|

|

市場調査レポート

商品コード

1648938

BaaS(Battery as a Service)の世界市場:リースタイプ別、用途別、車両タイプ別、バッテリー容量別、地域別 - 予測(~2035年)Battery as a Service Market by Leasing Type (Subscription, Pay-per-use), Usage (Private, Commercial), Vehicle Type (Two-wheelers, Three-wheelers, Passenger Cars, Commercial Vehicles), Battery Capacity, and Region - Global Forecast to 2035 |

||||||

カスタマイズ可能

|

|||||||

| BaaS(Battery as a Service)の世界市場:リースタイプ別、用途別、車両タイプ別、バッテリー容量別、地域別 - 予測(~2035年) |

|

出版日: 2025年01月30日

発行: MarketsandMarkets

ページ情報: 英文 256 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のBaaS(Battery as a Service)の市場規模は、2024年に6億6,000万米ドル、2035年までに144億5,000万米ドルに達すると予測され、2024年~2035年にCAGRで32.4%の成長が見込まれます。

BaaS(Battery as a Service)モデルが提供するコスト削減と運用効率によって、電気自動車の商業採用が増加すると予測されます。このモデルは、運用コストの削減、ダウンタイムの短縮、車両性能の向上に役立ちます。EV売上の40~60%がフリート向けである欧州では、バッテリー価格が安定すれば、バッテリーリースが非常に魅力的な選択肢になる可能性が高いです。さらに、特に急速に都市化が進む地域では、ラストマイル配送や公共交通機関において電動三輪車の需要が高まっており、バッテリーリースサービスの採用を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2035年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2035年 |

| 単位 | 数量(個)、金額(100万米ドル) |

| セグメント | リースタイプ、用途、車両タイプ、バッテリー容量、地域 |

| 対象地域 | アジア太平洋、欧州、北米 |

「三輪車セグメントが予測期間に市場でもっとも急速に成長する見込みです。」

三輪車セグメントが予測期間にもっとも高い成長を示すと予測されており、これは主にインドなどの新興市場における電動三輪車や配送車の急速な普及によるものです。バッテリーリースサービスが提供する費用対効果と、手頃な価格で持続可能な輸送ソリューションへのニーズが、この成長を後押ししています。Mahindra Last Mile Mobility(インド)は、2024年以来、インドでZor GrandとTreo Plusの三輪車モデル向けにバッテリーリースソリューションを提供しています。2024年12月、同社はVidyutTech(インド)と提携し、商用電気三輪車向けに、1キロメートル当たりわずか2.50ルピーからの従量制バッテリーレンタルサービスを提供することで、EVの所有をより手頃なものにすることを目的としたBaaS(Battery as a Service)を導入しました。同様に2024年9月、Neuron Energy(インド)はPointo(インド)と提携し、商用電気リキシャ向けにリチウムイオンバッテリーをリースしています。Neuron Energyは、鉛蓄電池に代わり、L3カテゴリの電気リキシャ向けに最大12,000個の大容量5.1kWhリチウムイオンバッテリーを供給します。さらに2024年4月、Neuron EnergyはUrja Mobility(インド)と提携し、コルカタにおける電気リキシャ(通称「toto」)のバッテリーリースモデルを主導しました。両社は合わせて、全国で500万台の電気リキシャを保有することを目指しました。同様に、2024年3月には、Sun Mobility(インド)とRevfin(インド)が提携し、BaaS(Battery as a Service)モデルの下、約10万台の電気二輪・三輪車に資金を融資し、展開しました。

「商業セグメントが予測期間に市場でもっとも速く成長する見込みです。」

バッテリーリースは、フリート運用者に提供するコスト効率と運用の柔軟性により、商業セグメントで急成長を示しています。リースオプションを利用することで、商業フリートのオーナーは初期投資コストを下げ、バッテリーの劣化に関する懸念を軽減することができます。コスト削減と合理化された運用を活用できるフリート運用者にとって、この価値提案は特に有益であるため、自動車のフリート使用はより急速に成長すると予測されます。

当レポートでは、世界のBaaS(Battery as a Service)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- BaaS(Battery as a Service)市場の企業にとって魅力的な機会

- BaaS(Battery as a Service)市場:リースタイプ別

- BaaS(Battery as a Service)市場:用途別

- BaaS(Battery as a Service)市場:車両タイプ別

- BaaS(Battery as a Service)市場:バッテリー容量別

- BaaS(Battery as a Service)市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 購入基準

- エコシステム分析

- バッテリーメーカー

- OEM

- バッテリー資産管理企業

- 金融機関

- バリューチェーン分析

- 価格分析

- 主要企業の平均販売価格

- 平均販売価格の動向:車両タイプ別

- 平均販売価格の動向:地域別

- BaaS(Battery as a Service)市場:ビジネスモデル

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 投資シナリオ

- 特許分析

- 顧客ビジネスに影響を与える動向と混乱

- ケーススタディ分析

- 主な会議とイベント(2025年~2026年)

- 規制情勢

- 規制機関、政府機関、その他の組織

- BaaS(Battery as a Service)市場に対するAIの影響

- 商用車におけるバッテリーリース

- 二輪車

第6章 BaaS(Battery as a Service)市場:バッテリー容量別

- イントロダクション

- 5kWh未満

- 5~10kWh

- 11~50kWh

- 51~100kWh

- 100kWh超

- 主な産業考察

第7章 BaaS(Battery as a Service)市場:車両タイプ別

- イントロダクション

- 二輪車

- 三輪車

- 乗用車

- 商用車

- 主な産業考察

第8章 BaaS(Battery as a Service)市場:リースタイプ別

- イントロダクション

- サブスクリプション

- 従量課金制

- 主な産業考察

第9章 BaaS(Battery as a Service)市場:用途別

- イントロダクション

- 個人

- 商業

- 主な産業考察

第10章 BaaS(Battery as a Service)市場:地域別

- イントロダクション

- アジア太平洋

- マクロ経済の見通し

- 中国

- インド

- 日本

- 韓国

- 北米

- マクロ経済の見通し

- 米国

- カナダ

- 欧州

- マクロ経済の見通し

- ドイツ

- フランス

- イタリア

- スペイン

- 英国

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2021年~2024年)

- 市場シェア分析(2023年)

- 収益分析(2019年~2023年)

- 企業の評価と財務指標

- ブランド/サービスの比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- NIO

- GOGORO

- XPENG INC.

- SAIC MOTOR CORPORATION LIMITED

- VINFAST

- MAHINDRA&MAHINDRA LTD.

- BOUNCE INFINITY

- YINSON GREEN TECHNOLOGIES

- LECTRIX E-VEHICLE PVT. LTD.

- HYUNDAI MOTOR COMPANY

- YAMAHA MOTOR CO., LTD.

- NISSAN MOTOR CO., LTD.

- その他の主要企業

- OEMS

- BATTERY ASSET MANAGEMENT COMPANIES

第13章 MARKETSANDMARKETSによる提言

- 商用EVの採用の増加がアジア太平洋のバッテリーリースサービスの需要に影響を及ぼす

- 顧客の利便性と利便性を高めるバッテリー交換サブスクリプションの利用

- 個人EVユーザーへの車両買戻しオプションの提供

- 結論

第14章 付録

List of Tables

- TABLE 1 MARKET DEFINITION, BY LEASING TYPE

- TABLE 2 MARKET DEFINITION, BY USAGE

- TABLE 3 MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 4 MARKET DEFINITION, BY BATTERY CAPACITY

- TABLE 5 USD EXCHANGE RATES, 2019-2024

- TABLE 6 COST SAVINGS OFFERED BY BATTERY LEASE MODEL

- TABLE 7 IMPACT OF MARKET DYNAMICS

- TABLE 8 KEY BUYING CRITERIA, BY USAGE

- TABLE 9 ROLE OF COMPANIES IN MARKET ECOSYSTEM

- TABLE 10 AVERAGE SELLING PRICE OF KEY PLAYERS, 2023 (USD)

- TABLE 11 AVERAGE SELLING PRICE TREND, BY VEHICLE TYPE, 2021-2025 (USD)

- TABLE 12 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2025 (USD)

- TABLE 13 PATENT ANALYSIS, 2020-2024

- TABLE 14 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

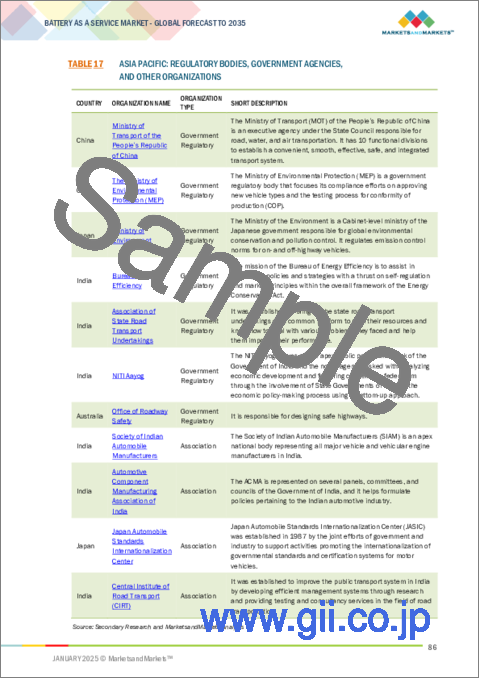

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 CHANGES IN GLOBAL REGULATORY ENVIRONMENT

- TABLE 19 REGULATIONS/VOLUNTARY PROCEDURES FOR PERFORMANCE OF EV BATTERIES

- TABLE 20 REGULATIONS/VOLUNTARY PROCEDURES FOR DURABILITY OF EV BATTERIES

- TABLE 21 REGULATIONS/VOLUNTARY PROCEDURES FOR SAFETY OF EV BATTERIES

- TABLE 22 REGULATIONS/VOLUNTARY PROCEDURES FOR RECYCLING EV BATTERIES

- TABLE 23 COST OF TWO-WHEELERS WITH AND WITHOUT BATTERY LEASING SERVICE

- TABLE 24 BATTERY AS A SERVICE MARKET, BY BATTERY CAPACITY, 2020-2023 (THOUSAND UNITS)

- TABLE 25 BATTERY AS A SERVICE MARKET, BY BATTERY CAPACITY, 2024-2030 (THOUSAND UNITS)

- TABLE 26 BATTERY AS A SERVICE MARKET, BY BATTERY CAPACITY, 2031-2035 (THOUSAND UNITS)

- TABLE 27 BELOW 5 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 28 BELOW 5 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 29 BELOW 5 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 30 5-10 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 31 5-10 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 32 5-10 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 33 11-50 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 34 11-50 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 35 11-50 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 36 51-100 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 37 51-100 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 38 51-100 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 39 ABOVE 100 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 40 ABOVE 100 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 41 ABOVE 100 KWH: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 42 BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 43 BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 44 BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 45 BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 46 BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 47 BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 48 OEMS OFFERING BATTERY LEASING SOLUTIONS WITH TWO-WHEELERS

- TABLE 49 TWO-WHEELERS: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 50 TWO-WHEELERS: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 51 TWO-WHEELERS: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 52 TWO-WHEELERS: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 53 TWO-WHEELERS: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 54 TWO-WHEELERS: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 55 THREE-WHEELERS: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 56 THREE-WHEELERS: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 57 THREE-WHEELERS: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 58 THREE-WHEELERS: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 59 THREE-WHEELERS: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 60 THREE-WHEELERS: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 61 OEMS OFFERING BATTERY LEASING SOLUTIONS WITH PASSENGER CARS

- TABLE 62 PASSENGER CARS: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 63 PASSENGER CARS: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 64 PASSENGER CARS: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 65 PASSENGER CARS: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 66 PASSENGER CARS: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 67 PASSENGER CARS: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 68 COMMERCIAL VEHICLES: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 69 COMMERCIAL VEHICLES: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 70 COMMERCIAL VEHICLES: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 71 COMMERCIAL VEHICLES: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 72 COMMERCIAL VEHICLES: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 73 COMMERCIAL VEHICLES: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 74 BATTERY AS A SERVICE MARKET, BY LEASING TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 75 BATTERY AS A SERVICE MARKET, BY LEASING TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 76 BATTERY AS A SERVICE MARKET, BY LEASING TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 77 BATTERY AS A SERVICE MARKET, BY LEASING TYPE, 2020-2023 (USD MILLION)

- TABLE 78 BATTERY AS A SERVICE MARKET, BY LEASING TYPE, 2024-2030 (USD MILLION)

- TABLE 79 BATTERY AS A SERVICE MARKET, BY LEASING TYPE, 2031-2035 (USD MILLION)

- TABLE 80 SUBSCRIPTION: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 81 SUBSCRIPTION: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 82 SUBSCRIPTION: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 83 SUBSCRIPTION: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 84 SUBSCRIPTION: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 85 SUBSCRIPTION: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 86 PAY-PER-USE: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 87 PAY-PER-USE: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 88 PAY-PER-USE: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 89 PAY-PER-USE: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 90 PAY-PER-USE: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 91 PAY-PER-USE: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 92 BATTERY AS A SERVICE MARKET, BY USAGE, 2020-2023 (THOUSAND UNITS)

- TABLE 93 BATTERY AS A SERVICE MARKET, BY USAGE, 2024-2030 (THOUSAND UNITS)

- TABLE 94 BATTERY AS A SERVICE MARKET, BY USAGE, 2031-2035 (THOUSAND UNITS)

- TABLE 95 BATTERY AS A SERVICE MARKET, BY USAGE, 2020-2023 (USD MILLION)

- TABLE 96 BATTERY AS A SERVICE MARKET, BY USAGE, 2024-2030 (USD MILLION)

- TABLE 97 BATTERY AS A SERVICE MARKET, BY USAGE, 2031-2035 (USD MILLION)

- TABLE 98 PRIVATE: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 99 PRIVATE: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 100 PRIVATE: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 101 PRIVATE: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 102 PRIVATE: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 103 PRIVATE: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 104 COMMERCIAL: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 105 COMMERCIAL: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 106 COMMERCIAL: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 107 COMMERCIAL: BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 108 COMMERCIAL: BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 109 COMMERCIAL: BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 110 BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 111 BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 112 BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 113 BATTERY AS A SERVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 114 BATTERY AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 115 BATTERY AS A SERVICE MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 116 ASIA PACIFIC: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 117 ASIA PACIFIC: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 118 ASIA PACIFIC: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2031-2035 (THOUSAND UNITS)

- TABLE 119 ASIA PACIFIC: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 120 ASIA PACIFIC: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 122 CHINESE OEMS OFFERING BATTERY LEASING SOLUTIONS

- TABLE 123 CHINA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 124 CHINA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 125 CHINA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 126 CHINA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 127 CHINA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 128 CHINA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 129 INDIAN OEMS OFFERING BATTERY LEASING SOLUTIONS

- TABLE 130 INDIA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 131 INDIA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 132 INDIA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 133 INDIA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 134 INDIA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 135 INDIA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 136 JAPAN: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 137 JAPAN: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 138 JAPAN: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 139 JAPAN: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 140 JAPAN: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 141 JAPAN: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 142 SOUTH KOREA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 143 SOUTH KOREA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 144 SOUTH KOREA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 145 SOUTH KOREA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 146 SOUTH KOREA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 147 SOUTH KOREA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 148 NORTH AMERICA: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 149 NORTH AMERICA: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 150 NORTH AMERICA: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2031-2035 (THOUSAND UNITS)

- TABLE 151 NORTH AMERICA: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 152 NORTH AMERICA: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 154 US: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 155 US: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 156 US: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 157 US: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 158 US: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 159 US: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 160 CANADA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 161 CANADA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 162 CANADA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 163 CANADA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 164 CANADA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 165 CANADA: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 166 EUROPE: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 167 EUROPE: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 168 EUROPE: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2031-2035 (THOUSAND UNITS)

- TABLE 169 EUROPE: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 170 EUROPE: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 171 EUROPE: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 172 GERMANY: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 173 GERMANY: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 174 GERMANY: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 175 GERMANY: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 176 GERMANY: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 177 GERMANY: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 178 FRANCE: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 179 FRANCE: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 180 FRANCE: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 181 FRANCE: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 182 FRANCE: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 183 FRANCE: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 184 ITALY: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 185 ITALY: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 186 ITALY: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 187 ITALY: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 188 ITALY: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 189 ITALY: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 190 SPAIN: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 191 SPAIN: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 192 SPAIN: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 193 SPAIN: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 194 SPAIN: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 195 SPAIN: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 196 UK: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 197 UK: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 198 UK: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 199 UK: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 200 UK: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 201 UK: BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 202 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- TABLE 203 MARKET SHARE ANALYSIS, 2023

- TABLE 204 REGION FOOTPRINT

- TABLE 205 USAGE FOOTPRINT

- TABLE 206 VEHICLE TYPE FOOTPRINT

- TABLE 207 LEASING TYPE FOOTPRINT

- TABLE 208 DETAILED LIST OF STARTUPS/SMES

- TABLE 209 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 210 BATTERY AS A SERVICE MARKET: SERVICE LAUNCHES/DEVELOPMENTS, JANUARY 2021-DECEMBER 2024

- TABLE 211 BATTERY AS A SERVICE MARKET: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 212 BATTERY AS A SERVICE MARKET: EXPANSION, JANUARY 2021-DECEMBER 2024

- TABLE 213 NIO: COMPANY OVERVIEW

- TABLE 214 NIO: SERVICES OFFERED

- TABLE 215 NIO: SERVICE LAUNCHES/DEVELOPMENTS

- TABLE 216 NIO: EXPANSION

- TABLE 217 GOGORO: COMPANY OVERVIEW

- TABLE 218 GOGORO: SERVICES OFFERED

- TABLE 219 GOGORO: DEALS

- TABLE 220 XPENG INC.: COMPANY OVERVIEW

- TABLE 221 XPENG INC.: SERVICES OFFERED

- TABLE 222 SAIC MOTOR CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 223 FEATURES OF BATTERY RENTAL SCHEME OFFERED BY SAIC MOTOR CORPORATION FOR MG MOTOR INDIA'S WINDSOR MODEL

- TABLE 224 SAIC MOTOR CORPORATION LIMITED: SERVICES OFFERED

- TABLE 225 SAIC MOTOR CORPORATION LIMITED: DEALS

- TABLE 226 VINFAST: COMPANY OVERVIEW

- TABLE 227 VINFAST: PRODUCT PORTFOLIO

- TABLE 228 VINFAST: SERVICES OFFERED

- TABLE 229 VINFAST: EXPANSION

- TABLE 230 MAHINDRA&MAHINDRA LTD.: COMPANY OVERVIEW

- TABLE 231 MAHINDRA&MAHINDRA LTD.: SERVICES OFFERED

- TABLE 232 MAHINDRA&MAHINDRA LTD.: DEALS

- TABLE 233 BOUNCE INFINITY: COMPANY OVERVIEW

- TABLE 234 BOUNCE INFINITY: SERVICES OFFERED

- TABLE 235 BOUNCE INFINITY: DEALS

- TABLE 236 YINSON GREEN TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 237 YINSON GREEN TECHNOLOGIES: SERVICES OFFERED

- TABLE 238 YINSON GREEN TECHNOLOGIES: EXPANSION

- TABLE 239 LECTRIX E-VEHICLE PVT. LTD.: COMPANY OVERVIEW

- TABLE 240 LECTRIX E-VEHICLE PVT. LTD.: SERVICES OFFERED

- TABLE 241 HYUNDAI MOTOR COMPANY: COMPANY OVERVIEW

- TABLE 242 HYUNDAI MOTOR COMPANY: SERVICE LAUNCHES/DEVELOPMENTS

- TABLE 243 HYUNDAI MOTOR COMPANY: DEALS

- TABLE 244 YAMAHA MOTOR CO., LTD.: COMPANY OVERVIEW

- TABLE 245 YAMAHA MOTOR CO., LTD.: SERVICE LAUNCHES/DEVELOPMENTS

- TABLE 246 YAMAHA MOTOR CO., LTD.: DEALS

- TABLE 247 NISSAN MOTOR CO., LTD.: COMPANY OVERVIEW

- TABLE 248 HERO ELECTRIC VEHICLES PVT LTD.: COMPANY OVERVIEW

- TABLE 249 KYMCO: COMPANY OVERVIEW

- TABLE 250 RENAULT GROUP: COMPANY OVERVIEW

- TABLE 251 BEIJING AUTOMOTIVE GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 252 KINETIC GREEN: COMPANY OVERVIEW

- TABLE 253 SWITCH MOBILITY: COMPANY OVERVIEW

- TABLE 254 HONDA POWER PACK ENERGY INDIA PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 255 ARC RIDE: COMPANY OVERVIEW

- TABLE 256 BASIGO: COMPANY OVERVIEW

- TABLE 257 URJA MOBILITY: COMPANY OVERVIEW

- TABLE 258 SUN MOBILITY: COMPANY OVERVIEW

- TABLE 259 OCTILLION: COMPANY OVERVIEW

- TABLE 260 BATTERY SMART: COMPANY OVERVIEW

- TABLE 261 MOVIO TECHNOLOGIES PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 262 CONTEMPORARY AMPEREX ENERGY SERVICE TECHNOLOGY LIMITED: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION NOTES

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 DEMAND- AND SUPPLY-SIDE FACTORS AND THEIR IMPACT ON MARKET

- FIGURE 9 MARKET GROWTH PROJECTIONS BASED ON DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 10 BATTERY AS A SERVICE MARKET OVERVIEW

- FIGURE 11 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 PASSENGER CARS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 SUBSCRIPTION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 KEY PLAYERS IN BATTERY AS A SERVICE MARKET

- FIGURE 15 RISING DEMAND FOR COST-EFFICIENT ELECTRIC VEHICLES TO DRIVE MARKET

- FIGURE 16 SUBSCRIPTION SEGMENT TO LEAD MARKET BY 2035

- FIGURE 17 COMMERCIAL SEGMENT TO ACHIEVE SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 18 PASSENGER CARS SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2035

- FIGURE 19 51-100 KWH SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 ASIA PACIFIC TO BE LARGEST MARKET IN 2024

- FIGURE 21 FRAMEWORK OF BATTERY AS A SERVICE MODEL

- FIGURE 22 BATTERY AS A SERVICE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 FUNCTIONING OF BATTERY SWAPPING STATIONS

- FIGURE 24 SECOND-LIFE APPLICATION OF EV BATTERIES

- FIGURE 25 BATTERY-LEASING SERVICE MODEL FOR HEAVY-DUTY COMMERCIAL VEHICLES

- FIGURE 26 LITHIUM RESERVES, BY COUNTRY, 2024 (THOUSAND METRIC TONS)

- FIGURE 27 BATTERY STANDARDIZATION PLANS IN INDIA

- FIGURE 28 KEY BUYING CRITERIA, BY USAGE

- FIGURE 29 ECOSYSTEM ANALYSIS

- FIGURE 30 VALUE CHAIN ANALYSIS

- FIGURE 31 AVERAGE SELLING PRICE OF KEY PLAYERS, 2023 (USD)

- FIGURE 32 AVERAGE SELLING PRICE TREND, BY VEHICLE TYPE, 2021-2025 (USD)

- FIGURE 33 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2025 (USD)

- FIGURE 34 BATTERY AS A SERVICE MARKET: BUSINESS MODEL

- FIGURE 35 ADVANTAGES OF SOLID-STATE BATTERY DESIGNS

- FIGURE 36 INVESTMENT SCENARIO, 2021-2024

- FIGURE 37 PATENT ANALYSIS, 2015-2024

- FIGURE 38 LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 39 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 40 USE OF AI IN BATTERY LIFECYCLE MANAGEMENT

- FIGURE 41 BATTERY AS A SERVICE MARKET, BY BATTERY CAPACITY, 2024 VS. 2035 (THOUSAND UNITS)

- FIGURE 42 BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE, 2024 VS. 2035 (USD MILLION)

- FIGURE 43 BATTERY AS A SERVICE MARKET, BY LEASING TYPE, 2024 VS. 2035 (USD MILLION)

- FIGURE 44 BATTERY AS A SERVICE MARKET, BY USAGE, 2024 VS. 2035 (USD MILLION)

- FIGURE 45 BATTERY AS A SERVICE MARKET, BY REGION, 2024 VS. 2035 (USD MILLION)

- FIGURE 46 ASIA PACIFIC: BATTERY AS A SERVICE MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 48 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 49 ASIA PACIFIC: CPI INFLATION RATE, BY COUNTRY, 2023-2025

- FIGURE 50 ASIA PACIFIC: AUTOMOTIVE INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2023 (USD TRILLION)

- FIGURE 51 ALTNA CO., LTD.: BATTERY AS A SERVICE OFFERINGS

- FIGURE 52 HYUNDAI MOTOR COMPANY: BATTERY LEASING PILOT

- FIGURE 53 NORTH AMERICA: BATTERY AS A SERVICE MARKET SNAPSHOT

- FIGURE 54 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 55 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 56 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2023-2025

- FIGURE 57 NORTH AMERICA: AUTOMOTIVE INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2023 (USD TRILLION)

- FIGURE 58 EUROPE: BATTERY AS A SERVICE MARKET, BY COUNTRY, 2024 VS. 2035 (USD MILLION)

- FIGURE 59 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 60 EUROPE: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 61 EUROPE: CPI INFLATION RATE, BY COUNTRY, 2023-2025

- FIGURE 62 EUROPE: AUTOMOTIVE INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2023 (USD TRILLION)

- FIGURE 63 MARKET SHARE ANALYSIS, 2023

- FIGURE 64 MARKET RANKING OF TOP FIVE PLAYERS, 2023

- FIGURE 65 REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD BILLION)

- FIGURE 66 COMPANY VALUATION OF KEY PLAYERS, 2025 (USD BILLION)

- FIGURE 67 EV/EBITDA OF KEY PLAYERS, 2024

- FIGURE 68 BRAND/SERVICE COMPARISON

- FIGURE 69 BATTERY AS A SERVICE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 70 COMPANY FOOTPRINT

- FIGURE 71 BATTERY AS A SERVICE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 72 NIO: COMPANY SNAPSHOT

- FIGURE 73 NIO: SALES OFFERING

- FIGURE 74 GOGORO: COMPANY SNAPSHOT

- FIGURE 75 XPENG INC.: COMPANY SNAPSHOT

- FIGURE 76 SAIC MOTOR CORPORATION LIMITED: COMPANY SNAPSHOT

- FIGURE 77 VINFAST: COMPANY SNAPSHOT

- FIGURE 78 FEATURES OF BATTERY LEASING SERVICES OFFERED BY VINFAST

- FIGURE 79 MAHINDRA&MAHINDRA LTD.: COMPANY SNAPSHOT

- FIGURE 80 YINSON GREEN TECHNOLOGIES: FEATURES OF SWAPPABLE BATTERIES

- FIGURE 81 YINSON GREEN TECHNOLOGIES: BATTERY SWAPPING PROCESS

- FIGURE 82 LECTRIX E-VEHICLE PVT. LTD.: FEATURES OF BATTERY SUBSCRIPTION

- FIGURE 83 HYUNDAI MOTOR COMPANY: COMPANY SNAPSHOT

- FIGURE 84 YAMAHA MOTOR CO., LTD.: COMPANY SNAPSHOT

- FIGURE 85 NISSAN MOTOR CO., LTD.: COMPANY SNAPSHOT

The global battery as a service market is projected to reach USD 0.66 billion in 2024 to USD 14.45 billion in 2035, at a CAGR of 32.4% from 2024-2035. The commercial adoption of electric cars is expected to rise, driven by the cost savings and operational efficiency offered by the battery as a service model. This model helps lower operating costs, reduce downtime, and improve fleet performance. In Europe, where 40-60% of EV sales are for fleet use, battery leasing is likely to become a highly attractive option once battery prices stabilize. Additionally, the growing demand for electric three-wheelers in last-mile delivery and public transport, especially in rapidly urbanizing areas, is boosting the adoption of battery leasing services.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2035 |

| Base Year | 2023 |

| Forecast Period | 2024-2035 |

| Units Considered | Volume (Units) and Value (USD Million) |

| Segments | Leasing Type, Usage, Vehicle Type, Battery Capacity, and Region |

| Regions covered | Asia Pacific, Europe, and North America |

"Three-wheelers segment is expected to grow at the fastest rate in the battery as a service market during the forecast period."

The three-wheelers segment is projected to exhibit the highest growth during the forecast period, primarily driven by the rapid adoption of electric three-wheelers and delivery vehicles in emerging markets such as India. The cost-effectiveness offered by battery leasing service and the need for affordable and sustainable transportation solutions fuel this growth. Mahindra Last Mile Mobility (India) has been offering battery leasing solutions for its Zor Grand and Treo Plus three-wheeler models in India since 2024. In December 2024, the company partnered with VidyutTech (India) to introduce a battery as a service offering for its three-wheeler commercial electric vehicles, with a aim to make EV ownership more affordable by providing a pay-as-you-go battery rental service, starting at just Rs 2.50 per kilometer. Similarly, in September 2024, Neuron Energy (India) partnered with Pointo (India) to lease lithium-ion batteries for commercial e-rickshaws. Neuron Energy to supply up to 12,000 high-capacity 5.1-kWh lithium-ion batteries for L3 category e-rickshaws, replacing lead-acid batteries. Further, in April 2024, Neuron Energy partnered with Urja Mobility (India) to lead the battery leasing model for e-rickshaws, commonly known as 'toto,' in Kolkata. Together, the companies aimed to establish a fleet of 5 million e-rickshaws across the country. Likewise, in March 2024, Sun Mobility (India) and Revfin (India) partnered to finance and deploy nearly 100,000 electric two- and three-wheelers under the battery as a service model.

"Commercial segment is expected to grow at the fastest rate in the battery as a service market during the forecast period."

Battery leasing is witnessing rapid growth in the commercial segment, driven by the cost efficiency and operational flexibility it offers to fleet operators. Using the leasing options, the commercial fleet owners can lower their initial investment costs and reduce concerns regarding battery degradation. Fleet usage for cars is expected to grow faster, as the value proposition is especially beneficial for fleet operators who can capitalize on lower costs and streamlined operations. In Europe, where 40-60% of EVs are sold to fleets, battery leasing solutions presents a strong value proposition for cars, particularly as battery prices stabilize. Similarly, in India, MG introduced a value proposition of USD 11,557 (Rs. 10 lakh) for fleet providers. Further, electric three-wheelers which are mostly used for commercial purposes, are gaining momentum in countries such as India and China. Similarly, in December 2024, Mahindra Last Mile Mobility (India), in partnership with VidyutTech (India), introduced a battery leasing program for Mahindra ZEO (4W), the Zor Grand, and Treo Plus (3Ws). Likewise, Jiangsu Hanbang Vehicle Industry Co., Ltd. (China) offers a battery leasing option for select models of Meidi three-wheeler vehicles.

"Europe is expected to grow at the fastest rate in battery as a service market during the forecast period."

Europe's electric vehicle market has grown substantially, driven by environmental awareness, stringent emission regulations, and significant government incentives. With major cities implementing low-emission zones and the EU aiming to meet its 2030 sustainability targets, the region's demand for electric mobility is accelerating. The UK, Germany, and France are leading this transition, with the UK becoming Europe's largest EV market in 2024, bolstered by policy shifts like the Zero Emission Vehicle (ZEV) mandate. The challenges of high upfront costs and limited infrastructure create a promising opportunity for the growth of the battery as a service market in Europe. Additionally, as the region pushes for strict emission targets and a shift away from internal combustion engine vehicles, the growth of the battery service market is expected to increase in the coming years. NIO (China), Renault Group (France), Yamaha Motor Co., Ltd. (Japan), and Switch Mobility (UK) are some of the OEMs providing battery as a service solution with their vehicle models. VinFast for instance, is offering battery subscription service in its VF8 and VF9 vehicle models since 2022 in European markets such as Germany, France and Netherlands. Similarly, NIO is offering battery leasing service in its ET5, ET7, EL6, EL7 vehicle models in Germany since 2023.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Tier I - 27%, Tier II - 21%, and OEMs - 52%

- By Designation: C-Level - 48%, D-Level - 36%, and Others - 16%

- By Region: Asia Pacific - 42%, North America - 28%, and Europe - 30%

The battery as a service market is dominated by major players, including NIO (China), Gogoro (Taiwan), XPENG INC. (China), SAIC Motor Corporation Limited (China), and Vinfast (Vietnam) and more. These companies are expanding their portfolios to strengthen their battery as a service market position.

Research Coverage:

The report covers the battery as a service market in terms of Leasing Type (Subscription, Pay-per-use), Usage (Private, Commercial), Vehicle Type (Two-wheelers, Three-wheelers, Passenger Cars, Commercial Vehicles), Battery Capacity (Below 5 KWH, 5-10 KWH, 11-50 KWH, 51-100 KWH, above 100 KWH), and Region. It covers the competitive landscape and company profiles of the significant battery as a service market player.

The study also includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the battery as a service market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trends of the battery as a service market.

- The report will help market leaders/new entrants with information on various trends in battery as a service market based on leasing type, usage, vehicle type, and other parameters.

The report provides insight on the following pointers:

- Analysis of key drivers (Ease of EV ownership with battery leasing, Integration of battery swapping service), restraints (Limited scope in North America and Europe for two-wheeler & three-wheeler segments, Limited scope in private vehicle segment), opportunities (Increasing reliance on micro-mobility, Second-life battery storage, Expansion of battery leasing in industrial and commercial applications), and challenges (Dependency on battery asset companies, Shortage of lithium for use in EV batteries, Limited standardization in battery technology)

- Service Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new service offerings in the battery as a service market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the battery as a service market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the battery as a service market.

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players like NIO (China), Gogoro (Taiwan), XPENG INC. (China), SAIC Motor Corporation Limited (China), and Vinfast (Vietnam), among others in battery as a service market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary participants

- 2.1.2.3 Primary interviewees

- 2.1.2.4 Breakdown of primary interviews

- 2.1.2.5 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS AND CONSIDERATIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BATTERY AS A SERVICE MARKET

- 4.2 BATTERY AS A SERVICE MARKET, BY LEASING TYPE

- 4.3 BATTERY AS A SERVICE MARKET, BY USAGE

- 4.4 BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE

- 4.5 BATTERY AS A SERVICE MARKET, BY BATTERY CAPACITY

- 4.6 BATTERY AS A SERVICE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Ease of EV ownership with battery leasing

- 5.2.1.2 Integration of battery swapping service into battery leasing model

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited scope in North America and Europe for two- and three-wheelers

- 5.2.2.2 Limited scope in private vehicles segment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing reliance on micromobility

- 5.2.3.2 Integration of second-life battery storage

- 5.2.3.3 Expansion of battery leasing model into industrial and commercial applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Dependence on battery asset companies

- 5.2.4.2 Shortage of lithium for use in EV batteries

- 5.2.4.3 Limited standardization in battery technology

- 5.2.1 DRIVERS

- 5.3 BUYING CRITERIA

- 5.3.1 BUYING CRITERIA

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 BATTERY MANUFACTURERS

- 5.4.2 OEMS

- 5.4.3 BATTERY ASSET MANAGEMENT COMPANIES

- 5.4.4 FINANCIAL INSTITUTIONS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS

- 5.6.2 AVERAGE SELLING PRICE TREND, BY VEHICLE TYPE

- 5.6.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7 BATTERY AS A SERVICE MARKET: BUSINESS MODEL

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 GPS technology

- 5.8.1.2 New battery chemistries

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 IoT in battery swapping

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Super hybrid battery

- 5.8.3.2 AB battery system

- 5.8.1 KEY TECHNOLOGIES

- 5.9 INVESTMENT SCENARIO

- 5.10 PATENT ANALYSIS

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 GALP PARTNERED WITH SWOBBEE AND BOOST LOGISTICS TO LAUNCH NETWORK OF BATTERY SWAPPING STATIONS

- 5.12.2 NIO AND TESLA ADOPTED BATTERY AS A SERVICE MODEL TO ADDRESS RANGE ANXIETY AND LONG CHARGING TIME

- 5.12.3 RENAULT INTRODUCED FLEXIBLE BATTERY LEASING MODEL FOR ELECTRIC VEHICLES

- 5.12.4 URJA MOBILITY INTRODUCED COST-EFFECTIVE BATTERY LEASING MODEL FOR COMMERCIAL ELECTRIC VEHICLES

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 IMPACT OF AI ON BATTERY AS A SERVICE MARKET

- 5.16 BATTERY LEASING IN COMMERCIAL FLEETS

- 5.16.1 TWO-WHEELERS

6 BATTERY AS A SERVICE MARKET, BY BATTERY CAPACITY

- 6.1 INTRODUCTION

- 6.2 BELOW 5 KWH

- 6.2.1 RISING POPULARITY OF ELECTRIC TWO-WHEELERS IN URBAN AREAS TO DRIVE MARKET

- 6.3 5-10 KWH

- 6.3.1 GROWING DEMAND FOR THREE-WHEELERS TO DRIVE MARKET

- 6.4 11-50 KWH

- 6.4.1 GROWING DEMAND FOR BUDGET-FRIENDLY EVS TO DRIVE MARKET

- 6.5 51-100 KWH

- 6.5.1 RISING POPULARITY OF LUXURY EVS AND COMMERCIAL VEHICLES TO BOOST DEMAND

- 6.6 ABOVE 100 KWH

- 6.6.1 DEMAND FOR HEAVY-DUTY COMMERCIAL VEHICLES TO DRIVE MARKET

- 6.7 KEY INDUSTRY INSIGHTS

7 BATTERY AS A SERVICE MARKET, BY VEHICLE TYPE

- 7.1 INTRODUCTION

- 7.2 TWO-WHEELERS

- 7.2.1 GROWING DEMAND FOR LOW-COST DELIVERY VEHICLES TO DRIVE MARKET

- 7.3 THREE-WHEELERS

- 7.3.1 GROWING DEMAND FOR THREE-WHEELERS FOR PUBLIC TRANSPORT TO DRIVE GROWTH

- 7.4 PASSENGER CARS

- 7.4.1 NEED FOR FLEXIBLE PRICING AND OWNERSHIP MODELS TO BOOST DEMAND

- 7.5 COMMERCIAL VEHICLES

- 7.5.1 FOCUS ON REDUCING FLEET EMISSIONS TO SPUR DEMAND

- 7.6 KEY INDUSTRY INSIGHTS

8 BATTERY AS A SERVICE MARKET, BY LEASING TYPE

- 8.1 INTRODUCTION

- 8.2 SUBSCRIPTION

- 8.2.1 DEMAND FOR COST-EFFECTIVE LEASING OPTIONS TO DRIVE GROWTH

- 8.3 PAY-PER-USE

- 8.3.1 GROWTH OF PRIVATE OWNERSHIP OF ELECTRIC VEHICLES TO DRIVE MARKET

- 8.4 KEY INDUSTRY INSIGHTS

9 BATTERY AS A SERVICE MARKET, BY USAGE

- 9.1 INTRODUCTION

- 9.2 PRIVATE

- 9.2.1 RISE IN NUMBER OF CONSUMERS SEEKING AFFORDABLE OPTIONS TO DRIVE MARKET

- 9.3 COMMERCIAL

- 9.3.1 NEED FOR REDUCED COST VALUE PROPOSITION AND OPTIONS FOR BUYBACK OFFERS TO CREATE DEMAND

- 9.4 KEY INDUSTRY INSIGHTS

10 BATTERY AS A SERVICE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 MACROECONOMIC OUTLOOK

- 10.2.2 CHINA

- 10.2.2.1 Focus of premium automakers on providing world-class features in EVs to drive growth

- 10.2.3 INDIA

- 10.2.3.1 Emphasis on providing cost-effective EV solutions to drive market

- 10.2.4 JAPAN

- 10.2.4.1 Focus of OEMs on developing advanced battery technologies to drive market

- 10.2.5 SOUTH KOREA

- 10.2.5.1 Government's plans to allow battery subscription services to drive growth

- 10.3 NORTH AMERICA

- 10.3.1 MACROECONOMIC OUTLOOK

- 10.3.2 US

- 10.3.2.1 Demand for cost-effective EVs to drive demand for battery leasing subscriptions

- 10.3.3 CANADA

- 10.3.3.1 Government policies encouraging adoption of EVs to boost demand

- 10.4 EUROPE

- 10.4.1 MACROECONOMIC OUTLOOK

- 10.4.2 GERMANY

- 10.4.2.1 Robust demand for EVs for commercial purposes to drive market

- 10.4.3 FRANCE

- 10.4.3.1 Need for strict adherence to emission regulations to drive growth

- 10.4.4 ITALY

- 10.4.4.1 Government's focus on fleet electrification to spur demand

- 10.4.5 SPAIN

- 10.4.5.1 Rising investments from key battery manufacturers to drive market

- 10.4.6 UK

- 10.4.6.1 Rising demand for BEVs to encourage market expansion

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 11.3 MARKET SHARE ANALYSIS, 2023

- 11.3.1 MARKET RANKING, 2023

- 11.4 REVENUE ANALYSIS, 2019-2023

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.5.1 COMPANY VALUATION

- 11.5.2 FINANCIAL METRICS

- 11.6 BRAND/SERVICE COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Usage footprint

- 11.7.5.4 Vehicle type footprint

- 11.7.5.5 Leasing type footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.8.5.1 Detailed list of startups/SMEs

- 11.8.5.2 Competitive benchmarking of startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 SERVICE LAUNCHES/DEVELOPMENTS

- 11.9.2 DEALS

- 11.9.3 EXPANSION

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 NIO

- 12.1.1.1 Business overview

- 12.1.1.2 Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Service launches/developments

- 12.1.1.3.2 Expansion

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 GOGORO

- 12.1.2.1 Business overview

- 12.1.2.2 Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 XPENG INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Services offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Key strengths

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 SAIC MOTOR CORPORATION LIMITED

- 12.1.4.1 Business overview

- 12.1.4.2 Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 VINFAST

- 12.1.5.1 Business overview

- 12.1.5.2 Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Expansion

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 MAHINDRA&MAHINDRA LTD.

- 12.1.6.1 Business overview

- 12.1.6.2 Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 BOUNCE INFINITY

- 12.1.7.1 Business overview

- 12.1.7.2 Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 YINSON GREEN TECHNOLOGIES

- 12.1.8.1 Business overview

- 12.1.8.2 Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Expansion

- 12.1.9 LECTRIX E-VEHICLE PVT. LTD.

- 12.1.9.1 Business overview

- 12.1.9.2 Services offered

- 12.1.10 HYUNDAI MOTOR COMPANY

- 12.1.10.1 Business overview

- 12.1.10.2 Recent developments

- 12.1.10.2.1 Service launches/developments

- 12.1.10.2.2 Deals

- 12.1.11 YAMAHA MOTOR CO., LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Recent developments

- 12.1.11.2.1 Service launches/developments

- 12.1.11.2.2 Deals

- 12.1.12 NISSAN MOTOR CO., LTD.

- 12.1.12.1 Business overview

- 12.1.1 NIO

- 12.2 OTHER KEY PLAYERS

- 12.2.1 OEMS

- 12.2.1.1 Hero Electric Vehicles Pvt Ltd.

- 12.2.1.2 KYMCO

- 12.2.1.3 Renault Group

- 12.2.1.4 Beijing Automotive Group Co., Ltd.

- 12.2.1.5 Kinetic Green

- 12.2.1.6 Switch Mobility

- 12.2.1.7 Honda Power Pack Energy India Private Limited

- 12.2.1.8 ARC Ride

- 12.2.1.9 Basigo

- 12.2.2 BATTERY ASSET MANAGEMENT COMPANIES

- 12.2.2.1 Urja Mobility

- 12.2.2.2 Sun Mobility

- 12.2.2.3 Octillion

- 12.2.2.4 Battery Smart

- 12.2.2.5 Movio Technologies Private Limited

- 12.2.2.6 Contemporary Amperex Energy Service Technology Limited

- 12.2.1 OEMS

13 RECOMMENDATIONS BY MARKETSANDMARKETS

- 13.1 RISING ADOPTION OF EVS FOR COMMERCIAL PURPOSES TO IMPACT DEMAND FOR BATTERY LEASING SERVICES IN ASIA PACIFIC

- 13.2 USE OF BATTERY SWAPPING SUBSCRIPTION FOR CUSTOMER EASE AND CONVENIENCE

- 13.3 PROVIDING VEHICLE BUYBACK OPTION TO PRIVATE EV USERS

- 13.4 CONCLUSION

14 APPENDIX

- 14.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.4.1 ADDITIONAL COMPANY PROFILES (UP TO FIVE)

- 14.4.2 ADDITIONAL COUNTRIES (UP TO THREE)

- 14.4.3 DETAILED ANALYSIS OF BATTERY AS A SERVICE MARKET, BY VEHICLE RANGE

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS