|

|

市場調査レポート

商品コード

1462411

自動車市場における水素の将来- 車両タイプ別、推進タイプ別、水素補給ポイント別、地域別 - 予測(~2035年)Future of Hydrogen in Automotive Market by Vehicle Type, Propulsion Type, H2 Refueling Points and Region - Global Forecast 2035 |

||||||

カスタマイズ可能

|

|||||||

| 自動車市場における水素の将来- 車両タイプ別、推進タイプ別、水素補給ポイント別、地域別 - 予測(~2035年) |

|

出版日: 2024年04月04日

発行: MarketsandMarkets

ページ情報: 英文 38 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の自動車における水素の未来の市場規模は、2024年の2万3,000ユニットから2035年までに35万3,000ユニットに拡大し、CAGRは28.3%になると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年数 | 2024年~2035年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2035年 |

| 考慮されるユニット | 値(ユニット) |

| セグメント | 車両タイプ別、推進タイプ別、水素補給ポイント別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米 |

排出量の増加、燃料価格の高騰、化石燃料の入手困難により、近年、ゼロエミッションの代替燃料車の需要が急増しています。この需要の急増は、水素モビリティへの関心の高まりに大きく貢献しています。非貴金属触媒ベースのプロトン交換膜燃料電池(PEM FC)、水素燃料電池パッケージシステムモジュール、小型軽量の微細構造などの代替技術の進歩により、車両の走行距離が延び、コストが下がり、全体的な効率が向上すると期待されています。同様に、パワートレイン技術の進歩により、水素燃料車市場に新たな道が開かれると期待されています。さらに、燃料電池ハイブリッド電気自動車(FCHEV)や水素内燃エンジン車(H2-ICEV)などの新しい水素ベースの出現により、市場情勢に新たな展望が生まれようとしています。さらに、政府の支援による水素インフラへの注目の高まりや、充電ステーションの開発は、予測期間中の市場成長に大きく貢献する要因の一部です。

「H2燃料ステーション分野はアジア太平洋地域がリードすると予想されます。」

H2燃料ステーション分野はアジア太平洋地域をリードすると予想されており、2035年までに1万4,000以上の燃料ステーションが建設されると予測されています。現在、この分野をリードしているのは中国で、全国でH2燃料ステーションの急速な建設が進んでおり、2024年1月時点で400以上の燃料補給ステーションが稼働しています。同様に、日本は2025年までに320の水素ステーションを設立する計画を概説しています。各国政府によるこれらの取り組みにより、この地域の自動車市場における水素の普及が促進されると予想されます。

「乗用車セグメントは、予測期間中に車種別に大幅な成長が見込まれます」

乗用車部門は予測期間中にCAGR49.4%の成長率を示し、2035年までに推定26万4,000台に達すると予測されています。欧州では、乗用車部門が優位性を維持し、市場シェアの80%を占めています。BMW、KIA、Hyundaiなどの著名なEVメーカーは、2024年末までに水素燃料電池乗用車市場で存在感を確立すると予想されています。最も売れているFCEV乗用車モデルには、Toyota MiraiやHyundai NEXOなどがあります。

当レポートでは、世界の自動車市場における水素の将来について調査し、車両タイプ別、推進タイプ別、水素補給ポイント別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

- 調査の目的

- 市場の定義

- 主要団体一覧

- イントロダクション

- 市場力学

- エコシステム分析

- バリューチェーン分析

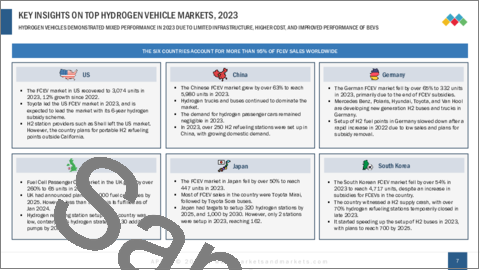

- 2023年の水素燃料自動車市場に関する主要な洞察

- 技術分析

- 技術ロードマップ

- 有望なビジネスモデル

- TCO分析

- H2生成とポータブル燃料補給の動向

- 自動車用H2と他の燃料タイプの比較に関するMNMの見解

- 自動車における水素の利用事例に関するMNMの見解

- FCEVの今後の発売計画に関するMNMの見解

- 大型商用車におけるH2の使用事例

- オフロード車両におけるH2の使用事例

- H2内燃機関車におけるH2の使用事例

- H2クラス8トラックのアーキテクチャの比較

- H2-ICE車両市場投入タイムライン

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- イントロダクション

- 乗用車

- 軽商用車

- バス

- トラック

- イントロダクション

- 燃料電池車

- FCHEV

- H2-ICEV

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- 概要

- 主要参入企業の戦略/強み

- 大手FCEVプロバイダーの協力と成長計画

- エコシステムにおける企業の前方/後方統合戦略

- 競合ベンチマーキング

The global future of hydrogen in automotive market size is projected to grow from 23 thousand units in 2024 to 353 thousand units by 2035, at a CAGR of 28.3%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2035 |

| Base Year | 2023 |

| Forecast Period | 2024-2035 |

| Units Considered | Value (Units) |

| Segments | Vehicle Type, Propulsion Type, H2 Refueling Points (Asia Pacific, Europe, and North America) and Region |

| Regions covered | Asia-Pacific, Europe, and North America |

The increasing emission levels, rising fuel prices, and limited availability of fossil fuels have spurred a burgeoning demand for zero-emission alternative fuel vehicles in recent years. This surge has notably contributed to the increasing interest in hydrogen mobility. Advancements in alternative technologies, including non-precious metal catalyst-based Proton Exchange Membrane Fuel Cells (PEM FC), hydrogen fuel-cell packaged system modules, and compact, lightweight microstructures, are expected to enhance vehicle range, decrease costs, and augment overall efficiency. Similarly, advancements in powertrain technology are expected to unveil fresh avenues within the hydrogen-fuel vehicle market. Additionally, the emergence of novel hydrogen-based applications such as Fuel Cell Hybrid Electric Vehicles (FCHEVs) and Hydrogen Internal Combustion Engine Vehicles (H2-ICEVs) is set to generate new prospects within the market landscape. Further, growing focus on hydrogen infrastructure with supportive government efforts, as well as the development of charging stations, are some of the factors that will significantly contribute to market growth during the forecast period.

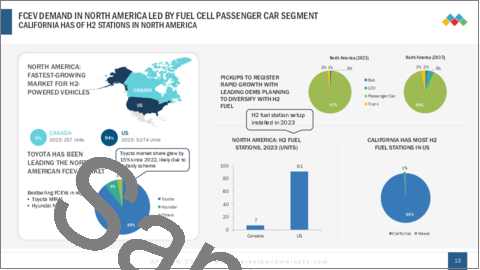

"H2-Fuel station segment is expected to lead by Asia Pacific region ."

The H2 fuel station segment is expected to lead the Asia Pacific region, projecting over 14 thousand fuel stations by the year 2035. China currently leads this segment, demonstrating rapid establishment of H2 fuel stations nationwide, with over 400 refueling stations operational as of January 2024. Similarly, Japan has outlined plans to establish 320 hydrogen stations by 2025. These initiatives by respective governments are anticipated to boost hydrogen in the automotive market within the region.

"Passenger car segment expected to grow at significant rate during the forecast period by Vehicle type"

The passenger car segment is projected to demonstrate a growth rate, of CAGR 49.4% during the forecast period, reaching an estimated 264 thousand units by the year 2035. Within Europe, the passenger car segment retained its dominance, commanding 80% of the market share. Esteemed EV manufacturers such as BMW, KIA, and Hyundai are expected to establish their presence in the hydrogen fuel cell passenger car market by the end of 2024. Some of the best-selling FCEV passenger car models include Toyota Mirai and Hyundai NEXO.

"Europe expected to be the fastest growing market during the forecast period."

Europe is expected to emerge as the fastest-growing market for FCEVs with new hydrogen plans announced by the EU to set up H2-fueling stations every 200km. Further supportive policies by the government are expected to bolster the market. For instance, the UK had announced plans for 4,000 fuel-cell buses by 2025. FCEV demand in Europe is mainly led by Germany, France, the Netherlands, and Switzerland. LCVs are the fastest-growing market in the region. Similarly, Toyota Motor Corporation (Japan) has been leading the European FCEV market.

In-depth interviews were conducted with CEOs, managers, and executives from various key organizations operating in this market.

- By Respondent Type - OEMs - 24% , Tier I - 67% , Tier II & III - 9%

- By Designation - C- level Executives - 33% , Managers - 52% , Executives - 15%

- By Region - North America - 28%, Asia Pacific - 38%, Europe - 34%

The future of hydrogen in automotive market is dominated by established players such as Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), SAIC Motors (China), FAW (China), and Yutong (China) among others. These companies manufacture fuel cell cars, buses, trucks, and LCVs with features such as higher range, and better fuel efficiency compared to ICE vehicles. Additionally, These companies have set up R&D facilities to develop best-in-class products as an alternative to EVs.

Research Coverage:

The report covers the future of hydrogen in automotive market, in terms of vehicle type (Passenger Cars , LCV,Bus, Truck), H2 fuel station (Asia Pacific, Europe, and North America), propulsion (FCEV, FCHEV, and H2-ICE), and region (Asia Oceania, Europe, and North America). It also covers the competitive landscape and company profiles of the major players in the future of hydrogen in automotive market ecosystem.

Key Benefits of the Report

- The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

- The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall future of hydrogen in automotive market and the subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (better fuel efficiency and increased driving range, rapid increase in investment and development for green hydrogen production, fast refuelling, reduced Oil dependency, lower emissions compared to other vehicles), restraints (highly flammable, hard to detect hydrogen leakage, high initial investment or hydrogen refuelling infrastructure, lower efficiency compared to BEV's and HEVs), challenges (rising demand for fuel cell vehicles in automotive and transportation sector, fuel cell vans to be an emerging opportunity for OEMs, government initiatives pertaining to hydrogen infrastructure ), and opportunities (high vehicle costs, insufficient hydrogen infrastructure, fast growing demand for BEVS and HEVs), influencing the growth of the authentication and brand protection market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive fuel cell market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the future of hydrogen in automotive market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the future of hydrogen in automotive market.

- Competitive Assessment: In-depth assessment of market ranking, growth strategies, and service offerings of leading players Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), SAIC Motors (China), FAW (china), and Yutong (China) among others in future of hydrogen in automotive market.

TABLE OF CONTENTS

1. INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 LIST OF KEY ASSOCIATIONS

2. MARKET OVERVIEW

- 2.1 INTRODUCTION

- 2.2 MARKET DYNAMICS

- 2.3 ECOSYSTEM ANALYSIS

- 2.4 VALUE CHAIN ANALYSIS

- 2.5 KEY H2 FUELED AUTOMOTIVE MARKET INSIGHTS OF 2023

- 2.6 TECHNOLOGY ANALYSIS

- 2.7 TECHNOLOGY ROADMAP

- 2.8 PROMISING BUSINESS MODELS

- 2.9 TCO ANALYSIS

- 2.10 H2 GENERATION AND PORTABLE REFUELING TRENDS

- 2.11 MNM INSIGHTS ON COMPARISON OF H2 VS OTHER FUEL TYPES FOR AUTOMOTIVE

- 2.12 MNM INSIGHTS ON USE CASES FOR HYDROGEN IN AUTOMOTIVE

- 2.13 MNM INSIGHTS ON UPCOMING LAUNCH PLANS FOR FCEVS

- 2.14 H2 USE CASE IN HEAVY-DUTY COMMERCIAL VEHICLES

- 2.15 H2 USE CASE IN OFF-ROAD VEHICLES

- 2.16 H2 USE CASE IN H2-ICE VEHICLES

- 2.17 H2 CLASS 8 TRUCK ARCHITECTURE COMPARISON

- 2.18 H2-ICE VEHICLE MARKET LAUNCH TIMELINE

3. MNM INSIGHTS ON H2 FUEL STATION SETUP

- 3.1 INTRODUCTION

- 3.2 ASIA PACIFIC

- 3.3 EUROPE

- 3.4 NORTH AMERICA

4. FUTURE OF HYDROGEN IN AUTOMOTIVE, VEHICLE TYPE OUTLOOK

- 4.1 INTRODUCTION

- 4.2 PASSENGER CAR

- 4.3 LIGHT COMMERCIAL VEHICLE

- 4.4 BUS

- 4.5 TRUCK

5. FUTURE OF HYDROGEN IN AUTOMOTIVE, PROPULSION TYPE OUTLOOK

- 5.1 INTRODUCTION

- 5.2 FCEV

- 5.3 FCHEV

- 5.4 H2-ICEV

6. FUTURE OF HYDROGEN IN AUTOMOTIVE, REGIONAL OUTLOOK

- 6.1 INTRODUCTION

- 6.2 ASIA PACIFIC

- 6.2.1 CHINA

- 6.2.2 JAPAN

- 6.2.3 SOUTH KOREA

- 6.2.4 INDIA

- 6.3 EUROPE

- 6.3.1 GERMANY

- 6.3.2 FRANCE

- 6.3.3 UK

- 6.3.4 SPAIN

- 6.3.5 AUSTRIA

- 6.3.6 THE NETHERLANDS

- 6.3.7 SWEDEN

- 6.3.8 NORWAY

- 6.3.9 ITALY

- 6.4 NORTH AMERICA

- 6.4.1 US

- 6.4.2 CANADA

7. COMPETITIVE LANDSCAPE

- 7.1 OVERVIEW

- 7.2 KEY PLAYER STRATEGIES/ RIGHT TO WIN

- 7.3 COLLABORATIONS AND GROWTH PLANS OF LEADING FCEV PROVIDERS

- 7.4 FORWARD/BACKWARD INTEGRATION STRATAGIES OF COMPANIES IN ECOSYSTEM

- 7.5 COMPETITIVE BENCHMARKING

8. RECOMMENDATIONS BY MARKETSANDMARKETS

9. APPENDIX