|

市場調査レポート

商品コード

1762525

ヘルスケアにおけるデジタルツイン市場:業界動向と世界の予測 - 治療領域別、デジタルツインタイプ別、応用分野別、エンドユーザー別、主要地域別Digital Twins in Healthcare Market: Industry Trends and Global Forecasts - Distribution by Therapeutic Area, Type of Digital Twin, Areas of Application, End Users and Key Geographical Regions |

||||||

カスタマイズ可能

|

|||||||

| ヘルスケアにおけるデジタルツイン市場:業界動向と世界の予測 - 治療領域別、デジタルツインタイプ別、応用分野別、エンドユーザー別、主要地域別 |

|

出版日: 2025年07月04日

発行: Roots Analysis

ページ情報: 英文 190 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

ヘルスケアにおけるデジタルツイン市場:概要

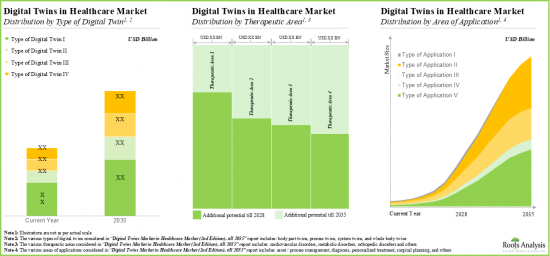

世界のヘルスケアにおけるデジタルツインの市場規模は、2035年までの予測期間中に29.6%のCAGRで拡大し、現在の25億米ドルから2035年までに334億米ドルに成長すると予測されています。

市場セグメンテーションでは、市場規模および機会分析を以下のパラメータで区分しています:

治療領域

- 心血管疾患

- 代謝疾患

- 整形外科疾患

- その他

デジタルツインタイプ

- プロセスツイン

- システムツイン

- 全身ツイン

- 身体部位ツイン

応用分野

- 資産/プロセス管理

- 個別化治療

- 手術計画

- 診断

- その他

エンドユーザー

- 製薬会社

- 医療機器メーカー

- ヘルスケアプロバイダー

- 患者

- その他

主要地域

- 北米

- 欧州

- アジア

- ラテンアメリカ

- 中東・北アフリカ

- その他の地域

ヘルスケアにおけるデジタルツイン市場:成長と動向

デジタルツインとは、現実世界のオブジェクト、プロセス、サービスのデジタルレプリカを指します。これらの仮想システムは、人工知能(AI)とデータ分析を使用して、モノのインターネット(IoT)デバイスやセンサーを使用して収集されたリアルタイムのデータに基づいてシミュレーションを実行し、元のシステムのワークフローを正確に再現します。注目すべきは、センサー、モデル、画像など、幅広いデータソースを使用してデジタルツインを作成できることです。現在、デジタルツイン(物理的な物体や環境の仮想レプリカ)はさまざまな業界で利用されており、ヘルスケアも例外ではありません。

ヘルスケアにおけるデジタルツインの応用は、患者ケアに革命をもたらし、遠隔ケアを改善し、個別化された治療を生み出し、コストを削減する可能性を秘めています。実際、ヘルスケアにおいて、これらの技術は患者の病歴、症状、現在の治療、さらには血圧や心拍数などの生体データまで完全に表現することができます。最近の業界洞察によると、ヘルスケア幹部の66%が、今後3年間でデジタルツインテクノロジーへの投資が増加すると予想しています。デジタルツインを活用することで、ヘルスケアプロバイダーはリアルタイムの患者データにアクセスし、患者の身体的、精神的、感情的なニーズについてより深い洞察を得て、より効果的でオーダーメイドのケアを提供することができます。その結果、多くのデジタルツイン企業がヘルスケア業界のニーズを満たすソリューションの開発に注力しています。

ヘルスケアにおけるデジタルツイン市場:主要インサイト

当レポートでは、ヘルスケアにおけるデジタルツイン市場の現状を掘り下げ、業界における潜在的な成長機会を明らかにしています。主な調査結果は以下の通りです。

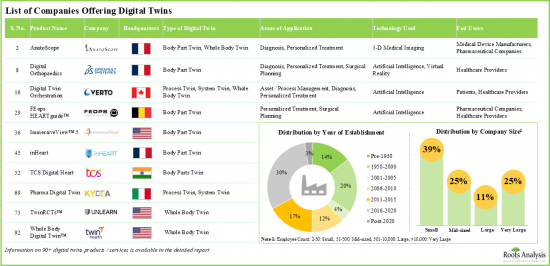

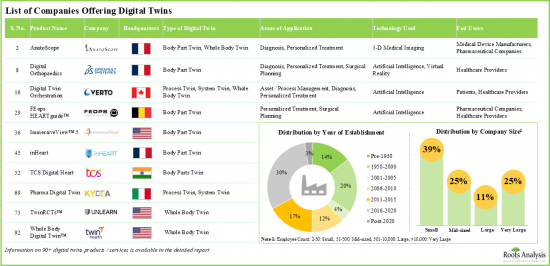

- 現在、90以上のデジタルツインが、診断、健康モニタリング、手術計画など、様々なヘルスケア関連用途向けに市販されているか、開発中です。

- 業界各社が提供するデジタルツインの42%以上はプロセスツインであり、その大半は主に資産/プロセス管理、個別化治療、手術計画を目的としています。

- ヘルスケア業界のデジタルツインで競争優位に立つため、各社は既存の製品を継続的にアップグレードし、ポートフォリオを拡大しています。

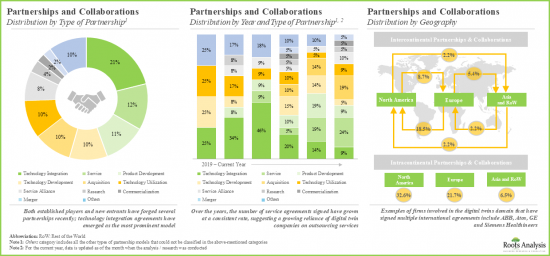

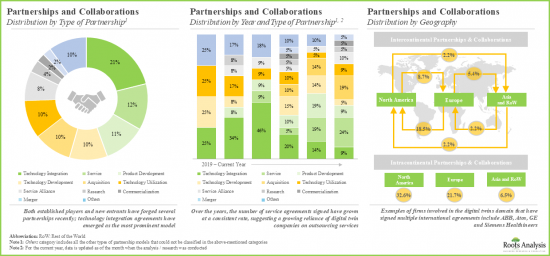

- この業界におけるパートナーシップ活動は、過去3年間で20%以上の割合で成長しており、45%以上の取引が過去2年間に締結されていることは注目に値します。

- 現在進行中のイノベーションを支援するため、複数の民間および公的投資家が多額の資本投資を行っています。

- デジタルツイン市場の新興企業は、競合他社との差別化を図るため、人工知能やブロックチェーンなどの先進的かつ革新的な技術を徐々に採用しています。

- ヘルスケアや製薬業界におけるデジタルツインテクノロジーの採用拡大に牽引され、ヘルスケア領域における世界のデジタルツイン市場は、2035年まで年率29.6%で成長すると予測しています。

- 全体的な市場機会は、様々なエンドユーザーにうまく分配される可能性が高いです。地域別では、北米が市場シェアの大半を占めると予想されます。

ヘルスケアにおけるデジタルツイン市場:主要セグメント

同市場は治療領域別に、心血管疾患、代謝疾患、整形外科疾患、その他の疾患に区分されます。現在、世界のデジタルツインヘルスケア市場では、心血管疾患分野が最大シェアを占めています。この動向は今後も変わらないとみられます。

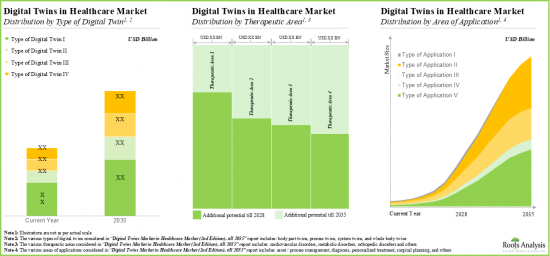

デジタルツインタイプによって、市場はプロセスツイン、システムツイン、全身ツイン、身体部位ツインに区分されます。現在、プロセスツインセグメントが世界のヘルスケアにおけるデジタルツイン市場で最も高い割合を占めています。その主な理由は、デジタルツインのプロセスにより、ヘルスケアのワークフローの詳細なシミュレーションと最適化が容易になり、効率化、コスト削減、患者転帰の改善につながるためです。さらに、ボディパーツツインセグメントは、今後最も高い成長率を示すと予測されています。

市場セグメンテーションでは、応用分野別に、アセット/プロセス管理、個別治療、手術計画、診断、その他に分類しています。現在、世界のヘルスケアにおけるデジタルツイン市場では、資産/プロセス管理分野が最大シェアを占めています。しかし、個別化治療セグメントは、その採用の増加により、今後より高いCAGRで成長することが期待されています。

エンドユーザー別では、市場は製薬会社、医療機器メーカー、ヘルスケアプロバイダー、患者、その他のエンドユーザーに区分されます。現在、製薬会社セグメントが世界のヘルスケアにおけるデジタルツイン市場で最大シェアを占めています。さらに、患者セグメントは予測期間中に高い成長率で成長すると予測されています。

主要な地域別では、市場は北米、欧州、アジア、ラテンアメリカ、中東・アフリカ、その他ラテンアメリカに区分されます。現在、北米が世界のデジタルツインヘルスケア市場を独占しており、最大の収益シェアを占めています。さらに、アジア市場は今後、より高いCAGRで成長する可能性が高いです。

ヘルスケアにおけるデジタルツイン市場の参入企業例

- BigBear.ai

- Certara

- Dassault Systemes

- DEO

- Mesh Bio

- NavvTrack

- OnScale

- Phesi

- PrediSurge

- SingHealth

- Twin Health

- Unlearn

- Verto

- VictoryXR

- Virtonomy

目次

第1章 序文

ヘルスケアにおけるデジタルツイン市場:市場概要

第2章 調査手法

第3章 経済的およびその他のプロジェクト特有の考慮事項

第4章 エグゼクティブサマリー

第5章 イントロダクション

- 章の概要

- ヘルスケアにおけるデジタルツインの概要

- ヘルスケアで利用されるデジタルツインタイプ

- ヘルスケア分野におけるデジタルツインの応用

- デジタルツインの導入に伴う課題

- 結論

第6章 市場情勢

- 章の概要

- ヘルスケアにおけるデジタルツイン:市場情勢

- ヘルスケアにおけるデジタルツイン:開発者の情勢

第7章 重要な洞察

- 章の概要

- 応用分野と開発状況別分析

- 使用される技術の種類とデジタルツインタイプ別分析

- エンドユーザーの種類とデジタルツインタイプ別分析

- 本社所在地と応用分野別の分析

- 企業規模と本社所在地別分析

第8章 企業競争力分析

- 章の概要

- 前提と主要なパラメータ

- 調査手法

- ヘルスケアにおけるデジタルツイン:企業競争力分析

第9章 詳細な企業プロファイル

- 章の概要

- BigBear.ai

- Certara

- Dassault Systemes

- NavvTrack

- Unlearn.ai

第10章 企業プロファイル一覧

- 章の概要

- 北米に拠点を置く企業

- OnScale

- Phesi

- Twin Health

- Verto

- VictoryXR

- 欧州に拠点を置く企業

- DEO

- PrediSurge

- Virtonomy

- アジアに拠点を置く企業

- Mesh Bio

- SingHealth

第11章 パートナーシップとコラボレーション

- 章の概要

- ヘルスケアにおけるデジタルツイン:パートナーシップとコラボレーション

第12章 資金調達と投資分析

- 章の概要

- 資金調達の種類

- ヘルスケアにおけるデジタルツイン:資金調達と投資のリスト

- 結論

第13章 BERKUSスタートアップの評価分析

- 章の概要

- 主要な前提と調査手法

- バーカススタートアップの評価:参入企業の総評価

- ヘルスケアにおけるデジタルツイン:Berkusスタートアップの評価パラメータのベンチマーク

- ヘルスケアにおけるデジタルツイン:参入企業のベンチマーク

第14章 市場影響分析:促進要因、抑制要因、機会、課題

第15章 ヘルスケア市場における世界デジタルツイン

第16章 ヘルスケアにおけるデジタルツイン市場(治療領域別)

第17章 ヘルスケアにおけるデジタルツイン市場(デジタルツインタイプ別)

第18章 ヘルスケアにおけるデジタルツイン市場(応用分野別)

第19章 ヘルスケアにおけるデジタルツイン市場(エンドユーザー別)

第20章 ヘルスケアにおけるデジタルツイン市場(地域別)

第21章 結論

第22章 エグゼクティブ洞察

第23章 付録I:表形式データ

第24章 付録II:企業および組織の一覧

List of Tables

- Table 6.1 Digital Twins in Healthcare: Information on Development Status

- Table 6.2 Digital Twins in Healthcare: Information on Therapeutic Area

- Table 6.3 Digital Twins in Healthcare: Information on Areas of Application

- Table 6.4 Digital Twins in Healthcare: Information on Type of Technology Used

- Table 6.5 Digital Twins in Healthcare: Information on End Users

- Table 6.6 Digital Twins in Healthcare: Information on Type of Digital Twin

- Table 6.7 Digital Twins Developers: Information on Year of Establishment, Company Size, Location of Headquarters, Region of Headquarters and Number of Products

- Table 9.1 List of Companies Profiled

- Table 9.2 BigBear.ai: Company Overview

- Table 9.3 BigBear.ai: Recent Developments and Future Outlook

- Table 9.4 Certara: Company Overview

- Table 9.5 Certara: Recent Developments and Future Outlook

- Table 9.6 Dassault Systemes: Company Overview

- Table 9.7 Dassault Systemes: Recent Developments and Future Outlook

- Table 9.8 NavvTrack: Company Overview

- Table 9.9 NavvTrack: Recent Developments and Future Outlook

- Table 9.10 Unlearn.ai: Company Overview

- Table 9.11 Unlearn.ai: Recent Developments and Future Outlook

- Table 10.1 List of Companies Profiled

- Table 10.2 OnScale: Company Overview

- Table 10.3 Phesi: Company Overview

- Table 10.4 Twin Health: Company Overview

- Table 10.5 Verto: Company Overview

- Table 10.6 VictoryXR: Recent Developments and Future Outlook

- Table 10.7 DEO: Company Overview

- Table 10.8 PrediSurge: Company Overview

- Table 10.9 Virtonomy: Company Overview

- Table 10.10 Mesh Bio: Company Overview

- Table 10.11 SingHealth: Company Overview

- Table 11.1 Digital Twins in Healthcare: List of Partnerships and Collaborations, Since 2018

- Table 11.2 Partnerships and Collaborations: Information on Type of Agreement (Country-wise and Continent-wise), Since 2018

- Table 12.1 Funding and Investments: Information on Year of Investment, Type of Funding, Amount and Investor, Since 2018

- Table 12.2 Funding and Investment Analysis: Regional Distribution by Total Amount Invested, Since 2018

- Table 13.1 Berkus Start-Up Valuation: Total Valuation of Players

- Table 22.1 Dassault Systemes: Company Snapshot

- Table 22.2 TwInsight: Company Snapshot

- Table 22.3 Unlearn.AI: Company Snapshot

- Table 22.4 Yokogawa Insilico Biotechnology: Company Snapshot

- Table 23.1 Digital Twins: Distribution by Development Status

- Table 23.2 Digital Twins: Distribution by Therapeutic Area

- Table 23.3 Digital Twins: Distribution by Areas of Application

- Table 23.4 Digital Twins: Distribution by Type of Technology Used

- Table 23.5 Digital Twins: Distribution by End Users

- Table 23.6 Digital Twins in Healthcare: Distribution by Type of Digital Twin

- Table 23.7 Digital Twin Developers: Distribution by Year of Establishment

- Table 23.8 Digital Twin Developers: Distribution by Company Size

- Table 23.9 Digital Twin Developers: Distribution by Location of Headquarters

- Table 23.10 BigBear.ai: Annual Revenues, Since 2021 (USD Million)

- Table 23.11 Certara: Annual Revenues, Since 2020 (USD Million)

- Table 23.12 Dassault Systemes: Annual Revenues, Since 2019 (EUR Billion)

- Table 23.13 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2018

- Table 23.14 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 23.15 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 23.16 Partnerships and Collaborations: Distribution by Type of Partnership and Company Size

- Table 23.17 Most Active Players: Distribution by Number of Partnerships

- Table 23.18 Partnerships and Collaborations: Local and International Agreements

- Table 23.19 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Table 23.20 Funding and Investment Analysis: Cumulative Year-wise Trend, Since 2018

- Table 23.21 Funding and Investment Analysis: Cumulative Amount Invested (USD Million), Since 2018

- Table 23.22 Funding and Investment Analysis: Distribution of Instances by Type of Funding, Since 2018

- Table 23.23 Funding and Investment Analysis: Year-Wise Distribution by Type of Funding, Since 2018

- Table 23.24 Funding and Investment Analysis: Distribution of Total Amount Invested (USD Million) by Type of Funding, Since 2018

- Table 23.25 Funding and Investment Analysis: Distribution by Geography

- Table 23.26 Most Active Players: Distribution by Number of Funding Instances, Since 2018

- Table 23.27 Most Active Players: Distribution by Amount Raised (USD Million), Since 2018

- Table 23.28 Global Digital Twins in Healthcare Market, Historical Trends, Since 2018 (USD Billion)

- Table 23.29 Global Digital Twins in Healthcare Market, Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 23.30 Global Digital Twins in Healthcare Market: Distribution by Therapeutic Area

- Table 23.31 Digital Twins in Healthcare Market for Cardiovascular Disorders, Historical Trends, Since 2018 (USD Billion)

- Table 23.32 Digital Twins in Healthcare Market for Cardiovascular Disorders, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.33 Digital Twins in Healthcare Market for Metabolic Disorders, Historical Trends, Since 2018 (USD Billion)

- Table 23.34 Digital Twins in Healthcare Market for Metabolic Disorders, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.35 Digital Twins in Healthcare Market for Orthopedic Disorders, Historical Trends, Since 2018 (USD Billion)

- Table 23.36 Digital Twins in Healthcare Market for Orthopedic Disorders, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.37 Digital Twins in Healthcare Market for Other Disorders, Historical Trends, Since 2018 (USD Billion)

- Table 23.38 Digital Twins in Healthcare Market for Other Disorders, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.39 Global Digital Twins in Healthcare Market: Distribution by Type of Digital Twin

- Table 23.40 Digital Twins in Healthcare Market for Process Twins, Historical Trends, Since 2018 (USD Billion)

- Table 23.41 Digital Twins in Healthcare Market for Process Twins, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.42 Digital Twins in Healthcare Market for System Twins, Historical Trends, Since 2018 (USD Billion)

- Table 23.43 Digital Twins in Healthcare Market for System Twins, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.44 Digital Twins in Healthcare Market for Whole Body Twins, Historical Trends, Since 2018 (USD Billion)

- Table 23.45 Digital Twins in Healthcare Market for Whole Body Twins, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.46 Digital Twins in Healthcare Market for Body Part Twins, Historical Trends, Since 2018 (USD Billion)

- Table 23.47 Digital Twins in Healthcare Market for Body Part Twins, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.48 Global Digital Twins in Healthcare Market: Distribution by Area of Application

- Table 23.49 Digital Twins in Healthcare Market for Asset / Process Management, Historical Trends, Since 2018 (USD Billion)

- Table 23.50 Digital Twins in Healthcare Market for Asset / Process Management, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.51 Digital Twins in Healthcare Market for Personalized Treatment, Historical Trends, Since 2018 (USD Billion)

- Table 23.52 Digital Twins in Healthcare Market for Personalized Treatment, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.53 Digital Twins in Healthcare Market for Surgical Planning, Historical Trends, Since 2018 (USD Billion)

- Table 23.54 Digital Twins in Healthcare Market for Surgical Planning, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.55 Digital Twins in Healthcare Market for Diagnosis, Historical Trends, Since 2018 (USD Billion)

- Table 23.56 Digital Twins in Healthcare Market for Diagnosis, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.57 Digital Twins in Healthcare Market for Other Application Areas, Historical Trends, Since 2018 (USD Billion)

- Table 23.58 Digital Twins in Healthcare Market for Other Application Areas, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.59 Global Digital Twins in Healthcare Market: Distribution by End Users

- Table 23.60 Digital Twins in Healthcare Market for Pharmaceutical Companies, Historical Trends, Since 2018 (USD Billion)

- Table 23.61 Digital Twins in Healthcare Market for Pharmaceutical Companies, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.62 Digital Twins in Healthcare Market for Medical Device Manufacturers, Historical Trends, Since 2018 (USD Billion)

- Table 23.63 Digital Twins in Healthcare Market for Medical Device Manufacturers, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.64 Digital Twins in Healthcare Market for Healthcare Providers, Historical Trends, Since 2018 (USD Billion)

- Table 23.65 Digital Twins in Healthcare Market for Healthcare Providers, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.66 Digital Twins in Healthcare Market for Patients, Historical Trends, Since 2018 (USD Billion)

- Table 23.67 Digital Twins in Healthcare Market for Patients, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.68 Digital Twins in Healthcare Market for Other End Users, Historical Trends, Since 2018 (USD Billion)

- Table 23.69 Digital Twins in Healthcare Market for Other End Users, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.70 Global Digital Twins in Healthcare Market: Distribution by Key Geographies

- Table 23.71 Digital Twins in Healthcare Market in North America, Historical Trends, Since 2018 (USD Billion)

- Table 23.72 Digital Twins in Healthcare Market in North America, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.73 Digital Twins in Healthcare Market in the US, Historical Trends, Since 2018 (USD Billion)

- Table 23.74 Digital Twins in Healthcare Market in the US, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.75 Digital Twins in Healthcare Market in Canada, Historical Trends, Since 2018 (USD Billion)

- Table 23.76 Digital Twins in Healthcare Market in Canada, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.77 Digital Twins in Healthcare Market in Europe, Historical Trends, Since 2018 (USD Billion)

- Table 23.78 Digital Twins in Healthcare Market in Europe, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.79 Digital Twins in Healthcare Market in France, Historical Trends, Since 2018 (USD Billion)

- Table 23.80 Digital Twins in Healthcare Market in France, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.81 Digital Twins in Healthcare Market in Germany, Historical Trends, Since 2018 (USD Billion)

- Table 23.82 Digital Twins in Healthcare Market in Germany, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.83 Digital Twins in Healthcare Market in Italy, Historical Trends, Since 2018 (USD Billion)

- Table 23.84 Digital Twins in Healthcare Market in Italy, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.85 Digital Twins in Healthcare Market in Spain, Historical Trends, Since 2018 (USD Billion)

- Table 23.86 Digital Twins in Healthcare Market in Spain, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.87 Digital Twins in Healthcare Market in the UK, Historical Trends, Since 2018 (USD Billion)

- Table 23.88 Digital Twins in Healthcare Market in the UK, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.89 Digital Twins in Healthcare Market in Rest of the Europe, Historical Trends, Since 2018 (USD Billion)

- Table 23.90 Digital Twins in Healthcare Market in Rest of the Europe, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.91 Digital Twins in Healthcare Market in Asia, Historical Trends, Since 2018 (USD Billion)

- Table 23.92 Digital Twins in Healthcare Market in Asia, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.93 Digital Twins in Healthcare Market in China, Historical Trends, Since 2018 (USD Billion)

- Table 23.94 Digital Twins in Healthcare Market in China, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.95 Digital Twins in Healthcare Market in India, Historical Trends, Since 2018 (USD Billion)

- Table 23.96 Digital Twins in Healthcare Market in India, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.97 Digital Twins in Healthcare Market in Japan, Historical Trends, Since 2018 (USD Billion)

- Table 23.98 Digital Twins in Healthcare Market in Japan, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.99 Digital Twins in Healthcare Market in Singapore, Historical Trends, Since 2018 (USD Billion)

- Table 23.100 Digital Twins in Healthcare Market in Singapore, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.101 Digital Twins in Healthcare Market in South Korea, Historical Trends, Since 2018 (USD Billion)

- Table 23.102 Digital Twins in Healthcare Market in South Korea, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.103 Digital Twins in Healthcare Market in Rest of the Asia, Historical Trends, Since 2018 (USD Billion)

- Table 23.104 Digital Twins in Healthcare Market in Rest of the Asia, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.105 Digital Twins in Healthcare Market in Latin America, Historical Trends, Since 2018 (USD Billion)

- Table 23.106 Digital Twins in Healthcare Market in Latin America, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.107 Digital Twins in Healthcare Market in Brazil, Historical Trends, Since 2018 (USD Billion)

- Table 23.108 Digital Twins in Healthcare Market in Brazil, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.109 Digital Twins in Healthcare Market in Middle East and North Africa, Historical Trends, Since 2018 (USD Billion)

- Table 23.110 Digital Twins in Healthcare Market in Middle East and North Africa, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.111 Digital Twins in Healthcare Market in UAE, Historical Trends, Since 2018 (USD Billion)

- Table 23.112 Digital Twins in Healthcare Market in UAE, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.113 Digital Twins in Healthcare Market in Rest of the World, Historical Trends, Since 2018 (USD Billion)

- Table 23.114 Digital Twins in Healthcare Market in Rest of the World, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.115 Digital Twins in Healthcare Market in Australia, Historical Trends, Since 2018 (USD Billion)

- Table 23.116 Digital Twins in Healthcare Market in Australia, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 23.117 Digital Twins in Healthcare Market in New Zealand, Historical Trends, Since 2018 (USD Billion)

- Table 23.118 Digital Twins in Healthcare Market in New Zealand, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

List of Figures

- Figure 2.1 Research Methodology: Research Assumptions

- Figure 2.2 Research Methodology: Project Methodology

- Figure 2.3 Research Methodology: Forecast Methodology

- Figure 2.4 Research Methodology: Robust Quality Control

- Figure 2.5 Research Methodology: Key Market Segmentations

- Figure 4.1 Executive Summary: Market Landscape

- Figure 4.2 Executive Summary: Partnerships and Collaborations

- Figure 4.3 Executive Summary: Funding and Investment Analysis

- Figure 4.4 Executive Summary: Market Forecast and Opportunity Analysis (I / II)

- Figure 4.5 Executive Summary: Market Forecast and Opportunity Analysis (II / II)

- Figure 5.1 Types of Digital Twins Used in Healthcare

- Figure 5.2 Applications of Digital Twins in the Healthcare Domain

- Figure 6.1 Digital Twins: Distribution by Development Status

- Figure 6.2 Digital Twins: Distribution by Therapeutic Area

- Figure 6.3 Digital Twins: Distribution by Areas of Application

- Figure 6.4 Digital Twins: Distribution by Type of Technology Used

- Figure 6.5 Digital Twins: Distribution by End Users

- Figure 6.6 Digital Twins: Distribution by Type of Digital Twin

- Figure 6.7 Digital Twin Developers: Distribution by Year of Establishment

- Figure 6.8 Digital Twin Developers: Distribution by Company Size

- Figure 6.9 Digital Twin Developers: Distribution by Location of Headquarters

- Figure 7.1 Key Insights: Distribution by Area of Application and Development Status

- Figure 7.2 Key Insights: Distribution by Type of Technology Used and Type of Digital Twin

- Figure 7.3 Key Insights: Distribution by Type of End User and Type of Digital Twin

- Figure 7.4 Key Insights: Distribution by Location of Headquarters and Area of Application

- Figure 7.5 Key Insights: Distribution by Company Size and Location of Headquarters

- Figure 8.1 Company Competitiveness Analysis: Benchmarking of Portfolio Strength

- Figure 8.2 Company Competitiveness Analysis: Benchmarking of Partnership Activity

- Figure 8.3 Company Competitiveness Analysis: Benchmarking of Funding Activity

- Figure 8.4 Company Competitiveness Analysis: Dot-plot Analysis of Players Based in North America

- Figure 8.5 Company Competitiveness Analysis: 3-D Bubble Chart Analysis of Players Based in North America

- Figure 8.6 Company Competitiveness Analysis: Dot-plot Analysis of Players Based in Europe

- Figure 8.7 Company Competitiveness Analysis: 3-D Bubble Chart Analysis of Players Based in Europe

- Figure 8.8 Company Competitiveness Analysis: 3-D Bubble Chart Analysis of Players Based in Asia and Rest of the World

- Figure 9.1 BigBear.ai: Annual Revenues, Since 2021 (USD Million)

- Figure 9.2 Certara: Annual Revenues, Since 2020 (USD Million)

- Figure 9.3 Dassault Systemes: Annual Revenues, Since 2019 (EUR Billion)

- Figure 11.1 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2018

- Figure 11.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 11.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 11.4 Partnerships and Collaborations: Distribution by Type of Partnership and Company Size

- Figure 11.5 Most Active Players: Distribution by Number of Partnerships

- Figure 11.6 Partnerships and Collaborations: Local and International Agreements

- Figure 11.7 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Figure 12.1 Funding and Investment Analysis: Cumulative Year-wise Trend, Since 2018

- Figure 12.2 Funding and Investment Analysis: Cumulative Amount Invested (USD Million), Since 2018

- Figure 12.3 Funding and Investment Analysis: Distribution of Instances by Type of Funding, Since 2018

- Figure 12.4 Funding and Investment Analysis: Year-Wise Distribution by Type of Funding, Since 2018

- Figure 12.5 Funding and Investment Analysis: Distribution of Total Amount Invested (USD Million) by Type of Funding, Since 2018

- Figure 12.6 Funding and Investment Analysis: Distribution by Geography

- Figure 12.7 Most Active Players: Distribution by Number of Funding Instances, Since 2018

- Figure 12.8 Most Active Players: Distribution by Amount Raised (USD Million), Since 2018

- Figure 12.9 Funding and Investment Summary, Since 2018 (USD Million)

- Figure 13.1 Berkus Start-Up Valuation: Total Valuation of Players (USD Million)

- Figure 13.2 AI Body: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.3 AnatoScope: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.4 Antleron: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.5 EmbodyBio: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.6 Klinik Sankt Moritz: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.7 MAI: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.8 Mindbank AI: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.9 Neo PLM: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.10 TwInsight: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.11 Sound Idea: Benchmarking of Players

- Figure 13.12 Prototype: Benchmarking of Players

- Figure 13.13 Management Experience: Benchmarking of Players

- Figure 13.14 Strategic Relationships: Benchmarking of Players

- Figure 13.15 Total Valuation: Benchmarking of Players

- Figure 14.1 Digital Twins in Healthcare: Market Drivers

- Figure 14.2 Digital Twins in Healthcare: Market Restraints

- Figure 14.3 Digital Twins in Healthcare: Market Opportunities

- Figure 14.4 Digital Twins in Healthcare: Market Challenges

- Figure 15.1 Global Digital Twins in Healthcare Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 15.2 Global Digital Twins in Healthcare Market, Forecasted Estimates (Till 2035): Conservative Scenario (USD Billion)

- Figure 15.3 Global Digital Twins in Healthcare Market, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Billion)

- Figure 16.1 Digital Twins in Healthcare Market: Distribution by Therapeutic Area

- Figure 16.2 Digital Twins in Healthcare Market for Cardiovascular Disorders, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.3 Digital Twins in Healthcare Market for Metabolic Disorders, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.4 Digital Twins in Healthcare Market for Orthopedic Disorders, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.5 Digital Twins in Healthcare Market for Other Disorders, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.1 Digital Twins in Healthcare Market: Distribution by Type of Digital Twin

- Figure 17.2 Digital Twins in Healthcare Market for Process Twins, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.3 Digital Twins in Healthcare Market for System Twins, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.4 Digital Twins in Healthcare Market for Whole Body Twins, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.5 Digital Twins in Healthcare Market for Body Part Twins, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.1 Digital Twins in Healthcare Market: Distribution by Area of Application

- Figure 18.2 Digital Twins in Healthcare Market for Asset / Process Management, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.3 Digital Twins in Healthcare Market for Personalized Treatment, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.4 Digital Twins in Healthcare Market for Surgical Planning, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.5 Digital Twins in Healthcare Market for Diagnosis, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.6 Digital Twins in Healthcare Market for Other Application Areas, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.1 Digital Twins in Healthcare Market: Distribution by End Users

- Figure 19.2 Digital Twins in Healthcare Market for Pharmaceutical Companies, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.3 Digital Twins in Healthcare Market for Medical Device Manufacturers, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.4 Digital Twins in Healthcare Market for Healthcare Providers, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.5 Digital Twins in Healthcare Market for Patients, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.6 Digital Twins in Healthcare Market for Other End Users, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.1 Digital Twins in Healthcare Market: Distribution by Key Geographies

- Figure 20.2 Digital Twins in Healthcare Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.3 Digital Twins in Healthcare Market in the US, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.4 Digital Twins in Healthcare Market in Canada, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.5 Digital Twins in Healthcare Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.6 Digital Twins in Healthcare Market in France, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.7 Digital Twins in Healthcare Market in Germany, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.8 Digital Twins in Healthcare Market in Italy, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.9 Digital Twins in Healthcare Market in Spain, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.10 Digital Twins in Healthcare Market in the UK, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.11 Digital Twins in Healthcare Market in Rest of the Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.12 Digital Twins in Healthcare Market in Asia, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.13 Digital Twins in Healthcare Market in China, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.14 Digital Twins in Healthcare Market in India, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.15 Digital Twins in Healthcare Market in Japan, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.16 Digital Twins in Healthcare Market in Singapore, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.17 Digital Twins in Healthcare Market in South Korea, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.18 Digital Twins in Healthcare Market in Rest of the Asia, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.19 Digital Twins in Healthcare Market in Latin America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.20 Digital Twins in Healthcare Market in Brazil, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.21 Digital Twins in Healthcare Market in Middle East and North Africa, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.22 Digital Twins in Healthcare Market in UAE, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.23 Digital Twins in Healthcare Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.24 Digital Twins in Healthcare Market in Australia, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.25 Digital Twins in Healthcare Market in New Zealand, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.1 Conclusion: Market Landscape

- Figure 21.2 Conclusion: Partnerships and Collaborations

- Figure 21.3 Conclusion: Funding and Investments

- Figure 21.4 Conclusion: Berkus Start-up Valuation Analysis

- Figure 21.5 Conclusion: Market Forecast (I / II)

- Figure 21.6 Conclusion: Market Forecast (II / II)

DIGITAL TWINS IN HEALTHCARE MARKET: OVERVIEW

As per Roots Analysis, the global digital twins in healthcare market is estimated to grow from USD 2.5 billion in the current year to USD 33.4 billion by 2035, at a CAGR of 29.6% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Therapeutic Area

- Cardiovascular Disorders

- Metabolic Disorders

- Orthopedic Disorders

- Other Disorders

Type of Digital Twin

- Process Twins

- System Twins

- Whole Body Twins

- Body Part Twins

Area of Application

- Asset / Process Management

- Personalized Treatment

- Surgical Planning

- Diagnosis

- Other Applications

End Users

- Pharmaceutical Companies

- Medical Device Manufacturers

- Healthcare Providers

- Patients

- Other End Users

Key Geographical Regions

- North America

- Europe

- Asia

- Latin America

- Middle East and North Africa

- Rest of the World

DIGITAL TWINS IN HEALTHCARE MARKET: GROWTH AND TRENDS

Digital twins refer to a digital replica of a real-world object, process, or service. These virtual systems use artificial intelligence (AI) and data analytics to run simulations based on the real-time data gathered using internet of things (IoT) devices and sensors, to accurately replicate the workflow of an original system. Notably, digital twins can be created using a wide range of data sources, such as sensors, models, and images. At present, digital twins, or virtual replicas of physical objects and environments, are being used in many different industries, and healthcare is no exception.

The application of digital twins in healthcare has the potential to revolutionize patient care, improve remote care, create personalized treatments and reduce costs. In fact, in healthcare, these technologies can provide the full representation of a patient's medical history, symptoms, current treatment, and even biometric data, such as blood pressure and heart rate. According to recent industry insights, 66% of healthcare executives anticipate increased investment in digital twin technologies over the next three years. By leveraging digital twins, healthcare providers can access real-time patient data, gaining deeper insight into their physical, mental, and emotional needs to deliver more effective and tailored care. Consequently, a number of digital twin companies are focusing on developing solutions that meet the needs of the healthcare industry.

DIGITAL TWINS IN HEALTHCARE MARKET: KEY INSIGHTS

The report delves into the current state of the digital twins in healthcare market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Currently, over 90 digital twins are either commercially available in the market or are under development for various healthcare related applications including diagnosis, health monitoring and surgical planning.

- Over 42% of the digital twins offered by industry players are process twins; majority of the twins are primarily intended for asset / process management, personalized treatment and surgical planning.

- In order to gain a competitive edge in digital twins in healthcare industry, companies are continuously upgrading their existing offerings to expand their portfolio.

- The partnership activity in this industry has grown at a rate of over 20% in the past three years; it is worth noting that over 45% of the deals have been signed in the last two years.

- To support the ongoing innovations, several private and public investors have made substantial capital investments; notably, most of the funding rounds took place in the past few years.

- Start-ups in the digital twin market are gradually adopting advanced and innovative technologies, such as artificial intelligence and blockchain, in order to differentiate themselves from their competitors.

- Driven by increasing adoption of digital twin technologies in healthcare and pharmaceutical industries, we anticipate the global digital twins market in healthcare domain to grow at an annualized rate of 29.6%, till 2035.

- The overall market opportunity is likely to be well distributed among various end users; in terms of geographical regions, North America is expected to capture the majority of the market share.

DIGITAL TWINS IN HEALTHCARE MARKET: KEY SEGMENTS

Cardiovascular Disorders Segment holds the Largest Share of the Digital Twins in Healthcare Market

Based on the therapeutic area, the market is segmented into cardiovascular disorders, metabolic disorders, orthopedic disorders, and other disorders. At present, the cardiovascular disorders segment holds the maximum share of the global digital twins in healthcare market. This trend is likely to remain the same in the coming years.

By Type of Digital Twin, Body Part Twins is the Fastest Growing Segment of the Global Digital Twins in Healthcare Market

Based on the type of digital twin, the market is segmented into process twins, system twins, whole body twins and body part twins. Currently, the process twins segment captures the highest proportion of the global digital twins in healthcare market. The primary reason for this is that the process of digital twins facilitates detailed simulations and optimizations of healthcare workflows, resulting in greater efficiency, cost reductions, and better patient outcomes, which fuels their broad adoption. Further, the body part twins segment is anticipated to show the highest growth rate in the coming future.

Asset / Process Management Segment Occupy the Largest Share of the Global Digital Twins in Healthcare Market by Area of Application

Based on the area of application, the market is segmented into asset / process management, personalized treatment, surgical planning, diagnosis and other applications. At present, the asset / process management segment holds the maximum share of the global digital twins in healthcare market. However, the market for personalized treatment segment is expected to grow at a higher CAGR in the coming future owing to its increasing adoption.

Pharmaceutical Companies Segment Account for the Largest Share of the Global Digital Twins in Healthcare Market

Based on the end users, the market is segmented into pharmaceutical companies, medical device manufacturers, healthcare providers, patients, and other end users. Currently, pharmaceutical companies segment holds the maximum share of the global digital twins in healthcare market. Further, the patient's segment is anticipated to grow at a higher growth rate during the forecasted period.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and Rest of the World. Currently, North America dominates the global digital twins in healthcare market and accounts for the largest revenue share. Further, the market Asia is likely to grow at a higher CAGR in the coming future.

Example Players in the Digital Twins in Healthcare Market

- BigBear.ai

- Certara

- Dassault Systemes

- DEO

- Mesh Bio

- NavvTrack

- OnScale

- Phesi

- PrediSurge

- SingHealth

- Twin Health

- Unlearn

- Verto

- VictoryXR

- Virtonomy

DIGITAL TWINS IN HEALTHCARE MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global digital twins in healthcare market, focusing on key market segments, including [A] therapeutic area, [B] type of digital twin, [C] area of application, [D] end users and [E] key geographical regions.

- Market Landscape: A comprehensive evaluation of players engaged in the development of digital twins, based on several relevant parameters, such as [A] year of establishment, [B] company size, and [C] location of headquarters. Additionally, a comprehensive evaluation of digital twins in the healthcare market, based on several relevant parameters, such as [D] status of development, [E] therapeutic area, [F] areas of application, [G] type of technology used, [H] type of digital twin and [I] end users.

- Key Insights: In-depth market analysis, highlighting the contemporary market trends, using five schematic representations, focusing on [A] areas of application and status of development, [B] type of technology used and type of digital twin, [C] type of end user and type of digital twin, [D] area of application and location of headquarters, and [E] company size and location of headquarters.

- Company Competitiveness Analysis: A comprehensive competitive analysis of players involved in the production / development of digital twins in the healthcare industry, examining factors, such as [A] years of experience, [B] portfolio strength, [C] partnership strength and [D] funding strength.

- Company Profiles: In-depth profiles of key players that are currently involved in the digital twins in healthcare market, focusing on [A] overview of the company, [B] financial information (if available) and [C] recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in this domain, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] most active players (in terms of the number of partnerships signed) and [D] geographical distribution of partnership activity.

- Funding and Investment Analysis: An in-depth analysis of the fundings received by players in digital twin domain, based on relevant parameters, such as [A] number of funding instances, [B] amount invested, [C] type of funding, [D] most active players, [E] most active investors and [F] geography.

- Berkus Start-up Valuation Analysis: A detailed analysis to evaluate start-ups engaged in digital twin domain, by assigning monetary values to various competition differentiators possessed by a player, focusing on the Berkus start-up valuation parameters, such as [A] sound idea, [B] prototype, [C] management experience and [D] strategic relationships undertaken by market players.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

1.1. Digital Twins in Healthcare Market: Market Overview

- 1.2. Market Share Insights

- 1.3. Market Segmentation Overview

- 1.4. Key Market Insights

- 1.5. Report Coverage

- 1.6. Key Questions Answered

- 1.7. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact / Related Factors

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Trends Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Overview of Digital Twins in Healthcare

- 5.3. Types of Digital Twins Used in Healthcare

- 5.3.1. System Twin

- 5.3.2. Process Twin

- 5.3.3. Human Digital Twin

- 5.4. Applications of Digital Twins in the Healthcare Domain

- 5.4.1. Asset / Process Management

- 5.4.2. Clinical Trial Evaluation

- 5.4.3. Personalized Medicine

- 5.4.4. Surgical Planning

- 5.5. Challenges Associated with the Adoption of Digital Twins

- 5.6. Concluding Remarks

6. MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Digital Twins in Healthcare: Overall Market Landscape

- 6.2.1. Analysis by Development Status

- 6.2.2. Analysis by Therapeutic Area

- 6.2.3. Analysis by Area of Application

- 6.2.4. Analysis by Type of Technology Used

- 6.2.5. Analysis by End Users

- 6.2.6. Analysis by Type of Digital Twin

- 6.3. Digital Twins in Healthcare: Developer Landscape

- 6.3.1. Analysis by Year of Establishment

- 6.3.2. Analysis by Company Size

- 6.3.3. Analysis by Location of Headquarters

7. KEY INSIGHTS

- 7.1. Chapter Overview

- 7.2. Analysis by Area of Application and Development Status

- 7.3. Analysis by Type of Technology Used and Type of Digital Twin

- 7.4. Analysis by Type of End User and Type of Digital Twin

- 7.5. Analysis by Location of Headquarters and Area of Application

- 7.6. Analysis by Company Size and Location of Headquarters

8. COMPANY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Digital Twins in Healthcare: Company Competitiveness Analysis

- 8.4.1. Company Competitiveness Analysis: Benchmarking of Portfolio Strength

- 8.4.2. Company Competitiveness Analysis: Benchmarking of Partnership Activity

- 8.4.3. Company Competitiveness Analysis: Benchmarking of Funding Activity

- 8.4.4. Company Competitiveness Analysis: Players Based in North America

- 8.4.5. Company Competitiveness Analysis: Players Based in Europe

- 8.4.6. Company Competitiveness Analysis: Players Based in Asia and Rest of the World

9. DETAILED COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. BigBear.ai

- 9.2.1. Company Overview

- 9.2.2. Financial Information

- 9.2.3. Recent Developments and Future Outlook

- 9.3. Certara

- 9.3.1. Company Overview

- 9.3.2. Financial Information

- 9.3.3. Recent Developments and Future Outlook

- 9.4. Dassault Systemes

- 9.4.1. Company Overview

- 9.4.2. Financial Information

- 9.4.3. Recent Developments and Future Outlook

- 9.5. NavvTrack

- 9.5.1. Company Overview

- 9.5.2. Recent Developments and Future Outlook

- 9.6. Unlearn.ai

- 9.6.1. Company Overview

- 9.6.2. Recent Developments and Future Outlook

10. TABULATED COMPANY PROFILES

- 10.1. Chapter Overview

- 10.2. Players Based in North America

- 10.2.1. OnScale

- 10.2.2. Phesi

- 10.2.3. Twin Health

- 10.2.4. Verto

- 10.2.5. VictoryXR

- 10.3. Players Based in Europe

- 10.3.1. DEO

- 10.3.2. PrediSurge

- 10.3.3. Virtonomy

- 10.4. Players Based in Asia

- 10.4.1. Mesh Bio

- 10.4.2. SingHealth

11. PARTNERSHIPS AND COLLABORATIONS

- 11.1. Chapter Overview

- 11.2. Digital Twins in Healthcare: Partnerships and Collaborations

- 11.2.1. Partnership Models

- 11.2.2. List of Partnerships and Collaborations

- 11.2.3. Analysis by Year of Partnership

- 11.2.4. Analysis by Type of Partnership

- 11.2.5. Analysis by Year and Type of Partnership

- 11.2.6. Analysis by Type of Partnership and Company Size

- 11.2.7. Most Active Players: Analysis by Number of Partnerships

- 11.2.8. Local and International Agreements

- 11.2.9. Intercontinental and Intracontinental Agreements

12. FUNDING AND INVESTMENTS ANALYSIS

- 12.1. Chapter Overview

- 12.2. Types of Funding

- 12.3. Digital Twins in Healthcare: List of Funding and Investments

- 12.3.1. Analysis by Number of Funding Instances

- 12.3.2. Analysis by Amount Invested

- 12.3.3. Analysis by Type of Funding

- 12.3.4. Analysis by Geography

- 12.3.5. Most Active Players: Analysis by Number of Funding Instances

- 12.3.6. Most Active Players: Analysis by Amount of Funding

- 12.3.7. Most Active Investors: Analysis by Number of Funding Instances

- 12.4. Concluding Remarks

13. BERKUS START-UP VALUATION ANALYSIS

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Berkus Start-Up Valuation: Total Valuation of Players

- 13.4. Digital Twins in Healthcare: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.1. AI Body: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.2. AnatoScope: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.3. Antleron: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.4. EmbodyBio: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.5. Klinik Sankt Moritz: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.6. KYDEA: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.7. MAI: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.8. Mindback AI: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.9. Neo PLM: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.10. Twinsight: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.11. Yokogawa Insilico Biotechnology: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.5. Digital Twins in Healthcare: Benchmarking of Players

- 13.5.1. Sound Idea: Benchmarking of Players

- 13.5.2. Prototype: Benchmarking of Players

- 13.5.3. Management Experience: Benchmarking of Players

- 13.5.4. Strategic Relationships: Benchmarking of Players

- 13.5.5. Total Valuation: Benchmarking of Players

14. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 14.1. Chapter Overview

- 14.2. Market Drivers

- 14.3. Market Restraints

- 14.4. Market Opportunities

- 14.5. Market Challenges

- 14.6. Conclusion

15. GLOBAL DIGITAL TWIN IN HEALTHCARE MARKET

- 15.1. Chapter Overview

- 15.2. Assumptions and Methodology

- 15.3. Global Digital Twin in Healthcare Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.3.1. Scenario Analysis

- 15.4. Key Market Segmentations

16. DIGITAL TWIN IN HEALTHCARE MARKET, BY THERAPEUTIC AREA

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Cardiovascular Disorders: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.4. Metabolic Disorders: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.5. Orthopedic Disorders: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.6. Other Disorders: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.7. Data Triangulation and Validation

17. DIGITAL TWIN IN HEALTHCARE MARKET, BY TYPE OF DIGITAL TWINS

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Process Twins: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.4. System Twins: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.5. Whole Body Twins: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.6. Body Part Twins: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.7. Data Triangulation and Validation

18. DIGITAL TWIN IN HEALTHCARE MARKET, BY AREA OF APPLICATION

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Asset / Process Management: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.4. Personalized Treatment: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.5. Surgical Planning: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.6. Diagnosis: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.7. Other Applications: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.8. Data Triangulation and Validation

19. DIGITAL TWIN IN HEALTHCARE MARKET, BY END USERS

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Pharmaceutical Companies: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.4. Medical Device Manufacturers: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.5. Healthcare Providers: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6. Patients: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.7. Other End Users: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.8. Data Triangulation and Validation

20. DIGITAL TWIN IN HEALTHCARE MARKET, BY GEOGRAPHY

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.3.1. US: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.3.2. Canada: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4. Europe: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.1. France: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.2. Germany: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.3. Italy: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.4. Spain: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.5. UK: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.6. Rest of Europe: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5. Asia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.1. China: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.2. India: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.3. Japan: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.4. Singapore: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.5. South Korea: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.6. Rest of Asia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6. Latin America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.1. Brazil: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.7. Middle East and North Africa: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.7.1. UAE: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.8. Rest of the World: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.8.1. Australia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.8.2. New Zealand: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.9. Data Triangulation and Validation

21. CONCLUSION

22. EXECUTIVE INSIGHTS

- 22.1. Chapter Overview

- 22.2. Company A

- 22.2.1. Company Snapshot

- 22.2.2. Interview Transcript, Business Consultant

- 22.3. Company B

- 22.3.1. Company Snapshot

- 22.3.2. Interview Transcript, Co-Founder and Chief Scientific Officer

- 22.4. Company C

- 22.4.1. Company Snapshot

- 22.4.2. Interview Transcript, Business Development Executive

- 22.5. Company D

- 22.5.1. Company Snapshot

- 22.5.2. Interview Transcript, Managing Director and Chief Executive Officer