|

|

市場調査レポート

商品コード

1859661

アプリケーション近代化サービスの世界市場 (~2031年):サービスタイプ (クラウドアプリケーション移行・アプリケーション再プラットフォーム化・ポストモダナイゼーション)・アプリケーションタイプ (レガシー・クラウドホスト・クラウドネイティブ) 別Application Modernization Services Market by Service Type (Cloud Application Migration, Application Re-Platforming, Post Modernization), Application Type (Legacy, Cloud-hosted, Cloud-native) - Global Forecast to 2031 |

||||||

カスタマイズ可能

|

|||||||

| アプリケーション近代化サービスの世界市場 (~2031年):サービスタイプ (クラウドアプリケーション移行・アプリケーション再プラットフォーム化・ポストモダナイゼーション)・アプリケーションタイプ (レガシー・クラウドホスト・クラウドネイティブ) 別 |

|

出版日: 2025年10月29日

発行: MarketsandMarkets

ページ情報: 英文 340 Pages

納期: 即納可能

|

概要

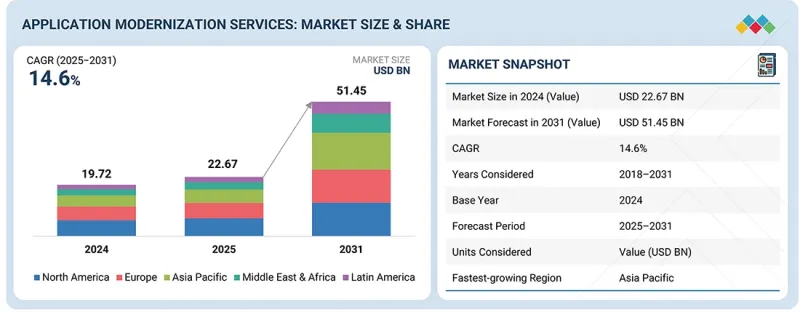

アプリケーション近代化サービスの市場規模は、2025年の226億7,000万米ドルから、CAGR 14.6%で推移し、2031年には514億5,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018-2031年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2031年 |

| 単位 | 金額 (米ドル) |

| セグメント | サービスタイプ・アプリケーションタイプ・産業・地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

アプリケーション近代化サービス市場は、いくつかの要因によって成長しています。急速な技術革新の時代において、企業は競争力を維持し効率を高めるために、古くなったアプリケーションを更新する必要性を無視することはできません。多くの場合、企業が事業規模やネットワーク、カバレッジを拡大すると、既存のレガシーシステムでは現在のビジネス需要に対応できなくなります。これは、規模の制約、柔軟性の不足、新しいテクノロジーとの統合の難しさによるものです。

クラウド技術の利用拡大も、もう一つの重要な成長要因です。多くの企業が、運用のスケーラビリティとコスト効率を求めてクラウドプロバイダーの活用を進めています。このデジタル変革の結果、企業はアプリケーションの変革を迫られています。AI、機械学習 (ML) 、IoTといった先進技術とシームレスに統合できるアプリケーションが不可欠になっているためです。

さらに、データセキュリティとコンプライアンスへの注目が高まる中で、企業はサイバーセキュリティ問題に対応する規制要件の変化に合わせて、新しいバージョンのアプリケーションへ積極的に移行しています。加えて、アプリケーションの性能向上やユーザーエクスペリエンスの改善も、近代化の流れを加速させる理由です。企業は、顧客がデジタル上で自社とどのように関わるかを常に改善しようとしています。さらに、運用コストを削減しつつ俊敏性と市場投入までのスピードを高めたいというニーズも大きな要因です。アプリケーションの近代化は、新しい機能やサービスを短期間で展開できるようにするためです。総じて、これらの理由からアプリケーション近代化サービスへの需要が高まっており、企業は戦略目標と業務効率性に応じて自社の技術基盤を再構築しようとしています。

"クラウドネイティブアプリケーション部門が予測期間中に最も高い成長率を示す見通し"

この部門は、スケーラビリティ、柔軟性、効率性といった面で高い成長可能性を持つことから、予測期間中に最も高い成長率を示すと見込まれています。レガシーアプリケーションは単一ユニットとして提供されることが多く、サーバーやデータセンターといった物理的インフラに依存しています。これに対し、クラウドネイティブアプリケーションはクラウドを中心に構築されており、マイクロサービス、コンテナ化ブート、スケジューリング管理システムといった高度なアーキテクチャ設計を採用しています。これにより、企業は事業環境の変化に柔軟に対応し、必要に応じてリソースを拡張し、不要な運用コストを最小化できます。さらに、クラウドベースのソリューションの普及とクラウド技術の成熟が、クラウドネイティブアプリケーションの需要を押し上げています。こうしたソリューションは、市場課題を克服し、より迅速で高品質な成果と最適化されたユーザーエクスペリエンスを提供しています。ビジネスプロセスのデジタル化を通じて効率を高めるという継続的な動きも、重要な技術トレンドです。そのため、現代のクラウドベースのニーズに応える高性能で応答性の高いシステムソリューションの開発が進み、クラウドネイティブアプリケーションへの移行が加速しており、この部門が高い成長率を示す理由となっています。

"アジア太平洋地域が予測期間中に最も高い成長率を記録する見通し"

これを支える要因の一つは、同地域で進むデジタルトランスフォーメーションです。クラウドコンピューティングやその他の新興技術の採用拡大、業務効率の追求が成長を後押ししています。中国やインドなどの国々では、IT支出やデジタル活動が増加しており、老朽化した管理システムの近代化や新技術の導入サービスの需要が高まっています。また、グローバルテクノロジープロバイダーの進出や、地域企業の台頭も市場競争を活発化させ、成長を加速させています。さらに、所得水準の上昇とテクノロジー志向の強い人口構成の変化も、同地域で高機能かつ大容量のアプリケーション近代化サービス需要を押し上げる主要要因となっています。

当レポートでは、世界のアプリケーション近代化サービスの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- アプリケーション近代化サービスの進化

- アプリケーション近代化サービス:エコシステム分析

- ケーススタディ分析

- サプライチェーン分析

- 規制状況

- 価格分析

- ポーターのファイブフォース分析

- 技術分析

- 特許分析

- 顧客の事業に影響を与える動向/ディスラプション

- 主要なステークホルダーと購入基準

- 2025-2026年の主な会議とイベント

- アプリケーション近代化サービス市場向け技術ロードマップ

- アプリケーション近代化サービス市場におけるベストプラクティス

- 現在のビジネスモデルと新興ビジネスモデル

- 投資と資金調達のシナリオ

- 生成AIがアプリケーション近代化サービス市場に与える影響

- 2025年の米国関税の影響 - 概要

- 主要な関税率

- 価格影響分析

- 国/地域への影響

- 産業

- アプリケーション近代化の7つの「R」

第6章 アプリケーション近代化サービス市場:サービスタイプ別

- 市場促進要因

- アプリケーションポートフォリオ評価

- クラウドアプリケーション移行

- アプリケーション再プラットフォーム化

- アプリケーション統合

- UI/UXの近代化

- ポストモダダイゼーションサービス

第7章 アプリケーション近代化サービス市場:アプリケーションタイプ別

- 市場促進要因

- レガシーアプリケーション

- クラウドホストアプリケーション

- クラウドネイティブアプリケーション

第8章 アプリケーション近代化サービス市場:産業別

- 市場促進要因

- BFSI

- IT・ITES

- ヘルスケア&ライフサイエンス

- 製造

- 通信

- 運輸・物流

- メディア&エンターテインメント

- 小売・eコマース

- 政府

- その他

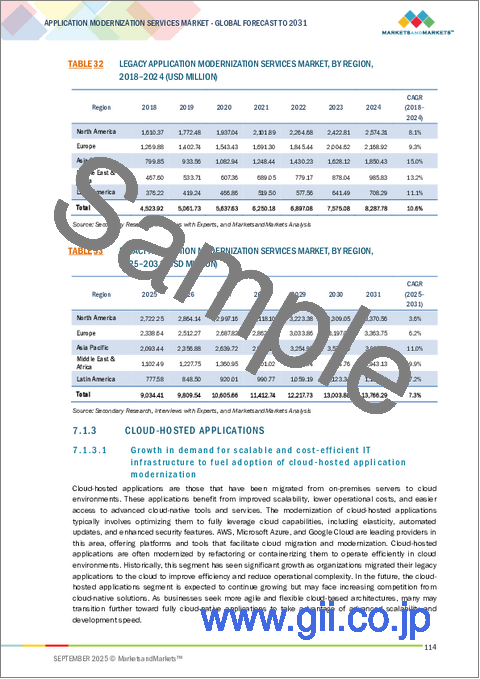

第9章 アプリケーション近代化サービス市場:地域別

- 北米

- マクロ経済見通し

- 米国

- カナダ

- 欧州

- マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- インド

- その他

- 中東・アフリカ

- マクロ経済見通し

- アラブ首長国連邦

- サウジアラビア

- アフリカ

- その他

- ラテンアメリカ

- マクロ経済見通し

- ブラジル

- メキシコ

- その他

第10章 競合情勢

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- ブランド/製品比較

- 企業評価と財務指標

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- IBM

- MICROSOFT

- HCL TECHNOLOGIES

- ACCENTURE

- AWS

- ATOS

- CAPGEMINI

- ORACLE

- COGNIZANT

- TCS

- INNOVA SOLUTIONS

- EPAM SYSTEMS

- ASPIRE SYSTEMS

- NTT DATA

- DELL TECHNOLOGIES

- DXC TECHNOLOGY

- LTIMINDTREE

- INFOSYS

- WIPRO

- ROCKET SOFTWARE, INC.

- FUJITSU

- HEXAWARE TECHNOLOGIES

- VIRTUSA

- MONGODB

- SCIENCESOFT

- SIMFORM

- UTTHUNGA

- RISHABH SOFTWARE

- スタートアップ/SME

- SOFTURA

- CLOUDHEDGE TECHNOLOGIES PVT. LTD.

- D3V TECHNOLOGY

- BAYSHORE INTELLIGENCE SOLUTIONS

- OPINOV8

- ICREON

- SYMPHONY SOLUTIONS

- CLEVEROAD

- TECHAHEAD

- GEOMOTIV

- SOFT SUAVE

- PALMDIGITALZ

- AVERISOURCE

- VERITIS