|

|

市場調査レポート

商品コード

1854606

軍用ドローン市場:ドローンタイプ、設計タイプ、推進タイプ、動作モード、航続距離、用途、エンドユーザー、流通チャネル別-2025~2032年の世界予測Military Drone Market by Drone Type, Design Type, Propulsion Type, Operational Mode, Range, Application, End-User, Distribution Channel - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 軍用ドローン市場:ドローンタイプ、設計タイプ、推進タイプ、動作モード、航続距離、用途、エンドユーザー、流通チャネル別-2025~2032年の世界予測 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 195 Pages

納期: 即日から翌営業日

|

概要

軍用ドローン市場は、2032年までにCAGR 7.49%で265億7,000万米ドルの成長が予測されています。

| 主要市場の統計 | |

|---|---|

| 基準年 2024年 | 149億米ドル |

| 推定年 2025年 | 159億6,000万米ドル |

| 予測年 2032年 | 265億7,000万米ドル |

| CAGR(%) | 7.49% |

最近の技術・動作的進化により、軍事用無人航空機システムが現代の戦略・調達的選択肢の中心となっていることを簡潔な枠組みで示します

軍事用無人航空機システムは、ニッチな偵察プラットフォームから現代の戦力構造に不可欠なコンポーネントへと進歩し、調達担当官、プログラム・マネージャー、戦略立案者に新たな明確さを要求しています。センサ、自律性、推進、ネットワークにおける最近の進歩は、ミッションの範囲を拡大する一方で、意思決定のタイムラインを短縮しており、技術的特性と動作コンセプトを統合する必要性を生み出しています。この分析では、この進化を前景化し、能力ベクターを取得レバーや産業の対応に結びつけることで、リーダーが性能、ロジスティクス、ライフサイクルの回復力の間で十分な情報に基づいたトレードオフを行えるようにします。

この分析では、まず、現在の技術を、作戦上の必須要件である、持続的なISR需要、競合する通信環境、過酷な条件下での迅速な持続性の要件の中に位置づける。続いて、相互動作性、サプライチェーンの安全性、国内製造のインセンティブなどの優先順位を含め、軍とそれを支える産業が利用可能な戦略的選択肢をフレームワーク化します。最後にイントロダクションでは、技術的な複雑さを実用的な意思決定ガイダンスに変換することで、読者が取得ロードマップを設計し、研究開発投資を調整し、ダイナミック地政学的状況におけるパートナーの行動を予測できるようにする、いう本報告書の意図を明確にしています。

軍事無人システムにおける能力開発、作戦ドクトリン、産業サプライチェーンを再構築する変革的シフト

ここ数年、技術の成熟とドクトリンの適応が合流し、それらが一体となって情勢の変革的シフトを構成しています。自律性とセンサの小型化の進歩により、ミッションの耐久性が向上し、乗組員の要求が軽減されました。一方、データリンクとネットワーク動作の改善により、異種フリート間での分散センシングと協力的な交戦が可能になりました。同時に、推進の革新とハイブリッド設計によってミッションプロファイルが拡大され、新たな戦術的持続性と迅速な対応が可能になりました。このような技術的ベクターは、現実の世界にも影響を及ぼします。戦力設計者は、有人プラットフォームから無人補完プラットフォームへとミッションセットを再配分しており、訓練パイプラインは、リモートクルーの熟練度やヒューマンマシンチーム編成の教義を取り入れるように進化しています。

同時に、産業の足跡も変化しています。サプライヤーは、システムインテグレーションの専門知識とソフトウェア定義のペイロードを中心に統合を進め、専門メーカーは、高耐久性や高機動性のプラットフォームでニッチを切り開こうとしています。地政学的な摩擦と貿易施策の転換によって、国内でのサステイナブル生産と安全な部品供給源の重要性が高まるにつれて、サプライチェーンの弾力性は、取締役会の重要課題となっています。その結果、戦略立案者は、能力の向上と、それに伴うロジスティクス、規制、相互動作性の課題の両方を考慮しなければならなくなりました。分析の残りの部分では、こうしたシフトが調達、アライアンス協力、エコシステム投資などを通じてどのように顕在化するかを追跡し、能力ニーズと産業戦略を整合させるために必要な状況をリーダーに記載しています。

米国が2025年に発動した関税シフトが調達、サプライチェーン、同盟産業施策に及ぼす累積的かつ体系的な影響

2025年に制定された関税措置は、軍事用無人システムの製造、調達、同盟国の供給体制に多面的な影響をもたらしました。直接的な影響のひとつは、国防総省の購買担当者がサプライヤーの選定基準を再評価したことです。その結果、調達チームは、機密性の高い部品生産の移転、信頼できるベンダーの資格認定の深化、国内生産可能なサブシステムの採用の加速化など、高関税生産ノードにさらされる機会を減らす調達戦略をますます優先するようになっています。このようなシフトは、防衛産業施策によって強化されてきました。防衛産業施策では、国産部品や技術移転にインセンティブを与えることで、国内のインテグレーターや提携メーカーとのパートナーシップの魅力を高めています。

現実的な面では、関税の影響を緩和するために企業が生産ラインを再編成し、サプライヤー基地を再構成するのに伴い、プログラムのスケジュールが調整されています。代替コンポーネントを検証し、新たな下請けサプライヤーを認定する必要があるため、認定サイクルが長くなり、堅牢なシステムエンジニアリングと供給保証計画が重視されるようになりました。同時に、関税は、関税の影響を受ける部品への依存度を下げる代替技術やモジュールアーキテクチャへの投資を促進しました。パートナーや同盟国にとって、この措置は、安全保障の目的を犠牲にすることなく相互動作性を維持するための二国間協定や相互調達の取り決めについて、より緊密な調整を促しています。これらの力学を総合すると、関税は単に単価を変えるだけでなく、産業の意思決定を再形成し、現地化の動向を加速させ、プログラムのリスク評価におけるサプライチェーンアーキテクチャーの戦略的重要性を高めていることがわかる。

プラットフォーム能力、設計の選択、推進、自律性のトレードオフをミッション主導の調達ロジックと調和させるセグメンテーションの主要な洞察

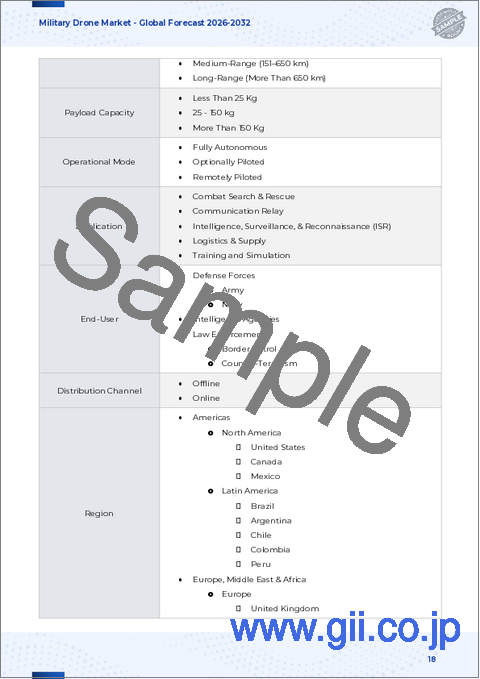

セグメンテーション構造により、能力と設計の選択が動作上の有用性にどのように反映されるかが明確になり、プログラムチームはプラットフォームの選択をミッションの優先順位に合わせることができます。ドローンタイプに基づき、市場は高高度長期耐久ドローン(HALE)、中高度長期耐久ドローン(MALE)、マイクロ&ナノドローン、ミニドローン、戦術ドローン、無人戦闘空中機(UCAV)にわたって調査され、戦略、劇場、戦術レイヤーの耐久性、ペイロード容量、生存性のトレードオフをフレームワークするのに役立っています。設計タイプに基づき、市場は固定翼ドローン、ハイブリッドドローン、回転翼ドローン全体で調査され、滑走路依存性、ホバー性能、VTOLロジスティクスを知らせる。推進タイプに基づき、市場はバッテリー式と燃料式で調査され、熱シグネチャー、出撃時間、維持フットプリントのトレードオフを明確にします。動作モードに基づき、市場は完全自律、任意操縦、遠隔操縦について調査され、これは紛争環境での使用における指揮統制や法的考慮事項に直接マッピングされます。射程距離別では、市場は長距離、中距離、短距離にわたって調査され、中継アーキテクチャや持続戦略に関する意思決定の指針となります。用途別では、戦闘捜索救助、通信中継、諜報・モニタリング・偵察(ISR)、兵站・補給、訓練シミュレーションの各セグメントで市場を調査し、プラットフォームの能力を任務の成果に結び付けます。エンドユーザーに基づいて、市場は国防軍、情報機関、法執行機関にわたって調査され、国防軍は陸軍と海軍にわたってさらに調査され、法執行機関は国境パトロールと対テロリズムにわたってさらに調査され、それによって取得チャネルとドクトリンを動作ガバナンスに整合させています。最後に、流通チャネルに基づき、市場はオフラインとオンラインにまたがって調査され、これにより調達様式とアフターマーケットサポートの考慮事項が明らかになります。

このセグメンテーションレンズを通して、リーダーは、プラットフォームのタイプ、設計、推進、自律性レベル、航続距離のどの組み合わせが、優先されるミッションに最も近いかを特定することができます。例えば、永続性を重視するISRでは、推進と設計の選択に慎重なバランス調整が必要であり、一方、戦術的な群作戦では、自律性と短距離生存性が重視されます。したがって、調達の枠組みは、推進、ペイロード、自律性の各レイヤーにわたってモジュール型のアップグレードを可能にし、プラットフォームを全面的に交換することなく、進化するミッション要件に適応できるように構築すべきです。要するに、セグメンテーションは、技術的属性をミッションレベルの意図と維持の現実に適合させるためのアーキテクチャを提供するものです。

南北アメリカ、欧州、中東・アフリカ、アジア太平洋の各地域の力学と競合のニュアンスが、需要プロファイルとアライアンスの協力を形成します

地域差によって、能力の嗜好、産業の対応、調達の流れが異なります。南北アメリカでは、投資の重点は、ハイエンドISR、長耐久ISRプラットフォーム、遠征や統合部隊のコンセプトをサポートする統合ネットワーク動作を優先する傾向があります。この環境はまた、完全なシステムインテグレーションと維持サービスを提供できる成熟したサプライヤー基盤に有利です。これとは対照的に、欧州・中東・アフリカでは、同盟国システムとの相互動作性、危機対応用迅速な展開、安全なサプライチェーンが最重要となる能力ニーズがモザイク状に存在します。これらの市場では、連合軍の要件や多様な作戦地域を満たすために、モジュール型アーキテクチャーや輸出準拠の設計が優先されることが多いです。一方、アジア太平洋では、海洋安全保障上の要請と空域紛争を背景に、ハイエンドの耐久性システムと分散型戦術能力の両方に対する需要が加速しており、これが国内産業への投資と地域パートナーシップのインセンティブとなっています。

全地域に共通しているのは、弾力性のあるサプライチェーンの必要性、安全な通信と強化されたセンサの優先順位、オペレーターの負担を軽減する自律性への関心の高まりなどです。しかし、調達スケジュール、現地調達要件、相互動作性の義務付けは大きく異なり、プログラム仕様とサプライヤーの商業戦略を形成しています。その結果、グローバルな競争を目指す企業は、ライフサイクルサポートと迅速なアップグレードパスを提供する能力を維持しながら、地域の施策枠組み、アライアンスアーキテクチャ、戦域特有の動作上の要求を考慮した柔軟な市場戦略を採用しなければなりません。

大手企業、ニッチスペシャリスト、インテグレーターが、エンドツーエンドの無人化ソリューションを提供するためにどのように競争し、協力しているかを浮き彫りにする企業と競合の力学

競合情勢は、二本立ての進化を特徴としています。一方のトラックでは、既存の防衛プライム企業や大手航空宇宙企業が、システムインテグレーションの専門知識、規模、規制の経験を活用して、複雑な複数領域のプログラムを獲得し続けています。これらの企業は、ソフトウェア定義のペイロード、オープンアーキテクチャ、ライフサイクルの維持に重点を置き、深いロジスティクスとプログラム上のコミットメントを必要とするプログラム・オブレコード契約の入札を可能にしています。他方、専門メーカーや新興企業は、高度自律性スタック、モジュール型センサポッド、小型推進システムなど、差別化された技術に重点を置き、ニッチなミッションへの迅速な参入を可能にしたり、大規模インテグレーターの技術サプライヤーとしての役割を果たしたりしています。戦略的パートナーシップやOEMとサプライヤーの提携が、規模拡大とイノベーションを両立させる手段として機能することが増えています。

このダイナミック動きは、M&A活動、合弁事業、サプライヤーエコシステムが、調達ルールや技術的閾値の変化に対する防御的かつ日和見的な対応となる市場を生み出します。安全なサプライチェーン、迅速な統合サイクル、標準規格による相互動作性を実証できる企業は競合を獲得し、一方、1つのサブシステムに焦点を絞った企業は、買収チームがモジュール型の代替品やアップグレードを求めている中で成功を収めることができます。最後に、企業戦略は、マネージドISR、トレーニング・アズ・アサービス、サステイメント契約など、買い手の統合負担を軽減し、サプライヤーに継続的な収益モデルを生み出すサービス提供に集約されつつあります。

製品ロードマップ、供給戦略、パートナーシップモデルを動作上の現実や調達上の制約と整合させるため、産業リーダーへの実行可能な提言

産業のリーダーは、プラットフォームの完全な交換を要求することなく、迅速なペイロードの交換、推進の代替、自律性のアップグレードを可能にする明確な製品モジュール性基準を定義することから始めるべきです。オープンインターフェースと共通データモデルを優先することで、企業はエンドユーザーの統合リスクを低減し、プラットフォームのライフサイクルを延長するアップグレードパスを構築することができます。次に、積極的なサプライチェーン戦略が不可欠です。サプライヤーは、重要部品を二重調達し、地域のサブティアーパートナーを認定し、信頼できるサプライヤーの有効なリストを維持することで、貿易施策の転換や関税エクスポージャーの影響を軽減すべきです。機密性の高いサブシステムのために国内または同盟国の生産能力に投資することは、調達摩擦を減らすだけでなく、契約評価時の競争上の差別化要因にもなります。

さらに、企業は、動作信頼性を実証しながら、規制や倫理的配慮に対処するヒューマンマシンチーミングや自律性検証フレームワークに投資すべきです。また、エンドユーザーと協力してトレーニングやシミュレーション環境を共同開発することで、受け入れが加速し、実戦投入のリスクが軽減されます。最後に、プラットフォームを維持管理サービスやデータ分析サービスとバンドルするビジネスモデルを追求することで、サプライヤーのインセンティブをミッションの成功と一致させ、継続的な収益を創出します。これらのステップを組み合わせることで、プログラム受賞の可能性を高め、展開されたシステムが新たな脅威や動作要件の変化に適応し続けることを確実にします。

一次調査、二次検証、専門家の統合をどのように組み合わせ、強固で擁護可能な洞察を生み出したかを説明する調査手法

本分析では、バランスのとれた視点と調査手法の厳密性を確保するため、複数の調査手法を統合しました。一次調査は、能力要件、調達のハードル、産業上の制約に関する生の視点を把握するため、プログラムマネージャー、取得担当者、プラットフォームインテグレーター、施策アドバイザーとの構造化されたインタビューとワークショップで構成されました。これらのインタビューは、性能トレードオフと認定スケジュールを検証するために、エンジニアやテストオペレーターとの技術的な協議によって補完されました。二次的検証では、施策文書、国防調達の枠組み、技術白書、公的プログラムの公開を活用し、主要な調査結果をより広範な制度動向の中に位置づけた。

データ統合では、潜在的な確認バイアスに注意を払いながら、文書化されたプログラム行動や観察可能な産業活動に対するインタビュー入力を三角比較する交差検証技法を採用しました。これを緩和するため、分析では検証可能な動向を重視し、複数の利害関係者にわたるインタビューの裏付けをとりました。全体を通して、分析上の仮定を文書化し、感度チェックを実施することで、施策や技術の進化に関するによる解釈の下でも結論が頑健であることを確認しました。

戦力の優位性を維持するために国防指導者が優先させなければならない戦略的要請と作戦上の意味を総合した結論

能力の階層や地域を問わず、一つの明確な必須事項が浮かび上がります。モジュール性を備え、自律性の迅速なアップデートをサポートし、弾力性のあるサプライチェーンの中で動作されるプラットフォームは、モノリシックなシステムよりも永続的な動作価値をもたらします。したがって、作戦立案者は、漸進的な能力挿入とプラットフォーム間の相互動作性を可能にするアーキテクチャを優先すべきであり、それによって陳腐化リスクを低減し、連合作戦を可能にします。産業の利害関係者は、調達の意思決定が、ハードウェアの性能だけでなく、供給保証、ソフトウェアの成熟度、統合の速度を反映するようになってきていることを認識しなければなりません。

最後に、進歩する自律性、進化する推進と設計の選択、変化する貿易施策の情勢が交錯する中、調達と産業戦略には総合的なアプローチが求められます。卓越した技術にサプライチェーンの先見性と機敏なビジネスモデルを組み合わせた組織は、新たなミッションのニーズを満たし、能力投資をサステイナブル動作上の優位性に転換する上で、最も有利な立場に立つことができると考えられます。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場概要

第5章 市場洞察

- 戦闘作戦における自律ドローンの世界の需要の高まり

- モニタリングと標的追跡用AI搭載ドローンの急速な成長

- 軍用ドローンを使った協調的な群集戦術の拡大

- 高度5Gネットワークの統合によりUAVの接続性を強化

- 高性能戦術ドローンシステムの小型化が進行中

- 次世代UAV技術におけるステルス機能への注目度が高まっている

- 軍の物流と補給におけるドローンへの依存の高まり

- 長期任務用長時間滞空型無人航空機の大きな進歩

- 脅威防御用強力な対ドローンシステムの開発

- 陸海空の戦争におけるドローンの展開増加

第6章 米国の関税の累積的な影響、2025年

第7章 AIの累積的影響、2025年

第8章 軍用ドローン市場:ドローンタイプ別

- 高高度長時間滞空型ドローン(HALE)

- 中高度長時間滞空型ドローン(MALE)

- マイクロドローンとナノドローン

- ミニドローン

- 戦術ドローン

- 無人戦闘航空機(UCAV)

第9章 軍用ドローン市場:設計タイプ別

- 固定翼ドローン

- ハイブリッドドローン

- 回転翼ドローン

第10章 軍用ドローン市場:推進タイプ別

- 電池駆動

- 燃料駆動

第11章 軍用ドローン市場:動作モード別

- 完全自律

- 任意操縦

- 遠隔操縦

第12章 軍用ドローン市場:航続距離別

- 長距離

- 中距離

- 短距離

第13章 軍用ドローン市場:用途別

- 戦闘捜索救助

- 通信リレー

- 情報・モニタリング・偵察(ISR)

- 物流・供給

- トレーニングとシミュレーション

第14章 軍用ドローン市場:エンドユーザー別

- 国防軍

- 陸軍

- 海軍

- 諜報機関

- 法執行機関

- 国境警備隊

- テロ対策

第15章 軍用ドローン市場:流通チャネル別

- オフライン

- オンライン

第16章 軍用ドローン市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋

第17章 軍用ドローン市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第18章 軍用ドローン市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第19章 競合情勢

- 市場シェア分析、2024年

- FPNVポジショニングマトリックス、2024年

- 競合分析

- Airbus SE

- Anduril Industries, Inc.

- Asteria Aerospace Limited

- BAE Systems plc

- Elbit Systems Ltd.

- General Atomics

- Griffon Aerospace, Inc.

- Israel Aerospace Industries Ltd.

- Leidos, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd.

- Robotican Corporation

- RTX Corporation

- Saab AB

- Safran Group

- Shield AI

- Skydio, Inc.

- SZ DJI Technology Co., Ltd

- Teal Drones, Inc. by Red Cat Holdings

- Teledyne Technologies Incorporated

- Textron Systems

- Thales Group

- The Boeing Company