|

|

市場調査レポート

商品コード

1478557

無酸素銅の世界市場:グレード別、製品形態別、最終用途産業別、地域別 - 予測(~2029年)Oxygen-Free Copper Market by Grade (Cu-OF, Cu-OFE), Product Form (Wires, Strips, Busbar & Rods), End-use Industry (Electronics & Electrical, Automotive), and Region( North America, Europe, APAC, MEA, South America) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 無酸素銅の世界市場:グレード別、製品形態別、最終用途産業別、地域別 - 予測(~2029年) |

|

出版日: 2024年05月01日

発行: MarketsandMarkets

ページ情報: 英文 285 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の無酸素銅の市場規模は、2024年の309億米ドルから2029年までに404億米ドルに達し、予測期間にCAGRで5.5%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 金額(100万米ドル/10億米ドル)、数量(キロトン) |

| セグメント | グレード、製品形態、最終用途産業、地域 |

| 対象地域 | 北米、アジア太平洋、欧州、中東・アフリカ、南米 |

市場は、世界の電子・電気産業と自動車産業の成長によって大きく成長すると予測されています。中国、ブラジル、インドなどの新興経済国における電子の発展と、航空宇宙、輸送、防衛産業における高品質材料への需要の高まりが、市場の成長促進要因となっています。

「グレード別では、Cu-OFが大きなシェアを占めます。」

Cu-OFは99.95%の純度と優れた導電性により、無酸素銅市場を独占しています。電子、通信、自動車部門で広く使われ、Cu-OFの優れた特性はCu-OFEよりも好まれ、その大きな市場シェアを牽引しています。

「製品形態別では、ワイヤーセグメントが大きなシェアを占めます。」

2023年、ワイヤーセグメントが市場を金額、数量ともに独占しました。予測期間中、このセグメントがその主導的な地位を維持すると見込まれます。無酸素銅ワイヤーは主にハイエンドのオーディオシステムやビデオシステムで使われ、カスタム無酸素銅配線アセンブリーにも使われます。スピーカーワイヤー、オーディオ/ビデオケーブル、アセンブリー、アンプワイヤーなどに使われます。標準的な銅線に比べ、無酸素銅線は導電性が向上し、低周波の音をより効果的に伝達できるなどの利点があります。

「最終用途産業別では、自動車セグメントが予測期間にもっとも高いCAGRを占めます。」

複数の要因により、自動車セグメントが市場でもっとも急成長しています。世界の電気自動車やハイブリッド車へのシフトにともない、自動車用途では無酸素銅のような高性能材料の需要が高まっています。無酸素銅の優れた電気伝導性は、電気自動車(EV)やハイブリッド車(HEV)のバッテリー部品、ワイヤーハーネス、電気システムに不可欠です。さらに自動車電子の進歩や、自動車の電気システムの複雑化が、無酸素銅の需要をさらに押し上げています。自動車メーカーが効率、性能、持続可能性を優先し続ける中、無酸素銅の使用はこの部門で急速に拡大すると予測され、無酸素銅市場でもっとも急成長しているセグメントとなっています。

「地域別では、アジア太平洋市場が予測期間に市場を独占します。」

アジア太平洋は無酸素銅市場を最大の消費者として独占しており、とりわけ電子・電気部門や自動車部門がそれを牽引しています。日本、中国、韓国、台湾、インド、シンガポールのような主要国は、無酸素銅の重要なユーザーである電気・電子製品の製造および販売の拠点となっています。またこの地域では、ハイブリッド電気自動車(HEV)を含む電気自動車(EV)への選好が高まっています。中国は電気・電子製品の生産と消費が盛んで、主要市場として際立っています。技術の進歩で知られる日本も、この銅グレードの注目すべき市場です。中国もインドも電子、電気、自動車製品の製造の中心地として台頭してきました。さらにアジア太平洋ではeコマース産業が拡大しており、電子製品の需要を押し上げています。安価な労働力や豊富な原材料といったコスト面での優位性から、この地域は特に製造において外国からの投資を引き付けています。全体として、アジア太平洋からの需要の増加が無酸素銅市場を牽引する見込みです。

当レポートでは、世界の無酸素銅市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 無酸素銅市場の企業にとって魅力的な機会

- 無酸素銅市場:グレード別

- 無酸素銅市場:製品形態別

- 無酸素銅市場:最終用途産業別

- アジア太平洋の無酸素銅市場:最終用途産業別、国別

- 無酸素銅市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 主要企業の平均販売価格の動向:最終用途産業別

- 主要企業の平均販売価格の動向:地域別

- バリューチェーン分析

- 著名企業

- 中小企業

- エコシステム/市場マップ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- イントロダクション

- 調査手法

- 貿易分析

- 主な会議とイベント

- 関税と規制情勢

- 規制機関、政府機関、その他の組織

- 平均関税率

- 無酸素銅市場における規制

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

- マクロ経済指標

- イントロダクション

- GDPの動向と予測

- 世界の自動車生産と成長

第6章 無酸素銅の市場:グレード別

- イントロダクション

- CU-OF

- CU-OFE

第7章 無酸素銅市場:製品形態別

- イントロダクション

- ワイヤー

- ストリップ

- バスバー・ロッド

- その他の製品形態

第8章 無酸素銅市場:最終用途産業別

- イントロダクション

- 電子・電気

- 自動車

- その他の最終用途産業

第9章 無酸素銅市場:地域別

- イントロダクション

- アジア太平洋

- 景気後退の影響

- 中国

- 日本

- インド

- タイ

- その他のアジア太平洋

- 北米

- 景気後退の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 景気後退の影響

- ドイツ

- 英国

- フランス

- ロシア

- イタリア

- スペイン

- その他の欧州

- 中東・アフリカ

- 景気後退の影響

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- 南米

- 南米に対する不況の影響

- ブラジル

- アルゼンチン

- その他の南米

第10章 競合情勢

- 概要

- 主な企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- 製品/ブランドの比較

- 企業評価マトリクス

- スタートアップ/中小企業の評価マトリクス(2022年)

- 競合ベンチマーキング

- 競合状況と動向

第11章 企業プロファイル

- 主要企業

- KGHM POLSKA MIEDZ SA KGHM POLSKA MIEDZ SA

- PROTERIAL METALS, LTD.

- MITSUBISHI MATERIALS CORPORATION

- AURUBIS AG

- IBC ADVANCED ALLOYS CORP.

- SAM DONG

- FREEPORT-MCMORAN

- METROD HOLDINGS BERHAD

- COPPER BRAID PRODUCTS

- PAN PACIFIC COPPER CO., LTD.

- AVIVA METALS

- その他の企業

- ZHEJIANG LIBO HOLDING GROUP CO., LTD.

- CITIZEN METALLOYS LIMITED

- WATTEREDGE LLC

- CUPORI OY

- SHANGHAI METAL CORPORATION

- SEQUOIA BRASS & COPPER

- KME GERMANY GMBH

- OLA ELECTRIC

- CLEAN ELECTRIC

- FARADAY FUTURE

- ABRACON

- XPENG, INC.

- RK COPPER & ALLOY LLP

- FARMERS COPPER LTD.

- NIKOLA MOTOR

- HUSSEY COPPER

第12章 隣接市場と関連市場

- イントロダクション

- ラミネートバスバー市場

- 市場の定義

- 市場の概要

- ラミネートバスバー市場:材料別

- ラミネートバスバー市場:絶縁材料別

- ラミネートバスバー市場:エンドユーザー別

- ラミネートバスバー市場:地域別

第13章 付録

The global oxygen-free copper market size is projected to grow from USD 30.9 billion in 2024 to USD 40.4 billion by 2029, at a CAGR of 5.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/USD Billion) and Volume (Kiloton) |

| Segments | Grade, Product Form, End-use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

The oxygen-free copper market is projected to grow considerably owing to the growing electronics & electrical and automotive industries globally. The increasing demand for high-quality materials in the aerospace, transportation, and defense industries along with the development of the electronics market in the economies like China, Brazil, and India has driven the growth in the market.

"By Grade, Cu-OF accounts for major market share."

Cu-OF (Copper Oxygen-Free) dominates the oxygen-free copper market due to its purity of 99.95% and excellent electrical conductivity. Widely used in electronics, telecommunications, and automotive sectors, Cu-OF's superior properties make it the preferred choice over Cu-OFE, driving its larger market share.

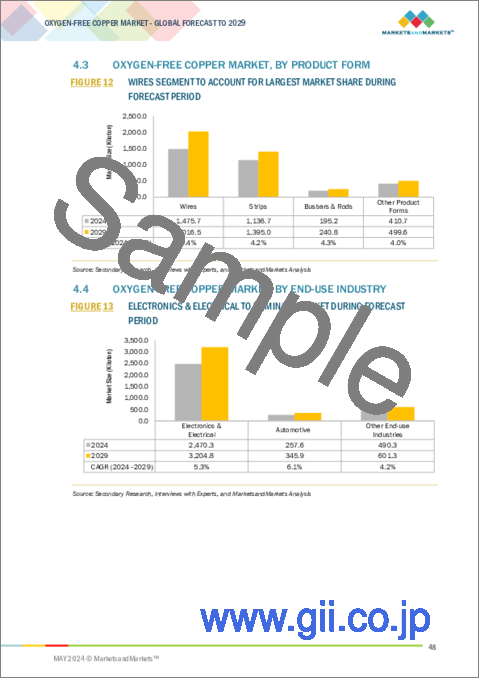

"By Product Form, Wires segment to account for major market share."

In 2023, the wire segment dominated the oxygen-free copper market in both value and volume. Throughout the forecast period, this segment is expected to maintain its leading position. Oxygen-free copper wires are primarily used in high-end audio and video systems, as well as for custom oxygen-free copper wiring assemblies. They are utilized in speaker wires, audio/video cables, assemblies, and amplifier wires. Compared to standard copper wires, oxygen-free copper wires offer benefits such as enhanced conductivity and the capability to transmit low-frequency sounds more effectively.

"By End Use Industry, the Automotive segment accounts for the highest CAGR during the forecast period."

The automotive segment is the fastest-growing segment in the oxygen-free copper market due to several key factors. With the global shift towards electric and hybrid vehicles, there's an increasing demand for high-performance materials like oxygen-free copper in automotive applications. Oxygen-free copper's superior electrical conductivity makes it essential for battery components, wiring harnesses, and electrical systems in Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs). Additionally, advancements in automotive electronics and the growing complexity of vehicle electrical systems further drive the demand for oxygen-free copper. As automotive manufacturers continue to prioritize efficiency, performance, and sustainability, the use of oxygen-free copper is expected to expand rapidly in this sector, making it the fastest-growing segment in the oxygen-free copper market.

"By region, Asia Pacific oxygen-free copper market to dominate the market during the forecast period."

Asia Pacific dominates the oxygen-free copper market as the largest consumer, driven by the electronics & electrical, and automotive sectors, among others. Key countries like Japan, China, Korea, Taiwan, India, and Singapore serve as primary hubs for the manufacturing and sale of electrical & electronic goods, which are significant users of oxygen-free copper. The region is also experiencing a growing preference for Electric Vehicles (EVs), including Hybrid Electric Vehicles (HEVs). China stands out as a major market due to its high production and consumption of electrical & electronic goods. Japan, known for its technological advancements, is also a notable market for this copper grade. Both China and India have emerged as key manufacturing centers for electronics, electrical, and automotive products. Furthermore, the expanding e-commerce industry in the Asia Pacific is boosting the demand for electronic goods. With cost advantages like cheap labor and abundant raw materials, the region attracts foreign investments, particularly in manufacturing. Overall, the increasing demand from Asia Pacific is poised to drive the oxygen-free copper market.

By Company: Tier1: 40%, Tier 2: 25%, Tier3: 4: 35%

By Designation: C-Level: 35%, Director Level: 30%, Others: 35%

By Region: North America: 25%, Europe: 20%, Asia Pacific: 45%, South America: 5%, and Middle East & Africa: 5%.

Companies Covered:

KGHM Polska Miedz SA (Poland), Proterial Metals, Ltd. (Japan), Mitsubishi Materials Corporation (Japan), Metrod Holdings Berhad (Malaysia), Aviva Metals (US), Aurubis AG (Germany), Copper Braid Products (UK), KME Germany GmbH (Germany), Sam Dong (South Korea), and others are covered in the oxygen free copper market.

Research Coverage

The market study covers the oxygen free copper market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on grade, product form, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the oxygen-free copper market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall oxygen-free copper market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing EV sales, increasing demand for oxygen-free copper in the electronics & electrical end-use industry), restraints (High cost of oxygen-free copper processing), opportunities (Strong demand from APAC region), and challenges (Volatile copper prices) influencing the growth of the oxygen-free copper market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the oxygen-free copper market

- Market Development: Comprehensive information about lucrative markets - the report analyses the oxygen-free copper market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the oxygen-free copper market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like KGHM Polska Miedz SA (Poland), Proterial Metals, Ltd. (Japan), Mitsubishi Materials Corporation (Japan), Metrod Holdings Berhad (Malaysia), Aviva Metals (US), Aurubis AG (Germany), Copper Braid Products (UK), KME Germany GmbH (Germany), Sam Dong (South Korea) among others in the oxygen-free copper market. The report also helps stakeholders understand the pulse of the oxygen-free copper market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 OXYGEN-FREE COPPER MARKET SEGMENTATION

- 1.3.1 YEARS CONSIDERED

- 1.3.2 REGIONS COVERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 OXYGEN-FREE COPPER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.2.1 VOLUME MARKET APPROACH

- 2.2.1.1 Approach based on oxygen-free copper consumption, by country

- 2.3 DATA TRIANGULATION

- FIGURE 5 OXYGEN-FREE COPPER MARKET: DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 IMPACT OF RECESSION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 6 CU-OF GRADE TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 7 WIRES TO BE FASTEST-GROWING PRODUCT FORM DURING FORECAST PERIOD

- FIGURE 8 ELECTRONICS & ELECTRICAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC DOMINATED OXYGEN-FREE COPPER MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN OXYGEN-FREE COPPER MARKET

- FIGURE 10 RAPID INDUSTRIALIZATION AND SURGE IN E-COMMERCE TO DRIVE MARKET

- 4.2 OXYGEN-FREE COPPER MARKET, BY GRADE

- FIGURE 11 CU-OF SEGMENT TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- 4.3 OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM

- FIGURE 12 WIRES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY

- FIGURE 13 ELECTRONICS & ELECTRICAL TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 ASIA PACIFIC OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY AND COUNTRY

- FIGURE 14 CHINA DOMINATED ASIA PACIFIC OXYGEN-FREE COPPER MARKET IN 2023

- 4.6 OXYGEN-FREE COPPER MARKET, BY KEY COUNTRIES

- FIGURE 15 CHINA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN OXYGEN-FREE COPPER MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in sales of electric vehicles

- FIGURE 17 ELECTRIC CAR SALES, 2017-2023

- 5.2.1.2 Rising demand for oxygen-free copper in electronics & electrical industry

- 5.2.1.3 Increasing e-commerce sales worldwide

- FIGURE 18 GLOBAL B2B E-COMMERCE GMV

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of oxygen-free copper processing

- 5.2.2.2 Increasing preference for electrolytic tough-pitch copper as a substitute

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Strong demand for oxygen-free copper in Asia Pacific

- 5.2.3.2 Untapped applications of copper-based magnetrons in various industries

- 5.2.4 CHALLENGES

- 5.2.4.1 Volatile price of copper

- FIGURE 19 PRICE OF COPPER (2000-2024)

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 20 REVENUE SHIFT FOR OXYGEN-FREE COPPER MANUFACTURERS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY

- FIGURE 21 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 END-USE INDUSTRIES

- TABLE 2 AVERAGE PRICE TREND OF KEY PLAYERS, BY TOP 3 END-USE INDUSTRIES (USD/KG), 2023

- 5.4.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY REGION

- FIGURE 22 AVERAGE SELLING PRICE TREND, BY REGION (USD/KG)

- TABLE 3 AVERAGE PRICE TREND, BY REGION (USD/KG)

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 23 OXYGEN-FREE COPPER MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 SMALL & MEDIUM ENTERPRISES

- 5.6 ECOSYSTEM/MARKET MAP

- FIGURE 24 OXYGEN-FREE COPPER MARKET: ECOSYSTEM MAP

- TABLE 4 OXYGEN-FREE COPPER MARKET: ROLE IN ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGY

- 5.7.1.1 Electrolytic refining

- 5.7.1.2 Casting and extrusion

- 5.7.1.3 Cold working and annealing

- 5.7.2 COMPLEMENTARY TECHNOLOGY

- 5.7.2.1 Semiconductor fabrication

- 5.7.2.2 Automotive technologies

- 5.7.3 ADJACENT TECHNOLOGY

- 5.7.3.1 Rautomead

- 5.7.1 KEY TECHNOLOGY

- 5.8 PATENT ANALYSIS

- 5.8.1 INTRODUCTION

- 5.8.2 METHODOLOGY

- FIGURE 25 TOP PATENT APPLICANTS

- TABLE 5 LIST OF MAJOR PATENTS FOR OXYGEN-FREE COPPER

- 5.9 TRADE ANALYSIS

- FIGURE 26 EXPORT SCENARIO, HS CODE 7403: COPPER, REFINED, AND UNWROUGHT COPPER ALLOYS

- FIGURE 27 IMPORT SCENARIO, HS CODE 7403: COPPER, REFINED, AND UNWROUGHT COPPER ALLOYS

- FIGURE 28 EXPORT SCENARIO, HS CODE 7407: BARS, RODS, AND PROFILES OF COPPER

- FIGURE 29 IMPORT SCENARIO, HS CODE 7407: BARS, RODS, AND PROFILES OF COPPER

- 5.10 KEY CONFERENCES AND EVENTS

- TABLE 6 OXYGEN-FREE COPPER MARKET: KEY CONFERENCES & EVENTS, 2024-2025

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 AVERAGE TARIFF RATES

- TABLE 9 TARIFF RELATED TO COPPER, REFINED, AND UNWROUGHT COPPER ALLOYS

- 5.11.3 REGULATIONS IN OXYGEN-FREE COPPER MARKET

- 5.11.3.1 EN 1977:2013

- 5.11.3.2 ASTM B49-20 (Standard Specification for Copper Rod for Electrical Purposes)

- 5.11.3.3 EN CW009A

- TABLE 10 SPECIFICATIONS RELATED TO OXYGEN-FREE COPPER PRODUCTS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 OXYGEN-FREE COPPER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 OXYGEN-FREE COPPER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES

- 5.13.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 CASE STUDY 1: OFHC FOR USE IN WINDING WIRE

- 5.14.2 CASE STUDY 2: USE OF OXYGEN-FREE COPPER FOR COST REDUCTION

- 5.14.3 CASE STUDY 3: TRACE ELEMENT TO ENHANCE HEAT AND STRESS RESISTANCE OF OXYGEN-FREE COPPER

- 5.15 INVESTMENT AND FUNDING SCENARIO

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO

- 5.16 MACROECONOMIC INDICATORS

- 5.16.1 INTRODUCTION

- 5.16.2 GDP TRENDS AND FORECASTS

- TABLE 14 WORLD GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- 5.16.3 GLOBAL AUTOMOBILE PRODUCTION AND GROWTH

- TABLE 15 GLOBAL AUTOMOBILE PRODUCTION (UNIT) AND GROWTH, BY COUNTRY (2021-2022)

6 OXYGEN-FREE COPPER MARKET, BY GRADE

- 6.1 INTRODUCTION

- FIGURE 34 CU-OF TO BE FASTER-GROWING SEGMENT DURING FORECAST PERIOD

- TABLE 16 OXYGEN-FREE COPPER MARKET SIZE, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 17 OXYGEN-FREE COPPER MARKET SIZE, BY GRADE, 2019-2021 (KILOTON)

- TABLE 18 OXYGEN-FREE COPPER MARKET SIZE, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 19 OXYGEN-FREE COPPER MARKET SIZE, BY GRADE, 2022-2029 (KILOTON)

- 6.2 CU-OF

- 6.2.1 CU-OF COMMONLY USED IN CUTTING-EDGE SCIENTIFIC EQUIPMENT

- TABLE 20 CU-OF: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 21 CU-OF: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2019-2021 (KILOTON)

- TABLE 22 CU-OF: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2022-2029 (USD MILLION)

- TABLE 23 CU-OF: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2022-2029 (KILOTON)

- 6.3 CU-OFE

- 6.3.1 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR CU-OFE SEGMENT

- TABLE 24 CU-OFE: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 25 CU-OFE: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2019-2021 (KILOTON)

- TABLE 26 CU-OFE: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2022-2029 (USD MILLION)

- TABLE 27 CU-OFE: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2022-2029 (KILOTON)

7 OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM

- 7.1 INTRODUCTION

- FIGURE 35 WIRES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 28 OXYGEN-FREE COPPER MARKET SIZE, BY PRODUCT FORM, 2019-2021 (USD MILLION)

- TABLE 29 OXYGEN-FREE COPPER MARKET SIZE, BY PRODUCT FORM, 2019-2021 (KILOTON)

- TABLE 30 OXYGEN-FREE COPPER MARKET SIZE, BY PRODUCT FORM, 2022-2029 (USD MILLION)

- TABLE 31 OXYGEN-FREE COPPER MARKET SIZE, BY PRODUCT FORM, 2022-2029 (KILOTON)

- 7.2 WIRES

- 7.2.1 MOST WIDELY USED FORM OF OXYGEN-FREE COPPER PRODUCT

- 7.3 STRIPS

- 7.3.1 INCREASING DEMAND FROM ELECTRONICS & ELECTRICAL INDUSTRY TO DRIVE MARKET

- 7.4 BUSBARS & RODS

- 7.4.1 USE IN ELECTRICAL TRANSMISSION LINES, TRANSFORMERS, AND INTERCONNECTING GENERATORS TO DRIVE MARKET

- 7.5 OTHER PRODUCT FORMS

8 OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 36 ELECTRONICS & ELECTRICAL TO BE DOMINANT END USER OF OXYGEN-FREE COPPER DURING FORECAST PERIOD

- TABLE 32 OXYGEN-FREE COPPER MARKET SIZE, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 33 OXYGEN-FREE COPPER MARKET SIZE, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 34 OXYGEN-FREE COPPER MARKET SIZE, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 35 OXYGEN-FREE COPPER MARKET SIZE, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 8.2 ELECTRONICS & ELECTRICAL

- 8.2.1 ELECTRONICS & ELECTRICAL SECTOR TO REMAIN LARGEST END USER OF OXYGEN-FREE COPPER

- TABLE 36 ELECTRONICS & ELECTRICAL: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 37 ELECTRONICS & ELECTRICAL: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2019-2021 (KILOTON)

- TABLE 38 ELECTRONICS & ELECTRICAL: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2022-2029 (USD MILLION)

- TABLE 39 ELECTRONICS & ELECTRICAL: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2022-2029 (KILOTON)

- 8.3 AUTOMOTIVE

- 8.3.1 OXYGEN-FREE COPPER WIDELY USED IN MANUFACTURING SPARE PARTS AND COMPONENTS

- TABLE 40 AUTOMOTIVE: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 41 AUTOMOTIVE: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2019-2021 (KILOTON)

- TABLE 42 AUTOMOTIVE: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2022-2029 (USD MILLION)

- TABLE 43 AUTOMOTIVE: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2022-2029 (KILOTON)

- 8.4 OTHER END-USE INDUSTRIES

- TABLE 44 OTHER END-USE INDUSTRIES: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2019-2021 (USD MILLION)

- TABLE 45 OTHER END-USE INDUSTRIES: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2019-2021 (KILOTON)

- TABLE 46 OTHER END-USE INDUSTRIES: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2022-2029 (USD MILLION)

- TABLE 47 OTHER END-USE INDUSTRIES: OXYGEN-FREE COPPER MARKET SIZE, BY REGION, 2022-2029 (KILOTON)

9 OXYGEN-FREE COPPER MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 37 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 48 OXYGEN-FREE COPPER MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 49 OXYGEN-FREE COPPER MARKET, BY REGION, 2019-2021 (KILOTON)

- TABLE 50 OXYGEN-FREE COPPER MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 51 OXYGEN-FREE COPPER MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 52 OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2019-2021 (USD MILLION)

- TABLE 53 OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2019-2021 (KILOTON)

- TABLE 54 OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2022-2029 (USD MILLION)

- TABLE 55 OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2022-2029 (KILOTON)

- TABLE 56 OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 57 OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 58 OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 59 OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 60 OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 61 OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 62 OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 63 OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.2 ASIA PACIFIC

- 9.2.1 RECESSION IMPACT

- FIGURE 38 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET SNAPSHOT

- TABLE 64 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 65 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY COUNTRY, 2019-2021 (KILOTON)

- TABLE 66 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 67 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 68 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2019-2021 (USD MILLION)

- TABLE 69 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2019-2021 (KILOTON)

- TABLE 70 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2022-2029 (USD MILLION)

- TABLE 71 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2022-2029 (KILOTON)

- TABLE 72 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 73 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 74 ASIA PACIFIC: OXYGEN FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 75 ASIA PACIFIC: OXYGEN FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 76 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 77 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 78 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 79 ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.2.2 CHINA

- 9.2.2.1 Development of advanced microchips and electronic components to drive market

- TABLE 80 CHINA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 81 CHINA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 82 CHINA: OXYGEN FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 83 CHINA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 84 CHINA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 85 CHINA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 86 CHINA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 87 CHINA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.2.3 JAPAN

- 9.2.3.1 Growth of automotive industry to boost market

- TABLE 88 JAPAN: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 89 JAPAN: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 90 JAPAN: OXYGEN FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 91 JAPAN: OXYGEN FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 92 JAPAN: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 93 JAPAN: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 94 JAPAN: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 95 JAPAN: OXYGEN FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.2.4 INDIA

- 9.2.4.1 Expansion of electric vehicles sector to fuel demand

- TABLE 96 INDIA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 97 INDIA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 98 INDIA: OXYGEN FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 99 INDIA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 100 INDIA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 101 INDIA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 102 INDIA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 103 INDIA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.2.5 THAILAND

- 9.2.5.1 Strong base of EV manufacturers to support market growth

- TABLE 104 THAILAND: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 105 THAILAND: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 106 THAILAND: OXYGEN FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 107 THAILAND: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 108 THAILAND: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 109 THAILAND: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 110 THAILAND: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 111 THAILAND: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.2.6 REST OF ASIA PACIFIC

- TABLE 112 REST OF ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 114 REST OF ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 115 REST OF ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 116 REST OF ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 117 REST OF ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 118 REST OF ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.3 NORTH AMERICA

- 9.3.1 RECESSION IMPACT

- TABLE 120 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 121 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY COUNTRY, 2019-2021 (KILOTON)

- TABLE 122 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 123 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 124 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2019-2021 (USD MILLION)

- TABLE 125 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2019-2021 (KILOTON)

- TABLE 126 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2022-2029 (USD MILLION)

- TABLE 127 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2022-2029 (KILOTON)

- TABLE 128 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 129 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 130 NORTH AMERICA: OXYGEN FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 131 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 132 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 133 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 134 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 135 NORTH AMERICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.3.2 US

- 9.3.2.1 Increased demand from electronics & electrical industry to drive market

- TABLE 136 US: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 137 US: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 138 US: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 139 US: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 140 US: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 141 US: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 142 US: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 143 US: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.3.3 CANADA

- 9.3.3.1 Growth of semiconductor industry to fuel demand

- TABLE 144 CANADA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 145 CANADA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 146 CANADA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 147 CANADA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 148 CANADA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 149 CANADA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 150 CANADA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 151 CANADA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.3.4 MEXICO

- 9.3.4.1 Regulatory reforms and liberalization in investment policies to drive market

- TABLE 152 MEXICO: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 153 MEXICO: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 154 MEXICO: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 155 MEXICO: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 156 MEXICO: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 157 MEXICO: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 158 MEXICO: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 159 MEXICO: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.4 EUROPE

- 9.4.1 RECESSION IMPACT

- TABLE 160 EUROPE: OXYGEN-FREE COPPER MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 161 EUROPE: OXYGEN-FREE COPPER MARKET, BY COUNTRY, 2019-2021 (KILOTON)

- TABLE 162 EUROPE: OXYGEN-FREE COPPER MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 163 EUROPE: OXYGEN-FREE COPPER MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 164 EUROPE: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2019-2021 (USD MILLION)

- TABLE 165 EUROPE: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2019-2021 (KILOTON)

- TABLE 166 EUROPE: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2022-2029 (USD MILLION)

- TABLE 167 EUROPE: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2022-2029 (KILOTON)

- TABLE 168 EUROPE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 169 EUROPE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 170 EUROPE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 171 EUROPE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 172 EUROPE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 173 EUROPE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 174 EUROPE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 175 EUROPE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.4.2 GERMANY

- 9.4.2.1 Investments in next-generation microelectronics research and innovation to drive market

- TABLE 176 GERMANY: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 177 GERMANY: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 178 GERMANY: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 179 GERMANY: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 180 GERMANY: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 181 GERMANY: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 182 GERMANY: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 183 GERMANY: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.4.3 UK

- 9.4.3.1 Growth of automotive industry to boost demand for oxygen-free copper

- TABLE 184 UK: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 185 UK: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 186 UK: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 187 UK: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 188 UK: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 189 UK: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 190 UK: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 191 UK: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.4.4 FRANCE

- 9.4.4.1 Rising demand for EVs to drive market growth

- TABLE 192 FRANCE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 193 FRANCE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 194 FRANCE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 195 FRANCE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 196 FRANCE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 197 FRANCE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 198 FRANCE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 199 FRANCE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.4.5 RUSSIA

- 9.4.5.1 Increased sales of electric cars to drive demand for oxygen-free copper

- TABLE 200 RUSSIA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 201 RUSSIA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 202 RUSSIA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 203 RUSSIA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 204 RUSSIA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 205 RUSSIA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 206 RUSSIA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 207 RUSSIA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.4.6 ITALY

- 9.4.6.1 Surge in automobile production to drive market

- TABLE 208 ITALY: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 209 ITALY: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 210 ITALY: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 211 ITALY: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 212 ITALY: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 213 ITALY: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 214 ITALY: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 215 ITALY: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.4.7 SPAIN

- 9.4.7.1 Government investments in automotive industry to drive demand

- TABLE 216 SPAIN: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 217 SPAIN: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 218 SPAIN: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 219 SPAIN: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 220 SPAIN: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 221 SPAIN: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 222 SPAIN: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 223 SPAIN: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.4.8 REST OF EUROPE

- TABLE 224 REST OF EUROPE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 225 REST OF EUROPE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 226 REST OF EUROPE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 227 REST OF EUROPE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 228 REST OF EUROPE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 229 REST OF EUROPE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 230 REST OF EUROPE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 231 REST OF EUROPE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 RECESSION IMPACT

- TABLE 232 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY COUNTRY, 2019-2021 (KILOTON)

- TABLE 234 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 236 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2019-2021 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2019-2021 (KILOTON)

- TABLE 238 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2022-2029 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2022-2029 (KILOTON)

- TABLE 240 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 242 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 244 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 246 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.5.2 GCC COUNTRIES

- TABLE 248 GCC: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 249 GCC: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 250 GCC: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 251 GCC: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 252 GCC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 253 GCC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 254 GCC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 255 GCC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.5.2.1 Saudi Arabia

- 9.5.2.1.1 Economic growth and increasing consumer demand to drive market

- 9.5.2.1 Saudi Arabia

- TABLE 256 SAUDI ARABIA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 257 SAUDI ARABIA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 258 SAUDI ARABIA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 259 SAUDI ARABIA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 260 SAUDI ARABIA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 261 SAUDI ARABIA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 262 SAUDI ARABIA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 263 SAUDI ARABIA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.5.2.2 UAE

- 9.5.2.2.1 Rising investments in semiconductor industry to drive market

- 9.5.2.2 UAE

- TABLE 264 UAE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 265 UAE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 266 UAE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 267 UAE: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 268 UAE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 269 UAE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 270 UAE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 271 UAE: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.5.2.3 Rest of GCC

- TABLE 272 REST OF GCC: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 273 REST OF GCC: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 274 REST OF GCC: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 275 REST OF GCC: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 276 REST OF GCC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 277 REST OF GCC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 278 REST OF GCC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 279 REST OF GCC: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.5.3 SOUTH AFRICA

- 9.5.3.1 Increased demand for electronics & electrical products to drive market

- TABLE 280 SOUTH AFRICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 281 SOUTH AFRICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 282 SOUTH AFRICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 283 SOUTH AFRICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 284 SOUTH AFRICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 285 SOUTH AFRICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 286 SOUTH AFRICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 287 SOUTH AFRICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 288 REST OF MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 289 REST OF MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 290 REST OF MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 291 REST OF MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 292 REST OF MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 293 REST OF MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 294 REST OF MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 295 REST OF MIDDLE EAST & AFRICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.6 SOUTH AMERICA

- 9.6.1 SOUTH AMERICA: RECESSION IMPACT

- TABLE 296 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 297 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY COUNTRY, 2019-2021 (KILOTON)

- TABLE 298 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 299 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 300 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2019-2021 (USD MILLION)

- TABLE 301 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2019-2021 (KILOTON)

- TABLE 302 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2022-2029 (USD MILLION)

- TABLE 303 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY PRODUCT FORM, 2022-2029 (KILOTON)

- TABLE 304 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 305 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 306 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 307 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 308 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 309 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 310 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 311 SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.6.2 BRAZIL

- 9.6.2.1 Rapid industrialization and urbanization to support market growth

- TABLE 312 BRAZIL: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 313 BRAZIL: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 314 BRAZIL: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 315 BRAZIL: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 316 BRAZIL: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 317 BRAZIL: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 318 BRAZIL: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 319 BRAZIL: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.6.3 ARGENTINA

- 9.6.3.1 Increased demand for EVs to boost market

- TABLE 320 ARGENTINA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 321 ARGENTINA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 322 ARGENTINA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 323 ARGENTINA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 324 ARGENTINA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 325 ARGENTINA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 326 ARGENTINA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 327 ARGENTINA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- 9.6.4 REST OF SOUTH AMERICA

- TABLE 328 REST OF SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (USD MILLION)

- TABLE 329 REST OF SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2019-2021 (KILOTON)

- TABLE 330 REST OF SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 331 REST OF SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY GRADE, 2022-2029 (KILOTON)

- TABLE 332 REST OF SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (USD MILLION)

- TABLE 333 REST OF SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2019-2021 (KILOTON)

- TABLE 334 REST OF SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 335 REST OF SOUTH AMERICA: OXYGEN-FREE COPPER MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- TABLE 336 STRATEGIES ADOPTED BY OXYGEN-FREE COPPER MANUFACTURERS

- 10.3 REVENUE ANALYSIS

- FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES, 2018-2022

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 40 GHM POLSKA MIEDZ SA LED OXYGEN-FREE COPPER MARKET IN 2023

- TABLE 337 OXYGEN-FREE COPPER MARKET: DEGREE OF COMPETITION

- 10.4.1 MARKET RANKING ANALYSIS

- FIGURE 41 RANKING OF TOP FIVE PLAYERS IN OXYGEN-FREE COPPER MARKET

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 42 COMPANY VALUATION (USD BILLION)

- FIGURE 43 FINANCIAL MATRIX: EV/EBITDA RATIO

- 10.6 PRODUCT/BRAND COMPARISON

- FIGURE 44 OXYGEN-FREE COPPER MARKET: PRODUCT/BRAND COMPARISON

- 10.7 COMPANY EVALUATION MATRIX

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- FIGURE 45 OXYGEN-FREE COPPER MARKET: COMPANY EVALUATION MATRIX, 2023

- 10.7.5 COMPANY FOOTPRINT

- FIGURE 46 OXYGEN-FREE COPPER: COMPANY OVERALL FOOTPRINT

- TABLE 338 OXYGEN-FREE COPPER MARKET: COMPANY REGION FOOTPRINT (18 COMPANIES)

- TABLE 339 OXYGEN-FREE COPPER MARKET: COMPANY PRODUCT FORM FOOTPRINT (18 COMPANIES)

- TABLE 340 OXYGEN-FREE COPPER MARKET: COMPANY GRADE FOOTPRINT (18 COMPANIES)

- TABLE 341 OXYGEN-FREE COPPER MARKET: COMPANY END-USE INDUSTRY FOOTPRINT (18 COMPANIES)

- 10.8 START-UPS/SMES EVALUATION MATRIX, 2022

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- FIGURE 47 OXYGEN-FREE COPPER MARKET: START-UPS/SMES EVALUATION MATRIX, 2022

- 10.9 COMPETITIVE BENCHMARKING

- TABLE 342 OXYGEN-FREE COPPER MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 343 OXYGEN-FREE COPPER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.10 COMPETITIVE SITUATION AND TRENDS

- 10.10.1 DEALS

- TABLE 344 OXYGEN-FREE COPPER MARKET: DEALS, JANUARY 2019-FEBRUARY 2024

- 10.10.2 EXPANSIONS

- TABLE 345 OXYGEN-FREE COPPER MARKET: EXPANSIONS, JANUARY 2019-FEBRUARY 2024

- 10.10.3 OTHER DEVELOPMENTS

- TABLE 346 OXYGEN-FREE COPPER MARKET: OTHER DEVELOPMENTS, JANUARY 2019-FEBRUARY 2024

11 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1 KEY PLAYERS

- 11.1.1 KGHM POLSKA MIEDZ SA KGHM POLSKA MIEDZ SA

- TABLE 347 KGHM POLSKA MIEDZ SA: COMPANY OVERVIEW

- FIGURE 48 KGHM POLSKA MIEDZ SA: COMPANY SNAPSHOT

- TABLE 348 KGHM POLSKA MIEDZ SA: DEALS, JANUARY 2019-DECEMBER 2023

- TABLE 349 KGHM POLSKA MIEDZ SA: OTHER DEVELOPMENTS, JANUARY 2019-FEBRUARY 2024

- 11.1.2 PROTERIAL METALS, LTD.

- TABLE 350 PROTERIAL METALS, LTD.: COMPANY OVERVIEW

- FIGURE 49 PROTERIAL METALS, LTD.: COMPANY SNAPSHOT

- 11.1.3 MITSUBISHI MATERIALS CORPORATION

- TABLE 351 MITSUBISHI MATERIALS CORPORATION: BUSINESS OVERVIEW

- FIGURE 50 MITSUBISHI MATERIALS CORPORATION: COMPANY SNAPSHOT

- TABLE 352 MITSUBISHI MATERIALS CORPORATION: DEALS, JANUARY 2019-FEBRUARY 2024

- TABLE 353 MITSUBISHI MATERIALS CORPORATION: EXPANSIONS, JANUARY 2019-FEBRUARY 2024

- TABLE 354 MITSUBISHI MATERIALS CORPORATION: OTHER DEVELOPMENTS, JANUARY 2019-FEBRUARY 2024

- 11.1.4 AURUBIS AG

- TABLE 355 AURUBIS AG: COMPANY OVERVIEW

- FIGURE 51 AURUBIS AG: COMPANY SNAPSHOT

- TABLE 356 AURUBIS AG: DEALS, JANUARY 2019-FEBRUARY 2024

- TABLE 357 AURUBIS AG: EXPANSIONS, JANUARY 2019-FEBRUARY 2024

- TABLE 358 AURUBIS AG: OTHER DEVELOPMENTS, JANUARY 2019-FEBRUARY 2024

- 11.1.5 IBC ADVANCED ALLOYS CORP.

- TABLE 359 IBC ADVANCED ALLOYS CORP.: COMPANY OVERVIEW

- FIGURE 52 IBC ADVANCED ALLOYS CORP.: COMPANY SNAPSHOT

- TABLE 360 IBC ADVANCED ALLOYS CORP.: EXPANSIONS, JANUARY 2019-FEBRUARY 2024

- TABLE 361 IBC ADVANCED ALLOYS CORP.: OTHER DEVELOPMENTS, JANUARY 2019-FEBRUARY 2024

- 11.1.6 SAM DONG

- TABLE 362 SAM DONG: COMPANY OVERVIEW

- 11.1.7 FREEPORT-MCMORAN

- TABLE 363 FREEPORT-MCMORAN: COMPANY OVERVIEW

- FIGURE 53 FREEPORT-MCMORAN: COMPANY SNAPSHOT

- 11.1.8 METROD HOLDINGS BERHAD

- TABLE 364 METROD HOLDINGS BERHAD: COMPANY OVERVIEW

- FIGURE 54 METROD HOLDINGS BERHAD: COMPANY SNAPSHOT

- 11.1.9 COPPER BRAID PRODUCTS

- TABLE 365 COPPER BRAID PRODUCTS: COMPANY OVERVIEW

- 11.1.10 PAN PACIFIC COPPER CO., LTD.

- TABLE 366 PAN PACIFIC COPPER CO., LTD.: COMPANY OVERVIEW

- FIGURE 55 PAN PACIFIC COPPER CO., LTD.: COMPANY SNAPSHOT

- 11.1.11 AVIVA METALS

- TABLE 367 AVIVA METALS: COMPANY OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 ZHEJIANG LIBO HOLDING GROUP CO., LTD.

- TABLE 368 ZHEJIANG LIBO HOLDING GROUP CO., LTD.: COMPANY OVERVIEW

- 11.2.2 CITIZEN METALLOYS LIMITED

- TABLE 369 CITIZEN METALLOYS LIMITED: COMPANY OVERVIEW

- 11.2.3 WATTEREDGE LLC

- TABLE 370 WATTEREDGE LLC: COMPANY OVERVIEW

- 11.2.4 CUPORI OY

- TABLE 371 CUPORI OY: COMPANY OVERVIEW

- 11.2.5 SHANGHAI METAL CORPORATION

- TABLE 372 SHANGHAI METAL CORPORATION: COMPANY OVERVIEW

- 11.2.6 SEQUOIA BRASS & COPPER

- TABLE 373 SEQUOIA BRASS & COPPER: COMPANY OVERVIEW

- 11.2.7 KME GERMANY GMBH

- TABLE 374 KME GERMANY GMBH: COMPANY OVERVIEW

- 11.2.8 OLA ELECTRIC

- TABLE 375 OLA ELECTRIC: COMPANY OVERVIEW

- 11.2.9 CLEAN ELECTRIC

- TABLE 376 CLEAN ELECTRIC: COMPANY OVERVIEW

- 11.2.10 FARADAY FUTURE

- TABLE 377 FARADAY FUTURE: COMPANY OVERVIEW

- 11.2.11 ABRACON

- TABLE 378 ABRACON: COMPANY OVERVIEW

- 11.2.12 XPENG, INC.

- TABLE 379 XPENG, INC.: COMPANY OVERVIEW

- 11.2.13 RK COPPER & ALLOY LLP

- TABLE 380 RK COPPER & ALLOY LLP: COMPANY OVERVIEW

- 11.2.14 FARMERS COPPER LTD.

- TABLE 381 FARMERS COPPER LTD.: COMPANY OVERVIEW

- 11.2.15 NIKOLA MOTOR

- TABLE 382 NIKOLA MOTOR: COMPANY OVERVIEW

- 11.2.16 HUSSEY COPPER

- TABLE 383 HUSSEY COPPER: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKET

- 12.1 INTRODUCTION

- 12.2 LAMINATED BUSBAR MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.3 LAMINATED BUSBAR MARKET, BY MATERIAL

- TABLE 384 LAMINATED BUSBAR MARKET SIZE, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 385 LAMINATED BUSBAR MARKET SIZE, BY MATERIAL, 2023-2030 (USD MILLION)

- 12.4 LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL

- TABLE 386 LAMINATED BUSBAR MARKET SIZE, BY INSULATION MATERIAL, 2018-2022 (USD MILLION)

- TABLE 387 LAMINATED BUSBAR MARKET SIZE, BY INSULATION MATERIAL, 2023-2030 (USD MILLION)

- 12.5 LAMINATED BUSBAR MARKET, BY END USER

- TABLE 388 LAMINATED BUSBAR MARKET SIZE, BY END USER, 2018-2022 (USD MILLION)

- TABLE 389 LAMINATED BUSBAR MARKET SIZE, BY END USER, 2023-2030 (USD MILLION)

- 12.6 LAMINATED BUSBAR MARKET, BY REGION

- TABLE 390 LAMINATED BUSBAR MARKET SIZE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 391 LAMINATED BUSBAR MARKET SIZE, BY REGION, 2023-2030 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS