|

|

市場調査レポート

商品コード

1448085

軍事ドローンの世界市場:規模・シェア・成長分析 - 機能 (プラットフォーム・アプリケーションソフトウェア・サービス・GCS・ドローン発射&回収システム)・用途・運用モード・地域別 - 予測(~2028年)Drone Warfare Market Size, Share & Industry Growth Analysis Report, By Capability (Platform, Application Software, Services, GCS, Drone launch & Recovery systems), Application, Mode of Operation & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 軍事ドローンの世界市場:規模・シェア・成長分析 - 機能 (プラットフォーム・アプリケーションソフトウェア・サービス・GCS・ドローン発射&回収システム)・用途・運用モード・地域別 - 予測(~2028年) |

|

出版日: 2024年03月06日

発行: MarketsandMarkets

ページ情報: 英文 303 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

軍事ドローンの市場規模は、予測期間中に8.6%のCAGRで推移し、2023年の201億米ドルから、2028年には305億米ドルの規模に成長すると予測されています。

この成長は、高度なC4ISR (指揮・統制・通信・コンピューター・情報・監視・偵察) 機能が重視されるようになったことに起因しています。C4ISRソリューションは、軍事および諜報の枠組みにおける指揮統制戦略の強化において重要な役割を果たし、陸・空、海の軍事作戦の成功に大きな影響を与えています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | 機能・用途・運用モード・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

機能別では、プラットフォームの部門が予測期間中にもっとも高い市場シェアで成長する見通し:

プラットフォームの部門は軍事ドローン市場において予測期間中にもっとも高いシェアを示すと予測されています。プラットフォームはさらに小型ドローン、戦術ドローン、戦略ドローンに分類されます。小型ドローンはさらに、ナノ、マイクロ、ミニのバリエーションで構成され、高度350メートル以下で動作します。戦術ドローンは、その汎用性、より良い状況認識、正確な攻撃能力、費用対効果から、市場で非常に求められています。戦略ドローンは空の目であり、遠くから戦場を一望できます。ドローンは、遠く離れた地域から詳細な情報を収集し、重要なターゲットを正確に攻撃することに特化しています。

欧州が予測期間中に大きく成長する可能性を示す:

地域別に見ると、欧州地域は予測期間中、軍事ドローンの高成長潜在市場として浮上すると予測されています。ドローンは、防衛軍に戦場のリアルタイムの状況認識を提供します。センサーや小型ペイロードなどのドローンの技術的アップグレードが、欧州地域のドローン市場の成長を促進しています。軍事用途におけるドローンの需要は継続的に増加しています。地政学的緊張の高まり、特にウクライナで進行中の戦争とロシアと中国の主張の高まりが、防衛能力強化の必要性を加速させています。偵察能力と攻撃能力の両方を提供するドローンは現在、地域の安全保障を強化するための重要な手段として認識されています。

当レポートでは、世界の軍事ドローンの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向とディスラプション

- エコシステム分析

- ビジネスモデル

- 技術分析

- 平均販売価格の分析

- ボリューム分析

- 主要なステークホルダーと購入基準

- 運用データ

- 投資と資金調達のシナリオ

- 総所有コスト

- 技術ロードマップ

- 規制状況

- 貿易データ分析

- 主要な会議とイベント

第6章 業界の動向

- 技術動向

- メガトレンドの影響

- サプライチェーン分析

- 使用事例の分析

- 特許分析

第7章 軍事ドローン市場:機能別

- プラットフォーム

- アプリケーションソフトウェア

- サービス

- 地上管制局

- ドローン発射・回収システム

第8章 軍事ドローン市場:用途別

- 無人戦闘航空機

- 致死性ドローン

- ステルスドローン

- 徘徊兵器

- ターゲットドローン

- ISR (情報・監視・偵察)

- 監視ドローン

- 偵察ドローン

- 目標捕捉ドローン

- デリバリー

第9章 軍事ドローン市場:運用モード別

- 半自動

- 自動

第10章 軍事ドローン市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東

- ラテンアメリカ

- アフリカ

第11章 競合情勢

- 企業概要

- 主要企業の戦略

- 市場ランキング分析

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 企業評価と財務指標

- ブランド/製品の比較

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- NORTHROP GRUMMAN

- RAYTHEON TECHNOLOGIES CORPORATION

- ISRAEL AEROSPACE INDUSTRIES LTD.

- GENERAL ATOMICS AERONAUTICAL SYSTEMS, INC.

- TELEDYNE FLIR LLC

- AEROVIRONMENT, INC.

- BOEING

- AIRBUS

- TEXTRON INC.

- LOCKHEED MARTIN CORPORATION

- ELBIT SYSTEMS LTD.

- THALES

- DRONEDEPLOY INC.

- KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

- LEIDOS

- AERONAUTICS

- その他の企業

- DYNETICS

- ROBOTICAN CORPORATION

- VOLANSI, INC.

- GRIFFON AEROSPACE

- PLATFORM AEROSPACE

- SHIELD AI

- INSTANTEYE ROBOTICS

- ATHLON AVIA

- SILVERTONE UAV

- BLUEBIRD AERO SYSTEMS LTD.

- ANDURIL INDUSTRIES

- SKYDIO INC.

- INDEMNIS, INC.

第13章 付録

The drone warfare market is anticipated to experience substantial growth, increasing from USD 20.1 billion in 2023 to USD 30.5 billion by 2028, with a Compound Annual Growth Rate (CAGR) of 8.6% during the forecast period. This growth is attributed to a heightened emphasis on advanced Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) capabilities. C4ISR solutions play a crucial role in reinforcing command and control strategies within military and intelligence frameworks, significantly impacting the success of air, naval, and military operations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million) |

| Segments | By Capability, Application, Mode of Operation & Region |

| Regions covered | North America, Europe, Asia Pacific, Rest of the World |

The military sector witness's continuous developments in Intelligence, Surveillance, and Reconnaissance (ISR) capabilities, with a notable example being the Fifth Generation C4ISR, a joint battle management system utilizing machine learning for data gathering, understanding, and seamless communication across its components. Artificial Intelligence (AI) in C4ISR enhances vehicle identification, image feeds, and provides driving assistance by issuing early warnings on obstacles and changing ground conditions. Governments worldwide are swiftly adopting these technologies to enhance their defense arsenals.

"Based on capability, the Platform segment is estimated to to grow with the highest market share in the forecast period."

The Platform segment expected to demonstrate the highest market share during the forecast period in the drone warfare market. The Drone warfare market, based on platform, is segmented into small, tactical, and strategic drones. Small drones, comprising nano, micro, and mini variants, operate at altitudes below 350 meters. Tactical drones are highly sought after in the drone warfare market due to their versatility, offering better awareness of situations, precise strike capabilities, and cost-effectiveness. Strategic drones are the eyes in the sky, offering a sweeping view of the battlefield from afar. They specialize in collecting detailed intelligence from distant areas and executing precise strikes on crucial targets with accuracy

"Based on platform, the Small segment witness strong growth in market during the forecast period."

Based on platform, the drone warfare market is divided into small, tactical, and strategic drones. Notably, the tactical segment is poised for robust growth throughout the forecast period. Small drones, comprising nano, micro, and mini variants, operate at altitudes below 350 meters. For instance, the Switchblade 300, akin to the size of a brick and weighing around 2.5 kilograms, stands as a representative small loitering munition drone, capable of targeting with a compact explosive payload. These drones are becoming increasingly sought-after by defense sectors for surveillance, reconnaissance, and border security needs due to their effective flight control systems and economical operational expenses. While technological enhancements tailor them for military use, challenges arise from the absence of proper air traffic management systems and safety concerns, especially concerning interactions with larger aircraft and critical ground installations like fuel depots, restraining their global expansion.

"The Europe regions are projected to be high growth potential markets for drone warfare during the forecast period."

Based on region, The Europe region is expected to emerge as a high-growth potential market for drone warfare during the forecast period. Drones provide real-time situational awareness of battlefields to defense forces. Technological upgrades in drones, in terms of sensors and miniature payloads, have fueled the growth of the market for drones in the European region. The demand for drones in military applications is continuously increasing. Heightened geopolitical tensions, particularly with the ongoing war in Ukraine and increased assertiveness from Russia and China, have accelerated the need for enhanced defense capabilities. Drone warfares, offering both reconnaissance and strike capabilities, are now recognized as crucial tools for bolstering regional security.

European countries are actively working towards harmonizing drone regulations, promoting cross-border collaboration, and streamlining deployment processes. This regulatory framework is expected to attract larger investments, facilitating market growth. the European drone warfare market is broadening its focus beyond traditional surveillance and reconnaissance. There is a growing exploration of drones for electronic warfare, logistics and resupply, and maritime patrol. This diversification of applications is opening new avenues for growth and market expansion.

The break-up of the profiles of primary participants in the drone warfare market is as follows:

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- By Designation: C Level Executives-35%; Directors-25%; and Others-40%

- By Region: North America-25%; Europe-25%; Asia Pacific-40%; Middle East-5%; Latin America-5%

Major players in the drone warfare market are Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Israel Aerospace Industries Ltd. (Israel), General Atomics Aeronautical Systems (GA-ASI) (US), and Teledyne FLIR LLC (US). These companies have strong distribution networks in the logistics business across North America, Europe, Asia Pacific and other regions in turn driving the demand for last mile deliveries and drone package deliveries.

Research Coverage

This research report categorizes the drone warfare market on the basis of solution (system, software, and infrastructure), Capability (Platform, Application Software, Services, ground control station and Drone launch and recovery system), application (UCAVS, and ISR (Intelligence, Surveillance, and Reconnaissance), Delivery ), mode of operation (Semi-Autonomous, Autonomous). These segments have been mapped across major regions, namely, North America, Europe, Asia Pacific, Middle East, Latin America, and Africa.

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the drone warfare market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches associated with the drone warfare market. Competitive analysis of upcoming startups in the drone warfare ecosystem is covered in this report.

Reasons to Buy this Report

This report is expected to help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall drone warfare market and its segments. This study is also expected to provide region wise information about the end-use industrial sectors, wherein drone is used. This report aims at helping the stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. This report is also expected to help them understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities influencing the growth of the market.

The report provides insights on the following pointers:

- Analysis of the key driver (Integration of Artificial Intelligence (AI) for enhanced target identification, decision-making, and autonomous combat capabilities, Drones offer significant cost advantages in terms of operation, maintenance, and training, Incorporation of drones into network-centric warfare for enhanced battlefield awareness and coordinated operations, Rising global conflicts and terrorist threats fuel demand for real-time surveillance and reconnaissance), restraint (International Legal And Ethical Frameworks Governing The Use Of Lethal Autonomous Weapons Systems (Laws) Are Still Under Development, Limited effectiveness in adverse weather conditions like strong winds, heavy rain, or low visibility, Dependence on robust communication infrastructure and vulnerability to jamming and hacking attempts) opportunities (Development of electronic warfare (EW) systems, anti-air lasers, and drone -hunting drone technologies, Miniaturized drones for covert operations and enhanced battlefield intelligence gathering, Growing demand for counter-drone systems to detect, track, and neutralize hostile drones) and challenges (Weather limitations and payload restrictions can hinder drone effectiveness in certain scenarios, Training personnel on drone operation, maintenance, and data analysis to ensure optimal performance) there are several factors that could contribute to an increase in the Drone Warfare market.

- Market Penetration: Comprehensive information on drone warfare offered by the top players in the market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the drone warfare market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the drone warfare market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the drone warfare market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the drone warfare market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 DRONE WARFARE MARKET SEGMENTATION

- 1.4.2 REGIONS COVERED

- 1.4.3 YEARS CONSIDERED

- 1.4.4 RECESSION IMPACT ANALYSIS

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key insights from primary sources

- 2.1.2.2 Key data from primary sources

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Methodology to arrive at market size using bottom-up approach

- FIGURE 4 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 7 SMALL DRONES SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST MARKET

- FIGURE 8 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 AUTONOMOUS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN DRONE WARFARE MARKET

- FIGURE 11 INCREASING USE OF DRONES BY DEFENSE FORCES WORLDWIDE TO DRIVE MARKET

- 4.2 DRONE WARFARE MARKET, BY CAPABILITY

- FIGURE 12 PLATFORMS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 DRONE WARFARE MARKET, BY MODE OF OPERATION

- FIGURE 13 SEMI-AUTONOMOUS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 DRONE WARFARE MARKET, BY APPLICATION

- FIGURE 14 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE TO BE DOMINANT SEGMENT DURING FORECAST PERIOD

- 4.5 DRONE WARFARE MARKET, BY PLATFORMS

- FIGURE 15 STRATEGIC DRONES SEGMENT TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising integration of artificial intelligence in drones

- 5.2.1.2 Growing cost advantages over manned aircraft

- 5.2.1.3 Increasing incorporation of drones into network-centric warfare

- 5.2.1.4 Surge in global conflicts and terrorist threats

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent legal and ethical frameworks

- 5.2.2.2 Limited effectiveness in adverse weather conditions

- 5.2.2.3 High dependence on robust communication infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of electronic warfare systems

- 5.2.3.2 Increasing adoption of miniaturized drones

- 5.2.3.3 Rising demand for counter drones

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex training programs

- 5.2.4.2 Limited energy density of current battery technology

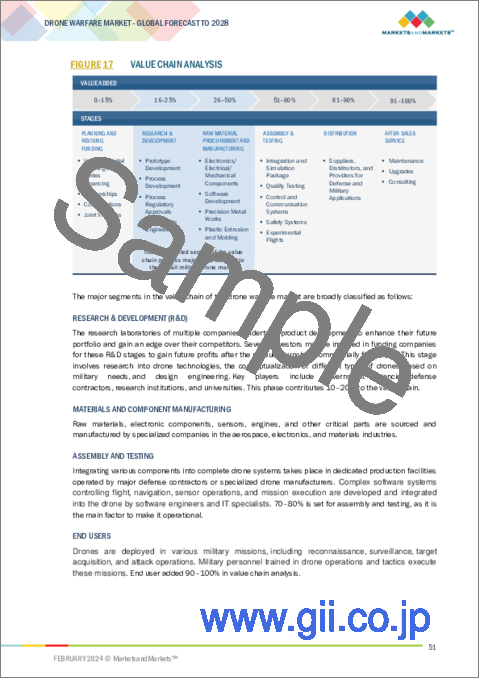

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 17 VALUE CHAIN ANALYSIS

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 18 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DRONE WARFARE MARKET PLAYERS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- FIGURE 19 ECOSYSTEM MAPPING

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM

- 5.6 BUSINESS MODEL

- FIGURE 20 BUSINESS MODEL

- TABLE 4 LEASED MILITARY DRONES

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 ARTIFICIAL INTELLIGENCE IN MILITARY DRONES

- TABLE 5 COMPANIES DEVELOPING DRONE SOFTWARE WITH AI

- TABLE 6 COMPANIES DEVELOPING DRONE EQUIPMENT WITH AI

- 5.7.2 MID-AIR REFUELING OF DRONES

- 5.7.3 SPY DRONES

- 5.8 AVERAGE SELLING PRICE ANALYSIS

- FIGURE 21 AVERAGE SELLING PRICE, BY KEY PLAYERS

- TABLE 7 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD MILLION)

- 5.8.1 AVERAGE SELLING PRICE, BY DRONE TYPE

- TABLE 8 AVERAGE SELLING PRICE, BY DRONE TYPE (USD MILLION)

- 5.8.2 AVERAGE SELLING PRICE, BY REGION

- TABLE 9 AVERAGE SELLING PRICE, BY REGION (USD MILLION)

- 5.8.3 AVERAGE SELLING PRICE, BY PLATFORM

- TABLE 10 AVERAGE SELLING PRICE, BY PLATFORM (USD MILLION)

- 5.8.4 AVERAGE SELLING PRICE OF UNMANNED AERIAL VEHICLES AND THEIR COMPONENTS

- TABLE 11 AVERAGE SELLING PRICE OF UNMANNED AERIAL VEHICLES AND THEIR COMPONENTS (USD)

- 5.9 VOLUME ANALYSIS

- TABLE 12 VOLUME DATA, BY PLATFORM (UNITS)

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.11 OPERATIONAL DATA

- FIGURE 24 TOTAL ACTIVE FLEET OF DRONES USED BY US NAVY AND MARINE (UNITS)

- FIGURE 25 TOTAL ACTIVE FLEET OF DRONES USED BY US AIR FORCE (UNITS)

- FIGURE 26 ARMED DRONES ACQUIRED, USED, AND DEVELOPED WORLDWIDE, 2000-2020

- 5.12 INVESTMENT AND FUNDING SCENARIO

- FIGURE 27 INVESTMENT SCENARIO, 2011-2022

- TABLE 15 INVESTMENT TREND IN DRONE INDUSTRY, 2022

- 5.12.1 DRONE STARTUP EQUITY FUNDING (USD BILLION)

- 5.13 TOTAL COST OF OWNERSHIP

- TABLE 16 ESTIMATED COST OF DRONES

- TABLE 17 TECHNICAL COST OF DRONES

- TABLE 18 TOTAL COST OF OWNERSHIP OF DRONE WARFARE

- 5.14 TECHNOLOGY ROADMAP

- FIGURE 28 TECHNOLOGY ROADMAP

- FIGURE 29 EVOLUTION OF TECHNOLOGY TRENDS

- FIGURE 30 EMERGING TRENDS

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 REGULATIONS AND APPROVALS TO OPERATE DRONES

- TABLE 24 DRONE OPERATIONS AND APPROVALS, BY COUNTRY

- TABLE 25 DRONE REGULATIONS, BY COUNTRY

- 5.15.2.1 Rules and guidelines to operate drones

- TABLE 26 US: RULES AND GUIDELINES TO OPERATE DRONES

- TABLE 27 CANADA: RULES AND GUIDELINES TO OPERATE DRONES

- TABLE 28 UK: RULES AND GUIDELINES TO OPERATE DRONES

- TABLE 29 GERMANY: RULES AND GUIDELINES TO OPERATE DRONES

- TABLE 30 FRANCE: RULES AND GUIDELINES TO OPERATE DRONES

- 5.16 TRADE DATA ANALYSIS

- TABLE 31 TRADE DATA OF MAJOR COUNTRIES

- 5.16.1 IMPORT DATA ANALYSIS

- 5.16.1.1 Unmanned aircraft with maximum take-off weight of >150 kg (HS Code: 880699)

- TABLE 32 TOP FIVE IMPORTING COUNTRIES, 2022 (USD MILLION)

- FIGURE 31 TOP 10 IMPORTING COUNTRIES, 2022 (USD THOUSAND)

- 5.16.2 EXPORT DATA ANALYSIS

- 5.16.2.1 Unmanned aircraft with maximum take-off weight of >150 kg (HS Code: 880699)

- TABLE 33 TOP FIVE EXPORTING COUNTRIES, 2022 (USD MILLION)

- FIGURE 32 TOP 10 EXPORTING COUNTRIES, 2022 (USD THOUSAND)

- 5.17 KEY CONFERENCES AND EVENTS

- TABLE 34 KEY CONFERENCES AND EVENTS, 2024-2025

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 MINIATURIZATION

- 6.2.2 ARTIFICIAL INTELLIGENCE AND AUTONOMY

- 6.2.3 ADVANCED SENSORS AND IMAGING

- 6.2.4 HYPERSONIC PROPULSION

- 6.2.5 CYBERSECURITY AND DATA PROTECTION

- 6.2.6 BIO-INSPIRED FLIGHT AND ROBOTICS

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 AUTONOMY

- 6.3.2 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 6.3.3 ADVANCED SENSORS

- 6.4 SUPPLY CHAIN ANALYSIS

- FIGURE 33 SUPPLY CHAIN ANALYSIS

- 6.5 USE CASE ANALYSIS

- 6.5.1 AEROVIRONMENT PUMA 3 AE FOR MARITIME USE

- 6.5.2 BAYRAKTAR TB-2 USED IN RUSSIA-UKRAINE CONFLICT

- 6.5.3 DRONES USED AT WEST BANK

- 6.6 PATENT ANALYSIS

- FIGURE 34 PATENT ANALYSIS

- FIGURE 35 REGIONAL ANALYSIS OF PATENTS, 2023

- TABLE 35 REGIONAL ANALYSIS OF PATENTS, 2023

- TABLE 36 INNOVATIONS AND PATENT REGISTRATIONS, 2019-2023

7 DRONE WARFARE MARKET, BY CAPABILITY

- 7.1 INTRODUCTION

- TABLE 37 DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 38 DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- 7.1.1 PLATFORMS

- FIGURE 36 DRONE WARFARE MARKET, BY PLATFORMS, 2023-2028 (USD MILLION)

- TABLE 39 DRONE WARFARE MARKET, BY PLATFORMS, 2020-2022 (USD MILLION)

- TABLE 40 DRONE WARFARE MARKET, BY PLATFORMS, 2023-2028 (USD MILLION)

- 7.1.1.1 Small drones

- 7.1.1.1.1 Increasing demand for surveillance and reconnaissance to drive market

- 7.1.1.2 Tactical drones

- 7.1.1.2.1 Growing need for improved situational awareness and precision strike capabilities to drive market

- 7.1.1.3 Strategic drones

- 7.1.1.3.1 Rising cost efficiency over piloted aircraft to drive market

- 7.1.1.1 Small drones

- 7.1.2 APPLICATION SOFTWARE

- 7.1.2.1 Border security and precision agriculture applications to drive market

- 7.1.3 SERVICES

- TABLE 41 DRONE WARFARE MARKET, BY SERVICES, 2020-2022 (USD MILLION)

- TABLE 42 DRONE WARFARE MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- 7.1.3.1 Repair and maintenance

- 7.1.3.1.1 Surge in checking pre- and post-flight operation efficiency to drive market

- 7.1.3.2 Simulation and training

- 7.1.3.2.1 Growing need for risk-free training environment to drive market

- 7.1.3.1 Repair and maintenance

- 7.1.4 GROUND CONTROL STATIONS

- 7.1.4.1 Portable 109 7.1.4.1.1 Increasing need for flexible deployment in challenging environments to drive market

- 7.1.4.2 Mobile

- 7.1.4.2.1 Growing need for resilient systems in harsh field conditions to drive market

- 7.1.5 DRONE LAUNCH AND RECOVERY SYSTEMS

- 7.1.5.1 Rising integration of drones into explosive devices to drive market

8 DRONE WARFARE MARKET, BY APPLICATION

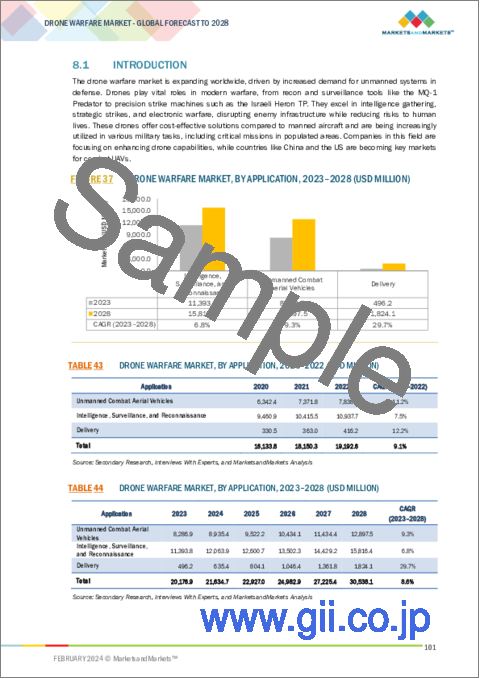

- 8.1 INTRODUCTION

- FIGURE 37 DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 43 DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 44 DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 UNMANNED COMBAT AERIAL VEHICLES

- TABLE 45 DRONE WARFARE MARKET, BY UNMANNED COMBAT AERIAL VEHICLES, 2020-2022 (USD MILLION)

- TABLE 46 DRONE WARFARE MARKET, BY UNMANNED COMBAT AERIAL VEHICLES, 2023-2028 (USD MILLION)

- 8.2.1 LETHAL DRONES

- 8.2.1.1 Increasing use in land and marine applications to drive market

- 8.2.2 STEALTH DRONES

- 8.2.2.1 Growing use in covert surveillance and rescue operations in inaccessible locations to drive market

- 8.2.3 LOITERING MUNITIONS

- TABLE 47 DRONE WARFARE MARKET, BY LOITERING MUNITIONS, 2020-2022 (USD MILLION)

- TABLE 48 DRONE WARFARE MARKET, BY LOITERING MUNITIONS, 2023-2028 (USD MILLION)

- 8.2.3.1 Recoverables

- 8.2.3.1.1 Retrievable and reusable features to drive market

- 8.2.3.2 Expendables

- 8.2.3.2.1 Increasing use of navigation and target acquisition systems to drive market

- 8.2.3.1 Recoverables

- 8.2.4 TARGET DRONES

- 8.2.4.1 Rising need for multi-spectrum operations for undetected operations to drive market

- 8.3 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE

- 8.3.1 SURVEILLANCE DRONES

- 8.3.1.1 Increasing developments in sensor technology and autonomy to drive market

- 8.3.2 RECONNAISSANCE DRONES

- 8.3.2.1 Rising preference for weapons without human intervention to drive market

- 8.3.3 TARGET ACQUISITION DRONES

- 8.3.3.1 Urban warfare and environmental monitoring applications to drive market

- 8.3.1 SURVEILLANCE DRONES

- 8.4 DELIVERY

- 8.4.1 NEED FOR CARGO DELIVERY OF MEDICAL AIDS, FOOD SUPPLIES, AND AMMUNITION ON BATTLEFIELDS TO DRIVE MARKET

9 DRONE WARFARE MARKET, BY MODE OF OPERATION

- 9.1 INTRODUCTION

- FIGURE 38 DRONE WARFARE MARKET, BY MODE OF OPERATION, 2023-2028 (USD MILLION)

- TABLE 49 DRONE WARFARE MARKET, BY MODE OF OPERATION, 2020-2022 (USD MILLION)

- TABLE 50 DRONE WARFARE MARKET, BY MODE OF OPERATION, 2023-2028 (USD MILLION)

- 9.2 SEMI-AUTONOMOUS

- 9.2.1 INCREASING NEED FOR IMPROVED BATTLEFIELD AWARENESS TO DRIVE MARKET

- 9.3 AUTONOMOUS

- 9.3.1 GROWING USE OF AUTONOMOUS MACHINES TO DRIVE MARKET

10 DRONE WARFARE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.1.1 REGIONAL RECESSION IMPACT ANALYSIS

- FIGURE 39 DRONE WARFARE MARKET, BY REGION, 2023-2028

- TABLE 51 DRONE WARFARE MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 52 DRONE WARFARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 RECESSION IMPACT ANALYSIS

- 10.2.2 PESTLE ANALYSIS

- FIGURE 40 NORTH AMERICA: DRONE WARFARE MARKET SNAPSHOT

- TABLE 53 NORTH AMERICA: DRONE WARFARE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 54 NORTH AMERICA: DRONE WARFARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 56 NORTH AMERICA: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Growing initiatives for unmanned aerial capabilities to drive market

- TABLE 59 US: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 60 US: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 61 US: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 62 US: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 63 US: DEFENSE PROGRAM MAPPING

- 10.2.4 CANADA

- 10.2.4.1 New contracts from Royal Canadian Air Force to drive market

- TABLE 64 CANADA: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 65 CANADA: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 66 CANADA: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 67 CANADA: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 68 CANADA: DEFENSE PROGRAM MAPPING

- 10.3 EUROPE

- 10.3.1 RECESSION IMPACT ANALYSIS

- 10.3.2 PESTLE ANALYSIS

- FIGURE 41 EUROPE: DRONE WARFARE MARKET SNAPSHOT

- TABLE 69 EUROPE: DRONE WARFARE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 70 EUROPE: DRONE WARFARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 71 EUROPE: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 72 EUROPE: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 73 EUROPE: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 74 EUROPE: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.3 RUSSIA

- 10.3.3.1 Growing border disputes with Ukraine to drive market

- TABLE 75 RUSSIA: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 76 RUSSIA: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 77 RUSSIA: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 78 RUSSIA: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 79 RUSSIA: DEFENSE PROGRAM MAPPING

- 10.3.4 FRANCE

- 10.3.4.1 Joint European drone warfare project deal to drive market

- TABLE 80 FRANCE: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 81 FRANCE: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 82 FRANCE: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 83 FRANCE: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 84 FRANCE: DEFENSE PROGRAM MAPPING

- 10.3.5 UK

- 10.3.5.1 Rise in domestic innovations and collaborations to drive market

- TABLE 85 UK: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 86 UK: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 87 UK: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 88 UK: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 89 UK: DEFENSE PROGRAM MAPPING

- 10.3.6 GERMANY

- 10.3.6.1 Increasing demand for drone warfare from armed forces to drive market

- TABLE 90 GERMANY: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 91 GERMANY: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 92 GERMANY: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 93 GERMANY: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 94 GERMANY: DEFENSE PROGRAM MAPPING

- 10.3.7 UKRAINE

- 10.3.7.1 Growing development of strike-capable drones to drive market

- TABLE 95 UKRAINE: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 96 UKRAINE: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 97 UKRAINE: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 98 UKRAINE: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 99 UKRAINE: DEFENSE PROGRAM MAPPING

- 10.3.8 ITALY

- 10.3.8.1 Surge in training initiatives to drive market

- TABLE 100 ITALY: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 101 ITALY: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 102 ITALY: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 103 ITALY: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 104 ITALY: DEFENSE PROGRAM MAPPING

- 10.3.9 SWEDEN

- 10.3.9.1 Increasing focus on developing drones and associated solutions to drive market

- TABLE 105 SWEDEN: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 106 SWEDEN: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 107 SWEDEN: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 108 SWEDEN: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.10 REST OF EUROPE

- TABLE 109 REST OF EUROPE: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 110 REST OF EUROPE: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 111 REST OF EUROPE: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 112 REST OF EUROPE: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 RECESSION IMPACT ANALYSIS

- 10.4.2 PESTLE ANALYSIS

- FIGURE 42 ASIA PACIFIC: DRONE WARFARE MARKET SNAPSHOT

- TABLE 113 ASIA PACIFIC: DRONE WARFARE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: DRONE WARFARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Increasing experimentation with hypersonic and solar-powered features to drive market

- TABLE 119 CHINA: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 120 CHINA: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 121 CHINA: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 122 CHINA: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 123 CHINA: DEFENSE PROGRAM MAPPING

- 10.4.4 INDIA

- 10.4.4.1 Rising defense budgets to drive market

- TABLE 124 INDIA: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 125 INDIA: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 126 INDIA: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 127 INDIA: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 128 INDIA: DEFENSE PROGRAM MAPPING

- 10.4.5 JAPAN

- 10.4.5.1 Growing demand for mini unmanned aerial vehicles to drive market

- TABLE 129 JAPAN: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 130 JAPAN: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 131 JAPAN: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 132 JAPAN: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 133 JAPAN: DEFENSE PROGRAM MAPPING

- 10.4.6 AUSTRALIA

- 10.4.6.1 High government funding for developing military drones to drive market

- TABLE 134 AUSTRALIA: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 135 AUSTRALIA: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 136 AUSTRALIA: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 137 AUSTRALIA: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 138 AUSTRALIA: DEFENSE PROGRAM MAPPING

- 10.4.7 SOUTH KOREA

- 10.4.7.1 Surge in threats from neighboring countries to drive market

- TABLE 139 SOUTH KOREA: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 140 SOUTH KOREA: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 141 SOUTH KOREA: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 142 SOUTH KOREA: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 143 SOUTH KOREA: DEFENSE PROGRAM MAPPING

- 10.4.8 REST OF ASIA PACIFIC

- TABLE 144 REST OF ASIA PACIFIC: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5 MIDDLE EAST

- 10.5.1 RECESSION IMPACT ANALYSIS

- 10.5.2 PESTLE ANALYSIS

- FIGURE 43 MIDDLE EAST: DRONE WARFARE MARKET SNAPSHOT

- TABLE 148 MIDDLE EAST: DRONE WARFARE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 149 MIDDLE EAST: DRONE WARFARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 150 MIDDLE EAST: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 151 MIDDLE EAST: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 152 MIDDLE EAST: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 153 MIDDLE EAST: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 154 GCC: DRONE WARFARE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 155 GCC: DRONE WARFARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.3 GCC

- 10.5.3.1 SAUDI ARABIA

- 10.5.3.1.1 General Authority for Civil Aviation initiatives to drive market

- 10.5.3.1 SAUDI ARABIA

- TABLE 156 SAUDI ARABIA: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 157 SAUDI ARABIA: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 158 SAUDI ARABIA: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 159 SAUDI ARABIA: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 160 SAUDI ARABIA: DEFENSE PROGRAM MAPPING

- 10.5.3.2 UAE

- 10.5.3.2.1 Increased innovations in artificial intelligence and swarm coordination to drive market

- 10.5.3.2 UAE

- TABLE 161 UAE: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 162 UAE: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 163 UAE: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 164 UAE: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.4 ISRAEL

- 10.5.4.1 Growing upgrades in payloads and sensors to drive market

- TABLE 165 ISRAEL: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 166 ISRAEL: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 167 ISRAEL: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 168 ISRAEL: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 169 ISRAEL: DEFENSE PROGRAM MAPPING

- 10.5.5 TURKEY

- 10.5.5.1 Rising deployment of unmanned aerial vehicles and their subsystems to drive market

- TABLE 170 TURKEY: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 171 TURKEY: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 172 TURKEY: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 173 TURKEY: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 174 TURKEY: DEFENSE PROGRAM MAPPING

- 10.5.6 REST OF MIDDLE EAST

- TABLE 175 REST OF MIDDLE EAST: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 176 REST OF MIDDLE EAST: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 RECESSION IMPACT ANALYSIS

- 10.6.2 PESTLE ANALYSIS

- FIGURE 44 LATIN AMERICA: DRONE WARFARE MARKET SNAPSHOT

- TABLE 179 LATIN AMERICA: DRONE WARFARE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 180 LATIN AMERICA: DRONE WARFARE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 181 LATIN AMERICA: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 182 LATIN AMERICA: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 183 LATIN AMERICA: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 184 LATIN AMERICA: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Increasing participation in international initiatives and agreements to drive market

- TABLE 185 BRAZIL: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 186 BRAZIL: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 187 BRAZIL: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 188 BRAZIL: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 189 BRAZIL: DEFENSE PROGRAM MAPPING

- 10.6.4 MEXICO

- 10.6.4.1 Growing use of drones in disaster management to drive market

- TABLE 190 MEXICO: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 191 MEXICO: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 192 MEXICO: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 193 MEXICO: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.7 AFRICA

- 10.7.1 RECESSION IMPACT ANALYSIS

- 10.7.2 PESTLE ANALYSIS

- FIGURE 45 AFRICA: DRONE WARFARE MARKET SNAPSHOT

- TABLE 194 AFRICA: DRONE WARFARE MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 195 AFRICA: DRONE WARFARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 196 AFRICA: DRONE WARFARE MARKET, BY CAPABILITY, 2020-2022 (USD MILLION)

- TABLE 197 AFRICA: DRONE WARFARE MARKET, BY CAPABILITY, 2023-2028 (USD MILLION)

- TABLE 198 AFRICA: DRONE WARFARE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 199 AFRICA: DRONE WARFARE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.7.3 SOUTH AFRICA

- 10.7.3.1 Increasing need to address unique geographical challenges to drive market

- TABLE 200 SOUTH AFRICA: DEFENSE PROGRAM MAPPING

- 10.7.4 NIGERIA

- 10.7.4.1 Rising use of drones to address complex security challenges to drive market

- TABLE 201 NIGERIA: DEFENSE PROGRAM MAPPING

- 10.7.5 REST OF AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 COMPANY OVERVIEW

- 11.3 STRATEGIES OF KEY PLAYERS

- TABLE 202 STRATEGIES OF KEY PLAYERS

- 11.4 MARKET RANKING ANALYSIS

- 11.5 REVENUE ANALYSIS

- 11.6 MARKET SHARE ANALYSIS

- TABLE 203 DEGREE OF COMPETITION

- 11.7 COMPANY EVALUATION MATRIX

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- FIGURE 49 DRONE WARFARE MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.7.5 COMPANY FOOTPRINT

- TABLE 204 DRONE WARFARE MARKET: COMPANY FOOTPRINT

- TABLE 205 DRONE WARFARE MARKET: PLATFORM FOOTPRINT

- TABLE 206 DRONE WARFARE MARKET: REGION FOOTPRINT

- 11.8 STARTUP/SME EVALUATION MATRIX

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- FIGURE 50 DRONE WARFARE MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- 11.8.5 COMPETITIVE BENCHMARKING

- TABLE 207 DRONE WARFARE MARKET: KEY STARTUPS/SMES

- TABLE 208 DRONE WARFARE MARKET: COMPETITIVE BENCHMARKING

- 11.9 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 51 EV/EBITDA OF KEY VENDORS

- 11.10 BRAND/PRODUCT COMPARISON

- FIGURE 52 BRAND/PRODUCT COMPARISON

- 11.11 COMPETITIVE SCENARIO

- 11.11.1 MARKET EVALUATION FRAMEWORK

- 11.11.2 PRODUCT LAUNCHES

- TABLE 209 DRONE WARFARE MARKET: PRODUCT LAUNCHES, APRIL 2020-AUGUST 2022

- 11.11.3 DEALS

- TABLE 210 DRONE WARFARE MARKET: DEALS, SEPTEMBER 2017-NOVEMBER 2023

- 11.11.4 OTHER DEVELOPMENTS

- TABLE 211 DRONE WARFARE MARKET: OTHER DEVELOPMENTS, APRIL 2020-SEPTEMBER 2023

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.2.1 NORTHROP GRUMMAN

- TABLE 212 NORTHROP GRUMMAN: COMPANY OVERVIEW

- FIGURE 53 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- TABLE 213 NORTHROP GRUMMAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 NORTHROP GRUMMAN: OTHER DEVELOPMENTS

- 12.2.2 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 215 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- FIGURE 54 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 216 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- 12.2.3 ISRAEL AEROSPACE INDUSTRIES LTD.

- TABLE 218 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY OVERVIEW

- FIGURE 55 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY SNAPSHOT

- TABLE 219 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCT LAUNCHES

- TABLE 221 ISRAEL AEROSPACE INDUSTRIES LTD.: DEALS

- TABLE 222 ISRAEL AEROSPACE INDUSTRIES LTD.: OTHER DEVELOPMENTS

- 12.2.4 GENERAL ATOMICS AERONAUTICAL SYSTEMS, INC.

- TABLE 223 GENERAL ATOMICS AERONAUTICAL SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 224 GENERAL ATOMICS AERONAUTICAL SYSTEMS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 225 GENERAL ATOMICS AERONAUTICAL SYSTEMS, INC.: DEALS

- TABLE 226 GENERAL ATOMICS AERONAUTICAL SYSTEMS, INC.: OTHER DEVELOPMENTS

- 12.2.5 TELEDYNE FLIR LLC

- TABLE 227 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- FIGURE 56 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- TABLE 228 TELEDYNE FLIR LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 TELEDYNE FLIR LLC: PRODUCT LAUNCHES

- TABLE 230 TELEDYNE FLIR LLC: DEALS

- TABLE 231 TELEDYNE FLIR LLC: OTHER DEVELOPMENTS

- 12.2.6 AEROVIRONMENT, INC.

- TABLE 232 AEROVIRONMENT, INC.: COMPANY OVERVIEW

- FIGURE 57 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

- TABLE 233 AEROVIRONMENT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 AEROVIRONMENT, INC.: PRODUCT LAUNCHES

- TABLE 235 AEROVIRONMENT, INC.: DEALS

- TABLE 236 AEROVIRONMENT, INC.: OTHER DEVELOPMENTS

- 12.2.7 BOEING

- TABLE 237 BOEING: COMPANY OVERVIEW

- FIGURE 58 BOEING: COMPANY SNAPSHOT

- TABLE 238 BOEING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 BOEING: PRODUCT LAUNCHES

- TABLE 240 BOEING: OTHER DEVELOPMENTS

- 12.2.8 AIRBUS

- TABLE 241 AIRBUS: COMPANY OVERVIEW

- FIGURE 59 AIRBUS: COMPANY SNAPSHOT

- TABLE 242 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 AIRBUS: OTHER DEVELOPMENTS

- 12.2.9 TEXTRON INC.

- TABLE 244 TEXTRON INC.: COMPANY OVERVIEW

- FIGURE 60 TEXTRON INC.: COMPANY SNAPSHOT

- TABLE 245 TEXTRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 TEXTRON INC.: OTHER DEVELOPMENTS

- 12.2.10 LOCKHEED MARTIN CORPORATION

- TABLE 247 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- FIGURE 61 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 248 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 LOCKHEED MARTIN CORPORATION: OTHER DEVELOPMENTS

- 12.2.11 ELBIT SYSTEMS LTD.

- TABLE 250 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- FIGURE 62 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- TABLE 251 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 ELBIT SYSTEMS LTD.: OTHER DEVELOPMENTS

- 12.2.12 THALES

- TABLE 253 THALES: COMPANY OVERVIEW

- FIGURE 63 THALES: COMPANY SNAPSHOT

- TABLE 254 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 THALES: OTHER DEVELOPMENTS

- 12.2.13 DRONEDEPLOY INC.

- TABLE 256 DRONEDEPLOY INC.: COMPANY OVERVIEW

- TABLE 257 DRONEDEPLOY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 DRONEDEPLOY INC.: DEALS

- 12.2.14 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

- TABLE 259 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: COMPANY OVERVIEW

- FIGURE 64 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: COMPANY SNAPSHOT

- TABLE 260 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: OTHER DEVELOPMENTS

- 12.2.15 LEIDOS

- TABLE 262 LEIDOS: COMPANY OVERVIEW

- FIGURE 65 LEIDOS: COMPANY SNAPSHOT

- TABLE 263 LEIDOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 LEIDOS: OTHER DEVELOPMENTS

- 12.2.16 AERONAUTICS

- TABLE 265 AERONAUTICS: COMPANY OVERVIEW

- TABLE 266 AERONAUTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 AERONAUTICS: OTHER DEVELOPMENTS

- 12.3 OTHER PLAYERS

- 12.3.1 DYNETICS

- TABLE 268 DYNETICS: COMPANY OVERVIEW

- 12.3.2 ROBOTICAN CORPORATION

- TABLE 269 ROBOTICAN CORPORATION: COMPANY OVERVIEW

- 12.3.3 VOLANSI, INC.

- TABLE 270 VOLANSI, INC.: COMPANY OVERVIEW

- 12.3.4 GRIFFON AEROSPACE

- TABLE 271 GRIFFON AEROSPACE: COMPANY OVERVIEW

- 12.3.5 PLATFORM AEROSPACE

- TABLE 272 PLATFORM AEROSPACE: COMPANY OVERVIEW

- 12.3.6 SHIELD AI

- TABLE 273 SHIELD AI: COMPANY OVERVIEW

- 12.3.7 INSTANTEYE ROBOTICS

- TABLE 274 INSTANTEYE ROBOTICS: COMPANY OVERVIEW

- 12.3.8 ATHLON AVIA

- TABLE 275 ATHLON AVIA: COMPANY OVERVIEW

- 12.3.9 SILVERTONE UAV

- TABLE 276 SILVERTONE UAV: COMPANY OVERVIEW

- 12.3.10 BLUEBIRD AERO SYSTEMS LTD.

- TABLE 277 BLUEBIRD AERO SYSTEMS LTD.: COMPANY OVERVIEW

- 12.3.11 ANDURIL INDUSTRIES

- TABLE 278 ANDURIL INDUSTRIES: COMPANY OVERVIEW

- 12.3.12 SKYDIO INC.

- TABLE 279 SKYDIO INC.: COMPANY OVERVIEW

- 12.3.13 INDEMNIS, INC.

- TABLE 280 INDEMNIS, INC.: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS