|

|

市場調査レポート

商品コード

1493073

水素エンジンの世界市場:状態別、用途別、定格出力別、混合別、地域別 - 予測(~2035年)Hydrogen IC Engines Market by State (Gas and Liquid), Application (Transportation and Power Generation), Power Rating (Low, Medium, and High), Blending (Mix Blend and Pure Hydrogen) and Region - Global Forecast to 2035 |

||||||

カスタマイズ可能

|

|||||||

| 水素エンジンの世界市場:状態別、用途別、定格出力別、混合別、地域別 - 予測(~2035年) |

|

出版日: 2024年06月07日

発行: MarketsandMarkets

ページ情報: 英文 201 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の水素エンジンの市場規模は、2024年の1,200万米ドルから2035年までに3億2,700万米ドルに達すると推定され、予測期間にCAGRで34.7%の成長が見込まれます。

水素エンジンは、従来の化石燃料エンジン、さらにはバッテリー電気自動車(EV)の潜在的な代替品として支持を集めており、水素エンジンインフラへの需要を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2035年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2035年 |

| 単位 | 100万米ドル |

| セグメント | 状態別、定格出力別、用途別、混合別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「液体:水素エンジン市場の状態別での急成長セグメント」

予測期間に液体セグメントがもっとも急成長する見込みです。液体水素の生産と貯蔵における近年の進歩により、エンジンの燃料としての利用可能性が大幅に高まっています。こうした改良は、コスト削減、効率向上、技術革新など、複数の主要セグメントにまたがり、水素を従来の化石燃料に代わる、より実用的で魅力的な選択肢にしています。

定格出力別では、中出力セグメントが予測期間にもっとも急成長する見込みです。

中出力セグメントが予測期間に市場でもっとも急成長するセグメントになる見込みです。海運、大型輸送、定置式発電などの産業は、ディーゼルエンジンや天然ガスエンジンに代わる持続可能な選択肢を探しています。水素エンジンは、その類似した運転特性により、実現可能な選択肢を提供します。

アジア太平洋が予測期間に市場で最大の地域になる見込みです。

アジア太平洋の急速な経済成長と都市化が、クリーンで効率的な輸送ソリューションへの需要を押し上げ、水素エンジンの大きな市場機会を生み出しています。アジア太平洋の政府は、水素技術の採用を促進する政策を実施し、インセンティブを提供するようになっています。日本や韓国のような国々は、野心的な水素ロードマップを設定し、水素自動車やインフラ開発に対する補助金や税制優遇措置を提供しています。

当レポートでは、世界の水素エンジン市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 水素エンジン市場の企業にとって魅力的な機会

- 水素エンジン市場:地域別

- 水素エンジン市場:状態別

- 水素エンジン市場:定格出力別

- 水素エンジン市場:用途別

- アジア太平洋の水素エンジン市場:状態別、用途別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 価格設定の分析(定性的)

- サプライチェーン分析

- メーカー

- 販売業者

- エンドユーザー

- エコシステム

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- ケーススタディ分析

- 特許分析

- 貿易分析

- 輸出シナリオ

- 輸入シナリオ

- 主な会議とイベント

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制枠組み

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 投資と資金調達のシナリオ

第6章 水素エンジン市場:混合別

- イントロダクション

- 混合

- 純水素

第7章 水素エンジン市場:状態別

- イントロダクション

- 気体

- 液体

第8章 水素エンジン市場:定格出力別

- イントロダクション

- 低出力

- 中出力

- 高出力

第9章 水素エンジン市場:用途別

- イントロダクション

- 輸送

- 発電

第10章 水素エンジン市場:地域別

- イントロダクション

- アジア太平洋

- アジア太平洋に対する不況の影響

- 中国

- インド

- 日本

- その他のアジア太平洋

- 欧州

- 欧州に対する不況の影響

- ドイツ

- 英国

- ノルウェー

- フランス

- イタリア

- その他の欧州

- 北米

- 北米に対する不況の影響

- 米国

- カナダ

- その他の地域

- その他の地域に対する不況の影響

- 南米

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要企業が採用した戦略

- 産業集中(2023年)

- 市場評価枠組み

- 主要市場企業のセグメント収益の分析

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 競合ベンチマーキング:主要企業(2023年)

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- WARTSILA

- GARRETT MOTION INC.

- BEHYDRO

- DEUTZ AG

- MAN ENERGY SOLUTIONS

- CUMMINS INC.

- KAWASAKI HEAVY INDUSTRIES, LTD.

- TOYOTA MOTOR CORPORATION

- MAZDA MOTOR CORPORATION

- RELIANCE INDUSTRIES LIMITED

- AVL

- AB VOLVO PENTA

- FAW JIEFANG AUTOMOTIVE CO., LTD

- KOHLER ENERGY

- J C BAMFORD EXCAVATORS LTD

- その他の企業(開発中の製品)

- LIEBHERR GROUP

- ROBERT BOSCH GMBH

- YANMAR HOLDINGS CO., LTD.

- KEYOU GMBH

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- ROLLS-ROYCE PLC

第13章 付録

The global hydrogen IC engines market is estimated to grow from USD 12 million in 2024 to USD 327 million by 2035; it is expected to record a CAGR of 34.7% during the forecast period. Hydrogen internal combustion engines (ICEs) are gaining traction as a potential alternative to traditional fossil-fuel engines and even to battery electric vehicles (EVs), driving the demand for hydrogen IC engines infrastructure.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2035 |

| Base Year | 2023 |

| Forecast Period | 2024-2035 |

| Units Considered | Value (USD Million) |

| Segments | Hydrogen IC Engines Market by state, power rating, application, blending and Region. |

| Regions covered | North America, Europe, Asia Pacific, and RoW. |

"Liquid": The fastest growing segment of the Hydrogen IC Engines market, by state "

Based on state, the hydrogen IC engines market has been segmented into gas and liquid. The liquid segment is expected to be the fastest-growing segment during the forecast period. Recent advancements in the production and storage of liquid hydrogen are significantly enhancing its viability as a fuel option for internal combustion engines (IC engines). These improvements span several key areas, including cost reductions, increased efficiency, and technological innovations, making hydrogen a more practical and attractive alternative to traditional fossil fuels.

"By power rating, the medium segment is expected to be the fastest growing segment during the forecast period."

Based on power rating, the hydrogen IC engines market is segmented into low, medium and high. The medium segment is expected to be the fastest-growing segment of the hydrogen IC engines market during the forecast period. Industries such as shipping, heavy-duty transport, and stationary power generation are looking for sustainable alternatives to diesel and natural gas engines. Hydrogen ICEs provide a feasible option due to their similar operational characteristics.

"Asia Pacific" is expected to be the largest region in the Hydrogen IC Engines market."

Asia pacific is expected to be the largest region in the hydrogen IC engines market during the forecast period. The rapid economic growth and urbanization in the Asia-Pacific region are boosting the demand for clean and efficient transportation solutions, creating a substantial market opportunity for hydrogen IC engines. Governments in the Asia Pacific region are increasingly implementing policies and providing incentives to promote the adoption of hydrogen technology. Countries like Japan and South Korea have set ambitious hydrogen roadmaps, offering subsidies and tax incentives for hydrogen-powered vehicles and infrastructure development.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 65%, Tier 2- 24%, and Tier 3- 11%

By Designation: C-Level- 30%, Director Level- 25%, and Others- 45%

By Region: North America- 20%, Europe- 25%, Asia Pacific- 30%, ROW-25%

Note: Others include sales managers, engineers, and regional managers.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2022. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The hydrogen IC engines market is dominated by a few major players that have a wide regional presence. The leading players in the hydrogen IC engines market are Wartsila (Finland), GARRETT MOTION INC. (Switzerland), BeHydro (Belgium), DEUTZ AG (Germany), MAN Energy Solutions (Germany). The major strategy adopted by the players includes new product launches, contracts, agreements, partnerships, joint ventures, acquisitions, and investments & expansions.

Research Coverage:

The report defines, describes, and forecasts the global hydrogen IC engines Market based on state, power rating, application, blending and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the hydrogen IC engines market.

Key Benefits of Buying the Report

- Government initiatives at the national and international levels amplify the impact of investment on the hydrogen IC engines market. Robust policy frameworks, often accompanied by financial incentives, subsidies, and regulatory support, encourage widespread adoption of hydrogen IC engines. Factors such as high initial cost and lack of infrastructure restrain the growth of the market. The growing energy transition towards renewable energy sources and rapid urbanization are expected to present lucrative opportunities for the players operating in the hydrogen IC engines.

- Product Development/ Innovation: The hydrogen IC engines market is witnessing significant product development and innovation, driven by the growing demand for environmentally friendly, safe and sustainable products. Companies are investing in developing advanced hydrogen IC engines technologies for various applications.

- Market Development: DEUTZ AG and RheinEnergie AG have partnered to initiate a pilot project focused on generating power using a stationary hydrogen engine. The objective is to utilize this engine to drive a generator capable of producing 170 kilovolt-amperes of electricity. The trial will take place at RheinEnergie's cogeneration plant in Cologne-Niehl, where RheinEnergie is responsible for sourcing the hydrogen and ensuring its supply. Initially, the two partners plan to invest a combined total of approximately USD 1.54 million in the trial operation at the Niehl facility.

- Market Diversification: Wartsila has entered into a partnership with energy firms EPV Energy and Vaasan Sahko to develop a hydrogen engine power plant. This collaboration presents a significant opportunity to explore Power-to-X-to-Power solutions. Extensive research will be conducted on various future fuels and engine technologies to expedite progress towards a cleaner environment. Additionally, both hydrogen production and storage capacities can be expanded in the future.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, like include Wartsila (Finland), GARRETT MOTION INC. (Switzerland), BeHydro (Belgium), DEUTZ AG (Germany), MAN Energy Solutions (Germany), among others in the hydrogen IC engines market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 HYDROGEN IC ENGINES MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- FIGURE 2 HYDROGEN IC ENGINES MARKET SEGMENTATION, BY REGION

- 1.3.3 YEARS CONSIDERED

- FIGURE 3 STUDY PERIOD CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 RESEARCH LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 4 HYDROGEN IC ENGINES MARKET: RESEARCH DESIGN

- 2.2 PRIMARY AND SECONDARY RESEARCH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of key secondary sources

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- 2.2.1.2 Key data from secondary sources

- FIGURE 5 KEY DATA FROM SECONDARY SOURCES

- 2.2.2 PRIMARY DATA

- 2.2.2.1 List of primary interview participants

- TABLE 2 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- 2.2.2.2 Key data from primary sources

- FIGURE 6 KEY DATA FROM PRIMARY SOURCES

- 2.2.2.3 Breakdown of primaries

- FIGURE 7 BREAKDOWN OF PRIMARY SOURCES, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 8 HYDROGEN IC ENGINES MARKET: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 9 HYDROGEN IC ENGINES MARKET: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- FIGURE 10 METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR HYDROGEN IC ENGINES

- 2.3.3.1 Assumptions for demand-side analysis

- 2.3.3.2 Calculations for demand-side analysis

- 2.3.4 SUPPLY-SIDE ANALYSIS

- FIGURE 11 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF HYDROGEN IC ENGINES

- 2.3.4.1 Assumptions for supply-side analysis

- 2.3.4.2 Calculations for supply-side analysis

- 2.4 FORECAST

- 2.5 DATA TRIANGULATION

- FIGURE 12 DATA TRIANGULATION

- 2.6 RISK ASSESSMENT

- 2.7 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- TABLE 3 HYDROGEN IC ENGINES MARKET SNAPSHOT

- FIGURE 13 EUROPE ACCOUNTED FOR LARGEST SHARE OF HYDROGEN IC ENGINES MARKET IN 2023

- FIGURE 14 LOW RATING HYDROGEN IC ENGINES TO DOMINATE MARKET THROUGH 2035

- FIGURE 15 LIQUID HYDROGEN IC ENGINES TO ACCOUNT FOR SIGNIFICANT SHARE OF MARKET THROUGH 2035

- FIGURE 16 TRANSPORTATION APPLICATION TO DOMINATE HYDROGEN IC ENGINES MARKET THROUGH 2035

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HYDROGEN IC ENGINES MARKET

- FIGURE 17 INVESTMENT IN HYDROGEN INFRASTRUCTURE TO DRIVE MARKET DURING FORECAST PERIOD

- 4.2 HYDROGEN IC ENGINES MARKET, BY REGION

- FIGURE 18 NORTH AMERICA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 HYDROGEN IC ENGINES MARKET, BY STATE

- FIGURE 19 LIQUID SEGMENT DOMINATED MARKET IN 2023

- 4.4 HYDROGEN IC ENGINES MARKET, BY POWER RATING

- FIGURE 20 LOW POWER RATING WAS LARGEST SEGMENT IN 2023

- 4.5 HYDROGEN IC ENGINES MARKET, BY APPLICATION

- FIGURE 21 TRANSPORTATION APPLICATION ACCOUNTED FOR LION'S SHARE IN 2023

- 4.6 ASIA PACIFIC: HYDROGEN IC ENGINES MARKET, BY STATE & APPLICATION

- FIGURE 22 LIQUID AND TRANSPORTATION ACCOUNTED FOR LARGEST SEGMENTAL SHARES IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 HYDROGEN IC ENGINES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Potential for long range and fast refueling

- 5.2.1.2 Growing Investments and government policies

- FIGURE 24 POTENTIAL DEMAND AND PRODUCTION TARGETS FOR LOW-EMISSION HYDROGEN, BY SECTOR, 2030 (METRIC TON)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Safety concerns regarding flammability

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Continuous technological advancements

- 5.2.3.2 Growing consumer interest

- 5.2.4 CHALLENGES

- 5.2.4.1 Competition from electric and fuel cell vehicles

- 5.2.4.2 Challenge in storing and distributing hydrogen safely and efficiently

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS (QUALITATIVE)

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 26 HYDROGEN IC ENGINES MARKET: SUPPLY CHAIN ANALYSIS

- 5.5.1 MANUFACTURERS

- 5.5.2 DISTRIBUTORS

- 5.5.3 END USERS

- 5.6 ECOSYSTEM

- TABLE 4 COMPANIES AND THEIR ROLES IN HYDROGEN IC ENGINES MARKET ECOSYSTEM

- FIGURE 27 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Fuel cell stack

- 5.7.1.2 Hydrogen management

- 5.7.1.3 Power electronics

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Renewable energy sources

- 5.7.2.2 Electrolyzers

- 5.7.2.3 Battery storage

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Solid-state hydrogen storage

- 5.7.3.2 High-temperature superconductors

- 5.7.3.3 Ammonia engines

- 5.7.1 KEY TECHNOLOGIES

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 EVOLUTION OF HYDROGEN TECHNOLOGY IN HEAVY-DUTY TRANSPORTATION

- 5.8.2 TUPY PARTNERED WITH AVL AND WESTPORT IN QUEST FOR ZERO-EMISSION SOLUTIONS

- 5.8.3 HYDROGEN-POWERED MINE TRUCK FOR ANGLO AMERICAN MINE

- 5.9 PATENT ANALYSIS

- FIGURE 28 HYDROGEN IC ENGINES MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2013-2023

- 5.9.1 LIST OF KEY PATENTS

- TABLE 5 HYDROGEN IC ENGINES MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2019-2023

- 5.10 TRADE ANALYSIS

- 5.10.1 EXPORT SCENARIO

- TABLE 6 EXPORT DATA FOR HS CODE 280410, BY COUNTRY, 2021-2023 (USD THOUSAND)

- FIGURE 29 EXPORT DATA FOR HS CODE 280410 FOR TOP FIVE COUNTRIES, 2021-2023 (USD THOUSAND)

- 5.10.2 IMPORT SCENARIO

- TABLE 7 IMPORT DATA FOR HS CODE 280410, BY COUNTRY, 2021-2023 (USD THOUSAND)

- FIGURE 30 IMPORT DATA FOR HS CODE 280410 FOR TOP FIVE COUNTRIES, 2021-2023 (USD THOUSAND)

- 5.11 KEY CONFERENCES AND EVENTS

- TABLE 8 HYDROGEN IC ENGINES MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2023-2024

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY FRAMEWORK

- TABLE 13 HYDROGEN IC ENGINES MARKET: REGULATIONS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 HYDROGEN IC ENGINES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 HYDROGEN IC ENGINES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

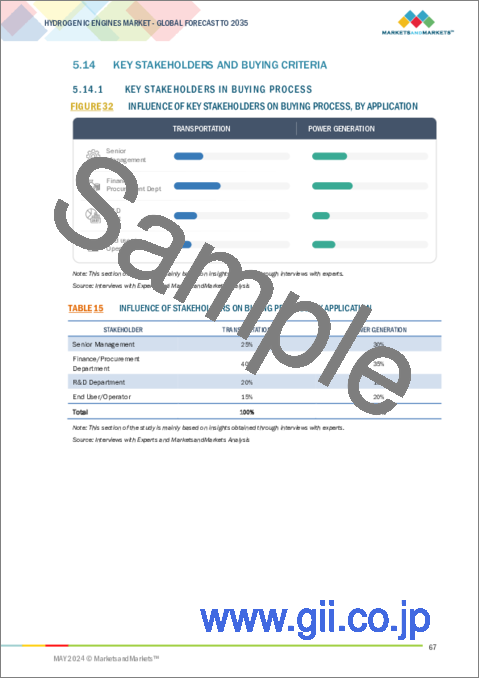

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 32 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- 5.14.2 BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA, BY POWER RATING

- TABLE 16 KEY BUYING CRITERIA, BY POWER RATING

- 5.15 INVESTMENT AND FUNDING SCENARIO

- FIGURE 34 INVESTMENT AND FUNDING SCENARIO (USD MILLION)

6 HYDROGEN IC ENGINES MARKET, BY BLENDING

- 6.1 INTRODUCTION

- 6.2 MIX BLEND

- 6.3 PURE HYDROGEN

7 HYDROGEN IC ENGINES MARKET, BY STATE

- 7.1 INTRODUCTION

- FIGURE 35 HYDROGEN IC ENGINES MARKET SHARE, BY STATE, 2023

- TABLE 17 HYDROGEN IC ENGINES MARKET, BY STATE, 2023-2035 (USD MILLION)

- 7.2 GAS

- 7.2.1 INCREASE IN HYDROGEN REFUELING STATIONS DESIGNED FOR GASEOUS HYDROGEN TO ENCOURAGE ADOPTION

- TABLE 18 GASEOUS HYDROGEN IC ENGINES MARKET, BY REGION, 2023-2035 (USD MILLION)

- 7.3 LIQUID

- 7.3.1 ADVANCES IN CRYOGENIC TECHNOLOGY IMPROVED FEASIBILITY OF STORING LIQUID HYDROGEN SAFELY AND EFFICIENTLY

- TABLE 19 LIQUID HYDROGEN IC ENGINES MARKET, BY REGION, 2023-2035 (USD MILLION)

8 HYDROGEN IC ENGINES MARKET, BY POWER RATING

- 8.1 INTRODUCTION

- FIGURE 36 HYDROGEN IC ENGINES MARKET SHARE, BY POWER RATING, 2023

- TABLE 20 HYDROGEN IC ENGINES MARKET, BY POWER RATING, 2023-2035 (USD MILLION)

- 8.2 LOW

- 8.2.1 SMOOTH POWER DELIVERY, WELL-SUITED FOR LOW-POWER APPLICATIONS

- TABLE 21 LOW-POWER HYDROGEN IC ENGINES MARKET, BY REGION, 2023-2035 (USD MILLION)

- 8.3 MEDIUM

- 8.3.1 INVESTMENTS IN HYDROGEN INFRASTRUCTURE DEVELOPMENT AND INITIATIVES TOWARD BUILDING EXTENSIVE NETWORK

- TABLE 22 MEDIUM-POWER HYDROGEN IC ENGINES MARKET, BY REGION, 2023-2035 (USD MILLION)

- 8.4 HIGH

- 8.4.1 INVESTMENT BY PROMINENT ENGINE MANUFACTURERS AND ENERGY COMPANIES

- TABLE 23 HIGH-POWER HYDROGEN IC ENGINES MARKET, BY REGION, 2023-2035 (USD MILLION)

9 HYDROGEN IC ENGINES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 37 HYDROGEN IC ENGINES MARKET SHARE, BY APPLICATION, 2023

- TABLE 24 HYDROGEN IC ENGINES MARKET, BY APPLICATION, 2023-2035 (USD MILLION)

- 9.2 TRANSPORTATION

- 9.2.1 ENVIRONMENTAL REGULATIONS ADVOCATING FOR CLEANER TRANSPORTATION SOLUTIONS

- TABLE 25 HYDROGEN IC ENGINES MARKET IN TRANSPORTATION, BY REGION, 2023-2035 (USD MILLION)

- 9.3 POWER GENERATION

- 9.3.1 KEY DRIVERS IN POWER GENERATION: GRID BALANCING AND PEAK POWER DEMANDS

- TABLE 26 HYDROGEN IC ENGINES MARKET IN POWER GENERATION, BY REGION, 2023-2035 (USD MILLION)

10 HYDROGEN IC ENGINES MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 38 HYDROGEN IC ENGINES MARKET IN NORTH AMERICA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 HYDROGEN IC ENGINES MARKET SHARE, BY REGION, 2023

- TABLE 27 HYDROGEN IC ENGINES MARKET, BY REGION, 2023-2035 (USD MILLION)

- 10.2 ASIA PACIFIC

- FIGURE 40 ASIA PACIFIC: REGIONAL SNAPSHOT, 2023

- 10.2.1 ASIA PACIFIC: RECESSION IMPACT

- TABLE 28 ASIA PACIFIC: HYDROGEN IC ENGINES MARKET, BY STATE, 2023-2035 (USD MILLION)

- TABLE 29 ASIA PACIFIC: HYDROGEN IC ENGINES MARKET, BY POWER RATING, 2023-2035 (USD MILLION)

- TABLE 30 ASIA PACIFIC: HYDROGEN IC ENGINES MARKET, BY APPLICATION, 2023-2035 (USD MILLION)

- 10.2.2 CHINA

- 10.2.2.1 Largest market for evs; focus on innovations in HICE

- 10.2.3 INDIA

- 10.2.3.1 Oems working toward goals set by National Green Hydrogen Mission

- 10.2.4 JAPAN

- 10.2.4.1 Policies mandating plans supporting non-fossil fuel-powered vehicles, with focus on trucks and passenger cars

- 10.2.5 REST OF ASIA PACIFIC

- 10.3 EUROPE

- FIGURE 41 EUROPE: REGIONAL SNAPSHOT, 2023

- 10.3.1 EUROPE: RECESSION IMPACT

- TABLE 31 EUROPE: HYDROGEN IC ENGINES MARKET, BY STATE, 2023-2035 (USD MILLION)

- TABLE 32 EUROPE: HYDROGEN IC ENGINES MARKET, BY POWER RATING, 2023-2035 (USD MILLION)

- TABLE 33 EUROPE: HYDROGEN IC ENGINES MARKET, BY APPLICATION, 2023-2035 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Rapid refueling advantage of hydrogen IC engine trucks

- 10.3.3 UK

- 10.3.3.1 HICE vehicles to reshape UK maritime landscape

- 10.3.4 NORWAY

- 10.3.4.1 Norway's commitment to green mobility aligning with global shifts

- 10.3.5 FRANCE

- 10.3.5.1 France's strategic move toward affordable hydrogen cars

- 10.3.6 ITALY

- 10.3.6.1 Increase in public awareness and acceptance of hydrogen as clean and sustainable energy source

- 10.3.7 REST OF EUROPE

- 10.4 NORTH AMERICA

- 10.4.1 NORTH AMERICA: RECESSION IMPACT

- TABLE 34 NORTH AMERICA: HYDROGEN IC ENGINES MARKET, BY STATE, 2023-2035 (USD MILLION)

- TABLE 35 NORTH AMERICA: HYDROGEN IC ENGINES MARKET, BY POWER RATING, 2023-2035 (USD MILLION)

- TABLE 36 NORTH AMERICA: HYDROGEN IC ENGINES MARKET, BY APPLICATION, 2023-2035 (USD MILLION)

- 10.4.2 US

- 10.4.2.1 Addressing concerns about emissions in heavy-duty transportation with regulations

- 10.4.3 CANADA

- 10.4.3.1 Potential for scalable hydrogen production methods

- 10.5 REST OF THE WORLD (ROW)

- 10.5.1 ROW: RECESSION IMPACT

- TABLE 37 ROW: HYDROGEN IC ENGINES MARKET, BY STATE, 2023-2035 (USD MILLION)

- TABLE 38 ROW: HYDROGEN IC ENGINES MARKET, BY POWER RATING, 2023-2035 (USD MILLION)

- TABLE 39 ROW: HYDROGEN IC ENGINES MARKET, BY APPLICATION, 2023-2035 (USD MILLION)

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Potential for easy recycling and reuse of components in hydrogen IC engines

- 10.5.3 MIDDLE EAST & AFRICA

- 10.5.3.1 Projects and initiatives aligning with vision for hydrogen export

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 40 HYDROGEN IC ENGINE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2024

- 11.3 INDUSTRY CONCENTRATION, 2023

- FIGURE 42 INDUSTRY CONCENTRATION OF PLAYERS IN HYDROGEN IC ENGINE MARKET, 2023

- 11.4 MARKET EVALUATION FRAMEWORK

- TABLE 41 MARKET EVALUATION FRAMEWORK, 2019-2023

- 11.5 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 43 HYDROGEN IC ENGINE MARKET: SEGMENTAL REVENUE ANALYSIS, 2019-2023 (USD MILLION)

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 44 COMPANY VALUATION, 2024 (USD MILLION)

- FIGURE 45 EV/EBITDA, 2024

- 11.7 BRAND/PRODUCT COMPARISON

- FIGURE 46 BRAND/PRODUCT COMPARISON

- 11.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- FIGURE 47 HYDROGEN IC ENGINE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS) 2023

- 11.8.5 COMPANY FOOTPRINT, KEY PLAYERS, 2023

- 11.8.5.1 Company footprint

- FIGURE 48 HYDROGEN IC ENGINE: PRODUCT FOOTPRINT, 2023

- FIGURE 49 HYDROGEN IC ENGINE: MARKET FOOTPRINT, 2023

- 11.8.5.2 Regional footprint

- TABLE 42 HYDROGEN IC ENGINE MARKET: REGIONAL FOOTPRINT, 2023

- 11.8.5.3 State footprint

- TABLE 43 HYDROGEN IC ENGINE MARKET: STATE FOOTPRINT, 2023

- 11.8.5.4 Application footprint

- TABLE 44 HYDROGEN IC ENGINE MARKET: APPLICATION FOOTPRINT, 2023

- 11.8.5.5 Power rating footprint

- TABLE 45 HYDROGEN IC ENGINE MARKET: POWER RATING FOOTPRINT, 2023

- 11.9 COMPETITIVE BENCHMARKING: KEY PLAYERS, 2023

- 11.9.1 LIST OF KEY PLAYERS

- TABLE 46 HYDROGEN IC ENGINE MARKET: KEY PLAYERS, 2023

- 11.9.2 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 47 HYDROGEN IC ENGINE: KEY PLAYERS, 2023

- 11.10 COMPETITIVE SCENARIOS AND TRENDS

- 11.10.1 PRODUCT LAUNCHES

- TABLE 48 HYDROGEN IC ENGINE MARKET: PRODUCT LAUNCHES, JANUARY 2019-MARCH 2024

- 11.10.2 DEALS

- TABLE 49 HYDROGEN IC ENGINE MARKET: DEALS, JANUARY 2019-MARCH 2024

- 11.10.3 OTHER DEVELOPMENTS

- TABLE 50 HYDROGEN IC ENGINE MARKET: EXPANSIONS, JANUARY 2019-MARCH 2024

- TABLE 51 HYDROGEN IC ENGINE MARKET: OTHERS, JANUARY 2019-MARCH 2024

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1.1 WARTSILA

- TABLE 52 WARTSILA: BUSINESS OVERVIEW

- FIGURE 50 WARTSILA: COMPANY SNAPSHOT

- TABLE 53 WARTSILA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 54 WARTSILA: PRODUCT LAUNCHES

- TABLE 55 WARTSILA: DEALS

- 12.1.2 GARRETT MOTION INC.

- TABLE 56 GARRETT MOTION INC.: BUSINESS OVERVIEW

- FIGURE 51 GARRETT MOTION INC.: COMPANY SNAPSHOT

- TABLE 57 GARRETT MOTION INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 58 GARRETT MOTION INC.: PRODUCT LAUNCHES

- 12.1.3 BEHYDRO

- TABLE 59 BEHYRDO: BUSINESS OVERVIEW

- TABLE 60 BEHYRDO: PRODUCTS SOLUTIONS/SERVICES OFFERED

- TABLE 61 BEHYRDO: PRODUCT LAUNCHES

- 12.1.4 DEUTZ AG

- TABLE 62 DEUTZ AG: BUSINESS OVERVIEW

- FIGURE 52 DEUTZ AG: COMPANY SNAPSHOT

- TABLE 63 DEUTZ AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 64 DEUTZ AG: PRODUCT LAUNCHES

- TABLE 65 DEUTZ AG: DEALS

- TABLE 66 DEUTZ AG: OTHERS

- 12.1.5 MAN ENERGY SOLUTIONS

- TABLE 67 MAN ENERGY SOLUTIONS: BUSINESS OVERVIEW

- TABLE 68 MAN ENERGY SOLUTIONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 69 MAN ENERGY SOLUTIONS: PRODUCT LAUNCHES

- TABLE 70 MAN ENERGY SOLUTIONS: DEALS

- 12.1.6 CUMMINS INC.

- TABLE 71 CUMMINS INC.: BUSINESS OVERVIEW

- FIGURE 53 CUMMINS INC.: COMPANY SNAPSHOT

- TABLE 72 CUMMINS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 73 CUMMINS INC.: PRODUCT LAUNCHES

- TABLE 74 CUMMINS INC.: DEALS

- TABLE 75 CUMMINS INC.: EXPANSIONS

- TABLE 76 CUMMINS INC.: OTHERS

- 12.1.7 KAWASAKI HEAVY INDUSTRIES, LTD.

- TABLE 77 KAWASAKI HEAVY INDUSTRIES, LTD.: BUSINESS OVERVIEW

- FIGURE 54 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- TABLE 78 KAWASAKI HEAVY INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 79 KAWASAKI HEAVY INDUSTRIES, LTD.: PRODUCT LAUNCHES

- TABLE 80 KAWASAKI HEAVY INDUSTRIES, LTD.: DEALS

- TABLE 81 KAWASAKI HEAVY INDUSTRIES, LTD.: OTHERS

- 12.1.8 TOYOTA MOTOR CORPORATION

- TABLE 82 TOYOTA MOTOR CORPORATION: BUSINESS OVERVIEW

- FIGURE 55 TOYOTA MOTOR CORPORATION: COMPANY SNAPSHOT

- TABLE 83 TOYOTA MOTOR CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 84 TOYOTA MOTOR CORPORATION: DEALS

- 12.1.9 MAZDA MOTOR CORPORATION

- TABLE 85 MAZDA MOTOR CORPORATION: BUSINESS OVERVIEW

- FIGURE 56 MAZDA MOTOR CORPORATION: COMPANY SNAPSHOT

- TABLE 86 MAZDA MOTOR CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- 12.1.10 RELIANCE INDUSTRIES LIMITED

- TABLE 87 RELIANCE INDUSTRIES LIMITED: BUSINESS OVERVIEW

- FIGURE 57 RELIANCE INDUSTRIES LIMITED: COMPANY SNAPSHOT

- TABLE 88 RELIANCE INDUSTRIES LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 89 RELIANCE INDUSTRIES LIMITED: PRODUCT LAUNCHES

- 12.1.11 AVL

- TABLE 90 AVL: BUSINESS OVERVIEW

- TABLE 91 AVL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 92 AVL: PRODUCT LAUNCHES

- TABLE 93 AVL: DEALS

- 12.1.12 AB VOLVO PENTA

- TABLE 94 AB VOLVO PENTA: BUSINESS OVERVIEW

- TABLE 95 AB VOLVO PENTA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 96 AB VOLVO PENTA: DEALS

- 12.1.13 FAW JIEFANG AUTOMOTIVE CO.,LTD

- TABLE 97 FAW JIEFANG AUTOMOTIVE CO., LTD: BUSINESS OVERVIEW

- TABLE 98 FAW JIEFANG AUTOMOTIVE CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.14 KOHLER ENERGY

- TABLE 99 KOHLER ENERGY: BUSINESS OVERVIEW

- TABLE 100 KOHLER ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 101 KOHLER ENERGY: PRODUCT LAUNCHES

- 12.1.15 J C BAMFORD EXCAVATORS LTD

- TABLE 102 J C BAMFORD EXCAVATORS LTD: BUSINESS OVERVIEW

- TABLE 103 J C BAMFORD EXCAVATORS LTD: PRODUCTS SOLUTIONS/SERVICES OFFERED

- TABLE 104 J C BAMFORD EXCAVATORS LTD: OTHERS

- 12.2 OTHER PLAYERS (PRODUCT UNDER DEVELOPMENT)

- 12.2.1 LIEBHERR GROUP

- TABLE 105 LIEBHERR GROUP: BUSINESS OVERVIEW

- TABLE 106 LIEBHERR GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 107 LIEBHERR GROUP: PRODUCT LAUNCHES

- 12.2.2 ROBERT BOSCH GMBH

- TABLE 108 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

- TABLE 109 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 110 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- 12.2.3 YANMAR HOLDINGS CO., LTD.

- TABLE 111 YANMAR HOLDINGS CO., LTD.: BUSINESS OVERVIEW

- TABLE 112 YANMAR HOLDINGS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 113 YANMAR HOLDINGS CO., LTD.: PRODUCT LAUNCHES

- 12.2.4 KEYOU GMBH

- TABLE 114 KEYOU GMBH: BUSINESS OVERVIEW

- TABLE 115 KEYOU GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 116 KEYOU GMBH: PRODUCT LAUNCHES

- TABLE 117 KEYOU GMBH: DEALS

- 12.2.5 MITSUBISHI HEAVY INDUSTRIES, LTD.

- TABLE 118 MITSUBISHI HEAVY INDUSTRIES, LTD.: BUSINESS OVERVIEW

- FIGURE 58 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- TABLE 119 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 120 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCT LAUNCHES

- 12.2.6 ROLLS-ROYCE PLC

- TABLE 121 ROLLS-ROYCE PLC: BUSINESS OVERVIEW

- FIGURE 59 ROLLS-ROYCE PLC: COMPANY SNAPSHOT

- TABLE 122 ROLLS-ROYCE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 123 ROLLS-ROYCE PLC: PRODUCT LAUNCHES

- TABLE 124 ROLLS-ROYCE PLC: DEALS

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS