|

|

市場調査レポート

商品コード

1617387

ZLDシステムの世界市場:タイプ別、プロセス別、処理能力別、用途別、最終用途産業別、地域別 - 予測(~2029年)Zero Liquid Discharge Systems Market by Type (Conventional, Hybrid), Process, Capacity, Application, End-use industry (Energy & Power, Chemicals & Petrochemicals, Food & Beverage), and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ZLDシステムの世界市場:タイプ別、プロセス別、処理能力別、用途別、最終用途産業別、地域別 - 予測(~2029年) |

|

出版日: 2024年12月05日

発行: MarketsandMarkets

ページ情報: 英文 280 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のZLD(Zero Liquid Discharge)システムの市場規模は、2024年の78億米ドルから2029年までに114億8,000万米ドルに達すると予測され、予測期間にCAGRで8.0%の成長が見込まれます。

市場は、その汎用性の高い特性により成長を示しており、またその卓越した特性によりさまざまな産業で広く使用されています。さらに、ZLDシステムは、エネルギー・電力、化学・石油化学、食品・飲料、テキスタイル、医薬品、半導体・電子などのさまざまな最終用途産業での利用に求められており、このことがZLDシステムのニーズを促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 金額(100万米ドル)、数量(台) |

| セグメント | システム、プロセス、処理能力、用途、最終用途産業、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

「前処理プロセスタイプが金額ベースで2番目に速いプロセスタイプになると予測されます。」

前処理プロセスは、ZLDシステムの初期プロセスの1つです。前処理プロセスは汚染を除去し、水の状態を整えます。前処理プロセスが行われる目的は、水中の汚染物質の量を減らし、下流の設備に備えることです。前処理方法には、ろ過、化学処理、凝集、清澄化、精密ろ過、限外ろ過などのプロセスが含まれます。このプロセスでは、総懸濁固体量、化学的酸素要求量、濁度も減少させます。前処理は、下流の膜プロセスを保護し、下流の処理の必要性を最小化し、下流の装置がより効率的に機能するのに役立つため、重要なプロセスです。前処理プロセスは主に、エネルギー・電力、化学・石油化学、テキスタイルなどの最終用途産業で実施されています。これらの産業では大量の廃水が発生するため、再利用水が必要となります。

「半導体・電子最終用途産業が、予測期間に金額ベースで2番目に急成長する最終用途産業となる見込みです。」

電子機器製造プロセスでは、繊細なコンポーネントの汚染を避けるために純度の高い水が必要とされます。世界的に環境規制が強化される中、最終用途産業はエコロジカルフットプリントを最小化する必要に迫られています。ZLDシステムは、廃液の排出をなくし、淡水の消費を削減することで、こうした規制に対応するのに役立ち、持続可能性の向上を目指すメーカーにとって魅力的な選択肢となっています。

「中東・アフリカは、予測期間に金額ベースで2番目に急成長する地域になると推定されます。」

これらの地域は深刻な水不足の課題に直面しており、効率的な水管理の実践が不可欠です。これらの地域では、化学・石油化学、石油・ガスなどのさまざまな最終用途産業で急速な産業化が進んでおり、これらの産業が拡大するにつれて、効果的な処理ソリューションを必要とする大量の廃水が発生します。また、政府は水質汚染の削減と持続可能な慣行の促進を目的としたさまざまな規制を実施しています。これらの変数は、ZLDシステム市場がより速く成長するのに役立っています。

当レポートでは、世界のZLDシステム市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- ZLDシステム市場の企業にとっての機会

- ZLDシステム市場:システム別

- ZLDシステム市場:処理能力別

- ZLDシステム市場:最終用途産業別

- ZLDシステム市場:国別

第5章 市場の概要

- イントロダクション

- AI/生成AIの影響

- イントロダクション

- 影響の概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済指標

- バリューチェーン分析

- 原材料サプライヤー

- メーカー

- サプライヤー/販売業者

- 最終用途産業

- エコシステム

- ケーススタディ分析

- 規制情勢

- 規制

- 規制機関、政府機関、その他の機関

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 顧客ビジネスに影響を与える動向/混乱

- 貿易分析

- 輸出シナリオ(HSコード842121)

- 輸入シナリオ(HSコード842121)

- 主な会議とイベント(2024年~2025年)

- 価格動向の分析

- 平均販売価格:地域別

- ZLDシステムの平均販売価格の動向

- 主要企業のZLDシステムの平均販売価格:処理能力別

- 主要企業のZLDシステムの平均販売価格の動向:最終用途産業別

- 主要企業のZLDシステムの平均販売価格:最終用途産業別

- ZLDシステムの平均販売価格:地域別

- 投資と資金調達のシナリオ

- 特許分析

- アプローチ

- 文書の種類

- 考察

- 特許の法的地位

- 管轄分析

- 主な企業/出願者

- 過去10年間の上位10の特許保有者(米国)

第6章 ZLDシステム市場:プロセス別

- イントロダクション

- ZLDプロセス

- 前処理

- ろ過

- 蒸発/結晶化

第7章 ZLDシステム市場:処理能力別

- イントロダクション

- 小規模

- 中規模

- 大規模

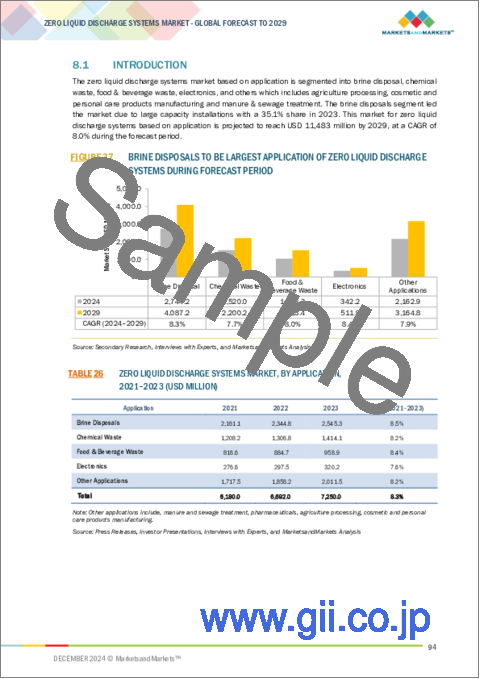

第8章 ZLDシステム市場:用途別

- イントロダクション

- 塩水処理

- 化学廃棄物

- 食品・飲料廃棄物

- 電子

- その他の用途

第9章 ZLDシステム市場:システム別

- イントロダクション

- 従来式

- ハイブリッド

第10章 ZLDシステム市場:最終用途産業別

- イントロダクション

- エネルギー・電力

- 化学品・石油化学品

- 食品・飲料

- テキスタイル

- 医薬品

- 半導体・電子

- その他の最終用途産業

第11章 ZLDシステム市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- スペイン

- 英国

- イタリア

- ロシア

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- 台湾

- オーストラリア

- その他のアジア太平洋

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2019年~2024年)

- 収益分析(2021年~2023年)

- 市場シェア分析(2023年)

- 企業の評価と財務指標(2023年)

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- ALFA LAVAL

- AQUARION AG

- VEOLIA

- AQUATECH

- GEA GROUP

- PRAJ INDUSTRIES

- H2O GMBH

- THERMAX LIMITED

- MITSUBISHI CHEMICAL CORPORATION

- ANDRITZ

- TOSHIBA INFRASTRUCTURE SYSTEMS & SOLUTIONS CORPORATION

- IEI(ION EXCHANGE)

- CONDORCHEM ENVIRO SOLUTIONS

- KURITA WATER INDUSTRIES LTD.

- EVOQUA WATER TECHNOLOGIES LLC

- その他の企業

- PETRO SEP CORPORATION

- FLUENCE CORPORATION LIMITED

- ENVISOL ARVIND

- SAMCO TECHNOLOGIES

- LENNTECH B.V.

- SHIVA GLOBAL ENVIRONMENTAL PRIVATE LIMITED

- GMM PFAUDLER

- IDE WATER TECHNOLOGIES

- SALTWORKS TECHNOLOGIES INC

- ENCON EVAPORATORS

- SCALEBAN EQUIPMENTS PVT.LTD.

- MEMSIFT INNOVATIONS PTE LTD.

- GRUNDFOS

- U.S. WATER SERVICES CORPORATION

第14章 付録

List of Tables

- TABLE 1 ZERO LIQUID DISCHARGE SYSTEMS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 INTERVIEWS WITH EXPERTS - DEMAND AND SUPPLY SIDES

- TABLE 3 REGION-WISE COST OF DESALINATION PLANTS, 2023

- TABLE 4 WATER STRESS RANKINGS

- TABLE 5 ZERO LIQUID DISCHARGE SYSTEMS MARKET: PORTER'S FIVE FORCES

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES (%)

- TABLE 7 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2029

- TABLE 8 ZERO LIQUID DISCHARGE SYSTEMS: ECOSYSTEM

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 12 EXPORT SCENARIO FOR HS CODE 842121-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 13 IMPORT SCENARIO FOR HS CODE 842121-COMPLIANT PRODUCTS, 2019-2023 (USD THOUSAND)

- TABLE 14 ZERO LIQUID DISCHARGE SYSTEMS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- TABLE 15 AVERAGE SELLING PRICE OF ZERO LIQUID DISCHARGE SYSTEMS OF KEY PLAYERS, BY CAPACITY (2022-2029)

- TABLE 16 AVERAGE SELLING PRICE OF ZERO LIQUID DISCHARGE SYSTEMS OF KEY PLAYERS, BY END-USE INDUSTRY, 2023

- TABLE 17 AVERAGE SELLING PRICE OF ZERO LIQUID DISCHARGE SYSTEMS, BY REGION (2022-2029)

- TABLE 18 TOTAL NUMBER OF PATENTS

- TABLE 19 TOP 10 PATENT OWNERS

- TABLE 20 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY PROCESS, 2021-2023 (USD MILLION)

- TABLE 21 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY PROCESS, 2024-2029 (USD MILLION)

- TABLE 22 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY CAPACITY, 2021-2023 (USD MILLION)

- TABLE 23 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY CAPACITY, 2024-2029 (USD MILLION)

- TABLE 24 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY CAPACITY, 2021-2023 (UNIT)

- TABLE 25 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY CAPACITY, 2024-2029 (UNIT)

- TABLE 26 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 27 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 28 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (USD MILLION)

- TABLE 29 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 30 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (UNIT)

- TABLE 31 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (UNIT)

- TABLE 32 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 33 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 34 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 35 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 36 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 37 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 38 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY REGION, 2021-2023 (UNIT)

- TABLE 39 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY REGION, 2024-2029 (UNIT)

- TABLE 40 NORTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 41 NORTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 42 NORTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2021-2023 (UNIT)

- TABLE 43 NORTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2024-2029 (UNIT)

- TABLE 44 NORTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (USD MILLION)

- TABLE 45 NORTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 46 NORTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (UNIT)

- TABLE 47 NORTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (UNIT)

- TABLE 48 NORTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY PROCESS, 2021-2023 (USD MILLION)

- TABLE 49 NORTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY PROCESS, 2024-2029 (USD MILLION)

- TABLE 50 NORTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 51 NORTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 52 NORTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 53 NORTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 54 US: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 55 US: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 56 US: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 57 US: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 58 CANADA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 59 CANADA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 60 CANADA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 61 CANADA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 62 MEXICO: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 63 MEXICO: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 64 MEXICO: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 65 MEXICO: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 66 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 67 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 68 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2021-2023 (UNIT)

- TABLE 69 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2024-2029 (UNIT)

- TABLE 70 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (USD MILLION)

- TABLE 71 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 72 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (UNIT)

- TABLE 73 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (UNIT)

- TABLE 74 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY PROCESS, 2021-2023 (USD MILLION)

- TABLE 75 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY PROCESS, 2024-2029 (USD MILLION)

- TABLE 76 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 77 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 78 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 79 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 80 GERMANY: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 81 GERMANY: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 82 GERMANY: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 83 GERMANY: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 84 FRANCE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 85 FRANCE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 86 FRANCE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 87 FRANCE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 88 SPAIN: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 89 SPAIN: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 90 SPAIN: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 91 SPAIN: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 92 UK: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 93 UK: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 94 UK: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 95 UK: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 96 ITALY: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 97 ITALY: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 98 ITALY: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 99 ITALY: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 100 RUSSIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 101 RUSSIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 102 RUSSIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 103 RUSSIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 104 REST OF EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 105 REST OF EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 106 REST OF EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 107 REST OF EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 108 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 109 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 110 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2021-2023 (UNIT)

- TABLE 111 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2024-2029 (UNIT)

- TABLE 112 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (USD MILLION)

- TABLE 113 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (UNIT)

- TABLE 115 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (UNIT)

- TABLE 116 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY PROCESS, 2021-2023 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY PROCESS, 2024-2029 (USD MILLION)

- TABLE 118 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 119 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 120 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 121 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 122 CHINA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 123 CHINA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 124 CHINA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 125 CHINA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 126 JAPAN: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 127 JAPAN: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 128 JAPAN: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 129 JAPAN: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 130 INDIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 131 INDIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 132 INDIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 133 INDIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 134 SOUTH KOREA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 135 SOUTH KOREA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 136 SOUTH KOREA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 137 SOUTH KOREA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 138 TAIWAN: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 139 TAIWAN: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 140 TAIWAN: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 141 TAIWAN: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 142 AUSTRALIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 143 AUSTRALIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 144 AUSTRALIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 145 AUSTRALIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 146 REST OF ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 149 REST OF ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 150 MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2021-2023 (UNIT)

- TABLE 153 MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2024-2029 (UNIT)

- TABLE 154 MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (UNIT)

- TABLE 157 MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (UNIT)

- TABLE 158 MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY PROCESS, 2021-2023 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY PROCESS, 2024-2029 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 163 MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 164 GCC COUNTRIES: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 165 GCC COUNTRIES: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 166 GCC COUNTRIES: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 167 GCC COUNTRIES: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 168 SAUDI ARABIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 169 SAUDI ARABIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 170 SAUDI ARABIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 171 SAUDI ARABIA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 172 UAE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 173 UAE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 174 UAE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 175 UAE: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 176 REST OF GCC COUNTRIES: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 177 REST OF GCC COUNTRIES: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 178 REST OF GCC COUNTRIES: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 179 REST OF GCC COUNTRIES: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 180 SOUTH AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 181 SOUTH AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 182 SOUTH AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 183 SOUTH AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 188 SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 189 SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 190 SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2021-2023 (UNIT)

- TABLE 191 SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY, 2024-2029 (UNIT)

- TABLE 192 SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (USD MILLION)

- TABLE 193 SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 194 SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2021-2023 (UNIT)

- TABLE 195 SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM, 2024-2029 (UNIT)

- TABLE 196 SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY PROCESS, 2021-2023 (USD MILLION)

- TABLE 197 SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY PROCESS, 2024-2029 (USD MILLION)

- TABLE 198 SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 199 SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 200 SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 201 SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 202 BRAZIL: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 203 BRAZIL: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 204 BRAZIL: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 205 BRAZIL: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 206 ARGENTINA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 207 ARGENTINA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 208 ARGENTINA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 209 ARGENTINA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 210 REST OF SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 211 REST OF SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 212 REST OF SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2021-2023 (UNIT)

- TABLE 213 REST OF SOUTH AMERICA: ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 214 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ZERO LIQUID DISCHARGE SYSTEMS MARKET BETWEEN 2019 AND 2024

- TABLE 215 ZERO LIQUID DISCHARGE SYSTEMS MARKET: DEGREE OF COMPETITION

- TABLE 216 ZERO LIQUID DISCHARGE SYSTEMS MARKET: REGION FOOTPRINT

- TABLE 217 ZERO LIQUID DISCHARGE SYSTEMS MARKET: SYSTEM FOOTPRINT

- TABLE 218 ZERO LIQUID DISCHARGE SYSTEMS MARKET: PROCESS FOOTPRINT

- TABLE 219 ZERO LIQUID DISCHARGE SYSTEMS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 220 ZERO LIQUID DISCHARGE SYSTEMS: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 221 ZERO LIQUID DISCHARGE SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 222 ZERO LIQUID DISCHARGE SYSTEMS MARKET: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 223 ZERO LIQUID DISCHARGE SYSTEMS MARKET: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 224 ZERO LIQUID DISCHARGE SYSTEMS MARKET: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 225 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 226 ALFA LAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 ALFA LAVAL: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 228 AQUARION AG: COMPANY OVERVIEW

- TABLE 229 AQUARION AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 AQUARION AG: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 231 AQUARION AG: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 232 VEOLIA: COMPANY OVERVIEW

- TABLE 233 VEOLIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 VEOLIA: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 235 VEOLIA: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 236 VEOLIA: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 237 AQUATECH: COMPANY OVERVIEW

- TABLE 238 AQUATECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 AQUATECH: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 240 GEA GROUP: COMPANY OVERVIEW

- TABLE 241 GEA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 GEA GROUP: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 243 PRAJ INDUSTRIES: COMPANY OVERVIEW

- TABLE 244 PRAJ INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 H2O GMBH: COMPANY OVERVIEW

- TABLE 246 H2O GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 THERMAX LIMITED: COMPANY OVERVIEW

- TABLE 248 THERMAX LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 THERMAX LIMITED: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 250 THERMAX LIMITED: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 251 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 252 MITSUBISHI CHEMICAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 ANDRITZ: COMPANY OVERVIEW

- TABLE 254 ANDRITZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 TOSHIBA INFRASTRUCTURE SYSTEMS & SOLUTIONS CORPORATION: COMPANY OVERVIEW

- TABLE 256 TOSHIBA INFRASTRUCTURE SYSTEMS & SOLUTIONS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 IEI: COMPANY OVERVIEW

- TABLE 258 IEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 CONDORCHEM ENVIRO SOLUTIONS: COMPANY OVERVIEW

- TABLE 260 CONDORCHEM ENVIRO SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 CONDORCHEM ENVIRO SOLUTIONS: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 262 KURITA WATER INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 263 KURITA WATER INDUSTRIES LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 EVOQUA WATER TECHNOLOGIES LLC: COMPANY OVERVIEW

- TABLE 265 EVOQUA WATER TECHNOLOGIES LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 EVOQUA WATER TECHNOLOGIES LLC: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 267 EVOQUA WATER TECHNOLOGIES LLC: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 268 PETRO SEP CORPORATION: COMPANY OVERVIEW

- TABLE 269 FLUENCE CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 270 ENVISOL ARVIND: COMPANY OVERVIEW

- TABLE 271 SAMCO TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 272 LENNTECH B.V.: COMPANY OVERVIEW

- TABLE 273 SHIVA GLOBAL ENVIRONMENTAL PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 274 GMM PFAUDLER: COMPANY OVERVIEW

- TABLE 275 IDE WATER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 276 SALTWORKS TECHNOLOGIES INC: COMPANY OVERVIEW

- TABLE 277 ENCON EVAPORATORS: COMPANY OVERVIEW

- TABLE 278 SCALEBAN EQUIPMENTS PVT.LTD.: COMPANY OVERVIEW

- TABLE 279 MEMSIFT INNOVATIONS PTE LTD.: COMPANY OVERVIEW

- TABLE 280 GRUNDFOS: COMPANY OVERVIEW

- TABLE 281 U.S. WATER SERVICES CORPORATION: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ZERO LIQUID DISCHARGE SYSTEMS MARKET SEGMENTATION

- FIGURE 2 ZERO LIQUID DISCHARGE SYSTEMS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION APPROACH: DEMAND SIDE

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 ZERO LIQUID DISCHARGE SYSTEMS MARKET: DATA TRIANGULATION

- FIGURE 7 ZERO LIQUID DISCHARGE SYSTEMS MARKET: FACTORS IMPACTING MARKET

- FIGURE 8 CONVENTIONAL ZERO LIQUID DISCHARGE SYSTEMS TO BE LARGER SEGMENT DURING FORECAST PERIOD

- FIGURE 9 EVAPORATION/CRYSTALLIZATION PROCESS TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 10 ENERGY & POWER TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING ZERO LIQUID DISCHARGE SYSTEMS MARKET

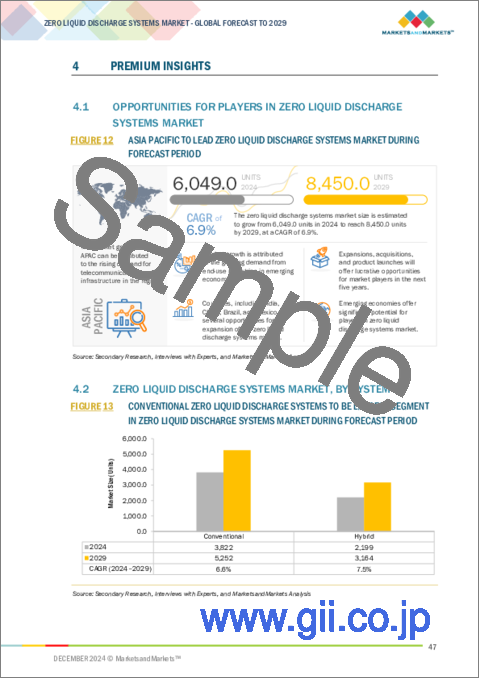

- FIGURE 12 ASIA PACIFIC TO LEAD ZERO LIQUID DISCHARGE SYSTEMS MARKET DURING FORECAST PERIOD

- FIGURE 13 CONVENTIONAL ZERO LIQUID DISCHARGE SYSTEMS TO BE LARGEST SEGMENT IN ZERO LIQUID DISCHARGE SYSTEMS MARKET DURING FORECAST PERIOD

- FIGURE 14 SMALL SCALE SEGMENT TO CAPTURE LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 15 ENERGY & POWER END-USE INDUSTRY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR IN ZERO LIQUID DISCHARGE SYSTEMS MARKET

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ZERO LIQUID DISCHARGE SYSTEMS MARKET

- FIGURE 18 ZERO LIQUID DISCHARGE SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF KEY END-USE INDUSTRIES

- FIGURE 20 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 21 OVERVIEW OF ZERO LIQUID DISCHARGE SYSTEMS VALUE CHAIN

- FIGURE 22 ZERO LIQUID DISCHARGE SYSTEMS: ECOSYSTEM

- FIGURE 23 GROWING DEMAND IN VARIOUS END-USE INDUSTRIES TO INFLUENCE ZERO LIQUID DISCHARGE SYSTEMS MARKET

- FIGURE 24 EXPORT DATA FOR HS CODE 842121-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 25 IMPORT SCENARIO FOR HS CODE 842121-COMPLIANT PRODUCTS, 2019-2023 (USD THOUSAND)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF ZERO LIQUID DISCHARGE SYSTEMS, 2021-2023

- FIGURE 27 AVERAGE SELLING PRICE, BY CAPACITY, USD/UNIT (2022-2029)

- FIGURE 28 AVERAGE SELLING PRICE TREND OF ZERO LIQUID DISCHARGE SYSTEMS OF KEY PLAYERS, BY END-USE INDUSTRY, 2023

- FIGURE 29 AVERAGE SELLING PRICE, BY REGION, USD/UNIT (2022-2029)

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2019-2023

- FIGURE 31 TOTAL NUMBER OF PATENTS

- FIGURE 32 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 33 TOP JURISDICTION - BY DOCUMENT

- FIGURE 34 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 35 EVAPORATION/CRYSTALLIZATION TO BE LARGEST PROCESS DURING FORECAST PERIOD

- FIGURE 36 MEDIUM SCALE TO BE LARGEST CAPACITY SEGMENT OF ZERO LIQUID DISCHARGE SYSTEMS MARKET DURING FORECAST PERIOD

- FIGURE 37 BRINE DISPOSALS TO BE LARGEST APPLICATION OF ZERO LIQUID DISCHARGE SYSTEMS DURING FORECAST PERIOD

- FIGURE 38 CONVENTIONAL SYSTEM TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 39 ENERGY & POWER TO BE LARGEST END-USE INDUSTRY OF ZERO LIQUID DISCHARGE SYSTEMS MARKET

- FIGURE 42 EUROPE: ZERO LIQUID DISCHARGE SYSTEMS MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: ZERO LIQUID DISCHARGE SYSTEMS MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF KEY COMPANIES IN ZERO LIQUID DISCHARGE SYSTEMS MARKET, 2021-2023

- FIGURE 45 SHARE OF LEADING COMPANIES IN ZERO LIQUID DISCHARGE SYSTEMS MARKET, 2023

- FIGURE 46 COMPANY VALUATION OF KEY COMPANIES IN ZERO LIQUID DISCHARGE SYSTEMS MARKET, 2023

- FIGURE 47 FINANCIAL METRICS OF KEY COMPANIES IN ZERO LIQUID DISCHARGE SYSTEMS MARKET, 2023

- FIGURE 48 ZERO LIQUID DISCHARGE SYSTEMS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 ZERO LIQUID DISCHARGE SYSTEMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 50 ZERO LIQUID DISCHARGE SYSTEMS MARKET: COMPANY FOOTPRINT

- FIGURE 51 ZERO LIQUID DISCHARGE SYSTEMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 52 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 53 VEOLIA: COMPANY SNAPSHOT

- FIGURE 54 GEA GROUP: COMPANY SNAPSHOT

- FIGURE 55 PRAJ INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 56 THERMAX LIMITED: COMPANY SNAPSHOT

- FIGURE 57 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 ANDRITZ: COMPANY SNAPSHOT

- FIGURE 59 TOSHIBA INFRASTRUCTURE SYSTEMS & SOLUTIONS CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 IEI: COMPANY SNAPSHOT

- FIGURE 61 KURITA WATER INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 62 EVOQUA WATER TECHNOLOGIES LLC: COMPANY SNAPSHOT

The Zero liquid discharge system market size is projected to grow from USD 7.80 billion in 2024 to USD 11.48 billion by 2029, registering a CAGR of 8.0% during the forecast period in terms of value. The global zero liquid discharge system market is witnessing growth due to its versatile properties and it is also widely used in various industries due to its exceptional properties. Furthermore, zero liquid discharge system are required for the application in various end use industries like energy & power, chemicals & petrochemicals, food & beverages, textiles, pharmaceuticals, semiconductors & electronics, and other end use industries , which fuels the need for zero liquid discharge systems.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million), Volume (Units) |

| Segments | System, Process, Capacity, Application, End Use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Pre treatment process type is projected to be the second fastest process type in terms of value."

Pre treatment process type is projected to be the second fastest process type in terms of value in the zero liquid discharge system market due to various factors. The pre treatment process is one of the initial process in the zero liquid discharge systems. As pre treatment process removes contamination and its conditions the water. The goal with which the pre treatment process is done is to reduce the amount of contaminants in the water and prepare it for downstream equipment. The pre treatment method includes process like filtering, chemical treatment, coagulation, clarification, microfiltration and ultrafiltration. This process also reduces total suspended solids, chemical oxygen demand, and turbidity. Pre treatment is important process as it helps to protect downstream membrane process, minimize the need for downstream treatment and it also help downstream equipment perform more efficiently. Pre treatment process is carried out mostly in end use industries like energy & power, chemicals & petrochemicals, textiles. The process is followed amongst these industries as they produce large volumes of waste water and these industries require recycled water to carry out their functions.

"Semiconductors & electronics end use industry is expected to be the second fastest growing end use industry for forecasted period in terms of value."

Semiconductors & electronics end use industry is expected to be the second fastest growing end use industry for forecasted period in terms of value. Electronics manufacturing process requires high purity water to avoid contamination of sensitive components. As the environmental regulations are tightened globally, the end use industry face pressure to minimize its ecological footprint. ZLD systems help the companies to adopt to these regulations by eliminating liquid waste discharge and reducing freshwater consumption, making them an attractive option for manufacturers looking to enhance their sustainability practices.

"Middle East & Africa is estimated to be the second fastest growing region in terms of value for the forecasted period."

Middle East and Africa region is expected to be the second fastest growing region in forecasted period in terms of value. As these region faces severe water scarcity challenges which make it essential for the countries to practice efficient water management practices. Rapid industrialization across various end use industries like chemicals and petrochemicals, oil and gas is occuring in these region, as these industries expand they generate substantial amount of wastewater that require effective treatment solutions. Also government are implementing various regulations aimed at reducing water pollution and promoting sustainable practices. These parameters are helping the ZLD system market to grow at a faster rate.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the zero liquid discharge system market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives- 20%, Directors - 10%, and Others - 70%

- By Region: North America - 22%, Europe - 22%, APAC - 45%, ROW -11%

The Zero liquid discharge system market comprises major players such as Alfa Laval (Sweden), AQUARION AG (Switzerland), Veolia (France), Aquatech (US), GEA Group (Germany), Praj Industries Ltd (India), H2O GmbH (Germany), Thermax Limited (India), Mitsubishi Chemical Corporation. (Japan), ANDRITZ (Austria), Toshiba Infrastructure Systems & Solutions Corporation (Japan), IEI (India), Condorchem Enviro Solutions (Spain), Kurita Water Industries Ltd (Japan), Evoqua Water Technologies LLC (US). The study includes in-depth competitive analysis of these key players in the zero liquid discharge system market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for zero liquid discharge system market on the basis of system, process, capacity, application, end use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for zero liquid discharge system market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the zero liquid discharge system market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the zero liquid discharge system market offered by top players in the global zero liquid discharge system market.

- Analysis of drivers: (Growth trends in Asia Pacific region, uptrend in desalination equipment costs, Government implementing stringent regulations and new policies regarding water treatment) restraints (High initial investment and complexity of systems, Availability of substitutes for water treatment), opportunities (Growing public concern about water scarcity and environmental degradation, Higher growth in emerging economies of Asia Pacific) and challenges (Operational cost and high maintenance, Controlling water loss during the operation)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the zero liquid discharge system market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for zero liquid discharge system market across regions.

- Market Capacity: Production capacities of companies producing zero liquid discharge system are provided wherever available with upcoming capacities for the zero liquid discharge system market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the zero liquid discharge system market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 ZERO LIQUID DISCHARGE SYSTEMS MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 FACTOR ANALYSIS

- 2.6 GROWTH FORECAST

- 2.6.1 SUPPLY SIDE

- 2.6.2 DEMAND SIDE

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN ZERO LIQUID DISCHARGE SYSTEMS MARKET

- 4.2 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM

- 4.3 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY CAPACITY

- 4.4 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY

- 4.5 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 IMPACT OF AI/GEN AI

- 5.2.1 INTRODUCTION

- 5.2.2 OVERVIEW OF IMPACT

- 5.2.2.1 Transforming zero liquid discharge systems with AI and machine learning

- 5.2.2.2 Impact of AI/GenAI on reverse osmosis

- 5.2.2.3 Impact of AI on water treatment and zero liquid discharge systems

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Stringent environmental regulations, industrial expansion, and increasing water scarcity in Asia Pacific

- 5.3.1.2 Uptrend in cost of desalination equipment

- 5.3.1.3 Implementation of stringent regulations and new policies regarding water treatment

- 5.3.1.4 Commitment of various organizations to sustainability initiatives

- 5.3.1.5 Increasing water scarcity across regions

- 5.3.2 RESTRAINTS

- 5.3.2.1 High initial investments and complexity of systems

- 5.3.2.2 Availability of substitutes for water treatment

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Growing public concerns about water scarcity and environmental degradation

- 5.3.3.2 Rapid industrial growth in emerging economies of Asia Pacific

- 5.3.4 CHALLENGES

- 5.3.4.1 High maintenance and operational cost

- 5.3.4.2 Controlling water loss during operation

- 5.3.1 DRIVERS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF SUBSTITUTES

- 5.4.2 BARGAINING POWER OF BUYERS

- 5.4.3 THREAT OF NEW ENTRANTS

- 5.4.4 BARGAINING POWER OF SUPPLIERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.5.2 BUYING CRITERIA

- 5.6 MACROECONOMIC INDICATORS

- 5.6.1 GLOBAL GDP TRENDS

- 5.7 VALUE CHAIN ANALYSIS

- 5.7.1 RAW MATERIAL SUPPLIERS

- 5.7.2 MANUFACTURERS

- 5.7.3 SUPPLIERS/DISTRIBUTORS

- 5.7.4 END-USE INDUSTRIES

- 5.8 ECOSYSTEM

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 ZERO LIQUID DISCHARGE AT PEARL GTL PLANT

- 5.9.2 WASTEWATER RECYCLING AND ZERO LIQUID DISCHARGE SYSTEM FOR CTX INDUSTRY IN CHINA

- 5.9.3 ZERO LIQUID DISCHARGE IN WASTEWATER TREATMENT

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATIONS

- 5.10.1.1 Europe

- 5.10.1.2 Asia Pacific

- 5.10.1.3 North America

- 5.10.2 REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES

- 5.10.1 REGULATIONS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Membrane technology

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Ultrafiltration technology

- 5.11.2.2 Falling film evaporators

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Forward osmosis

- 5.11.1 KEY TECHNOLOGIES

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 TRADE ANALYSIS

- 5.13.1 EXPORT SCENARIO (HS CODE 842121)

- 5.13.2 IMPORT SCENARIO (HS CODE 842121)

- 5.14 KEY CONFERENCES & EVENTS, 2024-2025

- 5.15 PRICING TREND ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE, BY REGION

- 5.15.2 AVERAGE SELLING PRICE TREND OF ZERO LIQUID DISCHARGE SYSTEMS

- 5.15.3 AVERAGE SELLING PRICE OF ZERO LIQUID DISCHARGE SYSTEMS OF KEY PLAYERS, BY CAPACITY

- 5.15.4 AVERAGE SELLING PRICE TREND OF ZERO LIQUID DISCHARGE SYSTEMS OF KEY PLAYERS, BY END-USE INDUSTRY

- 5.15.5 AVERAGE SELLING PRICE OF ZERO LIQUID DISCHARGE SYSTEMS OF KEY PLAYERS, BY END-USE INDUSTRY

- 5.15.6 AVERAGE SELLING PRICE OF ZERO LIQUID DISCHARGE SYSTEMS, BY REGION

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 PATENT ANALYSIS

- 5.17.1 APPROACH

- 5.17.2 DOCUMENT TYPE

- 5.17.3 INSIGHTS

- 5.17.4 LEGAL STATUS OF PATENTS

- 5.17.5 JURISDICTION ANALYSIS

- 5.17.6 TOP COMPANIES/APPLICANTS

- 5.17.7 TOP 10 PATENT OWNERS (US) LAST 10 YEARS

6 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY PROCESS

- 6.1 INTRODUCTION

- 6.2 ZERO LIQUID DISCHARGE PROCESSES

- 6.2.1 PRETREATMENT

- 6.2.1.1 Prevention of scaling or fouling by suspended solids and contaminants to drive market

- 6.2.2 FILTRATION

- 6.2.2.1 Reuse of recovered permeates to fuel demand

- 6.2.3 EVAPORATION/CRYSTALLIZATION

- 6.2.3.1 Demand for removal of contaminants to propel market

- 6.2.1 PRETREATMENT

7 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY CAPACITY

- 7.1 INTRODUCTION

- 7.2 SMALL SCALE

- 7.2.1 DEMAND FOR INDUSTRIES WITH LIMITED WATER RESOURCES TO DRIVE MARKET

- 7.3 MEDIUM SCALE

- 7.3.1 WIDE USE IN TEXTILES, PHARMACEUTICALS, AND FOOD PROCESSING INDUSTRIES TO PROPEL MARKET

- 7.4 LARGE SCALE

- 7.4.1 CRITICAL USE IN PETROCHEMICAL, PHARMACEUTICAL, AND POWER GENERATION SECTORS TO FUEL DEMAND

8 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 BRINE DISPOSAL

- 8.2.1 ELIMINATION OF DISCHARGE OF CONCENTRATED BRINE INTO MARINE ENVIRONMENTS TO FUEL MARKET

- 8.3 CHEMICAL WASTE

- 8.3.1 ENVIRONMENTAL REGULATIONS TO PROPEL MARKET

- 8.4 FOOD & BEVERAGE WASTE

- 8.4.1 PREVENTION OF CONTAMINATION TO DRIVE MARKET

- 8.5 ELECTRONICS

- 8.5.1 RECOVERY OF VALUABLE METALS SUCH AS GOLD, SILVER, AND PALLADIUM TO FUEL DEMAND

- 8.6 OTHER APPLICATIONS

9 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY SYSTEM

- 9.1 INTRODUCTION

- 9.2 CONVENTIONAL

- 9.2.1 REQUIREMENT IN SMALL AND MEDIUM CAPACITY PLANTS TO DRIVE MARKET

- 9.3 HYBRID

- 9.3.1 HIGH WATER RECOVERY RATE TO PROMOTE USE

10 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 ENERGY & POWER

- 10.2.1 THERMAL POWER INDUSTRY TO DRIVE MARKET

- 10.2.2 POWER GENERATION

- 10.2.3 OIL & GAS

- 10.3 CHEMICALS & PETROCHEMICALS

- 10.3.1 HIGHLY WATER-INTENSIVE SECTOR TO PROPEL MARKET

- 10.4 FOOD & BEVERAGES

- 10.4.1 SIGNIFICANT EFFLUENT VOLUMES TO FUEL DEMAND

- 10.5 TEXTILES

- 10.5.1 HEAVY EFFLUENT DISCHARGE TO DRIVE MARKET

- 10.6 PHARMACEUTICALS

- 10.6.1 DISCHARGE OF HAZARDOUS CHEMICALS AND SALTS TO PROPEL MARKET

- 10.7 SEMICONDUCTORS & ELECTRONICS

- 10.7.1 CRITICALITY OF PROCESSES TO FUEL MARKET

- 10.8 OTHER END-USE INDUSTRIES

11 ZERO LIQUID DISCHARGE SYSTEMS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Rapid growth of energy & power and chemicals & petrochemicals end-use industries to drive market

- 11.2.2 CANADA

- 11.2.2.1 Industrial expansion to enhance market demand

- 11.2.3 MEXICO

- 11.2.3.1 Scarcity of fresh water and increased investments in manufacturing sector to drive growth

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Strong manufacturing base to drive market growth

- 11.3.2 FRANCE

- 11.3.2.1 Large chemical industry to drive market

- 11.3.3 SPAIN

- 11.3.3.1 Chemicals & petrochemicals, energy & power, and pharmaceuticals sectors to drive demand

- 11.3.4 UK

- 11.3.4.1 Government policies to drive market

- 11.3.5 ITALY

- 11.3.5.1 Healthcare and pharmaceutical industries to drive demand

- 11.3.6 RUSSIA

- 11.3.6.1 Growing concerns about water scarcity and pollution to drive market

- 11.3.7 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Power and wastewater treatment sectors to propel market

- 11.4.2 JAPAN

- 11.4.2.1 Technological innovations in water treatment to propel market

- 11.4.3 INDIA

- 11.4.3.1 Urbanization and industrialization to propel market growth

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Food & beverage industry to create demand

- 11.4.5 TAIWAN

- 11.4.5.1 Regulatory framework for treatment of reclaimed water to drive market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Established infrastructure for water & wastewater treatment to lead to steady demand

- 11.4.7 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Economic diversification to enhance market growth

- 11.5.1.2 UAE

- 11.5.1.2.1 Rising oil production to boost market

- 11.5.1.3 Rest of GCC countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Large chemical industry to propel demand

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Chemical processing, pharmaceutical, oil & gas processing, and food & beverage industries to drive market

- 11.6.2 ARGENTINA

- 11.6.2.1 Investment in sanitation services to drive market growth

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019-2024

- 12.3 REVENUE ANALYSIS, 2021-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS, 2023

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 System footprint

- 12.7.5.4 Process footprint

- 12.7.5.5 End-use industry footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 EXPANSIONS

- 12.9.3 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ALFA LAVAL

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 AQUARION AG

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.3 VEOLIA

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 AQUATECH

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 GEA GROUP

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 PRAJ INDUSTRIES

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 MnM view

- 13.1.6.3.1 Right to win

- 13.1.6.3.2 Strategic choices

- 13.1.6.3.3 Weaknesses and competitive threats

- 13.1.7 H2O GMBH

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 MnM view

- 13.1.8 THERMAX LIMITED

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.8.4 MnM view

- 13.1.8.4.1 Right to win

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses and competitive threats

- 13.1.9 MITSUBISHI CHEMICAL CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.10 ANDRITZ

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.11 TOSHIBA INFRASTRUCTURE SYSTEMS & SOLUTIONS CORPORATION

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 MnM view

- 13.1.12 IEI (ION EXCHANGE)

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 MnM view

- 13.1.13 CONDORCHEM ENVIRO SOLUTIONS

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Expansions

- 13.1.13.4 MnM view

- 13.1.14 KURITA WATER INDUSTRIES LTD.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 MnM view

- 13.1.15 EVOQUA WATER TECHNOLOGIES LLC

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Deals

- 13.1.15.3.2 Expansions

- 13.1.15.4 MnM view

- 13.1.1 ALFA LAVAL

- 13.2 OTHER PLAYERS

- 13.2.1 PETRO SEP CORPORATION

- 13.2.2 FLUENCE CORPORATION LIMITED

- 13.2.3 ENVISOL ARVIND

- 13.2.4 SAMCO TECHNOLOGIES

- 13.2.5 LENNTECH B.V.

- 13.2.6 SHIVA GLOBAL ENVIRONMENTAL PRIVATE LIMITED

- 13.2.7 GMM PFAUDLER

- 13.2.8 IDE WATER TECHNOLOGIES

- 13.2.9 SALTWORKS TECHNOLOGIES INC

- 13.2.10 ENCON EVAPORATORS

- 13.2.11 SCALEBAN EQUIPMENTS PVT.LTD.

- 13.2.12 MEMSIFT INNOVATIONS PTE LTD.

- 13.2.13 GRUNDFOS

- 13.2.14 U.S. WATER SERVICES CORPORATION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS