|

|

市場調査レポート

商品コード

1543645

アブレーション技術の世界市場 (~2029年):技術・製品・用途・エンドユーザー・地域別Ablation Technology Market by Technology, Product, Application, Enduser & Region Global Forecasts to 2029 |

||||||

カスタマイズ可能

|

|||||||

| アブレーション技術の世界市場 (~2029年):技術・製品・用途・エンドユーザー・地域別 |

|

出版日: 2024年08月23日

発行: MarketsandMarkets

ページ情報: 英文 291 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のアブレーション技術の市場規模は、2024年の61億1,000万米ドルから、予測期間中は9.5%のCAGRで推移し、2029年には96億2,000万米ドルの規模に成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額(米ドル) |

| セグメント | 技術・製品・用途・エンドユーザー・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・ラテンアメリカ・中東&アフリカ |

技術別では、高周波アブレーションの部門が2023年に最大のシェアを占める"

心筋アブレーション術や腫瘍アブレーション術に対する需要の増加、早期診断に対する意識の高まり、技術の進歩がこの部門の最大シェアに寄与しています。

製品別では、消耗品の部門が2023年に最大のシェアを占める"

消耗品部門の大きなシェアは、エンドユーザー施設におけるアブレーションシステムの採用増加によって支えられています。消耗品は患者の安全を確保するため、処置ごとに交換する必要があります。美容や疼痛管理などの用途の拡大、最近の技術的進歩、患者の安全性を確保するための厳格な規制方針などが同部門の高シェアに寄与しています。

"用途別では、心血管疾患治療の部門が2023年に最大のシェアを占める"

CVDに対するアブレーション治療の成功率の向上と新しいアブレーション技術が同部門の成長を牽引しています。

"アジア太平洋地域が予測期間中にもっとも高い成長を遂げると予想される"

特に新興国における医療サービスおよびインフラへの一貫した投資の増加が、アブレーションシステムの導入増加を支えています。主要参入企業は、アブレーション処置の需要増に対応するため、新興国でのプレゼンス拡大に注力しています。さらに、同地域における病院数の増加も、高度な治療処置の利用可能性とアクセシビリティを高め、アブレーションシステムと消耗品の需要をさらに促進しています。

当レポートでは、世界のアブレーション技術の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制・償還環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の内訳、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 規制状況

- 償還シナリオ分析

- 投資と資金調達のシナリオ

- 価格分析

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 主な会議とイベント

- ケーススタディ分析

- 技術分析

- 顧客ビジネスに影響を与える動向/ディスラプション

- アンメットニーズ

- AI/生成AIがアブレーション技術市場に与える影響

第6章 アブレーション技術市場:技術別

- 高周波アブレーション

- レーザー/光アブレーション

- 超音波アブレーション

- 電気アブレーション

- 冷凍アブレーション

- マイクロ波アブレーション

- パルスフィールドアブレーション

- ハイドロサーマル/ハイドロメカニカルアブレーション

第7章 アブレーション技術市場:製品別

- 高周波アブレーションシステム

- 温度制御高周波アブレーションシステム

- 流体冷却式高周波アブレーションシステム

- ロボットカテーテル操作システム

- レーザー/光アブレーションシステム

- エキシマレーザーアブレーションシステム

- コールドレーザーアブレーションシステム

- 超音波アブレーションシステム

- 超音波外科用アブレーションシステム

- 高強度焦点式超音波アブレーションシステム

- 体外衝撃波結石破砕システム

- 磁気共鳴誘導集束超音波アブレーションシステム

- 電気アブレーションシステム

- アルゴンプラズマ/ビーム凝固システム

- 不可逆的電気穿孔アブレーションシステム

- 冷凍アブレーションシステム

- 表皮および皮下凍結融解デバイス

- マイクロ波アブレーションシステム

- マイクロ波温熱療法システム

- ハイドロサーマル/ハイドロメカニカルアブレーションシステム

- 子宮内膜ハイドロサーマルバルーンアブレーションデバイス

- 消耗品

第8章 アブレーション技術市場:用途別

- 心血管疾患治療

- 癌治療

- 肝臓癌

- 腎臓癌

- 前立腺癌

- 肺癌

- 骨転移

- 乳癌

- 整形外科治療

- 美容整形

- 泌尿器科治療

- 婦人科治療

- 疼痛管理

- 眼科治療

- その他

第9章 アブレーション技術市場:エンドユーザー別

- 病院・外科センター・アブレーションセンター

- 外来手術センター

- メディカルスパおよび美容・皮膚科クリニック

- その他

第10章 アブレーション技術市場:地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 主要企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- JOHNSON & JOHNSON

- MEDTRONIC

- BOSTON SCIENTIFIC CORPORATION

- ABBOTT

- ATRICURE, INC.

- ANGIODYNAMICS

- CONMED CORPORATION

- OLYMPUS CORPORATION

- VARIAN MEDICAL SYSTEMS, INC.

- SMITH+NEPHEW

- STRYKER

- CYNOSURE LUTRONIC

- BIOVENTUS

- MERIT MEDICAL SYSTEMS

- CANYON MEDICAL INC.

- その他の企業

- ARTHREX, INC.

- ICECURE MEDICAL

- MINIMAX MEDICAL HOLDING GROUP

- CARDIOFOCUS

- EDAP TMS

- MERMAID MEDICAL

- MONTERIS

- SONABLATE CORP.

- ECO MEDICAL

- SURGNOVA

第13章 付録

List of Tables

- TABLE 1 ABLATION TECHNOLOGY MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 ABLATION TECHNOLOGY MARKET: STUDY ASSUMPTIONS

- TABLE 3 ABLATION TECHNOLOGY MARKET: RISK ASSESSMENT

- TABLE 4 ESTIMATED GERIATRIC POPULATION, BY REGION, 2015 VS. 2030 (IN MILLION)

- TABLE 5 CPT CODES FOR REIMBURSEMENT OF ABLATION TECHNOLOGIES

- TABLE 6 ALTERNATIVE THERAPIES/PROCEDURES FOR ABLATION

- TABLE 7 ABLATION TECHNOLOGY MARKET: ROLE IN ECOSYSTEM

- TABLE 8 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 9 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 10 US: CLASSIFICATION OF ABLATION DEVICES

- TABLE 11 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 12 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PHARMACEUTICAL AND MEDICAL DEVICE AGENCY (PMDA)

- TABLE 13 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 14 REGULATORY APPROVALS REQUIRED FOR ABLATION DEVICES, BY COUNTRY

- TABLE 15 NORTH AMERICA: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LATIN AMERICA: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 MIDDLE EAST & AFRICA: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 MEDICAL REIMBURSEMENT CODES FOR CRYOABLATION PROCEDURAL SERVICES IN US (2024)

- TABLE 21 MEDICAL REIMBURSEMENT CODES FOR ABLATION TECHNOLOGY IN US, 2021-2024

- TABLE 22 INDICATIVE SELLING PRICE OF ABLATION SYSTEMS, BY REGION, 2021-2023 (USD)

- TABLE 23 IMPORT DATA FOR ABLATION PRODUCTS (HS CODE 9018), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 24 EXPORT DATA FOR ABLATION PRODUCTS (HS CODE 9018), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 25 LIST OF MAJOR PATENTS IN ABLATION TECHNOLOGY MARKET, JANUARY 2022-MARCH 2024

- TABLE 26 ABLATION TECHNOLOGY MARKET: PORTER'S FIVE FORCES

- TABLE 27 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS

- TABLE 28 INFLUENCE OF KEY END USERS ON BUYING PROCESS

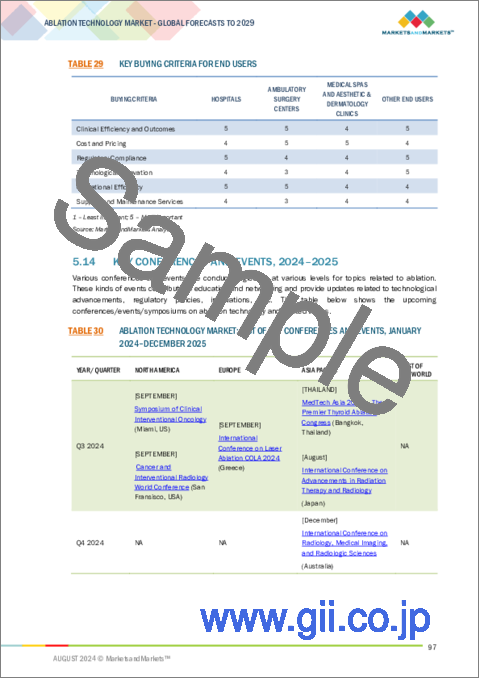

- TABLE 29 KEY BUYING CRITERIA FOR END USERS

- TABLE 30 ABLATION TECHNOLOGY MARKET: LIST OF KEY CONFERENCES AND EVENTS, JANUARY 2024-DECEMBER 2025

- TABLE 31 CASE STUDY 1: RADIOFREQUENCY ABLATION ANALYSIS CASE STUDY

- TABLE 32 CASE STUDY 2: THERMOCOOL CATHETER CASE STUDY

- TABLE 33 THERMAL ABLATION TECHNOLOGY: KEY BRAND MAPPING

- TABLE 34 NON-THERMAL ABLATION TECHNOLOGY: KEY BRAND MAPPING

- TABLE 35 ABLATION TECHNOLOGY MARKET: INTENSITY OF CURRENT UNMET NEEDS

- TABLE 36 ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 37 RADIOFREQUENCY ABLATION TECHNOLOGY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 38 LASER/LIGHT ABLATION TECHNOLOGY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 39 ULTRASOUND ABLATION TECHNOLOGY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 40 ELECTRICAL ABLATION TECHNOLOGY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 41 CRYOABLATION TECHNOLOGY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 42 MICROWAVE ABLATION TECHNOLOGY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 43 PULSED-FIELD ABLATION TECHNOLOGY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 44 HYDROTHERMAL/HYDROMECHANICAL ABLATION TECHNOLOGY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 45 ABLATION TECHNOLOGY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 46 ABLATION TECHNOLOGY SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 47 RADIOFREQUENCY ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 48 RADIOFREQUENCY ABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 49 TEMPERATURE-CONTROLLED RADIOFREQUENCY ABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 50 FLUID-COOLED RADIOFREQUENCY ABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 51 ROBOTIC CATHETER MANIPULATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 52 LASER/LIGHT ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 53 LASER/LIGHT ABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 54 EXCIMER LASER ABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 55 COLD LASER ABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 56 ULTRASOUND ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 57 ULTRASOUND ABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 58 ULTRASONIC SURGICAL ABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 59 HIGH-INTENSITY FOCUSED ULTRASOUND ABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 60 EXTRACORPOREAL SHOCK WAVE LITHOTRIPSY SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 61 MAGNETIC RESONANCE-GUIDED FOCUSED ULTRASOUND ABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 62 ELECTRICAL ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 63 ELECTRICAL ABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 64 ARGON PLASMA/BEAM COAGULATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 65 IRREVERSIBLE ELECTROPORATION ABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 66 CRYOABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 67 MICROWAVE ABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 68 HYDROTHERMAL/HYDROMECHANICAL ABLATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 69 ABLATION TECHNOLOGY CONSUMABLES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 70 ABLATION TECHNOLOGY MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 71 ABLATION TECHNOLOGY MARKET FOR CARDIOVASCULAR DISEASE TREATMENT, BY REGION, 2022-2029 (USD MILLION)

- TABLE 72 ABLATION TECHNOLOGY MARKET FOR CANCER TREATMENT, BY REGION, 2022-2029 (USD MILLION)

- TABLE 73 ABLATION TECHNOLOGY MARKET FOR ORTHOPEDIC TREATMENT, BY REGION, 2022-2029 (USD MILLION)

- TABLE 74 ABLATION TECHNOLOGY MARKET FOR COSMETIC/AESTHETIC SURGERY, BY REGION, 2022-2029 (USD MILLION)

- TABLE 75 ABLATION TECHNOLOGY MARKET FOR UROLOGICAL TREATMENT, BY REGION, 2022-2029 (USD MILLION)

- TABLE 76 ABLATION TECHNOLOGY MARKET FOR GYNECOLOGICAL TREATMENT, BY REGION, 2022-2029 (USD MILLION)

- TABLE 77 ABLATION TECHNOLOGY MARKET FOR PAIN MANAGEMENT, BY REGION, 2022-2029 (USD MILLION)

- TABLE 78 ABLATION TECHNOLOGY MARKET FOR OPHTHALMOLOGICAL TREATMENT, BY REGION, 2022-2029 (USD MILLION)

- TABLE 79 ABLATION TECHNOLOGY MARKET FOR OTHER APPLICATIONS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 80 ABLATION TECHNOLOGY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 81 ABLATION TECHNOLOGY MARKET FOR HOSPITALS, SURGICAL CENTERS, AND ABLATION CENTERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 82 ABLATION TECHNOLOGY MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 83 ABLATION TECHNOLOGY MARKET FOR MEDICAL SPAS AND AESTHETIC & DERMATOLOGY CLINICS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 84 ABLATION TECHNOLOGY MARKET FOR OTHER END USERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 85 ABLATION TECHNOLOGY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 86 NORTH AMERICA: ABLATION TECHNOLOGY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 87 NORTH AMERICA: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: ABLATION TECHNOLOGY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 89 NORTH AMERICA: ABLATION TECHNOLOGY SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 90 NORTH AMERICA: RADIOFREQUENCY ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 91 NORTH AMERICA: LASER/LIGHT ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 92 NORTH AMERICA: ULTRASOUND ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 93 NORTH AMERICA: ELECTRICAL ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 94 NORTH AMERICA: ABLATION TECHNOLOGY MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 95 NORTH AMERICA: ABLATION TECHNOLOGY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 96 NORTH AMERICA: KEY MACROINDICATORS

- TABLE 97 US: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 98 CANADA: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 99 EUROPE: ABLATION TECHNOLOGY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 100 EUROPE: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 101 EUROPE: ABLATION TECHNOLOGY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 102 EUROPE: ABLATION TECHNOLOGY SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 103 EUROPE: RADIOFREQUENCY ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 104 EUROPE: LASER/LIGHT ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 105 EUROPE: ULTRASOUND ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 106 EUROPE: ELECTRICAL ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 107 EUROPE: ABLATION TECHNOLOGY MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 108 EUROPE: ABLATION TECHNOLOGY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 109 EUROPE: KEY MACROINDICATORS

- TABLE 110 GERMANY: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 111 FRANCE: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 112 UK: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 113 ITALY: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 114 SPAIN: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 115 REST OF EUROPE: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ABLATION TECHNOLOGY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 118 ASIA PACIFIC: ABLATION TECHNOLOGY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 119 ASIA PACIFIC: ABLATION TECHNOLOGY SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 120 ASIA PACIFIC: RADIOFREQUENCY ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 121 ASIA PACIFIC: LASER/LIGHT ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 122 ASIA PACIFIC: ULTRASOUND ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 123 ASIA PACIFIC: ELECTRICAL ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 124 ASIA PACIFIC: ABLATION TECHNOLOGY MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 125 ASIA PACIFIC: ABLATION TECHNOLOGY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 126 ASIA PACIFIC: KEY MACROINDICATORS

- TABLE 127 JAPAN: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 128 CHINA: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 129 INDIA: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 130 AUSTRALIA: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 131 SOUTH KOREA: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 133 LATIN AMERICA: ABLATION TECHNOLOGY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 134 LATIN AMERICA: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 135 LATIN AMERICA: ABLATION TECHNOLOGY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 136 LATIN AMERICA: ABLATION TECHNOLOGY SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 137 LATIN AMERICA: RADIOFREQUENCY ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 138 LATIN AMERICA: LASER/LIGHT ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 139 LATIN AMERICA: ULTRASOUND ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 140 LATIN AMERICA: ELECTRICAL ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 141 LATIN AMERICA: ABLATION TECHNOLOGY MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 142 LATIN AMERICA: ABLATION TECHNOLOGY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 143 LATIN AMERICA: KEY MACROINDICATORS

- TABLE 144 BRAZIL: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 145 MEXICO: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 146 REST OF LATIN AMERICA: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: ABLATION TECHNOLOGY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: ABLATION TECHNOLOGY SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: RADIOFREQUENCY ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: LASER/LIGHT ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: ULTRASOUND ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: ELECTRICAL ABLATION SYSTEMS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: ABLATION TECHNOLOGY MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: ABLATION TECHNOLOGY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: KEY MACROINDICATORS

- TABLE 157 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN ABLATION TECHNOLOGY MARKET

- TABLE 158 ABLATION TECHNOLOGY MARKET: DEGREE OF COMPETITION

- TABLE 159 ABLATION TECHNOLOGY MARKET: TECHNOLOGY FOOTPRINT

- TABLE 160 ABLATION TECHNOLOGY MARKET: PRODUCT FOOTPRINT

- TABLE 161 ABLATION TECHNOLOGY MARKET: APPLICATION FOOTPRINT

- TABLE 162 ABLATION TECHNOLOGY MARKET: END-USER FOOTPRINT

- TABLE 163 ABLATION TECHNOLOGY MARKET: REGION FOOTPRINT

- TABLE 164 ABLATION TECHNOLOGY MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 165 ABLATION TECHNOLOGY MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS

- TABLE 166 ABLATION TECHNOLOGY MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-JULY 2024

- TABLE 167 ABLATION TECHNOLOGY MARKET: DEALS, JANUARY 2021-JULY 2024

- TABLE 168 ABLATION TECHNOLOGY MARKET: EXPANSIONS, JANUARY 2021-JULY 2024

- TABLE 169 JOHNSON & JOHNSON: COMPANY OVERVIEW

- TABLE 170 JOHNSON & JOHNSON: PRODUCTS OFFERED

- TABLE 171 JOHNSON & JOHNSON: PRODUCT APPROVALS, JANUARY 2021-JULY 2024

- TABLE 172 JOHNSON & JOHNSON: DEALS, JANUARY 2021-JULY 2024

- TABLE 173 MEDTRONIC: COMPANY OVERVIEW

- TABLE 174 MEDTRONIC: PRODUCTS OFFERED

- TABLE 175 MEDTRONIC: PRODUCT APPROVALS, JANUARY 2021-JULY 2024

- TABLE 176 BOSTON SCIENTIFIC CORPORATION: COMPANY OVERVIEW

- TABLE 177 BOSTON SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- TABLE 178 BOSTON SCIENTIFIC CORPORATION: PRODUCT APPROVALS, JANUARY 2021-JULY 2024

- TABLE 179 BOSTON SCIENTIFIC CORPORATION: DEALS, JANUARY 2021-JULY 2024

- TABLE 180 ABBOTT: COMPANY OVERVIEW

- TABLE 181 ABBOTT: PRODUCTS OFFERED

- TABLE 182 ABBOTT: PRODUCT APPROVALS, JANUARY 2021-JULY 2024

- TABLE 183 ABBOTT: DEALS, JANUARY 2021-JULY 2024

- TABLE 184 ATRICURE, INC.: COMPANY OVERVIEW

- TABLE 185 ATRICURE, INC.: PRODUCTS OFFERED

- TABLE 186 ATRICURE, INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-JULY 2024

- TABLE 187 ANGIODYNAMICS: COMPANY OVERVIEW

- TABLE 188 ANGIODYNAMICS: PRODUCTS OFFERED

- TABLE 189 ANGIODYNAMICS: DEALS, JANUARY 2021-JULY 2024

- TABLE 190 CONMED CORPORATION: COMPANY OVERVIEW

- TABLE 191 CONMED CORPORATION: PRODUCTS OFFERED

- TABLE 192 OLYMPUS CORPORATION: COMPANY OVERVIEW

- TABLE 193 OLYMPUS CORPORATION: PRODUCTS OFFERED

- TABLE 194 OLYMPUS CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-JULY 2024

- TABLE 195 OLYMPUS CORPORATION: DEALS, JANUARY 2021-JULY 2024

- TABLE 196 VARIAN MEDICAL SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 197 VARIAN MEDICAL SYSTEMS, INC.: PRODUCTS OFFERED

- TABLE 198 VARIAN MEDICAL SYSTEMS, INC.: PRODUCT LAUNCHES, JANUARY 2021-JULY 2024

- TABLE 199 VARIAN MEDICAL SYSTEMS, INC.: DEALS, JANUARY 2021-JULY 2024

- TABLE 200 SMITH+NEPHEW: COMPANY OVERVIEW

- TABLE 201 SMITH+NEPHEW: PRODUCTS OFFERED

- TABLE 202 SMITH+NEPHEW: EXPANSIONS, JANUARY 2021-JULY 2024

- TABLE 203 STRYKER: COMPANY OVERVIEW

- TABLE 204 STRYKER: PRODUCTS OFFERED

- TABLE 205 STRYKER: PRODUCT APPROVALS, JANUARY 2021-JULY 2024

- TABLE 206 STRYKER: EXPANSIONS, JANUARY 2021-JULY 2024

- TABLE 207 CYNOSURE LUTRONIC: COMPANY OVERVIEW

- TABLE 208 CYNOSURE LUTRONIC: PRODUCTS OFFERED

- TABLE 209 CYNOSURE LUTRONIC: DEALS, JANUARY 2021-JULY 2024

- TABLE 210 BIOVENTUS: COMPANY OVERVIEW

- TABLE 211 BIOVENTUS: PRODUCTS OFFERED

- TABLE 212 BIOVENTUS: DEALS, JANUARY 2021-JULY 2024

- TABLE 213 MERIT MEDICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 214 MERIT MEDICAL SYSTEMS: PRODUCTS OFFERED

- TABLE 215 CANYON MEDICAL INC.: COMPANY OVERVIEW

- TABLE 216 CANYON MEDICAL INC.: PRODUCTS OFFERED

- TABLE 217 ARTHREX, INC.: COMPANY OVERVIEW

- TABLE 218 ICECURE MEDICAL: COMPANY OVERVIEW

- TABLE 219 MINIMAX MEDICAL HOLDING GROUP: COMPANY OVERVIEW

- TABLE 220 CARDIOFOCUS: COMPANY OVERVIEW

- TABLE 221 EDAP TMS: COMPANY OVERVIEW

- TABLE 222 MERMAID MEDICAL: COMPANY OVERVIEW

- TABLE 223 MONTERIS: COMPANY OVERVIEW

- TABLE 224 SONABLATE CORP.: COMPANY OVERVIEW

- TABLE 225 ECO MEDICAL: COMPANY OVERVIEW

- TABLE 226 SURGNOVA: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ABLATION TECHNOLOGY MARKET: SEGMENTS CONSIDERED

- FIGURE 2 ABLATION TECHNOLOGY MARKET: YEARS CONSIDERED

- FIGURE 3 ABLATION TECHNOLOGY MARKET: RESEARCH DESIGN

- FIGURE 4 ABLATION TECHNOLOGY MARKET: KEY PRIMARY SOURCES

- FIGURE 5 ABLATION TECHNOLOGY MARKET: KEY PRIMARY INSIGHTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 9 ABLATION TECHNOLOGY MARKET: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 10 ABLATION TECHNOLOGY MARKET: CUSTOMER-BASED MARKET ESTIMATION

- FIGURE 11 CAGR PROJECTION: SUPPLY-SIDE ANALYSIS

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2024 VS. 2029 (USD MILLION)

- FIGURE 14 ABLATION TECHNOLOGY MARKET, BY PRODUCT, 2024 VS. 2029 (USD MILLION)

- FIGURE 15 ABLATION TECHNOLOGY MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 16 ABLATION TECHNOLOGY MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 17 ABLATION TECHNOLOGY MARKET: REGIONAL SNAPSHOT

- FIGURE 18 INCREASING DEMAND FOR MINIMALLY INVASIVE PROCEDURES TO DRIVE MARKET

- FIGURE 19 PULSED-FIELD ABLATION TO REGISTER HIGHEST CAGR IN NORTH AMERICAN MARKET DURING FORECAST PERIOD

- FIGURE 20 AMBULATORY SURGERY CENTERS TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 21 CARDIOVASCULAR DISEASE TREATMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 22 INDIA TO WITNESS HIGHEST CAGR DURING STUDY PERIOD

- FIGURE 23 ABLATION TECHNOLOGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 ABLATION TECHNOLOGY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 ABLATION TECHNOLOGY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 ABLATION TECHNOLOGY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 PREMARKET NOTIFICATION: 510(K) APPROVAL FOR MEDICAL DEVICES

- FIGURE 28 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

- FIGURE 29 EUROPE: CE APPROVAL PROCESS FOR MEDICAL DEVICES

- FIGURE 30 FUNDING AND NUMBER OF DEALS IN ABLATION TECHNOLOGY MARKET, 2018-2022 (USD MILLION)

- FIGURE 31 NUMBER OF INVESTOR DEALS IN ABLATION TECHNOLOGY MARKET, BY KEY PLAYER, 2018-2022 (UNIT)

- FIGURE 32 VALUE OF INVESTOR DEALS IN ABLATION TECHNOLOGY MARKET, BY KEY PLAYER, 2018-2022 (USD MILLION)

- FIGURE 33 AVERAGE SELLING PRICE TREND OF ABLATION SYSTEMS, BY TECHNOLOGY (2023)

- FIGURE 34 AVERAGE SELLING PRICE TREND OF ABLATION SYSTEMS, BY REGION (2023)

- FIGURE 35 TOP PATENT OWNERS/APPLICANTS IN ABLATION TECHNOLOGY MARKET (2013-2023)

- FIGURE 36 ABLATION TECHNOLOGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ABLATION TECHNOLOGY PRODUCTS

- FIGURE 38 KEY BUYING CRITERIA

- FIGURE 39 KEY BUYING CRITERIA FOR END USERS

- FIGURE 40 ABLATION TECHNOLOGY MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 41 MARKET POTENTIAL OF AI/GENERATIVE AI ON ABLATION TECHNOLOGIES

- FIGURE 42 NORTH AMERICA: ABLATION TECHNOLOGY MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: ABLATION TECHNOLOGY MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF KEY PLAYERS IN ABLATION TECHNOLOGY MARKET (2019-2023)

- FIGURE 45 MARKET SHARE ANALYSIS OF KEY PLAYERS IN ABLATION TECHNOLOGY MARKET (2023)

- FIGURE 46 ABLATION TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 47 ABLATION TECHNOLOGY MARKET: COMPANY FOOTPRINT

- FIGURE 48 ABLATION TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 49 EV/EBITDA OF KEY VENDORS

- FIGURE 50 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 51 ABLATION TECHNOLOGY MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 52 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2023)

- FIGURE 53 MEDTRONIC: COMPANY SNAPSHOT (2023)

- FIGURE 54 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 55 ABBOTT: COMPANY SNAPSHOT (2023)

- FIGURE 56 ATRICURE, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 57 ANGIODYNAMICS: COMPANY SNAPSHOT (2023)

- FIGURE 58 CONMED CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 59 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 60 VARIAN MEDICAL SYSTEMS, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 61 SMITH+NEPHEW: COMPANY SNAPSHOT (2023)

- FIGURE 62 STRYKER: COMPANY SNAPSHOT (2023)

- FIGURE 63 BIOVENTUS: COMPANY SNAPSHOT (2023)

- FIGURE 64 MERIT MEDICAL SYSTEMS: COMPANY SNAPSHOT (2023)

The global ablation technology market is projected to reach USD 9.62 billion by 2029 from USD 6.11 billion in 2024, at a CAGR of 9.5% from 2024 to 2029. Increasing risk for targeted diseases, supportive regulatory standards, and strategic partnerships and collaborations have driven demand for ablation technology market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | Technology, Product, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

"The radiofrequency ablation segment of technology segment held the largest share of the market in 2023"

The ablation technology market is segmented based on technology into radiofrequency ablation, laser/light ablation, ultrasound ablation, electrical ablation, cryoablation, microwave ablation, pulsed field ablation and hydrothermal/hydromechanical ablation. Increasing demand for cardiac and tumor ablation procedures, growing awareness for early diagnosis, and technological advancements contributes to the largest share for this segment.

"The consumable segment of product segment held the largest share of the market in 2023"

The ablation technology market is segmented based on product into systems and consumables. Large share of consumables segment is supported by rising adoption of ablation systems in the end user facilities. Consumables need to be replaced for each procedure ensuring the patient safety. Extended application areas such as aesthetics, pain management, recent technological advancements, and strict regulatory policies to ensuring patient safety contribute to the highest share of the segment.

"The cardiovascular disease treatment segment for application segment held the largest share of the market in 2023".

Based on application, the ablation technology market is segmented by application into cardiovascular disease treatment, cancer treatment, orthopedic treatment, cosmetic/aesthetic treatment, urological treatment, gynecological treatment, pain management, ophthalmological treatment and other applications. Cardiovascular disease treatment segment held largest share of the segment in 2023. Improved success rate of ablation treatment for CVD and emerging technologies in ablation drives the segment growth.

"The Ambulatory surgery centers segment for the end user segment is projected to register a significant CAGR during the forecast period."

The ablation technology market is segmented by end user into hospitals, surgical centers and ablation centers, ambulatory surgery centers, medical spas and aesthetic clinics & dermatology clinics, and other end users. The hospitals, surgical centers and ablation centers segment accounted for a significant market share in 2023. Improved insurance coverage and an increase in outpatient treatments are two major factors driving the expansion of the ambulatory surgery center segment.

"The market in the Asia pacific region is expected to witness the highest growth during the forecast period."

Consistent rise in investment for healthcare services and infrastructure, especially in emerging economies, supports the rising installation of ablation systems. Key players in the market are focusing on expanding their presence in emerging countries to cater the increasing demand for ablation procedures. Moreover, the increasing number of hospitals, particularly in APAC region, increases the availability and accessibility of advanced treatment procedures, further driving the demand for ablation systems and consumables.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-30%, Tier 2-42%, and Tier 3- 28%

- By Designation: Director-level-10%, C-level-14%, and Others-76%

- By Region: North America-40%, Europe-30%, Asia Pacific-22%, Latin America-6%, and the Middle East & Africa-2%

The prominent players in the ablation technology market Johnson & Johnson (US), Medtronic (US), Boston Scientific Corporation (US), Abbott (US), Atricure, Inc. (US), AngioDynamics (US), CONMED corporation (US), Olympus (Japan) among others.

Research Coverage

This report studies the ablation technology market based on technology, product, application, end user, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions.

Reasons to Buy the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall ablation technology market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights on the following pointers:

- Analysis of key drivers (Emerging technologies in the field of ablation, increasing demand for minimally invasive procedures, favorable reimbursement scenario in developed markets, and growing target patient population), restraints (presence of strong alternative therapies, stringent regulatory system), opportunities (growth potential in emerging countries), and challenges (focus on reuse and reprocessing of devices, therapeutic challenges and hazardous effects of ablation) influencing the growth of the ablation technology market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the ablation technology market

- Market Development: Comprehensive information about lucrative markets-the report analyses the ablation technology market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the ablation technology market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players - such as Johnson & Johnson (US), Medtronic (US), Boston Scientific Corporation (US), Abbott (US), Atricure, Inc. (US), AngioDynamics (US), CONMED corporation (US), Olympus (Japan) among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 SEGMENTS CONSIDERED

- 1.4.2 YEARS CONSIDERED

- 1.4.3 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Objectives of primary research

- 2.1.2.3 Key primary insights

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation approach

- 2.2.1.2 Customer-based market estimation

- 2.2.1.3 Growth forecast

- 2.2.1.4 CAGR projections

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH LIMITATIONS

- 2.5 MARKET SHARE ANALYSIS

- 2.6 STUDY ASSUMPTIONS

- 2.7 GROWTH RATE ASSUMPTIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ABLATION TECHNOLOGY MARKET OVERVIEW

- 4.2 NORTH AMERICA: ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2024 VS. 2029 (USD MILLION)

- 4.3 ASIA PACIFIC: ABLATION TECHNOLOGY MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- 4.4 EUROPE: ABLATION TECHNOLOGY MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- 4.5 GEOGRAPHIC SNAPSHOT OF ABLATION TECHNOLOGY MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Emerging ablation technologies

- 5.2.1.2 Increasing demand for minimally invasive procedures

- 5.2.1.3 Growing target patient population

- 5.2.1.3.1 Rapid growth in geriatric population with higher risk of targeted diseases

- 5.2.1.3.2 Increasing incidence of cancer and sports injuries

- 5.2.1.3.3 Rising prevalence of atrial fibrillation and other cardiovascular diseases

- 5.2.1.4 Favorable reimbursement scenario in developed markets

- 5.2.2 RESTRAINTS

- 5.2.2.1 Strong market positioning of alternative therapies

- 5.2.2.2 Stringent regulatory systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth potential in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Focus on reuse and reprocessing of devices

- 5.2.4.2 Therapeutic challenges and hazardous effects of ablation

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RESEARCH & PRODUCT DEVELOPMENT

- 5.3.2 RAW MATERIAL PROCUREMENT AND MANUFACTURING

- 5.3.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.4.1 MANUFACTURERS

- 5.4.1.1 Prominent companies

- 5.4.1.2 Small and medium-sized enterprises

- 5.4.2 END USERS

- 5.4.1 MANUFACTURERS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY ANALYSIS

- 5.6.1.1 North America

- 5.6.1.1.1 US

- 5.6.1.1.2 Canada

- 5.6.1.2 Europe

- 5.6.1.3 Asia Pacific

- 5.6.1.3.1 Japan

- 5.6.1.3.2 China

- 5.6.1.3.3 India

- 5.6.1.4 Latin America

- 5.6.1.4.1 Brazil

- 5.6.1.1 North America

- 5.6.2 REGULATORY APPROVALS

- 5.6.3 KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.3.1 North America

- 5.6.3.2 Europe

- 5.6.3.3 Asia Pacific

- 5.6.3.4 Latin America

- 5.6.3.5 Middle East & Africa

- 5.6.1 REGULATORY ANALYSIS

- 5.7 REIMBURSEMENT SCENARIO ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 PRICING ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA FOR ABLATION PRODUCTS (HS CODE 9018)

- 5.10.2 EXPORT DATA FOR ABLATION PRODUCTS (HS CODE 9018)

- 5.11 PATENT ANALYSIS

- 5.11.1 TOP PATENT OWNERS/APPLICANTS

- 5.11.2 LIST OF MAJOR PATENTS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 KEY BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 RADIOFREQUENCY ABLATION ANALYSIS CASE STUDY

- 5.15.2 THERMOCOOL CATHETER CASE STUDY

- 5.16 TECHNOLOGY ANALYSIS

- 5.16.1 KEY TECHNOLOGIES

- 5.16.1.1 Thermal ablation technology

- 5.16.1.2 Non-thermal ablation technology

- 5.16.2 COMPLEMENTARY TECHNOLOGIES

- 5.16.2.1 Medical cooling systems

- 5.16.3 ADJACENT TECHNOLOGIES

- 5.16.3.1 Ablation planning software

- 5.16.1 KEY TECHNOLOGIES

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.18 UNMET NEEDS

- 5.19 IMPACT OF AI/GEN AI ON ABLATION TECHNOLOGY MARKET

- 5.19.1 KEY USE CASES

6 ABLATION TECHNOLOGY MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 RADIOFREQUENCY ABLATION

- 6.2.1 LOWER COST AND HIGHER EFFICACY TO PROPEL MARKET GROWTH

- 6.3 LASER/LIGHT ABLATION

- 6.3.1 LOWER RISK OF TISSUE DAMAGE AND BETTER REAL-TIME MONITORING TO AID MARKET GROWTH

- 6.4 ULTRASOUND ABLATION

- 6.4.1 HIGH INCIDENCE OF LIVER TUMORS AND CANCER TO FUEL MARKET GROWTH

- 6.5 ELECTRICAL ABLATION

- 6.5.1 INCREASING NUMBER OF CARDIAC ARRESTS TO BOOST ADOPTION

- 6.6 CRYOABLATION

- 6.6.1 FEWER COMPLICATIONS AND SHORTER PROCEDURAL TIME TO DRIVE MARKET

- 6.7 MICROWAVE ABLATION

- 6.7.1 FASTER ABLATION TIME AND LESSER PROCEDURAL PAIN TO AUGMENT MARKET GROWTH

- 6.8 PULSED-FIELD ABLATION

- 6.8.1 IMPROVED SAFETY, SHORTER PROCEDURAL TIME, AND FEWER COMPLICATIONS TO PROPEL MARKET GROWTH

- 6.9 HYDROTHERMAL/HYDROMECHANICAL ABLATION

- 6.9.1 INCREASED USAGE IN GYNECOLOGICAL DISORDERS AND MENORRHAGIA TO AID MARKET GROWTH

7 ABLATION TECHNOLOGY MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 RADIOFREQUENCY ABLATION SYSTEMS

- 7.2.1 TEMPERATURE-CONTROLLED RADIOFREQUENCY ABLATION SYSTEMS

- 7.2.1.1 Technological advancements and improved clinical outcomes to propel segment growth

- 7.2.2 FLUID-COOLED RADIOFREQUENCY ABLATION SYSTEMS

- 7.2.2.1 Rising incidence of arrhythmia and growing focus on reducing collateral tissue damage to boost demand

- 7.2.3 ROBOTIC CATHETER MANIPULATION SYSTEMS

- 7.2.3.1 Manual control of catheter movement and remote navigation to fuel segment

- 7.2.1 TEMPERATURE-CONTROLLED RADIOFREQUENCY ABLATION SYSTEMS

- 7.3 LASER/LIGHT ABLATION SYSTEMS

- 7.3.1 EXCIMER LASER ABLATION SYSTEMS

- 7.3.1.1 Low direct tissue interaction, precise ablation zone, and high procedural efficiency to drive adoption

- 7.3.2 COLD LASER ABLATION SYSTEMS

- 7.3.2.1 Cold laser ablator treatment to release endorphins and support pain management

- 7.3.1 EXCIMER LASER ABLATION SYSTEMS

- 7.4 ULTRASOUND ABLATION SYSTEMS

- 7.4.1 ULTRASONIC SURGICAL ABLATION SYSTEMS

- 7.4.1.1 Development of user-friendly surgical ablation systems to drive segment growth

- 7.4.2 HIGH-INTENSITY FOCUSED ULTRASOUND ABLATION SYSTEMS

- 7.4.2.1 Low procedural time and reduced bleeding to support system adoption

- 7.4.3 EXTRACORPOREAL SHOCK WAVE LITHOTRIPSY SYSTEMS

- 7.4.3.1 Growing incidence of obesity and diabetes to drive segment

- 7.4.4 MAGNETIC RESONANCE-GUIDED FOCUSED ULTRASOUND ABLATION SYSTEMS

- 7.4.4.1 Non-pregnancy safe treatment procedure to limit adoption

- 7.4.1 ULTRASONIC SURGICAL ABLATION SYSTEMS

- 7.5 ELECTRICAL ABLATION SYSTEMS

- 7.5.1 ARGON PLASMA/BEAM COAGULATION SYSTEMS

- 7.5.1.1 Increased focus on treating Barrett's esophagus without dysplasia to augment segment growth

- 7.5.2 IRREVERSIBLE ELECTROPORATION ABLATION SYSTEMS

- 7.5.2.1 Selective targeting and better control to aid segment growth

- 7.5.1 ARGON PLASMA/BEAM COAGULATION SYSTEMS

- 7.6 CRYOABLATION SYSTEMS

- 7.6.1 TECHNOLOGICAL ADVANCEMENTS AND INTRODUCTION OF NEW CRYOPROBES TO AID ADOPTION

- 7.6.2 EPIDERMAL AND SUBCUTANEOUS CRYOABLATION DEVICES

- 7.7 MICROWAVE ABLATION SYSTEMS

- 7.7.1 PRODUCTION OF LARGE ABLATION ZONES WITHOUT HEAT-SINK EFFECT ON SURROUNDING TISSUES TO DRIVE MARKET

- 7.7.2 MICROWAVE THERMOTHERAPY SYSTEMS

- 7.8 HYDROTHERMAL/HYDROMECHANICAL ABLATION SYSTEMS

- 7.8.1 INCREASED NEED FOR MINIMALLY INVASIVE PROCEDURES FOR GYNECOLOGICAL DISORDERS TO SUPPORT MARKET GROWTH

- 7.8.2 ENDOMETRIAL HYDROTHERMAL BALLOON ABLATION DEVICES

- 7.9 CONSUMABLES

- 7.9.1 GROWING PREFERENCE FOR ADVANCED MINIMALLY INVASIVE PROCEDURES TO SPUR MARKET GROWTH

8 ABLATION TECHNOLOGY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 CARDIOVASCULAR DISEASE TREATMENT

- 8.2.1 INCREASING TARGET PATIENT POPULATION TO PROPEL MARKET GROWTH

- 8.3 CANCER TREATMENT

- 8.3.1 HIGH PREVALENCE OF CANCER AND NEED FOR ADVANCED TREATMENT PROCEDURES TO AUGMENT MARKET GROWTH

- 8.3.2 LIVER CANCER

- 8.3.3 KIDNEY CANCER

- 8.3.4 PROSTATE CANCER

- 8.3.5 LUNG CANCER

- 8.3.6 BONE METASTASIS

- 8.3.7 BREAST CANCER

- 8.4 ORTHOPEDIC TREATMENT

- 8.4.1 GROWING DISEASE PREVALENCE AND RISING GERIATRIC POPULATION TO SPUR MARKET GROWTH

- 8.5 COSMETIC/AESTHETIC SURGERY

- 8.5.1 INCREASING DEMAND FOR AESTHETIC SURGICAL PROCEDURES TO FUEL MARKET GROWTH

- 8.6 UROLOGICAL TREATMENT

- 8.6.1 HIGH DEMAND FOR MINIMALLY INVASIVE PROCEDURES AMONG PATIENTS TO DRIVE MARKET

- 8.7 GYNECOLOGICAL TREATMENT

- 8.7.1 INCREASING REPRODUCTIVE HEALTH CONCERNS AND DECREASING FERTILITY RATE TO PROPEL MARKET GROWTH

- 8.8 PAIN MANAGEMENT

- 8.8.1 MINIMUM RECOVERY TIME AND LONG-LASTING PAIN RELIEF TO SUPPORT MARKET GROWTH

- 8.9 OPHTHALMOLOGICAL TREATMENT

- 8.9.1 RISING PREVALENCE OF VISION DISORDERS AMONG ALL AGE GROUPS TO AID MARKET GROWTH

- 8.10 OTHER APPLICATIONS

9 ABLATION TECHNOLOGY MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS, SURGICAL CENTERS, AND ABLATION CENTERS

- 9.2.1 HIGH ADOPTION OF ROBOTIC PROCEDURES IN SURGERIES AND IMPROVED HEALTHCARE INFRASTRUCTURE TO DRIVE MARKET

- 9.3 AMBULATORY SURGERY CENTERS

- 9.3.1 NEED FOR COST-EFFECTIVE OUTPATIENT TREATMENTS TO SPUR MARKET GROWTH

- 9.4 MEDICAL SPAS AND AESTHETIC & DERMATOLOGY CLINICS

- 9.4.1 INCREASING PREFERENCE FOR MINIMALLY INVASIVE AND NON-INVASIVE AESTHETIC PROCEDURES TO BOOST MARKET GROWTH

- 9.5 OTHER END USERS

10 ABLATION TECHNOLOGY MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 US to dominate North American ablation technology market during forecast period

- 10.2.3 CANADA

- 10.2.3.1 Rising burden of cancer and growing demand for minimally invasive procedures to support market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Developed healthcare infrastructure and high incidence of chronic diseases to support market growth

- 10.3.3 FRANCE

- 10.3.3.1 Growing geriatric population and rising prevalence of cancer to aid market growth

- 10.3.4 UK

- 10.3.4.1 Rising target patient population and growing awareness about advanced treatment options to drive market

- 10.3.5 ITALY

- 10.3.5.1 Increasing number of clinical trials and growing focus on advanced research activities to augment market growth

- 10.3.6 SPAIN

- 10.3.6.1 Increasing government research funding and growing focus on effective cancer diagnosis to propel market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 JAPAN

- 10.4.2.1 Presence of universal healthcare reimbursement system to augment market growth

- 10.4.3 CHINA

- 10.4.3.1 Increased patient pool and favorable government initiatives to fuel market growth

- 10.4.4 INDIA

- 10.4.4.1 Modernization of healthcare infrastructure and increased medical tourism to aid market growth

- 10.4.5 AUSTRALIA

- 10.4.5.1 Increased research investments and favorable government initiatives to spur market growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Focus on healthcare R&D and supportive government initiatives to positively impact market growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Increasing government funding and growing burden of chronic diseases to propel market growth

- 10.5.3 MEXICO

- 10.5.3.1 Availability of advanced care initiatives and awareness programs to fuel market growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 IMPROVED HEALTHCARE INFRASTRUCTURE AND HIGH PUBLIC-PRIVATE INVESTMENTS TO STIMULATE MARKET GROWTH

- 10.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ABLATION TECHNOLOGY MARKET

- 11.3 REVENUE ANALYSIS, 2019-2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.5.5.1 Company footprint

- 11.5.5.2 Technology footprint

- 11.5.5.3 Product footprint

- 11.5.5.4 Application footprint

- 11.5.5.5 End-user footprint

- 11.5.5.6 Region footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES AND APPROVALS

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 JOHNSON & JOHNSON

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product approvals

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 MEDTRONIC

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product approvals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 BOSTON SCIENTIFIC CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product approvals

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices made

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 ABBOTT

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product approvals

- 12.1.4.3.2 Deals

- 12.1.5 ATRICURE, INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches and approvals

- 12.1.6 ANGIODYNAMICS

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 CONMED CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.8 OLYMPUS CORPORATION

- 12.1.8.1 Products offered

- 12.1.8.2 Recent developments

- 12.1.8.2.1 Product launches

- 12.1.8.2.2 Deals

- 12.1.9 VARIAN MEDICAL SYSTEMS, INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.3.2 Deals

- 12.1.10 SMITH+NEPHEW

- 12.1.10.1 Business overview

- 12.1.10.2 Product offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Expansions

- 12.1.11 STRYKER

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product approvals

- 12.1.11.3.2 Expansions

- 12.1.12 CYNOSURE LUTRONIC

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.13 BIOVENTUS

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.2.1 Deals

- 12.1.14 MERIT MEDICAL SYSTEMS

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.15 CANYON MEDICAL INC.

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.1 JOHNSON & JOHNSON

- 12.2 OTHER PLAYERS

- 12.2.1 ARTHREX, INC.

- 12.2.2 ICECURE MEDICAL

- 12.2.3 MINIMAX MEDICAL HOLDING GROUP

- 12.2.4 CARDIOFOCUS

- 12.2.5 EDAP TMS

- 12.2.6 MERMAID MEDICAL

- 12.2.7 MONTERIS

- 12.2.8 SONABLATE CORP.

- 12.2.9 ECO MEDICAL

- 12.2.10 SURGNOVA

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS