|

|

市場調査レポート

商品コード

1712824

アプリケーションライフサイクル管理の世界市場:オファリング別、プラットフォーム別、組織規模別、展開モード別、業界別、地域別 - 2029年までの予測Application Lifecycle Management Market by Offering (Software, Services), Platform (Web-based ALM, Mobile-based ALM), Deployment (On-premises, Cloud), Vertical (IT & Software development, Telecom, BFSI) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| アプリケーションライフサイクル管理の世界市場:オファリング別、プラットフォーム別、組織規模別、展開モード別、業界別、地域別 - 2029年までの予測 |

|

出版日: 2025年04月17日

発行: MarketsandMarkets

ページ情報: 英文 263 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

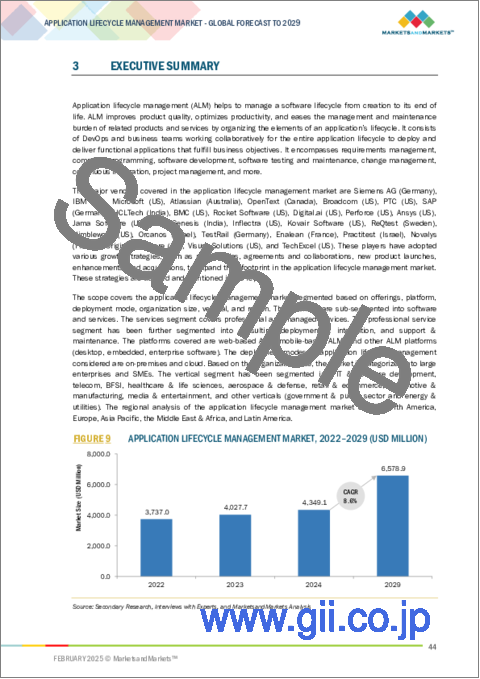

アプリケーションライフサイクル管理の市場規模は、2024年に43億5,000万米ドルとなりました。

同市場は、2029年には65億8,000万米ドルに達すると推定され、年間平均成長率(CAGR)は8.6%と見込まれています。開発プロセスを組織の目標に結びつけることで、ソフトウェアデリバリーのパフォーマンスを高める戦略として、価値ストリーム管理(VSM)を導入する企業が増えています。価値ストリーム管理(VSM)へのシフトは、ワークフローの監視と合理化を改善するVSM機能を実装したALMプラットフォームの採用を企業に促しています。これらのプラットフォームはVSM機能を統合しており、開発パイプラインをエンドツーエンドで可視化し、チームがボトルネックを特定し、ワークフローを最適化し、開発努力を主要なビジネス目標に合わせることを可能にします。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2029年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント別 | オファリング別、プラットフォーム別、組織規模別、展開モード別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

ウェブベースのアプリケーションライフサイクル管理プラットフォームは、単一のインターネット・ブラウザ・インターフェイスからアプリケーション開発全体を安全に管理する統合システムをチームに提供します。このようなソリューションは、バージョン管理、プロジェクト監視、自動テスト、配備監視のための重要な機能を提供することで、最新のチームがプロジェクトに同時に取り組むことを可能にします。ウェブベースのツールは、分散したチームが最新の情報を効率的に共有できるため、組織が開発ワークフローを最適に管理するのに役立ちます。このツールは柔軟なスケーリングを可能にし、資本集約的なインフラストラクチャのセットアップを行うことなく、ビジネスがシステムを通じて変革する必要がある場合に、企業が運用能力を変更できるよう支援します。WebベースのALMプラットフォームは、さまざまな支援ツールやサービスとシームレスに結合し、運用効率を最適化し、計画から展開までの一貫した開発順序を維持します。ウェブベースのALMプラットフォームは、市場投入までの時間を短縮し、調整の改善とライフサイクルエラーの削減を通じて高品質のソフトウェアを維持し、組織の業績向上につながります。

クラウドベースのALM導入は、サードパーティのクラウドプラットフォーム上でアプリケーションライフサイクル管理インフラとツールをホストします。このモデルは、柔軟性、拡張性、アクセシビリティを特徴としており、開発チームが干渉されることなく、異なる場所で共同作業を行うことを可能にします。クラウドベースのALMは、クラウドプロバイダーのリソースと専門知識を利用するため、企業がオンプレミスのインフラに資本を費やす必要はありません。この展開戦略により、人手を介することなくソフトウェアの更新や機能追加が中断されることなく行われ、常に最新の機能がユーザーに提供されます。また、プロジェクト要件に応じてALMリソースを動的に拡張できるため、運用コストを削減し、全体的な効率を向上させることができます。さらに、クラウドベースのモデルはリモートワーク機能を向上させるため、分散したチームや世界なチームに最適です。クラウドALMの導入には、セキュリティ脅威、プライバシー保護、データ管理が厳しく規制される業界のコンプライアンス要件への対応など、さまざまな課題があるが、クラウドベースのALMは、その使いやすさ、コスト削減、新しいアジャイル戦略やDevOps戦略のサポートにより、広く採用されるようになっています。

アジア太平洋のアプリケーションライフサイクル管理(ALM)市場は、AIを活用した自動化、アジャイル開発、DevOpsの採用により、急速に成長しています。TTC世界は2024年4月24日、Leapworkとの提携を発表し、Microsoft Dynamics 365とPower Platformのユーザー向けに、テストの自動化を強化し、運用効率を高めるAI搭載のノーコード・ソリューションを提供します。デジタルトランスフォーメーションの地域的な推進により、企業は高品質のソフトウェアアウトプットを提供しながら開発サイクルを最適化するALMソリューションを採用するようになっています。トライセンティスやSAPジャパンなどの主要企業は、継続的インテグレーションとデプロイメント、自動化に対する市場の需要が拡大し続ける中、AIを活用したテストと品質管理をリードしています。日本におけるALMソリューションの採用は、デジタルトランスフォーメーションへの取り組みとデータ保護規制によって推進されており、アプリケーションの安全な展開と運用の効率化につながっています。自動化とソフトウェア品質が依然として優先事項であるため、アジア太平洋地域のALM市場は、進化する業界の需要に対応するためのイノベーションを促進しながら、持続的に拡大する態勢を整えています。

当レポートでは、世界のアプリケーションライフサイクル管理市場について調査し、オファリング別、プラットフォーム別、組織規模別、展開モード別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- アプリケーションライフサイクル管理の歴史

- サプライチェーン分析

- エコシステム分析

- ケーススタディ分析

- 規制状況

- 価格分析

- 技術分析

- 特許分析

- ポーターのファイブフォース分析

- 顧客ビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

- 2025年~2026年の主な会議とイベント

- アプリケーションライフサイクル管理市場向け技術ロードマップ

- アプリケーションライフサイクル管理に実装するベストプラクティス

- 現在のビジネスモデルと新興ビジネスモデル

- ツール、フレームワーク、テクニック

- AI/生成AIがアプリケーションライフサイクル管理市場に与える影響

- 投資と資金調達のシナリオ

- アプリケーションライフサイクル管理ツールのカテゴリ

第6章 アプリケーションライフサイクル管理市場(オファリング別)

- イントロダクション

- ソフトウェア

- サービス

第7章 アプリケーションライフサイクル管理市場(プラットフォーム別)

- イントロダクション

- ウェブベースのアプリケーションライフサイクル管理

- モバイルベースのアプリケーションライフサイクル管理

- その他

第8章 アプリケーションライフサイクル管理市場(組織規模別)

- イントロダクション

- 大企業

- 中小企業

第9章 アプリケーションライフサイクル管理市場(展開モード別)

- イントロダクション

- オンプレミス

- クラウド

第10章 アプリケーションライフサイクル管理市場(業界別)

- イントロダクション

- IT・ソフトウェア開発

- 通信

- BFSI

- ヘルスケア・ライフサイエンス

- 航空宇宙・防衛

- 小売・Eコマース

- 自動車・製造業

- メディア・エンターテインメント

- その他

第11章 アプリケーションライフサイクル管理市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:マクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 北欧諸国

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- インド

- オーストラリアとニュージーランド

- 韓国

- 東南アジア

- その他

- 中東・アフリカ

- 中東・アフリカ:マクロ経済見通し

- サウジアラビア王国(KSA)

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他

- ラテンアメリカ

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2022年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- ブランド/製品比較

- 企業評価と財務指標

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- ATLASSIAN

- OPENTEXT

- IBM

- MICROSOFT

- PTC

- BROADCOM

- DASSAULT SYSTEMES

- BMC SOFTWARE

- HCLTECH

- SAP

- SIEMENS AG

- その他の企業

- DIGITAL.AI

- PERFORCE SOFTWARE

- ANSYS

- ROCKET SOFTWARE

- スタートアップ/中小企業

- MICROGENESIS

- REQTEST

- NIMBLEWORK

- KOVAIR SOFTWARE

- JAMA SOFTWARE

- INFLECTRA

- ENALEAN

- ORIGINAL SOFTWARE

- PRACTITEST

- ORCANOS

- TECHEXCEL

- TESTRAIL

- VISURE SOLUTIONS

- NOVALYS

第14章 隣接市場/関連市場

第15章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 3 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 AVERAGE SELLING PRICE TREND AMONG KEY PLAYERS, BY DEPLOYMENT MODE (USD)

- TABLE 9 INDICATIVE PRICING LEVELS OF KEY PLAYERS, BY OFFERING, 2024

- TABLE 10 APPLICATION LIFECYCLE MANAGEMENT MARKET: KEY PATENTS

- TABLE 11 APPLICATION LIFECYCLE MANAGEMENT MARKET: PORTER'S FIVE FORCES

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 14 APPLICATION LIFECYCLE MANAGEMENT MARKET: CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 16 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 17 APPLICATION LIFECYCLE MANAGEMENT SOFTWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 18 APPLICATION LIFECYCLE MANAGEMENT SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

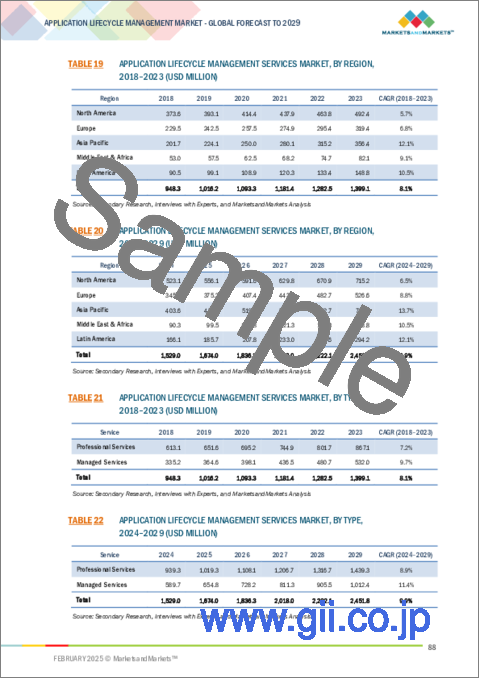

- TABLE 19 APPLICATION LIFECYCLE MANAGEMENT SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 20 APPLICATION LIFECYCLE MANAGEMENT SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 21 APPLICATION LIFECYCLE MANAGEMENT SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 22 APPLICATION LIFECYCLE MANAGEMENT SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 23 APPLICATION LIFECYCLE MANAGEMENT PROFESSIONAL SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 24 APPLICATION LIFECYCLE MANAGEMENT PROFESSIONAL SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 25 APPLICATION LIFECYCLE MANAGEMENT PROFESSIONAL SERVICES MARKET, 2018-2023 (USD MILLION)

- TABLE 26 APPLICATION LIFECYCLE MANAGEMENT PROFESSIONAL SERVICES MARKET, 2024-2029 (USD MILLION)

- TABLE 27 APPLICATION LIFECYCLE MANAGEMENT CONSULTING SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 28 APPLICATION LIFECYCLE MANAGEMENT CONSULTING SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 29 APPLICATION LIFECYCLE MANAGEMENT DEPLOYMENT & INTEGRATION SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 30 APPLICATION LIFECYCLE MANAGEMENT DEPLOYMENT & INTEGRATION SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 31 APPLICATION LIFECYCLE MANAGEMENT SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 32 APPLICATION LIFECYCLE MANAGEMENT SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 APPLICATION LIFECYCLE MANAGEMENT MANAGED SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 34 APPLICATION LIFECYCLE MANAGEMENT MANAGED SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 35 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2018-2023 (USD MILLION)

- TABLE 36 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 37 WEB-BASED APPLICATION LIFECYCLE MANAGEMENT PLATFORMS MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 38 WEB-BASED APPLICATION LIFECYCLE MANAGEMENT PLATFORMS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 MOBILE-BASED APPLICATION LIFECYCLE MANAGEMENT PLATFORMS MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 40 MOBILE-BASED APPLICATION LIFECYCLE MANAGEMENT PLATFORMS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 41 OTHER APPLICATION LIFECYCLE MANAGEMENT PLATFORMS MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 42 OTHER APPLICATION LIFECYCLE MANAGEMENT PLATFORMS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 43 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 44 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 45 APPLICATION LIFECYCLE MANAGEMENT MARKET FOR LARGE ENTERPRISES, BY REGION, 2018-2023 (USD MILLION)

- TABLE 46 APPLICATION LIFECYCLE MANAGEMENT MARKET FOR LARGE ENTERPRISES, BY REGION, 2024-2029 (USD MILLION)

- TABLE 47 APPLICATION LIFECYCLE MANAGEMENT MARKET FOR SMALL & MEDIUM-SIZED ENTERPRISES, BY REGION, 2018-2023 (USD MILLION)

- TABLE 48 APPLICATION LIFECYCLE MANAGEMENT MARKET FOR SMALL & MEDIUM-SIZED ENTERPRISES, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 50 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 51 ON-PREMISE APPLICATION LIFECYCLE MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 52 ON-PREMISE APPLICATION LIFECYCLE MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 53 CLOUD-BASED APPLICATION LIFECYCLE MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 54 CLOUD-BASED APPLICATION LIFECYCLE MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 55 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 56 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 57 APPLICATION LIFECYCLE MANAGEMENT MARKET IN IT & SOFTWARE DEVELOPMENT, BY REGION, 2018-2023 (USD MILLION)

- TABLE 58 APPLICATION LIFECYCLE MANAGEMENT MARKET IN IT & SOFTWARE DEVELOPMENT, BY REGION, 2024-2029 (USD MILLION)

- TABLE 59 APPLICATION LIFECYCLE MANAGEMENT MARKET IN TELECOM, BY REGION, 2018-2023 (USD MILLION)

- TABLE 60 APPLICATION LIFECYCLE MANAGEMENT MARKET IN TELECOM, BY REGION, 2024-2029 (USD MILLION)

- TABLE 61 APPLICATION LIFECYCLE MANAGEMENT MARKET IN BFSI, BY REGION, 2018-2023 (USD MILLION)

- TABLE 62 APPLICATION LIFECYCLE MANAGEMENT MARKET IN BFSI, BY REGION, 2024-2029 (USD MILLION)

- TABLE 63 APPLICATION LIFECYCLE MANAGEMENT MARKET IN HEALTHCARE & LIFE SCIENCES, BY REGION, 2018-2023 (USD MILLION)

- TABLE 64 APPLICATION LIFECYCLE MANAGEMENT MARKET IN HEALTHCARE & LIFE SCIENCES, BY REGION, 2024-2029 (USD MILLION)

- TABLE 65 APPLICATION LIFECYCLE MANAGEMENT MARKET IN AEROSPACE & DEFENSE, BY REGION, 2018-2023 (USD MILLION)

- TABLE 66 APPLICATION LIFECYCLE MANAGEMENT MARKET IN AEROSPACE & DEFENSE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 67 APPLICATION LIFECYCLE MANAGEMENT MARKET IN RETAIL & ECOMMERCE, BY REGION, 2018-2023 (USD MILLION)

- TABLE 68 APPLICATION LIFECYCLE MANAGEMENT MARKET IN RETAIL & ECOMMERCE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 69 APPLICATION LIFECYCLE MANAGEMENT MARKET IN AUTOMOTIVE & MANUFACTURING, BY REGION, 2018-2023 (USD MILLION)

- TABLE 70 APPLICATION LIFECYCLE MANAGEMENT MARKET IN AUTOMOTIVE & MANUFACTURING, BY REGION, 2024-2029 (USD MILLION)

- TABLE 71 APPLICATION LIFECYCLE MANAGEMENT MARKET IN MEDIA & ENTERTAINMENT, BY REGION, 2018-2023 (USD MILLION)

- TABLE 72 APPLICATION LIFECYCLE MANAGEMENT MARKET IN MEDIA & ENTERTAINMENT, BY REGION, 2024-2029 (USD MILLION)

- TABLE 73 APPLICATION LIFECYCLE MANAGEMENT MARKET IN OTHER VERTICALS, BY REGION, 2018-2023 (USD MILLION)

- TABLE 74 APPLICATION LIFECYCLE MANAGEMENT MARKET IN OTHER VERTICALS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 75 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 76 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 77 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 78 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 79 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 80 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 81 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 82 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 83 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2018-2023 (USD MILLION)

- TABLE 84 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 85 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 86 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 87 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 88 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 89 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 90 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 91 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 92 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 93 US: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 94 US: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 95 US: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 96 US: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 97 US: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 98 US: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 99 US: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2018-2023 (USD MILLION)

- TABLE 100 US: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 101 US: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 102 US: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 103 US: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 104 US: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 105 US: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 106 US: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 107 CANADA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 108 CANADA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 109 CANADA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 110 CANADA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 111 CANADA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 112 CANADA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 113 CANADA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2018-2023 (USD MILLION)

- TABLE 114 CANADA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 115 CANADA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 116 CANADA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 117 CANADA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 118 CANADA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 119 CANADA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 120 CANADA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 121 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 122 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 123 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 124 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 125 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 126 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 127 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2018-2023 (USD MILLION)

- TABLE 128 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 129 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 130 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 131 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 132 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 133 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 134 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 135 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 136 EUROPE: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 137 GERMANY: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 138 GERMANY: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 139 GERMANY: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 140 GERMANY: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 141 GERMANY: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 142 GERMANY: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 143 GERMANY: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2018-2023 (USD MILLION)

- TABLE 144 GERMANY: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 145 GERMANY: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 146 GERMANY: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 147 GERMANY: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 148 GERMANY: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 149 GERMANY: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 150 GERMANY: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 151 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 152 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 153 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 154 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 155 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 156 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 157 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2018-2023 (USD MILLION)

- TABLE 158 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 159 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 160 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 161 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 162 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 163 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 164 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 165 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 166 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 167 CHINA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 168 CHINA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 169 CHINA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 170 CHINA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 171 CHINA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 172 CHINA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 173 CHINA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2018-2023 (USD MILLION)

- TABLE 174 CHINA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 175 CHINA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 176 CHINA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 177 CHINA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 178 CHINA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 179 CHINA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 180 CHINA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2018-2023 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 197 KSA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 198 KSA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 199 KSA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 200 KSA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 201 KSA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 202 KSA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 203 KSA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2018-2023 (USD MILLION)

- TABLE 204 KSA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 205 KSA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 206 KSA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 207 KSA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 208 KSA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 209 KSA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 210 KSA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 211 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 212 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 213 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 214 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 215 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 216 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 217 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2018-2023 (USD MILLION)

- TABLE 218 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 219 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 220 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 221 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 222 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 223 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 224 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 225 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 226 LATIN AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 227 BRAZIL: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 228 BRAZIL: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 229 BRAZIL: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 230 BRAZIL: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 231 BRAZIL: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 232 BRAZIL: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 233 BRAZIL: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2018-2023 (USD MILLION)

- TABLE 234 BRAZIL: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 235 BRAZIL: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 236 BRAZIL: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 237 BRAZIL: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 238 BRAZIL: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 239 BRAZIL: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 240 BRAZIL: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 241 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS, 2022-2025

- TABLE 242 APPLICATION LIFECYCLE MANAGEMENT MARKET: DEGREE OF COMPETITION

- TABLE 243 APPLICATION LIFECYCLE MANAGEMENT MARKET: REGION FOOTPRINT, 2024

- TABLE 244 APPLICATION LIFECYCLE MANAGEMENT MARKET: OFFERING FOOTPRINT, 2024

- TABLE 245 APPLICATION LIFECYCLE MANAGEMENT MARKET: DEPLOYMENT MODE FOOTPRINT, 2024

- TABLE 246 APPLICATION LIFECYCLE MANAGEMENT MARKET: VERTICAL FOOTPRINT, 2024

- TABLE 247 APPLICATION LIFECYCLE MANAGEMENT MARKET: KEY STARTUPS/SMES, 2024

- TABLE 248 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 249 APPLICATION LIFECYCLE MANAGEMENT: PRODUCT LAUNCHES, JANUARY 2022-FEBRUARY 2025

- TABLE 250 APPLICATION LIFECYCLE MANAGEMENT MARKET: DEALS, JANUARY 2022-FEBRUARY 2025

- TABLE 251 ATLASSIAN: COMPANY OVERVIEW

- TABLE 252 ATLASSIAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 ATLASSIAN: DEALS

- TABLE 254 OPENTEXT: COMPANY OVERVIEW

- TABLE 255 OPENTEXT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 OPENTEXT: DEALS

- TABLE 257 IBM: COMPANY OVERVIEW

- TABLE 258 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 IBM: PRODUCT LAUNCHES

- TABLE 260 MICROSOFT: COMPANY OVERVIEW

- TABLE 261 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 MICROSOFT: DEALS

- TABLE 263 PTC: COMPANY OVERVIEW

- TABLE 264 PTC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 PTC: DEALS

- TABLE 266 BROADCOM: COMPANY OVERVIEW

- TABLE 267 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 BROADCOM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 269 DASSAULT SYSTEMES: COMPANY OVERVIEW

- TABLE 270 DASSAULT SYSTEMES: DEALS

- TABLE 271 BMC SOFTWARE: COMPANY OVERVIEW

- TABLE 272 BMC SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 BMC SOFTWARE: PRODUCT LAUNCHES

- TABLE 274 HCLTECH: COMPANY OVERVIEW

- TABLE 275 HCLTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 HCLTECH: PRODUCT LAUNCHES

- TABLE 277 SAP: COMPANY OVERVIEW

- TABLE 278 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 280 SAP: DEALS

- TABLE 281 SIEMENS AG: COMPANY OVERVIEW

- TABLE 282 SIEMENS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 SIEMENS AG: DEALS

- TABLE 284 APPLICATION MODERNIZATION SERVICES MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 285 APPLICATION MODERNIZATION SERVICES MARKET, BY SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 286 APPLICATION MODERNIZATION SERVICES MARKET, BY APPLICATION TYPE, 2018-2023 (USD MILLION)

- TABLE 287 APPLICATION MODERNIZATION SERVICES MARKET, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 288 APPLICATION MODERNIZATION SERVICES MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 289 APPLICATION MODERNIZATION SERVICES MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 290 APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 291 APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 292 APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 293 APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 294 PLATFORMS: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 295 PLATFORMS: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 296 APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 297 APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 298 APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 299 APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 300 APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 301 APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 APPLICATION LIFECYCLE MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 APPLICATION LIFECYCLE MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN APPLICATION LIFECYCLE MANAGEMENT MARKET

- FIGURE 5 APPROACH 2 (DEMAND SIDE): APPLICATION LIFECYCLE MANAGEMENT MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 APPLICATION LIFECYCLE MANAGEMENT MARKET, 2022-2029 (USD MILLION)

- FIGURE 10 APPLICATION LIFECYCLE MANAGEMENT MARKET SNAPSHOT, BY REGION, 2024

- FIGURE 11 RISE IN EMPHASIS ON REGULATORY COMPLIANCE AND QUALITY ASSURANCE TO DRIVE MARKET GROWTH

- FIGURE 12 APPLICATION LIFECYCLE MANAGEMENT SOFTWARE TO DOMINATE MARKET IN 2029

- FIGURE 13 PROFESSIONAL SERVICES OF APPLICATION LIFECYCLE MANAGEMENT TO ACCOUNT FOR LARGER MARKET IN 2029

- FIGURE 14 DEPLOYMENT & INTEGRATION SEGMENT TO ACCOUNT FOR LARGEST PROFESSIONAL SERVICE IN 2024

- FIGURE 15 WEB-BASED APPLICATION LIFECYCLE MANAGEMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 16 LARGE ENTERPRISES SEGMENT TO ADOPT APPLICATION LIFECYCLE MANAGEMENT MORE THAN SMES IN 2024

- FIGURE 17 ON-PREMISE DEPLOYMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 18 IT & SOFTWARE DEVELOPMENT TO ACCOUNT FOR LARGEST MARKET SHARES IN 2024 AND 2029

- FIGURE 19 SOFTWARE & WEB-BASED APPLICATION LIFECYCLE MANAGEMENT PLATFORM TO ACCOUNT FOR SIGNIFICANT RESPECTIVE SEGMENTAL SHARES IN 2024

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN APPLICATION LIFECYCLE MANAGEMENT MARKET

- FIGURE 21 HISTORY OF APPLICATION LIFE CYCLE MANAGEMENT

- FIGURE 22 APPLICATION LIFECYCLE MANAGEMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 APPLICATION LIFECYCLE MANAGEMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 AVERAGE SELLING PRICES AMONG KEY PLAYERS, BY DEPLOYMENT MODE

- FIGURE 25 MAJOR PATENTS FOR APPLICATION LIFECYCLE MANAGEMENT SOLUTIONS

- FIGURE 26 APPLICATION LIFECYCLE MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 30 APPLICATION LIFECYCLE MANAGEMENT MARKET: TOOLS, FRAMEWORKS, AND TECHNIQUES

- FIGURE 31 USE CASES OF GENERATIVE AI IN APPLICATION LIFECYLE MANAGEMENT

- FIGURE 32 APPLICATION LIFECYCLE MANAGEMENT MARKET: INVESTMENT AND FUNDING SCENARIO, 2020-2023

- FIGURE 33 APPLICATION LIFECYCLE MANAGEMENT SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 MOBILE-BASED ALM PLATFORMS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 SMALL & MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 AUTOMOTIVE & MANUFACTURING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: APPLICATION LIFECYCLE MANAGEMENT MARKET SNAPSHOT

- FIGURE 41 SHARE OF LEADING COMPANIES IN APPLICATION LIFECYCLE MANAGEMENT MARKET, 2024

- FIGURE 42 MARKET RANKING OF TOP FIVE PLAYERS, 2024

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS IN APPLICATION LIFECYCLE MANAGEMENT MARKET, 2020-2024 (USD MILLION)

- FIGURE 44 APPLICATION LIFECYCLE MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 APPLICATION LIFECYCLE MANAGEMENT MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 46 APPLICATION LIFECYCLE MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 BRAND/PRODUCT COMPARISON

- FIGURE 48 COMPANY VALUATION OF KEY APPLICATION LIFECYCLE MANAGEMENT SOFTWARE PROVIDERS, 2025 (USD BILLION)

- FIGURE 49 FINANCIAL METRICS OF KEY APPLICATION LIFECYCLE MANAGEMENT SOFTWARE PROVIDERS, 2025

- FIGURE 50 ATLASSIAN: COMPANY SNAPSHOT

- FIGURE 51 OPENTEXT: COMPANY SNAPSHOT

- FIGURE 52 IBM: COMPANY SNAPSHOT

- FIGURE 53 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 54 PTC: COMPANY SNAPSHOT

- FIGURE 55 BROADCOM: COMPANY SNAPSHOT

- FIGURE 56 DASSAULT SYSTEMES: COMPANY SNAPSHOT

- FIGURE 57 HCLTECH: COMPANY SNAPSHOT

- FIGURE 58 SAP: COMPANY SNAPSHOT

- FIGURE 59 SIEMENS AG: COMPANY SNAPSHOT

The Application Lifecycle Management market is estimated at USD 4.35 billion in 2024 to USD 6.58 billion by 2029, at a Compound Annual Growth Rate (CAGR) of 8.6%. Businesses are increasingly implementing value stream management (VSM) as a strategy to boost software delivery performance by connecting development processes to their organizational aims. The shift towards value stream management (VSM) directs organizations to adopt ALM platforms that implement VSM features for better workflow monitoring and streamlining. These platforms integrate VSM capabilities, providing end-to-end visibility into the development pipeline and enabling teams to identify bottlenecks, optimize workflows, and align development efforts with key business objectives.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2029 |

| Base Year | 2024 |

| Forecast Period | 2024-2029 |

| Units Considered | USD (Billion) |

| Segments | by offering, by deployment mode, by platform, by organization size large enterprises, SMEs), by vertical (IT & software development, telecom, BFSI, healthcare & life sciences, aerospace & defense,, retail & ecommerce, automotive & manufacturing, media & entertainment, other verticals) |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

By platform, the web-based ALM segment is expected to have the largest market size during the forecast period.

A web-based application lifecycle management platform offers teams one consolidated system that securely manages full application development from a single internet browser interface. Such solutions enable modern teams to work simultaneously on projects by offering vital features for version control, project monitoring, automated testing, and deployment oversight. Web-based tools help organizations optimally manage development workflows because they enable distributed teams to share current information effectively. The tools enable flexible scaling that helps businesses change their operational capacities when business needs to transform through systems without capital-intensive infrastructure setups. Web-based ALM platforms combine seamlessly with different supportive tools and services which optimize operational effectiveness and preserve a coherent development sequence starting from planning to deployment. Web-based ALM platforms accelerate time-to-market and maintain high-quality software through improved coordination and reduced lifecycle errors, leading to better organizational results.

"The Cloud-based ALM segment will register the fastest growth rate during the forecast period."

Cloud-based ALM deployment hosts Application Lifecycle Management infrastructure and tools on third-party cloud platforms. The model is characterized by flexibility, scalability, and accessibility, enabling development teams to work together across different locations without any interference. Cloud-based ALM does not require companies to spend capital on on-premise infrastructure since it uses the cloud provider's resources and expertise. This deployment strategy facilitates uninterrupted software updates and feature additions without human intervention, providing users with the most current capabilities at all times. It also allows organizations to dynamically scale their ALM resources according to project requirements dynamically, lowering operational expenses and improving overall efficiency. In addition, the cloud-based model improves remote working capabilities, which makes it best suited for distributed or global teams. While all these issues make it challenging to implement cloud ALM, such as security threats, privacy protection, and meeting compliance requirements for industries with highly regulated data control, cloud-based ALM gained widespread adoption based on its ease of use, cost savings, and support of new agile and DevOps strategies.

"Asia Pacific is expected to hold the highest market growth rate during the forecast period."

The Application Lifecycle Management (ALM) market in Asia-Pacific is growing rapidly, driven by AI-powered automation, agile development, and DevOps adoption. TTC Global announced its partnership with Leapwork on April 24, 2024 to bring AI-powered no-code solutions for Microsoft Dynamics 365 and Power Platform users which enhance testing automation and boost operational efficiency. The regional push for digital transformation has led businesses to adopt ALM solutions that optimize their development cycles while delivering high-quality software outputs. Companies such as Tricentis and SAP Japan lead the way in AI-driven testing and quality management as the market demand for continuous integration and deployment and automation continues to grow. The adoption of ALM solutions in Japan is driven by digital transformation efforts and data protection regulations, which lead to secure deployment and operational efficiency of applications. As automation and software quality remain priorities, the Asia-Pacific ALM market is poised for sustained expansion, fostering innovation to meet evolving industry demands.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the Application Lifecycle Management market.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: Directors -25%, Managers - 35%, and Others - 40%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, and Other-5%

The major players in the Application Lifecycle Management market Microsoft (US), Atlassian (Australia), IBM (US), OpenText (Canada), Broadcom (US), Siemens (Germany), PTC (US), SAP (Germany), HCLTech (India), Dassault Systemes (France), BMC Software (US), Rocket Software (US), Digital.ai (US), Perforce (US), Ansys (US), Microgenesis (India), ReQtest (Sweden), Nimblework (US), Kovair Software (US), Jama Software (US), Inflectra (US), Enalean (France), Original Software (UK), Practitest (Israel), Orcanos (Israel), Novalys (France), Visure Solutions (US), Techexcel (US), TestRail (Germany). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their Application Lifecycle Management market footprint.

Research Coverage

The market study covers the Application Lifecycle Management market size across different segments. It aims at estimating the market size and the growth potential across various segments, including by offering ( software, services (professional services (consulting, deployment & integration, support & maintenance) managed services), by deployment mode (on-premises, cloud), by platform ( web-based ALM, mobile-based ALM, other ALM platforms), by organization size ( large enterprises, SMEs), by vertical (IT & software development, telecom, BFSI, healthcare & life sciences, aerospace & defense,, retail & ecommerce, automotive & manufacturing, media & entertainment, other verticals) and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the global Application Lifecycle Management market's revenue numbers and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing focus on devops & agile methodologies, increased focus on compliance & security, growing demand for rapid software development and deployment), restraints (high implementation costs, complexity in integrating alm solutions with existing enterprise applications) opportunities (integration with DevSecOps, adoption of low-code & no-code platforms), and challenges (managing multi-cloud & hybrid environments, lack of consistent visibility) influencing the growth of the Application Lifecycle Management market.

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Application Lifecycle Management market.

Market Development: The report provides comprehensive information about lucrative markets and analyses the Application Lifecycle Management market across various regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Application Lifecycle Management market.

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading include Microsoft (US), Atlassian (Australia), IBM (US), OpenText (Canada), Broadcom (US), Siemens (Germany), PTC (US), SAP (Germany), HCLTech (India), Dassault Systemes (France), BMC Software (US), Rocket Software (US), Digital.ai (US), Perforce (US), Ansys (US), Microgenesis (India), ReQtest (Sweden), Nimblework (US), Kovair Software (US), Jama Software (US), Inflectra (US), Enalean (France), Original Software (UK), Practitest (Israel), Orcanos (Israel), Novalys (France), Visure Solutions (US), Techexcel (US), TestRail (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR KEY PLAYERS IN APPLICATION LIFECYCLE MANAGEMENT MARKET

- 4.2 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING

- 4.3 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY SERVICE

- 4.4 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE

- 4.5 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM

- 4.6 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 4.7 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE

- 4.8 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL

- 4.9 NORTH AMERICA: APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING AND PLATFORM

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing focus on DevOps & Agile methodologies

- 5.2.1.2 Increased focus on compliance and security

- 5.2.1.3 Growing demand for rapid software development and deployment

- 5.2.2 RESTRAINTS

- 5.2.2.1 High implementation costs

- 5.2.2.2 Complexity in integration with existing enterprise applications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration with DevSecOps

- 5.2.3.2 Adoption of low-code and no-code platforms

- 5.2.4 CHALLENGES

- 5.2.4.1 Managing multi-cloud and hybrid environments

- 5.2.4.2 Lack of consistent visibility

- 5.2.1 DRIVERS

- 5.3 HISTORY OF APPLICATION LIFECYCLE MANAGEMENT

- 5.3.1 1980-2000

- 5.3.2 2000-2010

- 5.3.3 2010-2020

- 5.3.4 2020-PRESENT

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 NAVYA ACHIEVED TRANSPARENCY, CONSISTENCY, AND EFFICIENCY WITH CODEBEAMER

- 5.6.2 GENERALI INSURANCE ACHIEVED REAL-TIME QUALITY VISIBILITY WITH SPIRATEAM FROM INFLECTRA

- 5.6.3 NINTENDO AUTOMATED DEVELOPMENT PROCESSES AND MEETS COMPLIANCE WITH ROCKET ALM

- 5.6.4 ENHANCED REQUIREMENT MANAGEMENT AND COLLABORATION AT HONEYWELL WITH KOVAIR ALM

- 5.6.5 XELLIA PHARMACEUTICALS ENHANCED COMPLIANCE AND EFFICIENCY WITH OPENTEXT ALM

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.2 KEY REGULATIONS: APPLICATION LIFECYCLE MANAGEMENT

- 5.7.2.1 North America

- 5.7.2.1.1 US

- 5.7.2.1.2 Canada

- 5.7.2.2 Europe

- 5.7.2.2.1 UK

- 5.7.2.2.2 France

- 5.7.2.2.3 Germany

- 5.7.2.2.4 Italy

- 5.7.2.3 Asia Pacific

- 5.7.2.3.1 China

- 5.7.2.3.2 India

- 5.7.2.3.3 Japan

- 5.7.2.3.4 South Korea

- 5.7.2.4 Middle East & Africa

- 5.7.2.4.1 UAE

- 5.7.2.4.2 KSA

- 5.7.2.5 Latin America

- 5.7.2.5.1 Brazil

- 5.7.2.5.2 Mexico

- 5.7.2.1 North America

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND AMONG KEY PLAYERS, BY DEPLOYMENT MODE

- 5.8.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY OFFERING

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Artificial intelligence & machine learning

- 5.9.1.2 Blockchain & DevSecOps

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Edge computing

- 5.9.2.2 Internet of Things

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Cloud computing

- 5.9.3.2 API management

- 5.9.3.3 Digital twins and simulations

- 5.9.3.4 Extended reality

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 BARGAINING POWER OF SUPPLIERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 TECHNOLOGY ROADMAP FOR APPLICATION LIFECYCLE MANAGEMENT MARKET

- 5.15.1 SHORT-TERM ROADMAP (2025-2026)

- 5.15.2 MID-TERM ROADMAP (2027-2028)

- 5.15.3 LONG-TERM ROADMAP (2029-2030)

- 5.16 BEST PRACTICES TO IMPLEMENT IN APPLICATION LIFECYCLE MANAGEMENT

- 5.17 CURRENT AND EMERGING BUSINESS MODELS

- 5.18 TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.19 IMPACT OF AI/GEN AI ON APPLICATION LIFECYCLE MANAGEMENT MARKET

- 5.19.1 USE CASES OF GENERATIVE AI IN APPLICATION LIFECYCLE MANAGEMENT

- 5.20 INVESTMENT AND FUNDING SCENARIO

- 5.21 APPLICATION LIFECYCLE MANAGEMENT TOOL CATEGORIES

- 5.21.1 ENTERPRISE ALM SUITES

- 5.21.2 AGILE & DEVOPS-FOCUSED ALM TOOLS

- 5.21.3 OPEN-SOURCE ALM TOOLS

- 5.21.4 CLOUD-BASED ALM SOLUTIONS

6 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: APPLICATION LIFECYCLE MANAGEMENT MARKET DRIVERS

- 6.2 SOFTWARE

- 6.2.1 INCREASE IN FOCUS ON CAPTURING ALL STAKEHOLDER NEEDS AND EASILY MANAGING OPTIMIZATION OF APPLICATIONS POST-DEPLOYMENT

- 6.2.1.1 Requirements management

- 6.2.1.2 Software configuration & change management

- 6.2.1.3 Application development management

- 6.2.1.4 Application testing & quality assurance software

- 6.2.1.5 Application release & deployment management software

- 6.2.1.6 Application maintenance

- 6.2.1 INCREASE IN FOCUS ON CAPTURING ALL STAKEHOLDER NEEDS AND EASILY MANAGING OPTIMIZATION OF APPLICATIONS POST-DEPLOYMENT

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 ALM tool adoption to increase demand for professional services in implementation, integration, and customization

- 6.3.1.1.1 Consulting

- 6.3.1.1.2 Deployment & Integration

- 6.3.1.1.3 Support & Maintenance

- 6.3.1.1 ALM tool adoption to increase demand for professional services in implementation, integration, and customization

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Managed services to provide flexibility to scale ALM solutions quickly, helping organizations maintain agility as their needs evolve

- 6.3.1 PROFESSIONAL SERVICES

7 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- 7.1.1 PLATFORM: APPLICATION LIFECYCLE MANAGEMENT MARKET DRIVERS

- 7.2 WEB-BASED APPLICATION LIFECYCLE MANAGEMENT

- 7.2.1 NEED FOR CENTRALIZED AND BROWSER-BASED ALM ENVIRONMENT

- 7.3 MOBILE-BASED APPLICATION LIFECYCLE MANAGEMENT

- 7.3.1 SHIFT TOWARD CLOUD-NATIVE MOBILE DEVELOPMENT ACROSS WIDE RANGE OF DEVICES

- 7.4 OTHER APPLICATION LIFECYCLE MANAGEMENT PLATFORMS

8 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZE: APPLICATION LIFECYCLE MANAGEMENT MARKET DRIVERS

- 8.2 LARGE ENTERPRISES

- 8.2.1 LARGE ENTERPRISES PRIORITIZE SCALABILITY, COMPLIANCE, AI, AND SECURITY, CONTRIBUTING TO HIGHER ALM ADOPTION

- 8.3 SMALL & MEDIUM-SIZED ENTERPRISES

- 8.3.1 SMES INCREASE FOCUS ON COST, EASE OF USE, CLOUD-BASED ALM, AND AGILITY

9 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE

- 9.1 INTRODUCTION

- 9.1.1 DEPLOYMENT MODE: APPLICATION LIFECYCLE MANAGEMENT MARKET DRIVERS

- 9.2 ON-PREMISES

- 9.2.1 ON-PREMISE DEPLOYMENT TO OFFER GREATER CONTROL OVER SENSITIVE DATA

- 9.3 CLOUD

- 9.3.1 COST-EFFECTIVE CLOUD-BASED ALM TO DRIVE MARKET GROWTH

10 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICAL: APPLICATION LIFECYCLE MANAGEMENT MARKET DRIVERS

- 10.2 IT & SOFTWARE DEVELOPMENT

- 10.2.1 INCREASE IN DEMAND FOR RAPID MODERN SOFTWARE DEVELOPMENT

- 10.2.2 USE CASES

- 10.2.2.1 Automated testing

- 10.2.2.2 Bug tracking and issue management

- 10.2.2.3 Software architecture management

- 10.3 TELECOM

- 10.3.1 RISE IN FOCUS ON CUSTOMER SERVICE APPLICATIONS

- 10.3.2 USE CASES

- 10.3.2.1 Network management

- 10.3.2.2 Customer service applications

- 10.3.2.3 Billing systems

- 10.4 BFSI

- 10.4.1 NEED FOR DEVELOPMENT OF ROBUST FINANCIAL SOFTWARE DUE TO GROWTH IN THREAT OF CYBER-ATTACKS

- 10.4.2 USE CASES

- 10.4.2.1 Compliance monitoring

- 10.4.2.2 Risk management applications

- 10.5 HEALTHCARE & LIFE SCIENCES

- 10.5.1 RISE IN DEMAND FOR COMPLIANCE AND PROTECTION-SENSITIVE DATA IN HEALTHCARE

- 10.5.2 USE CASES

- 10.5.2.1 Health analytics platform development

- 10.5.2.2 EHR software management

- 10.6 AEROSPACE & DEFENSE

- 10.6.1 DEMAND FOR ROBUST LIFECYCLE MANAGEMENT SOLUTIONS DUE TO INVESTMENTS IN NEXT-GEN AEROSPACE & DEFENSE TECHNOLOGIES

- 10.6.2 USE CASES

- 10.6.2.1 Satellite systems management

- 10.6.2.2 Avionics software development

- 10.7 RETAIL & ECOMMERCE

- 10.7.1 NEED FOR SEAMLESS DEPLOYMENT DUE TO SHIFT TO MOBILE COMMERCE AND CLOUD-BASED RETAIL SOLUTIONS

- 10.7.2 USE CASES

- 10.7.2.1 Payment gateway integration

- 10.7.2.2 Inventory management systems

- 10.8 AUTOMOTIVE & MANUFACTURING

- 10.8.1 DEMAND FOR STREAMLINED SOFTWARE MANAGEMENT FOR AUTONOMOUS AND ELECTRIC VEHICLES

- 10.8.2 USE CASES

- 10.8.2.1 Product lifecycle management for automotive

- 10.8.2.2 Digital twin management for smart factories

- 10.9 MEDIA & ENTERTAINMENT

- 10.9.1 NEED FOR CONTINUOUS UPDATES AND BUG FIXES IN MEDIA APPLICATIONS TO ENHANCE USER EXPERIENCE

- 10.9.2 USE CASES

- 10.9.2.1 Real-time audience analytics & personalization

- 10.9.2.2 Streaming platform stability & updates

- 10.10 OTHER VERTICALS

- 10.10.1 USE CASES

- 10.10.1.1 Public safety & emergency response systems

- 10.10.1.2 Government data management & compliance

- 10.10.1 USE CASES

11 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.2 US

- 11.2.2.1 Increase in cloud adoption and digitalization in US

- 11.2.3 CANADA

- 11.2.3.1 Government-backed programs and funding in AI research in Canada

- 11.3 EUROPE

- 11.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.2 GERMANY

- 11.3.2.1 Significant investments and collaborative projects in Germany by large players

- 11.3.3 UK

- 11.3.3.1 Rise in demand for cloud migration and digitalization in various sectors in UK

- 11.3.4 FRANCE

- 11.3.4.1 Increased digitalization initiatives for SMEs such as France Num

- 11.3.5 ITALY

- 11.3.5.1 Private players and Industry 4.0 to complement initiatives such as National Recovery and Resilience Plan

- 11.3.6 SPAIN

- 11.3.6.1 Initiatives such as Digital Spain 2025 with focus on cloud adoption and data sovereignty

- 11.3.7 NORDIC COUNTRIES

- 11.3.7.1 Thriving startup ecosystem with robust infrastructure for innovation and regulatory frameworks

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.2 CHINA

- 11.4.2.1 Digital Silk Road, push for smart cities, and AI Development Plan in China

- 11.4.3 JAPAN

- 11.4.3.1 Increasing demand for AI-driven testing solutions and focus on compliance with local regulations

- 11.4.4 INDIA

- 11.4.4.1 Growing digitalization among enterprises, including push from government's Digital India initiative

- 11.4.5 AUSTRALIA & NEW ZEALAND

- 11.4.5.1 Prominent government funding as part of Australia's digital economy strategy; presence of prominent platers in New Zealand

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Supportive regulatory framework and initiatives such as eGovFrame in South Korea

- 11.4.7 SOUTHEAST ASIA

- 11.4.7.1 Rapid digital transformation initiatives and embracing Agile methodologies in Southeast Asian countries

- 11.4.8 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.2 KINGDOM OF SAUD ARABIA (KSA)

- 11.5.2.1 Increased IT investments across industries, focus on customer experience management, and shift toward cloud migration in KSA

- 11.5.3 UAE

- 11.5.3.1 Increase in digital transformation initiatives and industry-specific advancements in UAE

- 11.5.4 QATAR

- 11.5.4.1 Heavy cloud investments by government to modernize public services in Qatar

- 11.5.5 SOUTH AFRICA

- 11.5.5.1 Increase in demand for ALM tools in retail and for scalable software delivery in South Africa

- 11.5.6 REST OF THE MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.2 BRAZIL

- 11.6.2.1 Increase in growth of IT sector with digitalization efforts, including Missao 4.0 da Nova Industria Brasileira

- 11.6.3 MEXICO

- 11.6.3.1 Cloud computing initiatives and strong regulatory framework in Mexico

- 11.6.4 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.3.1 MARKET RANKING

- 12.4 REVENUE ANALYSIS, 2020-2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Offering footprint

- 12.5.5.4 Deployment mode footprint

- 12.5.5.5 Vertical footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 BRAND/PRODUCT COMPARISON

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ATLASSIAN

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM View

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 OPENTEXT

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM View

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 IBM

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM View

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 MICROSOFT

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM View

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 PTC

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM View

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 BROADCOM

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches and enhancements

- 13.1.7 DASSAULT SYSTEMES

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 BMC SOFTWARE

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches and enhancements

- 13.1.9 HCLTECH

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches and enhancements

- 13.1.10 SAP

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches and enhancements

- 13.1.10.3.2 Deals

- 13.1.11 SIEMENS AG

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.1 ATLASSIAN

- 13.2 OTHER PLAYERS

- 13.2.1 DIGITAL.AI

- 13.2.2 PERFORCE SOFTWARE

- 13.2.3 ANSYS

- 13.2.4 ROCKET SOFTWARE

- 13.3 STARTUPS/SMES

- 13.3.1 MICROGENESIS

- 13.3.2 REQTEST

- 13.3.3 NIMBLEWORK

- 13.3.4 KOVAIR SOFTWARE

- 13.3.5 JAMA SOFTWARE

- 13.3.6 INFLECTRA

- 13.3.7 ENALEAN

- 13.3.8 ORIGINAL SOFTWARE

- 13.3.9 PRACTITEST

- 13.3.10 ORCANOS

- 13.3.11 TECHEXCEL

- 13.3.12 TESTRAIL

- 13.3.13 VISURE SOLUTIONS

- 13.3.14 NOVALYS

14 ADJACENT/RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 APPLICATION MODERNIZATION SERVICES MARKET

- 14.2.1 MARKET DEFINITION

- 14.2.2 APPLICATION MODERNIZATION SERVICES MARKET, BY SERVICE TYPE

- 14.2.3 APPLICATION MODERNIZATION SERVICES MARKET, BY APPLICATION TYPE

- 14.2.4 APPLICATION MODERNIZATION SERVICES MARKET, BY VERTICAL

- 14.3 APPLICATION INTEGRATION MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 APPLICATION INTEGRATION MARKET, BY OFFERING

- 14.3.4 APPLICATION INTEGRATION MARKET, BY SERVICE

- 14.3.5 APPLICATION INTEGRATION MARKET, BY PLATFORM

- 14.3.6 APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE

- 14.3.7 APPLICATION INTEGRATION MARKET, BY APPLICATION

- 14.3.8 APPLICATION INTEGRATION MARKET, BY VERTICAL

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS