|

|

市場調査レポート

商品コード

1648941

連続サーマルモニタリングの世界市場:提供別、用途別、エンドユーザー別、地域別 - 予測(~2030年)Continuous Thermal Monitoring Market by Offering (Hardware, Software, Service), Application (Bus Duct Monitors, Switchgear, Motor Control Centers, Low-voltage Transformers, Dry Transformers), End User, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 連続サーマルモニタリングの世界市場:提供別、用途別、エンドユーザー別、地域別 - 予測(~2030年) |

|

出版日: 2025年01月31日

発行: MarketsandMarkets

ページ情報: 英文 260 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

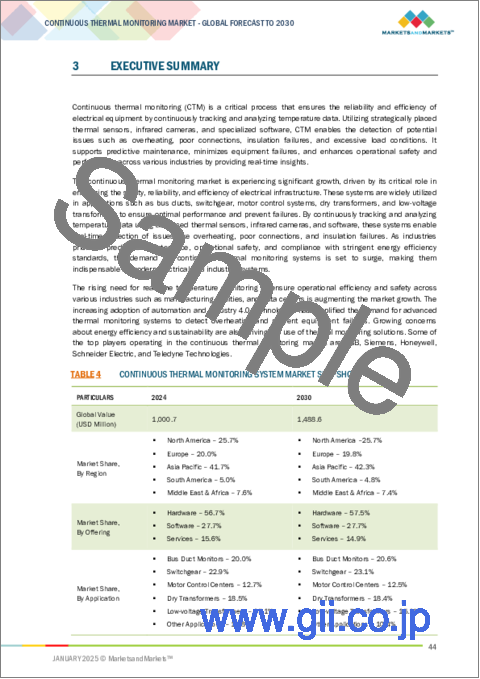

世界の連続サーマルモニタリングの市場規模は、2024年の推定10億米ドルから2030年までに14億9,000万米ドルに達すると予測され、予測期間(2024年~2030年)にCAGRで6.8%の成長が見込まれます。

市場は、産業におけるエネルギー効率への注目の高まり、小型で高性能な電子機器への需要の高まり、データセンターやクラウドコンピューティングサービスの増加といった要因によって牽引されています。こうした動向は、最適な性能を確保し過熱を防止する効率的な熱管理ソリューションを必要とするため、連続サーマルモニタリング技術の需要を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 提供、用途、エンドユーザー、地域 |

| 対象地域 | アジア太平洋、欧州、北米、南米、中東・アフリカ |

「ハードウェアが予測期間にもっとも成長率の高いセグメントとなる見込みです。」

ハードウェアコンポーネントは、正確で信頼性の高い温度識別を可能にする重要な役割を担っているため、最速のセグメントとなっています。ハードウェアは、多くの産業で過熱を防止するための温度異常の検出に広く使用されています。また、リアルタイムで熱パターンを特定することができるため、業務効率も最大化します。予知保全は、製造、ユーティリティ、データセンター運営などの数多くの産業でさまざまに利用されているため、高い需要が続いています。また、技術の進歩により、コンパクトで手頃な価格のIoT対応ハードウェアが登場し、スマートモニタリングシステムとうまく統合できるようになったため、これらのデバイスはより魅力的なものとなっています。

「用途別では、バスダクトモニターセグメントがもっとも急成長するセグメントとして浮上する見込みです。」

バスダクトモニタリングにおける連続サーマルモニタリング市場は、電気インフラの信頼性とセキュリティの重要性により、絶大な成長を示しています。これは、コストのかかる故障や火災の予防と回避、スマートグリッドの採用の拡大、データセンターや再生可能エネルギーからの新たな需要により、さらに勢いを増しています。規制基準の厳格化、IoTと予測分析の進歩、システムのダウンタイムに伴う膨大なコストにより、リアルタイムサーマルモニタリングは絶対に必要なものとなっています。産業化は高速で進行しており、焦点は効率と安全性に移っています。バスダクトモニタリングは、現代の配電システムにとって不可欠なものとなりつつあります。

「中国がアジア太平洋の連続サーマルモニタリング市場でもっとも高いCAGRで成長します。」

中国は、その広大な産業基盤、急速な都市化、広大なインフラ開発により、アジア太平洋の連続サーマルモニタリング市場でもっとも急速に成長しています。エネルギー効率と厳格な安全規制を重視する同国は、配電網、データセンター、再生可能エネルギープロジェクトにおけるハイテクモニタリングシステムの展開をさらに加速させています。さらに、スマートグリッド開発とIoT技術の導入に対する政府の積極的な関心は、リアルタイムサーマルモニタリングソリューションの導入に大きな勢いをもたらしています。ダウンタイムとエネルギー損失を最小化するという確固たるコミットメントを持った産業オートメーションへの多額の投資は、中国がこの地域で最新のサーマルモニタリング技術を採用する最前線に立つ原動力となっています。

当レポートでは、世界の連続サーマルモニタリング市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 連続サーマルモニタリング市場の企業にとって魅力的な機会

- アジア太平洋の連続サーマルモニタリング市場:提供別、国別

- 連続サーマルモニタリング市場:提供別

- 連続サーマルモニタリング市場:用途別

- 連続サーマルモニタリング市場:エンドユーザー別

- 連続サーマルモニタリング市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- バリューチェーン分析

- エコシステム分析

- ケーススタディ分析

- 技術分析

- 主要技術

- 隣接技術

- 補完技術

- 価格分析

- 連続サーマルモニタリングソリューションの参考価格:提供別(2023年)

- ハードウェアの平均販売価格の動向:地域別(2021年~2023年)

- 貿易分析

- 輸入シナリオ(HSコード903289)

- 輸出シナリオ(HSコード903289)

- 特許分析

- 主な会議とイベント(2024年~2025年)

- 投資と資金調達のシナリオ

- 関税と規制情勢

- 継続的な温度監視に関する関税

- 規制機関、政府機関、その他の組織

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 連続サーマルモニタリング市場に対するAI/生成AIの影響

- 連続サーマルモニタリング市場におけるAI/生成AIアプリケーションの採用

- AI/生成AIの提供に対する影響:地域別

- 連続サーマルモニタリング市場に対するAI/生成AIの影響:地域別

- 連続サーマル市場のマクロ経済の見通し

- イントロダクション

- GDPの動向と予測

- インフレ

第6章 連続サーマルモニタリング市場:提供別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第7章 連続サーマルモニタリング市場:用途別

- イントロダクション

- バスダクトモニター

- スイッチギア

- モーターコントロールセンター

- 乾式変圧器

- 低電圧変圧器

- その他の用途

第8章 連続サーマルモニタリング市場:エンドユーザー別

- イントロダクション

- データセンター

- 石油・ガス

- ロジスティクス

- ユーティリティ

- 製造

- 医療

- 小売

- 通信

- その他のエンドユーザー

第9章 連続サーマルモニタリング市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- オーストラリア

- インド

- 日本

- 韓国

- その他のアジア太平洋

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他の欧州

- 中東・アフリカ

- GCC

- 南アフリカ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2020年~2024年)

- 収益分析(2019年~2023年)

- 市場シェア分析(2023年)

- 企業の評価と財務指標(2025年)

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- ABB

- SIEMENS

- HONEYWELL INTERNATIONAL INC.

- SCHNEIDER ELECTRIC

- ADVANCED ENERGY

- MICROCHIP TECHNOLOGY INC.

- TELEDYNE TECHNOLOGIES INCORPORATED

- WIKA ALEXANDER WIEGAND SE & CO. KG

- CALEX ELECTRONICS LIMITED

- OMRON CORPORATION

- POWELL INDUSTRIES

- DYNAMIC RATINGS

- DOBLE ENGINEERING COMPANY

- EXTERTHERM

- OPTRIS

- その他の企業

- OSENSA INNOVATIONS

- BLUE JAY TECHNOLOGY CO. LTD.

- AP SENSING

- RUGGED MONITORING

- INFRASENSING

- TRISQUARE SWITCHGEARS PVT. LTD.

- GRACE TECHNOLOGIES, INC.

- DPSTAR GROUP

- COMEM S.P.A.

- ORION ITALIA S.R.L

第12章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS: BY OFFERING

- TABLE 2 INCLUSIONS AND EXCLUSIONS: BY APPLICATION

- TABLE 3 INCLUSIONS AND EXCLUSIONS: BY END USER

- TABLE 4 CONTINUOUS THERMAL MONITORING SYSTEM MARKET SNAPSHOT

- TABLE 5 LIST OF PROJECTS FUNDED BY SMART GRID PROGRAM, 2023

- TABLE 6 MAJOR COUNTRIES WITH COLOCATION DATA CENTERS

- TABLE 7 COMPANIES AND THEIR ROLES IN CONTINUOUS THERMAL MONITORING ECOSYSTEM

- TABLE 8 INDICATIVE PRICING OF CONTINUOUS THERMAL MONITORING SOLUTIONS, 2023

- TABLE 9 AVERAGE SELLING PRICE TREND OF HARDWARE, BY REGION, 2021-2023

- TABLE 10 IMPORT DATA FOR HS CODE 903289-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR HS CODE 903289-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 12 LIST OF MAJOR PATENTS, 2020-2022

- TABLE 13 LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 14 IMPORT TARIFF FOR HS CODE 903289-COMPLIANT PRODUCTS, 2023

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP OFFERINGS

- TABLE 21 KEY BUYING CRITERIA FOR TOP OFFERINGS

- TABLE 22 WORLD GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 23 ANNUAL PERCENTAGE CHANGE IN INFLATION RATE AS PER AVERAGE CONSUMER PRICE IN 2024, BY REGION

- TABLE 24 CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 25 CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 26 HARDWARE: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 27 HARDWARE: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 28 SOFTWARE: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 29 SOFTWARE: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 30 SERVICES: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 31 SERVICES: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 32 CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 33 CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 34 CONTINUOUS THERMAL MONITORING MARKET, BY SWITCHGEAR, 2021-2023 (USD MILLION)

- TABLE 35 CONTINUOUS THERMAL MONITORING MARKET, BY SWITCHGEAR, 2024-2030 (USD MILLION)

- TABLE 36 BUS DUCT MONITORS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 37 BUS DUCT MONITORS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 38 SWITCHGEAR: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 39 SWITCHGEAR: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 40 LOW-VOLTAGE SWITCHGEAR: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 41 LOW-VOLTAGE SWITCHGEAR: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 42 MEDIUM-VOLTAGE SWITCHGEAR: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 43 MEDIUM-VOLTAGE SWITCHGEAR: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 44 MOTOR CONTROL CENTERS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 45 MOTOR CONTROL CENTERS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 46 DRY TRANSFORMERS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 47 DRY TRANSFORMERS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 48 LOW-VOLTAGE TRANSFORMERS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 49 LOW-VOLTAGE TRANSFORMERS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 50 OTHER APPLICATIONS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 51 OTHER APPLICATIONS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 52 CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 53 CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 54 DATA CENTERS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 55 DATA CENTERS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 56 OIL & GAS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 57 OIL & GAS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 58 LOGISTICS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 59 LOGISTICS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 60 UTILITIES: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 61 UTILITIES: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 62 MANUFACTURING: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 63 MANUFACTURING: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 64 HEALTHCARE: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 65 HEALTHCARE: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 66 RETAIL: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 67 RETAIL: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 68 TELECOMMUNICATIONS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 69 TELECOMMUNICATIONS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 70 OTHER END USERS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 71 OTHER END USERS: CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 72 CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 73 CONTINUOUS THERMAL MONITORING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 75 NORTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 77 NORTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY SWITCHGEAR, 2021-2023 (USD MILLION)

- TABLE 79 NORTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY SWITCHGEAR, 2024-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 81 NORTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 83 NORTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 84 US: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 85 US: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 86 CANADA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 87 CANADA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 88 MEXICO: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 89 MEXICO: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 91 ASIA PACIFIC: CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 93 ASIA PACIFIC: CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: CONTINUOUS THERMAL MONITORING MARKET, BY SWITCHGEAR, 2021-2023 (USD MILLION)

- TABLE 95 ASIA PACIFIC: CONTINUOUS THERMAL MONITORING MARKET, BY SWITCHGEAR, 2024-2030 (USD MILLION)

- TABLE 96 ASIA PACIFIC: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 97 ASIA PACIFIC: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 98 ASIA PACIFIC: CONTINUOUS THERMAL MONITORING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 99 ASIA PACIFIC: CONTINUOUS THERMAL MONITORING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 100 CHINA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 101 CHINA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 102 AUSTRALIA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 103 AUSTRALIA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 104 INDIA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 105 INDIA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 106 JAPAN: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 107 JAPAN: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 108 SOUTH KOREA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 109 SOUTH KOREA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 112 EUROPE: CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 113 EUROPE: CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 114 EUROPE: CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 115 EUROPE: CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 116 EUROPE: CONTINUOUS THERMAL MONITORING MARKET, BY SWITCHGEAR, 2021-2023 (USD MILLION)

- TABLE 117 EUROPE: CONTINUOUS THERMAL MONITORING MARKET, BY SWITCHGEAR, 2024-2030 (USD MILLION)

- TABLE 118 EUROPE: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 119 EUROPE: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 120 EUROPE: CONTINUOUS THERMAL MONITORING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 121 EUROPE: CONTINUOUS THERMAL MONITORING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 122 GERMANY: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 123 GERMANY: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 124 UK: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 125 UK: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 126 FRANCE: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 127 FRANCE: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 128 ITALY: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 129 ITALY: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 130 RUSSIA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 131 RUSSIA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 132 REST OF EUROPE: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 133 REST OF EUROPE: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: CONTINUOUS THERMAL MONITORING MARKET, BY SWITCHGEAR, 2021-2023 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: CONTINUOUS THERMAL MONITORING MARKET, BY SWITCHGEAR, 2024-2030 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: CONTINUOUS THERMAL MONITORING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: CONTINUOUS THERMAL MONITORING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 144 GCC: CONTINUOUS THERMAL MONITORING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 145 GCC: CONTINUOUS THERMAL MONITORING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 146 SAUDI ARABIA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 147 SAUDI ARABIA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 148 UAE: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 149 UAE: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 150 KUWAIT: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 151 KUWAIT: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 152 REST OF GCC: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 153 REST OF GCC: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 154 SOUTH AFRICA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 155 SOUTH AFRICA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST & AFRICA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 157 REST OF MIDDLE EAST & AFRICA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 158 SOUTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 159 SOUTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 160 SOUTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 161 SOUTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 162 SOUTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY SWITCHGEAR, 2021-2023 (USD MILLION)

- TABLE 163 SOUTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY SWITCHGEAR, 2024-2030 (USD MILLION)

- TABLE 164 SOUTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 165 SOUTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 166 SOUTH AMERICA: CONTINUOUS THERMAL MONITORING, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 167 SOUTH AMERICA: CONTINUOUS THERMAL MONITORING, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 168 BRAZIL: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 169 BRAZIL: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 170 ARGENTINA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 171 ARGENTINA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 172 REST OF SOUTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 173 REST OF SOUTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 174 CONTINUOUS THERMAL MONITORING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 175 CONTINUOUS THERMAL MONITORING MARKET: DEGREE OF COMPETITION, 2023

- TABLE 176 CONTINUOUS THERMAL MONITORING MARKET: REGION FOOTPRINT

- TABLE 177 CONTINUOUS THERMAL MONITORING MARKET: OFFERING FOOTPRINT

- TABLE 178 CONTINUOUS THERMAL MONITORING MARKET: APPLICATION FOOTPRINT

- TABLE 179 CONTINUOUS THERMAL MONITORING MARKET: END USER FOOTPRINT

- TABLE 180 CONTINUOUS THERMAL MONITORING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 181 CONTINUOUS THERMAL MONITORING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 182 CONTINUOUS THERMAL MONITORING MARKET: PRODUCT LAUNCHES, JANUARY 2020-DECEMBER 2024

- TABLE 183 CONTINUOUS THERMAL MONITORING MARKET: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 184 CONTINUOUS THERMAL MONITORING MARKET: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 185 CONTINUOUS THERMAL MONITORING MARKET: OTHER DEVELOPMENTS, JANUARY 2020-DECEMBER 2024

- TABLE 186 ABB: COMPANY OVERVIEW

- TABLE 187 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 ABB: PRODUCT LAUNCHES

- TABLE 189 ABB: DEALS

- TABLE 190 ABB: EXPANSIONS

- TABLE 191 ABB: OTHER DEVELOPMENTS

- TABLE 192 SIEMENS: COMPANY OVERVIEW

- TABLE 193 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 SIEMENS: DEALS

- TABLE 195 SIEMENS: OTHER DEVELOPMENTS

- TABLE 196 SIEMENS: EXPANSIONS

- TABLE 197 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 198 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 HONEYWELL INTERNATIONAL INC.: EXPANSIONS

- TABLE 200 HONEYWELL INTERNATIONAL INC.: OTHER DEVELOPMENTS

- TABLE 201 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 202 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 204 SCHNEIDER ELECTRIC: EXPANSIONS

- TABLE 205 SCHNEIDER ELECTRIC: OTHER DEVELOPMENTS

- TABLE 206 ADVANCED ENERGY: COMPANY OVERVIEW

- TABLE 207 ADVANCED ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 ADVANCED ENERGY: EXPANSIONS

- TABLE 209 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 210 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES

- TABLE 212 MICROCHIP TECHNOLOGY INC.: DEVELOPMENTS

- TABLE 213 MICROCHIP TECHNOLOGY INC.: EXPANSIONS

- TABLE 214 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 215 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 216 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES

- TABLE 217 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

- TABLE 218 WIKA ALEXANDER WIEGAND SE & CO. KG: COMPANY OVERVIEW

- TABLE 219 WIKA ALEXANDER WIEGAND SE & CO. KG: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 220 CALEX ELECTRONICS LIMITED: COMPANY OVERVIEW

- TABLE 221 CALEX ELECTRONICS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 223 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 POWELL INDUSTRIES: COMPANY OVERVIEW

- TABLE 225 POWELL INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 DYNAMIC RATINGS: COMPANY OVERVIEW

- TABLE 227 DYNAMIC RATINGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 DYNAMIC RATINGS: EXPANSIONS

- TABLE 229 DOBLE ENGINEERING COMPANY: COMPANY OVERVIEW

- TABLE 230 DOBLE ENGINEERING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 DOBLE ENGINEERING COMPANY: EXPANSION

- TABLE 232 EXERTHERM: COMPANY OVERVIEW

- TABLE 233 EXERTHERM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 EXERTHERM: DEALS

- TABLE 235 OPTRIS: COMPANY OVERVIEW

- TABLE 236 OPTRIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 CONTINUOUS THERMAL MONITORING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 CONTINUOUS THERMAL MONITORING MARKET: RESEARCH DESIGN

- FIGURE 3 CONTINUOUS THERMAL MONITORING MARKET: DATA TRIANGULATION

- FIGURE 4 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR CONTINUOUS THERMAL MONITORING

- FIGURE 5 CONTINUOUS THERMAL MONITORING MARKET: BOTTOM-UP APPROACH

- FIGURE 6 CONTINUOUS THERMAL MONITORING MARKET: TOP-DOWN APPROACH

- FIGURE 7 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF CONTINUOUS THERMAL MONITORING

- FIGURE 8 CONTINUOUS THERMAL MONITORING MARKET: MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY-SIDE ANALYSIS)

- FIGURE 9 CONTINUOUS THERMAL MONITORING MARKET: RESEARCH ASSUMPTIONS

- FIGURE 10 CONTINUOUS THERMAL MONITORING MARKET: RESEARCH LIMITATIONS

- FIGURE 11 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 HARDWARE SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 13 BUS DUCT MONITORS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 DATA CENTERS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 INCREASING DEMAND FOR RELIABLE AND EFFICIENT POWER INFRASTRUCTURE TO FOSTER MARKET GROWTH

- FIGURE 16 HARDWARE SEGMENT AND CHINA DOMINATED CONTINUOUS THERMAL MONITORING MARKET IN 2024

- FIGURE 17 HARDWARE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 18 SWITCHGEAR SEGMENT TO CLAIM LARGEST MARKET SHARE IN 2030

- FIGURE 19 UTILITIES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 20 ASIA PACIFIC TO REGISTER HIGHEST CAGR MARKET DURING FORECAST PERIOD

- FIGURE 21 CONTINUOUS THERMAL MONITORING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 ANNUAL PRIVATE INVESTMENT IN AI, 2019-2023 (USD BILLION)

- FIGURE 23 REGION/COUNTRY-WISE INVESTMENT DATA ON ELECTRICITY GRIDS, 2015-2022 (USD BILLION)

- FIGURE 24 SHARE OF RENEWABLE ENERGY GENERATION, BY TECHNOLOGY, 2020-2028

- FIGURE 25 INTERNET CRIME COMPLAINTS AND LOSSES, 2019-2023

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 CONTINUOUS THERMAL MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 CONTINUOUS THERMAL MONITORING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 AVERAGE SELLING PRICE TREND OF HARDWARE, BY REGION, 2021-2023

- FIGURE 30 IMPORT DATA FOR HS CODE 903289-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- FIGURE 31 EXPORT DATA FOR HS CODE 903289-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- FIGURE 32 PATENTS APPLIED AND GRANTED, 2013-2023

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO, 2024

- FIGURE 34 CONTINUOUS THERMAL MONITORING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP OFFERINGS

- FIGURE 36 KEY BUYING CRITERIA FOR TOP OFFERINGS

- FIGURE 37 IMPACT OF AI/GENERATIVE AI ON OFFERING, BY REGION

- FIGURE 38 CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING, 2023

- FIGURE 39 CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION, 2023

- FIGURE 40 CONTINUOUS THERMAL MONITORING MARKET, BY END USER, 2023

- FIGURE 41 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 CONTINUOUS THERMAL MONITORING MARKET, BY REGION

- FIGURE 43 NORTH AMERICA: CONTINUOUS THERMAL MONITORING MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: CONTINUOUS THERMAL MONITORING MARKET SNAPSHOT

- FIGURE 45 CONTINUOUS THERMAL MONITORING MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2019-2023

- FIGURE 46 MARKET SHARE ANALYSIS OF COMPANIES OFFERING CONTINUOUS THERMAL MONITORING SERVICES, 2023

- FIGURE 47 COMPANY VALUATION, 2025

- FIGURE 48 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 49 BRAND/PRODUCT COMPARISON

- FIGURE 50 CONTINUOUS THERMAL MONITORING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 51 CONTINUOUS THERMAL MONITORING MARKET: COMPANY FOOTPRINT

- FIGURE 52 CONTINUOUS THERMAL MONITORING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 53 ABB: COMPANY SNAPSHOT

- FIGURE 54 SIEMENS: COMPANY SNAPSHOT

- FIGURE 55 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 56 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 57 ADVANCED ENERGY: COMPANY SNAPSHOT

- FIGURE 58 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 59 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 60 OMRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 POWELL INDUSTRIES: COMPANY SNAPSHOT

The continuous thermal monitoring market is projected to reach USD 1.49 billion by 2030 from an estimated USD 1.00 billion in 2024, at a CAGR of 6.8% during the forecast period (2024-2030). The continuous thermal monitoring market is driven by factors such as an increased focus on energy efficiency among industries, an increased demand for smaller and more powerful electronic devices, and a growing number of data centers and cloud computing services. These trends require efficient thermal management solutions that ensure optimal performance and prevent overheating, hence driving the demand for continuous thermal monitoring technologies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering By Application By End User By Region |

| Regions covered | Asia Pacific, Europe, North America, South America, Middle East & Africa |

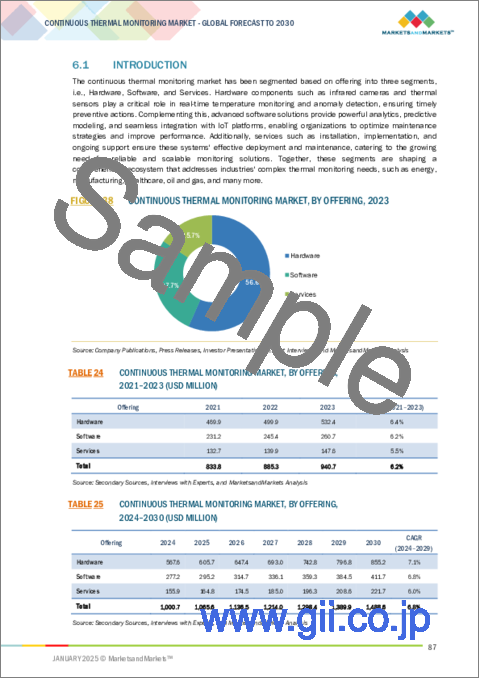

"Hardware is expected to have the highest growth rate segment during the forecast period."

The hardware component is the fastest segment due to its critical role to enable accurate, reliable temperature identification. Hardware machines are widely used in numerous industries for the detection of thermal anomalies so that overheating is prevented. They also maximize operational efficiency as they can operate to identify thermal patterns in real-time. Predictive maintenance continues to be of high demand due to its various applications in numerous industries such as manufacturing, utility, and data center operations. Technological advancements also led to a compact, affordable, and even IoT-enabled hardware that integrates so well with a smart monitoring system, making these devices more alluring.

"Bus Duct Monitors segment is expected to emerge as the fastest growing segment by application."

The continuous thermal monitoring market in bus duct monitoring is gaining immense growth due to the importance of reliability and security for electrical infrastructure. This further gains momentum due to prevention and avoidance of costly failures and fire hazards, growing smart grid adoption, and emerging demand from data centers and renewable energy. The increasing stringency of regulatory standards, advancement in IoT and predictive analytics, and the massive costs associated with system downtime make real-time thermal monitoring an absolute necessity. Industrialization is growing at a faster pace, and the focus has shifted towards efficiency and safety. Bus duct monitoring is rapidly becoming an essential part of modern power distribution systems.

"China to grow at the highest CAGR for Asia Pacific Continuous thermal monitoring market."

China is the Asia-Pacific region's fastest growing market for continuous thermal monitoring in Asia Pacific, given its vast industrial base, rapid urbanization, and vast infrastructure developments. The strong focus on energy efficiency and rigid safety regulations by the nation has further accelerated the deployment of high-tech monitoring systems across power distribution networks, data centers, and renewable energy projects. Moreover, the proactive interest of the government in smart grid development and the incorporation of IoT technology has created a tremendous momentum for implementing real-time thermal monitoring solutions. Significant investment in industrial automation with a firm commitment to minimizing downtime and energy losses drives China at the fore in the region to embrace leading-edge thermal monitoring technologies.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 30%, Tier 2- 45%, and Tier 3- 25%

By Designation: Director Levels- 20%, C-Level- 30%, and Others- 50%

By Region: North America- 18%, Europe- 8%, Asia Pacific- 60%, the Middle East & Africa- 10%, and South America- 4%

Note: Others include sales managers, engineers, and regional managers.

Note: The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Honeywell International Inc. (US) and Teledyne Technologies (US) are some of the key players in the continuous thermal monitoring market.

The study includes an in-depth competitive analysis of these key players in the continuous thermal monitoring market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report defines, describes, and forecasts the continuous thermal monitoring market by offering (hardware, software, services), By Application (Bus Duct Monitors, Switchgear, Motor Control Centers, Dry Transformers, Low-voltage Transformers, Other Applications), By End User (Data Centers, Oil & Gas, Logistics, Utilities, Manufacturing, Healthcare, Retail, Telecommunications, Other End Users) and By Region (North America, South America, Europe, Asia Pacific, and Middle east & Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the continuous thermal monitoring market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements, investment, divestment, new product & service launches, and recent developments associated with the continuous thermal monitoring market. Competitive analysis of upcoming startups in the continuous thermal monitoring market ecosystem is covered in this report.

Key Benefits of Buying the Report

- Analysis of key drivers (Growing emphasis on predictive maintenance, Rising adoption of IoT and AI technology, Increasing adoption of industrial automation), restraints (High initial costs associated with advanced monitoring systems and Technical complexities in integrating advanced monitoring systems with existing industrial infrastructure), opportunities (Rapid deployment of smart grids, Rapid deployment of smart grids, and Rising adoption of data centers), and challenges (Rising cyberattacks) influences the growth of the continuous thermal monitoring market.

- Product Development/ Innovation: Microchip Technology introduced the MCP998x family, comprising 10 automotive-qualified remote temperature sensors capable of monitoring multiple channels accurately. These sensors feature integrated resistance error correction and beta compensation, enhancing precision and reducing the need for additional components. Designed to operate across a wide temperature range, the MCP998x family offers up to five monitoring channels, with certain models including fixed shutdown temperature setpoints for added safety. This product line addresses the growing demand for reliable thermal management in automotive and industrial applications.

- Market Development: The development of continuous thermal monitoring systmes are moving towards greater efficiency and electrical equipment safety. Additionally, the growing focus on energy efficiency and sustainability has led industries to implement thermal monitoring systems to optimize energy use and reduce carbon footprints.

- Market Diversification: Honeywell expanded its Emissions Management Suite to include decarbonization audits and reduction roadmaps for thermal solutions. This enhancement aimed to help industries identify emissions reduction opportunities and implement tailored strategies to achieve sustainability goals, aligning with global efforts to combat climate change.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Honeywell International Inc. (US) and Teledyne Technologies Incorporated (US) among others in the continuous thermal monitoring market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 UNIT CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 List of primary interview participants

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.3 MARKET SCOPE

- 2.4 MARKET SIZE ESTIMATION METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Demand-side analysis

- 2.4.1.2 Regional analysis

- 2.4.1.3 Country-level analysis

- 2.4.1.4 Demand-side assumptions

- 2.4.1.5 Demand-side calculations

- 2.4.2 TOP-DOWN APPROACH

- 2.4.2.1 Supply-side analysis

- 2.4.2.2 Supply-side assumptions

- 2.4.2.3 Supply-side calculations

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 FORECAST ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CONTINUOUS THERMAL MONITORING MARKET

- 4.2 CONTINUOUS THERMAL MONITORING MARKET IN ASIA PACIFIC, BY OFFERING AND COUNTRY

- 4.3 CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING

- 4.4 CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION

- 4.5 CONTINUOUS THERMAL MONITORING MARKET, BY END USER

- 4.6 CONTINUOUS THERMAL MONITORING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing emphasis on predictive maintenance

- 5.2.1.2 Rising adoption of IoT and AI technology

- 5.2.1.3 Increasing adoption of industrial automation

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial costs associated with advanced monitoring systems

- 5.2.2.2 Technical complexities in integrating advanced monitoring systems with existing industrial infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid deployment of smart grids

- 5.2.3.2 Growing demand in renewable energy sector

- 5.2.3.3 Increasing demand for data centers

- 5.2.4 CHALLENGES

- 5.2.4.1 Rising cyberattacks

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 SENZMATE IMPLEMENTS REAL-TIME TEMPERATURE MONITORING SOLUTIONS IN PHARMACEUTICAL WAREHOUSES TO BOOST OPERATIONAL EFFICIENCY

- 5.6.2 EMERSON PROVIDES SABIC WITH ROSEMOUNT WIRELESS TRANSMITTERS THAT OFFER CONTINUOUS AND REAL-TIME TEMPERATURE MONITORING ACROSS CRITICAL EQUIPMENT

- 5.6.3 GRACESENSE HOT SPOT MONITORING ADDRESSES OVERHEATING ISSUES IN ELECTRICAL EQUIPMENT IN INDUSTRIAL FACILITIES

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Thermal sensors and infrared cameras

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 Predictive maintenance

- 5.7.3 COMPLEMENTARY TECHNOLOGIES

- 5.7.3.1 Acoustic imaging

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 INDICATIVE PRICING OF CONTINUOUS THERMAL MONITORING SOLUTIONS, BY OFFERING, 2023

- 5.8.2 AVERAGE SELLING PRICE TREND OF HARDWARE, BY REGION, 2021-2023

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 903289)

- 5.9.2 EXPORT SCENARIO (HS CODE 903289)

- 5.10 PATENT ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFFS RELATED TO CONTINUOUS THERMAL MONITORING

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF SUBSTITUTES

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF NEW ENTRANTS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GENERATIVE AI IN CONTINUOUS THERMAL MONITORING MARKET

- 5.16.1 ADOPTION OF AI/GENERATIVE AI APPLICATIONS IN CONTINUOUS THERMAL MONITORING MARKET

- 5.16.2 IMPACT OF AI/GENERATIVE AI ON OFFERING, BY REGION

- 5.16.3 IMPACT OF AI/GENERATIVE AI ON CONTINUOUS THERMAL MONITORING MARKET, BY REGION

- 5.17 MACROECONOMIC OUTLOOK ON CONTINUOUS THERMAL MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 GDP TRENDS AND FORECAST

- 5.17.3 INFLATION

6 CONTINUOUS THERMAL MONITORING MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 GROWING ADOPTION OF INDUSTRY 4.0 AND IOT-ENABLED SOLUTIONS TO BOOST DEMAND

- 6.3 SOFTWARE

- 6.3.1 RISING EMPHASIS ON DIGITAL TRANSFORMATION TO FUEL MARKET GROWTH

- 6.4 SERVICES

- 6.4.1 INCREASING ADOPTION OF IOT-ENABLED TECHNOLOGIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

7 CONTINUOUS THERMAL MONITORING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 BUS DUCT MONITORS

- 7.2.1 GROWING DEMAND FOR UNINTERRUPTED POWER DISTRIBUTION AND OPERATIONAL SAFETY TO FUEL MARKET GROWTH

- 7.3 SWITCHGEAR

- 7.3.1 LOW-VOLTAGE SWITCHGEAR

- 7.3.1.1 Increasing adoption of automation and energy-efficient systems to boost demand

- 7.3.2 MEDIUM-VOLTAGE SWITCHGEAR

- 7.3.2.1 Growing adoption in utilities, manufacturing, and renewable energy sectors to support market growth

- 7.3.1 LOW-VOLTAGE SWITCHGEAR

- 7.4 MOTOR CONTROL CENTERS

- 7.4.1 RISING COMPLEXITIES ASSOCIATED WITH AUTOMATED AND CONNECTED SYSTEMS TO FOSTER MARKET GROWTH

- 7.5 DRY TRANSFORMERS

- 7.5.1 INCREASING ADOPTION OF RENEWABLE ENERGY AND SMART GRIDS TO BOOST DEMAND

- 7.6 LOW-VOLTAGE TRANSFORMERS

- 7.6.1 INTEGRATION OF COMPACT THERMAL SENSORS AND ADVANCED ANALYTICS TOOLS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 7.7 OTHER APPLICATIONS

8 CONTINUOUS THERMAL MONITORING MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 DATA CENTERS

- 8.2.1 RISING DEMAND FOR CLOUD COMPUTING AND EDGE COMPUTING TO FUEL MARKET GROWTH

- 8.3 OIL & GAS

- 8.3.1 NEED TO REDUCE RELIANCE ON COMPLEX ELECTRICAL EQUIPMENT OPERATING IN HAZARDOUS ENVIRONMENTS TO BOOST DEMAND

- 8.4 LOGISTICS

- 8.4.1 INCREASING EMPHASIS ON ENERGY EFFICIENCY AND SUSTAINABILITY TO SUPPORT MARKET GROWTH

- 8.5 UTILITIES

- 8.5.1 RISING NEED TO ENHANCE PERFORMANCE OF SUBSTATIONS, TRANSFORMERS, AND DISTRIBUTION NETWORKS TO FOSTER SEGMENTAL GROWTH

- 8.6 MANUFACTURING

- 8.6.1 GROWING DEPENDENCE ON HIGH-PERFORMANCE ELECTRICAL EQUIPMENT TO BOOST DEMAND

- 8.7 HEALTHCARE

- 8.7.1 INCREASING APPLICATION OF IOT-ENABLED DEVICES TO SUPPORT MARKET GROWTH

- 8.8 RETAIL

- 8.8.1 GROWING ADOPTION OF AUTOMATED CHECKOUT SYSTEMS, SMART LIGHTING, AND REFRIGERATION UNITS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 8.9 TELECOMMUNICATIONS

- 8.9.1 EXPANSION OF 5G NETWORKS TO FOSTER MARKET GROWTH

- 8.10 OTHER END USERS

9 CONTINUOUS THERMAL MONITORING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Rising emphasis on expanding advanced manufacturing and energy infrastructure to boost demand

- 9.2.2 CANADA

- 9.2.2.1 Expanding industrial sector to fuel market growth

- 9.2.3 MEXICO

- 9.2.3.1 Growing emphasis on energy efficiency and sustainability to support market growth

- 9.2.1 US

- 9.3 ASIA PACIFIC

- 9.3.1 CHINA

- 9.3.1.1 Growing demand for healthcare services and medical devices to fuel market growth

- 9.3.2 AUSTRALIA

- 9.3.2.1 Transition toward low-carbon future to offer lucrative growth opportunities

- 9.3.3 INDIA

- 9.3.3.1 Rising oil consumption and data center growth to support market growth

- 9.3.4 JAPAN

- 9.3.4.1 Rising demand for inpatient care to foster market growth

- 9.3.5 SOUTH KOREA

- 9.3.5.1 Growing demand for high-tech manufacturing and sustainable technologies to fuel market growth

- 9.3.6 REST OF ASIA PACIFIC

- 9.3.1 CHINA

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Rising demand for natural gas and reliance on LNG imports to fuel market growth

- 9.4.2 UK

- 9.4.2.1 Government-led initiatives to boost development of data centers to foster market growth

- 9.4.3 FRANCE

- 9.4.3.1 Growing need for maintaining optimal storage conditions for sensitive goods to accelerate demand

- 9.4.4 ITALY

- 9.4.4.1 Rising emphasis on reducing energy wastage to support market growth

- 9.4.5 RUSSIA

- 9.4.5.1 Expanding manufacturing sector to fuel market growth

- 9.4.6 REST OF EUROPE

- 9.4.1 GERMANY

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Rising shift toward cleaner energy technologies to foster market growth

- 9.5.1.2 UAE

- 9.5.1.2.1 Growing demand for advanced thermal monitoring systems in food & beverage sector to support market growth

- 9.5.1.3 Kuwait

- 9.5.1.3.1 Ongoing technological advancements in thermal imaging systems to offer lucrative growth opportunities

- 9.5.1.4 Rest of GCC

- 9.5.1.1 Saudi Arabia

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Increasing adoption of solar energy solutions to fuel market growth

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- 9.5.1 GCC

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Rising emphasis on developing digital infrastructure to drive market

- 9.6.2 ARGENTINA

- 9.6.2.1 Rapid development in healthcare sector to boost demand

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 10.3 REVENUE ANALYSIS, 2019-2023

- 10.4 MARKET SHARE ANALYSIS, 2023

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Offering footprint

- 10.7.5.4 Application footprint

- 10.7.5.5 End user footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ABB

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.3.4 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 SIEMENS

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Other developments

- 11.1.2.3.3 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 HONEYWELL INTERNATIONAL INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Expansions

- 11.1.3.3.2 Other developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 SCHNEIDER ELECTRIC

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Expansions

- 11.1.4.3.3 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses/Competitive threats

- 11.1.5 ADVANCED ENERGY

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Expansions

- 11.1.6 MICROCHIP TECHNOLOGY INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Developments

- 11.1.6.3.3 Expansions

- 11.1.7 TELEDYNE TECHNOLOGIES INCORPORATED

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.7.4 MnM view

- 11.1.7.4.1 Key strengths/Right to win

- 11.1.7.4.2 Strategic choices

- 11.1.7.4.3 Weaknesses/Competitive threats

- 11.1.8 WIKA ALEXANDER WIEGAND SE & CO. KG

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.9 CALEX ELECTRONICS LIMITED

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.10 OMRON CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.11 POWELL INDUSTRIES

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.12 DYNAMIC RATINGS

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Expansions

- 11.1.13 DOBLE ENGINEERING COMPANY

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Expansion

- 11.1.14 EXTERTHERM

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Deals

- 11.1.15 OPTRIS

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.1 ABB

- 11.2 OTHER PLAYERS

- 11.2.1 OSENSA INNOVATIONS

- 11.2.2 BLUE JAY TECHNOLOGY CO. LTD.

- 11.2.3 AP SENSING

- 11.2.4 RUGGED MONITORING

- 11.2.5 INFRASENSING

- 11.2.6 TRISQUARE SWITCHGEARS PVT. LTD.

- 11.2.7 GRACE TECHNOLOGIES, INC.

- 11.2.8 DPSTAR GROUP

- 11.2.9 COMEM S.P.A.

- 11.2.10 ORION ITALIA S.R.L

12 APPENDIX

- 12.1 INSIGHTS OF INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS