|

|

市場調査レポート

商品コード

1594227

衛星通信(SATCOM)機器の世界市場:ソリューション別、プラットフォーム別、タイプ別、業界別、周波数別、接続性別、地域別 - 予測(~2029年)Satellite Communication (SATCOM) Equipment Market by Solution (Product (Antennas, Transceivers, Power Amplifiers, Converters), Service (Engineering)), Platform, Type, Vertical, Frequency, Connectivity, and Region- Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 衛星通信(SATCOM)機器の世界市場:ソリューション別、プラットフォーム別、タイプ別、業界別、周波数別、接続性別、地域別 - 予測(~2029年) |

|

出版日: 2024年11月14日

発行: MarketsandMarkets

ページ情報: 英文 350 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の衛星通信(SATCOM)機器の市場規模は、2024年に242億7,000万米ドルであり、2029年までに415億1,000万米ドルに達すると予測され、2024年~2029年にCAGRで11.3%の成長が見込まれます。

SATCOMはここ2~3年、技術的な進歩だけでなく市場需要の変化という面でも大きな発展を示しています。例えば、LEO衛星コンステレーションは、低遅延と広帯域で接続性に革命をもたらしました。高スループット衛星とフェーズドアレイアンテナは、データ転送だけでなく、エンドユーザーエクスペリエンスにも革命をもたらしました。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | ソリューション、サービス、プラットフォーム、タイプ、業界、周波数、接続性、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

衛星は、20世紀には不可能だった音声、データ、放送ソリューションの数々を提供します。このコンバージェンスにより、中断のない可用性、信頼性、セキュリティを提供するネットワークへの要求が高まっています。そして、より多くのミッションクリティカルな用途がネットワークに依存するようになり、ネットワークの問題に対する許容度はゼロに近づいています。

ブロードバンド接続に対する需要の増加、セルラーネットワークによる範囲の拡大、IoT接続の必要性、衛星通信関連インフラへの政府投資の増加などが市場を牽引しています。これらの要因を総合すると、複数の周波数帯で動作し、より高いデータレート、効率、信頼性を持つ、先進の衛星通信機器が顧客にとって魅力的なものとなります。HTSは、従来の衛星に利用されていた技術に革命をもたらし、市場を大幅に高いデータレートと容量へと変えると見られます。HTSは、ブロードバンドインターネットからビデオストリーミングや企業ネットワークに至るまで、広範な用途やサービスの提供に、特定の地理的エリアに帯域幅を集中させるスポットビームを使用します。

5Gや6Gといった地上ネットワークと統合された衛星通信機器も、注目すべき市場の動向の1つです。統合によってシームレスな接続性が強化され、衛星通信と地上通信の両方の強みを生かすことで、より耐障害性の高いネットワークが実現します。衛星通信(SATCOM)機器市場の主要企業は、性能効率と信頼性を高めるため、GaAs、Gallium RF技術のような最先端技術を革新する研究開発に多くの投資を行っています。主要企業はまた、この機会を生かし、顧客の要求を満たすソリューションを提供するために、戦略的パートナーシップや提携を模索しています。

「周波数別では、マルチバンド周波数が予測期間の2024年~2029年に最高を記録する見込みです。」

周波数別では、マルチバンド周波数が予測期間の2024年~2029年にもっとも高いCAGRを記録する見込みです。マルチバンド周波数は、ネットワークとグリッド間のシームレスで確実な接続の必要性から、ますます使用されるようになっています。

「接続性別では、MEO/GEO軌道セグメントが予測期間の2024年~2029年に市場をリードします。」

MEOの高スループット衛星は、ビット当たりのコストと全体的な運用効率でGEO衛星に課題を突きつけています。著名なコンステレーションで使用されている小型衛星の低い製造コストなど、複数の利点が、通信向けの大型GEO衛星に実行可能な商業的選択肢をもたらしています。さらに、より地表に近い位置にあるため、これらの衛星はデータ接続の範囲において効果的です。2023年2月、Marlinkはフランス領ギアナの都市部と農村部の両方をカバーする衛星ネットワーク経由のブロードバンドインターネットと4G/5Gサービスを展開する公共サービス委任契約を獲得しました。15年間の契約で、MarlinkとSESはSESのマルチGEO/MEOネットワークを活用し、フランス地域全体で3万人を超えるユーザーに高速なサービスを提供します。

当レポートでは、世界の衛星通信(SATCOM)機器市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 衛星通信(SATCOM)機器市場の企業にとって魅力的な機会

- 衛星通信(SATCOM)機器市場:プラットフォーム別

- 衛星通信(SATCOM)機器市場:航空セグメント別

- 衛星通信(SATCOM)機器市場:商業界別

- 衛星通信(SATCOM)機器市場:技術別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 顧客ビジネスに影響を与える動向と混乱

- エコシステム分析

- 著名な企業

- 民間企業と中小企業

- エンドユーザー

- ビジネスモデル

- 総所有コスト

- 部品表

- 技術ロードマップ

- 数量データ

- 価格分析

- ポータブルSATCOM機器の参考価格分析

- 海上SATCOM機器の参考価格分析

- 陸上移動SATCOM機器の参考価格分析

- ケーススタディ分析

- 規制情勢

- 主なステークホルダーと購入基準

- 貿易分析

- 輸入データ

- 輸出データ

- 主な会議とイベント(2024年~2025年)

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- マクロ経済の見通し

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東

- ラテンアメリカ、アフリカ

第6章 産業動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- サプライチェーン分析

- 特許分析

- 生成AIの影響

第7章 衛星通信(SATCOM)機器市場:接続性別

- イントロダクション

- LEO

- MEO/GEO

第8章 衛星通信(SATCOM)機器市場:周波数別

- イントロダクション

- Cバンド

- L・Sバンド

- Xバンド

- KAバンド

- KUバンド

- VHF/UHFバンド

- EHF/SHFバンド

- マルチバンド

- Qバンド

第9章 衛星通信(SATCOM)機器市場:タイプ別

- イントロダクション

- 移動中の衛星通信

- 静止中の衛星通信

第10章 衛星通信(SATCOM)機器市場:業界別

- イントロダクション

- 商業

- 政府・防衛

第11章 衛星通信(SATCOM)機器市場:ソリューション別

- イントロダクション

- 製品

- サービス

第12章 衛星通信(SATCOM)機器市場:プラットフォーム別

- イントロダクション

- ポータブル

- 陸上移動

- 陸上固定

- 航空

- 海上

第13章 衛星通信(SATCOM)機器市場:端末別

- イントロダクション

- LTEベース

- 非LTEベース

第14章 衛星通信(SATCOM)機器市場:技術別

- イントロダクション

- 次世代

- レガシー

第15章 衛星通信(SATCOM)機器市場:地域別

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- ロシア

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- PESTLE分析

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他のアジア太平洋

- 中東・アフリカ

- PESTLE分析

- 湾岸協力会議(GCC)

- イスラエル

- トルコ

- アフリカ

- ラテンアメリカ

- PESTLE分析

- ブラジル

- メキシコ

- アルゼンチン

第16章 競合情勢

- イントロダクション

- 主要企業戦略/有力企業(2020年~2024年)

- 収益分析(2020年~2023年)

- 市場シェア分析(2023年)

- 企業の評価と財務指標

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- ブランド/製品の比較

- 競合シナリオ

第17章 企業プロファイル

- 主要企業

- ECHOSTAR CORPORATION

- L3HARRIS TECHNOLOGIES, INC.

- THALES

- RTX

- GENERAL DYNAMICS CORPORATION

- COBHAM SATCOM

- HONEYWELL INTERNATIONAL INC.

- VIASAT, INC.

- GILAT SATELLITE NETWORKS

- IRIDIUM COMMUNICATIONS INC.

- ASELSAN A.S.

- INTELLIAN TECHNOLOGIES, INC.

- ST ENGINEERING

- SPACEX

- ELBIT SYSTEMS LTD.

- その他の企業

- CAMPBELL SCIENTIFIC, INC.

- ND SATCOM GMBH

- SATCOM GLOBAL

- HOLKIRK COMMUNICATIONS LTD.

- AVL TECHNOLOGIES

- ONEWEB

- THINKOM SOLUTIONS INC.

- VIKING SATCOM

- NORSAT INTERNATIONAL INC.

- CESIUMASTRO, INC.

第18章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 OPERATIONAL INFORMATION ON LEO AND MEO CONSTELLATIONS

- TABLE 4 DEVELOPMENT INFORMATION ON LEO AND MEO CONSTELLATIONS

- TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 BUSINESS MODELS OF SATCOM EQUIPMENT MARKET

- TABLE 7 TOTAL COST OF OWNERSHIP OF SATCOM EQUIPMENT

- TABLE 8 INDICATIVE PRICING ANALYSIS OF PORTABLE SATCOM EQUIPMENT (USD)

- TABLE 9 INDICATIVE PRICING ANALYSIS OF MARITIME SATCOM EQUIPMENT (USD)

- TABLE 10 INDICATIVE PRICING ANALYSIS OF LAND MOBILE SATCOM EQUIPMENT (USD)

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VERTICAL (%)

- TABLE 16 KEY BUYING CRITERIA FOR SATCOM EQUIPMENT, BY VERTICAL

- TABLE 17 IMPORT DATA FOR HS CODE 880260, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 18 EXPORT DATA FOR HS CODE 880260, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 19 KEY CONFERENCES AND EVENTS

- TABLE 20 PATENT ANALYSIS, 2017-2023

- TABLE 21 SATCOM EQUIPMENT MARKET, BY CONNECTIVITY, 2020-2023 (USD MILLION)

- TABLE 22 SATCOM EQUIPMENT MARKET, BY CONNECTIVITY, 2024-2029 (USD MILLION)

- TABLE 23 SATCOM EQUIPMENT MARKET, BY FREQUENCY, 2020-2023 (USD MILLION)

- TABLE 24 SATCOM EQUIPMENT MARKET, BY FREQUENCY, 2024-2029 (USD MILLION)

- TABLE 25 SATCOM EQUIPMENT MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 26 SATCOM EQUIPMENT MARKET, BY TYPE, 2024-2029 (USD MILLION)

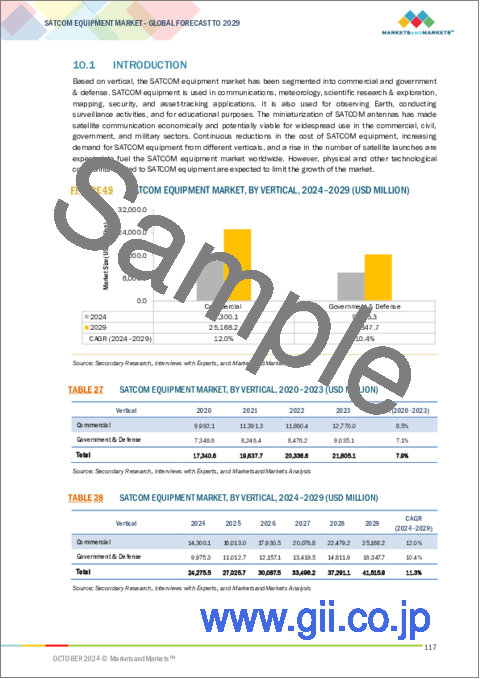

- TABLE 27 SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 28 SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 29 COMMERCIAL: SATCOM EQUIPMENT MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 30 COMMERCIAL: SATCOM EQUIPMENT MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 31 GOVERNMENT & DEFENSE: SATCOM EQUIPMENT MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 32 GOVERNMENT & DEFENSE: SATCOM EQUIPMENT MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 33 SATCOM EQUIPMENT MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 34 SATCOM EQUIPMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 35 PRODUCT: SATCOM EQUIPMENT MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 36 PRODUCT: SATCOM EQUIPMENT MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 37 SATCOM EQUIPMENT MARKET, BY ANTENNA TYPE, 2020-2023 (USD MILLION)

- TABLE 38 SATCOM EQUIPMENT MARKET, BY ANTENNA TYPE, 2024-2029 (USD MILLION)

- TABLE 39 SATCOM EQUIPMENT MARKET, BY TRANSCEIVER TYPE, 2020-2023 (USD MILLION)

- TABLE 40 SATCOM EQUIPMENT MARKET, BY TRANSCEIVER TYPE, 2024-2029 (USD MILLION)

- TABLE 41 SERVICE: SATCOM EQUIPMENT MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 42 SERVICE: SATCOM EQUIPMENT MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 43 SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 44 SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 45 PORTABLE: SATCOM EQUIPMENT MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 46 PORTABLE: SATCOM EQUIPMENT MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 47 LAND MOBILE: SATCOM EQUIPMENT MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 48 LAND MOBILE: SATCOM EQUIPMENT MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 49 LAND FIXED: SATCOM EQUIPMENT MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 50 LAND FIXED: SATCOM EQUIPMENT MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 51 AIRBORNE: SATCOM EQUIPMENT MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 52 AIRBORNE: SATCOM EQUIPMENT MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 53 MARITIME: SATCOM EQUIPMENT MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 54 MARITIME: SATCOM EQUIPMENT MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 55 SATCOM EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 SATCOM EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 57 NORTH AMERICA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 58 NORTH AMERICA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 59 NORTH AMERICA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 60 NORTH AMERICA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 61 NORTH AMERICA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 62 NORTH AMERICA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 63 NORTH AMERICA: SATCOM EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 64 NORTH AMERICA: SATCOM EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 65 US: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 66 US: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 67 US: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 68 US: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 69 US: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 70 US: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 71 CANADA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 72 CANADA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 73 CANADA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 74 CANADA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 75 CANADA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 76 CANADA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 77 EUROPE: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 78 EUROPE: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 79 EUROPE: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 80 EUROPE: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 81 EUROPE: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 82 EUROPE: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 83 EUROPE: SATCOM EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 84 EUROPE: SATCOM EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 85 RUSSIA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 86 RUSSIA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 87 RUSSIA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 88 RUSSIA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 89 RUSSIA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 90 RUSSIA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 91 GERMANY: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 92 GERMANY: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 93 GERMANY: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 94 GERMANY: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 95 GERMANY: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 96 GERMANY: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 97 FRANCE: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 98 FRANCE: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 99 FRANCE: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 100 FRANCE: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 101 FRANCE: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 102 FRANCE: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 103 UK: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 104 UK: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 105 UK: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 106 UK: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 107 UK: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 108 UK: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 109 ITALY: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 110 ITALY: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 111 ITALY: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 112 ITALY: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 113 ITALY: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 114 ITALY: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 115 SPAIN: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 116 SPAIN: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 117 SPAIN: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 118 SPAIN: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 119 SPAIN: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 120 SPAIN: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 121 REST OF EUROPE: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 122 REST OF EUROPE: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 123 REST OF EUROPE: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 124 REST OF EUROPE: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 125 REST OF EUROPE: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 126 REST OF EUROPE: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 127 ASIA PACIFIC: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 128 ASIA PACIFIC: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 129 ASIA PACIFIC: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 130 ASIA PACIFIC: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 131 ASIA PACIFIC: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 132 ASIA PACIFIC: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 133 ASIA PACIFIC: SATCOM EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 134 ASIA PACIFIC: SATCOM EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 135 CHINA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 136 CHINA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 137 CHINA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 138 CHINA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 139 CHINA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 140 CHINA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 141 INDIA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 142 INDIA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 143 INDIA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 144 INDIA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 145 INDIA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 146 INDIA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 147 JAPAN: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 148 JAPAN: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 149 JAPAN: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 150 JAPAN: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 151 JAPAN: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 152 JAPAN: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 153 SOUTH KOREA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 154 SOUTH KOREA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 155 SOUTH KOREA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 156 SOUTH KOREA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 157 SOUTH KOREA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 158 SOUTH KOREA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 159 AUSTRALIA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 160 AUSTRALIA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 161 AUSTRALIA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 162 AUSTRALIA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 163 AUSTRALIA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 164 AUSTRALIA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: SATCOM EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: SATCOM EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 179 SAUDI ARABIA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 180 SAUDI ARABIA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 181 SAUDI ARABIA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 182 SAUDI ARABIA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 183 SAUDI ARABIA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 184 SAUDI ARABIA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 185 UAE: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 186 UAE: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 187 UAE: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 188 UAE: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 189 UAE: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 190 UAE: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 191 ISRAEL: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 192 ISRAEL: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 193 ISRAEL: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 194 ISRAEL: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 195 ISRAEL: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 196 ISRAEL: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 197 TURKEY: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 198 TURKEY: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 199 TURKEY: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 200 TURKEY: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 201 TURKEY: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 202 TURKEY: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 203 AFRICA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 204 AFRICA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 205 AFRICA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 206 AFRICA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 207 AFRICA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 208 AFRICA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 209 LATIN AMERICA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 210 LATIN AMERICA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 211 LATIN AMERICA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 212 LATIN AMERICA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 213 LATIN AMERICA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 214 LATIN AMERICA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 215 LATIN AMERICA: SATCOM EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 216 LATIN AMERICA: SATCOM EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 217 BRAZIL: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 218 BRAZIL: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 219 BRAZIL: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 220 BRAZIL: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 221 BRAZIL: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 222 BRAZIL: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 223 MEXICO: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 224 MEXICO: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 225 MEXICO: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 226 MEXICO: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 227 MEXICO: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 228 MEXICO: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 229 ARGENTINA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 230 ARGENTINA: SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 231 ARGENTINA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 232 ARGENTINA: SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 233 ARGENTINA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 234 ARGENTINA: SATCOM EQUIPMENT MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 235 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 236 SATCOM EQUIPMENT MARKET: DEGREE OF COMPETITION

- TABLE 237 SOLUTION FOOTPRINT

- TABLE 238 VERTICAL FOOTPRINT

- TABLE 239 PLATFORM FOOTPRINT

- TABLE 240 REGION FOOTPRINT

- TABLE 241 LIST OF START-UPS/SMES

- TABLE 242 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 243 SATCOM EQUIPMENT MARKET: PRODUCT/SERVICE LAUNCHES, 2020-2024

- TABLE 244 SATCOM EQUIPMENT MARKET: DEALS, 2020-2024

- TABLE 245 SATCOM EQUIPMENT MARKET: OTHERS, 2020-2024

- TABLE 246 ECHOSTAR CORPORATION: COMPANY OVERVIEW

- TABLE 247 ECHOSTAR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 ECHOSTAR CORPORATION: PRODUCT/SERVICE LAUNCHES

- TABLE 249 ECHOSTAR CORPORATION: DEALS

- TABLE 250 ECHOSTAR CORPORATION: OTHERS

- TABLE 251 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 252 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 L3HARRIS TECHNOLOGIES, INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 254 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 255 L3HARRIS TECHNOLOGIES, INC.: OTHERS

- TABLE 256 THALES: COMPANY OVERVIEW

- TABLE 257 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 THALES: DEALS

- TABLE 259 THALES: OTHERS

- TABLE 260 RTX: COMPANY OVERVIEW

- TABLE 261 RTX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 RTX: OTHERS

- TABLE 263 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 264 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 GENERAL DYNAMICS CORPORATION: OTHERS

- TABLE 266 COBHAM SATCOM: COMPANY OVERVIEW

- TABLE 267 COBHAM SATCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 COBHAM SATCOM: PRODUCT/SERVICE LAUNCHES

- TABLE 269 COBHAM SATCOM: DEALS

- TABLE 270 COBHAM SATCOM: OTHERS

- TABLE 271 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 272 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 HONEYWELL INTERNATIONAL INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 274 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 275 HONEYWELL INTERNATIONAL INC.: OTHERS

- TABLE 276 VIASAT, INC.: COMPANY OVERVIEW

- TABLE 277 VIASAT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 VIASAT, INC.: DEALS

- TABLE 279 VIASAT, INC.: OTHERS

- TABLE 280 GILAT SATELLITE NETWORKS: COMPANY OVERVIEW

- TABLE 281 GILAT SATELLITE NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 GILAT SATELLITE NETWORKS: DEALS

- TABLE 283 GILAT SATELLITE NETWORKS: OTHERS

- TABLE 284 IRIDIUM COMMUNICATIONS INC.: COMPANY OVERVIEW

- TABLE 285 IRIDIUM COMMUNICATIONS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 286 IRIDIUM COMMUNICATIONS INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 287 IRIDIUM COMMUNICATIONS INC.: DEALS

- TABLE 288 IRIDIUM COMMUNICATIONS INC.: OTHERS

- TABLE 289 ASELSAN A.S.: COMPANY OVERVIEW

- TABLE 290 ASELSAN A.S.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 ASELSAN A.S.: PRODUCT/SERVICE LAUNCHES

- TABLE 292 ASELSAN A.S.: OTHERS

- TABLE 293 INTELLIAN TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 294 INTELLIAN TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 INTELLIAN TECHNOLOGIES, INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 296 INTELLIAN TECHNOLOGIES, INC.: DEALS

- TABLE 297 INTELLIAN TECHNOLOGIES, INC.: OTHERS

- TABLE 298 ST ENGINEERING: COMPANY OVERVIEW

- TABLE 299 ST ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 ST ENGINEERING: PRODUCT/SERVICE LAUNCHES

- TABLE 301 ST ENGINEERING: DEALS

- TABLE 302 ST ENGINEERING: OTHERS

- TABLE 303 SPACEX: COMPANY OVERVIEW

- TABLE 304 SPACEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 SPACEX: PRODUCT/SERVICE LAUNCHES

- TABLE 306 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 307 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 ELBIT SYSTEMS LTD.: PRODUCT/SERVICE LAUNCHES

- TABLE 309 ELBIT SYSTEMS LTD.: DEALS

- TABLE 310 ELBIT SYSTEMS LTD.: OTHERS

- TABLE 311 CAMPBELL SCIENTIFIC, INC.: COMPANY OVERVIEW

- TABLE 312 ND SATCOM GMBH: COMPANY OVERVIEW

- TABLE 313 SATCOM GLOBAL: COMPANY OVERVIEW

- TABLE 314 HOLKIRK COMMUNICATIONS LTD.: COMPANY OVERVIEW

- TABLE 315 AVL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 316 ONEWEB: COMPANY OVERVIEW

- TABLE 317 THINKOM SOLUTIONS INC.: COMPANY OVERVIEW

- TABLE 318 VIKING SATCOM: COMPANY OVERVIEW

- TABLE 319 NORSAT INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 320 CESIUMASTRO, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SATCOM EQUIPMENT MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 AIRBORNE SEGMENT TO HOLD LEADING POSITION DURING FORECAST PERIOD

- FIGURE 8 SATCOM-ON-THE-MOVE SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 9 PRODUCT SEGMENT TO SECURE HIGHER SHARE THAN SERVICE SEGMENT IN 2029

- FIGURE 10 COMMERCIAL SEGMENT TO BE LARGER THAN GOVERNMENT & DEFENSE SEGMENT DURING FORECAST PERIOD

- FIGURE 11 LEO TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 12 MULTI-BAND SEGMENT TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 NORTH AMERICA TO BE LARGEST MARKET FOR SATCOM EQUIPMENT DURING FORECAST PERIOD

- FIGURE 14 EXTENSIVE USE OF SATCOM EQUIPMENT FOR TRACKING, MONITORING, AND SURVEILLANCE TO DRIVE MARKET

- FIGURE 15 AIRBORNE SEGMENT TO BE PREVALENT DURING FORECAST PERIOD

- FIGURE 16 COMMERCIAL AIRCRAFT TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 17 RETAIL & CONSUMER TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 18 SATCOM-ON-THE-MOVE SEGMENT TO ACCOUNT FOR MAXIMUM SHARE IN 2024

- FIGURE 19 SATCOM EQUIPMENT MARKET DYNAMICS

- FIGURE 20 VALUE CHAIN ANALYSIS

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 ECOSYSTEM ANALYSIS

- FIGURE 23 BUSINESS MODELS OF SATCOM EQUIPMENT MARKET

- FIGURE 24 BREAKDOWN OF TOTAL COST OF OWNERSHIP OF SATCOM EQUIPMENT

- FIGURE 25 BILL OF MATERIALS FOR PORTABLE SATCOM EQUIPMENT

- FIGURE 26 BILL OF MATERIALS FOR LAND MOBILE SATCOM EQUIPMENT

- FIGURE 27 BILL OF MATERIALS FOR LAND FIXED SATCOM EQUIPMENT

- FIGURE 28 BILL OF MATERIALS FOR AIRBORNE SATCOM EQUIPMENT

- FIGURE 29 BILL OF MATERIALS FOR MARITIME SATCOM EQUIPMENT

- FIGURE 30 EVOLUTION OF SATCOM EQUIPMENT TECHNOLOGY

- FIGURE 31 INTRODUCTION TO TECHNOLOGY ROADMAP

- FIGURE 32 EMERGING TRENDS

- FIGURE 33 INDICATIVE PRICING OF SATCOM EQUIPMENT, BY PLATFORM (USD)

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VERTICAL

- FIGURE 35 KEY BUYING CRITERIA FOR SATCOM EQUIPMENT, BY VERTICAL

- FIGURE 36 IMPORT DATA FOR HS CODE 880260, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 37 EXPORT DATA FOR HS CODE 880260, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 38 INVESTMENTS IN START-UP SATELLITE COMPANIES, 2022

- FIGURE 39 VENTURE CAPITAL FUNDING, 2017-2022 (USD BILLION)

- FIGURE 40 SUPPLY CHAIN ANALYSIS

- FIGURE 41 PATENT ANALYSIS, 2013-2023

- FIGURE 42 AI IN SATCOM INDUSTRY

- FIGURE 43 ADOPTION OF AI IN SPACE BY TOP COUNTRIES

- FIGURE 44 IMPACT OF AI ON SATCOM PLATFORMS

- FIGURE 45 IMPACT OF AI ON SATCOM EQUIPMENT MARKET

- FIGURE 46 SATCOM EQUIPMENT MARKET, BY CONNECTIVITY, 2024-2029 (USD MILLION)

- FIGURE 47 SATCOM EQUIPMENT MARKET, BY FREQUENCY, 2024-2029 (USD MILLION)

- FIGURE 48 SATCOM EQUIPMENT MARKET, BY TYPE, 2024-2029 (USD MILLION)

- FIGURE 49 SATCOM EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- FIGURE 50 SATCOM EQUIPMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- FIGURE 51 SATCOM EQUIPMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- FIGURE 52 SATCOM EQUIPMENT MARKET, BY REGION, 2024-2029

- FIGURE 53 NORTH AMERICA: SATCOM EQUIPMENT MARKET SNAPSHOT

- FIGURE 54 EUROPE: SATCOM EQUIPMENT MARKET SNAPSHOT

- FIGURE 55 ASIA PACIFIC: SATCOM EQUIPMENT MARKET SNAPSHOT

- FIGURE 56 MIDDLE EAST & AFRICA: SATCOM EQUIPMENT MARKET SNAPSHOT

- FIGURE 57 LATIN AMERICA: SATCOM EQUIPMENT MARKET SNAPSHOT

- FIGURE 58 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2023 (USD MILLION)

- FIGURE 59 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 60 VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 61 EV/EBIDTA OF PROMINENT MARKET PLAYERS

- FIGURE 62 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 63 COMPANY FOOTPRINT

- FIGURE 64 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 65 BRAND/PRODUCT COMPARISON

- FIGURE 66 ECHOSTAR CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 68 THALES: COMPANY SNAPSHOT

- FIGURE 69 RTX: COMPANY SNAPSHOT

- FIGURE 70 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 72 VIASAT, INC.: COMPANY SNAPSHOT

- FIGURE 73 GILAT SATELLITE NETWORKS: COMPANY SNAPSHOT

- FIGURE 74 IRIDIUM COMMUNICATIONS INC.: COMPANY SNAPSHOT

- FIGURE 75 ASELSAN A.S.: COMPANY SNAPSHOT

- FIGURE 76 INTELLIAN TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 77 ST ENGINEERING: COMPANY SNAPSHOT

- FIGURE 78 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

The SATCOM equipment market is valued at USD 24.27 billion in 2024 and is projected to reach USD 41.51 billion by 2029, at a CAGR of 11.3% from 2024 to 2029. SATCOM has witnessed significant development in the last two-three years, both in the arena of technological advancement as well as the changing nature of market demand. For instance, LEO constellations have revolutionized connectivity with lower latency and more bandwidth. High throughput satellites and phased array antennas have revolutionized data transmissions as well as the end user experience.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Solution, Services, Platform, Type, Vertical, Frequency, Connectivity, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Satellites provide a host of voice, data, and broadcast solutions that wouldn't have been possible in the 20th century. This convergence drives increased network demands to deliver uninterrupted availability, reliability, and security. And, as more mission-critical applications become dependent on the network, tolerance for network problems approaches zero.

The increasing demand for broadband connectivity, extension of coverage by cellular networks, the need for IoT connectivity, and increasing government investment in satellite communication-related infrastructure drive the market. In total, these factors make more sophisticated satcom equipment to work at multiple frequency bands, have higher data rates, efficiency, and reliability appealing to customers. HTS will change the satcom equipment market to significantly higher data rates and capacity, revolutionizing the technology as applied to traditional satellites. It uses spot beams that concentrate bandwidth over particular geographic areas for delivering broad applications and services, from broadband internet to video streaming and enterprise networks.

Satcom equipment integrated with terrestrial networks, such as 5G and 6G, is another notable market trend. Integration will enhance seamless connectivity, with a much more resilient network by exploiting both strengths in satellite and terrestrial communications. Top companies in the satcom equipment market invest a lot in R&D to innovate the most advanced technologies like GaAs and Gallium RF technology to enhance performance efficiency and reliability. The top players are also scouting for strategic partnerships and collaborations to capitalize on this opportunity and provide solutions which meet the requirements of the customers.

"Based on frequency, the multiband frequency is projected to register the highest during the forecast period 2024-2029."

Based on frequency, the SATCOM equipment market has been segmented into C band, L&S band, X band, Ka band, Ku band, VHF/UHF band, EHF/SHF band, Multiband, and Q band. Based on frequency, the multiband frequency is projected to register the highest CAGR during the forecast period 2024-2029. Multi-band frequency is being increasingly used due to the need for seamless, assured connectivity between the network and grid.

"Based on connectivity, MEO/GEO orbit segment is to lead the market during the forecast period 2024-2029."

The SATCOM equipment market has been segmented based on connectivity into LEO and MEO/GEO orbit. MEO/GEO orbit segment to lead the market during the forecast period 2024-2029. MEO high throughput satellites are challenging GEO satellites in cost per bit and overall operational efficiency. Several advantages, including the low manufacturing cost of smaller satellites used in prominent constellations, provide a viable commercial option for large GEO satellites for communication. Moreover, closer positioning to Earth's surface makes these satellites effective in the coverage of data connections. In February 2023, Marlink was awarded a Public Service Delegation contract to deploy broadband Internet and 4G/5G services via satellite networks, covering both urban and rural areas in French Guiana. In a 15-year agreement, Marlink and SES will leverage SES's multi-orbit geostationary (GEO) and Medium Earth Orbit (MEO) satellite network to provide high-speed services to over 30,000 users across the French region.

"The North American market is projected to contribute the most significant share from 2024 to 2029 in the SATCOM equipment market."

North America is projected to dominate the SATCOM equipment market from 2024 to 2029 by region. The North American segment, particularly the US, possesses a highly rewarding demand for SATCOM equipment. The US government has been continually investing in SATCOM with the intention of improving the quality and efficiency of satellite communication. The increasing investment in SATCOM equipment is mainly for upgrading the defense and surveillance of the armed forces, improving the modernization of military platforms' communication systems, and supporting critical infrastructure and law enforcement agencies. Such factors are significantly responsible for the growth of the North American SATCOM equipment market. Some of the notable players from this region are L3Harris Technologies (US), Honeywell International Inc. (US), EchoStar Corporation (US), Viasat, Inc. (US), and so on. Prominent players from this region include L3Harris Technologies (US), Honeywell International Inc. (US), EchoStar Corporation (US), Viasat, Inc. (US), and others.

The break-up of the profile of primary participants in the SATCOM equipment market:

- By Company Type: Tier 1 - 49%, Tier 2 - 37%, and Tier 3 - 14%

- By Designation: C Level - 55%, Managers - 27%, and Others - 18%

- By Region: North America - 32%, Europe - 32%, Asia Pacific - 16%, Middle East & Africa - 10%, Latin America - 10%

Major companies profiled in the report include Echostar Corporation (US), L3Harris Technologies, Inc. (US), Thales (France), RTX (US), General Dynamics Corporation (US), Cobham Satcom (Denmark), Honeywell International Inc. (US), Viasat, Inc. (US), Gilat Satellite Networks (Israel), Aselsan A.S (Turkey), Iridium Communication Inc. (US), Intellian Technologies Inc. ( South Korea), ST Engineering (Singapore), SpaceX (US), Elbit Systems Ltd. (Israel), Campbell Scientific, Inc. (US), among others.

Research Coverage:

This market study covers the SATCOM equipment market across various segments and subsegments. It aims to estimate this market's size and growth potential across different parts based on Solutions (Products, Services) Verticals ( Commercial, Government & Defense), Type ( SATCOM-on-the-Move, SATCOM-on-the-Pause), Connectivity (LEO, MEO/GEO), Frequency (C-Band, L&S-Band, X-Band, Ka-Band, Ku-Band, VHF/UHF-Band, EHF/SHF-Band, Multi-Band, Q-Band) , Platform( Portable, Land Fixed, land Mobile, Maritime, Airborne) and Region (North America, Europe, Asia Pacific, Middle East & Africa, Latin America). This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall SATCOM equipment market. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market Drivers (Large-scale adoption of electronically steered phased antennas Increased LEO Satellite launches,Integration of SOTM solutions into unmanned ground vehicles, Need for Earth observation imagery and analytics, Surge in demand for high-speed data and voice services from aviation and maritime sectors, Growing preference for connected devices and IoT)

, Restraints ( High development and maintenance cost of SATCOM infrastructure, Stringent government regulations and policies) , Challenges (Need for high-speed, reliable communications networks in remote locations, Rapid adoption of cloud-based services ,Development of ultra-compact SATCOM terminals for ground combat vehicles, Extensive use of portable SATCOM terminals by retail consumers, Deployment of SATCOM systems in healthcare and emergency response sectors) , and opportunities (Electromagnetic compatibility-related challenges associated with satellites, Threat of cybersecurity attacks) . The growth of the market can be attributed to the increasing launch of low earth orbit (LEO) satellites and constellations of satellites for communications applications, increasing usage of ESPA Antenna, and Increasing demand for customized SATCOM-on-the-Move solutions for unmanned ground vehicles.

The report provides insights on the following pointers:

Rising demand for SATCOM equipment in commercial aviation drive the market.

- Market Penetration: Comprehensive information on SATCOM equipment offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the SATCOM equipment market

- Market Development: Comprehensive information about lucrative markets - the report analyses the SATCOM equipment market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the SATCOM equipment market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the SATCOM equipment market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary respondents

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SATCOM EQUIPMENT MARKET

- 4.2 SATCOM EQUIPMENT MARKET, BY PLATFORM

- 4.3 SATCOM EQUIPMENT MARKET, BY AIRBORNE SEGMENT

- 4.4 SATCOM EQUIPMENT MARKET, BY COMMERCIAL VERTICAL

- 4.5 SATCOM EQUIPMENT MARKET, BY TECHNOLOGY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Large-scale adoption of electronically steered phased antennas

- 5.2.1.2 Increasing LEO satellite launches

- 5.2.1.3 Integration of SOTM solutions into unmanned ground vehicles

- 5.2.1.4 Need for Earth observation imagery and analytics

- 5.2.1.5 Surge in demand for high-speed data and voice services from aviation and maritime sectors

- 5.2.1.6 Growing preference for connected devices and IoT

- 5.2.2 RESTRAINTS

- 5.2.2.1 High development and maintenance cost of SATCOM infrastructure

- 5.2.2.2 Stringent government regulations and policies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Need for high-speed, reliable communication networks in remote locations

- 5.2.3.2 Rapid adoption of cloud-based services

- 5.2.3.3 Development of ultra-compact SATCOM terminals for ground combat vehicles

- 5.2.3.4 Extensive use of portable SATCOM terminals by retail consumers

- 5.2.3.5 Deployment of SATCOM systems in healthcare and emergency response sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Electromagnetic compatibility-related challenges associated with satellites

- 5.2.4.2 Threat of cybersecurity attacks

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- 5.6 BUSINESS MODELS

- 5.7 TOTAL COST OF OWNERSHIP

- 5.8 BILL OF MATERIALS

- 5.9 TECHNOLOGY ROADMAP

- 5.10 VOLUME DATA

- 5.11 PRICING ANALYSIS

- 5.11.1 INDICATIVE PRICING ANALYSIS OF PORTABLE SATCOM EQUIPMENT

- 5.11.2 INDICATIVE PRICING ANALYSIS OF MARITIME SATCOM EQUIPMENT

- 5.11.3 INDICATIVE PRICING ANALYSIS OF LAND MOBILE SATCOM EQUIPMENT

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 MULTI-LINK ROUTING

- 5.12.2 METAMATERIAL ANTENNA

- 5.12.3 SATELLITE-BASED IOT NETWORK

- 5.12.4 MARITIME NETWORK CONNECTION

- 5.13 REGULATORY LANDSCAPE

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 TRADE ANALYSIS

- 5.15.1 IMPORT DATA

- 5.15.2 EXPORT DATA

- 5.16 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 TECHNOLOGY ANALYSIS

- 5.18.1 KEY TECHNOLOGIES

- 5.18.1.1 Power amplifiers

- 5.18.1.2 Low-noise block downconverters

- 5.18.2 COMPLEMENTARY TECHNOLOGIES

- 5.18.2.1 Beamforming

- 5.18.2.2 Multiple input multiple output

- 5.18.1 KEY TECHNOLOGIES

- 5.19 MACROECONOMIC OUTLOOK

- 5.19.1 INTRODUCTION

- 5.19.2 NORTH AMERICA

- 5.19.3 EUROPE

- 5.19.4 ASIA PACIFIC

- 5.19.5 MIDDLE EAST

- 5.19.6 LATIN AMERICA AND AFRICA

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 TERRESTRIAL NETWORKS

- 6.2.2 HIGH-THROUGHPUT SATELLITES

- 6.2.3 ON-THE-MOVE TERMINALS

- 6.2.4 ACTIVE ELECTRONICALLY SCANNED ARRAYS

- 6.2.5 GALLIUM ARSENIDE AND GALLIUM NITRIDE RF TECHNOLOGY

- 6.2.6 DIGITALIZED SATELLITE COMMUNICATION PAYLOAD TECHNOLOGY

- 6.2.7 FLAT ANTENNA TECHNOLOGY

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 LEO/MEO MISSION ANTENNAS

- 6.3.2 MULTI-BAND MULTI-MISSION ANTENNAS

- 6.3.3 SMART ANTENNAS

- 6.3.4 HYBRID BEAMFORMING

- 6.3.5 5G

- 6.3.6 INTERNET OF THINGS

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 PATENT ANALYSIS

- 6.6 IMPACT OF GENERATIVE AI

- 6.6.1 INTRODUCTION

- 6.6.2 ADOPTION OF AI IN SPACE BY TOP COUNTRIES

- 6.6.3 IMPACT OF AI ON SATCOM EQUIPMENT USE CASES

- 6.6.4 IMPACT OF AI ON SATCOM EQUIPMENT MARKET

7 SATCOM EQUIPMENT MARKET, BY CONNECTIVITY

- 7.1 INTRODUCTION

- 7.2 LEO

- 7.2.1 FASTER SPEED AND LOWER LATENCY THAN TRADITIONAL GEOSTATIONARY SATELLITES TO DRIVE MARKET

- 7.3 MEO/GEO

- 7.3.1 ADVANCEMENTS IN HIGH-THROUGHPUT SATELLITES TO DRIVE MARKET

8 SATCOM EQUIPMENT MARKET, BY FREQUENCY

- 8.1 INTRODUCTION

- 8.2 C-BAND

- 8.2.1 PREVALENCE IN MODERATE- TO HIGH-SPEED DATA TRANSMISSION APPLICATIONS TO DRIVE MARKET

- 8.3 L & S-BAND

- 8.3.1 SHIFT TOWARD SATELLITE-BASED SERVICES FOR CRITICAL INFRASTRUCTURE TO DRIVE MARKET

- 8.4 X-BAND

- 8.4.1 EMPHASIS ON NATIONAL SECURITY TO DRIVE MARKET

- 8.5 KA-BAND

- 8.5.1 ELEVATED DEMAND FOR HIGH-SPEED COMMUNICATION TO DRIVE MARKET

- 8.6 KU-BAND

- 8.6.1 FASTER TRANSMISSION SPEED THAN KA-BAND TO DRIVE MARKET

- 8.7 VHF/UHF-BAND

- 8.7.1 LARGE-SCALE USE IN DIGITAL AUDIO AND FM RADIO BROADCASTING TO DRIVE MARKET

- 8.8 EHF/SHF-BAND

- 8.8.1 NEED FOR ULTRA-FAST INTERNET IN DATA-INTENSIVE APPLICATIONS TO DRIVE MARKET

- 8.9 MULTI-BAND

- 8.9.1 GROWING CONSUMER DEMAND FOR SEAMLESS CONNECTIVITY TO DRIVE DEMAND

- 8.10 Q-BAND

- 8.10.1 FOCUS ON MITIGATING SIGNAL FADING TO DRIVE MARKET

9 SATCOM EQUIPMENT MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 SATCOM-ON-THE-MOVE

- 9.2.1 INCREASING INTEGRATION IN DEFENSE AND TRANSPORTATION SECTORS TO DRIVE MARKET

- 9.3 SATCOM-ON-THE-PAUSE

- 9.3.1 EXTENSIVE USE IN DISASTER-PRONE AND TOUGH TERRAIN LOCATIONS TO DRIVE MARKET

10 SATCOM EQUIPMENT MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.2 COMMERCIAL

- 10.2.1 TELECOMMUNICATIONS & CELLULAR BACKHAUL

- 10.2.1.1 Surge in demand for reliable wireless connections to drive market

- 10.2.2 MEDIA & ENTERTAINMENT

- 10.2.2.1 Growing reliance on satellite communication to drive market

- 10.2.3 BUSINESS & ENTERPRISE

- 10.2.3.1 Increased funding in small satellites to drive market

- 10.2.4 TRANSPORTATION & LOGISTICS

- 10.2.4.1 Need for real-time tracking and communication solutions to drive market

- 10.2.5 SCIENTIFIC RESEARCH & DEVELOPMENT

- 10.2.5.1 Miniaturization of SATCOM equipment to drive market

- 10.2.6 AVIATION

- 10.2.6.1 Escalating demand for in-flight connectivity to drive market

- 10.2.7 MARINE

- 10.2.7.1 Rising adoption of very small aperture terminals to drive market

- 10.2.8 RETAIL & CONSUMER

- 10.2.8.1 Growth in e-commerce to drive market

- 10.2.9 OTHERS

- 10.2.1 TELECOMMUNICATIONS & CELLULAR BACKHAUL

- 10.3 GOVERNMENT & DEFENSE

- 10.3.1 MILITARY

- 10.3.1.1 High demand for ISR capabilities to drive market

- 10.3.2 HOMELAND SECURITY & EMERGENCY MANAGEMENT

- 10.3.2.1 Rapid deployment of SATCOM equipment in emergency scenarios to drive market

- 10.3.1 MILITARY

11 SATCOM EQUIPMENT MARKET, BY SOLUTION

- 11.1 INTRODUCTION

- 11.2 PRODUCT

- 11.2.1 GROWING INVESTMENTS IN SATELLITE INFRASTRUCTURE TO DRIVE MARKET

- 11.2.2 ANTENNA

- 11.2.2.1 Phased array

- 11.2.2.1.1 Passive phased array

- 11.2.2.1.2 Active electronically steered array

- 11.2.2.1.3 Hybrid beamforming

- 11.2.2.1.4 Digital beamforming

- 11.2.2.2 Multiple input and multiple output array

- 11.2.2.3 Others

- 11.2.2.1 Phased array

- 11.2.3 TRANSCEIVER

- 11.2.3.1 Receiver

- 11.2.3.2 Transmitter

- 11.2.4 POWER AMPLIFIER

- 11.2.5 CONVERTER

- 11.2.6 GYRO STABILIZER

- 11.2.7 MODEM & ROUTER

- 11.2.8 RADIO

- 11.2.9 RADOME

- 11.2.10 OTHER PRODUCTS

- 11.3 SERVICE

- 11.3.1 INCREASING LEO SATELLITE LAUNCHES TO DRIVE MARKET

- 11.3.2 ENGINEERING & INTEGRATION

- 11.3.3 INSTALLATION

- 11.3.4 LOGISTICS & MAINTENANCE

12 SATCOM EQUIPMENT MARKET, BY PLATFORM

- 12.1 INTRODUCTION

- 12.2 PORTABLE 136 12.2.1 MANPACK

- 12.2.2 HANDHELD

- 12.2.3 DEPLOYABLE/FLYAWAY

- 12.3 LAND MOBILE

- 12.3.1 COMMERCIAL VEHICLE

- 12.3.2 MILITARY VEHICLE

- 12.3.3 EMERGENCY VEHICLE

- 12.3.4 UNMANNED GROUND VEHICLE

- 12.3.5 TRAIN

- 12.4 LAND FIXED

- 12.4.1 COMMAND & CONTROL CENTER

- 12.4.2 EARTH/GROUND STATION

- 12.4.3 DIRECT-TO-HOME (DTH)/SATELLITE TV

- 12.4.4 ENTERPRISE SYSTEM

- 12.5 AIRBORNE

- 12.5.1 COMMERCIAL AIRCRAFT

- 12.5.2 MILITARY AIRCRAFT

- 12.5.3 BUSINESS JET

- 12.5.4 UNMANNED AERIAL VEHICLE

- 12.6 MARITIME

- 12.6.1 COMMERCIAL SHIP

- 12.6.2 MILITARY SHIP

- 12.6.3 SUBMARINE

- 12.6.4 UNMANNED MARITIME VEHICLE

13 SATCOM EQUIPMENT MARKET, BY TERMINAL

- 13.1 INTRODUCTION

- 13.2 LTE-BASED

- 13.3 NON-LTE-BASED

14 SATCOM EQUIPMENT MARKET, BY TECHNOLOGY

- 14.1 INTRODUCTION

- 14.2 NEXT-GENERATION

- 14.3 LEGACY

15 SATCOM EQUIPMENT MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 PESTLE ANALYSIS

- 15.2.2 US

- 15.2.2.1 Presence of prominent SATCOM equipment manufacturers to drive market

- 15.2.3 CANADA

- 15.2.3.1 Favorable government initiatives for development of SATCOM equipment to drive market

- 15.3 EUROPE

- 15.3.1 PESTLE ANALYSIS

- 15.3.2 RUSSIA

- 15.3.2.1 Ongoing development of radio broadcasting, navigation, and remote sensing technologies to drive market

- 15.3.3 GERMANY

- 15.3.3.1 Booming satellite industry to drive market

- 15.3.4 FRANCE

- 15.3.4.1 Advancements in ground SATCOM systems to drive market

- 15.3.5 UK

- 15.3.5.1 Rising number of LEO constellations and high-throughput satellites to drive market

- 15.3.6 ITALY

- 15.3.6.1 Development of secure SATCOM systems to drive market

- 15.3.7 SPAIN

- 15.3.7.1 Increasing government investments in SATCOM infrastructure to drive market

- 15.3.8 REST OF EUROPE

- 15.4 ASIA PACIFIC

- 15.4.1 PESTLE ANALYSIS

- 15.4.2 CHINA

- 15.4.2.1 Extensive use of SATCOM terminals in military applications to drive market

- 15.4.3 INDIA

- 15.4.3.1 High demand for satellite communication in remote areas to drive market

- 15.4.4 JAPAN

- 15.4.4.1 Need for satellites for surveillance activities to drive market

- 15.4.5 SOUTH KOREA

- 15.4.5.1 Government support for domestic production of SATCOM equipment to drive market

- 15.4.6 AUSTRALIA

- 15.4.6.1 Installation of SATCOM antenna systems for ground network to drive market

- 15.4.7 REST OF ASIA PACIFIC

- 15.5 MIDDLE EAST & AFRICA

- 15.5.1 PESTLE ANALYSIS

- 15.5.2 GULF COOPERATION COUNCIL (GCC)

- 15.5.2.1 Saudi Arabia

- 15.5.2.1.1 Rising use of advanced SATCOM equipment as countermeasures for terror attacks to drive market

- 15.5.2.2 UAE

- 15.5.2.2.1 Increasing procurement of advanced SATCOM equipment to drive market

- 15.5.2.1 Saudi Arabia

- 15.5.3 ISRAEL

- 15.5.3.1 Incorporation of latest technologies in SATCOM equipment manufacturing to drive market

- 15.5.4 TURKEY

- 15.5.4.1 Regular updates of communication systems to drive market

- 15.5.5 AFRICA

- 15.5.5.1 Flourishing telecommunications infrastructure to drive market

- 15.6 LATIN AMERICA

- 15.6.1 PESTLE ANALYSIS

- 15.6.2 BRAZIL

- 15.6.2.1 Expansion of telecommunications services to drive market

- 15.6.3 MEXICO

- 15.6.3.1 Focus on improving national security to drive market

- 15.6.4 ARGENTINA

- 15.6.4.1 Development of modern satellite infrastructure with innovative ground systems to drive market

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 16.3 REVENUE ANALYSIS, 2020-2023

- 16.4 MARKET SHARE ANALYSIS, 2023

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 16.6.1 STARS

- 16.6.2 EMERGING LEADERS

- 16.6.3 PERVASIVE PLAYERS

- 16.6.4 PARTICIPANTS

- 16.6.5 COMPANY FOOTPRINT

- 16.6.5.1 Company footprint

- 16.6.5.2 Solution footprint

- 16.6.5.3 Vertical footprint

- 16.6.5.4 Platform footprint

- 16.6.5.5 Region footprint

- 16.7 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 16.7.1 PROGRESSIVE COMPANIES

- 16.7.2 RESPONSIVE COMPANIES

- 16.7.3 DYNAMIC COMPANIES

- 16.7.4 STARTING BLOCKS

- 16.7.5 COMPETITIVE BENCHMARKING

- 16.7.5.1 List of start-ups/SMEs

- 16.7.5.2 Competitive benchmarking of start-ups/SMEs

- 16.8 BRAND/PRODUCT COMPARISON

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT/SERVICE LAUNCHES

- 16.9.2 DEALS

- 16.9.3 OTHERS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 ECHOSTAR CORPORATION

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product/Service launches

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Others

- 17.1.1.4 MnM view

- 17.1.1.4.1 Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 L3HARRIS TECHNOLOGIES, INC.

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product/Service launches

- 17.1.2.3.2 Deals

- 17.1.2.3.3 Others

- 17.1.2.4 MnM view

- 17.1.2.4.1 Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 THALES

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Deals

- 17.1.3.3.2 Others

- 17.1.3.4 MnM view

- 17.1.3.4.1 Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 RTX

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Others

- 17.1.4.4 MnM view

- 17.1.4.4.1 Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 GENERAL DYNAMICS CORPORATION

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Others

- 17.1.5.4 MnM view

- 17.1.5.4.1 Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 COBHAM SATCOM

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product/Service launches

- 17.1.6.3.2 Deals

- 17.1.6.3.3 Others

- 17.1.7 HONEYWELL INTERNATIONAL INC.

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product/Service launches

- 17.1.7.3.2 Deals

- 17.1.7.3.3 Others

- 17.1.8 VIASAT, INC.

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Deals

- 17.1.8.3.2 Others

- 17.1.9 GILAT SATELLITE NETWORKS

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Deals

- 17.1.9.3.2 Others

- 17.1.10 IRIDIUM COMMUNICATIONS INC.

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product/Service launches

- 17.1.10.3.2 Deals

- 17.1.10.3.3 Others

- 17.1.11 ASELSAN A.S.

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions/Services offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Product/Service launches

- 17.1.11.3.2 Others

- 17.1.12 INTELLIAN TECHNOLOGIES, INC.

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions/Services offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Product/Service launches

- 17.1.12.3.2 Deals

- 17.1.12.3.3 Others

- 17.1.13 ST ENGINEERING

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Solutions/Services offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Product/Service launches

- 17.1.13.3.2 Deals

- 17.1.13.3.3 Others

- 17.1.14 SPACEX

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Solutions/Services offered

- 17.1.14.3 Recent developments

- 17.1.14.3.1 Product/Service launches

- 17.1.15 ELBIT SYSTEMS LTD.

- 17.1.15.1 Business overview

- 17.1.15.2 Products/Solutions/Services offered

- 17.1.15.3 Recent developments

- 17.1.15.3.1 Product/Service launches

- 17.1.15.3.2 Deals

- 17.1.15.3.3 Others

- 17.1.1 ECHOSTAR CORPORATION

- 17.2 OTHER PLAYERS

- 17.2.1 CAMPBELL SCIENTIFIC, INC.

- 17.2.2 ND SATCOM GMBH

- 17.2.3 SATCOM GLOBAL

- 17.2.4 HOLKIRK COMMUNICATIONS LTD.

- 17.2.5 AVL TECHNOLOGIES

- 17.2.6 ONEWEB

- 17.2.7 THINKOM SOLUTIONS INC.

- 17.2.8 VIKING SATCOM

- 17.2.9 NORSAT INTERNATIONAL INC.

- 17.2.10 CESIUMASTRO, INC.

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 ANNEXURE A: OTHER MAPPED COMPANIES

- 18.3 ANNEXURE B: DEFENSE PROGRAM MAPPING

- 18.4 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.5 CUSTOMIZATION OPTIONS

- 18.6 RELATED REPORTS

- 18.7 AUTHOR DETAILS