW POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 50 LOW POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 51 LOW POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 52 MEDIUM POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 53 MEDIUM POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 54 MEDIUM POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 55 MEDIUM POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 56 HIGH POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 57 HIGH POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 58 HIGH POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 59 HIGH POWER DRIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 60 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 61 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 62 PUMPS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 63 PUMPS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 64 PUMPS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 65 PUMPS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 66 FANS & BLOWERS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 67 FANS & BLOWERS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 68 FANS & BLOWERS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 69 FANS & BLOWERS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 70 COMPRESSORS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 71 COMPRESSORS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 72 COMPRESSORS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 73 COMPRESSORS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 74 CONVEYORS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 75 CONVEYORS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 76 CONVEYORS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 77 CONVEYORS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 78 OTHER APPLICATIONS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 79 OTHER APPLICATIONS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 OTHER APPLICATIONS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 81 OTHER APPLICATIONS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 82 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 83 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 84 POWER: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 85 POWER: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 86 POWER: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 87 POWER: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 88 OIL & GAS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 89 OIL & GAS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 OIL & GAS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 91 OIL & GAS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 92 CHEMICALS & PETROCHEMICALS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 93 CHEMICALS & PETROCHEMICALS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 94 CHEMICALS & PETROCHEMICALS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 95 CHEMICALS & PETROCHEMICALS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 96 MINING & METAL: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 97 MINING & METAL: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 98 MINING & METAL: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 99 MINING & METAL: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 100 CONSTRUCTION/INFRASTRUCTURE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 101 CONSTRUCTION/INFRASTRUCTURE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 102 CONSTRUCTION/INFRASTRUCTURE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 103 CONSTRUCTION/INFRASTRUCTURE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 104 FOOD & BEVERAGE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 105 FOOD & BEVERAGE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 106 FOOD & BEVERAGE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 107 FOOD & BEVERAGE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 108 AUTOMOTIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 109 AUTOMOTIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 110 AUTOMOTIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 111 AUTOMOTIVE: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 112 WATER & WASTEWATER TREATMENT: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 113 WATER & WASTEWATER TREATMENT: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 114 WATER & WASTEWATER TREATMENT: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 115 WATER & WASTEWATER TREATMENT: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 116 OTHER END USERS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 117 OTHER END USERS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 OTHER END USERS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2021-2024 (USD MILLION)

- TABLE 119 OTHER END USERS: MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 132 GCC: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 133 GCC: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 134 GCC: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 135 GCC: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 136 GCC: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 137 GCC: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 138 GCC: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 GCC: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 GCC: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 141 GCC: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 142 SAUDI ARABIA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 143 SAUDI ARABIA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 144 SAUDI ARABIA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 145 SAUDI ARABIA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 146 SAUDI ARABIA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 147 SAUDI ARABIA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 148 SAUDI ARABIA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 149 SAUDI ARABIA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 150 SAUDI ARABIA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 151 SAUDI ARABIA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 152 UAE: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 153 UAE: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 154 UAE: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 155 UAE: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 156 UAE: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 157 UAE: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 158 UAE: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 159 UAE: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 160 UAE: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 161 UAE: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 162 REST OF GCC: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 163 REST OF GCC: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 164 REST OF GCC: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 165 REST OF GCC: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 166 REST OF GCC: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 167 REST OF GCC: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 168 REST OF GCC: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 169 REST OF GCC: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 170 REST OF GCC: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 171 REST OF GCC: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 172 SOUTH AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 173 SOUTH AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 174 SOUTH AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 175 SOUTH AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 176 SOUTH AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 177 SOUTH AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 178 SOUTH AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 179 SOUTH AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 180 SOUTH AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 181 SOUTH AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 182 NIGERIA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 183 NIGERIA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 184 NIGERIA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 185 NIGERIA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 186 NIGERIA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 187 NIGERIA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 188 NIGERIA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 189 NIGERIA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 190 NIGERIA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 191 NIGERIA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 192 ZAMBIA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 193 ZAMBIA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 194 ZAMBIA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 195 ZAMBIA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 196 ZAMBIA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 197 ZAMBIA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 198 ZAMBIA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 199 ZAMBIA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 200 ZAMBIA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 201 ZAMBIA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 202 REST OF MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 203 REST OF MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 205 REST OF MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 206 REST OF MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 207 REST OF MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 211 REST OF MIDDLE EAST & AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 212 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 213 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 214 POWER RATING FOOTPRINT

- TABLE 215 TYPE FOOTPRINT

- TABLE 216 APPLICATION FOOTPRINT

- TABLE 217 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET: PRODUCT LAUNCHES, JANUARY 2020-JANUARY 2025

- TABLE 218 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET: DEALS, JANUARY 2020- JANUARY 2025

- TABLE 219 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 220 SCHNEIDER ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 221 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 222 SCHNEIDER ELECTRIC: DEALS

- TABLE 223 ABB: COMPANY OVERVIEW

- TABLE 224 ABB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 225 SIEMENS: COMPANY OVERVIEW

- TABLE 226 SIEMENS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 227 SIEMENS: PRODUCT LAUNCHES

- TABLE 228 DANFOSS: COMPANY OVERVIEW

- TABLE 229 DANFOSS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 230 DANFOSS: PRODUCT LAUNCHES

- TABLE 231 DANFOSS: DEALS

- TABLE 232 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 233 ROCKWELL AUTOMATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 234 ROCKWELL AUTOMATION: PRODUCT LAUNCHES

- TABLE 235 GENERAL ELECTRIC: COMPANY OVERVIEW

- TABLE 236 GENERAL ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 237 WEG: COMPANY OVERVIEW

- TABLE 238 WEG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 239 WEG: PRODUCT LAUNCHES

- TABLE 240 YASKAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 241 YASKAWA ELECTRIC CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 242 YASKAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 243 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 244 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 245 DELTA ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 246 DELTA ELECTRONICS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 247 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 248 SUMITOMO HEAVY INDUSTRIES, LTD.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 249 TRIOL CORPORATION: COMPANY OVERVIEW

- TABLE 250 TRIOL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

List of Figures

- FIGURE 1 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR VARIABLE FREQUENCY DRIVES IN MIDDLE EAST & AFRICA

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY-SIDE ANALYSIS)

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 AC DRIVE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 9 MEDIUM VOLTAGE SEGMENT TO GROW AT HIGHER CAGR THAN LOW VOLTAGE SEGMENT DURING FORECAST PERIOD

- FIGURE 10 PUMPS TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 11 LOW POWER DRIVE SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 12 POWER TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 13 INCREASING DEMAND FOR INFRASTRUCTURE DEVELOPMENTS TO DRIVE MARKET

- FIGURE 14 AC DRIVE AND GCC SEGMENTS ACCOUNTED FOR SUBSTANTIAL SHARE IN 2024

- FIGURE 15 LOW VOLTAGE SEGMENT TO BE LARGER THAN MEDIUM VOLTAGE SEGMENT IN 2030

- FIGURE 16 LOW POWER DRIVE SEGMENT TO HOLD HIGHEST SHARE IN 2030

- FIGURE 17 PUMPS SEGMENT TO BE PREVALENT IN 2030

- FIGURE 18 POWER TO BE LEADING END-USE INDUSTRY IN 2030

- FIGURE 19 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET DYNAMICS

- FIGURE 20 SAUDI ARABIA: CONTRACTS AWARDED PER SECTOR, Q1 2024

- FIGURE 21 DUBAI CLEAN ENERGY STRATEGY 2050

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 VALUE CHAIN ANALYSIS

- FIGURE 24 ECOSYSTEM ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE OF VARIABLE FREQUENCY DRIVES, BY POWER RATING, 2021-2024 (USD/UNIT)

- FIGURE 26 IMPORT DATA FOR HS CODE 850110-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 27 EXPORT DATA FOR HS CODE 850110-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 28 IMPORT DATA FOR HS CODE 850120-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 29 EXPORT DATA FOR HS CODE 850120-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 30 PATENT ANALYSIS

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO, 2024

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TYPE

- FIGURE 34 KEY BUYING CRITERIA, BY TYPE

- FIGURE 35 IMPACT OF AI/GENERATIVE AI ON DRIVE TYPES, BY REGION

- FIGURE 36 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2024

- FIGURE 37 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2024

- FIGURE 38 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2024

- FIGURE 39 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2024

- FIGURE 40 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2024

- FIGURE 41 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 42 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 43 COMPANY VALUATION

- FIGURE 44 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 45 BRAND/PRODUCT COMPARISON

- FIGURE 46 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 COMPANY FOOTPRINT

- FIGURE 48 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 49 ABB: COMPANY SNAPSHOT

- FIGURE 50 SIEMENS: COMPANY SNAPSHOT

- FIGURE 51 DANFOSS: COMPANY SNAPSHOT

- FIGURE 52 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 53 GENERAL ELECTRIC: COMPANY SNAPSHOT

- FIGURE 54 WEG: COMPANY SNAPSHOT

- FIGURE 55 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 57 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- FIGURE 58 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

The MEA variable frequency drive market is projected to reach USD 1.29 billion by 2030 from an estimated USD 0.98 billion in 2025, at a CAGR of 5.6% during the forecast period (2025-2030). Continued industrialization in the MEA region is increasing the demand for energy. There is a growing demand for variable frequency drives that improve the efficiency of motors, minimize energy consumption, and improve efficiency. As the drive to enhance energy-saving and operational efficiency intensifies, the adoption of VFDs is gaining traction in critical sectors such as oil & gas, manufacturing, and infrastructure.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By type, end user, power rating, application, voltage, and region |

| Regions covered | Middle East & Africa |

"AC drives segment projected to witness highest growth during the forecast period."

The AC drive segment is projected to register the highest growth in the MEA VFD market due to its high energy efficiency characteristic and accurate motor performance. With the rapid pace of industrialization in the region, the manufacturing, oil & gas, HVAC, and water treatment sectors are witnessing significant adoption of energy-efficient technologies to enhance productivity and reduce operational expenses. AC drives support these objectives, maximizing energy efficiency, minimizing mechanical stress, and increasing system reliability.

"Pumps segment to be largest application in MEA variable frequency drive market"

The pump segment is anticipated to lead the overall variable frequency drive market in the Middle East & Africa due to its potential for energy saving and broad application in various industries. VFDs allow for precise speed control of pump systems, leading to greater efficiency and energy savings, which is important in the water & wastewater, HVAC, and oil & gas industries. By controlling motor speed according to actual requirements, VFDs reduce not only energy loss but also mechanical wear.

"South Africa to register highest CAGR in MEA variable frequency drive market"

South Africa is projected to be the fastest-growing variable frequency drive market in the MEA region. This high growth is fueled by fast-paced industrialization and growth in infrastructure renewal activities. Furthermore, the continued modernization of power systems and the growing application of automation across mining, manufacturing, and water treatment industries will drive the demand in the country. Furthermore, government-sponsored energy conservation programs are encouraging industrial sectors to install VFDs.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 30%, Tier 2- 45%, and Tier 3- 25%

By Designation: C-Level- 30%, Director Levels- 20%, and Others- 50%

Note 1: Others include sales managers, engineers, and regional managers.

Note 2: The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Danfoss (Denmark), and Rockwell Automation (US) are some of the key players in the MEA variable frequency drive market.

The study includes an in-depth competitive analysis of these key players in the MEA variable frequency drive market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report defines, describes, and forecasts the MEA variable frequency drive market by type (AC drives, DC drivers and servo motors), by power rating (Micro power drive, low power drive, medium power drive and high power drive), by application (pumps, compressors, conveyors, fans, and others), by end user (Oil & gas, chemicals & petrochemicals, mining & metals, construction/infrastructure, food & beverage, automotive, power, water & wastewater treatment), by voltage (low voltage and medium voltage), and by region (Middle East & Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the variable frequency drive market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies such as contracts, partnerships, agreements, new product & service launches, and mergers & acquisitions; and recent developments associated with the MEA variable frequency drive market. Competitive analysis of upcoming startups in the variable frequency drive market ecosystem is covered in this report.

Key Benefits of Buying the Report

- Analysis of key drivers (Increasing industrialization and growing demand for energy efficiency, rising need for enhancing energy efficiency and decreasing energy consumption, supportive regulatory environment for efficient and effective energy utilization), restraints (stagnant growth of oil & gas industry and decline in exploration and production activities, increase in maintenance cost of systems after implementation of variable frequency drives (VFDs), opportunities (modernization of power infrastructure, growing use of Industrial Internet of Things (IoT) and robotics technologies), and challenges (availability of low-cost products in gray market, shortage of components and parts due to supply chain disruptions) influencing the growth of the variable frequency drive market.

- Product Development/Innovation: In line with the increased investments in industrial infrastructure and energy efficiency, manufacturers in the MEA region are increasing their local production capabilities for manufacturing variable frequency drives in the region. Recent facility expansions in the UAE and Saudi Arabia are intended to respond to the increasing demand for automation and sophisticated motor control solutions. These developments are likely to improve VFD adoption due to short lead times and availability of tailor-made solutions that match the specific requirements of regional industries.

- Market Diversification: In January 2024, Siemens introduced its SINAMICS S210 servo drive system with a new hardware architecture and V6 software generation that expanded the system's range of applications. This system is particularly beneficial for industries such as manufacturing, packaging, and logistics, where high-speed and precise motion control are crucial.

- Market Development: Developments in variable frequency drives are increasingly focused on enhancing efficiency, sustainability, and power generation. Favorable government policies regarding carbon emission reduction and increasing demand for variable frequency drive in transportation and industrial sectors are driving the variable frequency drive market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Danfoss (Denmark), and Rockwell Automation (US), among others, in the MEA variable frequency drive market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Demand-side analysis

- 2.2.1.2 Regional analysis

- 2.2.1.3 Country-level analysis

- 2.2.1.4 Demand-side assumptions

- 2.2.1.5 Demand-side calculations

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Supply-side analysis

- 2.2.2.2 Supply-side assumptions

- 2.2.2.3 Supply-side calculations

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

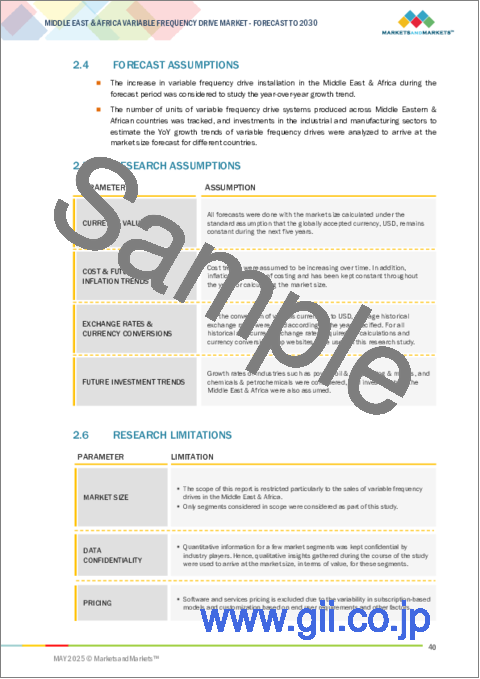

- 2.4 FORECAST ASSUMPTIONS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET

- 4.2 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY TYPE AND COUNTRY

- 4.3 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE

- 4.4 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING

- 4.5 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION

- 4.6 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY END USER

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expansion of oil and gas projects in Saudi Arabia

- 5.2.1.2 Increasing investments in clean energy in Middle East & Africa

- 5.2.2 RESTRAINTS

- 5.2.2.1 Unstable power supply in Africa

- 5.2.2.2 High installation and maintenance costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Implementation of wastewater treatment programs in Middle Eastern countries

- 5.2.3.2 Surge in infrastructure and energy projects

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skilled workforce

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RAW MATERIAL PROVIDERS/COMPONENT MANUFACTURERS/SUPPLIERS

- 5.4.2 VARIABLE FREQUENCY DRIVE MANUFACTURERS/ASSEMBLERS

- 5.4.3 DISTRIBUTORS/RESELLERS

- 5.4.4 END USERS

- 5.4.5 MAINTENANCE/SERVICE PROVIDERS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 MEDIUM-VOLTAGE VFD FOR PREHEATER HELPED CEMENT PLANT ACHIEVE SUBSTANTIAL ENERGY SAVINGS

- 5.6.2 11 KV MOTOR FOR 6.6 KV VFD WITH STAR-DELTA SOLUTION ADDRESSED VOLTAGE INCOMPATIBILITY

- 5.6.3 OPTIDRIVE P2 VFD FOR 450 KW MOTOR ENHANCED BALL MILL EFFICIENCY IN IRON ORE MINING

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Direct torque control

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Internet of Things

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Harmonic filtering

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND, BY POWER RATING

- 5.9 REGULATORY LANDSCAPE

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 850110)

- 5.10.2 EXPORT SCENARIO (HS CODE 850110)

- 5.10.3 IMPORT SCENARIO (HS CODE 850120)

- 5.10.4 EXPORT SCENARIO (HS CODE 850120)

- 5.11 PATENT ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS, 2025

- 5.13 INVESTMENT AND FUNDING SCENARIO

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF SUBSTITUTES

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF NEW ENTRANTS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GENERATIVE AI

- 5.16.1 ADOPTION OF AI/GENERATIVE AI IN VARIABLE FREQUENCY DRIVE MARKET

- 5.16.2 IMPACT OF AI/GENERATIVE AI ON DRIVE TYPES, BY REGION

- 5.16.3 IMPACT OF AI/GENERATIVE AI ON VARIABLE FREQUENCY DRIVE MARKET, BY REGION

- 5.17 MACROECONOMIC OUTLOOK

- 5.17.1 INTRODUCTION

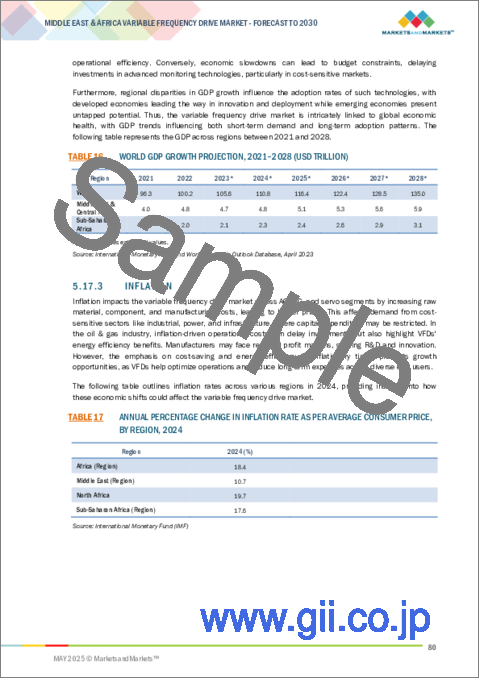

- 5.17.2 GDP TRENDS AND FORECAST

- 5.17.3 INFLATION

- 5.18 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON MIDDLE EAST & AFRICA

6 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 AC DRIVE

- 6.2.1 RISE IN INDUSTRIAL AUTOMATION TO DRIVE MARKET

- 6.3 DC DRIVE

- 6.3.1 SHIFT TOWARD PROCESS OPTIMIZATION TO DRIVE MARKET

- 6.4 SERVO DRIVE

- 6.4.1 ELEVATED DEMAND FOR SMART MANUFACTURING TO DRIVE MARKET

7 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE

- 7.1 INTRODUCTION

- 7.2 LOW VOLTAGE

- 7.2.1 INCLINATION TOWARD SUSTAINABILITY TO DRIVE MARKET

- 7.3 MEDIUM VOLTAGE

- 7.3.1 EMPHASIS ON COST SAVINGS AND OPERATIONAL EFFICIENCY TO DRIVE MARKET

8 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING

- 8.1 INTRODUCTION

- 8.2 MICRO POWER DRIVE

- 8.2.1 EXTENSIVE USE IN FOOD PROCESSING DUE TO LOW POWER REQUIREMENTS TO DRIVE MARKET

- 8.3 LOW POWER DRIVE

- 8.3.1 HIGH DEMAND FOR ENERGY EFFICIENCY ACROSS DIVERSE INDUSTRIES TO DRIVE MARKET

- 8.4 MEDIUM POWER DRIVE

- 8.4.1 ESTABLISHMENT OF NEW MANUFACTURING PLANTS TO DRIVE MARKET

- 8.5 HIGH POWER DRIVE

- 8.5.1 ONGOING DEVELOPMENTS IN STEEL AND MINING INDUSTRIES TO DRIVE MARKET

9 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 PUMPS

- 9.2.1 NEED FOR ENERGY-EFFICIENT SOLUTIONS TO DRIVE MARKET

- 9.3 FANS & BLOWERS

- 9.3.1 ABILITY TO ENHANCE SYSTEM PERFORMANCE TO DRIVE MARKET

- 9.4 COMPRESSORS

- 9.4.1 SUBSTANTIAL ENERGY SAVINGS TO DRIVE MARKET

- 9.5 CONVEYORS

- 9.5.1 REDUCED MECHANICAL STRESS AND ADAPTABILITY TO DRIVE MARKET

- 9.6 OTHER APPLICATIONS

10 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 POWER

- 10.2.1 GROWING EMPHASIS ON ENERGY EFFICIENCY TO DRIVE MARKET

- 10.3 OIL & GAS

- 10.3.1 SURGE IN INVESTMENTS TO DRIVE MARKET

- 10.4 CHEMICALS & PETROCHEMICALS

- 10.4.1 LOW OPERATIONAL COSTS AND REDUCED CARBON EMISSIONS TO DRIVE MARKET

- 10.5 MINING & METAL

- 10.5.1 ENVIRONMENTAL SUSTAINABILITY GOALS TO DRIVE MARKET

- 10.6 CONSTRUCTION/INFRASTRUCTURE

- 10.6.1 PRECISE CONTROL OVER ACCELERATION AND DECELERATION TO DRIVE MARKET

- 10.7 FOOD & BEVERAGE

- 10.7.1 STRINGENT SAFETY AND HYGIENE STANDARDS TO DRIVE MARKET

- 10.8 AUTOMOTIVE

- 10.8.1 DEPLOYMENT IN VEHICLE PRODUCTION TO DRIVE MARKET

- 10.9 WATER & WASTEWATER TREATMENT

- 10.9.1 FOCUS ON REGULATING SEWAGE TREATMENT TO DRIVE MARKET

- 10.10 OTHER END USERS

11 MIDDLE EAST & AFRICA VARIABLE FREQUENCY DRIVE MARKET, BY REGION

- 11.1 MIDDLE EAST & AFRICA

- 11.1.1 GCC

- 11.1.1.1 Saudi Arabia

- 11.1.1.1.1 Commitment to sustainability and net-zero emissions to drive market

- 11.1.1.2 UAE

- 11.1.1.2.1 Rapid industrial growth to drive market

- 11.1.1.3 Rest of GCC

- 11.1.1.1 Saudi Arabia

- 11.1.2 SOUTH AFRICA

- 11.1.2.1 Restructuring of oil & gas industry to drive market

- 11.1.3 NIGERIA

- 11.1.3.1 Rapid reforms in power industry to drive market

- 11.1.4 ZAMBIA

- 11.1.4.1 Robust mining industry and push for energy efficiency to drive market

- 11.1.5 REST OF MIDDLE EAST & AFRICA

- 11.1.1 GCC

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Power rating footprint

- 12.7.5.3 Type footprint

- 12.7.5.4 Application footprint

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 PRODUCT LAUNCHES

- 12.8.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SCHNEIDER ELECTRIC

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 ABB

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Right to win

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses and competitive threats

- 13.1.3 SIEMENS

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 DANFOSS

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 ROCKWELL AUTOMATION

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Services/Solutions offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 GENERAL ELECTRIC

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Services/Solutions offered

- 13.1.7 WEG

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 YASKAWA ELECTRIC CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.9 HONEYWELL INTERNATIONAL INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Services/Solutions offered

- 13.1.10 DELTA ELECTRONICS, INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Services/Solutions offered

- 13.1.11 SUMITOMO HEAVY INDUSTRIES, LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Services/Solutions offered

- 13.1.12 TRIOL CORPORATION

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Services/Solutions offered

- 13.1.1 SCHNEIDER ELECTRIC

14 APPENDIX

- 14.1 KEY INDUSTRY INSIGHTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS