|

|

市場調査レポート

商品コード

1635135

空港情報システムの世界市場:用途別、タイプ別、実装別、地域別 - 予測(~2030年)Airport Information System Market by Application (Passenger Processing, Flight Operation, Cargo and Baggage Management, Resource Management, Airside Operations), Type, Implementation and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 空港情報システムの世界市場:用途別、タイプ別、実装別、地域別 - 予測(~2030年) |

|

出版日: 2025年01月13日

発行: MarketsandMarkets

ページ情報: 英文 334 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の空港情報システムの市場規模は、2024年に42億4,000万米ドルであり、2030年までに53億6,000万米ドルに達すると予測され、2024年~2030年にCAGRで4.0%の成長が見込まれます。

空港情報システムは、革新的な技術と統合されたソリューションにより、空港経営と旅客体験を変革します。AIS技術は、フライト情報、リソース管理、手荷物の取り扱い、セキュリティなどの重要な機能を合理化します。航空旅行の増加により、現代の需要を満たすためにAISに最先端技術を適用することが求められています。主な技術革新には、航空企業、空港スタッフ、乗客間の容易なコミュニケーションを可能にするリアルタイムのデータ統合などがあります。IoTとクラウドコンピューティングにより、システムはターミナル間で接続され、リアルタイムで更新されます。AIと機械学習は、予測分析、リソース割り当ての最適化、混雑を緩和するための乗客の流れの予測にますます応用されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 技術、用途、タイプ、実装、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

最新の動向では、セルフサービスキオスクやモバイルアプリでの乗客認証に利用する生体認証システムの開発がAISと統合され、セキュリティ面だけでなく乗客の待ち時間の短縮をももたらしています。貨物管理もブロックチェーン技術を採用し、航空貨物業務の安全で透明な取引を保証しています。

貨物/手荷物管理に基づくと、手荷物/貨物ハンドリング・追跡ソフトウェアが、予測期間の2024年~2030年に市場をリードします。

手荷物/貨物ハンドリング・追跡ソフトウェアは、業務効率の改善、顧客満足度の向上、航空部門におけるシームレスなロジスティクスに対する需要の高まりに対応する上で重要な役割を果たすため、市場をリードする見込みです。一般的に、旅客と貨物の数量の増加に伴い、空港と航空企業は、手荷物と貨物を迅速かつ正確に処理する高い圧力に苦しんでいます。手荷物や貨物をリアルタイムで管理することは、エンドツーエンドの透明性から直接恩恵を受けます。先進の追跡技術には、RFID、GPS、IoTセンサーが含まれ、品物をシームレスに監視できるため、ルーティングによる紛失や遅延を防ぎ、運用の可視性を高めることができます。

空港デジタルサイネージ・ディスプレイシステムに基づくと、フライト情報ディスプレイシステム(FIDS)セグメントが予測期間に市場をリードします。

フライト情報ディスプレイシステム(FIDS)セグメントが予測期間の2024年~2030年に市場をリードします。フライト情報ディスプレイシステムは、旅客体験を向上させるシームレスなコミュニケーションを確保する上でその関連性が明らかになり、空港情報システム市場の先陣を切ると見られます。FIDSはまた、到着、出発、ゲート変更、遅延に関する最新情報を通じてリアルタイムのフライト情報を提供する、現代の空港の主要インターフェースとなっています。世界の航空旅行の拡大に伴い、正確でリアルタイムの情報に対する旅客の期待は高まっています。FIDSは、航空管制システムや航空企業のデータベースなどの先進のデータソースと統合することで、リアルタイムで正確な最新情報を提供し、この期待に応えています。また、スマート空港では、乗客があらゆるタッチポイントで常に最新情報を得られるよう、モバイルアプリやデジタルサイネージと組み合わせてマルチチャネルコミュニケーションに利用されることも多く、FIDSの重要性が高まっています。

当レポートでは、世界の空港情報システム市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 空港情報システム市場の企業にとって魅力的な機会

- 空港情報システム市場:実装別

- 空港情報システム市場:用途別

- 空港情報システム市場:タイプ別

- 空港情報システム市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 著名な企業

- 民間企業と中小企業

- エンドユーザー

- 価格分析

- 貿易分析

- 輸入シナリオ(サービスコード9)

- 輸出シナリオ(サービスコード9)

- ケーススタディ分析

- 主な会議とイベント(2025年)

- 規制情勢

- 購入プロセスにおける主なステークホルダー

- 技術分析

- 主要技術

- 補完技術

- 空港情報システム市場:ビジネスモデル

- 投資と資金調達のシナリオ

- 総所有コスト(TCO)

- 空港情報システム市場に対する生成AIの影響

- イントロダクション

- 民間航空における生成AIの導入

- 部品表(BOM)

- 技術ロードマップ

- マクロ経済の見通し

- 北米

- 欧州

- アジア太平洋

- 中東

- ラテンアメリカ

- アフリカ

第6章 産業の動向

- イントロダクション

- 新たな動向

- 最先端の空港経営システム

- スマートフライト情報表示ソフトウェア(PADS4)

- SPIDER A-CDM

- SPIDERパックス検証

- Dolphin空港情報

- 技術動向

- NFC

- RFID

- ARMADILLO統合セキュリティ

- UBD施設

- モバイルアプリ

- 特許分析

第7章 空港情報システム技術市場

- イントロダクション

- 非接触

- リアルタイムモニタリング・アナリティクス

- 先進のセキュリティ・監視

- スマートディスプレイ・視覚化

- コラボレーション・意思決定

- 動的収益最適化

第8章 空港情報システム市場:実装別

- イントロダクション

- アップグレード・近代化

- 新設

第9章 空港情報システム市場:タイプ別

- イントロダクション

- 乗客中心のシステム

- 空港経営支援システム

第10章 空港情報システム市場:用途別

- イントロダクション

- 貨物/手荷物管理

- フライト経営

- セキュリティ・監視

- リソース管理

- エアサイド経営

- 財務・収益管理

- 乗客処理

第11章 空港情報システム市場:地域別

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- フランス

- ドイツ

- オランダ

- その他の欧州

- アジア太平洋

- PESTLE分析

- 中国

- インド

- 日本

- シンガポール

- オーストラリア

- その他のアジア太平洋

- 中東

- PESTLE分析

- GCC

- その他の中東

- その他の地域

- ブラジル

- メキシコ

- 南アフリカ

- その他の地域

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2020年~2024年)

- 収益分析(2020年~2023年)

- 市場シェア分析(2023年)

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 競合シナリオと動向

第13章 企業プロファイル

- 主要企業

- SITA

- AMADEUS IT GROUP SA

- VANDERLANDE INDUSTRIES B.V.

- INDRA

- RTX

- SIEMENS AG

- THALES

- ADB SAFEGATE

- RESA

- TAV TECHNOLOGIES

- DAMAREL SYSTEMS INTERNATIONAL LTD.

- CGI INC.

- AIRPORT INFORMATION SYSTEMS

- NEC CORPORATION

- HONEYWELL INTERNATIONAL, INC.

- DEUTSCHE TELEKOM AG

- その他の企業

- AEROCLOUD SYSTEMS LTD.

- VELOCITY AIRPORT SOLUTIONS

- XOVIS AG

- VEOVO

- TREBIDE

- INFORM SOFTWARE

- PADS4 & NDS

- INFAX, INC.

- A-ICE SRL

- ASSAIA INTERNATIONAL LTD.

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2023

- TABLE 2 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 3 INDICATIVE PRICING OF NEWLY INSTALLED AIRPORT INFORMATION SYSTEMS, BY AIRPORT SIZE, 2024

- TABLE 4 INDICATIVE PRICING OF UPGRADED/MODERNIZED AIRPORT INFORMATION SYSTEMS, BY AIRPORT SIZE, 2024

- TABLE 5 IMPORT DATA FOR SERVICE CODE 9-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 6 EXPORT DATA FOR SERVICE CODE 9-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 7 KEY CONFERENCES & EVENTS, 2025

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- TABLE 13 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- TABLE 14 AIRPORT INFORMATION SYSTEMS MARKET: BUSINESS MODELS

- TABLE 15 TCO COMPARISON BETWEEN KEY APPLICATIONS OF AIRPORT INFORMATION SYSTEMS

- TABLE 16 PATENTS GRANTED, 2021-2023

- TABLE 17 AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 18 AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 19 AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 20 AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 21 AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 22 AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 23 AIRPORT INFORMATION SYSTEMS MARKET, BY CARGO & BAGGAGE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 24 AIRPORT INFORMATION SYSTEMS MARKET, BY CARGO & BAGGAGE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 25 AIRPORT INFORMATION SYSTEMS MARKET, BY FLIGHT OPERATIONS, 2020-2023 (USD MILLION)

- TABLE 26 AIRPORT INFORMATION SYSTEMS MARKET, BY FLIGHT OPERATIONS, 2024-2030 (USD MILLION)

- TABLE 27 AIRPORT INFORMATION SYSTEMS MARKET, BY AIRPORT DIGITAL SIGNAGE & DISPLAY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 28 AIRPORT INFORMATION SYSTEMS MARKET, BY AIRPORT DIGITAL SIGNAGE & DISPLAY SYSTEM, 2024-2030 (USD MILLION)

- TABLE 29 AIRPORT INFORMATION SYSTEMS MARKET, BY SECURITY & SURVEILLANCE, 2020-2023 (USD MILLION)

- TABLE 30 AIRPORT INFORMATION SYSTEMS MARKET, BY SECURITY & SURVEILLANCE, 2024-2030 (USD MILLION)

- TABLE 31 AIRPORT INFORMATION SYSTEMS MARKET, BY RESOURCE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 32 AIRPORT INFORMATION SYSTEMS MARKET, BY RESOURCE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 33 AIRPORT INFORMATION SYSTEMS MARKET, BY AIRSIDE OPERATIONS, 2020-2023 (USD MILLION)

- TABLE 34 AIRPORT INFORMATION SYSTEMS MARKET, BY AIRSIDE OPERATIONS, 2024-2030 (USD MILLION)

- TABLE 35 AIRPORT INFORMATION SYSTEMS MARKET, BY FINANCIAL & REVENUE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 36 AIRPORT INFORMATION SYSTEMS MARKET, BY FINANCIAL & REVENUE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 37 AIRPORT INFORMATION SYSTEMS MARKET, BY PASSENGER PROCESSING, 2020-2023 (USD MILLION)

- TABLE 38 AIRPORT INFORMATION SYSTEMS MARKET, BY PASSENGER PROCESSING, 2024-2030 (USD MILLION)

- TABLE 39 AIRPORT INFORMATION SYSTEMS MARKET, BY DEPARTURE CONTROL SYSTEM, 2020-2023 (USD MILLION)

- TABLE 40 AIRPORT INFORMATION SYSTEMS MARKET, BY DEPARTURE CONTROL SYSTEM, 2024-2030 (USD MILLION)

- TABLE 41 AIRPORT INFORMATION SYSTEMS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 42 AIRPORT INFORMATION SYSTEMS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 44 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 46 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY PASSENGER PROCESSING, 2020-2023 (USD MILLION)

- TABLE 48 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY PASSENGER PROCESSING, 2024-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY FLIGHT OPERATIONS, 2020-2023 (USD MILLION)

- TABLE 50 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY FLIGHT OPERATIONS, 2024-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY CARGO & BAGGAGE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 52 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY CARGO & BAGGAGE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY RESOURCE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 54 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY RESOURCE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY SECURITY & SURVEILLANCE, 2020-2023 (USD MILLION)

- TABLE 56 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY SECURITY & SURVEILLANCE, 2024-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY AIRSIDE OPERATIONS, 2020-2023 (USD MILLION)

- TABLE 58 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY AIRSIDE OPERATIONS, 2024-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY FINANCIAL & REVENUE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 60 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY FINANCIAL & REVENUE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 62 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 64 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 65 US: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 66 US: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 67 US: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 68 US: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 69 CANADA: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 70 CANADA: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 71 CANADA: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 72 CANADA: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 73 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 74 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 75 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 76 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 77 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY PASSENGER PROCESSING, 2020-2023 (USD MILLION)

- TABLE 78 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY PASSENGER PROCESSING, 2024-2030 (USD MILLION)

- TABLE 79 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY FLIGHT OPERATIONS, 2020-2023 (USD MILLION)

- TABLE 80 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY FLIGHT OPERATIONS, 2024-2030 (USD MILLION)

- TABLE 81 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY CARGO & BAGGAGE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 82 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY CARGO & BAGGAGE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 83 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY RESOURCE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 84 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY RESOURCE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 85 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY SECURITY & SURVEILLANCE, 2020-2023 (USD MILLION)

- TABLE 86 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY SECURITY & SURVEILLANCE, 2024-2030 (USD MILLION)

- TABLE 87 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY AIRSIDE OPERATIONS, 2020-2023 (USD MILLION)

- TABLE 88 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY AIRSIDE OPERATIONS, 2024-2030 (USD MILLION)

- TABLE 89 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY FINANCIAL & REVENUE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 90 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY FINANCIAL & REVENUE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 91 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 92 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 93 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 94 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 95 UK: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 96 UK: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 97 UK: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 98 UK: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 99 FRANCE: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 100 FRANCE: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 101 FRANCE: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 102 FRANCE: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 103 GERMANY: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 104 GERMANY: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 105 GERMANY: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 106 GERMANY: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 107 NETHERLANDS: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 108 NETHERLANDS: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 109 NETHERLANDS: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 110 NETHERLANDS: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 111 REST OF EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 112 REST OF EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 113 REST OF EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 114 REST OF EUROPE: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 116 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 118 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY PASSENGER PROCESSING, 2020-2023 (USD MILLION)

- TABLE 120 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY PASSENGER PROCESSING, 2024-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY FLIGHT OPERATIONS, 2020-2023 (USD MILLION)

- TABLE 122 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY FLIGHT OPERATIONS, 2024-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY CARGO & BAGGAGE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 124 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY CARGO & BAGGAGE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY RESOURCE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 126 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY RESOURCE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY SECURITY & SURVEILLANCE, 2020-2023 (USD MILLION)

- TABLE 128 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY SECURITY & SURVEILLANCE, 2024-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY AIRSIDE OPERATIONS, 2020-2023 (USD MILLION)

- TABLE 130 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY AIRSIDE OPERATIONS, 2024-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY FINANCIAL & REVENUE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 132 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY FINANCIAL & REVENUE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 136 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 137 CHINA: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 138 CHINA: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 139 CHINA: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 140 CHINA: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 141 INDIA: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 142 INDIA: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 143 INDIA: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 144 INDIA: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 145 JAPAN: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 146 JAPAN: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 147 JAPAN: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 148 JAPAN: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 149 SINGAPORE: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 150 SINGAPORE: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 151 SINGAPORE: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 152 SINGAPORE: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 153 AUSTRALIA: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 154 AUSTRALIA: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 155 AUSTRALIA: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 156 AUSTRALIA: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 162 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 164 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY PASSENGER PROCESSING, 2020-2023 (USD MILLION)

- TABLE 166 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY PASSENGER PROCESSING, 2024-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY FLIGHT OPERATIONS, 2020-2023 (USD MILLION)

- TABLE 168 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY FLIGHT OPERATIONS, 2024-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY CARGO & BAGGAGE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 170 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY CARGO & BAGGAGE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY RESOURCE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 172 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY RESOURCE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY SECURITY & SURVEILLANCE, 2020-2023 (USD MILLION)

- TABLE 174 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY SECURITY & SURVEILLANCE, 2024-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY AIRSIDE OPERATIONS, 2020-2023 (USD MILLION)

- TABLE 176 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY AIRSIDE OPERATIONS, 2024-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY FINANCIAL & REVENUE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 178 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY FINANCIAL & REVENUE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 179 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 180 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 181 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 182 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 183 UAE: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 184 UAE: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 185 UAE: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 186 UAE: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 187 SAUDI ARABIA: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 188 SAUDI ARABIA: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 189 SAUDI ARABIA: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 190 SAUDI ARABIA: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 191 REST OF MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 192 REST OF MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 193 REST OF MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 194 REST OF MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 195 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY COUNTRY/REGION, 2020-2023 (USD MILLION)

- TABLE 196 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY COUNTRY/REGION, 2024-2030 (USD MILLION)

- TABLE 197 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 198 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 199 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY PASSENGER PROCESSING, 2020-2023 (USD MILLION)

- TABLE 200 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY PASSENGER PROCESSING, 2024-2030 (USD MILLION)

- TABLE 201 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY FLIGHT OPERATIONS, 2020-2023 (USD MILLION)

- TABLE 202 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY FLIGHT OPERATIONS, 2024-2030 (USD MILLION)

- TABLE 203 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY CARGO & BAGGAGE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 204 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY CARGO & BAGGAGE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 205 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY RESOURCE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 206 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY RESOURCE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 207 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY SECURITY & SURVEILLANCE, 2020-2023 (USD MILLION)

- TABLE 208 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY SECURITY & SURVEILLANCE, 2024-2030 (USD MILLION)

- TABLE 209 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY AIRSIDE OPERATIONS, 2020-2023 (USD MILLION)

- TABLE 210 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY AIRSIDE OPERATIONS, 2024-2030 (USD MILLION)

- TABLE 211 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY FINANCIAL & REVENUE MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 212 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY FINANCIAL & REVENUE MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 213 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 214 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 215 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 216 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 217 BRAZIL: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 218 BRAZIL: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 219 BRAZIL: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 220 BRAZIL: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 221 MEXICO: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 222 MEXICO: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 223 MEXICO: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 224 MEXICO: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 225 SOUTH AFRICA: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 226 SOUTH AFRICA: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 227 SOUTH AFRICA: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 228 SOUTH AFRICA: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 229 OTHERS IN ROW: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 230 OTHERS IN ROW: AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 231 OTHERS IN ROW: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 232 OTHERS IN ROW: AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 233 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 234 AIRPORT INFORMATION SYSTEMS MARKET: DEGREE OF COMPETITION

- TABLE 235 REGION FOOTPRINT

- TABLE 236 TYPE FOOTPRINT

- TABLE 237 APPLICATION FOOTPRINT

- TABLE 238 LIST OF STARTUPS/SMES

- TABLE 239 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 240 AIRPORT INFORMATION SYSTEMS MARKET: PRODUCT LAUNCHES, JANUARY 2020-NOVEMBER 2024

- TABLE 241 AIRPORT INFORMATION SYSTEMS MARKET: DEALS, JANUARY 2020-NOVEMBER 2024

- TABLE 242 AIRPORT INFORMATION SYSTEMS MARKET: OTHER DEVELOPMENTS, JANUARY 2020-NOVEMBER 2024

- TABLE 243 SITA: COMPANY OVERVIEW

- TABLE 244 SITA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 SITA: DEALS

- TABLE 246 SITA: OTHER DEVELOPMENTS

- TABLE 247 AMADEUS IT GROUP SA: COMPANY OVERVIEW

- TABLE 248 AMADEUS IT GROUP SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 AMADEUS IT GROUP SA: DEALS

- TABLE 250 AMADEUS IT GROUP SA: OTHER DEVELOPMENTS

- TABLE 251 VANDERLANDE INDUSTRIES B.V.: COMPANY OVERVIEW

- TABLE 252 VANDERLANDE INDUSTRIES B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 VANDERLANDE INDUSTRIES B.V.: PRODUCT LAUNCHES

- TABLE 254 VANDERLANDE INDUSTRIES B.V.: DEALS

- TABLE 255 VANDERLANDE INDUSTRIES B.V.: OTHER DEVELOPMENTS

- TABLE 256 INDRA: COMPANY OVERVIEW

- TABLE 257 INDRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 INDRA: DEALS

- TABLE 259 INDRA: OTHER DEVELOPMENTS

- TABLE 260 RTX: COMPANY OVERVIEW

- TABLE 261 RTX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 RTX: PRODUCT LAUNCHES

- TABLE 263 RTX: OTHER DEVELOPMENTS

- TABLE 264 SIEMENS AG: COMPANY OVERVIEW

- TABLE 265 SIEMENS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 SIEMENS AG: DEALS

- TABLE 267 THALES: COMPANY OVERVIEW

- TABLE 268 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 THALES: DEALS

- TABLE 270 THALES: OTHER DEVELOPMENTS

- TABLE 271 ADB SAFEGATE: COMPANY OVERVIEW

- TABLE 272 ADB SAFEGATE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 ADB SAFEGATE: DEALS

- TABLE 274 ADB SAFEGATE: OTHER DEVELOPMENTS

- TABLE 275 RESA: COMPANY OVERVIEW

- TABLE 276 RESA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 RESA: DEALS

- TABLE 278 RESA: OTHER DEVELOPMENTS

- TABLE 279 TAV TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 280 TAV TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 TAV TECHNOLOGIES: DEALS

- TABLE 282 TAV TECHNOLOGIES: OTHER DEVELOPMENTS

- TABLE 283 DAMAREL SYSTEMS INTERNATIONAL LTD.: COMPANY OVERVIEW

- TABLE 284 DAMAREL SYSTEMS INTERNATIONAL LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 DAMAREL SYSTEMS INTERNATIONAL LTD.: PRODUCT LAUNCHES

- TABLE 286 DAMAREL SYSTEMS INTERNATIONAL LTD.: OTHER DEVELOPMENTS

- TABLE 287 CGI INC.: COMPANY OVERVIEW

- TABLE 288 CGI INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 CGI INC.: DEALS

- TABLE 290 AIRPORT INFORMATION SYSTEMS: COMPANY OVERVIEW

- TABLE 291 AIRPORT INFORMATION SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 AIRPORT INFORMATION SYSTEMS: DEALS

- TABLE 293 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 294 NEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 NEC CORPORATION: PRODUCT LAUNCHES

- TABLE 296 NEC CORPORATION: DEALS

- TABLE 297 NEC CORPORATION: OTHER DEVELOPMENTS

- TABLE 298 HONEYWELL INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 299 HONEYWELL INTERNATIONAL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 HONEYWELL INTERNATIONAL, INC.: OTHER DEVELOPMENTS

- TABLE 301 DEUTSCHE TELEKOM AG: COMPANY OVERVIEW

- TABLE 302 DEUTSCHE TELEKOM AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 303 DEUTSCHE TELEKOM AG: DEALS

- TABLE 304 AEROCLOUD SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 305 VELOCITY AIRPORT SOLUTIONS: COMPANY OVERVIEW

- TABLE 306 XOVIS AG: COMPANY OVERVIEW

- TABLE 307 VEOVO: COMPANY OVERVIEW

- TABLE 308 TREBIDE: COMPANY OVERVIEW

- TABLE 309 INFORM SOFTWARE: COMPANY OVERVIEW

- TABLE 310 PADS4 & NDS: COMPANY OVERVIEW

- TABLE 311 INFAX, INC.: COMPANY OVERVIEW

- TABLE 312 A-ICE SRL: COMPANY OVERVIEW

- TABLE 313 ASSAIA INTERNATIONAL LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 UPGRADES & MODERNIZATION SEGMENT TO ACHIEVE SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 8 AIRPORT OPERATIONAL SUPPORT SYSTEMS SEGMENT TO ACHIEVE HIGHER CAGR THAN PASSENGER-CENTRIC SYSTEMS SEGMENT BY 2030

- FIGURE 9 PASSENGER PROCESSING SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2030

- FIGURE 10 NORTH AMERICA TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 RISE IN AIRPORT EXPANSION PROJECTS TO DRIVE GROWTH OF AIRPORT INFORMATION SYSTEMS MARKET

- FIGURE 12 NEW INSTALLATION SEGMENT TO LEAD MARKET IN 2024

- FIGURE 13 PASSENGER PROCESSING SEGMENT TO LEAD MARKET BY 2030

- FIGURE 14 PASSENGER-CENTRIC SYSTEMS SEGMENT TO LEAD MARKET BY 2030

- FIGURE 15 SOUTH AFRICA TO ACHIEVE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 AIRPORT INFORMATION SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 IT INVESTMENT BY AIRPORTS, 2020-2023 (USD BILLION)

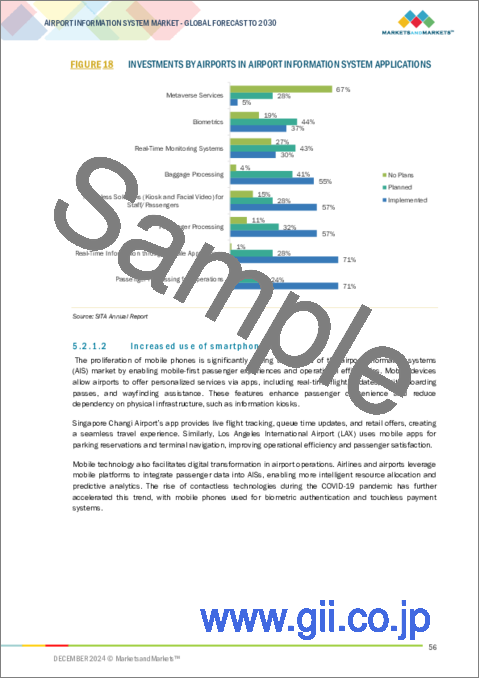

- FIGURE 18 INVESTMENTS BY AIRPORTS IN AIRPORT INFORMATION SYSTEM APPLICATIONS

- FIGURE 19 SELF-SERVICE TECHNOLOGIES IMPLEMENTED AT AIRPORTS, 2015-2024

- FIGURE 20 TOTAL NUMBER OF CYBERATTACKS AT KEY AIRPORTS BETWEEN 2021 AND 2023

- FIGURE 21 AIRPORT INFORMATION SYSTEMS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 REVENUE SHIFT FOR AIRPORT INFORMATION SYSTEMS MARKET PLAYERS

- FIGURE 23 AIRPORT INFORMATION SYSTEMS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 IMPORT DATA FOR SERVICE CODE 9-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 25 EXPORT DATA FOR SERVICE CODE 9-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 27 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- FIGURE 28 KEY PLAYERS AND BUSINESS MODELS IN AIRPORT INFORMATION SYSTEMS MARKET

- FIGURE 29 INVESTMENT & FUNDING SCENARIO, 2020-2023 (USD MILLION)

- FIGURE 30 AIRPORT INFORMATION SYSTEMS MARKET: TOTAL COST OF OWNERSHIP

- FIGURE 31 GENERATIVE AI LANDSCAPE

- FIGURE 32 ADOPTION OF GENERATIVE AI IN COMMERCIAL AVIATION BY KEY COUNTRIES

- FIGURE 33 BILL OF MATERIALS FOR SECURITY & SURVEILLANCE SYSTEMS

- FIGURE 34 BILL OF MATERIALS FOR CARGO & BAGGAGE MANAGEMENT SYSTEMS

- FIGURE 35 EVOLUTION OF AIRPORT INFORMATION SYSTEMS

- FIGURE 36 ADOPTION OF AIRPORT INFORMATION SYSTEM TECHNOLOGIES

- FIGURE 37 PATENTS GRANTED, 2013-2023

- FIGURE 38 AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION, 2024 VS. 2030 (USD MILLION)

- FIGURE 39 AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 40 AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION, 2024 VS. 2030 (USD MILLION)

- FIGURE 41 AIRPORT INFORMATION SYSTEMS MARKET, BY REGION

- FIGURE 42 NORTH AMERICA: AIRPORT INFORMATION SYSTEMS MARKET SNAPSHOT

- FIGURE 43 EUROPE: AIRPORT INFORMATION SYSTEMS MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: AIRPORT INFORMATION SYSTEMS MARKET SNAPSHOT

- FIGURE 45 MIDDLE EAST: AIRPORT INFORMATION SYSTEMS MARKET SNAPSHOT

- FIGURE 46 REST OF THE WORLD: AIRPORT INFORMATION SYSTEMS MARKET SNAPSHOT

- FIGURE 47 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2023 (USD MILLION)

- FIGURE 48 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 49 AIRPORT INFORMATION SYSTEMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 50 COMPANY FOOTPRINT

- FIGURE 51 AIRPORT INFORMATION SYSTEMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 52 COMPANY VALUATION OF KEY MARKET PLAYERS

- FIGURE 53 EV/EBIDTA OF KEY MARKET PLAYERS

- FIGURE 54 BRAND/PRODUCT COMPARISON

- FIGURE 55 AMADEUS IT GROUP SA: COMPANY SNAPSHOT

- FIGURE 56 INDRA: COMPANY SNAPSHOT

- FIGURE 57 RTX: COMPANY SNAPSHOT

- FIGURE 58 SIEMENS AG: COMPANY SNAPSHOT

- FIGURE 59 THALES: COMPANY SNAPSHOT

- FIGURE 60 TAV TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 61 CGI INC.: COMPANY SNAPSHOT

- FIGURE 62 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 HONEYWELL INTERNATIONAL, INC.: COMPANY SNAPSHOT

- FIGURE 64 DEUTSCHE TELEKOM AG: COMPANY SNAPSHOT

The Airport Information Systems market is valued at USD 4.24 billion in 2024 and is projected to reach USD 5.36 billion by 2030, at a CAGR of 4.0% from 2024 to 2030. Airport Information Systems transform airport operations and passenger experiences with innovative technologies and integrated solutions. AIS technologies thus streamline critical functions such as flight information, resource management, baggage handling, and security. Increasing air travel warrants the application of cutting-edge technologies in AIS to meet modern demands. Some of the key innovations include real-time data integration, which allows for easy communication among airlines, airport staff, and passengers. With IoT and cloud computing, systems are connected across terminals and updated in real time. AI and machine learning increasingly find applications in predictive analytics, optimizing resource allocation, and predicting passenger flows to reduce congestion.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By technology, application, type, implementation, and region |

| Regions covered | North America, Europe, APAC, RoW |

The latest trends indicate the development of biometric systems for passenger recognition in self-service kiosks and mobile apps to integrate with AIS, which brings about not only the security aspect of it but also reduces the waiting time of passengers. Cargo management also adopts blockchain technology to ensure safe and transparent transactions of air freight operations.

Based on cargo and baggage management, the Baggage & Cargo Handling and Tracking Software is projected to lead the market during the forecast period 2024-2030.

Baggage & Cargo Handling and Tracking Software will lead the market because it plays a critical role in improving operational efficiency, enhancing customer satisfaction, and meeting the growing demand for seamless logistics in the aviation sector. In general, with the increase of volume both in passengers and freight cargos, airports and airlines suffer high pressure to handle baggage and freight to act much speedily and accurately. Managing luggage and cargo in real time directly benefits from end-to-end transparency, as advanced tracking technology involves RFID, GPS, and IoT sensors for seamless observation of items, therefore preventing loss or delay through routing and increasing operational visibility.

Based on Airport Digital Signage and Display Systems, Flight Information Display Systems (FIDS) segment is to lead the market during the forecast period

The Airport Information Systems market has been segmented based on Airport Digital Signage and Display Systems into Flight Information Display Systems (FIDS) and digital signage. Flight Information Display Systems (FIDS) segment to lead the market during the forecast period 2024-2030. The Flight Information Display System is poised to spearhead the Airport Information Systems market, as its relevance in ensuring seamless communication to enhance passenger experience becomes apparent. FIDS has also become the primary interface of a modern airport for real-time flight information through updates on arrivals, departures, gate changes, and delays. As global air travel expands, the expectation of passenger demand for accurate, real-time information increases. FIDS fulfills this expectation by integrating with advanced sources of data, such as air traffic control systems and airline databases, to give precise updates in real time. Smart airports also enhance the significance of FIDS as it is often used together with mobile apps and digital signage for multi-channel communication to make sure that passengers are constantly updated at every touch point.

The Asia Pacific market is projected to contribute the most significant share from 2024 to 2030 in the Airport Information Systems market.

Asia-Pacific is expected to lead the Airport Information Systems (AIS) market, driven by rapid economic growth, high demand for air travel, and massive investments in aviation infrastructure in the region. Passenger and cargo volumes in Asia-Pacific are rapidly increasing due to the rising middle-class population, urbanization, and tourism. Some of the fastest-growing aviation markets are in countries such as China, India, and the Southeast Asian nations. They require more sophisticated AIS solutions to manage increased traffic more efficiently. The region hosts several greenfield airport projects and major expansions of existing airports. These include the Beijing Daxing International Airport in China and the Navi Mumbai International Airport in India. These projects are incorporating the best-of-breed AIS solutions for passenger processing, baggage handling, and real-time operations management from the beginning.

The break-up of the profile of primary participants in the Airport Information Systems market:

- By Company Type: Tier 1 - 49%, Tier 2 - 37%, and Tier 3 - 14%

- By Designation: C Level - 55%, Director Level - 27%, and Others - 18%

- By Region: North America - 32%, Europe - 32%, Asia Pacific - 16%, Middle East & Africa - 10%, Latin America - 10%

Major companies profiled in the report include SITA (US), Indra. (US), Thales (France), RTX (US), Amadeus (Spain), ADB Safegate (Belgium), Amadeus IT Group S.A (Spain), Siemens A.G (Germany), RESA ( Germany), TAV Technologies (Turkey), Damarel Systems International Ltd. (US), CGI Inc. (Canada), Airport information Systems (England), NEC Corporation (Japan), Honeywell International Inc. (US), Deutsche Telekom AG (Germany), among others.

Research Coverage:

This market study covers the Airport Information Systems market across various segments and subsegments. It aims to estimate this market's size and growth potential across different parts based on Application (Passenger processing, Flight Operation, Cargo & Baggage Management, Resource management, Security & Surveillance, Airside operations, Financial & revenue Management) Type (Passenger Centric, Airport Operational Support ), Implementation ( Upgrades & Modernization, New Installation) and Region (North America, Europe, Asia Pacific, Middle East, Rest of the World).

This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall Airport Information Systems market. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market Drivers (Rise in IT spending in recent years,Increase in use of smartphones, Need for real time information, Increase in use of self-services Technologies at airports), Restraints ( High operating costs, Data and Privacy concerns) , Challenges (Increased investments in airport expansion in emerging economies, Emergence of smart airports) , and opportunities (Management of large sets of datasets and generation of predictive insights). The growth of the market can be attributed to increasing air traffic, rising passenger expectations, and the need for enhanced operational efficiency and security at airports.

The report provides insights on the following pointers:

Rising demand for Airport information Systems in commercial aviation drive the market.

- Market Penetration: Comprehensive information on Airport information Systems offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the Airport information Systems market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Airport information Systems market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Airport information Systems market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the Airport information Systems market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRPORT INFORMATION SYSTEMS MARKET

- 4.2 AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION

- 4.3 AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION

- 4.4 AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE

- 4.5 AIRPORT INFORMATION SYSTEMS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in IT spending by airports

- 5.2.1.2 Increased use of smartphones

- 5.2.1.3 Need for real-time information

- 5.2.1.4 Increasing use of self-service technologies at airports

- 5.2.2 RESTRAINTS

- 5.2.2.1 High operating costs

- 5.2.2.2 Data and privacy concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased investments for airport expansion in emerging economies

- 5.2.3.2 Emergence of smart airports

- 5.2.4 CHALLENGES

- 5.2.4.1 Management of large datasets

- 5.2.4.2 Complexity in integrating new technologies into legacy systems

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR OEMS OFFERING AIRPORT INFORMATION SYSTEMS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- 5.6 PRICING ANALYSIS

- 5.6.1 INDICATIVE PRICING ANALYSIS OF AIRPORT INFORMATION SYSTEMS, BY IMPLEMENTATION

- 5.6.1.1 Factors affecting pricing of newly installed information systems at small airports

- 5.6.1.2 Factors affecting pricing of newly installed airport information systems at mid-sized airports

- 5.6.1.3 Factors affecting pricing of newly installed airport information systems at large airports

- 5.6.1.4 Factors affecting pricing of upgraded/modernized information systems at small airports

- 5.6.1.5 Factors affecting pricing of upgraded/modernized information systems at mid-sized airports

- 5.6.1.6 Factors affecting pricing of upgraded/modernized information systems at large airports

- 5.6.1.7 Factors affecting pricing of maintenance & repair services for airport information systems

- 5.6.1 INDICATIVE PRICING ANALYSIS OF AIRPORT INFORMATION SYSTEMS, BY IMPLEMENTATION

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (SERVICE CODE 9)

- 5.7.2 EXPORT SCENARIO (SERVICE CODE 9)

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 HEATHROW AIRPORT DEPLOYED BIOMETRICS TO REDUCE PROCESSING TIME AND IMPROVE OVERALL PASSENGER EXPERIENCE

- 5.8.2 DUBAI INTERNATIONAL AIRPORT DEPLOYED FACIAL RECOGNITION SYSTEMS AND RFID TAGS TO STREAMLINE PASSENGER FLOW

- 5.8.3 SINGAPORE'S CHANGI AIRPORT ADOPTED AI-POWERED ANALYTICS TO ADDRESS CONGESTION DURING PEAK HOURS

- 5.8.4 SHENZHEN AIRPORT UNDERTOOK COMPREHENSIVE DIGITAL TRANSFORMATION TO MODERNIZE OPERATIONS

- 5.8.5 HARTSFIELD-JACKSON ATLANTA INTERNATIONAL AIRPORT (ATL) MIGRATED TO AWS TO TRANSFORM ITS OPERATIONAL CAPABILITIES

- 5.8.6 HONG KONG INTERNATIONAL AIRPORT (HKIA) IMPLEMENTED AI-POWERED CROWD MANAGEMENT TOOL TO MANAGE CONGESTION DURING PEAK HOURS

- 5.8.7 PARIS CHARLES DE GAULLE AIRPORT ADOPTED BIG DATA PLATFORM TO MANAGE BAGGAGE HANDLING AND RETAIL ACTIVITIES

- 5.9 KEY CONFERENCES & EVENTS, 2025

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.1 BUYING CRITERIA

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Data integration platforms

- 5.12.1.2 Real-time analytics

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 RFID and barcode technology

- 5.12.2.2 Digital twin technology

- 5.12.1 KEY TECHNOLOGIES

- 5.13 AIRPORT INFORMATION SYSTEMS MARKET: BUSINESS MODELS

- 5.14 INVESTMENT & FUNDING SCENARIO

- 5.15 TOTAL COST OF OWNERSHIP (TCO)

- 5.16 IMPACT OF GENERATIVE AI ON AIRPORT INFORMATION SYSTEMS MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 ADOPTION OF GENERATIVE AI IN COMMERCIAL AVIATION

- 5.17 BILL OF MATERIALS (BOM)

- 5.18 TECHNOLOGY ROADMAP

- 5.19 MACROECONOMIC OUTLOOK

- 5.19.1 NORTH AMERICA

- 5.19.2 EUROPE

- 5.19.3 ASIA PACIFIC

- 5.19.4 MIDDLE EAST

- 5.19.5 LATIN AMERICA

- 5.19.6 AFRICA

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 EMERGING TRENDS

- 6.2.1 STATE-OF-THE-ART AIRPORT OPERATING SYSTEMS

- 6.2.2 SMART FLIGHT INFORMATION DISPLAY SOFTWARE (PADS4)

- 6.2.3 SPIDER A-CDM

- 6.2.4 SPIDER PAXVALIDATION

- 6.2.5 DOLPHIN AIRPORT INFORMATION

- 6.2.5.1 Dolphin Flight Information Display System (FIDS)

- 6.2.5.2 Dolphin Advertising Content Management System (ADS)

- 6.2.5.3 Dolphin Automatic Flight Announcement System (AFAS)

- 6.3 TECHNOLOGY TRENDS

- 6.3.1 NEAR-FIELD COMMUNICATION (NFC)

- 6.3.2 RADIO FREQUENCY IDENTIFICATION (RFID)

- 6.3.3 ARMADILLO INTEGRATED SECURITY

- 6.3.4 UNASSISTED BAG-DROP (UBD) FACILITY

- 6.3.5 MOBILE APPLICATIONS

- 6.4 PATENT ANALYSIS

7 AIRPORT INFORMATION SYSTEM TECHNOLOGY MARKET

- 7.1 INTRODUCTION

- 7.2 CONTACTLESS

- 7.2.1 NEED FOR ENHANCING SECURITY AND STREAMLINING OPERATIONS TO DRIVE GROWTH OF CONTACTLESS TECHNOLOGIES

- 7.2.2 FACIAL RECOGNITION ALGORITHM

- 7.2.3 IRIS SCANNING TECHNOLOGY

- 7.2.4 NEAR-FIELD COMMUNICATION

- 7.2.5 RFID AND BARCODE SCANNING

- 7.3 REAL-TIME MONITORING & ANALYTICS

- 7.3.1 FOCUS ON FACILITATING REAL-TIME DATA COLLECTION AND ENABLING EFFICIENT AIRPORT OPERATIONS TO BOOST GROWTH

- 7.3.2 IOT SENSOR

- 7.3.3 AI ANALYTICS FOR CONGESTION MANAGEMENT

- 7.3.4 EDGE COMPUTING FOR AIRSIDE MANAGEMENT

- 7.3.5 BIG DATA ANALYTICS FOR REAL-TIME DECISION-MAKING

- 7.4 ADVANCED SECURITY & SURVEILLANCE

- 7.4.1 EMPHASIS ON REAL-TIME MONITORING AND INTELLIGENT DECISION-MAKING ACROSS AIRLINE FUNCTIONS TO BOOST MARKET

- 7.4.2 AI-POWERED VIDEO ANALYTICS

- 7.4.3 X-RAY AND MILLIMETER-WAVE SCANNER

- 7.4.4 BIOMETRIC ACCESS CONTROL SYSTEM

- 7.4.5 LIDAR (LIGHT DETECTION AND RANGING)

- 7.4.6 THERMAL IMAGING SENSOR

- 7.5 SMART DISPLAY & VISUALIZATION

- 7.5.1 GROWING FOCUS ON ENHANCED PASSENGER EXPERIENCE TO BOOST GROWTH

- 7.5.2 AUGMENTED REALITY

- 7.5.3 HAPTIC FEEDBACK TECHNOLOGY

- 7.6 COLLABORATIVE & DECISION-MAKING

- 7.6.1 NEED FOR PERSONALIZED TRAVEL EXPERIENCE TO ENCOURAGE USE OF COLLABORATIVE AND DECISION-MAKING TECHNOLOGIES

- 7.6.2 APPLICATION PROGRAMMING INTERFACE (API)

- 7.6.3 MACHINE LEARNING ALGORITHM

- 7.6.4 CLOUD COMPUTING FOR DATA STORAGE AND PROCESSING

- 7.7 DYNAMIC REVENUE OPTIMIZATION

- 7.7.1 GROWING DEMAND FOR EFFICIENT REVENUE MANAGEMENT TO DRIVE DYNAMIC OPTIMIZATION SOLUTIONS

- 7.7.2 AI-POWERED PRICING ALGORITHMS

- 7.7.3 PREDICTIVE ANALYTICS FOR FINANCIAL PLANNING

- 7.7.4 IOT-BASED REVENUE TRACKING

8 AIRPORT INFORMATION SYSTEMS MARKET, BY IMPLEMENTATION

- 8.1 INTRODUCTION

- 8.2 UPGRADES & MODERNIZATION

- 8.2.1 REDUCED COST OF UPGRADES AND MODERNIZATION TO DRIVE GROWTH

- 8.3 NEW INSTALLATION

- 8.3.1 GROWING DEMAND FOR INFRASTRUCTURE EQUIPPED WITH ADVANCED TECHNOLOGIES TO BOOST GROWTH

9 AIRPORT INFORMATION SYSTEMS MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 PASSENGER-CENTRIC SYSTEMS

- 9.2.1 NEED FOR IMPROVED PASSENGER EXPERIENCE AND REDUCTION IN WAITING TIME TO DRIVE MARKET

- 9.2.1.1 Use Case 1: SITA adopted passenger processing solutions to enhance airport operations and streamline passenger journey

- 9.2.1.2 Use Case 2: Changi Airport implemented advanced automated immigration checkpoint system to streamline passenger processing and improve overall efficiency

- 9.2.1.3 Use Case 3: Detroit Metropolitan Airport implemented "Parallel Reality" flight information board to display flight information

- 9.2.1.4 Use Case 4: Hamad International Airport implemented advanced airport information systems that use AI-driven predictive analysis

- 9.2.1 NEED FOR IMPROVED PASSENGER EXPERIENCE AND REDUCTION IN WAITING TIME TO DRIVE MARKET

- 9.3 AIRPORT OPERATIONAL SUPPORT SYSTEMS

- 9.3.1 NEED FOR IMPROVED OPERATIONAL EFFICIENCY TO DRIVE MARKET

- 9.3.1.1 Use Case 1: Zurich Airport Group implemented new remote operational center of optical sensors for tower operations

- 9.3.1.2 Use Case 2: Frankfurt Airport tests R&S QPS Walk2000 Walk-through Scanner to enhance security screening

- 9.3.1.3 Use Case 3: Heathrow Airport implemented Beekeeper's mobile-first platform to streamline communication

- 9.3.1.4 Use Case 4: London Stansted Airport implemented advanced surveillance systems to enhance operational efficiency

- 9.3.1 NEED FOR IMPROVED OPERATIONAL EFFICIENCY TO DRIVE MARKET

10 AIRPORT INFORMATION SYSTEMS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 CARGO & BAGGAGE MANAGEMENT

- 10.2.1 NEED FOR AUTOMATED, REAL-TIME CARGO AND BAGGAGE TRACKING SYSTEMS TO DRIVE MARKET

- 10.2.2 BAGGAGE RECONCILIATION SOFTWARE

- 10.2.3 AUTOMATED STORAGE & RETRIEVAL SYSTEM (ASRS)

- 10.2.4 BAGGAGE & CARGO HANDLING AND TRACKING SOFTWARE

- 10.3 FLIGHT OPERATIONS

- 10.3.1 NEED FOR ENHANCED SAFETY AND EFFICIENCY TO DRIVE MARKET

- 10.3.2 AIRPORT DIGITAL SIGNAGE & DISPLAY SYSTEM

- 10.3.2.1 FLIGHT INFORMATION DISPLAY SYSTEM

- 10.3.2.2 DIGITAL SIGNAGE

- 10.3.3 GATE MANAGEMENT SOFTWARE

- 10.3.4 AIRPORT OPERATIONAL DATABASE (AODB)

- 10.4 SECURITY & SURVEILLANCE

- 10.4.1 INCREASING GLOBAL CONCERNS OVER AVIATION SECURITY TO DRIVE GROWTH

- 10.4.2 ACCESS CONTROL SYSTEM

- 10.4.3 CCTV SURVEILLANCE SYSTEM

- 10.4.4 BIOMETRIC ACCESS SYSTEM

- 10.4.5 PERIMETER INTRUSION DETECTION SYSTEM

- 10.4.6 PASSENGER SCREENING SYSTEM

- 10.5 RESOURCE MANAGEMENT

- 10.5.1 NEED FOR INCREASED OPERATIONAL EFFICIENCY TO BOOST GROWTH

- 10.5.2 RESOURCE ALLOCATION SOFTWARE

- 10.5.3 AIRSIDE VEHICLE TRACKING SOFTWARE

- 10.5.4 STAFF SCHEDULING SOFTWARE

- 10.6 AIRSIDE OPERATIONS

- 10.6.1 GROWING COMPLEXITY OF AIR TRAVEL TO PROPEL MARKET

- 10.6.2 GROUND HANDLING SOFTWARE

- 10.6.3 AIRPORT COLLABORATIVE DECISION-MAKING SOFTWARE

- 10.6.4 AUTOMATIC TERMINAL INFORMATION SYSTEM

- 10.7 FINANCIAL & REVENUE MANAGEMENT

- 10.7.1 NEED TO OPTIMIZE AIRPORT OPERATIONS TO DRIVE MARKET

- 10.7.2 AERONAUTICAL BILLING SOFTWARE

- 10.7.3 NON-AERONAUTICAL BILLING SOFTWARE

- 10.7.4 AIRPORT REVENUE ANALYSIS SOFTWARE

- 10.8 PASSENGER PROCESSING

- 10.8.1 NEED FOR IMPROVED OPERATIONAL EFFICIENCY AND IMPROVED CUSTOMER EXPERIENCE TO DRIVE MARKET

- 10.8.2 DEPARTURE CONTROL SYSTEMS

- 10.8.2.1 Common use passenger processing system (CUPPS)

- 10.8.2.2 Common-use self-service (CUSS) kiosk

- 10.8.3 BIOMETRIC IDENTIFICATION SYSTEM

- 10.8.4 PASSENGER FLOW MANAGEMENT SOFTWARE

11 AIRPORT INFORMATION SYSTEMS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 PESTLE ANALYSIS

- 11.2.2 US

- 11.2.2.1 High air traffic to necessitate effective air information system management

- 11.2.3 CANADA

- 11.2.3.1 Government initiatives to modernize airport infrastructure to drive market

- 11.3 EUROPE

- 11.3.1 PESTLE ANALYSIS

- 11.3.2 UK

- 11.3.2.1 Focus on modernizing airport infrastructure to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Sustainability initiatives to drive market

- 11.3.4 GERMANY

- 11.3.4.1 Rising demand for technological innovation to drive market

- 11.3.5 NETHERLANDS

- 11.3.5.1 Need to prioritize seamless multi-modal connectivity between air travel and public transportation systems to drive market

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 PESTLE ANALYSIS

- 11.4.2 CHINA

- 11.4.2.1 Focus on building world-class transportation hubs to drive market

- 11.4.3 INDIA

- 11.4.3.1 Growing middle-class population and increasing air travel to boost growth

- 11.4.4 JAPAN

- 11.4.4.1 Unique regional dynamics and technological advancements to drive market

- 11.4.5 SINGAPORE

- 11.4.5.1 Integration of advanced airport information system technologies to drive market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Nation's commitment to sustainability to drive market

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST

- 11.5.1 PESTLE ANALYSIS

- 11.5.2 GCC

- 11.5.2.1 UAE

- 11.5.2.1.1 Rising need for advanced airport information system types to drive market

- 11.5.2.2 Saudi Arabia

- 11.5.2.2.1 Initiatives, such as 'Vision 2030' to boost growth of airport information systems market

- 11.5.2.1 UAE

- 11.5.3 REST OF MIDDLE EAST

- 11.6 REST OF THE WORLD

- 11.6.1 BRAZIL

- 11.6.1.1 Focus on implementing sophisticated information systems to drive market

- 11.6.2 MEXICO

- 11.6.2.1 Adoption of airport information system types for advanced air traffic management to drive market

- 11.6.3 SOUTH AFRICA

- 11.6.3.1 Need for improved operational efficiency to drive market

- 11.6.4 OTHERS IN ROW

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 12.3 REVENUE ANALYSIS, 2020-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SITA

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 AMADEUS IT GROUP SA

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 VANDERLANDE INDUSTRIES B.V.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 INDRA

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 RTX

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 SIEMENS AG

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 THALES

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.3.2 Other developments

- 13.1.8 ADB SAFEGATE

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Other developments

- 13.1.9 RESA

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Other developments

- 13.1.10 TAV TECHNOLOGIES

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.3.2 Other developments

- 13.1.11 DAMAREL SYSTEMS INTERNATIONAL LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.11.3.2 Other developments

- 13.1.12 CGI INC.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.13 AIRPORT INFORMATION SYSTEMS

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Deals

- 13.1.14 NEC CORPORATION

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Product launches

- 13.1.14.3.2 Deals

- 13.1.14.3.3 Other developments

- 13.1.15 HONEYWELL INTERNATIONAL, INC.

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Other developments

- 13.1.16 DEUTSCHE TELEKOM AG

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Deals

- 13.1.1 SITA

- 13.2 OTHER PLAYERS

- 13.2.1 AEROCLOUD SYSTEMS LTD.

- 13.2.2 VELOCITY AIRPORT SOLUTIONS

- 13.2.3 XOVIS AG

- 13.2.4 VEOVO

- 13.2.5 TREBIDE

- 13.2.6 INFORM SOFTWARE

- 13.2.7 PADS4 & NDS

- 13.2.8 INFAX, INC.

- 13.2.9 A-ICE SRL

- 13.2.10 ASSAIA INTERNATIONAL LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS