|

|

市場調査レポート

商品コード

1618948

噴霧熱分解の世界市場:プロセス別、装置タイプ別、用途別、最終用途産業別、地域別 - 2029年までの予測Spray Pyrolysis Market by Device Type (Ultrasonic Spray Pyrolysis System, High-Throughput Spray Pyrolysis System), Process, Application, End-Use Industry (Energy & Utilities, Electronics & Semiconductors), and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 噴霧熱分解の世界市場:プロセス別、装置タイプ別、用途別、最終用途産業別、地域別 - 2029年までの予測 |

|

出版日: 2024年12月16日

発行: MarketsandMarkets

ページ情報: 英文 214 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

噴霧熱分解の市場規模は、2024年の1億6,730万米ドルから2029年には2億3,420万米ドルに成長し、予測期間中のCAGRは7.0%になると予測されています。

世界の噴霧熱分解市場は、その特性や材料、フィルムの作成に役立つことから成長が促進されています。このため、エネルギー・公益事業、半導体・エレクトロニクス、製薬・バイオテクノロジーなど、さまざまな最終用途産業で応用されています。これらの特性と、高度で持続可能な高性能材料への需要の高まりとの融合により、噴霧熱分解は世界市場において重要な実現技術として位置づけられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 対象台数 | 金額(100万米ドル)、数量(台) |

| セグメント | プロセス別、装置タイプ別、用途別、最終用途産業別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

火炎アシスト噴霧熱分解システム(FASP)タイプは、噴霧熱分解市場において金額ベースで2番目に大きな市場シェアを持つと予測されます。FASPシステムでは、原料は液体溶液の形でネブライズされ、炎中に噴霧され、そこで液滴は蒸発や化学反応によってフィルムやコーティング、ナノ粒子に急速に変換されます。火炎の熱源を利用した高温は、加工が容易で、結晶の完成度や純度が高い材料を製造したり、所望の特性を持つ材料を合成したりするのに非常に重要です。このシステムは、特定の粒子径と形態を持つ酸化物や複合材料の製造に特に有用です。

医薬品・バイオテクノロジー最終用途産業は、予測期間中、金額ベースで3番目に大きく成長する最終用途産業となる見込みです。製薬・バイオテクノロジー産業は、材料合成における精度と汎用性のために噴霧熱分解システムを使用しています。このシステムは、標的ドラッグデリバリーのためのナノ粒子の製造、溶解性の向上、特にがん治療における治療成績向上のための制御放出を可能にする上で極めて重要です。また、医療用インプラント用の生体適合性コーティングや、診断用の高度なバイオセンサーを作る際にも重要です。噴霧熱分解システムは、均一性、拡張性、適応性を保証し、この分野の厳しい要件を満たすと同時に、個別化医療、生物製剤、高度診断ツールのイノベーションをサポートします。

当レポートでは、世界の噴霧熱分解市場について調査し、プロセス別、装置タイプ別、用途別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- バリューチェーン分析

- エコシステム分析

- 2024年~2025年の主な会議とイベント

- 特許分析

- 貿易分析

- AIの影響

- 規制状況

- マクロ経済指標

- 技術分析

- 価格分析

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向/混乱

第6章 噴霧熱分解市場(プロセス別)

- イントロダクション

- 低速熱分解

- 高速熱分解

- フラッシュ熱分解

第7章 噴霧熱分解市場(装置タイプ別)

- イントロダクション

- 超音波噴霧熱分解システム

- 高スループット噴霧熱分解システム

- 火炎噴霧熱分解システム

- 真空噴霧熱分解システム

第8章 噴霧熱分解市場(用途別)

- イントロダクション

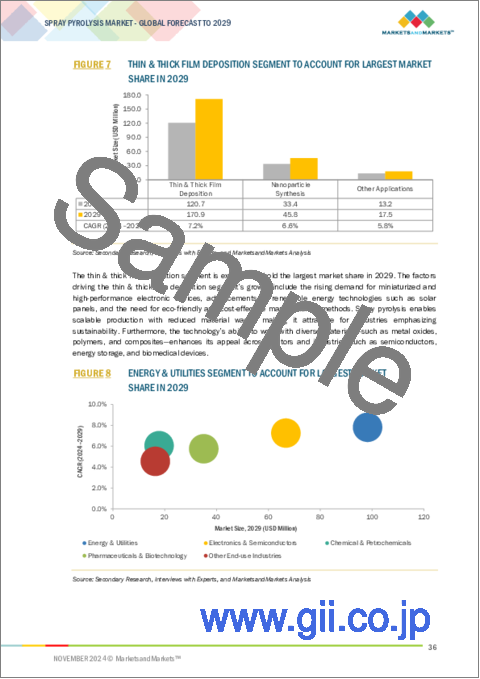

- 薄膜および厚膜堆積

- ナノ粒子合成

- その他

第9章 噴霧熱分解市場(最終用途産業別)

- イントロダクション

- エネルギー・ユーティリティ

- エレクトロニクス・半導体

- 化学製品・石油化学製品

- 医薬品・バイオテクノロジー

- その他

第10章 噴霧熱分解市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業価値評価と財務指標

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- MTI CORPORATION

- SONO-TEK CORPORATION

- HOLMARC OPTO-MECHATRONICS LTD.

- ACMEFIL ENGINEERING SYSTEMS PVT LTD.

- ZHENGZHOU CY SCIENTIFIC INSTRUMENT CO., LTD.

- HANSUN

- CHEERSONIC ULTRASONICS EQUIPMENTS CO., LTD.

- SIANSONIC

- NAVSON TECHNOLOGIES PVT. LTD.

- SHANGHAI HUASHAO INTELLIGENT EQUIPMENT CO., LTD.

- その他の企業

- PRIZMA

- SHENYANG KEJING AUTO-INSTRUMENT CO., LTD.

- XIAMEN TMAX BATTERY EQUIPMENTS LIMITED

- SONEAR INC.

- VB CERAMIC CONSULTANTS(VBCC)

- XIAMEN LITH MACHINE LIMITED

- PREMIER SOLUTIONS PTE. LTD.

- DAS INSTRUMENT AND SOLUTIONS

- CAPITAL LAB TECH

- INTEGRATED ENERGY ENGINEERING

- HANGZHOU POWERSONIC EQUIPMENT CO., LTD.

- RUBRODER GROUP

- RK ENGINEERING SERVICE

- WAVENXD TECHNOLOGIES PVT. LTD.

- PI-KEM

第13章 付録

List of Tables

- TABLE 1 SPRAY PYROLYSIS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 SPRAY PYROLYSIS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 4 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 5 ROLES OF COMPANIES IN SPRAY PYROLYSIS ECOSYSTEM

- TABLE 6 SPRAY PYROLYSIS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 7 TOP 10 PATENT OWNERS DURING LAST 10 YEARS, 2014-2023

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REGULATIONS/VOLUNTARY PROCEDURES FOR EV BATTERY PERFORMANCE

- TABLE 11 REGULATIONS/VOLUNTARY PROCEDURES FOR EV BATTERY DURABILITY

- TABLE 12 REGULATIONS/VOLUNTARY PROCEDURES FOR EV BATTERY SAFETY

- TABLE 13 REGULATIONS/VOLUNTARY PROCEDURES FOR EV BATTERY RECYCLING

- TABLE 14 TRENDS OF PER CAPITA GDP, BY COUNTRY, 2020-2023 (USD)

- TABLE 15 GDP GROWTH ESTIMATES AND PROJECTIONS OF KEY COUNTRIES, 2024-2027 (USD)

- TABLE 16 VEHICLE PRODUCTION STATISTICS, BY COUNTRY, 2021-2023 (UNITS)

- TABLE 17 INDICATIVE PRICING ANALYSIS OF SPRAY PYROLYSIS SYSTEMS OFFERED BY KEY PLAYERS, BY DEVICE TYPE, 2023 (USD/UNIT)

- TABLE 18 INDICATIVE PRICING ANALYSIS OF SPRAY PYROLYSIS SYSTEMS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2023 (USD/UNIT)

- TABLE 19 SPRAY PYROLYSIS MARKET, BY DEVICE TYPE, 2021-2023 (USD MILLION)

- TABLE 20 SPRAY PYROLYSIS MARKET, BY DEVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 21 SPRAY PYROLYSIS MARKET, BY DEVICE TYPE, 2021-2023 (UNITS)

- TABLE 22 SPRAY PYROLYSIS MARKET, BY DEVICE TYPE, 2024-2029 (UNITS)

- TABLE 23 SPRAY PYROLYSIS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 24 SPRAY PYROLYSIS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 25 SPRAY PYROLYSIS MARKET, BY APPLICATION, 2021-2023 (UNITS)

- TABLE 26 SPRAY PYROLYSIS MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 27 SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 28 SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 29 SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 30 SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 31 SPRAY PYROLYSIS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 32 SPRAY PYROLYSIS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 SPRAY PYROLYSIS MARKET, BY REGION, 2021-2023 (UNITS)

- TABLE 34 SPRAY PYROLYSIS MARKET, BY REGION, 2024-2029 (UNITS)

- TABLE 35 NORTH AMERICA: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 36 NORTH AMERICA: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 37 NORTH AMERICA: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2021-2023 (UNITS)

- TABLE 38 NORTH AMERICA: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2024-2029 (UNITS)

- TABLE 39 NORTH AMERICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 40 NORTH AMERICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 41 NORTH AMERICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 42 NORTH AMERICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 43 US: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 44 US: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 45 US: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 46 US: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 47 CANADA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 48 CANADA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 49 CANADA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 50 CANADA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 51 MEXICO: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 52 MEXICO: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 53 MEXICO: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 54 MEXICO: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 55 EUROPE: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 56 EUROPE: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 57 EUROPE: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2021-2023 (UNITS)

- TABLE 58 EUROPE: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2024-2029 (UNITS)

- TABLE 59 EUROPE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 60 EUROPE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 61 EUROPE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 62 EUROPE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 63 GERMANY: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 64 GERMANY: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 65 GERMANY: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 66 GERMANY: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 67 UK: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 68 UK: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 69 UK: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 70 UK: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 71 FRANCE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 72 FRANCE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 73 FRANCE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 74 FRANCE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 75 ITALY: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 76 ITALY: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 77 ITALY: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 78 ITALY: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 79 SPAIN: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 80 SPAIN: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 81 SPAIN: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 82 SPAIN: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 83 REST OF EUROPE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 84 REST OF EUROPE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 85 REST OF EUROPE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 86 REST OF EUROPE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 87 ASIA PACIFIC: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 88 ASIA PACIFIC: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 89 ASIA PACIFIC: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2021-2023 (UNITS)

- TABLE 90 ASIA PACIFIC: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2024-2029 (UNITS)

- TABLE 91 ASIA PACIFIC: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 92 ASIA PACIFIC: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 94 ASIA PACIFIC: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 95 CHINA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 96 CHINA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 97 CHINA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 98 CHINA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 99 JAPAN: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 100 JAPAN: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 101 JAPAN: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 102 JAPAN: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 103 INDIA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 104 INDIA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 105 INDIA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 106 INDIA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 107 SOUTH KOREA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 108 SOUTH KOREA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 109 SOUTH KOREA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 110 SOUTH KOREA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 111 REST OF ASIA PACIFIC: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 114 REST OF ASIA PACIFIC: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 115 MIDDLE EAST & AFRICA: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2021-2023 (UNITS)

- TABLE 118 MIDDLE EAST & AFRICA: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2024-2029 (UNIT)

- TABLE 119 MIDDLE EAST & AFRICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 122 MIDDLE EAST & AFRICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 123 GCC COUNTRIES: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 124 GCC COUNTRIES: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 125 GCC COUNTRIES: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 126 GCC COUNTRIES: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 127 SAUDI ARABIA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 128 SAUDI ARABIA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 129 SAUDI ARABIA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 130 SAUDI ARABIA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 131 UAE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 132 UAE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 133 UAE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 134 UAE: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 135 REST OF GCC COUNTRIES: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 136 REST OF GCC COUNTRIES: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 137 REST OF GCC COUNTRIES: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 138 REST OF GCC COUNTRIES: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 139 SOUTH AFRICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 140 SOUTH AFRICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 141 SOUTH AFRICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 142 SOUTH AFRICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 143 REST OF MIDDLE EAST & AFRICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 144 REST OF MIDDLE EAST & AFRICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 145 REST OF MIDDLE EAST & AFRICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 146 REST OF MIDDLE EAST & AFRICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 147 SOUTH AMERICA: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 148 SOUTH AMERICA: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 149 SOUTH AMERICA: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2021-2023 (UNITS)

- TABLE 150 SOUTH AMERICA: SPRAY PYROLYSIS MARKET, BY COUNTRY, 2024-2029 (UNITS)

- TABLE 151 SOUTH AMERICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 152 SOUTH AMERICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 153 SOUTH AMERICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 154 SOUTH AMERICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 155 BRAZIL: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 156 BRAZIL: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 157 BRAZIL: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 158 BRAZIL: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 159 ARGENTINA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 160 ARGENTINA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 161 ARGENTINA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 162 ARGENTINA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 163 REST OF SOUTH AMERICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 164 REST OF SOUTH AMERICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 165 REST OF SOUTH AMERICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNITS)

- TABLE 166 REST OF SOUTH AMERICA: SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 167 SPRAY PYROLYSIS MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2023 (USD MILLION)

- TABLE 168 SPRAY PYROLYSIS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 169 SPRAY PYROLYSIS MARKET: APPLICATION FOOTPRINT

- TABLE 170 SPRAY PYROLYSIS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 171 SPRAY PYROLYSIS MARKET: REGION FOOTPRINT

- TABLE 172 SPRAY PYROLYSIS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 173 SPRAY PYROLYSIS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 174 SPRAY PYROLYSIS MARKET: OTHERS, APRIL 2020-JUNE 2024

- TABLE 175 MTI CORPORATION: COMPANY OVERVIEW

- TABLE 176 MTI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 SONO-TEK CORPORATION: COMPANY OVERVIEW

- TABLE 178 SONO-TEK CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 SONO-TEK CORPORATION: OTHERS

- TABLE 180 HOLMARC OPTO-MECHATRONICS LTD.: COMPANY OVERVIEW

- TABLE 181 HOLMARC OPTO- MECHATRONICS LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 182 ACMEFIL ENGINEERING SYSTEMS PVT LTD.: COMPANY OVERVIEW

- TABLE 183 ACMEFIL ENGINEERING SYSTEMS PVT LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 184 ZHENGZHOU CY SCIENTIFIC INSTRUMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 185 ZHENGZHOU CY SCIENTIFIC INSTRUMENT CO., LTD.: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 186 HANSUN: COMPANY OVERVIEW

- TABLE 187 HANSUN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 CHEERSONIC ULTRASONIC EQUIPMENTS CO., LTD.: COMPANY OVERVIEW

- TABLE 189 CHEERSONIC ULTRASONIC EQUIPMENTS CO., LTD.: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 190 SIANSONIC: COMPANY OVERVIEW

- TABLE 191 SIANSONIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 NAVSON TECHNOLOGIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 193 NAVSON TECHNOLOGIES PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 SHANGHAI HUASHAO INTELLIGENT EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 195 SHANGHAI HUASHAO INTELLIGENT EQUIPMENT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 PRIZMA: COMPANY OVERVIEW

- TABLE 197 SHENYANG KEJING AUTO-INSTRUMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 198 XIAMEN TMAX BATTERY EQUIPMENTS LIMITED: COMPANY OVERVIEW

- TABLE 199 SONEAR INC.: COMPANY OVERVIEW

- TABLE 200 VB CERAMIC CONSULTANTS (VBCC): COMPANY OVERVIEW

- TABLE 201 XIAMEN LITH MACHINE LIMITED: COMPANY OVERVIEW

- TABLE 202 PREMIER SOLUTIONS PTE. LTD.: COMPANY OVERVIEW

- TABLE 203 DAS INSTRUMENT AND SOLUTIONS: COMPANY OVERVIEW

- TABLE 204 CAPITAL LAB TECH: COMPANY OVERVIEW

- TABLE 205 INTEGRATED ENERGY ENGINEERING: COMPANY OVERVIEW

- TABLE 206 HANGZHOU POWERSONIC EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 207 RUBRODER GROUP: COMPANY OVERVIEW

- TABLE 208 RK ENGINEERING SERVICE: COMPANY OVERVIEW

- TABLE 209 WAVENXD TECHNOLOGIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 210 PI-KEM: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SPRAY PYROLYSIS MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SPRAY PYROLYSIS MARKET: RESEARCH DESIGN

- FIGURE 3 SPRAY PYROLYSIS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 SPRAY PYROLYSIS MARKET: TOP-DOWN APPROACH

- FIGURE 5 SPRAY PYROLYSIS MARKET: DATA TRIANGULATION

- FIGURE 6 ULTRASONIC SPRAY PYROLYSIS SYSTEM SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 7 THIN & THICK FILM DEPOSITION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 8 ENERGY & UTILITIES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR SPRAY PYROLYSIS DURING FORECAST PERIOD

- FIGURE 10 INCREASING DEMAND FROM ELECTRONICS AND SEMICONDUCTOR INDUSTRIES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 11 ULTRASONIC SPRAY PYROLYSIS SYSTEM SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 THIN & THICK FILM DEPOSITION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 ENERGY & UTILITIES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 SPRAY PYROLYSIS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 SPRAY PYROLYSIS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 18 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 19 SPRAY PYROLYSIS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 SPRAY PYROLYSIS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 DOCUMENT TYPE, 2014-2023

- FIGURE 22 NUMBER OF PATENTS GRANTED PER YEAR, 2014-2023

- FIGURE 23 TOP JURISDICTION, BY DOCUMENT, 2014-2023

- FIGURE 24 APPLICANT ANALYSIS, 2014-2023

- FIGURE 25 IMPORT DATA RELATED TO HS CODE 8424-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 26 EXPORT DATA RELATED TO HS CODE 8424-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF SPRAY PYROLYSIS SYSTEMS, BY REGION, 2022-2029 (USD/UNIT)

- FIGURE 28 SPRAY PYROLYSIS MARKET: INVESTMENT AND FUNDING SCENARIO, 2019-2023 (USD MILLION)

- FIGURE 29 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 30 ULTRASONIC SPRAY PYROLYSIS SYSTEM TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 THIN & THICK FILM DEPOSITION SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 ENERGY & UTILITIES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR SPRAY PYROLYSIS DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: SPRAY PYROLYSIS MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: SPRAY PYROLYSIS MARKET SNAPSHOT

- FIGURE 36 SPRAY PYROLYSIS MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2024

- FIGURE 37 SPRAY PYROLYSIS MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2023 (USD MILLION)

- FIGURE 38 SPRAY PYROLYSIS MARKET SHARE ANALYSIS, 2023

- FIGURE 39 SPRAY PYROLYSIS MARKET: COMPANY VALUATION OF LEADING COMPANIES, 2023 (USD MILLION)

- FIGURE 40 SPRAY PYROLYSIS MARKET: FINANCIAL METRICS OF LEADING COMPANIES, 2023

- FIGURE 41 SPRAY PYROLYSIS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 42 SPRAY PYROLYSIS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 43 SPRAY PYROLYSIS MARKET: COMPANY FOOTPRINT

- FIGURE 44 SPRAY PYROLYSIS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 45 SONO-TEK CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 HOLMARC OPTO-MECHATRONICS LTD.: COMPANY SNAPSHOT

The Spray Pyrolysis market size is projected to grow from USD 167.3 million in 2024 to USD 234.2 million by 2029, registering a CAGR of 7.0 % during the forecast period in terms of value. The global spray pyrolysis market is witnessing growth due to the properties and materials and films they help create. Due to this, it has found application in various end use industries like energy & utilities, semiconductor & electronics, pharmaceuticals & biotechnology and others. The convergence of these properties with the growing demand for advanced, sustainable, and high-performance materials positions spray pyrolysis as a critical enabling technology in the global market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million), Volume (Units) |

| Segments | Device Type, Process, Application, End Use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, South America |

"Flame Assisted Spray Pyrolysis System, type is projected to have the second largest market share in terms of value."

Flame assisted spray pyrolysis system (FASP) type is projected to have second largest market share in terms of value in the spray pyrolysis market. In FASP system, feedstock, in the form of a liquid solution, is nebulized and sprayed into a flame where droplets are rapidly converted into films or coatings, nanoparticles by evaporation, and chemical reactions. High temperature with the help of flame heat source offers ease of processing, is crucial for the production of material that has high degree of crystalline perfection and purity as well as for the synthesis of materials with desired properties. This system is especially useful in producing oxides, composite materials with a particular particle size and morphology.

"Pharmaceuticals & biotechnology end use industry is expected to be the third largest growing end use industry for forecasted period in terms of value."

Pharmaceuticals & biotechnology end use industry is expected to be the third largest growing end use industry for forecasted period in terms of value. The pharmaceuticals and biotechnology industry uses spray pyrolysis systems for their precision and versatility in material synthesis. This system is crucial in producing nanoparticles for targeted drug delivery, enhancing solubility, and enabling controlled release for improved therapeutic outcomes, especially in cancer treatments. It is also important in creating biocompatible coatings for medical implants and advanced biosensors for diagnostics. Spray pyrolysis system ensures uniformity, scalability, and adaptability, meeting the stringent requirements of this sector while supporting innovations in personalized medicine, biologics, and advanced diagnostic tools.

"Asia Pacific is estimated to be the fastest growing region in terms of value for the forecasted period."

Asia Pacific region is expected to be the fastest growing region in forecasted period in terms of value. As China, India, Japan, and South Korea are the major Asian emerging countries. This region is likely to see an increase in growth in the market for spray pyrolysis system as the countries here are heavily investing into various end-use industries such as solar and semiconductor, in which spray pyrolysis system are specifically used for coating purpose. Also governments of Asian countries giving strong financial support to these end-use industries, driving the adoption of spray pyrolysis in various applications such as thin & thick film deposition and nano pariticle formation.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the spray pyrolysis market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Directors- 20%, Managers - 10%, and Others - 70%

- By Region: North America - 22%, Europe - 22%, APAC - 45%, ROW -11%

The spray pyrolysis market comprises major players such as Hansun (China), Sono-Tek Corporation (US), MTI Corporation (US), Zhengzhou CY Scientific Instrument Co., Ltd. (China), Acmefil Engineering Systems Pvt. Ltd. (India), Holmarc Opto-Mechatronics Ltd. (India), Cheerssonic Ultrasonic Equipments Co., Ltd.(China), Siansonic (China), Navson Technologies Pvt. Ltd. (India), and Shanghai Huashao Intelligent Equipment Co., ltd. (China). The study includes in-depth competitive analysis of these key players in the spray pyrolysis market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for spray pyrolysis market on the basis of device type, application, process, end use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for spray pyrolysis market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the spray pyrolysiss market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the spray pyrolysis market offered by top players in the global spray pyrolysis market.

- Analysis of drivers: (Growing solar energy sector, Rapid growth in global battery sector, Increased growth in electronics and optoelectronics) restraints (High competition from alternative technologies, ), opportunities (Emerging applications of spray pyrolysis in healthcare, Increased adoption in healthcare applications.) and challenges (Complexity of process control in spray pyrolysis)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the spray pyrolysis market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for spray pyrolysis market across regions.

- Market Capacity: Equipment manufacturing capacities of companies producing spray pyrolysis systems are provided wherever available with upcoming capacities for the spray pyrolysis market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the spray pyrolysis market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.3.2 DEMAND-SIDE ANALYSIS

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SPRAY PYROLYSIS MARKET

- 4.2 SPRAY PYROLYSIS MARKET, BY DEVICE TYPE

- 4.3 SPRAY PYROLYSIS MARKET, BY APPLICATION

- 4.4 SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY

- 4.5 SPRAY PYROLYSIS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding solar energy industry

- 5.2.1.2 Rapid growth of global battery industry

- 5.2.1.3 Increased use of electronics and optoelectronics

- 5.2.2 RESTRAINTS

- 5.2.2.1 High competition from alternative technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging applications in healthcare industry

- 5.2.3.2 Increasing adoption in environmental applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexity associated with process control in spray pyrolysis

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.8 PATENT ANALYSIS

- 5.8.1 METHODOLOGY

- 5.8.2 DOCUMENT TYPES

- 5.8.3 PUBLICATION TRENDS

- 5.8.4 INSIGHTS

- 5.8.5 JURISDICTION ANALYSIS

- 5.8.6 TOP APPLICANTS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8424)

- 5.9.2 EXPORT SCENARIO (HS CODE 8424)

- 5.10 IMPACT OF AI

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATIONS/STANDARDS ON ELECTRIC VEHICLE (EV) BATTERIES

- 5.11.3 EUROPE AND US REGULATIONS ON LITHIUM-ION BATTERY PRODUCTION

- 5.11.4 REGULATIONS ON BATTERIES AND ACCUMULATORS

- 5.11.5 REGULATIONS ON TRANSPORTATION OF LITHIUM-ION BATTERIES

- 5.12 MACROECONOMIC INDICATORS

- 5.12.1 GLOBAL GDP TRENDS

- 5.12.2 GLOBAL VEHICLE PRODUCTION STATISTICS

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.1.1 High-throughput spray pyrolysis system

- 5.13.1.2 Advanced atomization techniques

- 5.13.2 COMPLEMENTARY TECHNOLOGIES

- 5.13.2.1 Plasma-assisted spray pyrolysis

- 5.13.1 KEY TECHNOLOGIES

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.14.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY DEVICE TYPE

- 5.14.3 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY END-USE INDUSTRY

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 HOLMARC OPTO-MECHATRONICS HELPED WAAREE ENERGIES TACKLE CHALLENGES IN ACHIEVING CONSISTENT AND UNIFORM DEPOSITION OF TCO LAYERS ACROSS LARGE GLASS SUBSTRATES

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

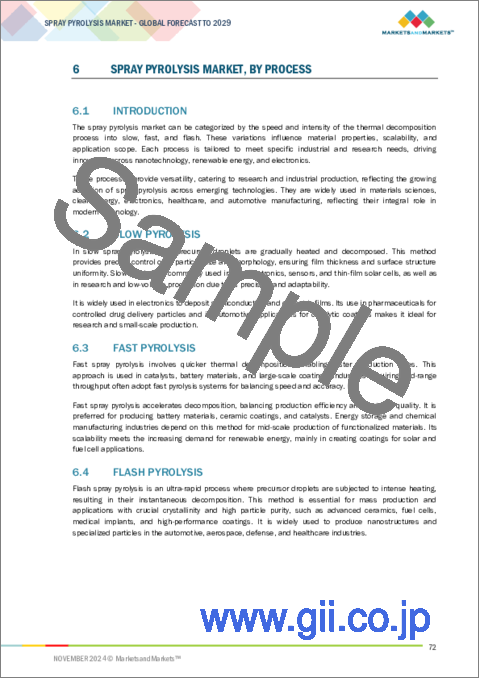

6 SPRAY PYROLYSIS MARKET, BY PROCESS

- 6.1 INTRODUCTION

- 6.2 SLOW PYROLYSIS

- 6.3 FAST PYROLYSIS

- 6.4 FLASH PYROLYSIS

7 SPRAY PYROLYSIS MARKET, BY DEVICE TYPE

- 7.1 INTRODUCTION

- 7.2 ULTRASONIC SPRAY PYROLYSIS SYSTEM

- 7.2.1 POTENTIAL TO REVOLUTIONIZE THIN FILM PRODUCTION TO DRIVE MARKET

- 7.3 HIGH THROUGHPUT SPRAY PYROLYSIS SYSTEM

- 7.3.1 INCREASING APPLICATIONS IN SOLAR AND ELECTRONICS SYSTEMS TO BOOST DEMAND

- 7.4 FLAME-ASSISTED SPRAY PYROLYSIS SYSTEM

- 7.4.1 GROWING DEMAND FROM VARIOUS END-USE INDUSTRIES TO DRIVE MARKET

- 7.5 VACUUM SPRAY PYROLYSIS SYSTEM

- 7.5.1 SURGING USE IN SOLAR CELLS AND SENSORS TO BOOST MARKET GROWTH

8 SPRAY PYROLYSIS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 THIN & THICK FILM DEPOSITION

- 8.2.1 RISING APPLICATIONS IN TRANSISTORS AND DIODES TO DRIVE MARKET

- 8.3 NANOPARTICLE SYNTHESIS

- 8.3.1 INCREASING DEMAND FROM MEDICAL SECTOR TO DRIVE MARKET

- 8.4 OTHER APPLICATIONS

9 SPRAY PYROLYSIS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 ENERGY & UTILITIES

- 9.2.1 GLOBAL TRANSITION TO RENEWABLE ENERGY TO DRIVE SEGMENT

- 9.2.1.1 Solar panels

- 9.2.1.2 Batteries

- 9.2.1.3 Fuel cells

- 9.2.1.4 Other energy & utilities industries

- 9.2.1 GLOBAL TRANSITION TO RENEWABLE ENERGY TO DRIVE SEGMENT

- 9.3 ELECTRONICS & SEMICONDUCTORS

- 9.3.1 RAPID ADVANCEMENTS IN MINIATURIZATION AND FUNCTIONALITY TO BOOST DEMAND

- 9.3.1.1 Sensors & detectors

- 9.3.1.2 Optoelectronics

- 9.3.1.3 Transistors

- 9.3.1.4 Semiconductor devices & integrated circuits (ICs)

- 9.3.1.5 Other electronics & semiconductors industries

- 9.3.1 RAPID ADVANCEMENTS IN MINIATURIZATION AND FUNCTIONALITY TO BOOST DEMAND

- 9.4 CHEMICALS & PETROCHEMICALS

- 9.4.1 HIGH USE TO MANUFACTURE HIGH-PURITY NANOPARTICLES AND COATING PRECURSORS TO DRIVE MARKET

- 9.4.1.1 Specialty chemicals production

- 9.4.1.2 Polymer manufacturing

- 9.4.1 HIGH USE TO MANUFACTURE HIGH-PURITY NANOPARTICLES AND COATING PRECURSORS TO DRIVE MARKET

- 9.5 PHARMACEUTICAL & BIOTECHNOLOGY

- 9.5.1 INCREASING DEMAND FOR ACTIVE PHARMACEUTICAL INGREDIENTS TO DRIVE MARKET

- 9.6 OTHER END-USE INDUSTRIES

10 SPRAY PYROLYSIS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Booming solar energy industry to drive market

- 10.2.2 CANADA

- 10.2.2.1 High investments in battery sector to boost market growth

- 10.2.3 MEXICO

- 10.2.3.1 Expansion of solar and EV industries to drive market

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 High growth of solar industry to drive market

- 10.3.2 UK

- 10.3.2.1 Government-led support and high investments in energy and utilities industries to drive market

- 10.3.3 FRANCE

- 10.3.3.1 Rising investments in renewable energy, battery manufacturing, and EV production to drive market

- 10.3.4 ITALY

- 10.3.4.1 Booming solar industry to drive market

- 10.3.5 SPAIN

- 10.3.5.1 Renewable energy ambitions, EV market growth, and surge in battery demand to drive market

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Industrial expansion and government-led initiatives promoting sustainable practices to propel market

- 10.4.2 JAPAN

- 10.4.2.1 Growing electronics industry to drive market

- 10.4.3 INDIA

- 10.4.3.1 Strong demand from renewable energy, battery storage, and electronics industries to drive market

- 10.4.4 SOUTH KOREA

- 10.4.4.1 High battery production and growing EV market to drive market

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Significant industrial growth and government-led initiatives related to renewable energy to drive market

- 10.5.1.2 UAE

- 10.5.1.2.1 Expansion plans related to clean energy and sustainable transportation to drive market

- 10.5.1.3 Rest of GCC countries

- 10.5.1.1 Saudi Arabia

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Rising demand for advanced battery materials to boost market growth

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Expanding automotive industry to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Growing solar industry to drive market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Company footprint

- 11.7.5.2 Application footprint

- 11.7.5.3 End-use industry footprint

- 11.7.5.4 Region footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 OTHERS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 MTI CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Key strengths/Right to win

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses/Competitive threats

- 12.1.2 SONO-TEK CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Others

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 HOLMARC OPTO-MECHATRONICS LTD.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Key strengths/Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses/Competitive threats

- 12.1.4 ACMEFIL ENGINEERING SYSTEMS PVT LTD.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Key strengths/Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses/Competitive threats

- 12.1.5 ZHENGZHOU CY SCIENTIFIC INSTRUMENT CO., LTD.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths/Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses/Competitive threats

- 12.1.6 HANSUN

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 MnM view

- 12.1.7 CHEERSONIC ULTRASONICS EQUIPMENTS CO., LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 MnM view

- 12.1.8 SIANSONIC

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.9 NAVSON TECHNOLOGIES PVT. LTD.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.10 SHANGHAI HUASHAO INTELLIGENT EQUIPMENT CO., LTD.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.1 MTI CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 PRIZMA

- 12.2.2 SHENYANG KEJING AUTO-INSTRUMENT CO., LTD.

- 12.2.3 XIAMEN TMAX BATTERY EQUIPMENTS LIMITED

- 12.2.4 SONEAR INC.

- 12.2.5 VB CERAMIC CONSULTANTS (VBCC)

- 12.2.6 XIAMEN LITH MACHINE LIMITED

- 12.2.7 PREMIER SOLUTIONS PTE. LTD.

- 12.2.8 DAS INSTRUMENT AND SOLUTIONS

- 12.2.9 CAPITAL LAB TECH

- 12.2.10 INTEGRATED ENERGY ENGINEERING

- 12.2.11 HANGZHOU POWERSONIC EQUIPMENT CO., LTD.

- 12.2.12 RUBRODER GROUP

- 12.2.13 RK ENGINEERING SERVICE

- 12.2.14 WAVENXD TECHNOLOGIES PVT. LTD.

- 12.2.15 PI-KEM

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS