|

|

市場調査レポート

商品コード

1618946

C5ISRの世界市場:ソリューション別、エンドユーザー別、設置別、地域別 - 2029年までの予測C5ISR Market by Solution (Hardware, Software, and Services), End User (Army, Navy, Airforce, and Government & Law Enforcement), Installation (New Installations, and Upgrades) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| C5ISRの世界市場:ソリューション別、エンドユーザー別、設置別、地域別 - 2029年までの予測 |

|

出版日: 2024年12月13日

発行: MarketsandMarkets

ページ情報: 英文 341 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

C5ISRの市場規模は、2024年の107億2,010万米ドルから2029年には192億8,080万米ドルに達し、CAGRは12.5%になると予測されています。

C5ISR市場を牽引するのは、緊急対応における意思決定を支援する状況認識強化の需要であるが、こうしたソリューションの開発と維持に関連するコストは高いです。同市場におけるさまざまな機会には、技術の進歩や軍用機器/技術間の相互運用性のニーズの高まりが含まれます。データの保存と統合の問題は、引き続き市場の課題となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | ソリューション別、エンドユーザー別、設置別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

C5ISRソリューションの技術的進歩は、世界の攻撃の脅威の増大によって実施されています。各国政府は、国家の安全保障を強化するため、先進的なC5ISRソリューションの開発に多額の投資を行っています。通信、センサー、データストレージ、処理能力、サイバーセキュリティの技術的進歩は、強化された高効率のC5ISRソリューションの開発を可能にしています。

エンドユーザー別では、陸軍セグメントは、その広範な運用範囲と陸上任務のための統合システムへの依存により、C5ISR市場を独占しています。陸軍は、戦場認識、リアルタイムの指揮統制、安全な通信、情報収集などのミッションクリティカルな機能のために高度なC5ISR機能を必要としています。これらの能力は、複雑でダイナミックな環境において作戦の有効性を確保するために極めて重要です。加えて、電子戦システム、無人地上車両、サイバー防衛ソリューションなどの技術による地上部隊の近代化投資の増加が、陸軍セグメントの優位性をさらに高めています。陸上部隊は依然として世界の軍事作戦の中心であるため、包括的なC5ISRソリューションに対する需要が引き続き市場をリードしています。

設置別では、世界中の防衛軍で先進的で近代化されたシステムが広く採用されているため、新規設置セグメントがC5ISR市場を独占すると予測されます。サイバー攻撃やマルチドメイン戦争などの新たな脅威に対処するため、軍はますます能力のアップグレードに重点を置くようになっており、最先端のC5ISRソリューションに多額の投資を行っています。特に、AIやビッグデータ分析、自律型システムといった、レガシーシステムに必ずしもシームレスに後付けできない先進技術を統合するためには、新たな設備が不可欠です。さらに、新興国における近代化プログラムや、最先端システムをサポートするための新しいインフラの必要性は、このセグメントの成長に大きく寄与しており、市場最大となっています。

当レポートでは、世界のC5ISR市場について調査し、ソリューション別、エンドユーザー別、設置別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向と混乱

- エコシステム分析

- バリューチェーン分析

- 価格分析

- 運用データ

- ケーススタディ分析

- 2024年~2025年の主な会議とイベント

- 貿易分析

- 関税と規制状況

- 主な利害関係者と購入基準

- 投資と資金調達のシナリオ

- ビジネスモデル

- 総所有コスト

- 部品表

- 技術分析

- マクロ経済見通し

第6章 業界の動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- サプライチェーン分析

- 特許分析

- 技術ロードマップ

- 生成AIがC5ISR市場に与える影響

第7章 C5ISR市場(ソリューション別)

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第8章 C5ISR市場(エンドユーザー別)

- イントロダクション

- 陸軍

- 海軍

- 空軍

- 政府と法執行機関

第9章 C5ISR市場(設置別)

- イントロダクション

- 新規設置

- アップグレード

第10章 地域分析

- イントロダクション

- 北米

- PESTLE分析:北米

- 米国

- カナダ

- 欧州

- PESTLE分析:欧州

- 英国

- フランス

- ドイツ

- イタリア

- アジア太平洋

- PESTLE分析:アジア太平洋

- インド

- 日本

- オーストラリア

- 中東

- PESTLE分析:中東

- GCC諸国

- イスラエル

- トルコ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場シェア分析、2023年

- 収益分析、2020年~2023年

- ブランド/製品比較

- 会社の財務指標

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

- その他の展開

第12章 企業プロファイル

- 主要参入企業

- NORTHROP GRUMMAN

- LOCKHEED MARTIN CORPORATION

- THALES

- BAE SYSTEMS

- L3HARRIS TECHNOLOGIES, INC.

- RTX

- GENERAL DYNAMICS CORPORATION

- LEONARDO S.P.A.

- ELBIT SYSTEMS LTD.

- SAAB AB

- AIRBUS

- RHEINMETALL AG

- CACI INTERNATIONAL INC

- INDRA SISTEMAS, S.A.

- LEIDOS

- その他の企業

- SERCO GROUP PLC

- MAG AEROSPACE

- SIGMA DEFENSE SYSTEMS

- SEV1TECH, LLC.

- MANTECH INTERNATIONAL CORPORATION

- NOBLE

- DARLEY

- ASSURED INFORMATION SECURITY, INC.

- ATSS

- CSMI

第13章 付録

List of Tables

- TABLE 1 C5ISR MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 IMPACT OF RUSSIA-UKRAINE WAR ON MICRO FACTORS OF C5ISR MARKET

- TABLE 4 MARKET SIZE ESTIMATION AND METHODOLOGY

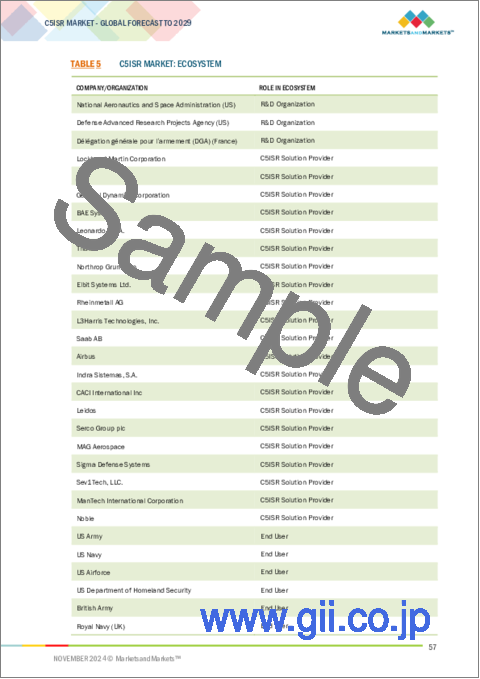

- TABLE 5 C5ISR MARKET: ECOSYSTEM

- TABLE 6 INDICATIVE PRICE ANALYSIS FOR C5ISR SOLUTIONS

- TABLE 7 INDICATIVE PRICE ANALYSIS FOR C5ISR SOLUTIONS IN DIFFERENT REGIONS

- TABLE 8 ACTIVE FLEET OF ARMORED VEHICLES, BY COUNTRY, 2023

- TABLE 9 ACTIVE FLEET OF COMBAT AIRCRAFT, BY COUNTRY, 2023

- TABLE 10 ACTIVE FLEET OF NAVAL SHIPS, BY COUNTRY, 2023

- TABLE 11 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 12 TARIFFS FOR RADAR APPARATUS (HS CODE: 852610)

- TABLE 13 TARIFFS FOR TRANSMISSION OR RECEPTION OF VOICE, IMAGES, OR OTHER DATA (HS CODE: 851769)

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SOLUTION (%)

- TABLE 19 KEY BUYING CRITERIA, BY SOLUTION

- TABLE 20 TOTAL COST OF OWNERSHIP OF C5ISR SOLUTIONS, BY APPLICATION

- TABLE 21 PATENT ANALYSIS, 2020-2024

- TABLE 22 IMPACT OF GENERATIVE AI ON MILITARY APPLICATION

- TABLE 23 C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 24 C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 25 HARDWARE: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 26 HARDWARE: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 27 SOFTWARE: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 28 SOFTWARE: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 29 SERVICES: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 30 SERVICES: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 31 C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 32 C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 33 C5ISR MARKET, BY INSTALLATION, 2020-2023 (USD MILLION)

- TABLE 34 C5ISR MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 35 C5ISR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 C5ISR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 NORTH AMERICA: C5ISR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 38 NORTH AMERICA: C5ISR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 39 NORTH AMERICA: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 40 NORTH AMERICA: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 41 NORTH AMERICA: HARDWARE: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 42 NORTH AMERICA: HARDWARE: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 43 NORTH AMERICA: SOFTWARE: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 44 NORTH AMERICA: SOFTWARE: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 45 NORTH AMERICA: SERVICES: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 46 NORTH AMERICA: SERVICES: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 47 NORTH AMERICA: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 48 NORTH AMERICA: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 49 NORTH AMERICA: C5ISR MARKET, BY INSTALLATION, 2020-2023 (USD MILLION)

- TABLE 50 NORTH AMERICA: C5ISR MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 51 US: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 52 US: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 53 US: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 54 US: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 55 CANADA: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 56 CANADA: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 57 CANADA: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 58 CANADA: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 59 EUROPE: C5ISR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 60 EUROPE: C5ISR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 61 EUROPE: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 62 EUROPE: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 63 EUROPE: HARDWARE: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 64 EUROPE: HARDWARE: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 65 EUROPE: SOFTWARE: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 66 EUROPE: SOFTWARE: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 67 EUROPE: SERVICES: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 68 EUROPE: SERVICES: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 69 EUROPE: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 70 EUROPE: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 71 EUROPE: C5ISR MARKET, BY INSTALLATION, 2020-2023 (USD MILLION)

- TABLE 72 EUROPE: C5ISR MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 73 UK: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 74 UK: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 75 UK: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 76 UK: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 77 FRANCE: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 78 FRANCE: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 79 FRANCE: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 80 FRANCE: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 81 GERMANY: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 82 GERMANY: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 83 GERMANY: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 84 GERMANY: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 85 ITALY: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 86 ITALY: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 87 ITALY: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 88 ITALY: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 89 ASIA PACIFIC: C5ISR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 90 ASIA PACIFIC: C5ISR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 91 ASIA PACIFIC: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 92 ASIA PACIFIC: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: HARDWARE: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 94 ASIA PACIFIC: HARDWARE: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 95 ASIA PACIFIC: SOFTWARE: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 96 ASIA PACIFIC: SOFTWARE: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 97 ASIA PACIFIC: SERVICES: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 98 ASIA PACIFIC: SERVICES: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 99 ASIA PACIFIC: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 100 ASIA PACIFIC: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 101 ASIA PACIFIC: C5ISR MARKET, BY INSTALLATION, 2020-2023 (USD MILLION)

- TABLE 102 ASIA PACIFIC: C5ISR MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 103 INDIA: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 104 INDIA: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 105 INDIA: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 106 INDIA: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 107 JAPAN: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 108 JAPAN: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 109 JAPAN: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 110 JAPAN: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 111 AUSTRALIA: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 112 AUSTRALIA: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 113 AUSTRALIA: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 114 AUSTRALIA: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 115 MIDDLE EAST: C5ISR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 116 MIDDLE EAST: C5ISR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 117 MIDDLE EAST: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 118 MIDDLE EAST: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 119 MIDDLE EAST: HARDWARE: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 120 MIDDLE EAST: HARDWARE: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 121 MIDDLE EAST: SOFTWARE: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 122 MIDDLE EAST: SOFTWARE: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 123 MIDDLE EAST: SERVICES: C5ISR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 124 MIDDLE EAST: SERVICES: C5ISR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 125 MIDDLE EAST: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 126 MIDDLE EAST: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 127 MIDDLE EAST: C5ISR MARKET, BY INSTALLATION, 2020-2023 (USD MILLION)

- TABLE 128 MIDDLE EAST: C5ISR MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 129 UAE: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 130 UAE: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 131 UAE: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 132 UAE: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 133 SAUDI ARABIA: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 134 SAUDI ARABIA: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 135 SAUDI ARABIA: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 136 SAUDI ARABIA: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 137 ISRAEL: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 138 ISRAEL: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 139 ISRAEL: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 140 ISRAEL: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 141 TURKIYE: C5ISR MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 142 TURKIYE: C5ISR MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 143 TURKIYE: C5ISR MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 144 TURKIYE: C5ISR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 145 OVERVIEW OF KEY STRATEGIES ADOPTED BY LEADING PLAYERS IN C5ISR MARKET, 2023

- TABLE 146 C5ISR MARKET: DEGREE OF COMPETITION

- TABLE 147 C5ISR MARKET: SOLUTION FOOTPRINT

- TABLE 148 C5ISR MARKET: COMPANY INSTALLATION FOOTPRINT

- TABLE 149 C5ISR MARKET: COMPANY REGION FOOTPRINT

- TABLE 150 C5ISR MARKET: KEY STARTUPS/SMES

- TABLE 151 C5ISR MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 152 C5ISR MARKET: PRODUCT LAUNCHES, FEBRUARY 2020-SEPTEMBER 2024

- TABLE 153 C5ISR MARKET: DEALS, FEBRUARY 2020-SEPTEMBER 2024

- TABLE 154 C5ISR MARKET: OTHER DEVELOPMENTS, FEBRUARY 2020-SEPTEMBER 2024

- TABLE 155 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 156 NORTHROP GRUMMAN: SOLUTIONS OFFERED

- TABLE 157 NORTHROP GRUMMAN: PRODUCT LAUNCHES

- TABLE 158 NORTHROP GRUMMAN: DEALS

- TABLE 159 NORTHROP GRUMMAN: OTHER DEVELOPMENTS

- TABLE 160 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 161 LOCKHEED MARTIN CORPORATION: SOLUTIONS OFFERED

- TABLE 162 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 163 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 164 LOCKHEED MARTIN CORPORATION: OTHER DEVELOPMENTS

- TABLE 165 THALES: COMPANY OVERVIEW

- TABLE 166 THALES: SOLUTIONS OFFERED

- TABLE 167 THALES: PRODUCT LAUNCHES

- TABLE 168 THALES: DEALS

- TABLE 169 THALES: OTHER DEVELOPMENTS

- TABLE 170 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 171 BAE SYSTEMS: SOLUTIONS OFFERED

- TABLE 172 BAE SYSTEMS: PRODUCT LAUNCHES

- TABLE 173 BAE SYSTEMS: DEALS

- TABLE 174 BAE SYSTEMS: OTHER DEVELOPMENTS

- TABLE 175 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 176 L3HARRIS TECHNOLOGIES, INC.: SOLUTIONS OFFERED

- TABLE 177 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 178 L3HARRIS TECHNOLOGIES, INC.: EXPANSIONS

- TABLE 179 L3HARRIS TECHNOLOGIES, INC.: OTHER DEVELOPMENTS

- TABLE 180 RTX: COMPANY OVERVIEW

- TABLE 181 RTX: SOLUTIONS OFFERED

- TABLE 182 RTX: PRODUCT LAUNCHES

- TABLE 183 RTX: DEALS

- TABLE 184 RTX: OTHER DEVELOPMENTS

- TABLE 185 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 186 GENERAL DYNAMICS CORPORATION: SOLUTIONS OFFERED

- TABLE 187 GENERAL DYNAMICS CORPORATION: PRODUCT LAUNCHES

- TABLE 188 GENERAL DYNAMICS CORPORATION: OTHER DEVELOPMENTS

- TABLE 189 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 190 LEONARDO S.P.A.: SOLUTIONS OFFERED

- TABLE 191 LEONARDO S.P.A.: PRODUCT LAUNCHES

- TABLE 192 LEONARDO S.P.A.: DEALS

- TABLE 193 LEONARDO S.P.A.: OTHER DEVELOPMENTS

- TABLE 194 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 195 ELBIT SYSTEMS LTD.: SOLUTIONS OFFERED

- TABLE 196 ELBIT SYSTEMS LTD.: PRODUCT LAUNCHES

- TABLE 197 ELBIT SYSTEMS LTD.: DEALS

- TABLE 198 ELBIT SYSTEMS LTD.: OTHER DEVELOPMENTS

- TABLE 199 SAAB AB: COMPANY OVERVIEW

- TABLE 200 SAAB AB: SOLUTIONS OFFERED

- TABLE 201 SAAB AB: PRODUCT LAUNCHES

- TABLE 202 SAAB AB: DEALS

- TABLE 203 SAAB AB: OTHER DEVELOPMENTS

- TABLE 204 AIRBUS: COMPANY OVERVIEW

- TABLE 205 AIRBUS: SOLUTIONS OFFERED

- TABLE 206 AIRBUS: DEALS

- TABLE 207 AIRBUS: OTHER DEVELOPMENTS

- TABLE 208 RHEINMETALL AG: COMPANY OVERVIEW

- TABLE 209 RHEINMETALL AG: SOLUTIONS OFFERED

- TABLE 210 RHEINMETALL AG: DEALS

- TABLE 211 RHEINMETALL AG: OTHER DEVELOPMENTS

- TABLE 212 CACI INTERNATIONAL INC: COMPANY OVERVIEW

- TABLE 213 CACI INTERNATIONAL INC: SOLUTIONS OFFERED

- TABLE 214 CACI INTERNATIONAL INC: DEALS

- TABLE 215 CACI INTERNATIONAL INC: OTHER DEVELOPMENTS

- TABLE 216 INDRA SISTEMAS, S.A.: COMPANY OVERVIEW

- TABLE 217 INDRA SISTEMAS, S.A.: SOLUTIONS OFFERED

- TABLE 218 INDRA SISTEMAS, S.A.: PRODUCT LAUNCHES

- TABLE 219 INDRA SISTEMAS, S.A.: DEALS

- TABLE 220 INDRA SISTEMAS, S.A.: OTHER DEVELOPMENTS

- TABLE 221 LEIDOS: COMPANY OVERVIEW

- TABLE 222 LEIDOS: SOLUTIONS OFFERED

- TABLE 223 LEIDOS: OTHER DEVELOPMENTS

- TABLE 224 SERCO GROUP PLC: COMPANY OVERVIEW

- TABLE 225 MAG AEROSPACE: COMPANY OVERVIEW

- TABLE 226 SIGMA DEFENSE SYSTEMS: COMPANY OVERVIEW

- TABLE 227 SEV1TECH, LLC.: COMPANY OVERVIEW

- TABLE 228 MANTECH INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- TABLE 229 NOBLE: COMPANY OVERVIEW

- TABLE 230 DARLEY: COMPANY OVERVIEW

- TABLE 231 ASSURED INFORMATION SECURITY, INC.: COMPANY OVERVIEW

- TABLE 232 ATSS: COMPANY OVERVIEW

- TABLE 233 CSMI: COMPANY OVERVIEW

List of Figures

- FIGURE 1 C5ISR MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 IMPACT OF RUSSIA-UKRAINE WAR ON MACRO FACTORS OF C5ISR MARKET

- FIGURE 6 IMPACT OF RUSSIA-UKRAINE WAR ON MICRO INDICATORS OF C5ISR MARKET

- FIGURE 7 BOTTOM-UP APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 SOFTWARE TO BE FASTEST-GROWING SOLUTION SEGMENT DURING FORECAST PERIOD

- FIGURE 11 ARMY END USER SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 NEW INSTALLATIONS SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 13 NORTH AMERICA TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 14 NEED FOR ENHANCED DEFENSE AND SURVEILLANCE CAPABILITY TO DRIVE MARKET

- FIGURE 15 HARDWARE SOLUTION TO ACCOUNT FOR HIGHEST SHARE IN 2024

- FIGURE 16 SENSOR SYSTEM HARDWARE SOLUTION TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 17 AIR FORCE END-USER SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARE DURING FORECAST PERIOD

- FIGURE 18 NEW INSTALLATIONS SEGMENT TO ACCOUNT FOR HIGHER SHARE IN 2024

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN C5ISR MARKET

- FIGURE 20 FATALITIES CAUSED BY TERRORIST ATTACKS GLOBALLY, 2010-2022

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 ECOSYSTEM MAP

- FIGURE 23 VALUE CHAIN ANALYSIS

- FIGURE 24 IMPORT SCENARIO FOR HS CODE: 852610, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 25 EXPORT SCENARIO FOR HS CODE: 852610, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 26 IMPORT SCENARIO FOR HS CODE: 847170, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 27 EXPORT SCENARIO FOR HS CODE: 847170, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 28 IMPORT SCENARIO FOR HS CODE: 851769, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 29 EXPORT SCENARIO FOR HS CODE: 851769, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SOLUTION

- FIGURE 31 KEY BUYING CRITERIA, BY SOLUTION

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO IN C5ISR MARKET

- FIGURE 33 BUSINESS MODELS

- FIGURE 34 TOTAL COST OF OWNERSHIP OF C5ISR SOLUTIONS

- FIGURE 35 BILL OF MATERIALS FOR C5ISR SOLUTION COMPONENTS

- FIGURE 36 MACROECONOMIC OUTLOOK FOR NORTH AMERICA, EUROPE, ASIA PACIFIC, AND MIDDLE EAST

- FIGURE 37 TECHNOLOGY TRENDS IN C5ISR MARKET

- FIGURE 38 SUPPLY CHAIN ANALYSIS

- FIGURE 39 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 40 EVOLUTION OF C5ISR TECHNOLOGY

- FIGURE 41 TECHNOLOGY ROADMAP FOR C5ISR MARKET

- FIGURE 42 EMERGING TRENDS IN C5ISR SOLUTIONS

- FIGURE 43 GENERATIVE AI IN DEFENSE: LANDSCAPE

- FIGURE 44 GENERATIVE AI ADOPTION IN MILITARY FOR TOP COUNTRIES

- FIGURE 45 IMPACT OF GENERATIVE AI ON VARIOUS MILITARY PLATFORMS

- FIGURE 46 IMPACT OF GENERATIVE AI ON C5ISR MARKET

- FIGURE 47 SERVICES SOLUTION SEGMENT TO ACCOUNT FOR SECOND-LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 48 ARMY AND AIR FORCE END USER SEGMENTS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 NEW INSTALLATIONS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 50 NORTH AMERICA TO DOMINATE C5ISR MARKET FROM 2024 TO 2029

- FIGURE 51 C5ISR MARKET: NORTH AMERICA SNAPSHOT

- FIGURE 52 C5ISR MARKET: EUROPE SNAPSHOT

- FIGURE 53 C5ISR MARKET: ASIA PACIFIC SNAPSHOT

- FIGURE 54 C5ISR MARKET: MIDDLE EAST SNAPSHOT

- FIGURE 55 C5ISR MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- FIGURE 56 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020-2023

- FIGURE 57 C5ISR MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 58 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

- FIGURE 59 VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 60 C5ISR MARKET: COMPETITIVE EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 61 C5ISR MARKET: COMPANY PRODUCT FOOTPRINT

- FIGURE 62 C5ISR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 63 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 64 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 THALES: COMPANY SNAPSHOT

- FIGURE 66 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 67 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 68 RTX: COMPANY SNAPSHOT

- FIGURE 69 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 70 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 71 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 72 SAAB AB: COMPANY SNAPSHOT

- FIGURE 73 AIRBUS: COMPANY SNAPSHOT

- FIGURE 74 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 75 CACI INTERNATIONAL INC: COMPANY SNAPSHOT

- FIGURE 76 INDRA SISTEMAS, S.A.: COMPANY SNAPSHOT

- FIGURE 77 LEIDOS: COMPANY SNAPSHOT

The C5ISR market is projected to reach USD 19,280.8 million by 2029, from USD 10,720.1 million in 2024, at a CAGR of 12.5%. The demand for enhanced situational awareness drives the C5ISR market, supporting decision-making in emergency response but, the costs related to developing and sustaining these solutions are high. Various opportunities in the market include technological advancements and an increasing need for interoperability between military devices/technologies. Data storage and integration issues continue to pose challenges for the market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Solution, End User, and Installation |

| Regions covered | North America, Europe, APAC, RoW |

Technological advancements in C5ISR solutions are being undertaken owing to the increased threats of attacks worldwide. Governments of various countries are making significant investments in developing advanced C5ISR solutions to enhance national security. Technological advancements in communications, sensors, data storage, processing power, and cybersecurity have enabled the development of enhanced and highly efficient C5ISR solutions.

"Based on end user, the army segment is estimated to capture the largest share in the market during the forecast period"

Based on end user, the army segment is dominating the C5ISR market due to its extensive operational scope and reliance on integrated systems for land-based missions. Armies require advanced C5ISR capabilities for mission-critical functions such as battlefield awareness, real-time command and control, secure communications, and intelligence gathering. These capabilities are crucial for ensuring operational effectiveness in complex and dynamic environments. In addition, increasing investments in modernizing ground forces with technologies like electronic warfare systems, unmanned ground vehicles, and cyber defense solutions further drive the dominance of the army segment. As land forces remain central to military operations worldwide, their demand for comprehensive C5ISR solutions continues to lead the market.

"Based on installation, the new installation segment is estimated to dominate the market during the forecast period"

Based on installation, the new installation segment is projected to dominate the C5ISR market due to the widespread adoption of advanced and modernized systems by defense forces worldwide. As militaries increasingly focus on upgrading their capabilities to address emerging threats, such as cyberattacks and multi-domain warfare, they are investing heavily in state-of-the-art C5ISR solutions. New installations are particularly critical for integrating advanced technologies like AI, big data analytics, and autonomous systems, which cannot always be seamlessly retrofitted into legacy systems. Furthermore, modernization programs in emerging economies and the need for new infrastructure to support cutting-edge systems contribute significantly to the growth of this segment, making it the largest in the market.

" The North America region is estimated to be the largest market during the forecast period"

North America holds the highest market share in the C5ISR market due to the region's robust defense spending, particularly by the US, which accounts for the largest share of global military expenditures. The US Department of Defense (DoD) is heavily investing in advanced C5ISR technologies to maintain its technological edge in multi-domain operations, including land, air, sea, space, and cyber warfare around the world. The region is also home to major C5ISR providers such as Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), General Dynamics Corporation (US) and RTX Corporation (US), which drive innovation and deliver cutting-edge solutions. The focus on modernizing military infrastructure, the growing adoption of AI and cyber defense systems, and the rising need for integrated solutions to counter emerging threats further cement North America's dominance in this market

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the C5ISR marketplace.

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America- 35%, Europe - 25%, Asia Pacific- 35%, and Middle East - 5%

include General Dynamics Corporation (US), Leidos (US), Lockheed Martin Corporation (US), CACI International Inc. (US), Airbus (France), Northrop Grumman (US), Lockheed Martin Corporation (US), BAE Systems (UK), Thales (France), L3harris Technologies Inc. (US), Elbit Systems Ltd. (Israel), Leonardo S.p.A (Italy) are some of the leading players operating in the C5ISR market.

Research Coverage

This research report categorizes the C5ISR market by Solution (Hardware, Software and Sevices), by End User (Army, Navy, Airforce, and Government & Law Enforcements), by Installations (New Installation, and Upgraded) and by Region (North America, Europe, Asia Pacific, and Middle East). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the C5ISR market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, and services; key strategies; Contracts, partnerships, agreements, new product launches, and recent developments associated with the C5ISR market. Competitive analysis of upcoming startups in the C5ISR market ecosystem is covered in this report.

Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall C5ISR market and its subsegments. The report covers the entire ecosystem of the C5ISR market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key Drivers (Need for enhanced situational awareness to support decision-making in emergency response, Rise in terrorism necessitating advanced C5ISR solutions, and Evolving cybersecurity threats), restrains (Regulatory constraints related to technology transfer, and High development and sustainment costs), opportunities (Technological advancements, and Increasing need for interoperability between military devices/technologies) and challenges (Data storage and transmission limitations, and Integration challenges) influencing the growth of the market.

- Product Development/Innovation: Detailed Insights on upcoming technologies, R&D activities, and new products/solutions launched in the market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the C5ISR market across varied regions

- Market Diversification: Exhaustive information about new solutions, recent developments, and investments in the C5ISR market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players including General Dynamics Corporation (US), Leidos (US), Lockheed Martin Corporation (US), CACI International Inc. (US), and Airbus (France) among others in the C5ISR market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary insights

- 2.1.2.2 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.2.1 Geopolitical tensions and maritime security concerns

- 2.2.2.2 Technological advancements

- 2.2.2.3 Defense spending and military modernization programs

- 2.2.2.4 Environmental alliance commitments and international collaborations

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.3.1 Financial trends of defense contractors

- 2.2.4 RUSSIA-UKRAINE WAR IMPACT ANALYSIS

- 2.2.4.1 Impact of Russia-Ukraine war on macro factors of C5ISR market

- 2.2.4.2 Impact of Russia-Ukraine war on micro factors of C5ISR market

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISKS ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN C5ISR MARKET

- 4.2 C5ISR MARKET, BY SOLUTION

- 4.3 C5ISR MARKET, BY HARDWARE SOLUTION

- 4.4 C5ISR MARKET, BY END USER

- 4.5 C5ISR MARKET, BY INSTALLATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Need for enhanced situational awareness to support decision-making in emergency response

- 5.2.1.2 Rise in terrorism necessitating advanced C5ISR solutions

- 5.2.1.3 Evolving cybersecurity threats

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory constraints related to technology transfer

- 5.2.2.2 High development and sustainment costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements

- 5.2.3.2 Increasing need for interoperability between military devices/technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Data storage and transmission limitations

- 5.2.4.2 Integration challenges

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 PRIVATE AND SMALL ENTERPRISES

- 5.4.3 END USERS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 FACTORS INFLUENCING PRICES

- 5.6.2 INDICATIVE PRICE ANALYSIS, BY SOLUTION

- 5.6.3 INDICATIVE PRICE ANALYSIS, BY REGION

- 5.7 OPERATIONAL DATA

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 US ARMY'S 2024 NETWORK MODERNIZATION EFFORTS ADVANCING C5ISR CAPABILITIES

- 5.8.2 INTEGRATION AND REAL-TIME SHARING OF ISR DATA TO ENHANCE MILITARY CAPABILITIES

- 5.8.3 ENHANCING COMMUNICATION BETWEEN IRIDIUM AND JBC-P SYSTEMS

- 5.9 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.10 TRADE ANALYSIS

- 5.10.1 RADAR APPARATUS

- 5.10.1.1 Import scenario (HS Code: 852610)

- 5.10.1.2 Export scenario (HS Code: 852610)

- 5.10.2 DATA STORAGE UNITS

- 5.10.2.1 Import scenario (HS Code: 847170)

- 5.10.3 EXPORT SCENARIO (HS CODE: 847170)

- 5.10.4 COMMUNICATIONS SYSTEMS

- 5.10.4.1 Import scenario (HS Code: 851769)

- 5.10.4.2 Export scenario (HS Code: 851769)

- 5.10.1 RADAR APPARATUS

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 TARIFFS RELATED TO C5ISR SOLUTIONS

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 INVESTMENT AND FUNDING SCENARIO

- 5.14 BUSINESS MODELS

- 5.14.1 PRIME CONTRACTING MODEL

- 5.14.2 HARDWARE-BASED MODEL

- 5.14.3 SERVICE-BASED MODEL

- 5.14.4 HYBRID MODEL

- 5.15 TOTAL COST OF OWNERSHIP

- 5.16 BILL OF MATERIALS

- 5.17 TECHNOLOGY ANALYSIS

- 5.17.1 KEY TECHNOLOGIES

- 5.17.1.1 Sensors

- 5.17.1.2 Communications technology

- 5.17.1.3 Cybersecurity

- 5.17.2 COMPLEMENTARY TECHNOLOGIES

- 5.17.2.1 Positioning, navigation, and timing (PNT)

- 5.17.2.2 Augmented reality and virtual reality

- 5.17.3 ADJACENT TECHNOLOGIES

- 5.17.3.1 Human-machine interface

- 5.17.3.2 Automation

- 5.17.1 KEY TECHNOLOGIES

- 5.18 MACROECONOMIC OUTLOOK

- 5.18.1 INTRODUCTION

- 5.18.2 NORTH AMERICA

- 5.18.3 EUROPE

- 5.18.4 ASIA PACIFIC

- 5.18.5 MIDDLE EAST

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 CLOUD-BASED COMMAND AND CONTROL SOLUTIONS

- 6.2.2 5G

- 6.2.3 ELECTRONIC WARFARE

- 6.2.4 CYBER-RESILIENT COMMUNICATION

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 BIG DATA AND ANALYTICS

- 6.3.2 BLOCKCHAIN

- 6.3.3 INTERNET OF THINGS

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 PATENT ANALYSIS

- 6.6 TECHNOLOGICAL ROADMAP

- 6.7 GENERATIVE AI IMPACT ON C5ISR MARKET

- 6.7.1 INTRODUCTION

- 6.7.2 GENERATIVE AI ADOPTION FOR TOP COUNTRIES IN MILITARY

- 6.7.3 IMPACT OF GENERATIVE AI ON DEFENSE USE CASES

- 6.7.4 IMPACT OF GENERATIVE AI ON C5ISR MARKET

7 C5ISR MARKET, BY SOLUTION

- 7.1 INTRODUCTION

- 7.2 HARDWARE

- 7.2.1 COMMAND AND CONTROL SYSTEM

- 7.2.1.1 Rising geopolitical tensions and defense budgets to drive market

- 7.2.1.2 Use case: Small form factor command and control node

- 7.2.2 COMMUNICATION SYSTEM AND DATALINK

- 7.2.2.1 Investments in 5G network to drive growth

- 7.2.2.2 Use case: StarLite-X data-link series

- 7.2.3 IT INFRASTRUCTURE

- 7.2.3.1 Need to integrate various assets to enable real-time situational awareness to drive market

- 7.2.3.2 Use case: Command and control personal computer

- 7.2.4 SENSOR SYSTEM

- 7.2.4.1 Increased R&D efforts in radar technology to drive growth

- 7.2.4.2 Use case: AN/TPQ-53 radar system

- 7.2.5 CYBER WARFARE SYSTEM

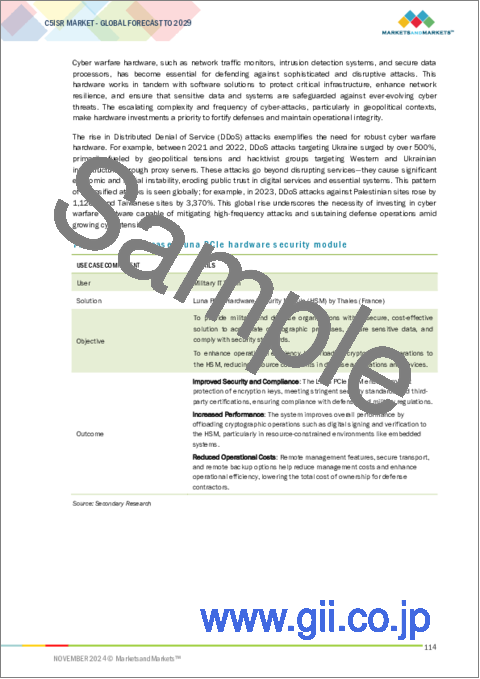

- 7.2.5.1 Escalating complexity and frequency of cyber-attacks to drive market

- 7.2.5.2 Use case: Luna PCIe hardware security module

- 7.2.6 ELECTRONIC WARFARE SYSTEM

- 7.2.6.1 Need to upgrade critical equipment to defend against evolving electronic threats to drive market

- 7.2.6.2 Use case: Scorpius-SJ ELL-8251SB AESA support jammer system

- 7.2.1 COMMAND AND CONTROL SYSTEM

- 7.3 SOFTWARE

- 7.3.1 COMMAND AND CONTROL SOFTWARE

- 7.3.1.1 Investment in joint command and control framework to boost market

- 7.3.1.2 Use case: Sensor command and control planning suite

- 7.3.2 COMMUNICATION SOFTWARE

- 7.3.2.1 Reliable communication for effective and coordinated military operations to drive market

- 7.3.2.2 Use case: Command, control, battle management, and communications

- 7.3.3 CYBER WARFARE SOFTWARE

- 7.3.3.1 Need for defensive cyber warfare to drive market

- 7.3.3.2 Use case: SystemX software platform

- 7.3.4 ELECTRONIC WARFARE SOFTWARE

- 7.3.4.1 Need to enhance airborne EW situational awareness to boost market

- 7.3.4.2 Use case: Scorpius-Fortion electronic warfare analyst

- 7.3.5 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE SOFTWARE

- 7.3.5.1 Need for advanced software to handle large volume of data to drive market

- 7.3.5.2 Use case: Scorpius-RECCE touch software

- 7.3.1 COMMAND AND CONTROL SOFTWARE

- 7.4 SERVICES

- 7.4.1 SYSTEM INTEGRATION AND ENGINEERING

- 7.4.1.1 Ongoing evolution of modern military to drive growth

- 7.4.2 LOGISTICS AND MAINTENANCE

- 7.4.2.1 Need to ensure readiness and longevity of C5ISR systems to drive growth

- 7.4.3 OTHER SERVICES

- 7.4.1 SYSTEM INTEGRATION AND ENGINEERING

8 C5ISR MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 ARMY

- 8.2.1 NEED FOR ENHANCED SITUATIONAL AWARENESS IN BATTLEFIELD OPERATIONS TO DRIVE MARKET

- 8.2.1.1 Business use case: Leidos proposed a solution to address US Army's challenge

- 8.2.1 NEED FOR ENHANCED SITUATIONAL AWARENESS IN BATTLEFIELD OPERATIONS TO DRIVE MARKET

- 8.3 NAVY

- 8.3.1 NEED FOR ENHANCED MARITIME AWARENESS AND REAL-TIME INTELLIGENCE TO DRIVE MARKET

- 8.3.1.1 Business use case: BAE Systems helped US Navy to maintain and modernize C5ISR and radio systems

- 8.3.1 NEED FOR ENHANCED MARITIME AWARENESS AND REAL-TIME INTELLIGENCE TO DRIVE MARKET

- 8.4 AIR FORCE

- 8.4.1 NEED FOR ENHANCED AIR MISSION COORDINATION TO DRIVE MARKET

- 8.4.1.1 Business use case: CACI International Inc. helped US Air Force Research Laboratory to advance C5ISR capabilities

- 8.4.1 NEED FOR ENHANCED AIR MISSION COORDINATION TO DRIVE MARKET

- 8.5 GOVERNMENT AND LAW ENFORCEMENT

- 8.5.1 NEED FOR INTEGRATED INTELLIGENCE AND SURVEILLANCE SYSTEMS TO DRIVE MARKET

- 8.5.1.1 Business use case: Sev1Tech helped US Department of Homeland Security to modernize IT infrastructure

- 8.5.1 NEED FOR INTEGRATED INTELLIGENCE AND SURVEILLANCE SYSTEMS TO DRIVE MARKET

9 C5ISR MARKET, BY INSTALLATION

- 9.1 INTRODUCTION

- 9.2 NEW INSTALLATIONS

- 9.2.1 RISING NEED FOR COORDINATION AND MANAGEMENT CAPABILITIES TO DRIVE MARKET

- 9.3 UPGRADES

- 9.3.1 REGULAR DEFENSE UPDATES FOR COMMAND-AND-CONTROL SYSTEMS TO DRIVE MARKET

10 REGIONAL ANALYSIS

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 PESTLE ANALYSIS: NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Increasing need for advanced defense systems to boost market

- 10.2.3 CANADA

- 10.2.3.1 Investment in advanced C5ISR solutions to enhance defense capabilities

- 10.3 EUROPE

- 10.3.1 PESTLE ANALYSIS: EUROPE

- 10.3.2 UK

- 10.3.2.1 Increased focus on mobile deployed C5ISR solutions to drive market

- 10.3.3 FRANCE

- 10.3.3.1 Strategic collaborations to enhance internal security to drive market

- 10.3.4 GERMANY

- 10.3.4.1 Growing focus on enhancing its C5ISR capabilities to drive market

- 10.3.5 ITALY

- 10.3.5.1 Emphasis on modernizing military capabilities to drive market

- 10.4 ASIA PACIFIC

- 10.4.1 PESTLE ANALYSIS: ASIA PACIFIC

- 10.4.2 INDIA

- 10.4.2.1 Indigenous development of C5ISR solutions to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Investment in modern defense capabilities to drive growth

- 10.4.4 AUSTRALIA

- 10.4.4.1 Strategic investments and collaborations to enhance national defense capabilities to drive market

- 10.5 MIDDLE EAST

- 10.5.1 PESTLE ANALYSIS: MIDDLE EAST

- 10.5.2 GCC COUNTRIES

- 10.5.2.1 UAE

- 10.5.2.1.1 Major cyber-attacks to create need for cyber defense technologies

- 10.5.2.2 Saudi Arabia

- 10.5.2.2.1 Growing need for advanced cyber defense to drive market

- 10.5.2.1 UAE

- 10.5.3 ISRAEL

- 10.5.3.1 Advanced autonomous C5ISR technologies to drive market

- 10.5.4 TURKIYE

- 10.5.4.1 Prioritized self-reliance in defense technology to boost market

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS, 2023

- 11.4 REVENUE ANALYSIS, 2020-2023

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY FINANCIAL METRICS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Company product footprint

- 11.7.5.2 Solution footprint

- 11.7.5.3 Installation footprint

- 11.7.5.4 Region footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.10 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 NORTHROP GRUMMAN

- 12.1.1.1 Business overview

- 12.1.1.2 Solutions offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 LOCKHEED MARTIN CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Solutions offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 THALES

- 12.1.3.1 Business overview

- 12.1.3.2 Solutions offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 BAE SYSTEMS

- 12.1.4.1 Business overview

- 12.1.4.2 Solutions offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 L3HARRIS TECHNOLOGIES, INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Solutions offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.3.2 Expansions

- 12.1.5.3.3 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 RTX

- 12.1.6.1 Business overview

- 12.1.6.2 Solutions offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Other developments

- 12.1.7 GENERAL DYNAMICS CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Solutions offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Other developments

- 12.1.8 LEONARDO S.P.A.

- 12.1.8.1 Business overview

- 12.1.8.2 Solutions offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Other developments

- 12.1.9 ELBIT SYSTEMS LTD.

- 12.1.9.1 Business overview

- 12.1.9.2 Solutions offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.3.2 Deals

- 12.1.9.3.3 Other developments

- 12.1.10 SAAB AB

- 12.1.10.1 Business overview

- 12.1.10.2 Solutions offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.10.3.3 Other developments

- 12.1.11 AIRBUS

- 12.1.11.1 Business overview

- 12.1.11.2 Solutions offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.11.3.2 Other developments

- 12.1.12 RHEINMETALL AG

- 12.1.12.1 Business overview

- 12.1.12.2 Solutions offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.12.3.2 Other developments

- 12.1.13 CACI INTERNATIONAL INC

- 12.1.13.1 Business overview

- 12.1.13.2 Solutions offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.13.3.2 Other developments

- 12.1.14 INDRA SISTEMAS, S.A.

- 12.1.14.1 Business overview

- 12.1.14.2 Solutions offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches

- 12.1.14.3.2 Deals

- 12.1.14.3.3 Other developments

- 12.1.15 LEIDOS

- 12.1.15.1 Business overview

- 12.1.15.2 Solutions offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Other developments

- 12.1.1 NORTHROP GRUMMAN

- 12.2 OTHER PLAYERS

- 12.2.1 SERCO GROUP PLC

- 12.2.2 MAG AEROSPACE

- 12.2.3 SIGMA DEFENSE SYSTEMS

- 12.2.4 SEV1TECH, LLC.

- 12.2.5 MANTECH INTERNATIONAL CORPORATION

- 12.2.6 NOBLE

- 12.2.7 DARLEY

- 12.2.8 ASSURED INFORMATION SECURITY, INC.

- 12.2.9 ATSS

- 12.2.10 CSMI

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 ANNEXURE

- 13.2.1 DEFENSE PROGRAMS

- 13.2.2 LIST OF COMPANIES MAPPED DURING RESEARCH

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS