|

|

市場調査レポート

商品コード

1724766

経口タンパク質・ペプチドの世界市場:分子別、薬剤クラス別、治療領域別、剤形別 - 予測(~2030年)Oral Proteins & Peptides Market by Molecule (Semaglutide, Linaclotide, Calcitonin), Drug Class (GLP-1 Receptor Agonist, GEP, CGRP), Therapeutic Area (Diabetes, Gastroenterology, Genetic Disorder), Formulation (Tablet, Capsule) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 経口タンパク質・ペプチドの世界市場:分子別、薬剤クラス別、治療領域別、剤形別 - 予測(~2030年) |

|

出版日: 2025年04月24日

発行: MarketsandMarkets

ページ情報: 英文 326 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の経口タンパク質・ペプチドの市場規模は、2025年の88億5,000万米ドルから2030年までに240億米ドルに達すると予測され、2025年~2030年の予測期間にCAGRで22.1%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 分子、薬剤クラス、治療領域、剤形、エンドユーザー |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

経口ペプチド、特に糖尿病や中枢神経系(CNS)障害などの慢性疾患の治療に用いるものに対する需要の増加が、市場成長の主な促進要因となっています。さらに、主要企業による研究開発への投資の増加が、革新的な経口ペプチドの創出と上市につながっています。ドラッグデリバリー技術の継続的な進歩も市場の拡大に寄与しています。

しかし、市場は高い開発コストや製剤と安定性に関する障害などの課題に直面しており、これが成長の妨げとなっています。

「分子別では、セマグルチド分子が2024年に最大のシェアを占めました。」

セマグルチドはグルカゴン様ペプチド-1(GLP-1)のアナログで、血糖値と食欲の調節に重要な役割を果たすホルモンです。2型糖尿病や肥満症の治療に用いられます。セマグルチドは、血糖値の上昇に応じてインスリンの分泌を促進し、グルカゴン(通常、血糖値を上昇させる)の分泌を抑制し、食後の満腹感を促進することにより、食事摂取量を減少させます。

RYBELSUSとして上市されている経口セマグルチドは、2型糖尿病の治療薬として米国FDAに承認された初の経口GLP-1受容体作動薬です。クラスとして、GLP-1受容体作動薬は2型糖尿病の管理に広く利用され、推奨されています。

「米国が予測期間に経口タンパク質・ペプチド市場を独占し続ける見込みです。」

米国は世界最大のバイオ医薬品市場であり、バイオ医薬品研究と投資のリーダーです。この成長は、感染症患者の増加、バイオ医薬品の重要性の高まり、医療部門における安全で高品質な製品へのニーズなどの複数の要因によるものです。製薬企業やバイオテクノロジー企業だけでなく、政府機関からも生物医学研究への投資や資金提供が大幅に増加しています。

さらに、新技術や代替療法の早期採用、経口タンパク質・ペプチドの普及も市場の拡大を後押ししています。Novo Nordisk A/S(デンマーク)、AbbVie, Inc.(米国)、Pfizer Inc.(米国)などの複数の主要市場企業のプレゼンスも、この成長の重大な要因となっています。

当レポートでは、世界の経口タンパク質・ペプチド市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 経口タンパク質・ペプチド市場の概要

- 北米の経口タンパク質・ペプチドの市場シェア:剤形別、国別(2024年)

- 経口タンパク質・ペプチドの市場シェア:治療領域別(2024年)

- 経口タンパク質・ペプチドの市場シェア:エンドユーザー別(2025年・2030年)

- 経口タンパク質・ペプチド市場:地理的成長機会

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- エコシステム分析

- 原材料ベンダーの役割

- 製品プロバイダーの役割

- エンドユーザーの役割

- 規制当局の役割

- バリューチェーン分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 価格分析

- 平均販売価格:主要企業別

- 平均販売価格:国/地域別

- 規制情勢

- 規制シナリオ

- 規制機関、政府機関、その他の組織

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- パイプライン分析

- 特許分析

- 調査手法

- 特許出願と取得件数(2014年~2025年)

- 償還シナリオ

- 主な会議とイベント(2025年~2026年)

- 投資と資金調達のシナリオ

- 経口タンパク質・ペプチド市場におけるAIの影響

- 2025年の米国関税の影響 - 経口タンパク質・ペプチド市場

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 製造に対する影響

- メーカーへの提言

第6章 経口タンパク質・ペプチド市場:分子別

- イントロダクション

- セマグルチド

- カルシトニン

- リナクロチド

- トロフィネタイド

- ボクロスポリン

- プレカナチド

- その他の分子

第7章 経口タンパク質・ペプチド市場:薬剤クラス別

- イントロダクション

- グルカゴン様ペプチド-1受容体作動薬

- カルシトニン遺伝子関連ペプチド受容体拮抗薬

- グアニル酸シクラーゼC作動薬

- グリシン-プロリン-グルタミン酸

- カルシニューリン阻害薬免疫抑制薬

- その他の薬剤クラス

第8章 経口タンパク質・ペプチド市場:剤形別

- イントロダクション

- 錠剤

- カプセル

- 経口液剤

第9章 経口タンパク質・ペプチド市場:治療領域別

- イントロダクション

- 糖尿病

- 中枢神経系疾患

- 消化器内科

- 遺伝性疾患

- 腎臓

- 肥満・過体重

- その他の治療領域

第10章 経口タンパク質・ペプチド市場:エンドユーザー別

- イントロダクション

- 在宅医療

- 長期ケア施設

- 病院・専門クリニック

第11章 経口タンパク質・ペプチド市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東

- 中東のマクロ経済の見通し

- GCC諸国

- その他の中東

- アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析(2022年~2024年)

- 市場シェア分析(2024年)

- 企業の評価マトリクス

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 評価と財務指標

- ブランド/製品の比較

- 競合シナリオ

第13章 企業プロファイル

- イントロダクション

- 主要企業

- NOVO NORDISK A/S

- ABBVIE INC.

- PFIZER INC.

- BAUSCH HEALTH COMPANIES INC.

- CHIESI FARMACEUTICI S.P.A.

- ACADIA PHARMACEUTICALS INC.

- AURINIA PHARMACEUTICALS INC.

- MERCK & CO., INC.

- JOHNSON & JOHNSON SERVICES, INC.

- SWK HOLDINGS

- R-PHARM JSC

- ENTERA BIO LTD.

- PROXIMA CONCEPTS

- その他の企業

- ASTRAZENECA PLC

- REGOR THERAPEUTICS GROUP

- TERNS PHARMACEUTICALS, INC.

- STRUCTURE THERAPEUTICS

- VIKING THERAPEUTICS

- PROTAGONIST THERAPEUTICS INC.

- RANI THERAPEUTICS

- CARMOT THERAPEUTICS, INC.

- ZEALAND PHARMA

- SCIWIND BIOSCIENCES CO., LTD.

- JIANGSU HENGRUI PHARMACEUTICALS CO., LTD.

第14章 付録

List of Tables

- TABLE 1 ORAL PROTEINS & PEPTIDES MARKET: IMPACT ANALYSIS

- TABLE 2 ORAL PROTEINS & PEPTIDES MARKET: ROLE OF RAW MATERIAL VENDORS

- TABLE 3 ORAL PROTEINS & PEPTIDES MARKET: ROLE OF PRODUCT PROVIDERS

- TABLE 4 ORAL PROTEINS & PEPTIDES MARKET: ROLE OF END USERS

- TABLE 5 ORAL PROTEINS & PEPTIDES MARKET: ROLE OF REGULATORY AUTHORITIES

- TABLE 6 ORAL PROTEINS & PEPTIDES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 BUYING CRITERIA FOR ORAL PROTEINS & PEPTIDES, BY END USER

- TABLE 8 AVERAGE SELLING PRICE OF ORAL PROTEIN & PEPTIDE PRODUCTS, BY KEY PLAYER, 2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE OF ORAL PROTEIN & PEPTIDE PRODUCTS, BY COUNTRY AND REGION, 2024 (USD)

- TABLE 10 REGULATORY SCENARIO FOR ORAL PROTEINS & PEPTIDES MARKET

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ORAL PEPTIDES IN CLINICAL PIPELINE (AS OF JANUARY 2025)

- TABLE 16 PATENTS FILED, 2014-2025

- TABLE 17 INNOVATIONS AND PATENT REGISTRATIONS, 2023-2024

- TABLE 18 ORAL PROTEINS & PEPTIDES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 19 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 21 SEMAGLUTIDE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 22 NORTH AMERICA: SEMAGLUTIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 23 EUROPE: SEMAGLUTIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 24 ASIA PACIFIC: SEMAGLUTIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 25 LATIN AMERICA: SEMAGLUTIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 MIDDLE EAST: SEMAGLUTIDE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 27 GCC COUNTRIES: SEMAGLUTIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 CALCITONIN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 NORTH AMERICA: CALCITONIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 EUROPE: CALCITONIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 ASIA PACIFIC: CALCITONIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 LATIN AMERICA: CALCITONIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 MIDDLE EAST: CALCITONIN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 GCC COUNTRIES: CALCITONIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 LINACLOTIDE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 NORTH AMERICA: LINACLOTIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 EUROPE: LINACLOTIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 ASIA PACIFIC: LINACLOTIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 LATIN AMERICA: LINACLOTIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 MIDDLE EAST: LINACLOTIDE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 GCC COUNTRIES: LINACLOTIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 TROFINETIDE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: TROFINETIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 EUROPE: TROFINETIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: TROFINETIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 LATIN AMERICA: TROFINETIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 MIDDLE EAST: TROFINETIDE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 GCC COUNTRIES: TROFINETIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 VOCLOSPORIN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: VOCLOSPORIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 EUROPE: VOCLOSPORIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 ASIA PACIFIC: VOCLOSPORIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 LATIN AMERICA: VOCLOSPORIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 PLECANATIDE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: PLECANATIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 EUROPE: PLECANATIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 ASIA PACIFIC: PLECANATIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 LATIN AMERICA: PLECANATIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 MIDDLE EAST: PLECANATIDE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 GCC COUNTRIES: PLECANATIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 OTHER ORAL PROTEIN & PEPTIDE MOLECULES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: OTHER ORAL PROTEIN & PEPTIDE MOLECULES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 EUROPE: OTHER ORAL PROTEIN & PEPTIDE MOLECULES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 ASIA PACIFIC: OTHER ORAL PROTEIN & PEPTIDE MOLECULES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

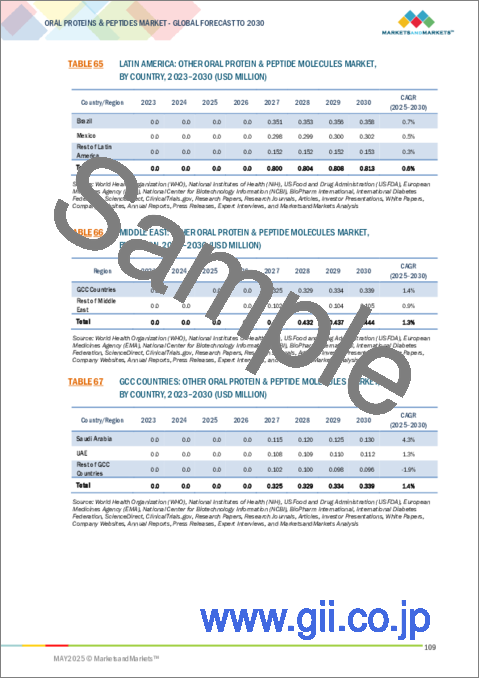

- TABLE 65 LATIN AMERICA: OTHER ORAL PROTEIN & PEPTIDE MOLECULES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 MIDDLE EAST: OTHER ORAL PROTEIN & PEPTIDE MOLECULES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 67 GCC COUNTRIES: OTHER ORAL PROTEIN & PEPTIDE MOLECULES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 69 GLP-1 RECEPTOR AGONISTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: GLP-1 RECEPTOR AGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 EUROPE: GLP-1 RECEPTOR AGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 ASIA PACIFIC: GLP-1 RECEPTOR AGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 LATIN AMERICA: GLP-1 RECEPTOR AGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 MIDDLE EAST: GLP-1 RECEPTOR AGONISTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 75 GCC COUNTRIES: GLP-1 RECEPTOR AGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 CGRP RECEPTOR ANTAGONISTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: CGRP RECEPTOR ANTAGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 EUROPE: CGRP RECEPTOR ANTAGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 ASIA PACIFIC: CGRP RECEPTOR ANTAGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 LATIN AMERICA: CGRP RECEPTOR ANTAGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 MIDDLE EAST: CGRP RECEPTOR ANTAGONISTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 82 GCC COUNTRIES: CGRP RECEPTOR ANTAGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 GC-C AGONISTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: GC-C AGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: GC-C AGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 ASIA PACIFIC: GC-C AGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 LATIN AMERICA: GC-C AGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 MIDDLE EAST: GC-C AGONISTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 89 GCC COUNTRIES: GC-C AGONISTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 GPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: GPE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 EUROPE: GPE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 93 ASIA PACIFIC: GPE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 LATIN AMERICA: GPE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 MIDDLE EAST: GPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 96 GCC COUNTRIES: GPE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 CNI MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: CNI MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 99 EUROPE: CNI MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: CNI MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 OTHER ORAL PROTEIN & PEPTIDE DRUG CLASSES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: OTHER ORAL PROTEIN & PEPTIDE DRUG CLASSES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 EUROPE: OTHER ORAL PROTEIN & PEPTIDE DRUG CLASSES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 ASIA PACIFIC: OTHER ORAL PROTEIN & PEPTIDE DRUG CLASSES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 105 LATIN AMERICA: OTHER ORAL PROTEIN & PEPTIDE DRUG CLASSES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 106 MIDDLE EAST: OTHER ORAL PROTEIN & PEPTIDE DRUG CLASSES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 107 GCC COUNTRIES: OTHER ORAL PROTEIN & PEPTIDE DRUG CLASSES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 108 ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 109 ORAL PROTEIN & PEPTIDE TABLETS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: ORAL PROTEIN & PEPTIDE TABLETS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 111 EUROPE: ORAL PROTEIN & PEPTIDE TABLETS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ORAL PROTEIN & PEPTIDE TABLETS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 LATIN AMERICA: ORAL PROTEIN & PEPTIDE TABLETS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 MIDDLE EAST: ORAL PROTEIN & PEPTIDE TABLETS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 115 GCC COUNTRIES: ORAL PROTEIN & PEPTIDE TABLETS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 116 ORAL PROTEIN & PEPTIDE CAPSULES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: ORAL PROTEIN & PEPTIDE CAPSULES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 118 EUROPE: ORAL PROTEIN & PEPTIDE CAPSULES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: ORAL PROTEIN & PEPTIDE CAPSULES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 120 LATIN AMERICA: ORAL PROTEIN & PEPTIDE CAPSULES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 121 MIDDLE EAST: ORAL PROTEIN & PEPTIDE CAPSULES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 122 GCC COUNTRIES: ORAL PROTEIN & PEPTIDE CAPSULES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 123 ORAL PROTEIN & PEPTIDE SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: ORAL PROTEIN & PEPTIDE SOLUTIONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 125 EUROPE: ORAL PROTEIN & PEPTIDE SOLUTIONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: ORAL PROTEIN & PEPTIDE SOLUTIONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 127 LATIN AMERICA: ORAL PROTEIN & PEPTIDE SOLUTIONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 MIDDLE EAST: ORAL PROTEIN & PEPTIDE SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 129 GCC COUNTRIES: ORAL PROTEIN & PEPTIDE SOLUTIONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 130 ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 131 ORAL PROTEINS & PEPTIDES MARKET FOR DIABETES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR DIABETES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 133 EUROPE: ORAL PROTEINS & PEPTIDES MARKET FOR DIABETES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET FOR DIABETES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 135 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR DIABETES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 136 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET FOR DIABETES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 137 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET FOR DIABETES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 ORAL PROTEINS & PEPTIDES MARKET FOR CNS DISORDERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR CNS DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 140 EUROPE: ORAL PROTEINS & PEPTIDES MARKET FOR CNS DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET FOR CNS DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 142 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR CNS DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 143 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET FOR CNS DISORDERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 144 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET FOR CNS DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 145 ORAL PROTEINS & PEPTIDES MARKET FOR GASTROENTEROLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 146 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR GASTROENTEROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 147 EUROPE: ORAL PROTEINS & PEPTIDES MARKET FOR GASTROENTEROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET FOR GASTROENTEROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 149 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR GASTROENTEROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 150 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET FOR GASTROENTEROLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 151 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET FOR GASTROENTEROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 152 ORAL PROTEINS & PEPTIDES MARKET FOR GENETIC DISORDERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR GENETIC DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 154 EUROPE: ORAL PROTEINS & PEPTIDES MARKET FOR GENETIC DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET FOR GENETIC DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 156 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR GENETIC DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET FOR GENETIC DISORDERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 158 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET FOR GENETIC DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 159 ORAL PROTEINS & PEPTIDES MARKET FOR NEPHROLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 160 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR NEPHROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 161 EUROPE: ORAL PROTEINS & PEPTIDES MARKET FOR NEPHROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET FOR NEPHROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 163 ORAL PROTEINS & PEPTIDES MARKET FOR OBESITY & OVERWEIGHT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 164 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR OBESITY & OVERWEIGHT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 165 EUROPE: ORAL PROTEINS & PEPTIDES MARKET FOR OBESITY & OVERWEIGHT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 166 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET FOR OBESITY & OVERWEIGHT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 167 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR OBESITY & OVERWEIGHT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 168 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET FOR OBESITY & OVERWEIGHT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 169 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET FOR OBESITY & OVERWEIGHT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 170 ORAL PROTEINS & PEPTIDES MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 171 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 172 EUROPE: ORAL PROTEINS & PEPTIDES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 174 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 176 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 177 ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 178 ORAL PROTEINS & PEPTIDES MARKET FOR HOME CARE SETTINGS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 179 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 180 EUROPE: ORAL PROTEINS & PEPTIDES MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 182 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 183 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET FOR HOME CARE SETTINGS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 184 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 185 ORAL PROTEINS & PEPTIDES MARKET FOR LONG-TERM CARE FACILITIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 186 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 187 EUROPE: ORAL PROTEINS & PEPTIDES MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 188 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 189 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 190 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET FOR LONG-TERM CARE FACILITIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 191 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 192 ORAL PROTEINS & PEPTIDES MARKET FOR HOSPITALS & SPECIALTY CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 193 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR HOSPITALS & SPECIALTY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 194 EUROPE: ORAL PROTEINS & PEPTIDES MARKET FOR HOSPITALS & SPECIALTY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 195 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET FOR HOSPITALS & SPECIALTY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 196 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET FOR HOSPITALS & SPECIALTY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET FOR HOSPITALS & SPECIALTY CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 198 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET FOR HOSPITALS & SPECIALTY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 199 ORAL PROTEINS & PEPTIDES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 200 NORTH AMERICA: KEY MACROINDICATORS

- TABLE 201 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 202 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 203 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 204 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 205 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 206 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 207 US: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 208 US: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 209 US: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 210 US: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 211 US: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 212 CANADA: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 213 CANADA: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 214 CANADA: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 215 CANADA: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 216 CANADA: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 217 EUROPE: KEY MACROINDICATORS

- TABLE 218 EUROPE: ORAL PROTEINS & PEPTIDES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 219 EUROPE: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 220 EUROPE: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 221 EUROPE: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 222 EUROPE: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 223 EUROPE: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 224 GERMANY: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 225 GERMANY: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 226 GERMANY: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 227 GERMANY: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 228 GERMANY: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 229 UK: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 230 UK: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 231 UK: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 232 UK: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 233 UK: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 234 FRANCE: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 235 FRANCE: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 236 FRANCE: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 237 FRANCE: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 238 FRANCE: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 239 ITALY: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 240 ITALY: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 241 ITALY: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 242 ITALY: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 243 ITALY: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 244 SPAIN: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 245 SPAIN: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 246 SPAIN: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 247 SPAIN: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 248 SPAIN: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 249 NETHERLANDS: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 250 NETHERLANDS: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 251 NETHERLANDS: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 252 NETHERLANDS: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 253 NETHERLANDS: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 254 REST OF EUROPE: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 255 REST OF EUROPE: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 256 REST OF EUROPE: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 257 REST OF EUROPE: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 258 REST OF EUROPE: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 259 ASIA PACIFIC: KEY MACROINDICATORS

- TABLE 260 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 261 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 262 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 263 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 264 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 265 ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 266 CHINA: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 267 CHINA: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 268 CHINA: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 269 CHINA: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 270 CHINA: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 271 JAPAN: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 272 JAPAN: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 273 JAPAN: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 274 JAPAN: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 275 JAPAN: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 276 INDIA: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 277 INDIA: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 278 INDIA: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 279 INDIA: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 280 INDIA: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 281 AUSTRALIA: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 282 AUSTRALIA: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 283 AUSTRALIA: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 284 AUSTRALIA: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 285 AUSTRALIA: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 286 SOUTH KOREA: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 287 SOUTH KOREA: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 288 SOUTH KOREA: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 289 SOUTH KOREA: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 290 SOUTH KOREA: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 291 REST OF ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 292 REST OF ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 293 REST OF ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 294 REST OF ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 295 REST OF ASIA PACIFIC: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 296 LATIN AMERICA: KEY MACROINDICATORS

- TABLE 297 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 298 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 299 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 300 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 301 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 302 LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 303 BRAZIL: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 304 BRAZIL: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 305 BRAZIL: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 306 BRAZIL: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 307 BRAZIL: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 308 MEXICO: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 309 MEXICO: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 310 MEXICO: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 311 MEXICO: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 312 MEXICO: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 313 REST OF LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 314 REST OF LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 315 REST OF LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 316 REST OF LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 317 REST OF LATIN AMERICA: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 318 MIDDLE EAST: KEY MACROINDICATORS

- TABLE 319 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 320 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 321 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 322 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 323 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 324 MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 325 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 326 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 327 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 328 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 329 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 330 GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 331 SAUDI ARABIA: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 332 SAUDI ARABIA: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 333 SAUDI ARABIA: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 334 SAUDI ARABIA: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 335 SAUDI ARABIA: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 336 UAE: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 337 UAE: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 338 UAE: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 339 UAE: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 340 UAE: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 341 REST OF GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 342 REST OF GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 343 REST OF GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 344 REST OF GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 345 REST OF GCC COUNTRIES: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 346 REST OF MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 347 REST OF MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 348 REST OF MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 349 REST OF MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 350 REST OF MIDDLE EAST: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 351 AFRICA: KEY MACROINDICATORS

- TABLE 352 AFRICA: ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2023-2030 (USD MILLION)

- TABLE 353 AFRICA: ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS, 2023-2030 (USD MILLION)

- TABLE 354 AFRICA: ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 355 AFRICA: ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION, 2023-2030 (USD MILLION)

- TABLE 356 AFRICA: ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 357 OVERVIEW OF STRATEGIES DEPLOYED BY KEY ORAL PROTEIN & PEPTIDE MANUFACTURERS

- TABLE 358 ORAL PROTEINS & PEPTIDES MARKET: DEGREE OF COMPETITION

- TABLE 359 ORAL PROTEINS & PEPTIDES MARKET: REGION FOOTPRINT (KEY PLAYERS)

- TABLE 360 ORAL PROTEINS & PEPTIDES MARKET: REGION FOOTPRINT (PLAYERS WITH PRODUCTS IN PIPELINE)

- TABLE 361 ORAL PROTEINS & PEPTIDES MARKET: MOLECULE FOOTPRINT (KEY PLAYERS)

- TABLE 362 ORAL PROTEINS & PEPTIDES MARKET: FORMULATION FOOTPRINT (KEY PLAYERS)

- TABLE 363 ORAL PROTEINS & PEPTIDES MARKET: THERAPEUTIC AREA FOOTPRINT (KEY PLAYERS)

- TABLE 364 ORAL PROTEINS & PEPTIDES MARKET: THERAPEUTIC AREA FOOTPRINT (PLAYERS WITH PRODUCTS IN PIPELINE)

- TABLE 365 ORAL PROTEINS & PEPTIDES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 366 ORAL PROTEINS & PEPTIDES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 367 ORAL PROTEINS & PEPTIDES MARKET: PRODUCT APPROVALS, JANUARY 2021-JANUARY 2025

- TABLE 368 ORAL PROTEINS & PEPTIDES MARKET: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 369 ORAL PROTEINS & PEPTIDES MARKET: EXPANSIONS, JANUARY 2021- JANUARY 2025

- TABLE 370 ORAL PROTEINS & PEPTIDES MARKET: OTHER DEVELOPMENTS, JANUARY 2021- JANUARY 2025

- TABLE 371 NOVO NORDISK A/S: COMPANY OVERVIEW

- TABLE 372 NOVO NORDISK A/S: PRODUCTS OFFERED

- TABLE 373 NOVO NORDISK A/S: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-MARCH 2025

- TABLE 374 NOVO NORDISK A/S: DEALS, JANUARY 2021-MARCH 2025

- TABLE 375 NOVO NORDISK: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 376 NOVO NORDISK: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 377 ABBVIE INC.: COMPANY OVERVIEW

- TABLE 378 ABBVIE INC.: PRODUCTS OFFERED

- TABLE 379 ABBVIE INC.: PRODUCT APPROVALS, JANUARY 2021-JANUARY 2025

- TABLE 380 ABBVIE INC.: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 381 PFIZER INC.: COMPANY OVERVIEW

- TABLE 382 PFIZER INC.: PRODUCT PIPELINE

- TABLE 383 PFIZER INC.: PRODUCT APPROVALS, JANUARY 2021-MARCH 2025

- TABLE 384 PFIZER INC.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 385 PFIZER INC.: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 386 BAUSCH HEALTH COMPANIES: COMPANY OVERVIEW

- TABLE 387 BAUSCH HEALTH COMPANIES: PRODUCTS OFFERED

- TABLE 388 BAUSCH HEALTH COMPANIES: PRODUCT APPROVALS, JANUARY 2021-JANUARY 2025

- TABLE 389 CHIESI FARMACEUTICI S.P.A.: COMPANY OVERVIEW

- TABLE 390 CHIESI FARMACEUTICI S.P.A.: PRODUCTS OFFERED

- TABLE 391 CHIESI FARMACEUTICI S.P.A.: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 392 ACADIA PHARMACEUTICALS INC.: COMPANY OVERVIEW

- TABLE 393 ACADIA PHARMACEUTICALS INC.: PRODUCTS OFFERED

- TABLE 394 ACADIA PHARMACEUTICALS INC.: PRODUCT APPROVALS, JANUARY 2021-JANUARY 2025

- TABLE 395 AURINIA PHARMACEUTICALS INC.: COMPANY OVERVIEW

- TABLE 396 AURINIA PHARMACEUTICALS INC.: PRODUCTS OFFERED

- TABLE 397 AURINIA PHARMACEUTICALS INC.: PRODUCT APPROVALS, JANUARY 2021-JANUARY 2025

- TABLE 398 MERCK & CO., INC.: COMPANY OVERVIEW

- TABLE 399 MERCK & CO., INC.: PRODUCT PIPELINE

- TABLE 400 MERCK & CO., INC.: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 401 MERCK & CO., INC.: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2025

- TABLE 402 JOHNSON & JOHNSON SERVICES, INC.: COMPANY OVERVIEW

- TABLE 403 JOHNSON & JOHNSON SERVICES, INC.: PRODUCT PIPELINE

- TABLE 404 JOHNSON & JOHNSON SERVICES, INC.: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 405 SWK HOLDINGS: COMPANY OVERVIEW

- TABLE 406 SWK HOLDINGS: PRODUCT PIPELINE

- TABLE 407 SWK HOLDINGS: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2025

- TABLE 408 R-PHARM JSC: COMPANY OVERVIEW

- TABLE 409 R-PHARM JSC: PRODUCTS IN PIPELINE

- TABLE 410 ENTERA BIO: COMPANY OVERVIEW

- TABLE 411 ENTERA BIO: PRODUCT PIPELINE

- TABLE 412 ENTERA BIO: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 413 ENTERA BIO: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2025

- TABLE 414 PROXIMA CONCEPTS: COMPANY OVERVIEW

- TABLE 415 PROXIMA CONCEPTS: PRODUCTS IN PIPELINE

List of Figures

- FIGURE 1 BREAKDOWN OF PRIMARIES: SUPPLY AND DEMAND-SIDE PARTICIPANTS

- FIGURE 2 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS, 2024

- FIGURE 3 MARKET SIZE ESTIMATION: APPROACH 1 (REVENUE SHARE ANALYSIS), 2024

- FIGURE 4 MARKET VALIDATION FROM PRIMARY EXPERTS

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 CAGR PROJECTIONS: ORAL PROTEINS & PEPTIDES MARKET, 2025-2030

- FIGURE 7 IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ORAL PROTEINS & PEPTIDES MARKET

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE, 2025 VS. 2030 (USD MILLION)

- FIGURE 10 ORAL PROTEINS & PEPTIDES MARKET SHARE, BY DRUG CLASS, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 ORAL PROTEINS & PEPTIDES MARKET SHARE, BY THERAPEUTIC AREA, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 ORAL PROTEINS & PEPTIDES MARKET SHARE, BY FORMULATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 ORAL PROTEINS & PEPTIDES MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF ORAL PROTEINS & PEPTIDES MARKET

- FIGURE 15 INCREASING APPROVALS OF ORAL PROTEIN & PEPTIDE DRUGS TO DRIVE MARKET GROWTH

- FIGURE 16 TABLETS ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2024

- FIGURE 17 DIABETES ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 18 HOME CARE SETTINGS TO DOMINATE MARKET TILL 2030

- FIGURE 19 UK TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 ORAL PROTEINS & PEPTIDES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 ORAL PROTEINS & PEPTIDES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 ORAL PROTEINS & PEPTIDES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 ORAL PROTEINS & PEPTIDES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 ORAL PROTEINS & PEPTIDES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF ORAL PROTEINS & PEPTIDES

- FIGURE 26 KEY BUYING CRITERIA FOR END USERS

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 28 PATENT ANALYSIS OF ORAL PROTEINS & PEPTIDE MARKET, JANUARY 2014-JANUARY 2025

- FIGURE 29 ORAL PROTEINS & PEPTIDES MARKET: INVESTMENT & FUNDING SCENARIO

- FIGURE 30 NORTH AMERICA ORAL PROTEINS & PEPTIDES MARKET SNAPSHOT

- FIGURE 31 EUROPE: ORAL PROTEINS & PEPTIDES MARKET SNAPSHOT

- FIGURE 32 REVENUE ANALYSIS OF KEY PLAYERS IN ORAL PROTEINS & PEPTIDES MARKET, 2022-2024 (USD MILLION)

- FIGURE 33 MARKET SHARE ANALYSIS OF KEY PLAYERS IN ORAL PROTEINS & PEPTIDES (2024)

- FIGURE 34 ORAL PROTEINS & PEPTIDES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 35 ORAL PROTEINS & PEPTIDES MARKET: COMPANY EVALUATION MATRIX (PLAYERS WITH PRODUCTS IN PIPELINE), 2024

- FIGURE 36 ORAL PROTEINS & PEPTIDES MARKET: COMPANY FOOTPRINT (KEY PLAYERS)

- FIGURE 37 ORAL PROTEINS & PEPTIDES MARKET: COMPANY FOOTPRINT (PLAYERS WITH PRODUCTS IN PIPELINE)

- FIGURE 38 ORAL PROTEINS & PEPTIDES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 39 EV/EBITDA OF KEY VENDORS

- FIGURE 40 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 41 ORAL PROTEINS & PEPTIDES MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 42 NOVO NORDISK A/S: COMPANY SNAPSHOT (2024)

- FIGURE 43 ABBVIE INC.: COMPANY SNAPSHOT (2024)

- FIGURE 44 PFIZER INC.: COMPANY SNAPSHOT (2024)

- FIGURE 45 BAUSCH HEALTH COMPANIES: COMPANY SNAPSHOT (2024)

- FIGURE 46 CHIESI FARMACEUTICI S.P.A.: COMPANY SNAPSHOT (2024)

- FIGURE 47 ACADIA PHARMACEUTICALS INC.: COMPANY SNAPSHOT (2024)

- FIGURE 48 AURINIA PHARMACEUTICALS INC.: COMPANY SNAPSHOT (2024)

- FIGURE 49 MERCK & CO., INC.: COMPANY SNAPSHOT (2024)

- FIGURE 50 JOHNSON & JOHNSON SERVICES, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 51 SWK HOLDINGS: COMPANY SNAPSHOT (2024)

The global market for oral proteins and peptides is projected to reach USD 24.00 billion by 2030 from USD 8.85 billion in 2025, at a CAGR of 22.1% during the forecast period from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Molecule, Drug Class, Therapeutic Area, Formulation, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

The increase in demand for oral peptides, particularly for the treatment of chronic diseases such as diabetes and central nervous system (CNS) disorders, is a major driver of growth in this market. Additionally, rising investments in research and development by key players are leading to the creation and launch of innovative oral peptides. Continuous advancements in drug delivery technologies are also contributing to market expansion.

However, the market faces challenges, including high development costs and obstacles related to formulation and stability, which hinder growth.

"The semaglutide molecule segment accounted for the largest share of the market, by molecule, in 2024."

In 2024, the semaglutide segment held the largest share of the global oral proteins and peptides market. Semaglutide is an analog of glucagon-like peptide-1 (GLP-1), a hormone that plays a key role in regulating blood sugar levels and appetite. It is used to manage type 2 diabetes and obesity. Semaglutide functions by enhancing insulin secretion in response to elevated blood glucose levels, reducing glucagon release (which normally raises blood sugar), and promoting a feeling of fullness after eating, thereby helping to reduce food intake.

Oral semaglutide, marketed as RYBELSUS, is the first oral GLP-1 receptor agonist approved by the US FDA for the treatment of type 2 diabetes. As a class, GLP-1 receptor agonists are widely utilized and recommended for managing type 2 diabetes.

"The US will continue to dominate the oral proteins and peptides market during the forecast period."

The US is the largest biopharmaceutical market in the world and a leader in biopharmaceutical research and investments. This growth is driven by several factors, including the increasing patient population suffering from infectious diseases, the rising importance of biopharmaceuticals, and the need for safe, high-quality products in the healthcare sector. There has been a significant increase in investments and funding for biomedical research from government agencies as well as pharmaceutical and biotechnology companies.

Furthermore, the early adoption of emerging technologies and alternative therapies and the widespread availability of oral proteins and peptides in the region support market expansion. The strong presence of several key market players, including Novo Nordisk A/S (Denmark), AbbVie, Inc. (US), and Pfizer Inc. (US), is another crucial factor contributing to this growth.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side (70%) and Demand Side (30%)

- By Designation: Managers (45%), CXOs & Directors (30%), and Executives (25%)

- By Region: North America (40%), Europe (25%), Asia Pacific (25%), Latin America (5%), and Middle East & Africa (5%)

List of Key Companies Profiled in the Report:

Novo Nordisk A/S (Denmark), AbbVie Inc. (US), Pfizer Inc. (US), Acadia Pharmaceuticals Inc. (US), Aurinia Pharmaceuticals Inc. (Canada), Bausch Health Companies Inc. (Canada), CHIESI Farmaceutici S.p.A. (Italy), EnteraBio Ltd. (Israel), Merck & Co., Inc. (US), Johnson & Johnson Services, Inc. (US), R-Pharm JSC (Russia), Proxima Concepts (US), and SWK Holdings Corporation (US)

Research Coverage:

This research report categorizes the oral proteins and peptides market by molecule (trofinetide, semaglutide, linaclotide, voclosporin, plecanatide, calcitonin, and other drugs), drug class (analog of glycine-proline-glutamate (GPE), glucagon-like peptide-1 (GLP-1) receptor agonists, guanylate cyclase-C agonists, calcineurin-inhibitor immunosuppressants, calcitonin gene-related peptide (CGRP) receptor antagonists, and other drugs), therapeutic area (genetic disorders, diabetes, nephrology, gastroenterology, CNS disorders, obesity & overweight, and other therapeutic areas), formulation (tablets, capsules, and oral solutions), end user (home care settings, long-term care facilities, and hospitals & specialty clinics), and region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the oral proteins and peptides market. A comprehensive analysis of key industry players has been conducted to provide insights into their business overview, products, solutions, strategies, collaborations, partnerships, agreements, new launches, acquisitions, and recent developments associated with the oral proteins and peptides market.

Key Benefits of Buying the Report:

The report will help market leaders and new entrants by providing the closest approximations of the revenue numbers for the oral proteins and peptides market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their businesses and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (rising prevalence of chronic diseases such as diabetes, gastroenterology diseases, and kidney diseases; advancements in drug delivery technologies; patient preference and compliance for oral route of drug administration; and increasing adoption of inorganic growth strategies such as collaborations and agreements), restraints (high cost associated with drug development, contraindication of oral proteins and peptides, and stringent regulatory approval process), opportunities (robust clinical trial pipeline for oral proteins and peptides and growing demand for non-invasive and patient-friendly treatment options), and Challenges (hurdles in formulation and stability and availability of alternative therapies) influencing the growth of the market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the oral proteins and peptides market.

- Market Development: Comprehensive information about lucrative markets; the report analyzes the market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the oral proteins and peptides market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players. A detailed analysis of the key industry players has been done to provide insights into their key strategies, product launches/approvals, pipeline analysis, acquisitions, partnerships, agreements, collaborations, other recent developments, investment and funding activities, brand/product comparative analysis, and vendor valuation and financial metrics of the oral proteins and peptides market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS AND REGIONS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 RESEARCH DESIGN

- 2.1.2 SECONDARY DATA

- 2.1.3 PRIMARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 INSIGHTS FROM PRIMARIES

- 2.2.2 MARKET SIZE ASSESSMENT AT SEGMENT LEVEL

- 2.3 MARKET GROWTH FORECAST

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ORAL PROTEINS & PEPTIDES MARKET OVERVIEW

- 4.2 NORTH AMERICA: ORAL PROTEINS & PEPTIDES MARKET SHARE, BY FORMULATION AND COUNTRY (2024)

- 4.3 ORAL PROTEINS & PEPTIDES MARKET SHARE, BY THERAPEUTIC AREA, 2024

- 4.4 ORAL PROTEINS & PEPTIDES MARKET SHARE, BY END USER, 2025 VS. 2030

- 4.5 ORAL PROTEINS & PEPTIDES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing burden of chronic diseases

- 5.2.1.2 Advancements in drug delivery technologies

- 5.2.1.3 Higher patient compliance and preference for oral route

- 5.2.1.4 Expanding therapeutic applications of oral proteins & peptides

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of drug development

- 5.2.2.2 Contraindication of oral proteins & peptides

- 5.2.2.3 Stringent regulatory approval process

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Robust clinical trial pipeline for oral proteins & peptides

- 5.2.3.2 Growing demand for personalized medicine

- 5.2.4 CHALLENGES

- 5.2.4.1 Hurdles in formulation and stability

- 5.2.4.2 Availability of alternative therapies

- 5.2.1 DRIVERS

- 5.3 ECOSYSTEM ANALYSIS

- 5.3.1 ROLE OF RAW MATERIAL VENDORS

- 5.3.2 ROLE OF PRODUCT PROVIDERS

- 5.3.3 ROLE OF END USERS

- 5.3.4 ROLE OF REGULATORY AUTHORITIES

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS

- 5.7.2 BUYING CRITERIA

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.8.2 AVERAGE SELLING PRICE, BY COUNTRY & REGION

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY SCENARIO

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Transient permeation enhancers

- 5.11.1.2 Gastrointestinal permeation enhancement technology

- 5.11.1.3 Oral sCT (OSTORA) technology

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Peptelligence

- 5.11.2.2 ThioMatrix

- 5.11.2.3 Transferrin-based recombinant fusion proteins

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Oramed and Orasome

- 5.11.3.2 Q-sphera

- 5.11.3.3 Nanoinclusion

- 5.11.3.4 Oleotec and Soctec

- 5.11.1 KEY TECHNOLOGIES

- 5.12 PIPELINE ANALYSIS

- 5.13 PATENT ANALYSIS

- 5.13.1 METHODOLOGY

- 5.13.2 PATENTS APPLIED AND GRANTED, 2014-2025

- 5.14 REIMBURSEMENT SCENARIO

- 5.15 KEY CONFERENCES & EVENTS, 2025-2026

- 5.16 INVESTMENT & FUNDING SCENARIO

- 5.17 IMPACT OF AI ON ORAL PROTEINS & PEPTIDES MARKET

- 5.18 IMPACT OF 2025 US TARIFFS-ORAL PROTEINS & PEPTIDES MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRIES/REGIONS

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON MANUFACTURING INDUSTRIES

- 5.18.6 RECOMMENDATIONS FOR MANUFACTURERS

6 ORAL PROTEINS & PEPTIDES MARKET, BY MOLECULE

- 6.1 INTRODUCTION

- 6.2 SEMAGLUTIDE

- 6.2.1 INCREASED PATIENT COMPLIANCE TO BOOST MARKET GROWTH

- 6.3 CALCITONIN

- 6.3.1 NEED FOR EFFECTIVE ANTI-MIGRAINE DRUGS TO SUPPORT ADOPTION

- 6.4 LINACLOTIDE

- 6.4.1 RISING PREVALENCE OF GASTRIC DISORDERS TO SUPPORT GROWTH

- 6.5 TROFINETIDE

- 6.5.1 FDA APPROVAL TO DRIVE MARKET

- 6.6 VOCLOSPORIN

- 6.6.1 INCREASING REGULATORY APPROVALS TO DRIVE PATIENT ACCESS AND ADOPTION

- 6.7 PLECANATIDE

- 6.7.1 INCREASED PATIENT CONVENIENCE TO SUPPORT GROWTH

- 6.8 OTHER MOLECULES

7 ORAL PROTEINS & PEPTIDES MARKET, BY DRUG CLASS

- 7.1 INTRODUCTION

- 7.2 GLUCAGON-LIKE PEPTIDE-1 RECEPTOR AGONISTS

- 7.2.1 INCREASING ADOPTION TO SUPPORT GROWTH

- 7.3 CALCITONIN GENE-RELATED PEPTIDE RECEPTOR ANTAGONISTS

- 7.3.1 INCREASING PREVALENCE OF MIGRAINE TO DRIVE ADOPTION

- 7.4 GUANYLATE CYCLASE-C AGONISTS

- 7.4.1 RISING PREVALENCE OF IBS AND CIC TO DRIVE MARKET

- 7.5 GLYCINE-PROLINE-GLUTAMATE

- 7.5.1 FOCUS ON DEVELOPING GPE-CLASS DRUGS TO SUPPORT GROWTH

- 7.6 CALCINEURIN-INHIBITOR IMMUNOSUPPRESSANTS

- 7.6.1 INCREASING NUMBER OF ORGAN TRANSPLANTS TO PROMOTE GROWTH

- 7.7 OTHER DRUG CLASSES

8 ORAL PROTEINS & PEPTIDES MARKET, BY FORMULATION

- 8.1 INTRODUCTION

- 8.2 TABLETS

- 8.2.1 HIGH ADOPTION AND EASE OF ADMINISTRATION TO SUPPORT GROWTH

- 8.3 CAPSULES

- 8.3.1 RISING DEMAND FOR ORAL BIOLOGICS AND INCREASED PATIENT COMPLIANCE TO DRIVE MARKET

- 8.4 ORAL SOLUTIONS

- 8.4.1 GROWING FOCUS ON IMPROVING BIOAVAILABILITY AND PATIENT CONVENIENCE TO SUPPORT MARKET GROWTH

9 ORAL PROTEINS & PEPTIDES MARKET, BY THERAPEUTIC AREA

- 9.1 INTRODUCTION

- 9.2 DIABETES

- 9.2.1 HIGH EFFICACY TO SUPPORT END-USER ADOPTION

- 9.3 CNS DISORDERS

- 9.3.1 GROWING BURDEN OF NEUROLOGICAL DISORDERS TO PROPEL MARKET

- 9.4 GASTROENTEROLOGY

- 9.4.1 RISING PREVALENCE OF GASTROINTESTINAL DISORDERS TO SUPPORT SEGMENT GROWTH

- 9.5 GENETIC DISORDERS

- 9.5.1 GROWING PREVALENCE OF GENETIC DISORDERS TO SUPPORT GROWTH

- 9.6 NEPHROLOGY

- 9.6.1 RISING PREVALENCE OF KIDNEY DISORDERS IN GERIATRIC POPULATION TO PROPEL MARKET

- 9.7 OBESITY & OVERWEIGHT

- 9.7.1 RISING INCIDENCE OF OBESITY TO PROPEL MARKET GROWTH

- 9.8 OTHER THERAPEUTIC AREAS

10 ORAL PROTEINS & PEPTIDES MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOME CARE SETTINGS

- 10.2.1 RISING NUMBER OF TELEHEALTH COMPANIES AND CONVENIENCE OF HOME CARE TO SUPPORT MARKET GROWTH

- 10.3 LONG-TERM CARE FACILITIES

- 10.3.1 RISING GERIATRIC POPULATION AND PREVALENCE OF CHRONIC DISEASES TO SUPPORT GROWTH

- 10.4 HOSPITALS & SPECIALTY CLINICS

- 10.4.1 ADOPTION OF ORAL PEPTIDES FOR VARIED INDICATIONS TO DRIVE MARKET

11 ORAL PROTEINS & PEPTIDES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 US to hold large shares in North American and global markets

- 11.2.3 CANADA

- 11.2.3.1 Increasing prevalence of obesity and heart failure to support market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Germany to hold largest share of European market

- 11.3.3 UK

- 11.3.3.1 Strong focus on advancement of life sciences to support market growth

- 11.3.4 FRANCE

- 11.3.4.1 Growing prevalence of diabetes and government initiatives to boost market growth

- 11.3.5 ITALY

- 11.3.5.1 Presence of major pharmaceutical and biotechnology companies to drive market

- 11.3.6 SPAIN

- 11.3.6.1 Initiatives associated with GLP-1 drugs to drive market

- 11.3.7 NETHERLANDS

- 11.3.7.1 Rising awareness and focus on pharmaceutical R&D to support market growth

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Increasing R&D expenditure to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Increasing prevalence of diabetes to drive market

- 11.4.4 INDIA

- 11.4.4.1 Strong initiatives to develop cost-effective and patient-friendly medications to aid market growth

- 11.4.5 AUSTRALIA

- 11.4.5.1 Rising access to GLP-1 drugs and government support to drive market

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Growing focus on development of innovative treatment solutions to propel market growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Brazil to hold largest market share in Latin America

- 11.5.3 MEXICO

- 11.5.3.1 Growing diabetes and obesity cases to drive market

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Saudi Arabia

- 11.6.2.1.1 Growing availability of GLP-1 drugs to support market growth

- 11.6.2.2 UAE

- 11.6.2.2.1 Regulatory approvals for GLP-1 drugs to propel market

- 11.6.2.3 Rest of GCC countries

- 11.6.2.1 Saudi Arabia

- 11.6.3 REST OF MIDDLE EAST

- 11.7 AFRICA

- 11.7.1 LARGE AND GROWING PATIENT POPULATION AND FAVORABLE HEALTHCARE REFORMS TO DRIVE MARKET

- 11.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN ORAL PROTEINS & PEPTIDES MARKET

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX

- 12.5.1 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1.1 Stars

- 12.5.1.2 Emerging leaders

- 12.5.1.3 Pervasive players

- 12.5.1.4 Participants

- 12.5.2 COMPANY EVALUATION MATRIX: PLAYERS WITH PRODUCTS IN PIPELINE, 2024

- 12.5.2.1 Stars

- 12.5.2.2 Emerging leaders

- 12.5.2.3 Pervasive players

- 12.5.2.4 Participants

- 12.5.3 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.3.1 Company footprint

- 12.5.3.2 Region footprint

- 12.5.3.3 Molecule footprint

- 12.5.3.4 Formulation footprint

- 12.5.3.5 Therapeutic area footprint

- 12.5.1 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 VALUATION & FINANCIAL METRICS

- 12.7.1 FINANCIAL METRICS

- 12.7.2 COMPANY VALUATION

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 NOVO NORDISK A/S

- 13.2.1.1 Business overview

- 13.2.1.2 Products offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches & approvals

- 13.2.1.3.2 Deals

- 13.2.1.3.3 Expansions

- 13.2.1.3.4 Other developments

- 13.2.1.4 MnM view

- 13.2.1.4.1 Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses & competitive threats

- 13.2.2 ABBVIE INC.

- 13.2.2.1 Business overview

- 13.2.2.2 Products offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product approvals

- 13.2.2.3.2 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses & competitive threats

- 13.2.3 PFIZER INC.

- 13.2.3.1 Business overview

- 13.2.3.2 Product pipeline

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product approvals

- 13.2.3.3.2 Deals

- 13.2.3.3.3 Other developments

- 13.2.3.4 MnM view

- 13.2.3.4.1 Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses & competitive threats

- 13.2.4 BAUSCH HEALTH COMPANIES INC.

- 13.2.4.1 Business overview

- 13.2.4.2 Products offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product approvals

- 13.2.5 CHIESI FARMACEUTICI S.P.A.

- 13.2.5.1 Business overview

- 13.2.5.2 Products offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Deals

- 13.2.6 ACADIA PHARMACEUTICALS INC.

- 13.2.6.1 Business overview

- 13.2.6.2 Products offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product approvals

- 13.2.7 AURINIA PHARMACEUTICALS INC.

- 13.2.7.1 Business overview

- 13.2.7.2 Products offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Product approvals

- 13.2.8 MERCK & CO., INC.

- 13.2.8.1 Business overview

- 13.2.8.2 Product pipeline

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Deals

- 13.2.8.3.2 Other developments

- 13.2.9 JOHNSON & JOHNSON SERVICES, INC.

- 13.2.9.1 Business overview

- 13.2.9.2 Product pipeline

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Other developments

- 13.2.10 SWK HOLDINGS

- 13.2.10.1 Business overview

- 13.2.10.2 Product pipeline

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Other developments

- 13.2.11 R-PHARM JSC

- 13.2.11.1 Business overview

- 13.2.11.2 Products in pipeline

- 13.2.12 ENTERA BIO LTD.

- 13.2.12.1 Business overview

- 13.2.12.2 Product pipeline

- 13.2.12.3 Recent developments

- 13.2.12.3.1 Deals

- 13.2.12.3.2 Other developments

- 13.2.13 PROXIMA CONCEPTS

- 13.2.13.1 Business overview

- 13.2.13.2 Products in pipeline

- 13.2.1 NOVO NORDISK A/S

- 13.3 OTHER PLAYERS

- 13.3.1 ASTRAZENECA PLC

- 13.3.2 REGOR THERAPEUTICS GROUP

- 13.3.3 TERNS PHARMACEUTICALS, INC.

- 13.3.4 STRUCTURE THERAPEUTICS

- 13.3.5 VIKING THERAPEUTICS

- 13.3.6 PROTAGONIST THERAPEUTICS INC.

- 13.3.7 RANI THERAPEUTICS

- 13.3.8 CARMOT THERAPEUTICS, INC.

- 13.3.9 ZEALAND PHARMA

- 13.3.10 SCIWIND BIOSCIENCES CO., LTD.

- 13.3.11 JIANGSU HENGRUI PHARMACEUTICALS CO., LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS