|

|

市場調査レポート

商品コード

1583646

NFCの世界市場:製品別、動作方式別、ユースケース別 - 予測(~2029年)NFC Market by Offering (NFC ICs, NFC Antennas, NFC Tags, NFC Readers), Operating Mode (Reader Emulation, Peer-to-Peer, Card Emulation), Use Cases (Payment and Transactions, Product Identification, Ticketing, Access Control) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| NFCの世界市場:製品別、動作方式別、ユースケース別 - 予測(~2029年) |

|

出版日: 2024年10月30日

発行: MarketsandMarkets

ページ情報: 英文 227 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のNFCの市場規模は、2024年に216億9,000万米ドルであり、2029年までに305億5,000万米ドルに達すると予測され、予測期間にCAGRで7.1%の成長が見込まれます。

NFC技術は、小売、輸送、自動車、コンシューマーエレクトロニクス、銀行・金融、接客などの産業で広く使用されています。これらの業界でもっとも一般的なNFCのユースケースには、製品識別、在庫管理、アクセス制御、決済・取引、データ転送などがあります。簡単で安全な非接触型決済やデータ転送などの利点が、今後数年間におけるNFC技術の需要を押し上げると見られます。オンラインと店舗でのモバイル決済用途は、将来的にNFC市場を牽引すると予測されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 提供、動作方式、ユースケース、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「ピアツーピアセグメントが予測期間に目覚しいCAGRで成長すると予測されます。」

ピアツーピアセグメントは、この方式が2つのNFCデバイス間の直接通信を可能にすることから、予測期間に大幅な成長が予測されます。小売や医療などの部門における安全で効率的な決済ソリューションやデータ転送オプションへの需要が、この方式の成長を促進しています。さらに、NFC技術における継続的な進歩や、IoTやブロックチェーンなどの他の技術との統合が、このセグメントをさらに押し上げると予測されます。ピアツーピア方式はまた、使いやすさ、迅速なデータ転送、不正アクセスのリスク低減など、複数の重要な利点を提供します。さらに、連絡先情報の共有やファイル転送などのさまざまな機能もサポートしています。

「小売セグメントが2024年に第2位の市場規模を占める可能性が高いです。」

NFC用途は、NFC対応スマートフォンの生産により小売産業において大幅な成長を示しています。消費者はNFCタグの前で携帯電話を振るだけでよく、必要な残高はバンキングゲートウェイや信頼できるサービスマネージャーの助けを借りて口座から引き落とされます。商品やサービスの購入とその決済は、オンラインまたは店頭で行われます。小売産業では、NFC技術はアクセス制御、製品識別、取引用途に使用されています。

「北米セグメントが予測期間に2番目に高いCAGRで成長する可能性が高いです。」

米国は、AIやIoTなどの先進技術を採用する先進国の1つであり、小売から自動車に至るまで、さまざまな産業全体で一貫して自動化の導入を推進しています。米国はまた、アクセス制御やチケット発券に利用するNFCなどの非接触技術の導入を含むスマートシティ構想への支出でも上位3ヶ国にランクインしています。さらに、技術開発に対する政府の支援や、NFC、AI、IoTなどの技術を開発し実装するのに有利な規制枠組みが、同国のNFC市場の成長を加速させています。

当レポートでは、世界のNFC市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- NFC市場の企業にとって魅力的な機会

- NFC市場:提供別

- NFC市場:業界別

- 北米のNFC市場:業界別、国別

- NFC市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 主要企業の平均販売価格の動向:ハードウェアタイプ別

- 平均販売価格の動向:ハードウェアタイプ別

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸入シナリオ(HSコード852352)

- 輸出シナリオ(HSコード852352)

- 主な会議とイベント(2024年~2025年)

- ケーススタディ

- ONEID、ID文書のNFC読み取りを最適化し、安全なデータ転送を保証するユーザーフレンドリーなアプリを開発

- NIKE、NFC技術を導入し売上と顧客エンゲージメントを向上

- BARBADILLO、NFCタグを採用し顧客エンゲージメントと売上を向上

- 規制情勢

- 規制機関、政府機関、その他の組織

- 標準

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- NFC市場に対するAI/生成AIの影響

- イントロダクション

- 主なNFC用途に対するAI/生成AIの影響

- ユースケース

- AI/生成AIを導入している主要企業

- NFCエコシステムにおけるAI/生成AIの未来

第6章 NFC信号伝達技術

- イントロダクション

- NFC-A

- NFC-B

- NFC-F

第7章 NFC市場:提供別

- イントロダクション

- ハードウェア

- NFC IC、アンテナ

- NFCタグ

- NFCリーダー

- ソフトウェア

第8章 NFC市場:動作方式別

- イントロダクション

- カードエミュレーション

- リーダーエミュレーション

- ピアツーピア

第9章 NFC市場:業界別

- イントロダクション

- 小売

- 製品識別

- 決済・取引

- 輸送

- 発券業務

- アクセス制御

- 自動車

- 住宅・商業施設

- アクセス制御

- 勤怠管理

- ホームオートメーション

- 医療

- 患者識別

- 製品識別

- アクセス制御

- コンシューマーエレクトロニクス

- ウェアラブルデバイス

- 携帯電話/タブレット

- ノートパソコン/パソコン

- その他のコンシューマーエレクトロニクス

- 銀行・金融

- ホスピタリティ

- アクセス制御

- 決済・取引

- その他の業界

第10章 NFC市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- イタリア

- フランス

- スペイン

- スイス

- オランダ

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 中東

- 南米

- アフリカ

第11章 競合情勢

- 概要

- 主要企業戦略/有力企業(2020年~2024年)

- 収益分析(2019年~2023年)

- 市場シェア分析(2023年)

- 企業の評価と財務指標(2024年)

- 製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- NXP SEMICONDUCTORS

- BROADCOM

- QUALCOMM TECHNOLOGIES, INC.

- TEXAS INSTRUMENTS INCORPORATED

- STMICROELECTRONICS

- RENESAS ELECTRONICS CORPORATION

- AMS-OSRAM AG

- THALES

- INFINEON TECHNOLOGIES AG

- SONY CORPORATION

- AVERY DENNISON CORPORATION

- SAMSUNG

- IDENTIV, INC.

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- その他の企業

- FLOMIO, INC.

- SHANGHAI FUDAN MICROELECTRONICS GROUP CO., LTD.

- HID GLOBAL CORPORATION

- RESOURCE LABEL GROUP, LLC

- PREMIER LABELS UK

- ADVANCED CARD SYSTEMS LTD.

- CRYPTERA

- PERFECT ID

- ID TECH

- OMNIA TECHNOLOGIES PVT. LTD.

- ELATEC GMBH

第13章 付録

List of Tables

- TABLE 1 NFC MARKET: RISK ANALYSIS

- TABLE 2 AVERAGE SELLING PRICING TREND OF NFC ICS & ANTENNAS OFFERED BY KEY PLAYERS, 2020-2023 (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF NFC ICS & ANTENNAS, 2020-2023 (USD)

- TABLE 4 ROLE OF COMPANIES IN NFC ECOSYSTEM

- TABLE 5 LIST OF MAJOR PATENTS, 2023

- TABLE 6 IMPORT DATA FOR HS CODE 852352-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 7 EXPORT DATA FOR HS CODE 852352-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 8 LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 STANDARDS

- TABLE 14 PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 17 NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 18 NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 19 HARDWARE: NFC MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 20 HARDWARE: NFC MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 21 NFC MARKET, BY HARDWARE, 2020-2023 (MILLION UNITS)

- TABLE 22 NFC MARKET, BY HARDWARE, 2024-2029 (MILLION UNITS)

- TABLE 23 NFC ICS & ANTENNAS: NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 24 NFC ICS & ANTENNAS: NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 25 NFC TAGS: NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 26 NFC TAGS: NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 27 NFC READERS: NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 28 NFC READERS: NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 29 SOFTWARE: NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 30 SOFTWARE: NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 31 NFC MARKET, BY OPERATING MODE, 2020-2023 (USD MILLION)

- TABLE 32 NFC MARKET, BY OPERATING MODE, 2024-2029 (USD MILLION)

- TABLE 33 BENEFITS AND FUTURE SCOPE OF NFC DEVICE OPERATING MODES

- TABLE 34 NFC MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 35 NFC MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 36 RETAIL: NFC MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 37 RETAIL: NFC MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 38 RETAIL: NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 39 RETAIL: NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 40 TRANSPORTATION: NFC MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 41 TRANSPORTATION: NFC MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 42 TRANSPORTATION: NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 43 TRANSPORTATION: NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 44 AUTOMOTIVE: NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 45 AUTOMOTIVE: NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 46 RESIDENTIAL & COMMERCIAL: NFC MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 47 RESIDENTIAL & COMMERCIAL: NFC MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 48 RESIDENTIAL & COMMERCIAL: NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 49 RESIDENTIAL & COMMERCIAL: NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 50 HEALTHCARE: NFC MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 51 HEALTHCARE: NFC MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 52 HEALTHCARE: NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 53 HEALTHCARE: NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 54 CONSUMER ELECTRONICS: NFC MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 55 CONSUMER ELECTRONICS: NFC MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 56 CONSUMER ELECTRONICS: NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 57 CONSUMER ELECTRONICS: NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 58 BANKING & FINANCE: NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 59 BANKING & FINANCE: NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 60 HOSPITALITY: NFC MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 61 HOSPITALITY: NFC MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 62 HOSPITALITY: NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 63 HOSPITALITY: NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 64 OTHER VERTICALS: NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 65 OTHER VERTICALS: NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 66 NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 67 NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 68 NFC MARKET, BY REGION, 2020-2023 (MILLION UNITS)

- TABLE 69 NFC MARKET, BY REGION, 2024-2029 (MILLION UNITS)

- TABLE 70 NORTH AMERICA: NFC MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 71 NORTH AMERICA: NFC MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 72 NORTH AMERICA: NFC MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 73 NORTH AMERICA: NFC MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 74 NORTH AMERICA: NFC MARKET FOR RETAIL, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 75 NORTH AMERICA: NFC MARKET FOR RETAIL, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 76 NORTH AMERICA: NFC MARKET FOR TRANSPORTATION, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 77 NORTH AMERICA: NFC MARKET FOR TRANSPORTATION, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 78 NORTH AMERICA: NFC MARKET FOR RESIDENTIAL & COMMERCIAL, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 79 NORTH AMERICA: NFC MARKET FOR RESIDENTIAL & COMMERCIAL, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 80 NORTH AMERICA: NFC MARKET FOR HEALTHCARE, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 81 NORTH AMERICA: NFC MARKET FOR HEALTHCARE, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 82 NORTH AMERICA: NFC MARKET FOR CONSUMER ELECTRONICS, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 83 NORTH AMERICA: NFC MARKET FOR CONSUMER ELECTRONICS, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 84 NORTH AMERICA: NFC MARKET FOR HOSPITALITY, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 85 NORTH AMERICA: NFC MARKET FOR HOSPITALITY, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 86 US: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 87 US: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 88 CANADA: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 89 CANADA: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 90 MEXICO: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 91 MEXICO: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 92 EUROPE: NFC MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 93 EUROPE: NFC MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 94 EUROPE: NFC MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 95 EUROPE: NFC MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 96 EUROPE: NFC MARKET FOR RETAIL, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 97 EUROPE: NFC MARKET FOR RETAIL, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 98 EUROPE: NFC MARKET FOR TRANSPORTATION, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 99 EUROPE: NFC MARKET FOR TRANSPORTATION, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 100 EUROPE: NFC MARKET FOR RESIDENTIAL & COMMERCIAL, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 101 EUROPE: NFC MARKET FOR RESIDENTIAL & COMMERCIAL, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 102 EUROPE: NFC MARKET FOR HEALTHCARE, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 103 EUROPE: NFC MARKET FOR HEALTHCARE, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 104 EUROPE: NFC MARKET FOR CONSUMER ELECTRONICS, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 105 EUROPE: NFC MARKET FOR CONSUMER ELECTRONICS, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 106 EUROPE: NFC MARKET FOR HOSPITALITY, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 107 EUROPE: NFC MARKET FOR HOSPITALITY, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 108 UK: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 109 UK: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 110 GERMANY: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 111 GERMANY: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 112 ITALY: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 113 ITALY: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 114 FRANCE: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 115 FRANCE: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 116 SPAIN: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 117 SPAIN: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 118 SWITZERLAND: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 119 SWITZERLAND: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 120 NETHERLANDS: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 121 NETHERLANDS: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 122 REST OF EUROPE: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 123 REST OF EUROPE: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 124 ASIA PACIFIC: NFC MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 125 ASIA PACIFIC: NFC MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 126 ASIA PACIFIC: NFC MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 127 ASIA PACIFIC: NFC MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 128 ASIA PACIFIC: NFC MARKET FOR RETAIL, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 129 ASIA PACIFIC: NFC MARKET FOR RETAIL, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 130 ASIA PACIFIC: NFC MARKET FOR TRANSPORTATION, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 131 ASIA PACIFIC: NFC MARKET FOR TRANSPORTATION, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 132 ASIA PACIFIC: NFC MARKET FOR RESIDENTIAL & COMMERCIAL, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 133 ASIA PACIFIC: NFC MARKET FOR RESIDENTIAL & COMMERCIAL, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 134 ASIA PACIFIC: NFC MARKET FOR HEALTHCARE, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 135 ASIA PACIFIC: NFC MARKET FOR HEALTHCARE, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 136 ASIA PACIFIC: NFC MARKET FOR CONSUMER ELECTRONICS, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 137 ASIA PACIFIC: NFC MARKET FOR CONSUMER ELECTRONICS, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 138 ASIA PACIFIC: NFC MARKET FOR HOSPITALITY, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 139 ASIA PACIFIC: NFC MARKET FOR HOSPITALITY, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 140 CHINA: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 141 CHINA: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 142 JAPAN: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 143 JAPAN: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 144 INDIA: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 145 INDIA: NFC MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 146 SOUTH KOREA: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 147 SOUTH KOREA: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 148 AUSTRALIA: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 149 AUSTRALIA: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 150 INDONESIA: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 151 INDONESIA: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 154 ROW: NFC MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 155 ROW: NFC MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 156 ROW: NFC MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 157 ROW: NFC MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 158 ROW: NFC MARKET FOR RETAIL, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 159 ROW: NFC MARKET FOR RETAIL, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 160 ROW: NFC MARKET FOR TRANSPORTATION, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 161 ROW: NFC MARKET FOR TRANSPORTATION, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 162 ROW: NFC MARKET FOR RESIDENTIAL & COMMERCIAL, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 163 ROW: NFC MARKET FOR RESIDENTIAL & COMMERCIAL, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 164 ROW: NFC MARKET FOR HEALTHCARE, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 165 ROW: NFC MARKET FOR HEALTHCARE, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 166 ROW: NFC MARKET FOR CONSUMER ELECTRONICS, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 167 ROW: NFC MARKET FOR CONSUMER ELECTRONICS, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 168 ROW: NFC MARKET FOR HOSPITALITY, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 169 ROW: NFC MARKET FOR HOSPITALITY, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 170 MIDDLE EAST: NFC MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 171 MIDDLE EAST: NFC MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 172 MIDDLE EAST: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 173 MIDDLE EAST: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 174 SOUTH AMERICA: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 175 SOUTH AMERICA: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 176 AFRICA: NFC MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 177 AFRICA: NFC MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 178 NFC MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020-JULY 2024

- TABLE 179 NFC MARKET: DEGREE OF COMPETITION, 2023

- TABLE 180 NFC MARKET: REGION FOOTPRINT

- TABLE 181 NFC MARKET: VERTICAL FOOTPRINT

- TABLE 182 NFC MARKET: OPERATING MODE FOOTPRINT

- TABLE 183 NFC MARKET: OFFERING FOOTPRINT

- TABLE 184 NFC MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 185 NFC MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 186 NFC MARKET: PRODUCT LAUNCHES, JANUARY 2020-JULY 2024

- TABLE 187 NFC MARKET: DEALS, JANUARY 2020-JULY 2024

- TABLE 188 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 189 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

- TABLE 191 BROADCOM: COMPANY OVERVIEW

- TABLE 192 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 194 QUALCOMM TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 QUALCOMM TECHNOLOGIES, INC.: DEALS

- TABLE 196 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 197 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 199 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 201 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 202 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 RENESAS ELECTRONICS CORPORATION: DEALS

- TABLE 204 AMS-OSRAM AG: COMPANY OVERVIEW

- TABLE 205 AMS-OSRAM AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 THALES: COMPANY OVERVIEW

- TABLE 207 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 209 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 211 SONY CORPORATION: COMPANY OVERVIEW

- TABLE 212 SONY CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

- TABLE 214 AVERY DENNISON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 AVERY DENNISON CORPORATION: PRODUCT LAUNCHES

- TABLE 216 SAMSUNG: COMPANY OVERVIEW

- TABLE 217 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 IDENTIV, INC.: COMPANY OVERVIEW

- TABLE 219 IDENTIV, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY OVERVIEW

- TABLE 221 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 NFC MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 NFC MARKET: RESEARCH DESIGN

- FIGURE 3 NFC MARKET: RESEARCH APPROACH

- FIGURE 4 NFC MARKET: TOP-DOWN APPROACH

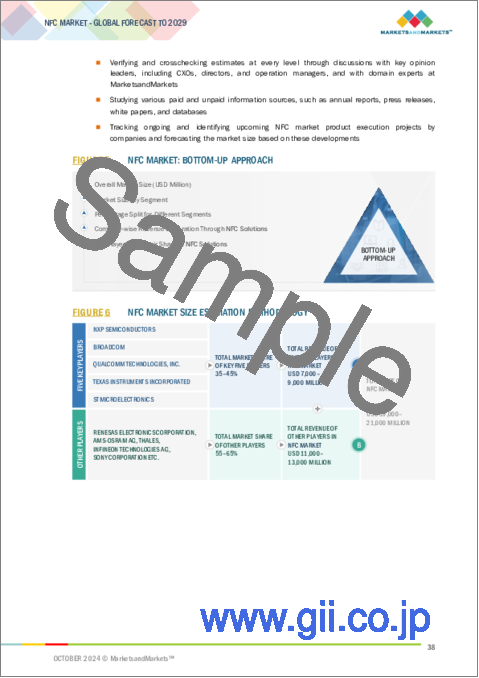

- FIGURE 5 NFC MARKET: BOTTOM-UP APPROACH

- FIGURE 6 NFC MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 7 NFC MARKET: DATA TRIANGULATION

- FIGURE 8 NFC MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 NFC MARKET SIZE, 2020-2029

- FIGURE 10 HARDWARE SEGMENT TO REGISTER HIGHER CAGR IN NFC MARKET FROM 2024 TO 2029

- FIGURE 11 CARD EMULATION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 12 BANKING & FINANCE SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF NFC MARKET IN 2023

- FIGURE 14 RISING TREND TOWARD CONTACTLESS PAYMENT TO CONTRIBUTE TO MARKET GROWTH

- FIGURE 15 HARDWARE SEGMENT TO HOLD LARGER SHARE OF NFC MARKET IN 2029

- FIGURE 16 CONSUMER ELECTRONICS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 CONSUMER ELECTRONICS SEGMENT AND US ACCOUNTED FOR LARGEST SHARES OF NORTH AMERICAN NFC MARKET IN 2023

- FIGURE 18 INDIA TO RECORD HIGHEST CAGR IN GLOBAL NFC MARKET DURING FORECAST PERIOD

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 IMPACT ANALYSIS: DRIVERS

- FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 22 CELLULAR IOT CONNECTIONS, 2023 VS. 2029

- FIGURE 23 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 24 IMPACT ANALYSIS: CHALLENGES

- FIGURE 25 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 26 AVERAGE SELLING PRICE TREND OF NFC ICS & ANTENNAS OFFERED BY KEY PLAYERS

- FIGURE 27 AVERAGE SELLING PRICE TREND OF NFC ICS & ANTENNAS, 2020-2023

- FIGURE 28 AVERAGE SELLING PRICE TREND OF NFC ICS & ANTENNAS, BY REGION, 2020-2023

- FIGURE 29 VALUE CHAIN ANALYSIS

- FIGURE 30 NFC ECOSYSTEM

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO, 2017-2022

- FIGURE 32 PATENTS APPLIED AND GRANTED, 2014-2023

- FIGURE 33 IMPORT DATA FOR HS CODE 852352-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 34 EXPORT DATA FOR HS CODE 852352-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 35 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 38 NFC MARKET, BY OFFERING

- FIGURE 39 HARDWARE SEGMENT TO EXHIBIT HIGHER CAGR FROM 2024 TO 2029

- FIGURE 40 NFC MARKET, BY OPERATING MODE

- FIGURE 41 CARD EMULATION SEGMENT TO EXHIBIT HIGHEST CAGR IN NFC MARKET FROM 2024 TO 2029

- FIGURE 42 NFC MARKET, BY VERTICAL

- FIGURE 43 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 44 NFC MARKET, BY REGION

- FIGURE 45 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL NFC MARKET DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA: NFC MARKET SNAPSHOT

- FIGURE 47 US TO DOMINATE NORTH AMERICAN NFC MARKET DURING FORECAST PERIOD

- FIGURE 48 EUROPE: NFC MARKET SNAPSHOT

- FIGURE 49 GERMANY TO DOMINATE EUROPEAN NFC MARKET FROM 2023 TO 2028

- FIGURE 50 ASIA PACIFIC: NFC MARKET SNAPSHOT

- FIGURE 51 INDIA TO RECORD HIGHEST CAGR IN ASIA PACIFIC NFC MARKET BETWEEN 2024 AND 2029

- FIGURE 52 SOUTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF ROW NFC MARKET IN 2029

- FIGURE 53 NFC MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2019-2023

- FIGURE 54 MARKET SHARE ANALYSIS OF COMPANIES OFFERING NFC SOLUTIONS, 2023

- FIGURE 55 COMPANY VALUATION, 2024

- FIGURE 56 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 57 PRODUCT COMPARISON

- FIGURE 58 NFC MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 59 NFC MARKET: COMPANY FOOTPRINT

- FIGURE 60 NFC MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 61 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 62 BROADCOM: COMPANY SNAPSHOT

- FIGURE 63 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 64 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 65 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 66 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 AMS-OSRAM AG: COMPANY SNAPSHOT

- FIGURE 68 THALES: COMPANY SNAPSHOT

- FIGURE 69 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 70 SONY CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

- FIGURE 72 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 73 IDENTIV, INC.: COMPANY SNAPSHOT

- FIGURE 74 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY SNAPSHOT

The global NFC market was valued at USD 21.69 billion in 2024 and is projected to reach USD 30.55 billion by 2029; it is expected to register a CAGR of 7.1% during the forecast period. NFC technology is widely used in industries such as retail, transportation, automotive, consumer electronics, banking & finance, and hospitality. Some of the most common use cases of NFC in these verticals include product identification, inventory management, access control, payments & transactions, and data transfer, among others. Benefits such as easy and secure contactless payments and data transfer will boost the demand for NFC technology in the coming years. Mobile payment applications, both online and in-store, are expected to drive the NFC market in the future.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Operating Mode, Use Cases and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Peer-to-peer segment is expected to grow at the impressive CAGR during the forecast period."

The peer-to-peer segment is projected to grow significantly during the forecast period as this mode allows direct communication between two NFC devices. The demand for secure and efficient payment solutions and data transfer options in sectors like retail and healthcare is driving the growth in this mode. Further, ongoing advancements in NFC technology and its integration with other technologies such as IoT and blockchain, are expected to further boost this segment. The peer-to-peer mode also offers several key benefits, like ease of use, quick data transfer, and reduced risk of unauthorized access. Additionally, it supports various other functions such as sharing contact information and transferring files.

"Retail segment is likely to hold the second largest market in 2024."

The NFC application has shown tremendous growth in the retail industry, owing to the production of NFC-enabled smartphones. These phones have an embedded NFC chip; the consumers only have to wave the mobile phone in front of the NFC tag, and the required balance gets deducted from their account with the help of banking gateways and trusted service managers. The purchasing of the goods and services and their payment is done either online or at the point-of-sale. In the retail industry, NFC technology is used for access control, product identification, and transaction applications.

"The North America segment is likely to grow at the second highest CAGR during the forecast period."

The US is one of the leading adopters of advanced technologies such as AI and IoT, and consistently pushing the implementation of automation across various industry verticals ranging from retail to automotive. US also ranks among the top three nations in terms of expenditure on smart city initiatives that include the implementation of contactless technologies such as NFC for access control and ticketing. Additionally, government support for technological development and favorable regulatory frameworks to develop and implement technologies such as NFC, AI, and IoT to accelerate the growth of NFC market in the country.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 25%, Tier 2 - 30%, Tier 3 - 45%

- By Designation- C-level Executives - 30%, Directors - 40%, Others - 30%

- By Region-North America - 30%, Europe - 20%, Asia Pacific - 40%, RoW - 10%

The NFC market is dominated by a few globally established players such as NXP Semiconductors (Netherlands), Broadcom (US), Qualcomm Technologies, Inc. (US), Texas Instruments Incorporated (US), STMicroelectronics (Switzerland), Renesas Electronics Corporation (Japan), ams-OSRAM AG (Austria), Thales (France), and Infineon Technologies AG (Germany). The study includes an in-depth competitive analysis of these key players in the NFC market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the NFC market and forecasts its size by signaling technology, offering, type, operating mode, vertical, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the NFC ecosystem.

Key Benefits to Buy the Report:

- Analysis of key drivers (Rising interest towards the adoption of mobile commerce, Rising trend of wearable technology), Restraint (Security concerns related to NFC, Competition from alternative payment methods), Opportunity (Rising urbanization in emerging economies, Increasing online and in-Store payment, Growing trend of contactless technology, Rising need for connectivity between different devices), Challenges (Lack of awareness about the benefits associated with NFC).

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the NFC market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the NFC market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the NFC market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players NXP Semiconductors (Netherlands), Broadcom (US), Qualcomm Technologies, Inc. (US), Texas Instruments Incorporated (US), STMicroelectronics (Switzerland), among others in the NFC market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 TOP-DOWN APPROACH

- 2.2.1.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.1 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NFC MARKET

- 4.2 NFC MARKET, BY OFFERING

- 4.3 NFC MARKET, BY VERTICAL

- 4.4 NFC MARKET IN NORTH AMERICA, BY VERTICAL AND COUNTRY

- 4.5 NFC MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising interest in mobile commerce

- 5.2.1.2 Mounting demand for smart wearables and IoT devices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability of alternative technologies for contactless applications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid urbanization in emerging economies

- 5.2.3.2 Reliance on PoS systems and smart posters to enhance shopping experiences

- 5.2.3.3 Implementation of electronic shelf labels in retail stores

- 5.2.3.4 Rise in cellular IoT connections

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of awareness about NFC benefits

- 5.2.4.2 Security concerns related to contactless payments

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY HARDWARE TYPE

- 5.4.2 AVERAGE SELLING PRICE TREND, BY HARDWARE TYPE

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 NFC-enabled wearables

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Internet of Things (IoT)

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Radio-frequency identification (RFID)

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 852352)

- 5.10.2 EXPORT SCENARIO (HS CODE 852352)

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 CASE STUDY

- 5.12.1 ONEID DEVELOPS USER-FRIENDLY APP TO OPTIMIZE NFC READING FOR ID DOCUMENTS AND ENSURE SECURE DATA TRANSMISSION

- 5.12.2 NIKE INTEGRATES NFC TECHNOLOGY TO INCREASE SALES AND CUSTOMER ENGAGEMENT

- 5.12.3 BARBADILLO ADOPTS NFC TAGS TO INCREASE CUSTOMER ENGAGEMENT AND SALES

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON NFC MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 AI/GEN AI IMPACT ON KEY NFC APPLICATIONS

- 5.16.2.1 Retail

- 5.16.2.2 Consumer electronics

- 5.16.3 USE CASES

- 5.16.4 KEY COMPANIES IMPLEMENTING AI/GEN AI

- 5.16.5 FUTURE OF AI/GEN AI IN NFC ECOSYSTEM

6 NFC SIGNALING TECHNOLOGIES

- 6.1 INTRODUCTION

- 6.2 NFC-A

- 6.3 NFC-B

- 6.4 NFC-F

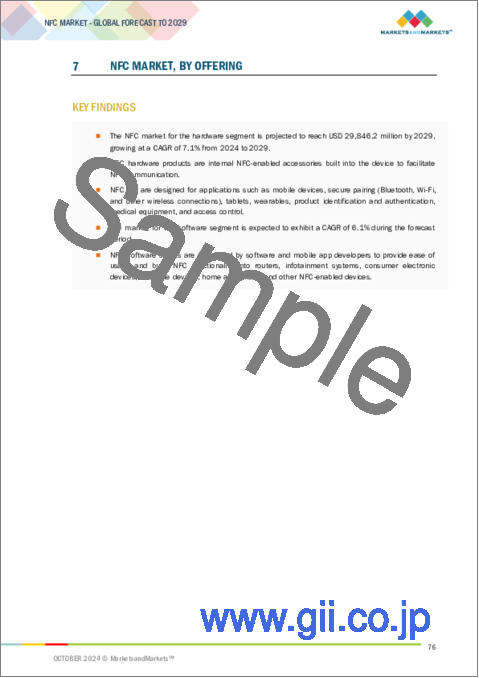

7 NFC MARKET, BY OFFERING

- 7.1 INTRODUCTION

- 7.2 HARDWARE

- 7.2.1 NFC ICS & ANTENNAS

- 7.2.1.1 Emphasis on ensuring proper electrical interface and maximizing power transfer to bolster segmental growth

- 7.2.2 NFC TAGS

- 7.2.2.1 Ability to identify proximity and vicinity to contribute to segmental growth

- 7.2.3 NFC READERS

- 7.2.3.1 Emphasis on seamless communication and data exchange among devices to foster segmental growth

- 7.2.1 NFC ICS & ANTENNAS

- 7.3 SOFTWARE

- 7.3.1 EASE OF USE AND FUNCTIONALITY IN ROUTERS, INFOTAINMENT SYSTEMS, AND CONSUMER ELECTRONICS TO DRIVE MARKET

8 NFC MARKET, BY OPERATING MODE

- 8.1 INTRODUCTION

- 8.2 CARD EMULATION

- 8.2.1 INCREASING USE TO CONVERT NFC DEVICES TO CONTACTLESS SMART CARDS TO BOOST SEGMENTAL GROWTH

- 8.3 READER EMULATION

- 8.3.1 RISING ADOPTION TO READ DATA FROM MANDATED NFC TAGS TO FUEL SEGMENTAL GROWTH

- 8.4 PEER-TO-PEER

- 8.4.1 ABILITY TO OFFER LINK-LEVEL COMMUNICATION BETWEEN TWO NFC DEVICES TO ACCELERATE SEGMENTAL GROWTH

9 NFC MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.2 RETAIL

- 9.2.1 PRODUCT IDENTIFICATION

- 9.2.1.1 Increasing need to identify product location and availability in retail stores to foster segmental growth

- 9.2.2 PAYMENT & TRANSACTION

- 9.2.2.1 Growing adoption of NFC-enabled devices as contactless cards to expedite segmental growth

- 9.2.1 PRODUCT IDENTIFICATION

- 9.3 TRANSPORTATION

- 9.3.1 TICKETING

- 9.3.1.1 Strong focus on convenience and security in ticketing process to augment segmental growth

- 9.3.2 ACCESS CONTROL

- 9.3.2.1 Ability of NFC to reduce cash handling to contribute to segmental growth

- 9.3.1 TICKETING

- 9.4 AUTOMOTIVE

- 9.4.1 RISING DEPLOYMENT IN ACCESS CONTROL AND IN-CAR INFOTAINMENT APPLICATIONS TO BOOST SEGMENTAL GROWTH

- 9.5 RESIDENTIAL & COMMERCIAL

- 9.5.1 ACCESS CONTROL

- 9.5.1.1 Reliance on NFC to offer physical access control in buildings to fuel segmental growth

- 9.5.2 TIME & ATTENDANCE

- 9.5.2.1 Requirement to keep track of in-time and out-time in commercial sector to augment segmental growth

- 9.5.3 HOME AUTOMATION

- 9.5.3.1 Use of smart lighting solutions with wireless switch capabilities to boost segmental growth

- 9.5.1 ACCESS CONTROL

- 9.6 HEALTHCARE

- 9.6.1 PATIENT IDENTIFICATION

- 9.6.1.1 Increasing deployment of NFC tags to secure access to healthcare information to bolster segmental growth

- 9.6.2 PRODUCT IDENTIFICATION

- 9.6.2.1 Growing preference for remote patient monitoring to augment segmental growth

- 9.6.3 ACCESS CONTROL

- 9.6.3.1 Rising need to identify patient health cards and other medical items to expedite segmental growth

- 9.6.1 PATIENT IDENTIFICATION

- 9.7 CONSUMER ELECTRONICS

- 9.7.1 WEARABLE DEVICES

- 9.7.1.1 Ability to interact with NFC-enabled devices to fuel segmental growth

- 9.7.2 MOBILE PHONES/TABLETS

- 9.7.2.1 Adoption of home automation and control solutions to bolster segmental growth

- 9.7.3 LAPTOPS/PERSONAL COMPUTERS

- 9.7.3.1 Growing popularity of touchless laptops to contribute to segmental growth

- 9.7.4 OTHER CONSUMER ELECTRONICS

- 9.7.1 WEARABLE DEVICES

- 9.8 BANKING & FINANCE

- 9.8.1 RELIANCE ON ADVANCED TECHNOLOGIES TO ENHANCE SECURITY TO BOOST SEGMENTAL GROWTH

- 9.9 HOSPITALITY

- 9.9.1 ACCESS CONTROL

- 9.9.1.1 Rising awareness about benefits of NFC-enabled smartphones in check-in process in hotels to drive market

- 9.9.2 PAYMENT & TRANSACTION

- 9.9.2.1 Growing preference for contactless payment to contribute to segmental growth

- 9.9.1 ACCESS CONTROL

- 9.10 OTHER VERTICALS

10 NFC MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Increasing adoption of smart city initiatives to accelerate market growth

- 10.2.3 CANADA

- 10.2.3.1 Rising deployment of advanced communication technologies to improve enterprise efficiency to fuel market growth

- 10.2.4 MEXICO

- 10.2.4.1 Growing interest toward digital payments to contribute to market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 UK

- 10.3.2.1 Rising awareness about contactless payment systems to augment market growth

- 10.3.3 GERMANY

- 10.3.3.1 Increasing access of payment service providers to NFC antennas to bolster market growth

- 10.3.4 ITALY

- 10.3.4.1 Rapid digitalization and adoption of contactless payments to expedite market growth

- 10.3.5 FRANCE

- 10.3.5.1 Growing demand for advanced technologies to allow dynamic pricing and real-time product positioning to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Rising implementation of biometric security payment solutions to accelerate market growth

- 10.3.7 SWITZERLAND

- 10.3.7.1 Growing focus on secure payment networks and reliable connectivity to foster market growth

- 10.3.8 NETHERLANDS

- 10.3.8.1 Rising emphasis on security and privacy to contribute to market growth

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Growing focus on expanding public transportation to boost market growth

- 10.4.3 JAPAN

- 10.4.3.1 Rising trend for e-money smart cards powered by NFC technology to drive market

- 10.4.4 INDIA

- 10.4.4.1 Increasing use of NFC-enabled contactless credit cards to fuel market growth

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Mounting demand for high-end smartphones to contribute to market growth

- 10.4.6 AUSTRALIA

- 10.4.6.1 Growing adoption of contactless payment methods to bolster market growth

- 10.4.7 INDONESIA

- 10.4.7.1 Rising focus on digital infrastructure development to fuel market growth

- 10.4.8 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Burgeoning demand for NFC-enabled smartphones to accelerate market growth

- 10.5.2.2 GCC countries

- 10.5.2.3 Rest of Middle East

- 10.5.3 SOUTH AMERICA

- 10.5.3.1 Increasing smartphone penetration and mobile payments to drive market

- 10.5.4 AFRICA

- 10.5.4.1 Rising preference for payments using contactless cards to contribute to market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 REVENUE ANALYSIS, 2019-2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 11.6 PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Vertical footprint

- 11.7.5.4 Operating mode footprint

- 11.7.5.5 Offering footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 NXP SEMICONDUCTORS

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 BROADCOM

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Key strengths/Right to win

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses/Competitive threats

- 12.1.3 QUALCOMM TECHNOLOGIES, INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 TEXAS INSTRUMENTS INCORPORATED

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Key strengths/Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses/Competitive threats

- 12.1.5 STMICROELECTRONICS

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 RENESAS ELECTRONICS CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 AMS-OSRAM AG

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.8 THALES

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.9 INFINEON TECHNOLOGIES AG

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.10 SONY CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.11 AVERY DENNISON CORPORATION

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.12 SAMSUNG

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.13 IDENTIV, INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.14 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.1 NXP SEMICONDUCTORS

- 12.2 OTHER PLAYERS

- 12.2.1 FLOMIO, INC.

- 12.2.2 SHANGHAI FUDAN MICROELECTRONICS GROUP CO., LTD.

- 12.2.3 HID GLOBAL CORPORATION

- 12.2.4 RESOURCE LABEL GROUP, LLC

- 12.2.5 PREMIER LABELS UK

- 12.2.6 ADVANCED CARD SYSTEMS LTD.

- 12.2.7 CRYPTERA

- 12.2.8 PERFECT ID

- 12.2.9 ID TECH

- 12.2.10 OMNIA TECHNOLOGIES PVT. LTD.

- 12.2.11 ELATEC GMBH

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS