|

|

市場調査レポート

商品コード

1596807

超軽量・軽飛行機の世界市場:販売場所別、システム別、飛行操作別、技術別、推進方式別、最終用途別、材料別、地域別 - 2029年までの予測Ultralight & Light Aircraft Market by Propulsion (Electric/Hybrid, Conventional), System (Aerostructures, Avionics, Cabin Interiors), Technology (Manned, Unmanned), Flight Operation (CTOL, VTOL), Point of Sale End Use, Material -Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 超軽量・軽飛行機の世界市場:販売場所別、システム別、飛行操作別、技術別、推進方式別、最終用途別、材料別、地域別 - 2029年までの予測 |

|

出版日: 2024年11月19日

発行: MarketsandMarkets

ページ情報: 英文 299 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

超軽量・軽飛行機の市場規模は2024年に101億7,000万米ドルと予測され、予測期間中のCAGRは11.2%と見込まれており、2029年には172億9,000万米ドルに達すると予測されています。

航空機は、観光、キャンプ、釣りなどのレクリエーション飛行に使われることが多くなっています。また、個人的な通勤などの交通手段としても利用されています。また、超軽量機や軽飛行機は、手頃な価格で維持・運用が可能です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 販売場所別、システム別、飛行操作別、技術別、推進方式別、最終用途別、材料別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

低コスト運用とメンテナンスが超軽量・軽飛行機市場の2大成長要因です。超軽量・小型航空機は、大型機と比べて設計がシンプルで、燃料消費量が少なく、機械的な複雑さも少ないため、運航コストが大幅に削減されます。このため、個人所有者やレクリエーション・パイロットから、飛行学校や小規模な商業オペレーターまで、幅広いユーザーを魅了しています。軽飛行機は、訓練や短距離任務に経済的な選択肢を提供することで、航空への幅広いアクセスを可能にしています。より軽量であることに加え、燃費の良いエンジンはメンテナンスの頻度を減らすため、個人・職業を問わず、より多くの人々にアピールすることができます。

飛行操作別では、超軽量・軽飛行機市場は従来型離着陸(CTOL)と垂直離着陸(VTOL)に区分されます。CTOLは、最も発達していながら比較的安価で、さまざまな用途に使用されるインフラを提供するため、超軽量・軽飛行機市場の大部分を占めるとも予想されます。CTOL機は滑走路を使って着陸または離陸する必要があるため、現在の小規模な地方空港の分布は、特定の独自のインフラを必要とせずに統合するのに適しています。VTOL機は通常、特に都市環境での安全な運用のために新たな施設や改修を必要とするため、これはVTOL機を上回る利点のひとつです。

当レポートでは、世界の超軽量・軽飛行機市場について調査し、販売場所別、システム別、飛行操作別、技術別、推進方式別、最終用途別、材料別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- ハイブリッドおよび電気推進の技術動向

- 価格分析

- ケーススタディ分析

- 貿易分析、2019年~2023年

- 2025年の主な会議とイベント

- 規制状況

- 購入プロセスにおける主要な利害関係者

- 技術分析

- ビジネスモデル

- 投資と資金調達のシナリオ

- 生成AI/AIの影響

- 部品表

- 技術ロードマップ

- マクロ経済見通し

第6章 業界の動向

- イントロダクション

- 技術分析

- メガトレンドの影響

- イノベーションと特許登録

第7章 超軽量・軽飛行機市場(販売場所別)

- イントロダクション

- メーカー

- アフターマーケット

第8章 超軽量・軽飛行機市場(システム別)

- イントロダクション

- 航空構造物

- 航空電子工学

- 航空機システム

- キャビン内装

第9章 超軽量・軽飛行機市場(飛行操作別)

- イントロダクション

- 従来型離着陸(CTOL)

- 垂直離着陸機(VTOL)

第10章 超軽量・軽飛行機市場(技術別)

- イントロダクション

- 有人

- 無人

第11章 超軽量・軽飛行機市場(推進方式別)

- イントロダクション

- 電動ハイブリッド

- 従来燃料

第12章 超軽量・軽飛行機市場(最終用途別)

- イントロダクション

- 民間および商業

- 軍隊

第13章 超軽量・軽飛行機市場(材料別)

- イントロダクション

- アルミニウム

- 複合材料

- その他

第14章 超軽量・軽飛行機市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東

- アフリカ

- ラテンアメリカ

第15章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析、2020年~2023年

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第16章 企業プロファイル

- 主要参入企業

- CIRRUS AIRCRAFT

- COSTRUZIONI AERONAUTICHE TECNAM SPA

- TEXTRON INC.

- PILATUS AIRCRAFT

- PIPER AIRCRAFT, INC.

- EVEKTOR AEROTECHNIK

- AMERICAN LEGEND AIRCRAFT CO.

- THRUST AIRCRAFT PRIVATE LIMITED

- AIR TRACTOR

- P&M AVIATION

- QUICKSILVER AIRCRAFT

- FLIGHT DESIGN GENERAL AVIATION GMBH

- AEROPRO

- AUTOGYRO GMBH

- VULCANAIR

- HONDA AIRCRAFT COMPANY

- その他の企業

- VOLOCOPTER GMBH

- LILIUM GMBH

- NEVA AEROSPACE

- OPENER AERO

- WISK AERO

- JOBY AVIATION

- WING AVIATION LLC

- KAREM AIRCRAFT INC.

- LIFT AIRCRAFT INC.

- XTI AIRCRAFT

第17章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 OWNERSHIP COST ANALYSIS OF ULTRALIGHT AIRCRAFT

- TABLE 3 US AIRCRAFT GENERAL AVIATION ACCIDENTS, FATAL ACCIDENTS, AND FATALITIES, 2013-2019

- TABLE 4 ULTRALIGHT AND LIGHT AIRCRAFT MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE OF LIGHT AIRCRAFT, 2023 (USD MILLION)

- TABLE 6 PRICE LIST FOR CIRRUS AIRCRAFT

- TABLE 7 AVERAGE SELLING PRICE OF KEY PLAYERS FOR ULTRALIGHT AND LIGHT AIRCRAFT (USD THOUSAND)

- TABLE 8 ULTRALIGHT AND LIGHT AIRCRAFT MARKET: KEY CONFERENCES AND EVENTS, 2025

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ULTRALIGHT AND LIGHT AIRCRAFT (%)

- TABLE 14 KEY BUYING CRITERIA FOR ULTRALIGHT AND LIGHT AIRCRAFT TYPES

- TABLE 15 BUSINESS MODELS IN ULTRALIGHT AND LIGHT AIRCRAFT MARKET

- TABLE 16 MAJOR DEVELOPMENTS IN DRONE TAXIES

- TABLE 17 PATENT REGISTRATIONS, 2020-2024

- TABLE 18 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

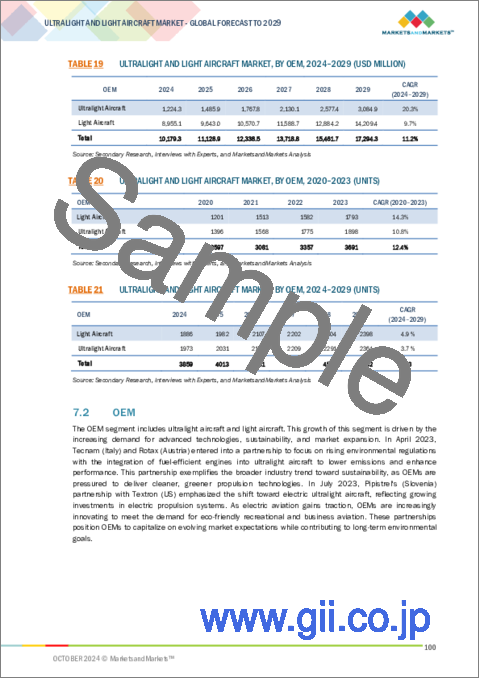

- TABLE 19 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 20 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (UNITS)

- TABLE 21 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (UNITS)

- TABLE 22 AEROLITE 103: SPECIFICATIONS

- TABLE 23 CESSNA 162 SKYCATCHER: SPECIFICATIONS

- TABLE 24 DA 40 NG: SPECIFICATIONS

- TABLE 25 KING AIR 260: SPECIFICATIONS

- TABLE 26 LIGHT AIRCRAFT MARKET, BY MTOW, 2020-2023 (USD MILLION)

- TABLE 27 LIGHT AIRCRAFT MARKET, BY MTOW, 2024-2029 (USD MILLION)

- TABLE 28 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY AFTERMARKET, 2020-2023 (USD MILLION)

- TABLE 29 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY AFTERMARKET, 2024-2029 (USD MILLION)

- TABLE 30 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 31 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 32 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 33 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 34 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 35 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 36 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 37 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 38 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY ELECTRIC-HYBRID PROPULSION, 2020-2023 (USD MILLION)

- TABLE 39 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY ELECTRIC-HYBRID PROPULSION, 2024-2029 (USD MILLION)

- TABLE 40 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY CONVENTIONAL FUEL, 2020-2023 (USD MILLION)

- TABLE 41 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY CONVENTIONAL FUEL, 2024-2029 (USD MILLION)

- TABLE 42 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 43 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 44 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY CIVIL & COMMERCIAL END USE, 2020-2023 (USD MILLION)

- TABLE 45 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY CIVIL & COMMERCIAL END USE, 2024-2029 (USD MILLION)

- TABLE 46 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MILITARY END USE, 2020-2023 (USD MILLION)

- TABLE 47 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MILITARY END USE, 2024-2029 (USD MILLION)

- TABLE 48 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 49 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 50 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 51 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 53 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 54 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 55 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 56 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 57 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 58 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR CIVIL & COMMERCIAL END USE, 2020-2023 (USD MILLION)

- TABLE 59 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR CIVIL & COMMERCIAL END USE, 2024-2029 (USD MILLION)

- TABLE 60 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR MILITARY END USE, 2020-2023 (USD MILLION)

- TABLE 61 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR MILITARY END USE, 2024-2029 (USD MILLION)

- TABLE 62 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 63 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 64 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 65 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 66 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 67 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 68 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 69 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 70 US: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 71 US: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 72 US: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 73 US: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 74 US: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 75 US: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 76 US: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 77 US: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 78 CANADA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 79 CANADA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 80 CANADA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 81 CANADA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 82 CANADA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 83 CANADA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 84 CANADA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 85 CANADA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 86 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 87 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 88 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 89 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 90 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 91 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 92 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR CIVIL & COMMERCIAL END USE, 2020-2023 (USD MILLION)

- TABLE 93 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR CIVIL & COMMERCIAL END USE, 2024-2029 (USD MILLION)

- TABLE 94 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR MILITARY END USE, 2020-2023 (USD MILLION)

- TABLE 95 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR MILITARY END USE, 2024-2029 (USD MILLION)

- TABLE 96 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 97 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 98 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 99 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 100 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 101 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 102 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 103 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 104 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 105 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 106 UK: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 107 UK: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 108 UK: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 109 UK: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 110 UK: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 111 UK: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 112 UK: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 113 UK: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 114 FRANCE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 115 FRANCE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 116 FRANCE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 117 FRANCE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 118 FRANCE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 119 FRANCE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 120 FRANCE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 121 FRANCE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 122 GERMANY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 123 GERMANY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 124 GERMANY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 125 GERMANY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 126 GERMANY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 127 GERMANY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 128 GERMANY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 129 GERMANY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 130 RUSSIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 131 RUSSIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 132 RUSSIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 133 RUSSIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 134 RUSSIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 135 RUSSIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 136 RUSSIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 137 RUSSIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 138 ITALY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 139 ITALY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 140 ITALY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 141 ITALY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 142 ITALY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 143 ITALY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 144 ITALY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 145 ITALY: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 146 SPAIN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 147 SPAIN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 148 SPAIN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 149 SPAIN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 150 SPAIN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 151 SPAIN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 152 SPAIN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 153 SPAIN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 154 REST OF EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 155 REST OF EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 156 REST OF EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 157 REST OF EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 158 REST OF EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 159 REST OF EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 160 REST OF EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 161 REST OF EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 162 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 163 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 164 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 165 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 166 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 167 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 168 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR CIVIL & COMMERCIAL END USE, 2020-2023 (USD MILLION)

- TABLE 169 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR CIVIL & COMMERCIAL END USE, 2024-2029 (USD MILLION)

- TABLE 170 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR MILITARY END USE, 2020-2023 (USD MILLION)

- TABLE 171 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR MILITARY END USE, 2024-2029 (USD MILLION)

- TABLE 172 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 173 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 174 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 175 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 176 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 177 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 178 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 179 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 180 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 181 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 182 CHINA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 183 CHINA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 184 CHINA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 185 CHINA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 186 CHINA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 187 CHINA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 188 CHINA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 189 CHINA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 190 INDIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 191 INDIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 192 INDIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 193 INDIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 194 INDIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 195 INDIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 196 INDIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 197 INDIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 198 JAPAN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 199 JAPAN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 200 JAPAN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 201 JAPAN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 202 JAPAN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 203 JAPAN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 204 JAPAN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 205 JAPAN: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 206 AUSTRALIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 207 AUSTRALIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 208 AUSTRALIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 209 AUSTRALIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 210 AUSTRALIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 211 AUSTRALIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 212 AUSTRALIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 213 AUSTRALIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 214 SOUTH KOREA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 215 SOUTH KOREA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 216 SOUTH KOREA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 217 SOUTH KOREA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 218 SOUTH KOREA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 219 SOUTH KOREA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 220 SOUTH KOREA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 221 SOUTH KOREA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 222 REST OF ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 224 REST OF ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 225 REST OF ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 226 REST OF ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 227 REST OF ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 228 REST OF ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 229 REST OF ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 230 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 231 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 232 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 233 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 234 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 235 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 236 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR CIVIL & COMMERCIAL END USE, 2020-2023 (USD MILLION)

- TABLE 237 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR CIVIL & COMMERCIAL END USE, 2024-2029 (USD MILLION)

- TABLE 238 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR MILITARY END USE, 2020-2023 (USD MILLION)

- TABLE 239 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR MILITARY END USE, 2024-2029 (USD MILLION)

- TABLE 240 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 241 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 242 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 243 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 244 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 245 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 246 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 247 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 248 UAE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 249 UAE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 250 UAE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 251 UAE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 252 UAE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 253 UAE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 254 UAE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 255 UAE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 256 SAUDI ARABIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 257 SAUDI ARABIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 258 SAUDI ARABIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 259 SAUDI ARABIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 260 SAUDI ARABIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 261 SAUDI ARABIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 262 SAUDI ARABIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 263 SAUDI ARABIA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 264 REST OF MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 265 REST OF MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 266 REST OF MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 267 REST OF MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 268 REST OF MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 269 REST OF MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 270 REST OF MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 271 REST OF MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 272 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 273 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 274 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 275 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 276 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 277 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 278 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR CIVIL & COMMERCIAL END USE, 2020-2023 (USD MILLION)

- TABLE 279 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR CIVIL & COMMERCIAL END USE, 2024-2029 (USD MILLION)

- TABLE 280 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR MILITARY END USE, 2020-2023 (USD MILLION)

- TABLE 281 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET FOR MILITARY END USE, 2024-2029 (USD MILLION)

- TABLE 282 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 283 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 284 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 285 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 286 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 287 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 288 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 289 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 290 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 291 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 292 SOUTH AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 293 SOUTH AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 294 SOUTH AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 295 SOUTH AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 296 SOUTH AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 297 SOUTH AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 298 SOUTH AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 299 SOUTH AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 300 REST OF AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2020-2023 (USD MILLION)

- TABLE 301 REST OF AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- TABLE 302 REST OF AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 303 REST OF AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 304 REST OF AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2020-2023 (USD MILLION)

- TABLE 305 REST OF AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- TABLE 306 REST OF AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 307 REST OF AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 ULTRALIGHT AND LIGHT AIRCRAFT MARKET SEGMENTATION

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 ULTRALIGHT AND LIGHT AIRCRAFT MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- FIGURE 7 AIRCRAFT SYSTEMS TO LEAD ULTRALIGHT AND LIGHT AIRCRAFT MARKET DURING FORECAST PERIOD

- FIGURE 8 MANNED TECHNOLOGY SEGMENT TO LEAD ULTRALIGHT AND LIGHT AIRCRAFT MARKET BY 2029

- FIGURE 9 CONVENTIONAL FUEL TO HOLD LARGER SHARE OF ULTRALIGHT AND LIGHT AIRCRAFT MARKET THAN ELECTRIC-HYBRID DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 DEMAND FOR URBAN AIR MOBILITY AND PASSENGER DRONES TO DRIVE MARKET

- FIGURE 12 ULTRALIGHT AIRCRAFT SEGMENT TO CAPTURE LARGER MARKET SHARE THAN LIGHT AIRCRAFT DURING FORECAST PERIOD

- FIGURE 13 CTOL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 COMPOSITES TO BE LEADING MATERIAL SEGMENT DURING FORECAST PERIOD

- FIGURE 15 CIVIL & COMMERCIAL TO REGISTER HIGHER CAGR THAN MILITARY SEGMENT DURING FORECAST PERIOD

- FIGURE 16 ULTRALIGHT AND LIGHT AIRCRAFT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 ULTRALIGHT AND LIGHT AIRCRAFT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 19 ULTRALIGHT AND LIGHT AIRCRAFT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 20 AVERAGE SELLING PRICE OF KEY PLAYERS FOR ULTRALIGHT AND LIGHT AIRCRAFT

- FIGURE 21 AVERAGE SELLING PRICE OF ULTRALIGHT AND LIGHT AIRCRAFT, BY REGION, 2020-2023 (USD MILLION)

- FIGURE 22 IMPORT DATA OF HS CODE 8802, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 23 EXPORT DATA OF HS CODE 8802, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ULTRALIGHT AND LIGHT AIRCRAFT

- FIGURE 25 KEY BUYING CRITERIA

- FIGURE 26 KEY PLAYERS AND BUSINESS MODELS OPERATING IN ULTRALIGHT AND LIGHT AIRCRAFT MARKET

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 28 GENERATIVE AI LANDSCAPE

- FIGURE 29 ADOPTION OF GENERATIVE AI IN COMMERCIAL AVIATION BY TOP COUNTRIES

- FIGURE 30 BILL OF MATERIALS FOR ULTRALIGHT AIRCRAFT

- FIGURE 31 BILL OF MATERIALS FOR LIGHT AIRCRAFT

- FIGURE 32 EVOLUTION OF ULTRALIGHT AND LIGHT AIRCRAFT

- FIGURE 33 ADOPTION OF ULTRALIGHT AND LIGHT AIRCRAFT TECHNOLOGY

- FIGURE 34 HYBRID-ELECTRIC PROPULSION SYSTEM ARCHITECTURE

- FIGURE 35 ALL-ELECTRIC PROPULSION SYSTEM ARCHITECTURE

- FIGURE 36 NUMBER OF PATENTS GRANTED FOR ULTRALIGHT AND LIGHT AIRCRAFT MARKET, 2014-2023

- FIGURE 37 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM, 2024-2029 (USD MILLION)

- FIGURE 38 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- FIGURE 39 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION, 2024-2029 (USD MILLION)

- FIGURE 40 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- FIGURE 41 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- FIGURE 42 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE, 2024-2029 (USD MILLION)

- FIGURE 43 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- FIGURE 44 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 45 NORTH AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET SNAPSHOT

- FIGURE 46 EUROPE: ULTRALIGHT AND LIGHT AIRCRAFT MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: ULTRALIGHT AND LIGHT AIRCRAFT MARKET SNAPSHOT

- FIGURE 48 MIDDLE EAST: ULTRALIGHT AND LIGHT AIRCRAFT MARKET SNAPSHOT

- FIGURE 49 AFRICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET SNAPSHOT

- FIGURE 50 LATIN AMERICA: ULTRALIGHT AND LIGHT AIRCRAFT MARKET SNAPSHOT

- FIGURE 51 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020-2023

- FIGURE 52 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 53 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 54 ULTRALIGHT AND LIGHT AIRCRAFT MARKET: COMPANY FOOTPRINT

- FIGURE 55 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 56 VALUATION OF PROMINENT MARKET PLAYERS, 2023

- FIGURE 57 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS, 2023

- FIGURE 58 BRAND/PRODUCT COMPARISON

- FIGURE 59 TEXTRON INC.: COMPANY SNAPSHOT

- FIGURE 60 PILATUS AIRCRAFT: COMPANY SNAPSHOT

The ultralight and light aircraft market is estimated to be USD 10.17 billion in 2024 and is projected to reach USD 17.29 billion by 2029, at a CAGR of 11.2 % during the forecast period. The aircraft is increasingly being used for recreational flying, such as sightseeing, camping, and fishing. They are also used for transportation, such as personal commuting. Ultralight and light aircraft also affordable to maintain and operate.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Propulsion, System, Technology, Flight Operation, Point of Sale End Use and Material |

| Regions covered | North America, Europe, APAC, RoW |

"Low-cost operation and maintenance of ultralight aircraft are driving the ultralight and light aircraft market."

Low-cost operations and maintenance are the two main growth drivers in the ultralight and light aircraft market. These have simpler designs, consume lesser fuel, and have less mechanical complexity compared to their larger counterparts, which significantly cuts down on the operating cost. This has attracted wide users, ranging from private owners and recreational pilots to flight schools and small commercial operators. Light aircraft present an economical alternative for training and short-haul missions, thereby allowing wider access to aviation. Being more lightweight plus fuel-efficient engines reduce the frequency of maintenance and thus appeal to more people in both personal and professional sectors.

"Based on flight operation, the CTOL segment accounts for the largest market size during the forecast period."

Based on flight operation, the ultralight and light aircraft market is segmented into Conventional Take-off and Landing (CTOL) and Vertical Take-off and Landing (VTOL). CTOLs are also expected to capture the bulk of the market for ultralight and light aircraft because they provide an infrastructure that is most well-developed, yet relatively cheaper, and used in different applications. A CTOL aircraft needs to land or take off with a runway, making the current distribution of small regional airports friendly to them to integrate without requiring specific and unique infrastructures. This is one benefit over VTOL aircraft, since those normally require new or modified facilities for safe operation, particularly in urban environments.

The cost is relatively low on development, production, and operations for the CTOL aircraft compared to the newest emerging VTOL models. This is because the operating procedures of the CTOLs are not very complex and involve a known technology base that guarantees the dependability of the aircraft, which is less costly to maintain. Such factors make the aircraft appealing to personal and recreational pilots, flight schools, and small businesses.

"Based on the system, the aircraft systems segment is projected to grow at the highest CAGR during the forecast period."

Based on system, the ultralight and light aircraft market is segmented into aerostructure, avionics, aircraft systems, and cabin interiors. Aircraft systems will dominate the ultralight and light aircraft market because of their critical role in enhancement of performance, safety, and user experience as this sector attracts a wider range of pilots and applications. The, autopilot, stability controls, and safety features are becoming more complex and reachable with the advancement of digital technology and miniaturization. For example, those formerly only available on higher-up, commercial aircraft-now, digital avionics and glass cockpits are available on many small light and ultralight planes. This capability includes real-time feeds that navigate, weather, or information on engine performance right out to the pilot through direct vision, providing infinitely higher situational awareness than there could be before and ease a pilot's flying for this reason.

"Based on technology , the unmanned segment to grow at the highest CAGR during the forecast period."

The ultralight and light aircraft market has been segmented on the basis of technology into the manned and unmanned segments. Unmanned segment is projected to grow at the highest CAGR as UAV has more prominent benefits than manned counterparts with respect to all applications pertaining to safety, cost, and convenience. These aircraft can do tasks and operate in conditions that would be too dangerous or impractical for a human pilot, including surveillance, agricultural monitoring, search and rescue, and environmental research. Therefore, agricultural operations, infrastructure inspection, and public safety are all finding a use for unmanned aircraft in order to provide very accurate and efficient operation.

"Asia Pacific is projected to account for the second largest market share during the forecast period."

The Asia-Pacific region is expected to account for the second largest market share due to several strong factors, such as high economic growth, rising disposable incomes, and a growing interest in aviation. The more these countries continue to expand their economies, more people and businesses are looking at having affordable air travel options, which boost demand for light aircraft to be used for personal, recreational, and commercial purposes.

In addition, the region's vast geography, comprising many islands and remote areas, presents unique opportunities for light aircraft to provide essential connectivity where traditional transportation options may be limited. Another emerging trend is urban air mobility solutions, including air taxis and cargo drones, gaining traction in densely populated cities, stimulating demand further.

The break-up of profile of primary participants in the ultralight and light aircraft market:

- By Company Type: Tier 1 - 49%, Tier 2 - 37%, and Tier 3 - 14%

- By Designation: C Level - 55%, Director Level - 27%, and Others - 18%

- By Region: North America - 32%, Europe - 32%, Asia Pacific - 16%, Middle East & Africa - 10%, Latin America - 10%

Major players operating in the ultralight and light aircraft market are Cirrus Aircraft (US), Costruzioni Aeronautiche TECNAM SpA (Italy) , Textron Inc. (US) , Pilatus Aircraft (US) , Piper Aircraft, Inc. (US) , Evektor Aerotechnik (Czech Republic) , American Legend Aircraft Co. (US) , Thrust Aircraft Private Limited (India) , Air Tractor (US) , P&M Aviation (India) , Quicksilver Aircraft (US) , Flight Design General Aviation GmbH (Germany) , Aeropro (Canada), Autogyro GmbH (Germany) , Vulcanair (Italy), Honda Aircraft Company (Japan).

Research Coverage:

This research report categorizes the ultralight and light aircraft market basis of By Pointt of sale (OEM and Aftermarket) , End Use (Civil and Commercial and Military),Flight Operation (CTOL and VTOL), Technology (Manned and Unmanned), Propulsion (Conventional Fuel and Electric-Hybrid), Material (Aluminium, Composites and Other Materials), System (Aerostructures, Avionics, Cabin Interiors and Aircraft Systems), in these segments have been mapped across major Regions (North America, Europe, Asia Pacific, Middle East and Africa, Latin America).

A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; agreements, collaborations, new product launches, contracts, expansion, acquisitions, and partnerships associated with the aircraft health monitoring market. Competitive analysis of upcoming startups in the ultralight and light aircraft market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall ultralight and light aircraft market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- The scope of the report covers detailed information regarding the major factors, such as drivers ( Low-cost operation and maintenance of ultralight aircraft, Growing use of UAVs in various military operations , Growing use of light aircraft in aviation schools, Growing demand for personal and recreational flying), restraints ( Delay in aircraft deliveries, Safety considerations for operation of ultralight and light aircraft), challenges ( Development costs outweigh benefits of ultralight and light aircraft, Limited range and payload of ultralight aircraft), and opportunities (Advancements in traditional aircraft propulsion, advancements in passenger drones and UAV payload), influencing the growth of the ultralight and light aircraft market.

- Market Penetration: Comprehensive information on ultralight and light aircraft offered by the top players in the market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the ultralight and light aircraft market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the aircraft health monitoring market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Ultralight and light aircraft market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players in the ultralight and light aircraft market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.2.1 Rise in global air passenger and cargo traffic

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SCOPE

- 2.3.1 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TYPE

- 2.3.2 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE

- 2.3.3 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION

- 2.4 RESEARCH APPROACH AND METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Regional ultralight and light aircraft market

- 2.4.1.2 Segment size of ultralight and light aircraft market

- 2.4.1.3 Ultralight and light aircraft market, by end use

- 2.4.1.4 Ultralight and light aircraft market, by hybrid-electric

- 2.4.2 PRICING ANALYSIS

- 2.4.3 TOP-DOWN APPROACH

- 2.4.4 CONVENTIONAL ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY REGION AND COUNTRY

- 2.4.5 HYBRID-ELECTRIC ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY REGION AND COUNTRY

- 2.4.6 OVERALL ULTRALIGHT AND LIGHT MARKET, BY REGION AND COUNTRY

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.6.1 CONVENTIONAL ULTRALIGHT AND LIGHT AIRCRAFT

- 2.6.2 HYBRID-ELECTRIC ULTRALIGHT AND LIGHT AIRCRAFT

- 2.6.3 ULTRALIGHT AND LIGHT AIRCRAFT AFTERMARKET

- 2.6.4 OTHER ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ULTRALIGHT AND LIGHT AIRCRAFT MARKET

- 4.2 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM

- 4.3 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION

- 4.4 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL

- 4.5 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Low-cost operation and maintenance of ultralight aircraft

- 5.2.1.2 Increasing use of UAVs in various military operations

- 5.2.1.3 Growing use of light aircraft in aviation schools

- 5.2.1.4 Rising demand for personal and recreational flying

- 5.2.2 RESTRAINTS

- 5.2.2.1 Delay in aircraft deliveries

- 5.2.2.2 Safety considerations for operation of ultralight and light aircraft

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in traditional aircraft propulsion

- 5.2.3.2 Advancements in passenger drones and UAV payload

- 5.2.4 CHALLENGES

- 5.2.4.1 Development costs outweigh benefits of ultralight and light aircraft

- 5.2.4.2 Limited range and payload of ultralight aircraft

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- 5.6 TECHNOLOGY TRENDS IN HYBRID AND ELECTRIC PROPULSION

- 5.6.1 FUEL CELLS

- 5.6.2 LITHIUM-SULFUR (LI-S)

- 5.6.3 DISTRIBUTED ELECTRIC PROPULSION (DEP)

- 5.6.4 MULTIFUNCTIONAL STRUCTURES FOR HIGH-ENERGY LIGHTWEIGHT LOADBEARING STORAGE (M-SHELLS)

- 5.6.5 INTEGRATED COMPUTATIONAL-EXPERIMENTAL DEVELOPMENT OF LI-AIR BATTERIES FOR ELECTRIC AIRCRAFT

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF LIGHT AIRCRAFT

- 5.7.2 AVERAGE SELLING PRICE OF KEY PLAYERS FOR ULTRALIGHT AND LIGHT AIRCRAFT

- 5.7.3 AVERAGE SELLING PRICE OF ULTRALIGHT AND LIGHT AIRCRAFT, BY REGION

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CASE STUDY 1: VTOL BUSINESS JET

- 5.8.2 CASE STUDY 2: FIRST MANNED TEST OF EVTOL

- 5.8.3 CASE STUDY 3: EVTOL FOR AGRICULTURAL APPLICATIONS

- 5.9 TRADE ANALYSIS, 2019-2023

- 5.10 KEY CONFERENCES AND EVENTS, 2025

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 NORTH AMERICA

- 5.11.2 EUROPE

- 5.11.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.1.1 Battery and energy storage solutions

- 5.13.1.2 Hybrid powertrains

- 5.13.2 COMPLEMENTARY TECHNOLOGIES

- 5.13.2.1 Advanced coating and anti-corrosion technologies

- 5.13.2.2 Lightweight solar panels

- 5.13.1 KEY TECHNOLOGIES

- 5.14 BUSINESS MODELS

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 IMPACT OF GENERATIVE AI/AI

- 5.16.1 INTRODUCTION

- 5.16.2 ADOPTION OF GENERATIVE AI IN COMMERCIAL AVIATION BY TOP COUNTRIES

- 5.17 BILL OF MATERIALS

- 5.18 TECHNOLOGY ROADMAP

- 5.19 MACROECONOMIC OUTLOOK

- 5.19.1 NORTH AMERICA

- 5.19.2 EUROPE

- 5.19.3 ASIA PACIFIC

- 5.19.4 MIDDLE EAST

- 5.19.5 LATIN AMERICA

- 5.19.6 AFRICA

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY ANALYSIS

- 6.2.1 PASSENGER DRONES

- 6.2.2 COMBAT DRONES

- 6.2.3 EVTOL AIRCRAFT

- 6.2.4 URBAN AIR MOBILITY

- 6.2.5 ADVANCED AVIONICS

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 ELECTRIC PROPULSION

- 6.3.1.1 Hybrid electric propulsion system design

- 6.3.1.2 All-electric propulsion system design

- 6.3.2 AUTONOMOUS AIRCRAFT

- 6.3.3 ADVANCED MATERIALS AND MANUFACTURING

- 6.3.1 ELECTRIC PROPULSION

- 6.4 INNOVATIONS AND PATENT REGISTRATIONS

7 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY POINT OF SALE

- 7.1 INTRODUCTION

- 7.2 OEM

- 7.2.1 ULTRALIGHT AIRCRAFT

- 7.2.1.1 Advancement in sustainable aviation technologies to drive market.

- 7.2.1.2 <400 KG MTOW

- 7.2.1.3 400-600 KG MTOW

- 7.2.2 LIGHT AIRCRAFT

- 7.2.2.1 Growing demand for private and business aviation to drive market

- 7.2.3 600-2,500 KG MTOW

- 7.2.4 2,500-5,700 KG MTOW

- 7.2.1 ULTRALIGHT AIRCRAFT

- 7.3 AFTERMARKET

- 7.3.1 MRO

- 7.3.1.1 increasing regulatory requirements to drive market

- 7.3.2 PARTS REPLACEMENTS

- 7.3.2.1 Emphasis on modernization and regulatory compliance to drive market

- 7.3.1 MRO

8 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM

- 8.1 INTRODUCTION

- 8.2 AEROSTRUCTURES

- 8.2.1 DEMAND FOR LIGHTWEIGHT MATERIALS TO DRIVE MARKET

- 8.3 AVIONICS

- 8.3.1 NEED FOR REAL-TIME DATA AND SITUATIONAL AWARENESS TO ENSURE PASSENGER SAFETY TO DRIVE MARKET

- 8.4 AIRCRAFT SYSTEMS

- 8.4.1 TECHNOLOGICAL ADVANCEMENTS IN ELECTRIC PROPULSION TO DRIVE MARKET

- 8.5 CABIN INTERIORS

- 8.5.1 INCREASING DEMAND FOR IN-FLIGHT ENTERTAINMENT SYSTEMS FOR BUSINESS AIRCRAFT TO DRIVE MARKET

9 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION

- 9.1 INTRODUCTION

- 9.2 CONVENTIONAL TAKE-OFF AND LANDING (CTOL)

- 9.2.1 SUITABLE FOR PRIVATE JETS, FLIGHT TRAINING, AND SHORT-DISTANCE TRAVEL

- 9.3 VERTICAL TAKE-OFF AND LANDING (VTOL)

- 9.3.1 IDEAL FOR ENVIRONMENTS WITHOUT RUNWAY INFRASTRUCTURE

10 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 MANNED

- 10.2.1 INCREASING DEMAND IN COMMERCIAL AND AGRICULTURAL APPLICATIONS TO DRIVE MARKET

- 10.3 UNMANNED

- 10.3.1 OPERATES ON PRE-DETERMINED SET OF AUTOMATED COMMANDS

11 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION

- 11.1 INTRODUCTION

- 11.2 ELECTRIC-HYBRID

- 11.2.1 HYBRID

- 11.2.1.1 Solar

- 11.2.1.1.1 Rising demand for zero-emission aircraft to drive market

- 11.2.1.2 Battery

- 11.2.1.2.1 Growing popularity of hybrid electric aircraft models to drive market

- 11.2.1.3 Fuel Cell

- 11.2.1.3.1 Need to reduce fuel consumption and emissions to drive market

- 11.2.1.1 Solar

- 11.2.2 FULLY ELECTRIC

- 11.2.2.1 Heavy investment in R&D to drive market

- 11.2.1 HYBRID

- 11.3 CONVENTIONAL FUEL

- 11.3.1 TURBOPROP

- 11.3.1.1 Superior fuel efficiency over traditional jet engines to drive market

- 11.3.2 PISTON ENGINE

- 11.3.2.1 Low cost and high performance to drive market

- 11.3.1 TURBOPROP

12 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE

- 12.1 INTRODUCTION

- 12.2 CIVIL & COMMERCIAL

- 12.2.1 PASSENGER

- 12.2.1.1 Lower operating and maintenance costs of light business aircraft to drive market

- 12.2.1.2 Use case: Pilatus PC-12 in passenger charter services

- 12.2.2 PERSONAL

- 12.2.2.1 Increasing procurement of light aircraft for business travel to drive market

- 12.2.2.2 Use case: Piper Navajo Chieftain for executive business travel

- 12.2.3 COMMERCIAL CARGO

- 12.2.3.1 Helps in transfer of cargo to remote areas

- 12.2.3.2 Use case: Cessna 208 Caravan in cargo transport

- 12.2.4 TRAINING

- 12.2.4.1 Constant demand for pilot training to drive market

- 12.2.4.2 Use case: TRAC20 G7 at Western Michigan University for pilot training

- 12.2.5 AGRICULTURE

- 12.2.5.1 Demand in various farming tasks to drive market

- 12.2.5.2 Use case: Air Tractor AT-802 for agricultural spraying

- 12.2.6 SURVEY & RESEARCH

- 12.2.6.1 Need to collect important data to drive market

- 12.2.6.2 Use case: Dornier 228 in environmental surveying

- 12.2.7 MEDICAL

- 12.2.7.1 Usage in emergency services

- 12.2.7.2 Use case: Med-Trans Corporation and Beechcraft King Air 350

- 12.2.1 PASSENGER

- 12.3 MILITARY

- 12.3.1 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

- 12.3.1.1 Gathers battle intelligence through surveillance

- 12.3.1.2 Use case: ISR support in anti-terrorism operations

- 12.3.2 SEARCH & RESCUE

- 12.3.2.1 Provides aid during distress situations

- 12.3.2.2 Use case: Mountainous search & rescue operation

- 12.3.3 MILITARY CARGO

- 12.3.3.1 Transfers cargo to sensitive military locations

- 12.3.3.2 Use case: Rapid resupply in remote combat outpost

- 12.3.4 TRAINING

- 12.3.4.1 Conducts training of pilots for military flying

- 12.3.4.2 Use case: US Air Force Pilot Training Program

- 12.3.1 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

13 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL

- 13.1 INTRODUCTION

- 13.2 ALUMINUM

- 13.2.1 LIGHTWEIGHT AND HIGH-STRENGTH MATERIAL

- 13.3 COMPOSITES

- 13.3.1 ADVANTAGE OF BEING LIGHTER THAN ALUMINUM

- 13.4 OTHER MATERIALS

14 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 PESTLE ANALYSIS

- 14.2.2 US

- 14.2.2.1 Rising demand for personal aviation to drive market

- 14.2.3 CANADA

- 14.2.3.1 Rising interest in recreational aviation to drive market

- 14.3 EUROPE

- 14.3.1 PESTLE ANALYSIS

- 14.3.2 UK

- 14.3.2.1 Technological advancements and increasing interest in sustainable aviation to drive market

- 14.3.3 FRANCE

- 14.3.3.1 R&D of green aviation to drive market

- 14.3.4 GERMANY

- 14.3.4.1 Government environmental policies to drive market

- 14.3.5 RUSSIA

- 14.3.5.1 Increasing adoption of light aircraft in rural areas to drive market

- 14.3.6 ITALY

- 14.3.6.1 Government incentives for R&D in green aviation technologies to drive market

- 14.3.7 SPAIN

- 14.3.7.1 Investment in aviation R&D to drive market

- 14.3.8 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 PESTLE ANALYSIS

- 14.4.2 CHINA

- 14.4.2.1 Regulatory reforms and increasing investments in domestic aerospace technology to drive market

- 14.4.3 INDIA

- 14.4.3.1 UDAN scheme for regional air travel to drive market

- 14.4.4 JAPAN

- 14.4.4.1 Focus on aerospace innovation to drive market

- 14.4.5 AUSTRALIA

- 14.4.5.1 Favorable aviation regulations to drive market

- 14.4.6 SOUTH KOREA

- 14.4.6.1 Increasing interest in private aviation to drive market

- 14.4.7 REST OF ASIA PACIFIC

- 14.5 MIDDLE EAST

- 14.5.1 PESTLE ANALYSIS

- 14.5.2 GCC

- 14.5.2.1 UAE

- 14.5.2.1.1 Growing popularity of desert tourism to drive market

- 14.5.2.2 Saudi Arabia

- 14.5.2.2.1 Expanding aviation accessibility to drive market

- 14.5.2.1 UAE

- 14.5.3 REST OF MIDDLE EAST

- 14.6 AFRICA

- 14.6.1 PESTLE ANALYSIS

- 14.6.2 SOUTH AFRICA

- 14.6.2.1 Well-established aviation ecosystem to drive market

- 14.6.3 REST OF AFRICA

- 14.7 LATIN AMERICA

- 14.7.1 PESTLE ANALYSIS

- 14.7.2 BRAZIL

- 14.7.2.1 Government's aviation programs to improve connectivity in remote areas to drive market

- 14.7.3 MEXICO

- 14.7.3.1 Booming tourism sector to drive market

- 14.7.4 REST OF LATIN AMERICA

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 15.3 REVENUE ANALYSIS, 2020-2023

- 15.4 MARKET SHARE ANALYSIS, 2023

- 15.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 15.5.1 STARS

- 15.5.2 EMERGING LEADERS

- 15.5.3 PERVASIVE PLAYERS

- 15.5.4 PARTICIPANTS

- 15.5.5 COMPANY FOOTPRINT

- 15.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 RESPONSIVE COMPANIES

- 15.6.3 DYNAMIC COMPANIES

- 15.6.4 STARTING BLOCKS

- 15.6.5 COMPETITIVE BENCHMARKING

- 15.7 COMPANY VALUATION AND FINANCIAL METRICS

- 15.8 BRAND/PRODUCT COMPARISON

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 CIRRUS AIRCRAFT

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 COSTRUZIONI AERONAUTICHE TECNAM SPA

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 TEXTRON INC.

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 PILATUS AIRCRAFT

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 PIPER AIRCRAFT, INC.

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 EVEKTOR AEROTECHNIK

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.7 AMERICAN LEGEND AIRCRAFT CO.

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.8 THRUST AIRCRAFT PRIVATE LIMITED

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.9 AIR TRACTOR

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.10 P&M AVIATION

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.11 QUICKSILVER AIRCRAFT

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Solutions/Services offered

- 16.1.12 FLIGHT DESIGN GENERAL AVIATION GMBH

- 16.1.12.1 Business overview

- 16.1.12.2 Products/Solutions/Services offered

- 16.1.12.3 Recent developments

- 16.1.13 AEROPRO

- 16.1.13.1 Business overview

- 16.1.13.2 Products/Solutions/Services offered

- 16.1.14 AUTOGYRO GMBH

- 16.1.14.1 Business overview

- 16.1.14.2 Products/Solutions/Services offered

- 16.1.15 VULCANAIR

- 16.1.15.1 Business overview

- 16.1.15.2 Products/Solutions/Services offered

- 16.1.16 HONDA AIRCRAFT COMPANY

- 16.1.16.1 Business overview

- 16.1.16.2 Products/Solutions/Services offered

- 16.1.1 CIRRUS AIRCRAFT

- 16.2 OTHER PLAYERS

- 16.2.1 VOLOCOPTER GMBH

- 16.2.2 LILIUM GMBH

- 16.2.3 NEVA AEROSPACE

- 16.2.4 OPENER AERO

- 16.2.5 WISK AERO

- 16.2.6 JOBY AVIATION

- 16.2.7 WING AVIATION LLC

- 16.2.8 KAREM AIRCRAFT INC.

- 16.2.9 LIFT AIRCRAFT INC.

- 16.2.10 XTI AIRCRAFT

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS