|

|

市場調査レポート

商品コード

1566247

腹膜透析の世界市場:オファリング別、モダリティ別、適応疾患別、エンドユーザー別、地域別 - 2029年までの予測Peritoneal Dialysis Market by Offering (Peritoneal Dialysis Solution Bags, Machines), Modality (Continuous Ambulatory Peritoneal Dialysis Center(CAPD)), Disease Indication (End-Stage Renal Disease), End User (Hospitals) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 腹膜透析の世界市場:オファリング別、モダリティ別、適応疾患別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2024年10月04日

発行: MarketsandMarkets

ページ情報: 英文 253 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

腹膜透析(PD)の市場規模は、2024年の95億8,000万米ドルから2029年には127億米ドルに達すると予測され、予測期間中のCAGRは5.8%になるとみられています。

新興国市場では医療政策が好意的であり、多くの国で在宅透析治療に対する償還が行われるようになったため、腹膜透析へのアクセスが非常に増加しています。ほとんどの場合、米国、カナダ、および欧州の他の数カ国は、腹膜透析の費用対効果と患者への便益が血液透析よりも優れていることを認める政策を打ち出しています。このような政策は、腹膜透析に関連する治療費のかなりの部分に対する払い戻しを確立することにより、治療費に関連する障壁を軽減します。これにより、PDは患者にとってより安価で利用しやすい治療法となり、償還制度は、在宅での治療管理を希望する患者にも、その柔軟性と実用性からPDを勧める医療従事者の実践を促進します。例えば米国では、メディケアのESRDプログラムにより、在宅透析への払い戻しが行われ、普及が促進されています。同様に、他の新興国市場でも、在宅透析は入院を減らし、患者の予後を改善し、ヘルスケア施設の負担を軽減することから、在宅透析を支持し、奨励しています。在宅透析に伴う経済的支援は、高齢者や寝たきりの患者にとって、体を動かさず、身の回りの世話を強化することで、より良い生活を送ることができる理由となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | オファリング別、モダリティ別、適応疾患別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ、GCC |

腹膜透析液バッグは、高価な技術やメンテナンスに依存しないため、機械よりも安価です。このため、腹膜透析バッグは患者やヘルスケアシステムにとって非常に安価であり、その製造・流通コストにより、特に医療予算が厳しく制限されている国々では、誰もが手の届く価格で販売することが可能です。溶液バッグはまた、高価な機器やスタッフのトレーニングの必要性を減らし、治療費全体を削減します。このことは、資源の乏しい環境において、より多くの患者が必要な透析を受けるための治療オプションとして、溶液バッグの魅力をさらに高めています。

CAPD用品、特に溶液バッグの普及率が高まったことで、特に発展途上国での導入が活発化しています。CAPDは、透析治療のあらゆる形態において、溶液バッグのような基本的な消耗品しか必要としないため、医療資源が非常に乏しい地域でも、高価な機械よりも流通や導入がはるかに簡単です。したがって、低資源環境の患者にとって、より費用対効果が高く、実際に提供される透析形態として利用しやすいです。使いやすさと病院施設の最小化により、CAPDの普及率はさらに高まり、世界的に恵まれない地域での透析医療へのアクセスが増加しています。

ほとんどのヘルスケアシステムは、末期腎不全(ESRD)に起因する通院の有病率を低下させ、その後の医療費全体を節約するために、在宅透析オプションを推進しています。医療機関は、在宅腹膜透析を導入することで、施設内での透析の必要性を減らし、病院の設備容量を節約し、施設や職員に与える問題を最小限に抑えることができます。在宅透析はまた、患者が自分の治療をコントロールできるようになるため、患者の生活も改善されます。さらに、在宅透析の利点は、交通費を節約できるため非常に経済的であること、感染症にかかりにくいこと、ケアの継続性を促進できることであり、医療システムにとって魅力的な方法です。

当レポートでは、世界の腹膜透析市場について調査し、オファリング別、モダリティ別、適応疾患別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 技術分析

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- ポーターのファイブフォース分析

- 規制分析

- 特許分析

- 価格分析

- 2024年~2025年の主な会議とイベント

- 主な利害関係者と購入基準

- エコシステム分析

- 隣接市場分析

- ケーススタディ分析

- 腹膜透析市場における生成AIの影響

- アンメットニーズとエンドユーザーの期待

- 顧客のビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- 手順データ分析

第6章 腹膜透析市場(オファリング別)

- イントロダクション

- 腹膜透析製品

- 腹膜透析サービス

第7章 腹膜透析市場(モダリティ別)

- イントロダクション

- 持続携帯型腹膜透析(CAPD)

- 自動腹膜透析(APD)

第8章 腹膜透析市場(適応疾患別)

- イントロダクション

- 末期腎疾患

- 急性腎障害

- その他

第9章 腹膜透析市場(エンドユーザー別)

- イントロダクション

- 在宅ケア

- 病院および独立透析センター

- その他

第10章 腹膜透析市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- GCC諸国

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業評価と財務指標

- 競合シナリオ

- ブランド/製品比較

- 腹膜透析市場:研究開発費

第12章 企業プロファイル

- 主要参入企業

- FRESENIUS MEDICAL CARE AG

- BAXTER INTERNATIONAL INC.

- MEDTRONIC PLC

- DAVITA INC.

- BECTON, DICKINSON AND COMPANY

- TERUMO CORPORATION

- UTAH MEDICAL PRODUCTS, INC.

- DIAVERUM AB

- MEDIONICS

- NEWSOL TECHNOLOGIES INC.

- APOLLO DIALYSIS PVT. LTD.

- U.S. RENAL CARE, INC.

- NORTHWEST KIDNEY CENTERS

- RELAVO

- MITRA INDUSTRIES PVT. LTD.

- その他の企業

- JMS CO., LTD.

- AMECATH

- POLYMEDICURE

- HUAREN PHARMACEUTICAL

- AWAK TECHNOLOGIES

- INNOVATIVE RENAL CARE

- ROMSONS

- SSEM MTHEMBU MEDICAL(PTY)LTD.

- RENAX BIOMEDICAL TECHNOLOGY CO., LTD.

- ADVIN HEALTH CARE

第13章 付録

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 NUMBER OF PEOPLE AGED 65 YEARS OR OVER, BY REGION, 2022 VS. 2050

- TABLE 3 UTILIZATION OF KIDNEY REPLACEMENT THERAPIES (PERITONEAL DIALYSIS VS. HEMODIALYSIS)

- TABLE 4 COST OF KIDNEY REPLACEMENT THERAPIES (2021)

- TABLE 5 TRADE ANALYSIS OF MEDICAL DEVICE PRODUCTS

- TABLE 6 IMPORT DATA FOR PERITONEAL DIALYSIS MACHINES, SOLUTION BAGS, CATHETERS, AND TRANSFER SETS (HS CODE 9018), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 7 EXPORT DATA FOR PERITONEAL DIALYSIS MACHINES, SOLUTION BAGS, CATHETERS AND TRANSFER SETS (HS CODE 9018), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 8 PERITONEAL DIALYSIS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 AVERAGE SELLING PRICE OF PERITONEAL DIALYSIS PRODUCTS AND CONSUMABLES, BY KEY PLAYER, 2023 (USD)

- TABLE 15 PERITONEAL DIALYSIS MARKET: DETAILED LIST OF KEY CONFERENCES & EVENTS, 2024-2025

- TABLE 16 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR PERITONEAL DIALYSIS PRODUCTS

- TABLE 17 BUYING CRITERIA FOR PERITONEAL DIALYSIS PRODUCTS

- TABLE 18 PERITONEAL DIALYSIS MARKET: ECOSYSTEM ANALYSIS

- TABLE 19 CASE STUDY 1: CUSTOMIZED DIALYSIS TUBING SETS

- TABLE 20 CASE STUDY 2: CUSTOMIZED SOFTWARE FOR AUTOMATED PERITONEAL DIALYSIS (APD) MACHINE

- TABLE 21 PERITONEAL DIALYSIS MARKET: UNMET NEEDS

- TABLE 22 PERITONEAL DIALYSIS MARKET: END-USER EXPECTATIONS

- TABLE 23 PREVALENCE DATA, BY COUNTRY, 2021-2023 (PMP)

- TABLE 24 NUMBER OF PERITONEAL DIALYSIS PATIENTS, BY REGION, 2019-2023

- TABLE 25 NUMBER OF PERITONEAL DIALYSIS PATIENTS, BY REGION, 2024-2029

- TABLE 26 PROCEDURE DATA FOR PERITONEAL DIALYSIS, BY COUNTRY, 2019-2023

- TABLE 27 PROCEDURE DATA FOR PERITONEAL DIALYSIS, BY COUNTRY, 2024-2029

- TABLE 28 PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 29 PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 30 PERITONEAL DIALYSIS PRODUCTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 31 AVERAGE VOLUME OF EXCHANGE, BY REGION, 2019-2023 (MILLION LITERS)

- TABLE 32 AVERAGE VOLUME OF EXCHANGE, BY REGION, 2024-2029 (MILLION LITERS)

- TABLE 33 PERITONEAL DIALYSIS SOLUTION BAGS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 34 PERITONEAL DIALYSIS SOLUTION BAGS MARKET, BY REGION, 2022-2029 (THOUSAND UNITS)

- TABLE 35 PERITONEAL DIALYSIS MACHINES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 36 PERITONEAL DIALYSIS MACHINES MARKET, BY REGION, 2022-2029 (THOUSAND UNITS)

- TABLE 37 PERITONEAL DIALYSIS CATHETERS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 38 PERITONEAL DIALYSIS TRANSFER SETS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 39 OTHER PERITONEAL DIALYSIS PRODUCTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 40 PERITONEAL DIALYSIS SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 41 PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 42 CONTINUOUS AMBULATORY PERITONEAL DIALYSIS (CAPD) MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 43 AMBULATORY PERITONEAL DIALYSIS (APD) MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 44 PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 45 PERITONEAL DIALYSIS MARKET FOR END-STAGE RENAL DISEASE, BY REGION, 2022-2029 (USD MILLION)

- TABLE 46 PERITONEAL DIALYSIS MARKET FOR ACUTE KIDNEY INJURY, BY REGION, 2022-2029 (USD MILLION)

- TABLE 47 PERITONEAL DIALYSIS MARKET FOR OTHER DISEASES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 48 PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 49 PERITONEAL DIALYSIS MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 50 PERITONEAL DIALYSIS MARKET FOR HOSPITALS & INDEPENDENT DIALYSIS CENTERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 51 PERITONEAL DIALYSIS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 52 PERITONEAL DIALYSIS PREVALENCE DATA, BY COUNTRY, 2019-2023

- TABLE 53 PERITONEAL DIALYSIS PREVALENCE DATA, BY COUNTRY, 2024-2029

- TABLE 54 PERITONEAL DIALYSIS PROCEDURE DATA, BY REGION, 2019-2023 (MILLION PROCEDURES)

- TABLE 55 PERITONEAL DIALYSIS PROCEDURE DATA, BY REGION, 2024-2029 (MILLION PROCEDURES)

- TABLE 56 PERITONEAL DIALYSIS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 57 NORTH AMERICA: PERITONEAL DIALYSIS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 58 NORTH AMERICA: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 59 NORTH AMERICA: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 60 NORTH AMERICA: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 61 NORTH AMERICA: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 62 NORTH AMERICA: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 63 US: MACROECONOMIC INDICATORS

- TABLE 64 US: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 65 US: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 66 US: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 67 US: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 68 US: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 69 CANADA: MACROECONOMIC INDICATORS

- TABLE 70 CANADA: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 71 CANADA: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 72 CANADA: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 73 CANADA: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 74 CANADA: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 75 EUROPE: PERITONEAL DIALYSIS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 76 EUROPE: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 77 EUROPE: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 78 EUROPE: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 79 EUROPE: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 80 EUROPE: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 81 GERMANY: MACROECONOMIC INDICATORS

- TABLE 82 GERMANY: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 83 GERMANY: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 84 GERMANY: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 85 GERMANY: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 86 GERMANY: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 87 UK: MACROECONOMIC INDICATORS

- TABLE 88 UK: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 89 UK: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 90 UK: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 91 UK: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 92 UK: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 93 FRANCE: MACROECONOMIC INDICATORS

- TABLE 94 FRANCE: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 95 FRANCE: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 96 FRANCE: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 97 FRANCE: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 98 FRANCE: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 99 ITALY: MACROECONOMIC INDICATORS

- TABLE 100 ITALY: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 101 ITALY: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 102 ITALY: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 103 ITALY: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 104 ITALY: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 105 SPAIN: MACROECONOMIC INDICATORS

- TABLE 106 SPAIN: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 107 SPAIN: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 108 SPAIN: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 109 SPAIN: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 110 SPAIN: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 111 REST OF EUROPE: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 112 REST OF EUROPE: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 113 REST OF EUROPE: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 114 REST OF EUROPE: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 115 REST OF EUROPE: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 116 ASIA PACIFIC: PERITONEAL DIALYSIS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 117 ASIA PACIFIC: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 118 ASIA PACIFIC: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 119 ASIA PACIFIC: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 120 ASIA PACIFIC: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 121 ASIA PACIFIC: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 122 JAPAN: MACROECONOMIC INDICATORS

- TABLE 123 JAPAN: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 124 JAPAN: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 125 JAPAN: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 126 JAPAN: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 127 JAPAN: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 128 CHINA: MACROECONOMIC INDICATORS

- TABLE 129 CHINA: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 130 CHINA: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 131 CHINA: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 132 CHINA: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 133 CHINA: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 134 INDIA: MACROECONOMIC INDICATORS

- TABLE 135 INDIA: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 136 INDIA: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 137 INDIA: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 138 INDIA: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 139 INDIA: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 140 AUSTRALIA: MACROECONOMIC INDICATORS

- TABLE 141 AUSTRALIA: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 142 AUSTRALIA: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 143 AUSTRALIA: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 144 AUSTRALIA: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 145 AUSTRALIA: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 146 SOUTH KOREA: MACROECONOMIC INDICATORS

- TABLE 147 SOUTH KOREA: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 148 SOUTH KOREA: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 149 SOUTH KOREA: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 150 SOUTH KOREA: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 151 SOUTH KOREA: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 157 LATIN AMERICA: PERITONEAL DIALYSIS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 158 LATIN AMERICA: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 159 LATIN AMERICA: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 160 LATIN AMERICA: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 161 LATIN AMERICA: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 162 LATIN AMERICA: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 163 BRAZIL: MACROECONOMIC INDICATORS

- TABLE 164 BRAZIL: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 165 BRAZIL: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 166 BRAZIL: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 167 BRAZIL: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 168 BRAZIL: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 169 MEXICO: MACROECONOMIC INDICATORS

- TABLE 170 MEXICO: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 171 MEXICO: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 172 MEXICO: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 173 MEXICO: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 174 MEXICO: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 175 REST OF LATIN AMERICA: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 176 REST OF LATIN AMERICA: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 177 REST OF LATIN AMERICA: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 178 REST OF LATIN AMERICA: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 179 REST OF LATIN AMERICA: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 185 GCC COUNTRIES: PERITONEAL DIALYSIS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 186 GCC COUNTRIES: PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 187 GCC COUNTRIES: PERITONEAL DIALYSIS MARKET, BY MODALITY, 2022-2029 (USD MILLION)

- TABLE 188 GCC COUNTRIES: PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2022-2029 (USD MILLION)

- TABLE 189 GCC COUNTRIES: PERITONEAL DIALYSIS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 190 PERITONEAL DIALYSIS MARKET: DEGREE OF COMPETITION

- TABLE 191 PERITONEAL DIALYSIS MARKET: OFFERING FOOTPRINT

- TABLE 192 PERITONEAL DIALYSIS MARKET: MODALITY FOOTPRINT

- TABLE 193 PERITONEAL DIALYSIS MARKET: DISEASE INDICATION FOOTPRINT

- TABLE 194 PERITONEAL DIALYSIS MARKET: END-USER FOOTPRINT

- TABLE 195 PERITONEAL DIALYSIS MARKET: REGION FOOTPRINT

- TABLE 196 PERITONEAL DIALYSIS MARKET: DETAILED LIST OF KEY START-UP/SME PLAYERS

- TABLE 197 PERITONEAL DIALYSIS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UP/SME PLAYERS REGION FOOTPRINT

- TABLE 198 PERITONEAL DIALYSIS MARKET: PRODUCT APPROVALS (JANUARY 2021- SEPTEMBER 2024)

- TABLE 199 PERITONEAL DIALYSIS MARKET: DEALS, JANUARY 2020-SEPTEMBER 2024

- TABLE 200 PERITONEAL DIALYSIS MARKET: EXPANSIONS, JANUARY 2020-SEPTEMBER 2024

- TABLE 201 FRESENIUS MEDICAL CARE AG: COMPANY OVERVIEW

- TABLE 202 FRESENIUS MEDICAL CARE AG: PRODUCTS & SERVICES OFFERED

- TABLE 203 FRESENIUS MEDICAL CARE AG: DEALS, JANUARY 2021-SEPTEMBER 2024

- TABLE 204 BAXTER INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 205 BAXTER INTERNATIONAL INC.: PRODUCTS & SERVICES OFFERED

- TABLE 206 BAXTER INTERNATIONAL INC.: DEALS, JANUARY 2021-SEPTEMBER 2024

- TABLE 207 MEDTRONIC PLC: COMPANY OVERVIEW

- TABLE 208 MEDTRONIC PLC: PRODUCTS & SERVICES OFFERED

- TABLE 209 MEDTRONIC PLC: DEALS, JANUARY 2021-SEPTEMBER 2024

- TABLE 210 DAVITA INC.: COMPANY OVERVIEW

- TABLE 211 DAVITA INC.: PRODUCTS & SERVICES OFFERED

- TABLE 212 DAVITA INC.: DEALS, JANUARY 2021-SEPTEMBER 2024

- TABLE 213 DAVITA INC.: EXPANSIONS, JANUARY 2021-SEPTEMBER 2024

- TABLE 214 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 215 BECTON, DICKINSON AND COMPANY: PRODUCTS & SERVICES OFFERED

- TABLE 216 BECTON, DICKINSON AND COMPANY: EXPANSIONS, JANUARY 2021-SEPTEMBER 2024

- TABLE 217 TERUMO CORPORATION: COMPANY OVERVIEW

- TABLE 218 TERUMO CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 219 TERUMO CORPORATION: PRODUCT APPROVALS, JANUARY 2021-SEPTEMBER 2024

- TABLE 220 TERUMO CORPORATION: DEALS, JANUARY 2021-SEPTEMBER 2024

- TABLE 221 TERUMO CORPORATION: EXPANSIONS, JANUARY 2021-SEPTEMBER 2024

- TABLE 222 UTAH MEDICAL PRODUCTS, INC.: BUSINESS OVERVIEW

- TABLE 223 UTAH MEDICAL PRODUCTS, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 224 DIAVERUM AB: COMPANY OVERVIEW

- TABLE 225 DIAVERUM AB: PRODUCTS & SERVICES OFFERED

- TABLE 226 MEDIONICS: BUSINESS OVERVIEW

- TABLE 227 MEDIONICS: PRODUCTS & SERVICES OFFERED

- TABLE 228 NEWSOL TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 229 NEWSOL TECHNOLOGIES INC.: PRODUCTS & SERVICES OFFERED

- TABLE 230 APOLLO DIALYSIS PVT. LTD.: BUSINESS OVERVIEW

- TABLE 231 APOLLO DIALYSIS PVT. LTD.: PRODUCTS & SERVICES OFFERED

- TABLE 232 U.S. RENAL CARE, INC.: BUSINESS OVERVIEW

- TABLE 233 U.S. RENAL CARE, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 234 NORTHWEST KIDNEY CENTERS: COMPANY OVERVIEW

- TABLE 235 NORTHWEST KIDNEY CENTERS: PRODUCTS & SERVICES OFFERED

- TABLE 236 NORTHWEST KIDNEY CENTERS: DEALS, JANUARY 2021-SEPTEMBER 2024

- TABLE 237 NORTHWEST KIDNEY CENTERS: EXPANSIONS, JANUARY 2021-SEPTEMBER 2024

- TABLE 238 RELAVO: COMPANY OVERVIEW

- TABLE 239 RELAVO: PRODUCTS & SERVICES OFFERED

- TABLE 240 MITRA INDUSTRIES PVT. LTD.: BUSINESS OVERVIEW

- TABLE 241 MITRA INDUSTRIES PVT. LTD.: PRODUCTS & SERVICES OFFERED

List of Figures

- FIGURE 1 PERITONEAL DIALYSIS MARKET: SEGMENTS COVERED

- FIGURE 2 RESEARCH DESIGN: PERITONEAL DIALYSIS MARKET

- FIGURE 3 INDICATIVE LIST OF SECONDARY SOURCES

- FIGURE 4 LIST OF KEY PRIMARY SOURCES

- FIGURE 5 KEY INDUSTRY INSIGHTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 9 REVENUE SHARE ANALYSIS ILLUSTRATION

- FIGURE 10 SUPPLY-SIDE MARKET SIZE ESTIMATION: PERITONEAL DIALYSIS MARKET (2023)

- FIGURE 11 ESTIMATION OF PERITONEAL DIALYSIS PROCEDURES, BY COUNTRY/REGION

- FIGURE 12 MARKET SIZE ESTIMATION: PERITONEAL DIALYSIS MARKET, BY PRODUCT UTILIZATION METHODOLOGY

- FIGURE 13 MARKET SIZE ESTIMATION: PERITONEAL DIALYSIS SERVICES MARKET, BY REVENUE MAPPING METHODOLOGY

- FIGURE 14 PERITONEAL DIALYSIS: AVERAGE VOLUME EXCHANGE ESTIMATION MODEL

- FIGURE 15 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2024-2029)

- FIGURE 16 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 17 DATA TRIANGULATION METHODOLOGY

- FIGURE 18 PERITONEAL DIALYSIS MARKET, BY OFFERING, 2024 VS. 2029 (USD MILLION)

- FIGURE 19 PERITONEAL DIALYSIS PRODUCTS MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 20 PERITONEAL DIALYSIS MARKET, BY MODALITY, 2024 VS. 2029 (USD MILLION)

- FIGURE 21 PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 22 PERITONEAL DIALYSIS MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 23 GEOGRAPHIC SNAPSHOT: PERITONEAL DIALYSIS MARKET

- FIGURE 24 INCREASING PREVALENCE OF ESRD TO DRIVE MARKET GROWTH

- FIGURE 25 JAPAN ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2023

- FIGURE 26 INDIA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 27 NORTH AMERICA TO CONTINUE TO DOMINATE PERITONEAL DIALYSIS MARKET DURING FORECAST PERIOD

- FIGURE 28 DEVELOPING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 29 PERITONEAL DIALYSIS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 30 CANADA: NUMBER OF END-STAGE RENAL DISEASE PATIENTS, BY AGE GROUP (2022)

- FIGURE 31 US: REPORTED CAUSES OF END-STAGE RENAL DISEASES, 2023

- FIGURE 32 INCIDENCE OF TREATED END-STAGE RENAL DISEASE, 2021

- FIGURE 33 SHORTAGES OF NEPHROLOGISTS IN LOW-INCOME AND LOWER-MIDDLE-INCOME COUNTRIES (LLMICS)

- FIGURE 34 PERITONEAL DIALYSIS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 35 PERITONEAL DIALYSIS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 36 PERITONEAL DIALYSIS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 PATENT PUBLICATION TRENDS (2014-2024)

- FIGURE 38 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR PERITONEAL DIALYSIS PATENTS (JANUARY 2014-SEPTEMBER 2024)

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PERITONEAL DIALYSIS PRODUCTS

- FIGURE 40 KEY BUYING CRITERIA FOR PERITONEAL DIALYSIS PRODUCTS

- FIGURE 41 HEMODIALYSIS AND PERITONEAL DIALYSIS MARKET OVERVIEW

- FIGURE 42 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET OVERVIEW

- FIGURE 43 KEY FEATURES OF GENERATIVE AI IN PERITONEAL DIALYSIS MARKET

- FIGURE 44 PERITONEAL DIALYSIS MARKET: TRENDS/DISRUPTIONS AFFECTING CUSTOMERS' BUSINESSES

- FIGURE 45 NUMBER OF DEALS & FUNDING ACTIVITY IN PERITONEAL DIALYSIS MARKET, 2019-2023 (USD MILLION)

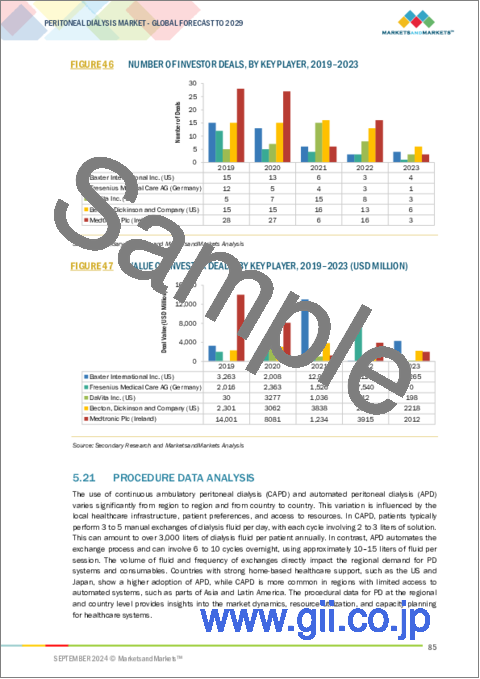

- FIGURE 46 NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 47 VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 48 NORTH AMERICA: PERITONEAL DIALYSIS MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: PERITONEAL DIALYSIS MARKET SNAPSHOT

- FIGURE 50 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PRODUCT & SERVICE COMPANIES

- FIGURE 51 REVENUE ANALYSIS OF TOP THREE PLAYERS IN PERITONEAL DIALYSIS MARKET (2019-2023)

- FIGURE 52 MARKET SHARE ANALYSIS OF KEY PLAYERS IN PERITONEAL DIALYSIS MARKET (2023)

- FIGURE 53 PERITONEAL DIALYSIS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 54 PERITONEAL DIALYSIS MARKET: COMPANY FOOTPRINT

- FIGURE 55 PERITONEAL DIALYSIS MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 56 EV/EBITDA OF KEY VENDORS

- FIGURE 57 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 58 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 59 R&D EXPENDITURE OF KEY PLAYERS (2022 VS. 2023)

- FIGURE 60 FRESENIUS MEDICAL CARE AG: COMPANY SNAPSHOT (2023)

- FIGURE 61 BAXTER INTERNATIONAL INC.: COMPANY SNAPSHOT (2023)

- FIGURE 62 MEDTRONIC PLC: COMPANY SNAPSHOT (2023)

- FIGURE 63 DAVITA INC.: COMPANY SNAPSHOT (2023)

- FIGURE 64 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2023)

- FIGURE 65 TERUMO CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 66 UTAH MEDICAL PRODUCTS, INC.: COMPANY SNAPSHOT (2023)

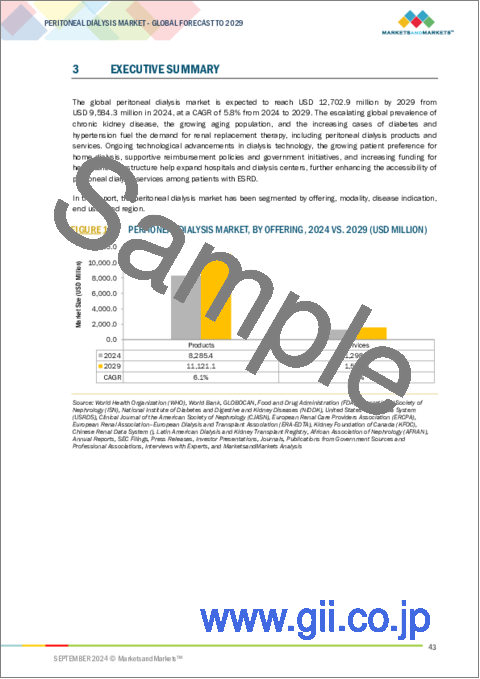

The peritoneal dialysis market is projected to reach USD 12.70 Billion by 2029 from USD 9.58 Billion in 2024 at a CAGR of 5.8% during the forecast period. Favorable healthcare policies in developed markets have highly increased access to peritoneal dialysis since many now offer reimbursements for home-based dialysis treatments. In most cases, the United States, Canada, and several others in Europe have come up with policies that acknowledge the cost-effectiveness and better benefits for patients through peritoneal dialysis over in-center hemodialysis. Such policies reduce the barriers associated with the cost of treatment by establishing reimbursement coverage for a significant portion of the PD-associated treatment costs. This could make PD a much more affordable and accessible form of therapy for patients, and reimbursement programs promote the practice of healthcare providers to recommend PD due to its flexibility and practicality, also for those preferring home management of treatment. For instance, in the United States, Medicare's ESRD program encourages wider adoption by providing reimbursements for home dialysis. Likewise, other developed markets also are following and encouraging home dialysis since it reduces hospital admissions, improves patient outcomes, and reduces burdens on the healthcare facilities. The financial support that comes with PD has become a reason for the aged and bedridden patients who have been able to live better as a result of reduced immobilization and enhanced personal care.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | By Offering, Modality, Disease Indication, End User and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa and GCC |

"The peritoneal solution bags segment is accounted for the largest share of peritoneal dialysis market."

Peritoneal dialysis solution bags are less expensive than machines because they are not reliant upon pricey technology and maintenance. Because of this, these bags are very inexpensive for patients and healthcare systems, whose production and distribution costs make it possible to sell these bags at prices within everyone's reach, especially in countries that have tightly constrained health care budgets. Solution bags also reduce the requirement for costly equipment and training of the staff, thereby reducing the overall cost of treatment. This adds to the attractiveness of solution bags as a treatment option for a larger number of patients in resource-poor settings for access to necessary dialysis.

"Continuous Ambulatory Peritoneal Dialysis (CAPD) segment holds the largest market share of peritoneal dialysis market."

The increased coverage of CAPD supplies, especially the solution bags, has stimulated its adoption, especially in developing countries. CAPD, being any form of dialysis treatment, requires only basic supplies, like solution bags, and hence is much simpler to distribute and implement in areas with very poor healthcare resources than expensive machinery. Therefore, it is more cost-effective and accessible to patients in low-resource settings as a practically offered form of dialysis. Ease of use and minimization of the use of hospital facilities further increase the adoption rate of CAPD, thereby increasing access to dialysis care in underprivileged areas globally.

"End-stage renal disease segment holds the largest market share in the global peritoneal dialysis market and expected to grow at the highest CAGR during the forecast period"

Most healthcare systems promote home dialysis options to decrease the prevalence of hospital visits attributed to end-stage renal disease (ESRD), which subsequently saves the overall cost of healthcare. Health care providers would benefit from home peritoneal dialysis by reducing the need for in-center dialysis, thus saving hospital facility capacities and minimizing the problems it poses both to facilities and personnel. Home dialysis will also improve patients' lives as they assume control over their treatment. An added advantage of home-based PD is that it is very economical since it saves transportation costs, it minimizes the susceptibility to infection, and encourages continuity of care, which makes it an attractive modality for health care systems.

"Home care setttings segment accounted for the largest market share in the global peritoneal dialysis market and expected to grow at the highest CAGR during the forecast period."

Portable and user-friendly dialysis equipment have further improved the safety and ease of treatment in the home setting for patients. Modern peritoneal dialysis machines are well designed with intuitive interfaces, automation, and compact size, making them devices that patients can use with relative ease, without relying so much on medical knowledge. Thus, independent and comfortable home-based dialysis has reduced a patient's dependence on healthcare professionals. Safety measures have upgraded with live monitoring and automatic alarms that enhanced outcomes best dealt with early before dangers occur. In those innovations, patient confidence in handling their care improved, while the treatment compliance was generally enhanced.

"North America to witness the substantial growth rate during the forecast period."

The peritoneal dialysis market is segmented into North America, Europe, Asia Pacific, Latin America, the Middle East & Africa and GCC Countries based on the region type. In 2023, the Asia Pacific region is projected to exhibit the highest CAGR during the forecast period. However, North America accounts for the largest market share of the peritoneal dialysis market in 2023. North America is the largest regional market for global peritoneal dialysis, and this is partly because healthcare providers in this region have been trained specifically to manage this treatment. This places them in a better position to ensure that patients requiring the treatment receive a holistic education on how to carry out procedures safely and effectively at home. Moreover, these professionals provide timely interventions through effective monitoring, thus making the outcomes better as well as complications as low as possible. Specialized training programs and ongoing professional development in the region further underpin quality care. Such professionalism among healthcare professionals has indeed contributed to success in the introduction and spread of peritoneal dialysis in North America.

A breakdown of the primary participants (supply-side) for the peritoneal dialysis market referred to for this report is provided below:

- By Company Type: Tier 1-45%, Tier 2-30%, and Tier 3-25%

- By Designation: C-level-35%, Director Level-25%, and Others-40%

- By Region: North America-40%, Europe-20%, Asia Pacific-25%, Latin America- 10%, and Middle East and Africa- 3% and GCC Countries- 2%

Prominent players in this market include Baxter International Inc. (US), Fresenius Medical Care AG (Germany), Medtronic plc (Ireland), Davita Inc. (US), Becton, Dickinson and Company (US), Utah Medical Products, Inc. (US), Terumo Corporation (Japan), Diaverum AB (Sweden), Medionics (Canada), Newsol Technologies (Canada), Apollo Dialysis Pvt Ltd (India), U.S. Renal Care, Inc. (US), Northwest Kidney Centers (US), Relavo (US), Mitra Industries Pvt Ltd (India), JMS Co., Ltd. (Japan), AMECATH (Egypt), Polymedicure (India), Huaren Pharmaceutical (China), AWAK Technologies (Singapore), Innovative Renal Care (US), Romsons (India), SSEM Mthembu Medical (Pty) Ltd (South Africa), Renax Biomedical Technology Co., Ltd (China), and Advin Health Care (India).

Research Coverage:

The market study covers the peritoneal dialysis market across various segments. It aims at estimating the market size and the growth potential of this market across different segments by offering, modality, disease indication, end user and region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights on:

- Analysis of Market Dynamics: Drivers (rising prevalence of chronic kidney diseases, growing prevalence of diabetes and hypertension, and technological advancements and increased investment in R&D) restraints (underutilization of peritoneal dialysis in low-income and lower-middle-income countries (LLMICs)) opportunities (increasing growth opportunities in emerging economies, and surge in demand for home dialysis treatment), and challenges (growing incidence of treated kidney failure, and shortage of skilled nephrologists in low-income and lower-middle-income countries (LLMICs))

- Services/Innovations: Detailed insights on upcoming technologies, research & development activities, and new product launches in the peritoneal dialysis market.

- Market Development: Comprehensive information on the lucrative emerging markets, components, demographics, end-user, and region.

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the peritoneal dialysis market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the peritoneal dialysis market like Baxter International Inc. (US), Fresenius Medical Care AG (Germany), Medtronic plc (Ireland), Davita Inc. (US), Becton, Dickinson and Company (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 IMPACT OF AI/GEN AI

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

- 2.2.2 COMPANY PRESENTATIONS AND PRIMARY INTERVIEWS

- 2.2.3 USAGE-BASED MARKET ESTIMATION

- 2.2.4 PRIMARY RESEARCH VALIDATION

- 2.3 GROWTH FORECAST ESTIMATION

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 PERITONEAL DIALYSIS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: PERITONEAL DIALYSIS MARKET, BY OFFERING (2023)

- 4.3 PERITONEAL DIALYSIS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 REGIONAL MIX: PERITONEAL DIALYSIS MARKET (2024-2029)

- 4.5 PERITONEAL DIALYSIS MARKET: DEVELOPED VS. DEVELOPING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising prevalence of chronic kidney diseases

- 5.2.1.2 Growing prevalence of diabetes and hypertension

- 5.2.1.3 Technological advancements and increased investment in R&D

- 5.2.2 RESTRAINTS

- 5.2.2.1 Underutilization of peritoneal dialysis in low-income and lower-middle-income countries (LLMICs)

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing growth opportunities in emerging economies

- 5.2.3.2 Surge in demand for home dialysis treatment

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled nephrologists in low-income and lower-middle-income countries (LLMICs)

- 5.2.4.2 High risk of peritonitis as a barrier to peritoneal dialysis adoption

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 INCREASED ADOPTION OF HOME-BASED TREATMENTS

- 5.3.2 RISING INCIDENCE OF CHRONIC KIDNEY DISEASE (CKD)

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Automated peritoneal dialysis (APD) machines

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Remote monitoring systems

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Wearable technology

- 5.4.1 KEY TECHNOLOGIES

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 TRADE ANALYSIS FOR PERITONEAL DIALYSIS MACHINES, SOLUTION BAGS, CATHETERS, AND TRANSFER SETS (HS CODE 9018)

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 REGULATORY ANALYSIS

- 5.9.1 REGULATORY LANDSCAPE

- 5.9.1.1 North America

- 5.9.1.1.1 US

- 5.9.1.1.2 Canada

- 5.9.1.2 Europe

- 5.9.1.3 Asia Pacific

- 5.9.1.3.1 India

- 5.9.1.3.2 China

- 5.9.1.3.3 Japan

- 5.9.1.3.4 South Korea

- 5.9.1.4 Latin America

- 5.9.1.4.1 Brazil

- 5.9.1.4.2 Mexico

- 5.9.1.5 Middle East

- 5.9.1.6 Africa

- 5.9.1.1 North America

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.1 REGULATORY LANDSCAPE

- 5.10 PATENT ANALYSIS

- 5.10.1 PATENT PUBLICATION TRENDS FOR PERITONEAL DIALYSIS MARKET

- 5.10.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE OF PERITONEAL DIALYSIS PRODUCTS AND CONSUMABLES, BY KEY PLAYER (2023)

- 5.12 KEY CONFERENCES & EVENTS, 2024-2025

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 KEY BUYING CRITERIA

- 5.14 ECOSYSTEM ANALYSIS

- 5.15 ADJACENT MARKET ANALYSIS

- 5.15.1 HEMODIALYSIS AND PERITONEAL DIALYSIS MARKET

- 5.15.2 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET

- 5.16 CASE STUDY ANALYSIS

- 5.17 IMPACT OF GENERATIVE AI ON PERITONEAL DIALYSIS MARKET

- 5.18 UNMET NEEDS AND END-USER EXPECTATIONS

- 5.19 TRENDS/DISRUPTIONS AFFECTING CUSTOMERS' BUSINESSES

- 5.20 INVESTMENT & FUNDING SCENARIO

- 5.21 PROCEDURE DATA ANALYSIS

- 5.21.1 PREVALENCE DATA FOR TREATED KIDNEY FAILURE

6 PERITONEAL DIALYSIS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 PERITONEAL DIALYSIS PRODUCTS

- 6.2.1 PERITONEAL DIALYSIS SOLUTION BAGS

- 6.2.1.1 High demand for solutions to boost segmental growth

- 6.2.2 PERITONEAL DIALYSIS MACHINES

- 6.2.2.1 Rising prevalence of chronic diseases in emerging economies to boost adoption

- 6.2.3 PERITONEAL DIALYSIS CATHETERS

- 6.2.3.1 Favorable reimbursement policies to support market growth

- 6.2.4 PERITONEAL DIALYSIS TRANSFER SETS

- 6.2.4.1 Product recalls to limit market growth

- 6.2.5 OTHER PERITONEAL DIALYSIS PRODUCTS

- 6.2.1 PERITONEAL DIALYSIS SOLUTION BAGS

- 6.3 PERITONEAL DIALYSIS SERVICES

- 6.3.1 BETTER PRIVACY AND INCREASED COMFORT OF AT-HOME DIALYSIS TREATMENT TO DRIVE MARKET

7 PERITONEAL DIALYSIS MARKET, BY MODALITY

- 7.1 INTRODUCTION

- 7.2 CONTINUOUS AMBULATORY PERITONEAL DIALYSIS (CAPD)

- 7.2.1 SUPERIOR CLEARANCE OF HIGH-MOLECULAR-WEIGHT SUBSTANCES TO DRIVE MARKET

- 7.3 AUTOMATED PERITONEAL DIALYSIS (APD)

- 7.3.1 RISK OF RAPID DECLINE IN RESIDUAL RENAL FUNCTIONS TO LIMIT ADOPTION

8 PERITONEAL DIALYSIS MARKET, BY DISEASE INDICATION

- 8.1 INTRODUCTION

- 8.2 END-STAGE RENAL DISEASE

- 8.2.1 GROWING GERIATRIC POPULATION AND INCREASING PREVALENCE OF DIABETES TO DRIVE MARKET

- 8.3 ACUTE KIDNEY INJURY

- 8.3.1 INCREASING HOSPITALIZATIONS TO PROPEL MARKET GROWTH

- 8.4 OTHER DISEASES

9 PERITONEAL DIALYSIS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOME CARE SETTINGS

- 9.2.1 LOWER COST AND SHORTER HOSPITAL STAYS TO AID MARKET GROWTH

- 9.3 HOSPITALS & INDEPENDENT DIALYSIS CENTERS

- 9.3.1 IMPROVED FACILITIES AND INCREASED GOVERNMENT SUPPORT TO DRIVE MARKET

- 9.4 OTHER END USERS

10 PERITONEAL DIALYSIS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.1.1 PERITONEAL DIALYSIS PREVALENCE DATA

- 10.1.2 PERITONEAL DIALYSIS PROCEDURE DATA

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 US to account for largest market share during study period

- 10.2.3 CANADA

- 10.2.3.1 Shortage of dialysis facilities and increased treatment cost to limit market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Rising number of end-stage renal disease (ESRD) patients to boost market growth

- 10.3.3 UK

- 10.3.3.1 Increased number of new dialysis centers and technological advancements to support market growth

- 10.3.4 FRANCE

- 10.3.4.1 Low cost of peritoneal dialysis and consistent reimbursement policies to drive market growth

- 10.3.5 ITALY

- 10.3.5.1 Increasing research activities and growing patient population with acute renal failure to augment market growth

- 10.3.6 SPAIN

- 10.3.6.1 Favorable reimbursement scenario to boost market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 JAPAN

- 10.4.2.1 High prevalence of end-stage renal disease (ESRD) and large geriatric population to support market growth

- 10.4.3 CHINA

- 10.4.3.1 Increasing prevalence of diabetes and hypertension to drive market

- 10.4.4 INDIA

- 10.4.4.1 Favorable government initiatives and high prevalence of kidney disease to fuel market growth

- 10.4.5 AUSTRALIA

- 10.4.5.1 Increasing government initiatives about renal care to support market growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Growing geriatric population with chronic kidney disease to propel market growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Brazil to account for largest share of Latin American market during forecast period

- 10.5.3 MEXICO

- 10.5.3.1 Increasing patient population and growing middle class population to boost market growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GROWING DEMAND FOR CONVENIENT AND ACCESSIBLE RENAL CARE TO PROPEL GROWTH

- 10.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.7 GCC COUNTRIES

- 10.7.1 HIGHER DISPOSABLE INCOME AND INCREASED GOVERNMENT HEALTHCARE EXPENDITURE TO PROPEL MARKET GROWTH

- 10.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN PERITONEAL DIALYSIS MARKET

- 11.3 REVENUE ANALYSIS, 2019-2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.5.5.1 Company footprint

- 11.5.5.2 Offering footprint

- 11.5.5.3 Modality footprint

- 11.5.5.4 Disease indication footprint

- 11.5.5.5 End-user footprint

- 11.5.5.6 Region footprint

- 11.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.7 COMPANY VALUATION & FINANCIAL METRICS

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT APPROVALS

- 11.8.2 DEALS

- 11.8.3 EXPANSIONS

- 11.9 BRAND/PRODUCT COMPARISON

- 11.10 PERITONEAL DIALYSIS MARKET: R&D EXPENDITURE

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 FRESENIUS MEDICAL CARE AG

- 12.1.1.1 Business overview

- 12.1.1.2 Products & services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 BAXTER INTERNATIONAL INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products & services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 MEDTRONIC PLC

- 12.1.3.1 Business overview

- 12.1.3.2 Products & services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 DAVITA INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products & services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 BECTON, DICKINSON AND COMPANY

- 12.1.5.1 Business overview

- 12.1.5.2 Products & services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 TERUMO CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products & services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product approvals

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Expansions

- 12.1.7 UTAH MEDICAL PRODUCTS, INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products & services offered

- 12.1.8 DIAVERUM AB

- 12.1.8.1 Business overview

- 12.1.8.2 Products & services offered

- 12.1.9 MEDIONICS

- 12.1.9.1 Business overview

- 12.1.9.2 Products & services offered

- 12.1.10 NEWSOL TECHNOLOGIES INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products & services offered

- 12.1.11 APOLLO DIALYSIS PVT. LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products & services offered

- 12.1.12 U.S. RENAL CARE, INC.

- 12.1.12.1 Business overview

- 12.1.12.2 Products & services offered

- 12.1.13 NORTHWEST KIDNEY CENTERS

- 12.1.13.1 Business overview

- 12.1.13.2 Products & services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.13.3.2 Expansions

- 12.1.14 RELAVO

- 12.1.14.1 Business overview

- 12.1.14.2 Products & services offered

- 12.1.15 MITRA INDUSTRIES PVT. LTD.

- 12.1.15.1 Business overview

- 12.1.15.2 Products & services offered

- 12.1.1 FRESENIUS MEDICAL CARE AG

- 12.2 OTHER PLAYERS

- 12.2.1 JMS CO., LTD.

- 12.2.2 AMECATH

- 12.2.3 POLYMEDICURE

- 12.2.4 HUAREN PHARMACEUTICAL

- 12.2.5 AWAK TECHNOLOGIES

- 12.2.6 INNOVATIVE RENAL CARE

- 12.2.7 ROMSONS

- 12.2.8 SSEM MTHEMBU MEDICAL (PTY) LTD.

- 12.2.9 RENAX BIOMEDICAL TECHNOLOGY CO., LTD.

- 12.2.10 ADVIN HEALTH CARE

13 APPENDIX

- 13.1 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.2 CUSTOMIZATION OPTIONS

- 13.3 RELATED REPORTS

- 13.4 AUTHOR DETAILS