|

|

市場調査レポート

商品コード

1340764

ハイブリッド航空機市場:航空機タイプ別、動力源別、リフト技術別、運転モード別、航続距離別、システム別、地域別-2030年までの予測Hybrid Aircraft Market by Aircraft Type (Regional Transport Aircraft, Business Jets, Light Aircraft, UAVs, AAM), Power Source (Fuel Hybrid, Hydrogen Hybrid), Lift Technology, Mode of Operation, Range, System and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ハイブリッド航空機市場:航空機タイプ別、動力源別、リフト技術別、運転モード別、航続距離別、システム別、地域別-2030年までの予測 |

|

出版日: 2023年08月22日

発行: MarketsandMarkets

ページ情報: 英文 248 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

ハイブリッド航空機の市場規模は、2023年の12億米ドルから2030年には132億米ドルに成長し、2023年から2030年までのCAGRは41.6%と予測されています。

ハイブリッド推進の技術的進歩や持続可能な市場開拓の必要性の高まりなど、様々な要因がハイブリッド航空機市場を牽引しています。しかし、重量や積載量に制限があることや、ハイブリッド航空機に関わる規制認可の障害が、市場全体の成長を制限しています。

2023年には燃料ハイブリッド分野が最大のシェアを占めると予測されています。燃料ハイブリッド推進システムは、電力と内燃機関またはタービンを組み合わせたものです。この構成は、電気効率と航続距離の延長能力の間でバランスが取れています。バッテリーは、飛行の1つ以上の段階で推進用のエネルギーを供給します。電気モーターと内燃機関を備えた燃料ハイブリッド推進システムは、燃料を節約し、離陸時の騒音と排気ガスレベルを低減するのに役立ちます。したがって、燃料ハイブリッド航空機の使用の増加がハイブリッド電気航空機市場を牽引しています。

運行形態セグメントの自律型ハイブリッド航空機が2023年に最大のシェアを占めると予測されます。自律型セグメントでは、eVTOL、UAVなどのハイブリッド航空機は、高度なセンサー、人工知能、高度な飛行制御システムに頼って航行し、意思決定を行うことで、人間が直接介入することなく動作します。自律型航空機は、人間のパイロットを必要とせずにオンデマンドで効率的な空中移動を可能にすることで輸送業界に革命をもたらす可能性など、いくつかの注目すべき利点を提供します。自律システムの成長は、高度なアルゴリズムを活用して飛行経路を最適化し、混雑を最小限に抑え、リアルタイムの状況認識を通じて安全性を高めることが期待されています。

VTOLセグメントは、2023年に第2位のシェアを持つと予測されています。ハイブリッド電気航空機市場におけるVTOLハイブリッド航空機は著しい成長を遂げています。都市の混雑と、より高速で柔軟な輸送ソリューションへのニーズが、VTOL技術への投資と研究を促進し、航空とモビリティの将来にとって有望な手段となっています。VTOL機の例としては、ヘリコプター、マルチローター機、ティルトローター/ティルトウィング機などがあります。このセグメントの成長は、都市部の航空輸送における効率性の向上、排出量の削減、持続可能性の促進に向けた継続的な取り組みによるものです。

アジア太平洋は、2023年にハイブリッド電気航空機市場で第2位のシェアを占めると推定されます。本調査におけるアジア太平洋地域は、中国、インド、日本、オーストラリア、韓国、その他アジア太平洋地域で構成されます。アジア太平洋地域のハイブリッド航空機市場は、近年著しい急成長を遂げています。同地域の成長は、ハイブリッド航空機やハイブリッドUAMの開発を積極的に受け入れていることによるもので、都市部での輸送に革命をもたらすと期待されています。日本や中国のような国々は、専用インフラとハイブリッド航空機の開発に投資しています。

当レポートでは、世界のハイブリッド航空機市場について調査し、航空機タイプ別、動力源別、リフト技術別、運転モード別、航続距離別、システム別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ハイブリッド航空機市場に対する景気後退の影響

- バリューチェーン分析

- 生態系マッピング

- 顧客のビジネスに影響を与える動向と混乱

- ポーターのファイブフォース分析

- 価格分析

- ボリュームデータ

- 貿易分析

- 関税と規制状況

- 2023年~2024年の主要な会議とイベント

- 使用事例分析

- 主要な利害関係者と購入基準

第6章 業界の動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- イノベーションと特許分析

- ハイブリッド航空機商業化へのロードマップ

第7章 ハイブリッド航空機市場、航空機タイプ別

- イントロダクション

- 地域輸送機

- ビジネスジェット

- 軽量および超軽量航空機

- 無人航空機

- 次世代空モビリティ

第8章 ハイブリッド航空機市場、動力源別

- イントロダクション

- 燃料ハイブリッド

- 水素ハイブリッド

第9章 ハイブリッド航空機市場、運転モード別

- イントロダクション

- 操縦型

- 自律型

第10章 ハイブリッド航空機市場、リフト技術別

- イントロダクション

- CTOL

- STOL

- VTOL

第11章 ハイブリッド航空機市場、航続距離別

- イントロダクション

- 100キロ未満

- 101~500キロ

- 501キロ超

第12章 ハイブリッド航空機市場、システム別

- イントロダクション

- バッテリーと燃料電池

- 電動モーター

- 発電機/エンジン

- 航空構造物

- アビオニクス

- ソフトウェア

- その他

第13章 ハイブリッド航空機市場、地域別

- イントロダクション

- 地域不況の影響分析

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- その他の地域

第14章 競合情勢

- イントロダクション

- ランキング分析、2022年

- 収益分析、2022年

- 市場シェア分析、2022年

- 企業評価マトリックス

- 企業のフットプリント

- 新興企業/中小企業の評価マトリックス

- 競争シナリオと動向

第15章 企業プロファイル

- 主要参入企業

- AIRBUS

- TEXTRON INC.

- EMBRAER

- ZEROAVIA

- AMPAIRE, INC.

- FARADAIR AEROSPACE

- HEART AEROSPACE

- HORIZON AIRCRAFT, INC.

- BOMBARDIER, INC.

- SAFRAN

- RAYTHEON TECHNOLOGIES CORPORATION

- HONEYWELL

- GENERAL ELECTRIC

- ROLLS ROYCE

- GKN AEROSPACE

- VOLTAERO

- ELECTRIC AVIATION GROUP

- PLANA

- ASCENDANCE FLIGHT TECHNOLOGIES

- XTI AIRCRAFT

- その他の企業

- ELECTRA.AERO, INC.

- MANTA AIRCRAFT

- AMSL AERO PTY. LTD.

- TRANSCEND AIR CORPORATION

- AVA PROPULSION, INC.

- SKYFLY TECHNOLOGIES LTD.

- H2FLY

- COSTRUZIONI AERONAUTICHE TECNAM S.P.A.

- ELROY AIR

- AIRSPACE EXPERIENCE TECHNOLOGIES, INC.

第16章 付録

The hybrid aircraft market is projected to grow from USD 1.2 Billion in 2023 to USD 13.2 Billion by 2030, at a CAGR of 41.6% from 2023 to 2030. Various factors, such as the growing technological advancements in hybrid propulsion and need for sustainable development to drive the hybrid aircraft market. However, limited in weight and payload and regulatory approval obstacles involving hybrid aircraft are limiting the overall growth of the market.

"Fuel Hybrid: The largest share in power source segment in the hybrid aircraft market in 2023."

The fuel hybrid segment is projected to have the largest share in 2023. Fuel hybrid propulsion systems combine electric power and an internal combustion engine or a turbine. This configuration balances between electric efficiency and extended range capabilities. Batteries provide energy for propulsion during one or more phases of the flight. Fuel Hybrid propulsion systems with an electric motor and internal combustion engine help save fuel and reduce take-off noise and emission levels. Thus, the increasing use of fuel hybrid aircraft is driving the hybrid-electric aircraft market.

"Autonomous hybrid aircraft: The largest share in mode of operation segment in the hybrid aircraft market in 2023."

The autonomous hybrid aircraft from the mode of operation segment is projected to have the largest share in 2023. In the autonomous segment, hybrid aircraft such as eVTOLs, UAVs operate without direct human intervention, relying on advanced sensors, artificial intelligence, and sophisticated flight control systems to navigate and make decisions. Autonomous aircraft offer several notable advantages such as the potential to revolutionize the transportation industry by enabling on-demand and efficient aerial mobility without the need for human pilots. Autonomous systems growth is expected to leverage advanced algorithms to optimize flight paths, minimize congestion, and enhance safety through real-time situational awareness.

"VTOL: The second largest share in lift technology segment in the hybrid aircraft market in 2023."

The VTOL segment is projected to have the second-largest share in 2023. VTOL Hybrid aircraft in hybrid-electric aircraft market has experienced remarkable growth. Urban congestion and the need for faster, more flexible transportation solutions have driven investment and research into VTOL technology, making it a promising avenue for the future of aviation and mobility. Few examples of VTOL aircraft are helicopters, multirotor aircraft, and tiltrotor/tilt-wing aircraft. The growth of this segment is due to ongoing efforts to enhance efficiency, reduce emissions, and promote sustainability in urban air transportation.

"The Asia-Pacific region is estimated to have the second largest share in the hybrid aircraft market in 2023."

Asia-Pacific is estimated to account for the second-largest share in hybrid-electric aircraft market in 2023. The Asia-pacific region for this study comprises China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The hybrid aircraft market in Asia Pacific has experienced a remarkable surge in recent years. The growth of the region is due to actively embracing developments in hybrid aircraft and hybrid UAM which is expected to revolutionize transportation within urban areas. Countries like Japan and the China are investing in the development of dedicated infrastructure and hybrid aircraft.

The break-up of the profiles of primary participants in the hybrid-electric aircraft market is as follows:

- By Company Type: Tier 1 - 55%; Tier 2 - 25%; and Tier 3 - 20%

- By Designation: C-Level Executives - 50%; Directors - 25%; and Others - 25%

- By Region: North America - 32%, Europe - 32%, Asia Pacific - 16%, Latin America -10% Rest of the World - 10%.

Major Players in the hybrid-electric aircraft market are Textron Inc. (US), VoltAero (France), Electric Aviation Group (US), Ascendance Flight Technologies (France), XTI Aircraft (US) and Embraer (Brazil)among others.

Research Coverage

The market study covers the Hybrid Aircraft market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on Power Source (Fuel Hybrid, Hydrogen Hybrid), Mode of Operation (Autonomous, Piloted), By Range (< 100 km, 101 km to 500km, > 501 km), By System (Batteries & Fuel Cells, Electric Motors, Generators/Engines, Aerostructures, Avionics, Software, Others), By Aircraft Type (Regional Transport Aircraft, Business Jets, Light And Ultralight Aircraft, Advanced Air Mobility, Unmanned Aerial Vehicles), By Lift Technology (CTOL, STOL, VTOL) and Region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report:

This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall hybrid-electric aircraft market and its subsegments. The report covers the entire ecosystem of the hybrid-electric aircraft industry and will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on hybrid aircraft market offered by the top players in the market.

- Market Drivers: Increasing demand for green energy and noise free aircraft with alternate modes of transport, increasing demand for short haul range connectivity, technological convergence is driving factors for the hybrid-electric aircraft market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the hybrid aircraft market

- Market Development: Comprehensive information about lucrative markets - the report analyses the hybrid aircraft market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the hybrid aircraft market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the hybrid aircraft market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 HYBRID AIRCRAFT MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 RECESSION IMPACT ANALYSIS

- 2.4 RESEARCH APPROACH AND METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 5 BOTTOM-UP APPROACH: MARKET SIZE CALCULATION

- FIGURE 6 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.6 GROWTH RATE FACTORS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 PILOTED SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 >501 KM TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 11 HYDROGEN HYBRID SEGMENT TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA TO BE LARGEST MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HYBRID AIRCRAFT MARKET

- FIGURE 13 INCREASE IN DEMAND FOR GREEN AVIATION SOLUTIONS

- 4.2 HYBRID AIRCRAFT MARKET, BY SYSTEM

- FIGURE 14 BATTERIES AND FUEL CELLS TO HOLD MAXIMUM MARKET SHARE IN 2023

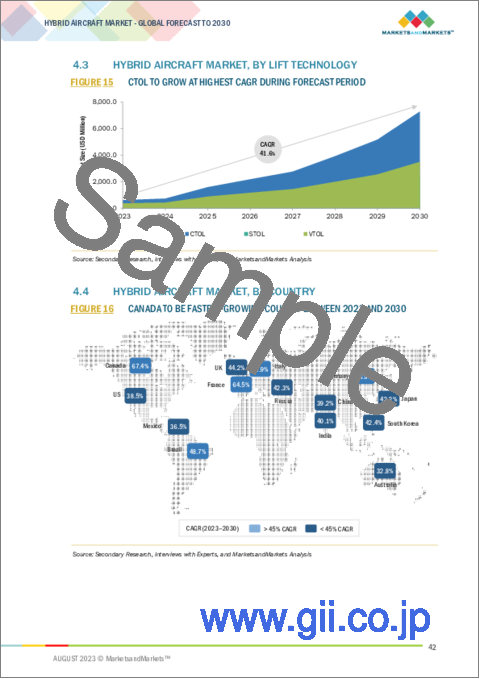

- 4.3 HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY

- FIGURE 15 CTOL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 HYBRID AIRCRAFT MARKET, BY COUNTRY

- FIGURE 16 CANADA TO BE FASTEST-GROWING COUNTRY BETWEEN 2023 AND 2030

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 HYBRID AIRCRAFT MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for green and noise-free aircraft

- 5.2.1.2 Need for alternate mode of transportation

- FIGURE 18 RISE IN GLOBAL POPULATION, 1950-2050

- 5.2.1.3 Increasing preference for short-haul connectivity

- 5.2.1.4 Rising fuel prices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Implications of increased aircraft weight

- 5.2.2.2 Lack of robust infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Focus on sustainable development

- 5.2.3.2 Expansion of hybrid propulsion systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent regulatory processes

- 5.2.4.2 Challenges associated with supply chain integration

- 5.3 IMPACT OF RECESSION ON HYBRID AIRCRAFT MARKET

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 19 VALUE CHAIN ANALYSIS

- 5.4.1 RAW MATERIALS

- 5.4.2 R&D

- 5.4.3 COMPONENT MANUFACTURING

- 5.4.4 OEMS

- 5.4.5 END USERS

- 5.5 ECOSYSTEM MAPPING

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- FIGURE 20 ECOSYSTEM MAPPING

- TABLE 3 ROLE OF KEY PLAYERS IN ECOSYSTEM

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- TABLE 5 AVERAGE PRICE TREND OF HYBRID AIRCRAFT, BY AIRCRAFT TYPE

- 5.9 VOLUME DATA

- TABLE 6 VOLUME DATA, BY AIRCRAFT TYPE (UNITS)

- 5.10 TRADE ANALYSIS

- TABLE 7 COUNTRY-WISE IMPORTS, 2020-2022 (USD THOUSAND)

- TABLE 8 COUNTRY-WISE EXPORTS, 2020-2022 (USD THOUSAND)

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- 5.12 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 12 KEY CONFERENCES AND EVENTS, 2023-2024

- 5.13 USE CASE ANALYSIS

- 5.13.1 URBAN AIR MOBILITY

- 5.13.2 ENVIRONMENTAL SUSTAINABILITY

- 5.13.3 AIR CARGO AND LOGISTICS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING HYBRID AIRCRAFT, BY MODE OF OPERATION

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING HYBRID AIRCRAFT, BY MODE OF OPERATION (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR HYBRID AIRCRAFT, BY MODE OF OPERATION

- TABLE 14 KEY BUYING CRITERIA FOR HYBRID AIRCRAFT, BY MODE OF OPERATION

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 ARTIFICIAL INTELLIGENCE

- 6.2.2 AUTOMATION

- 6.2.3 IMPLEMENTATION OF HYBRID POWER SOURCES FOR URBAN AIR MOBILITY

- 6.2.4 ADVANCED MANUFACTURING TECHNIQUES AND MATERIALS

- 6.2.5 ADVANCEMENTS IN BATTERY TECHNOLOGY

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 TECHNOLOGICAL ADVANCEMENTS

- 6.3.2 INTERNET OF THINGS

- 6.3.3 SUSTAINABLE AVIATION FUEL

- 6.4 INNOVATION AND PATENT ANALYSIS

- TABLE 15 INNOVATION AND PATENT ANALYSIS

- 6.5 ROADMAP TO HYBRID AIRCRAFT COMMERCIALIZATION

- FIGURE 25 DEVELOPMENT POTENTIAL OF HYBRID AIRCRAFT MARKET, 2020-2035

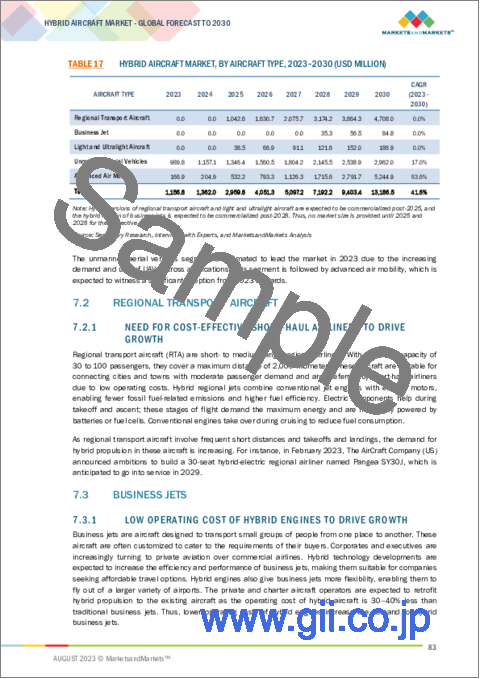

7 HYBRID AIRCRAFT MARKET, BY AIRCRAFT TYPE

- 7.1 INTRODUCTION

- FIGURE 26 HYBRID AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2023-2030

- TABLE 16 HYBRID AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 17 HYBRID AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2023-2030 (USD MILLION)

- 7.2 REGIONAL TRANSPORT AIRCRAFT

- 7.2.1 NEED FOR COST-EFFECTIVE SHORT-HAUL AIRLINERS TO DRIVE GROWTH

- 7.3 BUSINESS JETS

- 7.3.1 LOW OPERATING COST OF HYBRID ENGINES TO DRIVE GROWTH

- 7.4 LIGHT AND ULTRALIGHT AIRCRAFT

- 7.4.1 EXTENDED OPERATIONAL RANGE TO DRIVE GROWTH

- 7.5 UNMANNED AERIAL VEHICLES

- 7.5.1 IMPROVED PAYLOAD CAPACITY TO DRIVE GROWTH

- 7.6 ADVANCED AIR MOBILITY

- 7.6.1 FOCUS ON ECO-FRIENDLY TRANSPORTATION TO DRIVE GROWTH

8 HYBRID AIRCRAFT MARKET, BY POWER SOURCE

- 8.1 INTRODUCTION

- FIGURE 27 HYBRID AIRCRAFT MARKET, BY POWER SOURCE, 2023-2030

- TABLE 18 HYBRID AIRCRAFT MARKET, BY POWER SOURCE, 2020-2022 (USD MILLION)

- TABLE 19 HYBRID AIRCRAFT MARKET, BY POWER SOURCE, 2023-2030 (USD MILLION)

- 8.2 FUEL HYBRID

- 8.2.1 INCREASING FUEL PRICES TO DRIVE GROWTH

- 8.3 HYDROGEN HYBRID

- 8.3.1 LOW MAINTENANCE CAPABILITIES TO DRIVE GROWTH

9 HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION

- 9.1 INTRODUCTION

- FIGURE 28 HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030

- TABLE 20 HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 21 HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- 9.2 PILOTED

- 9.2.1 ABILITY TO HANDLE COMPLEX SCENARIOS TO DRIVE GROWTH

- 9.3 AUTONOMOUS

- 9.3.1 NEED FOR LIMITED HUMAN INTERVENTION TO DRIVE GROWTH

10 HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY

- 10.1 INTRODUCTION

- FIGURE 29 HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030

- TABLE 22 HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 23 HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 10.2 CTOL

- 10.2.1 RIGOROUS DEVELOPMENTS IN BUSINESS JETS TO DRIVE GROWTH

- 10.3 STOL

- 10.3.1 WIDESPREAD USE IN URBAN TRANSPORTATION TO DRIVE GROWTH

- 10.4 VTOL

- 10.4.1 FLEXIBLE TRANSPORTATION CAPABILITIES TO DRIVE GROWTH

11 HYBRID AIRCRAFT MARKET, BY RANGE

- 11.1 INTRODUCTION

- FIGURE 30 HYBRID AIRCRAFT MARKET, BY RANGE, 2023-2030

- TABLE 24 HYBRID AIRCRAFT MARKET, BY RANGE, 2020-2022 (USD MILLION)

- TABLE 25 HYBRID AIRCRAFT MARKET, BY RANGE, 2023-2030 (USD MILLION)

- 11.2 <100 KM

- 11.2.1 ABILITY TO FIT IN SMALL SPACES TO DRIVE GROWTH

- 11.3 101-500 KM

- 11.3.1 RISE IN INTERCITY TRAVEL TO DRIVE GROWTH

- 11.4 >501 KM

- 11.4.1 INCREASED PREFERENCE FOR LONG-HAUL FLIGHTS TO DRIVE GROWTH

12 HYBRID AIRCRAFT MARKET, BY SYSTEM

- 12.1 INTRODUCTION

- FIGURE 31 HYBRID AIRCRAFT MARKET, BY SYSTEM, 2023-2030

- TABLE 26 HYBRID AIRCRAFT MARKET, BY SYSTEM, 2020-2022 (USD MILLION)

- TABLE 27 HYBRID AIRCRAFT MARKET, BY SYSTEM, 2023-2030 (USD MILLION)

- 12.2 BATTERIES AND FUEL CELLS

- 12.2.1 ADVANCEMENTS IN BATTERY POWER DENSITY AND HYDROGEN FUEL CELLS TO DRIVE GROWTH

- 12.3 ELECTRIC MOTORS

- 12.3.1 IMPROVED POWER-TO-WEIGHT RATIO TO DRIVE GROWTH

- 12.4 GENERATORS/ENGINES

- 12.4.1 DEMAND FOR SUSTAINABLE AVIATION SOLUTIONS TO DRIVE GROWTH

- 12.5 AEROSTRUCTURES

- 12.5.1 ENHANCED PERFORMANCE AND SAFETY TO DRIVE GROWTH

- 12.6 AVIONICS

- 12.6.1 ABILITY TO MAINTAIN STABLE FLIGHT DYNAMICS TO DRIVE GROWTH

- 12.7 SOFTWARE

- 12.7.1 NEED FOR REAL-TIME FLEET HEALTH MONITORING TO DRIVE GROWTH

- 12.8 OTHERS

13 HYBRID AIRCRAFT MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 32 HYBRID AIRCRAFT MARKET, BY REGION, 2023-2030

- TABLE 28 HYBRID AIRCRAFT MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 29 HYBRID AIRCRAFT MARKET, BY REGION, 2023-2030 (USD MILLION)

- 13.2 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 30 REGIONAL RECESSION IMPACT ANALYSIS

- 13.3 NORTH AMERICA

- 13.3.1 RECESSION IMPACT ANALYSIS

- 13.3.2 PESTLE ANALYSIS

- FIGURE 33 NORTH AMERICA: HYBRID AIRCRAFT MARKET SNAPSHOT

- TABLE 31 NORTH AMERICA: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 32 NORTH AMERICA: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 NORTH AMERICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 36 NORTH AMERICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.3.3 US

- 13.3.3.1 Presence of domestic market leaders to drive growth

- TABLE 37 US: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 38 US: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 39 US: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 40 US: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.3.4 CANADA

- 13.3.4.1 Availability of low-cost raw materials to drive growth

- TABLE 41 CANADA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 42 CANADA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 43 CANADA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 44 CANADA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.4 EUROPE

- 13.4.1 RECESSION IMPACT ANALYSIS

- 13.4.2 PESTLE ANALYSIS

- FIGURE 34 EUROPE: HYBRID AIRCRAFT MARKET SNAPSHOT

- TABLE 45 EUROPE: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 46 EUROPE: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 EUROPE: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 48 EUROPE: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 49 EUROPE: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 50 EUROPE: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.4.3 UK

- 13.4.3.1 Technological advancements to drive growth

- TABLE 51 UK: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 52 UK: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 53 UK: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 54 UK: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.4.4 FRANCE

- 13.4.4.1 Short-distance air travel to drive growth

- TABLE 55 FRANCE: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 56 FRANCE: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 57 FRANCE: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 58 FRANCE: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.4.5 GERMANY

- 13.4.5.1 Increasing investments in R&D to drive growth

- TABLE 59 GERMANY: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 60 GERMANY: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 61 GERMANY: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 62 GERMANY: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.4.6 ITALY

- 13.4.6.1 High demand for hybrid aircraft from commercial end users to drive growth

- TABLE 63 ITALY: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 64 ITALY: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 65 ITALY: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 66 ITALY: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.4.7 RUSSIA

- 13.4.7.1 Rising awareness toward environmental sustainability to drive growth

- TABLE 67 RUSSIA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 68 RUSSIA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 69 RUSSIA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 70 RUSSIA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.4.8 REST OF EUROPE

- TABLE 71 REST OF EUROPE: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 72 REST OF EUROPE: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 73 REST OF EUROPE: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 74 REST OF EUROPE: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.5 ASIA PACIFIC

- 13.5.1 RECESSION IMPACT ANALYSIS

- 13.5.2 PESTLE ANALYSIS

- FIGURE 35 ASIA PACIFIC: HYBRID AIRCRAFT MARKET SNAPSHOT

- TABLE 75 ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 76 ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 79 ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.5.3 CHINA

- 13.5.3.1 Strategic planning for hybrid aircraft development to drive growth

- TABLE 81 CHINA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 82 CHINA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 83 CHINA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 84 CHINA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.5.4 INDIA

- 13.5.4.1 Dense population and urban congestion to drive growth

- TABLE 85 INDIA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 86 INDIA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 87 INDIA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 88 INDIA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.5.5 JAPAN

- 13.5.5.1 Diversification of commercial operations to drive growth

- TABLE 89 JAPAN: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 90 JAPAN: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 91 JAPAN: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 92 JAPAN: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.5.6 AUSTRALIA

- 13.5.6.1 Well-defined hybrid aircraft laws to drive growth

- TABLE 93 AUSTRALIA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 94 AUSTRALIA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 95 AUSTRALIA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 96 AUSTRALIA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.5.7 SOUTH KOREA

- 13.5.7.1 Favorable government initiatives to drive growth

- TABLE 97 SOUTH KOREA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 98 SOUTH KOREA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 99 SOUTH KOREA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 100 SOUTH KOREA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.5.8 REST OF ASIA PACIFIC

- TABLE 101 REST OF ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.6 LATIN AMERICA

- 13.6.1 RECESSION IMPACT ANALYSIS

- 13.6.2 PESTLE ANALYSIS

- FIGURE 36 LATIN AMERICA: HYBRID AIRCRAFT MARKET SNAPSHOT

- TABLE 105 LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 106 LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 107 LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 108 LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 109 LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 110 LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.6.3 BRAZIL

- 13.6.3.1 Intercity and intracity air taxi services by Airbus to drive growth

- TABLE 111 BRAZIL: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 112 BRAZIL: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 113 BRAZIL: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 114 BRAZIL: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.6.4 MEXICO

- 13.6.4.1 Surge in VVIP travel to drive growth

- TABLE 115 MEXICO: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 116 MEXICO: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 117 MEXICO: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 118 MEXICO: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.6.5 REST OF LATIN AMERICA

- TABLE 119 REST OF LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 120 REST OF LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 121 REST OF LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 122 REST OF LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.7 REST OF THE WORLD

- 13.7.1 RECESSION IMPACT ANALYSIS

- TABLE 123 REST OF THE WORLD: HYBRID AIRCRAFT MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 124 REST OF THE WORLD: HYBRID AIRCRAFT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 125 REST OF THE WORLD: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 126 REST OF THE WORLD: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 127 REST OF THE WORLD: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 128 REST OF THE WORLD: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.7.2 MIDDLE EAST

- 13.7.2.1 Domestic airport expansion to drive growth

- TABLE 129 MIDDLE EAST: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 130 MIDDLE EAST: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 131 MIDDLE EAST: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 132 MIDDLE EAST: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

- 13.7.3 AFRICA

- 13.7.3.1 Widespread use of hybrid aircraft for emergency medical services to drive growth

- TABLE 133 AFRICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 134 AFRICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023-2030 (USD MILLION)

- TABLE 135 AFRICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 136 AFRICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023-2030 (USD MILLION)

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- TABLE 137 STRATEGIES ADOPTED BY KEY PLAYERS IN HYBRID AIRCRAFT MARKET, 2022-2023

- 14.2 RANKING ANALYSIS, 2022

- FIGURE 37 MARKET RANKING OF KEY PLAYERS, 2022

- 14.3 REVENUE ANALYSIS, 2022

- FIGURE 38 REVENUE ANALYSIS OF KEY PLAYERS, 2022

- 14.4 MARKET SHARE ANALYSIS, 2022

- FIGURE 39 MARKET SHARE OF KEY PLAYERS, 2022

- TABLE 138 HYBRID AIRCRAFT MARKET: DEGREE OF COMPETITION

- 14.5 COMPANY EVALUATION MATRIX

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- FIGURE 40 COMPANY EVALUATION MATRIX, 2022

- 14.6 COMPANY FOOTPRINT

- TABLE 139 COMPANY FOOTPRINT

- TABLE 140 SEGMENT FOOTPRINT

- 14.7 START-UP/SME EVALUATION MATRIX

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- FIGURE 41 START-UP/SME EVALUATION MATRIX, 2022

- TABLE 141 HYBRID AIRCRAFT MARKET: KEY START-UPS/SMES

- 14.7.5 COMPETITIVE BENCHMARKING

- TABLE 142 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 14.8 COMPETITIVE SCENARIOS AND TRENDS

- 14.8.1 PRODUCT LAUNCHES

- TABLE 143 PRODUCT LAUNCHES, 2020-2023

- 14.8.2 DEALS

- TABLE 144 DEALS, 2020-2023

15 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 15.1 KEY PLAYERS

- 15.1.1 AIRBUS

- TABLE 145 AIRBUS: COMPANY OVERVIEW

- FIGURE 42 AIRBUS: COMPANY SNAPSHOT

- TABLE 146 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 147 AIRBUS: PRODUCT LAUNCHES

- TABLE 148 AIRBUS: DEALS

- 15.1.2 TEXTRON INC.

- TABLE 149 TEXTRON INC.: COMPANY OVERVIEW

- FIGURE 43 TEXTRON INC.: COMPANY SNAPSHOT

- TABLE 150 TEXTRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 151 TEXTRON INC.: DEALS

- 15.1.3 EMBRAER

- TABLE 152 EMBRAER: COMPANY OVERVIEW

- FIGURE 44 EMBRAER: COMPANY SNAPSHOT

- TABLE 153 EMBRAER: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 154 EMBRAER: DEALS

- 15.1.4 ZEROAVIA

- TABLE 155 ZEROAVIA: COMPANY OVERVIEW

- TABLE 156 ZEROAVIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 157 ZEROAVIA: DEALS

- 15.1.5 AMPAIRE, INC.

- TABLE 158 AMPAIRE, INC.: COMPANY OVERVIEW

- TABLE 159 AMPAIRE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 160 AMPAIRE, INC.: DEALS

- 15.1.6 FARADAIR AEROSPACE

- TABLE 161 FARADAIR AEROSPACE: COMPANY OVERVIEW

- TABLE 162 FARADAIR AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 163 FARADAIR AEROSPACE: DEALS

- 15.1.7 HEART AEROSPACE

- TABLE 164 HEART AEROSPACE: COMPANY OVERVIEW

- TABLE 165 HEART AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 166 HEART AEROSPACE: DEALS

- 15.1.8 HORIZON AIRCRAFT, INC.

- TABLE 167 HORIZON AIRCRAFT, INC.: COMPANY OVERVIEW

- TABLE 168 HORIZON AIRCRAFT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 169 HORIZON AIRCRAFT, INC.: DEALS

- 15.1.9 BOMBARDIER, INC.

- TABLE 170 BOMBARDIER, INC.: COMPANY OVERVIEW

- FIGURE 45 BOMBARDIER, INC.: COMPANY SNAPSHOT

- TABLE 171 BOMBARDIER, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- 15.1.10 SAFRAN

- TABLE 172 SAFRAN: COMPANY OVERVIEW

- FIGURE 46 SAFRAN: COMPANY SNAPSHOT

- TABLE 173 SAFRAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 174 SAFRAN: DEALS

- 15.1.11 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 175 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- FIGURE 47 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 176 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 177 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- 15.1.12 HONEYWELL

- TABLE 178 HONEYWELL: COMPANY OVERVIEW

- FIGURE 48 HONEYWELL: COMPANY SNAPSHOT

- TABLE 179 HONEYWELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 180 HONEYWELL: PRODUCT LAUNCHES

- TABLE 181 HONEYWELL: DEALS

- 15.1.13 GENERAL ELECTRIC

- TABLE 182 GENERAL ELECTRIC: COMPANY OVERVIEW

- FIGURE 49 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 183 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 184 GENERAL ELECTRIC: PRODUCT LAUNCHES

- TABLE 185 GENERAL ELECTRIC: DEALS

- 15.1.14 ROLLS ROYCE

- TABLE 186 ROLLS ROYCE: COMPANY OVERVIEW

- FIGURE 50 ROLLS ROYCE: COMPANY SNAPSHOT

- TABLE 187 ROLLS ROYCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 188 ROLLS ROYCE: PRODUCT LAUNCHES

- 15.1.15 GKN AEROSPACE

- TABLE 189 GKN AEROSPACE: COMPANY OVERVIEW

- TABLE 190 GKN AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- 15.1.16 VOLTAERO

- TABLE 191 VOLTAERO: COMPANY OVERVIEW

- TABLE 192 VOLTAERO: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 193 VOLTAERO: PRODUCT LAUNCHES

- TABLE 194 VOLTAERO: DEALS

- 15.1.17 ELECTRIC AVIATION GROUP

- TABLE 195 ELECTRIC AVIATION GROUP: COMPANY OVERVIEW

- TABLE 196 ELECTRIC AVIATION GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 197 ELECTRIC AVIATION GROUP: DEALS

- 15.1.18 PLANA

- TABLE 198 PLANA: COMPANY OVERVIEW

- TABLE 199 PLANA: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 200 PLANA: DEALS

- 15.1.19 ASCENDANCE FLIGHT TECHNOLOGIES

- TABLE 201 ASCENDANCE FLIGHT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 202 ASCENDANCE FLIGHT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 203 ASCENDANCE FLIGHT TECHNOLOGIES: DEALS

- 15.1.20 XTI AIRCRAFT

- TABLE 204 XTI AIRCRAFT: COMPANY OVERVIEW

- TABLE 205 XTI AIRCRAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 206 XTI AIRCRAFT: DEALS

- 15.2 OTHER PLAYERS

- 15.2.1 ELECTRA.AERO, INC.

- 15.2.2 MANTA AIRCRAFT

- 15.2.3 AMSL AERO PTY. LTD.

- 15.2.4 TRANSCEND AIR CORPORATION

- 15.2.5 AVA PROPULSION, INC.

- 15.2.6 SKYFLY TECHNOLOGIES LTD.

- 15.2.7 H2FLY

- 15.2.8 COSTRUZIONI AERONAUTICHE TECNAM S.P.A.

- 15.2.9 ELROY AIR

- 15.2.10 AIRSPACE EXPERIENCE TECHNOLOGIES, INC.

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS