|

|

市場調査レポート

商品コード

1741575

軍用ドローンの世界市場:プラットフォーム別、タイプ別、用途別、推進別、MTOW別、動作方式別、発射方式別、地域別、予測(~2030年)Military Drone Market by Platform, Type, Application, Propulsion, MTOW, Operation Mode, Launching Mode & Region Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 軍用ドローンの世界市場:プラットフォーム別、タイプ別、用途別、推進別、MTOW別、動作方式別、発射方式別、地域別、予測(~2030年) |

|

出版日: 2025年05月27日

発行: MarketsandMarkets

ページ情報: 英文 358 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の軍用ドローンの市場規模は、2025年に158億米ドル、2030年までに228億1,000万米ドルに達すると予測され、CAGRで7.6%の成長が見込まれます。

この成長は、先進の指揮、統制、通信、コンピューター、情報収集、警戒監視、偵察(C4ISR)能力への注目の高まりに起因します。C4ISRソリューションは、軍事と情報収集の枠組みにおける指揮統制戦略の強化において重要な役割を果たし、航空、海上、軍事作戦の成功に大きな影響を与えます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル |

| セグメント | プラットフォーム、用途、MTOW、速度、タイプ、動作方式、発射方式、推進、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「戦術セグメントが予測期間に市場で力強く成長します。」

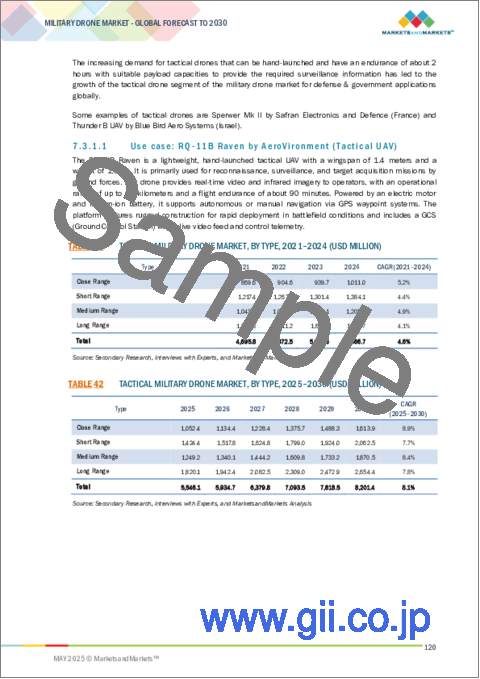

高度3,000~8,000メートルで運用される戦術ドローンは、小型ドローンの柔軟性と大型システムの能力を兼ね備えています。効果的な警戒監視に適切なペイロードと2時間の耐久性を持つ手投げ戦術ドローンへの需要の増加が、防衛や政府用途でのこの成長を推進しています。注目すべき例としては、Safran Electronics and Defence(フランス)のSperwer Mk IIやBlue Bird Aero Systems(イスラエル)のThunder B UAVがあります。

「配送用途セグメントが、市場でもっとも速い成長を記録すると推定されます。」

軍用ドローンは、弾薬や食料などの緊急物資を戦場に届けるために世界中で使用されるようになっています。米海兵隊は、過酷な条件下でも動作可能な重量1,320ポンド以下の無人機の情報をUAVメーカーに求めています。このような成長は、技術の進歩、戦場でのニーズの変化、費用対効果、人道的利用によってもたらされます。しかし、サイバーセキュリティの脅威、天候の制限、既存の兵站システムとの統合などの課題には注意が必要です。AIと自律技術の継続的な進歩に伴い、軍用配送ドローンは、責任を持って開発し展開された場合、兵站を変革する可能性を秘めています。

「北米が軍用ドローン市場で最大の地域になると推定されます。」

2025年、北米がこの市場で最大のシェアを占めると予測されます。この大きなシェアは、米国にGeneral Atomics、Lockheed Martin Corporation、Raytheon Technologies Corporation、Northrop Grumman Corporationなど多数の軍用UAVメーカーが存在することが主因です。さらに、武装UAV技術の進歩が米国の軍用ドローン市場の成長に寄与しています。さらに、米国政府は軍事力を強化するために多額の国防予算を計上しており、このことが予測期間を通じて市場成長を促進する見込みです。

当レポートでは、世界の軍用ドローン市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 軍用ドローン市場の企業にとって魅力的な成長機会

- 軍用ドローン市場:プラットフォーム別

- 軍用ドローン市場:動作方式別

- 軍用ドローン市場:発射方式別

- 軍用ドローン市場:タイプ別

- 軍用ドローン市場:MTOW別

- 軍用ドローン市場:速度別

- 軍用ドローン市場:推進別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 運用データ

- 顧客のビジネスに影響を与える動向と混乱

- エコシステム分析

- 著名企業

- 民間企業、中小企業

- スタートアップ

- エンドユーザー

- バリューチェーン分析

- 価格分析

- 主要企業の平均販売価格:主要モデル別

- 主要企業の平均販売価格の動向:用途別

- 平均販売価格の動向:タイプ別(2024年)

- 平均販売価格の動向:地域別(2024年)

- 平均販売価格の動向:プラットフォーム別(2024年)

- 貿易データアナリティクス

- 輸入シナリオ(HSコード8806)

- 輸出シナリオ(HSコード8806)

- 主な会議とイベント(2025年~2026年)

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 主なステークホルダーと購入基準

- 関税と規制情勢

- 規制機関、政府機関、その他の組織

- 北米

- 欧州

- 投資と資金調達のシナリオ

- テクノロジーロードマップ

- 数量データ

- マクロ経済の見通し

- イントロダクション

- 北米、欧州、アジア太平洋、中東のマクロ経済の見通し

- ラテンアメリカとアフリカのマクロ経済の見通し

第6章 産業動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- サプライチェーン分析

- ユースケース分析

- ドローン技術の成熟度マッピング

- 特許分析

- AIの影響

第7章 軍用ドローン市場:プラットフォーム別

- イントロダクション

- 小型

- 戦術

- 戦略

第8章 軍用ドローン市場:用途別

- イントロダクション

- UCAV

- ISR

- 配送

第9章 軍用ドローン市場:MTOW別

- イントロダクション

- 150kg未満

- 150~1,200kg

- 1,200kg超

第10章 軍用ドローン市場:速度別

- イントロダクション

- 亜音速

- 超音速

第11章 軍用ドローン市場:タイプ別

- イントロダクション

- 固定翼

- 回転翼

- ハイブリッド

第12章 軍用ドローン市場:動作方式別

- イントロダクション

- 遠隔操縦

- 操縦可能

- 完全自律

第13章 軍用ドローン市場:発射方式別

- イントロダクション

- 垂直離陸

- 自動離着陸

- カタパルトランチャー

- 手投げ

第14章 軍用ドローン市場:推進別

- イントロダクション

- 燃料駆動

- 電池駆動

第15章 軍用ドローン市場:地域別

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- アジア太平洋

- PESTLE分析

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他のアジア太平洋

- 欧州

- PESTLE分析

- ロシア

- フランス

- 英国

- ドイツ

- ウクライナ

- イタリア

- スウェーデン

- その他の欧州

- 中東

- PESTLE分析

- GCC

- イスラエル

- トルコ

- その他の中東

- ラテンアメリカ

- PESTLE分析

- ブラジル

- メキシコ

- アフリカ

- PESTLE分析

- 南アフリカ

- ナイジェリア

- その他のアフリカ

第16章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2021年~2024年)

- 主要企業の市場シェア分析(2024年)

- 企業の評価と財務指標

- 企業の評価マトリクス

- ブランド/製品の比較

- スタートアップ/中小企業の評価マトリクス

- 競合シナリオ

第17章 企業プロファイル

- イントロダクション

- 主要企業

- NORTHROP GRUMMAN CORPORATION

- RTX CORPORATION

- ISRAEL AEROSPACE INDUSTRIES LTD.

- GENERAL ATOMICS AERONAUTICAL SYSTEMS

- TELEDYNE FLIR LLC

- AEROVIRONMENT, INC.

- THE BOEING COMPANY

- AIRBUS

- TEXTRON INC.

- LOCKHEED MARTIN CORPORATION

- ELBIT SYSTEMS LTD.

- DASSAULT AVIATION

- BAE SYSTEMS PLC

- THALES GROUP

- LEONARDO S.P.A.

- KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

- BAYKAR TECH

- その他の企業

- DYNETICS, INC.

- ROBOTICAN CORPORATION

- GRIFFON AEROSPACE

- PLATFORM AEROSPACE

- SHIELD AI

- INSTANTEYE ROBOTICS

- ATHLON AVIA

- SILVERTONE UAV

- BLUEBIRD AERO SYSTEMS LTD.

- XTEND DEFENSE

第18章 付録

List of Tables

- TABLE 1 MILITARY DRONE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES, 2020-2024

- TABLE 3 DEFENSE SPENDING OF MAJOR ECONOMIES

- TABLE 4 ENDURANCE-BASED MAPPING OF POWER SOURCES

- TABLE 5 ROLE OF COMPANIES IN MILITARY DRONE MARKET ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE OF TOP MODELS (USD MILLION)

- TABLE 7 AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR TOP 3 APPLICATIONS, (USD MILLION)

- TABLE 8 AVERAGE SELLING PRICE TREND, BY TYPE, 2024 (USD MILLION)

- TABLE 9 AVERAGE SELLING PRICE TREND, BY REGION, 2024 (USD MILLION)

- TABLE 10 AVERAGE SELLING PRICE TREND, BY PLATFORM, 2024 (USD MILLION)

- TABLE 11 US, CHINA, AND ISRAEL: IMPORT AND EXPORT STATISTICS FOR MILITARY DRONES

- TABLE 12 IMPORT DATA FOR HS CODE 8806, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR HS CODE 8806, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 14 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 COMPANIES DEVELOPING DRONE SOFTWARE WITH AI

- TABLE 16 COMPANIES DEVELOPING DRONE EQUIPMENT WITH AI

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 18 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 DRONE REGULATIONS AND APPROVALS FOR COMMERCIAL SECTOR, BY COUNTRY

- TABLE 25 US: RULES AND GUIDELINES BY FAA FOR OPERATING DRONES

- TABLE 26 CANADA: RULES AND GUIDELINES FOR OPERATING DRONES

- TABLE 27 UK: RULES AND GUIDELINES BY CAA FOR OPERATING DRONES

- TABLE 28 GERMANY: RULES AND GUIDELINES FOR OPERATING DRONES

- TABLE 29 FRANCE: RULES AND GUIDELINES FOR OPERATING DRONES

- TABLE 30 DRONE REGULATIONS, BY COUNTRY

- TABLE 31 VOLUME DATA OF KEY PLAYERS, BY PLATFORM (UNITS), 2021-2024

- TABLE 32 AEROVIRONMENT UAS FOR MARITIME COUNTER-TRAFFICKING OPERATIONS

- TABLE 33 BIG GUNS AND SMALL DRONES: DEVASTATING COMBO USED BY UKRAINE TO FIGHT OFF RUSSIA

- TABLE 34 NAGORNO-KARABAKH CONFLICT INDICATED INCREASING IMPORTANCE OF ARMED DRONES, ALONG WITH OTHER WEAPONS AND HIGHLY TRAINED GROUND FORCES

- TABLE 35 EXPERIMENTING WITH DRONES FOR TEAR GAS DROP

- TABLE 36 PATENTS RELATED TO MILITARY DRONES GRANTED BETWEEN 2019 AND 2024

- TABLE 37 MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 38 MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 39 SMALL MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 40 SMALL MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 41 TACTICAL MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 42 TACTICAL MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 43 STRATEGIC MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 44 STRATEGIC MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 45 MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 46 MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 47 UCAVS: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 48 UCAVS: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 49 LOITERING MUNITION UCAVS: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 50 LOITERING MUNITION UCAVS: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 51 MILITARY DRONE MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 52 MILITARY DRONE MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 53 MILITARY DRONE MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 54 MILITARY DRONE MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 55 SUBSONIC MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 56 SUBSONIC MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 57 MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 58 MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 59 MILITARY DRONE MARKET, BY OPERATION MODE, 2021-2024 (USD MILLION)

- TABLE 60 MILITARY DRONE MARKET, BY OPERATION MODE, 2025-2030 (USD MILLION)

- TABLE 61 MILITARY DRONE MARKET, BY LAUNCH MODE, 2021-2024 (USD MILLION)

- TABLE 62 MILITARY DRONE MARKET, BY LAUNCH MODE, 2025-2030 (USD MILLION)

- TABLE 63 MILITARY DRONE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 64 MILITARY DRONE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 65 FUEL POWERED: MILITARY DRONE MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 66 FUEL POWERED: MILITARY DRONE MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 67 BATTERY POWERED: MILITARY DRONE MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 68 BATTERY POWERED: MILITARY DRONE MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 69 MILITARY DRONE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 MILITARY DRONE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: MILITARY DRONE VOLUME DATA (UNITS), BY PLATFORM

- TABLE 72 NORTH AMERICA: MILITARY DRONE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: MILITARY DRONE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 75 NORTH AMERICA: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 77 NORTH AMERICA: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 80 US: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 81 US: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 82 US: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 83 US: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 84 US: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 85 US: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 86 CANADA: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 87 CANADA: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 88 CANADA: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 89 CANADA: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 90 CANADA: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 91 CANADA: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MILITARY DRONE VOLUME DATA (UNITS), BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MILITARY DRONE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MILITARY DRONE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 101 CHINA: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 102 CHINA: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 103 CHINA: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 104 CHINA: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 CHINA: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 106 CHINA: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 107 INDIA: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 108 INDIA: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 109 INDIA: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 110 INDIA: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111 INDIA: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 112 INDIA: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 113 JAPAN: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 114 JAPAN: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 115 JAPAN: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 116 JAPAN: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 117 JAPAN: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 118 JAPAN: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 119 AUSTRALIA: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 120 AUSTRALIA: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 121 AUSTRALIA: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 122 AUSTRALIA: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 123 AUSTRALIA: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 124 AUSTRALIA: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 125 SOUTH KOREA: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 126 SOUTH KOREA: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 127 SOUTH KOREA: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 128 SOUTH KOREA: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 SOUTH KOREA: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 130 SOUTH KOREA: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: MILITARY DRONE VOLUME DATA (UNITS), BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 138 EUROPE: MILITARY DRONE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 139 EUROPE: MILITARY DRONE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 141 EUROPE: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 143 EUROPE: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 EUROPE: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 145 EUROPE: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 146 RUSSIA: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 147 RUSSIA: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 148 RUSSIA: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 149 RUSSIA: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 150 RUSSIA: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 151 RUSSIA: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 152 FRANCE: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 153 FRANCE: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 154 FRANCE: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 155 FRANCE: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 156 FRANCE: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 157 FRANCE: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 158 UK: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 159 UK: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 160 UK: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 161 UK: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 162 UK: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 163 UK: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 164 GERMANY: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 165 GERMANY: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 166 GERMANY: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 167 GERMANY: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 168 GERMANY: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 169 GERMANY: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 170 UKRAINE: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 171 UKRAINE: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 172 UKRAINE: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 173 UKRAINE: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 174 UKRAINE: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 175 UKRAINE: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 176 ITALY: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 177 ITALY: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 178 ITALY: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 179 ITALY: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 180 ITALY: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 181 ITALY: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 182 SWEDEN: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 183 SWEDEN: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 184 SWEDEN: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 185 SWEDEN: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 186 SWEDEN: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 187 SWEDEN: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 188 REST OF EUROPE: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 189 REST OF EUROPE: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 190 REST OF EUROPE: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 191 REST OF EUROPE: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 192 REST OF EUROPE: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 193 REST OF EUROPE: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 194 MIDDLE EAST: MILITARY DRONE VOLUME DATA (UNITS), BY PLATFORM, 2021-2024

- TABLE 195 MIDDLE EAST: MILITARY DRONE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 196 MIDDLE EAST: MILITARY DRONE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 197 GCC: MILITARY DRONE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 198 GCC: MILITARY DRONE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 199 MIDDLE EAST: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 200 MIDDLE EAST: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 201 MIDDLE EAST: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 202 MIDDLE EAST: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 203 MIDDLE EAST: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 204 MIDDLE EAST: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 205 SAUDI ARABIA: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 206 SAUDI ARABIA: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 207 SAUDI ARABIA: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 208 SAUDI ARABIA: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 209 SAUDI ARABIA: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 210 SAUDI ARABIA: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 211 UAE: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 212 UAE: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 213 UAE: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 214 UAE: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 215 UAE: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 216 UAE: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 217 ISRAEL: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 218 ISRAEL: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 219 ISRAEL: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 220 ISRAEL: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 221 ISRAEL: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 222 ISRAEL: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 223 TURKEY: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 224 TURKEY: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 225 TURKEY: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 226 TURKEY: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 227 TURKEY: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 228 TURKEY: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 229 REST OF MIDDLE EAST: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 230 REST OF MIDDLE EAST: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 231 REST OF MIDDLE EAST: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 232 REST OF MIDDLE EAST: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 233 REST OF MIDDLE EAST: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 234 REST OF MIDDLE EAST: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 235 LATIN AMERICA: MILITARY DRONE VOLUME DATA (UNITS), BY PLATFORM, 2021-2024

- TABLE 236 LATIN AMERICA: MILITARY DRONE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 237 LATIN AMERICA: MILITARY DRONE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 238 LATIN AMERICA: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 239 LATIN AMERICA: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 240 LATIN AMERICA: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 241 LATIN AMERICA: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 242 LATIN AMERICA: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 243 LATIN AMERICA: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 244 BRAZIL: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 245 BRAZIL: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 246 BRAZIL: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 247 BRAZIL: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 248 BRAZIL: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 249 BRAZIL: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 250 MEXICO: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 251 MEXICO: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 252 MEXICO: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 253 MEXICO: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 254 MEXICO: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 255 MEXICO: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 256 AFRICA: MILITARY DRONE VOLUME DATA (UNITS), BY PLATFORM, 2021-2024

- TABLE 257 AFRICA: MILITARY DRONE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 258 AFRICA: MILITARY DRONE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 259 AFRICA: MILITARY DRONE MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 260 AFRICA: MILITARY DRONE MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 261 AFRICA: MILITARY DRONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 262 AFRICA: MILITARY DRONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 263 AFRICA: MILITARY DRONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 264 AFRICA: MILITARY DRONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 265 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- TABLE 266 MILITARY DRONE MARKET: DEGREE OF COMPETITION

- TABLE 267 MILITARY DRONE MARKET: REGION FOOTPRINT OF KEY PLAYERS

- TABLE 268 MILITARY DRONE MARKET: PLATFORM FOOTPRINT OF KEY PLAYERS

- TABLE 269 MILITARY DRONE MARKET: APPLICATION FOOTPRINT OF KEY PLAYERS

- TABLE 270 MILITARY DRONE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 271 MILITARY DRONE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 272 MILITARY DRONE MARKET: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 273 MILITARY DRONE MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 274 MILITARY DRONE MARKET: OTHERS, JANUARY 2021-MAY 2025

- TABLE 275 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- TABLE 276 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES (JULY 2024-MAY 2025)

- TABLE 278 NORTHROP GRUMMAN CORPORATION: OTHER DEVELOPMENTS (JANUARY 2021-MARCH 2025)

- TABLE 279 RTX CORPORATION: COMPANY OVERVIEW

- TABLE 280 RTX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 RTX CORPORATION: PRODUCT LAUNCHES (JANUARY 2021-MARCH 2025)

- TABLE 282 RTX CORPORATION: OTHER DEVELOPMENTS (MAY 2023-MARCH 2025)

- TABLE 283 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 284 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCT LAUNCHES (JANUARY 2021-SEPTEMBER 2023)

- TABLE 286 ISRAEL AEROSPACE INDUSTRIES LTD.: DEALS (FEBRUARY 2020-MAY 2025)

- TABLE 287 ISRAEL AEROSPACE INDUSTRIES LTD.: OTHER DEVELOPMENTS (JANUARY 2021-JANUARY 2025)

- TABLE 288 GENERAL ATOMICS AERONAUTICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 289 GENERAL ATOMICS AERONAUTICAL SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 290 GENERAL ATOMICS AERONAUTICAL SYSTEMS: PRODUCT LAUNCHES (DECEMBER 2021-MARCH 2025)

- TABLE 291 GENERAL ATOMICS AERONAUTICAL SYSTEMS: DEALS (JANUARY 2021-APRIL 2022)

- TABLE 292 GENERAL ATOMICS AERONAUTICAL SYSTEMS: OTHER DEVELOPMENTS (JANUARY 2021- JANUARY 2025)

- TABLE 293 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- TABLE 294 TELEDYNE FLIR LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 TELEDYNE FLIR LLC: PRODUCT LAUNCHES (OCTOBER 2021-MAY 2025)

- TABLE 296 TELEDYNE FLIR LLC: DEALS, (JANUARY 2021-JUNE 2022)

- TABLE 297 TELEDYNE FLIR LLC: OTHER DEVELOPMENTS (MAY 2021-FEBRUARY 2025)

- TABLE 298 AEROVIRONMENT, INC.: COMPANY OVERVIEW

- TABLE 299 AEROVIRONMENT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 AEROVIRONMENT, INC.: PRODUCT LAUNCHES (FEBRUARY 2025-MAY 2025)

- TABLE 301 AEROVIRONMENT, INC.: DEALS (FEBRUARY 2021)

- TABLE 302 AEROVIRONMENT, INC.: OTHER DEVELOPMENTS (JULY 2021-MAY 2025)

- TABLE 303 THE BOEING COMPANY: COMPANY OVERVIEW

- TABLE 304 THE BOEING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 THE BOEING COMPANY: PRODUCT LAUNCHES (MARCH 2021)

- TABLE 306 THE BOEING COMPANY: OTHER DEVELOPMENTS (OCTOBER 2021-FEBRUARY 2025)

- TABLE 307 AIRBUS: COMPANY OVERVIEW

- TABLE 308 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 AIRBUS: DEALS (MAY 2025)

- TABLE 310 AIRBUS: OTHER DEVELOPMENTS (FEBRUARY 2021-NOVEMBER 2024)

- TABLE 311 TEXTRON INC.: COMPANY OVERVIEW

- TABLE 312 TEXTRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 TEXTRON INC.: PRODUCT LAUNCHES (DECEMBER 2024- JANUARY 2025)

- TABLE 314 TEXTRON INC.: OTHER DEVELOPMENTS (MARCH 2021-MARCH 2025)

- TABLE 315 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 316 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES (APRIL 2024-FEBRUARY 2025)

- TABLE 318 LOCKHEED MARTIN CORPORATION: OTHER DEVELOPMENTS (OCTOBER 2023- JANUARY 2024)

- TABLE 319 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 320 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 ELBIT SYSTEMS LTD.: OTHER DEVELOPMENTS (MARCH 2021-NOVEMBER 2024)

- TABLE 322 DASSAULT AVIATION: COMPANY OVERVIEW

- TABLE 323 DASSAULT AVIATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 DASSAULT AVIATION: OTHER DEVELOPMENTS (JUNE 2023- JANUARY 2024)

- TABLE 325 BAE SYSTEMS PLC: COMPANY OVERVIEW

- TABLE 326 BAE SYSTEMS PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 BAE SYSTEMS PLC: PRODUCT LAUNCHES (FEBRUARY 2023-APRIL 2025)

- TABLE 328 BAE SYSTEMS PLC: DEALS (SEPTEMBER 2023-FEBRUARY 2024)

- TABLE 329 BAE SYSTEMS PLC: OTHER DEVELOPMENTS (MAY 2023-MAY 2025)

- TABLE 330 THALES GROUP: COMPANY OVERVIEW

- TABLE 331 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 THALES GROUP: DEALS (JUNE 2024)

- TABLE 333 THALES GROUP: OTHER DEVELOPMENTS (FEBRUARY 2023-MARCH 2023)

- TABLE 334 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 335 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 336 LEONARDO S.P.A.: DEALS (JULY 2022-MARCH 2025)

- TABLE 337 LEONARDO S.P.A.: OTHER DEVELOPMENTS (JUNE 2022)

- TABLE 338 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 339 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: PRODUCT LAUNCHES (MAY 2025)

- TABLE 341 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: DEALS (APRIL 2024)

- TABLE 342 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: OTHER DEVELOPMENTS (DECEMBER 2024- JANUARY 2025)

- TABLE 343 BAYKAR TECH: COMPANY OVERVIEW

- TABLE 344 BAYKAR TECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 345 BAYKAR TECH: PRODUCT LAUNCHES (AUGUST 2024-JANUARY 2025)

- TABLE 346 BAYKAR TECH: DEALS (OCTOBER 2024-MARCH 2025)

- TABLE 347 BAYKAR TECH: OTHER DEVELOPMENTS (JANUARY 2023-MARCH 2025)

- TABLE 348 DYNETICS, INC.: COMPANY OVERVIEW

- TABLE 349 ROBOTICAN CORPORATION: COMPANY OVERVIEW

- TABLE 350 GRIFFON AEROSPACE: COMPANY OVERVIEW

- TABLE 351 PLATFORM AEROSPACE: COMPANY OVERVIEW

- TABLE 352 SHIELD AI: COMPANY OVERVIEW

- TABLE 353 INSTANTEYE ROBOTICS: COMPANY OVERVIEW

- TABLE 354 ATHLON AVIA: COMPANY OVERVIEW

- TABLE 355 SILVERTONE UAV: COMPANY OVERVIEW

- TABLE 356 BLUEBIRD AERO SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 357 XTEND DEFENSE: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MILITARY DRONE MARKETS COVERED & REGIONS CONSIDERED

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 STRATEGIC SEGMENT TO CAPTURE LARGEST SHARE DURING FORECAST MARKET

- FIGURE 8 ISR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 FIXED WING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 11 INCREASING GOVERNMENT FUNDING ON MILITARY DRONES TO DRIVE MARKET

- FIGURE 12 STRATEGIC SEGMENT TO LEAD MARKET FROM 2025 TO 2030

- FIGURE 13 FULLY AUTONOMOUS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 AUTOMATIC TAKE-OFF AND LANDING SEGMENT DOMINATED MARKET IN 2024

- FIGURE 15 FIXED WING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 >1,200 KG SEGMENT TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 17 SUBSONIC SEGMENT DOMINATED MARKET IN 2024

- FIGURE 18 FUEL POWERED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 MILITARY DRONE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 NUMBER OF ARMED CONFLICTS WORLDWIDE

- FIGURE 21 NUMBER OF COUNTRIES DEVELOPING, ACQUIRING, AND USING ARMED DRONES, 2000-2024

- FIGURE 22 DECREASING PRICE OF DRONE COMPONENTS (USD)

- FIGURE 23 TOTAL ACTIVE FLEET OF DRONES USED BY US NAVY AND MARINE (BY UNITS)

- FIGURE 24 TOTAL ACTIVE FLEET OF DRONES USED BY US AIR FORCE (BY UNITS)

- FIGURE 25 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 ECOSYSTEM ANALYSIS OF MILITARY DRONE MARKET

- FIGURE 27 MILITARY DRONE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR TOP 3 APPLICATIONS

- FIGURE 29 IMPORT DATA FOR HS CODE 8806, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 30 EXPORT DATA FOR HS CODE 8806, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO, 2019-2024 (USD BILLION)

- FIGURE 34 MILITARY DRONE MARKET: TECHNOLOGY ROADMAP

- FIGURE 35 MILITARY DRONE MARKET: TECHNOLOGY MAP, BY SEGMENT

- FIGURE 36 EMERGING TRENDS IN MILITARY DRONE MARKET

- FIGURE 37 MACROECONOMIC OUTLOOK: NORTH AMERICA, EUROPE, ASIA PACIFIC, AND MIDDLE EAST

- FIGURE 38 MACROECONOMIC OUTLOOK: LATIN AMERICA AND AFRICA

- FIGURE 39 SUPPLY CHAIN ANALYSIS OF MILITARY DRONE MARKET

- FIGURE 40 MATURITY STAGES OF DRONE TECHNOLOGIES

- FIGURE 41 LIST OF MAJOR PATENTS FOR MILITARY DRONE MARKET, 2015-2024

- FIGURE 42 ANALYSIS OF PATENTS FOR TOP COUNTRIES

- FIGURE 43 IMPACT OF AI ON DEFENSE INDUSTRY

- FIGURE 44 ADOPTION OF AI IN MILITARY, BY TOP COUNTRIES

- FIGURE 46 STRATEGIC SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 47 ISR SEGMENT TO LEAD MARKET FROM 2025 TO 2030

- FIGURE 48 >1,200 KG SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 49 SUBSONIC SEGMENT TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 50 FIXED WING SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 51 OPTIONALLY PILOTED SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 52 AUTOMATIC TAKE-OFF AND LANDING SEGMENT TO LEAD MARKET FROM 2025 TO 2030

- FIGURE 53 BATTERY POWERED SEGMENT TO RECORD HIGHEST GROWTH RATE FROM 2025 TO 2030

- FIGURE 54 MILITARY DRONE MARKET: REGIONAL SNAPSHOT

- FIGURE 55 NORTH AMERICA: MILITARY DRONE MARKET SNAPSHOT

- FIGURE 56 ASIA PACIFIC: MILITARY DRONE MARKET SNAPSHOT

- FIGURE 57 EUROPE: MILITARY DRONE MARKET SNAPSHOT

- FIGURE 58 MIDDLE EAST: MILITARY DRONE MARKET SNAPSHOT

- FIGURE 59 LATIN AMERICA: MILITARY DRONE MARKET SNAPSHOT

- FIGURE 60 AFRICA: MILITARY DRONE MARKET SNAPSHOT

- FIGURE 61 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2021-2024

- FIGURE 62 FINANCIAL METRICS OF PROMINENT PLAYERS

- FIGURE 63 VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 64 MILITARY DRONE MARKET: COMPANY EVALUATION MATRIX, 2024

- FIGURE 65 MILITARY DRONE MARKET: COMPANY FOOTPRINT

- FIGURE 66 BRAND/PRODUCT COMPARISON IN MILITARY DRONE MARKET

- FIGURE 67 MILITARY DRONE MARKET: STARTUP/SME EVALUATION MATRIX, 2024

- FIGURE 68 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 RTX CORPORATION: COMPANY SNAPSHOT

- FIGURE 70 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 71 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- FIGURE 72 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

- FIGURE 73 THE BOEING COMPANY: COMPANY SNAPSHOT

- FIGURE 74 AIRBUS: COMPANY SNAPSHOT

- FIGURE 75 TEXTRON INC.: COMPANY SNAPSHOT

- FIGURE 76 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 77 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 78 DASSAULT AVIATION: COMPANY SNAPSHOT

- FIGURE 79 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 80 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 81 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 82 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: COMPANY SNAPSHOT

The military drone market is expected to be valued at USD 15.80 billion in 2025 and projected to reach USD 22.81 billion by 2030, at a CAGR of 7.6%. This growth is attributed to a heightened emphasis on advanced command, control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR) capabilities. C4ISR solutions play a crucial role in reinforcing command and control strategies within military and intelligence frameworks, significantly impacting the success of air, naval, and military operations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Platform, application, MTOW, speed, type, operation mode, launching mode, propulsion, and region |

| Regions covered | North America, Europe, APAC, RoW |

"The tactical segment will witness strong growth in the market during the forecast period"

The military drone market is divided into small, tactical, and strategic drones, with the tactical segment poised for significant growth. Operating at altitudes of 3,000 to 8,000 meters, tactical drones combine the flexibility of small drones with the capabilities of larger systems. Increased demand for hand-launched tactical drones with a 2-hour endurance and suitable payloads for effective surveillance drives this growth in defense and government applications. Notable examples include the Sperwer Mk II from Safran Electronics and Defence (France) and the Thunder B UAV from Blue Bird Aero Systems (Israel).

"The delivery application segment is estimated to register the fastest growth in the market."

Based on the platform, the military drone market is divided into small, tactical, and strategic drones. The delivery segment witnessed significant growth during the forecast period.

Military drones are increasingly used worldwide to deliver emergency supplies to battlefields, including ammunition and food. The US Marine Corps has sought information from UAV manufacturers for unmanned vehicles weighing up to 1,320 pounds that can operate in harsh conditions. This growth is driven by technological advancements, changing battlefield needs, cost-effectiveness, and humanitarian uses. However, challenges such as cybersecurity threats, weather limitations, and integration with existing logistics systems require attention. With continued advancements in AI and autonomous technology, military delivery drones have the potential to transform battlefield logistics when developed and deployed responsibly.

"North America is estimated to be the largest region in the military drone market."

The military drone market in the North American region has been studied for the US and Canada. In 2025, North America is expected to hold the largest share of this market. This significant share is primarily due to the presence of numerous military UAV manufacturers in the US, including General Atomics, Lockheed Martin Corporation, Raytheon Technologies Corporation, and Northrop Grumman Corporation. Additionally, advancements in armed UAV technology have contributed to the growth of the military drone market in the US. Furthermore, the US government's significant defense budget allocation to enhance military capabilities is anticipated to drive market growth throughout the forecast period. General Atomics, Lockheed Martin Corporation, Raytheon Technologies Corporation, and Northrop Grumman Corporation. Moreover, technological upgrades in armed UAVs have fueled the growth of the military drone market in the US. In addition, the US government's high defense budget for improving military capabilities is expected to drive market growth during the forecast period.

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-49%; Tier 2-37%; and Tier 3-14%

- By Designation: C Level-55%; Directors-27%; and Others-18%

- By Region: North America-32%; Europe-32%; Asia Pacific-16%; Middle East-10%; Latin America-8%; Latin America-2%

Elbit Systems (US), Lockheed Martin (US), Israel Aerospace Industries (Israel), Textron Systems (US), and Thales (France) are some of the leading players operating in the military drone market.

Research Coverage

This research report categorizes the military drone market based on solution (system, software, and infrastructure), platform (freight drone, passenger drone, and air ambulance drone), application (logistics, and transportation), range [close range (<50 Kilometer), short range (50-150 kilometers), mid-range (150-650 kilometers), long range (>650 kilometers)], and user (defense and commercial). These segments have been mapped across major regions: North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa.

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the military drone market. A detailed analysis of the key industry players has been done to provide insights into their business overviews, solutions & services, key strategies, contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches in this market. The report includes the competitive analysis of upcoming startups in the military drone market ecosystem.

Key benefits of buying this report: This report will help market leaders/entrants with information on the closest approximations of the revenue numbers for the military drone market and its subsegments. The report covers the entire ecosystem of the market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (military advances in response to shifting warfare dynamics, the rise of advanced avionics technologies in military drones, increasing government funding on military drones, growing prominence of intensified military training, increasing use of UAVs for marine border patrolling, decreasing price of drone components, growing focus on advanced c4isr capabilities), restraints (limited flight time of military drones due to battery life, lack of skilled & trained personnel to operate drones, concern and call to ban fully autonomous drones) opportunities (state policies aimed at boosting domestic manufacturers, use of UAVs for cargo delivery in military operations, technological advancements in drone payloads, full-scale conversion of drones for the simulation of war scenarios) and challenges (defining secure identification for safety, issues with hijacking and security of UAVs, lack of sustainable power sources to improve endurance of drones)

- Market Penetration: Comprehensive information on military drones offered by the top players

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches

- Market Development: Comprehensive information about lucrative markets - the report analyzes the military drone market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the military drone market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the military drone market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key insights from primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation & methodology

- 2.3.1.2 Regional split of military drone market

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN MILITARY DRONE MARKET

- 4.2 MILITARY DRONE MARKET, BY PLATFORM

- 4.3 MILITARY DRONE MARKET, BY OPERATION MODE

- 4.4 MILITARY DRONE MARKET, BY LAUNCH MODE

- 4.5 MILITARY DRONE MARKET, BY TYPE

- 4.6 MILITARY DRONE MARKET, BY MTOW

- 4.7 MILITARY DRONE MARKET, BY SPEED

- 4.8 MILITARY DRONE MARKET, BY PROPULSION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Emergence of non-traditional adversaries and asymmetric warfare

- 5.2.1.2 Rise of advanced avionics technologies

- 5.2.1.3 Increased government funding for military drones

- 5.2.1.4 Growing prominence of intensified military training

- 5.2.1.5 Increasing use of UAVs for marine border patrolling

- 5.2.1.6 Decreasing price of drone components

- 5.2.1.7 Growing focus on advanced C4ISR capabilities

- 5.2.2 RESTRAINTS

- 5.2.2.1 Endurance and range limitations

- 5.2.2.2 Lack of skilled and trained operators

- 5.2.2.3 Concern and call to ban fully autonomous drones

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 State policies aimed at boosting domestic manufacturers

- 5.2.3.2 Use of UAVs for cargo delivery in military operations

- 5.2.3.3 Technological advancements in drone payloads

- 5.2.3.4 Full-scale conversion of drones for simulation of war scenario

- 5.2.4 CHALLENGES

- 5.2.4.1 Defining secure identification for safety

- 5.2.4.2 Issues with hijacking and security of UAVs

- 5.2.4.3 Lack of sustainable power sources to improve drone endurance

- 5.2.1 DRIVERS

- 5.3 OPERATIONAL DATA

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 STARTUPS

- 5.5.4 END USERS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TOP MODEL

- 5.7.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- 5.7.3 AVERAGE SELLING PRICE TREND, BY TYPE, 2024

- 5.7.4 AVERAGE SELLING PRICE TREND, BY REGION, 2024

- 5.7.5 AVERAGE SELLING PRICE TREND, BY PLATFORM, 2024

- 5.8 TRADE DATA ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 8806)

- 5.8.1.1 Unmanned aircraft, with maximum take-off weight >150 kg RC only (HS code: 880629)

- 5.8.1.2 Top five countries importing unmanned aircraft in 2024

- 5.8.2 EXPORT SCENARIO (HS CODE 8806)

- 5.8.2.1 Unmanned aircraft, with maximum take-off weight >150 kg (HS code: 880629)

- 5.8.2.2 Top five countries exporting unmanned aircraft in 2024

- 5.8.1 IMPORT SCENARIO (HS CODE 8806)

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 AI in military drones

- 5.10.1.2 Mid-air refueling of drones

- 5.10.1.3 Spy drones

- 5.10.1.4 Unmanned combat aerial vehicles

- 5.10.1.5 Anti-UAV defense systems

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Swarm technology

- 5.10.2.2 Autonomous take-off & landing systems

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 5G and IoT

- 5.10.3.2 Additive manufacturing

- 5.10.1 KEY TECHNOLOGIES

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 NORTH AMERICA

- 5.12.2.1 US

- 5.12.2.2 Canada

- 5.12.3 EUROPE

- 5.12.3.1 UK

- 5.12.3.2 Germany

- 5.12.3.3 France

- 5.13 INVESTMENT AND FUNDING SCENARIO

- 5.14 TECHNOLOGY ROADMAP

- 5.15 VOLUME DATA

- 5.16 MACROECONOMIC OUTLOOK

- 5.16.1 INTRODUCTION

- 5.16.2 MACROECONOMIC OUTLOOK FOR NORTH AMERICA, EUROPE, ASIA PACIFIC, AND MIDDLE EAST

- 5.16.2.1 North America

- 5.16.2.2 Europe

- 5.16.2.3 Asia Pacific

- 5.16.2.4 Middle East

- 5.16.3 MACROECONOMIC OUTLOOK FOR LATIN AMERICA AND AFRICA

- 5.16.3.1 Latin America

- 5.16.3.2 Africa

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 SYNTHETIC APERTURE RADAR

- 6.2.2 SIGINT BY DRONES

- 6.2.3 ELECTRONIC WARFARE USING MILITARY DRONES

- 6.2.4 MANNED UNMANNED TEAMING (MUM-T)

- 6.2.5 EO/IR SYSTEMS

- 6.2.6 TARGET DRONES

- 6.2.7 ENDURANCE

- 6.2.8 HYPERSONIC ARMED DRONES

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 CLIMATE CHANGE:

- 6.3.2 GREATER CUSTOMIZATION

- 6.3.3 DISRUPTIVE TECHNOLOGIES

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 USE CASE ANALYSIS

- 6.5.1 MARITIME INITIATIVE BY AEROVIRONMENT

- 6.5.2 TURKISH-MADE DRONES HELP SINK MOSKVA, FLAGSHIP OF RUSSIAN BLACK SEA FLEET

- 6.5.3 NAGORNO-KARABAKH CONFLICT

- 6.5.4 TEAR GAS BY DRONES

- 6.6 MATURITY MAPPING OF DRONE TECHNOLOGIES

- 6.7 PATENT ANALYSIS

- 6.8 IMPACT OF AI

- 6.8.1 INTRODUCTION

- 6.8.2 IMPACT OF AI ON DEFENSE INDUSTRY

- 6.8.3 ADOPTION OF AI IN MILITARY, BY TOP COUNTRIES

- 6.8.4 IMPACT OF AI ON MILITARY DRONE MARKET

7 MILITARY DRONE MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- 7.2 SMALL

- 7.2.1 GROWING ADOPTION OF SMALL MILITARY DRONES FOR ISR APPLICATIONS WORLDWIDE TO DRIVE MARKET

- 7.2.1.1 Use case: Black Hornet Nano by Teledyne FLIR (Small UAV)

- 7.2.2 NANO

- 7.2.3 MICRO

- 7.2.4 MINI

- 7.2.1 GROWING ADOPTION OF SMALL MILITARY DRONES FOR ISR APPLICATIONS WORLDWIDE TO DRIVE MARKET

- 7.3 TACTICAL

- 7.3.1 GROWING NEED FOR REAL-TIME SURVEILLANCE DATA BY MILITARIES TO DRIVE MARKET

- 7.3.1.1 Use case: RQ-11B Raven by AeroVironment (Tactical UAV)

- 7.3.2 CLOSE RANGE

- 7.3.3 SHORT RANGE

- 7.3.4 MEDIUM RANGE

- 7.3.5 LONG RANGE

- 7.3.1 GROWING NEED FOR REAL-TIME SURVEILLANCE DATA BY MILITARIES TO DRIVE MARKET

- 7.4 STRATEGIC

- 7.4.1 INCREASING DEMAND FOR HIGH PAYLOAD-CARRYING CAPACITY TO DRIVE MARKET

- 7.4.1.1 Use case: MQ-9 Reaper by General Atomics (Strategic UAV)

- 7.4.2 HALE

- 7.4.3 MALE

- 7.4.1 INCREASING DEMAND FOR HIGH PAYLOAD-CARRYING CAPACITY TO DRIVE MARKET

8 MILITARY DRONE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 UCAVS

- 8.2.1 EMERGENCE OF UCAVS AS GENUINE MILITARY FORCE MULTIPLIERS TO DRIVE DEMAND

- 8.2.2 LETHAL

- 8.2.3 STEALTH

- 8.2.4 LOITERING MUNITION

- 8.2.4.1 Recoverable

- 8.2.4.2 Expandable

- 8.2.5 TARGET

- 8.3 ISR

- 8.3.1 GROWING DEMAND FOR ADVANCED SURVEILLANCE TO DRIVE MARKET

- 8.4 DELIVERY

- 8.4.1 NEED FOR CARGO DELIVERY OF MEDICAL AIDS, FOOD SUPPLIES, AND AMMUNITION ON BATTLEFIELDS TO DRIVE MARKET

9 MILITARY DRONE MARKET, BY MTOW

- 9.1 INTRODUCTION

- 9.2 <150 KG

- 9.2.1 GROWING USE OF LOW-WEIGHT NANO AND MICRO DRONES FOR SURVEILLANCE IN URBAN BATTLEFIELDS AND CONFINED SPACES TO DRIVE MARKET

- 9.3 150-1,200 KG

- 9.3.1 RISING ADOPTION OF UAVS WITH 150-1,200 KG MTOW IN MILITARY APPLICATIONS TO DRIVE MARKET

- 9.4 >1,200 KG

- 9.4.1 INCREASING USE OF HIGH PAYLOAD CAPACITY COMBAT DRONES BY ARMED FORCES TO DRIVE MARKET

10 MILITARY DRONE MARKET, BY SPEED

- 10.1 INTRODUCTION

- 10.2 SUBSONIC

- 10.2.1 DEVELOPMENT OF SUBSONIC AERIAL TARGET DRONES WITH ANTI-CRUISE MISSILE CAPABILITIES TO DRIVE MARKET

- 10.2.2 <100 KM/HR

- 10.2.3 100-300 KM/HR

- 10.2.4 >300 KM/HR

- 10.3 SUPERSONIC

- 10.3.1 RISING DEMAND FOR HIGH-SPEED AERIAL COMBAT VEHICLES TO DRIVE MARKET

11 MILITARY DRONE MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 FIXED WING

- 11.2.1 DEMAND FOR LONG-RANGE AND HIGH-SPEED MILITARY DRONES TO DRIVE MARKET

- 11.3 ROTARY WING

- 11.3.1 RISING ADOPTION OF ROTARY-WING DRONES FOR ISR APPLICATIONS TO DRIVE MARKET

- 11.4 HYBRID

- 11.4.1 CAPABILITY TO CARRY HEAVY PAYLOADS TO DRIVE MARKET

12 MILITARY DRONE MARKET, BY OPERATION MODE

- 12.1 INTRODUCTION

- 12.2 REMOTELY PILOTED

- 12.2.1 RISING ADOPTION OF REMOTELY PILOTED MAN-PORTABLE DRONES BY ARMED FORCES TO DRIVE MARKET

- 12.3 OPTIONALLY PILOTED

- 12.3.1 INCREASING USE OF OPTIONALLY PILOTED DRONES FOR ISR APPLICATIONS TO DRIVE MARKET

- 12.4 FULLY AUTONOMOUS

- 12.4.1 SURGE IN DEVELOPMENT OF LETHAL AUTONOMOUS WEAPON SYSTEMS TO DRIVE MARKET

13 MILITARY DRONE MARKET, BY LAUNCH MODE

- 13.1 INTRODUCTION

- 13.2 VERTICAL TAKE-OFF

- 13.2.1 GROWING USE OF ROTARY-WING DRONES TO DRIVE MARKET

- 13.3 AUTOMATIC TAKE-OFF AND LANDING

- 13.3.1 INCREASING DEMAND FOR HALE AND MALE DRONES TO DRIVE MARKET

- 13.4 CATAPULT LAUNCHER

- 13.4.1 RISING ADOPTION OF SMALL DRONES FOR ISR ACTIVITIES TO DRIVE MARKET

- 13.5 HAND LAUNCHED

- 13.5.1 GROWING USE OF MINI AND NANO DRONES BY TROOPS IN HAZARDOUS AREAS TO DRIVE MARKET

14 MILITARY DRONE MARKET, BY PROPULSION

- 14.1 INTRODUCTION

- 14.2 FUEL POWERED

- 14.2.1 LONGER FLIGHT TIME FOR DELIVERY APPLICATIONS TO DRIVE MARKET

- 14.2.2 TURBO ENGINES

- 14.2.3 PISTON ENGINES

- 14.3 BATTERY POWERED

- 14.3.1 RISING POPULARITY OF FUEL CELL-OPERATED DRONES IN MILITARY APPLICATIONS TO DRIVE MARKET

- 14.3.2 BATTERIES

- 14.3.3 FUEL CELLS

- 14.3.4 HYBRID CELLS

15 MILITARY DRONE MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 PESTLE ANALYSIS

- 15.2.2 US

- 15.2.2.1 Strategic defense initiatives and capability modernization to drive market

- 15.2.3 CANADA

- 15.2.3.1 Increasing development and procurement of UAVs to drive market

- 15.3 ASIA PACIFIC

- 15.3.1 PESTLE ANALYSIS

- 15.3.2 CHINA

- 15.3.2.1 Advancements in high-altitude drone platforms and swarm capabilities drive market

- 15.3.3 INDIA

- 15.3.3.1 Rising procurement of drones to strengthen defense capabilities to drive market

- 15.3.4 JAPAN

- 15.3.4.1 Strategic investments and international collaborations to drive market

- 15.3.5 AUSTRALIA

- 15.3.5.1 Strategic investment and increased focus on military drone development to drive market

- 15.3.6 SOUTH KOREA

- 15.3.6.1 Strategic partnerships and indigenous advancements to drive market

- 15.3.7 REST OF ASIA PACIFIC

- 15.4 EUROPE

- 15.4.1 PESTLE ANALYSIS

- 15.4.2 RUSSIA

- 15.4.2.1 Increasing procurement of modern military drones to enhance defense capabilities to drive market

- 15.4.3 FRANCE

- 15.4.3.1 Rising focus on developing more advanced military drones to drive market

- 15.4.4 UK

- 15.4.4.1 Technological developments to enhance military drone capabilities to drive market

- 15.4.5 GERMANY

- 15.4.5.1 Rising demand for military drones from armed forces to drive market

- 15.4.6 UKRAINE

- 15.4.6.1 Growing procurement of armed drones to enhance military capabilities to drive market

- 15.4.7 ITALY

- 15.4.7.1 Procurement of components to develop technologically advanced MALE drones to drive market

- 15.4.8 SWEDEN

- 15.4.8.1 Increasing focus on developing drones and associated solutions to drive market

- 15.4.9 REST OF EUROPE

- 15.5 MIDDLE EAST

- 15.5.1 PESTLE ANALYSIS

- 15.5.2 GCC

- 15.5.2.1 Saudi Arabia

- 15.5.2.1.1 Rising adoption of UAVs for military applications to drive market

- 15.5.2.2 UAE

- 15.5.2.2.1 Increasing procurement of drones to drive market

- 15.5.2.1 Saudi Arabia

- 15.5.3 ISRAEL

- 15.5.3.1 Combat-proven platforms and AI integration to define global leadership in UAV development

- 15.5.4 TURKEY

- 15.5.4.1 Strategic autonomy and battlefield-tested UAVs to shape country's growing presence in global drone landscape

- 15.5.5 REST OF MIDDLE EAST

- 15.6 LATIN AMERICA

- 15.6.1 PESTLE ANALYSIS

- 15.6.2 BRAZIL

- 15.6.2.1 Increasing procurement of UAVs for safety, security, and advanced intelligence missions to drive market

- 15.6.3 MEXICO

- 15.6.3.1 Growing focus on developing drones for monitoring and curbing forest fires to drive market

- 15.7 AFRICA

- 15.7.1 PESTLE ANALYSIS

- 15.7.2 SOUTH AFRICA

- 15.7.2.1 Exploration of artificial intelligence and swarm technology to drive market

- 15.7.3 NIGERIA

- 15.7.3.1 Growing partnerships to access technology and expertise to drive market

- 15.7.4 REST OF AFRICA

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 REVENUE ANALYSIS, 2021-2024

- 16.4 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 COMPANY EVALUATION MATRIX

- 16.6.1 STARS

- 16.6.2 EMERGING LEADERS

- 16.6.3 PERVASIVE PLAYERS

- 16.6.4 PARTICIPANTS

- 16.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.6.5.1 Company footprint

- 16.6.5.2 Region footprint

- 16.6.5.3 Platform footprint

- 16.6.5.4 Application footprint

- 16.7 BRAND/PRODUCT COMPARISON

- 16.8 STARTUP/SME EVALUATION MATRIX

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 OTHERS

17 COMPANY PROFILES

- 17.1 INTRODUCTION

- 17.2 KEY PLAYERS

- 17.2.1 NORTHROP GRUMMAN CORPORATION

- 17.2.1.1 Business overview

- 17.2.1.2 Products/Solutions/Services offered

- 17.2.1.3 Recent developments

- 17.2.1.3.1 Product launches

- 17.2.1.3.2 Other developments

- 17.2.1.4 MnM view

- 17.2.1.4.1 Key strengths

- 17.2.1.4.2 Strategic choices

- 17.2.1.4.3 Weaknesses and competitive threats

- 17.2.2 RTX CORPORATION

- 17.2.2.1 Business overview

- 17.2.2.2 Products/Solutions/Services offered

- 17.2.2.3 Recent developments

- 17.2.2.3.1 Product launches

- 17.2.2.3.2 Other developments

- 17.2.2.4 MnM view

- 17.2.2.4.1 Key strengths

- 17.2.2.4.2 Strategic choices

- 17.2.2.4.3 Weaknesses and competitive threats

- 17.2.3 ISRAEL AEROSPACE INDUSTRIES LTD.

- 17.2.3.1 Business overview

- 17.2.3.2 Products/Solutions/Services offered

- 17.2.3.3 Recent developments

- 17.2.3.3.1 Product launches

- 17.2.3.3.2 Deals

- 17.2.3.3.3 Other developments

- 17.2.3.4 MnM view

- 17.2.3.4.1 Key strengths

- 17.2.3.4.2 Strategic choices

- 17.2.3.4.3 Weaknesses and competitive threats

- 17.2.4 GENERAL ATOMICS AERONAUTICAL SYSTEMS

- 17.2.4.1 Business overview

- 17.2.4.2 Products/Solutions/Services offered

- 17.2.4.3 Recent developments

- 17.2.4.3.1 Product launches

- 17.2.4.3.2 Deals

- 17.2.4.3.3 Other developments

- 17.2.4.4 MnM view

- 17.2.4.4.1 Key strengths

- 17.2.4.4.2 Strategic choices

- 17.2.4.4.3 Weaknesses and competitive threats

- 17.2.5 TELEDYNE FLIR LLC

- 17.2.5.1 Business overview

- 17.2.5.2 Products/Solutions/Services offered

- 17.2.5.3 Recent developments

- 17.2.5.3.1 Product launches

- 17.2.5.3.2 Deals

- 17.2.5.3.3 Other developments

- 17.2.5.4 MnM view

- 17.2.5.4.1 Key strengths

- 17.2.5.4.2 Strategic choices

- 17.2.5.4.3 Weaknesses and competitive threats

- 17.2.6 AEROVIRONMENT, INC.

- 17.2.6.1 Business overview

- 17.2.6.2 Products/Solutions/Services offered

- 17.2.6.3 Recent developments

- 17.2.6.3.1 Product launches

- 17.2.6.3.2 Deals

- 17.2.6.3.3 Other developments

- 17.2.7 THE BOEING COMPANY

- 17.2.7.1 Business overview

- 17.2.7.2 Products/Solutions/Services offered

- 17.2.7.3 Recent developments

- 17.2.7.3.1 Product launches

- 17.2.7.3.2 Other developments

- 17.2.8 AIRBUS

- 17.2.8.1 Business overview

- 17.2.8.2 Products/Solutions/Services offered

- 17.2.8.3 Recent developments

- 17.2.8.3.1 Deals

- 17.2.8.3.2 Other developments

- 17.2.9 TEXTRON INC.

- 17.2.9.1 Business overview

- 17.2.9.2 Products/Solutions/Services offered

- 17.2.9.3 Recent developments

- 17.2.9.3.1 Product launches

- 17.2.9.3.2 Other developments

- 17.2.10 LOCKHEED MARTIN CORPORATION

- 17.2.10.1 Business overview

- 17.2.10.2 Products/Solutions/Services offered

- 17.2.10.3 Recent developments

- 17.2.10.3.1 Product launches

- 17.2.10.3.2 Other developments

- 17.2.11 ELBIT SYSTEMS LTD.

- 17.2.11.1 Business overview

- 17.2.11.2 Products/Solutions/Services offered

- 17.2.11.3 Recent developments

- 17.2.11.3.1 Other developments

- 17.2.12 DASSAULT AVIATION

- 17.2.12.1 Business overview

- 17.2.12.2 Products/Solutions/Services offered

- 17.2.12.3 Recent developments

- 17.2.12.3.1 Other developments

- 17.2.13 BAE SYSTEMS PLC

- 17.2.13.1 Business overview

- 17.2.13.2 Products/Solutions/Services offered

- 17.2.13.3 Recent developments

- 17.2.13.3.1 Product launches

- 17.2.13.3.2 Deals

- 17.2.13.3.3 Other developments

- 17.2.14 THALES GROUP

- 17.2.14.1 Business overview

- 17.2.14.2 Products/Solutions/Services offered

- 17.2.14.3 Recent developments

- 17.2.14.3.1 Deals

- 17.2.14.3.2 Other developments

- 17.2.15 LEONARDO S.P.A.

- 17.2.15.1 Business overview

- 17.2.15.2 Products/Solutions/Services offered

- 17.2.15.3 Recent developments

- 17.2.15.3.1 Deals

- 17.2.15.3.2 Other developments

- 17.2.16 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

- 17.2.16.1 Business overview

- 17.2.16.2 Products/Solutions/Services offered

- 17.2.16.3 Recent developments

- 17.2.16.3.1 Product launches

- 17.2.16.3.2 Deals

- 17.2.16.3.3 Other developments

- 17.2.17 BAYKAR TECH

- 17.2.17.1 Business overview

- 17.2.17.2 Products/Solutions/Services Offered

- 17.2.17.3 Recent developments

- 17.2.17.3.1 Product Launches

- 17.2.17.3.2 Deals

- 17.2.17.3.3 Other developments

- 17.2.1 NORTHROP GRUMMAN CORPORATION

- 17.3 OTHER PLAYERS

- 17.3.1 DYNETICS, INC.

- 17.3.2 ROBOTICAN CORPORATION

- 17.3.3 GRIFFON AEROSPACE

- 17.3.4 PLATFORM AEROSPACE

- 17.3.5 SHIELD AI

- 17.3.6 INSTANTEYE ROBOTICS

- 17.3.7 ATHLON AVIA

- 17.3.8 SILVERTONE UAV

- 17.3.9 BLUEBIRD AERO SYSTEMS LTD.

- 17.3.10 XTEND DEFENSE

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 LAUNDRY LIST OF MARKET PLAYERS

- 18.6 AUTHOR DETAILS