|

|

市場調査レポート

商品コード

1931746

極端紫外線(EUV)リソグラフィの世界市場:コンポーネント別、システムタイプ別、エンドユーザー別、用途別、地域別 - 2032年までの予測Extreme Ultraviolet (EUV) Lithography Market by Component (Light Sources, Optics, Masks), System Type (0.33 NA EUV System (NXE), 0.55 NA EUV System (EXE)), Integrated Device Manufacturers, Foundries, Logic Chips, Memory Chips - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 極端紫外線(EUV)リソグラフィの世界市場:コンポーネント別、システムタイプ別、エンドユーザー別、用途別、地域別 - 2032年までの予測 |

|

出版日: 2026年02月03日

発行: MarketsandMarkets

ページ情報: 英文 206 Pages

納期: 即納可能

|

概要

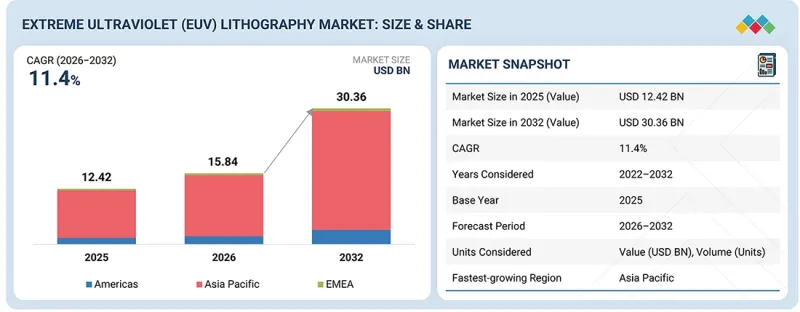

世界の極端紫外線(EUV)リソグラフィの市場規模は、2026年の158億4,000万米ドルから2032年までに303億6,000万米ドルへ、CAGR 11.4%で成長すると予測されています。スマートフォン、ウェアラブル機器、タブレット、ゲーム機器などの民生用電子機器の急速な進歩により、高性能化、小型設計、エネルギー効率の向上を実現する先進的な半導体チップに対する持続的な需要が高まっています。高速処理、高度なグラフィックス、長寿命バッテリーの実現を支援するため、メーカーはより小型のトランジスタと高密度なトランジスタ配置を可能にするEUVリソグラフィへの依存度を高めています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 対象単位 | 金額(10億米ドル) |

| セグメント | コンポーネント別、システムタイプ別、エンドユーザー別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

折りたたみ式ディスプレイ、拡張現実(AR)、仮想現実(VR)などの次世代技術への移行は、チップの複雑性をさらに高め、高精度なEUVベースの製造の必要性を強化しています。民生用電子機器や自律型用途において性能と小型化の要求が継続的に高まる中、EUVリソグラフィは先進ノードにおける信頼性の高い高性能集積回路の製造を可能にする重要な技術となっています。

光源は、先進的な半導体プロセスにおけるシステム生産性、スループット、コスト効率に直接影響を与えるため、極端紫外線(EUV)リソグラフィ市場において最も高いCAGRを記録すると予想されます。ウェーハスループットの継続的な向上要求は、EUV光源出力の増強、安定性の向上、稼働時間の延長を必要とし、既存光源モジュールの頻繁なアップグレードや交換を促しています。さらに、より先進的なプロセスノードへの移行と次世代EUVプラットフォームへの段階的な移行により、光源に対する性能要件が高まっており、研究開発投資と採用が加速しています。高い技術的複雑性、限られたサプライヤー基盤、生産性向上を重視した強化への強い焦点が、他のEUVシステム要素と比較して、このコンポーネントの収益成長をより速く支えています。

2025年、極端紫外線(EUV)リソグラフィ市場の応用分野において、ロジックチップが最大の市場シェアを占めました。これは、先進プロセスノードにおけるEUVの早期かつ広範な採用が牽引したものです。7nm、5nm、3nmといった最先端ロジックデバイスには、極めて微細なパターニング、厳密なオーバーレイ制御、高トランジスタ密度が求められますが、これらはマルチパターニングDUV技術と比較してEUVを使用することでより効率的に達成されます。人工知能、高性能コンピューティング、データセンター、先進自動車エレクトロニクスなどの用途の急速な成長が、高性能ロジックチップへの強い需要を牽引し、EUV装置の利用率と生産能力の拡大を加速させています。一方、メモリメーカーは特定の層に焦点を当て、より選択的にEUVを採用しており、これによりロジックチップが極紫外線(EUV)リソグラフィの全体需要において優位性をさらに強めています。

アジア太平洋は、主要な半導体ファウンドリや統合デバイスメーカー(IDM)が集中していること、および先進ノード製造への継続的な投資に支えられ、予測期間中に最も高いCAGRを記録すると見込まれています。この地域の優位性は、5nm、3nm、サブ3nmプロセスにおける大規模な生産能力拡張、AI・高性能コンピューティング・先進家電向けロジックチップの需要増加、EUV導入を迅速化する成熟した半導体サプライチェーンによって支えられています。さらに、持続的な設備投資、積極的な技術ロードマップ、国内半導体能力強化に向けた政府主導の取り組みがEUV装置の導入を加速させています。これらの要因が相まって、アジア太平洋地域は世界の極端紫外線(EUV)リソグラフィ市場における主要な需要拠点かつ成長エンジンとしての地位を確立しています。

主要調査対象者の内訳

極紫外線(EUV)リソグラフィ市場で事業を展開する主要組織の経営幹部(CEO、マーケティングディレクター、イノベーション・テクノロジーディレクターなど)に対し、詳細なインタビューを実施しました。

極端紫外線(EUV)リソグラフィ市場は、EUVリソグラフィ製品の唯一のメーカーであるASML(オランダ)が支配的であり、また、TRUMPF(ドイツ)、Ushio Inc.(日本)、Energetiq(米国)、Zeiss Group(ドイツ)、NTT Advanced Technology Corporation(日本)、Rigaku Holdings Corporation(日本)、Edmund Optics Inc.(米国)、AGC Inc.(日本)、Tekscend Photomasks(日本)、Lasertec Corporation(日本)、HOYA Corporation(日本)、NuFlare Technology, Inc.(日本)、KLA Corporation(米国)、ADVANTEST CORPORATION(日本)、SUSS MicroTec SE(ドイツ)、Applied Materials, Inc.(米国)、Park Systems(韓国)、Imagine Optic(フランス)、MKS Inc.(米国)、Taiwan Semiconductor Manufacturing Company Limited(TSMC)(台湾)、Intel Corporation(米国)、Samsung(韓国)、SK HYNIX INC.(韓国)、Micron Technology(米国)などの部品メーカーも支配的です。本調査では、極端紫外線(EUV)リソグラフィ市場におけるこれらの主要企業について、企業プロファイル、最近の動向、主要な市場戦略を含む詳細な競合分析を実施しております。

調査範囲

当レポートは、極端紫外線(EUV)リソグラフィ市場をセグメント化し、その構成要素、システムタイプ、エンドユーザー、用途、地域別の予測を行います。また、市場に関連する促進要因、抑制要因、機会、課題についても論じています。アメリカ大陸、アジア太平洋、EMEA(欧州・中東・アフリカ)の3つの主要地域にわたる市場の詳細な見解を提供します。主要プレイヤーのバリューチェーン分析と、EUVリソグラフィエコシステム分析も含まれています。

当レポート購入の主なメリット

- 極端紫外線(EUV)リソグラフィ市場の成長に影響を与える主要な促進要因(最先端ファウンドリノードにおけるEUVリソグラフィの導入急増)、抑制要因(初期資本投資の高さ)、機会(先進的なEUVリソグラフィおよび半導体デバイスへの投資増加)、課題(代替リソグラフィ技術との競合)の分析

- 製品・ソリューション・サービスの開発・革新:EUVリソグラフィ市場における今後のコンポーネント、技術、研究開発活動に関する詳細な洞察

- 市場開発:収益性の高い市場に関する包括的な情報-当レポートでは、様々な地域における極端紫外線(EUV)リソグラフィ市場を分析しております

- 市場の多様化:未開拓地域における新たなEUVリソグラフィ技術、最近の動向、およびEUVリソグラフィ市場への投資に関する包括的な情報

- 競合評価:KLA Corporation(米国)、ZEISS Group(ドイツ)、TRUMPF(ドイツ)、AGC株式会社(日本)、Lasertec Corporation(日本)など、EUVリソグラフィのコンポーネントを提供する主要企業の市場シェア、成長戦略、提供製品に関する詳細な評価

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要考察

第4章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第5章 業界動向

- ポーターのファイブフォース分析

- マクロ経済見通し

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 貿易分析

- 2026年~2027年の主な会議とイベント

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税が極端紫外線(EUV)リソグラフィ市場に与える影響

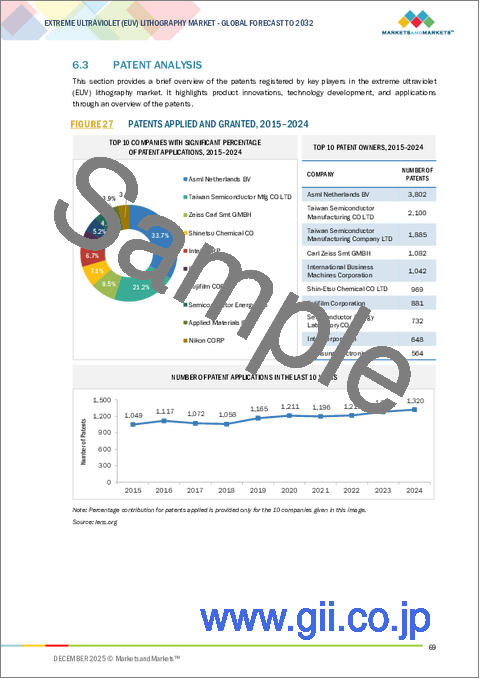

第6章 技術の進歩、AIによる影響、特許、イノベーション

- 技術分析

- 技術/製品ロードマップ

- 特許分析

- AIがEUVリソグラフィに与える影響

第7章 規制状況

- 規制機関、政府機関、その他の組織

- 規則

- 標準

- 政府規制

- 持続可能性への影響と規制政策の取り組み

- 認証、ラベル、環境基準

第8章 顧客情勢と購買行動

- 意思決定プロセス

- 主要な利害関係者と購入基準

- 採用障壁と内部課題

- さまざまなエンドユーザーのアンメットニーズ

- 市場収益性

第9章 極端紫外線(EUV)リソグラフィ技術の応用ノード

- 7NM

- 5NM

- 3NM

- 2NM

- サブ2NM

第10章 極端紫外線(EUV)リソグラフィ市場(コンポーネント別)

- 光源

- 光学

- マスク

- その他

第11章 極端紫外線(EUV)リソグラフィ市場(システムタイプ別)

- 0.33 NA EUVシステム(NXE)

- 0.55 NA EUVシステム(EXE)

第12章 極端紫外線(EUV)リソグラフィ市場(エンドユーザー別)

- 統合デバイスメーカー(IDMS)

- 鋳造所

第13章 極端紫外線(EUV)リソグラフィ市場(用途別)

- ロジックチップ

- メモリチップ

第14章 極端紫外線(EUV)リソグラフィ市場(地域別)

- 南北アメリカ

- EMEA

- アジア太平洋

第15章 競合情勢

- 概要

- 主要参入企業の競争戦略/強み、2024年~2025年

- 収益分析、2021年~2025年

- 市場シェア分析、2025年

- 企業評価と財務指標

- 製品比較

- 企業評価マトリックス:主要参入企業、2025年

- 企業評価マトリックス:スタートアップ/中小企業、2025年

- 競合シナリオ

第16章 企業プロファイル

- 主要システムメーカー

- ASML

- 主要コンポーネントメーカー

- LIGHT SOURCE MANUFACTURERS

- OPTICS MANUFACTURERS

- MASK MANUFACTURERS

- その他

- エンドユーザー

- TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED

- INTEL CORPORATION

- SAMSUNG

- SK HYNIX INC.

- MICRON TECHNOLOGY, INC.