|

|

市場調査レポート

商品コード

1720951

ダイナミックポジショニングシステム(自動船位保持装置)の世界市場:設備クラス別、システム別、フィット方式別、船舶タイプ別、地域別 - 2030年までの予測Dynamic Positioning System Market by Equipment Class (Class 1, Class 2, Class 3), System (Position Reference & Tracking, Thruster & Propulsion, Power Management, DP Control, Motion & Environment Sensor), Fit, Ship Type & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ダイナミックポジショニングシステム(自動船位保持装置)の世界市場:設備クラス別、システム別、フィット方式別、船舶タイプ別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月05日

発行: MarketsandMarkets

ページ情報: 英文 289 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ダイナミックポジショニングシステム(自動船位保持装置)の市場規模は、2025年の63億6,000万米ドルから2030年には86億5,000万米ドルに成長し、6.3%のCAGRで拡大すると予測されています。

この成長にはいくつかの重要な要因があります。海洋石油・ガス探査と生産の増加により、深海や厳しい海域で安定性を維持できる船舶の需要が高まっています。さらに、洋上風力エネルギーや再生可能な海洋インフラの増加により、洋上でのタービンやその他の機器の設置・保守に信頼性の高いDPシステムが必要とされています。自律的でスマートな海洋技術の採用が増加しているため、制御、安全性、運用効率を高める先進的なDPシステムを統合する船舶が増えています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 設備クラス別、システム別、フィット方式別、船舶タイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

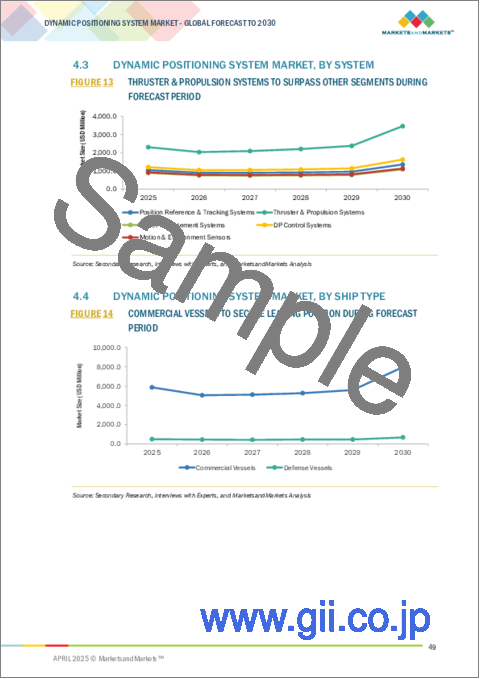

スラスターと推進システムは、特に課題の多い条件下での船舶の位置決めと移動制御に不可欠です。特にDP2やDP3のような高度なDPシステムでは、1つのスラスターが故障しても稼働可能なスラスターが必要です。バックアップ機能は、スラスターやシステムの故障時に安全モードに切り替えるために不可欠です。潤滑、冷却、電力供給などの補助システムはスラスターの運転をサポートし、ピッチとRPMの制御とフィードバックシステムは正確な応答性を保証します。緊急停止、アラーム、リアルタイム監視などの安全機能は船舶の安全維持に役立ち、ダイナミックポジショニングシステム市場におけるスラスターの重要性を際立たせています。

ダイナミックポジショニングシステム市場のラインフィット部門は最も急成長しており、スラスター、電力管理、DP制御システムを建造段階で船舶に直接組み込むことに焦点を当てています。この費用対効果の高いアプローチは、システム統合を改善し、設置を迅速化するため、新造船にとって効率的です。linefitは、ダイナミック・ポジショニング技術を最初からシームレスに組み込むことで、近代的な海上業務の高度なニーズを満たし、設置コストを削減し、船舶が高性能な使用に対応できるようにします。

欧州は世界最大のダイナミックポジショニングシステム市場であり、これは主に北海を中心としたオフショアエネルギー産業の好調によるものです。フランス、ノルウェー、英国、オランダ、デンマークといった国々は、オフショア石油・ガス、再生可能風力エネルギーのリーダーであり、高度な測位システムの需要を高めています。欧州の海運会社は、安全、環境規則、新技術を優先しており、DPシステムメーカーがバックアップ、自動化、エネルギー効率を改善したシステムを設計するよう、さらに駆り立てています。オフショア風力発電所、特に大型浮体式風力発電プロジェクトの成長は、石油・ガス以外にもDPシステムの利用を広げています。さらに、持続可能な活動や自律型船舶に対する政府の後押しもあり、欧州の先進DPシステム市場は2030年まで安定的に成長すると見られています。

当レポートでは、世界のダイナミックポジショニングシステム市場について調査し、設備クラス別、システム別、フィット方式別、船舶タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 顧客のビジネスに影響を与える動向と混乱

- 貿易分析

- 関税と規制状況

- ケーススタディ分析

- 主要な利害関係者と購入基準

- 2025年~2026年の主な会議とイベント

- 投資と資金調達のシナリオ

- 運用データ

- ビジネスモデル

- マクロ経済見通し

- AIが海洋産業に与える影響

- AIがダイナミックポジショニングシステム市場に与える影響

- 総所有コスト

- 部品表

- 技術ロードマップ

第6章 業界動向

- イントロダクション

- 技術動向

- ダイナミックポジショニングシステム市場における先進技術

- メガトレンドの影響

- 特許分析

第7章 ダイナミックポジショニングシステム市場(設備クラス別)

- イントロダクション

- クラス1

- クラス2

- クラス3

第8章 ダイナミックポジショニングシステム市場(システム別)

- イントロダクション

- 位置参照および追跡システム

- スラスターおよび推進システム

- 電力管理システム

- DP制御システム

- モーション&環境センサー

第9章 ダイナミックポジショニングシステム市場(フィット方式別)

- イントロダクション

- ラインフィット

- レトロフィット

第10章 ダイナミックポジショニングシステム市場(船舶タイプ別)

- イントロダクション

- 商用船舶

- 防衛艦艇

第11章 ダイナミックポジショニングシステム市場(地域別)

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- フランス

- ドイツ

- デンマーク

- ノルウェー

- その他

- アジア太平洋

- PESTLE分析

- 中国

- インド

- 日本

- 韓国

- その他

- 中東

- PESTLE分析

- GCC

- その他

- ラテンアメリカとアフリカ

- PESTLE分析

- ブラジル

- メキシコ

- アフリカ

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年~2024年

- 収益分析、2021年~2024年

- 市場シェア分析、2024年

- ブランド/製品比較

- 企業評価と財務指標

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- ABB

- GE VERNOVA

- KONGSBERG MARITIME

- WARTSILA

- BRUNVOLL AS

- ROLLS-ROYCE PLC

- SIREHNA

- NAVIS

- RH MARINE NETHERLANDS B.V.

- PRAXIS AUTOMATION TECHNOLOGY B.V.

- JAPAN RADIO CO.

- ROYAL IHC

- TWIN DISC, INC.

- AB VOLVO PENTA

- L3HARRIS TECHNOLOGIES, INC.

- その他の企業

- COMEX

- TRITEK POWER AND AUTOMATION

- MARINE TECHNOLOGIES, LLC

- NAVIS ENGINEERING

- KDU

- MARINE ELECTRONICS

- THRUSTMASTER OF TEXAS, INC.

- XENTA S.R.L.

- SUBSEA CONNECT

- NORWEGIAN ELECTRIC SYSTEMS

第14章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 MARKET SIZE ESTIMATION METHODOLOGY

- TABLE 4 FLAGSHIP OFFSHORE PROJECTS

- TABLE 5 OFFSHORE WIND SUPPLY CHAIN POTENTIAL IN ASIA PACIFIC, 2025-2050 (USD BILLION)

- TABLE 6 AVERAGE SELLING PRICE OF DYNAMIC POSITIONING SYSTEMS OFFERED BY KEY PLAYERS, 2024 (USD MILLION)

- TABLE 7 AVERAGE SELLING PRICE OF DYNAMIC POSITIONING SYSTEMS, BY CLASS, 2024 (USD MILLION)

- TABLE 8 AVERAGE SELLING PRICE OF DYNAMIC POSITIONING SYSTEMS, BY SYSTEM, 2024 (USD MILLION)

- TABLE 9 AVERAGE SELLING PRICE OF DYNAMIC POSITIONING SYSTEMS, BY SHIP TYPE, 2024 (USD MILLION)

- TABLE 10 AVERAGE SELLING PRICE OF DYNAMIC POSITIONING SYSTEMS, BY REGION, 2024 (USD MILLION)

- TABLE 11 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 12 IMPORT DATA FOR HS CODE 89-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR HS CODE 89-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 TARIFFS FOR HS CODE 89-COMPLIANT PRODUCTS, 2024

- TABLE 15 INTERNATIONAL MARINE REGULATORY BODIES

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 LATIN AMERICA & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 IMO EQUIPMENT CLASS AND CLASSIFICATION SOCIETY NOTATIONS

- TABLE 22 IMO GUIDELINES FOR VESSELS EQUIPPED WITH DYNAMIC POSITIONING SYSTEMS

- TABLE 23 MINIMUM SYSTEM REQUIREMENT AND CONFIGURATION BY CLASS

- TABLE 24 SAFETY STANDARDS FOR DYNAMIC POSITIONING SYSTEMS

- TABLE 25 FAILURE MODES AND RISK ASSESSMENT IN DYNAMIC POSITIONING SYSTEMS

- TABLE 26 REGULATORY COMPLIANCE AND CERTIFICATION OF DYNAMIC POSITIONING SYSTEMS

- TABLE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SHIP TYPE (%)

- TABLE 28 KEY BUYING CRITERIA, BY SHIP TYPE

- TABLE 29 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 30 ACTIVE FLEET OF ELIGIBLE VESSELS FOR DYNAMIC POSITIONING SYSTEMS, 2020-2024

- TABLE 31 IMPACT OF AI ON MARINE APPLICATIONS

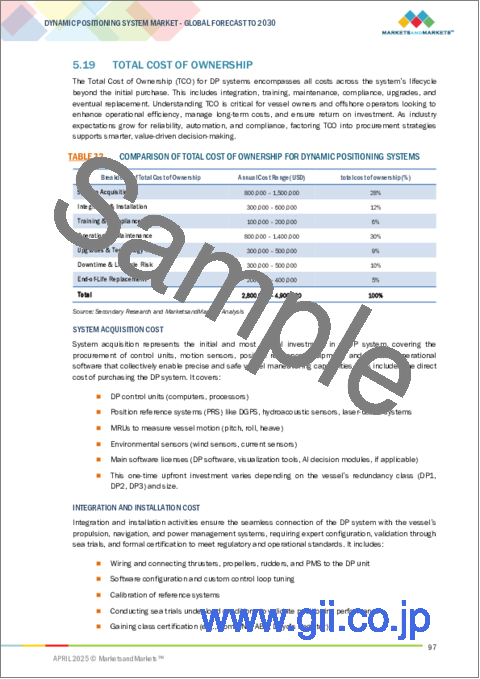

- TABLE 32 COMPARISON OF TOTAL COST OF OWNERSHIP FOR DYNAMIC POSITIONING SYSTEMS

- TABLE 33 BILL OF MATERIALS FOR DYNAMIC POSITIONING SYSTEMS

- TABLE 34 PATENT ANALYSIS

- TABLE 35 DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 36 DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 37 DYNAMIC POSITIONING SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 38 DYNAMIC POSITIONING SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 39 DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 40 DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 41 DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 42 DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 43 COMMERCIAL VESSELS: DYNAMIC POSITIONING SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 44 COMMERCIAL VESSELS: DYNAMIC POSITIONING SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 45 DEFENSE VESSELS: DYNAMIC POSITIONING SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 46 DEFENSE VESSELS: DYNAMIC POSITIONING SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 47 DYNAMIC POSITIONING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 DYNAMIC POSITIONING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 52 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 54 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 56 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 58 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET, BY COMMERCIAL VESSEL, 2021-2024 (USD MILLION)

- TABLE 60 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET, BY COMMERCIAL VESSEL, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET, BY DEFENSE VESSEL, 2021-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET, BY DEFENSE VESSEL, 2025-2030 (USD MILLION)

- TABLE 63 US: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 64 US: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 65 US: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 66 US: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 67 US: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 68 US: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 69 CANADA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 70 CANADA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 71 CANADA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 72 CANADA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 73 CANADA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 74 CANADA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 75 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 76 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 77 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 78 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 79 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 80 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 81 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 82 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 83 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 84 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 85 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY COMMERCIAL VESSEL, 2021-2024 (USD MILLION)

- TABLE 86 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY COMMERCIAL VESSEL, 2025-2030 (USD MILLION)

- TABLE 87 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY DEFENSE VESSEL, 2021-2024 (USD MILLION)

- TABLE 88 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY DEFENSE VESSEL, 2025-2030 (USD MILLION)

- TABLE 89 UK: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 90 UK: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 91 UK: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 92 UK: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 93 UK: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 94 UK: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 95 FRANCE: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 96 FRANCE: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 97 FRANCE: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 98 FRANCE: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 99 FRANCE: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 100 FRANCE: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 101 GERMANY: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 102 GERMANY: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 103 GERMANY: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 104 GERMANY: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 105 GERMANY: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 106 GERMANY: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 107 DENMARK: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 108 DENMARK: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 109 DENMARK: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 110 DENMARK: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 111 DENMARK: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 112 DENMARK: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 113 NORWAY: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 114 NORWAY: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 115 NORWAY: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 116 NORWAY: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 117 NORWAY: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 118 NORWAY: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 119 REST OF EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 120 REST OF EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 121 REST OF EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 122 REST OF EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 123 REST OF EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 124 REST OF EUROPE: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 128 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY COMMERCIAL VESSEL, 2021-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY COMMERCIAL VESSEL, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY DEFENSE VESSEL, 2021-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY DEFENSE VESSEL, 2025-2030 (USD MILLION)

- TABLE 139 CHINA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 140 CHINA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 141 CHINA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 142 CHINA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 143 CHINA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 144 CHINA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 145 INDIA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 146 INDIA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 147 INDIA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 148 INDIA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 149 INDIA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 150 INDIA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 151 JAPAN: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 152 JAPAN: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 153 JAPAN: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 154 JAPAN: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 155 JAPAN: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 156 JAPAN: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 157 SOUTH KOREA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 158 SOUTH KOREA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 159 SOUTH KOREA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 160 SOUTH KOREA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 161 SOUTH KOREA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 162 SOUTH KOREA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 170 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 172 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 174 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 178 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 179 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY COMMERCIAL VESSEL, 2021-2024 (USD MILLION)

- TABLE 180 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY COMMERCIAL VESSEL, 2025-2030 (USD MILLION)

- TABLE 181 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY DEFENSE VESSEL, 2021-2024 (USD MILLION)

- TABLE 182 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY DEFENSE VESSEL, 2025-2030 (USD MILLION)

- TABLE 183 SAUDI ARABIA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 184 SAUDI ARABIA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 185 SAUDI ARABIA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 186 SAUDI ARABIA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 187 SAUDI ARABIA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 188 SAUDI ARABIA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 189 UAE: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 190 UAE: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 191 UAE: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 192 UAE: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 193 UAE: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 194 UAE: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 195 REST OF MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 196 REST OF MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 197 REST OF MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 198 REST OF MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 199 REST OF MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 200 REST OF MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 201 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 202 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 203 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 204 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 205 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 206 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 207 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 208 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 209 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 210 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 211 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY COMMERCIAL VESSEL, 2021-2024 (USD MILLION)

- TABLE 212 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY COMMERCIAL VESSEL, 2025-2030 (USD MILLION)

- TABLE 213 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY DEFENSE VESSEL, 2021-2024 (USD MILLION)

- TABLE 214 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY DEFENSE VESSEL, 2025-2030 (USD MILLION)

- TABLE 215 BRAZIL: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 216 BRAZIL: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 217 BRAZIL: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 218 BRAZIL: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 219 BRAZIL: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 220 BRAZIL: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 221 MEXICO: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 222 MEXICO: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 223 MEXICO: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 224 MEXICO: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 225 MEXICO: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 226 MEXICO: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 227 AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2021-2024 (USD MILLION)

- TABLE 228 AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- TABLE 229 AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 230 AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 231 AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 232 AFRICA: DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 233 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- TABLE 234 DYNAMIC POSITIONING SYSTEM MARKET: DEGREE OF COMPETITION

- TABLE 235 REGION FOOTPRINT

- TABLE 236 EQUIPMENT CLASS FOOTPRINT

- TABLE 237 SYSTEM FOOTPRINT

- TABLE 238 FIT FOOTPRINT

- TABLE 239 LIST OF START-UPS/SMES

- TABLE 240 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 241 DYNAMIC POSITIONING SYSTEM MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2021-2025

- TABLE 242 DYNAMIC POSITIONING SYSTEM MARKET: DEALS, 2021-2025

- TABLE 243 DYNAMIC POSITIONING SYSTEM MARKET: OTHERS, 2021-2025

- TABLE 244 ABB: COMPANY OVERVIEW

- TABLE 245 ABB: PRODUCTS OFFERED

- TABLE 246 ABB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 247 ABB: OTHERS

- TABLE 248 GE VERNOVA: COMPANY OVERVIEW

- TABLE 249 GE VERNOVA: PRODUCTS OFFERED

- TABLE 250 GE VERNOVA: OTHERS

- TABLE 251 KONGSBERG MARITIME: COMPANY OVERVIEW

- TABLE 252 KONGSBERG MARITIME: PRODUCTS OFFERED

- TABLE 253 KONGSBERG MARITIME: OTHERS

- TABLE 254 WARTSILA: COMPANY OVERVIEW

- TABLE 255 WARTSILA: PRODUCTS OFFERED

- TABLE 256 BRUNVOLL AS: COMPANY OVERVIEW

- TABLE 257 BRUNVOLL AS: PRODUCTS OFFERED

- TABLE 258 BRUNVOLL AS: OTHERS

- TABLE 259 ROLLS-ROYCE PLC: COMPANY OVERVIEW

- TABLE 260 ROLLS-ROYCE PLC: PRODUCTS OFFERED

- TABLE 261 SIREHNA: COMPANY OVERVIEW

- TABLE 262 SIREHNA: PRODUCTS OFFERED

- TABLE 263 SIREHNA: DEALS

- TABLE 264 SIREHNA: OTHERS

- TABLE 265 NAVIS: COMPANY OVERVIEW

- TABLE 266 NAVIS: PRODUCTS OFFERED

- TABLE 267 NAVIS: DEALS

- TABLE 268 RH MARINE NETHERLANDS B.V.: COMPANY OVERVIEW

- TABLE 269 RH MARINE NETHERLANDS B.V.: PRODUCTS OFFERED

- TABLE 270 RH MARINE NETHERLANDS B.V.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 271 PRAXIS AUTOMATION TECHNOLOGY B.V.: COMPANY OVERVIEW

- TABLE 272 PRAXIS AUTOMATION TECHNOLOGY B.V.: PRODUCTS OFFERED

- TABLE 273 PRAXIS AUTOMATION TECHNOLOGY B.V.: OTHERS

- TABLE 274 JAPAN RADIO CO.: COMPANY OVERVIEW

- TABLE 275 JAPAN RADIO CO.: PRODUCTS OFFERED

- TABLE 276 JAPAN RADIO CO.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 277 JAPAN RADIO CO.: DEALS

- TABLE 278 ROYAL IHC: COMPANY OVERVIEW

- TABLE 279 ROYAL IHC: PRODUCTS OFFERED

- TABLE 280 TWIN DISC, INC.: COMPANY OVERVIEW

- TABLE 281 TWIN DISC, INC.: PRODUCTS OFFERED

- TABLE 282 AB VOLVO PENTA: COMPANY OVERVIEW

- TABLE 283 AB VOLVO PENTA: PRODUCTS OFFERED

- TABLE 284 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 285 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 286 COMEX: COMPANY OVERVIEW

- TABLE 287 TRITEK POWER AND AUTOMATION: COMPANY OVERVIEW

- TABLE 288 MARINE TECHNOLOGIES, LLC: COMPANY OVERVIEW

- TABLE 289 NAVIS ENGINEERING: COMPANY OVERVIEW

- TABLE 290 KDU: COMPANY OVERVIEW

- TABLE 291 MARINE ELECTRONICS: COMPANY OVERVIEW

- TABLE 292 THRUSTMASTER OF TEXAS, INC.: COMPANY OVERVIEW

- TABLE 293 XENTA S.R.L.: COMPANY OVERVIEW

- TABLE 294 SUBSEA CONNECT: COMPANY OVERVIEW

- TABLE 295 NORWEGIAN ELECTRIC SYSTEMS: COMPANY OVERVIEW

- TABLE 296 DYNAMIC POSITIONING SYSTEM MARKET: LAUNDRY LIST OF OTHER MAPPED COMPANIES

List of Figures

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 CLASS 3 TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 7 THRUSTER & PROPULSION SYSTEMS SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 8 LINEFIT SEGMENT TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 9 COMMERCIAL VESSELS SEGMENT TO BE LARGER THAN DEFENSE VESSELS SEGMENT DURING FORECAST PERIOD

- FIGURE 10 EUROPE TO BE LARGEST MARKET FOR DYNAMIC POSITIONING SYSTEMS DURING FORECAST PERIOD

- FIGURE 11 EXPANSION OF OFFSHORE OIL & GAS EXPLORATION TO DRIVE MARKET

- FIGURE 12 CLASS 2 SEGMENT TO ACQUIRE MAXIMUM SHARE IN 2025

- FIGURE 13 THRUSTER & PROPULSION SYSTEMS TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 14 COMMERCIAL VESSELS TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 15 RETROFIT TO HOLD HIGHER SHARE THAN LINEFIT IN 2025

- FIGURE 16 DYNAMIC POSITIONING SYSTEM MARKET DYNAMICS

- FIGURE 17 UPSTREAM OIL & GAS CAPEX, 2019-2024

- FIGURE 18 ACTIVE NUMBER OF SHIPS, BY AGE, 2023

- FIGURE 19 VALUE CHAIN ANALYSIS

- FIGURE 20 ECOSYSTEM ANALYSIS

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 IMPORT DATA FOR HS CODE 89-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 23 EXPORT DATA FOR HS CODE 89-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SHIP TYPE

- FIGURE 25 KEY BUYING CRITERIA, BY SHIP TYPE

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2018-2024 (USD MILLION)

- FIGURE 27 BUSINESS MODELS IN DYNAMIC POSITIONING SYSTEM MARKET

- FIGURE 28 DIRECT PROCUREMENT MODEL

- FIGURE 29 IMPACT OF AI ON MARINE APPLICATIONS

- FIGURE 30 BILL OF MATERIALS FOR DYNAMIC POSITIONING SYSTEMS

- FIGURE 31 EVOLUTION OF DYNAMIC POSITIONING TECHNOLOGIES

- FIGURE 32 ROADMAP FOR DYNAMIC POSITIONING TECHNOLOGIES

- FIGURE 33 TECHNOLOGY TRENDS

- FIGURE 34 KEY ENABLING TECHNOLOGIES FOR PREDICTIVE MAINTENANCE

- FIGURE 35 KEY ENABLING TECHNOLOGIES FOR ENHANCED CONTROL ALGORITHMS

- FIGURE 36 KEY ENABLING TECHNOLOGIES FOR HYBRID NAVIGATION SYSTEMS

- FIGURE 37 KEY ENABLING TECHNOLOGIES FOR AUTONOMOUS VESSEL NAVIGATION

- FIGURE 38 KEY ENABLING TECHNOLOGIES FOR TRAINING SIMULATORS

- FIGURE 39 KEY ENABLING TECHNOLOGIES FOR ENHANCED OPERATOR AWARENESS

- FIGURE 40 PATENTS ANALYSIS

- FIGURE 41 DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS, 2025-2030 (USD MILLION)

- FIGURE 42 DYNAMIC POSITIONING SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- FIGURE 43 DYNAMIC POSITIONING SYSTEM MARKET, BY FIT, 2025-2030 (USD MILLION)

- FIGURE 44 DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE, 2025-2030 (USD MILLION)

- FIGURE 45 DYNAMIC POSITIONING SYSTEM MARKET, BY REGION, 2025-2030

- FIGURE 46 NORTH AMERICA: DYNAMIC POSITIONING SYSTEM MARKET SNAPSHOT

- FIGURE 47 EUROPE: DYNAMIC POSITIONING SYSTEM MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: DYNAMIC POSITIONING SYSTEM MARKET SNAPSHOT

- FIGURE 49 MIDDLE EAST: DYNAMIC POSITIONING SYSTEM MARKET SNAPSHOT

- FIGURE 50 LATIN AMERICA & AFRICA: DYNAMIC POSITIONING SYSTEM MARKET SNAPSHOT

- FIGURE 51 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2024

- FIGURE 52 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- FIGURE 53 BRAND/PRODUCT COMPARISON

- FIGURE 54 FINANCIAL METRICS OF PROMINENT PLAYERS

- FIGURE 55 VALUATION OF PROMINENT PLAYERS

- FIGURE 56 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 57 COMPANY FOOTPRINT

- FIGURE 58 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 59 ABB: COMPANY SNAPSHOT

- FIGURE 60 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 61 KONGSBERG MARITIME: COMPANY SNAPSHOT

- FIGURE 62 WARTSILA: COMPANY SNAPSHOT

- FIGURE 63 ROLLS-ROYCE PLC: COMPANY SNAPSHOT

- FIGURE 64 ROYAL IHC: COMPANY SNAPSHOT

- FIGURE 65 TWIN DISC, INC.: COMPANY SNAPSHOT

- FIGURE 66 AB VOLVO PENTA: COMPANY SNAPSHOT

- FIGURE 67 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

The dynamic positioning system market is projected to grow from an estimated USD 6.36 billion in 2025 to USD 8.65 billion by 2030, achieving a CAGR of 6.3%. Several key factors drive this growth. The increase in offshore oil & gas exploration and production has heightened the demand for vessels capable of maintaining stability in deep and challenging waters. Additionally, the rise of offshore wind energy and renewable marine infrastructure requires reliable DP systems to install and maintain turbines and other equipment at sea. The growing adoption of autonomous and smart marine technologies is further prompting more ships to integrate advanced DP systems, which enhance control, safety, and operational efficiency.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Equipment Class, System, Fit, Ship Type & Region |

| Regions covered | North America, Europe, APAC, RoW |

"The thruster & propulsion systems segment is expected to hold the largest share during the forecast period."

Thruster and propulsion systems are vital for vessel positioning and movement control, especially in challenging conditions. Proper sizing and positioning are crucial for effective station-keeping, particularly in advanced DP systems like DP2 and DP3, which require operational thrusters even if one fails. Backup features are essential to switch to a safe mode during a thruster or system failure. Auxiliary systems, such as lubrication, cooling, and power supply, support thruster operation, while pitch and RPM controls, along with feedback systems, ensure precise responsiveness. Safety features, including emergency stops, alarms, and real-time monitoring, help maintain vessel security, highlighting the importance of thrusters in the dynamic positioning system market.

"Linefit is expected to be the fastest-growing segment during the forecast period."

The linefit segment of the dynamic positioning system market is the fastest growing, focusing on integrating thrusters, power management, and DP control systems directly into vessels during their construction phase. This cost-effective approach improves system integration and speeds up installation, making it efficient for new-build ships. By ensuring that dynamic positioning technology is seamlessly incorporated from the start, linefit helps meet the advanced needs of modern maritime operations, reducing installation costs and ensuring vessels are ready for high-performance use.

"Europe is expected to be the leading market for dynamic positioning systems during the forecast period."

Europe is the largest dynamic positioning system market globally, mainly due to its strong offshore energy industry, especially in the North Sea. Countries like France, Norway, the UK, the Netherlands, and Denmark are leaders in offshore oil, gas, and renewable wind energy, which is increasing the demand for advanced station-keeping systems. European maritime companies prioritize safety, environmental rules, and new technologies, further driving DP system manufacturers to design systems with improved backup, automation, and energy efficiency. The growth of offshore wind farms, especially large floating wind projects, is broadening the use of DP systems beyond oil & gas. Moreover, with government backing for sustainable practices and autonomous ships, the market for advanced DP systems in Europe is set to grow steadily through 2030.

Breakdown of Primaries

The study contains insights from various industry experts, ranging from component suppliers to tier-1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 49%, Tier 2 -37%, and Tier 3 -14%

- By Designation: C Level - 55%, Director Level - 27%, and Others - 18%

- By Region: North America - 32%, Europe - 32%, Asia Pacific - 16%, Middle East - 10%, Latin America - 7%, Africa-3%

Kongsberg Maritime (Norway), Wartsila (Finland), GE Vernova (US), ABB (Switzerland), and Brunvoll AS (Norway) are among the leading players operating in the dynamic positioning system market.

Research Coverage

The study covers the dynamic positioning system market across various segments and subsegments. It aims to estimate this market's size and growth potential across different segments based on equipment class, system, fit, ship type, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key Benefits of Buying this Report:

This report provides valuable information for both market leaders and new entrants in the dynamic positioning system market, offering estimates of overall revenue and insights into its subsegments. It encompasses the entire market ecosystem, helping stakeholders better understand the competitive landscape. This understanding will enable them to position their businesses effectively and develop appropriate go-to-market strategies. Additionally, the report will offer insights into the market's current trends and highlight key drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers, such as the rise of offshore oil & gas exploration and production activities, the expansion of offshore wind energy and renewable marine infrastructure, and the rapid adoption of autonomous and smart marine technologies in the dynamic positioning system market

- Product Development: In-depth analysis of product innovation/development by companies across various regions

- Market Development: Comprehensive information about lucrative markets

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the dynamic positioning system market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 DYNAMIC POSITIONING SYSTEM MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Primary insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE INDICATORS

- 2.3.2 SUPPLY-SIDE INDICATORS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DYNAMIC POSITIONING SYSTEM MARKET

- 4.2 DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS

- 4.3 DYNAMIC POSITIONING SYSTEM MARKET, BY SYSTEM

- 4.4 DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE

- 4.5 DYNAMIC POSITIONING SYSTEM MARKET, BY FIT

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise of offshore oil & gas exploration and production activities

- 5.2.1.2 Expansion of offshore wind energy and renewable marine infrastructure

- 5.2.1.3 Rapid adoption of autonomous and smart marine technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High upfront cost of dynamic positioning systems

- 5.2.2.2 Regulatory compliance and periodic system audits

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Retrofitting of older vessels with modern dynamic positioning systems

- 5.2.3.2 Increased investments in coastal defense and naval modernization programs

- 5.2.3.3 Emergence of resident subsea systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Interoperability across multi-vendor navigation and propulsion systems

- 5.2.4.2 Maintenance of system redundancy and fail-safe mechanisms in harsh environments

- 5.2.4.3 Vulnerability to GNSS spoofing or signal loss in remote locations

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE OF DYNAMIC POSITIONING SYSTEMS OFFERED BY KEY PLAYERS

- 5.3.2 AVERAGE SELLING PRICE, BY CLASS

- 5.3.3 AVERAGE SELLING PRICE, BY SYSTEM

- 5.3.4 AVERAGE SELLING PRICE, BY SHIP TYPE

- 5.3.5 AVERAGE SELLING PRICE, BY REGION

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Dynamic positioning control system software

- 5.6.1.2 Thruster control systems

- 5.6.1.3 Motion reference units

- 5.6.1.4 Position reference systems

- 5.6.1.4.1 Differential GPS

- 5.6.1.4.2 Hydroacoustic position reference

- 5.6.1.4.3 Laser/Optical sensors

- 5.6.1.4.4 Taut wire systems

- 5.6.1.5 Operator workstations

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Vessel automation and bridge control systems

- 5.6.2.2 Dynamic simulation and sea trial tools

- 5.6.2.3 Hybrid-electric and battery energy management systems

- 5.6.2.4 Weather and wave forecasting integration tools

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Autonomous and unmanned vessel navigation systems

- 5.6.3.2 Satellite communication systems

- 5.6.3.3 AI-based route optimization platforms

- 5.6.3.4 Offshore wind turbine installation technologies

- 5.6.1 KEY TECHNOLOGIES

- 5.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 89)

- 5.8.2 EXPORT SCENARIO (HS CODE 89)

- 5.9 TARIFF AND REGULATORY LANDSCAPE

- 5.9.1 TARIFF DATA

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.3 SAFETY REQUIREMENTS AND STANDARDS FOR DYNAMIC POSITIONING SYSTEMS

- 5.9.3.1 Equipment classes and classification society notations

- 5.9.3.2 IMO guidelines

- 5.9.3.3 Minimum system requirements

- 5.9.3.4 Safety standards

- 5.9.4 FAILURE MODES AND RISK ASSESSMENT

- 5.9.5 REGULATORY COMPLIANCE AND CERTIFICATION

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 DYNAMIC POSITIONING ON PIONEERING SPIRIT FOR OFFSHORE PLATFORM REMOVAL

- 5.10.2 DEEP OCEAN DRILLING WITH DYNAMIC POSITIONING SYSTEMS

- 5.10.3 OPTIMIZED TOWING OF OFFSHORE STRUCTURES WITH DYNAMIC POSITIONING TECHNOLOGY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 INVESTMENT AND FUNDING SCENARIO

- 5.14 OPERATIONAL DATA

- 5.15 BUSINESS MODELS

- 5.15.1 DIRECT PROCUREMENT MODEL

- 5.15.1.1 Key characteristics

- 5.15.1.2 Advantages

- 5.15.1.3 Typical customer profiles

- 5.15.2 RETROFIT AND MODULAR UPGRADE MODEL

- 5.15.2.1 Key characteristics

- 5.15.2.2 Advantages

- 5.15.2.3 Typical customer profiles

- 5.15.3 SYSTEM INTEGRATION MODEL

- 5.15.3.1 Key characteristics

- 5.15.3.2 Advantages

- 5.15.3.3 Typical customer profiles

- 5.15.4 AFTERMARKET SERVICES MODEL

- 5.15.4.1 Key characteristics

- 5.15.4.2 Advantages

- 5.15.4.3 Typical customer profiles

- 5.15.1 DIRECT PROCUREMENT MODEL

- 5.16 MACROECONOMIC OUTLOOK

- 5.16.1 INTRODUCTION

- 5.16.2 NORTH AMERICA

- 5.16.3 EUROPE

- 5.16.4 ASIA PACIFIC

- 5.16.5 MIDDLE EAST

- 5.16.6 LATIN AMERICA & AFRICA

- 5.17 IMPACT OF AI ON MARINE INDUSTRY

- 5.18 IMPACT OF AI ON DYNAMIC POSITIONING SYSTEM MARKET

- 5.19 TOTAL COST OF OWNERSHIP

- 5.20 BILL OF MATERIALS

- 5.21 TECHNOLOGY ROADMAP

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 REAL-TIME ENVIRONMENTAL INTELLIGENCE INTEGRATION

- 6.2.2 MULTI-SENSOR FUSION AND POSITIONING REDUNDANCY

- 6.2.3 DIGITAL TWIN

- 6.2.4 CONDITION-BASED MONITORING

- 6.2.5 REMOTE AND AUTONOMOUS DYNAMIC POSITIONING CAPABILITIES

- 6.3 ADVANCED TECHNOLOGIES IN DYNAMIC POSITIONING SYSTEM MARKET

- 6.3.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 6.3.1.1 Predictive maintenance

- 6.3.1.2 Enhanced control algorithms

- 6.3.2 INTEGRATED POSITIONING AND NAVIGATION SYSTEMS

- 6.3.2.1 Hybrid navigation systems

- 6.3.2.2 Autonomous vessel navigation

- 6.3.3 VIRTUAL REALITY AND AUGMENTED REALITY

- 6.3.3.1 Training simulators

- 6.3.3.2 Enhanced operator awareness

- 6.3.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 6.4 IMPACT OF MEGATRENDS

- 6.4.1 DECARBONIZATION AND ENERGY TRANSITION

- 6.4.2 EXPANSION OF OFFSHORE RENEWABLE ENERGY

- 6.4.3 BIG DATA AND ANALYTICS

- 6.4.4 INTERNET OF THINGS

- 6.5 PATENT ANALYSIS

7 DYNAMIC POSITIONING SYSTEM MARKET, BY EQUIPMENT CLASS

- 7.1 INTRODUCTION

- 7.2 CLASS 1

- 7.2.1 EXTENSIVE USE IN COASTAL AND LOW-RISK OPERATIONS TO DRIVE MARKET

- 7.2.2 USE CASE: K-POS DP-11 AND DP-12 SYSTEMS BY KONGSBERG MARITIME

- 7.3 CLASS 2

- 7.3.1 NEED FOR INCREASED OPERATIONAL SAFETY IN MODERATELY CRITICAL OFFSHORE ACTIVITIES TO DRIVE MARKET

- 7.3.2 USE CASE: ABILITY MARINE PILOT CONTROL BY ABB

- 7.4 CLASS 3

- 7.4.1 STRICT SAFETY AND RELIABILITY REQUIREMENTS FOR HIGH-RISK MISSIONS TO DRIVE MARKET

- 7.4.2 USE CASE: ICON DP BY ROLLS-ROYCE PLC

8 DYNAMIC POSITIONING SYSTEM MARKET, BY SYSTEM

- 8.1 INTRODUCTION

- 8.2 POSITION REFERENCE & TRACKING SYSTEMS

- 8.2.1 NEED FOR PRECISE VESSEL POSITIONING TO ENSURE OPERATIONAL SAFETY TO DRIVE MARKET

- 8.2.2 USE CASE: RHODIUM DYNAMIC POSITIONING AND TRACKING SYSTEM BY RH MARINE

- 8.2.3 GPS-BASED POSITIONING SYSTEMS

- 8.2.4 HYDROACOUSTIC POSITIONING SYSTEMS

- 8.2.5 LASER-BASED POSITIONING SYSTEMS

- 8.2.6 INERTIAL NAVIGATION SYSTEMS

- 8.3 THRUSTER & PROPULSION SYSTEMS

- 8.3.1 DEMAND FOR HIGH-PERFORMANCE PROPULSION FOR ACCURATE STATION-KEEPING AND MANEUVERING TO DRIVE MARKET

- 8.3.2 USE CASE: MINEHUNTING PROPULSION SYSTEM BY L3HARRIS TECHNOLOGIES, INC.

- 8.3.3 AZIMUTH THRUSTERS

- 8.3.4 FIXED PITCH & CONTROLLABLE PITCH PROPELLERS

- 8.3.5 TUNNEL THRUSTERS & WATERJETS

- 8.3.6 PROPULSION SYSTEMS

- 8.4 POWER MANAGEMENT SYSTEMS

- 8.4.1 SHIFT TOWARD HYBRID AND ALL-ELECTRIC PROPULSION TECHNOLOGIES TO DRIVE MARKET

- 8.4.2 USE CASE: DP5000 BY NAVIS

- 8.4.3 ELECTRICAL POWER SYSTEMS

- 8.4.4 POWER BACKUP & REDUNDANCY FEATURES

- 8.5 DP CONTROL SYSTEMS

- 8.5.1 RISE IN DEMAND FOR DYNAMIC POSITIONING SYSTEMS FROM OFFSHORE AND ENERGY SECTORS TO DRIVE MARKET

- 8.5.2 USE CASE: MEGA-GUARD JOYSTICK CONTROL SYSTEM BY PRAXIS AUTOMATION TECHNOLOGY B.V.

- 8.5.3 DP CONTROL CONSOLES

- 8.5.4 DP PROCESSING UNITS

- 8.5.5 DP CONTROL ALGORITHMS

- 8.6 MOTION & ENVIRONMENT SENSORS

- 8.6.1 NEED FOR REAL-TIME DATA TO MONITOR VESSEL MOVEMENT AND ENVIRONMENTAL CONDITIONS TO DRIVE MARKET

- 8.6.2 USE CASE: DYNAMIC MOTION SENSORS BY TELEDYNE MARINE TECHNOLOGIES INCORPORATED

- 8.6.3 MOTION REFERENCE UNITS

- 8.6.4 SENSORS

9 DYNAMIC POSITIONING SYSTEM MARKET, BY FIT

- 9.1 INTRODUCTION

- 9.2 LINEFIT

- 9.2.1 REDUCED INSTALLATION COSTS AND QUICKER PROJECT TIMELINES TO DRIVE MARKET

- 9.3 RETROFIT

- 9.3.1 UPGRADE OF OLDER VESSELS TO MEET REGULATORY REQUIREMENTS TO DRIVE MARKET

10 DYNAMIC POSITIONING SYSTEM MARKET, BY SHIP TYPE

- 10.1 INTRODUCTION

- 10.2 COMMERCIAL VESSELS

- 10.2.1 USE CASE: ALPHADYNAPOS BY JAPAN RADIO CO.

- 10.2.2 YACHTS

- 10.2.2.1 Heightened demand for precision maneuvering, enhanced safety, and operational efficiency on luxury vessels to drive market

- 10.2.3 FERRIES

- 10.2.3.1 Shift toward automation, fuel efficiency, and environmental compliance to drive market

- 10.2.4 CRUISE SHIPS

- 10.2.4.1 Rising demand for environmentally sustainable operations in luxury cruising to drive market

- 10.2.5 TUGS & WORKBOATS

- 10.2.5.1 Increasing operational demands in offshore activities that require accurate vessel control to drive market

- 10.2.6 RESEARCH VESSELS

- 10.2.6.1 Escalating demand for marine research and offshore exploration to drive market

- 10.2.7 DREDGERS

- 10.2.7.1 Need for precise vessel positioning during complex dredging operations to drive market

- 10.2.8 SHUTTLE TANKERS

- 10.2.8.1 Rise in offshore oil production to drive market

- 10.2.9 CABLE-LAYING VESSELS

- 10.2.9.1 Urgent need for offshore renewable energy installations and subsea communication networks to drive market

- 10.2.10 DRILLSHIPS

- 10.2.10.1 Growing exploration of deep-water and ultra-deep-water offshore oil & gas reserves to drive market

- 10.2.11 OFFSHORE SUPPORT VESSELS

- 10.2.11.1 Expanding offshore exploration, subsea work, and renewable energy support to drive market

- 10.3 DEFENSE VESSELS

- 10.3.1 USE CASE: SIREHNA DP SYSTEM

- 10.3.2 PATROL VESSELS

- 10.3.2.1 Elevated demand for precise navigation and stability in maritime security operations to drive market

- 10.3.3 MINESWEEPERS

- 10.3.3.1 Focus on maritime security and mine clearance capabilities to drive market

11 DYNAMIC POSITIONING SYSTEM MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 PESTLE ANALYSIS

- 11.2.2 US

- 11.2.2.1 Developments in energy sector, naval programs, and maritime infrastructure to drive market

- 11.2.3 CANADA

- 11.2.3.1 Expanding deepwater oil & gas projects and evolving regulatory standards to drive market

- 11.3 EUROPE

- 11.3.1 PESTLE ANALYSIS

- 11.3.2 UK

- 11.3.2.1 High demand from offshore oil, gas, and wind projects to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Growth in offshore wind energy and naval modernization programs to drive market

- 11.3.4 GERMANY

- 11.3.4.1 Offshore wind expansion under national energy targets to drive market

- 11.3.5 DENMARK

- 11.3.5.1 Incorporation of dynamic positioning systems into patrol and support vessels to drive market

- 11.3.6 NORWAY

- 11.3.6.1 Need for advanced dynamic positioning systems in emerging floating wind projects to drive market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 PESTLE ANALYSIS

- 11.4.2 CHINA

- 11.4.2.1 Booming offshore oil & gas and wind energy sectors to drive market

- 11.4.3 INDIA

- 11.4.3.1 Ongoing offshore energy projects and naval modernization programs to drive market

- 11.4.4 JAPAN

- 11.4.4.1 Development of autonomous maritime technologies to drive market

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Shipbuilding leadership and rapid defense modernization to drive market

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST

- 11.5.1 PESTLE ANALYSIS

- 11.5.2 GCC

- 11.5.2.1 Saudi Arabia

- 11.5.2.1.1 Maritime industrialization under Vision 2030 to drive market

- 11.5.2.2 UAE

- 11.5.2.2.1 Expansion of offshore oil production capacity and infrastructure development to drive market

- 11.5.2.1 Saudi Arabia

- 11.5.3 REST OF MIDDLE EAST

- 11.6 LATIN AMERICA & AFRICA

- 11.6.1 PESTLE ANALYSIS

- 11.6.2 BRAZIL

- 11.6.2.1 Rise of deepwater and ultra-deepwater offshore oil & gas projects to drive market

- 11.6.3 MEXICO

- 11.6.3.1 Demand for advanced dynamic positioning systems from offshore oil fields to drive market

- 11.6.4 AFRICA

- 11.6.4.1 Ongoing developments such as BP's Greater Tortue Ahmeyim LNG Project to drive market

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 12.3 REVENUE ANALYSIS, 2021-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Equipment class footprint

- 12.7.5.4 System footprint

- 12.7.5.5 Fit footprint

- 12.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 List of start-ups/SMEs

- 12.8.5.2 Competitive benchmarking of start-ups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 12.9.2 DEALS

- 12.9.3 OTHERS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ABB

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches/developments

- 13.1.1.3.2 Others

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 GE VERNOVA

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Others

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 KONGSBERG MARITIME

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Others

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 WARTSILA

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses and competitive threats

- 13.1.5 BRUNVOLL AS

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Others

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 ROLLS-ROYCE PLC

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.7 SIREHNA

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.3.2 Others

- 13.1.8 NAVIS

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 RH MARINE NETHERLANDS B.V.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches/developments

- 13.1.10 PRAXIS AUTOMATION TECHNOLOGY B.V.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Others

- 13.1.11 JAPAN RADIO CO.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches/developments

- 13.1.11.3.2 Deals

- 13.1.12 ROYAL IHC

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 TWIN DISC, INC.

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.14 AB VOLVO PENTA

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 L3HARRIS TECHNOLOGIES, INC.

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.1 ABB

- 13.2 OTHER PLAYERS

- 13.2.1 COMEX

- 13.2.2 TRITEK POWER AND AUTOMATION

- 13.2.3 MARINE TECHNOLOGIES, LLC

- 13.2.4 NAVIS ENGINEERING

- 13.2.5 KDU

- 13.2.6 MARINE ELECTRONICS

- 13.2.7 THRUSTMASTER OF TEXAS, INC.

- 13.2.8 XENTA S.R.L.

- 13.2.9 SUBSEA CONNECT

- 13.2.10 NORWEGIAN ELECTRIC SYSTEMS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 ANNEXURE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS