|

|

市場調査レポート

商品コード

1864595

ドローン戦争市場:ドローンタイプ別、能力別、運用モード別、射程距離別、用途別、エンドユーザー別- 世界予測2025-2032Drone Warfare Market by Drone Type, Capability, Operation Mode, Range, Application, End-User - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ドローン戦争市場:ドローンタイプ別、能力別、運用モード別、射程距離別、用途別、エンドユーザー別- 世界予測2025-2032 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 198 Pages

納期: 即日から翌営業日

|

概要

ドローン戦争市場は、2032年までにCAGR8.62%で462億6,000万米ドル規模に成長すると予測されております。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 238億5,000万米ドル |

| 推定年2025 | 257億9,000万米ドル |

| 予測年2032 | 462億6,000万米ドル |

| CAGR(%) | 8.62% |

自律性、センサー、システム統合の進歩が、無人航空プラットフォームを現代の紛争における基盤的資産へと変貌させた経緯を包括的に紹介する

現代の無人航空システムは、ニッチな実験段階から、現代の軍事および国土安全保障作戦の中核的な柱へと進化しました。センサー、自律性、ミッションソフトウェアの進歩により、使用事例は偵察を超えて拡大し、紛争地域における持続的な監視、精密攻撃、兵站支援を可能にしています。その結果、調達サイクルと作戦教義は、相互運用性、電子的耐障害性、およびミッション固有のタスクのためのペイロードの迅速な再構成を優先するように適応しつつあります。

本エグゼクティブサマリーでは、技術動向、規制圧力、地政学的要因が相互に作用して形成する運用環境と産業構造を統合的に分析します。本分析では、プラットフォーム設計の選択が任務効果に与える影響、発射・回収機構を跨ぐシステム統合が機体選定と同等に重要である理由、リスクと能力の両立を図るため「人間が関与する」ワークフローと自律型ワークフローが如何にバランスされているかを強調します。能力ブロック(プラットフォーム、制御アーキテクチャ、センサー、ソフトウェア、持続性)を軸に議論を構成することで、読者は調達とイノベーションの意思決定を支援する統合的視座を得られます。

全編を通じて、意思決定者にとっての実践的示唆に重点が置かれております。すなわち、複雑かつ急速に変化する紛争環境において作戦上の優位性を維持するため、投資の優先順位付け、サプライチェーンリスクの軽減、技術成熟度に応じた教義の調整といった課題への対応策が示されております。

自律性、モジュラーペイロード、商用技術の普及、相互運用性の優先順位、サプライチェーンの再編といったドローン戦術を再構築する要素について、実証に基づいた検証を行います

ドローン戦争の情勢は、戦略的判断と調達優先順位を同時に変える一連の変革的変化によって再構築されつつあります。第一に、自律性は限定的な実証段階から作戦上有用なモードへと移行し、運用者の負担を軽減しながらより長距離・複雑な任務を可能にしています。この変化は組織に対し、指揮統制アーキテクチャの再考と、耐障害性のある通信・安全なデータリンクへの投資を迫っています。第二に、モジュラーペイロードのエコシステムにより、単一の機体で複数の役割を遂行できるようになり、構想から任務遂行までの時間を短縮し、ライフサイクルの柔軟性を高めています。

第三に、低コストで商用技術を応用した技術の普及により、非国家主体と国家主体の双方にとって参入障壁が低下し、多層的な対策と電子戦優位性の必要性が高まっています。第四に、システム・オブ・システムズ思考が主流となりつつあります。地上管制所、発射・回収システム、後方支援網間の相互運用性が、戦力増幅の核心要素となっています。最後に、規制および輸出管理体制がサプライヤーの戦略に影響を与え、重要部品のニアショアリングや代替調達を促進しています。これらの変化を総合すると、計画立案者や産業パートナーは、適応性、回復力、新興能力の迅速な統合を重視した能力開発に取り組むことが求められます。

2025年までの米国の関税措置が、調達リスク計算を変えるサプライヤー多様化、オンショアリング、モジュール設計戦略をいかに促進したかに関する実践的分析

政策および産業の観点から、2025年までに米国が導入した関税および貿易措置の累積的影響は、サプライチェーン、調達行動、ベンダー戦略にわたり複数の下流効果を生み出しています。関税によるコスト圧力は、航空電子機器、センサー、推進システムなどの重要部品の代替調達源を統合企業が模索する中で、サプライヤーの多様化を加速させています。同時に、調達担当当局は、戦略的依存度の低減と危機時の潜在的な混乱の緩和を図るため、国内製造拠点や信頼できる供給エコシステムを有するサプライヤーを優先する姿勢を示しています。

これらの措置は、機密性の高いサブシステム向け生産ラインの確保を目指す利害関係者の動きとして、国内能力開発や同盟国との産業協力への投資を促進する触媒ともなっています。一方で、取引コストの上昇や輸入コンプライアンスの複雑化は、関税対象要素と国内調達可能なシステムを分離するモジュール設計アプローチを促進する要因となっています。これらの複合的な結果として、コスト・スケジュール・リスクのトレードオフが再調整されています。プログラム管理者は、外部依存度低減という戦略的メリットとバランスを取りつつ、新規サプライヤーに対するより長い認定期間を考慮に入れる必要が生じました。重要なことに、こうした動向は、安全な調達経路、コンプライアンス対応準備、重要な製造工程の現地化能力を実証できるサプライヤーにとって新たな機会を創出しています。

プラットフォームのクラス、能力、自律性、航続距離、用途、エンドユーザーの優先事項が、設計と配備の要件をどのように独自に形作るかを明らかにする、詳細なセグメンテーションに基づく調査

セグメンテーション分析により、能力要求、運用概念、ユーザー優先度が、機種・能力・運用モード・航続距離・用途・エンドユーザーごとに如何に異なるかが明らかになります。ドローン機種別に見ると、固定翼システムは航続時間と航続距離を要する任務で優位性を示し、ハイブリッドプラットフォームは航続性と垂直離着陸の柔軟性の折衷案を提供し、回転翼プラットフォームは対象地点に近い低速・高機動性任務で卓越した性能を発揮します。能力カテゴリーの評価により、発射・回収システム、地上管制ステーション、プラットフォームハードウェア、サービス、ミッションソフトウェアがそれぞれ固有の制約と価値要因をもたらすことが明らかになります。いずれかの領域における成熟度や脆弱性は、ミッション全体におけるボトルネックとなり得ます。

運用モードの区分では、持続的かつ反復的な任務における自律運用への移行が進む一方、人間の判断と監視によるリスク軽減が不可欠な領域では半自律モードが依然として重要であることが浮き彫りとなります。通信範囲の分類(視認範囲から延長視認範囲、視認範囲外まで)は、通信アーキテクチャ、指令遅延要件、規制の複雑性を直接的に決定づけます。用途別区分では、情報収集・監視・偵察任務と、兵站・輸送任務、無人戦闘航空機の運用とを区別します。それぞれが異なるセンサースイート、生存性対策、交戦規則の考慮を必要とします。最後に、エンドユーザーの差異も重要です。国土安全保障運用では、迅速な展開と民間監視を重視した国境警備および対反乱能力が優先されます。一方、空軍、陸軍、海軍などの軍事ユーザーは、広範な部隊構造への統合、堅牢な通信、戦域固有の脅威に合わせた持続性モデルを必要とします。

南北アメリカ、欧州、中東・アフリカ、アジア太平洋における作戦上の要請と規制体制が、調達、産業戦略、配備にどのように影響するかを詳細に比較した地域別評価

地域的な力学は、アメリカ大陸、欧州、中東・アフリカ、アジア太平洋地域における教義、調達経路、産業パートナーシップに深い影響を及ぼします。アメリカ大陸では、意思決定者は運用上の柔軟性を維持するため、レガシープラットフォームの近代化とモジュラーシステムの迅速な配備のバランスを取っています。この地域では、国土安全保障任務のための省庁間調整を重視すると同時に、新たな需要に対応できる深い防衛産業基盤を維持しています。欧州・中東・アフリカ地域では、パッチワーク状の規制環境と多様な脅威プロファイルが、各国の要件に合わせて調整可能な相互運用性のあるシステムへの需要を生み出しています。これにより、基準、対UAS能力、比較優位性を活用したニッチ分野の専門性に関する地域協力が促進されています。

アジア太平洋地域においては、広大な海洋空間と激化する地政学的競合に対処するため、長距離航続能力、海洋領域認識、分散型作戦が運用上の重要課題として優先されています。サプライチェーン戦略は地域によって顕著に異なり、重要部品の確保のためにニアショアリングやパートナー国の産業化を追求する地域もあれば、能力導入を加速するためにグローバルな商業エコシステムを活用する地域もあります。全地域において、特に視界外運用やデータ主権に関する規制の進化は、運用拡大の重要な促進要因または制約要因であり続けており、地域安全保障構造が能力投資のペースと方向性を引き続き決定づけています。

統合を重視するプライム企業、自律技術・センサー分野の専門革新企業、ライフサイクルサービス提供者が、無人システム分野における競争優位性をどのように形成しているかについての分析的概観

無人システムの情勢は、従来の防衛プライム企業、専門プラットフォームメーカー、ソフトウェア・AI企業、そして拡大を続ける中小規模の革新企業群が混在する特徴を有しています。確立されたシステムインテグレーターは、プラットフォーム納入、システム統合、維持管理に対するエンドツーエンドの責任を要する大規模なマルチドメインプログラムを引き続き主導しています。一方で、自律スタック、センサーフュージョン、指揮統制ミドルウェアに特化したニッチベンダーは、迅速なアップグレードやミッション特化のカスタマイズを可能にするソリューションにより、戦略的重要性を増しています。

この二つの産業構造が共存する状況は、プライム企業がサードパーティの自律システムやセンサーソリューションを組み込むことで、開発期間の短縮とコスト削減を図るパートナーシップの機会を生み出しています。また、貿易規制や輸出管理の監視が強化される中、信頼性の高い調達と出所の保証を提供できる企業にとって、新たな市場機会も創出しています。訓練、任務計画、ロジスティクスを含むエンドツーエンドのライフサイクルサポートを提供するサービスプロバイダーは、過酷な環境下での保守性を考慮した設計能力とサイバー衛生の確保能力によって、ますます差別化が進んでいます。要するに、技術的専門性と実証済みのシステム統合能力、そして強固なサプライチェーンガバナンスを組み合わせた組織に、競争優位性がもたらされる時代となっています。

競争環境下における運用優位性を維持するため、リーダーがモジュール性、相互運用性、サプライチェーンのレジリエンス、安全な自律性を優先すべき実践的かつ影響力の大きい提言

関連性の維持・拡大を目指す業界リーダー向けに、実行可能な提言を以下に示します。焦点はレジリエンス、相互運用性、情報に基づく投資にあります。迅速なペイロード交換を可能にし認証プロセスを簡素化するモジュラーアーキテクチャを優先してください。これにより任務開始までの時間を短縮し、敏感なコンポーネントを分離することで関税やサプライチェーンの混乱を軽減できます。地上局、発射・回収機構、同盟プラットフォーム間におけるシステム・オブ・システムズ統合を促進するため、相互運用性基準とオープンAPIへの投資を推進し、連合体での有用性と輸出可能性を高めます。サプライヤー監査、重要部品の二重調達戦略、選択的な国内回帰または同盟製造パートナーシップを通じたサプライチェーンのトレーサビリティ強化により、戦略的依存度とコンプライアンスリスクを低減します。

加えて、ミッションの有効性と法的・倫理的制約のバランスを取るため、多層的な人的監視を伴うセキュアな自律性の採用を加速します。強固なデータリンク耐障害性と強化されたサイバー保護を開発し、電磁環境が競合する状況下でもミッション継続性を維持します。最後に、エンドユーザーとの共同開発プログラムを通じて、研究開発と調達を現実的な運用シナリオに整合させます。これにより、現場からのフィードバックが反復的な改善を形作り、必要に応じて迅速な拡張を支援する維持モデルが確保されます。

戦略的意思決定に資するため、専門家インタビュー、公開技術文献、能力ギャップ分析、シナリオベース評価を組み合わせた透明性・再現性のある調査手法を採用

本調査は定性的・定量的手法を統合し、ドローン戦争の情勢に関する均衡のとれた、説得力のある見解を導出します。主要な入力情報には、防衛計画担当者、プログラム管理者、技術責任者との構造化インタビューが含まれ、技術的仮定と運用上の制約を検証する専門家ワークショップによって補完されます。二次情報源としては、査読付き研究論文、公開されている政府・防衛関連刊行物、規制関連文書などを網羅し、コンプライアンスや輸出管理の動向評価に活用しております。本調査手法では三角測量(トライアングレーション)を重視し、一次情報の見解が異なる場合には、独立した技術文献や過去のプログラム分析を通じて裏付けを求めております。

適用される分析フレームワークには、能力ギャップ分析、サプライチェーンリスクマッピング、シナリオベースの影響評価が含まれ、政策行動や技術的転換点が異なるタイムライン下でどのように現れるかを探求します。再現性を支援するため、仮定とデータの出所は文書化され、感度分析を用いて代替サプライヤー構成や規制変更がプログラムのリスクプロファイルに与える影響を検証します。本調査手法では一貫して透明性と運用上の関連性を優先し、調達当局、産業パートナー、将来の教義形成に関わる意思決定者にとって実践可能な知見を確保しております。

結論として、適応型調達、強靭なサプライチェーン、相互運用可能なシステム、安全な自律性の必要性を強調し、変化する紛争地域における作戦準備態勢の維持を提言します

結論として、無人システム分野は転換点を越えました。技術的成熟、規制の進化、地政学的圧力が集結し、空・海・陸の戦力が作戦を構想する方法を再定義する段階に至っています。自律性、モジュール設計、強靭なサプライチェーンの相互作用が核心となります。これらの要素を統合しつつ、安全で相互運用可能なアーキテクチャを維持できる組織が作戦上の優位性を獲得するでしょう。関税や貿易措置は調達・製造戦略の構造調整を加速させ、商業的イノベーションの価値を損なうことなく、信頼できるサプライヤーと連合工業協力への重点強化を促しています。

したがって、意思決定者は迅速な能力導入と厳格なリスク管理のバランスを取る適応的な姿勢を採用する必要があります。調達、研究開発、維持戦略をモジュール性、供給源保証、安全な自律性を中心に調整することで、利害関係者は複雑化が進む状況においても任務遂行準備態勢と対応力を維持できます。今後の道筋には、技術的進歩を教義に体系的に統合すること、強靭なサプライチェーンへの持続的投資、そして運用者と産業界の継続的な連携が求められます。これにより、システムが現代戦場の現実に対応することを保証できるのです。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 協調的な戦場作戦のためのAI駆動自律型群集ドローンの開発

- 安全なドローン通信のための量子耐性暗号プロトコルの実装

- 指向性エネルギー及びレーダー検知技術を活用した対ドローン防衛システムの拡充

- 作戦の柔軟性向上を目的とした航空任務における有人・無人機ハイブリッド連携の採用

- 戦術ドローン偵察任務におけるリアルタイムデータ分析とエッジコンピューティングの統合

- 自律型致死兵器の配備と倫理的コンプライアンスに対応する規制枠組みの進化

- 高性能センサーの小型化と長寿命電源システムの発展による市場成長

- 防衛関連企業とAIソフトウェアスタートアップ企業との間で、ドローン戦術革新に向けた戦略的提携が形成

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 ドローン戦争市場ドローンタイプ別

- 固定翼ドローン

- ハイブリッドドローン

- 回転翼ドローン

第9章 ドローン戦争市場能力別

- ドローン発射・回収システム

- 地上管制ステーション

- プラットフォーム

- サービス

- ソフトウェア

第10章 ドローン戦争市場運用モード別

- 自律型

- 半自律型

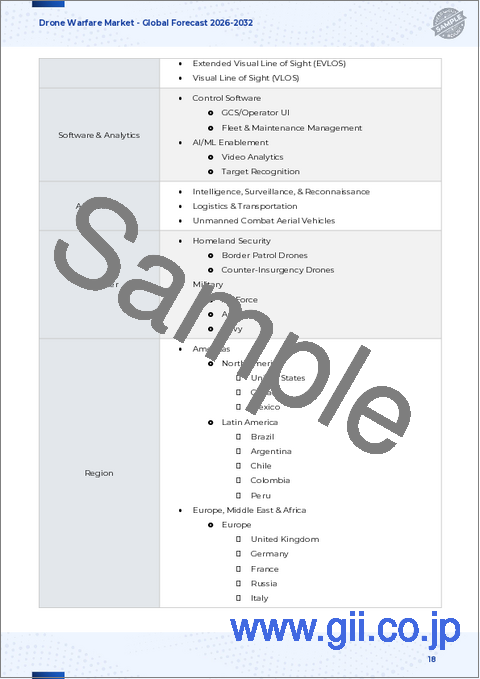

第11章 ドローン戦争市場:範囲別

- 視界外(BVLOS)

- 拡張視界内(EVLOS)

- 可視視界内(VLOS)

第12章 ドローン戦争市場:用途別

- 情報収集・監視・偵察

- 物流・輸送

- 無人戦闘航空機

第13章 ドローン戦争市場:エンドユーザー別

- 国土安全保障

- 国境警備ドローン

- 対反乱ドローン

- 軍事

- 空軍

- 陸軍

- 海軍

第14章 ドローン戦争市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州、中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第15章 ドローン戦争市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第16章 ドローン戦争市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第17章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- AeroVironment, Inc.

- Airbus SE

- Azur Drones, SAS

- BAE Systems PLC

- Baykar Tech

- Dassault Aviation SA

- Delair

- ECA Group

- Elbit Systems Ltd.

- Embraer S.A.

- General Atomics

- Insitu Inc.

- Israel Aerospace Industries Ltd.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Parrot SA

- RTX Corporation

- Saab AB

- SZ DJI Technology Co., Ltd.

- Teledyne FLIR LLC

- Textron Inc.

- Thales Group

- The Boeing Company