|

|

市場調査レポート

商品コード

1856926

鉄道車両の世界市場 (~2032年):コンポーネント・製品タイプ (機関車・高速鉄道・客車)・機関車技術 (従来型・ターボチャージャー・磁気浮上式)・用途 (旅客輸送・貨物輸送)・地域別Rolling Stock Market by Component, Product Type (Locomotive, Rapid Transit, Coach), Locomotive Technology (Conventional, Turbocharged, Maglev), Application (Passenger Transportation, Freight Transportation) and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 鉄道車両の世界市場 (~2032年):コンポーネント・製品タイプ (機関車・高速鉄道・客車)・機関車技術 (従来型・ターボチャージャー・磁気浮上式)・用途 (旅客輸送・貨物輸送)・地域別 |

|

出版日: 2025年10月13日

発行: MarketsandMarkets

ページ情報: 英文 387 Pages

納期: 即納可能

|

概要

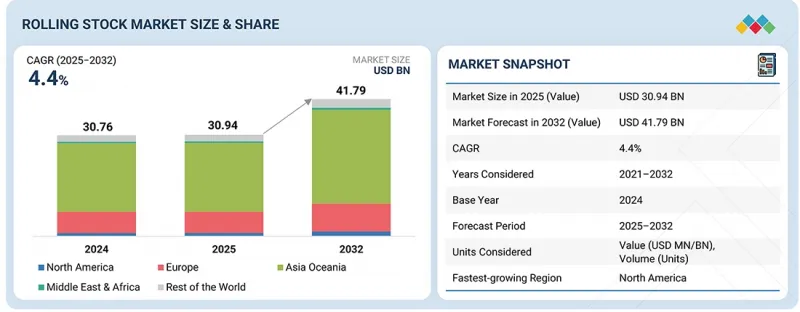

鉄道車両の市場規模は、CAGR 4.4%で推移し、2025年の309億4,000万米ドルから、2032年には417億9,000万米ドルに成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2032年 |

| 単位 | 金額 (米ドル) ・数量 (ユニット) |

| セグメント | 製品タイプ、機関車技術、コンポーネント、用途、地域別 |

| 対象地域 | アジア・オセアニア、欧州、北米、その他中東とアフリカ、その他の地域 |

鉄道車両の需要は主に、新規鉄道プロジェクト、鉄道路線の拡張、老朽化した列車の更新需要によって牽引されています。各国政府や企業は、列車をより自動化し、人の関与を減らしつつ、移動時間の短縮を目指しています。鉄道網の電化、拡張、近代化への投資が増加しており、それが新たな鉄道車両の需要を押し上げています。さらに、自律走行型、バッテリー駆動型、水素燃料電池式機関車の開発が進むことで、業界関係者に新たなビジネス機会が生まれています。

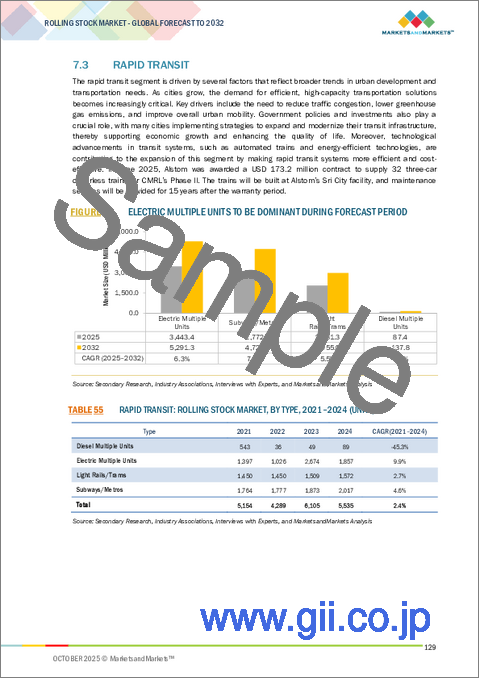

”地下鉄の部門が都市高速鉄道市場で予測期間中に大きなシェアを占める見通し"

世界最大の地下鉄網を有する中国は、軌道延長の面で最大の地下鉄市場であり、広大な鉄道網に多数の列車が運行しています。急速な都市化と交通渋滞の深刻化が、地下鉄などの効率的で大容量の交通手段への需要を押し上げています。政府および民間のステークホルダーは、既存ネットワークの拡張、新路線の開発、インフラの高度化に投資しており、旅客輸送能力と運行信頼性の向上を図っている。これらのシステムは、都市部の交通渋滞の緩和、二酸化炭素排出の削減、経済成長の支援といった役割を担うものとして広く認識されており、それが地下鉄部門への継続的な資金投入と開発を支えています。同様に、インドでも都市交通網の拡大が地下鉄市場の成長を後押ししています。

旅客輸送用鉄道車両の市場では、予測期間中に客車の部門がリードする見通し”

客車は、短距離通勤から長距離移動まで多様な旅行ニーズに対応できる汎用性の高さから、旅客輸送用鉄道車両市場を牽引すると見込まれています。また、世界的に持続可能でコスト効率の高い交通手段への関心が高まる中、客車は多くの代替輸送手段よりもエネルギー効率が高いため、需要を押し上げています。例えば、インド鉄道 (Indian Railways) は2024~2025年度に4,601両の客車を製造しました。近年の客車設計は、安全性向上のために衝突防止技術、強化構造、火災検知・抑制システム、改良された非常口などを備える一方で、乗客の快適性も大幅に向上させ、人間工学に基づく座席設計、空調制御、防音設計、Wi-Fi接続、最新のインフォテインメントシステムなどにより、安全で快適な移動を実現しています。さらに、客車の運用は需要に応じて柔軟に輸送力を調整できるため、運行効率の最適化が可能です。世界各地で進む鉄道ネットワークの近代化も、客車の拡充やアップグレードを後押ししており、現代的な基準や乗客の期待に応える形で市場拡大を支えています。

"予測期間中、欧州が鉄道車両市場で大きなシェアを占める見通し"

欧州は、広範で高度に近代化・電化された鉄道インフラを有することから、鉄道車両市場で大きなシェアを占めると予想されています。欧州連合 (EU) は持続可能性と脱炭素化を重視しており、バッテリー電車や水素駆動列車などのグリーン鉄道技術に多額の投資を行っており、二酸化炭素排出の削減とクリーン輸送の促進というEUの目標が後押しされています。ドイツ、フランス、英国などの国々では、高速鉄道や地域列車の導入が進んでおり、乗客需要と環境政策の両面がこの動きを支えています。European Green DealやDigital Rail Agendaといった取り組みも、鉄道車両の自動化、デジタル化、国境を越えた相互運用性の推進を加速させています。また、Siemens Mobility、Alstom、Stadler Railといった主要メーカーを擁する強力な製造基盤も、国内外の市場供給を支え、欧州の鉄道車両生産におけるリーダーシップを強化しています。都市化と持続可能なモビリティの進展に伴い、効率的で環境に優しい鉄道輸送への需要も一層高まっています。

当レポートでは、世界の鉄道車両の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- 顧客の事業に影響を与える動向と混乱

- 価格分析

- エコシステム分析

- サプライチェーン分析

- ケーススタディ分析

- 特許分析

- 技術分析

- 投資と資金調達のシナリオ

- 資金提供

- AI/生成AIの影響

- 貿易分析

- 関税と規制状況

- 主要な会議とイベント

- 主要なステークホルダーと購入基準

- 代替推進システムのための戦略的道筋

- 鉄道インフラ近代化戦略

- 自動運転列車技術の実装フレームワーク

第7章 鉄道車両市場:製品タイプ別

- 機関車

- ディーゼル機関車

- 電気機関車

- 電気ディーゼル機関車

- 都市高速鉄道

- ディーゼル式動力分散車

- 電車 (電動動力分散車)

- ライトレール/トラム

- 地下鉄

- モノレール

- 客車

- 貨車

- その他

- 主要な洞察

第8章 鉄道車両市場:機関車技術別

- 従来型機関車

- ターボチャージャー付き機関車

- 超電導磁気浮上式鉄道 (MAGLEV)

- 電磁サスペンション方式

- 電動サスペンション方式

- インダクトラック方式

- 主要な洞察

第9章 鉄道車両市場:用途別

- 旅客輸送

- 機関車

- 客車

- 貨物輸送

- 機関車

- 貨車

- 主要な洞察

第10章 鉄道車両市場:コンポーネント別

- 列車制御システム

- パンタグラフ

- 車軸

- 輪軸

- トラクションモーター

- 旅客情報システム

- ブレーキ

- 空調システム

- 補助電源システム

- ギアボックス

- バッフルギア

- カップラー

第11章 鉄道車両市場:地域別

- アジア・オセアニア

- マクロ経済見通し

- 都市高速鉄道プロジェクト

- ライトレール (路面電車) プロジェクト

- 高速鉄道/新幹線プロジェクト

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- マレーシア

- 欧州

- マクロ経済見通し

- 地下鉄/高速鉄道プロジェクト

- 都市高速鉄道プロジェクト

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- スイス

- オーストリア

- スウェーデン

- 北米

- マクロ経済見通し

- 高速鉄道/新幹線プロジェクト

- 都市高速鉄道プロジェクト

- 米国

- メキシコ

- カナダ

- 中東・アフリカ

- マクロ経済見通し

- 地下鉄/モノレールプロジェクト

- 都市高速鉄道プロジェクト

- 南アフリカ

- アラブ首長国連邦

- エジプト

- イラン

- 世界のその他の地域

- マクロ経済見通し

- 地下鉄/モノレールプロジェクト

- ブラジル

- ロシア

- アルゼンチン

第12章 競合情勢

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:新興企業/中小企業

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- CRRC CORPORATION LIMITED

- SIEMENS AG

- ALSTOM SA

- STADLER RAIL AG

- WABTEC CORPORATION

- KAWASAKI HEAVY INDUSTRIES, LTD.

- CAF GROUP

- HYUNDAI ROTEM COMPANY

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- TALGO

- TRANSMASHHOLDING

- TITAGARH RAIL SYSTEMS LIMITED

- その他の企業

- TOSHIBA CORPORATION

- HITACHI RAIL LIMITED

- STRUKTON

- DEUTSCHE BAHN AG

- BEML LIMITED

- RAIL VIKAS NIGAM LIMITED

- BRAITHWAITE & CO. (INDIA) LTD.

- CHITTARANJAN LOCOMOTIVE WORKS

- WJIS

- RHOMBERG SERSA RAIL HOLDING GMBH

- SINARA TRANSPORT MACHINES

- TRINITY INDUSTRIES, INC.

- THE GREENBRIER COMPANIES

- DAWONSYS CO., LTD.

第14章 MARKETSANDMARKETSによる提言

- アジア・オセアニア地域が鉄道車両市場を牽引

- 貨物輸送の増加に伴う貨車需要の高まり

- 都市高速交通への需要増が地下鉄・メトロ市場を拡大

- 結論