|

|

市場調査レポート

商品コード

1594718

ハイブリッドUAVの世界市場:タイプ別、推進方式別、耐久性別、産業別、動力別、地域別 - 2030年までの予測Hybrid UAV Market by Type (STOL UAV, Multirotor UAV, Lift + Cruise UAV), Industry (Commercial, Defense & Government), Propulsion (Hybrid Electric, Fuel cell), Endurance (Short, Medium, Long), Power and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ハイブリッドUAVの世界市場:タイプ別、推進方式別、耐久性別、産業別、動力別、地域別 - 2030年までの予測 |

|

出版日: 2024年11月15日

発行: MarketsandMarkets

ページ情報: 英文 254 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

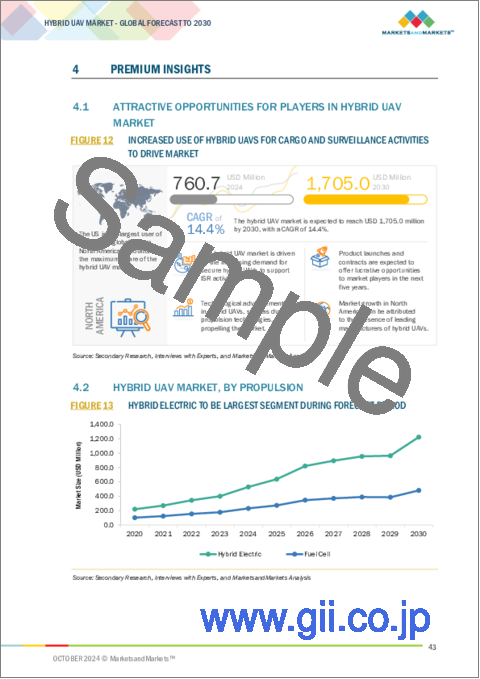

ハイブリッドUAVの市場規模は、2024年には7億6,070万機、2030年には17億500万機になると予測され、CAGRは14.4%と見込まれています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | タイプ別、推進方式別、耐久性別、産業別、動力別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

さまざまな産業で汎用性が高く効率的な空中ソリューションに対する需要の高まりが、監視、配達、農業監視などの用途でハイブリッドUAV市場を牽引しています。VTOLと固定翼の機能を併せ持つハイブリッドUAVは、航続距離の延長、飛行時間の延長、ペイロード容量の強化を実現し、従来のドローンでは不十分な分野で貴重な存在となっています。防衛やロジスティクスなどの分野では、特に複雑な地形での柔軟で長時間の運用を必要とするタスクのためにハイブリッドUAVに投資しています。推進技術の進歩と自律航行のためのAIの統合により、ハイブリッドUAVは商業および政府用途の多様なミッションに不可欠なものとなりつつあります。

リフト+クルーズUAVは、回転翼機と固定翼機の利点を併せ持つことで持つユニークな特徴のため、非常に高い需要があります。ハイブリッドUAVは、空力設計、統合推進システム、軽量素材の進歩から最大限の性能を達成するように作られています。これにより、垂直離着陸や効果的な巡航飛行への移行が可能となり、都市部での航空機動、ロジスティクス、緊急対応など、数多くの用途に適しています。例えば、NASAの揚力+巡航コンセプト機は、離着陸時にヘリコプターのような操作を可能にする構成であると同時に、航続距離と速度を拡大するための固定翼でもあるため、この技術の可能性を提示しています。

特に都市部では、交通渋滞を緩和し、より多くの移動手段を提供するために、都市部向けの効率的な輸送ソリューションを求める動きが市場の成長を後押ししています。高度な自動操縦システムは、ナビゲーションと制御を改善し、人間の介入の必要性を減らし、安全性を高める。将来の産業界が空を通じて先見性のあるソリューションを求める中、リフト+巡航VTOL UAVの分野は、商業的ニーズと公共安全の課題の両方を解決することで、明日の輸送と物流の未来を定義する上で大きな役割を果たすとみられています。

当レポートでは、世界のハイブリッドUAV市場について調査し、タイプ別、推進方式別、耐久性別、産業別、動力別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- エコシステム分析

- 顧客ビジネスに影響を与える動向と混乱

- バリューチェーン分析

- 貿易分析

- 価格分析

- 部品表

- 総所有コスト

- ビジネスモデル

- ボリュームデータ

- 運用データ

- 投資と資金調達のシナリオ

- 主な利害関係者と購入基準

- 技術ロードマップ

- AIの影響

- 使用事例分析

- 技術分析

- 規制状況

- 2024年~2025年の主な会議とイベント

- マクロ経済見通し

第6章 業界の動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- ハイブリッドUAV技術の成熟度マッピング

- サプライチェーン分析

- 特許分析

第7章 ハイブリッドUAV市場(タイプ別)

- イントロダクション

- マルチコプターUAV

- リフト+ クルーズUAV

- STOL無人航空機

第8章 ハイブリッドUAV市場(推進方式別)

- イントロダクション

- ハイブリッド電気

- 燃料電池

第9章 ハイブリッドUAV市場(耐久性別)

- イントロダクション

- 短

- 中

- 長

第10章 ハイブリッドUAV市場(産業別)

- イントロダクション

- 政府・防衛

- 商業

第11章 ハイブリッドUAV市場(動力別)

- イントロダクション

- 低

- 中

- 高

- 超高

第12章 ハイブリッドUAV市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- THALES

- NORTHROP GRUMMAN

- JOUAV

- ELROY AIR

- ELBIT SYSTEMS LTD.

- DRAGANFLY

- PIPISTREL

- HARRIS AERIAL

- NATILUS

- DOOSAN MOBILITY INNOVATION

- MOYA AERO

- WAVEAEROSPACE

- AERONAUTICS

- SKYFRONT

- WALKERA

- XER TECHNOLOGIES

- AVARTEK

- ELEVONX

- ALTI UNMANNED

- その他の企業

- ACECORE TECHNOLOGIES

- PTERODYNAMICS INC.

- ZALA

- PARALLEL FLIGHT TECHNOLOGIES

- EQUINOX INNOVATIVE SYSTEMS

- TOP FLIGHT TECHNOLOGIES

- DUFOUR AEROSPACE

- MOOG INC.

第15章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 COMMERCIAL INDUSTRIES EXEMPTED BY FAA

- TABLE 4 ENDURANCE-BASED MAPPING OF POWER SOURCES

- TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 IMPORT DATA OF HS CODE 8806, BY COUNTRY, 2022-2023 (USD THOUSAND)

- TABLE 7 EXPORT DATA OF HS CODE 8806, BY COUNTRY, 2022-2023 (USD THOUSAND)

- TABLE 8 INDICATIVE PRICING ANALYSIS, BY KEY PLAYER

- TABLE 9 INDICATIVE PRICING ANALYSIS, BY REGION

- TABLE 10 ESTIMATED COST OF HYBRID UAV

- TABLE 11 TECHNICAL COST OF HYBRID UAV

- TABLE 12 TOTAL COST OF OWNERSHIP OF HYBRID UAV

- TABLE 13 HYBRID UAV VOLUME, BY INDUSTRY, 2020-2024 (UNITS)

- TABLE 14 SHIPMENTS OF DRONES USED BY COMMERCIAL AND GOVERNMENT & DEFENSE INDUSTRIES, BY REGION, 2021-2023 (UNITS)

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY INDUSTRY (%)

- TABLE 16 KEY BUYING CRITERIA, BY INDUSTRY

- TABLE 17 COMPANIES WORKING TOWARD DEVELOPMENT OF DRONE SOFTWARE WITH AI

- TABLE 18 COMPANIES WORKING TOWARD DEVELOPMENT OF DRONE EQUIPMENT WITH AI

- TABLE 19 UAV INNOVATIONS

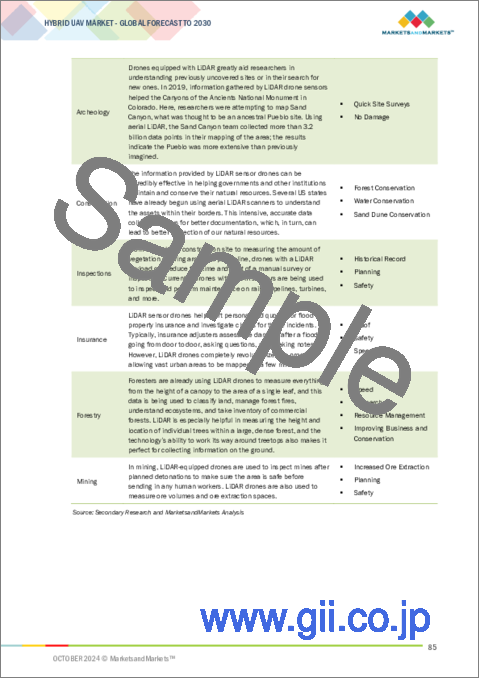

- TABLE 20 USE OF DRONES WITH LIDAR

- TABLE 21 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 REGULATIONS FOR COMMERCIAL DRONES, BY COUNTRY

- TABLE 26 US: RULES FOR OPERATION OF DRONES

- TABLE 27 CANADA: RULES FOR OPERATION OF DRONES

- TABLE 28 UK: RULES FOR OPERATION OF DRONES

- TABLE 29 GERMANY: RULES FOR OPERATION OF DRONES

- TABLE 30 FRANCE: RULES FOR OPERATION OF DRONES

- TABLE 31 UAV REGULATIONS, BY COUNTRY

- TABLE 32 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 33 PATENT ANALYSIS

- TABLE 34 HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 35 HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 36 HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 37 HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 38 HYBRID ELECTRIC UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 39 HYBRID ELECTRIC UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 40 HYBRID UAV MARKET, BY ENDURANCE, 2020-2023 (USD MILLION)

- TABLE 41 HYBRID UAV MARKET, BY ENDURANCE, 2024-2030 (USD MILLION)

- TABLE 42 HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 43 HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 44 HYBRID UAV MARKET, BY POWER, 2020-2023 (USD MILLION)

- TABLE 45 HYBRID UAV MARKET, BY POWER, 2024-2030 (USD MILLION)

- TABLE 46 HYBRID UAV MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 47 HYBRID UAV MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 49 NORTH AMERICA: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: HYBRID UAV MARKET, BY HYBRID ELECTRIC PROPULSION, 2020-2023 (USD MILLION)

- TABLE 51 NORTH AMERICA: HYBRID UAV MARKET, BY HYBRID ELECTRIC PROPULSION, 2024-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 53 NORTH AMERICA: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 55 NORTH AMERICA: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: HYBRID UAV MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 57 NORTH AMERICA: HYBRID UAV MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 58 US: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 59 US: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 60 US: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 61 US: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 62 US: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 63 US: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 64 CANADA: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 65 CANADA: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 66 CANADA: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 67 CANADA: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 68 CANADA: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 69 CANADA: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 70 EUROPE: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 71 EUROPE: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 72 EUROPE: HYBRID UAV MARKET, BY HYBRID ELECTRIC PROPULSION, 2020-2023 (USD MILLION)

- TABLE 73 EUROPE: HYBRID UAV MARKET, BY HYBRID ELECTRIC PROPULSION, 2024-2030 (USD MILLION)

- TABLE 74 EUROPE: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 75 EUROPE: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 76 EUROPE: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 77 EUROPE: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 78 EUROPE: HYBRID UAV MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 79 EUROPE: HYBRID UAV MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 80 UK: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 81 UK: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 82 UK: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 83 UK: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 84 UK: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 85 UK: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 86 GERMANY: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 87 GERMANY: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 88 GERMANY: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 89 GERMANY: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 90 GERMANY: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 91 GERMANY: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 92 FRANCE: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 93 FRANCE: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 94 FRANCE: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 95 FRANCE: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 96 FRANCE: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 97 FRANCE: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 98 ITALY: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 99 ITALY: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 100 ITALY: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 101 ITALY: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 102 ITALY: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 103 ITALY: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 104 RUSSIA: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 105 RUSSIA: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 106 RUSSIA: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 107 RUSSIA: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 108 RUSSIA: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 109 RUSSIA: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 110 REST OF EUROPE: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 111 REST OF EUROPE: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 112 REST OF EUROPE: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 113 REST OF EUROPE: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 114 REST OF EUROPE: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 115 REST OF EUROPE: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 117 ASIA PACIFIC: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: HYBRID UAV MARKET, BY HYBRID ELECTRIC PROPULSION, 2020-2023 (USD MILLION)

- TABLE 119 ASIA PACIFIC: HYBRID UAV MARKET, BY HYBRID ELECTRIC PROPULSION, 2024-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 121 ASIA PACIFIC: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 123 ASIA PACIFIC: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: HYBRID UAV MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 125 ASIA PACIFIC: HYBRID UAV MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 126 CHINA: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 127 CHINA: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 128 CHINA: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 129 CHINA: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 130 CHINA: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 131 CHINA: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 132 INDIA: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 133 INDIA: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 134 INDIA: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 135 INDIA: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 136 INDIA: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 137 INDIA: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 138 JAPAN: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 139 JAPAN: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 140 JAPAN: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 141 JAPAN: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 142 JAPAN: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 143 JAPAN: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 144 AUSTRALIA: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 145 AUSTRALIA: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 146 AUSTRALIA: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 147 AUSTRALIA: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 148 AUSTRALIA: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 149 AUSTRALIA: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 150 SOUTH KOREA: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 151 SOUTH KOREA: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 152 SOUTH KOREA: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 153 SOUTH KOREA: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 154 SOUTH KOREA: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 155 SOUTH KOREA: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 162 REST OF THE WORLD: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 163 REST OF THE WORLD: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 164 REST OF THE WORLD: HYBRID UAV MARKET, BY HYBRID ELECTRIC PROPULSION, 2020-2023 (USD MILLION)

- TABLE 165 REST OF THE WORLD: HYBRID UAV MARKET, BY HYBRID ELECTRIC PROPULSION, 2024-2030 (USD MILLION)

- TABLE 166 REST OF THE WORLD: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 167 REST OF THE WORLD: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 168 REST OF THE WORLD: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 169 REST OF THE WORLD: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 170 REST OF THE WORLD: HYBRID UAV MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 171 REST OF THE WORLD: HYBRID UAV MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 178 LATIN AMERICA: HYBRID UAV MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 179 LATIN AMERICA: HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 180 LATIN AMERICA: HYBRID UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 181 LATIN AMERICA: HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 182 LATIN AMERICA: HYBRID UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 183 LATIN AMERICA: HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 184 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 185 HYBRID UAV MARKET: DEGREE OF COMPETITION

- TABLE 186 INDUSTRY FOOTPRINT

- TABLE 187 TYPE FOOTPRINT

- TABLE 188 PROPULSION FOOTPRINT

- TABLE 189 REGION FOOTPRINT

- TABLE 190 LIST OF START-UPS/SMES

- TABLE 191 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 192 HYBRID UAV MARKET: PRODUCT LAUNCHES, 2020-2024

- TABLE 193 HYBRID UAV MARKET: DEALS, 2020-2024

- TABLE 194 HYBRID UAV MARKET: OTHERS, 2020-2024

- TABLE 195 THALES: COMPANY OVERVIEW

- TABLE 196 THALES: PRODUCTS OFFERED

- TABLE 197 THALES: DEALS

- TABLE 198 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 199 NORTHROP GRUMMAN: PRODUCTS OFFERED

- TABLE 200 JOUAV: COMPANY OVERVIEW

- TABLE 201 JOUAV: PRODUCTS OFFERED

- TABLE 202 JOUAV: PRODUCT LAUNCHES

- TABLE 203 ELROY AIR: COMPANY OVERVIEW

- TABLE 204 ELROY AIR: PRODUCTS OFFERED

- TABLE 205 ELROY AIR: DEALS

- TABLE 206 ELROY AIR: OTHERS

- TABLE 207 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 208 ELBIT SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 209 ELBIT SYSTEMS LTD.: OTHERS

- TABLE 210 DRAGANFLY: COMPANY OVERVIEW

- TABLE 211 DRAGANFLY: PRODUCTS OFFERED

- TABLE 212 DRAGANFLY: DEALS

- TABLE 213 DRAGANFLY: OTHERS

- TABLE 214 PIPISTREL: COMPANY OVERVIEW

- TABLE 215 PIPISTREL: PRODUCTS OFFERED

- TABLE 216 PIPISTREL: DEALS

- TABLE 217 HARRIS AERIAL: COMPANY OVERVIEW

- TABLE 218 HARRIS AERIAL: PRODUCTS OFFERED

- TABLE 219 NATILUS: COMPANY OVERVIEW

- TABLE 220 NATILUS: PRODUCTS OFFERED

- TABLE 221 NATILUS: DEALS

- TABLE 222 NATILUS: OTHERS

- TABLE 223 DOOSAN MOBILITY INNOVATION: COMPANY OVERVIEW

- TABLE 224 DOOSAN MOBILITY INNOVATION: PRODUCTS OFFERED

- TABLE 225 DOOSAN MOBILITY INNOVATION: DEALS

- TABLE 226 DOOSAN MOBILITY INNOVATION: OTHERS

- TABLE 227 MOYA AERO: COMPANY OVERVIEW

- TABLE 228 MOYA AERO: PRODUCTS OFFERED

- TABLE 229 MOYA AERO: DEALS

- TABLE 230 WAVEAEROSPACE: COMPANY OVERVIEW

- TABLE 231 WAVEAEROSPACE: PRODUCTS OFFERED

- TABLE 232 WAVEAEROSPACE: PRODUCT LAUNCHES

- TABLE 233 AERONAUTICS: COMPANY OVERVIEW

- TABLE 234 AERONAUTICS: PRODUCTS OFFERED

- TABLE 235 AERONAUTICS: DEALS

- TABLE 236 AERONAUTICS: OTHERS

- TABLE 237 SKYFRONT: COMPANY OVERVIEW

- TABLE 238 SKYFRONT: PRODUCTS OFFERED

- TABLE 239 WALKERA: COMPANY OVERVIEW

- TABLE 240 WALKERA: PRODUCTS OFFERED

- TABLE 241 XER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 242 XER TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 243 XER TECHNOLOGIES: DEALS

- TABLE 244 AVARTEK: COMPANY OVERVIEW

- TABLE 245 AVARTEK: PRODUCTS OFFERED

- TABLE 246 ELEVONX: COMPANY OVERVIEW

- TABLE 247 ELEVONX: PRODUCTS OFFERED

- TABLE 248 ALTI UNMANNED: COMPANY OVERVIEW

- TABLE 249 ALTI UNMANNED: PRODUCTS OFFERED

- TABLE 250 ALTI UNMANNED: DEALS

- TABLE 251 ACECORE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 252 PTERODYNAMICS INC.: COMPANY OVERVIEW

- TABLE 253 ZALA: COMPANY OVERVIEW

- TABLE 254 PARALLEL FLIGHT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 255 EQUINOX INNOVATIVE SYSTEMS: COMPANY OVERVIEW

- TABLE 256 TOP FLIGHT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 257 DUFOUR AEROSPACE: COMPANY OVERVIEW

- TABLE 258 MOOG INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HYBRID UAV MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 HYBRID ELECTRIC SEGMENT TO BE LARGER THAN FUEL CELL SEGMENT DURING FORECAST PERIOD

- FIGURE 8 ICE TO HOLD HIGHER SHARE THAN TURBINE DURING FORECAST PERIOD

- FIGURE 9 LIFT + CRUISE UAV SEGMENT TO HOLD LARGEST SHARE IN 2030

- FIGURE 10 COMMERCIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA TO BE LARGEST MARKET FOR HYBRID UAVS DURING FORECAST PERIOD

- FIGURE 12 INCREASED USE OF HYBRID UAVS FOR CARGO AND SURVEILLANCE ACTIVITIES TO DRIVE MARKET

- FIGURE 13 HYBRID ELECTRIC TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 14 LIFT + CRUISE UAV TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 15 SHORT ENDURANCE TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 16 MEDIUM POWER SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 17 COMMERCIAL SEGMENT TO BE PREVALENT DURING FORECAST PERIOD

- FIGURE 18 HYBRID UAV MARKET DYNAMICS

- FIGURE 19 BENEFITS OF AGRICULTURE HYBRID DRONES

- FIGURE 20 DECREASING PRICE OF DRONE COMPONENTS

- FIGURE 21 INVESTMENTS IN COMMERCIAL DRONE INDUSTRY, 2013-2023 (USD MILLION)

- FIGURE 22 ECOSYSTEM ANALYSIS

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 VALUE CHAIN ANALYSIS

- FIGURE 25 IMPORT DATA OF HS CODE 8806, BY COUNTRY, 2022-2023 (USD THOUSAND)

- FIGURE 26 EXPORT DATA OF HS CODE 8806, BY COUNTRY, 2022-2023 (USD THOUSAND)

- FIGURE 27 HYBRID UAV COMPONENTS DISTRIBUTION

- FIGURE 28 BREAKDOWN OF TOTAL COST OF OWNERSHIP FOR HYBRID UAV

- FIGURE 29 UAV LIFECYCLE PHASES

- FIGURE 30 AVERAGE BREAKDOWN OF MAJOR COST CATEGORIES AS % OF TOTAL LIFECYCLE COST

- FIGURE 31 DIRECT SALE BUSINESS MODEL

- FIGURE 32 SUBSCRIPTION-BASED SERVICE MODEL

- FIGURE 33 BUSINESS MODELS OF HYBRID UAV MARKET

- FIGURE 34 COMPARISON BETWEEN BUSINESS MODELS

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO, 2019-2023 (USD BILLION)

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY INDUSTRY

- FIGURE 37 KEY BUYING CRITERIA, BY INDUSTRY

- FIGURE 38 TECHNOLOGY ROADMAP

- FIGURE 39 EMERGING TRENDS

- FIGURE 40 IMPACT OF AI ON HYBRID UAV MARKET

- FIGURE 41 MATURITY STAGES OF HYBRID UAV TECHNOLOGIES

- FIGURE 42 SUPPLY CHAIN ANALYSIS

- FIGURE 43 PATENTS ANALYSIS

- FIGURE 44 HYBRID UAV MARKET, BY TYPE, 2024-2030 (USD MILLION)

- FIGURE 45 HYBRID UAV MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- FIGURE 46 HYBRID UAV MARKET, BY ENDURANCE, 2024-2030 (USD MILLION)

- FIGURE 47 HYBRID UAV MARKET, BY INDUSTRY, 2024-2030 (USD MILLION)

- FIGURE 48 HYBRID UAV MARKET, BY POWER, 2024-2030 (USD MILLION)

- FIGURE 49 HYBRID UAV MARKET, BY REGION, 2024-2030

- FIGURE 50 NORTH AMERICA: HYBRID UAV MARKET SNAPSHOT

- FIGURE 51 EUROPE: HYBRID UAV MARKET SNAPSHOT

- FIGURE 52 ASIA PACIFIC: HYBRID UAV MARKET SNAPSHOT

- FIGURE 53 REVENUE ANALYSIS OF TOP FOUR PLAYERS, 2019-2023

- FIGURE 54 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 55 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 56 COMPANY FOOTPRINT

- FIGURE 57 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 58 VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 59 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

- FIGURE 60 BRAND/PRODUCT COMPARISON

- FIGURE 61 THALES: COMPANY SNAPSHOT

- FIGURE 62 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 63 JOUAV: COMPANY SNAPSHOT

- FIGURE 64 DRAGANFLY: COMPANY SNAPSHOT

The Hybrid UAV is expected to be 760.7 million in 2024 and is projected to be 1,705.0 million in 2030 at a CAGR of 14.4%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Industry, Propulsion, Endurance, Power and Region |

| Regions covered | North America, Europe, APAC, RoW |

Rising demand for versatile and efficient aerial solutions across various industries is driving the hybrid UAV market, with applications in surveillance, delivery, and agricultural monitoring. Hybrid UAVs, which combine VTOL and fixed-wing capabilities, offer extended range, longer flight times, and enhanced payload capacity, making them invaluable in areas where traditional drones fall short. Sectors such as defense and logistics are investing in hybrid UAVs for tasks that require flexible, long-duration operations, especially in complex terrains. With advancements in propulsion technology and the integration of AI for autonomous navigation, hybrid UAVs are becoming essential for diverse missions in commercial and government applications.

"Lift + Cruise UAVs is set to dominate the satellites market."

Lift + cruise UAVs have very high demand because of unique features they possess by being a combination of rotorcraft and fixed-wing aircraft advantage. Hybrid UAVs made to achieve maximum performance from advancements in aerodynamic designs, integrated propulsion systems, and lightweight materials. It gives them the ability to make vertical takeoff and landings and transition into effective cruise flight, which then makes them suitable for numerous applications such as urban air mobility, logistics, or emergency response. For example, NASA's lift + cruise concept aircraft presents a potential in this technology due to the configuration that will enable helicopter-like operations during the takeoff and landing as well as fixed-wing for extended range and speed.

A drive for efficient transportation solutions for urban areas is helping market growth, especially for urban cities to alleviate traffic congestion and provide more options of mobility. Advanced autopilot systems improve navigation and control, reduce the intervention need of human beings, and increase safety. As industries into the future seek visionary solutions through the skies, areas of lift + cruise VTOL UAV will go to great lengths in defining transportation and logistics futures of tomorrow by solving both commercial needs and public safety challenges..

"Commerical by industry segment is estimated to grow at highest share in forecast period."

The demand for commercial hybrid UAVs has increased dramatically. Its versatility and enhanced operational capabilities contribute to increased demand in numerous industries. Hybrid UAVs integrate the advantages of both electric and internal combustion propulsion systems to provide longer ranges and better payload capacities than either technology alone. Commercial is the fastest-growing category in the hybrid UAV market, since more and more businesses start using UAV technology for applications such as aerial surveys, inspections, cargo transport, and surveillance. For instance, companies use hybrid UAVs to track crop health and resource usage in precision agriculture, improving efficiency in farming operations.

In addition, hybrid UAVs are very attractive for logistics and emergency response scenarios as they can work in different environments without extensive infrastructure. Advanced avionics and AI technology integrate into them to enhance their autonomy and provide real-time data collection and analysis with minimal human intervention. The commercial hybrid UAV will, in all probability, claim the lion's share in this regard as well while providing cost-effective aerial solutions for industries with increased competition in a world full of innovation and new business opportunities.

"Asia Pacific is expected to hold the highest market share in 2024."

Asia Pacific is set to represent the largest share in the satellite market because of heavy investment by key economies such as China, India, Japan, and South Korea in telecommunications, defense, Earth observation, and space exploration. China's BRI and India's ISRO create both domestic and international demand for satellite deployment, but the accelerating growth is because of the high demand for broadband connectivity and 5G networks in underserved areas. Defense satellites for intelligence and surveillance are also gaining takers in this region due to a focus on national security. Besides, the public-private partnerships, the improved miniature satellites technology, and a favorable regulatory environment are strengthening Asia Pacific's position at the top of the satellite market.

The break-up of the profile of primary participants in the Satellites market:

- By Company Type: Tier 1 - 49%, Tier 2 - 37%, and Tier 3 - 14%

- By Designation: C Level - 55%, Director Level - 27%, Others - 18%

- By Region: North America - 32%, Europe - 32%, Asia Pacific - 16%, Rest of the World - 20%

Northrop Grumman (US), Thale (France), L3Harris Technologies, Inc., (US) ), JOUAV (China), Elroy Air (US), Draganfly (Canda), Pipistrel (Italy), Harris Aerial (US), Natilus (US), Doosan Mobility Innovation (South Korea) Moya aero (Brazil), Waveaerospace (US), Aeronautics (Israel), Skyfront (US), Xer Technologies. Avartek (UK), ElevonX (US), ALTI Unmanned (South Africa) and Elbit Systems Ltd. (Israel) are some of the key players in the satellites market.

The study includes an in-depth competitive analysis of these key players in the hybrid UAV market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

This research report categorizes the satellites market by Type (Multicopter UAV, Lift + Cruise, STOL UAV), by Industry (commercial, government & defense), by Propulsion (Hybrid electric , Fuel cell), by Power (Low Power (<1 kW), Medium Power (1-10 kW), High Power (10-100 kW), Very High Power (>100 kW)), by Endurance (Short Endurance (1-6 Hours), Medium Endurance (6-12 Hours), Long Endurance (>12 Hours)), and by region (North America, Europe, Asia Pacific, Middle East, and RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the satellites market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the Hybrid UAV market. Competitive analysis of upcoming startups in the satellites market ecosystem is covered in this report.

Reasons to buy this report:

The report will enable market leaders/new entrants in the market to understand the approximate revenue numbers of the entire market and subsegments. This will help them in developing a complete understanding of the competitive landscape, making well-informed decisions that will place them in the market, and develop effective go-to-market strategies.This report provides several very valuable insights into market dynamics and offers such information concerning crucial factors as a driver, restraints, challenge, and opportunity in order to help different stakeholders gauge the pulse of the market.

The report provides insights on the following pointers:

- Analysis of the key driver (Intelligent energy management in hybrid UAVs Advancements in hybrid propulsion systems, Enhanced endurance and efficiency, Demand for optimization of farm management using agricultural drones), restraint (High upfront costs of hybrid systems, Information security risk and lack of standardized air traffic regulations, Limited payload capacity of hybrid drones), opportunities (Growing investments by commercial players, Technological advancements to enhance accuracy of package delivery), and challenges (Rapid advancements in battery technology and all-electric UAV systems, Shortage of sustainable power sources, Operational constraints of hybrid UAVs), several factors could contribute to an increase in the hybrid UAV market.

- Market Penetration: Comprehensive information on hybrid UAV offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the hybrid UAV market

- Market Development: Comprehensive information about lucrative markets - the report analyses the hybrid UAV market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the hybrid UAV market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Northrop Grumman (US), Thale (France), L3Harris Technologies, Inc., (US) ), JOUAV (China), Elroy Air (US), Draganfly (Canda), Pipistrel (Italy), Harris Aerial (US), Natilus (US), Doosan Mobility Innovation (South Korea) Moya aero (Brazil), Waveaerospace (US), Aeronautics (Israel), Skyfront (US), Xer Technologies. Avartek (UK), ElevonX (US), ALTI Unmanned (South Africa) and Elbit Systems Ltd. (Israel) among others in the hybrif UAV market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology

- 2.3.1.2 Regional split

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HYBRID UAV MARKET

- 4.2 HYBRID UAV MARKET, BY PROPULSION

- 4.3 HYBRID UAV MARKET, BY TYPE

- 4.4 HYBRID UAV MARKET, BY ENDURANCE

- 4.5 HYBRID UAV MARKET, BY POWER

- 4.6 HYBRID UAV MARKET, BY INDUSTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Intelligent energy management in hybrid UAVs

- 5.2.1.2 Advancements in hybrid propulsion systems

- 5.2.1.3 Enhanced endurance and efficiency

- 5.2.1.4 Surge in demand for agricultural drones

- 5.2.1.5 Rapid development of sensor technology

- 5.2.1.6 Favorable government regulations and initiatives

- 5.2.2 RESTRAINTS

- 5.2.2.1 High upfront cost of hybrid systems

- 5.2.2.2 Information security risk and lack of standardized air traffic regulations

- 5.2.2.3 Limited payload capacity of hybrid drones

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing investments by commercial players

- 5.2.3.2 Technological advancements to enhance accuracy of package delivery

- 5.2.3.3 Innovations in energy storage technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Rapid advancements in battery technology and all-electric UAV systems

- 5.2.4.2 Shortage of sustainable power sources

- 5.2.4.3 Fluctuations in weather

- 5.2.4.4 Potential threats to safety and violation of privacy

- 5.2.4.5 Operational constraints of hybrid UAVs

- 5.2.1 DRIVERS

- 5.3 ECOSYSTEM ANALYSIS

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT DATA

- 5.6.2 EXPORT DATA

- 5.7 PRICING ANALYSIS

- 5.7.1 INDICATIVE PRICING ANALYSIS, BY KEY PLAYER

- 5.7.2 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.8 BILL OF MATERIALS

- 5.9 TOTAL COST OF OWNERSHIP

- 5.10 BUSINESS MODELS

- 5.10.1 DIRECT SALE BUSINESS MODEL

- 5.10.2 SUBSCRIPTION-BASED SERVICE MODEL

- 5.11 VOLUME DATA

- 5.12 OPERATIONAL DATA

- 5.13 INVESTMENT AND FUNDING SCENARIO

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 TECHNOLOGY ROADMAP

- 5.16 IMPACT OF AI

- 5.17 USE CASE ANALYSIS

- 5.17.1 HYBRID PROPULSION UAV FOR MONITORING GALAPAGOS ISLANDS

- 5.17.2 HYBRID ELECTRIC AIRCRAFT PROPULSION FOR SKYDIVING MISSIONS

- 5.17.3 HYDROGEN FUEL CELL FOR GAS DETECTION UAV

- 5.18 TECHNOLOGY ANALYSIS

- 5.18.1 KEY TECHNOLOGIES

- 5.18.1.1 Artificial intelligence

- 5.18.1.2 Anti-UAV defense systems

- 5.18.1.3 LiDAR

- 5.18.2 COMPLEMENTARY TECHNOLOGIES

- 5.18.2.1 Beyond visual line of sight

- 5.18.2.2 Automated air traffic management systems

- 5.18.2.3 Security protocols

- 5.18.1 KEY TECHNOLOGIES

- 5.19 REGULATORY LANDSCAPE

- 5.19.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.19.2 REGULATIONS FOR COMMERCIAL DRONES

- 5.19.2.1 North America

- 5.19.2.1.1 US

- 5.19.2.1.2 Canada

- 5.19.2.2 Europe

- 5.19.2.2.1 UK

- 5.19.2.2.2 Germany

- 5.19.2.2.3 France

- 5.19.2.1 North America

- 5.20 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.21 MACROECONOMIC OUTLOOK

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 FUEL CELLS

- 6.2.2 HYBRID ENERGY MANAGEMENT SYSTEMS

- 6.2.3 MANNED-UNMANNED TEAMING

- 6.2.4 ADVANCED MATERIALS

- 6.2.5 SIGINT

- 6.2.6 NETWORK FUNCTIONS VIRTUALIZATION

- 6.2.7 MICROTURBINE ENGINES

- 6.2.8 SOFTWARE-DEFINED NETWORKING

- 6.2.9 MILLIMETER-WAVE TECHNOLOGY

- 6.2.10 TARGET DRONES

- 6.2.11 PILOT-ON-A-CHIP TECHNOLOGY

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 NANOTECHNOLOGY

- 6.3.2 GREEN INITIATIVE

- 6.3.3 CUSTOMIZATION

- 6.3.4 BLOCKCHAIN TECHNOLOGY

- 6.3.5 MOBILE INTERNET OF THINGS

- 6.3.6 3D PRINTING

- 6.4 MATURITY MAPPING OF HYBRID UAV TECHNOLOGIES

- 6.5 SUPPLY CHAIN ANALYSIS

- 6.6 PATENT ANALYSIS

7 HYBRID UAV MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 MULTICOPTER UAV

- 7.2.1 LONGER FLIGHT DURATIONS THAN TRADITIONAL MODELS TO DRIVE MARKET

- 7.3 LIFT + CRUISE UAV

- 7.3.1 INNOVATIONS IN WING DESIGN TO DRIVE MARKET

- 7.4 STOL UAV

- 7.4.1 ADVANCES IN ENGINE DESIGN TO DRIVE MARKET

8 HYBRID UAV MARKET, BY PROPULSION

- 8.1 INTRODUCTION

- 8.2 HYBRID ELECTRIC

- 8.2.1 ICE

- 8.2.1.1 Development of advanced power management systems to drive market

- 8.2.2 TURBINE

- 8.2.2.1 Integration of advanced control systems to drive market

- 8.2.1 ICE

- 8.3 FUEL CELL

- 8.3.1 OPTIMUM ENERGY USE WITH EXTENDED ENDURANCE TO DRIVE MARKET

9 HYBRID UAV MARKET, BY ENDURANCE

- 9.1 INTRODUCTION

- 9.2 SHORT ENDURANCE

- 9.2.1 ADVANCEMENTS IN PROPULSION SYSTEMS AND AERODYNAMICS TO DRIVE MARKET

- 9.3 MEDIUM ENDURANCE

- 9.3.1 EXTENSIVE USE OF LIGHTWEIGHT COMPOSITES AND INTELLIGENT POWER MANAGEMENT SYSTEMS TO DRIVE MARKET

- 9.4 LONG ENDURANCE

- 9.4.1 RAPID INTEGRATION OF AI AND AUTONOMOUS SYSTEMS TO DRIVE MARKET

10 HYBRID UAV MARKET, BY INDUSTRY

- 10.1 INTRODUCTION

- 10.2 GOVERNMENT & DEFENSE

- 10.2.1 INCREASED DEFENSE BUDGETS TO ENHANCE NATIONAL SECURITY TO DRIVE MARKET

- 10.3 COMMERCIAL

- 10.3.1 WIDE ACCEPTANCE IN DIVERSE APPLICATIONS TO DRIVE MARKET

11 HYBRID UAV MARKET, BY POWER

- 11.1 INTRODUCTION

- 11.2 LOW POWER

- 11.2.1 SURGE IN DEMAND DUE TO EASE OF USE AND COST-EFFECTIVENESS TO DRIVE MARKET

- 11.3 MEDIUM POWER

- 11.3.1 RAPID DEPLOYMENT IN SEARCH AND RESCUE OPERATIONS TO DRIVE MARKET

- 11.4 HIGH POWER

- 11.4.1 EXCELLENT PERFORMANCE CAPABILITIES TO DRIVE MARKET

- 11.5 VERY HIGH POWER

- 11.5.1 NEED FOR ADVANCED AERIAL SOLUTIONS TO DRIVE MARKET

12 HYBRID UAV MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 PESTLE ANALYSIS

- 12.2.2 US

- 12.2.2.1 Increasing investments in advanced drone technology to drive market

- 12.2.3 CANADA

- 12.2.3.1 Rising procurement of hybrid UAVs to drive market

- 12.3 EUROPE

- 12.3.1 PESTLE ANALYSIS

- 12.3.2 UK

- 12.3.2.1 Continuous advancements in hybrid UAVs to drive market

- 12.3.3 GERMANY

- 12.3.3.1 Significant presence of leading companies and research institutions to drive market

- 12.3.4 FRANCE

- 12.3.4.1 Favorable government initiatives to drive market

- 12.3.5 ITALY

- 12.3.5.1 Focus on sustainability and environmental protection to drive market

- 12.3.6 RUSSIA

- 12.3.6.1 Surge in demand from military and civilian sectors to drive market

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 PESTLE ANALYSIS

- 12.4.2 CHINA

- 12.4.2.1 Ongoing development of high-performance drones to drive market

- 12.4.3 INDIA

- 12.4.3.1 Emphasis on indigenous drone manufacturing to drive market

- 12.4.4 JAPAN

- 12.4.4.1 Rapid technological advancements to drive market

- 12.4.5 AUSTRALIA

- 12.4.5.1 Government push for enhancing UAV technology to drive market

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Rising incorporation of hybrid UAVs in military operations to drive market

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 REST OF THE WORLD

- 12.5.1 PESTLE ANALYSIS

- 12.5.2 MIDDLE EAST & AFRICA

- 12.5.2.1 High demand in defense and commercial applications to drive market

- 12.5.3 LATIN AMERICA

- 12.5.3.1 Shift toward precision farming techniques to drive market

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 13.3 REVENUE ANALYSIS, 2019-2023

- 13.4 MARKET SHARE ANALYSIS, 2023

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT

- 13.5.5.1 Company footprint

- 13.5.5.2 Industry footprint

- 13.5.5.3 Type footprint

- 13.5.5.4 Propulsion footprint

- 13.5.5.5 Region footprint

- 13.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING

- 13.6.5.1 List of start-ups/SMEs

- 13.6.5.2 Competitive benchmarking of start-ups/SMEs

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8 BRAND/PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 OTHERS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 THALES

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 NORTHROP GRUMMAN

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 MnM view

- 14.1.2.3.1 Right to win

- 14.1.2.3.2 Strategic choices

- 14.1.2.3.3 Weaknesses and competitive threats

- 14.1.3 JOUAV

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 ELROY AIR

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.3.2 Others

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 ELBIT SYSTEMS LTD.

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Others

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 DRAGANFLY

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.3.2 Others

- 14.1.7 PIPISTREL

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.8 HARRIS AERIAL

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.9 NATILUS

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.9.3.2 Others

- 14.1.10 DOOSAN MOBILITY INNOVATION

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Deals

- 14.1.10.3.2 Others

- 14.1.11 MOYA AERO

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.12 WAVEAEROSPACE

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Product launches

- 14.1.13 AERONAUTICS

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.13.3.2 Others

- 14.1.14 SKYFRONT

- 14.1.14.1 Business overview

- 14.1.14.2 Products offered

- 14.1.15 WALKERA

- 14.1.15.1 Business overview

- 14.1.15.2 Products offered

- 14.1.16 XER TECHNOLOGIES

- 14.1.16.1 Business overview

- 14.1.16.2 Products offered

- 14.1.16.3 Recent developments

- 14.1.16.3.1 Deals

- 14.1.17 AVARTEK

- 14.1.17.1 Business overview

- 14.1.17.2 Products offered

- 14.1.18 ELEVONX

- 14.1.18.1 Business overview

- 14.1.18.2 Products offered

- 14.1.19 ALTI UNMANNED

- 14.1.19.1 Business overview

- 14.1.19.2 Products offered

- 14.1.19.3 Recent developments

- 14.1.19.3.1 Deals

- 14.1.1 THALES

- 14.2 OTHER PLAYERS

- 14.2.1 ACECORE TECHNOLOGIES

- 14.2.2 PTERODYNAMICS INC.

- 14.2.3 ZALA

- 14.2.4 PARALLEL FLIGHT TECHNOLOGIES

- 14.2.5 EQUINOX INNOVATIVE SYSTEMS

- 14.2.6 TOP FLIGHT TECHNOLOGIES

- 14.2.7 DUFOUR AEROSPACE

- 14.2.8 MOOG INC.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS