|

|

市場調査レポート

商品コード

1562745

産業用ロボットの世界市場:ロボット別、ペイロード別、提供製品別 - 予測(~2029年)Industrial Robotics Market by Robot (Articulated, SCARA, Cartesian, Parallel, Cylindrical, Collaborative), Payload (up to 16 kg, >16 to 60 kg, >60 to 225 kg, >225 kg), Offering (End Effectors, Controllers, Drive Units, Sensors) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 産業用ロボットの世界市場:ロボット別、ペイロード別、提供製品別 - 予測(~2029年) |

|

出版日: 2024年09月24日

発行: MarketsandMarkets

ページ情報: 英文 440 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

産業用ロボットの市場規模は、2024年の168億9,000万米ドルから、予測期間中は11.7%のCAGRで推移し、2029年には294億3,000万米ドルの規模に成長すると予測されています。

産業用ロボット市場の成長を促進する要因としては、インダストリー4.0技術の展開の高まり、ファクトリーオートメーション技術の急速な進歩、エレクトロニクス製造における自動化の高まりなどが挙げられます。一方で、ハイエンドロボットのセットアップには広範なトレーニングと専門知識が必要であり、コボットを多様なワークステーションに統合することに伴う複雑さが、近い将来の市場の課題となっています。参入事業者にとっては、インダストリー5.0の出現が大きな成長の機会となる見通しです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | ロボット・ペイロード・提供製品・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

"用途別では、ハンドリングの部門が予測期間中にもっとも高いシェアを占める見込み"

これは、自動車産業において、組立ラインでの車体の移動や機械・電子部品の取り付けなどの活動に多く採用されているためです。また、eコマース産業の成長が物流・倉庫の位置付けに革命的な変化をもたらし、自動マテリアルハンドリングシステムに高い需要をもたらしています。オンラインショッピングが飛躍的に増加するにつれ、フルフィルメントセンターにとって、より大量の商品を高速かつ正確に処理することが課題となっています。そのため、商品の仕分け、梱包、運搬を行うハンドリングロボットは、この業界では必要不可欠なものとなっています。

"ロボットタイプ別では、従来型ロボットの部門が予測期間中にもっとも高いシェアを占める見込み"

これらのロボットは、ここ10年で普及した協働ロボットよりもずっと古くから使用されています。自動車、エレクトロニクス、金属など、生産工程の自動化が進んでいる産業では、これらのロボットがもっとも効率的に使用されています。

"地域別では、アジア太平洋地域が予測期間中に最大のシェアを占める見通し"

アジア太平洋地域は、供給と需要の創出の双方で市場をリードしています。日本、中国、韓国、台湾は、自動車、電子機器、機械セクターでロボットの利用率が高い上位国です。アジア諸国の政府は、製造業の自動化を促進するプログラムやインセンティブを打ち出しています。これらの取り組みには、税制優遇から研究機関や大学との協力に至るまで、さまざまな財政出動が含まれています。当局は、最近の技術の促進とは別に、さまざまなタイプの教育プログラムや職業プログラムを通じて、技術開発への投資を行っています。これらのことから、同地域の産業用ロボット分野の絶え間ない発展と競争力の強化が確実なものとなっています。

当レポートでは、世界の産業用ロボットの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 投資と資金調達のシナリオ

- 顧客ビジネスに影響を与える動向/ディスラプション

- 生成AI/AIが産業用ロボット市場に与える影響

- 技術分析

- ケーススタディ分析

- 特許分析

- 貿易分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 関税と規制状況

- 主な会議とイベント

第6章 産業用ロボットの改修

- 主なパラメータ

- サイクルタイム

- パフォーマンス・精度

- 摩耗・損傷

- 産業用ロボット改修の動向

- 再生ロボットを導入している上位5つの業界

- 自動車

- 金属・機械

- 電気・電子

- 食品・飲料

- 医薬品・ヘルスケア

- 物流・倉庫

- 産業用ロボットのOEMメーカーが採用している重要な実践

- 新しいロボットへの注目

- アフターサービス

- 研究開発

- カスタマイズ・柔軟性

- 統合・接続性

- 安全基準・コンプライアンス

第7章 産業用ロボット市場:ロボットタイプ別

- 従来型ロボット

- 多関節ロボット

- スカラロボット

- 直交ロボット

- 平行ロボット

- 円筒ロボット

- その他

- 協働ロボット

第8章 産業用ロボット市場:ペイロード別

- 16kgまで

- 16~60kg

- 60~225kg

- 225kg以上

第9章 産業用ロボット市場:提供製品別

- 産業用ロボット

- ロボットアクセサリ

- エンドエフェクター

- コントローラー

- ドライブユニット

- ビジョンシステム

- センサー

- 電源アクセサリ

- その他

- その他のロボットハードウェア

- 安全フェンスハードウェア

- 固定具ツール

- コンベアハードウェア

- システムエンジニアリング

- ソフトウェア・プログラミング

第10章 産業用ロボット市場:用途別

- ハンドリング

- ピック&プレース

- マテリアルハンドリング

- 梱包とパレタイジング

- 組み立て・分解

- 溶接・はんだ付け

- ディスペンシング

- 接着

- 塗装

- 食品ディスペンシング

- 加工

- 研削・研磨

- フライス加工

- 切断

- クリーンルーム

- その他

第11章 産業用ロボット市場:エンドユーザー産業別

- 自動車

- 電気・電子

- 金属・機械

- プラスチック・ゴム・化学薬品

- 食品・飲料

- 精密工学・光学

- 医薬品・化粧品

- 石油・ガス

- その他

第12章 産業用ロボット市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第13章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- ABB

- YASKAWA ELECTRIC CORPORATION

- FANUC CORPORATION

- KUKA AG

- MITSUBISHI ELECTRIC CORPORATION

- KAWASAKI HEAVY INDUSTRIES, LTD.

- DENSO CORPORATION

- NACHI-FUJIKOSHI CORP.

- SEIKO EPSON CORPORATION

- DURR GROUP

- その他の企業

- YAMAHA MOTOR CO., LTD.

- ESTUN AUTOMATION CO.,LTD

- SHIBAURA MACHINE

- DOVER CORPORATION

- AUROTEK CORPORATION

- HIRATA CORPORATION

- RETHINK ROBOTICS

- FRANKA ROBOTICS GMBH

- TECHMAN ROBOT INC.

- BOSCH REXROTH AG

- UNIVERSAL ROBOTS A/S

- OMRON CORPORATION

- STAUBLI INTERNATIONAL AG

- COMAU

- B+M SURFACE SYSTEMS GMBH

- ICR SERVICES

- IRS ROBOTICS

- HD HYUNDAI ROBOTICS

- SIASUN ROBOT & AUTOMATION CO., LTD

- ROBOTWORX

第15章 付録

List of Tables

- TABLE 1 INDUSTRIAL ROBOTICS MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 INDUSTRIAL ROBOTICS MARKET: RISK ANALYSIS

- TABLE 3 ORIGINAL EQUIPMENT MANUFACTURERS OF INDUSTRIAL ROBOTS

- TABLE 4 ROLE OF COMPANIES IN INDUSTRIAL ROBOTICS ECOSYSTEM

- TABLE 5 INDICATIVE PRICING TREND OF INDUSTRIAL ROBOTS OFFERED BY KEY PLAYERS, BY ROBOT TYPE (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF TRADITIONAL INDUSTRIAL ROBOTS, BY TYPE (USD)

- TABLE 7 LIST OF MAJOR PATENTS, 2022-2024

- TABLE 8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 11 MFN TARIFF FOR HS CODE 847950-COMPLIANT INDUSTRIAL ROBOTS EXPORTED BY US, 2023

- TABLE 12 MFN TARIFF FOR HS CODE 847950-COMPLIANT INDUSTRIAL ROBOTS EXPORTED BY CHINA, 2023

- TABLE 13 MFN TARIFF FOR HS CODE 847950-COMPLIANT INDUSTRIAL ROBOTS EXPORTED BY GERMANY, 2023

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 INTERNATIONAL: SAFETY STANDARDS

- TABLE 19 NORTH AMERICA: SAFETY STANDARDS

- TABLE 20 EUROPE: SAFETY STANDARDS

- TABLE 21 ASIA PACIFIC: SAFETY STANDARDS

- TABLE 22 ROW: SAFETY STANDARDS

- TABLE 23 LIST OF KEY CONFERENCES AND EVENTS. 2024-2025

- TABLE 24 INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (USD MILLION)

- TABLE 25 INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (USD MILLION)

- TABLE 26 INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 27 INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 28 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 29 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 30 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 31 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 32 TRADITIONAL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 33 TRADITIONAL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 34 SUMMARY OF ARTICULATED ROBOTS

- TABLE 35 ARTICULATED INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 36 ARTICULATED INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 37 ARTICULATED INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 38 ARTICULATED INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (THOUSAND UNITS)

- TABLE 39 ARTICULATED INDUSTRIAL ROBOTICS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 40 ARTICULATED INDUSTRIAL ROBOTICS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 41 ARTICULATED INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 42 ARTICULATED INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 43 ARTICULATED INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 44 ARTICULATED INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 45 ARTICULATED ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 46 ARTICULATED ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 47 SUMMARY OF SCARA ROBOTS

- TABLE 48 SCARA INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 49 SCARA INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 50 SCARA INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 51 SCARA INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (THOUSAND UNITS)

- TABLE 52 SCARA ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 53 SCARA ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 54 SCARA INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 55 SCARA INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 56 SCARA INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 57 SCARA INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 58 SCARA ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 59 SCARA ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 60 SUMMARY OF PARALLEL ROBOTS

- TABLE 61 PARALLEL INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 62 PARALLEL INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 63 PARALLEL INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 64 PARALLEL INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (THOUSAND UNITS)

- TABLE 65 PARALLEL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 66 PARALLEL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 67 PARALLEL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 68 PARALLEL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 69 PARALLEL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 70 PARALLEL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (THOUSAND UNITS)

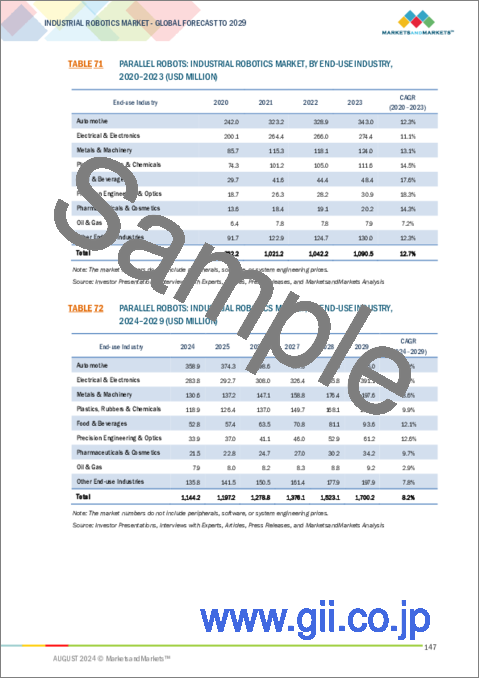

- TABLE 71 PARALLEL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 72 PARALLEL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 73 SUMMARY OF CARTESIAN ROBOTS

- TABLE 74 CARTESIAN INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 75 CARTESIAN INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 76 CARTESIAN INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 77 CARTESIAN INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (THOUSAND UNITS)

- TABLE 78 CARTESIAN ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 79 CARTESIAN ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 80 CARTESIAN INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 81 CARTESIAN INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 82 CARTESIAN INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 83 CARTESIAN INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 84 CARTESIAN ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 85 CARTESIAN ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 86 SUMMARY OF CYLINDRICAL ROBOTS

- TABLE 87 CYLINDRICAL INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 88 CYLINDRICAL INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 89 CYLINDRICAL INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 90 CYLINDRICAL INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (THOUSAND UNITS)

- TABLE 91 CYLINDRICAL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 92 CYLINDRICAL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 93 CYLINDRICAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 94 CYLINDRICAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 95 CYLINDRICAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 96 CYLINDRICAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 97 CYLINDRICAL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 98 CYLINDRICAL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 99 SUMMARY OF SPHERICAL ROBOTS

- TABLE 100 SUMMARY OF SWING-ARM ROBOTS

- TABLE 101 OTHER TRADITIONAL ROBOTS: INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 102 OTHER TRADITIONAL ROBOTS: INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 103 OTHER TRADITIONAL ROBOTS: INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 104 OTHER TRADITIONAL ROBOTS: INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (THOUSAND UNITS)

- TABLE 105 OTHER TRADITIONAL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 106 OTHER TRADITIONAL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 107 OTHER TRADITIONAL ROBOTS: INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 108 OTHER TRADITIONAL ROBOTS: INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 109 OTHER TRADITIONAL ROBOTS: INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 110 OTHER TRADITIONAL ROBOTS: INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 111 OTHER TRADITIONAL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 112 OTHER TRADITIONAL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 113 SUMMARY OF COLLABORATIVE ROBOTS

- TABLE 114 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY VALUE AND VOLUME, 2020-2023

- TABLE 115 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY VALUE AND VOLUME, 2024-2029

- TABLE 116 INDUSTRIAL ROBOTS MARKET, BY PAYLOAD, 2020-2023 (USD MILLION)

- TABLE 117 INDUSTRIAL ROBOTS MARKET, BY PAYLOAD, 2024-2029 (USD MILLION)

- TABLE 118 INDUSTRIAL ROBOTS MARKET, BY PAYLOAD, 2020-2023 (THOUSAND UNITS)

- TABLE 119 INDUSTRIAL ROBOTS MARKET, BY PAYLOAD, 2024-2029 (THOUSAND UNITS)

- TABLE 120 TYPES OF INDUSTRIAL ROBOTS WITH UP TO 16 KG PAYLOAD CAPACITY

- TABLE 121 TYPES OF INDUSTRIAL ROBOTS WITH >16 TO 60 KG PAYLOAD CAPACITY

- TABLE 122 TYPES OF INDUSTRIAL ROBOTS WITH >60 TO 225 KG PAYLOAD CAPACITY

- TABLE 123 TYPES OF INDUSTRIAL ROBOTS WITH ABOVE 225 KG PAYLOAD CAPACITY

- TABLE 124 TRADITIONAL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 125 TRADITIONAL ROBOTS: INDUSTRIAL ROBOTICS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 126 COMPARISON AMONG MECHANICAL, ELECTRIC, AND MAGNETIC GRIPPERS

- TABLE 127 INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 128 INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 129 INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 130 INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (THOUSAND UNITS)

- TABLE 131 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 132 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 133 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 134 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (THOUSAND UNITS)

- TABLE 135 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 136 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 137 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 138 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2024-2029 (THOUSAND UNITS)

- TABLE 139 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR HANDLING APPLICATIONS

- TABLE 140 HANDLING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (USD MILLION)

- TABLE 141 HANDLING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (USD MILLION)

- TABLE 142 HANDLING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 143 HANDLING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 144 HANDLING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 145 HANDLING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 146 HANDLING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 147 HANDLING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 148 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR ASSEMBLING & DISASSEMBLING APPLICATIONS

- TABLE 149 ASSEMBLING & DISASSEMBLING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (USD MILLION)

- TABLE 150 ASSEMBLING & DISASSEMBLING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (USD MILLION)

- TABLE 151 ASSEMBLING & DISASSEMBLING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 152 ASSEMBLING & DISASSEMBLING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 153 ASSEMBLING & DISASSEMBLING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 154 ASSEMBLING & DISASSEMBLING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 155 ASSEMBLING & DISASSEMBLING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 156 ASSEMBLING & DISASSEMBLING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 157 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR WELDING & SOLDERING APPLICATIONS

- TABLE 158 WELDING & SOLDERING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (USD MILLION)

- TABLE 159 WELDING & SOLDERING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (USD MILLION)

- TABLE 160 WELDING & SOLDERING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 161 WELDING & SOLDERING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 162 WELDING & SOLDERING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 163 WELDING & SOLDERING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 164 WELDING & SOLDERING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 165 WELDING & SOLDERING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 166 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR DISPENSING APPLICATIONS

- TABLE 167 DISPENSING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (USD MILLION)

- TABLE 168 DISPENSING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (USD MILLION)

- TABLE 169 DISPENSING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 170 DISPENSING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 171 DISPENSING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 172 DISPENSING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 173 DISPENSING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 174 DISPENSING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 175 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR PROCESSING APPLICATIONS

- TABLE 176 PROCESSING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (USD MILLION)

- TABLE 177 PROCESSING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (USD MILLION)

- TABLE 178 PROCESSING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 179 PROCESSING: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 180 PROCESSING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 181 PROCESSING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 182 PROCESSING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 183 PROCESSING: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 184 CLEANROOM: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (USD MILLION)

- TABLE 185 CLEANROOM: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (USD MILLION)

- TABLE 186 CLEANROOM: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 187 CLEANROOM: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 188 CLEANROOM: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 189 CLEANROOM: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 190 CLEANROOM: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 191 CLEANROOM: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 192 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR OTHER APPLICATIONS

- TABLE 193 OTHER APPLICATIONS: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (USD MILLION)

- TABLE 194 OTHER APPLICATIONS: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (USD MILLION)

- TABLE 195 OTHER APPLICATIONS: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 196 OTHER APPLICATIONS: INDUSTRIAL ROBOTS MARKET, BY ROBOT TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 197 OTHER APPLICATIONS: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 198 OTHER APPLICATIONS: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 199 OTHER APPLICATIONS: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 200 OTHER APPLICATIONS: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 201 INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 202 INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 203 INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 204 INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 205 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 206 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 207 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 208 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 209 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 210 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 211 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 212 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 213 AUTOMOTIVE: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 214 AUTOMOTIVE: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 215 AUTOMOTIVE: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 216 AUTOMOTIVE: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 217 AUTOMOTIVE: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 218 AUTOMOTIVE: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 219 AUTOMOTIVE: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 220 AUTOMOTIVE: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 221 AUTOMOTIVE: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 222 AUTOMOTIVE: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 223 ELECTRICAL & ELECTRONICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 224 ELECTRICAL & ELECTRONICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 225 ELECTRICAL & ELECTRONICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 226 ELECTRICAL & ELECTRONICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 227 ELECTRICAL & ELECTRONICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 228 ELECTRICAL & ELECTRONICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 229 ELECTRICAL & ELECTRONICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 230 ELECTRICAL & ELECTRONICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 231 ELECTRICAL & ELECTRONICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 232 ELECTRICAL & ELECTRONICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 233 METALS & MACHINERY: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 234 METALS & MACHINERY: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 235 METALS & MACHINERY: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 236 METALS & MACHINERY: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 237 METALS & MACHINERY: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 238 METALS & MACHINERY: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 239 METALS & MACHINERY: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 240 METALS & MACHINERY: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 241 METALS & MACHINERY: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 242 METALS & MACHINERY: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 243 PLASTICS, RUBBER & CHEMICALS: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 244 PLASTICS, RUBBER & CHEMICALS: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 245 PLASTICS, RUBBER & CHEMICALS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 246 PLASTICS, RUBBER & CHEMICALS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 247 PLASTICS, RUBBER & CHEMICALS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 248 PLASTICS, RUBBER & CHEMICALS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 249 PLASTICS, RUBBER & CHEMICALS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 250 PLASTICS, RUBBER & CHEMICALS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 251 PLASTICS, RUBBER & CHEMICALS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 252 PLASTICS, RUBBER & CHEMICALS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 253 FOOD & BEVERAGES: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 254 FOOD & BEVERAGES: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 255 FOOD & BEVERAGES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 256 FOOD & BEVERAGES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 257 FOOD & BEVERAGES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 258 FOOD & BEVERAGES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 259 FOOD & BEVERAGES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 260 FOOD & BEVERAGES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 261 FOOD & BEVERAGES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 262 FOOD & BEVERAGES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 263 PRECISION ENGINEERING & OPTICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 264 PRECISION ENGINEERING & OPTICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 265 PRECISION ENGINEERING & OPTICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 266 PRECISION ENGINEERING & OPTICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 267 PRECISION ENGINEERING & OPTICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 268 PRECISION ENGINEERING & OPTICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 269 PRECISION ENGINEERING & OPTICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 270 PRECISION ENGINEERING & OPTICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 271 PRECISION ENGINEERING & OPTICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 272 PRECISION ENGINEERING & OPTICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 273 PHARMACEUTICALS & COSMETICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 274 PHARMACEUTICALS & COSMETICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 275 PHARMACEUTICALS & COSMETICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 276 PHARMACEUTICALS & COSMETICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 277 PHARMACEUTICALS & COSMETICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 278 PHARMACEUTICALS & COSMETICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 279 PHARMACEUTICALS & COSMETICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 280 PHARMACEUTICALS & COSMETICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 281 PHARMACEUTICALS & COSMETICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 282 PHARMACEUTICALS & COSMETICS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 283 OIL & GAS: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 284 OIL & GAS: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 285 OIL & GAS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 286 OIL & GAS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 287 OIL & GAS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 288 OIL & GAS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 289 OIL & GAS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 290 OIL & GAS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 291 OIL & GAS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 292 OIL & GAS: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 293 OTHER END-USE INDUSTRIES: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 294 OTHER END-USE INDUSTRIES: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 295 OTHER END-USE INDUSTRIES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 296 OTHER END-USE INDUSTRIES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 297 OTHER END-USE INDUSTRIES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 298 OTHER END-USE INDUSTRIES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 299 OTHER END-USE INDUSTRIES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 300 OTHER END-USE INDUSTRIES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 301 OTHER END-USE INDUSTRIES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 302 OTHER END-USE INDUSTRIES: TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 303 INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 304 INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 305 INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 306 INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 307 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 308 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 309 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 310 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 311 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 312 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 313 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 314 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 315 NORTH AMERICA: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 316 NORTH AMERICA: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 317 NORTH AMERICA: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 318 NORTH AMERICA: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 319 NORTH AMERICA: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 320 NORTH AMERICA: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 321 NORTH AMERICA: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 322 NORTH AMERICA: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 323 EUROPE: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 324 EUROPE: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 325 EUROPE: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 326 EUROPE: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 327 EUROPE: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 328 EUROPE: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 329 EUROPE: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 330 EUROPE: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 331 ASIA PACIFIC: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 332 ASIA PACIFIC: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 333 ASIA PACIFIC: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 334 ASIA PACIFIC: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 335 ASIA PACIFIC: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 336 ASIA PACIFIC: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 337 ASIA PACIFIC: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 338 ASIA PACIFIC: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 339 ROW: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 340 ROW: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 341 ROW: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 342 ROW: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 343 ROW: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 344 ROW: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 345 ROW: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 346 ROW: COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 347 MIDDLE EAST: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 348 MIDDLE EAST: TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY COUNTRY, 2024-2029 (THOUSAND UNITS)

- TABLE 349 INDUSTRIAL ROBOTICS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 350 INDUSTRIAL ROBOTS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 351 INDUSTRIAL ROBOTICS MARKET: PAYLOAD FOOTPRINT

- TABLE 352 INDUSTRIAL ROBOTICS MARKET: ROBOT TYPE FOOTPRINT

- TABLE 353 INDUSTRIAL ROBOTICS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 354 INDUSTRIAL ROBOTICS MARKET: REGION FOOTPRINT

- TABLE 355 INDUSTRIAL ROBOTICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 356 INDUSTRIAL ROBOTICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 357 INDUSTRIAL ROBOTICS MARKET: PRODUCT LAUNCHES, JANUARY 2020-JULY 2024

- TABLE 358 INDUSTRIAL ROBOTICS MARKET: DEALS, JANUARY 2020-JULY 2024

- TABLE 359 INDUSTRIAL ROBOTICS MARKET: EXPANSIONS, JANUARY 2020-JULY 2024

- TABLE 360 ABB: COMPANY OVERVIEW

- TABLE 361 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 362 ABB: PRODUCT LAUNCHES

- TABLE 363 ABB: DEALS

- TABLE 364 ABB: EXPANSIONS

- TABLE 365 YASKAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 366 YASKAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 367 YASKAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 368 YASKAWA ELECTRIC CORPORATION: DEALS

- TABLE 369 YASKAWA ELECTRIC CORPORATION: EXPANSIONS

- TABLE 370 FANUC CORPORATION: COMPANY OVERVIEW

- TABLE 371 FANUC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 372 FANUC CORPORATION: PRODUCT LAUNCHES

- TABLE 373 FANUC CORPORATION: DEALS

- TABLE 374 FANUC CORPORATION: EXPANSIONS

- TABLE 375 KUKA AG: COMPANY OVERVIEW

- TABLE 376 KUKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 377 KUKA AG: PRODUCT LAUNCHES

- TABLE 378 KUKA AG: DEALS

- TABLE 379 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 380 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 381 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 382 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 383 MITSUBISHI ELECTRIC CORPORATION: EXPANSIONS

- TABLE 384 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 385 KAWASAKI HEAVY INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 386 KAWASAKI HEAVY INDUSTRIES, LTD.: PRODUCT LAUNCHES

- TABLE 387 KAWASAKI HEAVY INDUSTRIES, LTD.: DEALS

- TABLE 388 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 389 DENSO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 390 DENSO CORPORATION: PRODUCT LAUNCHES

- TABLE 391 NACHI-FUJIKOSHI CORP.: COMPANY OVERVIEW

- TABLE 392 NACHI-FUJIKOSHI CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 393 NACHI-FUJIKOSHI CORP.: PRODUCT LAUNCHES

- TABLE 394 SEIKO EPSON CORPORATION: COMPANY OVERVIEW

- TABLE 395 SEIKO EPSON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 396 SEIKO EPSON CORPORATION: PRODUCT LAUNCHES

- TABLE 397 SEIKO EPSON CORPORATION: DEALS

- TABLE 398 DURR: COMPANY OVERVIEW

- TABLE 399 DURR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 400 DURR: PRODUCT LAUNCHES

- TABLE 401 DURR: DEALS

List of Figures

- FIGURE 1 INDUSTRIAL ROBOTICS MARKET SEGMENTATION

- FIGURE 2 INDUSTRIAL ROBOTICS MARKET: RESEARCH DESIGN

- FIGURE 3 INDUSTRIAL ROBOTS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 INDUSTRIAL ROBOTS MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- FIGURE 5 INDUSTRIAL ROBOTS MARKET: TOP-DOWN APPROACH

- FIGURE 6 INDUSTRIAL ROBOTS MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 7 INDUSTRIAL ROBOTICS MARKET: DATA TRIANGULATION

- FIGURE 8 INDUSTRIAL ROBOTICS MARKET: RESEARCH LIMITATIONS

- FIGURE 9 ARTICULATED ROBOTS TO DOMINATE TRADITIONAL INDUSTRIAL ROBOTS MARKET, IN TERMS OF VOLUME, DURING FORECAST PERIOD

- FIGURE 10 >16 TO 60 KG SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2024 AND 2029

- FIGURE 11 SOFTWARE & PROGRAMMING SEGMENT TO RECORD HIGHEST CAGR IN TRADITIONAL INDUSTRIAL ROBOTICS MARKET DURING FORECAST PERIOD

- FIGURE 12 HANDLING SEGMENT TO HOLD LARGEST SHARE OF INDUSTRIAL ROBOTS MARKET IN 2024

- FIGURE 13 FOOD & BEVERAGES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 15 RAPID DIGITALIZATION AND ADOPTION OF IOT TECHNOLOGIES TO CONTRIBUTE TO MARKET GROWTH

- FIGURE 16 COLLABORATIVE ROBOTS SEGMENT HELD LARGER MARKET SHARE IN 2024

- FIGURE 17 ELECTRICAL & ELECTRONICS SEGMENT AND CHINA TO HOLD LARGEST SHARES OF ASIA PACIFIC INDUSTRIAL ROBOTS MARKET IN 2024

- FIGURE 18 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL INDUSTRIAL ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 IMPACT ANALYSIS: DRIVERS

- FIGURE 21 SHIPMENT OF COLLABORATIVE ROBOTS, 2020-2022

- FIGURE 22 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 23 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 24 IMPACT ANALYSIS: CHALLENGES

- FIGURE 25 INDUSTRIAL ROBOTICS VALUE CHAIN

- FIGURE 26 INDUSTRIAL ROBOTICS ECOSYSTEM

- FIGURE 27 INDICATIVE PRICING TREND OF INDUSTRIAL ROBOTS OFFERED BY KEY PLAYERS, BY ROBOT TYPE

- FIGURE 28 AVERAGE SELLING PRICE TREND OF TRADITIONAL INDUSTRIAL ROBOTS, BY TYPE, 2020-2023

- FIGURE 29 AVERAGE SELLING PRICE TREND OF ARTICULATED ROBOTS, BY REGION, 2020-2023

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 PATENTS APPLIED AND GRANTED, 2013-2023

- FIGURE 33 IMPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 34 EXPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 35 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 38 COLLABORATIVE ROBOTS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 ARTICULATED ROBOTS SEGMENT TO HOLD LARGEST SHARE OF MARKET, IN TERMS OF VOLUME, IN 2024

- FIGURE 40 REPRESENTATION OF 6-AXIS ARTICULATED ROBOTS

- FIGURE 41 PROCESSING SEGMENT TO EXHIBIT HIGHEST CAGR IN MARKET FOR ARTICULATED ROBOTS FROM 2024 TO 2029

- FIGURE 42 REPRESENTATION OF 4-AXIS SCARA ROBOTS

- FIGURE 43 HANDLING SEGMENT TO DOMINATE MARKET FOR SCARA ROBOTS BETWEEN 2024 AND 2029

- FIGURE 44 REPRESENTATION OF PARALLEL ROBOTS

- FIGURE 45 DISPENSING SEGMENT TO REGISTER HIGHEST CAGR IN MARKET FOR PARALLEL ROBOTS DURING FORECAST PERIOD

- FIGURE 46 REPRESENTATION OF CARTESIAN ROBOTS

- FIGURE 47 PROCESSING SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 HANDLING SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET FOR CYLINDRICAL ROBOTS IN 2029

- FIGURE 49 DISPENSING SEGMENT TO EXHIBIT HIGHEST CAGR IN MARKET FOR OTHER TRADITIONAL ROBOTS FROM 2024 TO 2029

- FIGURE 50 >16 TO 60 KG SEGMENT TO RECORD HIGHEST CAGR IN INDUSTRIAL ROBOTS MARKET BETWEEN 2024 AND 2029

- FIGURE 51 SOFTWARE & PROGRAMMING SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 52 HANDLING SEGMENT TO DOMINATE INDUSTRIAL ROBOTS MARKET FROM 2024 TO 2029

- FIGURE 53 HANDLING SEGMENT TO HOLD LARGEST SHARE OF TRADITIONAL INDUSTRIAL ROBOTS MARKET IN 2029

- FIGURE 54 HANDLING SEGMENT TO ACCOUNT FOR LARGEST SHARE OF COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN 2029

- FIGURE 55 AUTOMOTIVE SEGMENT TO DOMINATE INDUSTRIAL ROBOTS MARKET BETWEEN 2024 AND 2029

- FIGURE 56 ASIA PACIFIC TO HOLD LARGEST SHARE OF INDUSTRIAL ROBOTS MARKET FOR AUTOMOTIVE, IN TERMS OF VOLUME, IN 2024

- FIGURE 57 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MARKET FOR ELECTRICAL & ELECTRONICS, IN TERMS OF VOLUME, BETWEEN 2024 AND 2029

- FIGURE 58 ASIA PACIFIC TO HOLD LARGEST SHARE OF MARKET FOR METALS & MACHINERY, IN TERMS OF VOLUME, IN 2029

- FIGURE 59 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF MARKET FOR PLASTICS, RUBBER & CHEMICALS, IN TERMS OF VOLUME, IN 2029

- FIGURE 60 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR FOR TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR FOOD & BEVERAGES FROM 2024 TO 2029

- FIGURE 61 ASIA PACIFIC TO RECORD HIGHEST CAGR IN MARKET FOR PRECISION ENGINEERING & OPTICS DURING FORECAST PERIOD

- FIGURE 62 ASIA PACIFIC TO HOLD LARGEST SHARE OF MARKET FOR PHARMACEUTICALS & COSMETICS, IN TERMS OF VOLUME, IN 2024

- FIGURE 63 NORTH AMERICA TO RECORD HIGHEST CAGR IN MARKET FOR OIL & GAS, IN TERMS OF VOLUME, BETWEEN 2024 AND 2029

- FIGURE 64 ASIA PACIFIC TO HOLD LARGEST SHARE OF MARKET FOR OTHER END-USE INDUSTRIES, IN TERMS OF VOLUME, IN 2029

- FIGURE 65 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL INDUSTRIAL ROBOTS MARKET, IN TERMS OF VOLUME, BETWEEN 2024 AND 2029

- FIGURE 66 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 67 NORTH AMERICA: INDUSTRIAL ROBOTS MARKET SNAPSHOT

- FIGURE 68 EUROPE: INDUSTRIAL ROBOTS MARKET SNAPSHOT

- FIGURE 69 ASIA PACIFIC: INDUSTRIAL ROBOTS MARKET SNAPSHOT

- FIGURE 70 INDUSTRIAL ROBOTS MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2019-2023

- FIGURE 71 MARKET SHARE ANALYSIS OF KEY PLAYERS OFFERING INDUSTRIAL ROBOTS, 2023

- FIGURE 72 COMPANY VALUATION, 2024

- FIGURE 73 FINANCIAL METRICS, 2024 (EV/EBITDA)

- FIGURE 74 BRAND/PRODUCT COMPARISON

- FIGURE 75 INDUSTRIAL ROBOTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 76 INDUSTRIAL ROBOTICS MARKET: COMPANY FOOTPRINT

- FIGURE 77 INDUSTRIAL ROBOTICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 78 ABB LTD: COMPANY SNAPSHOT

- FIGURE 79 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 80 FANUC CORPORATION: COMPANY SNAPSHOT

- FIGURE 81 KUKA AG: COMPANY SNAPSHOT

- FIGURE 82 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 83 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 84 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 85 NACHI-FUJIKOSHI CORP.: COMPANY SNAPSHOT

- FIGURE 86 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

- FIGURE 87 DURR: COMPANY SNAPSHOT

The industrial robots market is projected to grow from USD 16.89 billion in 2024 to USD 29.43 billion by 2029; it is expected to grow at a CAGR of 11.7% during the forecast period. factors driving the growth of the industrial robotics market include rising deployment of Industry 4.0 technologies, rapid advancement in factory automation technologies, and rising automation in electronics manufacturing. However, the requirement for extensive training and expertise for setting up high-end robots and the complexities associated with integrating cobots into diverse workstations are a challenge for the market in the near future. The major growth the emergence of industry opportunity for the market players is the emergence of Industry 5.0.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Robot, Payload, Offering and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The market for handling application in the industrial robotics market is expected to have the highest share during the forecast period."

During the forecasted period, handling will be the industrial robotics market segment with the largest share. The biggest share of industrial robots during the forecast period is attributed to the heavy adoption in the automotive industry for activities such as moving vehicle bodies in assembly lines and mounting mechanical and electronic parts. The increasing growth of the e-commerce industry has caused a revolutionary change in logistic and warehouse positions, which put high demand on automated material handling systems. As online shopping rises exponentially, processing higher volume at high speed with accuracy becomes a challenge for fulfillment centers. Handling robots, therefore, which work to sort, package, and transport items, are quite essential in the industry.

"Traditional robots segment in industrial robotics market is expected to have highest share during the forecast period."

The traditional robots segment of the industrial robotics market is anticipated to witness the highest share during the forecast period. These robots have been used much longer than collaborative robots, which have only gained traction in the last decade. Industries with heavily automated production processes, such as automotive, electronics, and metals, use these robots most efficiently. FANUC CORPORATION (Japan) is one of the leading robotics companies, offers variety of robots for applications like material handling, welding, assembling, and painting. ABB (Switzerland) Robotics, a Swiss-based multinational organization, has a varied range of industrial robots for diverse sectors such as automotive, metal fabrication, and logistics. Other major companies in this sector are KUKA (Germany), Yaskawa (Japan), and Universal Robots (Denmark).

" Asia Pacific is expected to have the largest share among other regions in the forecast period."

Asia Pacific is expected to have the largest share of industrial robots in the forecast period.

Asia Pacific leads the industrial robots market by providing both suppliers and demand creators. Japan, China, South Korea, and Taiwan are among the top countries where robotic usage is at higher in the automotive, electronics, and machinery sectors. The government in Asian countries has launched programs and incentives to promote automation in manufacturing. These initiatives involve financial mobilizations ranging from tax relief to cooperation with research institutions and universities. The authorities, aside from promoting recent technologies, are investing in, and developing skills through different types of educational and vocational programs. This ensures the constant development and the enhanced competitiveness of the Asia Pacific industrial robotics sector.

The market size for segments and subsegments was gathered through extensive secondary research, and primary interviews were conducted with key industry experts in the industrial robotics market.

The break-up of primary participants for the report has been shown below:

- By company type: Tier 1 - 35%, Tier 2 - 40%, and Tier 3 - 25%

- By designation: C-Level Executives - 45%, Managers - 35%, and Others - 20%

- By region: North America - 30%, Europe - 20%, Asia Pacific - 40%, and RoW - 10%

The report profiles key players in the industrial robotics market with their respective market ranking analyses. FANUC CORPORATION (Japan), ABB (Switzerland), Yaskawa Electric Corporation (Japan), KUKA AG (Germany), Mitsubishi Electric Corporation (Japan), Kawasaki Heavy Industries, Ltd, (Japan), Denso Corporation (Japan), Nachi-Fujikoshi (Japan), Seiko Epson Corporation (Japan), and Durr Group (Germany), among others.

Research Coverage

This research report categorizes the industrial robotics market based on robot type, offering, application, payload, end-use industry, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the industrial robotics market and forecasts the same till 2029. The report also consists of leadership mapping and analysis of companies in the industrial robotics ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall industrial robotics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical drivers (increasing adoption of collaborative robots across industries, shortage of skilled workforce in manufacturing sector, rising deployment of Industry 4.0 technologies, mounting adoption of automation solutions to optimize manufacturing operations, and rapid advances in AI and digital automation technologies), restraints (high costs of collaborative robots), opportunities (emergence of industry 5.0 and rising automation in electronics manufacturing), and challenges (complexities associated with integrating cobots into diverse workstations, lack of standardization and interoperability issues, and requirement for extensive training and expertise for setting up high-end robots) influencing the growth of the industrial robotics market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the industrial robotics market

- Market Development: Comprehensive information about lucrative markets - the report analyses the industrial robotics market across varied regions

- Market Diversification: Exhaustive information about new products & technologies, untapped geographies, recent developments, and investments in the industrial robotics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product/service offerings of leading players like FANUC CORPORATION (Japan), ABB (Switzerland), Yaskawa Electric Corporation (Japan), KUKA AG (Germany), Mitsubishi Electric Corporation (Japan), Kawasaki Heavy Industries, Ltd, (Japan), Denso Corporation (Japan), Nachi-Fujikoshi (Japan), Seiko Epson Corporation (Japan), and Durr Group (Germany), among others in the industrial robotics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL ROBOTS MARKET

- 4.2 INDUSTRIAL ROBOTS MARKET, BY TYPE

- 4.3 INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY END-USE INDUSTRY AND COUNTRY

- 4.4 INDUSTRIAL ROBOTS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing adoption of collaborative robots across industries

- 5.2.1.2 Shortage of skilled workforce in manufacturing sector

- 5.2.1.3 Rising deployment of Industry 4.0 technologies

- 5.2.1.4 Mounting adoption of automation solutions to optimize manufacturing operations

- 5.2.1.5 Rapid advances in AI and digital automation technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs of collaborative robots

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in automation in electronics manufacturing

- 5.2.3.2 Emergence of Industry 5.0

- 5.2.4 CHALLENGES

- 5.2.4.1 Requirement for extensive training and expertise in setting up high-end robots

- 5.2.4.2 Lack of standardization and interoperability issues

- 5.2.4.3 Complexities associated with integrating cobots into diverse workstations

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 SUPPLY CHAIN PARTICIPANTS

- 5.3.1.1 Original equipment manufacturers (OEMs)

- 5.3.1.2 Suppliers

- 5.3.1.3 Robot integrators

- 5.3.1.4 Distributors

- 5.3.1.5 IT/Big data companies

- 5.3.1.6 Research centers

- 5.3.1 SUPPLY CHAIN PARTICIPANTS

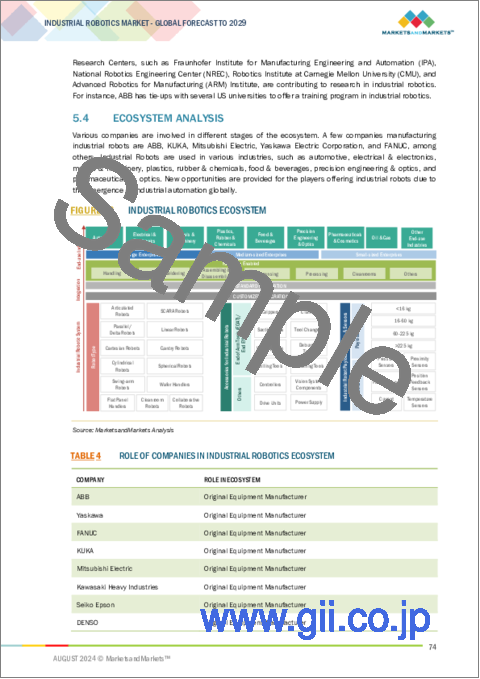

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING TREND OF KEY PLAYERS, BY ROBOT TYPE

- 5.5.2 AVERAGE SELLING PRICE TREND, BY TYPE

- 5.5.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 IMPACT OF GEN AI/AI ON INDUSTRIAL ROBOTICS MARKET

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Industrial robots and vision systems

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Industrial Internet of Things and artificial intelligence

- 5.9.2.2 Safety sensors

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 5G

- 5.9.1 KEY TECHNOLOGIES

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 QISDA ADOPTS TOUCHE SOLUTIONS' HUMAN-ROBOT COLLABORATION SAFETY SOLUTION TO MINIMIZE COLLISIONS

- 5.10.2 GREAT PLAINS MANUFACTURING IMPLEMENTS GENESIS' VIRTUAL SOLUTION FOR ROBOT WELDING TO INCREASE PRODUCTION SPEED

- 5.10.3 TTI, INC. USES DRIVERLESS ROBOTS TO AUTOMATE CART PICKING AND DELIVERY PROCESSES

- 5.10.4 SCHOTT AG IMPLEMENTS AUTOMATION SOLUTION USING ONROBOT'S RG2-FT GRIPPER TO MITIGATE MANUAL LOADING

- 5.10.5 EMERSON PROFESSIONAL TOOLS ADOPTS FANUC COBOT CRX-10IA/L TO MEET SAFETY REQUIREMENTS

- 5.10.6 GRUPO FORTEC LEVERAGES MITSUBISHI ELECTRIC'S ROBOTICS TECHNOLOGY TO FACILITATE BULK PALLETIZING

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA (HS CODE 847950)

- 5.12.2 EXPORT DATA (HS CODE 847950)

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 THREAT OF NEW ENTRANTS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 TARIFF ANALYSIS

- 5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.3 STANDARDS

- 5.16 KEY CONFERENCES AND EVENTS, 2024-2025

6 REFURBISHMENT OF INDUSTRIAL ROBOTS

- 6.1 INTRODUCTION

- 6.2 KEY PARAMETERS

- 6.2.1 CYCLE TIME

- 6.2.2 PERFORMANCE & ACCURACY

- 6.2.3 WEAR & TEAR

- 6.3 INDUSTRIAL ROBOT REFURBISHMENT TRENDS

- 6.4 TOP FIVE INDUSTRIES ADOPTING REFURBISHED ROBOTS

- 6.4.1 AUTOMOTIVE

- 6.4.2 METALS & MACHINERY

- 6.4.3 ELECTRICAL & ELECTRONICS

- 6.4.4 FOOD & BEVERAGES

- 6.4.5 PHARMACEUTICALS & HEALTHCARE

- 6.4.6 LOGISTICS & WAREHOUSING

- 6.5 KEY PRACTICES ADOPTED BY ORIGINAL EQUIPMENT MANUFACTURERS OF INDUSTRIAL ROBOTS

- 6.5.1 FOCUS ON NEW ROBOTS

- 6.5.2 POST-SALES SERVICES

- 6.5.3 RESEARCH & DEVELOPMENT

- 6.5.4 CUSTOMIZATION & FLEXIBILITY

- 6.5.5 INTEGRATION & CONNECTIVITY

- 6.5.6 SAFETY STANDARDS & COMPLIANCE

7 INDUSTRIAL ROBOTICS MARKET, BY ROBOT TYPE

- 7.1 INTRODUCTION

- 7.2 TRADITIONAL ROBOTS

- 7.2.1 ARTICULATED ROBOTS

- 7.2.1.1 Flexibility, accuracy, and cost-effectiveness to boost segmental growth

- 7.2.2 SCARA ROBOTS

- 7.2.2.1 Precision in material handling to contribute to segmental growth

- 7.2.3 PARALLEL ROBOTS

- 7.2.3.1 Enhanced stiffness, accuracy, and dynamic performance to augment segmental growth

- 7.2.4 CARTESIAN ROBOTS

- 7.2.4.1 Capability to handle heavy loads to accelerate segmental growth

- 7.2.5 CYLINDRICAL ROBOTS

- 7.2.5.1 Compact and space-saving structures to expedite segmental growth

- 7.2.6 OTHER TRADITIONAL ROBOTS

- 7.2.1 ARTICULATED ROBOTS

- 7.3 COLLABORATIVE ROBOTS

- 7.3.1 EASE OF USE AND LOW-COST DEPLOYMENT TO DRIVE MARKET

8 INDUSTRIAL ROBOTICS MARKET, BY PAYLOAD

- 8.1 INTRODUCTION

- 8.2 UP TO 16 KG

- 8.2.1 ADOPTION TO INCREASE MANUFACTURING EFFICIENCY AND PRECISION TO FOSTER SEGMENTAL GROWTH

- 8.3 >16 TO 60 KG

- 8.3.1 USE TO AUTOMATE HIGH-POWER ELECTRONIC CIRCUIT MANUFACTURING TO AUGMENT SEGMENTAL GROWTH

- 8.4 >60 TO 225 KG

- 8.4.1 DEPLOYMENT IN INDUSTRIES FOR LIFTING HEAVY PARTS TO BOOST SEGMENTAL GROWTH

- 8.5 ABOVE 225 KG

- 8.5.1 REQUIREMENT FOR AUTOMATED SYSTEMS TO HANDLE LARGE AND HEAVY COMPONENTS DURING AUTOMOTIVE MANUFACTURING TO FUEL SEGMENTAL GROWTH

9 INDUSTRIAL ROBOTICS MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.2 INDUSTRIAL ROBOTS

- 9.2.1 RISING PREFERENCE FOR AUTOMATED MACHINES TO REDUCE REPETITIVE TASKS TO AUGMENT SEGMENTAL GROWTH

- 9.3 ROBOT ACCESSORIES

- 9.3.1 INCREASING ADOPTION TO PERFORM COMPLEX MATERIAL HANDLING AND PACKAGING TASKS TO EXHIBIT SEGMENTAL GROWTH

- 9.3.2 END EFFECTORS

- 9.3.2.1 Welding guns

- 9.3.2.2 Grippers

- 9.3.2.2.1 Mechanical

- 9.3.2.2.2 Electric

- 9.3.2.2.3 Magnetic

- 9.3.2.3 Tool changers

- 9.3.2.4 Clamps

- 9.3.2.5 Suction cups

- 9.3.2.6 Other end effectors

- 9.3.3 CONTROLLERS

- 9.3.4 DRIVE UNITS

- 9.3.4.1 Hydraulic drives

- 9.3.4.2 Electric drives

- 9.3.4.3 Pneumatic drives

- 9.3.5 VISION SYSTEMS

- 9.3.6 SENSORS

- 9.3.7 POWER SUPPLY ACCESSORIES

- 9.3.8 OTHER ROBOT ACCESSORIES

- 9.4 OTHER ROBOTIC HARDWARE

- 9.4.1 GROWING FOCUS ON IMPROVING ACCURACY, SAFETY, AND FUNCTIONALITY OF ROBOTS TO ACCELERATE SEGMENTAL GROWTH

- 9.4.2 SAFETY FENCING HARDWARE

- 9.4.3 FIXTURES TOOLS

- 9.4.4 CONVEYORS HARDWARE

- 9.5 SYSTEM ENGINEERING

- 9.5.1 RISING EMPHASIS OF MAINTENANCE SPECIALISTS ON MITIGATING HAZARDS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.6 SOFTWARE & PROGRAMMING

- 9.6.1 INCREASING NEED FOR OPTIMAL MAINTENANCE AND OPERATION OF ROBOTS TO BOOST SEGMENTAL GROWTH

10 INDUSTRIAL ROBOTS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 HANDLING

- 10.2.1 INCREASING DEMAND FOR PALLETIZING ROBOTS TO MOVE HEAVY OBJECTS TO BOOST SEGMENTAL GROWTH

- 10.2.2 PICK & PLACE

- 10.2.3 MATERIAL HANDLING

- 10.2.4 PACKAGING & PALLETIZING

- 10.3 ASSEMBLING & DISASSEMBLING

- 10.3.1 RISING EMPHASIS ON MAINTAINING MANUFACTURING QUALITY AND CONSISTENCY TO FOSTER SEGMENTAL GROWTH

- 10.4 WELDING & SOLDERING

- 10.4.1 GROWING FOCUS ON IMPROVING WELD QUALITY AND JOINT INTEGRITY TO DRIVE MARKET

- 10.5 DISPENSING

- 10.5.1 RAPID ADVANCES IN MOTION CONTROL AND SENSING TECHNOLOGIES TO BOLSTER SEGMENTAL GROWTH

- 10.5.2 GLUING

- 10.5.3 PAINTING

- 10.5.4 FOOD DISPENSING

- 10.6 PROCESSING

- 10.6.1 RISING DEPLOYMENT OF ROBOTIC GRINDERS IN AUTOMOTIVE SECTOR TO FUEL SEGMENTAL GROWTH

- 10.6.2 GRINDING & POLISHING

- 10.6.3 MILLING

- 10.6.4 CUTTING

- 10.7 CLEANROOM

- 10.7.1 INCREASING NEED TO MINIMIZE PARTICLE GENERATION AND COMPLY WITH REGULATIONS TO AUGMENT SEGMENTAL GROWTH

- 10.8 OTHER APPLICATIONS

11 INDUSTRIAL ROBOTS MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 AUTOMOTIVE

- 11.2.1 INCREASING NEED FOR AUTOMATED SPOT WELDING AND PAINTING TO DRIVE MARKET

- 11.3 ELECTRICAL & ELECTRONICS

- 11.3.1 RISING ADOPTION OF SCARA ROBOTS IN CLEANROOM APPLICATIONS TO BOLSTER SEGMENTAL GROWTH

- 11.4 METALS & MACHINERY

- 11.4.1 INCREASING USE OF END EFFECTORS TO AUTOMATE HAZARDOUS TASKS TO FUEL SEGMENTAL GROWTH

- 11.5 PLASTICS, RUBBER & CHEMICALS

- 11.5.1 MOUNTING DEMAND FOR ROBOTS TO ENSURE HIGH-SPEED TASK EXECUTION TO ACCELERATE SEGMENTAL GROWTH

- 11.6 FOOD & BEVERAGES

- 11.6.1 INCREASING REQUIREMENT FOR WATER-RESISTANT ROBOTS TO FOSTER SEGMENTAL GROWTH

- 11.7 PRECISION ENGINEERING & OPTICS

- 11.7.1 RISING EMPHASIS ON REDUCING MANUAL LABOR AND AUTOMATING COMPLEX TASKS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.8 PHARMACEUTICALS & COSMETICS

- 11.8.1 ESCALATING ADOPTION OF AUTOMATED SYSTEMS TO MINIMIZE CONTAMINATION AND HUMAN ERROR TO DRIVE MARKET

- 11.9 OIL & GAS

- 11.9.1 GROWING FOCUS ON INCREASING ACCURACY OF DRILLING OPERATIONS TO BOOST SEGMENTAL GROWTH

- 11.10 OTHER END-USE INDUSTRIES

12 INDUSTRIAL ROBOTS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Increased emphasis on automating manufacturing operations to contribute to market growth

- 12.2.3 CANADA

- 12.2.3.1 Implementation of policies and grants to encourage adoption of robots to drive market

- 12.2.4 MEXICO

- 12.2.4.1 Expansion of manufacturing facilities to boost market growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Mounting investment in electric and hybrid vehicles to fuel market growth

- 12.3.3 ITALY

- 12.3.3.1 Escalating adoption of robots in automobile manufacturing facilities to augment market growth

- 12.3.4 FRANCE

- 12.3.4.1 Rising adoption of electric and hybrid vehicles to drive demand for robots

- 12.3.5 SPAIN

- 12.3.5.1 Increasing adoption of robots in surgical applications to accelerate market growth

- 12.3.6 UK

- 12.3.6.1 Rising deployment of advanced technologies in industrial sectors to foster market growth

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Mounting adoption of automation solutions due to labor shortage to drive market

- 12.4.3 SOUTH KOREA

- 12.4.3.1 Rising implementation of initiatives to support automated machine training to boost market growth

- 12.4.4 JAPAN

- 12.4.4.1 Increasing aging population and automation trends to contribute to market growth

- 12.4.5 TAIWAN

- 12.4.5.1 Rising implementation of government policies to promote research of automation technologies to drive market

- 12.4.6 INDIA

- 12.4.6.1 Mounting demand for cobots in industries to expedite market growth

- 12.4.7 THAILAND

- 12.4.7.1 Rising emphasis on automating manufacturing operations to fuel market growth

- 12.4.8 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Burgeoning demand for automated material handling systems to drive market

- 12.5.2.2 GCC

- 12.5.2.3 Rest of Middle East

- 12.5.3 AFRICA

- 12.5.3.1 Increasing shipment of robots for industrial operations to augment market growth

- 12.5.4 SOUTH AMERICA

- 12.5.4.1 Rapid urbanization and industrial development to fuel market growth

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 13.3 REVENUE ANALYSIS, 2019-2023

- 13.4 MARKET SHARE ANALYSIS, 2023

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.7.5.1 Company footprint

- 13.7.5.2 Payload footprint

- 13.7.5.3 Robot type footprint

- 13.7.5.4 End-use industry footprint

- 13.7.5.5 Region footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 ABB

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 YASKAWA ELECTRIC CORPORATION

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 FANUC CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 KUKA AG

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 MITSUBISHI ELECTRIC CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 KAWASAKI HEAVY INDUSTRIES, LTD.

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.7 DENSO CORPORATION

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.8 NACHI-FUJIKOSHI CORP.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.9 SEIKO EPSON CORPORATION

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Deals

- 14.1.10 DURR GROUP

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.1 ABB

- 14.2 OTHER PLAYERS

- 14.2.1 YAMAHA MOTOR CO., LTD.

- 14.2.2 ESTUN AUTOMATION CO.,LTD

- 14.2.3 SHIBAURA MACHINE

- 14.2.4 DOVER CORPORATION

- 14.2.5 AUROTEK CORPORATION

- 14.2.6 HIRATA CORPORATION

- 14.2.7 RETHINK ROBOTICS

- 14.2.8 FRANKA ROBOTICS GMBH

- 14.2.9 TECHMAN ROBOT INC.

- 14.2.10 BOSCH REXROTH AG

- 14.2.11 UNIVERSAL ROBOTS A/S

- 14.2.12 OMRON CORPORATION

- 14.2.13 STAUBLI INTERNATIONAL AG

- 14.2.14 COMAU

- 14.2.15 B+M SURFACE SYSTEMS GMBH

- 14.2.16 ICR SERVICES

- 14.2.17 IRS ROBOTICS

- 14.2.18 HD HYUNDAI ROBOTICS

- 14.2.19 SIASUN ROBOT & AUTOMATION CO., LTD

- 14.2.20 ROBOTWORX

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS