|

|

市場調査レポート

商品コード

1678867

リチウムイオン電池材料の世界市場:材料別、用途別、電池化学別、地域別 - 2029年までの予測Lithium-ion Battery Materials Market by Battery Chemistry (LFP, LCO, NMC, NCA, LMO), Material (Cathode, Anode, Electrolyte), Application (Portable Device, Electric Vehicle, Industrial, Power Tool, Medical Device), & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| リチウムイオン電池材料の世界市場:材料別、用途別、電池化学別、地域別 - 2029年までの予測 |

|

出版日: 2025年03月01日

発行: MarketsandMarkets

ページ情報: 英文 218 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のリチウムイオン電池材料の市場規模は、2024年の419億米ドルから2029年には1,209億米ドルに成長し、予測期間中のCAGRは23.6%と予測されています。

リチウムイオン電池材料市場は、さまざまな産業でリチウムイオン電池の需要が高まっていることから急速に拡大しています。正極材料、負極材料、電解質、セパレーターを含むこれらの材料は、電気自動車(EV)、家電製品、エネルギー貯蔵システムに使用される電池を製造するために必要です。この市場の主な促進要因は、世界の二酸化炭素排出量削減の試みと再生可能エネルギーへの傾向によって、EVの採用が増加していることです。さらに、ポータブル電子機器に対する需要の高まり、バッテリー技術の進歩、グリーンエネルギーを推進する政府のインセンティブが業界を前進させています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 対象単位 | 金額(10億米ドル)および数量(キロトン) |

| セグメント | 材料別、用途別、電池化学別、地域別 |

| 対象地域 | アジア太平洋地域、欧州、北米、その他の地域 |

携帯機器セグメントは予測期間中、第2位のシェアを確保すると予測されています。スマートフォン、タブレット、ノートパソコンなどの家電製品の需要が拡大していることから、携帯機器カテゴリーはリチウムイオン電池材料市場で2番目に大きな割合を占めると予測されています。リモートワークの普及拡大、オンライン教育、スマートガジェットへの欲求の高まりなどの要因が、ポータブル電子機器の需要を促進しており、それが効率的で長持ちするリチウムイオン電池の需要を促進しています。電池寿命が長く高性能な機器を好む消費者の増加は、携帯機器産業におけるリチウムイオン電池材料の需要を引き続き押し上げるとみられています。

電池化学別では、リン酸鉄リチウムセグメントが、その安全性、高サイクル寿命、費用対効果により、リチウムイオン電池材料市場で第2位のシェアを占めると予想されます。これらの電池は過熱しにくく、高温でも安定性があるため、エネルギー貯蔵システム、電気バス、特定の電気自動車での使用に適しています。さらに、再生可能エネルギーの統合とグリッド規模のエネルギー貯蔵システムが重視されるようになり、安全で耐久性のあるリン酸鉄リチウム電池の開発が促進されています。持続可能性とエネルギー効率に対する世界の注目が高まるにつれ、リチウムイオン電池材料、特にリン酸鉄リチウム電池に使用される材料の需要は大幅に増加すると予測されます。

電解質材料は、電池の性能と安全性において重要であるため、リチウムイオン電池材料市場で第2位のシェアを占めると予測されます。電解質は、負極と正極の間をリチウムイオンが流れるようにするもので、エネルギーの貯蔵と放電に必要なプロセスです。特に電気自動車やエネルギー貯蔵システムなどの用途で高性能リチウムイオン電池の必要性が高まるにつれ、革新的な電解質材料の必要性も高まっています。これらの化合物は、電池の効率、寿命、安全性を向上させるために不可欠です。電解質セグメントの拡大は、固体電解質や高電圧電解質などの電解質配合の革新を促進することにより、リチウムイオン電池材料市場全体を推進し、電池性能を向上させ、新たな応用機会を開拓します。

北米地域は、電気自動車(EV)の需要が旺盛で、再生可能エネルギーソリューションを重視する傾向が強まっていることから、リチウムイオン電池材料市場で第2位のシェアを占めると予想されます。二酸化炭素排出量を削減し、持続可能な輸送を促進する政府のインセンティブがEV市場の成長を後押ししており、メーカーと消費者の双方にリチウムイオン電池技術の使用を促しています。さらに、太陽光や風力などの再生可能エネルギー源の統合が進むにつれ、効果的なエネルギー貯蔵ソリューションが必要となり、リチウムイオン電池とその材料の需要を押し上げています。

当レポートでは、世界のリチウムイオン電池材料市場について調査し、材料別、用途別、電池化学別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 業界の動向

- 世界マクロ経済見通し

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 価格分析

- 関税と規制状況

- 2024年~2025年の主な会議とイベント

- 主な利害関係者と購入基準

- 特許分析

- 技術分析

- 貿易分析

- ケーススタディ分析

- 生成AIの影響

第7章 リチウムイオン電池材料市場(材料別)

- イントロダクション

- 陽極材料

- 陰極材料

- 電解質材料

- その他

第8章 リチウムイオン電池材料市場(用途別)

- イントロダクション

- ポータブルデバイス

- 電気自動車

- 工業

- その他

第9章 リチウムイオン電池材料市場(電池化学別)

- イントロダクション

- リチウムニッケルマンガンコバルト

- リン酸鉄リチウム

- マンガン酸リチウム

- リチウムニッケルコバルトアルミニウム酸化物

- リチウムコバルト酸化物

第10章 リチウムイオン電池材料市場(地域別)

- イントロダクション

- 欧州

- ドイツ

- 英国

- フランス

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 北米

- 米国

- カナダ

- メキシコ

- その他の地域

- 南米

- 中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2020年1月~2024年7月)

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- UMICORE

- SUMITOMO METAL MINING CO., LTD.

- BASF SE

- POSCO FUTURE M

- TANAKA CHEMICAL CORPORATION

- TODA KOGYO CORP.

- RESONAC HOLDINGS CORPORATION

- L&F CO., LTD.

- JFE CHEMICAL CORPORATION

- 3M

- SGL CARBON

- NEI CORPORATION

- KUREHA CORPORATION

- BTR NEW MATERIAL GROUP CO., LTD.

- UBE CORPORATION

- KURARAY CO., LTD.

- SHENZHEN DYNANONIC CO., LTD.

- ZHEJIANG HUAYOU COBALT

- AMERICAN ELEMENTS

- MORITA CHEMICAL INDUSTRIES CO., LTD.

- その他の企業

- ECOPRO BM

- CAPCHEM

- NICHIA CORPORATION

- ASCEND ELEMENTS, INC.

- PULEAD TECHNOLOGY INDUSTRY CO., LTD.

第13章 隣接市場と関連市場

第14章 付録

List of Tables

- TABLE 1 LITHIUM-ION BATTERY MATERIALS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 LITHIUM-ION BATTERY MATERIALS MARKET SNAPSHOT: 2024 VS. 2029

- TABLE 3 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE): KEY COUNTRIES

- TABLE 4 UNEMPLOYMENT RATE: KEY COUNTRIES

- TABLE 5 INFLATION RATE: AVERAGE CONSUMER PRICES, BY KEY COUNTRY

- TABLE 6 FOREIGN DIRECT INVESTMENT

- TABLE 7 LITHIUM-ION BATTERY MATERIALS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 8 LITHIUM-ION BATTERY MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 COLLECTION RATES FOR BATTERIES AND ACCUMULATORS AND LITHIUM-ION BATTERIES FROM EVS IN COLOMBIA

- TABLE 13 LITHIUM-ION BATTERY MATERIALS MARKET: KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR APPLICATIONS (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 16 IMPORT DATA FOR LITHIUM CELLS AND BATTERIES (HS CODE 850650), 2020-2023 (USD THOUSAND)

- TABLE 17 EXPORT DATA FOR LITHIUM CELLS AND BATTERIES (HS CODE 850650), 2020-2023 (USD THOUSAND)

- TABLE 18 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 19 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 20 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 21 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 22 ANODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 23 ANODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 24 ANODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 25 ANODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (KILOTONS)

- TABLE 26 CATHODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 27 CATHODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 28 CATHODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 29 CATHODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (KILOTONS)

- TABLE 30 ELECTROLYTE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 31 ELECTROLYTE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 32 ELECTROLYTE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 33 ELECTROLYTE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (KILOTONS)

- TABLE 34 OTHER MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 35 OTHER MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 36 OTHER MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 37 OTHER MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (KILOTONS)

- TABLE 38 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 39 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 40 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2018-2022 (KILOTONS)

- TABLE 41 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2023-2029 (KILOTONS)

- TABLE 42 PORTABLE DEVICES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 PORTABLE DEVICES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 44 PORTABLE DEVICES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 45 PORTABLE DEVICES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (KILOTONS)

- TABLE 46 ELECTRIC VEHICLES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 47 ELECTRIC VEHICLES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 48 ELECTRIC VEHICLES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 49 ELECTRIC VEHICLES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (KILOTONS)

- TABLE 50 INDUSTRIAL: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 51 INDUSTRIAL: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 52 INDUSTRIAL: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 53 INDUSTRIAL: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (KILOTONS)

- TABLE 54 OTHER APPLICATIONS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 OTHER APPLICATIONS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 56 OTHER APPLICATIONS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 57 OTHER APPLICATIONS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (KILOTONS)

- TABLE 58 LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2018-2022 (USD MILLION)

- TABLE 59 LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2023-2029 (USD MILLION)

- TABLE 60 LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2018-2022 (KILOTONS)

- TABLE 61 LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2023-2029 (KILOTONS)

- TABLE 62 LITHIUM NICKEL MANGANESE COBALT: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 63 LITHIUM NICKEL MANGANESE COBALT: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 64 LITHIUM NICKEL MANGANESE COBALT: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 65 LITHIUM NICKEL MANGANESE COBALT: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (KILOTONS)

- TABLE 66 LITHIUM IRON PHOSPHATE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 67 LITHIUM IRON PHOSPHATE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 68 LITHIUM IRON PHOSPHATE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 69 LITHIUM IRON PHOSPHATE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (KILOTONS)

- TABLE 70 LITHIUM MANGANESE OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 71 LITHIUM MANGANESE OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 72 LITHIUM MANGANESE OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 73 LITHIUM MANGANESE OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (KILOTONS)

- TABLE 74 LITHIUM NICKEL COBALT ALUMINUM OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 75 LITHIUM NICKEL COBALT ALUMINUM OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 76 LITHIUM NICKEL COBALT ALUMINUM OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 77 LITHIUM NICKEL COBALT ALUMINUM OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (KILOTONS)

- TABLE 78 LITHIUM COBALT OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 79 LITHIUM COBALT OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 80 LITHIUM COBALT OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 81 LITHIUM COBALT OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (KILOTONS)

- TABLE 82 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 83 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 84 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 85 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2023-2029 (KILOTONS)

- TABLE 86 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 87 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 88 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2018-2022 (KILOTONS)

- TABLE 89 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2023-2029 (KILOTONS)

- TABLE 90 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 91 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 92 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 93 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 94 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2018-2022 (USD MILLION)

- TABLE 95 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2023-2029 (USD MILLION)

- TABLE 96 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2018-2022 (KILOTONS)

- TABLE 97 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2023-2029 (KILOTONS)

- TABLE 98 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 99 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 100 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2018-2022 (KILOTONS)

- TABLE 101 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2023-2029 (KILOTONS)

- TABLE 102 GERMANY: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 103 GERMANY: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 104 GERMANY: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 105 GERMANY: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 106 UK: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 107 UK: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 108 UK: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 109 UK: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 110 FRANCE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 111 FRANCE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 112 FRANCE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 113 FRANCE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 114 REST OF EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 115 REST OF EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 116 REST OF EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 117 REST OF EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 118 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 120 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2018-2022 (KILOTONS)

- TABLE 121 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2023-2029 (KILOTONS)

- TABLE 122 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 124 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 125 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 126 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2018-2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2023-2029 (USD MILLION)

- TABLE 128 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2018-2022 (KILOTONS)

- TABLE 129 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2023-2029 (KILOTONS)

- TABLE 130 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 132 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2018-2022 (KILOTONS)

- TABLE 133 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2023-2029 (KILOTONS)

- TABLE 134 CHINA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 135 CHINA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 136 CHINA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 137 CHINA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 138 JAPAN: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 139 JAPAN: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 140 JAPAN: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 141 JAPAN: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 142 INDIA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 143 INDIA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 144 INDIA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 145 INDIA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 146 SOUTH KOREA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 147 SOUTH KOREA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 148 SOUTH KOREA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 149 SOUTH KOREA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 150 REST OF ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 153 REST OF ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 154 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 155 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 156 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2018-2022 (KILOTONS)

- TABLE 157 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2023-2029 (KILOTONS)

- TABLE 158 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 159 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 160 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 161 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 162 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2018-2022 (USD MILLION)

- TABLE 163 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2023-2029 (USD MILLION)

- TABLE 164 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2018-2022 (KILOTONS)

- TABLE 165 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2023-2029 (KILOTONS)

- TABLE 166 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 167 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 168 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2018-2022 (KILOTONS)

- TABLE 169 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2023-2029 (KILOTONS)

- TABLE 170 US: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 171 US: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 172 US: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 173 US: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 174 CANADA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 175 CANADA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 176 CANADA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 177 CANADA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 178 MEXICO: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 179 MEXICO: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 180 MEXICO: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 181 MEXICO: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 182 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 183 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 184 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2018-2022 (KILOTONS)

- TABLE 185 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2023-2029 (KILOTONS)

- TABLE 186 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 187 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 188 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 189 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 190 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2018-2022 (USD MILLION)

- TABLE 191 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2023-2029 (USD MILLION)

- TABLE 192 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2018-2022 (KILOTONS)

- TABLE 193 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2023-2029 (KILOTONS)

- TABLE 194 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 195 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 196 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2018-2022 (KILOTONS)

- TABLE 197 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2023-2029 (KILOTONS)

- TABLE 198 SOUTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 199 SOUTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 200 SOUTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 201 SOUTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 202 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2018-2022 (KILOTONS)

- TABLE 205 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2023-2029 (KILOTONS)

- TABLE 206 LITHIUM-ION BATTERY MATERIALS MARKET: DEGREE OF COMPETITION

- TABLE 207 LITHIUM-ION BATTERY MATERIALS MARKET: REGION FOOTPRINT

- TABLE 208 LITHIUM-ION BATTERY MATERIALS MARKET: MATERIAL FOOTPRINT

- TABLE 209 LITHIUM-ION BATTERY MATERIALS MARKET: BATTERY CHEMISTRY FOOTPRINT

- TABLE 210 LITHIUM-ION BATTERY MATERIALS MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2023

- TABLE 211 LITHIUM-ION BATTERY MATERIALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2023

- TABLE 212 LITHIUM-ION BATTERY MATERIALS MARKET: DEALS (JANUARY 2020-JULY 2024)

- TABLE 213 LITHIUM-ION BATTERY MATERIALS MARKET: EXPANSIONS (JANUARY 2020-JULY 2024)

- TABLE 214 UMICORE: COMPANY OVERVIEW

- TABLE 215 UMICORE: PRODUCTS OFFERED

- TABLE 216 UMICORE: DEALS

- TABLE 217 UMICORE: EXPANSIONS

- TABLE 218 SUMITOMO METAL MINING CO., LTD.: COMPANY OVERVIEW

- TABLE 219 SUMITOMO METAL MINING CO., LTD.: PRODUCTS OFFERED

- TABLE 220 SUMITOMO METAL MINING CO., LTD.: DEALS

- TABLE 221 SUMITOMO METAL MINING CO., LTD.: EXPANSIONS

- TABLE 222 BASF SE: COMPANY OVERVIEW

- TABLE 223 BASF SE: PRODUCTS OFFERED

- TABLE 224 BASF SE: DEALS

- TABLE 225 BASF SE: EXPANSIONS

- TABLE 226 POSCO FUTURE M: COMPANY OVERVIEW

- TABLE 227 POSCO FUTURE M: PRODUCTS OFFERED

- TABLE 228 POSCO FUTURE M: DEALS

- TABLE 229 POSCO FUTURE M: EXPANSIONS

- TABLE 230 TANAKA CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 231 TANAKA CHEMICAL CORPORATION: PRODUCTS OFFERED

- TABLE 232 TODA KOGYO CORP.: COMPANY OVERVIEW

- TABLE 233 TODA KOGYO CORP.: PRODUCTS OFFERED

- TABLE 234 TODA KOGYO CORP.: EXPANSIONS

- TABLE 235 RESONAC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 236 RESONAC HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 237 L&F CO., LTD.: COMPANY OVERVIEW

- TABLE 238 L&F CO., LTD.: PRODUCTS OFFERED

- TABLE 239 L&F CO., LTD.: EXPANSIONS

- TABLE 240 JFE CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 241 JFE CHEMICAL CORPORATION: PRODUCTS OFFERED

- TABLE 242 3M: COMPANY OVERVIEW

- TABLE 243 3M: PRODUCTS OFFERED

- TABLE 244 SGL CARBON: COMPANY OVERVIEW

- TABLE 245 SGL CARBON: PRODUCTS OFFERED

- TABLE 246 NEI CORPORATION: COMPANY OVERVIEW

- TABLE 247 NEI CORPORATION: PRODUCTS OFFERED

- TABLE 248 NEI CORPORATION: PRODUCT LAUNCHES

- TABLE 249 KUREHA CORPORATION: COMPANY OVERVIEW

- TABLE 250 KUREHA CORPORATION: PRODUCTS OFFERED

- TABLE 251 BTR NEW MATERIAL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 252 BTR NEW MATERIAL GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 253 BTR NEW MATERIAL GROUP CO., LTD.: DEALS

- TABLE 254 BTR NEW MATERIAL GROUP CO., LTD.: EXPANSIONS

- TABLE 255 UBE CORPORATION: COMPANY OVERVIEW

- TABLE 256 UBE CORPORATION: PRODUCTS OFFERED

- TABLE 257 UBE CORPORATION: DEALS

- TABLE 258 KURARAY CO., LTD.: COMPANY OVERVIEW

- TABLE 259 KURARAY CO., LTD.: PRODUCTS OFFERED

- TABLE 260 SHENZHEN DYNANONIC CO., LTD.: COMPANY OVERVIEW

- TABLE 261 SHENZHEN DYNANONIC CO., LTD.: PRODUCTS OFFERED

- TABLE 262 ZHEJIANG HUAYOU COBALT: COMPANY OVERVIEW

- TABLE 263 ZHEJIANG HUAYOU COBALT: PRODUCTS OFFERED

- TABLE 264 ZHEJIANG HUAYOU COBALT: DEALS

- TABLE 265 AMERICAN ELEMENTS: COMPANY OVERVIEW

- TABLE 266 AMERICAN ELEMENTS: PRODUCTS OFFERED

- TABLE 267 MORITA CHEMICAL INDUSTRIES CO., LTD.: COMPANY OVERVIEW

- TABLE 268 MORITA CHEMICAL INDUSTRIES CO., LTD.: PRODUCTS OFFERED

- TABLE 269 ECOPRO BM: COMPANY OVERVIEW

- TABLE 270 CAPCHEM: COMPANY OVERVIEW

- TABLE 271 NICHIA CORPORATION: COMPANY OVERVIEW

- TABLE 272 ASCEND ELEMENTS, INC.: COMPANY OVERVIEW

- TABLE 273 PULEAD TECHNOLOGY INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 274 LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2019-2022 (USD BILLION)

- TABLE 275 LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2023-2032 (USD BILLION)

List of Figures

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 LITHIUM-ION BATTERY MATERIALS MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR LITHIUM-ION BATTERY MATERIALS MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF LITHIUM-ION BATTERY MATERIALS MARKET (1/2)

- FIGURE 7 METHODOLOGY FOR SUPPLY-SIDE SIZING OF LITHIUM-ION BATTERY MATERIALS MARKET (2/2)

- FIGURE 8 LITHIUM-ION BATTERY MATERIALS MARKET: DATA TRIANGULATION

- FIGURE 9 CATHODE MATERIALS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 LITHIUM NICKEL MANGANESE COBALT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 ELECTRIC VEHICLES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 LITHIUM-ION BATTERY MATERIALS MARKET IN ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 INCREASING DEMAND FOR ELECTRIC VEHICLES TO DRIVE MARKET

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 CATHODE MATERIALS SEGMENT TO LEAD MARKET FROM 2024 TO 2029

- FIGURE 16 LITHIUM NICKEL MANGANESE COBALT SEGMENT TO DOMINATE MARKET BETWEEN 2024 AND 2029

- FIGURE 17 ELECTRIC VEHICLES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 LITHIUM-ION BATTERY MATERIALS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 LITHIUM-ION BATTERY PACK PRICES, 2013-2023 (USD/KWH)

- FIGURE 20 LITHIUM CARBONATE PRICES, 2020-2023 (USD THOUSAND/TON)

- FIGURE 21 GLOBAL BEV & PHEV SALES

- FIGURE 22 LITHIUM-ION BATTERY MATERIALS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 LITHIUM-ION BATTERY MATERIALS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 LITHIUM-ION BATTERY MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF LITHIUM CARBONATE, BY REGION

- FIGURE 26 AVERAGE SELLING PRICE OF COBALT, BY REGION

- FIGURE 27 AVERAGE SELLING PRICE OF NICKEL, BY REGION

- FIGURE 28 AVERAGE SELLING PRICE, BY METAL

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR APPLICATIONS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 31 TOP APPLICANTS AND OWNERS OF PATENTS RELATED TO LITHIUM-ION BATTERY MATERIALS

- FIGURE 32 IMPORT DATA FOR LITHIUM CELLS AND BATTERIES (HS CODE 850650) FOR KEY COUNTRIES, 2020-2023 (USD THOUSAND)

- FIGURE 33 EXPORT DATA FOR LITHIUM CELLS AND BATTERIES (HS CODE 850650) FOR KEY COUNTRIES, 2020-2023 (USD THOUSAND)

- FIGURE 34 LITHIUM-ION BATTERY MATERIALS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

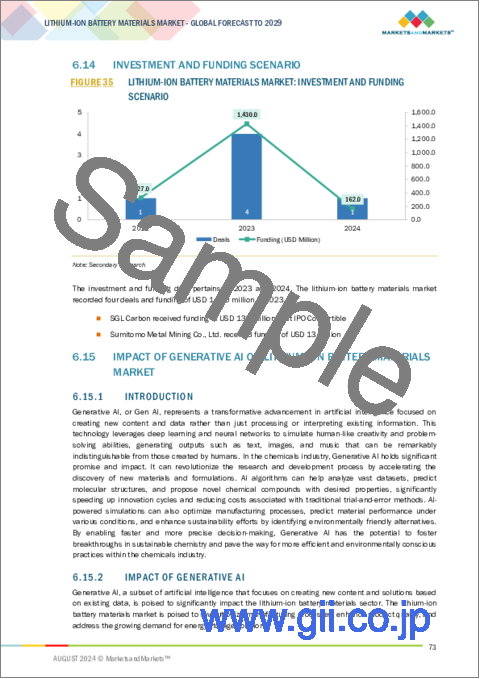

- FIGURE 35 LITHIUM-ION BATTERY MATERIALS MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 36 CATHODE MATERIALS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 37 ELECTRIC VEHICLES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 38 LITHIUM NICKEL MANGANESE COBALT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 40 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET SNAPSHOT

- FIGURE 43 LITHIUM-ION BATTERY MATERIALS MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2019-2023 (USD BILLION)

- FIGURE 44 LITHIUM-ION BATTERY MATERIALS MARKET SHARE ANALYSIS, 2023

- FIGURE 45 LITHIUM-ION BATTERY MATERIALS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 46 LITHIUM-ION BATTERY MATERIALS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 47 LITHIUM-ION BATTERY MATERIALS MARKET: COMPANY FOOTPRINT

- FIGURE 48 LITHIUM-ION BATTERY MATERIALS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 49 EV/EBITDA

- FIGURE 50 EV/REVENUE

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 52 UMICORE: COMPANY SNAPSHOT

- FIGURE 53 SUMITOMO METAL MINING CO., LTD.: COMPANY SNAPSHOT

- FIGURE 54 BASF SE: COMPANY SNAPSHOT

- FIGURE 55 POSCO FUTURE M: COMPANY SNAPSHOT

- FIGURE 56 TANAKA CHEMICAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 TODA KOGYO CORP.: COMPANY SNAPSHOT

- FIGURE 58 RESONAC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 L&F CO., LTD.: COMPANY SNAPSHOT

- FIGURE 60 3M: COMPANY SNAPSHOT

- FIGURE 61 SGL CARBON: COMPANY SNAPSHOT

- FIGURE 62 KUREHA CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 UBE CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 KURARAY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 65 ZHEJIANG HUAYOU COBALT: COMPANY SNAPSHOT

The global lithium-ion battery materials market is projected to grow from USD 41.9 billion in 2024 to USD 120.9 billion by 2029, at a CAGR of 23.6% during the forecast period. The lithium-ion battery materials market is expanding rapidly due to rising demand for lithium-ion batteries across a variety of industries. These materials, which include cathode and anode materials, electrolytes, and separators, are required to produce batteries used in electric vehicles (EVs), consumer electronics, and energy storage systems. The key drivers of this market are the rising adoption of EVs, which is being driven by worldwide attempts to reduce carbon emissions and a trend toward renewable energy. Furthermore, rising demand for portable electronic devices, advances in battery technology, and government incentives to promote green energy are moving the industry forward.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) and Volume (Kilotons) |

| Segments | Application, Battery Chemistry, Material, and Region |

| Regions covered | Asia Pacific, Europe, North America, and Rest of World |

"Portable devices segment, by application, is estimated to account for the second largest share during the forecast period"

The portable devices segment is projected to secure the second-largest share in the forecast period. Given the growing demand for consumer electronics such as smartphones, tablets, and laptops, the portable devices category is predicted to account for the second-largest proportion of the lithium-ion battery materials market. Factors such as the expanding popularity of remote work, online education, and the growing desire for smart gadgets are driving demand for portable electronics, which in turn fuels the demand for efficient and long-lasting lithium-ion batteries. The growing preference among consumers for high-performance devices with extended battery life will continue to boost demand for lithium-ion battery materials in the portable device industry.

"By battery chemistry, lithium iron phosphate segment is accounted for the second largest share during the forecast period"

The lithium iron phosphate segment by battery chemistry is expected to have the second-largest share of the lithium-ion battery materials market, owing to its safety features, high cycle life, and cost-effectiveness. These batteries are less prone to overheating and provide stability even at high temperatures, making them excellent for use in energy storage systems, electric buses, and certain electric automobiles. Furthermore, the increased emphasis on renewable energy integration and grid-scale energy storage systems is encouraging the development of lithium iron phosphate batteries, which are safe and durable. As the global focus on sustainability and energy efficiency grows, demand for lithium-ion battery materials, particularly those used in lithium iron phosphate batteries, is predicted to increase significantly.

"Electrolyte materials segment, by material, is estimated to account for the second largest share during the forecast period"

Electrolyte materials are expected to account for the second-largest share of the lithium-ion battery materials market due to their significance in battery performance and safety. Electrolytes allow lithium ions to flow between the anode and cathode, a process required for energy storage and discharge. As the need for high-performance lithium-ion batteries grows, especially in applications such as electric vehicles and energy storage systems, so does the need for innovative electrolyte materials. These compounds are critical to increasing battery efficiency, longevity, and safety. The expansion of the electrolyte segment will propel the overall lithium-ion battery materials market by driving innovations in electrolyte formulations, such as solid-state and high-voltage electrolytes, which improve battery performance and open up new application opportunities.

"North America region is estimated to account for the second largest share during the forecast period"

North America is expected to have the second-largest share of the lithium-ion battery materials market, owing to the region's strong demand for electric vehicles (EVs) and growing emphasis on renewable energy solutions. Government incentives to reduce carbon emissions and promote sustainable transportation are driving the EV market's growth, encouraging both manufacturers and consumers to use lithium-ion battery technologies. Furthermore, the increasing integration of renewable energy sources, such as solar and wind, needs effective energy storage solutions, driving up demand for lithium-ion batteries and their materials.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: C-level- 25%, Director Level- 30%, and Others - 45%

- By Region: North America - 20%, Europe - 15%, Asia Pacific - 55%, Rest of World - 10%

Umicore (Belgium), Sumitomo Metal Mining Co., Ltd. (Japan), BASF SE (Germany), POSCO Future M (South Korea), and Tanaka Chemical Corporation (Japan) are some of the major players operating in the lithium-ion battery materials market. These players have adopted strategies such as acquisitions, expansions, and partnerships in order to increase their market share business revenue.

Research Coverage:

The report defines, segments, and projects the lithium-ion battery materials market based on application, battery chemistry, material, and region. It provides detailed information regarding the major factors influencing the growth of the market, such as drivers, restraints, opportunities, and challenges. It strategically profiles, lithium-ion battery materials manufacturers and comprehensively analyses their market shares and core competencies as well as tracks and analyzes competitive developments, such as expansions, joint ventures, agreements, and acquisitions, undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them the closest approximations of revenue numbers of the lithium-ion battery materials market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (growth in production of lithium-ion batteries, surge in demand for consumer electronics), restraints (safety concerns regarding usage of gadgets or items installed with lithium-ion batteries, availability of substitutes), opportunities (growing R&D to enhance efficiency and upgrade lithium-ion batteries, decline in overall prices), and challenges (fluctuating raw material prices) influencing the growth of the lithium-ion battery materials market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the lithium-ion battery materials market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the lithium-ion battery materials market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the lithium-ion battery materials market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players such as Umicore (Belgium), Sumitomo Metal Mining Co., Ltd. (Japan), BASF SE (Germany), POSCO Future M (South Korea), Tanaka Chemical Corporation (Japan), Toda Kogyo Corp. (Japan), Resonac Holdings Corporation (Japan), L&F Co., Ltd. (South Korea), JFE Chemical Corporation (Japan), and 3M (US), and others in the lithium-ion battery materials market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS & EXCLUSIONS

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.3.4 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 DEMAND-SIDE MATRIX

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Calculations for supply-side analysis

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.5.1 RESEARCH ASSUMPTIONS

- 2.5.2 RESEARCH LIMITATIONS

- 2.5.3 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LITHIUM-ION BATTERY MATERIALS MARKET

- 4.2 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION

- 4.3 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL

- 4.4 LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY

- 4.5 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing adoption of electric vehicles

- 5.2.1.2 Surging demand for consumer electronics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Safety concerns related to gadgets with lithium-ion batteries

- 5.2.2.2 Availability of substitutes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing R&D to upgrade lithium-ion batteries

- 5.2.3.2 Declining lithium-ion battery prices

- 5.2.4 CHALLENGES

- 5.2.4.1 Fluctuating raw material prices

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 GLOBAL MACROECONOMIC OUTLOOK

- 6.1.1 GDP

- 6.1.2 RISING ADOPTION OF ELECTRIC VEHICLES

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 PORTER'S FIVE FORCES ANALYSIS

- 6.4.1 BARGAINING POWER OF SUPPLIERS

- 6.4.2 BARGAINING POWER OF BUYERS

- 6.4.3 THREAT OF NEW ENTRANTS

- 6.4.4 THREAT OF SUBSTITUTES

- 6.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE OF LITHIUM CARBONATE, BY REGION

- 6.5.2 AVERAGE SELLING PRICE OF COBALT, BY REGION

- 6.5.3 AVERAGE SELLING PRICE OF NICKEL, BY REGION

- 6.5.4 AVERAGE SELLING PRICE, BY METAL

- 6.6 TARIFF AND REGULATORY LANDSCAPE

- 6.6.1 TARIFF DATA

- 6.6.2 REGULATORY LANDSCAPE

- 6.6.2.1 Regulatory bodies, government agencies, and other organizations

- 6.6.3 PRACTICES AND POLICES IN LATIN AMERICAN COUNTRIES

- 6.6.3.1 Introduction

- 6.6.3.2 Colombia

- 6.6.3.3 Polices, regulations, and EPR schemes

- 6.6.3.4 Costa Rica

- 6.6.3.5 Polices, regulations, and EPR schemes

- 6.6.3.6 Existing recycling infrastructure and reuse initiatives

- 6.6.3.7 Chile

- 6.6.3.8 Polices, regulations, and EPR schemes

- 6.6.3.9 Existing recycling infrastructure and reuse initiatives

- 6.6.3.10 Mexico

- 6.6.3.11 Polices, regulations, and EPR schemes

- 6.6.3.12 Existing recycling infrastructure and reuse initiatives

- 6.7 KEY CONFERENCES AND EVENTS, 2024-2025

- 6.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.8.2 BUYING CRITERIA

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 MAJOR PATENTS

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGIES

- 6.10.1.1 High-nickel cathodes

- 6.10.2 COMPLEMENTARY TECHNOLOGIES

- 6.10.2.1 Lithium metal batteries

- 6.10.1 KEY TECHNOLOGIES

- 6.11 TRADE ANALYSIS

- 6.11.1 IMPORT SCENARIO (HS CODE 850650)

- 6.11.2 EXPORT SCENARIO (HS CODE 850650)

- 6.12 CASE STUDY ANALYSIS

- 6.12.1 HITACHI'S LESS-VOLATILE ELECTROLYTE ELIMINATES NEED FOR COOLING SYSTEM IN BATTERIES

- 6.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.14 INVESTMENT AND FUNDING SCENARIO

- 6.15 IMPACT OF GENERATIVE AI ON LITHIUM-ION BATTERY MATERIALS MARKET

- 6.15.1 INTRODUCTION

- 6.15.2 IMPACT OF GENERATIVE AI

- 6.15.2.1 Enhanced manufacturing efficiency

- 6.15.2.2 Reduced material waste

- 6.15.2.3 Improved quality control

7 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- 7.2 ANODE MATERIALS

- 7.2.1 GROWING DEMAND FOR LITHIUM-ION BATTERIES TO BOOST MARKET

- 7.3 CATHODE MATERIALS

- 7.3.1 GROWING DEMAND FOR ELECTRIC VEHICLES TO DRIVE MARKET

- 7.4 ELECTROLYTE MATERIALS

- 7.4.1 NEED FOR ENHANCED BATTERY OUTPUT TO DRIVE MARKET

- 7.5 OTHER MATERIALS

8 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 PORTABLE DEVICES

- 8.2.1 RAPID TECHNOLOGICAL CHANGES TO DRIVE DEMAND

- 8.3 ELECTRIC VEHICLES

- 8.3.1 GOVERNMENT EFFORTS TO PROMOTE CLEAN ENERGY SOLUTIONS TO DRIVE SEGMENT

- 8.4 INDUSTRIAL

- 8.4.1 FOCUS ON ENVIRONMENTAL SAFETY AND EQUIPMENT DURABILITY TO INCREASE DEMAND

- 8.5 OTHER APPLICATIONS

9 LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY

- 9.1 INTRODUCTION

- 9.2 LITHIUM NICKEL MANGANESE COBALT

- 9.2.1 HIGH CHARGE & DISCHARGE LIFE TO DRIVE MARKET

- 9.3 LITHIUM IRON PHOSPHATE

- 9.3.1 COST-EFFECTIVENESS AND SUPERIOR PERFORMANCE TO DRIVE DEMAND

- 9.4 LITHIUM MANGANESE OXIDE

- 9.4.1 EXCELLENT SAFETY CHARACTERISTICS TO BOOST MARKET

- 9.5 LITHIUM NICKEL COBALT ALUMINUM OXIDE

- 9.5.1 SUPERIOR CYCLE LIFE TO BOOST DEMAND

- 9.6 LITHIUM COBALT OXIDE

- 9.6.1 WIDE ADOPTION IN CONSUMER ELECTRONICS TO DRIVE MARKET

10 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 EUROPE

- 10.2.1 GERMANY

- 10.2.1.1 Growing demand for electric vehicles to drive market

- 10.2.2 UK

- 10.2.2.1 Rising sales of electric vehicles to drive demand

- 10.2.3 FRANCE

- 10.2.3.1 Increasing demand in automotive and marine industries to boost market

- 10.2.4 REST OF EUROPE

- 10.2.1 GERMANY

- 10.3 ASIA PACIFIC

- 10.3.1 CHINA

- 10.3.1.1 Growing production of electric vehicles to drive demand

- 10.3.2 JAPAN

- 10.3.2.1 Presence of leading lithium-ion battery manufacturers to propel market

- 10.3.3 INDIA

- 10.3.3.1 Development of smart cities to drive market

- 10.3.4 SOUTH KOREA

- 10.3.4.1 Government efforts to increase adoption of electric vehicles to fuel market

- 10.3.5 REST OF ASIA PACIFIC

- 10.3.1 CHINA

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Rising demand for electric vehicles to fuel market

- 10.4.2 CANADA

- 10.4.2.1 Government subsidies for electric vehicles to boost market

- 10.4.3 MEXICO

- 10.4.3.1 Growing demand in automotive sector to drive market

- 10.4.1 US

- 10.5 REST OF WORLD

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 Large lithium reserves to create market opportunities

- 10.5.2 MIDDLE EAST & AFRICA

- 10.5.2.1 Consumer goods and automobile industries to drive demand

- 10.5.1 SOUTH AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN (JANUARY 2020-JULY 2024)

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS (JANUARY 2020-JULY 2024)

- 11.3 REVENUE ANALYSIS, 2019-2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.4.1 BASF SE (GERMANY)

- 11.4.2 POSCO FUTURE M (SOUTH KOREA)

- 11.4.3 UMICORE (BELGIUM)

- 11.4.4 SUMITOMO METAL MINING CO., LTD. (JAPAN)

- 11.4.5 RESONAC HOLDINGS CORPORATION (JAPAN)

- 11.5 BRAND/PRODUCT COMPARISON

- 11.5.1 UMICORE

- 11.5.2 SUMITOMO METAL MINING CO., LTD.

- 11.5.3 BASF SE

- 11.5.4 POSCO FUTURE M

- 11.5.5 TANAKA CHEMICAL CORPORATION

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Material footprint

- 11.6.5.4 Battery chemistry footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2023

- 11.7.5.1 Lithium-ion battery materials market: Detailed list of key startups/SMEs, 2023

- 11.7.5.2 Lithium-ion battery materials market: Competitive benchmarking of key startups/SMEs, 2023

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- 11.9.2 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 UMICORE

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 SUMITOMO METAL MINING CO., LTD.

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 BASF SE

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 POSCO FUTURE M

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 TANAKA CHEMICAL CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 TODA KOGYO CORP.

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.7 RESONAC HOLDINGS CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.8 L&F CO., LTD.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Expansions

- 12.1.9 JFE CHEMICAL CORPORATION

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 3M

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 SGL CARBON

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.12 NEI CORPORATION

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches

- 12.1.13 KUREHA CORPORATION

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 BTR NEW MATERIAL GROUP CO., LTD.

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.14.3.2 Expansions

- 12.1.15 UBE CORPORATION

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.16 KURARAY CO., LTD.

- 12.1.16.1 Business overview

- 12.1.16.2 Products offered

- 12.1.17 SHENZHEN DYNANONIC CO., LTD.

- 12.1.17.1 Business overview

- 12.1.17.2 Products offered

- 12.1.18 ZHEJIANG HUAYOU COBALT

- 12.1.18.1 Business overview

- 12.1.18.2 Products offered

- 12.1.18.3 Recent developments

- 12.1.18.3.1 Deals

- 12.1.19 AMERICAN ELEMENTS

- 12.1.19.1 Business overview

- 12.1.19.2 Products offered

- 12.1.20 MORITA CHEMICAL INDUSTRIES CO., LTD.

- 12.1.20.1 Business overview

- 12.1.20.2 Products offered

- 12.1.1 UMICORE

- 12.2 OTHER PLAYERS

- 12.2.1 ECOPRO BM

- 12.2.2 CAPCHEM

- 12.2.3 NICHIA CORPORATION

- 12.2.4 ASCEND ELEMENTS, INC.

- 12.2.5 PULEAD TECHNOLOGY INDUSTRY CO., LTD.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 INTERCONNECTED MARKETS

- 13.4 LITHIUM-ION BATTERY MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- 13.4.3 LITHIUM-ION BATTERY MARKET, BY VOLTAGE

- 13.4.3.1 Low

- 13.4.3.1.1 Built-in battery management to drive demand in consumer electronics

- 13.4.3.2 Medium

- 13.4.3.2.1 Rising adoption in solar energy systems to drive market

- 13.4.3.3 High

- 13.4.3.3.1 Enhanced safety features to boost demand in marine and military sectors

- 13.4.3.1 Low

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS