|

|

市場調査レポート

商品コード

1623614

EVバッテリー試験の世界市場:EVタイプ別、フォームファクター別、推進力別、バッテリー技術別、化学別、調達タイプ別、試験タイプ別、地域別 - 2030年までの予測EV Battery Testing Market by Testing Type (Safety, Performance), Battery Technology (Conventional Batteries, CTP, CTC), Form Factor (Cylindrical, Prismatic, Pouch), Sourcing Type, Chemistry, Propulsion, EV Type, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| EVバッテリー試験の世界市場:EVタイプ別、フォームファクター別、推進力別、バッテリー技術別、化学別、調達タイプ別、試験タイプ別、地域別 - 2030年までの予測 |

|

出版日: 2024年12月18日

発行: MarketsandMarkets

ページ情報: 英文 239 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

EVバッテリー試験の市場規模は、2024年の33億5,000万米ドルから2030年には95億1,000万米ドルに成長し、予測期間中のCAGRは19.0%になると予測されています。

EVバッテリー試験市場は、排出規制の強化、政府の推計・予測、持続可能性を求める世界の動きに後押しされ、電気自動車の需要が拡大するにつれて成長しています。EVが約4,000万台普及し、2023年の世界販売台数の60%を中国が占め、次いで欧州(25%)、米国(10%)が続く中、信頼性の高いバッテリー試験のニーズはかつてないほど高まっています。試験は、特にバッテリーの発火や過熱といった事故に関する安全性と性能を保証します。ソリッドステートや高容量リチウムイオン化学物質を含むバッテリー技術の進歩は、その効率を検証するための特別なプロトコルを必要とします。自動車メーカーがゼロ・エミッション車の野心的な目標を設定する中、バッテリー試験は次世代バッテリーの安全性、性能、信頼性を確保する上で重要な役割を果たし、持続可能な輸送の未来を形作ります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2033年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント | EVタイプ別、フォームファクター別、推進力別、バッテリー技術別、化学別、調達タイプ別、試験タイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋 |

リチウムイオンバッテリーセグメントは、その確立された技術と電気自動車における重要な役割により、予測期間中にEVバッテリー試験市場を独占します。現在走行中のEVの約90%がリチウムイオン電池を搭載しており、市場での優位性が際立っています。これは、高いエネルギー密度、長いサイクル寿命、安全性、充電速度、コスト効率の継続的な改善といった利点によるものです。自動車メーカーがHyundai IONIQ 6、Hyundai Kona Electric、Toyota Bz4xのような先進的で高性能なEVモデルを投入するにつれ、さまざまな条件下での安全性と性能を確保するため、リチウムイオン電池の厳格な試験に対する需要が高まっています。

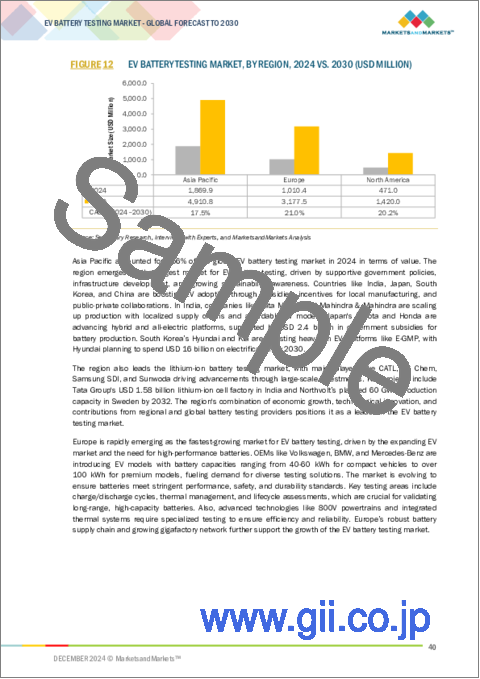

アジア太平洋は、大規模な投資と電池製造の進歩により、リチウムイオン電池試験市場をリードすると予想されます。例えば、Tata Groupはインドにリチウムイオン電池工場を建設するために15億8,000万米ドルを投じており、Northvoltは2032年までにスウェーデンで60GWhの生産能力を達成する計画です。さらに、規制への対応と安全性への懸念が、この分野での包括的な試験の必要性を高めています。政府の奨励策と技術の進歩に支えられたEVの世界の普及が、バッテリー試験サービスの需要をさらに押し上げています。

結論として、リチウムイオン電池分野は、確立された技術、汎用性、継続的な改良により、EV市場に不可欠なものとなっており、世界的に厳しい安全・性能基準を満たすための専門試験サービスの成長を促進しています。

性能試験分野は、高性能で安全かつ信頼性の高いEVバッテリーの需要増加により、予測期間中にEVバッテリー試験で最も急成長する市場になると予測されています。この種の試験は、バッテリー容量、充電速度、耐久性、安全性といった重要な側面を実環境下で評価します。TUV SUDのようなリチウムイオン電池の専門知識と高度な試験プロトコルを持つ企業は、サイクル試験やカレンダーエージング試験、急速充電プロファイル、電気化学インピーダンス分光法などのサービスを提供し、最適な電池性能を保証しています。アジア太平洋地域は、EV生産の大幅な進歩や、2023年にTUV Rheinlandの長江デルタハブが中国に開設されるなど、バッテリー試験インフラへの投資によって、このセグメントを支配すると予想されます。

当レポートでは、世界のEVバッテリー試験市場について調査し、EVタイプ別、フォームファクター別、推進力別、バッテリー技術別、化学別、調達タイプ別、試験タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 主な利害関係者と購入基準

- エコシステム分析

- ケーススタディ分析

- 技術分析

- 投資シナリオ

- 規制状況

- 特許分析

- 顧客ビジネスに影響を与える動向と混乱

- 2025年の主な会議とイベント

- バリューチェーン分析

- EVバッテリーテスト市場におけるAI/生成AIの影響

- 価格分析

第6章 EVバッテリーテスト市場(EVタイプ別)

- イントロダクション

- 小型車両

- 大型商用車

- 主な洞察

第7章 EVバッテリーテスト市場(フォームファクター別)

- イントロダクション

- プリズマティック

- ポーチ

- 円筒形

- 主な洞察

第8章 EVバッテリーテスト市場(推進力別)

- イントロダクション

- バッテリー電気自動車

- ハイブリッド電気自動車

- プラグインハイブリッド電気自動車

- 燃料電池電気自動車

- 主な洞察

第9章 EVバッテリーテスト市場(バッテリー技術別)

- イントロダクション

- セル・ツー・モジュール

- セル・ツー・パック

- セル・ツー・シャーシ/セル・ツー・ボディ

- 主要な洞察

第10章 EVバッテリー試験市場(化学別)

- イントロダクション

- リチウムイオン

- ソリッドステート

- その他

- 主要な洞察

第11章 EVバッテリーテスト市場(調達タイプ別)

- イントロダクション

- 社内

- アウトソーシング

- 主要な洞察

第12章 EVバッテリーテスト市場(試験タイプ別)

- イントロダクション

- 安全性試験

- 性能試験

- その他

- 主要な洞察

第13章 EVバッテリーテスト市場(地域別)

- イントロダクション

- アジア太平洋

- マクロ経済見通し

- 中国

- インド

- 日本

- 韓国

- 欧州

- マクロ経済見通し

- ドイツ

- フランス

- 英国

- スペイン

- ノルウェー

- その他

- 北米

- マクロ経済見通し

- 米国

- カナダ

- 主要な洞察

第14章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析、2023年

- 収益分析、2019年~2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第15章 企業プロファイル

- 主要参入企業

- TUV SUD

- INTERTEK GROUP PLC

- UL SOLUTIONS

- BUREAU VERITAS

- SGS SOCIETE GENERALE DE SURVEILLANCE SA.

- TUV RHEINLAND AG GROUP

- TUV NORD GROUP

- UTAC

- EUROFINS SCIENTIFIC

- DEKRA

- APPLUS+

- ELEMENT MATERIALS TECHNOLOGY

- その他の企業

- ELITE ELECTRONIC ENGINEERING

- INSTRON

- THE BRITISH STANDARDS INSTITUTION

- NEMKO

- ACS

- DNV GL

- KIWA

- CSA GROUP

- SOUTHWEST RESEARCH INSTITUTE

- HORIBA LTD

- KEYSIGHT TECHNOLOGIES

- HIOKI E.E. CORPORATION

- ATEQ LEAKTESTING

第16章 提言

第17章 付録

List of Tables

- TABLE 1 EV BATTERY TESTING MARKET DEFINITION, BY SOURCING TYPE

- TABLE 2 CURRENCY EXCHANGE RATES

- TABLE 3 SAFETY STANDARDS BY REGULATORY ORGANIZATIONS

- TABLE 4 INNOVATION IN BATTERIES BY KEY MANUFACTURERS

- TABLE 5 COST FOR BATTERY PACK CERTIFICATION

- TABLE 6 USE OF AI IN ELECTRIC VEHICLE BATTERY TESTING

- TABLE 7 TESTING TIME FOR BATTERY PACK CERTIFICATION

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TESTING TYPE

- TABLE 9 KEY BUYING CRITERIA, BY PROPULSION

- TABLE 10 EV BATTERY TESTING MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 CHINESE NATIONAL STANDARDS

- TABLE 14 US SAFETY STANDARDS

- TABLE 15 PATENT ANALYSIS, 2020-2024

- TABLE 16 EV BATTERY TESTING MARKET: KEY CONFERENCES AND EVENTS, 2025

- TABLE 17 EV BATTERY TESTING COST ANALYSIS, BY EV TYPE, 2023-2030 (USD)

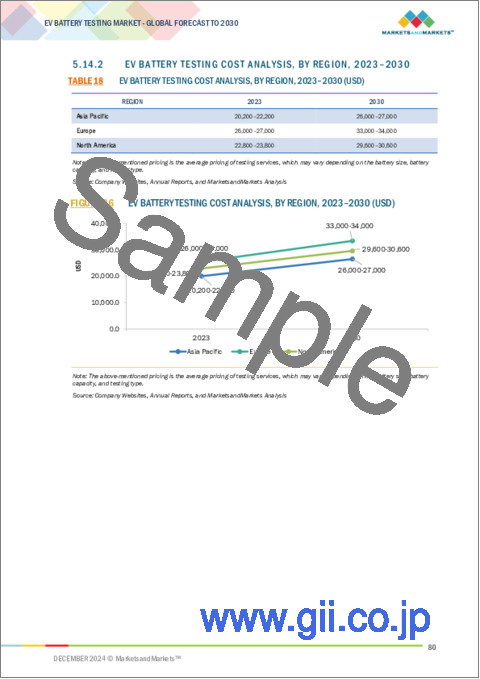

- TABLE 18 EV BATTERY TESTING COST ANALYSIS, BY REGION, 2023-2030 (USD)

- TABLE 19 EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 20 EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 21 LIGHT-DUTY VEHICLE: BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 22 LIGHT-DUTY VEHICLE: BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 23 HEAVY COMMERCIAL VEHICLE: BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 24 HEAVY COMMERCIAL VEHICLE: BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 25 EV BATTERY TESTING MARKET, BY FORM FACTOR, 2020-2023 (USD MILLION)

- TABLE 26 EV BATTERY TESTING MARKET, BY FORM FACTOR, 2024-2030 (USD MILLION)

- TABLE 27 PRISMATIC: EV BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 28 PRISMATIC: EV BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 29 POUCH: EV BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 30 POUCH: EV BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 31 CYLINDRICAL: EV BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 32 CYLINDRICAL: EV BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 33 EV BATTERY TESTING MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 34 EV BATTERY TESTING MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 35 BEV BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 BEV BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 37 HEV BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 HEV BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 39 PHEV BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 40 PHEV BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 41 FCEV BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 42 FCEV BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 43 EV BATTERY TESTING MARKET, BY BATTERY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 44 EV BATTERY TESTING MARKET, BY BATTERY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 45 CELL-TO-MODULE BATTERY: EV BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 46 CELL-TO-MODULE BATTERY: EV BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 47 CELL-TO-PACK: BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 48 CELL-TO-PACK: BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 49 CELL-TO-CHASSIS/CELL-TO-BODY: BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 50 CELL-TO-CHASSIS/CELL-TO-BODY: BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 51 EV BATTERY TESTING MARKET, BY CHEMISTRY, 2020-2023 (USD MILLION)

- TABLE 52 EV BATTERY TESTING MARKET, BY CHEMISTRY, 2024-2030 (USD MILLION)

- TABLE 53 LITHIUM-ION BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 54 LITHIUM-ION BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 55 SOLID-STATE BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 SOLID-STATE BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 57 OTHER CHEMISTRIES: EV BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 58 OTHER CHEMISTRIES: EV BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 59 EV BATTERY TESTING MARKET, BY SOURCING TYPE, 2020-2023 (USD MILLION)

- TABLE 60 EV BATTERY TESTING MARKET, BY SOURCING TYPE, 2024-2030 (USD MILLION)

- TABLE 61 IN-HOUSE EV BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 62 IN-HOUSE EV BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 63 OUTSOURCED EV BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 OUTSOURCED EV BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 65 EV BATTERY TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 66 EV BATTERY TESTING MARKET, BY TESTING TYPE, 2024-2030 (USD MILLION)

- TABLE 67 EV BATTERY SAFETY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 EV BATTERY SAFETY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 69 EV BATTERY PERFORMANCE TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 70 EV BATTERY PERFORMANCE TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 71 OTHER TESTING: EV BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 72 OTHER TESTING: EV BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 73 EV BATTERY TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 74 EV BATTERY TESTING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 75 ASIA PACIFIC: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 76 ASIA PACIFIC: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: EV BATTERY TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 78 ASIA PACIFIC: EV BATTERY TESTING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 79 CHINA: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 80 CHINA: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 81 INDIA: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 82 INDIA: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 83 JAPAN: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 84 JAPAN: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 85 SOUTH KOREA: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 86 SOUTH KOREA: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 87 EUROPE: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 88 EUROPE: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 89 EUROPE: EV BATTERY TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 90 EUROPE: EV BATTERY TESTING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 91 GERMANY: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 92 GERMANY: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 93 FRANCE: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 94 FRANCE: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 95 UK: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 96 UK: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 97 SPAIN: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 98 SPAIN: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 99 NORWAY: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 100 NORWAY: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 101 REST OF EUROPE: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 102 REST OF EUROPE: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 104 NORTH AMERICA: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: EV BATTERY TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 106 NORTH AMERICA: EV BATTERY TESTING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 107 US: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 108 US: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 109 CANADA: EV BATTERY TESTING MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 110 CANADA: EV BATTERY TESTING MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- TABLE 111 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- TABLE 112 EV BATTERY TESTING MARKET: DEGREE OF COMPETITION

- TABLE 113 EV BATTERY TESTING MARKET: PROPULSION FOOTPRINT, 2023

- TABLE 114 EV BATTERY TESTING MARKET: TESTING TYPE FOOTPRINT, 2023

- TABLE 115 EV BATTERY TESTING MARKET: REGION FOOTPRINT, 2023

- TABLE 116 EV BATTERY TESTING MARKET: LIST OF START-UPS/SMES

- TABLE 117 EV BATTERY TESTING MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 118 EV BATTERY TESTING MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, DECEMBER 2020-SEPTEMBER 2024

- TABLE 119 EV BATTERY TESTING MARKET: DEALS, JUNE 2022-OCTOBER 2024

- TABLE 120 EV BATTERY TESTING MARKET: EXPANSIONS, JANUARY 2021-SEPTEMBER 2024

- TABLE 121 EV BATTERY TESTING MARKET: OTHER DEVELOPMENTS, JANUARY 2021-SEPTEMBER 2024

- TABLE 122 TUV SUD: COMPANY OVERVIEW

- TABLE 123 TUV SUD: PRODUCTS/SERVICES OFFERED

- TABLE 124 TUV SUD: DEALS

- TABLE 125 TUV SUD: EXPANSIONS

- TABLE 126 INTERTEK GROUP PLC: COMPANY OVERVIEW

- TABLE 127 INTERTEK GROUP PLC: PRODUCTS/SERVICES OFFERED

- TABLE 128 INTERTEK GROUP PLC: DEALS

- TABLE 129 INTERTEK GROUP PLC: EXPANSIONS

- TABLE 130 UL SOLUTIONS: COMPANY OVERVIEW

- TABLE 131 UL SOLUTIONS: PRODUCTS/SERVICES OFFERED

- TABLE 132 UL SOLUTIONS: PRODUCT DEVELOPMENTS

- TABLE 133 UL SOLUTIONS: DEALS

- TABLE 134 UL SOLUTIONS: EXPANSIONS

- TABLE 135 UL SOLUTIONS: OTHER DEVELOPMENTS

- TABLE 136 BUREAU VERITAS: COMPANY OVERVIEW

- TABLE 137 BUREAU VERITAS: PRODUCTS/SERVICES OFFERED

- TABLE 138 BUREAU VERITAS: PRODUCT LAUNCHES

- TABLE 139 BUREAU VERITAS: DEALS

- TABLE 140 BUREAU VERITAS: EXPANSIONS

- TABLE 141 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: COMPANY OVERVIEW

- TABLE 142 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: PRODUCTS/SERVICES OFFERED

- TABLE 143 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: EXPANSIONS

- TABLE 144 TUV RHEINLAND AG GROUP: COMPANY OVERVIEW

- TABLE 145 TUV RHEINLAND AG GROUP: PRODUCTS AND SERVICES OFFERED

- TABLE 146 TUV RHEINLAND AG GROUP: PRODUCT DEVELOPMENTS

- TABLE 147 TUV RHEINLAND AG GROUP: DEALS

- TABLE 148 TUV RHEINLAND AG GROUP: EXPANSIONS

- TABLE 149 TUV NORD GROUP: COMPANY OVERVIEW

- TABLE 150 TUV NORD GROUP: PRODUCTS/SERVICES OFFERED

- TABLE 151 TUV NORD GROUP: DEALS

- TABLE 152 UTAC: COMPANY OVERVIEW

- TABLE 153 UTAC: PRODUCTS/SERVICES OFFERED

- TABLE 154 UTAC: OTHER DEVELOPMENTS

- TABLE 155 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 156 EUROFINS SCIENTIFIC: PRODUCTS/SERVICES OFFERED

- TABLE 157 EUROFINS SCIENTIFIC: EXPANSIONS

- TABLE 158 DEKRA: COMPANY OVERVIEW

- TABLE 159 DEKRA: PRODUCTS/SERVICES OFFERED

- TABLE 160 DEKRA: PRODUCT LAUNCHES

- TABLE 161 DEKRA: EXPANSIONS

- TABLE 162 DEKRA: OTHER DEVELOPMENTS

- TABLE 163 APPLUS+: COMPANY OVERVIEW

- TABLE 164 APPLUS+: PRODUCTS/SERVICES OFFERED

- TABLE 165 APPLUS+: DEALS

- TABLE 166 APPLUS+: EXPANSIONS

- TABLE 167 ELEMENT MATERIALS TECHNOLOGY: COMPANY OVERVIEW

- TABLE 168 ELEMENT MATERIALS TECHNOLOGY: PRODUCTS/SERVICES OFFERED

- TABLE 169 ELEMENT MATERIALS TECHNOLOGY: DEALS

- TABLE 170 ELEMENT MATERIALS TECHNOLOGY: EXPANSIONS

- TABLE 171 ELITE ELECTRONIC ENGINEERING: COMPANY OVERVIEW

- TABLE 172 INSTRON: COMPANY OVERVIEW

- TABLE 173 THE BRITISH STANDARDS INSTITUTION: COMPANY OVERVIEW

- TABLE 174 NEMKO: COMPANY OVERVIEW

- TABLE 175 ACS: COMPANY OVERVIEW

- TABLE 176 DNV GL: COMPANY OVERVIEW

- TABLE 177 KIWA: COMPANY OVERVIEW

- TABLE 178 CSA GROUP: COMPANY OVERVIEW

- TABLE 179 SOUTHWEST RESEARCH INSTITUTE: COMPANY OVERVIEW

- TABLE 180 HORIBA LTD: COMPANY OVERVIEW

- TABLE 181 KEYSIGHT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 182 HIOKI E.E. CORPORATION: COMPANY OVERVIEW

- TABLE 183 ATEQ LEAKTESTING: COMPANY OVERVIEW

List of Figures

- FIGURE 1 EV BATTERY TESTING MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 EV BATTERY TESTING MARKET: BOTTOM-UP APPROACH

- FIGURE 8 EV BATTERY TESTING MARKET: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- FIGURE 11 REPORT SUMMARY

- FIGURE 12 EV BATTERY TESTING MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

- FIGURE 13 ADVANCEMENT IN BATTERY TECHNOLOGIES TO DRIVE MARKET

- FIGURE 14 SAFETY TESTING TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- FIGURE 15 IN-HOUSE SEGMENT TO HOLD LARGER MARKET SHARE THAN OUTSOURCED SEGMENT DURING FORECAST PERIOD

- FIGURE 16 LITHIUM-ION TO SURPASS SOLID-STATE AND OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 17 CELL-TO-MODULE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 PRISMATIC SEGMENT TO ACQUIRE DOMINANT MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 BEV TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 20 LIGHT-DUTY VEHICLE TO BE LARGER SEGMENT THAN HEAVY COMMERCIAL VEHICLE DURING FORECAST PERIOD

- FIGURE 21 ASIA PACIFIC TO BE DOMINANT MARKET FOR EV BATTERY TESTING IN 2024

- FIGURE 22 EV BATTERY TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 ELECTRIFICATION TARGETS, 2025-2050

- FIGURE 24 ELECTRIC VEHICLE BATTERY DEMAND, BY GWH/YEAR

- FIGURE 25 KEY ELECTRIC VEHICLE STANDARDS

- FIGURE 26 BATTERY LAB INVESTMENTS BY OEMS, 2023-2024

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TESTING TYPE

- FIGURE 28 KEY BUYING CRITERIA, BY PROPULSION

- FIGURE 29 ECOSYSTEM ANALYSIS OF EV BATTERY TESTING MARKET

- FIGURE 30 INVESTMENT SCENARIO, 2020-2024

- FIGURE 31 PATENT ANALYSIS, 2014-2024

- FIGURE 32 LEGAL STATUS OF PATENTS, 2014-2024

- FIGURE 33 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 34 VALUE CHAIN ANALYSIS OF EV BATTERY TESTING MARKET

- FIGURE 35 EV BATTERY TESTING COST ANALYSIS, BY EV TYPE, 2023-2030 (USD)

- FIGURE 36 EV BATTERY TESTING COST ANALYSIS, BY REGION, 2023-2030 (USD)

- FIGURE 37 EV BATTERY TESTING MARKET, BY EV TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 38 EV BATTERY TESTING MARKET, BY FORM FACTOR, 2024 VS. 2030 (USD MILLION)

- FIGURE 39 EV BATTERY TESTING MARKET, BY PROPULSION, 2024 VS. 2030 (USD MILLION)

- FIGURE 40 EV BATTERY TESTING MARKET, BY BATTERY TECHNOLOGY, 2024 VS. 2030 (USD MILLION)

- FIGURE 41 EV BATTERY TESTING MARKET, BY CHEMISTRY, 2024 VS. 2030 (USD MILLION)

- FIGURE 42 EV BATTERY TESTING MARKET, BY SOURCING TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 43 EV BATTERY TESTING MARKET, BY TESTING TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 44 EV BATTERY TESTING MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

- FIGURE 45 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 46 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 47 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2023-2025

- FIGURE 48 ASIA PACIFIC: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2023

- FIGURE 49 ASIA PACIFIC: EV BATTERY TESTING MARKET SNAPSHOT

- FIGURE 50 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 51 EUROPE: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 52 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2023-2025

- FIGURE 53 EUROPE: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2023

- FIGURE 54 EUROPE: EV BATTERY TESTING MARKET SNAPSHOT

- FIGURE 55 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 56 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 57 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2023-2025

- FIGURE 58 NORTH AMERICA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2023

- FIGURE 59 NORTH AMERICA: EV BATTERY TESTING MARKET SNAPSHOT

- FIGURE 60 MARKET SHARE ANALYSIS, 2023

- FIGURE 61 REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD BILLION)

- FIGURE 62 COMPANY VALUATION, 2024

- FIGURE 63 EV/EBIDTA OF KEY PLAYERS, 2024

- FIGURE 64 BRAND/PRODUCT COMPARISON

- FIGURE 65 EV BATTERY TESTING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 66 EV BATTERY TESTING MARKET: COMPANY FOOTPRINT, 2023

- FIGURE 67 EV BATTERY TESTING MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 68 TUV SUD: COMPANY SNAPSHOT

- FIGURE 69 INTERTEK GROUP PLC: COMPANY SNAPSHOT

- FIGURE 70 UL SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 71 BUREAU VERITAS: COMPANY SNAPSHOT

- FIGURE 72 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: COMPANY SNAPSHOT

- FIGURE 73 TUV RHEINLAND AG GROUP: COMPANY SNAPSHOT

- FIGURE 74 TUV NORD GROUP: COMPANY SNAPSHOT

- FIGURE 75 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- FIGURE 76 DEKRA: COMPANY SNAPSHOT

- FIGURE 77 APPLUS+: COMPANY SNAPSHOT

- FIGURE 78 ELEMENT MATERIALS TECHNOLOGY: COMPANY SNAPSHOT

The EV battery testing market is estimated to grow from USD 3.35 billion in 2024 to USD 9.51 billion in 2030 at a CAGR of 19.0% during the forecast period.The EV battery testing market is growing as the demand for electric vehicles grows, driven by stricter emission regulations, government incentives, and the global push for sustainability. With around 40 million EVs on the road and China accounting for 60% of global sales in 2023, followed by Europe (25%) and the US (10%), the need for reliable battery testing is at an all-time high. Testing ensures safety and performance, especially concerning incidents like battery fires and overheating. Advancements in battery technologies, including solid-state and high-capacity lithium-ion chemistries, require specialized protocols to validate their efficiency. As automakers set ambitious goals for zero-emission vehicles, battery testing will play a critical role in ensuring next-generation batteries' safety, performance, and reliability, shaping the future of sustainable transport.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2033 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD million) |

| Segments | Testing Type, Chemistry, Battery Technology, Form Factor, Propulsion, EV Type, Sourcing Type and Region. |

| Regions covered | North America, Europe, and Asia-Pacific |

"Lithium-ion battery segment is estimated to hold the largest market share during the forecast period."

The lithium-ion battery segment will dominate the EV battery testing market during the forecast period due to its well-established technology and critical role in electric vehicles. Around 90% of EVs on the road today are equipped with lithium-ion batteries, highlighting their dominance in the market. This is due to its benefits, such as its high energy density, long cycle life, and continuous improvements in safety, charging speed, and cost efficiency. As automakers introduce advanced and high-performance EV models, like the Hyundai IONIQ 6, Hyundai Kona Electric, and Toyota Bz4x, the demand for rigorous testing of lithium-ion batteries is increasing to ensure safety and performance under various conditions.

Asia-Pacific is expected to lead the lithium-ion battery testing market, driven by large-scale investments and advancements in battery manufacturing. For instance, Tata Group has committed USD 1.58 billion to build a lithium-ion cell factory in India, and Northvolt plans to achieve a production capacity of 60 GWh in Sweden by 2032. Additionally, regulatory compliance and safety concerns have intensified this segment's need for comprehensive testing. The growing adoption of EVs globally, supported by government incentives and technological progress, further boosts the demand for battery testing services.

In conclusion, the lithium-ion battery segment's established technology, versatility, and continuous improvements make it essential for the EV market, driving the growth of specialized testing services to meet stringent safety and performance standards worldwide.

"Performance testing is estimated to be the fastest growing market by 2033."

The performance testing segment is projected to be the fastest-growing market in EV battery testing during the forecast period due to the increasing demand for high-performance, safe, and reliable EV batteries. This type of testing evaluates critical aspects such as battery capacity, charging speed, durability, and safety under real-world conditions. Companies like TUV SUD, with expertise in lithium-ion batteries and advanced testing protocols, offer services such as cyclic and calendar aging tests, rapid charging profiles, and electrochemical impedance spectroscopy to ensure optimal battery performance. Asia-Pacific is expected to dominate this segment, driven by significant advancements in EV production and investments in battery testing infrastructure, such as the opening of TUV Rheinland's Yangtze River Delta Hub in China in 2023.

Regulatory compliance requirements and the rising adoption of advanced battery technologies, including solid-state and high-capacity lithium-ion batteries fuel the segment's growth. Additionally, the need to meet safety standards and consumer expectations for longer battery life and faster charging speeds has further boosted demand for performance testing. In conclusion, the integration of automated and AI-driven testing technologies will continue to support the rapid expansion of this market, ensuring that EV batteries meet global safety and reliability standards.

"Europe is anticipated to be one of the fastest markets over the forecast period."

Europe is emerging as the fastest-growing market for EV battery testing, driven by the rapid expansion of the EV market and increasing demand for high-performance batteries. European OEMs like VW, BMW, and Mercedes-Benz are leading the shift to electrification, introducing models with varying battery capacities, from compact EVs with 40-60 kWh batteries to premium vehicles with capacities exceeding 100 kWh. This diversity in vehicle types and battery sizes has created a robust demand for diverse battery testing solutions.

Europe's EV battery testing market is evolving to ensure that batteries meet performance, safety, and durability standards. Performance testing, including charge/discharge tests, thermal management evaluations, and lifecycle assessments, has become critical due to the introduction of long-range and high-capacity battery variants. Automakers focus on advanced powertrain technologies like 800V architectures and integrated thermal management, which require specialized testing to validate efficiency and reliability. Additionally, the shift toward solid-state batteries, expected to revolutionize EV performance, has further propelled the need for more testing.

Moreover, Europe's strong ecosystem of battery supply chains and gigafactories also supports the testing market's growth. Initiatives like the European Battery Alliance and significant private investments enable the region to become more self-reliant in battery manufacturing, reducing dependence on the Asian market. Due to this, establishing advanced testing facilities by key service providers, including TUV SUD, Dekra, Applus+, TUV Rheinland, etc, are expanding their presence in Europe to meet the growing demand.

With EV adoption, battery innovation accelerating, and the region's commitment to achieving carbon neutrality, offering opportunities for testing providers will play a crucial role in ensuring EV batteries' safety, performance, and sustainability.

- By Company Type: Battery supplies - 20%, Testing companies - 30%, OEMs-50%.

- By Designation: C Level - 30%, D Level - 40%, and Others - 30%

- By Region: North America -30%, Europe - 20%, Asia Pacific - 50%

Research Coverage:

The EV battery testing market is segmented by testing type (Safety, Performance, others), by chemistry (Lithium-ion, Solid-state, others), by battery technology (Conventional batteries, CTP, CTC), by form factor (Cylindrical, Prismatic, Pouch), by sourcing type (In-house, outsourced), by propulsion (BEV, HEV, PHEV, FCEV), by EV type (LDV, HDV) and region (Asia Pacific, Europe, and North America).

Reasons to buy this report:

The report will provide market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall EV battery testing market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

The report provides insights on the following pointers:

- Analysis of key drivers (Global EV adoption growth and push for Decarbonization, Rise in Demand for GWh of Battery Capacity for EVs, Focus on Safety Standards, Advancements in Battery Technologies), restraints (High Testing Costs, Complexity of Testing Protocols & long testing duration), opportunities (Digital and AI-Driven Solutions, Increase in investments in battery technologies), and challenges (Extended Testing Duration and Capacity Constraints) are influencing the growth of the EV battery testing market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the EV battery testing market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the EV battery testing market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the EV battery testing market.

- Deep dive segments on the EV battery testing market and their trends.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like TUV SUD (UK), SGS S.A. (Switzerland), Intertek Group plc (UK), UL LLC (US), and Bureau Veritas (France) among others in the EV battery testing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights from primary interviews

- 2.1.2.2 List of primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EV BATTERY TESTING MARKET

- 4.2 EV BATTERY TESTING MARKET, BY TESTING TYPE

- 4.3 EV BATTERY TESTING MARKET, BY SOURCING TYPE

- 4.4 EV BATTERY TESTING MARKET, BY CHEMISTRY

- 4.5 EV BATTERY TESTING MARKET, BY BATTERY TECHNOLOGY

- 4.6 EV BATTERY TESTING MARKET, BY FORM FACTOR

- 4.7 EV BATTERY TESTING MARKET, BY PROPULSION

- 4.8 EV BATTERY TESTING MARKET, BY EV TYPE

- 4.9 EV BATTERY TESTING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Global electric vehicle adoption growth and push for decarbonization

- 5.2.1.2 Growing demand for high-capacity batteries for electric vehicles

- 5.2.1.3 Growing focus on safety standards

- 5.2.1.4 Advancements in battery technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexity of testing protocols and high investments leading to high testing costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integrating machine learning and AI-driven solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Extended testing duration and capacity constraints

- 5.2.1 DRIVERS

- 5.3 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.3.2 BUYING CRITERIA

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 BATTERY SUPPLIERS

- 5.4.2 TESTING EQUIPMENT MANUFACTURERS

- 5.4.3 TESTING SERVICE PROVIDERS

- 5.4.4 OEMS

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 COST-EFFECTIVE BATTERY PACK TEST SYSTEM BY DMC

- 5.5.2 ACERTA INTRODUCED LINPULSE TO ENHANCE LEAK TESTING FOR EV BATTERIES

- 5.5.3 KEITHLEY IMPROVED EFFICIENCY, ACCURACY, AND RELIABILITY OF BATTERY TESTING PROCESSES

- 5.5.4 ION ENERGY'S BMS ENHANCES SAFETY AND PRODUCTION FOR OFF-ROAD ELECTRIC VEHICLES

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 EV battery cell and module safety and performance

- 5.6.1.2 Battery management system testing for advanced battery systems

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Fast charging and high-power testing

- 5.6.2.2 Battery packaging and enclosure

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Energy storage and management systems

- 5.6.1 KEY TECHNOLOGIES

- 5.7 INVESTMENT SCENARIO

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 REGULATORY STANDARDS, BY KEY COUNTRY

- 5.8.2.1 China

- 5.8.2.2 US

- 5.9 PATENT ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 KEY CONFERENCES AND EVENTS, 2025

- 5.12 VALUE CHAIN ANALYSIS

- 5.13 IMPACT OF AI/GENERATIVE AI ON EV BATTERY TESTING MARKET

- 5.14 PRICING ANALYSIS

- 5.14.1 EV BATTERY TESTING COST ANALYSIS, BY EV TYPE, 2023-2030

- 5.14.2 EV BATTERY TESTING COST ANALYSIS, BY REGION, 2023-2030

6 EV BATTERY TESTING MARKET, BY EV TYPE

- 6.1 INTRODUCTION

- 6.2 LIGHT-DUTY VEHICLE

- 6.2.1 RISING DEMAND FOR ELECTRIC PASSENGER CARS TO DRIVE SEGMENTAL GROWTH

- 6.3 HEAVY COMMERCIAL VEHICLE

- 6.3.1 GOVERNMENT SUPPORT FOR ADOPTION OF ELECTRIC HEAVY COMMERCIAL VEHICLES TO DRIVE MARKET

- 6.4 KEY PRIMARY INSIGHTS

7 EV BATTERY TESTING MARKET, BY FORM FACTOR

- 7.1 INTRODUCTION

- 7.2 PRISMATIC

- 7.2.1 MORE COMPACT FORM OF CYLINDRICAL CELLS

- 7.3 POUCH

- 7.3.1 DESIGN FLEXIBILITY ALLOWS OPTIMUM CONSUMPTION FOR BATTERY SPACE

- 7.4 CYLINDRICAL

- 7.4.1 LOW-COST MANUFACTURING TO SUPPORT FASTER ADOPTION

- 7.5 KEY PRIMARY INSIGHTS

8 EV BATTERY TESTING MARKET, BY PROPULSION

- 8.1 INTRODUCTION

- 8.2 BATTERY ELECTRIC VEHICLE

- 8.2.1 DECLINING BATTERY COSTS TO DRIVE MARKET

- 8.3 HYBRID ELECTRIC VEHICLE

- 8.3.1 EMPHASIS ON MEETING FUEL EFFICIENCY GOALS TO DRIVE MARKET

- 8.4 PLUG-IN HYBRID ELECTRIC VEHICLE

- 8.4.1 EXPANDING CHARGING INFRASTRUCTURE TO DRIVE MARKET

- 8.5 FUEL CELL ELECTRIC VEHICLE

- 8.5.1 LONGER DRIVING RANGE TO DRIVE DEMAND

- 8.6 KEY PRIMARY INSIGHTS

9 EV BATTERY TESTING MARKET, BY BATTERY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 CELL-TO-MODULE

- 9.2.1 OFFERS ENHANCED PERFORMANCE AND DRIVING RANGE

- 9.3 CELL-TO-PACK

- 9.3.1 REDUCTION IN BATTERY WEIGHT AND COST TO DRIVE DEMAND

- 9.4 CELL-TO-CHASSIS/CELL-TO-BODY

- 9.4.1 BETTER VEHICLE PERFORMANCE AND COST EFFICIENCY TO DRIVE DEMAND

- 9.5 PRIMARY INSIGHTS

10 EV BATTERY TESTING MARKET, BY CHEMISTRY

- 10.1 INTRODUCTION

- 10.2 LITHIUM-ION

- 10.2.1 HIGH ENERGY DENSITY TO DRIVE SEGMENTAL GROWTH

- 10.3 SOLID-STATE

- 10.3.1 HIGH ENERGY STORAGE CAPABILITY WITH LONGER LIFESPAN TO DRIVE MARKET

- 10.4 OTHERS

- 10.5 PRIMARY INSIGHTS

11 EV BATTERY TESTING MARKET, BY SOURCING TYPE

- 11.1 INTRODUCTION

- 11.2 IN-HOUSE

- 11.2.1 LONG-TERM COST SAVINGS BY REDUCING RELIANCE ON EXTERNAL TESTING SERVICES

- 11.3 OUTSOURCED

- 11.3.1 ALLOWS OEMS AND BATTERY MANUFACTURERS TO ACCESS ADVANCED TESTING SOLUTIONS

- 11.4 PRIMARY INSIGHTS

12 EV BATTERY TESTING MARKET, BY TESTING TYPE

- 12.1 INTRODUCTION

- 12.2 SAFETY TESTING

- 12.2.1 EMERGENCE OF ADVANCED BATTERY TECHNOLOGIES TO DRIVE MARKET

- 12.3 PERFORMANCE TESTING

- 12.3.1 GROWING ADOPTION OF HIGH-CAPACITY AND HIGHER-PERFORMANCE BATTERIES TO DRIVE MARKET

- 12.4 OTHER TESTING

- 12.5 PRIMARY INSIGHTS

13 EV BATTERY TESTING MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 MACROECONOMIC OUTLOOK

- 13.2.2 CHINA

- 13.2.2.1 Leads global market for EV battery testing

- 13.2.3 INDIA

- 13.2.3.1 Growth of e-mobility industry to drive market

- 13.2.4 JAPAN

- 13.2.4.1 Commitment to clean energy vehicles to drive market

- 13.2.5 SOUTH KOREA

- 13.2.5.1 Electrochemical impedance spectroscopy method to drive market

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK

- 13.3.2 GERMANY

- 13.3.2.1 Shift to electric cars to drive market

- 13.3.3 FRANCE

- 13.3.3.1 Increasing demand for accurate and reliable testing services to drive market

- 13.3.4 UK

- 13.3.4.1 Investment in advanced battery solutions to drive market

- 13.3.5 SPAIN

- 13.3.5.1 Funding for research in advanced battery technologies to drive market

- 13.3.6 NORWAY

- 13.3.6.1 National targets to accelerate electric vehicle adoption to drive market

- 13.3.7 REST OF EUROPE

- 13.4 NORTH AMERICA

- 13.4.1 MACROECONOMIC OUTLOOK

- 13.4.2 US

- 13.4.2.1 Strong inclination toward battery and hybrid electric vehicle adoption to drive market

- 13.4.3 CANADA

- 13.4.3.1 Growing investment in electric vehicle battery supply chain to drive market

- 13.5 PRIMARY INSIGHTS

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.3 MARKET SHARE ANALYSIS, 2023

- 14.4 REVENUE ANALYSIS, 2019-2023

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.5.1 COMPANY VALUATION

- 14.5.2 FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 14.7.5.1 Company footprint

- 14.7.5.2 Propulsion footprint

- 14.7.5.3 Testing type footprint

- 14.7.5.4 Region footprint

- 14.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 14.8.5.1 List of start-ups/SMEs

- 14.8.5.2 Competitive benchmarking of start-ups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 TUV SUD

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 INTERTEK GROUP PLC

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 UL SOLUTIONS

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 BUREAU VERITAS

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 SGS SOCIETE GENERALE DE SURVEILLANCE SA.

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 TUV RHEINLAND AG GROUP

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Services offered

- 15.1.6.3 Recent developments

- 15.1.7 TUV NORD GROUP

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Services offered

- 15.1.7.3 Recent developments

- 15.1.8 UTAC

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Services offered

- 15.1.8.3 Recent developments

- 15.1.9 EUROFINS SCIENTIFIC

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Services offered

- 15.1.9.3 Recent developments

- 15.1.10 DEKRA

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Services offered

- 15.1.10.3 Recent developments

- 15.1.11 APPLUS+

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Services offered

- 15.1.11.3 Recent developments

- 15.1.12 ELEMENT MATERIALS TECHNOLOGY

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Services offered

- 15.1.12.3 Recent developments

- 15.1.1 TUV SUD

- 15.2 OTHER KEY PLAYERS

- 15.2.1 ELITE ELECTRONIC ENGINEERING

- 15.2.2 INSTRON

- 15.2.3 THE BRITISH STANDARDS INSTITUTION

- 15.2.4 NEMKO

- 15.2.5 ACS

- 15.2.6 DNV GL

- 15.2.7 KIWA

- 15.2.8 CSA GROUP

- 15.2.9 SOUTHWEST RESEARCH INSTITUTE

- 15.2.10 HORIBA LTD

- 15.2.11 KEYSIGHT TECHNOLOGIES

- 15.2.12 HIOKI E.E. CORPORATION

- 15.2.13 ATEQ LEAKTESTING

16 RECOMMENDATIONS

- 16.1 ASIA PACIFIC TO DOMINATE EV BATTERY TESTING MARKET DURING FORECAST PERIOD

- 16.2 SAFETY TESTING TO BE KEY FOCUS

- 16.3 CELL-TO-PACK BATTERY TECHNOLOGY TO GAIN FOCUS

- 16.4 CONCLUSION

17 APPENDIX

- 17.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS