|

|

市場調査レポート

商品コード

1462412

パレタイザーの世界市場:技術別、製品タイプ別、産業別、地域別 - 予測(~2029年)Palletizer Market by Technology (Conventional, Robotic), Product Type (Bags, Boxes and Cases, Pails and Drums), Industry (Food & Beverages, Chemicals, Pharmaceuticals, Cosmetics & Personal Care, E-commerce and Retail) & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| パレタイザーの世界市場:技術別、製品タイプ別、産業別、地域別 - 予測(~2029年) |

|

出版日: 2024年04月04日

発行: MarketsandMarkets

ページ情報: 英文 226 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

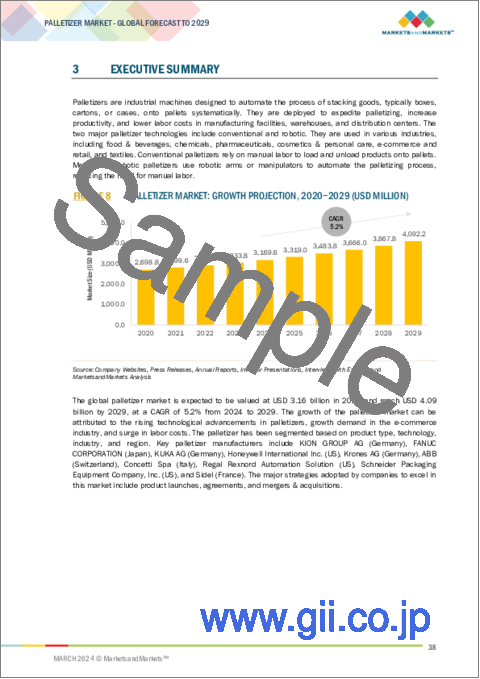

世界のパレタイザーの市場規模は、2024年の32億米ドルから、予測期間中は5.2%のCAGRで推移し、2029年には41億米ドルの規模に成長すると予測されています。

パレタイザーの技術の進歩、さまざま産業における人件費の高騰と自動化需要の増加、eコマース産業におけるパレタイザー需要の増加、食品・飲料産業におけるロボットパレタイザーの展開の増加などの要因が同市場の成長を推進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント | 技術・製品タイプ・産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

技術別では、ローレベルパレタイザーの部門が2023年に最大のシェアを示しています。ローレベルパレタイザーは、主にその費用対効果、汎用性、操作性によりパレタイザー市場を独占しています。ハイレベルパレタイザーと比較すると、中小企業を含む幅広い産業にとって、より利用しやすいソリューションを提供しています。パレタイザーは、ケースやカートンから袋やバンドルまで、多様な包装タイプやサイズを簡単に扱うことができ、さまざまな用途への適用性を高めています。また、ローレベルパレタイザーはコンパクトな設置面積のため、限られたスペースの施設に最適です。

産業別では、食品・飲料部門が2023年に最大のシェアを示しています。これは主に製造業における先進技術の広範な採用によるものです。まず、この分野では大量の製品を扱うため、効率的なハンドリングとパッケージングが必要となります。パレタイザーはこれらの作業を自動化し、手作業を減らして生産性を高めます。第二に、業界の厳しい衛生・安全基準はパレタイザーによって効果的に満たされ、信頼性の高い衛生的なハンドリング方法が保証されます。食品・飲料の普及がパレタイザー市場の成長に拍車をかけています。

地域別では、米国が2023年に最大のシェアを示しています。米国では、急速な技術導入と製品開発が市場成長に大きな役割を果たすと推定されます。小売分野における急速な技術の進歩が市場を牽引しています。小売業界の競争力の上昇に伴い、企業は変化する市場環境に適応するため、店舗を継続的に進化させています。これらの店舗は、より技術的に進歩し、パレタイザー、ASRS、AMRなど、いくつかの自動化設備が導入されています。

当レポートでは、世界のパレタイザーの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/ディスラプション

- 価格分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 主な会議とイベント

- ケーススタディ分析

- 規制状況

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 パレタイザー市場に関する最近の動向と展開

- 共同パレタイジング

- IOTと接続性

- 機械学習 (ML) とAI統合 (AI)

- エネルギー効率の高いソリューション

- カスタマイズと柔軟性

- 人間工学に基づいたデザインとユーザーフレンドリーなインターフェース

- モバイルパレタイジングソリューション

- 最適化のためのソフトウェア統合

- セーフティイノベーション

第7章 パレタイザーの主要コンポーネントとエンドユーザー

- パレタイジングシステムの主要コンポーネント

- インフィードコンベア

- パレットディスペンサー

- 製品アライメントおよび個別化システム

- 製品グリッパーまたはエンドエフェクター

- 機械式パレタイザー

- 安全システム

- 制御システム

- ソフトウェア

- パレタイジングシステムの主なエンドユーザー

- 工場

- 配送センター

- フルフィルメントセンター

第8章 パレタイザー市場:技術別

- 従来型パレタイザー

- ハイレベルパレタイザー

- ローレベルパレタイザー

- ロボットパレタイザー

- 従来型ロボットパレタイザー

- 協働パレタイザー

第9章 パレタイザー市場:製品タイプ別

- 袋

- 箱・ケース

- ペール缶・ドラム缶

- その他

第10章 パレタイザー市場:産業別

- 食品・飲料

- 化学品

- 医薬品

- 化粧品・パーソナルケア

- eコマース・小売

- テキスタイル

第11章 パレタイザー市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第12章 競合情勢

- 主要企業が採用する戦略:概要

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ・動向

第13章 企業プロファイル

- 主要企業

- KION GROUP AG

- FANUC CORPORATION

- KUKA AG

- HONEYWELL INTERNATIONAL INC.

- KRONES AG

- ABB

- CONCETTI SPA

- REGAL REXNORD AUTOMATION SOLUTIONS

- SCHNEIDER PACKAGING EQUIPMENT COMPANY, INC.

- SIDEL

- その他の企業

- A-B-C PACKAGING MACHINE CORPORATION

- AETNA GROUP SPA

- BEUMER GROUP

- BRILLOPAK

- BW INTEGRATED SYSTEMS

- COLUMBIA MACHINE, INC.

- EUROIMPIANTI SPA

- FUJI YUSOKI KOGYO CO., LTD.

- HAVER & BOECKER

- KHS GROUP

- MMCI

- OKURA YUSOKI CO., LTD.

- PROMACH

- ROTHE PACKTECH PVT. LTD.

- S&R ROBOT SYSTEMS, LLC

第14章 隣接市場・関連市場

第15章 付録

The palletizer market is expected to reach USD 4.1 billion by 2029 from USD 3.2 billion in 2024, at a CAGR of 5.2% from 2024-2029. Technological advancements in palletizers, Increased labor costs and demand for automation in various industries, Rising demand for palletizers in e-commerce industry, Increased deployment of robotic palletizers in food & beverages industry.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Product Type, Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Low level palletizer technology segment is to hold the largest market share of palletizer market in 2023."

Low-level palletizers dominate the palletizer market primarily due to their cost-effectiveness, versatility, and ease of operation. Compared to high-level palletizers, they offer a more accessible solution for a wide range of industries, including small and medium-sized enterprises. These palletizers can handle diverse packaging types and sizes with ease, from cases and cartons to bags and bundles, enhancing their applicability across various applications. Additionally, low-level palletizers compact footprint makes them ideal for facilities with limited space.

"Food & beverages industry is to hold the largest market share of palletizer market in 2023."

Food & beverages dominate the palletizer market, commanding the largest market share, primarily due to the widespread adoption of advanced technologies in the manufacturing industry. Firstly, the sector handles substantial product volumes that necessitate efficient handling and packaging. Palletizers automate these tasks, reducing manual labor and boosting productivity. Secondly, stringent hygiene and safety standards in the industry are effectively met by palletizers, ensuring reliable and sanitary handling methods. The rise in the adoption of food & beverages is fueling the a market growth.

"The US in holds the largest market share of palletizer market in 2023."

North America comprises the US, Canada, and Mexico. The US is the leading country in North America, accounting for the largest market share. In the US, rapid adoption of technologies and product development are estimated to play a significant role in market growth. The rapid technological advancements in retail sector to drive market. With the rise in the competitiveness of the retail sector, companies are continuously evolving their stores to adapt to the changing market environments; these stores are likely to be more technologically advanced and have included several automated equipment such as palletizers, ASRS, and AMRs. The growth of the market in US is also attributed to presence of prominent market players such as Honeywell International Inc. (US), Regal Rexnord Automation Solutions (US), and Schneider Packaging Equipment Company, Inc. (US).

The break-up of the profiles of primary participants:

- By Company Type - Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation - C-level Executives - 48%, Directors - 33%, and Others - 19%

- By Region - North America - 35%, Europe - 18%, Asia Pacific - 40%, and Rest of the World - 7%

Major players in the palletizer market include KION GROUP AG (Germany), FANUC CORPORATION (Japan), KUKA AG (Germany), Honeywell International Inc. (US), Krones AG (Germany), and others.

Research Coverage

The report segments the palletizer market by Technology, Product Type, Industry and Region. The report also comprehensively reviews drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the overall palletizer market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of critical drivers (Technological advancements in palletizers, Increased labor costs and demand for automation in various industries, Rising demand for palletizers in e-commerce industry, Increased deployment of robotic palletizers in food & beverages industry.), restraints (High initial investment in deploying palletizers ), opportunities (Integration of augmented reality (AR) and virtual reality (VR) technologies into palletizers, Integration of palletizers into warehouse automation), challenges (Complexities associated with integration of palletizers into existing production lines, Handling of fragile or irregularly shaped products) influencing the growth of the palletizer market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the palletizer market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the palletizer market across various regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the palletizer market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players including KION GROUP AG (Germany), FANUC CORPORATION (Japan), KUKA AG (Germany), Honeywell International Inc. (US), Krones AG (Germany), and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- FIGURE 1 PALLETIZER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key primary interview participants

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis (demand side)

- FIGURE 2 PALLETIZER MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis (supply side)

- FIGURE 3 PALLETIZER MARKET: TOP-DOWN APPROACH

- FIGURE 4 PALLETIZER MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 6 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- FIGURE 7 RISK ASSESSMENT

- 2.6 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON PALLETIZER MARKET

- TABLE 1 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON PALLETIZER MARKET

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 PALLETIZER MARKET: GROWTH PROJECTION, 2020-2029 (USD MILLION)

- FIGURE 9 BOXES AND CASES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 10 ROBOTIC PALLETIZERS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 11 PHARMACEUTICALS INDUSTRY TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO RECORD HIGHEST CAGR IN PALLETIZER MARKET FROM 2024 TO 2029

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PALLETIZER MARKET

- FIGURE 13 RISING DEMAND FOR PALLETIZERS IN E-COMMERCE INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- 4.2 PALLETIZER MARKET, BY TECHNOLOGY

- FIGURE 14 CONVENTIONAL PALLETIZERS SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2023

- 4.3 PALLETIZER MARKET, BY INDUSTRY

- FIGURE 15 FOOD & BEVERAGES SEGMENT TO LEAD PALLETIZER MARKET DURING FORECAST PERIOD

- 4.4 PALLETIZER MARKET, BY REGION

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR IN PALLETIZER MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 PALLETIZER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements in palletizers

- 5.2.1.2 Increased labor costs and demand for automation in various industries

- TABLE 2 GLOBAL LABOR COST, BY REGION, 2019-2023 (USD)

- 5.2.1.3 Rising demand for palletizers in e-commerce industry

- 5.2.1.4 Increased deployment of robotic palletizers in food & beverages industry

- FIGURE 18 PALLETIZER MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment in deploying palletizers

- FIGURE 19 PALLETIZER MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of augmented reality (AR) and virtual reality (VR) technologies into palletizers

- 5.2.3.2 Integration of palletizers into warehouse automation

- FIGURE 20 PALLETIZER MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities associated with integration of palletizers into existing production lines

- 5.2.4.2 Handling of fragile or irregularly shaped products

- FIGURE 21 PALLETIZER MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE (ASP) TREND OF ROBOTIC PALLETIZERS

- FIGURE 23 AVERAGE SELLING PRICE (ASP) TREND OF ROBOTIC PALLETIZERS, 2020-2029 (USD)

- 5.4.2 AVERAGE SELLING PRICE (ASP) OF PALLETIZERS OFFERED BY THREE KEY PLAYERS, BY TECHNOLOGY

- FIGURE 24 AVERAGE SELLING PRICE (ASP) OF PALLETIZERS OFFERED BY THREE KEY PLAYERS, BY TECHNOLOGY (USD)

- TABLE 3 AVERAGE SELLING PRICE (ASP) OF PALLETIZERS OFFERED BY THREE KEY PLAYERS, BY TECHNOLOGY (USD)

- 5.4.3 INDICATIVE PRICING TREND OF ROBOTIC PALLETIZERS, BY REGION

- FIGURE 25 INDICATIVE PRICING TREND OF ROBOTIC PALLETIZERS, BY REGION, 2021-2023 (USD)

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 26 PALLETIZER MARKET: SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 27 PALLETIZER MARKET: ECOSYSTEM ANALYSIS

- TABLE 4 ROLES OF COMPANIES IN PALLETIZER ECOSYSTEM

- 5.7 INVESTMENT AND FUNDING SCENARIO

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2017-2022

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGY

- 5.8.1.1 Machine vision

- 5.8.1.2 Augmented reality (AR)

- 5.8.1.3 Big data

- 5.8.1.4 Internet of Things (IoT)

- 5.8.2 COMPLEMENTARY TECHNOLOGY

- 5.8.2.1 Automated storage and retrieval system (ASRS)

- 5.8.3 ADJACENT TECHNOLOGY

- 5.8.3.1 Conveyor and sortation systems

- 5.8.1 KEY TECHNOLOGY

- 5.9 PATENT ANALYSIS

- FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 5 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- FIGURE 30 NUMBER OF PATENTS GRANTED PER YEAR, 2014-2023

- TABLE 6 LIST OF PATENTS RELATED TO PALLETIZERS, 2019-2023

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- FIGURE 31 IMPORT DATA FOR HS CODE 441520-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.10.2 EXPORT SCENARIO

- FIGURE 32 EXPORT DATA FOR HS CODE 441520-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 7 PALLETIZER MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 KAUFMAN DESIGNED KPAL V CENTRALIZED PALLETIZATION SYSTEM FOR CUSTOMER TO TACKLE MULTIPLE CHALLENGES

- 5.12.2 LEONARD'S DEPLOYED MODULAR ROBOTIC PALLETIZER OFFERED BY SCHNEIDER PACKAGING EQUIPMENT COMPANY, INC. AT FACILITY IN DETROIT TO INCREASE SPEED OF BOX PRODUCTION

- 5.12.3 REMIA DEPLOYED TWO NEW HIGHRUNNER PALLETIZERS OFFERED BY QIMAROX TO INCREASE PRODUCTION CAPACITY

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.13.2.1 ISO standard

- 5.13.2.1.1 ISO 10218-1:2011

- 5.13.2.1.2 ISO 12100:2010

- 5.13.2.1.3 ISO 18334:2010

- 5.13.2.1.4 ISO 8611 series

- 5.13.2.1 ISO standard

- TABLE 12 STANDARDS RELATED TO PALLETIZERS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 PALLETIZER MARKET: PORTER'S FIVE FORCES ANALYSIS, 2023

- TABLE 13 PALLETIZER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

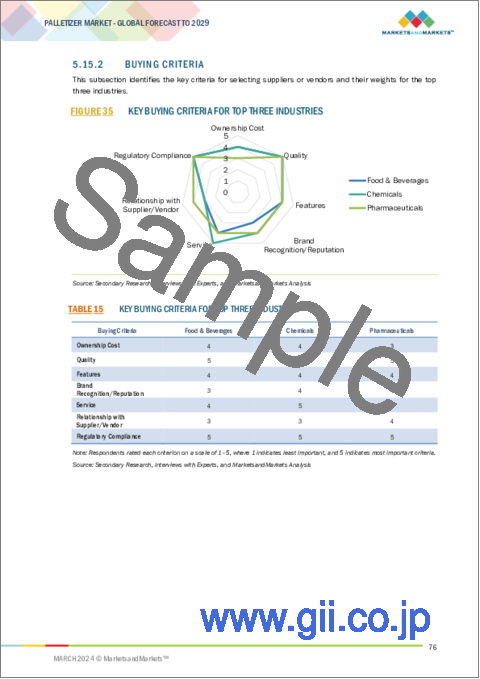

- 5.15.2 BUYING CRITERIA

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

6 RECENT TRENDS AND DEVELOPMENTS RELATED TO PALLETIZER MARKET

- 6.1 INTRODUCTION

- 6.2 COLLABORATIVE PALLETIZING

- 6.3 INTERNET OF THINGS (IOT) AND CONNECTIVITY

- 6.4 MACHINE LEARNING (ML) AND AI INTEGRATION (AI)

- 6.5 ENERGY-EFFICIENT SOLUTIONS

- 6.6 CUSTOMIZATION AND FLEXIBILITY

- 6.7 ERGONOMIC DESIGN AND USER-FRIENDLY INTERFACES

- 6.8 MOBILE PALLETIZING SOLUTIONS

- 6.9 SOFTWARE INTEGRATION FOR OPTIMIZATION

- 6.10 SAFETY INNOVATIONS

7 KEY COMPONENTS AND END USERS OF PALLETIZERS

- 7.1 INTRODUCTION

- 7.2 KEY COMPONENTS OF PALLETIZING SYSTEMS

- 7.2.1 INFEED CONVEYOR

- 7.2.2 PALLET DISPENSER

- 7.2.3 PRODUCT ALIGNMENT AND SINGULATION SYSTEM

- 7.2.4 PRODUCT GRIPPER OR END-EFFECTOR

- 7.2.5 MECHANICAL PALLETIZER

- 7.2.6 SAFETY SYSTEM

- 7.2.7 CONTROL SYSTEM

- 7.2.8 SOFTWARE

- 7.3 KEY END USERS OF PALLETIZING SYSTEMS

- 7.3.1 FACTORIES

- 7.3.2 DISTRIBUTION CENTERS

- 7.3.3 FULFILMENT CENTERS

8 PALLETIZER MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- FIGURE 36 PALLETIZER MARKET, BY TECHNOLOGY

- FIGURE 37 ROBOTIC PALLETIZERS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 16 PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 17 PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 18 PALLETIZER MARKET, 2020-2023 (UNITS)

- TABLE 19 PALLETIZER MARKET, 2024-2029 (UNITS)

- 8.2 CONVENTIONAL PALLETIZERS

- 8.2.1 HIGH-LEVEL PALLETIZERS

- 8.2.1.1 Rising preference for high-level palletizers in facilities with space constraints to drive market

- 8.2.2 LOW-LEVEL PALLETIZERS

- 8.2.2.1 Easy accessibility of low-level palletizers for operators and maintenance personnel, simplifying routine inspections and adjustments to drive demand

- TABLE 20 CONVENTIONAL PALLETIZERS: PALLETIZER MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 21 CONVENTIONAL PALLETIZERS: PALLETIZER MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 22 CONVENTIONAL PALLETIZERS: PALLETIZER MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 23 CONVENTIONAL PALLETIZERS: PALLETIZER MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 24 CONVENTIONAL PALLETIZERS: PALLETIZER MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 25 CONVENTIONAL PALLETIZERS: PALLETIZER MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 26 CONVENTIONAL PALLETIZERS: PALLETIZER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 27 CONVENTIONAL PALLETIZERS: PALLETIZER MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.2.1 HIGH-LEVEL PALLETIZERS

- 8.3 ROBOTIC PALLETIZERS

- 8.3.1 TRADITIONAL ROBOT PALLETIZERS

- 8.3.1.1 High flexibility and ability to handle various products, packaging types, and palletizing patterns to drive demand

- 8.3.2 COBOT PALLETIZERS

- 8.3.2.1 Capability to work alongside human operators and increase overall productivity and throughput to drive demand

- TABLE 28 ROBOTIC PALLETIZERS: PALLETIZER MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 29 ROBOTIC PALLETIZERS: PALLETIZER MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 30 ROBOTIC PALLETIZERS: PALLETIZER MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 31 ROBOTIC PALLETIZERS: PALLETIZER MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 32 ROBOTIC PALLETIZERS: PALLETIZER MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 33 ROBOTIC PALLETIZERS: PALLETIZER MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 34 ROBOTIC PALLETIZERS: PALLETIZER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 35 ROBOTIC PALLETIZERS: PALLETIZER MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3.1 TRADITIONAL ROBOT PALLETIZERS

9 PALLETIZER MARKET, BY PRODUCT TYPE

- 9.1 INTRODUCTION

- FIGURE 38 PALLETIZER MARKET, BY IMPLEMENTATION

- FIGURE 39 BOXES AND CASES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 36 PALLETIZER MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 37 PALLETIZER MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 9.2 BAGS

- 9.2.1 GROWTH OF E-COMMERCE INDUSTRY AND RETAIL PACKAGING TREND TO FUEL DEMAND

- TABLE 38 BAGS: PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 39 BAGS: PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 9.3 BOXES AND CASES

- 9.3.1 NEED FOR INCREASING EFFICIENCY AND PRODUCTIVITY OF PACKAGING OPERATIONS TO FUEL ADOPTION

- TABLE 40 BOXES AND CASES: PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 41 BOXES AND CASES: PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 9.4 PAILS AND DRUMS

- 9.4.1 HIGH USE OF PAIL AND DRUM PALLETIZERS IN CHEMICALS, PAINTS, COATINGS, AND FOOD PROCESSING INDUSTRIES TO DRIVE MARKET

- TABLE 42 PAILS AND DRUMS: PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 43 PAILS AND DRUMS: PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 9.5 OTHER PRODUCT TYPES

- TABLE 44 OTHER PRODUCT TYPES: PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 45 OTHER PRODUCT TYPES: PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

10 PALLETIZER MARKET, BY INDUSTRY

- 10.1 INTRODUCTION

- FIGURE 40 PALLETIZER MARKET, BY INDUSTRY

- FIGURE 41 PHARMACEUTICALS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 46 PALLETIZER MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 47 PALLETIZER MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- 10.2 FOOD & BEVERAGES

- 10.2.1 INCREASING DEMAND FOR FOOD & BEVERAGES AND NEED TO EFFICIENTLY HANDLE LARGE VOLUMES OF PRODUCTS AND ENSURE TIMELY DELIVERY TO DRIVE DEMAND

- TABLE 48 FOOD & BEVERAGES: PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 49 FOOD & BEVERAGES: PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 50 FOOD & BEVERAGES: PALLETIZER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 51 FOOD & BEVERAGES: PALLETIZER MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.3 CHEMICALS

- 10.3.1 ABILITY OF PALLETIZERS TO ENSURE COMPLIANCE WITH SAFETY REGULATIONS TO DRIVE DEMAND

- TABLE 52 CHEMICALS: PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 53 CHEMICALS: PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 54 CHEMICALS: PALLETIZER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 55 CHEMICALS: PALLETIZER MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.4 PHARMACEUTICALS

- 10.4.1 GROWING POPULARITY OF ROBOTIC PALLETIZERS IN ASIA PACIFIC PHARMACEUTICALS INDUSTRY TO DRIVE MARKET

- TABLE 56 PHARMACEUTICALS: PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 57 PHARMACEUTICALS: PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 58 PHARMACEUTICALS: PALLETIZER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 59 PHARMACEUTICALS: PALLETIZER MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.5 COSMETICS & PERSONAL CARE

- 10.5.1 INCREASING DEMAND FOR PALLETIZERS TO REDUCE PRODUCT DAMAGE TO DRIVE MARKET

- TABLE 60 COSMETICS & PERSONAL CARE: PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 61 COSMETICS & PERSONAL CARE: PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 62 COSMETICS & PERSONAL CARE: PALLETIZER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 63 COSMETICS & PERSONAL CARE: PALLETIZER MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.6 E-COMMERCE AND RETAIL

- 10.6.1 BOOMING E-COMMERCE INDUSTRY TO DRIVE DEMAND

- TABLE 64 E-COMMERCE AND RETAIL: PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 65 E-COMMERCE AND RETAIL: PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 66 E-COMMERCE AND RETAIL: PALLETIZER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 67 E-COMMERCE AND RETAIL: PALLETIZER MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.7 TEXTILES

- 10.7.1 RISE IN POPULARITY OF ROBOTIC PALLETIZERS OWING TO PRECISION AND VERSATILITY TO DRIVE MARKET

- TABLE 68 TEXTILES: PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 69 TEXTILES: PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 70 TEXTILES: PALLETIZER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 71 TEXTILES: PALLETIZER MARKET, BY REGION, 2024-2029 (USD MILLION)

11 PALLETIZER MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 42 CHINA TO EXHIBIT HIGHEST CAGR IN PALLETIZER MARKET DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA TO DOMINATE PALLETIZER MARKET FROM 2024 TO 2029

- TABLE 72 PALLETIZER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 73 PALLETIZER MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 IMPACT OF RECESSION ON PALLETIZER MARKET IN NORTH AMERICA

- FIGURE 44 NORTH AMERICA: PALLETIZER MARKET SNAPSHOT

- TABLE 74 NORTH AMERICA: PALLETIZER MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 75 NORTH AMERICA: PALLETIZER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 76 NORTH AMERICA: PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 77 NORTH AMERICA: PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 78 NORTH AMERICA: PALLETIZER MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 79 NORTH AMERICA: PALLETIZER MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Rapid technological advancements in retail sector to drive market

- 11.2.3 CANADA

- 11.2.3.1 Aging workforce to boost demand

- 11.2.4 MEXICO

- 11.2.4.1 Increased demand for convenience foods and prepared meals to drive demand

- 11.3 EUROPE

- 11.3.1 IMPACT OF RECESSION ON PALLETIZER MARKET IN EUROPE

- FIGURE 45 EUROPE: PALLETIZER MARKET SNAPSHOT

- TABLE 80 EUROPE: PALLETIZER MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 81 EUROPE: PALLETIZER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 82 EUROPE: PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 83 EUROPE: PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 84 EUROPE: PALLETIZER MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 85 EUROPE: PALLETIZER MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Expanding e-commerce industry and retail sector to drive market

- 11.3.3 GERMANY

- 11.3.3.1 Increased adoption of automation across various industries to drive market

- 11.3.4 FRANCE

- 11.3.4.1 Integration of advanced technologies into palletizers to drive market

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 IMPACT OF RECESSION ON PALLETIZER MARKET IN ASIA PACIFIC

- FIGURE 46 ASIA PACIFIC: PALLETIZER MARKET SNAPSHOT

- TABLE 86 ASIA PACIFIC: PALLETIZER MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 87 ASIA PACIFIC: PALLETIZER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 88 ASIA PACIFIC: PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 89 ASIA PACIFIC: PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 90 ASIA PACIFIC: PALLETIZER MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 91 ASIA PACIFIC: PALLETIZER MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Rise of e-commerce industry and preference for automation to boost demand

- 11.4.3 JAPAN

- 11.4.3.1 Development of robotic systems and AI-driven solutions to drive market

- 11.4.4 INDIA

- 11.4.4.1 Booming e-commerce industry to drive demand

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 ROW

- TABLE 92 ROW: PALLETIZER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 93 ROW: PALLETIZER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 94 ROW: PALLETIZER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 95 ROW: PALLETIZER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 96 ROW: PALLETIZER MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 97 ROW: PALLETIZER MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- 11.5.1 SOUTH AMERICA

- 11.5.1.1 Increasing foreign investments in manufacturing sector to fuel market growth

- 11.5.2 GCC COUNTRIES

- 11.5.2.1 Rapid industrialization to drive demand

- 11.5.3 AFRICA & REST OF MIDDLE EAST

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 98 PALLETIZER MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- 12.3 REVENUE ANALYSIS, 2018-2022

- FIGURE 47 PALLETIZER MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2018-2022

- 12.4 MARKET SHARE ANALYSIS, 2023

- TABLE 99 PALLETIZER MARKET: DEGREE OF COMPETITION, 2023

- FIGURE 48 PALLETIZER MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS, 2023

- FIGURE 49 PALLETIZER MARKET: COMPANY VALUATION, 2023

- FIGURE 50 PALLETIZER MARKET: FINANCIAL METRICS, 2023

- 12.6 BRAND/PRODUCT COMPARISON

- FIGURE 51 PALLETIZER MARKET: BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- FIGURE 52 PALLETIZER MARKET: COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.7.5.1 Overall footprint

- FIGURE 53 COMPANY OVERALL FOOTPRINT

- 12.7.5.2 Product type footprint

- TABLE 100 COMPANY PRODUCT TYPE FOOTPRINT

- 12.7.5.3 Technology footprint

- TABLE 101 COMPANY TECHNOLOGY FOOTPRINT

- 12.7.5.4 Industry footprint

- TABLE 102 COMPANY INDUSTRY FOOTPRINT

- 12.7.5.5 Regional footprint

- TABLE 103 COMPANY REGION FOOTPRINT

- 12.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- FIGURE 54 PALLETIZER MARKET: COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 12.8.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 12.8.5.1 List of key start-ups/SMEs

- TABLE 104 PALLETIZER MARKET: LIST OF KEY START-UPS/SMES

- 12.8.5.2 Competitive benchmarking of key start-ups/SMEs

- TABLE 105 PALLETIZER MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 12.9 COMPETITIVE SCENARIOS AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- TABLE 106 PALLETIZER MARKET: PRODUCT LAUNCHES, MAY 2020-JANUARY 2024

- 12.9.2 DEALS

- TABLE 107 PALLETIZER MARKET: DEALS, NOVEMBER 2021-OCTOBER 2023

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1.1 KION GROUP AG

- TABLE 108 KION GROUP AG: COMPANY OVERVIEW

- FIGURE 55 KION GROUP AG: COMPANY SNAPSHOT

- TABLE 109 KION GROUP AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.2 FANUC CORPORATION

- TABLE 110 FANUC CORPORATION: COMPANY OVERVIEW

- FIGURE 56 FANUC CORPORATION: COMPANY SNAPSHOT

- TABLE 111 FANUC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 112 FANUC CORPORATION: PRODUCT LAUNCHES

- 13.1.3 KUKA AG

- TABLE 113 KUKA AG: COMPANY OVERVIEW

- FIGURE 57 KUKA AG: COMPANY SNAPSHOT

- TABLE 114 KUKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 115 KUKA AG: PRODUCT LAUNCHES

- 13.1.4 HONEYWELL INTERNATIONAL INC.

- TABLE 116 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 58 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 117 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.5 KRONES AG

- TABLE 118 KRONES AG: COMPANY OVERVIEW

- FIGURE 59 KRONES AG: COMPANY SNAPSHOT

- TABLE 119 KRONES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.6 ABB

- TABLE 120 ABB: COMPANY OVERVIEW

- FIGURE 60 ABB: COMPANY SNAPSHOT

- TABLE 121 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.7 CONCETTI SPA

- TABLE 122 CONCETTI SPA: COMPANY OVERVIEW

- TABLE 123 CONCETTI SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.8 REGAL REXNORD AUTOMATION SOLUTIONS

- TABLE 124 REGAL REXNORD AUTOMATION SOLUTIONS: COMPANY OVERVIEW

- FIGURE 61 REGAL REXNORD AUTOMATION SOLUTIONS: COMPANY SNAPSHOT

- TABLE 125 REGAL REXNORD AUTOMATION SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 REGAL REXNORD AUTOMATION SOLUTIONS: DEALS

- 13.1.9 SCHNEIDER PACKAGING EQUIPMENT COMPANY, INC.

- TABLE 127 SCHNEIDER PACKAGING EQUIPMENT COMPANY, INC.: COMPANY OVERVIEW

- TABLE 128 SCHNEIDER PACKAGING EQUIPMENT COMPANY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 SCHNEIDER PACKAGING EQUIPMENT COMPANY, INC.: PRODUCT LAUNCHES

- TABLE 130 SCHNEIDER PACKAGING EQUIPMENT COMPANY, INC.: DEALS

- 13.1.10 SIDEL

- TABLE 131 SIDEL: COMPANY OVERVIEW

- TABLE 132 SIDEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 SIDEL: PRODUCT LAUNCHES

- 13.2 OTHER PLAYERS

- 13.2.1 A-B-C PACKAGING MACHINE CORPORATION

- TABLE 134 A-B-C PACKAGING MACHINE CORPORATION: COMPANY OVERVIEW

- 13.2.2 AETNA GROUP SPA

- TABLE 135 AETNA GROUP SPA: COMPANY OVERVIEW

- 13.2.3 BEUMER GROUP

- TABLE 136 BEUMER GROUP: COMPANY OVERVIEW

- 13.2.4 BRILLOPAK

- TABLE 137 BRILLOPAK: COMPANY OVERVIEW

- 13.2.5 BW INTEGRATED SYSTEMS

- TABLE 138 BW INTEGRATED SYSTEMS: COMPANY OVERVIEW

- 13.2.6 COLUMBIA MACHINE, INC.

- TABLE 139 COLUMBIA MACHINE, INC.: COMPANY OVERVIEW

- 13.2.7 EUROIMPIANTI SPA

- TABLE 140 EUROIMPIANTI SPA: COMPANY OVERVIEW

- 13.2.8 FUJI YUSOKI KOGYO CO., LTD.

- TABLE 141 FUJI YUSOKI KOGYO CO., LTD.: COMPANY OVERVIEW

- 13.2.9 HAVER & BOECKER

- TABLE 142 HAVER & BOECKER: COMPANY OVERVIEW

- 13.2.10 KHS GROUP

- TABLE 143 KHS GROUP: COMPANY OVERVIEW

- 13.2.11 MMCI

- TABLE 144 MMCI: COMPANY OVERVIEW

- 13.2.12 OKURA YUSOKI CO., LTD.

- TABLE 145 OKURA YUSOKI CO., LTD.: COMPANY OVERVIEW

- 13.2.13 PROMACH

- TABLE 146 PROMACH: COMPANY OVERVIEW

- 13.2.14 ROTHE PACKTECH PVT. LTD.

- TABLE 147 ROTHE PACKTECH PVT. LTD.: COMPANY OVERVIEW

- 13.2.15 S&R ROBOT SYSTEMS, LLC

- TABLE 148 S&R ROBOT SYSTEMS, LLC: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 AUTONOMOUS MOBILE ROBOTS MARKET

- FIGURE 62 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY

- FIGURE 63 E-COMMERCE SEGMENT TO EXHIBIT HIGHEST CAGR IN AUTONOMOUS MOBILE ROBOTS MARKET DURING FORECAST PERIOD

- TABLE 149 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 150 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 14.3 E-COMMERCE

- 14.3.1 EXPANSION OF E-COMMERCE INDUSTRY TO DRIVE MARKET

- TABLE 151 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 152 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 153 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2019-2022 (USD MILLION)

- TABLE 154 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2023-2028 (USD MILLION)

- TABLE 155 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 156 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.4 RETAIL

- 14.4.1 NEED TO IMPROVE INVENTORY MANAGEMENT EFFICIENCY TO BOOST DEMAND

- TABLE 157 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 158 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 159 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2019-2022 (USD MILLION)

- TABLE 160 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2023-2028 (USD MILLION)

- TABLE 161 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 162 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.5 MANUFACTURING

- 14.5.1 HIGH FOCUS ON OPTIMIZING MANUFACTURING WORKFLOW TO DRIVE DEMAND

- FIGURE 64 NORTH AMERICA TO CAPTURE LARGEST SHARE OF AUTONOMOUS MOBILE MARKET FOR MANUFACTURING IN 2028

- TABLE 163 MANUFACTURING: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 164 MANUFACTURING: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 165 MANUFACTURING: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2019-2022 (USD MILLION)

- TABLE 166 MANUFACTURING: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2023-2028 (USD MILLION)

- TABLE 167 MANUFACTURING: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 168 MANUFACTURING: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.6 FOOD & BEVERAGE

- 14.6.1 ADOPTION OF AUTONOMOUS MOBILE ROBOTS TO MEET REGULATORY REQUIREMENTS TO FUEL MARKET GROWTH

- TABLE 169 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 170 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 171 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2019-2022 (USD MILLION)

- TABLE 172 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2023-2028 (USD MILLION)

- TABLE 173 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 174 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.7 HEALTHCARE

- 14.7.1 EMPHASIS ON IMPROVING OPERATIONAL EFFICIENCY AND PATIENT CARE TO BOOST ADOPTION

- TABLE 175 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 176 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 177 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2019-2022 (USD MILLION)

- TABLE 178 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2023-2028 (USD MILLION)

- TABLE 179 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 180 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.8 LOGISTICS

- 14.8.1 RISING IMPORTANCE OF INVENTORY MANAGEMENT IN LOGISTICS TO DRIVE DEMAND

- FIGURE 65 100-500 KG SEGMENT TO ACCOUNT FOR LARGEST SHARE OF AUTONOMOUS MOBILE ROBOTS MARKET FOR LOGISTICS IN 2028

- TABLE 181 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 182 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 183 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2019-2022 (USD MILLION)

- TABLE 184 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2023-2028 (USD MILLION)

- TABLE 185 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 186 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.9 OTHERS

- TABLE 187 OTHERS: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 188 OTHERS: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 189 OTHERS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2019-2022 (USD MILLION)

- TABLE 190 OTHERS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2023-2028 (USD MILLION)

- TABLE 191 OTHERS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 192 OTHERS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2023-2028 (USD MILLION)

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS