|

|

市場調査レポート

商品コード

1462799

酵母の世界市場:タイプ別、用途別、形態別、属性別、酵母エキス別、地域別 - 予測(~2029年)Yeast Market by Type (Baker's Yeast, Brewer's Yeast, Wine Yeast, Probiotic Yeast), Application (Food, Feed), Form (Fresh, Instant, Active), Genus (Saccharomyces, Kluveromyces), Yeast extract (Qualitative) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 酵母の世界市場:タイプ別、用途別、形態別、属性別、酵母エキス別、地域別 - 予測(~2029年) |

|

出版日: 2024年03月26日

発行: MarketsandMarkets

ページ情報: 英文 267 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の酵母の市場規模は、2024年に55億米ドルになるとみられ、今後、8.9%のCAGRで拡大し、2029年には85億米ドルに達すると予測されています。

製パンにおいて重要な成分である酵母は、焼き菓子の食感、風味、焼き上がりを決定する上で中心的な役割を果たしています。職人手作りパンや特殊パンの人気、ホームベーカリーの動向、天然素材やクリーンラベルの原材料を好む消費者などの要因によってパンの需要が増加し続けているため、酵母の需要も並行して増加しています。世界のパンの輸入額が2020年の3,870万米ドルから2021年には4,430万米ドルへ、さらに2022年には4,970万米ドルへと増加していることは、世界規模でベーカリー製品に対する需要が拡大していることを示しています。このようなパン輸入の増加動向は、食品産業における酵母製品にとって大きなチャンスとなります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(米ドル)、数量(トン) |

| セグメント別 | タイプ別、用途別、形態別、属性別、酵母エキス別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

さらに、植物性タンパク質および代替タンパク質市場の拡大が、食品用途における酵母由来成分の機会をさらに増大させています。技術的進歩により酵母生産の効率と汎用性が強化され、製造業者は食品産業におけるこれらの増加する機会を活用するのに有利な立場にあり、酵母製品を活用して世界中の消費者の進化する需要に応えています。

"食生活の変化により、欧州は酵母市場の主要地域となっている"

欧州のイースト製品に対する需要は、いくつかの要因に後押しされ、最近顕著な高まりを経験しています。特にCOVID-19の大流行時に顕著であったホームベーカリーの増加傾向が大きな促進要因の一つです。このホームベーカリーの急増は、個人がパン作りの技術に癒しと満足を求めたため、パン作り目的のイーストの消費量の増加につながりました。COFALEC(欧州酵母生産者連盟)によると、欧州は世界の酵母の35%を生産しています。4億7,500万人の欧州人が、パン、ビール、ワインなど酵母を使った食品・飲料を日常的に消費しています。

同時に、酵母を含む発酵食品に関連する健康上の利点が認識されつつあります。プロバイオティクスの特性と腸の健康への貢献により、酵母は健康志向の消費者の間で注目を集めています。その汎用性と広範な適用性により、酵母は引き続き注目される素材であり、欧州市場における持続的な成長と革新が期待されます。

当レポートでは、世界の酵母市場について調査し、タイプ別、用途別、形態別、属性別、酵母エキス別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

第6章 業界の動向

- イントロダクション

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 価格分析

- エコシステム/市場マップ

- 顧客のビジネスに影響を与える動向/混乱

- 特許分析

- 主な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

第7章 酵母市場、タイプ別

- イントロダクション

- ビール酵母

- パン酵母

- ワイン酵母

- プロバイオティック酵母

- その他

第8章 酵母市場、用途別

- イントロダクション

- 食品・飲料

- 飼料

- その他

第9章 酵母市場、形態別

- イントロダクション

第10章 酵母市場、属性別

- イントロダクション

- サッカロミセス

- クルイベロミセス

- その他の属

第11章 酵母市場、酵母エキス別

- イントロダクション

- 酵母自己消化物

- 酵母加水分解物

- 酵母細胞壁

第12章 酵母市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第13章 競合情勢

- 概要

- 収益分析

- 市場シェア分析

- 主要参入企業の戦略/強み

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業

- 企業評価マトリックス:新興企業/中小企業

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- ANGELYEAST CO., LTD.

- ASSOCIATED BRITISH FOODS PLC

- ADM

- NISSHIN SEIFUN GROUP INC.

- KOTHARI FERMENTATION AND BIOCHEM LTD.

- ALLTECH

- LALLEMAND INC.

- ICC

- LEIBER

- LESAFFRE

- PACIFIC FERMENTATION IND. LTD.

- PAK HOLDING

- KEMIN INDUSTRIES, INC.

- LAFFORT

- UNIFERM GMBH & CO. KG

- CHR. OLESEN

- その他の企業

- AGRANO GMBH & CO. KG

- BIORIGIN

- BAKEMARK

- ABN APLICACIONES BIOLOGICAS A LA NUTRICION.

- BIOCHEM ZUSATZSTOFFE HANDELS-UND PRODUKTIONSGESELLSCHAFT MBH

- KELIFF'S

- ARSHINE PHARMACEUTICAL CO., LTD.

- UNIQUE BIOTECH LIMITED

- OENOBRANDS SAS

- ENZYM GROUP

第15章 隣接市場と関連市場

第16章 付録

The global yeast market is estimated to be valued at USD 5.5 billion in 2024 and is projected to reach USD 8.5 billion by 2029 at a CAGR of 8.9%. Yeast, a crucial ingredient in bread-making, plays a central role in determining the texture, flavor, and rise of baked goods. As the demand for bread continues to rise, driven by factors such as the popularity of artisanal and specialty breads, the home baking trend, and consumers' preference for natural and clean-label ingredients, there is a parallel increase in the demand for yeast. The increasing import figures for bread worldwide, from USD 38.7 million in 2020 to USD 44.3 million in 2021 and further to USD 49.7 million in 2022, indicate a growing demand for bakery products on the global scale. This upward trend in bread imports presents a significant opportunity for yeast products within the food industry.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD), Volume (Ton) |

| Segments | By Type, Applications, by Form, By Genus, By Yeast Extract (Qualitative) And Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

Moreover, the expanding market for plant-based and alternative proteins further amplifies the opportunities for yeast-derived ingredients in food applications. With technological advancements enhancing the efficiency and versatility of yeast production, manufacturers are well-positioned to capitalize on these rising opportunities within the food industry, leveraging yeast products to meet the evolving demands of consumers worldwide.

"Fresh form dominating within the form segment of the yeast market."

The increasing demand for fresh yeast stems from several factors, particularly its unique characteristics and advantages within the baking and confectionery industries. Unlike other forms of yeast, such as active or instant, fresh yeast offers distinct benefits that cater specifically to the needs of bakers and pastry chefs.

Fresh yeast is prized for its natural extraction process. It is derived from natural sources and undergoes minimal processing, preserving its inherent qualities. This natural origin appeals to consumers seeking wholesome, minimally processed ingredients in their baked goods. The rising demand for fresh yeast underscores its indispensable role in the bakery and confectionery sectors. Its natural origin, nutritional benefits, flavor-enhancing properties, and versatility in baking applications make it a preferred choice for consumers and professional bakers alike. As a result, the fresh yeast segment is poised for significant growth in the foreseeable future.

"Changes in dietary choices have positioned Europe as a dominating region in the yeast market."

The demand for yeast products in Europe has experienced a notable upsurge in recent times, fueled by several factors. One significant driver has been the rising trend of home baking, particularly accentuated during the COVID-19 pandemic. This surge in home baking has led to a heightened consumption of yeast for bread-making purposes as individuals sought solace and satisfaction in the art of baking. According to the COFALEC (Confederation of European Yeast Producers), Europe produces 35% of the yeast worldwide. 475 million Europeans consume, on a daily basis, food & drink products that are made using yeast, such as bread, beer, or wine.

Concurrently, there has been a growing recognition of the health benefits associated with fermented foods, including those containing yeast. With its probiotic properties and contributions to gut health, yeast has garnered increased attention among health-conscious consumers. With its versatility and widespread applicability, yeast continues to be a sought-after ingredient, promising sustained growth and innovation in the European market.

The break-up of the profile of primary participants in the yeast market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: CXO's - 20%, Managers - 50%, Executives- 30%

- By Region: North America - 25%, Europe - 20%, Asia Pacific - 30%, South America - 15% and Rest of the World -10%

Prominent companies ADM (US), Associated British Foods plc (UK), Alltech (US), AngelYeast Co., Ltd (China), Lallemand Inc. (Canada) among others.

Research Coverage:

This research report categorizes the yeast market by type (brewer's yeast, baker's yeast, wine yeast, probiotic yeast, other types), by applications (food, feed, other applications), form (fresh, instant, active), by yeast extract (Qualitative) and Region (North America, Europe, Asia Pacific, South America, RoW).

The report covers information about the key factors, such as drivers, restraints, opportunities, and challenges impacting the growth of the yeast market. It also provides a detailed analysis of the major players in the market including their business overview, products offered; key strategies; partnerships, new product launches, and acquisitions. Competitive benchmarking of upcoming startups in the yeast market is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall yeast market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Expansion of the bakery industry worldwide), restraints (Concerns regarding allergenic potential of yeast), opportunities (Strategic collaborations and partnerships between yeast manufacturers & other players), and challenges (Difficulty in achieving consistent product quality and performance due to variations in raw materials, fermentation conditions, and strain characteristics) influencing the growth of the yeast market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the yeast market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the yeast market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the yeast market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like ADM (US), Associated British Foods plc (UK), Alltech (US), AngelYeast Co., Ltd (China), Lallemand Inc. (Canada), ICC (Brazil), Leiber (Germany), Lesaffre (France) among others in the yeast market strategies. The report also helps stakeholders understand the yeast market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- FIGURE 1 YEAST MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 REGIONS COVERED

- FIGURE 2 YEAST MARKET SEGMENTATION, BY REGION

- 1.3.4 YEARS CONSIDERED

- 1.4 UNITS CONSIDERED

- 1.4.1 CURRENCY/VALUE UNIT

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019-2023

- 1.4.2 VOLUME UNIT

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 YEAST MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.3 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- FIGURE 6 YEAST MARKET SIZE CALCULATION: SUPPLY SIDE

- 2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 2.6 RECESSION IMPACT ANALYSIS

- 2.6.1 MACRO INDICATORS OF RECESSION

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 GLOBAL INFLATION RATE, 2011-2022

- FIGURE 11 GLOBAL GDP, 2011-2022 (USD TRILLION)

- FIGURE 12 RECESSION INDICATORS AND THEIR IMPACT ON YEAST MARKET

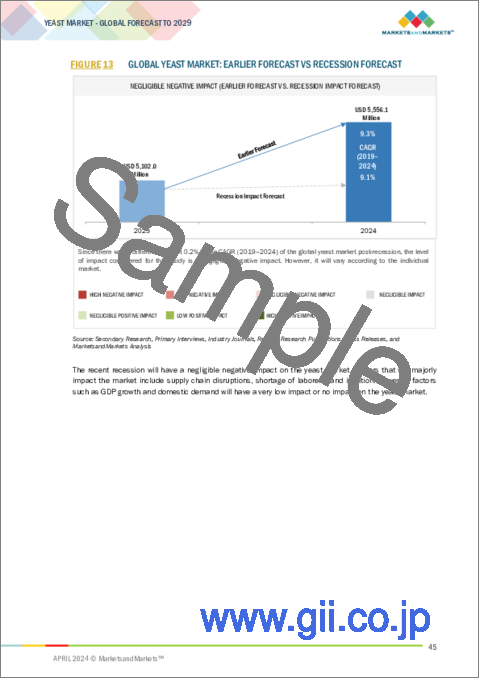

- FIGURE 13 GLOBAL YEAST MARKET: EARLIER FORECAST VS RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 2 YEAST MARKET SHARE SNAPSHOT, 2024 VS. 2029 (USD MILLION)

- FIGURE 14 YEAST MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 15 YEAST MARKET, BY FORM, 2024 VS. 2029 (USD MILLION)

- FIGURE 16 YEAST MARKET, BY GENUS, 2024 VS. 2029 (USD MILLION)

- FIGURE 17 YEAST MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 18 YEAST MARKET SHARE AND GROWTH RATE (VALUE), BY REGION, 2024

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN YEAST MARKET

- FIGURE 19 ASIA PACIFIC TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.2 ASIA PACIFIC: YEAST MARKET, BY FORM AND COUNTRY

- FIGURE 20 CHINA AND FRESH SEGMENTS ACCOUNTED FOR LARGEST SHARES IN ASIA PACIFIC YEAST MARKET IN 2024

- 4.3 YEAST MARKET, BY APPLICATION

- FIGURE 21 FOOD & BEVERAGE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 YEAST MARKET, BY FORM

- FIGURE 22 FRESH YEAST TO BE LARGEST FORM SEGMENT DURING FORECAST PERIOD

- 4.5 YEAST MARKET, BY GENUS

- FIGURE 23 SACCHAROMYCES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.6 YEAST MARKET, BY TYPE

- FIGURE 24 BAKER'S YEAST TO SIGNIFICANTLY LEAD MARKET DURING FORECAST PERIOD

- 4.7 YEAST MARKET, BY FORM AND REGION

- FIGURE 25 FRESH FORM TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.8 YEAST MARKET: KEY COUNTRIES

- FIGURE 26 US DOMINATED YEAST MARKET IN 2024

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 BURGEONING APPETITE FOR YEAST PRODUCTS WITH RISING POPULATION AND GDP

- FIGURE 27 GLOBAL POPULATION GROWTH, 1950-2050 (BILLION)

- FIGURE 28 GDP GROWTH, 2016-2022 (USD TRILLION)

- 5.2.2 EXPANSION OF YEAST PRODUCTS IN FOOD & BEVERAGE AND FEED INDUSTRIES

- 5.3 MARKET DYNAMICS

- FIGURE 29 YEAST MARKET: MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Global expansion of bakery industry

- 5.3.1.2 Increase in demand for yeast in brewing sector

- 5.3.1.3 Nutritional benefits popularizing yeast among feed additive manufacturers

- 5.3.2 RESTRAINTS

- 5.3.2.1 Concerns regarding allergenic potential of yeast

- 5.3.2.2 Competition for basic raw materials

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Strategic collaborations and partnerships between yeast manufacturers and other players

- 5.3.3.2 New varieties of yeast ingredients for improved functionality

- 5.3.4 CHALLENGES

- 5.3.4.1 Difficulty in achieving product consistency due to varying raw materials, fermentation conditions, and strain characteristics

- 5.3.4.2 High research & development costs

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 30 YEAST MARKET: SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- FIGURE 31 YEAST MARKET: VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH AND DEVELOPMENT

- 6.3.2 RAW MATERIAL SOURCING

- 6.3.3 PROCESSING AND MANUFACTURING

- 6.3.4 DISTRIBUTION

- 6.3.5 MARKETING & SALES

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO

- FIGURE 32 IMPORT VALUE OF YEASTS, ACTIVE OR INACTIVE, FOR KEY COUNTRIES, 2019-2023 (USD)

- TABLE 3 IMPORT SCENARIO FOR HS CODE: 2102, BY COUNTRY, 2022 (USD)

- 6.4.2 EXPORT SCENARIO

- FIGURE 33 EXPORT VALUE OF YEASTS, ACTIVE OR INACTIVE, FOR KEY COUNTRIES, FOR KEY COUNTRIES, 2019-2023 (USD)

- TABLE 4 EXPORT SCENARIO FOR HS CODE: 2102, BY COUNTRY, 2022 (USD)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGY

- 6.5.1.1 Yops

- 6.5.2 COMPLEMENTARY TECHNOLOGY

- 6.5.2.1 Innova

- 6.5.3 ADJACENT TECHNOLOGY

- 6.5.3.1 High-purity yeast beta-glucan technology

- 6.5.1 KEY TECHNOLOGY

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- FIGURE 34 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE (USD/KG)

- 6.6.2 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 5 YEAST MARKET: AVERAGE SELLING PRICE TREND, BY REGION, 2024-2029 (USD/TON)

- 6.6.3 AVERAGE SELLING PRICE TREND, BY TYPE

- TABLE 6 YEAST MARKET: AVERAGE SELLING PRICE TREND, BY TYPE, 2024-2029 (USD/TON)

- FIGURE 35 AVERAGE SELLING PRICE TREND, BY TYPE (USD/TON)

- 6.7 ECOSYSTEM/MARKET MAP

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- FIGURE 36 KEY PLAYERS IN YEAST ECOSYSTEM

- TABLE 7 YEAST MARKET: ECOSYSTEM

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 37 REVENUE SHIFT FOR YEAST MARKET VENDORS

- 6.9 PATENT ANALYSIS

- TABLE 8 LIST OF MAJOR PATENTS PERTAINING TO YEAST MARKET, 2014-2024

- FIGURE 38 NUMBER OF PATENTS GRANTED FOR YEAST, 2014-2023

- FIGURE 39 REGIONAL ANALYSIS OF PATENTS GRANTED FOR YEAST

- 6.10 KEY CONFERENCES & EVENTS

- TABLE 9 YEAST MARKET: LIST OF KEY CONFERENCES & EVENTS, 2024

- 6.11 TARIFFS AND REGULATORY LANDSCAPE

- 6.11.1 TARIFF DATA FOR YEAST (HS CODE 2102)

- 6.11.2 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.3 REGULATORY FRAMEWORK

- 6.11.3.1 North America

- 6.11.3.1.1 US

- 6.11.3.1.1.1 US Food and Drug Administration

- 6.11.3.1.2 Canada

- 6.11.3.1.1 US

- 6.11.3.2 Europe

- 6.11.3.2.1 European Union

- 6.11.3.3 South America

- 6.11.3.3.1 Argentina

- 6.11.3.4 Asia Pacific

- 6.11.3.4.1 Australia and New Zealand

- 6.11.3.4.2 India

- 6.11.3.4.2.1 FSSAI

- 6.11.3.1 North America

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 PORTER'S FIVE FORCES' IMPACT ON YEAST MARKET

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

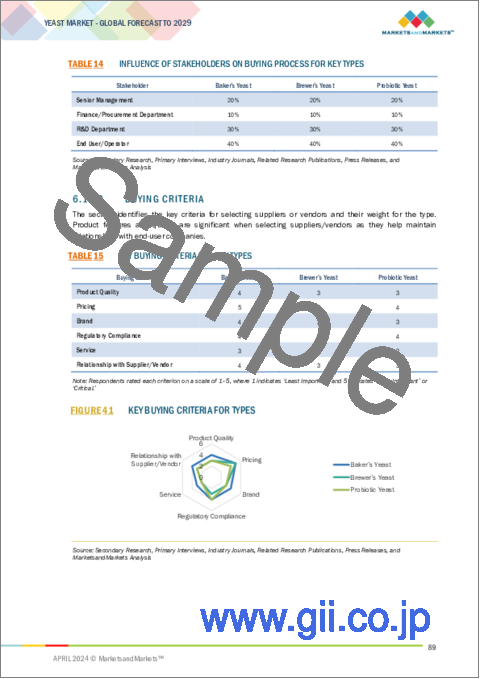

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPES

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPES

- 6.13.2 BUYING CRITERIA

- TABLE 15 KEY BUYING CRITERIA FOR KEY TYPES

- FIGURE 41 KEY BUYING CRITERIA FOR TYPES

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 INTEGRATION OF EVOLVA'S OPERATIONS INTO LALLEMAND'S BUSINESS HELPED IN BROADENING ITS PRODUCT PORTFOLIO

7 YEAST MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 42 YEAST MARKET, BY TYPE, 2023 VS. 2029 (USD MILLION)

- TABLE 16 YEAST MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 17 YEAST MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 18 YEAST MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 19 YEAST MARKET, BY TYPE, 2024-2029 (KT)

- 7.2 BREWER'S YEAST

- 7.2.1 RISE IN CONSUMPTION OF BEER AND TRADE OPPORTUNITIES FOR FERMENTED BEVERAGES

- TABLE 20 BREWER'S YEAST MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 21 BREWER'S YEAST MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 22 BREWER'S YEAST MARKET, BY REGION, 2019-2023 (KT)

- TABLE 23 BREWER'S YEAST MARKET, BY REGION, 2024-2029 (KT)

- 7.3 BAKER'S YEAST

- 7.3.1 HIGH DEMAND FOR BAKERY PRODUCTS, PARTICULARLY BREAD

- TABLE 24 BAKER'S YEAST MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 25 BAKER'S YEAST MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 26 BAKER'S YEAST MARKET, BY REGION, 2019-2023 (KT)

- TABLE 27 BAKER'S YEAST MARKET, BY REGION, 2024-2029 (KT)

- 7.4 WINE YEAST

- 7.4.1 RISE IN PRODUCTION OF VARIOUS TYPES OF WINE WITH DIFFERENT FLAVORS AND APPEARANCES

- TABLE 28 WINE YEAST MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 29 WINE YEAST MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 30 WINE YEAST MARKET, BY REGION, 2019-2023 (KT)

- TABLE 31 WINE YEAST MARKET, BY REGION, 2024-2029 (KT)

- 7.5 PROBIOTIC YEAST

- 7.5.1 ENGINEERED S. BOULARDII TO OFFER ENHANCED PROBIOTIC PROPERTIES

- TABLE 32 PROBIOTIC YEAST MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 33 PROBIOTIC YEAST MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 34 PROBIOTIC YEAST MARKET, BY REGION, 2019-2023 (KT)

- TABLE 35 PROBIOTIC YEAST MARKET, BY REGION, 2024-2029 (KT)

- 7.6 OTHER TYPES

- TABLE 36 OTHER YEAST TYPES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 37 OTHER YEAST TYPES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 38 OTHER YEAST TYPES MARKET, BY REGION, 2019-2023 (KT)

- TABLE 39 OTHER YEAST TYPES MARKET, BY REGION, 2024-2029 (KT)

8 YEAST MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 43 YEAST MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- TABLE 40 YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 41 YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 8.2 FOOD & BEVERAGES

- 8.2.1 NUTRITIONAL BENEFITS AND EXTENSIVE APPLICATIONS ACROSS FOOD AND BEVERAGES

- TABLE 42 YEAST MARKET IN FOOD & BEVERAGES, BY SUBAPPLICATION, 2019-2023 (USD MILLION)

- TABLE 43 YEAST MARKET IN FOOD & BEVERAGES, BY SUBAPPLICATION, 2024-2029 (USD MILLION)

- TABLE 44 YEAST MARKET IN FOOD & BEVERAGES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 45 YEAST MARKET IN FOOD & BEVERAGES, BY REGION, 2024-2029 (USD MILLION)

- 8.2.2 BAKERY PRODUCTS

- 8.2.2.1 Rise in demand for bakery ingredients, especially in Asian markets

- TABLE 46 YEAST MARKET IN BAKERY PRODUCTS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 47 YEAST MARKET IN BAKERY PRODUCTS, BY REGION, 2024-2029 (USD MILLION)

- 8.2.3 PREPARED MEALS

- 8.2.3.1 Production of processed & prepared food using yeast as food additive-convenience foods in emerging economies; canned food in developed regions

- TABLE 48 YEAST MARKET IN PREPARED MEALS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 49 YEAST MARKET IN PREPARED MEALS, BY REGION, 2024-2029 (USD MILLION)

- 8.2.4 BEVERAGES

- 8.2.4.1 Increase in production and demand for wine and beer in developed regions

- TABLE 50 YEAST MARKET IN BEVERAGES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 51 YEAST MARKET IN BEVERAGES, BY REGION, 2024-2029 (USD MILLION)

- 8.2.5 OTHER FOOD APPLICATIONS

- TABLE 52 YEAST MARKET IN OTHER FOOD APPLICATIONS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 53 YEAST MARKET IN OTHER FOOD APPLICATIONS, BY REGION, 2024-2029 (USD MILLION)

- 8.3 FEED

- 8.3.1 INCREASE IN DEMAND FOR HEALTHY AND SAFE PACKAGED ANIMAL PRODUCTS

- TABLE 54 YEAST MARKET IN FEED, BY SUBAPPLICATION, 2019-2023 (USD MILLION)

- TABLE 55 YEAST MARKET IN FEED, BY SUBAPPLICATION, 2024-2029 (USD MILLION)

- TABLE 56 YEAST MARKET IN FEED, BY REGION, 2019-2023 (USD MILLION)

- TABLE 57 YEAST MARKET IN FEED, BY REGION, 2024-2029 (USD MILLION)

- 8.3.2 SWINE FEED

- 8.3.2.1 Promise shown in yeast-included swine feed, especially in sows

- TABLE 58 YEAST MARKET IN SWINE FEED, BY REGION, 2019-2023 (USD MILLION)

- TABLE 59 YEAST MARKET IN SWINE FEED, BY REGION, 2024-2029 (USD MILLION)

- 8.3.3 POULTRY FEED

- 8.3.3.1 Benefits associated with yeast include improved gut and immune health

- TABLE 60 YEAST MARKET IN POULTRY FEED, BY REGION, 2019-2023 (USD MILLION)

- TABLE 61 YEAST MARKET IN POULTRY FEED, BY REGION, 2024-2029 (USD MILLION)

- 8.3.4 CATTLE FEED

- 8.3.4.1 Rise in cattle production to encourage consumption of feed yeast across regions

- TABLE 62 YEAST MARKET IN CATTLE FEED, BY REGION, 2019-2023 (USD MILLION)

- TABLE 63 YEAST MARKET IN CATTLE FEED, BY REGION, 2024-2029 (USD MILLION)

- 8.3.5 OTHER FEED APPLICATIONS

- TABLE 64 YEAST MARKET IN OTHER FEED APPLICATIONS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 65 YEAST MARKET IN OTHER FEED APPLICATIONS, BY REGION, 2024-2029 (USD MILLION)

- 8.4 OTHER APPLICATIONS

- TABLE 66 YEAST MARKET IN OTHER APPLICATIONS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 67 YEAST MARKET IN OTHER APPLICATIONS, BY REGION, 2024-2029 (USD MILLION)

9 YEAST MARKET, BY FORM

- 9.1 INTRODUCTION

- FIGURE 44 YEAST MARKET, BY FORM, 2024 VS. 2029 (USD MILLION)

- TABLE 68 YEAST MARKET, BY FORM, 2019-2023 (USD MILLION)

- TABLE 69 YEAST MARKET, BY FORM, 2024-2029 (USD MILLION)

- 9.1.1 FRESH

- 9.1.1.1 High use in bakery products, but requires cold chain facilities

- TABLE 70 FRESH YEAST MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 71 FRESH YEAST MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.1.2 INSTANT

- 9.1.2.1 Preferred for commercial use, especially for convenience foods

- TABLE 72 INSTANT YEAST MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 73 INSTANT YEAST MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.1.3 ACTIVE

- 9.1.3.1 Increase in wine and bread production

- TABLE 74 ACTIVE YEAST MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 75 ACTIVE YEAST MARKET, BY REGION, 2024-2029 (USD MILLION)

10 YEAST MARKET, BY GENUS

- 10.1 INTRODUCTION

- FIGURE 45 YEAST MARKET, BY GENUS, 2024 VS. 2029 (USD MILLION)

- TABLE 76 YEAST MARKET, BY GENUS, 2019-2023 (USD MILLION)

- TABLE 77 YEAST MARKET, BY GENUS, 2024-2029 (USD MILLION)

- 10.1.1 SACCHAROMYCES

- 10.1.1.1 Rise in demand for Saccharomyces in bakery and feed industries due to beneficial nutritional profile and growth performance

- TABLE 78 SACCHAROMYCES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 79 SACCHAROMYCES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.1.2 KLUYVEROMYCES

- 10.1.2.1 Kluyveromyces marxianus to be second-most common strain used for feed additives

- TABLE 80 KLUYVEROMYCES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 81 KLUYVEROMYCES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.1.3 OTHER GENERA

- TABLE 82 OTHER YEAST GENERA MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 83 OTHER YEAST GENERA MARKET, BY REGION, 2024-2029 (USD MILLION)

11 YEAST MARKET, BY YEAST EXTRACT

- 11.1 INTRODUCTION

- 11.2 YEAST AUTOLYSATES

- 11.3 YEAST HYDROLYSATES

- 11.4 YEAST CELL WALL

12 YEAST MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 46 YEAST MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- TABLE 84 YEAST MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 85 YEAST MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 86 YEAST MARKET, BY REGION, 2019-2023 (KT)

- TABLE 87 YEAST MARKET, BY REGION, 2024-2029 (KT)

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 47 NORTH AMERICA: INFLATION DATA, BY COUNTRY, 2017-2022

- FIGURE 48 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 88 NORTH AMERICA: YEAST MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 89 NORTH AMERICA: YEAST MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 90 NORTH AMERICA: YEAST MARKET, BY FORM, 2019-2023 (USD MILLION)

- TABLE 91 NORTH AMERICA: YEAST MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 92 NORTH AMERICA: YEAST MARKET, BY GENUS, 2019-2023 (USD MILLION)

- TABLE 93 NORTH AMERICA: YEAST MARKET, BY GENUS, 2024-2029 (USD MILLION)

- TABLE 94 NORTH AMERICA: YEAST MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 95 NORTH AMERICA: YEAST MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 96 NORTH AMERICA: YEAST MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 97 NORTH AMERICA: YEAST MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 98 NORTH AMERICA: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 99 NORTH AMERICA: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 100 NORTH AMERICA: YEAST MARKET IN FOOD & BEVERAGES, BY SUBAPPLICATION, 2019-2023 (USD MILLION)

- TABLE 101 NORTH AMERICA: YEAST MARKET IN FOOD & BEVERAGES, BY SUBAPPLICATION, 2024-2029 (USD MILLION)

- TABLE 102 NORTH AMERICA: YEAST MARKET IN FEED, BY SUBAPPLICATION, 2019-2023 (USD MILLION)

- TABLE 103 NORTH AMERICA: YEAST MARKET IN FEED, BY SUBAPPLICATION, 2024-2029 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 High demand for specialty yeast with growth in health consciousness and focus on sustainability

- TABLE 104 US: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 105 US: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Prominent in export market for baked goods

- TABLE 106 CANADA: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 107 CANADA: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.2.4 MEXICO

- 12.2.4.1 Presence as key player in beer brewing marketspace

- TABLE 108 MEXICO: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 109 MEXICO: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.3 EUROPE

- FIGURE 49 EUROPE: YEAST MARKET SNAPSHOT

- 12.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 50 EUROPE: INFLATION DATA, BY COUNTRY, 2017-2022

- FIGURE 51 EUROPE: RECESSION IMPACT ANALYSIS, 2023

- TABLE 110 EUROPE: YEAST MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 111 EUROPE: YEAST MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 112 EUROPE: YEAST MARKET, BY FORM, 2019-2023 (USD MILLION)

- TABLE 113 EUROPE: YEAST MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 114 EUROPE: YEAST MARKET, BY GENUS, 2019-2023 (USD MILLION)

- TABLE 115 EUROPE: YEAST MARKET, BY GENUS, 2024-2029 (USD MILLION)

- TABLE 116 EUROPE: YEAST MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 117 EUROPE: YEAST MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 118 EUROPE: YEAST MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 119 EUROPE: YEAST MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 120 EUROPE: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 121 EUROPE: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 122 EUROPE: YEAST MARKET IN FOOD & BEVERAGES, BY SUBAPPLICATION, 2019-2023 (USD MILLION)

- TABLE 123 EUROPE: YEAST MARKET IN FOOD & BEVERAGES, BY SUBAPPLICATION, 2024-2029 (USD MILLION)

- TABLE 124 EUROPE: YEAST MARKET IN FEED, BY SUBAPPLICATION, 2019-2023 (USD MILLION)

- TABLE 125 EUROPE: YEAST MARKET IN FEED, BY SUBAPPLICATION, 2024-2029 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Shift in trend toward innovative beer and increase in wine production

- TABLE 126 GERMANY: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 127 GERMANY: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 Increase in domestic demand and export opportunities for baked goods

- TABLE 128 FRANCE: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 129 FRANCE: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.3.4 UK

- 12.3.4.1 Growth in UK bakery market and livestock feed demand

- TABLE 130 UK: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 131 UK: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.3.5 ITALY

- 12.3.5.1 Traditional cuisine rooted in baked goods and export of fermented beverages

- TABLE 132 ITALY: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 133 ITALY: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.3.6 SPAIN

- 12.3.6.1 Increase in demand for frozen baked foods and innovation in winemaking

- TABLE 134 SPAIN: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 135 SPAIN: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.3.7 REST OF EUROPE

- TABLE 136 REST OF EUROPE: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 137 REST OF EUROPE: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.4 ASIA PACIFIC

- FIGURE 52 ASIA PACIFIC: REGIONAL SNAPSHOT, 2023

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 53 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 54 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2023

- TABLE 138 ASIA PACIFIC: YEAST MARKET, BY COUNTRY/REGION, 2019-2023 (USD MILLION)

- TABLE 139 ASIA PACIFIC: YEAST MARKET, BY COUNTRY/REGION, 2024-2029 (USD MILLION)

- TABLE 140 ASIA PACIFIC: YEAST MARKET, BY FORM, 2019-2023 (USD MILLION)

- TABLE 141 ASIA PACIFIC: YEAST MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 142 ASIA PACIFIC: YEAST MARKET, BY GENUS, 2019-2023 (USD MILLION)

- TABLE 143 ASIA PACIFIC: YEAST MARKET, BY GENUS, 2024-2029 (USD MILLION)

- TABLE 144 ASIA PACIFIC: YEAST MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 145 ASIA PACIFIC: YEAST MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 146 ASIA PACIFIC: YEAST MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 147 ASIA PACIFIC: YEAST MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 148 ASIA PACIFIC: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 149 ASIA PACIFIC: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 150 ASIA PACIFIC: YEAST MARKET IN FOOD & BEVERAGES, BY SUBAPPLICATION, 2019-2023 (USD MILLION)

- TABLE 151 ASIA PACIFIC: YEAST MARKET IN FOOD & BEVERAGES, BY SUBAPPLICATION, 2024-2029 (USD MILLION)

- TABLE 152 ASIA PACIFIC: YEAST MARKET IN FEED, BY SUBAPPLICATION, 2019-2023 (USD MILLION)

- TABLE 153 ASIA PACIFIC: YEAST MARKET IN FEED, BY SUBAPPLICATION, 2024-2029 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Leading yeast manufacturers capitalizing on rise in consumer preferences toward baked goods

- TABLE 154 CHINA: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 155 CHINA: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.4.3 JAPAN

- 12.4.3.1 Increase in trade opportunities in baked goods and preference for high-value functional foods

- TABLE 156 JAPAN: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 157 JAPAN: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.4.4 INDIA

- 12.4.4.1 Make in India initiative and investments in R&D by market leaders

- TABLE 158 INDIA: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 159 INDIA: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.4.5 AUSTRALIA & NEW ZEALAND

- 12.4.5.1 Growth in livestock breeding and rise in wine exports

- TABLE 160 AUSTRALIA & NEW ZEALAND: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 161 AUSTRALIA & NEW ZEALAND: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.4.6 SOUTH KOREA

- 12.4.6.1 High pork consumption and demand for naturally sourced feed additives

- TABLE 162 SOUTH KOREA: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 163 SOUTH KOREA: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.4.7 REST OF ASIA PACIFIC

- TABLE 164 REST OF ASIA PACIFIC: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.5 SOUTH AMERICA

- 12.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 55 SOUTH AMERICA: INFLATION DATA, BY KEY COUNTRY, 2017-2022

- FIGURE 56 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- TABLE 166 SOUTH AMERICA: YEAST MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 167 SOUTH AMERICA: YEAST MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 168 SOUTH AMERICA: YEAST MARKET, BY FORM, 2019-2023 (USD MILLION)

- TABLE 169 SOUTH AMERICA: YEAST MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 170 SOUTH AMERICA: YEAST MARKET, BY GENUS, 2019-2023 (USD MILLION)

- TABLE 171 SOUTH AMERICA: YEAST MARKET, BY GENUS, 2024-2029 (USD MILLION)

- TABLE 172 SOUTH AMERICA: YEAST MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 173 SOUTH AMERICA: YEAST MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 174 SOUTH AMERICA: YEAST MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 175 SOUTH AMERICA: YEAST MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 176 SOUTH AMERICA: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 177 SOUTH AMERICA: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 178 SOUTH AMERICA: YEAST MARKET IN FOOD & BEVERAGES, BY SUBAPPLICATION, 2019-2023 (USD MILLION)

- TABLE 179 SOUTH AMERICA: YEAST MARKET IN FOOD & BEVERAGES, BY SUBAPPLICATION, 2024-2029 (USD MILLION)

- TABLE 180 SOUTH AMERICA: YEAST MARKET IN FEED, BY SUBAPPLICATION, 2019-2023 (USD MILLION)

- TABLE 181 SOUTH AMERICA: YEAST MARKET IN FEED, BY SUBAPPLICATION, 2024-2029 (USD MILLION)

- 12.5.2 BRAZIL

- 12.5.2.1 Investments by large players with its position as prominent global meat exporter

- TABLE 182 BRAZIL: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 183 BRAZIL: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.5.3 ARGENTINA

- 12.5.3.1 Rise in awareness about sustainable and clean fuel-bioethanol

- TABLE 184 ARGENTINA: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 185 ARGENTINA: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.5.4 REST OF SOUTH AMERICA

- TABLE 186 REST OF SOUTH AMERICA: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 187 REST OF SOUTH AMERICA: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.6 REST OF THE WORLD (ROW)

- 12.6.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 57 ROW: INFLATION DATA, BY SUBREGION, 2017-2022

- FIGURE 58 ROW: RECESSION IMPACT ANALYSIS, 2023

- TABLE 188 ROW: YEAST MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 189 ROW: YEAST MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 190 ROW: YEAST MARKET, BY FORM, 2019-2023 (USD MILLION)

- TABLE 191 ROW: YEAST MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 192 ROW: YEAST MARKET, BY GENUS, 2019-2023 (USD MILLION)

- TABLE 193 ROW: YEAST MARKET, BY GENUS, 2024-2029 (USD MILLION)

- TABLE 194 ROW: YEAST MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 195 ROW: YEAST MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 196 ROW: YEAST MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 197 ROW: YEAST MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 198 ROW: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 199 ROW: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 200 ROW: YEAST MARKET IN FOOD & BEVERAGES, BY SUBAPPLICATION, 2019-2023 (USD MILLION)

- TABLE 201 ROW: YEAST MARKET IN FOOD & BEVERAGES, BY SUBAPPLICATION, 2024-2029 (USD MILLION)

- TABLE 202 ROW: YEAST MARKET IN FEED, BY SUBAPPLICATION, 2019-2023 (USD MILLION)

- TABLE 203 ROW: YEAST MARKET IN FEED, BY SUBAPPLICATION, 2024-2029 (USD MILLION)

- 12.6.2 AFRICA

- 12.6.2.1 Presence of bread as staple food product and rise in livestock production

- TABLE 204 AFRICA: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 205 AFRICA: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.6.3 MIDDLE EAST

- 12.6.3.1 Shift in consumer lifestyles and increase in consumption of fast food

- TABLE 206 MIDDLE EAST: YEAST MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 207 MIDDLE EAST: YEAST MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 REVENUE ANALYSIS

- FIGURE 59 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD BILLION)

- 13.3 MARKET SHARE ANALYSIS

- TABLE 208 YEAST MARKET: MARKET SHARE ANALYSIS, 2022

- 13.4 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- TABLE 209 OVERVIEW OF STRATEGIES ADOPTED BY KEY YEAST PLAYERS

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 60 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 61 EV/EBITDA OF KEY PLAYERS

- 13.6 BRAND/PRODUCT COMPARISON

- FIGURE 62 YEAST MARKET: BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- FIGURE 63 YEAST MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 13.7.5.1 Overall company footprint

- FIGURE 64 YEAST MARKET: OVERALL COMPANY FOOTPRINT FOR KEY PLAYERS, 2023

- 13.7.5.2 Regional footprint

- TABLE 210 COMPANY REGIONAL FOOTPRINT

- 13.7.5.3 Type footprint

- TABLE 211 COMPANY TYPE FOOTPRINT

- 13.7.5.4 Application footprint

- TABLE 212 COMPANY APPLICATION FOOTPRINT

- 13.7.5.5 Form footprint

- TABLE 213 COMPANY FORM FOOTPRINT

- 13.8 COMPANY EVALUATION MATRIX: START-UPS/SMES

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- FIGURE 65 YEAST MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2023

- 13.8.5 COMPETITIVE BENCHMARKING

- 13.8.5.1 Detailed list of key start-ups/SMEs

- TABLE 214 YEAST MARKET: LIST OF KEY START-UPS/SMES

- 13.8.5.2 Competitive benchmarking of key start-ups/SMEs

- TABLE 215 YEAST MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- TABLE 216 YEAST MARKET: PRODUCT LAUNCHES, JANUARY 2019-DECEMBER 2023

- 13.9.2 DEALS

- TABLE 217 YEAST MARKET: DEALS, JANUARY 2019-DECEMBER 2023

- 13.9.3 EXPANSIONS

- TABLE 218 YEAST MARKET: EXPANSIONS, JANUARY 2019-DECEMBER 2023

14 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 14.1 KEY PLAYERS

- 14.1.1 ANGELYEAST CO., LTD.

- TABLE 219 ANGELYEAST CO., LTD.: COMPANY OVERVIEW

- FIGURE 66 ANGELYEAST CO., LTD: COMPANY SNAPSHOT

- TABLE 220 ANGELYEAST CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 221 ANGELYEAST CO., LTD.: PRODUCT LAUNCHES

- 14.1.2 ASSOCIATED BRITISH FOODS PLC

- TABLE 222 ASSOCIATED BRITISH FOODS PLC: COMPANY OVERVIEW

- FIGURE 67 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

- TABLE 223 ASSOCIATED BRITISH FOODS PLC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 224 ASSOCIATED BRITISH FOODS PLC: EXPANSIONS

- 14.1.3 ADM

- TABLE 225 ADM: COMPANY OVERVIEW

- FIGURE 68 ADM: COMPANY SNAPSHOT

- TABLE 226 ADM: PRODUCTS/SOLUTIONS OFFERED

- 14.1.4 NISSHIN SEIFUN GROUP INC.

- TABLE 227 NISSHIN SEIFUN GROUP INC.: COMPANY OVERVIEW

- FIGURE 69 NISSHIN SEIFUN GROUP INC.: COMPANY SNAPSHOT

- TABLE 228 NISSHIN SEIFUN GROUP INC: PRODUCTS/SOLUTIONS OFFERED

- 14.1.5 KOTHARI FERMENTATION AND BIOCHEM LTD.

- TABLE 229 KOTHARI FERMENTATION AND BIOCHEM LTD.: COMPANY OVERVIEW

- FIGURE 70 KOTHARI FERMENTATION AND BIOCHEM LTD.: COMPANY SNAPSHOT

- TABLE 230 KOTHARI FERMENTATION AND BIOCHEM LTD.: PRODUCTS/SOLUTIONS OFFERED

- 14.1.6 ALLTECH

- TABLE 231 ALLTECH: COMPANY OVERVIEW

- TABLE 232 ALLTECH: PRODUCTS/SOLUTIONS OFFERED

- TABLE 233 ALLTECH: EXPANSIONS

- 14.1.7 LALLEMAND INC.

- TABLE 234 LALLEMAND INC: COMPANY OVERVIEW

- TABLE 235 LALLEMAND INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 236 LALLEMAND INC.: DEALS

- 14.1.8 ICC

- TABLE 237 ICC: COMPANY OVERVIEW

- TABLE 238 ICC: PRODUCTS/SOLUTIONS OFFERED

- 14.1.9 LEIBER

- TABLE 239 LEIBER: COMPANY OVERVIEW

- TABLE 240 LEIBER: PRODUCTS/SOLUTIONS OFFERED

- TABLE 241 LEIBER: EXPANSIONS

- 14.1.10 LESAFFRE

- TABLE 242 LESAFFRE: COMPANY OVERVIEW

- TABLE 243 LESAFFRE: PRODUCTS/SOLUTIONS OFFERED

- 14.1.11 PACIFIC FERMENTATION IND. LTD.

- TABLE 244 PACIFIC FERMENTATION IND. LTD.: COMPANY OVERVIEW

- TABLE 245 PACIFIC FERMENTATION IND. LTD.: PRODUCTS/SOLUTIONS OFFERED

- 14.1.12 PAK HOLDING

- TABLE 246 PAK HOLDING: COMPANY OVERVIEW

- TABLE 247 PAK HOLDING: PRODUCTS/SOLUTIONS OFFERED

- 14.1.13 KEMIN INDUSTRIES, INC.

- TABLE 248 KEMIN INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 249 KEMIN INDUSTRIES, INC.: PRODUCTS/SOLUTIONS OFFERED

- 14.1.14 LAFFORT

- TABLE 250 LAFFORT: COMPANY OVERVIEW

- TABLE 251 LAFFORT: PRODUCTS/SOLUTIONS OFFERED

- 14.1.15 UNIFERM GMBH & CO. KG

- TABLE 252 UNIFERM GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 253 UNIFERM GMBH & CO. KG: PRODUCTS OFFERED

- 14.1.16 CHR. OLESEN

- TABLE 254 CHR. OLESEN: COMPANY OVERVIEW

- TABLE 255 CHR. OLESEN: PRODUCTS/SOLUTIONS OFFERED

- 14.2 OTHER PLAYERS

- 14.2.1 AGRANO GMBH & CO. KG

- TABLE 256 AGRANO GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 257 AGRANO GMBH & CO. KG: PRODUCTS/SOLUTIONS OFFERED

- 14.2.2 BIORIGIN

- TABLE 258 BIORIGIN: COMPANY OVERVIEW

- TABLE 259 BIORIGIN: PRODUCTS/SOLUTIONS OFFERED

- 14.2.3 BAKEMARK

- TABLE 260 BAKEMARK: COMPANY OVERVIEW

- TABLE 261 BAKEMARK: PRODUCTS/SOLUTIONS OFFERED

- 14.2.4 ABN APLICACIONES BIOLOGICAS A LA NUTRICION.

- TABLE 262 ABN APLICACIONES BIOLOGICAS A LA NUTRICION.: COMPANY OVERVIEW

- TABLE 263 ABN APLICACIONES BIOLOGICAS A LA NUTRICION: PRODUCTS/SOLUTIONS OFFERED

- 14.2.5 BIOCHEM ZUSATZSTOFFE HANDELS- UND PRODUKTIONSGESELLSCHAFT MBH

- TABLE 264 BIOCHEM ZUSATZSTOFFE HANDELS- UND PRODUKTIONSGESELLSCHAFT MBH: COMPANY OVERVIEW

- TABLE 265 BIOCHEM ZUSATZSTOFFE HANDELS- UND PRODUKTIONSGESELLSCHAFT MBH: PRODUCTS/SOLUTIONS OFFERED

- 14.2.6 KELIFF'S

- 14.2.7 ARSHINE PHARMACEUTICAL CO., LTD.

- 14.2.8 UNIQUE BIOTECH LIMITED

- 14.2.9 OENOBRANDS SAS

- 14.2.10 ENZYM GROUP

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- TABLE 266 MARKETS ADJACENT TO YEAST MARKET

- 15.2 LIMITATIONS

- 15.3 FEED YEAST MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- TABLE 267 FEED YEAST MARKET, BY GENUS, 2016-2019 (USD MILLION)

- TABLE 268 FEED YEAST MARKET, BY GENUS, 2020-2025 (USD MILLION)

- 15.4 SPECIALTY YEAST MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- TABLE 269 SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 270 SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS