|

|

市場調査レポート

商品コード

1863601

フィールドサービス管理市場:オファリング別、展開モード別、組織規模別、業界別、地域別 - 2030年までの予測Field Service Management Market by Solutions, Deployment mode, Organization Size, Vertical and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| フィールドサービス管理市場:オファリング別、展開モード別、組織規模別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年11月05日

発行: MarketsandMarkets

ページ情報: 英文 280 Pages

納期: 即納可能

|

概要

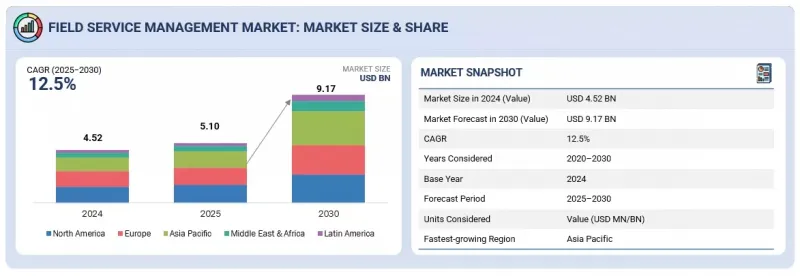

フィールドサービス管理の市場規模は急速に拡大しており、2025年の約51億米ドルから2030年までに91億7,000万米ドルへ成長し、CAGRは12.5%と予測されております。

この市場の急成長は、通信、製造、物流業界において、企業が業務効率化、顧客満足度向上、デジタルトランスフォーメーションを優先していることが主な要因となっております。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象単位 | 10億米ドル |

| セグメント | オファリング別、展開モード別、組織規模別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

最新のFSMプラットフォームは、従業員の効率性を最適化し、顧客体験を向上させ、クラウド、AI、IoT技術とのシームレスな統合を可能にすることで、エンドツーエンドの優れたサービスを実現します。主な要因としては、クラウドベースのプラットフォームと自動化の採用、リアルタイム追跡、予知保全、モバイル従業員管理などが挙げられ、これらを総合的に活用することで、スケジューリング、資産活用、サービス品質の向上が図られます。

AI、IoT、アナリティクスなどの先進技術の統合により、技術者の生産性向上とデータ駆動型の意思決定が可能となります。一方、規制順守や高まる顧客の期待が、フィールドサービス管理ソリューションの導入をさらに加速させています。しかしながら、市場には顕著な制約も存在します。具体的には、持続的な労働力スキル不足、レガシーインフラとの統合課題、クラウド環境におけるデータセキュリティ懸念などが挙げられます。これらの課題は研修・導入コストを増加させ、一部の組織では技術導入のペースを鈍化させる可能性があり、労働力開発と安全なデジタルトランスフォーメーションへの持続的な注力が求められます。

クラウド技術は、その本質的な拡張性、柔軟性、リアルタイムデータアクセス提供能力により、フィールドサービス管理市場の急速な成長を牽引する主要な要因です。クラウドベースのFSMソリューションは、技術者、顧客、バックオフィスチームが場所を問わずシームレスに連携することを可能にし、一元化されたデジタルプラットフォームを通じてスケジューリング、派遣、在庫管理を最適化します。クラウドはERPやCRMなどの補完的な企業システムとの統合を促進し、業務効率を高め、一貫性のあるワークフローを確保します。

さらに、クラウドインフラが支えるIoT、AI、モバイル接続性の進歩は、予知保全やインテリジェントなリソース配分を可能にし、ダウンタイムの削減と初回解決率の向上を実現します。クラウドFSMプラットフォームは、セルフサービスポータルやリアルタイムサービス追跡をサポートすることで顧客体験も向上させます。セキュリティとコンプライアンス機能は、分散環境における機密データの保護を確保する重要な構成要素です。クラウド技術はFSMにおける継続的な革新と適応性を支え、組織が業務を効率化し、進化する顧客の期待に費用対効果の高い方法で対応する上で競争優位性を提供します。

展開モード別では、最大の市場シェアを占めるソリューションは、企業が現場業務を管理する方法を簡素化・改善することで知られています。これらのソリューションは、作業スケジュールの管理、技術者の追跡、在庫管理、サービスリクエストの効率的な自動化を支援します。Oracle、Microsoft、Salesforce、SAPは、アクセスしやすく拡張性のあるクラウドベースのプラットフォームを提供しています。また、CRMやERPシステムなどの他のビジネスツールとも連携し、ワークフローを円滑に保ち、データの整合性を維持します。

さらに、これらのソリューションは人工知能やIoTなどのスマート技術を活用し、問題の予測や業務の最適化を行うことで、サービスの速度と品質を向上させます。ユーザーフレンドリーなインターフェースと堅牢なセキュリティ機能は、様々な業界の多様なニーズに対応し、信頼性の高い選択肢となっています。柔軟な価格設定とカスタマイズ可能な機能を提供する企業は、企業がFSMを自社の特定のニーズに適応させることを支援します。

北米地域は、リアルタイム可視性・自動化・顧客エンゲージメント強化に対する企業需要の高まりを背景に、フィールドサービス管理市場を牽引すると予測されます。同地域の先進的なデジタルインフラと、AI・IoT・分析ベースのFSMプラットフォームの早期導入により、組織はスケジューリング・派遣・予知保全業務の最適化を実現しています。ソリューションプロバイダーにとっては、公益事業・製造業・通信・医療など多様な業界向けに、拡張性と統合性を備えたプラットフォームを提供する機会が生まれています。

一方、アジア太平洋では、クラウドベースの展開モデルの採用拡大、モバイル接続性の拡大、デジタルサービス近代化を支援する政府プログラムにより、FSMの成長が加速しています。テクノロジーベンダーと地域企業との戦略的提携は、効率的なフィールドオペレーション、データ駆動型の意思決定、サービス提供モデルの改善を促進しています。これらの進歩を活用することで、FSMプロバイダーは従業員の生産性向上、運用コスト削減、多様な業界における顧客の進化する期待への対応が可能となります。

当レポートでは、世界のフィールドサービス管理市場について調査し、オファリング別、展開モード別、組織規模別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要考察

第4章 市場概要と業界動向

- イントロダクション

- 市場力学

- アンメットニーズと空白

- 相互接続された市場と分野横断的な機会

- 新たなビジネスモデルとエコシステムの変化

- ティア1/2/3企業の戦略的動き

- ポーターのファイブフォース分析

- マクロ経済指標

- サプライチェーン分析

- エコシステム分析

- 価格分析

- 2025年~2026年の主な会議とイベント

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税の影響- フィールドサービス管理市場

第5章 戦略的破壊:特許、デジタル、AIの導入

- 主要な新興技術

- 補完的技術

- 技術/製品ロードマップ

- 特許分析

- AI/生成AIがフィールドサービス管理市場に与える影響

第6章 規制状況

- イントロダクション

- 地域の規制とコンプライアンス

- 規制機関、政府機関、その他の組織

- 地域別の規制

- 業界標準

第7章 顧客情勢と購買行動

- 意思決定プロセス

- 購入者の利害関係者と購入評価基準

- 購入基準

- 採用障壁と内部課題

- さまざまな最終用途産業におけるアンメットニーズ

第8章 フィールドサービス管理市場(オファリング別)

- イントロダクション

- ソリューション

- サービス

第9章 フィールドサービス管理市場(展開モード別)

- イントロダクション

- オンプレミス

- クラウド

第10章 フィールドサービス管理市場(組織規模別)

- イントロダクション

- 大企業

- 中小企業

第11章 フィールドサービス管理市場(業界別)

- イントロダクション

- 製造

- 運輸・物流

- 建設・不動産

- ヘルスケア・ライフサイエンス

- エネルギー・公益事業

- 通信

- IT・ITES

- 石油・ガス

- その他

第12章 フィールドサービス管理市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- その他

- 中東・アフリカ

- 湾岸協力会議

- 南アフリカ

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2023年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- 競合シナリオ

第14章 企業プロファイル

- イントロダクション

- 主要参入企業

- ORACLE

- MICROSOFT

- SALESFORCE

- IFS

- SAP

- INFOR

- TRIMBLE

- COMARCH

- OVERIT

- PTC

- その他の企業

- SERVICEPOWER

- SYNCRON

- FIELDAWARE

- ZINIER

- ACCRUENT

- PRAXEDO

- FIELDEZ

- FIELDEDGE

- JOBBER

- SERVICETITAN

- PEGASYSTEMS

- SKEDULO

- SERVICE FUSION

- HUSKY INTELLIGENCE

- FIELDPULSE

- WORKIZ

- KICKSERV

- DASSAULT SYSTEMS