|

|

市場調査レポート

商品コード

1453090

航空エンジン用テストセルの世界市場:エンジンテスト・エンドユーザー・最終用途産業・POS・ソリューションタイプ・地域別 - 予測(~2028年)Aircraft Engine Test Cells Market by Engine Test (Turbofan, Turbojet, Turboshaft, Piston Engine and Apu), End User (Oems, Mros, Airlines and Operators), End-Use Industry, Point of Sale, Solution Type & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 航空エンジン用テストセルの世界市場:エンジンテスト・エンドユーザー・最終用途産業・POS・ソリューションタイプ・地域別 - 予測(~2028年) |

|

出版日: 2024年03月14日

発行: MarketsandMarkets

ページ情報: 英文 249 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

航空エンジン用テストセルの市場規模は、予測期間中に4.2%のCAGRで推移し、2023年の33億米ドルから、2028年には41億米ドルの規模に成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント | エンジンテスト・エンドユーザー・最終用途産業・POS・ソリューションタイプ・地域別 |

| 対象地域 | アジア太平洋・欧州・北米 |

ターボファンの部門が予測期間中に最大のシェアを占める:

エンジンテスト別では、他のエンジンと比較してより高い高度での飛行が可能であるため、ターボファンの部門が予測期間中の市場をリードすると予測されています。これらのエンジンはまた、他のタイプのエンジンと比較して騒音が少ないため、民間および軍事の双方において理想的な選択肢となっています。

OEMの部門が予測期間中に最大のシェアを占める:

エンドユーザー別では、エンジンテスト設備の近代化に大規模な投資を行っていることから、OEMの部門が2023年に最大のシェアを示しました。これらの投資は、先進的な試験装置に対する需要の増加を促進し、技術的進歩を促進し、参入企業の世界的なリーチを強化します。

アジア太平洋市場が予測期間中に最大のCAGRで成長する見通し:

地域別では、アジア太平洋地域が予測期間中に最大のCAGRを記録すると予測されています。同地域の航空セクターの拡大に後押しされ、同市場はダイナミックで急速な拡大を経験しています。この成長は、航空旅行数の増加、格安航空会社の普及、地域全体の航空インフラへの政府による大規模な投資など、さまざまな要因によって推進されています。航空エンジンの自国生産への野望が航空エンジンの試験・研究開発施設への大規模投資につながっています。

当レポートでは、世界の航空エンジン用テストセルの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/ディスラプション

- ビジネスモデル

- ケーススタディ分析

- 価格分析

- 総所有コスト

- エコシステム分析

- 貿易データ分析

- 運用データ

- 主要な会議とイベント

- 関税と規制状況

- 主要なステークホルダーと購入基準

第6章 業界の動向

- 技術動向

- 技術分析

- メガトレンドの影響

- サプライチェーン分析

- 特許分析

- 技術ロードマップ

第7章 航空エンジン用テストセル市場:エンジンテスト別

- ターボファン

- ターボジェット

- ターボシャフト

- ピストンエンジン

- 補助電源ユニット (APU)

第8章 航空エンジン用テストセル市場:エンドユーザー別

- OEM

- MRO

- 航空会社・オペレーター

第9章 航空エンジン用テストセル市場:最終用途産業別

- 商用

- 民間

第10章 航空エンジン用テストセル市場:POS別

- 新規設置

- 改修・アップグレード

- メンテナンスサービス

第11章 航空エンジン用テストセル市場:ソリューションタイプ別

- テストセル

- 固定

- モバイル

- コンポーネントテストベンチ

- データ収集および制御システム (DACS)

- ソフトウェア

- アンシラリーシステム

第12章 航空エンジン用テストセル市場:地域別

- 地域不況の影響分析

- 北米

- 欧州

- アジア太平洋

- その他の地域

第13章 競合情勢

- 主要企業の戦略

- 主要市場企業のランキング分析

- ブランド比較

- 財務指標

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- SAFRAN

- MDS AERO SUPPORT CORPORATION

- CALSPAN CORPORATION

- ATEC, INC.

- CEL

- GENERAL ELECTRIC

- RTX CORPORATION

- ROLLS-ROYCE PLC

- HONEYWELL INTERNATIONAL INC.

- THE BOEING COMPANY

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- DELTA AIR LINES, INC.

- STANDARDAERO

- TEXTRON INC.

- MTU AERO ENGINES AG

- EMIRATES GROUP

- その他の企業

- ACES SYSTEMS

- EDF INCORPORATED

- FROUDE, INC.

- INC ENGINEERING CO., LTD.

- INDUSTRIAL ACOUSTICS COMPANY GMBH

- NANDAN GSE PVT. LTD.

- ST ENGINEERING

- SWANDA AEROSPACE

- TAE AEROSPACE

第15章 付録

The global aircraft engine test cells market size is projected to grow from USD 3.3 billion in 2023 to USD 4.1 billion by 2028, at a CAGR of 4.2% from 2023 to 2028.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million) |

| Segments | By Engine Test, End User, End-Use Industry, Point of Sale, Solution Type & Region |

| Regions covered | Asia Pacific, Europe, and North America |

Furthermore, Growing Upgradation and Maintenance of Jet Engine Test Cells, and Increasing Demand for Commercial Aircraft and Associated MRO Services. However, Technological Complexities in Designing and Manufacturing of Aircraft Engine Test Cells pose a challenge for aircraft engine test cells market growth.

Safran (France), MDS Aero Support Corporation (US), Calspan Corporation (US), Atec, Inc. (US), and CEL (Canada) are some of the leading players operating in the Aircraft engine test cells market.

"The turbofan segment to account for largest market share in the aircraft engine test cells market during the forecast period."

Based on engine test, the aircraft engine test cells market has been classified into Turbofan, Turbojet, Turboshaft, Piston Engine, and APU (Auxiliary Power Unit). The turbofan segment is projected to lead the aircraft engine test cells market during the forecast period as these engines are much more capable of flying at a higher altitude when compared to other engines. These engines also have a less amount of noise as compared to other types of engines making them an ideal choice for both commercial and military end-use-industry.

"The OEM segment to account for largest market share in the aircraft engine test cells market during the forecast period."

Based on end-user, the aircraft engine test cells market has been segmented into OEMs, MROs, and airlines and operators. The OEMs segment will contribute to the highest market share in 2023 due to huge investments in modernizing engine test facilities. These investments drive increased demand for advanced testing equipment, fostering technological advancements, and enhancing the global reach of players in the market.

"The commercial end-use industry will dominate the aircraft engine test cells market during the forecast period."

Based on end-use industry, the aircraft engine test cells market has been segmented into commercial, and military. The commercial end-use industry will dominate the market during the forecast period as commercial industry has a considerably larger fleet compared to military aviation. Airlines and MRO Maintenance, Repair, and Overhaul (MRO) service providers are also collaborating with each other for aircraft engine maintenance.

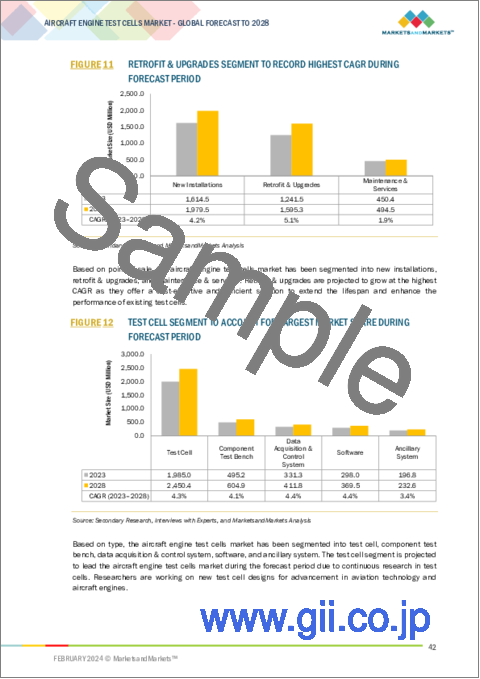

"The retrofit & upgrades segment is projected to grow at the highest CAGR in the aircraft engine test cells market during the forecast period."

Based on point of sale, the aircraft engine test cells market has been segmented into new installations, retrofit & upgrades, and maintenance & services. The retrofit & upgrades segment is projected to grow at the highest CAGR in the aircraft engine test cells market as these initiatives offer a cost-effective and efficient solution to extend the lifespan and enhance the performance of existing test cells.

"The test cells segment to account for largest market share in the aircraft engine test cells market during the forecast period."

Based on solution type, the aircraft engine test cells market has been segmented into test cells, component test benches, data acquisition & control systems, software, and ancillary systems. The test cells segment is projected to lead the aircraft engine test cells market during the forecast period due to continuous research in test cells. Researchers are working on new test cell design for advancement in aviation technology and improving various aspects of aircraft engines.

"The Asia Pacific market is projected to grow at highest CAGR during the forecast period."

Asia Pacific is expected to register the highest CAGR during the forecast period. The market for aircraft engine test cell solutions in the Asia-Pacific region is dynamic and experiencing rapid expansion, fueled by the region's expanding aviation sector. This growth is propelled by various factors such as the escalating volume of air travel, the proliferation of budget airlines, and substantial governmental investments in aviation infrastructure throughout the region. The ambition of self-reliance aircraft engine production has led to significant investments in aircraft engine testing and R&D facilities.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- By Designation: C Level-35%; Directors-25%; and Others-40%

- By Region: North America-45%; Europe-15%; Asia Pacific-25%; and RoW-15%

Safran (France), MDS Aero Support Corporation (US), Calspan Corporation (US), Atec, Inc. (US), CEL (Canada), General Electric (US), RTX Corporation (US), Rolls-Royce plc (UK), and Honeywell International Inc. (US) are some of the leading players operating in the aircraft engine test cells market .

Research Coverage

The study covers the aircraft engine test cells market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on Engine Test, End User, End-Use Industry, Point of Sale, Solution Type and Region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aircraft engine test cells market and its subsegments. The report covers the entire ecosystem of the aircraft engine test cells market . It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and several factors, such as growing investments to establish new aircraft engine test facilities, increasing Demand for Commercial Aircrafts and there MRO Services, others that could contribute to an increase in aircraft engine test cells market .

- Market Development: Comprehensive information about lucrative markets - the report analyses the aircraft engine test cells market across varied regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in aircraft engine test cells market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Safran (France), MDS Aero Support Corporation (US), Calspan Corporation (US), Atec, Inc. (US), and CEL (Canada) among others in the aircraft engine test cells market .

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 AIRCRAFT ENGINE TEST CELLS MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY AND PRICING

- TABLE 1 USD EXCHANGE RATES

- 1.5 INCLUSIONS AND EXCLUSIONS

- TABLE 2 INCLUSIONS AND EXCLUSIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RECESSION IMPACT ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 TURBOFAN SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 OEMS TO BE LARGEST END USER SEGMENT DURING FORECAST PERIOD

- FIGURE 10 COMMERCIAL END-USE INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 RETROFIT & UPGRADES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 TEST CELL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRCRAFT ENGINE TEST CELLS MARKET

- FIGURE 14 ESTABLISHMENT OF NEW TESTING FACILITIES TO DRIVE MARKET

- 4.2 AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST

- FIGURE 15 TURBOFAN SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 AIRCRAFT ENGINE TEST CELLS MARKET, BY END USER

- FIGURE 16 OEMS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY

- FIGURE 17 COMMERCIAL END-USE INDUSTRY TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.5 AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE

- FIGURE 18 NEW INSTALLATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.6 AIRCRAFT ENGINE TEST CELLS MARKET, BY SOLUTION TYPE

- FIGURE 19 TEST CELL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing investments to establish aircraft engine test facilities

- 5.2.1.2 Increasing demand for commercial aircraft and associated MRO services

- TABLE 3 COMMERCIAL AIRCRAFT DELIVERY FORECAST BY BOEING

- FIGURE 21 AIRLINE FLEET GROWTH, 2022-2042 (UNITS)

- 5.2.1.3 Growing upgrades and maintenance of jet engine test cells

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital investment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in engine technology

- 5.2.3.2 Adoption of sustainable aviation fuel

- 5.2.4 CHALLENGES

- 5.2.4.1 Technological complexities in designing and manufacturing aircraft engine test cells

- 5.2.4.2 Shortage of skilled workforce

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 22 VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN AIRCRAFT ENGINE TEST CELLS MARKET

- FIGURE 23 REVENUE SHIFT IN AIRCRAFT ENGINE TEST CELLS MARKET

- 5.5 BUSINESS MODEL

- 5.5.1 TRADITIONAL BUSINESS MODELS

- 5.5.2 EMERGING BUSINESS MODELS

- TABLE 4 BUSINESS MODEL OF KEY MARKET PLAYERS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 ROLLS-ROYCE'S ALECSYS DEMONSTRATOR ENGINE TESTING

- 5.6.2 VARMAN AVIATION'S ENGINE OVERHAUL AND EXCHANGE SERVICES

- 5.7 PRICING ANALYSIS

- 5.7.1 INDICATIVE PRICING ANALYSIS

- TABLE 5 INDICATIVE PRICING LEVELS OF KEY PLAYERS

- 5.7.2 AIRCRAFT ENGINE TEST CELL PRICE, BY REGION

- TABLE 6 AIRCRAFT ENGINE TEST CELL PRICE, BY REGION

- 5.8 TOTAL COST OF OWNERSHIP

- TABLE 7 TOTAL COST OF OWNERSHIP

- 5.9 ECOSYSTEM ANALYSIS

- 5.9.1 SOLUTION PROVIDERS

- 5.9.2 SOLUTION AND ASSOCIATED UPGRADE AND MAINTENANCE PROVIDERS

- 5.9.3 UPGRADE AND MAINTENANCE SERVICE PROVIDERS

- FIGURE 24 MARKET ECOSYSTEM MAP

- TABLE 8 ROLE OF COMPANIES IN ECOSYSTEM

- 5.10 TRADE DATA ANALYSIS

- 5.10.1 IMPORT DATA ANALYSIS

- 5.10.1.1 Spark-ignition reciprocating or rotary internal combustion piston engine for aircraft (HS Code: 840710)

- FIGURE 25 TOP 10 IMPORTING COUNTRIES, 2022 (USD THOUSAND)

- 5.10.2 EXPORT DATA STATISTICS

- 5.10.2.1 Spark-ignition reciprocating or rotary internal combustion piston engine for aircraft (HS Code: 840710)

- FIGURE 26 TOP 10 EXPORTING COUNTRIES, 2022 (USD THOUSAND)

- 5.10.1 IMPORT DATA ANALYSIS

- 5.11 OPERATIONAL DATA

- TABLE 9 OPERATIONAL AIRCRAFT ENGINE TEST FACILITIES, BY REGION (AS OF DECEMBER 2022)

- 5.12 KEY CONFERENCES AND EVENTS

- TABLE 10 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFFS

- 5.13.1.1 Tariffs for spark-ignition reciprocating or rotary internal combustion piston engine for aircraft

- TABLE 11 TARIFFS FOR SPARK-IGNITION RECIPROCATING OR ROTARY INTERNAL COMBUSTION PISTON ENGINE FOR AIRCRAFT, 2022

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.1 TARIFFS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR END USERS

- TABLE 17 KEY BUYING CRITERIA FOR END USERS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- FIGURE 29 TECHNOLOGY TRENDS

- 6.2.1 INCREASED AUTOMATION

- 6.2.2 ICE DETECTION TECHNOLOGY

- 6.2.3 USE OF ADVANCED SENSORS AND MONITORING SYSTEMS

- 6.2.4 BIG DATA PREDICTIVE MAINTENANCE

- 6.2.5 ADVANCED REAL-TIME DIAGNOSTICS

- 6.3 TECHNOLOGY ANALYSIS

- TABLE 18 TECHNOLOGY ANALYSIS, BY ENGINE TEST

- 6.4 IMPACT OF MEGATRENDS

- 6.4.1 ARTIFICIAL INTELLIGENCE

- 6.4.2 BIG DATA & ANALYTICS

- 6.4.3 INTERNET OF THINGS

- 6.5 SUPPLY CHAIN ANALYSIS

- FIGURE 30 SUPPLY CHAIN ANALYSIS

- 6.6 PATENT ANALYSIS

- FIGURE 31 NUMBER OF PATENTS GRANTED, 2013-2023

- TABLE 19 KEY PATENTS, 2020-2024

- 6.7 TECHNOLOGY ROADMAPP

- FIGURE 32 TECHNOLOGY ROADMAP

- FIGURE 33 EVOLUTION OF TECHNOLOGY TRENDS

- FIGURE 34 EMERGING TRENDS

7 AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST

- 7.1 INTRODUCTION

- FIGURE 35 TURBOFAN SEGMENT TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 20 AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 21 AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- 7.2 TURBOFAN

- 7.2.1 INCREASING NEED FOR TURBOFAN ENGINES THAT RUN ON SUSTAINABLE AVIATION FUEL TO DRIVE MARKET

- 7.3 TURBOJET

- 7.3.1 NEED FOR MAINTENANCE, REPAIR, AND OVERHAUL (MRO) OF EXISTING FLEETS TO DRIVE MARKET

- 7.4 TURBOSHAFT

- 7.4.1 INCREASING USE OF HELICOPTERS AND VTOL AIRCRAFT TO DRIVE MARKET

- 7.5 PISTON ENGINE

- 7.5.1 USE OF PISTON ENGINES IN SMALL DRONES AND AIRCRAFT TO DRIVE MARKET

- 7.6 AUXILIARY POWER UNIT (APU)

- 7.6.1 EXPANDING DEMAND FOR GAS TURBINE ENGINES TO DRIVE MARKET

8 AIRCRAFT ENGINE TEST CELLS MARKET, BY END USER

- 8.1 INTRODUCTION

- FIGURE 36 OEMS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 22 AIRCRAFT ENGINE TEST CELLS MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 23 AIRCRAFT ENGINE TEST CELLS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.2 OEMS

- 8.2.1 INVESTMENT IN MODERNIZING ENGINE TESTING FACILITIES TO DRIVE MARKET

- 8.3 MROS

- 8.3.1 NEED TO ENSURE AIRCRAFT SAFETY WITH COMPREHENSIVE ENGINE TESTING TO DRIVE MARKET

- 8.4 AIRLINES AND OPERATORS

- 8.4.1 NEED TO ENHANCE SAFETY AND EFFICIENCY WITH RIGOROUS ENGINE TESTING TO DRIVE MARKET

9 AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 37 COMMERCIAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 24 AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 25 AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.2 COMMERCIAL

- 9.2.1 LARGER FLEET THAN MILITARY AVIATION TO DRIVE MARKET

- 9.3 MILITARY

- 9.3.1 NEED FOR METICULOUS SCRUTINY OF ENGINES TO MEET STRINGENT REQUIREMENTS OF MILITARY MISSIONS TO DRIVE MARKET

10 AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE

- 10.1 INTRODUCTION

- FIGURE 38 NEW INSTALLATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 26 AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 27 AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 10.2 NEW INSTALLATIONS

- 10.2.1 GROWING ADVANCED TESTING SYSTEM INSTALLATIONS TO DRIVE MARKET

- 10.3 RETROFIT & UPGRADES

- 10.3.1 STRINGENT ENVIRONMENTAL EMISSIONS AND NOISE REDUCTION REQUIREMENTS TO DRIVE MARKET

- 10.4 MAINTENANCE & SERVICES

- 10.4.1 NEED FOR OPTIMIZING ENGINE TESTING TO DRIVE MARKET

11 AIRCRAFT ENGINE TEST CELLS MARKET, BY SOLUTION TYPE

- 11.1 INTRODUCTION

- FIGURE 39 TEST CELL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 28 AIRCRAFT ENGINE TEST CELLS MARKET, BY SOLUTION TYPE, 2020-2022 (USD MILLION)

- TABLE 29 AIRCRAFT ENGINE TEST CELLS MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- 11.2 TEST CELL

- 11.2.1 R&D IN TEST CELL TECHNOLOGY TO DRIVE MARKET

- 11.2.2 FIXED

- 11.2.3 MOBILE

- 11.3 COMPONENT TEST BENCH

- 11.3.1 ABILITY TO ACCELERATE DEVELOPMENT CYCLE TO DRIVE MARKET

- 11.4 DATA ACQUISITION & CONTROL SYSTEM (DACS)

- 11.4.1 ABILITY TO CONTINUOUSLY MONITOR ENGINE PARAMETERS TO DRIVE MARKET

- 11.5 SOFTWARE

- 11.5.1 NEED FOR STREAMLINING TESTING PROCESS SOLUTIONS TO DRIVE MARKET

- 11.6 ANCILLARY SYSTEM

- 11.6.1 ENSURING OPTIMAL PERFORMANCE OF AIRCRAFT ENGINES WITH RIGOROUS ANCILLARY SYSTEM TESTING TO DRIVE MARKET

12 AIRCRAFT ENGINE TEST CELLS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 40 NORTH AMERICA DOMINATES AIRCRAFT ENGINE TEST CELLS MARKET

- 12.2 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 30 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 31 AIRCRAFT ENGINE TEST CELLS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 32 AIRCRAFT ENGINE TEST CELLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.3 NORTH AMERICA

- 12.3.1 INTRODUCTION

- 12.3.2 PESTLE ANALYSIS

- 12.3.3 RECESSION IMPACT ANALYSIS

- FIGURE 41 NORTH AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET SNAPSHOT

- TABLE 33 NORTH AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 36 NORTH AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 38 NORTH AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 40 NORTH AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 42 NORTH AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.3.4 US

- 12.3.4.1 Rising aircraft demand and compliance with safety regulations to drive market

- TABLE 43 US: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 44 US: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 45 US: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 46 US: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 47 US: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 48 US: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.3.5 CANADA

- 12.3.5.1 Domestic players offering advanced engine testing and development solutions to drive market

- TABLE 49 CANADA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 50 CANADA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 51 CANADA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 52 CANADA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 53 CANADA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 54 CANADA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.4 EUROPE

- 12.4.1 INTRODUCTION

- 12.4.2 PESTLE ANALYSIS

- 12.4.3 RECESSION IMPACT ANALYSIS

- FIGURE 42 EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET SNAPSHOT

- TABLE 55 EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 56 EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 57 EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 58 EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 59 EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 60 EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 61 EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 62 EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 63 EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 64 EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.4.4 UK

- 12.4.4.1 Use of sustainable aviation fuel and modernization of engine test facilities to drive market

- TABLE 65 UK: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 66 UK: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 67 UK: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 68 UK: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 69 UK: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 70 UK: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.4.5 FRANCE

- 12.4.5.1 Presence of major industry players to drive market

- TABLE 71 FRANCE: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 72 FRANCE: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 73 FRANCE: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 74 FRANCE: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 75 FRANCE: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 76 FRANCE: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.4.6 GERMANY

- 12.4.6.1 Focus on innovation and sustainability to drive market

- TABLE 77 GERMANY: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 78 GERMANY: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 79 GERMANY: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 80 GERMANY: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 81 GERMANY: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 82 GERMANY: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.4.7 ITALY

- 12.4.7.1 Innovations and technological advancements to drive market

- TABLE 83 ITALY: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 84 ITALY: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 85 ITALY: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 86 ITALY: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 87 ITALY: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 88 ITALY: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.4.8 RUSSIA

- 12.4.8.1 New engine testing, key collaborations, and infrastructural advancements to drive market

- TABLE 89 RUSSIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 90 RUSSIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 91 RUSSIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 92 RUSSIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 93 RUSSIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 94 RUSSIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.4.9 REST OF EUROPE

- TABLE 95 REST OF EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 96 REST OF EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 97 REST OF EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 98 REST OF EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 99 REST OF EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 100 REST OF EUROPE: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.5 ASIA PACIFIC

- 12.5.1 INTRODUCTION

- 12.5.2 PESTLE ANALYSIS

- 12.5.3 RECESSION IMPACT ANALYSIS

- FIGURE 43 ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET SNAPSHOT

- TABLE 101 ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 106 ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.5.4 CHINA

- 12.5.4.1 Testing of new indigenous aircraft engines to drive market

- TABLE 111 CHINA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 112 CHINA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 113 CHINA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 114 CHINA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 115 CHINA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 116 CHINA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.5.5 JAPAN

- 12.5.5.1 Sustainable aviation fuel adoption to drive market

- TABLE 117 JAPAN: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 118 JAPAN: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 119 JAPAN: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 120 JAPAN: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 121 JAPAN: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 122 JAPAN: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.5.6 INDIA

- 12.5.6.1 Huge commercial deals and collaborative technology transfers to drive market

- TABLE 123 INDIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 124 INDIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 125 INDIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 126 INDIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 127 INDIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 128 INDIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.5.7 AUSTRALIA

- 12.5.7.1 International collaborations in domestic aerospace & defense industry to drive market

- TABLE 129 AUSTRALIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 130 AUSTRALIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 131 AUSTRALIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 132 AUSTRALIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 133 AUSTRALIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 134 AUSTRALIA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.5.8 REST OF ASIA PACIFIC

- TABLE 135 REST OF ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.6 REST OF THE WORLD

- 12.6.1 INTRODUCTION

- 12.6.2 PESTLE ANALYSIS

- FIGURE 44 REST OF THE WORLD: AIRCRAFT ENGINE TEST CELLS MARKET SNAPSHOT

- TABLE 141 REST OF THE WORLD: AIRCRAFT ENGINE TEST CELLS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 142 REST OF THE WORLD: AIRCRAFT ENGINE TEST CELLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 143 REST OF THE WORLD: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 144 REST OF THE WORLD: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 145 REST OF THE WORLD: AIRCRAFT ENGINE TEST CELLS MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 146 REST OF THE WORLD: AIRCRAFT ENGINE TEST CELLS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 147 REST OF THE WORLD: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 148 REST OF THE WORLD: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 149 REST OF THE WORLD: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 150 REST OF THE WORLD: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.6.3 MIDDLE EAST & AFRICA

- TABLE 151 MIDDLE EAST & AFRICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 12.6.4 LATIN AMERICA

- TABLE 157 LATIN AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2020-2022 (USD MILLION)

- TABLE 158 LATIN AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY ENGINE TEST, 2023-2028 (USD MILLION)

- TABLE 159 LATIN AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 160 LATIN AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 161 LATIN AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2020-2022 (USD MILLION)

- TABLE 162 LATIN AMERICA: AIRCRAFT ENGINE TEST CELLS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS' STRATEGIES

- TABLE 163 KEY DEVELOPMENTS OF LEADING PLAYERS IN AIRCRAFT ENGINE TEST CELLS MARKET, 2022-2023

- 13.3 RANKING ANALYSIS OF KEY MARKET PLAYERS

- FIGURE 45 RANKING OF KEY MARKET PLAYERS, 2022

- 13.4 BRAND COMPARISON

- FIGURE 46 BRAND COMPARISON, BY END USER

- 13.5 FINANCIAL METRICS

- FIGURE 47 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

- 13.6 REVENUE ANALYSIS

- FIGURE 48 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2018-2022

- 13.7 MARKET SHARE ANALYSIS

- FIGURE 49 MARKET SHARE ANALYSIS OF KEY COMPANIES, 2022

- TABLE 164 DEGREE OF COMPETITION

- 13.8 COMPANY EVALUATION MATRIX

- 13.8.1 STARS

- 13.8.2 EMERGING LEADERS

- 13.8.3 PERVASIVE PLAYERS

- 13.8.4 PARTICIPANTS

- FIGURE 50 COMPANY EVALUATION MATRIX, 2022

- 13.8.5 COMPANY FOOTPRINT

- FIGURE 51 COMPANY FOOTPRINT

- TABLE 165 COMPANY END USER FOOTPRINT

- TABLE 166 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 167 COMPANY REGION FOOTPRINT

- 13.9 START-UP/SME EVALUATION MATRIX

- 13.9.1 PROGRESSIVE COMPANIES

- 13.9.2 RESPONSIVE COMPANIES

- 13.9.3 DYNAMIC COMPANIES

- 13.9.4 STARTING BLOCKS

- FIGURE 52 START-UP/SME EVALUATION MATRIX, 2022

- 13.9.5 COMPETITIVE BENCHMARKING

- TABLE 168 LIST OF KEY START-UPS/SMES

- TABLE 169 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 13.10 COMPETITIVE SCENARIO

- 13.10.1 MARKET EVALUATION FRAMEWORK

- 13.10.2 PRODUCT LAUNCHES

- TABLE 170 AIRCRAFT ENGINE TEST CELLS MARKET: PRODUCT LAUNCHES, 2020-2023

- 13.10.3 DEALS

- TABLE 171 AIRCRAFT ENGINE TEST CELLS MARKET: DEALS, 2020-2023

- 13.10.4 OTHER DEALS/DEVELOPMENTS

- TABLE 172 AIRCRAFT ENGINE TEST CELLS MARKET: OTHER DEALS/DEVELOPMENTS, 2020-2023

- 13.10.5 EXPANSIONS

- TABLE 173 AIRCRAFT ENGINE TEST CELLS MARKET: EXPANSIONS, 2020-2023

14 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 14.1 KEY PLAYERS

- 14.1.1 SAFRAN

- TABLE 174 SAFRAN: COMPANY OVERVIEW

- FIGURE 53 SAFRAN: COMPANY SNAPSHOT

- TABLE 175 SAFRAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 SAFRAN: DEALS

- TABLE 177 SAFRAN: OTHER DEALS/DEVELOPMENTS

- 14.1.2 MDS AERO SUPPORT CORPORATION

- TABLE 178 MDS AERO SUPPORT CORPORATION: COMPANY OVERVIEW

- TABLE 179 MDS AERO SUPPORT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 MDS AERO SUPPORT CORPORATION: PRODUCT LAUNCHES

- TABLE 181 MDS AERO SUPPORT CORPORATION: DEALS

- 14.1.3 CALSPAN CORPORATION

- TABLE 182 CALSPAN CORPORATION: COMPANY OVERVIEW

- TABLE 183 CALSPAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 CALSPAN CORPORATION: DEALS

- 14.1.4 ATEC, INC.

- TABLE 185 ATEC, INC.: COMPANY OVERVIEW

- TABLE 186 ATEC, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 ATEC, INC.: OTHER DEALS/DEVELOPMENTS

- 14.1.5 CEL

- TABLE 188 CEL: COMPANY OVERVIEW

- TABLE 189 CEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.6 GENERAL ELECTRIC

- TABLE 190 GENERAL ELECTRIC: COMPANY OVERVIEW

- FIGURE 54 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 191 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 GENERAL ELECTRIC: PRODUCT LAUNCHES

- TABLE 193 GENERAL ELECTRIC: OTHER DEALS/DEVELOPMENTS

- 14.1.7 RTX CORPORATION

- TABLE 194 RTX CORPORATION: COMPANY OVERVIEW

- FIGURE 55 RTX CORPORATION: COMPANY SNAPSHOT

- TABLE 195 RTX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 RTX CORPORATION: PRODUCT LAUNCHES

- TABLE 197 RTX CORPORATION: OTHER DEALS/DEVELOPMENTS

- 14.1.8 ROLLS-ROYCE PLC

- TABLE 198 ROLLS-ROYCE PLC: COMPANY OVERVIEW

- FIGURE 56 ROLLS-ROYCE PLC: COMPANY SNAPSHOT

- TABLE 199 ROLLS-ROYCE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 ROLLS-ROYCE PLC: OTHER DEALS/DEVELOPMENTS

- 14.1.9 HONEYWELL INTERNATIONAL INC.

- TABLE 201 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 57 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 202 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 HONEYWELL INTERNATIONAL INC.: OTHER DEALS/DEVELOPMENTS

- 14.1.10 THE BOEING COMPANY

- TABLE 204 THE BOEING COMPANY: COMPANY OVERVIEW

- FIGURE 58 THE BOEING COMPANY: COMPANY SNAPSHOT

- TABLE 205 THE BOEING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 THE BOEING COMPANY: DEALS

- 14.1.11 MITSUBISHI HEAVY INDUSTRIES, LTD.

- TABLE 207 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- FIGURE 59 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- TABLE 208 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 MITSUBISHI HEAVY INDUSTRIES, LTD.: DEALS

- TABLE 210 MITSUBISHI HEAVY INDUSTRIES, LTD.: OTHER DEALS/DEVELOPMENTS

- 14.1.12 DELTA AIR LINES, INC.

- TABLE 211 DELTA AIR LINES, INC.: COMPANY OVERVIEW

- FIGURE 60 DELTA AIR LINES, INC.: COMPANY SNAPSHOT

- TABLE 212 DELTA AIR LINES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 DELTA AIR LINES, INC.: EXPANSIONS

- 14.1.13 STANDARDAERO

- TABLE 214 STANDARDAERO: COMPANY OVERVIEW

- TABLE 215 STANDARDAERO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 STANDARDAERO: DEALS

- TABLE 217 STANDARDAERO: EXPANSIONS

- TABLE 218 STANDARDAERO: OTHER DEALS/DEVELOPMENTS

- 14.1.14 TEXTRON INC.

- TABLE 219 TEXTRON INC.: COMPANY OVERVIEW

- FIGURE 61 TEXTRON INC.: COMPANY SNAPSHOT

- TABLE 220 TEXTRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 TEXTRON INC.: DEALS

- 14.1.15 MTU AERO ENGINES AG

- TABLE 222 MTU AERO ENGINES AG: COMPANY OVERVIEW

- FIGURE 62 MTU AERO ENGINES AG: COMPANY SNAPSHOT

- TABLE 223 MTU AERO ENGINES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 MTU AERO ENGINES AG: DEALS

- TABLE 225 MTU AERO ENGINES AG: EXPANSIONS

- TABLE 226 MTU AERO ENGINES AG: OTHER DEALS/DEVELOPMENTS

- 14.1.16 EMIRATES GROUP

- TABLE 227 EMIRATES GROUP: COMPANY OVERVIEW

- FIGURE 63 EMIRATES GROUP: COMPANY SNAPSHOT

- TABLE 228 EMIRATES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 EMIRATES GROUP: EXPANSIONS

- 14.2 OTHER PLAYERS

- 14.2.1 ACES SYSTEMS

- TABLE 230 ACES SYSTEMS: COMPANY OVERVIEW

- 14.2.2 EDF INCORPORATED

- TABLE 231 EDF INCORPORATED: COMPANY OVERVIEW

- 14.2.3 FROUDE, INC.

- TABLE 232 FROUDE, INC.: COMPANY OVERVIEW

- 14.2.4 INC ENGINEERING CO., LTD.

- TABLE 233 INC ENGINEERING CO., LTD.: COMPANY OVERVIEW

- 14.2.5 INDUSTRIAL ACOUSTICS COMPANY GMBH

- TABLE 234 INDUSTRIAL ACOUSTICS COMPANY GMBH: COMPANY OVERVIEW

- 14.2.6 NANDAN GSE PVT. LTD.

- TABLE 235 NANDAN GSE PVT. LTD.: COMPANY OVERVIEW

- 14.2.7 ST ENGINEERING

- TABLE 236 ST ENGINEERING: COMPANY OVERVIEW

- 14.2.8 SWANDA AEROSPACE

- TABLE 237 SWANDA AEROSPACE: COMPANY OVERVIEW

- 14.2.9 TAE AEROSPACE

- TABLE 238 TAE AEROSPACE: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 PROGRAMS RELATED TO AIRCRAFT ENGINE TEST CELLS MARKET

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS