|

|

市場調査レポート

商品コード

1681526

サーフェスレーダーの世界市場:プラットフォーム別、用途別、周波数帯別、次元別 - 予測(~2029年)Surface Radars Market by Platform (Critical Infrastructure, Vehicle-Mounted, Shipborne, Unmanned Surface Vehicles), Application (Surveillance, Air-Defense, Perimeter Security, Battlefield ISR), Frequency Band, Dimension - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| サーフェスレーダーの世界市場:プラットフォーム別、用途別、周波数帯別、次元別 - 予測(~2029年) |

|

出版日: 2025年03月01日

発行: MarketsandMarkets

ページ情報: 英文 312 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のサーフェスレーダーの市場規模は、2024年の172億6,000万米ドルから2029年までに224億9,000万米ドルに達すると予測され、CAGRで5.4%の成長が見込まれます。

サーフェスレーダーの数量は、2024年の4,690台から2029年までに6,113台に達すると予測されます。市場の主な促進要因は、脅威に対抗するための米国の防衛計画、進行中の紛争による需要の急増、世界の防衛支出などです。ミサイル防衛システムの開発と戦争の性質は、市場の成長をさらに促進します。しかし、武器移転に関する規制、メンテナンスを必要とする運用の複雑性、ミサイルシステムの開発コストなどの課題に直面し、市場の拡大の妨げとなっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | プラットフォーム、用途、範囲、周波数、次元、コンポーネント、波形 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

「周波数帯別では、Xバンドセグメントが予測期間に市場で最大のシェアを獲得すると推定されます。」

Xバンド周波数セグメントは、軍事と商業の双方の領域で高い利用率となり、予測期間内にサーフェスレーダー市場で最大のシェアを獲得する可能性が高いです。Xバンドレーダーは高精度で高感度であるため、ミサイル防衛システム、航空監視システム、海上レーダーシステムなどに使用されています。Xバンドレーダーは、ドローン、航空機、ミサイルなどのステルス性の物体に使用され、特に都市部や沿岸地域などのノイズの多い地域で使用されます。地政学的緊張の高まりや国境警備への関心の高まりも、軍事用途におけるXバンドレーダーの需要を高めています。しかし、アクティブ電子走査アレイなどの最新のレーダー技術により、Xバンドレーダーの追尾能力とともに、より強力な探知能力が提供されるようになり、Xバンドレーダーの需要はさらに高まっています。民間用途は、気象モニタリングや航空管制で増加傾向にあり、市場シェアを現在よりさらに押し上げています。

「波形別では、周波数変調連続波(FMCW)セグメントが予測期間に最高のCAGRで成長する見込みです。」

FMCWレーダーの進歩は、高解像度イメージングによるリアルタイムのターゲット識別をサポートし、それゆえ採用に火がついています。その結果、この種のレーダー技術は、監視システム、自動運転車、航空管制など、中断のない継続的な検出と測距が求められる用途に不可欠です。FMCWレーダーは、無人システムや対ドローン技術でもますます使用されるようになっており、そのため、FMCWレーダーが果たす役割は、現代の戦争や対テロ作戦にとって重要です。防衛用途において、より正確な追跡と目標識別への関心が高まっている現在、FMCWレーダーの需要は、その精度の優位性と従来のパルスレーダーよりも長い範囲により、強く後押しされています。この成長のその他の理由は、商業オートメーションや安全条件のモニタリングなどの産業用途にこれらの製品が多く組み込まれていることに関連しています。

「予測期間に欧州が最大の市場になると推定されます。」

複数の要因により、欧州が予測期間にサーフェスレーダー市場を独占する可能性が高いです。欧州には、Thales、BAE Systems、Leonardo S.p.Aなどの主要な防衛関連企業があり、軍事・民生用レーダーシステムの開発に多額の投資を行っています。NATOとロシアの関係により、国境警備上の懸念など地政学的緊張が高まっているため、欧州各国は現在、防空システムやミサイル防衛システムの改良を迫られています。

当レポートでは、世界のサーフェスレーダー市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- サーフェスレーダー市場の企業にとって魅力的な機会

- サーフェスレーダー市場:用途別

- サーフェスレーダー市場:部品別

- サーフェスレーダー市場:波形別

- サーフェスレーダー市場:重要インフラ別

- サーフェスレーダー市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向と混乱

- エコシステム分析

- 著名な企業

- 民間企業と中小企業

- エンドユーザー

- バリューチェーン分析

- 価格分析

- 運用データ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 貿易分析

- 輸入シナリオ(HSコード8526)

- 輸出シナリオ(HSコード8526)

- ユースケース分析

- 海上の防衛と監視を強化する、INS Vikrantへの先進のレーダーシステムの統合

- 世界クラスの性能を備えたモバイルレーダーの需要に応えるLeonardoのTMMRの展開

- Navtechのレーダー技術は、ますます複雑化し自律化する海洋環境において安全性と効率性を維持する

- 米国ミサイル防衛局とRaytheon Missiles & Defenseは協力し、海上Xバンドレーダー(SBX)の冷却システムを環境にやさしい新コンポーネントに置き換えた。

- 主な会議とイベント(2025年)

- 規制情勢

- 主なステークホルダーと購入基準

- 技術ロードマップ

- 総所有コスト

- 部品表

- サーフェスレーダー市場:ビジネスモデル

- 投資と資金調達のシナリオ

- マクロ経済の見通し

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東

- その他の地域

第6章 産業の動向

- イントロダクション

- 技術動向

- ソフトウェア定義レーダー

- MIMO

- 逆合成開口レーダー

- 量子レーダー

- メガトレンドの影響

- IoTの到来

- 世界の経済力のシフト

- レーダーシステム用アンテナの開発

- サプライチェーン分析

- サーフェスレーダー市場に対するAIの影響

- イントロダクション

- 軍隊におけるAIの採用:主要国別

- 防衛に対するAIの影響:ユースケース

- サーフェスレーダー市場に対するAIの影響

- 特許分析

第7章 サーフェスレーダー市場:プラットフォーム別

- イントロダクション

- 重要インフラ

- 車載

- 船上

- 無人水上機

- その他のプラットフォーム

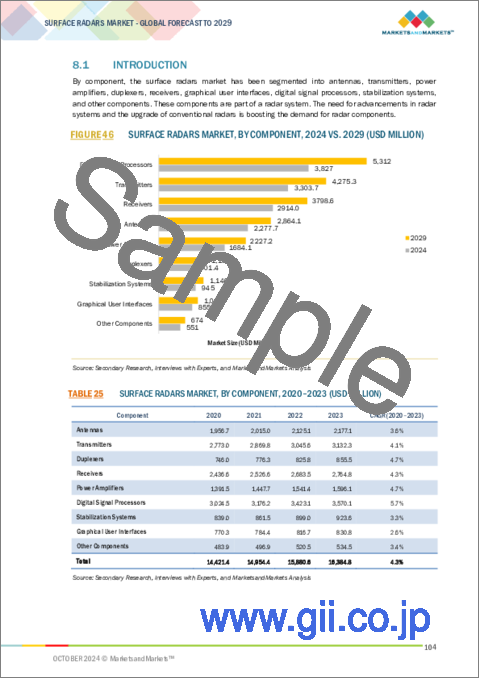

第8章 サーフェスレーダー市場:コンポーネント別

- イントロダクション

- アンテナ

- 送信機

- 受信機

- パワーアンプ

- デュプレクサー

- デジタル信号プロセッサー

- GUI

- 安定化システム

- その他のコンポーネント

第9章 サーフェスレーダー市場:波形別

- イントロダクション

- 周波数変調連続波(FMCW)

- ドップラー

第10章 サーフェスレーダー市場:周波数帯別

- イントロダクション

- HF/UHF/VHFバンド

- Lバンド

- Sバンド

- Cバンド

- Xバンド

- Kuバンド

- Kaバンド

- マルチバンド

第11章 サーフェスレーダー市場:範囲別

- イントロダクション

- 長距離

- 中距離

- 短距離

- 超短距離

第12章 サーフェスレーダー市場:用途別

- イントロダクション

- 監視

- 防空

- 境界セキュリティ

- 戦場ISR

- その他の用途

第13章 サーフェスレーダー市場:規模別

- イントロダクション

- 2D

- 3D

- 4D

第14章 サーフェスレーダー市場:技術別

- ソフトウェア定義レーダー

- 従来式レーダー

- 量子レーダー

第15章 サーフェスレーダー市場:地域別

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- PESTLE分析

- インド

- 日本

- 韓国

- オーストラリア

- その他のアジア太平洋

- 中東

- PESTLE分析

- GCC諸国

- トルコ

- イスラエル

- その他の地域

- PESTLE分析

- ラテンアメリカ

- アフリカ

第16章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- ブランドの比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価と財務指標

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第17章 企業プロファイル

- 主要企業

- RTX

- LOCKHEED MARTIN CORPORATION

- L3HARRIS TECHNOLOGIES, INC.

- THALES

- ISRAEL AEROSPACE INDUSTRIES

- LEONARDO S.P.A.

- BAE SYSTEMS

- NORTHROP GRUMMAN

- ELBIT SYSTEMS LTD.

- BHARAT ELECTRONICS LIMITED

- INDRA

- ASELSAN A.S.

- SAAB

- TELEDYNE FLIR LLC

- HENSOLDT

- その他の企業

- BLIGHTER SURVEILLANCE SYSTEMS LIMITED

- DETECT, INC.

- TERMA

- ACCIPITER RADAR

- PIERSIGHT

- REUTECH RADAR SYSTEMS

- SRC INC.

- EASAT RADAR SYSTEMS LIMITED

- ECHODYNE CORP.

- MAGOS SYSTEMS

第18章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2023

- TABLE 2 COMPARISON OF ADVANCED SURFACE RADAR SYSTEMS

- TABLE 3 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 4 INDICATIVE PRICING OF SURFACE RADARS, BY PLATFORM

- TABLE 5 INDICATIVE PRICING OF SURFACE RADAR PLATFORMS, BY REGION

- TABLE 6 VEHICLE-MOUNTED: OPERATIONAL DATA FOR ACTIVE FLEET OF MILITARY VEHICLES, BY COUNTRY, 2023

- TABLE 7 SHIPBORNE: OPERATIONAL DATA FOR ACTIVE FLEET OF COMMERCIAL SHIPS, BY COUNTRY, 2023

- TABLE 8 IMPORT DATA FOR HS CODE 8526-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 9 EXPORT DATA FOR HS CODE 8526-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 10 KEY CONFERENCES & EVENTS, 2025

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SURFACE RADAR PLATFORMS (%)

- TABLE 17 KEY BUYING CRITERIA, BY PLATFORM

- TABLE 18 TOTAL COST OF OWNERSHIP

- TABLE 19 COMPARISON OF BILL OF MATERIALS

- TABLE 20 SURFACE RADARS MARKET: BUSINESS MODELS

- TABLE 21 VENTURE CAPITAL AND DEALS, 2019-2022 (USD BILLION)

- TABLE 22 PATENT ANALYSIS

- TABLE 23 SURFACE RADARS MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 24 SURFACE RADARS MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 25 SURFACE RADARS MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 26 SURFACE RADARS MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 27 SURFACE RADARS MARKET, BY WAVEFORM, 2020-2023 (USD MILLION)

- TABLE 28 SURFACE RADARS MARKET, BY WAVEFORM, 2024-2029 (USD MILLION)

- TABLE 29 SURFACE RADAR BANDS AND THEIR FREQUENCY RANGES

- TABLE 30 SURFACE RADARS MARKET, BY FREQUENCY BAND, 2020-2023 (USD MILLION)

- TABLE 31 SURFACE RADARS MARKET, BY FREQUENCY BAND, 2024-2029 (USD MILLION)

- TABLE 32 SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 33 SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 34 SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 35 SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 36 SURFACE RADARS MARKET, BY DIMENSION, 2020-2023 (USD MILLION)

- TABLE 37 SURFACE RADARS MARKET, BY DIMENSION, 2024-2029 (USD MILLION)

- TABLE 38 SURFACE RADARS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 39 SURFACE RADARS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 40 NORTH AMERICA: SURFACE RADARS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 41 NORTH AMERICA: SURFACE RADARS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 42 NORTH AMERICA: SURFACE RADARS MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 43 NORTH AMERICA: SURFACE RADARS MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 44 NORTH AMERICA: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 45 NORTH AMERICA: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 46 NORTH AMERICA: SURFACE RADARS MARKET, BY FREQUENCY BAND, 2020-2023 (USD MILLION)

- TABLE 47 NORTH AMERICA: SURFACE RADARS MARKET, BY FREQUENCY BAND, 2024-2029 (USD MILLION)

- TABLE 48 NORTH AMERICA: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 49 NORTH AMERICA: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 50 NORTH AMERICA: SURFACE RADARS MARKET, BY DIMENSION, 2020-2023 (USD MILLION)

- TABLE 51 NORTH AMERICA: SURFACE RADARS MARKET, BY DIMENSION, 2024-2029 (USD MILLION)

- TABLE 52 NORTH AMERICA: SURFACE RADARS MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 53 NORTH AMERICA: SURFACE RADARS MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 54 NORTH AMERICA: SURFACE RADARS MARKET, BY WAVEFORM, 2020-2023 (USD MILLION)

- TABLE 55 NORTH AMERICA: SURFACE RADARS MARKET, BY WAVEFORM, 2024-2029 (USD MILLION)

- TABLE 56 US: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 57 US: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 58 US: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 59 US: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 60 CANADA: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 61 CANADA: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 62 CANADA: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 63 CANADA: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 64 EUROPE: SURFACE RADARS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 65 EUROPE: SURFACE RADARS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 66 EUROPE: SURFACE RADARS MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 67 EUROPE: SURFACE RADARS MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 68 EUROPE: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 69 EUROPE: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 70 EUROPE: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 71 EUROPE: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 72 EUROPE: SURFACE RADARS MARKET, BY FREQUENCY BAND, 2020-2023 (USD MILLION)

- TABLE 73 EUROPE: SURFACE RADARS MARKET, BY FREQUENCY BAND, 2024-2029 (USD MILLION)

- TABLE 74 EUROPE: SURFACE RADARS MARKET, BY DIMENSION, 2020-2023 (USD MILLION)

- TABLE 75 EUROPE: SURFACE RADARS MARKET, BY DIMENSION, 2024-2029 (USD MILLION)

- TABLE 76 EUROPE: SURFACE RADARS MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 77 EUROPE: SURFACE RADARS MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 78 EUROPE: SURFACE RADARS MARKET, BY WAVEFORM, 2020-2023 (USD MILLION)

- TABLE 79 EUROPE: SURFACE RADARS MARKET, BY WAVEFORM, 2024-2029 (USD MILLION)

- TABLE 80 UK: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 81 UK: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 82 UK: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 83 UK: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 84 GERMANY: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 85 GERMANY: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 86 GERMANY: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 87 GERMANY: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 88 FRANCE: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 89 FRANCE: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 90 FRANCE: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 91 FRANCE: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 92 ITALY: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 93 ITALY: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 94 ITALY: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 95 ITALY: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 96 REST OF EUROPE: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 97 REST OF EUROPE: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 98 REST OF EUROPE: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 99 REST OF EUROPE: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 100 ASIA PACIFIC: SURFACE RADARS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 101 ASIA PACIFIC: SURFACE RADARS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 102 ASIA PACIFIC: SURFACE RADARS MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 103 ASIA PACIFIC: SURFACE RADARS MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 104 ASIA PACIFIC: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 105 ASIA PACIFIC: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 106 ASIA PACIFIC: SURFACE RADARS MARKET, BY FREQUENCY, 2020-2023 (USD MILLION)

- TABLE 107 ASIA PACIFIC: SURFACE RADARS MARKET, BY FREQUENCY, 2024-2029 (USD MILLION)

- TABLE 108 ASIA PACIFIC: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 109 ASIA PACIFIC: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 110 ASIA PACIFIC: SURFACE RADARS MARKET, BY DIMENSION, 2020-2023 (USD MILLION)

- TABLE 111 ASIA PACIFIC: SURFACE RADARS MARKET, BY DIMENSION, 2024-2029 (USD MILLION)

- TABLE 112 ASIA PACIFIC: SURFACE RADARS MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 113 ASIA PACIFIC: SURFACE RADARS MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 114 ASIA PACIFIC: SURFACE RADARS MARKET, BY WAVEFORM, 2020-2023 (USD MILLION)

- TABLE 115 ASIA PACIFIC: SURFACE RADARS MARKET, BY WAVEFORM, 2024-2029 (USD MILLION)

- TABLE 116 INDIA: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 117 INDIA: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 118 INDIA: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 119 INDIA: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 120 JAPAN: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 121 JAPAN: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 122 JAPAN: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 123 JAPAN: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 124 SOUTH KOREA: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 125 SOUTH KOREA: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 126 SOUTH KOREA: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 127 SOUTH KOREA: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 128 AUSTRALIA: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 129 AUSTRALIA: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 130 AUSTRALIA: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 131 AUSTRALIA: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 136 MIDDLE EAST: SURFACE RADARS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 137 MIDDLE EAST: SURFACE RADARS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 138 MIDDLE EAST: SURFACE RADARS MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 139 MIDDLE EAST: SURFACE RADARS MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 140 MIDDLE EAST: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 141 MIDDLE EAST: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 142 MIDDLE EAST: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 143 MIDDLE EAST: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 144 MIDDLE EAST: SURFACE RADARS MARKET, BY FREQUENCY BAND, 2020-2023 (USD MILLION)

- TABLE 145 MIDDLE EAST: SURFACE RADARS MARKET, BY FREQUENCY BAND, 2024-2029 (USD MILLION)

- TABLE 146 MIDDLE EAST: SURFACE RADARS MARKET, BY DIMENSION, 2020-2023 (USD MILLION)

- TABLE 147 MIDDLE EAST: SURFACE RADARS MARKET, BY DIMENSION, 2024-2029 (USD MILLION)

- TABLE 148 MIDDLE EAST: SURFACE RADARS MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 149 MIDDLE EAST: SURFACE RADARS MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 150 MIDDLE EAST: SURFACE RADARS MARKET, BY WAVEFORM, 2020-2023 (USD MILLION)

- TABLE 151 MIDDLE EAST: SURFACE RADARS MARKET, BY WAVEFORM, 2024-2029 (USD MILLION)

- TABLE 152 SAUDI ARABIA: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 153 SAUDI ARABIA: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 154 SAUDI ARABIA: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 155 SAUDI ARABIA: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 156 UAE: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 157 UAE: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 158 UAE: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 159 UAE: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 160 TURKEY: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 161 TURKEY: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 162 TURKEY: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 163 TURKEY: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 164 ISRAEL: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 165 ISRAEL: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 166 ISRAEL: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 167 ISRAEL: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 168 REST OF THE WORLD: SURFACE RADARS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 169 REST OF THE WORLD: SURFACE RADARS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 170 REST OF THE WORLD: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 171 REST OF THE WORLD: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 172 REST OF THE WORLD: SURFACE RADARS MARKET, BY FREQUENCY BAND, 2020-2023 (USD MILLION)

- TABLE 173 REST OF THE WORLD: SURFACE RADARS MARKET, BY FREQUENCY BAND, 2024-2029 (USD MILLION)

- TABLE 174 REST OF THE WORLD: SURFACE RADARS MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 175 REST OF THE WORLD: SURFACE RADARS MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 176 REST OF THE WORLD: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 177 REST OF THE WORLD: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 178 REST OF THE WORLD: SURFACE RADARS MARKET, BY DIMENSION, 2020-2023 (USD MILLION)

- TABLE 179 REST OF THE WORLD: SURFACE RADARS MARKET, BY DIMENSION, 2024-2029 (USD MILLION)

- TABLE 180 REST OF THE WORLD: SURFACE RADARS MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 181 REST OF THE WORLD: SURFACE RADARS MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 182 REST OF THE WORLD: SURFACE RADARS MARKET, BY WAVEFORM, 2020-2023 (USD MILLION)

- TABLE 183 REST OF THE WORLD: SURFACE RADARS MARKET, BY WAVEFORM, 2024-2029 (USD MILLION)

- TABLE 184 LATIN AMERICA: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 185 LATIN AMERICA: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 186 LATIN AMERICA: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 187 LATIN AMERICA: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 188 AFRICA: SURFACE RADARS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 189 AFRICA: SURFACE RADARS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 190 AFRICA: SURFACE RADARS MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 191 AFRICA: SURFACE RADARS MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 192 STRATEGIES ADOPTED BY KEY PLAYERS, 2023

- TABLE 193 SURFACE RADARS MARKET: DEGREE OF COMPETITION

- TABLE 194 COMPANY WAVEFORM FOOTPRINT

- TABLE 195 COMPANY DIMENSION FOOTPRINT

- TABLE 196 COMPANY PLATFORM FOOTPRINT

- TABLE 197 COMPANY REGION FOOTPRINT

- TABLE 198 DETAILED LIST OF STARTUPS/SMES

- TABLE 199 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 200 SURFACE RADARS MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020-2024

- TABLE 201 SURFACE RADARS MARKET: DEALS, 2020-2024

- TABLE 202 SURFACE RADARS MARKET: OTHER DEVELOPMENTS, 2020-2024

- TABLE 203 RTX: COMPANY OVERVIEW

- TABLE 204 RTX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 RTX: OTHER DEVELOPMENTS

- TABLE 206 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 207 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 209 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 210 LOCKHEED MARTIN CORPORATION: OTHER DEVELOPMENTS

- TABLE 211 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 212 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 214 L3HARRIS TECHNOLOGIES, INC.: OTHER DEVELOPMENTS

- TABLE 215 THALES: COMPANY OVERVIEW

- TABLE 216 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 THALES: PRODUCT LAUNCHES

- TABLE 218 THALES: OTHER DEVELOPMENTS

- TABLE 219 ISRAEL AEROSPACE INDUSTRIES: COMPANY OVERVIEW

- TABLE 220 ISRAEL AEROSPACE INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 ISRAEL AEROSPACE INDUSTRIES: PRODUCT LAUNCHES

- TABLE 222 ISRAEL AEROSPACE INDUSTRIES: DEALS

- TABLE 223 ISRAEL AEROSPACE INDUSTRIES: OTHER DEVELOPMENTS

- TABLE 224 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 225 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 LEONARDO S.P.A.: DEALS

- TABLE 227 LEONARDO S.P.A.: OTHER DEVELOPMENTS

- TABLE 228 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 229 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 BAE SYSTEMS: PRODUCT LAUNCHES

- TABLE 231 BAE SYSTEMS: DEALS

- TABLE 232 BAE SYSTEMS: OTHER DEVELOPMENTS

- TABLE 233 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 234 NORTHROP GRUMMAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 NORTHROP GRUMMAN: PRODUCT LAUNCHES

- TABLE 236 NORTHROP GRUMMAN: OTHER DEVELOPMENTS

- TABLE 237 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 238 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 ELBIT SYSTEMS LTD.: PRODUCT LAUNCHES

- TABLE 240 ELBIT SYSTEMS LTD.: DEALS

- TABLE 241 ELBIT SYSTEMS LTD.: OTHER DEVELOPMENTS

- TABLE 242 BHARAT ELECTRONICS LIMITED: COMPANY OVERVIEW

- TABLE 243 BHARAT ELECTRONICS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 BHARAT ELECTRONICS LIMITED: PRODUCT LAUNCHES

- TABLE 245 BHARAT ELECTRONICS LIMITED: OTHER DEVELOPMENTS

- TABLE 246 INDRA: COMPANY OVERVIEW

- TABLE 247 INDRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 INDRA: PRODUCT LAUNCHES

- TABLE 249 INDRA: DEALS

- TABLE 250 INDRA: OTHER DEVELOPMENTS

- TABLE 251 ASELSAN A.S.: COMPANY OVERVIEW

- TABLE 252 ASELSAN A.S.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 ASELSAN A.S.: PRODUCT LAUNCHES

- TABLE 254 ASELSAN A.S.: DEALS

- TABLE 255 ASELSAN A.S.: OTHER DEVELOPMENTS

- TABLE 256 SAAB: COMPANY OVERVIEW

- TABLE 257 SAAB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 SAAB: OTHER DEVELOPMENTS

- TABLE 259 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- TABLE 260 TELEDYNE FLIR LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 TELEDYNE FLIR LLC: PRODUCT LAUNCHES

- TABLE 262 TELEDYNE FLIR LLC: DEALS

- TABLE 263 HENSOLDT: COMPANY OVERVIEW

- TABLE 264 HENSOLDT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 HENSOLDT: PRODUCT LAUNCHES

- TABLE 266 HENSOLDT: OTHER DEVELOPMENTS

- TABLE 267 BLIGHTER SURVEILLANCE SYSTEMS LIMITED: COMPANY OVERVIEW

- TABLE 268 DETECT, INC.: COMPANY OVERVIEW

- TABLE 269 TERMA: COMPANY OVERVIEW

- TABLE 270 ACCIPITER RADAR: COMPANY OVERVIEW

- TABLE 271 PIERSIGHT: COMPANY OVERVIEW

- TABLE 272 REUTECH RADAR SYSTEMS: COMPANY OVERVIEW

- TABLE 273 SRC INC.: COMPANY OVERVIEW

- TABLE 274 EASAT RADAR SYSTEMS LIMITED: COMPANY OVERVIEW

- TABLE 275 ECHODYNE CORP.: COMPANY OVERVIEW

- TABLE 276 MAGOS SYSTEMS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN MODEL

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 CRITICAL INFRASTRUCTURE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 7 LONG RANGE (200-500 KM) SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 3D SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2029

- FIGURE 9 X-BAND SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2029

- FIGURE 10 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 11 GOVERNMENT DEFENSE MODERNIZATION PROGRAMS ACROSS VARIOUS PLATFORMS TO DRIVE MARKET

- FIGURE 12 SURVEILLANCE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 DIGITAL SIGNAL PROCESSORS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 14 FREQUENCY MODULATED CONTINUOUS WAVE (FMCW) SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 AIRPORTS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 EUROPE TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 SURFACE RADARS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 DEFENSE EXPENDITURE OF KEY COUNTRIES, 2019-2023 (USD BILLION)

- FIGURE 19 DECLINING R&D PERCENTAGE, BY COMPANY, 2022-2023

- FIGURE 20 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 ECOSYSTEM ANALYSIS

- FIGURE 22 VALUE CHAIN ANALYSIS

- FIGURE 23 INDICATIVE PRICING, BY PLATFORM

- FIGURE 24 IMPORT DATA FOR HS CODE 8526-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 25 EXPORT DATA FOR HS CODE 8526-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PLATFORMS

- FIGURE 27 KEY BUYING CRITERIA, BY PLATFORM

- FIGURE 28 ANALYSIS OF TECHNOLOGY TRENDS

- FIGURE 29 EVOLUTION OF TECHNOLOGY TRENDS

- FIGURE 30 TOTAL COST OF OWNERSHIP

- FIGURE 31 BILL OF MATERIALS: AIR TRAFFIC CONTROL RADARS

- FIGURE 32 BILL OF MATERIALS: SURVEILLANCE AND AIR DEFENSE RADARS

- FIGURE 33 SURFACE RADARS MARKET: BUSINESS MODELS

- FIGURE 34 VENTURE CAPITAL AND DEALS, 2020-2024 (USD BILLION)

- FIGURE 35 MACROECONOMIC OUTLOOK FOR NORTH AMERICA, EUROPE, ASIA PACIFIC, MIDDLE EAST

- FIGURE 36 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- FIGURE 37 SIMPLIFIED ARCHITECTURE OF SDR SYSTEMS

- FIGURE 38 SUPPLY CHAIN ANALYSIS

- FIGURE 39 ADOPTION OF AI IN DEFENSE

- FIGURE 40 ADOPTION OF AI IN MILITARY BY TOP COUNTRIES

- FIGURE 41 IMPACT OF AI ON MILITARY PLATFORMS

- FIGURE 42 IMPACT OF AI ON SURFACE RADARS

- FIGURE 43 IMPACT OF AI ON SURFACE RADARS MARKET

- FIGURE 44 PATENTS ANALYSIS

- FIGURE 45 SURFACE RADARS MARKET, BY PLATFORM, 2024 VS. 2029 (USD MILLION)

- FIGURE 46 SURFACE RADARS MARKET, BY COMPONENT, 2024 VS. 2029 (USD MILLION)

- FIGURE 47 SURFACE RADARS MARKET, BY WAVEFORM, 2024 VS. 2029 (USD MILLION)

- FIGURE 48 SURFACE RADARS MARKET, BY FREQUENCY BAND, 2024 VS. 2029 (USD MILLION)

- FIGURE 49 SURFACE RADARS MARKET, BY RANGE, 2024 VS. 2029 (USD MILLION)

- FIGURE 50 SURFACE RADARS MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 51 SURFACE RADARS MARKET, BY DIMENSION, 2024 VS. 2029 (USD MILLION)

- FIGURE 52 SURFACE RADARS MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 53 NORTH AMERICA: SURFACE RADARS MARKET SNAPSHOT

- FIGURE 54 EUROPE: SURFACE RADARS MARKET SNAPSHOT

- FIGURE 55 ASIA PACIFIC: SURFACE RADARS MARKET SNAPSHOT

- FIGURE 56 MIDDLE EAST: SURFACE RADARS MARKET SNAPSHOT

- FIGURE 57 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- FIGURE 58 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2023

- FIGURE 59 SURFACE RADARS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 60 COMPANY PRODUCT FOOTPRINT

- FIGURE 61 EV/EBIDTA OF KEY PLAYERS, 2025

- FIGURE 62 COMPANY VALUATION OF KEY PLAYERS, 2025 (USD BILLION)

- FIGURE 63 SURFACE RADARS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES) 2023

- FIGURE 64 RTX: COMPANY SNAPSHOT

- FIGURE 65 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 67 THALES: COMPANY SNAPSHOT

- FIGURE 68 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 69 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 70 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 71 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 72 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 73 BHARAT ELECTRONICS LIMITED: COMPANY SNAPSHOT

- FIGURE 74 INDRA: COMPANY SNAPSHOT

- FIGURE 75 ASELSAN A.S.: COMPANY SNAPSHOT

- FIGURE 76 SAAB: COMPANY SNAPSHOT

The surface radars market is projected to reach USD 22.49 billion by 2029, from USD 17.26 billion in 2024, at a CAGR of 5.4%. The volume of surface radars is projected to grow from 4690 (in Units) in 2024 to 6113 (in Units) by 2029. The market is driven by key factors, including US defense programs to counter threats, a surge in demand due to ongoing conflicts, and global defense expenditure. The development of missile defense systems and the nature of warfare further fuel market growth. However, the market faces challenges from regulations on arms transfers, operational complexities requiring maintenance, and the development costs of missile systems, which can hinder expansion.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By platform, application, range, frequency, dimension, component, waveform. |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Based on frequency band, X-Band segment is estimated to capture the largest share in the market during the forecast period"

The X-Band frequency segment is likely to capture the largest share in the surface radar market within the forecast period with higher application in both military and commercial domains. X-Band radars are highly accurate and are more sensitive, hence used for missile defense systems, airborne surveillance, and naval radar systems. These are highly used for low-observable objects such as drones, aircraft, and missiles especially in areas with high clutter conditions like urban or coastal regions. The growing geopolitical tensions and the increase in interests in border security also contribute to high demand for X-Band radars in military applications. However, it is pushed further by the latest radar technologies in the offering, such as Active Electronically Scanned Array that, in turn provides greater power of detection along with tracking capabilities of X-Band radars. Civil application is on the rise in weather monitoring and air traffic control, pushing the market share even higher than the present rate.

"Based on waveform, the Frequency Modulated Continous Wave (FMCW) segment forecasted to grow at highest CAGR during forecast period "

The FMCW radar segment is likely to achieve the highest CAGR in the forecast period. Advances made in FMCW radars support real-time target identification with high-resolution imaging, hence igniting their adoption. Consequently, such a type of radar technology is critical for applications where continuous detection and ranging without any interruptions is sought after, including surveillance systems, autonomous vehicles, and air traffic control. FMCW radars are also increasingly used in unmanned systems and anti-drone technology, and for this reason, the role they play is key to modern warfare and counter-terrorist operations. Current interest in more precise tracking and target identification in defense applications gives the demand for FMCW radars a strong boost due to its accuracy advantage and longer range than traditional pulsed radars. Other reasons for this growth relate to the greater incorporation of these products into industrial applications, such as commercial automation and monitoring of safety conditions.

" The Europe region is estimated to be the largest market during the forecast period"

The Europe region is likely to dominate the surface radar market for the forecast period, driven by several key factors. There are several leading defense contractors such as Thales, BAE Systems, and Leonardo S.p.A located in Europe, which has been investing heavily in the development of the radar system for military and civil applications. This is now compelling European countries to improve their air and missile defense systems as rising geopolitical tensions in the region, including border security concerns, get on their nerves due to NATO-Russia relations. France, Germany, and the UK are among the countries increasing defense spending, and demand for such advanced radar technologies that can offer early warning and real-time surveillance will now be seen increasing. Furthermore, increased concern for the development of smart cities and civil infrastructure in Europe is driving the adoption of radar systems in smart city infrastructure, including applications in road traffic management and weather forecasting, for the protection of critical infrastructure. The collaborative defense programs that are ongoing, such as NATO defense initiatives, also promote market growth by expanding the deployment of radar systems across various NATO member countries.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the surface radars marketplace.

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America- 35%, Europe - 20%, Asia Pacific- 30%, Middle East - 10% and Rest of the World - 5%

include Lockheed Martin Corporation (US), RTX (US), BAE Systems (UK), Northrop Grumman (US), L3Harris Corporation (US), Leonardo S.p.A (Italy), Israel Aerospace Industries (Israel), Thales (France), Saab AB (Sweden), Elbit Systems Ltd. (Israel), and are some of the leading players operating in the surface radars market.

Research Coverage

This research report categorizes the surface radars market by platform, application, range, frequency, dimension, component, waveform, and by Region. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the surface radars market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, and services; key strategies; Contracts, partnerships, agreements, new product launches, and recent developments associated with the surface radars market. Competitive analysis of upcoming startups in surface radars market ecosystem is covered in this report.

Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall surface radars market and its subsegments. The report covers the entire ecosystem of the surface radars market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key Drivers (Focus on enhancing homeland security and border surveillance capabilities, advancements in radar technologies, emergence of modern warfare , requirement for drone detection systems at airports), restrains (Need for substantial R&D funding), opportunities (Increased advancements in Hardware & Software Integration in Radar Technology, increased Compact Radars for Anti-drones application , increasing preference for phased array solid-state radars, development of low-cost and miniaturized radars) and challenges (Extreme weather conditions, Vulnerability of radars to new jamming techniques) influencing the growth of the market.

- Product Development/Innovation: Detailed Insights on upcoming technologies, R&D activities, and new products/solutions launched in the market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the surface radars market across varied regions

- Market Diversification: Exhaustive information about new solutions, recent developments, and investments in the surface radars market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players including Lockheed Martin Corporation (US), RTX (US), BAE Systems (UK), Northrop Grumman (US), L3Harris Corporation (US), Leonardo S.p.A (Italy) and among others in the surface radars market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Insights from industry experts

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.2.3 SUPPLY-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SURFACE RADARS MARKET

- 4.2 SURFACE RADARS MARKET, BY APPLICATION

- 4.3 SURFACE RADARS MARKET, BY COMPONENT

- 4.4 SURFACE RADARS MARKET, BY WAVEFORM

- 4.5 SURFACE RADARS MARKET, BY CRITICAL INFRASTRUCTURE

- 4.6 SURFACE RADARS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Focus on enhancing homeland security and border surveillance capabilities

- 5.2.1.2 Advancements in radar technologies

- 5.2.1.3 Emergence of modern warfare

- 5.2.1.4 Requirements for drone detection systems at airports

- 5.2.1.5 Enhanced maritime safety and operational efficiency

- 5.2.2 RESTRAINTS

- 5.2.2.1 Insufficient R&D funding

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased advancements in hardware and software integration in radar technology

- 5.2.3.2 Increased use of compact radars for anti-drone applications

- 5.2.3.3 Preference for phased array solid-state radars

- 5.2.3.4 Development of low-cost, miniaturized radars

- 5.2.4 CHALLENGES

- 5.2.4.1 Extreme weather conditions

- 5.2.4.2 Vulnerability of radars to new jamming techniques

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 PRIVATE AND SMALL ENTERPRISES

- 5.4.3 END USERS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 INDICATIVE PRICING ANALYSIS, BY PLATFORM

- 5.7 OPERATIONAL DATA

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Gallium nitride semiconductor

- 5.8.1.2 Active electronically scanned array

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Quantum computing

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Sensor fusion

- 5.8.3.2 Photonics and optical technologies

- 5.8.3.3 Other technologies

- 5.8.1 KEY TECHNOLOGIES

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8526)

- 5.9.2 EXPORT SCENARIO (HS CODE 8526)

- 5.10 USE CASE ANALYSIS

- 5.10.1 INTEGRATION OF ADVANCED RADAR SYSTEMS IN INS VIKRANT TO ENHANCE NAVAL DEFENSE AND SURVEILLANCE

- 5.10.2 DEPLOYMENT OF LEONARDO'S TMMR TO MEET DEMAND FOR MOBILE RADARS WITH WORLD-CLASS PERFORMANCE

- 5.10.3 NAVTECH'S RADAR TECHNOLOGY MAINTAINS SAFETY AND EFFICIENCY IN INCREASINGLY COMPLEX AND AUTONOMOUS MARINE ENVIRONMENT

- 5.10.4 US MISSILE DEFENSE AGENCY AND RAYTHEON MISSILES & DEFENSE COLLABORATED TO REPLACE COOLING SYSTEM OF SEA-BASED X-BAND RADAR (SBX) WITH NEW, ENVIRONMENTALLY FRIENDLY COMPONENTS

- 5.11 KEY CONFERENCES & EVENTS, 2025

- 5.12 REGULATORY LANDSCAPE

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 TECHNOLOGY ROADMAP

- 5.15 TOTAL COST OF OWNERSHIP

- 5.16 BILL OF MATERIALS

- 5.17 SURFACE RADARS MARKET: BUSINESS MODELS

- 5.18 INVESTMENT AND FUNDING SCENARIO

- 5.19 MACROECONOMIC OUTLOOK

- 5.19.1 INTRODUCTION

- 5.19.2 NORTH AMERICA

- 5.19.3 EUROPE

- 5.19.4 ASIA PACIFIC

- 5.19.5 MIDDLE EAST

- 5.19.6 ROW

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 SOFTWARE-DEFINED RADARS

- 6.2.2 MULTIPLE-INPUT AND MULTIPLE-OUTPUT (MIMO)

- 6.2.3 INVERSE SYNTHETIC APERTURE RADARS

- 6.2.4 QUANTUM RADARS

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 ADVENT OF INTERNET OF THINGS

- 6.3.2 SHIFT IN GLOBAL ECONOMIC POWER

- 6.3.3 DEVELOPMENT OF ANTENNAS IN RADAR SYSTEMS

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 IMPACT OF AI ON SURFACE RADARS MARKET

- 6.5.1 INTRODUCTION

- 6.5.2 ADOPTION OF AI IN MILITARY BY TOP COUNTRIES

- 6.5.3 IMPACT OF AI ON DEFENSE: USE CASES

- 6.5.4 IMPACT OF AI ON SURFACE RADARS MARKET

- 6.6 PATENT ANALYSIS

7 SURFACE RADARS MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- 7.2 CRITICAL INFRASTRUCTURE

- 7.2.1 MODERNIZATION OF CRITICAL INFRASTRUCTURE TO LEAD TO INCREASED DEMAND FOR RADAR SYSTEMS

- 7.2.2 AIRPORTS

- 7.2.3 SEAPORTS

- 7.2.4 POWER PLANTS

- 7.2.5 MILITARY BASES & COMMAND CENTRES

- 7.2.6 OIL & GAS PRODUCTION SITES

- 7.3 VEHICLE-MOUNTED

- 7.3.1 NEED FOR WIDE SURVEILLANCE COVERAGE TO DRIVE DEMAND

- 7.3.2 MILITARY

- 7.3.3 COMMERCIAL

- 7.4 SHIPBORNE

- 7.4.1 INCREASE IN ILLEGAL MARITIME ACTIVITIES TO DRIVE DEMAND FOR SHIPBORNE RADAR SYSTEMS

- 7.4.2 MILITARY

- 7.4.3 COMMERCIAL

- 7.5 UNMANNED SURFACE VEHICLES

- 7.5.1 NEED FOR ADVANCED SOLUTIONS TO TRACK SECURITY THREATS TO SPUR GROWTH

- 7.5.2 MILITARY

- 7.5.3 COMMERCIAL

- 7.6 OTHER PLATFORMS

8 SURFACE RADARS MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 ANTENNAS

- 8.2.1 ADVANCED COMMUNICATION NEEDS AND MODERN WARFARE REQUIREMENTS TO DRIVE DEMAND FOR ANTENNAS

- 8.2.2 PARABOLIC REFLECTOR ANTENNAS

- 8.2.3 SLOTTED WAVEGUIDE ANTENNAS

- 8.2.4 PHASED ARRAY ANTENNAS

- 8.2.5 MULTIPLE-INPUT AND MULTIPLE-OUTPUT (MIMO)

- 8.2.6 ACTIVE SCANNED ARRAY ANTENNAS

- 8.2.7 PASSIVE SCANNED ARRAY ANTENNAS

- 8.3 TRANSMITTERS

- 8.3.1 INCREASED DEMAND FOR COMPLEX MILITARY COMMUNICATION INFRASTRUCTURE TO DRIVE GROWTH

- 8.3.2 MICROWAVE TUBE-BASED TRANSMITTERS

- 8.3.3 SOLID-STATE ELECTRONIC TRANSMITTERS

- 8.4 RECEIVERS

- 8.4.1 RADAR RECEIVERS USE POWER AMPLIFIERS FOR SIGNAL AMPLIFICATION

- 8.4.2 ANALOG

- 8.4.3 DIGITAL

- 8.5 POWER AMPLIFIERS

- 8.5.1 POWER AMPLIFIERS EMPLOY ELECTRONIC SYSTEM DESIGN TO FOCUS ON EFFICIENCY AND LINEARITY

- 8.5.2 TRAVELING WAVE TUBE AMPLIFIERS

- 8.5.3 SOLID-STATE POWER AMPLIFIERS

- 8.5.3.1 Gallium Arsenide (GaAs)

- 8.5.3.2 Gallium Nitride (GaN)

- 8.5.3.3 Silicon carbide

- 8.5.4 GALLIUM NITRIDE POWER AMPLIFIERS

- 8.6 DUPLEXERS

- 8.6.1 DUPLEXERS ARE REQUIRED WHEN SINGLE ANTENNA IS USED TO TRANSMIT AND RECEIVE SIGNALS

- 8.6.2 BRANCH-TYPE DUPLEXERS

- 8.6.3 BALANCED-TYPE DUPLEXERS

- 8.6.4 CIRCULATOR DUPLEXERS

- 8.7 DIGITAL SIGNAL PROCESSORS

- 8.7.1 NEED FOR ADVANCED, HIGH-END PROCESSORS TO DRIVE DEMAND FOR DIGITAL SIGNAL PROCESSORS

- 8.8 GRAPHICAL USER INTERFACES

- 8.8.1 GRAPHICAL USER INTERFACES ALLOW USERS TO COMMUNICATE USING GRAPHICAL ICONS AND TEXT-BASED INTERFACES WITH ELECTRONIC DEVICES

- 8.8.2 CONTROL PANELS

- 8.8.3 GRAPHIC PANELS

- 8.8.4 DISPLAYS

- 8.9 STABILIZATION SYSTEMS

- 8.9.1 STABILIZATION SYSTEMS ENHANCE MILITARY MOBILITY AND EFFECTIVENESS OF COMBATS

- 8.10 OTHER COMPONENTS

9 SURFACE RADARS MARKET, BY WAVEFORM

- 9.1 INTRODUCTION

- 9.2 FREQUENCY-MODULATED CONTINUOUS WAVE (FMCW)

- 9.2.1 NEED FOR VERSATILITY AND ACCURACY IN COVERT OPERATIONS TO DRIVE DEMAND

- 9.3 DOPPLER

- 9.3.1 DEMAND FOR ADVANCED WEATHER PREDICTION TECHNOLOGIES TO BOOST DEMAND FOR DOPPLER RADARS

- 9.3.2 CONVENTIONAL DOPPLER RADARS

- 9.3.3 PULSE DOPPLER RADARS

10 SURFACE RADARS MARKET, BY FREQUENCY BAND

- 10.1 INTRODUCTION

- 10.2 HF/UHF/VHF-BAND

- 10.2.1 HF/UHF/VHF-BAND RADARS FACILITATE LONG-RANGE SURVEILLANCE AND TRACKING

- 10.3 L-BAND

- 10.3.1 L-BAND RADARS ARE WIDELY USED IN SPACE-BASED PLATFORMS

- 10.4 S-BAND

- 10.4.1 S-BAND RADARS ARE USED FOR MODERATE-RANGE SURVEILLANCE

- 10.5 C-BAND

- 10.5.1 S-BAND RADARS PROVIDE ROBUST SURVEILLANCE AND PRECISE TARGET-TRACKING CAPABILITIES

- 10.6 X-BAND

- 10.6.1 X-BAND RADARS CAN DETECT HIDDEN WEAPONS AND EXPLORE SPACE ENVIRONMENT DURING MAPPING

- 10.7 KU-BAND

- 10.7.1 KU-BAND RADARS PROVIDE HIGH-RESOLUTION IMAGING WITH ROBUST SIGNAL

- 10.8 KA-BAND

- 10.8.1 KA-BAND RADARS DELIVER HIGH THROUGHPUT BEAMS AND HIGH BANDWIDTH COMMUNICATION

- 10.9 MULTI-BAND

- 10.9.1 GROWING DEMAND FOR BETTER RADAR SIGNALS TO BOOST ADOPTION OF MULTI-BAND RADARS

11 SURFACE RADARS MARKET, BY RANGE

- 11.1 INTRODUCTION

- 11.2 LONG RANGE

- 11.2.1 NEED FOR LONG-DISTANCE TRACKING AND ACCURATE LOCATION TO DRIVE MARKET

- 11.3 MEDIUM RANGE

- 11.3.1 MEDIUM-RANGE RADARS ENHANCE BORDER SECURITY AND WEAPON GUIDANCE

- 11.4 SHORT RANGE

- 11.4.1 SHORT-RANGE RADARS ARE USED IN COMMERCIAL APPLICATIONS OR MAN-PORTABLE RECONNAISSANCE MISSIONS

- 11.5 VERY SHORT RANGE

- 11.5.1 VERY SHORT-RANGE RADARS ARE EFFECTIVE IN TRACKING FLYING THREATS

12 SURFACE RADARS MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 SURVEILLANCE

- 12.2.1 SURVEILLANCE RADARS CAN TRACK AND IDENTIFY AIRCRAFT FLYING LOW AND AT GREAT DISTANCE

- 12.3 AIR DEFENSE

- 12.3.1 GROWING NUMBER AND SOPHISTICATION OF THREATS TO BOOST GROWTH

- 12.4 PERIMETER SECURITY

- 12.4.1 INCREASED INVESTMENTS IN BORDER SECURITY OPERATIONS TO ENCOURAGE MARKET EXPANSION

- 12.5 BATTLEFIELD ISR

- 12.5.1 RADAR SYSTEMS PROVIDE REAL-TIME DATA ON ENEMY MOVEMENTS, ALLOWING MILITARY FORCES TO MAKE INFORMED DECISIONS

- 12.6 OTHER APPLICATIONS

13 SURFACE RADARS MARKET, BY DIMENSION

- 13.1 INTRODUCTION

- 13.2 2D

- 13.2.1 2D RADARS ARE WIDELY ACCEPTED FOR TERRESTRIAL, NAVAL, AND AIRBORNE SURVEILLANCE

- 13.3 3D

- 13.3.1 ENHANCED CAPABILITIES OF 3D RADARS TO DRIVE THEIR DEMAND AND ADOPTION

- 13.4 4D

- 13.4.1 4D RADARS ARE USED FOR AUTONOMOUS TACTICAL SURVEILLANCE APPLICATIONS TO GENERATE HIGH-RESOLUTION TARGET SIGNALS

14 SURFACE RADARS MARKET, BY TECHNOLOGY

- 14.1 SOFTWARE-DEFINED RADARS

- 14.1.1 SOFTWARE-DEFINED RADARS OFFER ENHANCED DEFENSE AGAINST LIMITED, LOW-ALTITUDE AIR THREATS

- 14.1.2 MULTIPLE-INPUT AND MULTIPLE-OUTPUT

- 14.1.3 PHASED ARRAY RADARS

- 14.1.3.1 Active electronically scanned arrays

- 14.1.3.2 Passive electronically scanned arrays

- 14.2 CONVENTIONAL RADARS

- 14.2.1 CONVENTIONAL RADARS ARE IMMUNE TO JAMMING, DETECTION, AND EXTERNAL INTERFERENCE

- 14.3 QUANTUM RADARS

- 14.3.1 QUANTUM RADARS PERFORM ACCURATE RADAR DETECTION AND STRENGTHEN DEFENSE

15 SURFACE RADARS MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 PESTLE ANALYSIS

- 15.2.2 US

- 15.2.2.1 Need for strategic advancements in defense technologies to drive market

- 15.2.3 CANADA

- 15.2.3.1 Focus on improving surveillance radar technology to drive market

- 15.3 EUROPE

- 15.3.1 PESTLE ANALYSIS

- 15.3.2 UK

- 15.3.2.1 Rapid growth in military expenditure and increase in special surveillance and missile defense programs to drive market

- 15.3.3 GERMANY

- 15.3.3.1 Advanced technological capabilities and robust defense industry to drive market

- 15.3.4 FRANCE

- 15.3.4.1 Rising demand for surveillance systems to fuel market growth

- 15.3.5 ITALY

- 15.3.5.1 Focus on defense modernization and technological advancements

- 15.3.6 REST OF EUROPE

- 15.4 ASIA PACIFIC

- 15.4.1 PESTLE ANALYSIS

- 15.4.2 INDIA

- 15.4.2.1 Increased procurement of defense systems to drive market

- 15.4.3 JAPAN

- 15.4.3.1 Heightened security concerns to drive popularity of surface radars

- 15.4.4 SOUTH KOREA

- 15.4.4.1 Strategic investments and advancements in radar technology to fuel growth

- 15.4.5 AUSTRALIA

- 15.4.5.1 Emphasis on upgrading 737-based E-7 radar jets to indicate advancements in surface radars market

- 15.4.6 REST OF ASIA PACIFIC

- 15.5 MIDDLE EAST

- 15.5.1 PESTLE ANALYSIS

- 15.5.2 GCC COUNTRIES

- 15.5.2.1 Saudi Arabia

- 15.5.2.1.1 Government initiatives such as 'Vision 2030' to drive market

- 15.5.2.2 UAE

- 15.5.2.2.1 Increasing ballistic missile attacks from neighboring countries to drive market

- 15.5.2.1 Saudi Arabia

- 15.5.3 TURKEY

- 15.5.3.1 Increasing focus on modernizing defense capabilities to drive market

- 15.5.4 ISRAEL

- 15.5.4.1 Increasing domestic production capabilities and rise in government investments in defense sector to drive market

- 15.6 REST OF THE WORLD

- 15.6.1 PESTLE ANALYSIS

- 15.6.2 LATIN AMERICA

- 15.6.2.1 Rigorous efforts to strengthen defense forces to drive market

- 15.6.3 AFRICA

- 15.6.3.1 Focus on small CubeSats for space-based surveillance to drive market

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 MARKET SHARE ANALYSIS

- 16.4 REVENUE ANALYSIS

- 16.5 BRAND COMPARISON

- 16.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 16.6.1 STARS

- 16.6.2 EMERGING LEADERS

- 16.6.3 PERVASIVE PLAYERS

- 16.6.4 PARTICIPANTS

- 16.6.5 COMPANY FOOTPRINT: KEY PLAYERS

- 16.7 COMPANY VALUATION AND FINANCIAL METRICS

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 MARKET EVALUATION FRAMEWORK

- 16.9.2 PRODUCT LAUNCHES/DEVELOPMENTS

- 16.9.3 DEALS

- 16.9.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 RTX

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Other developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 LOCKHEED MARTIN CORPORATION

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.3.2 Deals

- 17.1.2.3.3 Other developments

- 17.1.2.4 MnM view

- 17.1.2.4.1 Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 L3HARRIS TECHNOLOGIES, INC.

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Deals

- 17.1.3.3.2 Other developments

- 17.1.3.4 MnM view

- 17.1.3.4.1 Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses & competitive threats

- 17.1.4 THALES

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.3.2 Other developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 ISRAEL AEROSPACE INDUSTRIES

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Other developments

- 17.1.5.4 MnM view

- 17.1.5.4.1 Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 LEONARDO S.P.A.

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Deals

- 17.1.6.3.2 Other developments

- 17.1.7 BAE SYSTEMS

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product launches

- 17.1.7.3.2 Deals

- 17.1.7.3.3 Other developments

- 17.1.8 NORTHROP GRUMMAN

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches

- 17.1.8.3.2 Other developments

- 17.1.9 ELBIT SYSTEMS LTD.

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches

- 17.1.9.3.2 Deals

- 17.1.9.3.3 Other developments

- 17.1.10 BHARAT ELECTRONICS LIMITED

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches

- 17.1.10.3.2 Other developments

- 17.1.11 INDRA

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions/Services offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Product launches

- 17.1.11.3.2 Deals

- 17.1.11.3.3 Other developments

- 17.1.12 ASELSAN A.S.

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions/Services offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Product launches

- 17.1.12.3.2 Deals

- 17.1.12.3.3 Other developments

- 17.1.13 SAAB

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Solutions/Services offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Other developments

- 17.1.14 TELEDYNE FLIR LLC

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Solutions/Services offered

- 17.1.14.3 Recent developments

- 17.1.14.3.1 Product launches

- 17.1.14.3.2 Deals

- 17.1.15 HENSOLDT

- 17.1.15.1 Business overview

- 17.1.15.2 Products/Solutions/Services offered

- 17.1.15.3 Recent developments

- 17.1.15.3.1 Product launches

- 17.1.15.3.2 Other developments

- 17.1.1 RTX

- 17.2 OTHER PLAYERS

- 17.2.1 BLIGHTER SURVEILLANCE SYSTEMS LIMITED

- 17.2.2 DETECT, INC.

- 17.2.3 TERMA

- 17.2.4 ACCIPITER RADAR

- 17.2.5 PIERSIGHT

- 17.2.6 REUTECH RADAR SYSTEMS

- 17.2.7 SRC INC.

- 17.2.8 EASAT RADAR SYSTEMS LIMITED

- 17.2.9 ECHODYNE CORP.

- 17.2.10 MAGOS SYSTEMS

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 ANNEXURE A: DEFENSE PROGRAM MAPPING

- 18.3 ANNEXURE B: OTHER MAPPED COMPANIES

- 18.4 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.5 CUSTOMIZATION OPTIONS

- 18.6 RELATED REPORTS

- 18.7 AUTHOR DETAILS