|

|

市場調査レポート

商品コード

1520991

坑井介入の世界市場:サービス別、介入別、用途別、坑井別、地域別 - 予測(~2029年)Well Intervention Market by Service (Logging and Bottomhole Survey, Tubing/Packer Failure and Repair, Stimulation), Intervention (Light, Medium, Heavy), Application (Onshore, Offshore) Well (Horizontal, Vertical) Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 坑井介入の世界市場:サービス別、介入別、用途別、坑井別、地域別 - 予測(~2029年) |

|

出版日: 2024年06月28日

発行: MarketsandMarkets

ページ情報: 英文 316 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の坑井介入の市場規模は、2024年の推定92億米ドルから2029年までに113億米ドルに達すると予測され、予測期間にCAGRで4.2%の成長が見込まれます。

市場の主な促進要因は、成熟した石油・ガス田の生産可能性を最大限に引き出す必要性の高まりです。オフショアおよび海底坑井への介入の需要の高まりと石油・ガスの発見の増加が、予測期間に市場に有利な機会を提供する見込みです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | サービス、介入タイプ、坑井タイプ、用途、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

「オンショア:用途別での市場の最速セグメント」

オンショアセグメントは、北米、アフリカ、アジア太平洋のようなオンショア坑井が普及している地域で石油・ガス活動が増加しているため、急成長が見込まれます。さらに、技術の進歩や非在来型資源の開発が、オンショア坑井介入サービス需要の急増に寄与しています。

「坑井タイプ別では、水平坑井セグメントが最大のセグメントとして浮上すると予測されます。」

石油・ガス産業におけるその広範な用途により、水平坑井セグメントが優位に立つ見込みです。水平坑井は、炭化水素を含む地層との接触を最大化することで貯留層の性能を高め、生産率を向上させます。特に北米などの地域では、継続的な頁岩開発と水平掘削技術の採用の増加により、このセグメントが急速に成長し、坑井介入市場全体に大きく寄与すると予測されています。

「欧州が坑井介入市場で第2位の地域に浮上すると予測されます。」

欧州は、特に英国、ノルウェー、ロシアのような国々における大きな石油・ガス産業のプレゼンスにより、坑井介入市場で第2位の市場となっています。この地域の広大なオフショア事業と重大なオンショア活動は、世界の坑井介入市場における同地域の傑出した地位の一因となっています。さらに、欧州の確立された規制枠組みと技術の進歩が市場成長をさらに促進し、石油・ガス部門の主要国となっています。

「市場のサービスセグメントでは、刺激がもっとも急速に成長すると予測されます。」

坑井介入市場における刺激セグメントの急成長は、坑井の生産性と回収率を向上させる必要性によって促進されており、水圧破砕、酸性化、マトリクス処理などの技術が重要な役割を果たしています。このセグメントは、特に北米などの地域で非在来型石油・ガス田の開発が急増していることから、大幅に拡大する見込みです。

当レポートでは、世界の坑井介入市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 坑井介入市場の企業にとって魅力的な機会

- 坑井介入市場:地域別

- 北米の坑井介入市場:介入タイプ別、国別

- 坑井介入市場:サービス別

- 坑井介入市場:介入タイプ別

- 坑井介入市場:坑井タイプ別

- 坑井介入市場:用途別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- バリューチェーン分析

- エコシステム分析

- ケーススタディ分析

- 技術分析

- 主要技術

- 隣接技術

- 補完技術

- 貿易分析

- 輸出シナリオ(HSコード730424)

- 輸入シナリオ(HSコード730424)

- 輸入シナリオ(HSコード730423)

- 輸出シナリオ(HSコード730423)

- 特許分析

- 主な会議とイベント(2024年~2025年)

- 価格分析

- 平均販売価格(ASP)の動向:地域別

- 価格動向:用途別

- 投資と資金調達のシナリオ

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- 規制枠組み

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 坑井介入市場:坑井タイプ別

- イントロダクション

- 水平坑井

- 垂直坑井

第7章 坑井介入市場:介入タイプ別

- イントロダクション

- 軽度の介入

- 中度の介入

- 重度の介入

第8章 坑井介入市場:用途別

- イントロダクション

- オンショア

- オフショア

- 浅海

- 大水深

- 超大水深

第9章 坑井介入市場:サービス別

- イントロダクション

- 伐採、坑底調査

- チュービング/パッカーの故障と修理

- 刺激

- 補修セメント

- ゾーン分離

- 砂防

- 人工リフト

- フィッシング

- 再穿孔

- その他

第10章 坑井介入市場:地域別

- イントロダクション

- 北米

- 北米の坑井介入市場に対する不況の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州の坑井介入市場に対する不況の影響

- ロシア

- ノルウェー

- 英国

- デンマーク

- その他の欧州

- アジア太平洋

- アジア太平洋の坑井介入市場に対する不況の影響

- 中国

- インド

- オーストラリア

- インドネシア

- マレーシア

- その他のアジア太平洋

- アフリカ

- アフリカの坑井介入市場に対する不況の影響

- ナイジェリア

- アルジェリア

- アンゴラ

- その他のアフリカ

- 中東

- 中東の坑井介入市場に対する不況の影響

- 湾岸協力会議

- イラク

- イラン

- その他の中東

- 中南米

- ブラジル

- ベネズエラ

- アルゼンチン

- その他の中南米

第11章 競合情勢

- 概要

- 主要企業戦略/有力企業(2020年~2024年)

- 市場シェア分析(2023年)

- 市場の評価フレームワーク

- 収益分析(2019年~2023年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- SLB

- HALLIBURTON

- BAKER HUGHES

- WEATHERFORD

- ARCHER

- EXPRO GROUP

- TRICAN.

- PATTERSON-UTI

- NINE ENERGY SERVICE

- KEY ENERGY SERVICES

- FORUM ENERGY TECHNOLOGIES, INC.

- OCEANEERING INTERNATIONAL, INC.

- INTERVENTEK SUBSEA ENGINEERING

- AJ LUCAS GROUP

- CHINA OILFIELD SERVICES LIMITED

- その他の企業

- OILSERV

- AKOFS OFFSHORE

- TAQA KSA

- WELLTEC

- HUNTING PLC

- HELIX ENERGY

- NOV

- SUPERIOR ENERGY SERVICES

- STEP ENERGY SERVICES

- PROWELL ENERGY

第13章 付録

List of Tables

- TABLE 1 WELL INTERVENTION MARKET: INCLUSIONS AND EXCLUSIONS, BY SERVICE

- TABLE 2 WELL INTERVENTION MARKET: INCLUSIONS AND EXCLUSIONS, BY INTERVENTION TYPE

- TABLE 3 WELL INTERVENTION MARKET: INCLUSIONS AND EXCLUSIONS, BY WELL TYPE

- TABLE 4 WELL INTERVENTION MARKET: INCLUSIONS AND EXCLUSIONS, BY APPLICATION

- TABLE 5 WELL INTERVENTION MARKET: INCLUSIONS AND EXCLUSIONS, BY REGION

- TABLE 6 DEMAND FOR WELL INTERVENTION SERVICES: NEW VS. OLD WELLS

- TABLE 7 COST & FREQUENCY OF WELLS IN DIFFERENT REGIONS GOING FOR WELL INTERVENTION

- TABLE 8 WELL INTERVENTION MARKET SNAPSHOT

- TABLE 9 NATURAL GAS AND CRUDE OIL PRODUCTION, BY REGION, 2022

- TABLE 10 ROLE OF COMPANIES IN WELL INTERVENTION ECOSYSTEM

- TABLE 11 EXPORT DATA RELATED TO HS CODE 730424-COMPLIANT PRODUCTS, BY REGION/COUNTRY, 2020-2022 (USD THOUSAND)

- TABLE 12 IMPORT DATA RELATED TO HS CODE 730424-COMPLIANT PRODUCTS, BY REGION/COUNTRY, 2020-2022 (USD THOUSAND)

- TABLE 13 IMPORT DATA RELATED TO HS CODE 730423-COMPLIANT PRODUCTS, BY REGION/COUNTRY, 2020-2022 (USD THOUSAND)

- TABLE 14 EXPORT DATA RELATED TO HS CODE 730423-COMPLIANT PRODUCTS, BY REGION/COUNTRY, 2020-2022 (USD THOUSAND)

- TABLE 15 WELL INTERVENTION MARKET: LIST OF MAJOR PATENTS RELATED TO WELL INTERVENTION SOLUTIONS, 2020-2024

- TABLE 16 WELL INTERVENTION MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 17 AVERAGE SELLING PRICE (ASP) TREND OF WELL INTERVENTION SERVICES, BY REGION, 2021-2029 (USD THOUSAND)

- TABLE 18 INDICATIVE PRICING TREND OF WELL INTERVENTION SERVICES, BY APPLICATION, 2023 (USD THOUSAND)

- TABLE 19 WEATHERFORD: FUNDING DETAILS

- TABLE 20 ARCHER: FUNDING DETAILS

- TABLE 21 KEY ENERGY SERVICES: FUNDING DETAILS

- TABLE 22 PIONEER ENERGY: FUNDING DETAILS

- TABLE 23 MFN TARIFF RELATED TO HS CODE 845921-COMPLIANT PRODUCTS, BY COUNTRY, 2022

- TABLE 24 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 SOUTH & CENTRAL AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 WELL INTERVENTION MARKET: REGULATORY FRAMEWORK

- TABLE 31 WELL INTERVENTION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 33 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 34 WELL INTERVENTION MARKET, BY WELL TYPE, 2019-2022 (USD MILLION)

- TABLE 35 WELL INTERVENTION MARKET, BY WELL TYPE, 2023-2029 (USD MILLION)

- TABLE 36 HORIZONTAL WELL: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 37 HORIZONTAL WELL: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 38 VERTICAL WELL: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 39 VERTICAL WELL: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 40 WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2019-2022 (USD MILLION)

- TABLE 41 WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2023-2029 (USD MILLION)

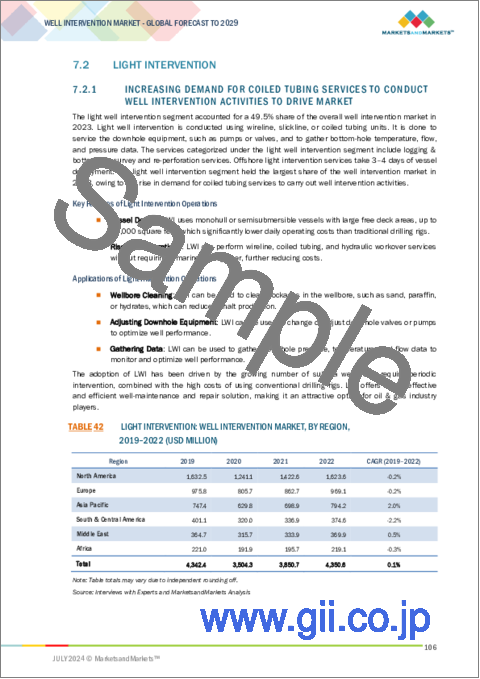

- TABLE 42 LIGHT INTERVENTION: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 43 LIGHT INTERVENTION: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 44 MEDIUM INTERVENTION: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 45 MEDIUM INTERVENTION: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 46 HEAVY INTERVENTION: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 47 HEAVY INTERVENTION: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 48 WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 49 WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 50 ONSHORE: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 ONSHORE: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 52 OFFSHORE: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 53 OFFSHORE: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 54 OFFSHORE: WELL INTERVENTION MARKET, BY DEPTH, 2019-2022 (USD MILLION)

- TABLE 55 OFFSHORE: WELL INTERVENTION MARKET, BY DEPTH, 2023-2029 (USD MILLION)

- TABLE 56 WELL INTERVENTION MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 57 WELL INTERVENTION MARKET, BY SERVICE, 2023-2029 (USD MILLION)

- TABLE 58 LOGGING & BOTTOMHOLE SURVEY: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 LOGGING & BOTTOMHOLE SURVEY: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 60 TUBING/PACKER FAILURE AND REPAIR: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 61 TUBING/PACKER FAILURE AND REPAIR: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 62 STIMULATION: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 STIMULATION: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 64 REMEDIAL CEMENTING: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 REMEDIAL CEMENTING: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 66 ZONAL ISOLATION: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 67 ZONAL ISOLATION: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 68 SAND CONTROL: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 69 SAND CONTROL: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 70 ARTIFICIAL LIFT: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 71 ARTIFICIAL LIFT: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 72 FISHING: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 73 FISHING: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 74 RE-PERFORATION: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 75 RE-PERFORATION: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 76 OTHERS: WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 77 OTHERS: WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 78 WELL INTERVENTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 79 WELL INTERVENTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 80 NORTH AMERICA: WELL INTERVENTION MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: WELL INTERVENTION MARKET, BY SERVICE, 2023-2029 (USD MILLION)

- TABLE 82 NORTH AMERICA: WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2019-2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2023-2029 (USD MILLION)

- TABLE 84 NORTH AMERICA: WELL INTERVENTION MARKET, BY WELL TYPE, 2019-2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: WELL INTERVENTION MARKET, BY WELL TYPE, 2023-2029 (USD MILLION)

- TABLE 86 NORTH AMERICA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: WELL INTERVENTION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: WELL INTERVENTION MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 90 US: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 91 US: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 92 CANADA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 93 CANADA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 94 MEXICO: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 95 MEXICO: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 96 EUROPE: WELL INTERVENTION MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 97 EUROPE: WELL INTERVENTION MARKET, BY SERVICE, 2023-2029 (USD MILLION)

- TABLE 98 EUROPE: WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2019-2022 (USD MILLION)

- TABLE 99 EUROPE: WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2023-2029 (USD MILLION)

- TABLE 100 EUROPE: WELL INTERVENTION MARKET, BY WELL TYPE, 2019-2022 (USD MILLION)

- TABLE 101 EUROPE: WELL INTERVENTION MARKET, BY WELL TYPE, 2023-2029 (USD MILLION)

- TABLE 102 EUROPE: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 103 EUROPE: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 104 EUROPE: WELL INTERVENTION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 105 EUROPE WELL INTERVENTION MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 106 RUSSIA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 107 RUSSIA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 108 NORWAY: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 109 NORWAY: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 110 UK: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 111 UK: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 112 DENMARK: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 113 DENMARK: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 114 REST OF EUROPE: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 115 REST OF EUROPE: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 116 ASIA PACIFIC: WELL INTERVENTION MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: WELL INTERVENTION MARKET, BY SERVICE, 2023-2029 (USD MILLION)

- TABLE 118 ASIA PACIFIC: WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2019-2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2023-2029 (USD MILLION)

- TABLE 120 ASIA PACIFIC: WELL INTERVENTION MARKET, BY WELL TYPE, 2019-2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: WELL INTERVENTION MARKET, BY WELL TYPE, 2023-2029 (USD MILLION)

- TABLE 122 ASIA PACIFIC: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 124 ASIA PACIFIC: WELL INTERVENTION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: WELL INTERVENTION MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 126 CHINA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 127 CHINA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 128 INDIA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 129 INDIA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 130 AUSTRALIA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 131 AUSTRALIA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 132 INDONESIA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 133 INDONESIA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 134 MALAYSIA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 135 MALAYSIA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 138 AFRICA: WELL INTERVENTION MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 139 AFRICA: WELL INTERVENTION MARKET, BY SERVICE, 2023-2029 (USD MILLION)

- TABLE 140 AFRICA: WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2019-2022 (USD MILLION)

- TABLE 141 AFRICA: WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2023-2029 (USD MILLION)

- TABLE 142 AFRICA: WELL INTERVENTION MARKET, BY WELL TYPE, 2019-2022 (USD MILLION)

- TABLE 143 AFRICA: WELL INTERVENTION MARKET, BY WELL TYPE, 2023-2029 (USD MILLION)

- TABLE 144 AFRICA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 145 AFRICA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 146 AFRICA: WELL INTERVENTION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 147 AFRICA: WELL INTERVENTION MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 148 NIGERIA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 149 NIGERIA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 150 ALGERIA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 151 ALGERIA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 152 ANGOLA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 153 ANGOLA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 154 REST OF AFRICA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 155 REST OF AFRICA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 156 MIDDLE EAST: WELL INTERVENTION MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 157 MIDDLE EAST: WELL INTERVENTION MARKET, BY SERVICE, 2023-2029 (USD MILLION)

- TABLE 158 MIDDLE EAST: WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2019-2022 (USD MILLION)

- TABLE 159 MIDDLE EAST: WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2023-2029 (USD MILLION)

- TABLE 160 MIDDLE EAST: WELL INTERVENTION MARKET, BY WELL TYPE, 2019-2022 (USD MILLION)

- TABLE 161 MIDDLE EAST: WELL INTERVENTION MARKET, BY WELL TYPE, 2023-2029 (USD MILLION)

- TABLE 162 MIDDLE EAST: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 163 MIDDLE EAST: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 164 MIDDLE EAST: WELL INTERVENTION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 165 MIDDLE EAST: WELL INTERVENTION MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 166 GCC: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 167 GCC: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 168 GCC: WELL INTERVENTION MARKET SIZE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 169 GCC: WELL INTERVENTION MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 170 SAUDI ARABIA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 171 SAUDI ARABIA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 172 UAE: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 173 UAE: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 174 REST OF GCC: HIGH-VOLTAGE POWER TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 175 REST OF GCC: HIGH-VOLTAGE POWER TRANSFORMER MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 176 IRAQ: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 177 IRAQ: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 178 IRAN: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 179 IRAN: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 180 REST OF MIDDLE EAST: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 182 SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 183 SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET, BY SERVICE, 2023-2029 (USD MILLION)

- TABLE 184 SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2019-2022 (USD MILLION)

- TABLE 185 SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2023-2029 (USD MILLION)

- TABLE 186 SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET, BY WELL TYPE, 2019-2022 (USD MILLION)

- TABLE 187 SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET, BY WELL TYPE, 2023-2029 (USD MILLION)

- TABLE 188 SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 189 SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 190 SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 191 SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 192 BRAZIL: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 193 BRAZIL: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 194 VENEZUELA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 195 VENEZUELA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 196 ARGENTINA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 197 ARGENTINA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 198 REST OF SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 199 REST OF SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 200 WELL INTERVENTION MARKET: OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, JANUARY 2020-MAY 2024

- TABLE 201 WELL INTERVENTION MARKET: DEGREE OF COMPETITION, 2023

- TABLE 202 MARKET EVALUATION FRAMEWORK, 2020-2024

- TABLE 203 WELL INTERVENTION MARKET: REGION FOOTPRINT

- TABLE 204 WELL INTERVENTION MARKET: SERVICE FOOTPRINT

- TABLE 205 WELL INTERVENTION MARKET: APPLICATION FOOTPRINT

- TABLE 206 WELL INTERVENTION MARKET: INTERVENTION TYPE FOOTPRINT

- TABLE 207 WELL INTERVENTION MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 208 WELL INTERVENTION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 209 WELL INTERVENTION MARKET: PRODUCT LAUNCHES, JANUARY 2020-MAY 2024

- TABLE 210 WELL INTERVENTION MARKET: DEALS, JANUARY 2020-MAY 2024

- TABLE 211 WELL INTERVENTION MARKET: OTHERS, JANUARY 2020-MAY 2024

- TABLE 212 SLB: COMPANY OVERVIEW

- TABLE 213 SLB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 214 SLB: PRODUCT LAUNCHES

- TABLE 215 SLB: DEALS

- TABLE 216 SLB: EXPANSIONS

- TABLE 217 SLB: OTHERS

- TABLE 218 HALLIBURTON: COMPANY OVERVIEW

- TABLE 219 HALLIBURTON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 220 HALLIBURTON: PRODUCT LAUNCHES

- TABLE 221 HALLIBURTON: DEALS

- TABLE 222 HALLIBURTON: OTHERS

- TABLE 223 BAKER HUGHES: COMPANY OVERVIEW

- TABLE 224 BAKER HUGHES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 225 BAKER HUGHES: PRODUCT LAUNCHES

- TABLE 226 BAKER HUGHES: DEALS

- TABLE 227 BAKER HUGHES: OTHERS

- TABLE 228 WEATHERFORD: COMPANY OVERVIEW

- TABLE 229 WEATHERFORD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 230 WEATHERFORD: PRODUCT LAUNCHES

- TABLE 231 WEATHERFORD: DEALS

- TABLE 232 WEATHERFORD: OTHERS

- TABLE 233 ARCHER: COMPANY OVERVIEW

- TABLE 234 ARCHER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 235 ARCHER: DEALS

- TABLE 236 ARCHER: OTHERS

- TABLE 237 EXPRO GROUP: COMPANY OVERVIEW

- TABLE 238 EXPRO GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 239 EXPRO GROUP: DEALS

- TABLE 240 EXPRO GROUP: OTHERS

- TABLE 241 TRICAN.: COMPANY OVERVIEW

- TABLE 242 TRICAN.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 243 PATTERSON-UTI: COMPANY OVERVIEW

- TABLE 244 PATTERSON-UTI: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 245 PATTERSON-UTI: DEALS

- TABLE 246 NINE ENERGY SERVICE: COMPANY OVERVIEW

- TABLE 247 NINE ENERGY SERVICE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 248 NINE ENERGY SERVICE: EXPANSIONS

- TABLE 249 KEY ENERGY SERVICES: COMPANY OVERVIEW

- TABLE 250 KEY ENERGY SERVICES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 251 KEY ENERGY SERVICES: DEALS

- TABLE 252 FORUM ENERGY TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 253 FORUM ENERGY TECHNOLOGIES, INC.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 254 FORUM ENERGY TECHNOLOGIES, INC.: OTHERS

- TABLE 255 OCEANEERING INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 256 OCEANEERING INTERNATIONAL, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 257 OCEANEERING INTERNATIONAL, INC.: DEALS

- TABLE 258 OCEANEERING INTERNATIONAL, INC.: OTHERS

- TABLE 259 INTERVENTEK SUBSEA ENGINEERING: COMPANY OVERVIEW

- TABLE 260 INTERVENTEK SUBSEA ENGINEERING: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 261 HALLIBURTON: PRODUCT LAUNCHES

- TABLE 262 INTERVENTEK SUBSEA ENGINEERING: DEALS

- TABLE 263 AJ LUCAS GROUP: COMPANY OVERVIEW

- TABLE 264 AJ LUCAS GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 265 AJ LUCAS GROUP: DEALS

- TABLE 266 CHINA OILFIELD SERVICES LIMITED: COMPANY OVERVIEW

- TABLE 267 CHINA OILFIELD SERVICES LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 268 CHINA OILFIELD SERVICES LIMITED: OTHERS

List of Figures

- FIGURE 1 WELL INTERVENTION MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 CRUDE OIL PRICE VS. RIG COUNT, 2013-2023 (USD PER BARREL)

- FIGURE 7 CRUDE OIL PRICE TREND, 2014-2023 (USD PER BARREL)

- FIGURE 8 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR WELL INTERVENTION SOLUTIONS AND SERVICES

- FIGURE 9 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF WELL INTERVENTION SOLUTIONS AND SERVICES

- FIGURE 10 WELL INTERVENTION MARKET: SUPPLY-SIDE ANALYSIS

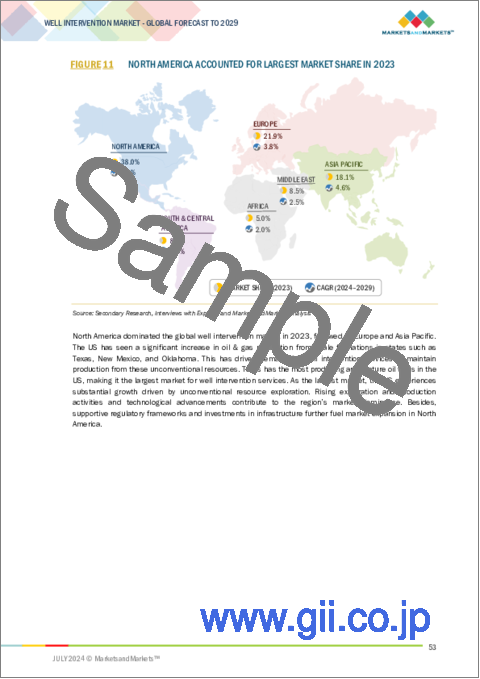

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 12 LOGGING & BOTTOMHOLE SURVEY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 13 LIGHT INTERVENTION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 14 HORIZONTAL WELL SEGMENT TO HOLD LARGER MARKET SHARE IN 2029

- FIGURE 15 ONSHORE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2029

- FIGURE 16 GROWING NEED TO INCREASE PRODUCTION FROM MATURE OIL & GAS FIELDS TO DRIVE DEMAND FOR WELL INTERVENTION SOLUTIONS AND SERVICES

- FIGURE 17 NORTH AMERICA TO RECORD HIGHEST CAGR IN WELL INTERVENTION MARKET BETWEEN 2024 AND 2029

- FIGURE 18 LIGHT INTERVENTION SEGMENT AND US HELD LARGEST SHARES OF NORTH AMERICAN WELL INTERVENTION MARKET IN 2023

- FIGURE 19 LOGGING & BOTTOMHOLE SURVEY SEGMENT TO ACCOUNT FOR LARGEST SHARE OF WELL INTERVENTION MARKET IN 2029

- FIGURE 20 LIGHT INTERVENTION SEGMENT TO ACCOUNT FOR LARGEST SHARE OF WELL INTERVENTION MARKET IN 2029

- FIGURE 21 HORIZONTAL WELL SEGMENT TO ACCOUNT FOR LARGER SHARE OF WELL INTERVENTION MARKET IN 2029

- FIGURE 22 ONSHORE SEGMENT TO ACCOUNT FOR LARGER SHARE OF WELL INTERVENTION MARKET IN 2029

- FIGURE 23 WELL INTERVENTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 OIL PRODUCTION, BY REGION, 2019-2023 (MILLION BARRELS/DAY)

- FIGURE 25 GLOBAL OIL DEMAND, 2019-2023 (THOUSAND BARRELS/DAY)

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 27 VALUE CHAIN ANALYSIS OF WELL INTERVENTION MARKET

- FIGURE 28 PARTICIPANTS IN WELL INTERVENTION ECOSYSTEM

- FIGURE 29 EXPORT DATA RELATED TO HS CODE 730424-COMPLIANT PRODUCTS FOR KEY REGIONS/COUNTRIES, 2020-2022 (USD THOUSAND)

- FIGURE 30 IMPORT DATA RELATED TO HS CODE 730424-COMPLIANT PRODUCTS FOR KEY REGIONS/COUNTRIES, 2020-2022 (USD THOUSAND)

- FIGURE 31 IMPORT DATA RELATED TO HS CODE 730423-COMPLIANT PRODUCTS FOR KEY REGIONS/COUNTRIES, 2020-2022 (USD THOUSAND)

- FIGURE 32 EXPORT DATA RELATED TO HS CODE 730423-COMPLIANT PRODUCTS FOR KEY REGIONS/COUNTRIES, 2020-2022 (USD THOUSAND)

- FIGURE 33 PATENTS APPLIED AND GRANTED RELATED TO WELL INTERVENTION SOLUTIONS, 2013-2023

- FIGURE 34 AVERAGE SELLING PRICE (ASP) TREND OF WELL INTERVENTION SERVICES, BY REGION, 2021-2029 (USD THOUSAND)

- FIGURE 35 INDICATIVE PRICING TREND OF WELL INTERVENTION SERVICES, BY APPLICATION, 2023 (USD THOUSAND)

- FIGURE 36 INVESTMENT AND FUNDING SCENARIO OF KEY PLAYERS IN WELL INTERVENTION MARKET, 2024 (USD BILLION)

- FIGURE 37 PORTER'S FIVE FORCES ANALYSIS RELATED TO WELL INTERVENTION MARKET

- FIGURE 38 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 39 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 40 WELL INTERVENTION MARKET, BY WELL TYPE, 2023

- FIGURE 41 WELL INTERVENTION MARKET, BY INTERVENTION TYPE, 2023

- FIGURE 42 WELL INTERVENTION MARKET, BY APPLICATION, 2023

- FIGURE 43 WELL INTERVENTION MARKET, BY SERVICE, 2023

- FIGURE 44 NORTH AMERICA TO REGISTER HIGHEST CAGR IN WELL INTERVENTION MARKET FROM 2024 TO 2029

- FIGURE 45 WELL INTERVENTION MARKET, BY REGION, 2023

- FIGURE 46 NORTH AMERICA: WELL INTERVENTION MARKET SNAPSHOT

- FIGURE 47 EUROPE: WELL INTERVENTION MARKET SNAPSHOT

- FIGURE 48 WELL INTERVENTION MARKET SHARE ANALYSIS, 2023

- FIGURE 49 WELL INTERVENTION MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019-2023 (USD BILLION)

- FIGURE 50 WELL INTERVENTION MARKET: COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 51 WELL INTERVENTION MARKET: FINANCIAL METRICS, 2024

- FIGURE 52 WELL INTERVENTION MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 53 WELL INTERVENTION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 54 WELL INTERVENTION MARKET: COMPANY FOOTPRINT

- FIGURE 55 WELL INTERVENTION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 56 SLB: COMPANY SNAPSHOT

- FIGURE 57 HALLIBURTON: COMPANY SNAPSHOT

- FIGURE 58 BAKER HUGHES: COMPANY SNAPSHOT

- FIGURE 59 WEATHERFORD: COMPANY SNAPSHOT

- FIGURE 60 ARCHER: COMPANY SNAPSHOT

- FIGURE 61 EXPRO GROUP: COMPANY SNAPSHOT

- FIGURE 62 TRICAN.: COMPANY SNAPSHOT

- FIGURE 63 PATTERSON-UTI: COMPANY SNAPSHOT

- FIGURE 64 NINE ENERGY SERVICE: COMPANY SNAPSHOT

- FIGURE 65 KEY ENERGY SERVICES: COMPANY SNAPSHOT

- FIGURE 66 FORUM ENERGY TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 67 OCEANEERING INTERNATIONAL, INC.: COMPANY SNAPSHOT

- FIGURE 68 AJ LUCAS GROUP: COMPANY SNAPSHOT

- FIGURE 69 CHINA OILFIELD SERVICES LIMITED: COMPANY SNAPSHOT

The Well Intervention market is expected to grow from an estimated USD 9.2 billion in 2024 to USD 11.3 billion by 2029, at a CAGR of 4.2% during the forecast period. The main driver for the well intervention market is the growing need to maximize the production potential of mature oil and gas fields. Growing demand for offshore and subsea well intervention and increasing oil and gas discoveries are expected to offer lucrative opportunities for the well intervention market during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | Service, Intervention Type, Well Type, Application and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Onshore: The fastest segment of the Well Intervention market, by application"

Based on application, the Well Intervention market has been split into two types: Onshore and Offshore. The onshore segment is poised for rapid growth due to increasing oil and gas activities in regions like North America, Africa, and Asia Pacific, where onshore wells are prevalent. Additionally, technological advancements and the development of unconventional resources contribute to the surge in demand for well intervention services onshore. This segment benefits from cost efficiencies compared to offshore operations, driving its prominence in the market.

"Horizontal Well segment is expected to emerge as the largest segment based on well type."

Based on well type, the Well Intervention market has been segmented into horizontal well and vertical well. The horizontal well segment is poised for dominance due to its extensive application in the oil and gas industry. Horizontal wells enhance reservoir performance by maximizing contact with hydrocarbon-bearing formations, thus increasing production rates. With continuous shale developments and the rising adoption of horizontal drilling techniques, particularly in regions like North America, this segment is projected to grow rapidly, contributing significantly to the overall well intervention market.

"Europe is expected to emerge as the second-largest region based on the Well Intervention market"

By region, the Well Intervention market has been segmented into Asia Pacific, North America, South America, Europe, and Middle East & Africa. Europe ranks as the second-largest market for well intervention due to its substantial oil and gas industry presence, particularly in countries like the United Kingdom, Norway, and Russia. The region's extensive offshore operations and significant onshore activities contribute to its prominent position in the global well intervention market. Moreover, Europe's well-established regulatory framework and technological advancements further bolster its market growth, making it a key oil and gas sector player.

"Stimulation is expected to be the fastest segment based on the service segment of the Well Intervention Market."

Based on service, the Well Intervention market has been segment into; logging and bottom hole survey, tubing/packer failure & repair, stimulation, remedial cementing, zonal isolation, sand control services, artificial lift, fishing, re-perforation, and others. The stimulation segment's rapid growth in the well intervention market is driven by the need to enhance well productivity and recovery rates, with techniques like hydraulic fracturing, acidizing, and matrix treatments playing crucial roles. This segment is expected to expand significantly, particularly due to the surge in developments in unconventional oil and gas fields, notably in regions like North America.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 45%, Tier 2- 30%, and Tier 3- 25%

By Designation: C-Level- 35%, Director Levels- 25%, and Others- 40%

By Region: North America- 35%, Europe- 20%, Asia Pacific- 33%, RoW-12%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The Well Intervention market is dominated by a few major players with a wide regional presence. The leading players are Halliburton (US), SLB (US), Baker Hughes (US), and Weatherford (US).

Research Coverage:

The report defines, describes, and forecasts the Well Intervention market, by service, intervention type, well type, application and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the Well Intervention market.

Key Benefits of Buying the Report

- Growing need for maximizing production potential of mature oil & gas fields drive the market. Lack of consistent financial support for well intervention installation hinders the market growth. Rising need for replacement of inefficient boilers offer lucrative opportunities in the market. Limited adoption of fossil fuel-based well intervention systems are major challenges faced by the market.

- Product Development/ Innovation: The trends, such as the integration of tools, technologies, and equipment by major players, are allowing companies to perform complex interventions.

- Market Development: The market for well intervention is rising due to increased demand for enhancing well productivity and recovery rates. Techniques like hydraulic fracturing, acidizing, and matrix treatments are essential for optimizing reservoir performance, particularly in unconventional oil and gas fields, driving the market's growth globally.

- Market Diversification: Weatherford International launched ForeSite sense, a reservoir monitoring solution that provides real-time critical downhole data such as pressure, temperature, and flow measurements. ForeSite sense serves applications across mature wells, shale wells, and deepwater wells.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the well intervention market, such as Halliburton (US), SLB (US), Baker Hughes (US), and Weatherford (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Participants for primary interviews

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primaries

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.3 KEY INFLUENCING FACTORS/DRIVERS

- 2.3.3.1 Well count

- 2.3.3.2 Rig count

- 2.3.3.3 Crude oil prices

- 2.3.4 DEMAND-SIDE ANALYSIS

- 2.3.4.1 Country-level analysis

- 2.3.4.2 Demand-side calculations

- 2.3.4.3 Assumptions for demand-side analysis

- 2.3.5 SUPPLY-SIDE ANALYSIS

- 2.3.5.1 Supply-side calculations

- 2.3.5.2 Assumptions for supply-side analysis

- 2.4 FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

- 2.8 RECESSION IMPACT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WELL INTERVENTION MARKET

- 4.2 WELL INTERVENTION MARKET, BY REGION

- 4.3 WELL INTERVENTION MARKET IN NORTH AMERICA, BY INTERVENTION TYPE AND COUNTRY

- 4.4 WELL INTERVENTION MARKET, BY SERVICE

- 4.5 WELL INTERVENTION MARKET, BY INTERVENTION TYPE

- 4.6 WELL INTERVENTION MARKET, BY WELL TYPE

- 4.7 WELL INTERVENTION MARKET, BY APPLICATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing need to increase production potential of mature oil & gas fields

- 5.2.1.2 Development of shale reservoirs

- 5.2.1.3 Increasing demand for oil & gas in Asia Pacific

- 5.2.2 RESTRAINTS

- 5.2.2.1 Strict government regulations pertaining to exploration and production activities

- 5.2.2.2 Declining oil demand in Europe

- 5.2.2.3 Volatility in oil prices and decline in upstream capital investments

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing oil & gas discoveries

- 5.2.3.2 Digitalization and automation of well intervention solutions

- 5.2.3.3 Growing demand for offshore and subsea well intervention

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities associated with well intervention operations in high-pressure, high-temperature (HPHT) environmental conditions

- 5.2.4.2 Implementation of artificial lift technologies in horizontal wells

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 PROJECTS IN NORTH SEA AND GULF OF MEXICO ENHANCED WELL INTERVENTION IN OIL & GAS INDUSTRY

- 5.6.2 REPOSOL SINOPEC RESOURCES UK LTD REQUESTED EXPRO TO CONDUCT PRODUCT OPTIMIZATION STUDY

- 5.6.3 INDEPENDENT WELL OPERATOR IN TEXAS AND OKLAHOMA RESOLVED SUSTAINED CASING PRESSURE PROBLEMS USING SLB'S CEMPRIME SCRUB SPACER AND CEMFIT HEAL SYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Reline mechanical non-slip (MNS)

- 5.7.1.2 Well integrity management systems

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 Logging and data acquisition

- 5.7.2.2 Remote monitoring and control

- 5.7.3 COMPLIMENTARY TECHNOLOGIES

- 5.7.3.1 Artificial Intelligence (AI) and Machine Learning (ML)

- 5.7.3.2 Digital twin

- 5.7.1 KEY TECHNOLOGIES

- 5.8 TRADE ANALYSIS

- 5.8.1 EXPORT SCENARIO (HS CODE 730424)

- 5.8.2 IMPORT SCENARIO (HS CODE 730424)

- 5.8.3 IMPORT SCENARIO (HS CODE 730423)

- 5.8.4 EXPORT SCENARIO (HS CODE 730423)

- 5.9 PATENT ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE (ASP) TREND, BY REGION

- 5.11.2 INDICATIVE PRICING TREND, BY APPLICATION

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 REGULATORY FRAMEWORK

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

6 WELL INTERVENTION MARKET, BY WELL TYPE

- 6.1 INTRODUCTION

- 6.2 HORIZONTAL WELL

- 6.2.1 SHALE DEVELOPMENTS TO BOOST SEGMENTAL GROWTH

- 6.3 VERTICAL WELL

- 6.3.1 INCREASING COUNT OF MATURE CONVENTIONAL FIELDS TO DRIVE MARKET

7 WELL INTERVENTION MARKET, BY INTERVENTION TYPE

- 7.1 INTRODUCTION

- 7.2 LIGHT INTERVENTION

- 7.2.1 INCREASING DEMAND FOR COILED TUBING SERVICES TO CONDUCT WELL INTERVENTION ACTIVITIES TO DRIVE MARKET

- 7.3 MEDIUM INTERVENTION

- 7.3.1 RISING DEVELOPMENTS IN UNCONVENTIONAL RESERVES WITH SUPPORT OF SNUBBING UNITS TO BOOST MARKET GROWTH

- 7.4 HEAVY INTERVENTION

- 7.4.1 DEVELOPMENTS IN MATURE FIELDS TO DRIVE DEMAND

8 WELL INTERVENTION MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 ONSHORE

- 8.2.1 INCREASING NUMBER OF ONSHORE OIL & GAS AND MATURE FIELDS TO DRIVE DEMAND

- 8.3 OFFSHORE

- 8.3.1 SHALLOW WATER

- 8.3.1.1 Maturing shallow oilfields in Middle East and Europe to fuel demand

- 8.3.2 DEEPWATER

- 8.3.2.1 Increase in deepwater exploration and production to create growth opportunities for market players

- 8.3.3 ULTRA-DEEPWATER

- 8.3.3.1 Critical environmental conditions in ultra-deepwater locations to drive demand

- 8.3.1 SHALLOW WATER

9 WELL INTERVENTION MARKET, BY SERVICE

- 9.1 INTRODUCTION

- 9.2 LOGGING & BOTTOMHOLE SURVEY

- 9.2.1 GROWING NEED TO ENHANCE WELL INTERVENTION EFFICIENCY THROUGH ADVANCED LOGGING & BOTTOMHOLE SURVEYS TO DRIVE MARKET

- 9.3 TUBING/PACKER FAILURE AND REPAIR

- 9.3.1 NEED TO MAINTAIN WELL INTEGRITY AND REDUCE DOWNTIME TO DRIVE DEMAND

- 9.4 STIMULATION

- 9.4.1 NEED FOR IMPROVED HYDROCARBON RECOVERY TO BOOST MARKET GROWTH

- 9.5 REMEDIAL CEMENTING

- 9.5.1 NEED TO RESTORE WELLBORE INTEGRITY TO DRIVE DEMAND

- 9.6 ZONAL ISOLATION

- 9.6.1 INCREASING OIL & GAS PRODUCTION FROM MATURE AND HORIZONTAL WELLS TO DRIVE MARKET

- 9.7 SAND CONTROL

- 9.7.1 REDEVELOPMENT OF AGING RESERVOIRS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- 9.8 ARTIFICIAL LIFT

- 9.8.1 NEED TO ENHANCE FLOW RATES AND MAINTAIN WELL PRODUCTION TO DRIVE DEMAND

- 9.9 FISHING

- 9.9.1 RISING DEMAND FOR EFFICIENCY AND COST-EFFECTIVENESS IN WELL INTERVENTION SERVICES TO DRIVE MARKET

- 9.10 RE-PERFORATION

- 9.10.1 GROWING PRODUCTION FROM MATURE WELLS TO SUPPORT MARKET GROWTH

- 9.11 OTHERS

10 WELL INTERVENTION MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 IMPACT OF RECESSION ON WELL INTERVENTION MARKET IN NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Increasing production from mature shale and tight oil reserves to drive demand

- 10.2.3 CANADA

- 10.2.3.1 Potential drilling of oil sands and increase in onshore oil production to boost demand

- 10.2.4 MEXICO

- 10.2.4.1 Increasing investments in enhancing production from aging fields and developing shale resources to drive market

- 10.3 EUROPE

- 10.3.1 IMPACT OF RECESSION ON WELL INTERVENTION MARKET IN EUROPE

- 10.3.2 RUSSIA

- 10.3.2.1 Increasing exploration and production activities to drive market

- 10.3.3 NORWAY

- 10.3.3.1 Rapidly depleting mature oil & gas fields and increase in exploration activities in Norwegian Continental Shelf (NCS) to fuel demand

- 10.3.4 UK

- 10.3.4.1 Maximizing production potential in brownfields to fuel market growth

- 10.3.5 DENMARK

- 10.3.5.1 Redevelopment of mature offshore fields to drive market

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 IMPACT OF RECESSION ON WELL INTERVENTION MARKET IN ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Increasing exploration and production from unconventional resources to fuel market growth

- 10.4.3 INDIA

- 10.4.3.1 Redevelopment of legacy oilfields and government initiatives to improve exploration activities to drive market

- 10.4.4 AUSTRALIA

- 10.4.4.1 Development of unconventional shale resources and focus on redeveloping mature fields to create growth opportunities for market players

- 10.4.5 INDONESIA

- 10.4.5.1 Steep decline in production from mature fields to fuel demand

- 10.4.6 MALAYSIA

- 10.4.6.1 Increasing capital expenditure on exploration and drilling activities to boost market growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 AFRICA

- 10.5.1 IMPACT OF RECESSION ON WELL INTERVENTION MARKET IN AFRICA

- 10.5.2 NIGERIA

- 10.5.2.1 Rise in exploration activities and developments in mature oil & gas fields to boost market growth

- 10.5.3 ALGERIA

- 10.5.3.1 Initiatives to increase exploration activities to support market growth

- 10.5.4 ANGOLA

- 10.5.4.1 Government-led incentives and initiatives to develop oil reserves to drive demand

- 10.5.5 REST OF AFRICA

- 10.6 MIDDLE EAST

- 10.6.1 IMPACT OF RECESSION ON WELL INTERVENTION MARKET IN MIDDLE EAST

- 10.6.2 GCC

- 10.6.2.1 Saudi Arabia

- 10.6.2.1.1 Increased crude production from onshore fields and surge in offshore exploration to drive market

- 10.6.2.2 UAE

- 10.6.2.2.1 Rising focus on increasing oil production per day to fuel demand

- 10.6.2.3 Rest of GCC

- 10.6.2.1 Saudi Arabia

- 10.6.3 IRAQ

- 10.6.3.1 Increasing onshore well drilling activities to create growth opportunities for market players

- 10.6.4 IRAN

- 10.6.4.1 Large oil reserves and high oil exploration to drive market

- 10.6.5 REST OF MIDDLE EAST

- 10.7 SOUTH & CENTRAL AMERICA

- 10.7.1 BRAZIL

- 10.7.1.1 Increasing offshore exploration and production activities to boost market growth

- 10.7.2 VENEZUELA

- 10.7.2.1 Government-led initiates to revitalize oil production activities to fuel demand

- 10.7.3 ARGENTINA

- 10.7.3.1 Shale developments to create potential demand

- 10.7.4 REST OF SOUTH & CENTRAL AMERICA

- 10.7.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 MARKET SHARE ANALYSIS, 2023

- 11.4 MARKET EVALUATION FRAMEWORK

- 11.5 REVENUE ANALYSIS, 2019-2023

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.8.1 STARS

- 11.8.2 PERVASIVE PLAYERS

- 11.8.3 EMERGING LEADERS

- 11.8.4 PARTICIPANTS

- 11.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.8.5.1 Company footprint

- 11.8.5.2 Region footprint

- 11.8.5.3 Service footprint

- 11.8.5.4 Application footprint

- 11.8.5.5 Intervention type footprint

- 11.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- 11.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.9.5.1 Detailed list of key startups/SMEs

- 11.9.5.2 Competitive benchmarking of key startups/SMEs

- 11.10 COMPETITIVE SCENARIOS AND TRENDS

- 11.10.1 PRODUCT LAUNCHES

- 11.10.2 DEALS

- 11.10.3 OTHERS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SLB

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Services/Solutions offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Expansions

- 12.1.1.3.4 Others

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 HALLIBURTON

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Services/Solutions offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Others

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 BAKER HUGHES

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Services/Solutions offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Others

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 WEATHERFORD

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Services/Solutions offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Others

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 ARCHER

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Services/Solutions offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.3.2 Others

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 EXPRO GROUP

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Services/Solutions offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.3.2 Others

- 12.1.7 TRICAN.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Services/Solutions offered

- 12.1.8 PATTERSON-UTI

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Services/Solutions offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 NINE ENERGY SERVICE

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Services/Solutions offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Expansions

- 12.1.10 KEY ENERGY SERVICES

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Services/Solutions offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.11 FORUM ENERGY TECHNOLOGIES, INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Services/Solutions offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Others

- 12.1.12 OCEANEERING INTERNATIONAL, INC.

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Services/Solutions offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.12.3.2 Others

- 12.1.13 INTERVENTEK SUBSEA ENGINEERING

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Services/Solutions offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches

- 12.1.13.3.2 Deals

- 12.1.14 AJ LUCAS GROUP

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Services/Solutions offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.15 CHINA OILFIELD SERVICES LIMITED

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Services/Solutions offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Others

- 12.1.1 SLB

- 12.2 OTHER PLAYERS

- 12.2.1 OILSERV

- 12.2.2 AKOFS OFFSHORE

- 12.2.3 TAQA KSA

- 12.2.4 WELLTEC

- 12.2.5 HUNTING PLC

- 12.2.6 HELIX ENERGY

- 12.2.7 NOV

- 12.2.8 SUPERIOR ENERGY SERVICES

- 12.2.9 STEP ENERGY SERVICES

- 12.2.10 PROWELL ENERGY

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS