|

|

市場調査レポート

商品コード

1452899

レーザーキャプチャーマイクロダイセクション (LCM) の世界市場:製品・システムタイプ・用途 (R&D・診断) 別 - 予測(~2029年)Laser Capture Microdissection Market by Product, System Type, Application (R&D, Diagnostics) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| レーザーキャプチャーマイクロダイセクション (LCM) の世界市場:製品・システムタイプ・用途 (R&D・診断) 別 - 予測(~2029年) |

|

出版日: 2024年03月14日

発行: MarketsandMarkets

ページ情報: 英文 188 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

レーザーキャプチャーマイクロダイセクション (LCM) の市場規模は、予測期間中に10.6%のCAGRで推移し、2024年の1億8,400万米ドルから、2029年には3億600万米ドルの規模に成長すると予測されています。

同市場の成長は、ゲノミクスおよびプロテオミクスの研究活動の高まり、創薬・薬剤開発の用途の拡大、LCMのアウトソーシングの増加に起因しています。活発な医薬品パイプラインは毎年増加しており、これは主に研究活動の増加に牽引されています。また、製薬会社は競争力を維持し、中核機能に集中するため、研究活動を学術機関やCROにアウトソーシングするケースが増えています。主にアウトソーシングされるR&D業務は、基礎研究から後期開発、遺伝子工学、ターゲットバリデーション、アッセイ開発、ヒット探索&リード最適化 、動物モデルでの安全性試験/テスト、ヒトを対象とした臨床試験まで多岐にわたります。製薬会社のパイプラインが増加していることが、サービスのアウトソーシングが増加している主な理由です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント | 製品タイプ・システムタイプ・用途・エンドユーザー |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

予測期間中、学術・政府研究機関の部門がエンドユーザー別で最大のシェアを占める:

2023年の市場においては、学術・政府研究機関の部門がエンドユーザー別で最大のシェアを示しました。LCMは、基礎研究や臨床に広く使用されています。ライフサイエンス分野における研究活動の世界的増加が、同部門の成長の主要な促進要因です。LCMは、異種混合物からの特定細胞の分離と特性評価に役立ちます。学術機関では、この技術は主に遺伝子解析、マイクロアレイ、タンパク質解析に使用されています。

地域別では、欧州が市場で2番目に大きい規模を示す:

欧州はLCM市場において北米に次いで2番目に大きな市場となりました。同地域市場は、慢性疾患の罹患率増加などの人口動態の変化により、近年著しい成長を遂げています。これは、同地域における老齢人口の増加に起因しています。European Commissionの発表によると、2025年までに欧州人口の20%以上が65歳以上になると予想されており、80歳以上の高齢者も急増することから、医療施設や疾病診断サービスに対する需要が大きく伸びることが予想されます。このことは、新薬発見のための製薬・バイオ医薬品の臨床試験活動を促進し、LCMなどの関連市場の成長に直接貢献するものと考えられています。

当レポートでは、世界のレーザーキャプチャーマイクロダイセクション (LCM) の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 動向

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- 主要な会議とイベント

- 規制分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 レーザーキャプチャーマイクロダイセクション (LCM) 市場:製品別

- 機器

- 消耗品

- 試薬・培地

- アッセイキット

- その他

- ソフトウェア・サービス

第7章 レーザーキャプチャーマイクロダイセクション (LCM) 市場:システムタイプ別

- 紫外線LCM

- 赤外線LCM

- 紫外線および赤外線LCM

- 免疫蛍光LCM

第8章 レーザーキャプチャーマイクロダイセクション (LCM) 市場:用途別

- R&D

- 分子生物学

- 細胞生物学

- 科学捜査

- 診断

- その他

第9章 レーザーキャプチャーマイクロダイセクション (LCM) 市場:エンドユーザー別

- 学術および政府研究機関

- 病院

- 製薬・バイオテクノロジー企業

- CRO

第10章 レーザーキャプチャーマイクロダイセクション (LCM) 市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- 主要企業の採用アプローチ

- 収益シェア分析

- 市場シェア分析

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- THERMO FISHER SCIENTIFIC INC.

- DANAHER CORPORATION

- CARL ZEISS AG

- F. HOFFMANN-LA ROCHE AG

- STANDARD BIOTOOLS

- JSR CORPORATION

- BIO-RAD LABORATORIES, INC.

- AGILENT TECHNOLOGIES, INC.

- BRUKER

- MOLECULAR MACHINES & INDUSTRIES GMBH

- OCIMUM BIOSOLUTIONS

- THERALINK TECHNOLOGIES, INC.

- 3DHISTECH LTD.

- CREATIVE BIOLABS

- DENOVA SCIENCES

- その他の企業

- LAXCO, INC.

- CARESBIO LABORATORY LLC

- VITROVIVO BIOTECH

- ANAPATH SERVICES GMBH

- GNOME DIAGNOSTICS & GNOME SCIENCES

- MONASTERIUM LABORATORY

- INDEPENDENT FORENSICS

- NORGEN BIOTEK CORP.

- CREATIVE BIOARRAY

- EPISTEM LTD.

第13章 付録

The global laser capture microdissection market is projected to reach USD 306 million by 2029 from USD 184 million in 2024, at a CAGR of 10.6% during the forecast period of 2024 to 2029. The growth of this market can be attributed to the rising research activities in genomics and proteomics, expanding applications in drug discovery and development, and increasing outsourcing of laser capture microdissection. For instance, The active pharmaceutical drug pipeline is increasing annually, primarily led by an increase in research activities. Pharmaceutical companies are increasingly outsourcing research activities to academic organizations and Contract Research Organizations (CROs) to stay competitive and retain focus on core functions. The R&D tasks primarily outsourced range from basic research to late-stage development, genetic engineering, target validation, assay development, hit exploration & lead optimization (hit candidates-as-a-service), safety studies/tests in animal models, and clinical trials involving humans. The growing pipeline of pharmaceutical companies is a key reason attributing to the high outsourcing of services.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) Million |

| Segments | Product, System Type, Application and End User |

| Regions covered | North America, Europe, Asia Pacific, and Rest of the World |

"The academic and government research institutes segment accounted for the largest share by end user during the forecast period"

In 2023, academic and government research institutes segment accounted for the largest share by end user in the global laser capture microdissection market. The academic research institutes segment comprises government-funded medical laboratories and university and research laboratories. Laser capture microdissection is widely used for basic research and clinical practice. Increase in the number of research activities in life science worldwide is a primary growth driver for this end-user segment. Laser capture microdissection helps in the isolation and characterization of specific cells from a heterogeneous mixture. In academic institutes, this technology is used mainly for genetic analysis, microarrays, and protein analysis. The technique helps scientists reduce contamination of surrounding morphologically non-malignant cell types. Protocols have been developed and optimized for acquisition of high-quality RNA and DNA, from both frozen and formalin-fixed, paraffin-embedded tissue.

"Europe: The second largest region in the laser capture microdissection market"

Europe accounted for the second-largest market for laser capture microdissection market after North America. The European laser capture microdissection market has witnessed significant growth in recent years, driven by demographic changes, such as the growing incidence of chronic diseases. This is attributed to the rising geriatric population in the region. As per the European Commission, by 2025, more than 20% of Europeans are expected to be 65 years and above, with a rapid increase in the number of people aged 80 years and above, indicating strong demand growth for healthcare facilities and disease diagnostics services. This will drive pharmaceutical and biopharmaceutical clinical trial activity for novel drug discoveries and directly contribute to the growth of associated markets, such as laser capture microdissection.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side- 60% and Demand Side 40%

- By Designation: C-level - 50%, D-level - 20%, and Others - 30%

- By Region: North America -40%, Europe -40%, and Asia-Pacific -20%

List of Companies Profiled in the Report:

- Thermo Fisher Scientific Inc. (US)

- Danaher Corporation (US)

- Carl Zeiss AG (Germany)

- F. Hoffmann-La Roche AG (Switzerland)

- Standard BioTools (US)

- JSR Corporation (Japan)

- Bio-Rad Laboratories, Inc. (US)

- Agilent Technologies, Inc. (US)

- Bruker (US)

- Molecular Machines & Industries GmbH (Germany)

- Ocimum Biosolutions (US)

- Theralink Technologies, Inc. (US)

- 3DHISTECH, Ltd. (Hungary)

- Creative Biolabs (US)

- DeNova Sciences (Singapore)

- Laxco, Inc. (US)

- CaresBio Laboratory LLC (US)

- VitroVivo Biotech (US)

- AnaPath Services GmbH (Switzerland)

- Gnome Diagnostics & Gnome Sciences (US)

- Monasterium Laboratory (Germany)

- Independent Forensics (US)

- Norgen Biotek Corp. (Canada)

- Creative Bioarray (US)

- Epistem Ltd. (UK)

Research Coverage:

This report provides a detailed picture of the laser capture microdissection market. It aims at estimating the size and future growth potential of the market across different segments such as the product, system type, application, end user and region. The report also includes an in-depth competitive analysis of the key market players along with their company profiles recent developments and key market strategies.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges

The report provides insights on the following pointers:

- Analysis of key drivers (Increase in R&D funding, Increase in healthcare expenditure, Technical advantages of LCM, and Contamination-free technique), restraints (High cost of instruments, accessories, and maintenance, Requirement of high degree of technical expertise, and RNA degradation), opportunities (Emerging markets and collaborative research initiatives, Integration with omics technologies), and challenges (Time consuming sample preparation process).

- Product Development/Innovation: Detailed insights on newly launched product and technological assessment of the laser capture microdissection market

- Market Development: Comprehensive information about lucrative markets - the report analyses the market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the laser capture microdissection market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Carl Zeiss AG (Germany), F. Hoffmann-La Roche AG (Switzerland), Standard BioTools (US), JSR Corporation (Japan), Bio-Rad Laboratories, Inc. (US), Agilent Technologies, Inc. (US), Bruker (US), Molecular Machines & Industries GmbH (Germany), Ocimum Biosolutions (US), Theralink Technologies, Inc. (US), 3DHISTECH, Ltd. (Hungary), Creative Biolabs (US), DeNova Sciences (Singapore), Laxco, Inc. (US), CaresBio Laboratory LLC (US), VitroVivo Biotech (US), AnaPath Services GmbH (Switzerland), Gnome Diagnostics & Gnome Sciences (US), Monasterium Laboratory (Germany), Independent Forensics (US), Norgen Biotek Corp. (Canada), Creative Bioarray (US), and Epistem Ltd. (UK).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 MARKET SEGMENTATION

- 1.4.2 REGIONS COVERED

- FIGURE 2 REGIONAL SEGMENTATION

- 1.4.3 YEARS CONSIDERED

- 1.4.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 RESEARCH LIMITATIONS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARIES

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 6 REVENUE SHARE ANALYSIS

- 2.2.1 PRIMARY INSIGHTS

- FIGURE 7 MARKET VALIDATION FROM PRIMARY EXPERTS

- 2.2.2 SEGMENTATION ASSESSMENT (BY PRODUCT, SYSTEM, APPLICATION, AND END USER)

- FIGURE 8 TOP-DOWN APPROACH

- 2.3 GROWTH FORECAST

- FIGURE 9 CAGR PROJECTIONS

- FIGURE 10 GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN LASER CAPTURE MICRODISSECTION MARKET

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 IMPACT OF RECESSION ON LASER CAPTURE MICRODISSECTION MARKET

3 EXECUTIVE SUMMARY

- FIGURE 12 LASER CAPTURE MICRODISSECTION MARKET, BY PRODUCT, 2024 VS. 2029 (USD MILLION)

- FIGURE 13 LASER CAPTURE MICRODISSECTION MARKET, BY SYSTEM TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 14 LASER CAPTURE MICRODISSECTION MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 15 LASER CAPTURE MICRODISSECTION MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 16 GEOGRAPHIC SNAPSHOT OF LASER CAPTURE MICRODISSECTION MARKET

4 PREMIUM INSIGHTS

- 4.1 LASER CAPTURE MICRODISSECTION MARKET OVERVIEW

- FIGURE 17 INCREASING R&D EXPENDITURE BY PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES TO DRIVE MARKET

- 4.2 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET, BY PRODUCT (2023)

- FIGURE 18 CONSUMABLES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- 4.3 ASIA PACIFIC: LASER CAPTURE MICRODISSECTION MARKET, BY APPLICATION AND END USER (2023)

- FIGURE 19 RESEARCH & DEVELOPMENT SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- 4.4 LASER CAPTURE MICRODISSECTION MARKET, BY END USER, 2023

- FIGURE 20 ACADEMIC & GOVERNMENT RESEARCH INSTITUTES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 LASER CAPTURE MICRODISSECTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES, AND TRENDS

- TABLE 1 LASER CAPTURE MICRODISSECTION MARKET: IMPACT ANALYSIS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing R&D expenditure by pharmaceutical and biotechnology companies

- FIGURE 22 GLOBAL PHARMACEUTICAL R&D EXPENDITURE (USD BILLION), 2014-2028

- 5.2.1.2 Rise in healthcare expenditure

- 5.2.1.3 Technical advantages of laser capture microdissection technique

- 5.2.1.4 Effective and contamination-free technique

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of instruments, accessories, and maintenance

- 5.2.2.2 Requirement of high degree of technical expertise

- 5.2.2.3 Difficulty in maintaining quality and stability of RNA

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth in emerging markets and increase in collaborative research initiatives

- 5.2.3.2 Easy and effective integration with omics technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Time-consuming sample preparation process

- 5.2.5 TRENDS

- 5.2.5.1 Technological advancements in molecular analytical techniques

- 5.3 PRICING ANALYSIS

- TABLE 2 LASER CAPTURE MICRODISSECTION PRODUCT PRICING

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RESEARCH AND DEVELOPMENT

- 5.4.2 MANUFACTURING AND ASSEMBLY

- 5.4.3 DISTRIBUTION, MARKETING & SALES, AND REGISTRATION & POST-MARKETING

- FIGURE 23 LASER CAPTURE MICRODISSECTION MARKET: VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 24 LASER CAPTURE MICRODISSECTION MARKET: ECOSYSTEM MAP

- TABLE 3 LASER CAPTURE MICRODISSECTION MARKET: ROLE IN ECOSYSTEM

- 5.6 TECHNOLOGY ANALYSIS

- TABLE 4 LASER CAPTURE MICRODISSECTION MARKET: TECHNOLOGY ANALYSIS

- 5.7 PATENT ANALYSIS

- FIGURE 25 TOP PATENT OWNERS IN LASER CAPTURE MICRODISSECTION MARKET (JANUARY 2013-DECEMBER 2023)

- 5.8 KEY CONFERENCES & EVENTS

- TABLE 5 LIST OF KEY CONFERENCES & EVENTS IN LASER CAPTURE MICRODISSECTION MARKET, JANUARY 2024-DECEMBER 2025

- 5.9 REGULATORY ANALYSIS

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 LASER CAPTURE MICRODISSECTION MARKET: PORTER'S FIVE FORCES ANALYSIS

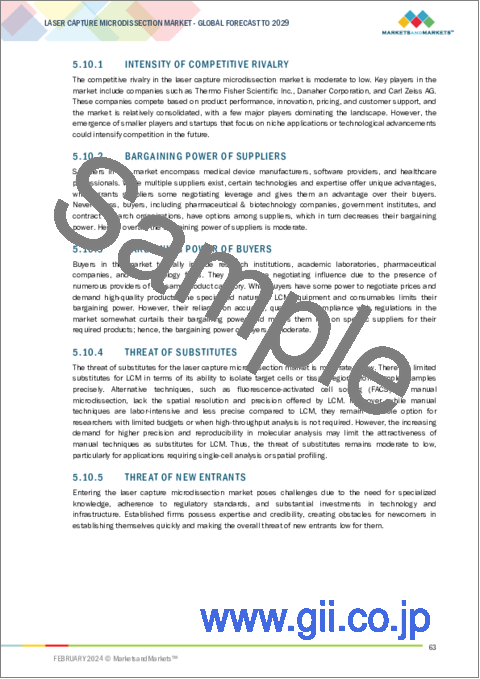

- 5.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.10.2 BARGAINING POWER OF SUPPLIERS

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 THREAT OF SUBSTITUTES

- 5.10.5 THREAT OF NEW ENTRANTS

- 5.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN LASER CAPTURE MICRODISSECTION MARKET

- 5.11.2 KEY BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA FOR END USERS IN LASER CAPTURE MICRODISSECTION MARKET

6 LASER CAPTURE MICRODISSECTION MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 12 LASER CAPTURE MICRODISSECTION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- 6.2 INSTRUMENTS

- 6.2.1 RISING TECHNOLOGICAL ADVANCEMENTS TO PROPEL MARKET GROWTH

- TABLE 13 EXAMPLES OF INSTRUMENTS OFFERED BY KEY PLAYERS

- TABLE 14 LASER CAPTURE MICRODISSECTION INSTRUMENTS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 15 NORTH AMERICA: LASER CAPTURE MICRODISSECTION INSTRUMENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.3 CONSUMABLES

- TABLE 16 LASER CAPTURE MICRODISSECTION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 17 LASER CAPTURE MICRODISSECTION CONSUMABLES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 18 NORTH AMERICA: LASER CAPTURE MICRODISSECTION CONSUMABLES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.3.1 REAGENTS & MEDIA

- 6.3.1.1 Real-time monitoring of molecular interactions to drive market

- TABLE 19 EXAMPLES OF REAGENTS & MEDIA OFFERED BY KEY PLAYERS

- TABLE 20 LASER CAPTURE MICRODISSECTION CONSUMABLES MARKET FOR REAGENTS & MEDIA, BY REGION, 2022-2029 (USD MILLION)

- TABLE 21 NORTH AMERICA: LASER CAPTURE MICRODISSECTION CONSUMABLES MARKET FOR REAGENTS & MEDIA, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.3.2 ASSAY KITS

- 6.3.2.1 Growing availability and long shelf life to fuel uptake

- TABLE 22 EXAMPLES OF ASSAY KITS OFFERED BY KEY PLAYERS

- TABLE 23 LASER CAPTURE MICRODISSECTION CONSUMABLES MARKET FOR ASSAY KITS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 24 NORTH AMERICA: LASER CAPTURE MICRODISSECTION CONSUMABLES MARKET FOR ASSAY KITS, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.3.3 OTHER CONSUMABLES

- TABLE 25 EXAMPLES OF OTHER CONSUMABLES OFFERED BY KEY PLAYERS

- TABLE 26 LASER CAPTURE MICRODISSECTION CONSUMABLES MARKET FOR OTHER CONSUMABLES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 27 NORTH AMERICA: LASER CAPTURE MICRODISSECTION CONSUMABLES MARKET FOR OTHER CONSUMABLES, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.4 SOFTWARE & SERVICES

- 6.4.1 RISING FOCUS ON AUTOMATION AND MACHINE LEARNING TO SUPPORT MARKET GROWTH

- TABLE 28 EXAMPLES OF SOFTWARE & SERVICES OFFERED BY KEY PLAYERS

- TABLE 29 LASER CAPTURE MICRODISSECTION SOFTWARE & SERVICES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 30 NORTH AMERICA: LASER CAPTURE MICRODISSECTION SOFTWARE & SERVICES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

7 LASER CAPTURE MICRODISSECTION MARKET, BY SYSTEM TYPE

- 7.1 INTRODUCTION

- TABLE 31 LASER CAPTURE MICRODISSECTION MARKET, BY SYSTEM TYPE, 2022-2029 (USD MILLION)

- 7.2 ULTRAVIOLET LCM

- 7.2.1 UTILIZATION OF HIGHLY FOCUSED LASER BEAMS TO BOOST DEMAND

- TABLE 32 LASER CAPTURE MICRODISSECTION MARKET FOR ULTRAVIOLET LCM, BY REGION, 2022-2029 (USD MILLION)

- TABLE 33 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR ULTRAVIOLET LCM, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.3 INFRARED LCM

- 7.3.1 RISING TECHNOLOGICAL ADVANCEMENTS TO PROPEL MARKET GROWTH

- TABLE 34 LASER CAPTURE MICRODISSECTION MARKET FOR INFRARED LCM, BY REGION, 2022-2029 (USD MILLION)

- TABLE 35 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR INFRARED LCM, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.4 ULTRAVIOLET AND INFRARED LCM

- 7.4.1 GROWING DEMAND FOR COMBINATION SYSTEMS FOR ADVANCED RESEARCH TO FUEL MARKET GROWTH

- TABLE 36 LASER CAPTURE MICRODISSECTION MARKET FOR ULTRAVIOLET AND INFRARED LCM, BY REGION, 2022-2029 (USD MILLION)

- TABLE 37 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR ULTRAVIOLET AND INFRARED LCM, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.5 IMMUNOFLUORESCENCE LCM

- 7.5.1 INTEGRATION OF TWO TECHNIQUES FOR DOWNSTREAM MOLECULAR ANALYSIS TO SUPPORT MARKET GROWTH

- TABLE 38 LASER CAPTURE MICRODISSECTION MARKET FOR IMMUNOFLUORESCENCE LCM, BY REGION, 2022-2029 (USD MILLION)

- TABLE 39 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR IMMUNOFLUORESCENCE LCM, BY COUNTRY, 2022-2029 USD MILLION)

8 LASER CAPTURE MICRODISSECTION MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 40 LASER CAPTURE MICRODISSECTION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- 8.2 RESEARCH & DEVELOPMENT

- TABLE 41 LASER CAPTURE MICRODISSECTION MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 42 LASER CAPTURE MICRODISSECTION MARKET FOR RESEARCH & DEVELOPMENT, BY REGION, 2022-2029 (USD MILLION)

- TABLE 43 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR RESEARCH & DEVELOPMENT, BY COUNTRY, 2022-2029 (USD MILLION)

- 8.2.1 MOLECULAR BIOLOGY

- 8.2.1.1 Increasing research on molecular profiling to drive market

- TABLE 44 LASER CAPTURE MICRODISSECTION MARKET FOR MOLECULAR BIOLOGY, BY REGION, 2022-2029 (USD MILLION)

- TABLE 45 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR MOLECULAR BIOLOGY, BY COUNTRY, 2022-2029 (USD MILLION)

- 8.2.2 CELL BIOLOGY

- 8.2.2.1 Increased ability to study biomolecular interactions to boost demand

- TABLE 46 LASER CAPTURE MICRODISSECTION MARKET FOR CELL BIOLOGY, BY REGION, 2022-2029 (USD MILLION)

- TABLE 47 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR CELL BIOLOGY, BY COUNTRY, 2022-2029 (USD MILLION)

- 8.2.3 FORENSIC SCIENCE

- 8.2.3.1 Rising utilization in pathology laboratories for sample preparation to support market growth

- TABLE 48 LASER CAPTURE MICRODISSECTION MARKET FOR FORENSIC SCIENCE, BY REGION, 2022-2029 (USD MILLION)

- TABLE 49 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR FORENSIC SCIENCE, BY COUNTRY, 2022-2029 (USD MILLION)

- 8.3 DIAGNOSTICS

- 8.3.1 GROWING FOCUS ON EARLY DISEASE DETECTION TO AID MARKET GROWTH

- TABLE 50 LASER CAPTURE MICRODISSECTION MARKET FOR DIAGNOSTICS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 51 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR DIAGNOSTICS, BY COUNTRY, 2022-2029 (USD MILLION)

- 8.4 OTHER APPLICATIONS

- TABLE 52 LASER CAPTURE MICRODISSECTION MARKET FOR OTHER APPLICATIONS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 53 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

9 LASER CAPTURE MICRODISSECTION MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 54 LASER CAPTURE MICRODISSECTION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.2 ACADEMIC & GOVERNMENT RESEARCH INSTITUTES

- 9.2.1 INCREASING INDUSTRY-ACADEMIA COLLABORATIONS FOR R&D ACTIVITIES TO PROPEL MARKET GROWTH

- TABLE 55 LASER CAPTURE MICRODISSECTION MARKET FOR ACADEMIC & GOVERNMENT RESEARCH INSTITUTES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 56 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR ACADEMIC & GOVERNMENT RESEARCH INSTITUTES, BY COUNTRY, 2022-2029 (USD MILLION)

- 9.3 HOSPITALS

- 9.3.1 ADVANCED HEALTHCARE INFRASTRUCTURE EQUIPMENT TO FUEL MARKET GROWTH

- TABLE 57 LASER CAPTURE MICRODISSECTION MARKET FOR HOSPITALS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 58 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR HOSPITALS, BY COUNTRY, 2022-2029 (USD MILLION)

- 9.4 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 9.4.1 RISING UTILIZATION IN DRUG DISCOVERY & DEVELOPMENT TO DRIVE MARKET

- TABLE 59 LASER CAPTURE MICRODISSECTION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 60 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022-2029 (USD MILLION)

- 9.5 CONTRACT RESEARCH ORGANIZATIONS

- 9.5.1 INCREASING PHARMACEUTICAL OUTSOURCING OF SERVICES TO SUPPORT MARKET GROWTH

- TABLE 61 LASER CAPTURE MICRODISSECTION MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 62 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

10 LASER CAPTURE MICRODISSECTION MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 63 LASER CAPTURE MICRODISSECTION MARKET, BY REGION, 2022-2029 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 28 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET SNAPSHOT

- TABLE 64 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 65 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 66 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR CONSUMABLES, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 67 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET, BY SYSTEM TYPE, 2022-2029 (USD MILLION)

- TABLE 68 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 69 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 70 NORTH AMERICA: LASER CAPTURE MICRODISSECTION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 High adoption of technologically advanced LCM instruments to propel market growth

- TABLE 71 US: LASER CAPTURE MICRODISSECTION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 72 US: LASER CAPTURE MICRODISSECTION MARKET FOR CONSUMABLES, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 73 US: LASER CAPTURE MICRODISSECTION MARKET, BY SYSTEM TYPE, 2022-2029 (USD MILLION)

- TABLE 74 US: LASER CAPTURE MICRODISSECTION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 75 US: LASER CAPTURE MICRODISSECTION MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 76 US: LASER CAPTURE MICRODISSECTION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Favorable government initiatives for biopharma & life sciences research to support market growth

- TABLE 77 CANADA: LASER CAPTURE MICRODISSECTION MARKET, BY PRODUCT, 2022-2029 USD MILLION)

- TABLE 78 CANADA: LASER CAPTURE MICRODISSECTION MARKET FOR CONSUMABLES, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 79 CANADA: LASER CAPTURE MICRODISSECTION MARKET, BY SYSTEM TYPE, 2022-2029 (USD MILLION)

- TABLE 80 CANADA: LASER CAPTURE MICRODISSECTION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 81 CANADA: LASER CAPTURE MICRODISSECTION MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 82 CANADA: LASER CAPTURE MICRODISSECTION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 GROWTH IN PROTEOMICS RESEARCH TO DRIVE MARKET

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 83 EUROPE: LASER CAPTURE MICRODISSECTION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 84 EUROPE: LASER CAPTURE MICRODISSECTION MARKET FOR CONSUMABLES, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 85 EUROPE: LASER CAPTURE MICRODISSECTION MARKET, BY SYSTEM TYPE, 2022-2029 (USD MILLION)

- TABLE 86 EUROPE: LASER CAPTURE MICRODISSECTION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 87 EUROPE: LASER CAPTURE MICRODISSECTION MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 88 EUROPE: LASER CAPTURE MICRODISSECTION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 RISING INVESTMENTS IN HEALTHCARE INFRASTRUCTURE TO BOOST MARKET GROWTH

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- TABLE 89 ASIA PACIFIC: LASER CAPTURE MICRODISSECTION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 90 ASIA PACIFIC: LASER CAPTURE MICRODISSECTION MARKET FOR CONSUMABLES, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 91 ASIA PACIFIC: LASER CAPTURE MICRODISSECTION MARKET, BY SYSTEM TYPE, 2022-2029 (USD MILLION)

- TABLE 92 ASIA PACIFIC: LASER CAPTURE MICRODISSECTION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: LASER CAPTURE MICRODISSECTION MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 94 ASIA PACIFIC: LASER CAPTURE MICRODISSECTION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.5 REST OF THE WORLD

- 10.5.1 REST OF THE WORLD: RECESSION IMPACT

- TABLE 95 REST OF THE WORLD: LASER CAPTURE MICRODISSECTION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 96 REST OF THE WORLD: LASER CAPTURE MICRODISSECTION MARKET FOR CONSUMABLES, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 97 REST OF THE WORLD: LASER CAPTURE MICRODISSECTION MARKET, BY SYSTEM TYPE, 2022-2029 (USD MILLION)

- TABLE 98 REST OF THE WORLD: LASER CAPTURE MICRODISSECTION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 99 REST OF THE WORLD: LASER CAPTURE MICRODISSECTION MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 100 REST OF THE WORLD: LASER CAPTURE MICRODISSECTION MARKET, BY END USER, 2022-2029 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

- FIGURE 29 STRATEGIES ADOPTED BY KEY PLAYERS IN LASER CAPTURE MICRODISSECTION MARKET, 2022-2024

- 11.3 REVENUE SHARE ANALYSIS

- FIGURE 30 REVENUE SHARE ANALYSIS OF KEY PLAYERS (2021-2023)

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 31 MARKET SHARE ANALYSIS OF KEY PLAYERS (2023)

- TABLE 101 LASER CAPTURE MICRODISSECTION MARKET: DEGREE OF COMPETITION

- 11.5 COMPETITIVE SCENARIO

- 11.5.1 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 102 LASER CAPTURE MICRODISSECTION MARKET: PRODUCT LAUNCHES/DEVELOPMENTS (JANUARY 2021-FEBRUARY 2024)

- 11.5.2 DEALS

- TABLE 103 LASER CAPTURE MICRODISSECTION MARKET: DEALS (JANUARY 2021-FEBRUARY 2024)

- 11.5.3 EXPANSIONS

- TABLE 104 LASER CAPTURE MICRODISSECTION MARKET: EXPANSIONS (JANUARY 2021-FEBRUARY 2024)

- 11.5.4 OTHER DEVELOPMENTS

- TABLE 105 LASER CAPTURE MICRODISSECTION MARKET: OTHER DEVELOPMENTS (JANUARY 2021-FEBRUARY 2024)

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1.1 THERMO FISHER SCIENTIFIC INC.

- TABLE 106 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- FIGURE 32 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2023)

- TABLE 107 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- 12.1.2 DANAHER CORPORATION

- TABLE 108 DANAHER CORPORATION: COMPANY OVERVIEW

- FIGURE 33 DANAHER CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 109 DANAHER CORPORATION: DEALS

- 12.1.3 CARL ZEISS AG

- TABLE 110 CARL ZEISS AG: COMPANY OVERVIEW

- FIGURE 34 CARL ZEISS AG: COMPANY SNAPSHOT (2023)

- TABLE 111 CARL ZEISS AG: EXPANSIONS

- 12.1.4 F. HOFFMANN-LA ROCHE AG

- TABLE 112 F. HOFFMANN-LA ROCHE AG: COMPANY OVERVIEW

- FIGURE 35 F. HOFFMANN-LA ROCHE AG: COMPANY SNAPSHOT (2023)

- TABLE 113 F. HOFFMANN-LA ROCHE AG: PRODUCT LAUNCHES/DEVELOPMENTS

- 12.1.5 STANDARD BIOTOOLS

- TABLE 114 STANDARD BIOTOOLS: COMPANY OVERVIEW

- FIGURE 36 STANDARD BIOTOOLS: COMPANY SNAPSHOT (2023)

- TABLE 115 STANDARD BIOTOOLS: OTHER DEVELOPMENTS

- 12.1.6 JSR CORPORATION

- TABLE 116 JSR CORPORATION: COMPANY OVERVIEW

- FIGURE 37 JSR CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 117 JSR CORPORATION: DEALS

- 12.1.7 BIO-RAD LABORATORIES, INC.

- TABLE 118 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- FIGURE 38 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2023)

- 12.1.8 AGILENT TECHNOLOGIES, INC.

- TABLE 119 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 39 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2023)

- 12.1.9 BRUKER

- TABLE 120 BRUKER: COMPANY OVERVIEW

- FIGURE 40 BRUKER: COMPANY SNAPSHOT (2023)

- TABLE 121 BRUKER: PRODUCT LAUNCHES/DEVELOPMENTS

- 12.1.10 MOLECULAR MACHINES & INDUSTRIES GMBH

- TABLE 122 MOLECULAR MACHINES & INDUSTRIES GMBH: COMPANY OVERVIEW

- 12.1.11 OCIMUM BIOSOLUTIONS

- TABLE 123 OCIMUM BIOSOLUTIONS: COMPANY OVERVIEW

- 12.1.12 THERALINK TECHNOLOGIES, INC.

- TABLE 124 THERALINK TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 125 THERALINK TECHNOLOGIES, INC.: DEALS

- TABLE 126 THERALINK TECHNOLOGIES, INC.: OTHER DEVELOPMENTS

- 12.1.13 3DHISTECH LTD.

- TABLE 127 3DHISTECH LTD.: COMPANY OVERVIEW

- 12.1.14 CREATIVE BIOLABS

- TABLE 128 CREATIVE BIOLABS: COMPANY OVERVIEW

- 12.1.15 DENOVA SCIENCES

- TABLE 129 DENOVA SCIENCES: COMPANY OVERVIEW

- 12.2 OTHER PLAYERS

- 12.2.1 LAXCO, INC.

- TABLE 130 LAXCO, INC.: COMPANY OVERVIEW

- 12.2.2 CARESBIO LABORATORY LLC

- TABLE 131 CARESBIO LABORATORY LLC: COMPANY OVERVIEW

- 12.2.3 VITROVIVO BIOTECH

- TABLE 132 VITROVIVO BIOTECH: COMPANY OVERVIEW

- 12.2.4 ANAPATH SERVICES GMBH

- TABLE 133 ANAPATH SERVICES GMBH: COMPANY OVERVIEW

- 12.2.5 GNOME DIAGNOSTICS & GNOME SCIENCES

- TABLE 134 GNOME DIAGNOSTICS & GNOME SCIENCES: COMPANY OVERVIEW

- 12.2.6 MONASTERIUM LABORATORY

- TABLE 135 MONASTERIUM LABORATORY: COMPANY OVERVIEW

- 12.2.7 INDEPENDENT FORENSICS

- TABLE 136 INDEPENDENT FORENSICS: COMPANY OVERVIEW

- 12.2.8 NORGEN BIOTEK CORP.

- TABLE 137 NORGEN BIOTEK CORP.: COMPANY OVERVIEW

- 12.2.9 CREATIVE BIOARRAY

- TABLE 138 CREATIVE BIOARRAY: COMPANY OVERVIEW

- 12.2.10 EPISTEM LTD.

- TABLE 139 EPISTEM LTD.: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS