|

|

市場調査レポート

商品コード

1724747

ヘルスケアにおけるデジタルツイン市場:コンポーネント別、タイプ別、用途別、エンドユーザー別、地域別 - 2030年までの予測Digital Twins in Healthcare Market by Component (Software, Services), Application (Personalized Medicine, Drug Discovery, Medical Education, Workflow Optimization), End User (Providers, Research & Academia, Payers), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ヘルスケアにおけるデジタルツイン市場:コンポーネント別、タイプ別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月05日

発行: MarketsandMarkets

ページ情報: 英文 255 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のヘルスケアにおけるデジタルツインの市場規模は、ヘルスケアにおけるデジタルツインの用途の拡大と、公共機関および民間企業による投資の拡大により、2024年に大きな成長を遂げました。

予測期間中のCAGRは68.0%で、市場は2025年の44億7,000万米ドルから2030年には599億4,000万米ドルに達すると予測されています。公共機関や民間企業は、イノベーションの推進や業務効率の向上につながる可能性を認識し、デジタルツインテクノロジーへの投資を増やしています。バレンシアに本社を置くQuibimは、精密医療に画像バイオマーカーを活用する最前線にいます。同社は最近、米国でのプレゼンスを確立するため、5,060万米ドルのシリーズA資金調達ラウンドを完了しました。Quibimはこれを、健康モニタリングを可能にし、患者の層別化を改善し、医薬品開発の成功率を高め、実施前の治療テストを容易にする、人間のデジタルツイン・ダイナミックモデルの作成に向けた重要な一歩と見なしています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | コンポーネント別、タイプ別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ。 |

2024年には、手術計画&医療教育アプリケーションセグメントが市場で最大のシェアを占めました。このセグメントの成長は、デジタルツインとバーチャルリアリティプラットフォームの統合によるもので、研修医の外科トレーニングを強化しています。この技術により、患者特有の解剖学的・生理学的特徴に合わせた手術のシミュレーションが可能になります。その結果、研修医は現実的なパフォーマンスの表現を体験し、術中の指標を追跡することができます。複数の企業が、医療解剖学や外科手術のシミュレーションを開発し、死体への依存を減らし、インタラクティブな学習を促進しています。

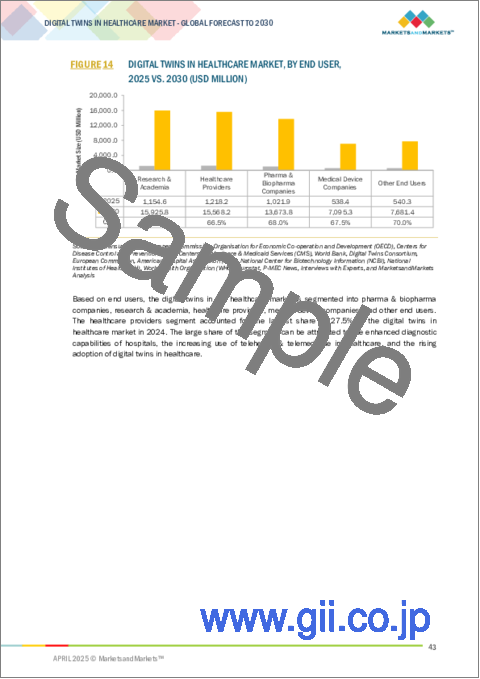

エンドユーザー別では、医療提供者セグメントが2024年の市場で最大のシェアを占めました。このセグメントの成長は、ワークフロー管理と手術計画における重要な役割に起因しています。デジタルツインは、正確な患者モデリング、個別化された治療計画、継続的なモニタリングなどのその他の特典を提供します。これらの利点は、臨床的意思決定の強化と患者の転帰の改善に寄与します。

2024年の市場シェアは欧州が第2位を占めました。ヘルスケアの進歩に影響を与える要因としては、技術投資の増加や、研究やゲノミクスへのデジタルツインの利用が挙げられます。欧州革新技術研究所(EIT)健康ドイツによると、欧州諸国は薬の処方を改善するためにデジタルツインを導入しています。例えば、デジタルヘルスを専門とするフランスのExactCureは、薬の副作用防止に力を入れています。最先端のオミックス、センシング、コンピューティング、通信技術を活用することで、デジツインは完全に個別化された予防医療を可能にし、ヘルスケアのパラダイムシフトにつながることを目指しています。

当レポートでは、世界のヘルスケアにおけるデジタルツイン市場について調査し、コンポーネント別、タイプ別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 技術分析

- ポーターのファイブフォース分析

- 規制状況

- バリューチェーン分析

- エコシステム分析

- 特許分析

- 隣接市場分析

- ケーススタディ分析

- 主要な利害関係者と購入基準

- 2025年~2026年の主な会議とイベント

- 購入者に影響を与える動向/混乱

第6章 ヘルスケアにおけるデジタルツイン市場(コンポーネント別)

- イントロダクション

- サービス

- ソフトウェア

第7章 ヘルスケアにおけるデジタルツイン市場(タイプ別)

- イントロダクション

- プロセス

- システム

- 全身

- 体の部位

第8章 ヘルスケアにおけるデジタルツイン市場(用途別)

- イントロダクション

- 創薬と開発

- パーソナライズ医療

- 手術計画と医学教育

- 医療機器の設計と試験

- ヘルスケアワークフローの最適化と資産管理

- その他

第9章 ヘルスケアにおけるデジタルツイン市場(エンドユーザー別)

- イントロダクション

- 製薬・バイオ製薬企業

- 研究と学術

- ヘルスケアプロバイダー

- 医療機器企業

- その他

第10章 ヘルスケアにおけるデジタルツイン市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 日本

- 中国

- インド

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/ソフトウェア比較

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- MICROSOFT CORPORATION

- SIEMENS HEALTHINEERS AG

- KONINKLIJKE PHILIPS N.V.

- AMAZON WEB SERVICES, INC.

- DASSAULT SYSTEMES

- GE HEALTHCARE

- ORACLE CORPORATION

- IBM

- PTC

- SAP

- ATOS SE

- NVIDIA CORPORATION

- ANSYS INC.

- FASTSTREAM TECHNOLOGIES

- RESCALE, INC.

- その他の企業

- TWIN HEALTH

- VERTO

- QBIO

- THOUGHTWIRE

- SIM AND CURE

- PREDICTIV

- NUREA

- UNLEARN.AI, INC.

- VIRTONOMY GMBH

- PREDISURGE

第13章 付録

List of Tables

- TABLE 1 DIGITAL TWINS IN HEALTHCARE MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 DIGITAL TWINS IN HEALTHCARE MARKET: STUDY ASSUMPTIONS

- TABLE 3 DIGITAL TWINS IN HEALTHCARE MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 4 MARKET DYNAMICS: DIGITAL TWINS IN HEALTHCARE MARKET

- TABLE 5 DIGITAL TWINS IN HEALTHCARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 DIGITAL TWINS IN HEALTHCARE MARKET: REGULATORY STANDARDS

- TABLE 11 KEY PATENTS IN DIGITAL TWINS IN HEALTHCARE MARKET

- TABLE 12 CASE STUDY 1: UTILIZATION OF DIGITAL TWIN TECHNOLOGY FOR SURGE PLANNING DECISIONS

- TABLE 13 CASE STUDY 2: PROVISION OF HOSPITAL GUIDANCE USING DIGITAL TWINS IN HEALTHCARE DURING COVID-19 PANDEMIC

- TABLE 14 CASE STUDY 3: OPTIMIZATION OF CARDIOVASCULAR SOLUTIONS FOR PERSONALIZED TREATMENTS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 16 KEY BUYING CRITERIA FOR DIGITAL TWIN COMPONENTS

- TABLE 17 DIGITAL TWINS IN HEALTHCARE MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 18 DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 19 DIGITAL TWINS IN HEALTHCARE SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 20 KEY SOFTWARE SOLUTIONS OFFERED BY MARKET PLAYERS

- TABLE 21 DIGITAL TWINS IN HEALTHCARE SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 22 DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 23 PROCESS TWINS CURRENTLY OFFERED BY MARKET PLAYERS

- TABLE 24 PROCESS TWINS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 25 SYSTEM TWINS CURRENTLY OFFERED BY MARKET PLAYERS

- TABLE 26 SYSTEM TWINS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 27 WHOLE BODY TWINS CURRENTLY OFFERED BY MARKET PLAYERS

- TABLE 28 WHOLE BODY TWINS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 BODY PART TWINS CURRENTLY OFFERED BY MARKET PLAYERS

- TABLE 30 BODY PART TWINS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 32 DIGITAL TWINS IN HEALTHCARE MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 DIGITAL TWINS IN HEALTHCARE MARKET FOR PERSONALIZED MEDICINE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 DIGITAL TWINS IN HEALTHCARE MARKET FOR SURGICAL PLANNING & MEDICAL EDUCATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 DIGITAL TWINS IN HEALTHCARE MARKET FOR MEDICAL DEVICE DESIGN & TESTING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 DIGITAL TWINS IN HEALTHCARE MARKET FOR HEALTHCARE WORKFLOW OPTIMIZATION & ASSET MANAGEMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 DIGITAL TWINS IN HEALTHCARE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 39 DIGITAL TWINS IN HEALTHCARE MARKET FOR PHARMA & BIOPHARMA COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 DIGITAL TWINS IN HEALTHCARE MARKET FOR RESEARCH & ACADEMIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 DIGITAL TWINS IN HEALTHCARE MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 DIGITAL TWINS IN HEALTHCARE MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 DIGITAL TWINS IN HEALTHCARE MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 DIGITAL TWINS IN HEALTHCARE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: DIGITAL TWINS IN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 50 US: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 51 US: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 52 US: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 53 US: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 54 CANADA: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 55 CANADA: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 56 CANADA: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 57 CANADA: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 58 EUROPE: DIGITAL TWINS IN HEALTHCARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 EUROPE: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 60 EUROPE: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 61 EUROPE: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 62 EUROPE: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 63 GERMANY: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 64 GERMANY: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 65 GERMANY: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 66 GERMANY: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 67 UK: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 68 UK: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 69 UK: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 70 UK: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 71 FRANCE: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 72 FRANCE: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 73 FRANCE: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 74 FRANCE: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 75 ITALY: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 76 ITALY: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 77 ITALY: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 78 ITALY: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 79 SPAIN: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 80 SPAIN: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 81 SPAIN: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 82 SPAIN: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 83 REST OF EUROPE: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 84 REST OF EUROPE: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 REST OF EUROPE: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 86 REST OF EUROPE: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 87 ASIA PACIFIC: DIGITAL TWINS IN HEALTHCARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 91 ASIA PACIFIC: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 92 JAPAN: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 93 JAPAN: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 94 JAPAN: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 95 JAPAN: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 96 CHINA: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 97 CHINA: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 CHINA: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 99 CHINA: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 100 INDIA: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 101 INDIA: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 INDIA: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 103 INDIA: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 108 LATIN AMERICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 LATIN AMERICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 110 LATIN AMERICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 LATIN AMERICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 112 LATIN AMERICA: DIGITAL TWINS IN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 113 BRAZIL: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 114 BRAZIL: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 BRAZIL: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 116 BRAZIL: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 117 MEXICO: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 118 MEXICO: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 MEXICO: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 120 MEXICO: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 121 REST OF LATIN AMERICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 122 REST OF LATIN AMERICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 REST OF LATIN AMERICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 124 REST OF LATIN AMERICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: DIGITAL TWINS IN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 130 GCC COUNTRIES: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 131 GCC COUNTRIES: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 GCC COUNTRIES: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 133 GCC COUNTRIES: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 134 REST OF THE MIDDLE EAST & AFRICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 135 REST OF THE MIDDLE EAST & AFRICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 REST OF THE MIDDLE EAST & AFRICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 137 REST OF THE MIDDLE EAST & AFRICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 138 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN DIGITAL TWINS IN HEALTHCARE MARKET, JANUARY 2021-MARCH 2025

- TABLE 139 DIGITAL TWINS IN HEALTHCARE MARKET: DEGREE OF COMPETITION

- TABLE 140 DIGITAL TWINS IN HEALTHCARE MARKET: REGION FOOTPRINT

- TABLE 141 DIGITAL TWINS IN HEALTHCARE MARKET: COMPONENT FOOTPRINT

- TABLE 142 DIGITAL TWINS IN HEALTHCARE MARKET: APPLICATION FOOTPRINT

- TABLE 143 DIGITAL TWINS IN HEALTHCARE MARKET: END-USER FOOTPRINT

- TABLE 144 DIGITAL TWINS IN HEALTHCARE MARKET: PRODUCT/SERVICE LAUNCHES, ENHANCEMENTS, AND APPROVALS, JANUARY 2021-MARCH 2025

- TABLE 145 DIGITAL TWINS IN HEALTHCARE MARKET: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 146 DIGITAL TWINS IN HEALTHCARE MARKET: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 147 DIGITAL TWINS IN HEALTHCARE MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 148 MICROSOFT CORPORATION: COMPANY OVERVIEW

- TABLE 149 MICROSOFT CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 150 MICROSOFT CORPORATION: DEALS, JANUARY 2021-MARCH 2025

- TABLE 151 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- TABLE 152 SIEMENS HEALTHINEERS AG: PRODUCTS/SERVICES OFFERED

- TABLE 153 SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2021-MARCH 2025

- TABLE 154 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 155 KONINKLIJKE PHILIPS N.V.: PRODUCTS/SERVICES OFFERED

- TABLE 156 KONINKLIJKE PHILIPS N.V: DEALS, JANUARY 2021-MARCH 2025

- TABLE 157 AMAZON WEB SERVICES, INC.: COMPANY OVERVIEW

- TABLE 158 AMAZON WEB SERVICES, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 159 AMAZON WEB SERVICES, INC.: PRODUCT/SERVICE LAUNCHES & ENHANCEMENTS, JANUARY 2021-MARCH 2025

- TABLE 160 AMAZON WEB SERVICES, INC.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 161 DASSAULT SYSTEMES: COMPANY OVERVIEW

- TABLE 162 DASSAULT SYSTEMES: PRODUCTS/SERVICES OFFERED

- TABLE 163 DASSAULT SYSTEMES: PRODUCT/SERVICE LAUNCHES & ENHANCEMENTS, JANUARY 2021-MARCH 2025

- TABLE 164 DASSAULT SYSTEMES: DEALS, JANUARY 2021-MARCH 2025

- TABLE 165 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 166 GE HEALTHCARE: PRODUCTS/SERVICES OFFERED

- TABLE 167 GE HEALTHCARE: DEALS, JANUARY 2021-MARCH 2025

- TABLE 168 ORACLE CORPORATION: COMPANY OVERVIEW

- TABLE 169 ORACLE CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 170 ORACLE CORPORATION: PRODUCT/SERVICE ENHANCEMENTS, JANUARY 2021-MARCH 2025

- TABLE 171 ORACLE CORPORATION: DEALS, JANUARY 2021-MARCH 2025

- TABLE 172 ORACLE CORPORATION: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 173 IBM: COMPANY OVERVIEW

- TABLE 174 IBM: PRODUCTS/SERVICES OFFERED

- TABLE 175 IBM: DEALS, JANUARY 2021-MARCH 2025

- TABLE 176 PTC: COMPANY OVERVIEW

- TABLE 177 PTC: PRODUCTS/SERVICES OFFERED

- TABLE 178 PTC: PRODUCT/SERVICE LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 179 PTC: DEALS, JANUARY 2021-MARCH 2025

- TABLE 180 SAP: COMPANY OVERVIEW

- TABLE 181 SAP: PRODUCTS/SERVICES OFFERED

- TABLE 182 SAP: DEALS, JANUARY 2021-MARCH 2025

- TABLE 183 SAP: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 184 ATOS SE: COMPANY OVERVIEW

- TABLE 185 ATOS SE: PRODUCTS/SERVICES OFFERED

- TABLE 186 ATOS SE: DEALS, JANUARY 2021-MARCH 2025

- TABLE 187 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 188 NVIDIA CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 189 NVIDIA CORPORATION: PRODUCT/SERVICE LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 190 NVIDIA CORPORATION: DEALS, JANUARY 2021-MARCH 2025

- TABLE 191 ANSYS INC.: COMPANY OVERVIEW

- TABLE 192 ANSYS INC.: PRODUCT/SERVICE LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 193 ANSYS INC.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 194 FASTSTREAM TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 195 FASTSTREAM TECHNOLOGIES: PRODUCTS/SERVICES OFFERED

- TABLE 196 RESCALE, INC.: COMPANY OVERVIEW

- TABLE 197 RESCALE, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 198 TWIN HEALTH: COMPANY OVERVIEW

- TABLE 199 TWIN HEALTH: PRODUCTS/SERVICES OFFERED

- TABLE 200 TWIN HEALTH: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 201 VERTO: COMPANY OVERVIEW

- TABLE 202 VERTO PRODUCTS/SERVICES OFFERED

- TABLE 203 VERTO: DEALS, JANUARY 2021-MARCH 2025

- TABLE 204 QBIO: COMPANY OVERVIEW

- TABLE 205 QBIO: PRODUCTS/SERVICES OFFERED

- TABLE 206 QBIO: PRODUCT/SERVICE LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 207 THOUGHTWIRE: COMPANY OVERVIEW

- TABLE 208 THOUGHTWIRE: PRODUCTS/SERVICES OFFERED

- TABLE 209 SIM AND CURE: COMPANY OVERVIEW

- TABLE 210 SIM AND CURE: PRODUCTS/SERVICES OFFERED

- TABLE 211 PREDICTIV: COMPANY OVERVIEW

- TABLE 212 PREDICTIV: PRODUCTS/SERVICES OFFERED

- TABLE 213 NUREA: COMPANY OVERVIEW

- TABLE 214 NUREA: PRODUCTS/SERVICES OFFERED

- TABLE 215 NUREA: PRODUCT/SERVICE APPROVALS, JANUARY 2021-MARCH 2025

- TABLE 216 NUREA: DEALS, JANUARY 2021-MARCH 2025

- TABLE 217 UNLEARN.AI, INC.: COMPANY OVERVIEW

- TABLE 218 UNLEARN.AI, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 219 UNLEARN.AI, INC.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 220 UNLEARN.AI, INC.: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

- TABLE 221 VIRTONOMY GMBH: BUSINESS OVERVIEW

- TABLE 222 VIRTONOMY GMBH: PRODUCTS/SERVICES OFFERED

- TABLE 223 PREDISURGE: COMPANY OVERVIEW

- TABLE 224 PREDISURGE: PRODUCTS/SERVICES OFFERED

- TABLE 225 PREDISURGE: DEALS, JANUARY 2021-MARCH 2025

- TABLE 226 PREDISURGE: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2025

List of Figures

- FIGURE 1 DIGITAL TWINS IN HEALTHCARE MARKET: SEGMENTATION & GEOGRAPHIC SPREAD

- FIGURE 2 DIGITAL TWINS IN HEALTHCARE MARKET: YEARS CONSIDERED

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 PRIMARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF DIGITAL TWINS IN HEALTHCARE INDUSTRY

- FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 10 DIGITAL TWINS IN HEALTHCARE MARKET: DATA TRIANGULATION

- FIGURE 11 DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 GEOGRAPHIC SNAPSHOT OF DIGITAL TWINS IN HEALTHCARE MARKET

- FIGURE 16 INCREASING USE OF DIGITAL TWINS AND GROWING IMPORTANCE OF PATIENT-CENTRIC HEALTHCARE TO PROPEL MARKET

- FIGURE 17 SOFTWARE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN US IN 2025

- FIGURE 18 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 20 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 21 DIGITAL TWINS IN HEALTHCARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 DIGITAL TWIN TECHNOLOGIES

- FIGURE 23 DIGITAL TWINS IN HEALTHCARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS

- FIGURE 25 DIGITAL TWINS IN HEALTHCARE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 GLOBAL PATENT PUBLICATION TRENDS IN DIGITAL TWINS IN HEALTHCARE MARKET, 2017-2024

- FIGURE 27 TOP APPLICANTS (COMPANIES/INSTITUTIONS) FOR DIGITAL TWIN PATENTS (JANUARY 2017-DECEMBER 2024)

- FIGURE 28 TOP APPLICANTS FOR DIGITAL TWIN PATENTS (COUNTRY/REGION) (JANUARY 2017-DECEMBER 2024)

- FIGURE 29 METAVERSE IN HEALTHCARE MARKET: MARKET OVERVIEW

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 31 KEY BUYING CRITERIA FOR DIGITAL TWIN COMPONENTS

- FIGURE 32 DIGITAL TWINS IN HEALTHCARE MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 33 NORTH AMERICA: DIGITAL TWINS IN HEALTHCARE MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: DIGITAL TWINS IN HEALTHCARE MARKET SNAPSHOT

- FIGURE 35 REVENUE ANALYSIS OF KEY PLAYERS IN DIGITAL TWINS IN HEALTHCARE MARKET, 2020-2024 (USD MILLION)

- FIGURE 36 MARKET SHARE ANALYSIS OF KEY PLAYERS IN DIGITAL TWINS IN HEALTHCARE MARKET (2024)

- FIGURE 37 DIGITAL TWINS IN HEALTHCARE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 38 DIGITAL TWINS IN HEALTHCARE MARKET: COMPANY FOOTPRINT

- FIGURE 39 DIGITAL TWINS IN HEALTHCARE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 40 EV/EBITDA OF KEY VENDORS

- FIGURE 41 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 42 DIGITAL TWINS IN HEALTHCARE MARKET: BRAND/SOFTWARE COMPARISON

- FIGURE 43 MICROSOFT CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 44 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2024)

- FIGURE 45 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 46 AMAZON WEB SERVICES, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 47 DASSAULT SYSTEMES: COMPANY SNAPSHOT (2024)

- FIGURE 48 GE HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 49 ORACLE CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 50 IBM: COMPANY SNAPSHOT (2024)

- FIGURE 51 PTC: COMPANY SNAPSHOT (2024)

- FIGURE 52 SAP: COMPANY SNAPSHOT (2024)

- FIGURE 53 ATOS SE: COMPANY SNAPSHOT (2024)

- FIGURE 54 NVIDIA CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 55 ANSYS INC.: COMPANY SNAPSHOT (2023)

The global digital twin healthcare market is experiencing significant growth in 2024, driven by the growing applications of digital twins in healthcare and growing investments by public & private entities. The market is projected to reach USD 59.94 billion by 2030 from USD 4.47 billion in 2025, at a CAGR of 68.0% during the forecast period. Public and private entities increasingly invest in digital twin technologies, recognizing their potential to drive innovation and enhance operational efficiency. Quibim, based in Valencia, is at the forefront of using imaging biomarkers for precision medicine. The company has recently completed a Series A funding round worth USD 50.6 million to establish a presence in the United States. Quibim views this as a significant step towards creating human digital twins-dynamic models that enable health monitoring and improve patient stratification, increase drug development success rates, and facilitate treatment testing before implementation.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Component, Type, Application, and End user. |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. |

"By application, the surgical planning & medical education segment accounted for the largest share of the market in 2024."

In 2024, the surgical planning & medical education application segment accounted for the largest share of the market. The growth of this segment is due to the integration of digital twins with virtual reality platforms, which enhances surgical training for residents. This technology allows them to simulate procedures tailored to patients' unique anatomical and physiological characteristics. As a result, trainees can experience a realistic representation of performance and track intraoperative metrics. Several companies have developed simulations of medical anatomy and surgical procedures to reduce the reliance on cadavers and promote interactive learning.

"By end user, the healthcare providers segment accounted for the largest share of the market in 2024."

By end user, the healthcare providers segment accounted for the largest share of the market in 2024. The growth of this segment is attributed to its important role in workflow management and surgical planning. Digital twins offer additional benefits, such as accurate patient modeling, personalized treatment planning, and ongoing monitoring. These advantages contribute to enhanced clinical decision-making and improved patient outcomes.

"By region, Europe accounted for the second-largest market share in 2024."

Europe accounted for the second-largest share of the market in 2024. Factors influencing advancements in healthcare include increased technological investments and the use of digital twins for research and genomics. According to the European Institute of Innovation & Technology (EIT) Health Germany, European nations are implementing digital twins to improve medication prescriptions. For example, the French company ExactCure, which specializes in digital health, is focused on preventing adverse drug effects. By utilizing cutting-edge omics, sensing, computing, and communication technologies, DigiTwins aims to enable completely personalized and preventive medicine, leading to a paradigm shift in healthcare.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 45%, Tier 2: 30%, and Tier 3: 25%

- By Designation - C-level: 42%, Director-level: 31%, and Others: 27%

- By Region - North America: 45%, Europe: 30%, Asia Pacific: 20%, Latin America: 3%, and Middle East & Africa: 2%.

Key Players in the Digital Twins in Healthcare Market

The key players operating in the digital twin in healthcare market include Microsoft Corporation (US), Siemens Healthineers AG (Germany), Koninklijke Philips N.V. (Netherlands), Amazon Web Services, Inc. (US), Dassault Systemes (France), GE Healthcare (US), IBM (US), NVIDIA Corporation (US), Oracle Corporation (US), PTC (US), SAP (Germany), Atos SE (France), ANSYS, Inc. (US), Faststream Technologies (US), Rescale, Inc. (US), Twin Health (US), NUREA (France), Predictiv (US), Verto (Canada), Qbio (US), Virtonomy GmbH (Germany), Unlearn.ai, Inc. (US), ThoughtWire (Canada), Sim and Cure (France), and PrediSurge (France).

Research Coverage:

The report analyzes the Digital Twins in Healthcare Market. It aims to estimate the market size and future growth potential of various market segments based on type, component, application, end user, and region. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms and new entrants/smaller firms to gauge the market's pulse, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the following strategies to strengthen their positions in the market.

This report provides insights on:

- Analysis of key drivers (increasing Investments in digital twins in developed as well as emerging technology adoption, rising demand for personalized medicine, increasing funding and investments in digital twin startups), restraints (accuracy and privacy issues with digital twin systems and high implementation costs), opportunities (growing importance of digital twin Iin emerging market, increasing focus on cutting edge real-time data analytics), and challenges (lack of technical expertise & data management issues) influencing the growth of the digital twin market

- Product/Service Development & Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the digital twins in healthcare market

- Market Development: Comprehensive information on the lucrative emerging markets by type, component, application, end user, and region

- Market Diversification: Comprehensive information about product portfolios, expanding geographies, recent developments, and investments in the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the digital twins in healthcare market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS & REGIONS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Insights from primary experts

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN DATA TRIANGULATION

- 2.4 STUDY ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 DIGITAL TWINS IN HEALTHCARE MARKET OVERVIEW

- 4.2 NORTH AMERICA: DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT AND COUNTRY (2025)

- 4.3 DIGITAL TWINS IN HEALTHCARE MARKET: COUNTRY MIX

- 4.4 DIGITAL TWINS IN HEALTHCARE MARKET: REGIONAL MIX

- 4.5 DIGITAL TWINS IN HEALTHCARE MARKET: DEVELOPED MARKETS VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 MARKET DRIVERS

- 5.2.1.1 Increasing investments by public and private entities

- 5.2.1.2 Growing applications of digital twins

- 5.2.1.3 Technological advancements

- 5.2.1.4 Growing funding and investments in digital twin startups

- 5.2.2 RESTRAINTS

- 5.2.2.1 Managing data quality, privacy issues, and high implementation costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing focus on cutting-edge real-time data analytics

- 5.2.3.2 Growing importance of digital twins in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skilled professionals

- 5.2.4.2 Integration with existing systems and outdated digital infrastructure

- 5.2.1 MARKET DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 TRANSFORMATION IN CLINICAL TRIALS

- 5.3.2 REVOLUTIONIZING MEDICAL TRAINING AND DIAGNOSTICS

- 5.3.3 IMPROVING OPERATIONAL EFFICIENCY IN HOSPITALS

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 TECHNOLOGY STACK

- 5.4.1.1 5G networks

- 5.4.1.2 Internet of Things

- 5.4.1.3 Cloud and edge computing

- 5.4.1.4 Blockchain

- 5.4.1.5 Augmented reality, virtual reality, and mixed reality

- 5.4.1.6 Artificial intelligence and machine learning

- 5.4.1 TECHNOLOGY STACK

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.5.2 BARGAINING POWER OF SUPPLIERS

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 THREAT OF NEW ENTRANTS

- 5.5.5 THREAT OF SUBSTITUTES

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7 VALUE CHAIN ANALYSIS

- 5.7.1 PLANNING & REVISING FUNDS

- 5.7.2 RESEARCH & DEVELOPMENT

- 5.7.3 SOFTWARE DESIGN, FRAMEWORK, AND DEVELOPMENT

- 5.7.4 PRODUCT/SOLUTION PROVIDERS

- 5.7.5 END USERS AND AFTER-SALES SERVICE PROVIDERS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 PATENT ANALYSIS

- 5.9.1 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.10 ADJACENT MARKET ANALYSIS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 UTILIZATION OF DIGITAL TWIN TECHNOLOGY FOR SURGE PLANNING DECISIONS

- 5.11.2 PROVISION OF HOSPITAL GUIDANCE USING DIGITAL TWINS IN HEALTHCARE DURING COVID-19 PANDEMIC

- 5.11.3 OPTIMIZATION OF CARDIOVASCULAR SOLUTIONS FOR PERSONALIZED TREATMENTS

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 TRENDS/DISRUPTIONS IMPACTING BUYERS

6 DIGITAL TWINS IN HEALTHCARE MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 SERVICES

- 6.2.1 INTRODUCTION OF COMPLEX SOFTWARE TO BOOST DEMAND

- 6.3 SOFTWARE

- 6.3.1 TRANSITION TO WEB/CLOUD-BASED MODELS TO PROPEL MARKET

7 DIGITAL TWINS IN HEALTHCARE MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 PROCESS TWINS

- 7.2.1 RISING DEMAND FOR HEALTHCARE WORKFLOWS AND OPERATIONAL PROCESSES TO DRIVE MARKET

- 7.3 SYSTEM TWINS

- 7.3.1 INCREASING DEMAND FOR OPERATIONAL EFFICIENCY IN HOSPITALS TO FUEL MARKET

- 7.4 WHOLE BODY TWINS

- 7.4.1 TECHNOLOGICAL ADVANCEMENTS SUCH AS AI AND ML TO FUEL MARKET

- 7.5 BODY PART TWINS

- 7.5.1 GRADUAL PREFERENCE FOR PERSONALIZED & PRECISION MEDICINE TO SUPPORT MARKET GROWTH

8 DIGITAL TWINS IN HEALTHCARE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 DRUG DISCOVERY & DEVELOPMENT

- 8.2.1 ABILITY OF DIGITAL TWINS TO ENHANCE DRUG DISCOVERY & DEVELOPMENT TO BOOST MARKET

- 8.3 PERSONALIZED MEDICINE

- 8.3.1 COST-EFFECTIVE DEVELOPMENT & TESTING OF PERSONALIZED DIAGNOSTICS TO SUPPORT MARKET GROWTH

- 8.4 SURGICAL PLANNING & MEDICAL EDUCATION

- 8.4.1 ABILITY ENHANCE TRAINING AND SIMULATE SURGICAL PROCEDURES TO BOOST DEMAND

- 8.5 MEDICAL DEVICE DESIGN & TESTING

- 8.5.1 MINIMIZING RISKS AND REDUCING DOWNTIME TO DRIVE MARKET

- 8.6 HEALTHCARE WORKFLOW OPTIMIZATION & ASSET MANAGEMENT

- 8.6.1 ADVANTAGES SUCH AS IMPROVED EFFICIENCY AND VALUABLE INSIGHTS TO SUPPORT DEMAND

- 8.7 OTHER APPLICATIONS

9 DIGITAL TWINS IN HEALTHCARE MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 PHARMA & BIOPHARMA COMPANIES

- 9.2.1 RISING DEMAND FOR SOLUTIONS TO REDUCE TIME AND COST OF DRUG DEVELOPMENT TO BOOST ADOPTION

- 9.3 RESEARCH & ACADEMIA

- 9.3.1 INTERACTIVE AND IMMERSIVE LEARNING EXPERIENCES OFFERED BY DIGITAL TWINS TO BOOST ADOPTION

- 9.4 HEALTHCARE PROVIDERS

- 9.4.1 LOWER COSTS AND BETTER PATIENT TREATMENT TO FAVOR MARKET GROWTH

- 9.5 MEDICAL DEVICE COMPANIES

- 9.5.1 GROWING USE OF DIGITAL TWINS FOR SOFTWARE OPTIMIZATION OF MEDICAL DEVICES TO FUEL GROWTH

- 9.6 OTHER END USERS

10 DIGITAL TWINS IN HEALTHCARE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Expanding applications of digital twins in healthcare to bolster market growth

- 10.2.3 CANADA

- 10.2.3.1 Growing investments in digital twin development to drive market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Collaborations & partnerships to drive adoption of digital twins

- 10.3.3 UK

- 10.3.3.1 Growing applications of digital twins to support growth

- 10.3.4 FRANCE

- 10.3.4.1 Growing government funding for digital twin development to bolster growth

- 10.3.5 ITALY

- 10.3.5.1 Rising focus on digital transformation for value-centric patient care to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Rising funding investments for digital health plans to boost market

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 JAPAN

- 10.4.2.1 Growing penetration of digital twin technologies to support market growth

- 10.4.3 CHINA

- 10.4.3.1 China to register highest CAGR during forecast period

- 10.4.4 INDIA

- 10.4.4.1 Improvements in healthcare infrastructure to support market growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Favorable digitization investments to support market growth

- 10.5.3 MEXICO

- 10.5.3.1 Supportive government strategies to fuel uptake

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Increasing healthcare infrastructure development and investments to support market growth

- 10.6.3 REST OF MIDDLE EAST AND AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DIGITAL TWINS IN HEALTHCARE MARKET

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Region footprint

- 11.5.5.2 Company footprint

- 11.5.5.3 Component footprint

- 11.5.5.4 Application footprint

- 11.5.5.5 End-user footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.6.5.1 Detailed list of key startups/SME players

- 11.6.5.2 Competitive benchmarking of key startups/SME players

- 11.7 COMPANY VALUATION & FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.8 BRAND/SOFTWARE COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT/SERVICE LAUNCHES, ENHANCEMENTS, AND APPROVALS

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 MICROSOFT CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 SIEMENS HEALTHINEERS AG

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 KONINKLIJKE PHILIPS N.V.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 AMAZON WEB SERVICES, INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product/Service launches & enhancements

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 DASSAULT SYSTEMES

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product/Service launches & enhancements

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 GE HEALTHCARE

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 ORACLE CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product/Service enhancements

- 12.1.7.3.2 Deals

- 12.1.7.3.3 Expansions

- 12.1.8 IBM

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 PTC

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product/Service launches

- 12.1.9.3.2 Deals

- 12.1.10 SAP

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.10.3.2 Other developments

- 12.1.11 ATOS SE

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.12 NVIDIA CORPORATION

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product/Service launches

- 12.1.12.3.2 Deals

- 12.1.13 ANSYS INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product/Service launches

- 12.1.13.3.2 Deals

- 12.1.14 FASTSTREAM TECHNOLOGIES

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Services offered

- 12.1.15 RESCALE, INC.

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Services offered

- 12.1.1 MICROSOFT CORPORATION

- 12.2 OTHER PAYERS

- 12.2.1 TWIN HEALTH

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Other developments

- 12.2.2 VERTO

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Deals

- 12.2.3 QBIO

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Product/Service launches

- 12.2.4 THOUGHTWIRE

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Services offered

- 12.2.5 SIM AND CURE

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Services offered

- 12.2.6 PREDICTIV

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Services offered

- 12.2.7 NUREA

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Services offered

- 12.2.7.3 Recent developments

- 12.2.7.3.1 Product/Service approvals

- 12.2.7.3.2 Deals

- 12.2.8 UNLEARN.AI, INC.

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Services offered

- 12.2.8.3 Recent developments

- 12.2.8.3.1 Deals

- 12.2.8.3.2 Other developments

- 12.2.9 VIRTONOMY GMBH

- 12.2.9.1 Business overview

- 12.2.9.2 Products/Services offered

- 12.2.10 PREDISURGE

- 12.2.10.1 Business overview

- 12.2.10.2 Products/Services offered

- 12.2.10.3 Recent developments

- 12.2.10.3.1 Deals

- 12.2.10.3.2 Other developments

- 12.2.1 TWIN HEALTH

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS