|

|

市場調査レポート

商品コード

1714901

宇宙サイバーセキュリティの世界市場:オファリング別、プラットフォーム別、エンドユーザー別、地域別 - 2029年までの予測Space Cybersecurity Market by Offering (Solutions, Services), Platform (Satellites, Space Launch Vehicles, Ground Stations, Spaceports & Launch Facilities, Command & Control Centers), End User and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 宇宙サイバーセキュリティの世界市場:オファリング別、プラットフォーム別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2025年04月23日

発行: MarketsandMarkets

ページ情報: 英文 308 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

宇宙サイバーセキュリティの市場規模は、2024年に45億2,000万米ドルとなりました。

同市場は、9.0%のCAGRで拡大し、2029年には69億6,000万米ドルに達すると予測されています。主な市場促進要因としては、宇宙資産に対するサイバー脅威の増加、宇宙および防衛構想の急速な軍事化、衛星インフラへの依存度の増加、衛星から地上への通信セキュリティに対する高い需要などが挙げられます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | オファリング別、プラットフォーム別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

宇宙サイバーセキュリティ市場は、ソリューション別に、ネットワークセキュリティ、エンドポイント&IoTセキュリティ、クラウドセキュリティ、アプリケーションセキュリティ、ID&アクセス管理、暗号化&トークン化、ログ管理&SIEM、データバックアップ&リカバリ、その他のソリューションに区分されています。このうち、ネットワーク・セキュリティが2024年に最大の市場シェアを占めています。

ネットワーク・セキュリティは、特に宇宙産業におけるサイバーセキュリティの基本です。これは、宇宙組織の地上および宇宙ベースのネットワークをサイバー攻撃や不正アクセスから保護することを含みます。通信、ナビゲーション、科学データ伝送のための衛星システムへの依存度が高まる中、ネットワーク・セキュリティは、これらの重要なネットワークが悪意のある干渉から安全であることを保証します。侵害は、宇宙船、地上局、制御センター間の通信を中断させ、宇宙運営を危険にさらす可能性があります。

欧州宇宙機関(ESA)は、衛星通信ネットワークを保護するために、高度なネットワーク・セキュリティ・ソリューションを導入しています。地上制御システムを保護するために、ファイアウォールと侵入検知システムを利用しています。このネットワーク・セキュリティの枠組みは、通信プロトコルに対するハッキングの試みや、データ漏洩や運用障害の原因となるシステムの脆弱性など、衛星システムを標的としたサイバー脅威からESAの業務を守るのに役立っています。

宇宙サイバーセキュリティ市場は、エンドユーザー別に、防衛、商業、政府に区分されています。宇宙サイバーセキュリティは、ハッキング、データ操作、信号妨害などのサイバー脅威から宇宙システムを保護します。宇宙ミッションの規模と複雑さが拡大するにつれ、サイバー攻撃のリスクはより顕著になっています。衛星やロケットから地上局や宇宙ステーションに至るまで、宇宙インフラにおける脆弱性は、宇宙事業や国家安全保障、営利企業、科学研究の完全性を脅かします。したがって、これらの分野では、重要な宇宙資産とインフラを保護するための特定のサイバーセキュリティ・ソリューションが必要とされています。

北米は、商業および防衛宇宙活動に牽引され、予測期間中、宇宙サイバーセキュリティの最大市場になると予測されています。米国は、国防総省や国家偵察局などの機関が管理する重要な防衛衛星と並んで、スターリンクやプロジェクト・カイパーのようなプログラムで衛星配備をリードしています。これらの資産には、進化する脅威に対処するための高度なサイバーセキュリティ・ソリューションが必要です。米国宇宙軍からの多額の投資は、国家安全保障上の必須事項として宇宙インフラ保護をさらに優先させています。この地域はまた、Lockheed Martin Corporation(米国)、Northrop Grumman(米国)、SpiderOak Inc.(米国)などの主要航空宇宙・サイバーセキュリティ企業の存在からも恩恵を受けています。国家宇宙政策指令5やNISTのガイドラインなどの指令に導かれた強固な規制の枠組みは、公共および民間の宇宙事業者に多額のサイバーセキュリティ予算を投入することを強いています。

当レポートでは、世界の宇宙サイバーセキュリティ市場について調査し、オファリング別、プラットフォーム別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向と混乱

- エコシステム分析

- バリューチェーン分析

- ケーススタディ

- 投資と資金調達のシナリオ

- HSコード

- 2025年~2026年の主な会議とイベント

- 規制状況

- 主要な利害関係者と購入基準

- 技術分析

- 価格分析

- 運用データ

- ビジネスモデル

- マクロ経済見通し

第6章 業界動向

- イントロダクション

- 新たな動向

- 技術ロードマップ

- メガ動向の影響

- 特許分析

第7章 宇宙サイバーセキュリティ市場(オファリング別)

- イントロダクション

- ソリューション

- サービス

第8章 宇宙サイバーセキュリティ市場(プラットフォーム別)

- イントロダクション

- 衛星

- 打ち上げロケット

- 地上局

- スペースポートと発射施設

- 指揮統制センター

- その他

第9章 宇宙サイバーセキュリティ市場(エンドユーザー別)

- イントロダクション

- 防衛

- 商業

- 政府

第10章 宇宙サイバーセキュリティ市場(地域別)

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- アジア太平洋

- PESTLE分析

- 日本

- インド

- オーストラリア

- マレーシア

- その他

- 欧州

- PESTLE分析

- 英国

- ドイツ

- フランス

- イタリア

- その他

- 中東

- PESTLE分析

- GCC

- イスラエル

- その他の地域

- PESTLE分析

- ラテンアメリカ

- アフリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年~2025年

- 収益分析

- 2023年の市場シェア分析

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- THALES

- LOCKHEED MARTIN CORPORATION

- LEONARDO S.P.A.

- SPACEX

- BOOZ ALLEN HAMILTON INC.

- NORTHROP GRUMMAN

- AIRBUS

- THALES ALENIA SPACE

- BAE SYSTEMS

- OHB SE

- MAXAR TECHNOLOGIES

- SPIDER OAK INC.

- GENERAL DYNAMICS CORPORATION

- CISCO SYSTEMS, INC.

- LEIDOS

- スタートアップ/中小企業

- XAGE SECURITY, INC.

- NIGHTWING

- D-ORBIT

- CYSEC

- REDWIRE CORPORATION

- GLOBALS INC.

- ID QUANTIQUE

- KONGSBERG DEFENSE AND AEROSPACE

- TELESPAZIO S.P.A.

- TYVAK INTERNATIONAL

- DARKTRACE HOLDINGS LIMITED

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2023

- TABLE 2 SPACE CYBERSECURITY MARKET SIZE ESTIMATION PROCEDURE

- TABLE 3 ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 4 NASA COLLABORATED WITH BITSIGHT TO ENHANCE CYBERSECURITY MONITORING FOR ITS VENDORS

- TABLE 5 ERG AEROSPACE REDUCED IT-RELATED RISKS AND COSTS BY IMPLEMENTING SNAP TECH IT SOLUTIONS

- TABLE 6 SPIDEROAK'S ORBITSECURE SOFTWARE ALLOWED LOCKHEED MARTIN TO PROTECT SENSITIVE MILITARY AND COMMERCIAL SATELLITE DATA

- TABLE 7 AIRBUS PARTNERED WITH EUROPEAN FIRMS TO ESTABLISH IRIS2 SECURE SATELLITE NETWORK

- TABLE 8 IMPORT DATA FOR HS CODE 847330-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 847330-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 17 KEY BUYING CRITERIA FOR END USERS

- TABLE 18 INDICATIVE PRICING ANALYSIS FOR SPACE CYBERSECURITY OFFERINGS, 2023

- TABLE 19 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, 2023

- TABLE 20 SPACE AND GROUND-BASED PLATFORMS/ASSETS, BY TYPE, 2021-2025 (UNITS)

- TABLE 21 ACTIVE SATELLITES, BY ORBIT, 2021-2025 (UNITS)

- TABLE 22 PATENT ANALYSIS, 2021-2024

- TABLE 23 SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 24 SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 25 SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 26 SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 27 NETWORK SECURITY: SPACE CYBERSECURITY MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 28 NETWORK SECURITY: SPACE CYBERSECURITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 29 ENDPOINT & IOT SECURITY: SPACE CYBERSECURITY MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 30 ENDPOINT & IOT SECURITY: SPACE CYBERSECURITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 31 CLOUD SECURITY: SPACE CYBERSECURITY MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 32 CLOUD SECURITY: SPACE CYBERSECURITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 33 APPLICATION SECURITY: SPACE CYBERSECURITY MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 34 APPLICATION SECURITY: SPACE CYBERSECURITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 35 SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 36 SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 37 PROFESSIONAL SERVICES: SPACE CYBERSECURITY MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 38 PROFESSIONAL SERVICES: SPACE CYBERSECURITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 39 SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 40 SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 41 SATELLITES: SPACE CYBERSECURITY MARKET, BY SATELLITE ORBIT, 2021-2023 (USD MILLION)

- TABLE 42 SATELLITES: SPACE CYBERSECURITY MARKET, BY SATELLITE ORBIT, 2024-2029 (USD MILLION)

- TABLE 43 LAUNCH VEHICLES: SPACE CYBERSECURITY MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 44 LAUNCH VEHICLES: SPACE CYBERSECURITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 45 SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 46 SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 47 SPACE CYBERSECURITY MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 48 SPACE CYBERSECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 50 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 51 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 52 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 53 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 54 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 55 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 56 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 57 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 58 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 59 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY SATELLITE ORBIT, 2021-2023 (USD MILLION)

- TABLE 60 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY SATELLITE ORBIT, 2024-2029 (USD MILLION)

- TABLE 61 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY LAUNCH VEHICLE, 2021-2023 (USD MILLION)

- TABLE 62 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY LAUNCH VEHICLE, 2024-2029 (USD MILLION)

- TABLE 63 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 64 NORTH AMERICA: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 65 US: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 66 US: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 67 US: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 68 US: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 69 US: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 70 US: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 71 US: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 72 US: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 73 US: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 74 US: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 75 CANADA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 76 CANADA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 77 CANADA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 78 CANADA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 79 CANADA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 80 CANADA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 81 CANADA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 82 CANADA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 83 CANADA: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 84 CANADA: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 85 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 86 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 87 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 88 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 89 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 90 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 91 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 92 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 94 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 95 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY SATELLITE ORBIT, 2021-2023 (USD MILLION)

- TABLE 96 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY SATELLITE ORBIT, 2024-2029 (USD MILLION)

- TABLE 97 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY LAUNCH VEHICLE, 2021-2023 (USD MILLION)

- TABLE 98 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY LAUNCH VEHICLE, 2024-2029 (USD MILLION)

- TABLE 99 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 100 ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 101 JAPAN: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 102 JAPAN: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 103 JAPAN: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 104 JAPAN: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 105 JAPAN: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 106 JAPAN: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 107 JAPAN: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 108 JAPAN: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 109 JAPAN: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 110 JAPAN: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 111 INDIA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 112 INDIA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 113 INDIA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 114 INDIA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 115 INDIA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 116 INDIA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 117 INDIA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 118 INDIA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 119 INDIA: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 120 INDIA: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 121 AUSTRALIA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 122 AUSTRALIA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 123 AUSTRALIA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 124 AUSTRALIA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 125 AUSTRALIA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 126 AUSTRALIA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 127 AUSTRALIA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 128 AUSTRALIA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 129 AUSTRALIA: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 130 AUSTRALIA: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 131 MALAYSIA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 132 MALAYSIA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 133 MALAYSIA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 134 MALAYSIA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 135 MALAYSIA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 136 MALAYSIA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 137 MALAYSIA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 138 MALAYSIA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 139 MALAYSIA: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 140 MALAYSIA: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 151 EUROPE: SPACE CYBERSECURITY MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 152 EUROPE: SPACE CYBERSECURITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 153 EUROPE: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 154 EUROPE: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 155 EUROPE: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 156 EUROPE: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 157 EUROPE: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 158 EUROPE: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 159 EUROPE: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 160 EUROPE: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 161 EUROPE: SPACE CYBERSECURITY MARKET, BY SATELLITE ORBIT, 2021-2023 (USD MILLION)

- TABLE 162 EUROPE: SPACE CYBERSECURITY MARKET, BY SATELLITE ORBIT, 2024-2029 (USD MILLION)

- TABLE 163 EUROPE: SPACE CYBERSECURITY MARKET, BY LAUNCH VEHICLE, 2021-2023 (USD MILLION)

- TABLE 164 EUROPE: SPACE CYBERSECURITY MARKET, BY LAUNCH VEHICLE, 2024-2029 (USD MILLION)

- TABLE 165 EUROPE: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 166 EUROPE: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 167 UK: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 168 UK: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 169 UK: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 170 UK: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 171 UK: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 172 UK: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 173 UK: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 174 UK: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 175 UK: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 176 UK: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 177 GERMANY: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 178 GERMANY: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 179 GERMANY: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 180 GERMANY: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 181 GERMANY: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 182 GERMANY: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 183 GERMANY: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 184 GERMANY: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 185 GERMANY: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 186 GERMANY: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 187 FRANCE: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 188 FRANCE: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 189 FRANCE: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 190 FRANCE: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 191 FRANCE: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 192 FRANCE: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 193 FRANCE: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 194 FRANCE: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 195 FRANCE: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 196 FRANCE: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 197 ITALY: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 198 ITALY: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 199 ITALY: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 200 ITALY: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 201 ITALY: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 202 ITALY: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 203 ITALY: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 204 ITALY: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 205 ITALY: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 206 ITALY: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 207 REST OF EUROPE: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 208 REST OF EUROPE: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 209 REST OF EUROPE: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 210 REST OF EUROPE: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 211 REST OF EUROPE: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 212 REST OF EUROPE: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 213 REST OF EUROPE: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 214 REST OF EUROPE: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 215 REST OF EUROPE: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 216 REST OF EUROPE: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 217 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 218 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 219 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY GCC COUNTRY, 2021-2023 (USD MILLION)

- TABLE 220 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY GCC COUNTRY, 2024-2029 (USD MILLION)

- TABLE 221 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 222 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 223 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 224 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 225 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 226 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 227 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 228 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 229 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY SATELLITE ORBIT, 2021-2023 (USD MILLION)

- TABLE 230 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY SATELLITE ORBIT, 2024-2029 (USD MILLION)

- TABLE 231 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY LAUNCH VEHICLE, 2021-2023 (USD MILLION)

- TABLE 232 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY LAUNCH VEHICLE, 2024-2029 (USD MILLION)

- TABLE 233 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 234 MIDDLE EAST: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 235 UAE: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 236 UAE: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 237 UAE: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 238 UAE: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 239 UAE: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 240 UAE: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 241 UAE: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 242 UAE: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 243 UAE: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 244 UAE: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 245 SAUDI ARABIA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 246 SAUDI ARABIA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 247 SAUDI ARABIA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 248 SAUDI ARABIA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 249 SAUDI ARABIA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 250 SAUDI ARABIA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 251 SAUDI ARABIA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 252 SAUDI ARABIA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 253 SAUDI ARABIA: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 254 SAUDI ARABIA: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 255 ISRAEL: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 256 ISRAEL: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 257 ISRAEL: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 258 ISRAEL: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 259 ISRAEL: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 260 ISRAEL: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 261 ISRAEL: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 262 ISRAEL: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 263 ISRAEL: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 264 ISRAEL: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 265 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 266 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 267 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 268 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 269 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 270 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 271 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 272 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 273 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 274 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 275 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY SATELLITE ORBIT, 2021-2023 (USD MILLION)

- TABLE 276 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY SATELLITE ORBIT, 2024-2029 (USD MILLION)

- TABLE 277 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY LAUNCH VEHICLE, 2021-2023 (USD MILLION)

- TABLE 278 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY LAUNCH VEHICLE, 2024-2029 (USD MILLION)

- TABLE 279 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 280 REST OF THE WORLD: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 281 LATIN AMERICA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 282 LATIN AMERICA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 283 LATIN AMERICA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 284 LATIN AMERICA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 285 LATIN AMERICA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 286 LATIN AMERICA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 287 LATIN AMERICA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 288 LATIN AMERICA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 289 LATIN AMERICA: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 290 LATIN AMERICA: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 291 AFRICA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 292 AFRICA: SPACE CYBERSECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 293 AFRICA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2021-2023 (USD MILLION)

- TABLE 294 AFRICA: SPACE CYBERSECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 295 AFRICA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 296 AFRICA: SPACE CYBERSECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 297 AFRICA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2021-2023 (USD MILLION)

- TABLE 298 AFRICA: SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 299 AFRICA: SPACE CYBERSECURITY MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 300 AFRICA: SPACE CYBERSECURITY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 301 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 302 SPACE CYBERSECURITY MARKET: DEGREE OF COMPETITION

- TABLE 303 COMPANY REGION FOOTPRINT

- TABLE 304 COMPANY OFFERING FOOTPRINT

- TABLE 305 COMPANY PLATFORM FOOTPRINT

- TABLE 306 DETAILED LIST OF KEY STARTUPS/SMES AND MEDIUM/LARGE ENTERPRISES

- TABLE 307 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 308 SPACE CYBERSECURITY MARKET: PRODUCT LAUNCHES, JUNE 2021-MARCH 2025

- TABLE 309 SPACE CYBERSECURITY MARKET: DEALS, JUNE 2021-MARCH 2025

- TABLE 310 SPACE CYBERSECURITY MARKET: OTHER DEVELOPMENTS, JUNE 2021-MARCH 2025

- TABLE 311 THALES: COMPANY OVERVIEW

- TABLE 312 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 THALES: DEALS

- TABLE 314 THALES: OTHER DEVELOPMENTS

- TABLE 315 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 316 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 318 LOCKHEED MARTIN CORPORATION: OTHER DEVELOPMENTS

- TABLE 319 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 320 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 LEONARDO S.P.A.: DEALS

- TABLE 322 LEONARDO S.P.A.: OTHER DEVELOPMENTS

- TABLE 323 SPACEX: COMPANY OVERVIEW

- TABLE 324 SPACEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 325 SPACEX: OTHER DEVELOPMENTS

- TABLE 326 BOOZ ALLEN HAMILTON INC.: COMPANY OVERVIEW

- TABLE 327 BOOZ ALLEN HAMILTON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 BOOZ ALLEN HAMILTON INC.: DEALS

- TABLE 329 BOOZ ALLEN HAMILTON INC.: OTHER DEVELOPMENTS

- TABLE 330 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 331 NORTHROP GRUMMAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 NORTHROP GRUMMAN: DEALS

- TABLE 333 NORTHROP GRUMMAN: OTHER DEVELOPMENTS

- TABLE 334 AIRBUS: COMPANY OVERVIEW

- TABLE 335 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 336 AIRBUS: DEALS

- TABLE 337 AIRBUS: OTHER DEVELOPMENTS

- TABLE 338 THALES ALENIA SPACE: COMPANY OVERVIEW

- TABLE 339 THALES ALENIA SPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 THALES ALENIA SPACE: DEALS

- TABLE 341 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 342 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 OHB SE: COMPANY OVERVIEW

- TABLE 344 OHB SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 345 OHB SE: DEALS

- TABLE 346 MAXAR TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 347 MAXAR TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 348 MAXAR TECHNOLOGIES: OTHER DEVELOPMENTS

- TABLE 349 SPIDEROAK INC.: COMPANY OVERVIEW

- TABLE 350 SPIDEROAK INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 351 SPIDEROAK INC.: PRODUCT LAUNCHES

- TABLE 352 SPIDEROAK INC.: OTHER DEVELOPMENTS

- TABLE 353 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 354 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 355 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 356 GENERAL DYNAMICS CORPORATION: OTHER DEVELOPMENTS

- TABLE 357 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 358 CISCO SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 359 CISCO SYSTEMS, INC.: DEALS

- TABLE 360 CISCO SYSTEMS, INC.: OTHER DEVELOPMENTS

- TABLE 361 LEIDOS: COMPANY OVERVIEW

- TABLE 362 LEIDOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 363 LEIDOS: OTHER DEVELOPMENTS

- TABLE 364 XAGE SECURITY, INC.: COMPANY OVERVIEW

- TABLE 365 NIGHTWING: COMPANY OVERVIEW

- TABLE 366 D-ORBIT: COMPANY OVERVIEW

- TABLE 367 CYSEC: COMPANY OVERVIEW

- TABLE 368 REDWIRE CORPORATION: COMPANY OVERVIEW

- TABLE 369 GLOBALS INC.: COMPANY OVERVIEW

- TABLE 370 ID QUANTIQUE: COMPANY OVERVIEW

- TABLE 371 KONGSBERG DEFENSE AND AEROSPACE: COMPANY OVERVIEW

- TABLE 372 TELESPAZIO S.P.A.: COMPANY OVERVIEW

- TABLE 373 TYVAK INTERNATIONAL: COMPANY OVERVIEW

- TABLE 374 DARKTRACE HOLDINGS LIMITED: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 SPACE CYBERSECURITY MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 SERVICES TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 8 SATELLITES SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 9 DEFENSE TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO BE LARGEST MARKET FOR SPACE CYBERSECURITY DURING FORECAST PERIOD

- FIGURE 11 NEED TO SECURE SATELLITE AND CRITICAL INFRASTRUCTURE FROM CYBERATTACKS TO DRIVE MARKET

- FIGURE 12 NETWORK SECURITY SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 13 NETWORK FIREWALLS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 LEO SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 15 DESIGN, CONSULTING, AND IMPLEMENTATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 SPACE CYBERSECURITY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 18 ECOSYSTEM ANALYSIS

- FIGURE 19 VALUE CHAIN ANALYSIS

- FIGURE 20 INVESTMENT & FUNDING SCENARIO, 2019-2024 (USD MILLION)

- FIGURE 21 IMPORT DATA FOR HS CODE 847330-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 22 EXPORT DATA FOR HS CODE 847330-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 24 KEY BUYING CRITERIA FOR END USERS

- FIGURE 25 SPACE CYBERSECURITY: BUSINESS MODELS

- FIGURE 26 EVOLUTION OF SPACE CYBERSECURITY TECHNOLOGIES

- FIGURE 27 ROADMAP FOR SPACE CYBERSECURITY TECHNOLOGIES

- FIGURE 28 EMERGING TECHNOLOGY TRENDS IN SPACE CYBERSECURITY MARKET

- FIGURE 29 PATENTS GRANTED, 2014-2024

- FIGURE 30 SPACE CYBERSECURITY MARKET, BY OFFERING, 2024 VS. 2029 (USD MILLION)

- FIGURE 31 SPACE CYBERSECURITY MARKET, BY PLATFORM, 2024 VS. 2029 (USD MILLION)

- FIGURE 32 SPACE CYBERSECURITY MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 33 SPACE CYBERSECURITY MARKET: REGIONAL SNAPSHOT

- FIGURE 34 NORTH AMERICA: SPACE CYBERSECURITY MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: SPACE CYBERSECURITY MARKET SNAPSHOT

- FIGURE 36 EUROPE: SPACE CYBERSECURITY MARKET SNAPSHOT

- FIGURE 37 MIDDLE EAST: SPACE CYBERSECURITY MARKET SNAPSHOT

- FIGURE 38 REST OF THE WORLD: SPACE CYBERSECURITY MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 40 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- FIGURE 41 BRAND/PRODUCT COMPARISON

- FIGURE 42 SPACE CYBERSECURITY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 43 COMPANY FOOTPRINT

- FIGURE 44 SPACE CYBERSECURITY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 45 THALES: COMPANY SNAPSHOT

- FIGURE 46 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 48 BOOZ ALLEN HAMILTON INC.: COMPANY SNAPSHOT

- FIGURE 49 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 50 AIRBUS: COMPANY SNAPSHOT

- FIGURE 51 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 52 OHB SE: COMPANY SNAPSHOT

- FIGURE 53 MAXAR TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 54 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 56 LEIDOS: COMPANY SNAPSHOT

The space cybersecurity market is estimated at USD 4.52 billion in 2024 and is expected to reach USD 6.96 billion by 2029, with a CAGR of 9.0%. Key market drivers include the rise in cyber threats to space assets, rapid militarization of space and defense initiatives, increased dependency on satellite infrastructure, and high demand for satellite-to-ground communication security.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Platform, End User and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The network security segment is projected to account for the largest share of the space cybersecurity market during the forecast period."

The space cybersecurity market, by solution, has been segmented into network security, endpoint & IoT security, cloud security, application security, identity & access management, encryption & tokenization, log management & SIEM, data backup & recovery, and other solutions. Among these, network security held the largest market share in 2024.

Network security is fundamental to cybersecurity, particularly in the space industry. It involves protecting a space organization's terrestrial and space-based networks from cyberattacks and unauthorized access. With the increasing reliance on satellite systems for communication, navigation, and scientific data transmission, network security ensures these critical networks are safe from malicious interference. Breaches can compromise space operations, disrupting communication between spacecraft, ground stations, and control centers.

The European Space Agency (ESA) has implemented advanced network security solutions to protect its satellite communication networks. It utilizes firewalls and intrusion detection systems to safeguard ground control systems. This network security framework helps protect ESA's operations from cyber threats targeting their satellite systems, such as hacking attempts on communication protocols or system vulnerabilities that could result in data leakage or operational failures.

"The commercial segment is projected to exhibit the fastest growth during the forecast period."

The space cybersecurity market, by end user, has been segmented into defense, commercial, and government. Space cybersecurity protects space systems from cyber threats, including hacking, data manipulation, and signal jamming. With space missions expanding in scale and complexity, cyberattack risks are becoming more pronounced. Vulnerabilities in space infrastructure-from satellites and launch vehicles to ground stations and space stations-threaten the integrity of space operations and national security, commercial enterprises, and scientific research. Thus, these sectors need specific cybersecurity solutions to safeguard critical space assets and infrastructure.

"North America is projected to lead the space cybersecurity market during the forecast period."

North America is expected to be the largest market for space cybersecurity during the forecast period, driven by commercial and defense space activities. The US leads in satellite deployments with programs like Starlink and Project Kuiper, alongside essential defense satellites managed by agencies such as the Department of Defense and the National Reconnaissance Office. These assets necessitate advanced cybersecurity solutions to address evolving threats. Significant investments from the US Space Force further prioritize space infrastructure protection as a national security imperative. The region also benefits from the presence of leading aerospace and cybersecurity companies like Lockheed Martin Corporation (US), Northrop Grumman (US), and SpiderOak Inc. (US). A robust regulatory framework, guided by directives such as the National Space Policy Directive 5 and NIST guidelines, compels public and private space operators to commit substantial cybersecurity budgets.

Breakdown of Primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 55%; Tier 2 - 25%; and Tier 3 - 20%

- By Designation: Directors - 50%; Managers - 30%; and Others - 20%

- By Region: North America - 30%; Europe - 20%; Asia Pacific - 35%; Middle East - 10%, and Rest of the World - 5%

Thales (France), Leonardo S.p.A. (Italy), Lockheed Martin Corporation (US), General Dynamics Corporation (US), Booz Allen Hamilton (US), SpiderOak Inc.(US), Leidos Holdings, Inc. (US), BAE Systems plc (UK), and Airbus (Netherlands) are among the leading players operating in the space cybersecurity market.

Research Coverage

The study examines the space cybersecurity market across various segments and subsegments. Its objective is to estimate the market size and growth potential based on offerings, platforms, end users, and regions. Additionally, this study includes a comprehensive competitive analysis of key market players, featuring their company profiles, essential observations related to their solutions and business offerings, recent developments, and the key market strategies they have adopted.

Key Benefits of Buying this Report:

This report provides valuable information for market leaders and new entrants in the space cybersecurity sector, including close estimates of revenue figures for the overall market and its subsegments. It covers the entire ecosystem of space cybersecurity, helping stakeholders understand the competitive landscape and gain insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report allows stakeholders to gauge market dynamics by highlighting key drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers, restraints, opportunities, and challenges impacting the market

- Product Development: In-depth analysis of product innovation/development by companies across various regions

- Market Development: Comprehensive information about lucrative

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the space cybersecurity market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and solution and service offerings of leading players, including Thales (France), Leonardo S.p.A. (Italy), Lockheed Martin Corporation (US), General Dynamics Corporation (US), Booz Allen Hamilton (US), SpiderOak Inc. (US), Leidos Holdings, Inc. (US), BAE Systems plc (UK), and Airbus (Netherlands)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary interviews

- 2.1.2.2 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 SEGMENTS & SUBSEGMENTS

- 2.3.2 RESEARCH APPROACH & METHODOLOGY

- 2.3.2.1 Bottom-up approach

- 2.3.2.2 Top-down approach

- 2.4 DATA TRIANGULATION AND VALIDATION

- 2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.5 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SPACE CYBERSECURITY MARKET

- 4.2 SPACE CYBERSECURITY MARKET, BY SOLUTION

- 4.3 SPACE CYBERSECURITY MARKET, BY NETWORK SECURITY SOLUTION

- 4.4 SPACE CYBERSECURITY MARKET, BY SATELLITE ORBIT

- 4.5 SPACE CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

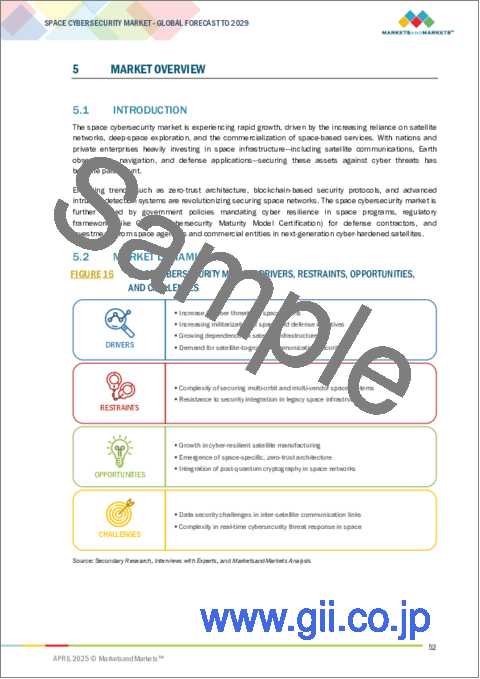

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in cyber threats on space assets

- 5.2.1.2 Increasing militarization of space and defense initiatives

- 5.2.1.3 Growing dependency on satellite infrastructure

- 5.2.1.4 Demand for satellite-to-ground communication security

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexity of securing multi-orbit and multi-vendor space systems

- 5.2.2.2 Resistance to security integration in legacy space infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth in cyber-resilient satellite manufacturing

- 5.2.3.2 Emergence of space-specific, zero-trust architecture

- 5.2.3.3 Integration of post-quantum cryptography into space networks

- 5.2.4 CHALLENGES

- 5.2.4.1 Data security challenges in inter-satellite communication links

- 5.2.4.2 Complexity in real-time cybersecurity threat response in space

- 5.2.1 DRIVERS

- 5.3 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 PRIVATE AND SMALL ENTERPRISES

- 5.4.3 END USERS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 CASE STUDIES

- 5.7 INVESTMENT & FUNDING SCENARIO

- 5.8 HS CODES

- 5.8.1 IMPORT SCENARIO

- 5.8.2 EXPORT SCENARIO

- 5.9 KEY CONFERENCES & EVENTS, 2025-2026

- 5.10 REGULATORY LANDSCAPE

- 5.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Encryption and quantum cryptography

- 5.12.1.2 Artificial Intelligence and Machine Learning (AI/ML)

- 5.12.1.3 Blockchain

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 Cloud computing for space data storage

- 5.12.2.2 Intrusion Detection and Prevention System (IDPS)

- 5.12.3 ADJACENT TECHNOLOGIES

- 5.12.3.1 Cybersecurity for IoT (Internet of Things)

- 5.12.3.2 5G and edge computing

- 5.12.1 KEY TECHNOLOGIES

- 5.13 PRICING ANALYSIS

- 5.14 OPERATIONAL DATA

- 5.15 BUSINESS MODELS

- 5.15.1 PRODUCT-BASED MODEL (HARDWARE & SOFTWARE SALES)

- 5.15.2 CYBERSECURITY-AS-A-SERVICE (CSAAS) MODEL

- 5.15.3 SYSTEM INTEGRATION & CONSULTING MODEL

- 5.15.4 HYBRID BUSINESS MODEL

- 5.16 MACROECONOMIC OUTLOOK

- 5.16.1 INTRODUCTION

- 5.16.2 NORTH AMERICA

- 5.16.3 EUROPE

- 5.16.4 ASIA PACIFIC

- 5.16.5 MIDDLE EAST

- 5.16.6 REST OF THE WORLD

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 EMERGING TRENDS

- 6.2.1 ZERO TRUST ARCHITECTURE (ZTA)

- 6.2.2 ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML) FOR THREAT DETECTION

- 6.2.3 BLOCKCHAIN FOR SECURE DATA TRANSMISSION

- 6.2.4 QUANTUM KEY DISTRIBUTION (QKD)

- 6.2.5 CYBERSECURITY MEASURES FOR SPACE ASSETS IN ORBIT

- 6.3 TECHNOLOGY ROADMAP

- 6.4 IMPACT OF MEGA TRENDS

- 6.4.1 ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML)

- 6.4.2 GEN AI (GENERATIVE AI)

- 6.4.3 QUANTUM CRYPTOGRAPHY AND COMPUTING

- 6.4.4 AUTONOMOUS AND EDGE SECURITY FOR SPACE SYSTEMS

- 6.5 PATENT ANALYSIS

7 SPACE CYBERSECURITY MARKET, BY OFFERING

- 7.1 INTRODUCTION

- 7.2 SOLUTIONS

- 7.2.1 NETWORK SECURITY

- 7.2.1.1 Network firewall

- 7.2.1.1.1 Risk of satellite mission failure to drive market

- 7.2.1.2 Intrusion detection & prevention systems

- 7.2.1.2.1 Need for prevention of malicious activities or policy violations to drive market

- 7.2.1.3 Virtual private network

- 7.2.1.3.1 Surge in demand from space agencies to protect communication links to drive market

- 7.2.1.4 Network access control

- 7.2.1.4.1 Need for controlled access to mission-critical systems to drive market

- 7.2.1.5 Other network security solutions

- 7.2.1.1 Network firewall

- 7.2.2 ENDPOINT & IOT SECURITY

- 7.2.2.1 Antivirus & anti-malware

- 7.2.2.1.1 Increasing sophistication of cyberattacks to drive market

- 7.2.2.2 Endpoint detection & response

- 7.2.2.2.1 Rising dependency on remote space devices to drive market

- 7.2.2.3 Patch management

- 7.2.2.3.1 Focus on eliminating software vulnerabilities to drive market

- 7.2.2.4 Other endpoint & IoT security solutions

- 7.2.2.1 Antivirus & anti-malware

- 7.2.3 CLOUD SECURITY

- 7.2.3.1 Cloud access security broker

- 7.2.3.1.1 Vast data generation by space missions to drive market

- 7.2.3.2 Security posture management

- 7.2.3.2.1 Dependency on cloud computing for mission-critical operations to drive market

- 7.2.3.1 Cloud access security broker

- 7.2.4 APPLICATION SECURITY

- 7.2.4.1 Secure development tools

- 7.2.4.1.1 Need for secure mission software to drive market

- 7.2.4.2 Web application firewall

- 7.2.4.2.1 Increasing risk of cyberattacks at space mission web interfaces to drive market

- 7.2.4.3 Other application security solutions

- 7.2.4.1 Secure development tools

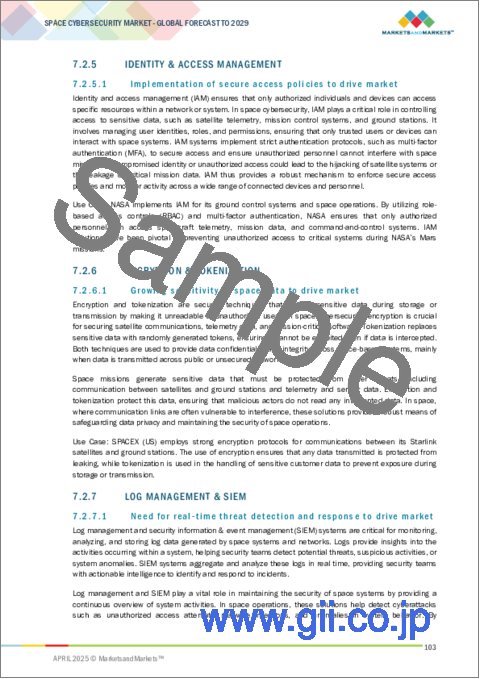

- 7.2.5 IDENTITY & ACCESS MANAGEMENT

- 7.2.5.1 Implementation of secure access policies to drive market

- 7.2.6 ENCRYPTION & TOKENIZATION

- 7.2.6.1 Growing sensitivity of space data to drive market

- 7.2.7 LOG MANAGEMENT & SIEM

- 7.2.7.1 Need for real-time threat detection and response to drive market

- 7.2.8 DATA BACKUP & RECOVERY

- 7.2.8.1 High risk associated with space missions to drive market

- 7.2.9 OTHER SOLUTIONS

- 7.2.1 NETWORK SECURITY

- 7.3 SERVICES

- 7.3.1 PROFESSIONAL SERVICES

- 7.3.1.1 Design, consulting, and implementation

- 7.3.1.1.1 Heightened demand for tailored cybersecurity strategies to drive market

- 7.3.1.2 Risk & threat management

- 7.3.1.2.1 Emphasis on reducing likelihood of security breaches to drive market

- 7.3.1.3 Support & maintenance

- 7.3.1.3.1 Need for continuous maintenance services in prolonged space missions to drive market

- 7.3.1.4 Training & education

- 7.3.1.4.1 Increasing complexity of space systems to drive market

- 7.3.1.1 Design, consulting, and implementation

- 7.3.2 MANAGED SECURITY SERVICES

- 7.3.2.1 Emerging trend of outsourcing cybersecurity services to drive market

- 7.3.1 PROFESSIONAL SERVICES

8 SPACE CYBERSECURITY MARKET, BY PLATFORM

- 8.1 INTRODUCTION

- 8.2 SATELLITES

- 8.2.1 LEO

- 8.2.1.1 Integration of robust security frameworks to drive market

- 8.2.2 MEO

- 8.2.2.1 Ongoing development of advanced security solutions to drive market

- 8.2.3 GEO

- 8.2.3.1 Susceptibility of GEOs to cyberattacks to drive market

- 8.2.1 LEO

- 8.3 LAUNCH VEHICLES

- 8.3.1 SMALL LIFT LAUNCH VEHICLES

- 8.3.1.1 Risk of mission failure and loss of valuable payloads to drive market

- 8.3.2 MEDIUM & HEAVY VEHICLES

- 8.3.2.1 Substantial investments in advanced encryption techniques to drive market

- 8.3.1 SMALL LIFT LAUNCH VEHICLES

- 8.4 GROUND STATIONS

- 8.4.1 DEPLOYMENT OF NEXT-GENERATION FIREWALLS FOR PREVENTING UNAUTHORIZED ACCESS TO DRIVE MARKET

- 8.5 SPACEPORTS & LAUNCH FACILITIES

- 8.5.1 INCREASE IN SPACE ACTIVITIES TO DRIVE MARKET

- 8.6 COMMAND & CONTROL CENTERS

- 8.6.1 IMPLEMENTATION OF MULTI-LAYERED CYBERSECURITY MEASURES TO DRIVE MARKET

- 8.7 OTHER PLATFORMS

9 SPACE CYBERSECURITY MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 DEFENSE

- 9.2.1 GROWING INVESTMENTS IN ROBUST SPACE CYBERSECURITY SOLUTIONS TO DRIVE MARKET

- 9.3 COMMERCIAL

- 9.3.1 NEED FOR SECURE SATELLITE INFRASTRUCTURE TO DRIVE MARKET

- 9.4 GOVERNMENT

- 9.4.1 INCREASING RELIANCE ON SPACE FOR NATIONAL SECURITY TO DRIVE MARKET

10 SPACE CYBERSECURITY MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 PESTLE ANALYSIS

- 10.2.2 US

- 10.2.2.1 Emphasis on securing space infrastructure to drive market

- 10.2.3 CANADA

- 10.2.3.1 Rising investments in national space missions to drive market

- 10.3 ASIA PACIFIC

- 10.3.1 PESTLE ANALYSIS

- 10.3.2 JAPAN

- 10.3.2.1 Strategic space defense initiatives to drive market

- 10.3.3 INDIA

- 10.3.3.1 Booming space industry to drive market

- 10.3.4 AUSTRALIA

- 10.3.4.1 Focus on secure space operations to drive market

- 10.3.5 MALAYSIA

- 10.3.5.1 Need for enhanced satellite protection to drive market

- 10.3.6 REST OF ASIA PACIFIC

- 10.4 EUROPE

- 10.4.1 PESTLE ANALYSIS

- 10.4.2 UK

- 10.4.2.1 Government-backed investments and international partnerships to drive market

- 10.4.3 GERMANY

- 10.4.3.1 Increasing threats to space infrastructure to drive market

- 10.4.4 FRANCE

- 10.4.4.1 Active participation in European space initiatives to drive market

- 10.4.5 ITALY

- 10.4.5.1 Collaboration with other EU nations and international partners to drive market

- 10.4.6 REST OF EUROPE

- 10.5 MIDDLE EAST

- 10.5.1 PESTLE ANALYSIS

- 10.5.2 GCC

- 10.5.2.1 UAE

- 10.5.2.1.1 Increasing focus on securing satellite networks to drive market

- 10.5.2.2 Saudi Arabia

- 10.5.2.2.1 Need for cybersecurity solutions amid expanding space programs to drive market

- 10.5.2.1 UAE

- 10.5.3 ISRAEL

- 10.5.3.1 Elevated demand for advanced defense systems and satellite security technologies to drive market

- 10.6 REST OF THE WORLD

- 10.6.1 PESTLE ANALYSIS

- 10.6.2 LATIN AMERICA

- 10.6.2.1 Need for addressing cybersecurity issues to drive market

- 10.6.3 AFRICA

- 10.6.3.1 Growing dependency on satellite communication to drive market

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES

- 11.8.2 DEALS

- 11.8.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 THALES

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 LOCKHEED MARTIN CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 LEONARDO S.P.A.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 SPACEX

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 BOOZ ALLEN HAMILTON INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.3.2 Other developments

- 12.1.6 NORTHROP GRUMMAN

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.3.2 Other developments

- 12.1.7 AIRBUS

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.3.2 Other developments

- 12.1.8 THALES ALENIA SPACE

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 BAE SYSTEMS

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 OHB SE

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.11 MAXAR TECHNOLOGIES

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Other developments

- 12.1.12 SPIDER OAK INC.

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches

- 12.1.12.3.2 Other developments

- 12.1.13 GENERAL DYNAMICS CORPORATION

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.13.3.2 Other developments

- 12.1.14 CISCO SYSTEMS, INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.14.3.2 Other developments

- 12.1.15 LEIDOS

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Other developments

- 12.1.1 THALES

- 12.2 STARTUPS/SMES

- 12.2.1 XAGE SECURITY, INC.

- 12.2.2 NIGHTWING

- 12.2.3 D-ORBIT

- 12.2.4 CYSEC

- 12.2.5 REDWIRE CORPORATION

- 12.2.6 GLOBALS INC.

- 12.2.7 ID QUANTIQUE

- 12.2.8 KONGSBERG DEFENSE AND AEROSPACE

- 12.2.9 TELESPAZIO S.P.A.

- 12.2.10 TYVAK INTERNATIONAL

- 12.2.11 DARKTRACE HOLDINGS LIMITED

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 ANNEXURE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS